Attached files

| file | filename |

|---|---|

| EX-32.1 - SECTION 1350 CERTIFICATION OF CHIEF EXECUTIVE OFFICER - Apextalk Holdings Inc | f10k2009ex32i_apextalk.htm |

| EX-31.2 - RULE 13A-14(A)/ 15D-14(A) CERTIFICATION OF CHIEF FINANCIAL OFFICER - Apextalk Holdings Inc | f10k2009ex31ii_apextalk.htm |

| EX-32.2 - SECTION 1350 CERTIFICATION OF CHIEF FINANCIAL OFFICER - Apextalk Holdings Inc | f10k2009ex32ii_apextalk.htm |

| EX-31.1 - RULE 13A-14(A)/ 15D-14(A) CERTIFICATION OF CHIEF EXECUTIVE OFFICER - Apextalk Holdings Inc | f10k2009ex31i_apextalk.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended December 31, 2009

|

o

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ___________ to __________

Commission

File No. 333-153838

APEXTALK

HOLDINGS, INC.

(Name

of small business issuer in its charter)

|

DELAWARE

|

26-1402471

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer Identification No.)

|

|

637

Howard Street

San

Francisco, CA

|

94105

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

(888)

228 2829

(Registrant’s

telephone number, including area code)

|

Securities

registered under Section 12(b) of the Exchange Act:

|

|

|

Title

of each class registered:

|

Name

of each exchange on which registered:

|

|

None

|

None

|

|

Securities

registered under Section 12(g) of the Exchange Act:

|

|

|

Common

Stock, par value $.001

(Title

of class)

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference Part III of this Form 10-K or

any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

o

|

Accelerated

filer

|

o

|

|

Non-accelerated

filer

(Do

not check if a smaller reporting company)

|

o

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes o No x

There is

no established public trading market for our common stock.

As of

April 8, 2010, the registrant had 1,293,040 shares of its common stock

outstanding.

Documents

Incorporated by Reference: None.

TABLE

OF CONTENTS

|

|

PART

I

|

||

|

ITEM

1.

|

Description of

Business

|

1

|

|

|

ITEM

1A.

|

Risk Factors

|

5

|

|

|

ITEM

2.

|

Description of

Property

|

6

|

|

|

ITEM

3.

|

Legal Proceedings

|

6

|

|

|

ITEM

4.

|

(Removed

and Reserved)

|

6

|

|

|

PART

II

|

|||

|

ITEM

5.

|

Market for Common Equity and Related Stockholder

Matters

|

6

|

|

|

ITEM

6.

|

Selected Financial

Data

|

6

|

|

|

ITEM

7.

|

Management’s Discussion and Analysis of Financial

Condition and Results of Operation

|

7

|

|

|

ITEM

7A.

|

Quantitative and Qualitative Disclosures About

Market Risk

|

11

|

|

|

ITEM

8.

|

Financial Statements and Supplementary

Data

|

F

|

|

|

ITEM

9.

|

Changes in and Disagreements with Accountants on

Accounting and Financial Disclosure

|

12

|

|

|

ITEM

9A(T)

|

Controls and

Procedures

|

12

|

|

|

PART

III

|

|||

|

ITEM

10.

|

Directors, Executive Officers, Control Persons and

Corporate Governance; Compliance with Section 16(a) of the Exchange

Act

|

13

|

|

|

ITEM

11.

|

Executive

Compensation

|

15

|

|

|

ITEM

12.

|

Security Ownership of Certain Beneficial Owners

and Management and Related Stockholder

Matters

|

16

|

|

|

ITEM

13.

|

Certain Relationships and Related Transactions,

and Director Independence

|

17

|

|

|

ITEM

14.

|

Principal Accounting Fees and

Services

|

17

|

|

|

PART

IV

|

|||

|

ITEM

15.

|

Exhibits, Financial Statement

Schedules

|

18

|

|

|

SIGNATURES

|

19

|

||

PART

I

ITEM

1. DESCRIPTION OF BUSINESS

General

Apextalk

Holdings, Inc. (the “Company or “we”) was incorporated in the State of Delaware

on November 7, 2007. On November 16, 2007 we entered into a share

exchange agreement with Apextalk, Inc., a California based corporation, whereby

Apextalk, Inc. became our wholly owned subsidiary. All of our

operations are conducted through Apextalk, Inc. On November 18, 2007,

we issued 89,619 common shares (post reverse split) to TLMS International, Inc.

and 44,810 common shares (post reverse split) to Spencer Luo for in exchange for

an aggregate $111,038 investment in us.

We have

integrated VoIP and wireless technology to develop various market driven

applications. With our “Soft-switch”, we have developed a few unique

applications with proprietary programming. These applications have

been soft launched on the US market by introducing our services slowly into the

market. We have approached the friends and business associates of our officers

and directors to test our services. During our “soft launch,” we

found great appreciation and acceptance of our products and services. Based upon

the positive feedbacks we have received, we believe we can expand our services

with additional funding and a systematic marketing and promotional plan in

place.

Objectives

We aim to

become one of the major value-added telecom service providers by partnering with

different local value-added service providers around the globe. With our

integrated soft-switch platform, our local partners will have the ability to

penetrate into their local market.

We have integrated VoIP and wireless technology to develop various market driven applications. With our “Soft-switch”, we have developed a few unique applications with proprietary programming.

Other

than the US market, our strategy is to open up the burgeoning market place in

the People’s Republic of China (“PRC”). We will attempt to establish strategic

alliances in China and Hong Kong to explore business opportunities within those

regions. We will also seek opportunities to acquire existing business

engaged in the telecom industry and or other business in the

PRC.

Products and Services

Our products and services are designed for small and medium size businesses although many individuals have also chosen to use our products and services. We generate revenue from the sale of minutes to our customers. The following summarizes the current services provided by us, as well as our planned services:

|

●

|

Speed

Dial: The user can set all the numbers that he/she most frequently calls

for up to 99 extensions.

|

|

●

|

Global

Forwarding: The customer is assigned a dedicated personal local DID and or

800 number, customer logs online, access to our web site. Customer can

route their personal number to any phone number wherever customer is out

of the office and or is traveling overseas. Customers can re-route to any

phone number at anytime using a landline phone or via the Internet. This

way, customers will not miss any calls originated from their home base

while they are traveling. Customers will pickup phone calls anywhere from

their friends, relatives and business associates while they are

traveling.

|

|

●

|

Virtual

office: Customers with small to medium offices can use this service to

route calls to anywhere when they are out of the

office.

|

|

●

|

Promotional

Minute - Interactive Voice Prompt Promotional System: This is our unique

application. Business buys bulk minutes from us, and then issue

phone cards and or VIP card and give to their loyal customers for

free. Each phone card carries Apextalk’s personal and dedicated

phone number. Their customer calls each one’s personal number, then “Press

the number “2” to get access to long distance connection for free or up to

a preset limit of usage set by the business.

