Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | d8k.htm |

| EX-99.1 - APRIL 7, 2010 EARNINGS CALL TRANSCRIPT - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | dex991.htm |

Allscripts

Investor

Presentation

–

April,

2010

Exhibit 99.2 |

2

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities

laws. Statements regarding future events, developments, the Company's future performance, as well

as management's expectations, beliefs, intentions, plans, estimates or projections relating to

the future are forward-looking statements within the meaning of these laws. These

forward-looking statements are subject to a number of risks and uncertainties, some of which

are outlined below. As a result, actual results may vary materially from those anticipated by

the forward-looking statements. Among the important factors that could cause actual results to differ

materially from those indicated by such forward-looking statements are: the volume and timing of

systems sales and installations; length of sales cycles and the installation process; the

possibility that products will not achieve or sustain market acceptance; the timing, cost and

success or failure of new product and service introductions, development and product upgrade

releases; the impact of the securities class action and other pending or threatened litigation;

competitive pressures including product offerings, pricing and promotional activities; our ability

to establish and maintain strategic relationships; undetected errors or similar problems in our

software products; compliance with existing laws, regulations and industry initiatives and

future changes in laws or regulations in the healthcare industry; possible regulation of the

Company's software by the U.S. Food and Drug Administration; failure to achieve certification

under the Health Information Technology for Economic and Clinical Health Act could result in

increased development costs, a breach of some customer obligations and put Allscripts at a competitive

disadvantage in the marketplace; unexpected requirements to achieve interoperability certification

pursuant to The Certification Commission for Healthcare Information Technology could result in

increased development and other costs for Allscripts; the possibility of product-related

liabilities; our ability to attract and retain qualified personnel; our ability to identify and

complete acquisitions, manage our growth and integrate acquisitions; the ability to recognize

the benefits of the merger with Misys Healthcare Systems, LLC ("Misys"); the integration of Misys with

the Company and the possible disruption of current plans and operations as a result thereof; the

implementation and speed of acceptance of the electronic record provisions of the American

Recovery and Reinvestment Act of 2009; maintaining our intellectual property rights and

litigation involving intellectual property rights; risks related to third-party suppliers;

our ability to obtain, use or successfully integrate third-party licensed technology; breach of

our security by third parties; and the risk factors detailed from time to time in our reports filed

with the Securities and Exchange Commission, including our 2009 Annual Report on Form 10-K

available through the Web site maintained by the Securities and Exchange Commission at

www.sec.gov. The Company undertakes no obligation to update publicly any forward-looking

statement, whether as a result of new information, future events or otherwise.

|

3

Agenda

›

Market Opportunity

›

“The Time is Now”

›

Why Allscripts?

›

Financial Update |

We

are at the beginning of what we expect will be the

single

fastest transformation

of any industry in US history |

5

2010: The “Year of the EHR” |

6

2010: The Year of the EHR

<20

%

Approx. 20% EHR

Physician Penetration

-Early Adopters

~

$30B

~$30 Billion in

Federal Funding

70

%

70% of Funding Will Be

Spent

in First 3 Years

Lower IT Investment in Healthcare Than Any Other Sector of Economy

Sources: United States Dept. of Health and Human Services: Fiscal Year 2010

Budget in Brief, ARRA Centers for Disease Control and Prevention

|

7

Market Potential

Practice Size

Total # of Practices

EHR Penetration

(FY08/09)

1-3 Physicians

163,000

~10%

4-9 Physician

27,000

~20%

10-25 Physicians

8,000

~25%

26+ Physicians

2,000

~40%

Total

200,000

~12%

Source: SK&A = SK&A Information Services which sells databases for sales

and marketing success in healthcare industry 7 |

8

Once in a Lifetime Opportunity… |

9

Meaningful Use 101: Key Components

›

The EHR Must be Certified

& Include e-Prescribing

›

The EHR Must be Connected

›

The EHR Must Include Reporting Capabilities on Clinical

Quality Metrics

›

The EHR Must be Used in a Meaningful Way |

10

“If you wait to purchase an EHR until the rules are final ...

