Attached files

| file | filename |

|---|---|

| EX-21.1 - EX211 - FIRST COLOMBIA GOLD CORP. | ex211.htm |

| EX-32.1 - EX321 - FIRST COLOMBIA GOLD CORP. | ex321.htm |

| EX-31.1 - EX311 - FIRST COLOMBIA GOLD CORP. | ex311.htm |

| EX-31.2 - EX312 - FIRST COLOMBIA GOLD CORP. | ex312.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

ý ANNUAL REPORT

UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended December 31,

2009

¨ TRANSITION REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from

to _______.

Commission

file number: 000-51203

Amazon

Goldsands Ltd.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

98-0425310

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

Jiron

Caracas 2226, Jesús María, Lima, Peru

|

||

|

(Address

of principal executive

offices) (Zip

Code)

|

||

|

Registrant’s

telephone, including area code: +(51 1) 989

184706

|

||

Securities

registered under Section 12(b) of the Exchange

Act: None.

Securities

registered under Section 12(g) of the Exchange Act:

|

Common

Stock, $0.00001 par value

|

Not

Applicable

|

|

(Title

of class)

|

(Name

of each exchange on which

registered)

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No ý

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

past 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes ý No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such

files). Yes ý No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (229.405 of this chapter) is not contained herein, and will be

contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ý

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

Large

accelerated filer ¨ Accelerated

filer ¨

Non-accelerated

filer ¨ (Do not check if a

smaller reporting

company)

Smaller reporting company ý

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No ý

As of

June 30, 2009, the aggregate market value of the Company’s common equity held by

non-affiliates computed by reference to the closing price $0.11

was: $1,165,845

The

number of shares of our common stock outstanding as of April 7, 2010 was: 36,853,585

FORM

10-K

AMAZON

GOLDSANDS LTD.

DECEMBER

31, 2009

PART

I

|

Page

|

|

|

Item

1. Business.

|

5

|

|

Item

1A. Risk

Factors.

|

8

|

|

Item

1B. Unresolved

Staff Comments.

|

15

|

|

Item

2. Properties.

|

15

|

|

Item

3. Legal Proceedings.

|

23

|

|

Item

4. Reserved.

|

23

|

|

PART

II

|

|

23

|

|

|

Item

6. Selected Financial Data.

|

25

|

|

25

|

|

|

32

|

|

|

32

|

|

|

32

|

|

|

Item

9A. Controls and

Procedures.

|

32

|

|

Item

9B. Other

Information.

|

33

|

|

PART

III

|

|

34

|

||

|

Item

11. Executive Compensation.

|

36

|

|

|

38

|

||

|

39

|

||

|

39

|

||

|

PART

IV

|

Cautionary

Note Regarding Forward Looking Statements

This

annual report contains forward-looking statements as that term is defined in

Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. In some cases,

you can identify forward-looking statements by terminology such as “may,”

“should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” “continue,” “intends,” and other variations of these

words or comparable words. In addition, any statements that refer to

expectations, projections or other characterizations of events, circumstances or

trends and that do not relate to historical matters are forward-looking

statements. These forward-looking statements are based largely on our

expectations or forecasts of future events, can be affected by inaccurate

assumptions, and are subject to various business risks and known and unknown

uncertainties, a number of which are beyond our control. Therefore,

actual results could differ materially from the forward-looking statements

contained in this document, and readers are cautioned not to place undue

reliance on such forward-looking statements. These statements are

only predictions and involve known and unknown risks, uncertainties and other

factors, including the risks in the section entitled “Risk Factors” that may

cause our or our industry’s actual results, levels of activity, performance or

achievements to be materially different from any future results, levels of

activity, performance or achievements expressed or implied by these

forward-looking statements.

Important

factors that may cause the actual results to differ from the forward-looking

statements, projections or other expectations include, but are not limited to,

the following:

|

·

|

risk

that we fail to meet the requirements of the agreements under which we

acquired our options, including any payments or any exploration

obligations that we have regarding these properties, which could result in

the loss of our right to exercise the options to acquire certain mining

and mineral rights underlying these

properties;

|

|

·

|

risk

that we cannot attract, retain and motivate qualified personnel,

particularly employees, consultants and contractors for our operations in

Peru;

|

|

·

|

risks

and uncertainties relating to the interpretation of drill results, the

geology, grade and continuity of mineral

deposits;

|

|

·

|

results

of initial feasibility, pre-feasibility and feasibility studies, and the

possibility that future exploration, development or mining results will

not be consistent with our

expectations;

|

|

·

|

mining

and development risks, including risks related to accidents, equipment

breakdowns, labor disputes or other unanticipated difficulties with or

interruptions in production;

|

|

·

|

the

potential for delays in exploration or development activities or the

completion of feasibility studies;

|

|

·

|

risks

related to the inherent uncertainty of production and cost estimates and

the potential for unexpected costs and

expenses;

|

|

·

|

risks

related to commodity price

fluctuations;

|

|

·

|

the

uncertainty of profitability based upon our history of

losses;

|

|

·

|

risks

related to failure to obtain adequate financing on a timely basis and on

acceptable terms for our planned exploration and development

projects;

|

|

·

|

risks

related to environmental regulation and

liability;

|

|

·

|

risks

that the amounts reserved or allocated for environmental compliance,

reclamation, post-closure control measures, monitoring and on-going

maintenance may not be sufficient to cover such

costs;

|

|

·

|

risks

related to tax assessments;

|

|

·

|

political

and regulatory risks associated with mining development and exploration;

and

|

|

·

|

other

risks and uncertainties related to our prospects, properties and business

strategy.

|

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. You should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

report. Except as required by law, we do not undertake to update or

revise any of the forward-looking statements to conform these statements to

actual results, whether as a result of new information, future events or

otherwise.

As used

in this annual report, “Amazon,” the “Company,” “we,” “us,” or “our” refer to

Amazon Goldsands Ltd., unless otherwise indicated.

If you

are not familiar with the mineral exploration terms used in this report, please

refer to the definitions of these terms under the caption “Glossary” at the end

of Item 15 of this report.

PART

I

ITEM 1. Business.

Corporate

History

We were

incorporated in the state of Nevada under the name Gondwana Energy, Ltd. on

September 5, 1997, and previously operated under the name FinMetal Mining

Ltd. We were previously focused on the acquisition and development of

our interests in the mineral rights on properties located in

Finland.

In

September 2008, we reorganized our operations and our current focus is on the

acquisition and development of our interests in the mineral rights on properties

located in northeastern Peru. Effective June 6, 2008, we merged with

our wholly-owned subsidiary, Amazon Goldsands Ltd., pursuant to Articles of

Merger that we filed with the Nevada Secretary of State. We decided

to change our name to "Amazon Goldsands Ltd." to better reflect our current

focus on the acquisition and development of certain mining and mineral rights

underlying properties located in South America.

