Attached files

| file | filename |

|---|---|

| EX-31.2 - BEKEM METALS INC | ex312k123109.htm |

| EX-31.1 - BEKEM METALS INC | ex311k123109.htm |

| EX-32.2 - BEKEM METALS INC | ex322k123109.htm |

| EX-32.1 - BEKEM METALS INC | ex321k123109.htm |

| EX-21.1 - BEKEM METALS INC | ex211k123109.htm |

| EX-10.25 - BEKEM METALS INC | ex1025k123109.htm |

| EX-10.26 - BEKEM METALS INC | ex1026k123109.htm |

| EX-10.30 - BEKEM METALS INC | ex1030k123109.htm |

| EX-10.27 - BEKEM METALS INC | ex1027k123109.htm |

| EX-1.28 - BEKEM METALS INC | ex1028k123109.htm |

|

UNITED

STATES

|

||||||||||||||||||||||||||||||||

|

SECURITIES

AND EXCHANGE COMMISSION

|

||||||||||||||||||||||||||||||||

|

Washington,

D.C. 20549

|

||||||||||||||||||||||||||||||||

|

FORM

10-K

|

||||||||||||||||||||||||||||||||

|

[X]

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|||||||||||||||||||||||||||||||

|

SECURITIES

EXCHANGE ACT OF 1934

|

||||||||||||||||||||||||||||||||

|

For

the fiscal year ended:

|

December

31, 2009

|

|||||||||||||||||||||||||||||||

|

OR

|

||||||||||||||||||||||||||||||||

|

[ ]

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|||||||||||||||||||||||||||||||

|

SECURITIES

EXCHANGE ACT OF 1934

|

||||||||||||||||||||||||||||||||

|

For

the transition period from:

|

to

|

|||||||||||||||||||||||||||||||

| Commission File Number 0-50218 | ||||||||||||||||||||||||||||||||

|

BEKEM

METALS, INC.

|

||||||||||||||||||||||||||||||||

|

(Exact

name of registrant as specified in its charter)

|

||||||||||||||||||||||||||||||||

|

Utah

|

87-0669131

|

|||||||||||||||||||||||||||||||

|

(State

or other jurisdiction of incorporation of organization)

|

(I.R.S.

Employer I.D. No.)

|

|||||||||||||||||||||||||||||||

|

149

Kyz Zhibek Street, Office 11

|

050020

|

|||||||||||||||||||||||||||||||

|

Almaty,

Kazakhstan

|

(Zip

Code)

|

|||||||||||||||||||||||||||||||

|

(Address

of principal executive offices)

|

||||||||||||||||||||||||||||||||

|

Registrant’s

telephone number including area code:

|

+7

7272 279405

|

|||||||||||||||||||||||||||||||

|

Securities

registered pursuant to Section 12(b) of the Act:

|

None

|

|||||||||||||||||||||||||||||||

|

Securities

registered pursuant to Section 12(g) of the Act:

|

||||||||||||||||||||||||||||||||

|

$.001

par value, common voting shares

|

||||||||||||||||||||||||||||||||

|

(Title

of class)

|

||||||||||||||||||||||||||||||||

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of

the Securities Act.

|

Yes o

No x

|

|

Indicate

by check mark if the registrant is not required to file reports pursuant

to Section 13 or 15(d)

of the Exchange Act.

|

Yes

o

No x

|

|

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the past 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such

filing requirements for the past 90

days.

|

Yes

x

No o

|

|

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form

10-K.

|

o

|

|

Indicate

by check mark whether the registrant is a large accelerated filed, an

accelerated filer, a non-accelerated filer or a smaller reporting company.

See the definitions of “large accelerated

filer,” “accelerated filer” and

“smaller reporting

company” in Rule 12b-2 of the Exchange

Act.

|

|

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o

|

Smaller

reporting company x

|

|

(Do

not check if smaller reporting company)

|

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act.

|

Yes o

No x

|

|

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the

common equity was last sold, or the average bid and asked price of such common equity as of June 30, 2009 was approximately $1,381,300. |

|

|

As

of March 31, 2010 the issuer had 125,172,011 shares of its $.001 par value

common stock outstanding.

|

|

|

Documents

incorporated by

reference: None

|

|

Table

of Contents

|

Page

|

||

|

PART

I

|

||

|

Item

1.

|

Business

|

4

|

|

Item

1A.

|

Risk

Factors

|

9

|

|

Item

1B.

|

Unresolved

Staff Comments

|

13

|

|

Item

2.

|

Properties

|

14

|

|

Item 3.

|

Legal Proceedings

|

18

|

|

Item 4.

|

Reserved

|

18

|

|

PART II

|

||

|

Item 5.

|

Market

for Registrant's Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

19

|

|

Item 6.

|

Selected Financial Data

|

20

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

|

20

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market

Risk

|

27

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

28

|

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 28 |

|

Item 9A(T).

|

Controls and Procedures

|

28

|

|

Item 9B.

|

Other Information

|

30

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate

Governance

|

30

|

|

Item 11.

|

Executive Compensation

|

37

|

|

Item 12.

|

Security

Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

46

|

|

Item 13.

|

Certain

Relationships and Related Transactions and

Director Independence

|

49

|

|

Item 14.

|

Principal Accounting Fees and Services

|

50

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

51

|

|

SIGNATURES

|

54

|

2

Information

Concerning Forward-Looking Statements

This

annual report on Form 10-K contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E

of the Securities Act of 1934, as amended, that are based on our management’s

beliefs and assumptions and on information currently available to our

management. For this purpose any statement contained in this annual

report that is not a statement of historical fact may be deemed to be

forward-looking, including statements about our revenue, spending, cash flow,

products, actions, intentions, plans, strategies and

objectives. Without limiting the foregoing, words such as “may,” “hope,” “will,” “expect,” “believe,” “anticipate,” “estimate” “projected” or “continue” or comparable

terminology are intended to identify forward-looking

statements. These statements by their nature involve substantial

risks and uncertainty, and actual results may differ materially depending on a

variety of factors, many of which are not within our control. These factors

include but are not limited to those relating to our plan of operations

including our ability to raise funds, construct a processing plant and put our

property into commercial production; economic conditions generally and in the

industry in which we and our customers participate; future commodity prices;

competition within our industry, including competition from much larger

competitors; future exploration; legislative requirements and changes and the

effect of such on our business; results of operations; sufficiency of future

working capital, borrowings and capital resources and liquidity and our ability

to generate future cash flow and our ability to continue to meet the

requirements of and maintain our rights to our properties.

Forward-looking statements are

predictions and not guarantees of future performance or events. The

forward-looking statements are based on current industry, financial and economic

information, which we have assessed but which by its nature is dynamic and

subject to rapid and possibly abrupt changes. Our actual results

could differ materially from those stated or implied by such forward-looking

statements due to risks and uncertainties associated with our

business. We hereby qualify all our forward-looking statements by

these cautionary statements. We undertake no obligation to amend this report or

revise publicly these forward looking statements (other than pursuant to

reporting obligations imposed on registrants pursuant to the Securities Exchange

Act of 1934) to reflect subsequent events or circumstances.

The following discussion should be read

in conjunction with our financial statements and the related notes contained

elsewhere in this report and in out our other filings with the Securities and

Exchange Commission.

Throughout

this report, unless otherwise indicated by the context, references herein to the

“Company”, “BMI”, “we”, our” or “us” means Bekem Metals, Inc, a Utah

corporation, and its corporate subsidiaries and predecessors.