I will put my reputation on the line and say that you will

not achieve meaningful use in 2011.”

Dr. Mark Leavitt

Chair of CCHIT

February 2010

The Time is Now… |

11

70% of

Funding

Used

2013

First

Checks

Cut

Q1

2011

ARRA

Announced

Q1

2009

MU

Finalized

Q1

2010

Catalysts for EHR Adoption

~20%

Physician

Penetration(a)

(a) ~20% estimate based on number of ambulatory physicians; penetration as a

percentage of number of physician practices, is approximatley ~12%

|

|

13

Go…

$44,000 to $64,000/MD &

$2,000,000/Hospital |

14

Guarantee our EHRs will meet the MU

certification criteria

The Assurance

Go… |

15

Go…

The Assurance

Set by Allscripts Clients:

160,000 MDs

800 Hospitals

8,000 Post Acute Care Facilities |

16

Why Allscripts?

›

Leadership

The clear leader in providing innovative software, connectivity and

information solutions that empower physicians and other healthcare

providers

to

improve

the

health

of

both

their

patients

and

their

bottom

line

›

A Safe Choice

Financially Strong

Revenue of ~ $700 mm

R&D F2010 ~$70 mm

›

People & Experience |

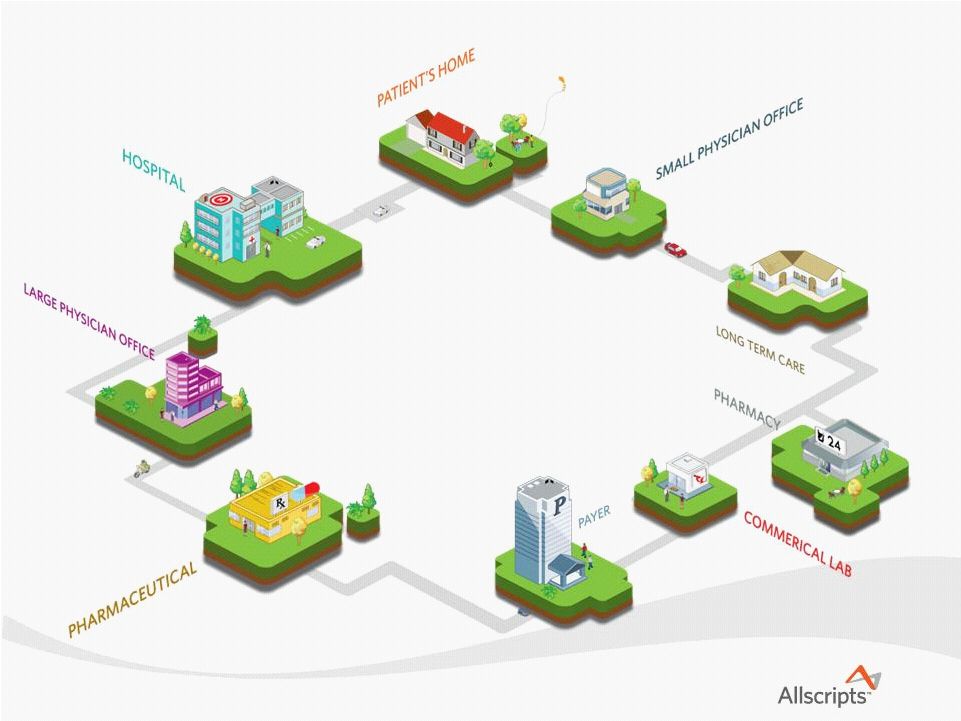

17

Our Footprint…

160,000 Physicians

8,000 Post-Acute Providers

800 Hospitals

and 80 million Rx… |

18

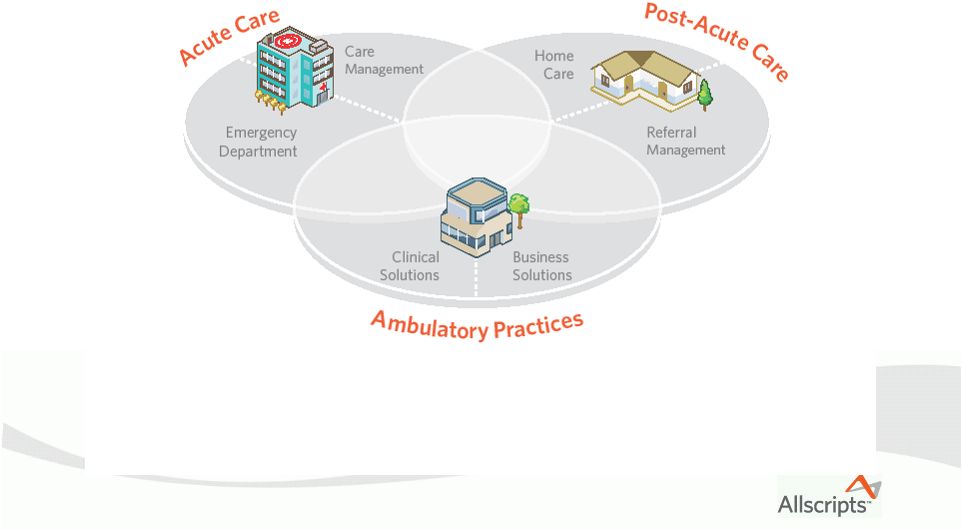

Comprehensive Portfolio…

Across the Continuum of Care |

19 |

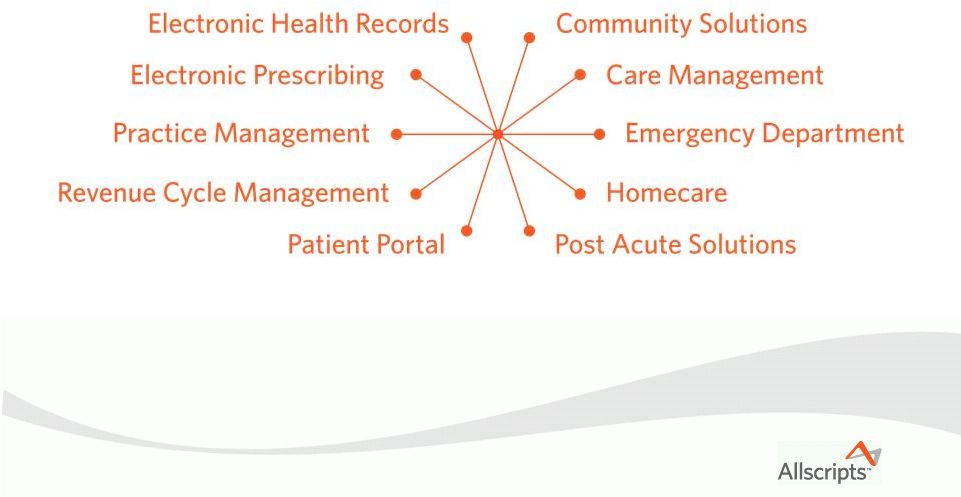

20

An Industry-Leading Portfolio |

21

Connect |

22

Powerful Engine to Drive Sales

Hospital/Community Distribution Partners

Exclusive Relationships: Henry Schein; Cardinal Health

Allscripts

Distribution Network

~250 Direct Sales Professionals

Direct Marketing |

23

Our Approach –

Allscripts Everywhere