We

allowed our options to acquire properties located in Finland to lapse and revert

back to the optionors so that we can pursue the development of our interests in

the mining and mineral rights to properties located in northeastern

Peru.

Exploration

Stage Company

We are

considered an exploration or exploratory stage company because we are involved

in the examination and investigation of land that we believe may contain

valuable minerals, for the purpose of discovering the presence of ore, if any,

and its extent. There is no assurance that a commercially viable mineral deposit

exists on any of the properties underlying our mineral property interests, and a

great deal of further exploration will be required before a final evaluation as

to the economic and legal feasibility for our future exploration is determined.

We have no known reserves of any type of mineral. To date, we have not

discovered an economically viable mineral deposit on any of the properties

underlying our mineral property interests, and there is no assurance that we

will discover one. If we cannot acquire or locate mineral deposits,

or if it is not economical to recover any mineral deposits that we do find, our

business and operations will be materially and adversely affected.

Summary

of our Mineral Property Interests

A

description of each of our options to acquire the mineral and mining rights

underlying properties located in Peru and the conditions that we must meet in

order to exercise these options is set forth in Item 2 of this annual

report.

Effect

of Governmental Regulation on Our Business

We will

be required to comply with all regulations, rules and directives of governmental

authorities and agencies applicable to the exploration of minerals in Peru.

The discussion that follows is a summary of the most significant

government regulations which we anticipate will impact our

operations.

Peru is

located on the western coast of South America and has a population of

approximately 28 million people. It covers a geographic area of

approximately 1.3 million square kilometres and is bordered by Bolivia, Brazil,

Chile, Colombia and Ecuador. Lima is the capital of Peru and its

principal city with a population of approximately 7 million people.

Peru has

become a leading country for mining activities. No special taxes or

registration requirements are imposed on foreign-owned companies and foreign

investment is treated as equal to domestic capital. Peruvian law

allows for full repatriation of capital and profits and the country’s mining

legislation provides access to mining concessions under an efficient

registration system.

Peruvian

Mining Law

Under

Peru’s Uniform Text of Mining Law (“UTM”), the right to explore for and exploit

minerals is granted by the government by way of concessions. A

Peruvian mining concession is a property right, independent from the ownership

of surface land on which it is located. There are no restrictions or

special requirements applicable to foreign companies or individuals regarding

the holding of mining concessions in Peru unless the concessions are within 50

kilometres of Peru's borders. The rights granted by a mining

concession can be transferred, or sold and, in general, may be the subject of

any transaction or contract. Mining concessions may be privately

owned and no state participation is required.

The

application for a mining concession involves the filing of documents before the

mining administrative authority. The mining concession boundaries are

specified in the application documents, with no requirement to mark the

concession boundaries in the field since the boundaries are fixed by UTM

coordinates. In order to conduct exploration or mining activities,

the holder of a mining concession must purchase the surface land required for

the project or reach agreement with the owner for its temporary

use. If any of this is not possible, a legal easement may be

requested from the mining authorities, although these easements have been rarely

granted.

Mining

concessions are irrevocable as long as their holders pay an annual fee of US $3

per hectare and reach minimum production levels within the terms set forth by

law or otherwise pay penalties, as applicable. Non-compliance with

any of these mining obligations for two consecutive years will result in the

cancellation of the mining concession.

Pursuant

to the original legal framework, in force since 1992, holders of mining

concessions are obliged to achieve a minimum production of US $100 per hectare

per year within six years following the year in which the respective mining

concession title is granted. If this minimum production is not reached, as of

the first six months of the seventh year, the holder of the concession shall pay

a US $6 penalty per hectare per year until such production is reached and

penalties increase to US $20 in the twelfth year. Likewise, it is possible to

avoid payment of the penalty if evidence is submitted to the mining authorities

that an amount ten times the applicable penalty or more had been

invested.

However,

this regime has been recently and partially amended providing for, among other

matters, increased minimum production levels, new terms for obtaining such

minimum production, increased penalties in case such minimum production is not

reached, and even the cancellation of mining concessions if minimum production

is not reached within certain terms. Pursuant to this new regime, the

holder of the mining concession should achieve a minimum production of at least

one tax unit (S/. 3,500, approximately US $1,100) per hectare per year, within a

ten-year term following the year in which the mining concession title is

granted. If such minimum production is not reached within the

referred term, the holder of the concession shall pay penalties equivalent to

10% of the tax unit.

If the

minimum production is not reached within a fifteen-year term following the

granting of the concession title, the mining concession shall be cancelled by

the mining authority, unless (i) a qualified force majeure event is evidenced to

and approved by the mining authority, or (ii) by paying the applicable penalties

and concurrently evidencing minimum investments of at least ten times the amount

of the applicable penalties; in which cases the concession may not be cancelled

up to a maximum term of five additional years. If minimum production

is not reached within a twenty-year term following the granting of the

concession title, the concession shall inevitably be cancelled.

This

amended regime is currently applicable to all new mining concessions granted

since October 11, 2008. Regarding those mining concessions existing

prior to such date, the new term for obtaining the increased minimum production

level or otherwise being required to pay the increased penalties pursuant to the

amended regime shall be counted as from the first business day of

2009. Nevertheless, until such new term for obtaining the increased

minimum production level does not expire, the minimum production level, the term

for obtaining such minimum production, the amount of the penalties and the

causes for cancellation of the mining concessions shall continue to be those

provided in the original legal framework existing since 1992.

The

amended regime shall not be applicable to those concessions handed by the

Peruvian State through private investment promotion procedures, which shall

maintain the production and investment obligations contained in their respective

agreements, or to titleholders of concessions with mining stability agreements

in force.

Environmental

Laws

The

Peruvian Ministry of Energy and Mines ("MEM") regulates environmental affairs in

the mining sector, including establishing environmental protection regulations;

while the Office for Supervising Investment in Energy and Mining verifies

environmental compliance and imposes administrative sanctions, although it is

likely that in the near future these functions be assumed by the recently

created Ministry of Environment.

Each

stage of exploration or mining requires some type of authorization or permit,

beginning with an application for an environmental permit for initial

exploration and continuing with an Environmental Impact Assessment ("EIA") for

mining, which includes public hearings.