Once

customers get use to their personalized number, they do not need to look

for the business’ phone number. Instead, they just need to dial their own

personal phone number and then “Press the number 1,” which will route the

call to the business’ main switch. By using our system, business operators

can easily get repeat customers, since the business’ number is already

built into the customers’ memory. Businesses can update their voice

prompts to promote their current marketing and sales pitches when their

customers press “number 1”.

|

1

|

●

|

Media

Tracker: Media Tracker is a dynamic tool, designed to help business to

determine the most effective means of marketing products and

services. By providing a different phone number for each

advertising media, such as TV commercials, radio spots, newspapers and

even flyers. Media Tracker gives customers live call-counting on each

phone number. This information can be used to monitor the

effectiveness of each media in order to streamline business’ adverting

budget more effectively.

|

Among our

products and services, “Speed Dial” and “Global Forwarding” are well accepted in

the market and currently generate revenues. We plan to build and improve market

depth of these two services in the near future. “Wholesale Call Minutes” is

currently generating revenues and we do not have any further development plan

for this service. “Media Tracker,” “promotion Minute,” and “Vertical Office” are

finished with their developed stage and were launched on December 1, 2008.

To date, we are planning to utilize approximately $8,000 to launch our

“Media Tracker,” “Promotional Minute,” and “Virtual Office” services to the

general public.

Currently,

our primary source of business is international call termination services.

International call termination has a higher profit margin than that of domestic

call termination. We believe that our users will find our system easier to use

to make international calls than other systems since their most frequent call

numbers are stored in our system for speed dialing. Other

international long distance calling requires users to key in many digits in

order to make low cost international calls.

Providing

convenience to make international calls is the key element of our business plan,

including our Promotional Call Minute program. Therefore, international call

termination services are important for our future business

development.

Termination

to international is conducted through Apex Telecom, a significant shareholder of

the Company, which is using Quest, Level 3 and other telecom

providers. However, we are planning to use some other international

call termination services to other providers and possible other carriers for

other countries.

By

connecting with different providers that are strong on connecting to their

particular country or market, the sound quality will be more reliable and

enhance our customers’ satisfaction. For the year ended December 31,

2009, the majority of our revenue is coming from retail including international

and domestic connections. Speed Dial and Global Forwarding generated

$12,825. However, the “Promotional Minute” concept is more likely to

use domestic connection instead of international call termination services, as

the sponsors are located in the domestic market.

Market

Opportunity

As

international trade dramatically increases and even small companies are

attempting to create their global presence. The need for a user-friendly, low

costs global communication program will continue to be in substantial

demand.

United States

Market

U.S.

corporations are expanding their global presence. By using our services, they

will be able to increase their methods of communication with substantial

discounts, and most importantly, the ease of use and convenience to make

calls.

Our

Virtual Office system offers small and medium size companies who are using our

Virtual Office system in similar functions that the expensive PBX or Key systems

can offer without buying and installing the system. In addition, customers using

our Virtual Office system can use other features included in the system such as

Speed Dial and Global Forwarding without additional payments.

China / Hong Kong

Market

China and

Hong Kong are major target markets to develop our presence. Since most of our

officers and directors immigrated to U.S. from Hong Kong or mainland China in

the 1980s, they have friends and business acquaintances in Hong Kong and China

who are in the telecom business. We have conducted preliminary discussions with

some companies and individuals in the telecom business about our business model

and the possibility of establishing joint ventures. To develop our plan for

establishing a joint venture, we are looking for one or several local

value-added telecom operators in each city of China and Hong Kong to implement

our applications to their local market places. Our goal is to collect loyalty

fees from each joint venture. Due to our strong connection with the local

telecom operators in China and Hong Kong, we are planning to develop a joint

venture program with local VoIP operators to sell our products and services; we

shall develop a strong market presence over there.

2

We have

not signed any agreement with any overseas telecom operators to date. The local

partners and or joint venture parties will be value-added telecom providers in

that particular country. This overseas partnership is part of our

international business model. It expands our coverage to other countries to

offer our products and services. At the same time, we can support our US

customers when they travel overseas to a country where we have local partners,

and the local partners will be able to support them when they have communication

problems.

We would

like to offer our unique “Promotional Minute” applications to those partners

which we believe it will increase their sales. When they are planning to sell

our products and services, we will negotiate and collect loyalty fee when they

offer these products and services. We will setup an Apextalk

soft-switch at their local data center. The partners and or joint venture

parties will provide their own local DID numbers to their

customers. We intend to provide them the marketing concept and all

the sales material.

With the

Chinese government entering the World Trade Organization, we believe the

government will gradually reduce their control over the telecom industry over

time, which will substantially benefit our plan of accessing local market places

and establishing joint ventures with local value-added telecom operators. To

facilitate the implementation of this plan, we are re-packaging our services

into more convenient, more user-friendly applications to meet the needs of the

domestic markets of China and Hong Kong, Many other countries are taking a

similar path by losing their control over the telecom market, which will open us

to more development and expansion opportunities.

Other

Markets

We plan

to expand and implement our products and services to Philippines, Japan, Korea

and Africa with local VoIP operators.

Regulation

In

September 2001, the Chinese government entered the World Trade Organization

(“WTO”). Based on the WTO requirement, China will become a member of the

Basic Telecom Agreement which provides that China has to implement the

pro-competitive regulatory principles embodied in the WTO agreement. China has

to use a standard as other members are using, such as cost-base pricing,

interconnected rights and independent regulatory authority. The Chinese

government also agreed to technology-neutral scheduling, which means foreign

suppliers can use any technology they choose to provide telecommunications

services. Before entering the WTO, China did not allow foreign investment in

telecommunication services. Now, China will allow 49 percent foreign

ownership for value-added telecommunication services.

According

to the agreement, we believe that China will phase out all geographic

restrictions for paging and value-added services in 2003, mobile/cellular in

2006 and domestic wireline services in 2007. Although written in the

WTO agreement, the Chinese government appears to be reluctant to open this

market as agreed and will most likely gradually reduce their control over

time.

Competition

The

customers in the telecom business segment where we are competing are mostly

driven by price, quality and effectiveness of products and services are

considered less important than price. Our Virtual Office system offers small and

medium size companies similar functions than the expensive PBX or Key systems

can offer without buying and installing the system. In addition, customers using

our Virtual Office system can use other features included in the system such as

Speed Dial and Global Forwarding without paying additional fees.

Our

business model offers unique, convenient, easy to use and cost effective telecom

tools that meet the needs of our customers. Speed Dial, Global Forwarding,

Instant Call Log-Continuous Record Keeping, Promotional Minutes and Virtual

office are some of the unique features that our system offers to

customers.

Sales and

Marketing

We plan

to recruit sales teams in Hong Kong, China and US to introduce the Interactive

Voice Prompt Promotional System and our products and services on all of the

above mentioned markets. Initial target customers are hotels,

casinos, department stores. Then, we plan to market this program to smaller

local telecom stores to maximize the market penetration.

