Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - STR HOLDINGS, INC. | a2197876zex-5_1.htm |

| EX-1.1 - EXHIBIT 1.1 - STR HOLDINGS, INC. | a2197876zex-1_1.htm |

| EX-23.1 - EXHIBIT 23.1 - STR HOLDINGS, INC. | a2197876zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on April 12, 2010

Registration No. 333-165893

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

STR Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 3081 | 27-1023344 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

10 Water Street

Enfield, CT 06082

(860) 749-8371

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Barry A. Morris

Executive Vice President and Chief Financial Officer

10 Water Street

Enfield, CT 06082

(860) 749-8371

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

| Copies to: | ||

| Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 |

Alan F. Denenberg, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "accelerated filer," "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Amount |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.01 per share |

8,050,000 | $19.67 | $158,343,500 | $11,290 | ||||

|

||||||||

- (1)

- Includes

shares subject to the underwriters' over-allotment option, if any.

- (2)

- Estimated

solely for the purposes of calculating the registration fee in accordance with Rule 457(c) promulgated under the Securities Act of 1933, as

amended, based on the average of the high and low sale prices of our common stock on April 9, 2010.

- (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 12, 2010

7,000,000 Shares

STR Holdings, Inc.

Common Stock

All of the shares of common stock are being sold by the selling stockholders, which include entities affiliated with members of our board of directors and an affiliate of Credit Suisse Securities (USA) LLC, an underwriter participating in this offering. In addition, certain of our executive officers and directors are selling a total of 480,417 shares of common stock. We will not receive any proceeds from this offering.

The underwriters have an option to purchase a maximum of 1,050,000 additional shares of common stock from the selling stockholders to cover over-allotment of shares. The underwriters can exercise this option at any time within 30 days from the date of this prospectus.

Our common stock is listed on the New York Stock Exchange under the symbol "STRI." On April 9, 2010, the last reported sales price of our common stock on the NYSE was $19.44 per share.

Investing in our common stock involves risks. See "Risk Factors" on page 11.

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Selling Stockholders |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||||||

Total |

$ | $ | $ | |||||||

Delivery of the shares of common stock in book-entry form only will be made on or about , 2010.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | Goldman, Sachs & Co. | |||

Cowen and Company |

Lazard Capital Markets |

Macquarie Capital |

||

The date of this prospectus is , 2010.

You should rely only on the information contained in this document and any free writing prospectus prepared by us or on our behalf. We and the selling stockholders have not, and the underwriters have not, authorized anyone to provide you with any additional information or information that is different. This document may only be used where it is legal to sell these securities. The information in this document is only accurate as of the date of this document.

"STR," "PhotoCap" and their respective logos are our trademarks. Solely for convenience, we refer to our trademarks in this prospectus without the ™ and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

i

This section summarizes key information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and consolidated financial statements included elsewhere in this prospectus. You should carefully review the entire prospectus, including the risk factors, the consolidated financial statements and the notes thereto, and the other documents to which this prospectus refers before making an investment decision. Unless the context requires otherwise, references in this prospectus to "STR," "we," "us," "our company" or similar terms refer to STR Holdings, Inc. and its subsidiaries and include the business conducted by us prior to our reorganization to a "C" corporation, which occurred in connection with our initial public offering on November 6, 2009. Unless otherwise indicated, references to our Solar manufacturing and production capacity are to estimated annual capacity.

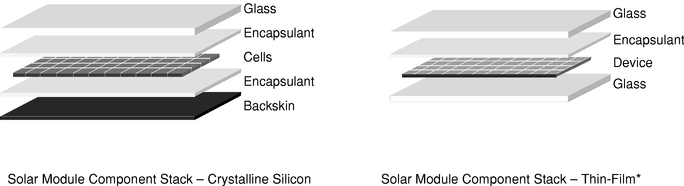

We are a global leader in each of our businesses: solar power module encapsulant manufacturing and consumer product quality assurance. Our Solar business is a leading global provider of encapsulants, which are specialty extruded sheets and film that hold a solar module together and protect the embedded semiconductor circuit. Encapsulants are a critical component used in solar modules. We supply solar module encapsulants to many of the major solar module manufacturers. We believe we were the primary supplier of encapsulants to each of our top 10 customers in 2009, which we believe is due to our superior product performance and customer service. Our encapsulants are used in both crystalline and thin-film solar modules.