3

Item

1. Business

Company History

We

incorporated in the state of Utah under the name EMPS Research Corporation on

January 30, 2001. Until the end of the 2004 fiscal year, our primary

business focus was the development, marketing and licensing of our patented

technology for use in commercially separating nonmagnetic particulate material

by building and testing a high frequency eddy-current separator

(“HFECS”).

We

changed our name to Bekem Metals, Inc., on March 16, 2005 following our

acquisition of Condesa Pacific, S.A., a British Virgin Islands international

business company (“Condesa”), and its wholly owned subsidiary Kaznickel, LLP in

January 2005. On July 24, 2006 Condesa transferred its interest in

Kaznickel to Bekem, making Kaznickel a wholly-owned subsidiary of

Bekem. On October 1, 2006 Bekem sold Condesa to a third party for

nominal value. With the acquisition of Kaznickel, our primary business focus

shifted from the development of our HFECS technology to exploring for nickel and

cobalt in Kazakhstan because the primary asset of Kaznickel was an exploration

and production concession which granted Kaznickel the exclusive right to explore

for nickel, cobalt and other minerals in northeastern Kazakhstan known as the

Gornostayevskoye (“Gornostai”) deposit. Declining metal prices and the

increasing difficulties in obtaining financing due to the global economic and

credit crisis forced us to sell our interest in Kaznickel during

2009. In November 2009 we completed the sale of our interest in

Kaznickel to a third party for approximately $1,867 and for repayment of

$5,000,000 worth of loans owed to Bekem by Kaznickel.

4

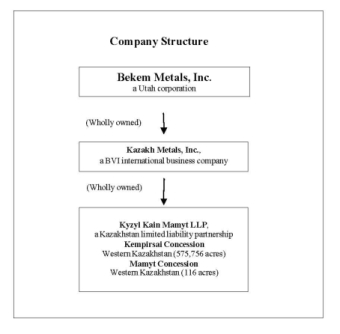

On

October 24, 2005, we acquired Kazakh Metals, Inc. (“KMI”), and its wholly owned

subsidiary Kyzyl Kain Mamyt LLP (“KKM”), in exchange for 61,200,000 shares of

our common stock. Under applicable accounting reporting rules, KMI

was considered the accounting acquirer.

KKM holds

the exclusive subsoil use contract to extract and process nickel and cobalt ore

from the Kempirsai deposit, which is comprised of the Kara-Obinskoye, and

Stepninskoye sections (collectively referred to as the “Kara-Obinskoye section”)

and Novo-Shandashinskoye section, and brown coal from its Mamyt

deposit. Unless

otherwise indicated by the context of the disclosure, the Kara-Obinskoye and the

Novo-Shandashinskoye sections are collectively referred to herein as the

“Kempirsai deposit.”

Business of the Company

Since

acquiring Condesa and KMI in 2005 our primary business focus has been the

exploration and development of the Kempirsai and, until November, 2009, the

Gornostai deposits. To date, we have mined and sold very little ore

from the Kempirsai deposit and none from the Gornostai deposit. We

have no proven mineral reserves that conform to the standards established by the

United States Securities and Exchange Commission (“SEC”). We have not

entered the development stage at any of our deposits, have no current production

and have very little ability to generate revenue. Since inception, we

have been completely reliant upon equity financing and loans to fund our

operations and have incurred an accumulated deficit of $30,229,302 through

December 31, 2009. At December 31, 2009 our current liabilities

exceeded current assets by $974,506. At December 31, 2009 we had cash

on hand of $534,619. We anticipate that cash on hand will be

sufficient to meet our general and administrative expenses until approximately

June 1, 2010. As discussed in Note 1 to our Consolidated Financial

Statements, our limited operating history, being at the exploration stage with

respect to our mineral interests and having not started production, declines in

nickel prices, and dependence upon debt or equity infusions to meet our work

program requirements under our government mineral licenses, combined with the

current global financial crisis, raise substantial doubt about our ability to

continue as a going concern.

Because

of our business and financial condition; difficulties in the broader world

economy, including the recent problems in the credit markets; steep declines in

world nickel prices and our inability to attract additional funding we sold our

interest in the Gornostai deposit during 2009 to help raise funds to meet our

ongoing expenses.

There is

very little demand for our nickel ore until it has been processed and

concentrated because of its low nickel content. Currently, there is

no nickel ore processing facility within the region of the Kempirsai

deposit. We have spent several years investigating processing

technologies and undertaking preliminary feasibility studies (“PFS”) for the

construction of a nickel ore processing facility. Based on the

results of the PFS, if we are able to secure funding, we intend to focus on the

Vanyukov Process for further development of the Kempirsai deposits and

construction of a nickel processing plant in the Aktobe region of Kazakhstan,

where the Kempirsai deposit is located. The Vanyukov Process, first developed in

the 1940’s in Russia, is capable of treating oxide nickel ores to form either a

nickel matte (by addition of a sulphur containing compound such as pyrite) or

directly to form a ferronickel alloy containing up to 20% nickel. The

anticipated cost to construct such a processing plant with the planned annual

capacity of 20,000 tons of ferronickel (5,000 tons of nickel) is approximately

$160 million.

5

In 2008

KKM entered into a preliminary consortium agreement, subject to negotiation

of the terms of a definitive agreement, with two Kazakhstani

companies, GRK Koitas LLP (“GRK”) and Asia-Invest Corporation LLP (“AI”) for the

purpose of jointly developing and constructing a processing plant. GRK and AI

have exploration and production licenses near our Kempirsai

deposit. Because of the proximity of their deposits, the parties felt

a consortium between the parties made the project more economically viable.

Under the preliminary consortium agreement, KKM is considered to be the operator

of the Consortium. The preliminary shares of the parties in the Consortium are

the following: KKM - 50%; GRK Koitas - 40%; and AI - 10%. Like us,

GRK, AI and their shareholders have been unsuccessful raising funds to finance

the Consortium due to the effects of the volatility in the world financial and

nickel markets. In 2009 GRK was successful in negotiating with the

Ministry of Energy and Mineral Resources of the Republic of Kazakhstan (the

“MEMR”) an extension of the investment obligations under its license to later

periods. Also, in March 2010 AI obtained a similar extension of its investment

obligations to later periods. We believe the extension of GRK’s and

AI’s licenses make it unlikely that the parties will finalize a definitive

consortium agreement or move forward with the joint development of a processing

plant.

Given our

current financial condition, coupled with current and projected nickel

inventories and world nickel prices over the next few years we believe our

prospects for securing funding to construct a nickel ore processing plant are

limited at best. We do not expect to generate revenue from ore

extraction and sales until such time as we are able to secure funding for and

construct a nickel processing facility.

As

discussed in more detail in the “Annual Work Programs of our

Deposits” section of Item 2. Properties of this

report, in order to retain our subsoil use contracts we are required to satisfy

minimum work program requirements each year. However, because of a

lack of funds, KKM did not meet the $6 million annual work program requirement

of the Kempirsai deposit for 2009. During 2009 KKM invested $1.7

million in the Kempirsai deposit. We anticipate the need to seek

significant additional funding during fiscal 2010 to satisfy the 2010 Kempirsai

deposit annual work program obligations (to invest up to $26.5 million) and to

satisfy the obligations KKM did not meet in 2009. Given our current

financial condition, economic and credit market conditions and the state of the

nickel market, our prospects for securing $30.8 million to fulfill our 2009 and

2010 obligations associated with the Kempirsai deposit are limited at

best.