For

permitting purposes, exploration activities in Peru are classified in two

categories:

|

·

|

Category

I projects: Mining exploration

activities that comprise any of the following: (i) a maximum of

twenty drilling platforms; (ii) a disturbed area of less than ten hectares

considering drilling platforms, trenches, auxiliary facilities and access

means; and, (iii) the construction of tunnels with a total maximum length

of fifty meters. Holders of these projects must submit an

Environmental Impact Statement (“EIS”) before the MEM, which in principle,

is subject to automatic approval upon its filing, and subject to

subsequent (ex post) review by the latter. Nevertheless, in any

of the following cases, the project shall not be subject to automatic

approval and shall necessarily obtain an express prior approval by MEM,

which should be granted, in principle, within a term of two months since

filing the EIS: (i) the project is located in a protected natural area or

its buffer zone; (ii) the project is oriented to determining the existence

of radioactive minerals; (iii) the platforms, drill holes, trenches,

tunnels or other components would be located within certain specially

environmental sensitive areas specified in the applicable regulations

(e.g., glaciers, springs, water wells, groundwater wells, protection

lands, primary woods, etc.); (iv) the project covers areas where mining

environmental contingencies or non-environmental rehabilitated previous

mining works, already exist.

|

|

·

|

Category

II projects: Mining exploration activities that comprise

any of the following: (i) more than twenty drilling platforms; (ii) a

disturbed area of more than ten hectares considering drilling plants,

trenches, auxiliary facilities and access means; and, (iii) the

construction of tunnels over a total length of fifty

meters. These projects require an authorization that are

typically granted once the semi-detailed Environmental Impact Assessment

(EIA) is approved by the MEM. In general, such authorization

should be able to be completed within approximately four

months.

|

Before

initiating construction or exploitation activities and before the expansion of

existing operations, an EIA approval should be obtained. This process

of authorization involves public hearings in the place where the project is

located and, in general, should conclude within a term of 120 calendar days,

although such process can require between eight months and one

year.

Holders

of mining activities performing mining exploration are required to conduct

remediation works of disturbed areas, as part of the progressive closure of the

project. Likewise, they are required to undertake the final closure

and post closure actions as set forth in the terms and conditions in the

approved environmental instrument.

If the

holder carries out mining exploration activities involving the removal of more

than 10,000 tonnes of material, or more than 1,000 tonnes of material with a

potential neutralization (“PN”) over potential acidity (“PA”) relation lower

than 3 (PN/PA<3), then they shall be required to file a Mine Closure Plan,

along with the corresponding environmental instrument, as well as to establish a

financial guarantee to secure compliance with such Mine Closure

Plan.

Holders

of mining exploitation activities must file a Mine Closure Plan with the MEM

within one year of the approval of their EIA. The Mine Closure Plan

must be implemented from the beginning of the mining

operation. Semi-annual reports must be filed evidencing compliance

with the Mine Closure Plan. An environmental guarantee covering the

Mine Closure Plan’s estimated costs is also required to be granted.

Mining

Royalties

Peruvian

law requires that concession holders pay a mining royalty as consideration for

the extraction of mineral resources. The mining royalty is payable

monthly on a variable cumulative rate of 1% to 3% of the value of the ore

concentrate or equivalent, calculated in accordance with price quotations in

international markets, subject to certain deductions such as indirect taxes,

insurance, freight and other specified expenses. The mining royalty

payable is determined based on the following schedule: (i) under US $60 million

of annual sales of concentrates: 1% royalty; (ii) in excess of US $60

million and up to US $120 million of annual sales: 2% royalty; and (iii) in

excess of US $120 million of annual sales: 3% royalty.

Competition

We are an

exploration stage mineral resource exploration company that competes with other

mineral resource exploration companies for financing and for the acquisition of

new mineral properties. Many of the mineral resource exploration

companies with whom we compete have greater financial and technical resources

than those available to us. Accordingly, these competitors may be

able to spend greater amounts on acquisitions of mineral properties of merit, on

exploration of their mineral properties and on development of their mineral

properties. In addition, they may be able to afford more geological

expertise in the targeting and exploration of mineral

properties. This competition could result in competitors having

mineral properties of greater quality and interest to prospective investors who

may finance additional exploration and development. This competition

could adversely impact on our ability to achieve the financing necessary for us

to conduct further exploration of our mineral properties. We will

also compete with other mineral exploration companies for financing from a

limited number of investors that are prepared to make investments in mineral

exploration companies. The presence of competing mineral exploration

companies may impact on our ability to raise additional capital in order to fund

our exploration programs if investors are of the view that investments in

competitors are more attractive based on the merit of the mineral properties

under investigation and the price of the investment offered to

investors. We will also compete with other mineral companies for

available resources, including, but not limited to, professional geologists,

camp staff, mineral exploration supplies and drill rigs.

Intellectual

Property

We do not

own, either legally or beneficially, any patent or trademark.

Employees

We have

no full-time employees at the present time. Our sole executive

officer does not devote his services full time to our operations. We

engage contractors from time to time to consult with us on specific corporate

affairs or to perform specific tasks in connection with our exploration

programs. As of December 31, 2009, we engaged two contractors that

provided work to us on a recurring basis.

Research

and Development Expenditures

We have

not incurred any research or development expenditures since our

incorporation.

Subsidiaries

Subsequent

to the year ended December 31, 2009, we acquired a 50% interest in the

issued and outstanding stock of Beardmore Holdings, Inc. ("Beardmore"), a

corporation incorporated under the laws of Panama. The remaining 50%

interest in the issued and outstanding stock of Beardmore is owned by Temasek

Investments Inc., a company incorporated under the laws of

Panama. Beardmore indirectly owns the mineral rights to certain

properties located in Peru held by its subsidiary, Rio Santiago Minerales

S.A.C.

ITEM 1A. Risk

Factors.

You

should carefully consider the following risk factors in evaluating our business

and us. The factors listed below represent certain important factors

that we believe could cause our business results to differ. These

factors are not intended to represent a complete list of the general or specific

risks that may affect us. It should be recognized that other risks

may be significant, presently or in the future, and the risks set forth below

may affect us to a greater extent than indicated. If any of the

following risks occur, our business, financial condition or results of

operations could be materially and adversely affected. You should

also consider the other information included in this Annual Report and

subsequent quarterly reports filed with the SEC.

Risk

Factors

Risks

Associated With Our Business

Our

accountants have raised substantial doubt with respect to our ability to

continue as a going concern.

As noted

in our financial statements, we have incurred a net loss of $9,714,204 for the

period from inception on September 5, 1997 to December 31, 2009 and have

presently no source of revenue. At December 31, 2009, we had a working

capital deficit of $808,681. As of December 31, 2009, we had cash and

cash equivalents in the amount of US $4,214. We will have to raise

additional funds to meet our currently budgeted operating requirements for the

next twelve months.