Our Quality Assurance business is a leader in the consumer products quality assurance market, and we believe our Quality Assurance business is the only global testing services provider exclusively focused on the consumer products market. Our Quality Assurance business provides inspection, testing and audit services that enable retailers and manufacturers to determine whether products and facilities meet applicable safety, regulatory, quality, performance and social standards.

Our Solar business is a leading manufacturer of encapsulants, which are specialty extruded sheets and film that hold a solar module together and protect the embedded semiconductor circuit. We were the first to develop the original ethylene-vinyl-acetate, or EVA, encapsulants used in commercial solar module manufacturing in the 1970s in conjunction with the Jet Propulsion Laboratory of the California Institute of Technology under a NASA contract for the U.S. Energy Research and Development Administration, which later became known as the U.S. Department of Energy. We have no ongoing relationships with any of these agencies. We have sold our EVA encapsulants commercially since the late 1970s. We have continually improved our encapsulants, and we have developed many significant solar encapsulant innovations since we first commercialized our encapsulants, including encapsulants that maintain their dimensional stability and ultra-fast curing formulations. Our encapsulants are used in both of the prevailing solar panel technologies, crystalline and thin-film, and are valued by our customers because they maintain their size and shape throughout the solar module manufacturing process, have fast curing times and have demonstrated long-term stability. These attributes are critical to solar module manufacturers, which typically provide 20- to 25-year warranties of the performance of their solar modules and continually seek to maximize manufacturing yield and optimize efficiency. Despite the critical nature of encapsulant to solar cell applications, the encapsulant represents a small percentage of the overall manufacturing cost of the total solar module.

Our PhotoCap products consist primarily of EVA, which is modified with additives and put through our proprietary manufacturing process to increase product stability and make the encapsulant suitable for use in extreme, long-term outdoor applications. The inclusion of specific additives results in a limited shelf life before our encapsulants must be integrated into a solar module, making stocking

1

impractical. Encapsulants are made-to-order to customer specifications for use in their solar module manufacturing process.

Solar energy has emerged as one of the most rapidly growing renewable energy sources. A number of different technologies have been developed to harness solar energy. The most prevalent technology is the use of inter-connected photovoltaic, or PV, cells to generate electricity directly from sunlight. PV systems are used in industrial, commercial and residential applications. Higher global energy prices, increased environmental awareness and the desire for energy independence are accelerating the adoption of renewable energy sources, including solar. Governments around the world have also implemented various tariffs, tax credits and other incentives designed to encourage the use of renewable energy sources, including solar.

According to Solarbuzz, an independent solar energy research firm, solar power industry revenues grew to approximately $34 billion in 2009 from approximately $4 billion in 2003.

Regardless of the technology used to create solar energy from a PV system, the core component of the solar cell is the semiconductor circuit. To protect and preserve the embedded semiconductor circuit, solar module manufacturers typically use an encapsulant. Encapsulants are critical to the proper functioning of solar modules, as they protect cells from the elements, bond the multiple layers of a module (top surface, PV cells, and rear surface) together, and provide electrical insulation. Because encapsulants are a critical and integral component of solar modules, demand for encapsulants is expected to track the strong growth forecasted for the global PV market.

Competitive Strengths of Our Solar Business

We believe that our Solar business possesses a number of key competitive strengths, including:

- •

- Primary Supplier to Leading Module

Manufacturers. Because our encapsulants are designed into our customers' manufacturing processes, offer

long-term stability and substantial manufacturing efficiencies, and are a small part of the overall cost of the solar module, we believe our customers will continue to be reluctant to

switch to other encapsulant suppliers. We believe we were the primary encapsulant supplier to each of our top 10 customers in 2009, which include many of the fastest growing solar module

manufacturers. As our customers look to secure materials or access to our production capacity to support their module production, we have recently entered into, or are in negotiations to enter into,

contracts that include periods of exclusivity and minimum purchase requirements. Although such contracts provide for the sale of encapsulants at lower prices than our shorter-term

arrangements, they will provide greater predictability of demand. We currently have contracts with six of our largest customers, including a renewed contract with a major global solar customer.