We plan

to setup a referral program that will give our existing customers a chance to

get free minutes and other incentive to refer their friends, relatives and

business associates to sign up our services.

Technology

Proprietary

& OEM Technologies

Apextalk

switch is a stand-alone PC-based PBX developed based on asterisk and Digium

network cards. Digium cards provide digital telephony interfaces supporting both

E1 and T1 environments that support PRI ISDN protocol families. Through the

Digium cards, the Apextalk switch is connected to the PSTN network through PRI

provided by different carrier.

3

Currently,

Apex Telecom, a minor shareholder who owns approximately 0.58% of our common

stock, provides phone service over broadband.

We order

Direct Inward Dialing (DID) numbers through Apex Telecom, which technically are

virtual telephone numbers acquired through Level 3, a major telecommunication

service provider. The DID numbers will be assigned to each individual

customer as their access number when they sign up for our services.

In

traditional telephone services, a telephone number is always tied to an end

device. For example, a telephone number always ties to a landline telephone or

cellular phone. In addition, a telephone numbers always ties to the end device

within a certain geographical area with an area code and country code. With the

latest technology, we are able to provide Virtual Telephone Numbers to overcome

the above limitation. For example, a New York company can order a San Francisco

telephone number while they do not have a physical presence in San Francisco.

Anyone can call this San Francisco number to reach the New York company without

paying long distance services.

DID is

not a regular telephone number provided by land line carriers. DID numbers need

to be connected to a soft-switch before it can connect to the other landline

telephone and/or wireless telephone.

Customers

are calling their own access numbers, and the calls will be inbound to the

Apextalk switch from the legacy PSTN network. The Apextalk switch will be

dialing the pre-programming numbers and terminated to the PSTN termination

partner.

We will

increase the network connectivity with other carriers when our customer base

increases. We do not currently have a contract with Level

3. We do not consider ourselves to be dependent upon our contract

with Apex Telecom because other services providers are readily

available.

The cost

break down will be:

|

·

|

Bandwidth

Fee $50 per month

|

|

·

|

Access

PRI is $350 per line per month

|

We are

currently paying fees of $0.60 per month per DID number, which is negotiable

with the carriers. The PRI or T1 costs $350 per month. We do not anticipate

these fees increasing over the next 12 months.

Our

“Soft-switch” is built around a flexible component-based architecture that

utilizes Linus, and Asterick PBX program; it consists of a set of discrete but

inter-operable modules that manage the complexity associated with secure content

delivery to multiple cellular networks and protocols that integrate with

multiple back-end applications/services.

The

applications and services are agnostic of the underlying network infrastructure

and will operate over GSM, CDMA, 3G networks concurrently and at

high-performance levels.

By combining the current VoIP technology and our proprietary rendering Engine, we developed the proprietary Voice Prompt & Content Management Gateway. The Rendering Engine optimizes the content presentation across devices and networks. It enables our “Soft-switch” to integrate new content with minimal programming effort.

Voice

Prompt, Content management and Systems Integration tools: The content

management and systems integration middleware engine provides a scalable and

reliable method for communicating between the web server and multiple back-end

systems and sources of information. The Voice Prompt will support our

Promotional Minute Program.

Rendering

Engine: The Rendering Engine allows our service to be compatible with

a multiple wireless devices. The advanced coding we have developed allows our

services to be accessible by most wireless networks around the world and also

allows us to add new technology as they are introduced to the market

place.

Next Generation Soft-switch Development

Next generation development –Cheuk Wong and Edward Seo are looking for capable programmers to further develop the Soft-switch with a more robust hardware and software to support custom-tailored features for specific customers and larger capacity of customer base.

Network Development

As

network speed,

reliability and performance has been improved over the years, the performance of

our network is improving, and when we open up other markets we will secure more

network connectivity with various backbone network providers.

We plan

to establish a Network Operation Centre (NOC) that allows interconnection and

network monitoring between different operators around the globe. As the Company

continues to grow, additional inbound PRI is required to provide adequate

capacity and redundancy. The existing price for each PRI, provided by APEX

Telecom, is $350 per month. Prices from other carriers average

$500.

4

At the

same time, the increase in customer base will require additional termination

partners to provide better quality product as well as redundancy. This will

result in additional deposit requirement; $10,000 is the average deposit

requirement for Tier-1 carrier.

When the

company begins to establish services in other country, we will be required to

establish a co-location in each country. The average cost to establish a

co-location averages a $10,000 non-recurring charge and $2,500 for monthly

recurring charge.

Web

Base Development

Customer

supports through web applications are important. These services will consist of

information caching, financial transaction processing and billing and smart

agent technologies.

|

●

|

Web

based Customer Service: Apextalk’s web site allows end users to manage

their personal calling functions and features

|

|

●

|

End-user

management modules

|

Intellectual Property

“Promotional

Minute” technology, is currently protected by U.S. Patents. U.S. Patents

pending number 12/371,454.

Material

Contracts

|

·

|

On

December 30, 2009, we entered into a stock purchase agreement with

Champion Investors (China) Ltd., a New York company, pursuant to which, we

agreed to sell and Champion Investors agreed to purchase a total of

1,666,668 shares of our newly issued common stock at a purchase price of

$2.40 per share equal to Four Million Dollars ($4,000,000) in the

aggregate in reliance upon Section 4(2) of the Securities

Act.

|

|

·

|

On

December 14, 2009, we entered into a stock purchase agreement (the

“Agreement”) with our then existing shareholders (the “Apextalk

Shareholders”), Apextalk, Inc., a California corporation and the wholly

owned subsidiary of Apextalk Holdings, Global Apex Holdings, Inc., a

Delaware corporation whose shareholders are identical to the Apextalk

Shareholders (“Global Apex Holdings”), Global Apex, Inc., a California

corporation and a wholly owned subsidiary of Global Apex Holdings (“Global

Apex”) and five individual purchasers set forth in the Agreement (the

“Purchasers”).

Pursuant

to the Agreement, the Apextalk Shareholders agreed to transfer to the

Purchasers an aggregate of 413,736 shares of our common stock (the

“Purchased Shares”), representing 90% of our issued and outstanding common

stock, at an aggregated purchase price of Three Hundred Thousand Dollars

($300,000) (the “Purchase Price”) in reliance upon the exemption from

securities registration provided by Section 4(2) of the Securities Act of

1933, as amended. Upon the final closing of the Stock Purchase, the

Purchasers shall aggregately hold 90% of our issued and outstanding common

stock. In addition, subject to the terms and condition of the Agreement,

we agreed to transfer 70% of our equity interest in Apextalk, Inc. to

Global Apex. We shall retain the remaining 30% equity interest in

Apextalk, Inc. As additional consideration, we agreed to grant Global Apex

Holdings the right to receive a cash payment in the amount of $30,000 for

each $1,000,000 invested into us of up to $4,000,000 in the aggregate from

outside investors. As of April 8, 2010, the transfer has not completed due

to the complications arising from operations and from net assets

transfer.

|

|

·

|

Since

July 1, 2008, Apex Telecom, a local telephone services provider in

California, provides access network to Apextalk. Apex Telecom provides

co-location space to Apextalk at a fixed monthly fee of $150 per month. In

additional, Apex Telecom is also providing us with access network which

includes $50 for 8 lines per month for internet access and PSTN

access.

|

Employees

As of April 8, 2010, we have three (3) full time employees.