MyWay

& Professional

•

Certification

Guarantee

•

Regional Extension

Center Strategy

•

Leverage installed

base

•

Distribution Network

•

Turn-key to Live

Professional & Enterprise

•

Certification Guarantee

•

Community Partners

•

Leverage installed base

•

Distribution Network

•

READY

Enterprise

•

Surround Suite

•

Community Partners

•

CONNECT

•

READY

1-3

Physicians

4-25

Physicians

25+

Physicians &

Community |

Summary -

Unparalleled Market Opportunity

Rapid Transformation

The Choice is Allscripts

Allscripts –

“Built to Last” |

25

Financial Overview |

26

Allscripts –

Financial Highlights

Bookings Momentum

$297 mm –

28% growth fiscal YTD

~$720.0 mm Revenue Run Rate

Top Line Visibility

63% recurring revenue in 3Q Fiscal 2010

Significant Mix of SaaS Bookings

22% in most recent quarter; 24% YTD

source of recurring revenue

Improving Gross Margins

56.5% in Q3 vs. 51.8% year-ago

Significant Operating Leverage

Substantial R&D Expenditures

estimated $70 mm or ~10% of Fiscal 2010 Revenue

Strong Financial Position |

27

Fiscal 3Q 2010 & YTD Bookings Results

% Change

2/28/09

2/28/10

Nine Months Ended

+28%

+25%

% Change

$231.5

$84.4

2/28/09

Total Bookings

Total Bookings

Quarter Ended

$296.8

$105.5

2/28/10

Strong 3Q and YTD bookings across all product offerings

|

28

Fiscal 3Q 2010 Revenue and Net Income

+39%

$13.3

$18.5

Net Income

+33%

$0.09

$0.12

EPS

+12%

$160.7

$179.9

Revenue

-

65%

65%

% YTD Recurring Revenue

% Change

Q3 ‘09

Q3 ‘10 |

29

Fiscal 3Q 2010

Non-GAAP(a)

Revenue and Net Income

+18%

$21.7

$25.6

Non-GAAP Net Income(a)

+21%

$0.14

$0.17

Non-GAAP EPS (a)

+16%

$155.3

$180.4

Non-GAAP Revenue(a)