Because of our limited prospects for

generating revenue or obtaining additional financing, we anticipate that we will

be unable to fulfill the 2010 minimum work associated with the Kempirsai

deposit. It is unclear how often the Ministry of Industry and New

Technologies (the “MINT”), (which was newly created in March 2010 to assume the

responsibilities of the MEMR with regard to non-oil-related licenses) will

review compliance with minimum annual work program requirements. If

the MINT reviews our compliance at a time when we are delinquent in meeting our

requirements, we expect the MINT will take action to terminate our subsoil use

contract to the Kempirsai deposit, as the MEMR did in 2007. To avoid

the loss of this contract, management plans to engage in discussions with the

appropriate governmental agencies to revise the terms of its annual work

program. The government is under no obligation to negotiate with us

and there is no guarantee that we can be successful in renegotiating the terms

of our work program.

We may also investigate the possibility

of selling our rights to the Kempirsai deposit.

6

KKM also

did not fully meet the 2009 annual work program requirements of the Mamyt

deposit to invest up to $1.8 million. KKM invested

$400,000. However, as discussed in more detail in the “Annual Work Programs of our

Deposits” section of Item 2. Properties of this

report, in December 2009 KKM received a letter from the MEMR granting our

request to decrease our annual work program for the period from 2009 to

2012. We anticipate an addendum to our license memorializing the

changes to the annual work program requirements to be prepared some time in

April 2010. We expect that the 2009 and 2010 annual work programs

will be reduced significantly to the level that was actually spent by KKM in

2009.

Because of the lack of readily

available market in Kazakhstan for low grade brown coal of the quality contained

at our Mamyt deposit, historically we had planned to use coal from the Mamyt

deposit primarily to provide power for our nickel processing

facility. Given the unlikelihood that we will obtain financing to

construct a processing plant, we have begun to investigate potential markets and

uses for our brown coal with a goal to generating revenue for the

Company.

In addition to its contracts to the

Kempirsai and Mamyt deposits, KKM also owns fuel tanks, locomotives, rail cars,

railway cranes, bridge cranes, railway cisterns, maintenance equipment,

excavators, motor graders, passenger vehicles, passenger buses, heavy dump

trucks, hoppers, scales, lathes, forging hammers, presses, grinding, milling and

boring machines, boilers, electrical substations, office equipment, business

machines, portable communication equipment, laboratory equipment and multiple

buildings. The machinery was manufactured between 1950 and the

present. The buildings were built between the 1940’s and the early

1990’s. Much of our existing equipment and buildings will need repair

and refurbishing prior to being put into active operation. We planned

to use this equipment to support our nickel mining activities at the Kempirsai

deposit. Given the unlikelihood that we will engage in nickel mining

activities, we are investigating whether this equipment can be put to other uses

to generate capital for the Company. We are also investigating

whether there is a market for the sale of this equipment.

Competition in the Nickel

Market

Norilsk

Nickel is the largest nickel producer in the world followed by CVRD, BHP

Billiton Plc, Eramet Group and Xtrata. These five companies account

for approximately 60% of the world’s primary nickel production, while more than

30 medium to small size companies produce the remaining

40%. Companies compete with each other generally across the globe and

are best categorized by their size, reserve base, ore richness, production

method and final product. Competition in this industry focuses

largely on price and nickel content, whether it is sold in unwrought or chemical

form. High nickel content material is sold at higher prices and is

most sought after among customers.

Currently

there are no nickel-producing companies in Kazakhstan although there are several

companies holding exploration and/or extraction rights to nickel deposits in

Kazakhstan. Currently none of these Kazakhstani companies extract nickel ore due

to problems related to marketing of the ore and financing and construction of

processing plants.

7

Tax

and Royalty Scheme in the Republic of Kazakhstan

In

January 2009 Kazakhstan adopted a new tax code. The new tax code

invalidates tax stability clauses in existing contracts and eliminated tax

stability in future contracts. The government has said that the

stability of tax clauses was retained only for existing production sharing

agreements that contained stability clauses and had undergone the mandatory tax

expert evaluation and subsurface use contracts approved by the President of

Kazakhstan.

The new

tax code increases the taxes paid by extractive industries while lowering the

general tax burden on the entire economy. In this respect, the new

tax code decreases the corporate tax rate from 30% to 20% beginning January 1,

2009. The corporate tax rate decreases to 17.5% in 2010, and to 15%

starting in 2011. Under the draft amendments planned to be introduced

to the Tax Code this year, however, the planned reductions in the corporate

income tax rate may be postponed, with rate decreases being postponed to 17.5%

in 2013 and to 15% starting from 2014.

The new

tax code also increases the tax burden of subsurface users by introducing a new

minerals extraction tax (“MET”), while canceling royalty payments. In

general, MET applies to the value of produced resources which is calculated

based on “world” prices. The current MET rate applicable to nickel is

set at 6%. Extractive companies are also liable to pay excess profit

tax (“EPT”). EPT liability arises when the ratio of aggregate annual

income to deductions allowable for EPT purposes relative to operations under a

specific subsurface use contract is more than 1.25 for the reporting tax period

which, in most cases, is a calendar year. The tax code provides for

an incremental sliding scale of EPT rates ranging from 0% to 60% for various

profit levels above the mentioned ratio. The planned amendments to the tax code

this year may change the current procedure of EPT calculation.

The new

tax code also makes rent tax applicable to exports of coal (previously

applicable only to exports of hydrocarbons). The rent tax at the rate of 2.1%

applies to value of exported coal calculated on the basis of the sale

prices.

Value-added

tax (“VAT”), which has decreased every year from 16% in 2006 to 12% in 2009, is

expected to stay at its current level. Under the new tax code, the

progressive scale of social tax rates imposed on employer’s payroll costs was

replaced with a flat rate of 11%. The personal income tax rate for

resident individuals is set at 10%. Depending on the specific type of

income, income of non-residents working in Kazakhstan is subject to income taxes

(withholding) at varying rates ranging from 5% to 20%.

During

2009 KKM received a letter from the MEMR requiring changes/addendums to the

taxation provisions of its existing subsurface use contracts to make them

consistent with the new tax regime. Despite the fact that KKM’s

existing subsurface use contracts include statements of stabilization of the tax

regime with regard to subsurface user taxes (such as royalty, excess profit

tax), the MEMR letter required the new tax regime to be applied to existing

contracts beginning January 1, 2009. In December 2009 KKM signed an

addendum to the Kempirsai subsoil use contract replacing the existing tax regime

indicated in the subsoil use contact to be in compliance with the new tax code

regime in exchange for changes in the annual work program proposed by

KKM. A similar addendum is expected to be signed for the Mamyt

subsoil use contract some time in April 2010.

8

Initially,

the Kempirsai contract required KKM to pay royalty payments equal to 2.21% of

gross ore sales. The Mamyt brown coal contract required a royalty

payment equal to nine tenths of one percent (0.9%) of gross coal

sales. Both contracts require KKM to pay an excess profits tax

ranging from 4 to 30 percent based upon an internal rate of return (as defined

in the contracts) ranging from 22 to 30 percent.