ITEM

1A. RISK

FACTORS

Not applicable because we are a smaller reporting company.

5

ITEM 2. DESCRIPTION OF PROPERTY

Our business office is located at 637 Howard Street, San Francisco, CA 94105. Our telephone number is (415) 462-0901. As we are expanding our operation, we currently lease more space to meet our need and we are paying $2,000 per month for our principal office. Currently, the space at Apex Telecom for our servers is still sufficient and we are paying $200 per month for it; however, if we expand our business, we will have to lease a larger space.

ITEM 3. LEGAL PROCEEDINGS

To our knowledge, we are not presently parties to any litigation, nor to our knowledge and belief is any litigation threatened.

ITEM

4. (REMOVED AND

RESERVED)

None

PART

II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED

STOCKHOLDER MATTERS

No Public Market for Common Stock

Our

common stock has been listed on the Over-the-Counter Bulletin Board system under

the symbol “APXG” since November 12, 2009. We effectuated a

one-for-twenty reverse stock split on our issued and outstanding common stock on

November 12, 2009. Currently, there is no public trading market for our

common stock.

Holders

As of April 15, 2010, we had 52 shareholders of our common stock.

Stock Option

Grants

To date,

we have not granted any stock options.

Registration

Rights

We have

not granted registration rights to the selling shareholders or to any other

persons.

Penny Stock Considerations

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules.

Dividends

Since inception we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future. Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

ITEM 6. SELECTED FINNACIAL

DATA

Not

applicable because we are a smaller reporting company.

6

ITEM

7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

The

following discussion contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 relating to future events or our future

performance. Actual results may materially differ from those

projected in the forward-looking statements as a result of certain risks and

uncertainties set forth in this prospectus. Although management

believes that the assumptions made and expectations reflected in the

forward-looking statements are reasonable, there is no assurance that the

underlying assumptions will, in fact, prove to be correct or that actual results

will not be different from expectations expressed in this report.

Corporate History and Structure

We were incorporated in the State of Delaware as Apextalk, Inc. on November 7, 2007. On November 12, 2007, we changed our name to Apextalk Holdings, Inc. On November 16, 2007, we entered into a share exchange agreement (“Share Exchange Agreement”) with ApexTalk, Inc., a California corporation, pursuant to which, the ApexTalk, Inc. shareholders transferred to us all of the issued and outstanding capital stock of ApexTalk, Inc. in exchange for 180,000 of our newly issued common shares. As a result, Apextalk, Inc. became our wholly owned subsidiary.

On

November 18, 2007, we issued 89,619 common shares to TLMS International, Inc.

and 44,810 shares to Spencer Luo in exchange for an aggregate $111,038 in the

Company.

On

December 14, 2009, we entered into a Stock Purchase Agreement (the “Stock

Purchase Agreement”) with our then existing shareholders (the “Apextalk

Shareholders”), Apextalk, Inc., Global Apex Holdings, Inc., a Delaware

corporation whose shareholders are identical to the Apextalk Shareholders

(“Global Apex Holdings”), Global Apex, Inc., a California corporation and a

wholly owned subsidiary of Global Apex Holdings (“Global Apex”) and five

individual purchasers set forth in the Agreement (the

“Purchasers”). Pursuant to the Agreement, the Apextalk Shareholders

transferred to the Purchasers an aggregate of 413,736 shares of our common

shares, representing 90% of our then issued and outstanding common shares at the

purchase price of $300,000. In addition, in connection with the closing of the

Stock Purchase Agreement, we reached an understanding to assign and transfer our

Apextalk Inc’s technologies and in-turn owns 30% of Global Apex,

Inc. As additional consideration to the closing, we agreed to grant

Global Apex Holdings, Inc. the right to receive a cash payment in the amount of

$30,000 for each $1,000,000 investment from outside investors invested into the

Company, up to $4,000,000 in the aggregate. With the additional

capital, the Company is planning to expand its current operations beyond its

current segment by acquiring other profitable businesses as the Company deems

necessary from time to time, to continue to enhance and maximize the

shareholders’ value. As of April 8, 2010, the transfer has not completed due to

the complications arise from operations and of net assets

transfer.

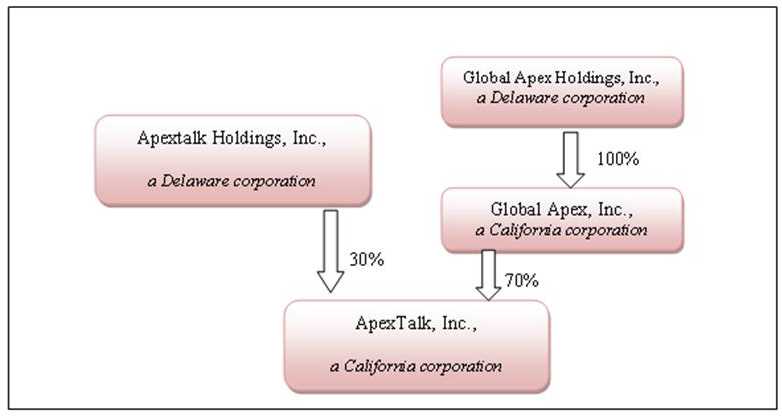

The

following chart depicts our current corporate structure:

Business

Overview

We have

integrated VoIP and wireless technology to develop various market driven

applications. With its “Soft-switch”, ApexTalk has developed a few unique

applications with proprietary programming. To date, these applications have only

been soft launched into the market by approaching our friends and business

associates to test our services as opposed to heavily promoting our services to

the public market.