- •

- Superior Product

Technology. Our encapsulants, some of which have been in the field nearly 30 years, play a critical role in

permanently bonding and protecting sensitive solar module components while helping to maintain solar module performance for extended periods under extreme environmental conditions. Our encapsulants

are manufactured to be non-shrinking so that they maintain their size and shape throughout the solar module manufacturing process, thereby reducing manufacturing defects. In addition to

providing dimensional stability, our highly engineered ultra-fast curing encapsulants provide for more rapid and efficient solar module manufacturing, enabling our customers to achieve

higher throughput rates and reduce their production costs.

- •

- History of Innovation. We have a long history of innovation. We, in conjunction with the predecessor to the U.S. Department of Energy, utilized our experience and technical expertise in

2

- •

- Global Manufacturing and Distribution

Base. We have invested heavily in developing our global production and distribution capacity through the construction and

acquisition of new plants, by increasing the number of our production lines and by upgrading our manufacturing equipment to meet our customers' needs. We currently operate 15 production lines

worldwide with total annual production capacity of 5,350 MW. We expect our global production capacity to increase to 6,350 MW by June 30, 2010.

- •

- Technical and Management Expertise. Our senior management team includes seasoned veterans with diverse business experiences who provide a broad range of perspectives and have enabled us to proactively manage our rapid organic growth, including the substantial expansion of our manufacturing operations.

the field of plastics to invent the original EVA encapsulant formulations used in commercial solar module manufacturing. In addition, we have developed many significant encapsulant innovations since we first introduced our encapsulants commercially in the late 1970s.

Growth Strategy of Our Solar Business

Our objective is to enhance our position as a leading global provider of encapsulants to solar module manufacturers. Our strategies to meet that objective are:

- •

- Leverage Global

Infrastructure. Our manufacturing facilities are designed to provide the ability to expand our capacity to meet customer

demand. To meet anticipated future growth in demand in the solar module market and increase our market share, we plan to continue to increase capacity by adding new production lines at our existing

facilities or opening new facilities. Since 2003, we have invested $47.0 million to expand our production capacity. We added four 500 MW production lines in 2008 and two 500 MW production lines

and a 100 MW production line in 2009, bringing our total global capacity to 5,350 MW as of December 31, 2009. We believe we can leverage our existing infrastructure to add capacity in targeted

markets. For example, we recently completed the construction of a new manufacturing facility in Malaysia, which has initially been designed for up to 2,000 MW of capacity and can be expanded to

accommodate up to 3,000 MW of capacity. The Malaysian facility currently has two 500 MW operational production lines, and we began shipping production quantities of encapsulants from that facility in

the third quarter of 2009. During the first quarter of 2010, our Malaysian facility received a 500 MW production line from Connecticut and a 500 MW production line from Spain to meet shifting

worldwide module demand from Europe to Asia. We expect our global production capacity to increase to 6,350 MW by June 30, 2010 and further expand in 2011.

- •

- Continue Product

Innovation. Throughout the history of our Solar business, we have continued to innovate our encapsulant technologies. We

intend to leverage our technical experience and the expertise derived from our nearly 30 years of innovation to continue to develop new products and technologies to meet evolving customer needs

and to maintain and enhance our competitive position. For example, we recently developed a new material specifically tailored to match the unique needs of thin-film solar technologies with

superior moisture resistant properties that we believe surpass those of other commercially available products.

- •

- Asia Growth Strategy. Our strategy for growing our Asia business is called 1 + China Growth Strategy. Our plant in Malaysia represents the beginning stages of the execution of this strategy utilizing Malaysia as a conduit to Asia. We provide encapsulants to many of the leading solar module manufacturers worldwide and intend to continue to seek new customer relationships. During 2009, global solar demand shifted as module manufacturers located in Asia, particularly in China, obtained market share from European competitors. Also, many Asian governments announced solar incentive programs in 2009 to increase the demand for solar energy in their respective countries, such as the Golden Sun and Building Integrated Photovoltaic Programs in

3

- •

- Further Reduce Manufacturing Costs. We continuously seek to improve our competitive position by reducing our manufacturing costs, and we have identified a number of cost reduction opportunities. For example, we have made modifications to our production process to achieve higher throughput and yield and are developing an encapsulant that eliminates the use of a paper liner, which represents the second largest material-related cost of our encapsulants.