As of

December 31, 2009, we are subject to the following taxes and royalties payable

to the Republic of Kazakhstan:

|

Class of Tax or Royalty

|

Basis of Tax

|

Payable Period

|

Annual Rate

|

|

Corporate

Income Tax

|

Profits

|

Monthly

|

20%

|

|

Social

Tax

|

Payroll

|

Monthly

|

11%

|

|

VAT

|

Value

added

|

Monthly

|

12%

|

|

Property

Tax

|

Property

|

Quarterly

|

1%

|

|

Minerals

Extraction Tax (ore)

|

Value

of extracted resources

|

Monthly

|

6%

|

|

Rent

Tax (brown coal)

|

Value

of exported coal

|

Monthly

|

2.1%

|

|

Excess

Profit Tax

|

Net

income

|

Annually

|

0-60%

|

Employees

We

currently employ approximately 148 employees, including part-time and full-time

working employees and 70 employees that have been sent on unpaid vacation due to

our current financial difficulties. We hire our employees under local

labor contracts complying with the governing laws of the Republic of

Kazakhstan. We anticipate the need to hire additional personnel only

if operations expand. Except for Company initiated work force

reductions, we have managed to maintain turnover of our work force at a low

level. We believe that future new labor requirements can be satisfied

and there is no significant risk of labor shortage.

Reports

to Security Holders

We are

subject to the reporting requirements of the Securities Exchange Act of

1934. As such, we are required to file annual, quarterly and current

reports, any amendments to those reports, proxy and registration statements and

other information with the United States Securities and Exchange Commission

(“SEC”) in accordance with reporting requirements. The public may

read and copy any materials filed by us with the SEC at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The

public may obtain information on the operation of the Public Reference Room by

calling the SEC at 202-551-8090. We are an electronic filer and the

SEC maintains an Internet site that contains reports and other information

regarding the Company that may be viewed at http://www.sec.gov.

Item

1A. Risk

Factors

If We

are Unable to Obtain Additional Financing in the Near Future, We May be Forced

to Terminate Operations. We have no proven

mineral reserves that conform to the standards established by the SEC. Our

Kempirsai and Mamyt deposits have not yet entered the development stage with

respect to their mineral interests and we have no production. We have realized

only limited revenue from the Kempirsai and Mamyt deposits and have very little

ability to generate revenue. We do not expect this to change until a nickel ore

processing plant is built and we have commenced commercial

operations. As we currently generate no revenue, we will need to

raise additional capital through the sale of our equity and/or debt

securities.

9

Our

management has expended significant time and effort trying to obtain additional

financing for the Company. To date, we have been unsuccessful in

securing sufficient additional financing to meet our needs. We

believe this is due to several factors. Since inception we have

incurred an accumulated deficit of $30,229,302. At December 31,

2009 our current liabilities exceeded current assets by $974,506. We

currently generate no revenue from operations and do not anticipate that to

change until such time as we are able to construct an ore processing

plant. When coupled with the difficulties in the broader world

economy, including the recent problems in the credit markets, steep declines in

worldwide nickel prices and volatility and downward trends in the stock market,

our prospects for obtaining additional funding in the near term are

limited.

If we are

unable to obtain additional financing in the near future, we will have

insufficient funds to satisfy our operating needs, much less to meet our annual

work program obligations to ensure we retain our licenses. If we have

insufficient funds to meet our operating needs we may be forced to cease

operations.

Failure

to Satisfy the Terms of Our Subsoil Use Contracts Could Result in the Loss of

our Contracts. Under

our subsoil use contracts we are required to satisfy our annual minimum work

program requirements. There is no guarantee that we will be able to

continue to meet these commitments in the future. If we fail to

satisfy these commitments we may be subject to penalties and fines and/or the

loss of our subsoil use contracts. The cancellation of our contracts

would have a material adverse effect on our business, results of operations and

financial condition. Although we would seek waivers of any breaches

or seek to renegotiate the terms of our commitments in the event we do not

believe we can meet such commitments, we cannot assure you that we would be

successful in doing so.

Our

Independent Registered Public Accounting Firm has Expressed Substantial Doubt

About Our Ability to Continue as a Going Concern. As disclosed in the

Report of Independent Registered Public Accounting Firm in our audited

Consolidated Financial Statements, given our limited operating history, being at

the exploration stage with respect to our mineral interests and having not

started production, the decline in nickel prices, and dependence upon debt or

equity infusions to meet our work program requirements our government mineral

licenses, combined with the current global financial crisis, raise substantial

doubt about our ability to continue as a going concern. If we are

unable to resolve these issues, it is unlikely we will be able to continue as a

going concern.

Fluctuations

in Commodity Price and Demand for Nickel and Cobalt Have and Will Likely

Continue to Adversely Impact the Company. Commodity prices and

demand for nickel and cobalt are cyclical and influenced strongly by world

economic growth, particularly in the U.S. and Asia (notably

China). Commodity prices have significantly declined recently and

prices can fluctuate widely. Such fluctuations could have a material

adverse impact on our revenues, earnings, cash flows, asset values and growth in

the future. As a result of difficult market and general economic

conditions (which may be long lasting and continue to deepen), there is reduced

direct and indirect demand for nickel and cobalt and these declines, if they do

not reverse are expected to a material adverse impact on our future revenues,

earnings, cash flows, asset values and growth.

10

Due to

the significant reduction in nickel prices we were required to recognize an

impairment of our mineral interests in 2008. According to our estimates, once we

construct a nickel processing facility, we can generate positive cash flows if

nickel prices are not lower than $12,000-$12,500 per ton. Nickel prices at

December 31, 2008, however, fell below this level, requiring us to recognize an

impairment of our mineral interests in the amount of $8,916,265.

Mineral

Exploration and Exploitation is Inherently Dangerous. The

search for valuable minerals involves numerous hazards. As a result, we may

become subject to liability for such hazards, including pollution, cave-ins and

other hazards against which we cannot insure or against which we may elect not

to insure. At the present time we have no coverage to insure against these

hazards. The payment of such liabilities may have a material adverse effect on

our financial position.

We are

Subject to All the Risks of Operating in a Foreign Country. In

recent years, the Republic of Kazakhstan has undergone substantial political and

economic change. As an emerging market, Kazakhstan does not possess

the well-developed business infrastructure that generally exists in more mature

free market economies. As a result, operations carried out in

Kazakhstan can involve significant risks that are not typically associated with

developed markets. Instability in the market reform process could

subject us to unpredictable changes in the basic business infrastructure in

which we currently operate. Therefore, we face risks inherent in

conducting business internationally, such as:

|

Ÿ

|

foreign

currency exchange fluctuations or imposition of currency exchange

controls;

|

|

Ÿ

|

legal

and governmental regulatory requirements;

|

|

Ÿ

|

disruption

of tenders resulting from disputes with governmental

authorities;

|

|

Ÿ

|

potential

seizure or nationalization of assets;

|

|

Ÿ

|

difficulties

in collecting accounts receivable and longer collection

periods;

|

|

Ÿ

|

political

and economic instability;

|

|

Ÿ

|

difficulties

and costs of staffing and managing international operations;

and

|

|

Ÿ

|

language

and cultural differences.

|

Any of

these factors could materially adversely affect our business and financial

condition. At this time, we are unable to estimate what, if any,

changes may occur or the resulting effect of any such changes on

us.

We also face a significant potential

risk of unfavorable tax treatment and currency law

violations. Legislation and regulations regarding taxation, foreign

currency transactions and licensing of foreign currency loans in the Republic of

Kazakhstan continue to evolve as the central government manages the

transformation from a command to a market-oriented economy. The

legislation and regulations are not always clearly written and their

interpretation is subject to the opinions of local tax

inspectors. Instances of inconsistent opinions between local,

regional and national tax authorities are not unusual.

The

current regime of penalties and interest related to reported and discovered

violations of Kazakhstan’s laws, decrees and related regulations can be

severe. Penalties include confiscation of the amounts at issue for

currency law violations, as well as fines of generally 100% of the taxes

unpaid. Interest is assessable at rates of generally 0.3% per

day. As a result, penalties and interest can result in amounts that

are multiples of any unreported taxes.