7

ApexTalk

has developed the following products and services:

|

Speed

Dial – 99 extensions with personal access number

|

|

Global

Forwarding – 800 number or local phone number capable for forwarding to

any phone numbers around the globe, travelers’ ideal communication

tools

|

|

Virtual

Office – small to medium size office phone system with personalize

greeting and multiple extension capability

|

|

Promotional

Minute – interactive voice prompt system for business using this system to

generate and keep repeated customers

|

|

Media

tracker – identify which media generates most of the

sales

|

Business

Plan

The

following outlines our business plan for the next 12 months:

|

1.

|

We

are a growing and value added telecom service provider, and we intend to

partner with different local value-added service providers around the

globe. In addition to the US market, our strategy is to open up

the burgeoning market place in the People’s Republic of China

(“PRC”). We will continue to reach out to potential candidates

in the PRC, Hong Kong, and the Philippines to develop global business

opportunities. We may also engage in opportunities to acquire

viable businesses in the telecom and financial consultation service

industries in the PRC to support our emerging global

presence.

|

|

2.

|

We

will continue to attract subscribers to sign up with our services through

various marketing channels such as a referral program, online advertising,

out-door sales teams going after telecom retail outlets, and also start

developing the alliance and the joint venture program with overseas

value-added telecom operators. We expect the total cost of the

marketing to substantially increase from

2009.

|

|

3.

|

On

November 17, 2009, we entered the Stock Purchase Agreement, in which 5

individuals from the PRC agreed to purchase 90% of our current outstanding

shares from all of our shareholders for $300,000. In connection

with the closing of the Stock Purchase Agreement on December 14, 2009, our

original executive officers and directors resigned and new officers and

directors were appointed.

As

a result of the closing of the Stock Purchase Agreement, we not only

formed a management team with both operational and financing expertise but

also acquired additional funding for our development of hardware and

software application business and financial consultation services both in

the China and in the U.S.

With

this new management and additional funding, we intend to launch new

product lines and services related to the telecom industry for Chinese and

US markets. One of the new product lines could be hardware

development for VoIP calling, other services related to telecom

consultation services or financial consultation services.

We

entered an agreement with a Chinese company - Guangdong Yi An Investment

Consulting Co., Ltd. (Yi An) on December 16, 2009, regarding an

acquisition of 51% of Yi An’s issued and outstanding common stocks. The

agreement was contingent on receiving approval from the Chinese

government. The transaction was approved by the Chinese relevant

authorities in March, 2010. Currently, we are in the process of finalizing

the transaction.

|

8

Results of Operation for the

Years Ended December 31, 2009 and 2008

The

following table presents certain consolidated statement of operations

information for the year ended December 31, 2009 and 2008. The

discussion following the table is based on these results.

| For the year ended |

For

the year ended

|

||||||

| December 31, 2009 |

December

31, 2008

|

||||||

|

Revenue

|

$

|

19,841

|

$

|

56,806

|

|||

|

Cost

of services

|

35,879

|

58,016

|

|||||

|

Gross

profit

|

(16,038

|

)

|

(1,210

|

)

|

|||

|

Operating

Expenses:

|

|||||||

|

Payroll

expenses

|

56,640

|

17,820

|

|||||

|

Rent

and utilities

|

5,340

|

5,340

|

|||||

|

General

and administrative

|

42,277

|

48,455

|

|||||

|

Legal

and professional fees

|

83,026

|

66,686

|

|||||

|

Total

Operating Expenses

|

187,283

|

138,301

|

|||||

|

Loss

from Operations before Income Taxes

|

(203,321

|

)

|

(139,511

|

)

|

|||

|

Provision

for Income Tax

|

(7,950

|

)

|

(7,546

|

)

|

|||

|

Net

Loss

|

$

|

(211,271

|

)

|

$

|

(147,057

|

)

|

|

|

Loss

per Share – Basic and Diluted

|

$

|

(0.47

|

)

|

$

|

(0.34

|

)

|

|

|

Weighted

average number of common shares outstanding

during

the period - Basic and Diluted

|

450,344

|

434,114

|

|||||

Revenue: Our revenue was generated

by existing customers and signing up of new customers through our referral

program and from our services rendered to business associates, friends and

relatives of our officer and directors. For the year ended December

31, 2009, we generated $19,841 in revenue, representing a decrease of $36,965

compared to the revenue of $56,806 during the same period ended on December 31,

2008. The decrease of our revenue was due to in part with the

softness of economy and in part the sales outreach by the directors and officers

have reached saturated point in their respective local regions, therefore new

shareholders and investors are recruited to bring new life sign to the

Company.

Cost of Service:

Our cost of services include expenses related to the purchase of

wholesale minutes and communication usage fees. Our cost of services

were $35,879 for the year ended December 31, 2009, compared to $58,016 for the

same period ended December 31, 2008, representing a decrease of $22,137 or

38.16%. The decrease was primarily due to in the respective decrease in sales

revenue and certain cost cutting measures instituted by the

management.

General and

Administrative Expenses: General and administrative expenses include

depreciation, licenses, payroll taxes, advertising, consulting fees, travel and

entertainment expenses. Our general and administrative

expenses were $42,277 for the year ended December 31, 2009, compared to

$48,455 in the same period ended December 31, 2008, representing an decrease of

$6,178 which caused by travel and related expenditures. The legal and

professional fees were $83,026 for the current period and $66,686 for the period

ended a year earlier. The increase was primarily attributable to the

ongoing activities related to sales of shares and transactions to five new

shareholders.

Liquidity

and Capital Resources

As of

December 31, 2009, we had $21,710 in cash, compared to $49,430 as of December

31, 2008. This decrease in cash was primarily due to

net cash used in operating activities of $118,465, and net cash proceeds of

$60,664 from the issuance of common stock between the first quarter and the

third quarter of 2009, and the $30,716 in shareholders loan from proceeds of the

sale of 90% of their common stock to the five new

shareholders.

Because

of the two million dollars new investment received in early 2010, the Company

believe that we have sufficient funding to satisfy our cash requirements for the

next twelve months.

In the

next 12 months, we believe we will require substantial capital injection

and financing to fully implement our business model in the telecommunication

section, as well as develop new line of business such as financial

consultation services. We expect the capital injection and financing

to be in the form of a private placement of equity or debt and should be from $3

million to $5 million. We intend to seek advice from investment

professionals and the 5 investors from the PRC on how to raise additional

capital and obtain financing.

Going

Concern

As

reflected in the accompanying financial statements, the Company had a net loss

of $211,271, a working capital deficiency of $108,025, used $118,465 in cash

flows from operations during 2009, and had an accumulated deficit of $415,955 at

December 31, 2009. This normally would raises substantial doubt about

its ability to continue as a going concern. The ability of the

Company to continue as a going concern is dependent on the Company’s ability to

raise additional capital and implement its business

plan. Nevertheless, with the confirmation of the additional capital

received in early 2010, the Company believes the financial statements do not

need to include any adjustments that might be necessary if the Company is unable

to continue as a going concern.

9

Off-Balance

Sheet Arrangements

We have

never entered into any off-balance sheet financing arrangements and have never

established any special purpose entities. We have not guaranteed any

debt or commitments of other entities or entered into any options on

non-financial assets.

Critical

Accounting Policies

The

discussion and analysis of our financial condition and results of operations are

based upon our consolidated financial statements, which have been prepared in

accordance with accounting principles generally accepted in the United States.