China. Based on these two emerging market patterns, we are actively seeking to increase our market share in the Asia-Pacific region and have recently signed contracts with two top-tier Chinese solar customers.

Our Quality Assurance Business

We have offered quality assurance services since 1973. Our Quality Assurance business helps clients determine whether the products designed and manufactured by them or on their behalf meet applicable safety, regulatory, quality, performance and social standards. The primary clients for quality assurance services are large North American and European retailers that manage global supply chains of manufacturers, vendors and importers. In particular, retailers, importers and manufacturers that choose to outsource production to developing countries rely on our Quality Assurance services to ensure product quality and standards.

Since forming our Quality Assurance business, we have expanded our Quality Assurance service offerings and have increased the scale of the business to meet the growing worldwide needs of the consumer products manufacturing industry. As of December 31, 2009, our Quality Assurance business had an extensive network of 17 laboratories, 72 inspection and audit offices and 21 sales offices in 36 countries across North America, South America, Europe, Asia, Indian sub-continent and Africa with an experienced team of over 1,000 scientists, technicians, engineers, auditors, trainers and inspectors. We have a broad client base, serving over 5,000 clients in 2009. Our Quality Assurance business's reputation for quality is demonstrated by our more than 40 internationally recognized accreditations and memberships.

Our business is subject to numerous risks, as discussed more fully in the section entitled "Risk Factors" beginning on page 11 of this prospectus, which you should read in its entirety. In particular:

- •

- If demand for solar energy in general and solar modules in particular does not continue to develop or takes longer to

develop than we anticipate, sales in our Solar business may not grow or may decline, which would negatively affect our financial condition and results of operations.

- •

- The impact of the current worldwide economic recession as well as volatility and disruption in the credit markets may

continue to slow the growth of the solar industry, may continue to cause our customers to experience a reduction in demand for their products and related financial difficulties and may continue to

adversely impact our Solar business.

- •

- A significant reduction or elimination of government subsidies and economic incentives or a change in government policies

that promote the use of solar energy could have a material adverse effect on our business and prospects.

- •

- Our Solar business is dependent on a limited number of customers, which may cause significant fluctuations or result in

declines in our Solar net sales.

- •

- Our Solar business's growth is dependent upon the growth of our key Solar customers and our ability to keep pace with our customers' growth.

4

- •

- Technological changes in the solar energy industry or our failure to develop and introduce or integrate new technologies

could render our encapsulants uncompetitive or obsolete, which would adversely affect our business.

- •

- We typically rely upon trade secrets and contractual restrictions, and not patents, to protect our proprietary rights.

Failure to protect our intellectual property rights may undermine our competitive position and protecting our rights or defending against third-party allegations of infringement may be costly.

- •

- We face competition in our Solar business from other companies producing encapsulants for solar modules.

- •

- Our failure to build and operate new manufacturing facilities and increase production capacity at our existing facilities

to meet our customers' requirements could harm our business and damage our customer relationships in the event demand for our encapsulants increases. Conversely, expanding our production in times of

overcapacity could have an adverse impact on our results of operations.

- •

- Our Solar business is exposed to risks related to running our facilities at full production capacity from time to time

that could result in decreased net sales and affect our ability to grow our business in future periods.

- •

- The quality assurance testing markets are highly competitive, and many of the companies with which we compete have

substantially greater resources and geographical presence than us.

- •

- Failure to maintain professional accreditations and memberships may affect our Quality Assurance business's ability to

compete or generate net sales.

- •

- Damage to the professional reputation of our Quality Assurance business would adversely affect our Quality Assurance net

sales and the growth prospects of our Quality Assurance business.

- •

- Our Quality Assurance business's growth depends on our ability to expand our operations and capacity and manage such

expansion effectively.