11

We may be

adversely affected by Kazakh political developments, including the application

of existing and future legislation and tax regulations.

In

December 2008, a new subsoil use legislation of Kazakhstan was submitted to

parliament, superseding legislation on oil production and exploration, mineral

resources mineral management, and production sharing agreements (“PSAs”). The

new subsoil use legislation of Kazakhstan, which is expected to be adopted by

parliament and signed by the President in second quarter 2010 and become

effective six months after its approval by parliament and the President, allows

the government to annul contracts in the extractive sector if they are deemed to

be harmful to Kazakhstan's economic security or national interests. The

legislation also requires separate contracts for exploration and production

operations, puts shorter time limits on exploration contracts, enhances the

government’s authority to terminate contracts not in compliance with the law,

and requires tax stability clauses in individual contracts to be approved by the

President of Kazakhstan. In addition, under the terms of the legislation, no

future contracts would be structured as a PSA, companies are required to

establish equal terms, conditions, and pay for Kazakhstani and foreign workers,

and the government would evaluate subsoil resource bids based on promised social

contributions. Also, the latest draft assumes that disputes between subsurface

users and the government will be settled in the courts of Kazakhstan, and does

not assume international arbitration. Disputes regarding the existing

subsurface use contracts would also be settled in the courts of

Kazakhstan.

In

January 2009, Kazakhstan adopted a new tax code. The new subsoil use and tax

legislation of Kazakhstan, which defines the framework and procedures connected

with the regulation of activities of subsoil users, introduces significant

changes in terms of the regulation of the activities of subsoil users, including

the abolition of the existing stabilization regime for all subsoil users. The

new tax code increases the taxes paid by extractive industries while lowering

the general tax burden on the entire economy. Details of the new tax code are

discussed above in Item 1. Business in the section

entitled “Tax and Royalty

Scheme in the Republic of Kazakhstan” of this report.

In

February 2009 Kazakhstan’s National Bank dramatically devalued the Tenge, the

local currency, from a range of 117-123 Tenge/U.S. dollar to 145-155 Tenge/U.S.

dollar, citing the decline in oil price (oil comprises 60% of Kazakh exports),

currency devaluations in Kazakhstan’s neighbors, particularly Russia, and the

fledgling state of the domestic banking sector. We have limited confidence in

the government’s ability to control prices in the near to medium term, and with

the value of Tenge wages falling, purchasing power is declining. The

future effect of the devaluation is difficult to project given the present

uncertainty on the currency markets and on the government’s policies regarding

exchange rates and/or foreign currency regulations. Although devaluation of the

local currency generally leads to reduced cost of operations, the foreign

exchange rate fluctuations, as well as, the deteriorating overall economic

situation in Kazakhstan increase uncertainties peculiar to long-term projects in

Kazakhstan.

In April

2009, because of the global economic crisis and to support local producers, the

government requested the MEMR to specify the “local content” requirements in

every subsoil use contract. The current subsoil use legislation of Kazakhstan

requires mining and oil companies to use local goods and services. According to

these “local content” regulations, subsurface users in Kazakhstan are obligated

to purchase goods and services from Kazakhstan entities, provided that the local

goods meet minimum project standards, and to give preference to the employment

of local personnel. Therefore, in April 2009 KKM and the MEMR signed an addendum

# 3 to its nickel subsoil use contract whereby KKM is obliged to the following

commitments:

12

|

Ÿ

|

Until

2013, at least 30% of KKM’s total procurements of equipment, materials and

other products, must be of goods produced in Kazakhstan, during 2013 and

2014, this percentage shall increase to 40%, after 2014, at least 50% of

KKM’s total procurements must have been of equipment, materials and other

products produced in Kazakhstan;

|

|

Ÿ

|

Of

the total percentage of nickel mining related services retained by KKM

until 2013, at least 70% shall be provided by Kazakhstani companies,

between 2013 and 2014 that percentage shall increase to 80%,

after 2014 the percentage shall increase to 90%;

|

|

Ÿ

|

Kazakhstan

citizens shall be given priority in personnel hiring, and depending upon

the type of position within KKM, Kazakhstani citizens should account for

80-100% of total KKM personnel until 2013, between 2013 and 2014 the

percentages increase to between 90 and 100%, and after 2015, 100% of KKM

employees shall be Kazakhstani

citizens.

|

On March

12, 2010, the Oil and Gas Ministry and a Ministry of Industry and New

Technologies were created by decree of the President of the Republic of

Kazakhstan. It is expected that these two ministries will replace the

MEMR. Also, it is expected that Ministry of Industry and New

Technologies will be responsible for development of the non-oil branch of the

MEMR, which will include the electric power industry, mining, nuclear, and

manufacturing industries.

We are

Subject to Strict Environmental Regulations. We are subject to

stringent federal, state and local laws and regulations relating to the release

or disposal of materials into the environment or otherwise relating to

environmental protection. These laws and regulations may require the

acquisition of permits before extraction activities commence, restrict the

types, quantities and concentration of substances that can be released into the

environment in connection with extraction and production activities and impose

substantial liabilities for pollution resulting from our

operations. Failure to comply with these laws and regulations may

result in the assessment of administrative, civil and criminal penalties,

incurrence of investigatory or remedial obligations or the imposition of

injunctive relief. Changes in environmental laws and regulations occur

frequently, and any changes that result in more stringent or costly waste

handling, storage, transport, disposal or cleanup requirements could require us

to make significant expenditures to maintain compliance, and may otherwise have

a material adverse effect on us as well as the industry in

general. Under these environmental laws and regulations, we could be

held strictly liable for the removal or remediation of previously released

materials or property contamination regardless of whether we were

responsible.

Liquidity

of Common Shares. Our common stock has limited trading volume

on the Over-the-Counter Bulletin Board and is not listed on a national

exchange. Moreover, a significant percentage of our outstanding

common stock is “restricted” and therefore subject to the resale restrictions

set forth in Rule 144 of the rules and regulations promulgated by the U.S.

Securities and Exchange Commission under the Securities Act of

1933. These factors could adversely affect the liquidity, trading

volume, price and transferability of our common shares.

Item

1B. Unresolved

Staff Comments

None.

13

Item

2. Properties

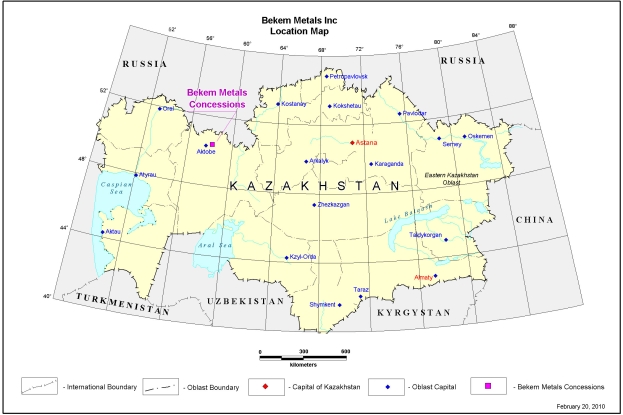

As

discussed above, through our subsidiary, we hold the rights to the Kempirsai

nickel and cobalt deposits and the Maymt brown coal deposit, which are located

in northwestern Kazakhstan.