The preparation of these consolidated financial statements requires us to make

estimates and judgments that affect the reported amounts of assets, liabilities,

revenues and expenses, and related disclosure of contingent assets and

liabilities. On an on-going basis, we evaluate our estimates based on historical

experience and on various other assumptions that are believed to be reasonable

under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities that are not

readily apparent from other sources. Actual results may differ from these

estimates under different assumptions or conditions.

A summary

of significant accounting policies is included in Note 2 to the consolidated

financial statements included in this annual report. Management

believes that the application of these policies on a consistent basis enables us

to provide useful and reliable financial information about our Company's

operating results and financial condition.

Recent

Accounting Pronouncements

In May

2009, the FASB issued FASB Accounting Standards Codification No. 855, Subsequent

Events. FASB Accounting Standards Codification No. 855

establishes general standards of accounting for and disclosure of events that

occur after the balance sheet date but before financial statements are issued or

are available to be issued. FASB Accounting Standards Codification

No. 855 sets forth (1) the period after the balance sheet date during which

management of a reporting entity should evaluate events or transactions that may

occur for potential recognition or disclosure in the financial statements, (2)

the circumstances under which an entity should recognize events or transactions

occurring after the balance sheet date in its financial statements and (3) the

disclosures that an entity should make about events or transactions that

occurred after the balance sheet date. FASB Accounting Standards

Codification No. 855 is effective for interim or annual financial periods ending

after September 15, 2009. The adoption of this FASB Accounting Standards

Codification No. 855 did not have a material effect on the Company’s financial

statements.

In June

2009, the FASB issued FASB Accounting Standards Codification No. 860, Transfers and

Servicing. FASB Accounting Standards Codification No. 860

improves the relevance, representational faithfulness, and comparability of the

information that a reporting entity provides in its financial statements about a

transfer of financial assets; the effects of a transfer on its financial

position, financial performance, and cash flows; and a transferor’s continuing

involvement, if any, in transferred financial assets. FASB Accounting

Standards Codification No. 860 is effective as of the beginning of each

reporting entity’s first annual reporting period that begins after November 15,

2009, for interim periods within that first annual reporting period and for

interim and annual reporting periods thereafter. The Company is

evaluating the impact the adoption that FASB Accounting Standards Codification

No. 860 will have on its financial statements.

In June

2009, the FASB issued FASB Accounting Standards Codification No. 810, Consolidation. FASB

Accounting Standards Codification No. 810 improves financial reporting by

enterprises involved with variable interest entities. FASB Accounting Standards

Codification No. 810 is effective as of the beginning of each reporting entity’s

first annual reporting period that begins after November 15, 2009, for interim

periods within that first annual reporting period, and for interim and annual

reporting periods thereafter. The Company is evaluating the impact

the adoption of FASB Accounting Standards Codification No. 810 will have on its

financial statements.

10

In June

2009, the FASB issued FASB Accounting Standards Codification No. 105, Generally Accepted Accounting

Principles. The FASB Accounting Standards Codification

(“Codification”) will be the single source of authoritative nongovernmental U.S.

generally accepted accounting principles. Rules and interpretive

releases of the SEC under authority of federal securities laws are also sources

of authoritative GAAP for SEC registrants. FASB Accounting Standards

Codification No. 105 is effective for interim and annual periods ending after

September 15, 2009. All existing accounting standards are superseded

as described in FASB Accounting Standards Codification No. 105. All

other accounting literature not included in the Codification is

nonauthoritative. The Codification is effective for us in the third

quarter of 2009. The adoption of this guidance only affected how

specific references to GAAP literature have been disclosed in the notes to the

Company's financial statements; it did not result in any impact on the Company's

results of operations, financial condition, or cash flows.

In

February 2010, the FASB issued update No. 2010-09 -- Subsequent Events (Topic 855):

Amendments to Certain Recognition and Disclosure Requirements. The

amendments remove the requirement for an SEC filer to disclose a date in both

issued and revised financial statements. The amendment is effective

for interim or annual periods ending after June 15, 2010.

ITEM

7A. QUANTITATIVE AND

QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not

applicable because we are a smaller reporting company.

11

ITEM 8. FINANCIAL STATEMENTS

Our

financial statements, together with the report of our independent auditors, are

as follows:

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

|

CONTENTS

|

||

|

PAGE

|

F1

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

PAGE

|

F2

|

CONSOLIDATED

BALANCE SHEETS AS OF DECEMBER 31, 2009 AND 2008

|

|

PAGE

|

F3

|

CONSOLIDATED

STATEMENTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2009 AND

2008

|

|

PAGE

|

F4

|

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIENCY) FOR THE YEARS ENDED

DECEMBER 31, 2009 AND 2008

|

|

PAGE

|

F5

|

CONSOLIDATED

STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2009 AND

2008

|

|

PAGES

|

F6

- F12

|

NOTES

TO CONSOLIDATED FINANCIAL

STATEMENTS

|

F

REPORT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Directors of:

Apextalk

Holdings, Inc.

We have

audited the accompanying consolidated balance sheets of Apextalk Holdings, Inc.

and Subsidiary as of December 31, 2009 and 2008, and the related statements of

operations, changes in stockholders’ equity (deficiency) and cash flows for the

years then ended. These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an

opinion on these financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require

that we plan and perform the audits to obtain reasonable assurance about whether

the financial statements are free of material misstatement. An audit

includes examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis

for our opinion.

In our

opinion, the financial statements referred to above present fairly in all

material respects, the financial position of Apextalk Holdings, Inc. and

Subsidiary as of December 31, 2009 and 2008 and the results of its operations

and its cash flows for the years then ended in conformity with accounting

principles generally accepted in the United States of America.

The

accompanying financial statements have been prepared assuming that the Company

will continue as a going concern. As discussed in Note 8 to the financial

statements, the Company has a net loss of $211,271, and used cash from

operations of $118,465 during the year ended December 31, 2009, and had an

accumulated deficit of $415,955 at December 31, 2009. These factors raise

substantial doubt about the Company's ability to continue as a going concern.

Management's plans concerning these matters are also described in Note 8. The

financial statements do not include any adjustments that might result from the

outcome of this uncertainty.

WEBB

& COMPANY, P.A.