-

65%

65%

% YTD Recurring Revenue

% Change

Q3 ‘09

Q3 ‘10

(a) Please see reconciliation and footnotes in appendix to this presentation

regarding non-GAAP revenue, net income and diluted earnings per share

for the three months ended February 28, 2010 and 2009. Information

also available at http://investor.allscripts.com

|

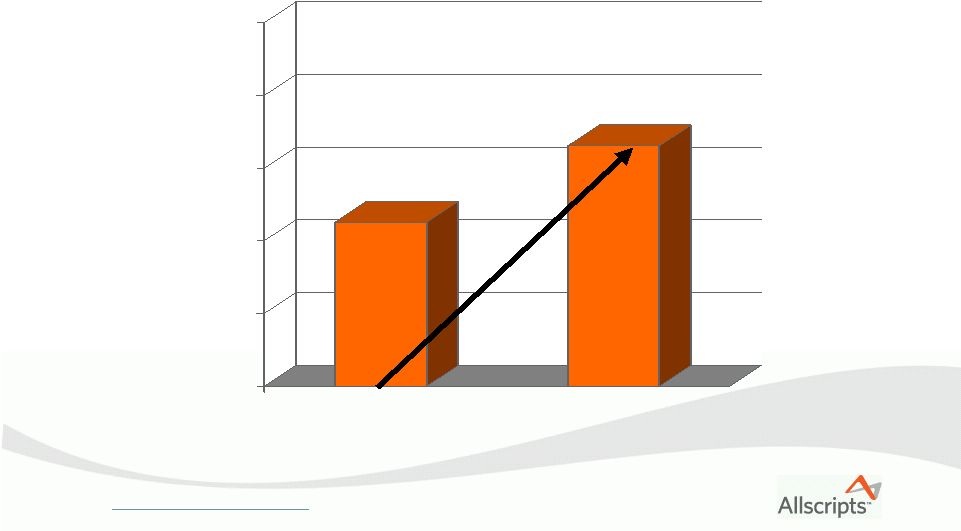

30

Non-GAAP(a) Gross Profit Margin

Improvement: Q3 2010 vs. Q3 2009

50%

52%

54%

56%

58%

60%

(a) Please see reconciliation and footnotes in appendix to this presentation

regarding non-GAAP gross profit margin for the three months ended

February 28, 2010 and 2009. Additional information also available at

http://investor.allscripts.com Q3 F2009

56.6%

Q3 F2010

54.5%

+210 BPS |

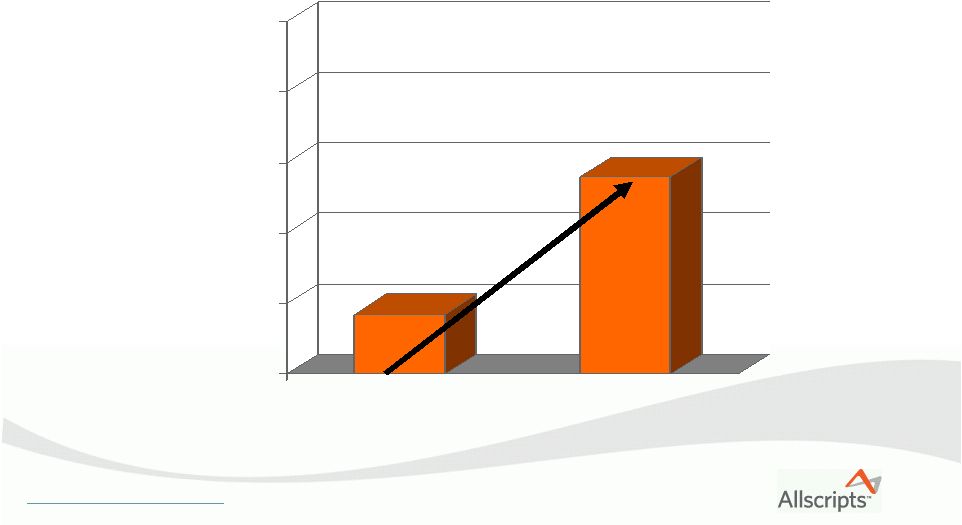

31

Non-GAAP(a) Net Income Growth:

Q3 2010 vs. Q3 2009

$20.0

$22.0

$24.0

$26.0

$28.0

$30.0

(a) Please see reconciliation and footnotes in appendix to this presentation

regarding non-GAAP net income for the three months ended February 28,