Location

and Access to our Deposits

The

Kempirsai deposit is located in the Khromtausky region of northwestern

Kazakhstan, approximately 130 kilometers northeast of Aktobe, Kazakhstan and

approximately 35 kilometers south of Badamsha village, Aktobe region,

Kazakhstan. The Mamyt deposit is located approximately 30 kilometers east of

Badamsha village, Aktobe region, Kazakhstan. Badamsha is a village of

approximately 6,000 people. The Aktubinsk-Karabutak asphalt highway

runs within 14 kilometers to the south of the nickel and cobalt

deposit. The nickel, cobalt and brown coal deposits can be accessed

through a network of country roads. The Orsk-Kandagash state railway

runs nearby the Kempirsai deposit and we own 55 kilometers of our own

railway. Our railway connects our deposits to a reloading station and

to a Russian railway.

14

Our

Subsoil Use Contracts

The

following table provides additional information regarding our subsoil use

contracts.

|

Territory

Name

|

Size

of Territory

|

Primary Minerals

|

License

Type

|

License

or Contract #

|

License and

Subsoil Use Contract

Term

|

|

Kempirsai

|

575,756

acres

|

Nickel

and cobalt ore

|

Production

|

MG

#420

MG

#426

|

Expires

Oct, 12, 2020 unless extended.

|

|

Mamyt

|

116

acres

|

Brown

coal

|

Production

|

MG

#9-D

|

Expires

Dec, 11 2018 unless extended.

|

The

Kempirsai and Mamyt licenses are independent of one another. The loss

of one would not trigger a loss of the other. Under our contracts we

have the right to negotiate with the government for extensions of the terms of

those contracts. If we are unsuccessful in negotiating extensions,

upon the expiration of our contracts our interest in and rights to those

deposits terminates and reverts back to the government of the Republic of

Kazakhstan, but we retain the rights to all tangible and intangible assets we

acquire for exploration, extraction and production at these

deposits.

15

For

additional details regarding the terms and obligations associated with our

subsoil use contracts and licenses, please see “Tax and Royalty Scheme in the

Republic of Kazakhstan” in Item 1 “Business”, “Annual Work Programs of our

Deposits” in this Item 2 “Properties”, “Summary of Material Contractual

Commitments” in Item 7 “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and “Note 3 – Property, Plant and Mineral

Interests”, “Note 6 –

Asset Retirement Obligations” and “Note 9 – Commitments and

Contingencies” contained in the Notes to our Consolidated Financial

Statements.

Annual

Work Programs of our Deposits

The

Kempirsai and Mamyt deposits were discovered and actively explored during the

Soviet era. In the 1980s the State Reserves Committee approved the

reserves (based on Soviet standards) and approved the Kempirsai deposit for

commercial production. The Kempirsai deposit was actively mined

during the 1980s and early 1990s. Active mining ceased in

1996.

The

subsoil use contracts and licenses for the Kempirsai and Mamyt deposits are

production contracts and do not require us to undertake significant exploration

activities. While we do not have fixed exploration obligations, in

order to retain our licenses, we are required to engage in certain

activities. Each year we must submit an annual work program to the

government. The annual work program indicates the scope of exploration and/or

production works and finance costs we are required to incur each

year.

Our

contracts and licenses call for KKM to extract the following amounts of ore from

the Kempirsai deposit and brown coal from the Mamyt deposit and make the

following investments in the ore mining and processing technology:

|

Kempirsai

(1)

|

Mamyt

(2)

|

||

|

Tons

of Ore

|

Investments,

$

|

Tons

of Brown

Coal |

|

|

2009

|

-

|

6,000,000

|

200,000

|

|

2010

|

-

|

26,500,000

|

200,000

|

|

2011

|

-

|

42,000,000

|

200,000

|

|

2012

|

-

|

36,500,000

|

200,000

|

|

2013

|

800,000

|

2,400,000

|

200,000

|

|

2014

|

800,000

|

2,000,000

|

200,000

|

|

2015

|

1,000,000

|

2,000,000

|

200,000

|

|

2016

|

1,000,000

|

2,000,000

|

200,000

|

|

2017

|

1,500,000

|

1,000,000

|

200,000

|

|

2018

|

1,500,000

|

1,000,000

|

200,000

|

|

2019

|

1,600,000

|

1,000,000

|

|

|

2020

|

1,234,900

|

1,000,000

|

|

|

Total

|

9,434,900

|

123,400,000

|

2,000,000

|

|

(1)

|

In

December 2008, KKM received a notice from the MEMR that it has agreed to

suspend ore mining requirements until the end of 2012 to allow KKM to

focus on the construction of an ore processing facility. The notice

indicated that under the annual work program, KKM is required to invest

$135,000,000 in its mining and ore processing technology during the period

from 2006 to 2020 (or $123.4 million for the remaining period). In

December 2009, KKM signed an addendum to the nickel and cobalt ore

production contract memorializing the amendments to KKM’s subsoil use

contract to incorporate the changes set forth in the notice received in

December 2008. The above table represents extraction and investment

obligations indicated in the December 2009 addendum.

|

|

(2)

|

In

December 2009 KKM received a letter from the MEMR granting KKM’s request

to decrease the coal volume production requirements of its work program

from 200,000 tons per year to 5,000 tons per year for the period from 2009

to 2012. We anticipate an addendum to this license memorializing the

changes to the annual work program requirements to be prepared some time

in April 2010. These changes are not reflected in the above table and will

be reflected when these changes are legally approved by the government by

signing the new addendum to the existing subsoil use

contract.

|

16

Geology

and Mineralization of the Kempirsai Deposit

Nickel

ferrous laterites make up approximately 70% of all land-based nickel resources,

though currently they constitute about 45% of the primary nickel

production. Nickel laterite deposits are formed as a result of

prolonged weathering of ‘ultramafic’ rocks containing ferromagnesian silicate

minerals. Under conditions of warm temperatures and high, frequent

rainfall, nickel leaches from the upper layers and precipitates in the lower

layers in a lattice of silicate and iron oxide minerals.

If an ore

deposit is outcropping or occurs near the surface, it can be extracted using

open cut methods. Open cut methods allow for lower extraction and

operating costs, which can allow low-grade deposits to be economically viable.

The topsoil and overburden are removed and stockpiled for later rehabilitation

and, as the mine increases in depth, the walls of the excavation are left at an

angle to avoid collapse. Open cut mines use large mobile machinery that enables

high production rates. Large haul trucks carry the ore and waste to surface

stockpiles. Rapid rates of mining in shallow weathered parts of the deposits

slow down as the depths increase due to the increased hardness of the material.

Nickel laterites are generally mined by surface operations up to 60 meters

deep.

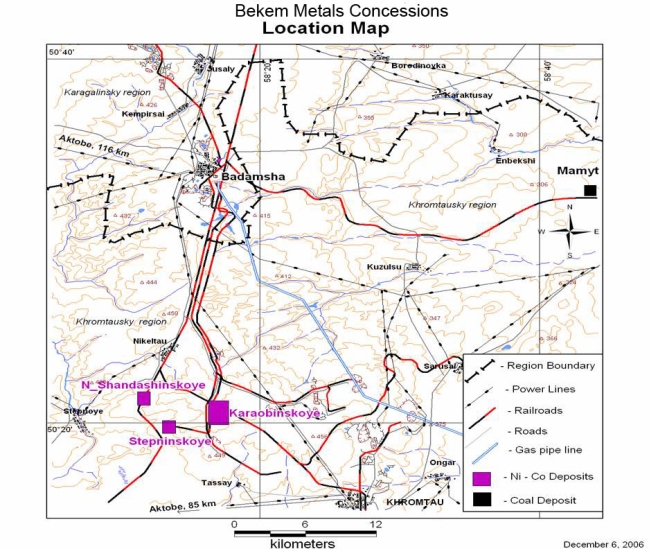

The

Kempirsai nickel and cobalt deposit is comprised of two deposits:

Kara-Obinskoye, and Novo-Shandashinskoye. These deposits are located

approximately 5-10 kilometers from each other. The results of

exploration carried out during the Soviet era show that nickel and cobalt ore is

located within the Kempirsai ultramafic massif. The minerals are

found in laterite form and are associated with leached nontronized

serpentinites. The ore bodies have a blanket-like shape and tend to lie

conformably on the underlying rocks. The depth of ore bodies from the

surface is 0-40 meters. In vertical section they are mainly

horizontal in attitude and show variable thickness. Thickness varies

from 2.0 meters to 30.0 meters, with an average thickness of 6.0

meters. Average stripping ratio is 1.5 cubic meters per

ton. The nickel content of the ore within the Kempirsai deposit

varies from 0.8% to 3.0% and cobalt – from 0.025% to 0.08%. The average nickel

and cobalt content for the Kara-Obinskoye are 1.1% and 0.066%

respectively. The average nickel and cobalt content for the

Novo-Shandashinskoye deposit are 1.38% and 0.045%.

17

Reserves

In

accordance with SEC Industry Guide 7 mineral deposits qualify as “reserves” only

to the extent some part of the deposit can be economically and legally extracted

or produced at the time of the reserve determination based on the bankable

feasibility study. At the present time, we have completed a

preliminary feasibility study for the Kempirsai deposit and, if and when funds

allow, we plan to retain Wardell Armstrong International to conduct a bankable

feasibility study of our Kempirsai deposit to provide detailed information on

mining, processing, metallurgical, economic and other relevant factors. Because

our deposits are without known reserves, our proposed programs should be

considered exploratory in nature.

Our

Offices

Bekem

leases approximately 400 square feet of office space located at 324 South 400

West, Suite 225, Salt Lake City, Utah 84101 for its administrative and

registered office in the United States. We pay annual rent of

approximately $7,800 for this space pursuant to a lease agreement that expired

in October 2009. We are currently renting this space on a

month-to-month basis at the same rate while we negotiate the terms of a new

one-year lease. We anticipate we will be successful in negotiating a

new lease on terms comparable to our previous lease, but if negotiations are

unsuccessful, we anticipate we will be able to find a replacement space under

similar terms.

We

maintain a representative office in Almaty, Kazakhstan, where we lease

approximately 645 square feet of office space. The lease agreement expires on

August 31, 2010. The monthly lease payment is $921. Following our policy of

cutting expenses where possible, we are in the process of closing the

representative office in Almaty. We expect that the representative

office will be officially closed by August 31, 2010 due to certain applicable

legal requirements in Kazakhstan.

KKM rents

approximately 1,796 square feet of office space in Aktobe, Kazakhstan. KKM pays

approximately $1,400 per month for this space. The lease agreement expires on

July 20, 2010. The agreement may be extended beyond its term upon mutual

agreement of the parties.

We

believe the various office spaces we rent are suitable and adequate for our

needs.

Item

3. Legal

Proceedings

We may, from time to time, be a party

to ordinary routine litigation incidental to our business. We are not

currently aware of any pending, or threatened litigation or proceedings that

could have a material adverse effect on our results of operations, cash flows or

financial condition.

Item

4. Reserved

18

Item

5. Market

for Common Equity, Related Stockholder Matters and Small Business Issuer

Purchases of Equity Securities

Our shares are currently traded on the

Over-the-Counter Bulletin Board ("OTCBB") under the symbol

“BKMM.” The following table presents the high and low bid quotations

for the fiscal years ended December 31, 2009 and 2008. The published

high and low bid quotations were furnished to us by Pink OTC Markets

Inc. These quotations reflect inter-dealer prices without retail

mark-up, mark-down or commissions and may not necessarily represent actual

transactions.

|

2009

|

High

|

Low

|

||

|

Oct.

1 thru Dec. 31

|

$0.07

|

$0.07

|

||

|

July

1 thru Sept. 30

|

0.12

|

0.02

|

||

|

Apr.

1 thru June 30

|

0.05

|

0.017

|

||

|

Jan.

1 thru Mar. 31

|

0.017

|

0.012

|

||

|

2008

|

||||

|

Oct.

1 thru Dec. 31

|

$0.18

|

$0.007

|

||

|

July

1 thru Sept. 30

|

0.54

|

0.16

|

||

|

Apr.

1 thru June 30

|

0.54

|

0.54

|

||

|

Jan.

1 thru Mar. 31

|

1.01

|

0.54

|

Record

Holders

As of March 31, 2010 we had

approximately 156 shareholders holding 125,172,011 shares of our common

stock. The number of record holders was determined from the records

of our stock transfer agent and does not include beneficial owners of common

stock whose shares are held in the names of various security brokers, dealers

and registered clearing houses.

Dividend

Policy

We have not declared a cash dividend on

any class of common equity during the past two fiscal years. Our

ability to pay dividends is subject to limitations imposed by Utah

law. Under Utah law, dividends may not be made if, after giving it

effect: a) the company would not be able to pay its debts as they become due in

the usual course of business; or b) the company’s total assets would be less

than the sum of its total liabilities plus the amount that would be needed to

satisfy the rights of any holders of preferential rights. Our board

of directors does not, however, anticipate paying any dividends in the

foreseeable future; it intends to retain the earnings that could be distributed,

if any, for the operations, expansion and development of its

business.

Performance

Graph

We are a smaller reporting company, as

defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, and

accordingly are not required to provide this information.

Recent

Sales of Unregistered Securities

During the quarter ended December 31,

2009 we did not sell any unregistered securities.

Purchases

of Equity Securities by the Issuer and Affiliated Purchasers

Neither we, nor any affiliated

purchasers, purchased any of our equity securities during the year ended

December 31, 2009.

19

Item

6. Selected

Financial Data

The selected consolidated financial

information set forth below is derived from our consolidated balance sheets and

statements of operations as of and for the years ended December 31, 2009, 2008,

2007, 2006 and 2005. The data set forth below should be read in

conjunction with “Management’s Discussion and Analysis” and the consolidated

financial statements and related notes thereto included in this Annual Report on

Form 10-K.

|

Consolidated

Statements of Operations Data:

|

For

the Years Ended December 31,

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||

|

General

and administrative expenses

|

$2,363,977

|

$4,068,004

|

$3,497,477

|

$2,574,591

|

$833,865

|

|

|

Research

and development costs

|

-

|

240,832

|

296,070

|

389,507

|

131,562

|

|

|

Exploratory

costs

|

124,886

|

763,405

|

1,608,479

|

314,270

|

74,050

|

|

|

Loss

from impairment of property

|

556,500

|

8,642,958

|

1,043,720

|

-

|

-

|

|

|

Loss

from operations

|

(3,912,546)

|

(14,311,699)

|

(6,884,436)

|

(3,438,711)

|

(1,048,562)

|

|

|

Interest

expense

|

-

|

-

|

(1,018)

|

(1,076,013)

|

(260,286)

|

|

|

Interest

income

|

75,853

|

221,084

|

324,976

|

85,337

|

-

|

|

|

Income

(Loss) from Discontinued Operations

|

||||||

|

(including

gain on disposal of Kaznickel

|

||||||

|

of

$6,082,390 in 2009)

|

6,044,447

|

(1,777,953)

|

(2,361,308)

|

(2,533,431)

|

(847,541)

|

|

|

Net

Income (Loss)

|

43,572

|

(15,348,975)