- •

- Our future success depends on our ability to retain our key employees.

- •

- Our substantial international operations subject us to a number of risks.

- •

- We and our results of operations could be materially and adversely affected by violations of applicable anti-corruption laws, including the U.S. Foreign Corrupt Practices Act of 1977.

On June 15, 2007, DLJ Merchant Banking Partners IV, L.P. and affiliated investment funds, or DLJMB, and its co-investors, together with members of our board of directors, our executive officers and other members of management, acquired 100% of the voting equity interests in our wholly-owned subsidiary, Specialized Technology Resources, Inc. for $365.6 million, including transaction costs. They acquired Specialized Technology Resources, Inc. for investment purposes. In connection with the acquisition, Specialized Technology Resources, Inc., as borrower, and STR Holdings LLC, as a guarantor, entered into a first lien credit facility providing for a fully drawn $185.0 million term loan facility and an undrawn $20.0 million revolving credit facility and a second lien credit facility providing for a fully drawn $75.0 million term loan facility, in each case, with Credit Suisse, as administrative agent and collateral agent.

5

We refer to the foregoing transactions collectively as the "DLJ Transactions." DLJMB is an affiliate of Credit Suisse Securities (USA) LLC, an underwriter participating in this offering, and Credit Suisse, the administrative agent and collateral agent under our first and second lien credit facilities. For further information regarding the DLJ Transactions, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—DLJ Transactions."

Corporate Reorganization and Initial Public Offering

Prior to November 5, 2009, we conducted our business through STR Holdings LLC and its subsidiaries. STR Holdings (New) LLC, or NewCo, a Delaware limited liability company, was formed on September 30, 2009 as an indirect subsidiary of STR Holdings LLC and held no material assets and did not engage in any operations. Pursuant to the corporate reorganization on November 5, 2009, STR Holdings LLC liquidated. A subsidiary of NewCo merged with and into Specialized Technologies Resources, Inc., or STRI, a former subsidiary of STR Holdings LLC, and, as a result, STRI became a wholly-owned subsidiary of NewCo. The unitholders of STR Holdings LLC became unitholders of NewCo. On November 6, 2009, NewCo converted from a limited liability company into a Delaware 'C' corporation, named STR Holdings, Inc., and all outstanding units of NewCo automatically converted into a single class of common stock of STR Holdings, Inc.

On November 12, 2009, we closed our initial public offering of 12,300,000 shares of common stock at an offering price of $10 per share, of which 3,300,000 shares were sold by the Company and 9,000,000 shares were sold by selling stockholders. On December 7, 2009, we closed the partial exercise of the over-allotment option granted by the selling stockholders given in connection with the initial public offering, which resulted in a total purchase of 1,695,000 shares at the initial public offering price of $10 per share. We did not receive any of the proceeds from the sale of the shares as a result of the exercise of the over-allotment option. For further information regarding the corporate reorganization and our initial public offering, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Corporate Reorganization and Initial Public Offering."

Although complete financial statements for the three months ended March 31, 2010 are not yet available, on April 5, 2010, we provided updated guidance regarding our projected financial results. We affirmed our 2010 full year guidance of total net sales of $310 million to $330 million and 2010 diluted non-GAAP earnings per share (EPS) of $1.05 to $1.10. We also affirmed our first quarter guidance of total net sales of $77 million to $81 million and first quarter diluted non-GAAP EPS of $0.23 to $0.25. We anticipate that, due to recent strength in the global solar market and reductions in anticipated orders by certain key clients in our Quality Assurance business, the projected revenue mix between segments is expected to change from our previous full year guidance with higher anticipated Solar net sales in the range of $195 million to $205 million and lower anticipated Quality Assurance net sales in the range of $115 million to $125 million. For the first quarter of 2010, the projected revenue mix is expected to change from our previous guidance to a range of $53 million to $55 million for Solar net sales and a range of $24 million to $26 million for Quality Assurance net sales. Diluted GAAP EPS ranges for our 2010 full year and first quarter are $0.73 to $0.78 and $0.12 to $0.14, respectively.