2010 and 2009. Additional information also available at

http://investor.allscripts.com

Q3 F2009

$21.7mm

$25.6 mm

Q3 F2010

+18% Growth |

32

Non-GAAP(a) Diluted Earnings Per Share:

Q3 2010 vs. Q3 2009

$0.10

$0.12

$0.14

$0.16

$0.18

$0.20

(a) Please see reconciliation and footnotes in appendix to this presentation

regarding non-GAAP diluted earnings per share for the three months ended

February 28, 2010 and 2009 . Additional information also available at

http://investor.allscripts.com Q3 F2009

$0.14

$0.17

Q3 F2010

+21% Growth |

33

Fiscal 2010 Outlook

$105.0 -

$112.0

Bookings(a)

$0.64 -

$0.65

Non-GAAP diluted EPS(b)

~150.0

Adjusted Weighted Diluted Shares

Outstanding

$700.0 -

$705.0

Revenue

$67.0 -

$68.5

Net income

$97.0 -

$98.5

Non-GAAP net income(b)

$0.44 -

$0.45

2010E

Diluted EPS

Financial Metrics

(a)

Bookings guidance range for fourth quarter ending May 31, 2010

(b)

Please see reconciliation and footnotes in appendix to this presentation regarding

non-GAAP net income and EPS for the year ending May 31, 2010.