The audit

report of James Stafford, Chartered Accountants for the fiscal year ended

December 31, 2009 contained a paragraph that emphasizes the substantial doubt as

to our continuance as a going concern. This is a significant risk

that we may not be able to generate or raise enough capital to remain

operational for an indefinite period of time.

We

own the options to acquire certain mining and mineral rights underlying certain

properties and if we fail to perform the obligations necessary to exercise these

options, we will lose our options and cease operations.

We hold

options to acquire certain mining and mineral rights underlying properties

located in northeastern Peru, subject to certain conditions. If we

fail to meet the requirements of the agreement under which we acquired such

options, including any payments or any exploration obligations that we have

regarding these properties, we may lose our right to exercise the options to

acquire certain mining and mineral rights underlying these properties located in

northeastern Peru. If we do not fulfill these conditions, then our

ability to commence or continue operations could be materially limited.

Accordingly, any adverse circumstances that affect the areas covered by these

options and our rights thereto would affect us and your entire investment in

shares of our common stock. If any of these situations were to arise,

we would need to consider alternatives, both in terms of our prospective

operations and for the financing of our activities. Management cannot

provide assurance that we will ultimately achieve profitable operations or

become cash-flow positive, or raise additional debt and/or equity

capital. If we are unable to raise additional capital in the near

future, we will experience liquidity problems and management expects that we

will need to curtail operations, liquidate assets, seek additional capital on

less favorable terms and/or pursue other remedial measures, including ceasing

operations.

We

have a limited operating history and have incurred losses that we expect to

continue into the future.

We have

not yet located any mineral reserve and we have never had any revenues from our

operations. In addition, we have a very limited operating history upon which an

evaluation of our future success or failure can be made. We have only

recently taken steps in a plan to engage in the acquisition of interests in

exploration and development properties in Peru, and it is too early to determine

whether such steps will prove successful. Our business plan is in its

early stages and faces numerous regulatory, practical, legal and other

obstacles. At this early stage of our operation, we also expect to

face the risks, uncertainties, expenses and difficulties frequently encountered

by companies at the start-up stage of their business development. We cannot be

sure that we will be successful in addressing these risks and uncertainties, and

our failure to do so could have a materially adverse effect on our financial

condition.

No

assurance can be given that we will be able to successfully complete the

purchase of mining rights to any properties, including the ones for which we

currently hold options. Our ability to achieve and maintain

profitability and positive cash flow over time will be dependent upon, among

other things, our ability to (i) identify and acquire gold mining properties or

interests therein that ultimately have probable or proven gold reserves, (ii)

sell such gold mining properties or interests to strategic partners or third

parties or commence mining of gold, (iii) produce and sell gold at profitable

margins, and (iv) raise the necessary capital to operate during this possible

extended period of time. At this stage in our development, it cannot

be predicted how much financing will be required to accomplish these

objectives.

We

have no known reserves and we may not find any mineral resources or, if we find

mineral resources, the deposits may be uneconomic or production from those

deposits may not be profitable.

Our due

diligence activities have been limited, and to a great extent, have relied upon

information provided to us by third parties. We have not established

that any of the properties for which we hold options contain adequate amounts of

gold or other mineral reserves to make mining any of the properties economically

feasible to recover that gold or other mineral reserves, or to make a profit in

doing so. If we do not, our business will fail. If we

cannot find economic mineral resources or if it is not economic to recover the

mineral resources, we will have to cease operations.

We

may not have access to all of the supplies and materials we need to begin

exploration that could cause us to delay or suspend operations.

Competition

and unforeseen limited sources of supplies in the industry could result in

occasional spot shortages of supplies, such as explosives, and certain

equipment, such as bulldozers and excavators, that we might need to conduct

exploration. We have not attempted to locate or negotiate with any

suppliers of products, equipment or materials. We will attempt to

locate products, equipment and materials. If we cannot find the

products and equipment we need, we will have to suspend our exploration plans

until we do find the products and equipment we need.

We

do not have enough money to complete our exploration and consequently may have

to cease or suspend our operations unless we are able to raise additional

financing.

We

presently do not have sufficient capital to exercise our options to acquire

interests in property located in Peru. Although management believes

that sources of financing are available to complete the acquisition of these

property interests, no assurance can be given that these financing sources will

ultimately be sufficient. Other forms of financing, if available, may

be on terms that are unfavorable to our stockholders.

As we

cannot assure a lender that we will be able to successfully explore and develop

our mineral properties, we will probably find it difficult to raise debt

financing from traditional lending sources. We have traditionally

raised our operating capital from sales of equity and debt securities, but there

can be no assurance that we will continue to be able to do so. If we cannot

raise the money that we need to continue exploration of our mineral properties,

we may be forced to delay, scale back, or eliminate our exploration activities.

If any of these were to occur, there is a substantial risk that our business

would fail.

Our

success is dependent upon a limited number of people.

The

ability to identify, negotiate and consummate transactions that will benefit us

is dependent upon the efforts of our management team. The loss of the

services of any member of our management could have a material adverse effect on

us.

Our

business will be harmed if we are unable to manage growth.

Our

business may experience periods of rapid growth that will place significant

demands on our managerial, operational and financial resources. In

order to manage this possible growth, we must continue to improve and expand our

management, operational and financial systems and controls, particularly those

related to subsidiaries that will be doing business in Peru. We will

need to expand, train and manage our employee base. We must carefully

manage our mining exploration activities. No assurance can be given

that we will be able to timely and effectively meet such demands.

We

may not be able to attract and retain qualified personnel necessary for the

implementation of its business strategy and gold exploration

programs.

Our

future success depends largely upon the continued service of board members,

executive officers and other key personnel. Our success also depends

on our ability to continue to attract, retain and motivate qualified personnel,

particularly employees, consultants and contractors for our operations in

Peru. Personnel represents a significant asset, and the competition

for such personnel is intense in the gold exploration industry. We

may have particular difficulty attracting and retaining key personnel in the

initial phases of our operations, particularly in Peru.

Our

officers and sole director may have conflicts of interest and do not devote full

time to our operations.

Our

officers and sole director may have conflicts of interest in that they are and

may become affiliated with other mining companies. In addition, our

officers do not devote their full time to our operations. Until such

time that we can afford executive compensation commensurate with that being paid

in the marketplace, our officers will not devote their full time and attention

to our operations. No assurance can be given as to when we will be

financially able to engage our officers on a full-time basis or engage

additional officers.

Because

our officers and sole director are located outside of the United States, you may

have no effective recourse against us or our management for misconduct and may

not be able to enforce judgment and civil liabilities against our officers,

director, experts and agents.