|

(8,701,550)

|

(4,951,212)

|

(1,271,137)

|

|

|

Basic

income (loss) per common share

|

$0.00

|

$0.00

|

$(0.07)

|

$(0.04)

|

$(0.03)

|

|

|

Balance

Sheet Data:

|

As

of December 31,

|

||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||

|

Total

current assets

|

$1,331,149

|

$16,651,082

|

$1,820,365

|

$9,711,374

|

$444,089

|

||||

|

Property,

plant and mineral interests, net

|

2,852,697

|

4,384,366

|

14,175,269

|

13,800,167

|

10,898,919

|

||||

|

Assets

of discontinued operations

|

-

|

144,764

|

1,007,800

|

1,109,949

|

951,248

|

||||

|

Total

assets

|

4,225,729

|

21,338,787

|

15,442,837

|

23,987,978

|

10,478,767

|

||||

|

Notes

payable

|

2,031,981

|

19,668,792

|

-

|

-

|

7,901,481

|

||||

|

Liabilities

of discontinued operations

|

-

|

1,284,228

|

943,521

|

1,106,640

|

1,520,661

|

||||

|

Total

liabilities

|

3,216,952

|

21,880,505

|

1,014,925

|

1,093,408

|

10,826,906

|

||||

|

Total

shareholders' equity (deficit)

|

1,008,777

|

(541,718)

|

14,492,191

|

22,897,879

|

(917,552)

|

||||

Item

7. Management's

Discussion and Analysis of Financial Condition and

Results of Operations

For a

complete understanding, this Management's Discussion and Analysis of Financial

Condition and Results of Operations should be read in conjunction with the

Consolidated Financial Statements and Notes to the Consolidated Financial

Statements contained in this Annual Report on Form 10-K.

Some of

the statements set forth in this section are forward-looking statements relating

to our future results of operations. Our actual results may vary from

the results anticipated by these statements. Please see “Information Concerning

Forward-Looking Statements” on page 4.

20

Results

of Operations

Comparison of the years

ended December 31, 2009 and 2008

While

reading this Results of

Operations section, it is important to keep in mind that during most of

2009 we had insufficient financial resources to fund our

activities.

During

2009 we sold our interest in Kaznickel to a third party for approximately $1,867

and for repayment of $5,000,000 worth of loans owed to Bekem Metals by

Kaznickel. We received an initial payment of $500,000 in March 2009.

The balance was paid in November 2009. As a result, the operations of

Kaznickel are consolidated in our consolidated financial statements until the

date we closed this transaction. The Kaznickel operations were reported in the

consolidated statements of operations as income (loss) from discontinued

operations.

General and Administrative

Expenses

Our

general and administrative expenses decreased from $4,068,004 during 2008 to

$2,363,977 during 2009. This 42% decrease was primarily the result of

lower payroll expenses. During 2009 payroll expense decreased by approximately

$743,000. We currently employ approximately 148 employees, including

part- and full-time working employees and 70 employees that have been sent on

unpaid vacation due to our current financial difficulties. General

and administrative expenses also decreased as a result of the Tenge devaluation

which occurred in the beginning of February 2009. The total estimated

effect of the Tenge devaluation on our general and administrative expenses is

approximately $474,000, including the effect of devaluation on payroll expenses

of approximately $276,000. The balance of the decrease (approximately $211,000)

resulted from the reduced scope of our operations during 2009 due to our current

financial difficulties.

Research and Development

Costs

During

2008 we incurred research and development cost of $240,832, which was related to

preparation of the preliminary feasibility study on the Kempirsai

deposits. During 2009 we did not incur any research and development

costs.

Exploratory

Costs

Our

exploratory costs decreased from $763,405 during the twelve months ended

December 31, 2008 to $124,886 during the twelve months ended December 31,

2009.

During

the twelve months ended December 31, 2009 we extracted 2,835 tons of

coals. No ore was extracted during 2009. By comparison,

during the twelve months ended December 31, 2008, we extracted 146,107 tons of

ore and 4,668 tons of coal. The extraction costs of $44,664 and

$393,018 (including stripping costs) for 2009 and 2008, respectively, were

included in exploratory costs since we are in the exploration

stage.

The

balance of exploratory cost of $80,222 and $370,387 for 2009 and 2008,

respectively, represent the cost of maintenance and repair works of KKM

assets.

21

Loss from Impairment of

Property

During

2008, due to the global financial crisis and sharp fall in nickel prices on the

world market, we reassessed our assets and recognized impairment of mineral

interests of $8,077,787. According to our estimates, once we have

built a processing facility that would allow us to produce a marketable product

(a ferronickel alloy containing 20% nickel) we can generate positive cash flows

if nickel prices are not lower than $12,000-$12,500 per ton. Nickel

prices at December 31, 2008, however, fell below this level, requiring us to

recognize an impairment of our mineral interests. We also recognized

impairment for other property in the amount of $565,171 for assets used in our

hydrochlorination technology pilot plant that will not be used in the Vanyukov’s

technology to be used at the nickel processing plant. Although nickel

prices have improved, we have recognized an additional impairment of $556,500 in

2009 for equipment to be used in the Vanyukov’s technology. The impairment was

recognized for about 40% of pilot plant cost due to our current poor financial

condition.

Accretion

Expense

We

realized accretion expense of $52,184 during the twelve months ended December

31, 2009. During the twelve months ended December 31, 2008 we

realized accretion expenses of $10,755. This increase in accretion

expense is due to the normal increase in the asset retirement obligation balance

over time.

Due to

our poor financial condition and the potential likelihood that our subsoil use

contract could be revoked, we estimated cost of liquidation and reclamation of

the KKM mines. As of December 31, 2009 the liquidation cost was estimated to be

up to $911,297, which is higher than the previously recognized asset retirement

obligations by $513,971. This amount was immediately recognized in

2009.

We

believe accretion expense during the upcoming fiscal year will be approximately

3.8 times higher due to revision of asset retirement obligation made for KKM in

2009.

Grant Compensation

Expense

During

the year ended December 31, 2009 we incurred $301,028 in grant compensation

expense for restricted stock grants issued to certain officers and key

employees. The amount is less than initially expected by $45,301 due

to the anticipated resignation of Zhassulan Bitenov who has been serving as our

Chief Financial Officer since January 2008. Half of the shares

granted to Mr. Bitenov will not vest because he has informed the Company he

intends to resign his position with the Company in April 2010, which is prior to

the vesting date of one-half of his stock grant. During 2008 grant

compensation expense amounted to $585,745. The reduction in grant

compensation expense resulted from the vesting of a significant portion of

shares granted in 2008 and reversal of shares granted to Mr. Bitenov which were

expected to vest in 2011. As a result, we anticipate deferred grant

compensation of $6,390 to be fully expensed next year, i.e., the whole amount

reported on the balance sheet as of December 31, 2009 is to be expensed next

year.

Total Operating Expenses and

Loss from Operations

As a

result of the factors described above, our total expenses and loss from

operations decreased by 73%, from $14,311,699 during fiscal 2008 to $3,912,546

during fiscal 2009. The principal reason for this decrease is that we

recognized impairment losses of $556,500 in 2009 while in 2008 loss from

impairment of property amounted to $8,642,958, which occurred mainly due to the

sharp fall in world nickel prices in the second half of 2008. Also, as a result

of our financial difficulties, we significantly reduced the scope of our

operations and recognized additional asset retirement costs of $513,971. As a

result of our lack of financial resources and the Tenge devaluation, general and

administrative expenses and exploratory costs in 2009 decreased by $2,342,546