Information also available at http://investor.allscripts.com |

Summary -

Excellent Sales Momentum

Large Mix of Recurring Revenue =

Excellent Top Line Visibility

Operating Leverage

Superior Long-Term Financial Model

Allscripts –

“Built to Last” |

|

36

Appendix: Non-GAAP Reconciliation

GAAP –

non-GAAP revenue reconciliation for the three months ended February 28, 2009

and 2010.

$180.4

$155.3

Revenue, non-GAAP

-

(8.5)

Elimination of prepackaged medications

0.5

3.1

Deferred revenue adjustment

$179.9

$160.7

Revenue, as reported

Revenue

Feb-10

Feb-09

2010

2009

Q3

Q3 |

37

Appendix: Non-GAAP Reconciliation

GAAP –

non-GAAP gross profit margin reconciliation for the three months ended

February 28, 2009 and 2010.

0.5

3.1

Deferred revenue adjustment

56.6%

54.5%

% of non-GAAP revenue

$102.2

$84.6

Gross profit, non-GAAP

-

(1.8)

Elimination of prepackaged medications

56.5%

51.8%

% of revenue

$101.7

$83.3

Gross profit, as reported

Gross profit

Feb-10

Feb-09

2010

2009

Q3

Q3 |

38

Appendix: Non-GAAP Reconciliation

GAAP –

non-GAAP EPS reconciliation for the three months ended February 28, 2009 and

2010. $25.6

$21.7

Net income, non-GAAP

$0.17

$0.14

Net income per share, non-GAAP, diluted

(4.0)

(5.5)

Non-GAAP adjustments tax effected at 39%

for 2010 & 40% for 2009

$0.12

$0.09

Net income per share, as reported, diluted

0.7

-

Tax rate alignment

-

3.5

Transaction-related expense

5.6

6.1

Acquisition-related amortization expense

4.3

2.2

Stock based compensation

0.5

3.1

Deferred revenue adjustment

-

(1.0)

Elimination of prepackaged medications

$ 18.5

$ 13.3

Net income, as reported

Net income

Feb-10

Feb-09

2010

2009

Q3

Q3 |

39

Appendix: Non-GAAP Reconciliation

GAAP –

non-GAAP Net Income and EPS reconciliation for the year ended May 31, 2009 and

2010 4.9

7.8

Deferred revenue adjustment

$0.64 to $0.65

$0.65

$0.61

Non-GAAP EPS

150.7

126.3

Share count

$97.0 to $98.5

$98.0

$76.8

Non-GAAP Net income

(19.3)

(29.9)

Tax effect of non-GAAP

adjustments (41% in 2009 and

39% in 2010)

5.3

39.9

Transaction-related expense

22.6

20.4

Acquisition-related amortization

expense

16.5

8.2

Stock based compensation

-

(2.3)

Elimination of prepackaged

medications

-

6.7

Allscripts pre-merger

Adjustments*

$0.44 to $0.45

$0.45

$0.21

GAAP EPS

$67.0 to $68.5

$68.0

$26.0

Net income

Guidance Range

Fiscal 2010

Guidance

Fiscal 2009 |

40

Basis of Presentation

The Company's GAAP results for the three and nine months ended February 28, 2010

include results of Allscripts for each such period. The Company's GAAP

results for the three and nine months ended February 28, 2009 include the

results of Misys Healthcare (Misys)

for

each

period

and

the

results

of

Allscripts

subsequent

to

a

merger

effected

on

October

10,

2008,

at

which

time

the

Company's

legal

name

was

changed

to

Allscripts-

Misys Healthcare Solutions, Inc.

Supplemental and non-GAAP financial information is also available at

http://investor.allscripts.com.