Our sole

director and officers are nationals and/or residents of countries other than the

United States, and all or a substantial portion of such persons' assets are

located outside the United States. As a result, it may be difficult for

investors to enforce within the United States any judgments obtained against our

officers or our sole director, including judgments predicated upon the civil

liability provisions of the securities laws of the United States or any state

thereof.

Risks

Associated With Mining

All

of our properties are in the exploration stage. There is no assurance

that we can establish the existence of any mineral resource on any of our

properties in commercially exploitable quantities. Until we can do so, we cannot

earn any revenues from operations and if we do not do so we will lose all of the

funds that we expend on exploration. If we do not discover any mineral resource

in a commercially exploitable quantity, our business will fail.

We have

not established that any of our properties contain any commercially exploitable

mineral reserve, nor can there be any assurance that we will be able to do so.

If we do not, our business will fail. A mineral reserve is defined by

the Securities and Exchange Commission in its Industry Guide 7 (which can be

viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7)

as that part of a mineral deposit which could be economically and legally

extracted or produced at the time of the reserve determination. The probability

of an individual prospect ever having a “reserve” that meets the requirements of

the Securities and Exchange Commission’s Industry Guide 7 is extremely remote;

in all probability our mineral resource property does not contain any ‘reserve’

and any funds that we spend on exploration will probably be lost.

Even if

we do eventually discover a mineral reserve on one or more of our properties,

there can be no assurance that we will be able to develop our properties into

producing mines and extract those resources. Both mineral exploration and

development involve a high degree of risk and few properties that are explored

are ultimately developed into producing mines. If we do discover

mineral resources in commercially exploitable quantities on any of our

properties, we will be required to expend substantial sums of money to establish

the extent of the resource, develop processes to extract it and develop

extraction and processing facilities and infrastructure.

The

commercial viability of an established mineral deposit will depend on a number

of factors including, by way of example, the size, grade and other attributes of

the mineral deposit, the proximity of the resource to infrastructure such as a

smelter, roads and a point for shipping, government regulation and market

prices. Most of these factors will be beyond our control, and any of them could

increase costs and make extraction of any identified mineral resource

unprofitable.

Mineral

operations are subject to applicable law and government regulation. Even if we

discover a mineral resource in a commercially exploitable quantity, these laws

and regulations could restrict or prohibit the exploitation of that mineral

resource. If we cannot exploit any mineral resource that we might

discover on our properties, our business may fail.

Both

mineral exploration and extraction require permits from various foreign,

federal, state, provincial and local governmental authorities and are governed

by laws and regulations, including those with respect to prospecting, mine

development, mineral production, transport, export, taxation, labor standards,

occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. There can be no assurance

that we will be able to obtain or maintain any of the permits required for the

continued exploration of our mineral properties or for the construction and

operation of a mine on our properties at economically viable

costs. If we cannot accomplish these objectives, our business could

fail.

We

believe that we are in compliance with all material laws and regulations that

currently apply to our activities but there can be no assurance that we can

continue to do so. Current laws and regulations could be amended and

we might not be able to comply with them, as amended. Further, there

can be no assurance that we will be able to obtain or maintain all permits

necessary for our future operations, or that we will be able to obtain them on

reasonable terms. To the extent such approvals are required and are

not obtained, we may be delayed or prohibited from proceeding with planned

exploration or development of our mineral properties.

If

we establish the existence of a mineral reserve on any of our properties, we

will require additional capital in order to develop the property into a

producing mine. If we cannot raise this additional capital, we will not be able

to exploit the reserve and our business could fail.

If we do

discover a mineral reserve on any of our properties, we will be required to

expend substantial sums of money to establish the extent of the reserve, develop

processes to extract it and develop extraction and processing facilities and

infrastructure. Although we may derive substantial benefits from the

discovery of a reserve, there can be no assurance that it will be large enough

to justify commercial operations, nor can there be any assurance that we will be

able to raise the funds required for development on a timely

basis. If we cannot raise the necessary capital or complete the

necessary facilities and infrastructure, our business may fail.

Because

our property interest and exploration activities in Peru are subject to

political, economic and other uncertainties, situations may arise that could

have a significantly adverse material impact on us.

Our

activities in Peru are subject to political, economic and other uncertainties,

including the risk of expropriation, nationalization, renegotiation or

nullification of existing contracts, mining licenses and permits or other

agreements, changes in laws or taxation policies, currency exchange

restrictions, changing political conditions and international monetary

fluctuations. Future government actions concerning the economy,

taxation, or the operation and regulation of nationally important facilities

such as mines could have a significant effect on our plans and on our ability to

operate. No assurance can be given that our plans and operations will

not be adversely affected by future developments in Peru.

Because

we presently do not carry title insurance and do not plan to secure any in the

future, we are vulnerable to loss of title.

We do not

maintain insurance against title. Title on mineral properties and

mining rights involves certain inherent risks due to the difficulties of

determining the validity of certain claims as well as the potential for problems

arising from the frequently ambiguous conveyance history characteristic of many

mining properties. Disputes over land ownership are common,

especially in the context of resource developments. We cannot give

any assurance that title to such properties will not be challenged or impugned

and cannot be certain that we will have or acquire valid title to these mining

properties. The possibility also exists that title to existing

properties or future prospective properties may be lost due to an omission in

the claim of title. As a result, any claims against us may result in

liabilities we will not be able to afford, resulting in the failure of our

business.

Because

we are subject to various governmental regulations and environmental risks, we

may incur substantial costs to remain in compliance.

Our

activities in Peru are subject to Peruvian and local laws and regulations

regarding environmental matters, the abstraction of water, and the discharge of

mining wastes and materials. Any significant mining operations will

have some environmental impact, including land and habitat impact, arising from

the use of land for mining and related activities, and certain impact on water

resources near the project sites, resulting from water use, rock disposal and

drainage run-off. No assurance can be given that such environmental

issues will not cause our operations in the future to fail.

The

Peruvian and/or local government could require us to remedy any negative

environmental impact. The costs of such remediation could cause us to

fail. Future environmental laws and regulations could impose

increased capital or operating costs on us and could restrict the development or

operation of any gold mines.

We have,

and will in the future, engage consultants to assist us with respect to our

operations in Peru. We are beginning to address the various

regulatory and governmental agencies, and the rules and regulations of such

agencies, in connection with the options for the properties in

Peru. No assurances can be given that we will be successful in our

efforts. Further, in order for us to operate and grow our business in

Peru, we need to continually conform to the laws, rules and regulations of such

country and local jurisdiction. It is possible that the legal and

regulatory environment pertaining to the exploration and development of gold

mining properties will change. Uncertainty and new regulations and

rules could dramatically increase our cost of doing business, or prevent us from

conducting its business; both situations could cause us to fail.