Certified

Public Accountants

Boynton

Beach, Florida

April 7,

2010

F-1

|

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

|

||||||||

|

CONSOLIDATED

BALANCE SHEETS

|

||||||||

|

AS

OF DECEMBER 31, 2009 AND 2008

|

||||||||

|

December

31, 2009

|

December

31, 2008

|

|||||||

|

ASSETS

|

||||||||

|

Current

Assets

|

|

|||||||

|

Cash

and cash equivalents

|

$ | 21,710 | $ | 49,430 | ||||

|

Accounts

receivable, net

|

3,085 | 9,201 | ||||||

|

Other

receivables, net

|

1,871 | 1,871 | ||||||

|

Inventory,

net

|

- | 1,840 | ||||||

|

Deposit

|

- | 11,000 | ||||||

|

Total

Currents Assets

|

26,666 | 73,342 | ||||||

|

Property

and Equipment, net

|

41,943 | 54,252 | ||||||

|

Patent

|

8,969 | 8,969 | ||||||

|

Total

Assets

|

$ | 77,578 | $ | 136,563 | ||||

|

LIABILITIES AND STOCKHOLDERS'

DEFICIT

|

||||||||

|

Current

Liabilities

|

||||||||

|

Accounts

payable

|

$ | 30,165 | $ | 40,266 | ||||

|

Accrued

expenses

|

61,093 | 40,747 | ||||||

|

Unearned

revenue

|

11,717 | 11,036 | ||||||

|

Shareholders'

loan

|

31,716 | 1,000 | ||||||

|

Total

Current Liabilities

|

134,691 | 93,049 | ||||||

|

Total

Liabilities

|

134,691 | 93,049 | ||||||

|

Stockholders'

Equity

|

||||||||

|

Common

stock, authorized 1,000,000,000 shares,

par

value $0.001, 459,706 shares and 434,429 shares

issued

and outstanding on December 31, 2009 and 2008,

respectively

|

459 | 434 | ||||||

|

Additional

paid-in-capital

|

358,383 | 247,764 | ||||||

|

Accumulated

deficit

|

(415,955 | ) | (204,684 | ) | ||||

|

Total

Stockholders' Equity (Deficiency)

|

(57,113 | ) | 43,514 | |||||

|

Total

Liabilities and Stockholders' Equity (Deficiency)

|

$ | 77,578 | $ | 136,563 | ||||

See

accompanying notes to consolidated financial statements

F-2

|

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

|

||||||||

|

CONSOLIDATED

STATEMENTS OF OPERATIONS

|

||||||||

|

FOR

THE YEARS ENDED DECEMBER 31, 2009 AND 2008

|

||||||||

|

|

||||||||

|

2009

|

2008

|

|||||||

|

|

|

|||||||

|

Revenue

|

$ | 19,841 | $ | 56,806 | ||||

|

Cost

of Services

|

35,879 | 58,016 | ||||||

|

Gross

profit

|

(16,038 | ) | (1,210 | ) | ||||

|

Operating

Expenses

|

||||||||

|

Payroll

expenses

|

56,640 | 17,820 | ||||||

|

Rent

and utilities

|

5,340 | 5,340 | ||||||

|

General

and administrative

|

42,277 | 48,455 | ||||||

|

Legal

and professional fees

|

83,026 | 66,686 | ||||||

|

Total

Operating Expenses

|

(187,283 | ) | (138,301 | ) | ||||

|

Loss

from Operations before Income Taxes

|

(203,321 | ) | (139,511 | ) | ||||

|

Provision

for Income Taxes

|

(7,950 | ) | (7,546 | ) | ||||

|

Net

Loss

|

$ | (211,271 | ) | $ | (147,057 | ) | ||

|

Loss

per Share - Basis and Diluted

|

$ | (0.47 | ) | $ | (0.34 | ) | ||

|

Weighted

average number of common shares outstanding

|

||||||||

|

during

the period - Basis and Diluted

|

450,344 | 434,115 | ||||||

See

accompanying notes to consolidated financial statements

F-3

|

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

|

||||||||||||||||||||||||

|

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS' EQUITY / (DEFICIENCY)

|

||||||||||||||||||||||||

|

FOR

THE YEARS ENDED DECEMBER 31, 2009 AND 2008

|

||||||||||||||||||||||||

|

Common

Stock

|

Paid

in

|

Subscriptions

|

Accumulated

|

Total

Equity

|

||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Receivable

|

Deficit

|

(Deficiency)

|

|||||||||||||||||||

|

Balance,

December 31, 2007

|

432,241 | $ | 432 | $ | 233,106 | $ | (85,538 | ) | $ | (57,627 | ) | $ | 90,373 | |||||||||||

|

Amount

received against the subscription receivable

|

- | - | - | 85,538 | - | 85,538 | ||||||||||||||||||

|

Common

stock issued for cash

|

2,188 | 2 | 3,498 | - | - | 3,500 | ||||||||||||||||||

|

In

kind contribution for services

|

- | - | 11,160 | - | - | 11,160 | ||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (147,057 | ) | (147,057 | ) | ||||||||||||||||

|

Balance,

December 31, 2008

|

434,429 | 434 | 247,764 | - | (204,684 | ) | 43,514 | |||||||||||||||||

|

Common

stock issued for cash

|

25,277 | 25 | 60,639 | - | - | 60,664 | ||||||||||||||||||

|

In

kind contribution for services

|

- | - | 49,980 | - | - | 49,980 | ||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (211,271 | ) | (211,271 | ) | ||||||||||||||||

|

Balance,

December 31, 2009

|

459,706 | $ | 459 | $ | 358,383 | $ | - | $ | (415,955 | ) | $ | (57,113 | ) | |||||||||||

See

accompanying notes to consolidated financial statements

F-4

|

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

|

||||||||

|

CONSOLIADTED

STATEMENTS OF CASH FLOWS

|

||||||||

|

FOR

THE YEARS ENDED DECEMBER 31, 2009 AND 2008

|

||||||||

|

|

|

|||||||

|

|

|

|||||||

|

2009

|

2008

|

|||||||

|

Cash

Flows from Operating Activities

|

||||||||

|

Net

loss

|

$ | (211,271 | ) | $ | (147,057 | ) | ||

|

Adjustment

to reconcile net loss to net cash provided by used in operating

activities:

|

||||||||

|

Depreciation

and amortization

|

12,944 | 7,872 | ||||||

|

Provision

for doubtful accounts

|

339 | 2,084 | ||||||

|

In

kind contribution of services

|

49,980 | 11,160 | ||||||

|

Change

in operating assets and liabilities:

|

||||||||

|

(Increase)

decrease in accounts receivable

|

5,777 | (10,223 | ) | |||||

|

(Increase)

decrease in accounts receivable, other

|

- | (1,871 | ) | |||||

|

(Increase)

decrease in inventories

|

1,840 | - | ||||||

|

Increase

(decrease) in unearned revenue

|

681 | 737 | ||||||

|

(Increase)

decrease in deposit

|

11,000 | (11,000 | ) | |||||

|

(Increase)

decrease in patents

|

- | (8,969 | ) | |||||

|

Increase

(decrease) in accounts payable

|

(10,101 | ) | 21,117 | |||||

|

Increase

(decrease) in accrued expenses

|

20,346 | 17,102 | ||||||

|

Net

Cash Used in Operating Activities

|

(118,465 | ) | (119,048 | ) | ||||

|

Cash

Flows from Investing Activities

|

||||||||

|

Equipment:

Software

|

(635 | ) | (57,765 | ) | ||||

|

Net

Cash Used In Investing Activities

|

(635 | ) | (57,765 | ) | ||||

|

Cash

Flows from Financing Activities:

|

||||||||

|

Proceeds

from issuance of common stock

|

60,664 | 89,038 | ||||||

|

Repayment

of stockholder loan

|

- | (1,840 | ) | |||||

|

Proceeds

from stockholder loan

|

30,716 | - | ||||||

|

Net

Cash Provided by Financing Activities

|

91,380 | 87,198 | ||||||

|

Net

Increase/ (Decrease) in Cash

|

(27,720 | ) | (89,615 | ) | ||||

|

Cash,

Beginning of Period

|

49,430 | 139,045 | ||||||

|

Cash,

Ending of Period

|

$ | 21,710 | $ | 49,430 | ||||

|

Interest

Paid

|

$ | - | $ | - | ||||

|

Income

Taxes paid

|

$ | 6,475 | $ | 2,671 | ||||

See

accompanying notes to consolidated financial statements

F-5

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2009 AND 2008

NOTE

1.