Please see next page for a further discussion of non-GAAP

measures. |

41

Explanation of Non-GAAP Financial Measures

›

Allscripts reports its financial results in accordance with generally accepted

accounting principles, or GAAP. To supplement this information, Allscripts

presents in this press release non-GAAP revenue, gross profit and net income, including non-GAAP net income on

a per share basis, which are non-GAAP financial measures under Section 101 of

Regulation G under the Securities Exchange Act of 1934, as amended.

Non-GAAP revenue consists of GAAP revenue as reported and legacy Allscripts revenue for periods prior to the

consummation date of the Merger and adds back the acquisition related deferred

revenue adjustment booked for GAAP purposes and excludes revenue from

prepackaged medications. Non-GAAP gross profit consists of GAAP gross profit as reported and legacy Allscripts

gross profit for periods prior to the consummation date of the Merger and adds back

the acquisition related deferred revenue adjustment booked for GAAP purposes

and excludes revenue from prepackaged medications. Non-GAAP net income consists of GAAP net income

as reported and includes legacy Allscripts net income for periods prior to the

consummation date of the Merger, excludes acquisition- related

amortization, stock-based compensation expense and transaction-related expenses, adds back the acquisition related deferred

revenue adjustment and excludes net income from prepackaged medications, in each

case net of any related tax effects. Acquisition-Related Amortization.

Acquisition-related amortization expense is a non-cash expense arising from the acquisition of

intangible assets in connection with acquisitions or investments. Allscripts

excludes acquisition-related amortization expense from non-GAAP net

income because it believes (i) the amount of such expenses in any specific period may not directly correlate to the

underlying performance of Allscripts business operations and (ii) such expenses

can vary significantly between periods as a result of

new

acquisitions

and

full

amortization

of

previously

acquired

intangible

assets.

Management

believes

that

this

adjustment

facilitates comparisons of the separate pre-merger results of legacy Misys and

legacy Allscripts to that of the Company's post- merger results.

Investors should note that the use of these intangible assets contributed to revenue in the periods presented and

will contribute to future revenue generation and should also note that such

expense will recur in future periods. Stock-Based Compensation Expense.

Stock-based compensation expense is a non-cash expense arising from the grant of stock

awards to employees. Allscripts excludes stock-based compensation expense from

non-GAAP net income because it believes (i) the amount of such expenses

in any specific period may not directly correlate to the underlying performance of Allscripts business

operations

and

(ii)

such

expenses

can

vary

significantly

between

periods

as

a

result

of

the

timing

of

grants

of

new

stock-based

awards, including grants in connection with acquisitions. Investors should note

that stock-based compensation is a key incentive offered to employees

whose efforts contributed to the operating results in the periods presented and are expected to contribute to

operating results in future periods and should also note that such expense will

recur in future periods. Transaction-Related Expenses.

Transaction-related expenses are fees and expenses, including legal, investment banking and

accounting fees, incurred in connection with announced transactions. Allscripts

excludes transaction-related expenses from non- GAAP net income

because it believes (i) the amount of such expenses in any specific period may not directly correlate to the

underlying performance of Allscripts business operations and (ii) such expenses

can vary significantly between periods Acquisition Related Deferred Revenue

Adjustment. Deferred revenue adjustment reflects the fair value adjustment to deferred

revenues acquired in connection with the Merger. The fair value of deferred

revenue represents an amount equivalent to the estimated cost plus an

appropriate profit margin, to perform services related to legacy Allscripts software and product support,

which

assumes

a

legal

obligation

to

do

so,

based

on

the

deferred

revenue

balances

as

of

October

10,

2008.

Allscripts

adds

back

this deferred revenue adjustment for non-GAAP revenue and non-GAAP net

income because it believes the inclusion of this amount directly correlates

to the underlying performance of Allscripts operations and facilitates comparisons of the separate pre-

merger results of legacy Misys and legacy Allscripts to that of the Company's

post-merger results. Tax Rate Alignment. Tax adjustment to align

the current fiscal quarter's effective tax rate to the expected annual effective tax rate. |