Mineral

exploration and development is subject to extraordinary operating risks. We do

not currently insure against these risks. In the event of a cave-in or similar

occurrence, our liabilities may exceed our resources, which could cause our

business to fail.

Mineral

exploration, development and production involves many risks which even a

combination of experience, knowledge and careful evaluation may not be able to

overcome. Our operations will be subject to all the hazards and risks

inherent in the exploration, development and production of resources, including

liability for pollution, cave-ins or similar hazards against which we cannot

insure or against which we may elect not to insure. Any such event could result

in work stoppages and damage to property, including damage to the

environment. We do not currently maintain any insurance coverage

against these operating hazards. The payment of any liabilities that

arise from any such occurrence could cause us to fail.

Mineral

prices are subject to dramatic and unpredictable fluctuations.

We expect

to derive revenues, if any, from the extraction and sale of precious and base

metals such as gold and silver. The price of those commodities has

fluctuated widely in recent years, and is affected by numerous factors beyond

our control including international, economic and political trends, expectations

of inflation, currency exchange fluctuations, interest rates, global or regional

consumptive patterns, speculative activities and increased production due to new

extraction developments and improved extraction and production

methods. The effect of these factors on the price of base and

precious metals, and, therefore, the economic viability of any of our

exploration projects, cannot accurately be predicted.

The

mining industry is highly competitive and there is no assurance that we will

continue to be successful in acquiring property interests. If we cannot continue

to acquire interests in properties to explore for mineral resources, we may be

required to reduce or cease operations.

The

mineral exploration, development, and production industry is largely

unintegrated. We compete with other exploration companies looking for

mineral resource properties. While we compete with other exploration

companies in the effort to locate and license mineral resource properties, we

will not compete with them for the removal or sales of mineral products from our

properties if we should eventually discover the presence of them in quantities

sufficient to make production economically feasible. Readily

available markets exist worldwide for the sale of gold and other mineral

products. Therefore, we will likely be able to sell any gold or

mineral products that we identify and produce.

We

compete with many companies possessing greater financial resources and technical

facilities. This competition could adversely affect our ability to acquire

suitable prospects for exploration in the future as well as our ability to

recruit and retain qualified personnel. Accordingly, there can be no assurance

that we will acquire any interest in additional mineral resource properties that

might yield reserves or result in commercial mining

operations.

Risks

Relating to our Common Stock

Trading on the over-the-counter

bulletin board may be volatile and sporadic, which could depress the market

price of our common stock and make it difficult for our stockholders to resell

their shares.

Our

common stock is quoted on the over-the-counter bulletin board service of the

Financial Industry Regulatory Authority (the “OTCBB”). Trading in

stock quoted on the OTCBB is often thin and characterized by wide fluctuations

in trading prices, due to many factors that may have little to do with our

operations or business prospects. This volatility could depress the

market price of our common stock for reasons unrelated to operating

performance. Moreover, the OTCBB is not a stock exchange, and trading

of securities on the OTCBB is often more sporadic than the trading of securities

listed on a quotation system like Nasdaq or a stock exchange like

Amex. Accordingly, shareholders may have difficulty reselling any of

the shares.

Because

our common stock is quoted and traded on the OTCBB, short selling could increase

the volatility of our stock price.

Short

selling occurs when a person sells shares of stock which the person does not yet

own and promises to buy stock in the future to cover the sale. The

general objective of the person selling the shares short is to make a profit by

buying the shares later, at a lower price, to cover the

sale. Significant amounts of short selling, or the perception that a

significant amount of short sales could occur, could depress the market price of

our common stock. In contrast, purchases to cover a short position may have the

effect of preventing or retarding a decline in the market price of our common

stock, and together with the imposition of the penalty bid, may stabilize,

maintain or otherwise affect the market price of our common stock. As

a result, the price of our common stock may be higher than the price that

otherwise might exist in the open market. If these activities are

commenced, they may be discontinued at any time. These transactions

may be effected on the OTCBB or any other available markets or

exchanges. Such short selling if it were to occur could impact the

value of our stock in an extreme and volatile manner to the detriment of our

shareholders.

We

have never paid dividends and have no plans to in the future.

Holders

of shares of our common stock are entitled to receive such dividends as may be

declared by our board of directors. To date, we have paid no cash

dividends on our shares of common stock and we do not expect to pay cash

dividends on our common stock in the foreseeable future. We intend to

retain future earnings, if any, to provide funds for operation of our

business. Therefore, any return investors in our common stock will

have to be in the form of appreciation, if any, in the market value of their

shares of common stock.

We

have additional securities available for issuance, which, if issued, could

adversely affect the rights of the holders of our common stock.

Our

Articles of Incorporation authorize the issuance of 200,000,000 shares of our

common stock and 200,000,000 shares of blank check preferred

stock. The common stock or blank check preferred stock can be issued

by our board of directors, without stockholder approval. Any future

issuances of our common stock would further dilute the percentage ownership of

our common stock held by public shareholders.

If

we issue shares of blank check preferred stock with superior rights than our

common stock, it could result in the decrease in the value of our common stock

and delay or prevent a change in control of us.

Our board

of directors is authorized to issue up to 200,000,000 shares of blank check

preferred stock. Our board of directors has the power to establish the dividend

rates, liquidation preferences, voting rights, redemption and conversion terms

and privileges with respect to any series of blank check preferred stock. The

issuance of any shares of blank check preferred stock having rights superior to

those of the common stock may result in a decrease in the value or market price

of the common stock. Holders of blank check preferred stock may have

the right to receive dividends, certain preferences in liquidation and

conversion rights. The issuance of blank check preferred stock could,

under certain circumstances, have the effect of delaying, deferring or

preventing a change in control of us without further vote or action by the

shareholders and may adversely affect the voting and other rights of the holders

of common stock.

Because

the SEC imposes additional sales practice requirements on brokers who deal in

our shares that are penny stocks, some brokers may be unwilling to trade them.

This means that you may have difficulty in reselling your shares and may cause

the price of the shares to decline.