SUMMARY OF ORGANIZATION

Apextalk,

Inc. was incorporated on November 7, 2007 under the laws of the state of

Delaware. On November 12, 2007, Apextalk, Inc. changed its name to Apextalk

Holdings, Inc. The company, located in San Francisco, California, is a holding

company whose subsidiary provides various telecom services.

Apextalk

Inc. was incorporated on June 8, 2004 under the laws of the state of California.

The company has integrated VoIP and wireless technology to develop various

market driven applications.

Apextalk

Holdings, Inc. completed the acquisition of Apextalk Inc. on November 16, 2007

where Apextalk Holdings, Inc. purchased all of the outstanding shares of

Apextalk Inc. The transaction was accounted for as a combination of entities

under common control and accordingly, recorded the merger at historical cost.

Accordingly, all shares and per share amounts have been retroactively

restated.

Apextalk

Holdings, Inc. and its wholly owned subsidiary Apextalk Inc. are hereafter

referred to as (the “Company”).

NOTE 2. SUMMARY OF

SIGNIFICANT ACCOUNTING POLICIES

Basis of

Presentation

The

accompanying consolidated financial statements a have been prepared by in

accordance with accounting principles general accepted in the United States of

America and the rules and regulations of the Securities and Exchange

Commission (“SEC”). Amounts presented in the accompanying financial

statements are expressed in U.S. dollars.

Cash

and Cash Equivalents

The

Company considers cash on hand and amounts on deposit with financial

institutions, which have original maturities of three months or less to be cash

and cash equivalents.

Earnings

(Loss) per Share

Basic and

diluted net loss per common share is computed based upon the weighted average

common shares outstanding Financial Accounting Standards Board (FASB) Accounting

Standards Codification No. 260, Earnings Per

Share. As of December 31, 2009 and 2008, there were no diluted

shares outstanding.

|

Income

Taxes

|

The

Company accounts for income taxes under FASB Accounting Standards Codification

No. 740, Income Taxes. Under FASB Accounting Standards Codification

No. 740, deferred tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statements

carrying amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. Under

FASB Accounting Standards Codification No. 740, the effect on deferred tax

assets and liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date.

Use

of Estimates

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenue and expenses during

the reporting period. Actual results could differ from those

estimates.

F-6

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2009 AND 2008

Business

Segments

The

Company operates in one segment and therefore segment information is not

presented.

Revenue

and Cost Recognition

The

Company recognizes revenue on arrangements in accordance with FASB Accounting

Standards Codification No. 605, Revenue Recognition. Revenue

is recognized when amounts are earned and when the amount and timing of the

revenue can be reasonably estimated. Expenses are recognized when they occurred

and matched against revenue, as a component of costs of services in the

statement of operations in accordance with FASB Accounting Standards

Codification No. 605, Revenue

Recognition. Revenues from internet communication services are recognized

in the period such services are used by the end user.

Allowance

for Doubtful Accounts

The

Company maintains an allowance for doubtful accounts for estimated losses

resulting from the inability of its customers to make required payments. The

Company evaluates the trends in customers’ payment patterns, including review of

specific delinquent accounts, changes in business conditions and external

communications available about customers to estimate the level of allowance that

is needed to address potential losses that the Company may incur due to the

customer’s inability to pay. Accounts are considered delinquent or

past due, if they have not been paid within the terms provided on the invoice.

Delinquent account balances are written off after management has determined that

the likelihood of collection is not probable. As of December 31, 2009 and 2008,

the Company has recorded an allowance for doubtful accounts in the amounts of

$2,423 and $2,084, respectively.

Inventory

Inventories

are valued at the lower of cost or market. Cost is determined using

the first-in, first-out (FIFO) method. As of December 31, 2009 and

2008, purchased finished goods inventory was $-0- and $1,840,

respectively. Provision for potentially obsolete or slow moving

inventory is made based on management’s analysis of inventory levels and future

sales forecasts.

Consolidation

The books

and records of the parent company Apextalk Holdings, Inc. have been consolidated

with the records of the wholly owned subsidiaries – Apextalk Inc. as of December

31, 2009 and 2008. All of the material inter-company transactions have been

eliminated.

Reclassification

Certain

amounts from the prior year financial statements have been reclassified to

conform to the current year presentation. These reclassifications had

no effect on the Company's consolidated net loss or stockholders'

deficit.

|

Property

and Equipment

|

Property

and equipment are stated at cost and are depreciated using 150% the

double-declining balance method over their estimated useful lives, which differ

by asset category:

•

Furniture & fixtures: 7 years

•

Equipment: 5-7 years

•

Software: 5 years

•

Leasehold improvements: 15 years

F-7

APEXTALK

HOLDINGS, INC. AND SUBSIDIARY

NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2009 AND 2008

The

residual value of property and equipment is estimated to be equal to 10% of the

original cost. Upon disposal, the assets and related accumulated

depreciation are removed from the Company’s accounts, and the resulting gains or

losses are reflected in the statements of operations.

Intangible

Assets

Intangible

assets are stated at cost and are amortized using straight-line method over

their estimated useful lives. Patent fees paid is not amortized until

approved.

Impairment

of Long-lived Assets

The

Company evaluates the recoverability of its long-lived assets, including

goodwill, on an annual basis or more frequently if indicators of potential

impairment arise. Following the criteria of FASB Accounting Standards

Codification No. 350, Intangibles-Goodwill &

Other, the Company evaluates the recoverability of its amortizable

purchased intangible assets based on an estimate of the undiscounted cash flows

resulting from the use of the related asset group and its eventual disposition.

The asset group represents the lowest level for which cash flows are largely

independent of cash flows of other assets and liabilities. Measurement of an

impairment loss for long-lived assets that the Company expects to hold and use

is based on the difference between the fair value and carrying value of the

asset. Long-lived assets to be disposed of are reported at the lower of carrying

amount or fair value less costs to sell.

|

NOTE 3.

|

RECENT

ACCOUNTING PRONOUNCEMENTS

|

In May