Our stock

is a penny stock. The Securities and Exchange Commission has adopted

Rule 15g-9 which generally defines “penny stock” to be any equity security that

has a market price (as defined) less than $5.00 per share or an exercise price

of less than $5.00 per share, subject to certain exceptions. Our securities are

covered by the penny stock rules, which impose additional sales practice

requirements on broker-dealers who sell to persons other than established

customers and “accredited investors”. The term “accredited investor”

refers generally to institutions with assets in excess of $5,000,000 or

individuals with a net worth in excess of $1,000,000 or annual income exceeding

$200,000 or $300,000 jointly with their spouse. The penny stock rules

require a broker-dealer, prior to a transaction in a penny stock not otherwise

exempt from the rules, to deliver a standardized risk disclosure document in a

form prepared by the SEC which provides information about penny stocks and the

nature and level of risks in the penny stock market. The

broker-dealer also must provide the customer with current bid and offer

quotations for the penny

stock,

the compensation of the broker-dealer and its salesperson in the transaction and

monthly account statements showing the market value of each penny stock held in

the customer’s account. The bid and offer quotations and the

broker-dealer and salesperson compensation information must be given to the

customer orally or in writing prior to effecting the transaction and must be

given to the customer in writing before or with the customer’s

confirmation. In addition, the penny stock rules require that prior

to a transaction in a penny stock not otherwise exempt from these rules, the

broker-dealer must make a special written determination that the penny stock is

a suitable investment for the purchaser and receive the purchaser’s written

agreement to the transaction. These disclosure requirements may have

the effect of reducing the level of trading activity in the secondary market for

the stock that is subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest

in, and limit the marketability of, our common stock.

In

addition to the “penny stock” rules promulgated by the Securities and Exchange

Commission, FINRA has adopted rules that require that in recommending an

investment to a customer, a broker-dealer must have reasonable grounds for

believing that the investment is suitable for that customer. Prior to

recommending speculative, low-priced securities to their non-institutional

customers, broker-dealers must make reasonable efforts to obtain information

about the customer’s financial status, tax status, investment objectives and

other information. Under interpretations of these rules, FINRA

believes that there is a high probability that speculative low-priced securities

will not be suitable for at least some customers. The FINRA

requirements make it more difficult for broker-dealers to recommend that their

customers buy our common stock, which may limit your ability to buy and sell our

stock.

Indemnification

of officers and directors.

Our

Articles of Incorporation and Bylaws contain broad indemnification and liability

limiting provisions regarding our officers, directors and employees, including

the limitation of liability for certain violations of fiduciary

duties. Our shareholders therefore will have only limited recourse

against the individuals.

ITEM 1B. Unresolved Staff

Comments.

None.

ITEM 2.

Properties.

Description

of our Mineral Property Interests

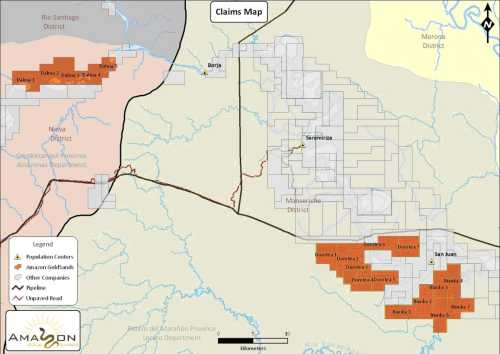

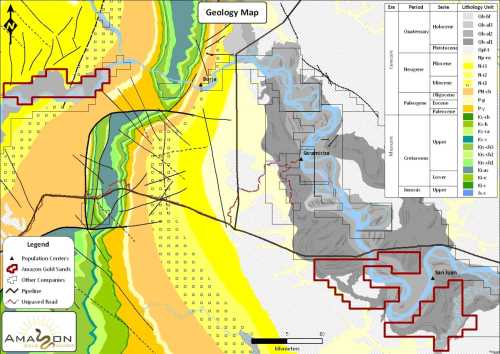

Our

properties are located in northeastern Peru and are in the exploration

stage. These properties are without known reserves and the proposed

plan of exploration detailed below is exploratory in nature. These

properties are described below.

Peru

Property

Our

property interests located in Peru are in the exploration

state. These properties are without known reserves and the proposed

plan of exploration detailed below is exploratory in nature. These

properties are described below.

We

entered into a Mineral Right Option Agreement with Temasek Investments Inc.

(“Temasek”), a company incorporated under the laws of Panama, on September 18,

2008 (the “Effective Date”), as amended and supplemented by Amendment No. 1

dated May 12, 2009 (“Amendment No. 1”) and Amendment No. 2 dated February 3,

2010 (“Amendment No. 2”) (collectively, the “Option Agreement”), in order to

acquire four separate options from Temasek, each providing for the acquisition

of a twenty-five percent interest in certain mineral rights (the “Mineral

Rights”) in certain properties in Peru, potentially resulting in our acquisition

of one hundred percent of the Mineral Rights. The Mineral Rights are

currently owned by Rio Santiago Minerales S.A.C. ("Rio

Santiago"). Beardmore Holdings, Inc. ("Beardmore") owns 999 shares of

the 1,000 shares of Rio Santiago that are issued and

outstanding. Temasek owns the single remaining share of Rio

Santiago. Our acquisition of each twenty-five percent interest in the

Mineral Rights is structured to occur through the transfer to us of twenty-five

percent of the outstanding shares of Beardmore upon the exercise of each of the

four options.

A

description of the Mineral Rights is set forth below:

|

Name

|

Area

(ha)

|

Code

|

Title

Nº

|

Owner

|

|

Bianka

1

|

1000

|

01-03905-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Bianka

2

|

1000

|

01-03878-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Bianka

3

|

900

|

01-03879-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Bianka

4

|

1000

|

01-03883-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Bianka

6

|

1000

|

01-03881-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Bianka

7

|

1000

|

01-03888-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dalma

1

|

1000

|

01-03859-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dalma

2

|

1000

|

01-03863-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dalma

3

|

1000

|

01-03857-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dalma

4

|

800

|

01-03865-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dalma

5

|

500

|

01-03866-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

1

|

1000

|

01-03909-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

2

|

900

|

01-03906-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

3

|

1000

|

01-03904-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

4

|

800

|

01-03908-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

5

|

1000

|

01-03910-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

6

|

1000

|

01-03901-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

|

Dorotea

7

|

1000

|

01-03899-08

|

00074599

|

Rio

Santiago Minerales S.A.C.

|

We

exercised the initial twenty-five percent option, which provided for the

acquisition of a twenty-five percent interest in the Mineral Rights, by paying

Temasek a total of $500,000 and issuing 2,500,000 shares of our common stock to

Temasek on or about January 12, 2009 in accordance with the terms of the Option

Agreement.

We

exercised the second twenty-five percent option, which resulted in our

acquisition of an aggregate fifty percent interest in the Mineral Rights, by

paying Temasek a total of $750,000 and issuing 3,500,000 shares of our common

stock to Temasek on or about March 22, 2010 in accordance with the terms of the

Option Agreement.

Under the

terms of the Option Agreement, as amended, we could have exercised the

third, twenty-five percent option, resulting in our acquisition of a

seventy-five percent interest in the Mineral Rights, after fulfilling the

following conditions:

|

·

|

Complete

the exercise of the second, twenty-five percent option, resulting in our

acquisition of a fifty percent interest in the Mineral

Rights;

|

|

·

|

Issuance

of 5,000,000 shares of our common stock to Temasek, or whoever persons

Temasek indicates, by March 5, 2010, which is within 30 days of the

effective date of Amendment No. 2 (which shares were issued on March 9,

2010);

|

|

·

|

Payment

of $250,000 to the order and the direction of Temasek by March 5, 2010,

which is within 30 days of the effective date of Amendment No. 2 (which

payment was made on March 22, 2010);

and

|

|

·

|

Payment

of $1,000,000 to the order and the direction of Temasek on or before

March 18, 2010, which is within eighteen months of the Effective

Date.

|

We could

have exercised the fourth, twenty-five percent option, resulting in our

acquisition of a one hundred percent interest in the Mineral Rights, after

fulfilling the following conditions by March 18, 2010, which is within eighteen

months of the Effective Date:

|

·

|

Exercise

and complete the initial, second, and third, twenty-five percent

options;

|

|

·

|

Payment

of an additional amount $2,500,000 to Temasek;

and

|

|

·

|

Issuance

of 5,500,000 additional shares of common stock to

Temasek.

|

As of the

end of the first quarter of 2010, we did not have sufficient financing to be

able to make the required cash payments to exercise the third and fourth

twenty-five percent options within the time period set forth in the Option

Agreement. We are in negotiations with Temasek to enter into another

amendment to the Option Agreement in order to revise the terms required for us

to exercise the third and fourth twenty-five percent options. There

can be no assurance that we will be successful in amending the Option Agreement

or securing the necessary funding to exercise the third or fourth twenty-five

percent options. In the event that we are unable to enter into

another amendment to the Option Agreement, our ownership interest in the Mineral

Rights would be limited to our fifty percent interest, we would lose our ability

to acquire the third and fourth twenty-five percent options to acquire an

aggregate seventy-five and one hundred percent interest in the Mineral Rights,

respectively, and not be entitled to recover the $250,000 paid and 5,000,000

shares of our common stock issued as partial consideration for the exercise of

the third twenty-five percent option.

If we are

able to complete the acquisition of a one hundred percent interest in the

Mineral Rights, Temasek will hold its single share of Rio Santiago in trust for

our sole benefit and hold the share strictly in accordance with our

instructions.

If we are

able to complete the acquisition of a one hundred percent interest in the

Mineral Rights, Temasek will be entitled to an annual 2.5% net returns

royalty. However, if we pay Temasek $2,000,000 within ninety days of

our acquisition of a one hundred percent interest in the Mineral Rights, Temasek

will only be entitled to an annual 1.5% net returns royalty.

If we

exercise the second, twenty-five percent option, resulting in our acquisition of

a fifty percent interest in the Mineral Rights, but fail to acquire a one

hundred percent interest in the Mineral Rights, the Option Agreement provides

that we and Temasek will form a joint venture for the purpose of placing the

Peru Property into commercial production. In the event that this

condition is satisfied and we enter into a joint venture with Temasek, out

responsibilities under the joint venture would include developing a feasible

mining project and all necessary facilities, and Temasek shall retain a carried

free interest in the mining rights. If we enter into a joint venture

with Temasek, but do not develop a feasible mining project within three years of

the Effective Date (or by September 18, 2011), we will be required to pay

Temasek an advance minimum mining royalty of $500,000 per year, which will be

deducted from Temasek's net return royalty.

Planned

Exploration Program

An

exploration base is being set up in the town of Saramiriza, which is located in

the center of the Manseriche alluvial camp on the western bank of the

Marañón.

Provided

we are successful in securing additional financing, we intend to conduct a

seismic survey along selected lines across the Marañón gravels in order to

define the gravel-bedrock contact. This information is needed to plan a

drilling program and to assist with locating drill collar

positions. The selection of seismic lines will be made on the basis

of interpretation of aerial photos and satellite images, as well as from

reconnaissance-scale mapping of sedimentary features. Scout drilling

utilizing churn drills will be undertaken on favorable areas, and anomalous

zones will be followed up with reverse circulation drilling (Becker) in order to

fully develop resources and reserves.

Provided

we are successful in securing additional financing and before implementing the

drilling plan, we intend to identify the landowners of the plots on which

the mines are located so as to determine who the legal owners or current

occupants are and/or the kind of tenancy or tenancy claim over the surface of

the land, as well as the location of Native or Creole communities within the

project’s area of influence. This process has commenced, but cannot

be completed without securing additional financing.

An

Environmental Impact Report will also be required to be drafted so as to obtain

the Environmental Impact Declaration from the Peruvian Mining Authorities, which

is an essential requirement for any kind of exploration in Peru.

We intend

to collect by backhoe and excavator a number of bulk samples for metallurgical

testing, and to confirm drill results. At the same time, mine

development planning, process design, and other engineering studies will be

conducted with a view to completing a feasibility study within an eighteen month

period. Permitting work will be initiated as early in the exploration

and development cycle as possible, so that trial or pilot dredging can be

started as soon as feasibility has been established. If we are able

to secure sufficient additional financing, we anticipate that we will commence

shortly thereafter the mapping and geophysics with the initial drilling to

follow.

Our

current cash on hand is insufficient to complete any of the activities set forth

in our planned exploration program. If we are unable to secure

additional financing in the near future, we will be forced to postpone the

commencement of our exploration and development program. Provided we

are able to secure additional financing through private equity offerings, we

anticipate that we will incur the following costs for the next twelve

months:

|

Activity

|

USD 000s

|

|

|

MINERAL

PROPERTY COSTS:

|

||

|

Annual

Fee

|

50

|

|

|

Surface

Rights Access

|

15

|

|

|

EXPLORATION

|

||

|

Mapping

|

25

|

|

|

Geophysics

– Seismic

|

50

|

|

|

DRILLING

|

||

|

Churn

Drilling

|

200

|

|

|

TECHNICAL

SERVICES

|

||

|

Consultants

|

90

|

|

|

Personnel

|

100

|

|

|

CAMP

AND FIELD EXPENSES

|

||

|

Camp

|

100

|

|

|

Field

|

75

|

|

|

TRANSPORT

AND LOGISTICS

|

||

|

Air

Transport

|

90

|

|

|

Water

Transport

|

40

|

|

|

Ground

Transport

|

25

|

|