6

The following is a reconciliation of our diluted non-GAAP EPS guidance:

| |

First Quarter Ended March 31, 2010 |

Year Ended December 31, 2010 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Low | High | Low | High | ||||||||||

| |

(Unaudited) |

(Unaudited) |

||||||||||||

| |

(in millions, except per share data) |

|||||||||||||

Net income |

$ | 4.8 | $ | 5.7 | $ | 30.6 | $ | 32.8 | ||||||

Adjustments to net income: |

||||||||||||||

Amortization of deferred financing costs |

0.3 | 0.3 | 1.3 | 1.3 | ||||||||||

Stock-based compensation expense |

3.9 | 3.9 | 7.9 | 7.9 | ||||||||||

Amortization of intangibles |

2.9 | 2.9 | 11.5 | 11.5 | ||||||||||

Tax effect of adjustments |

(2.6 | ) | (2.6 | ) | (7.5 | ) | (7.5 | ) | ||||||

Non-GAAP net income |

$ | 9.3 | $ | 10.2 | $ | 43.8 | $ | 46.0 | ||||||

Diluted shares outstanding |

41.3 |

41.3 |

41.9 |

41.9 |

||||||||||

Diluted net income per share |

$ |

0.12 |

$ |

0.14 |

$ |

0.73 |

$ |

0.78 |

||||||

Diluted non-GAAP net income per share |

$ |

0.23 |

$ |

0.25 |

$ |

1.05 |

$ |

1.10 |

||||||

We use the non-GAAP financial measure called non-GAAP earnings per share (EPS). We define non-GAAP EPS as net income not including the impact of amortization of deferred financing costs, stock-based compensation, intangible asset amortization expense and associated tax effect divided by the weighted average shares outstanding. It should be noted that diluted weighted average shares are determined on a GAAP basis and the resulting share count is used for computing both GAAP and non-GAAP diluted EPS.

Management believes that non-GAAP EPS provides meaningful supplemental information regarding our performance by excluding certain expenses that may not be indicative of the core business operating results and may help in comparing current-period results with those of prior periods as well as with our peers. Non-GAAP EPS is one of the main metrics used by management and our board of directors to plan and measure our operating performance. In addition, non-GAAP EPS will be one of the metrics and, in the case of our chief executive officer and chief financial officer, the only metric used to determine annual bonus compensation for our executive officers under our management incentive plan.

The financial data included in this Recent Development section has been prepared by, and is the responsibility of our management. Our independent registered public accounting firm, PricewaterhouseCoopers LLP, has not audited, reviewed, compiled or performed any procedures with respect to the accompanying financial data included in this Recent Development section. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. See "Risk Factors," "Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

We are a Delaware corporation. Our principal executive offices are located at 10 Water Street, Enfield, Connecticut 06082, and our telephone number is (860) 749-8371. Our web address is www.strholdings.com. The information that appears on our web site is not part of, and is not incorporated into, this prospectus.

7

Common stock offered by the selling stockholders |

7,000,000 shares. |

|

Common stock outstanding |

41,349,710 shares. |

|

Option to purchase additional shares |

The underwriters have an option to purchase a maximum of 1,050,000 additional shares of common stock from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

|

Use of proceeds |

We will not receive any proceeds from this offering. |

|

Dividend policy |

We do not anticipate paying any dividends on our common stock in the foreseeable future. See "Dividend Policy." |

|

Risk factors |

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 11 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

|

NYSE symbol |

"STRI." |

|

Conflicts of Interest |

Affiliates of Credit Suisse Securities (USA) LLC own 10% or more of our common stock. Thus, Credit Suisse Securities (USA) LLC has a "conflict of interest" under the applicable provisions of Rule 2720 of the Financial Industry Regulatory Authority. For more information, see "Conflicts of Interest." |

Unless otherwise indicated, all information in this prospectus:

- •

- excludes 4,710,000 shares of our common stock reserved for future grants under our compensation plans, including 3,495,685

shares of common stock issuable upon the exercise of options; and

- •

- assumes no exercise of the underwriters' option to purchase additional shares.

8

Summary Consolidated Financial and Other Data

The following table sets forth our summary consolidated financial and other data for the periods and as of the dates indicated. The balance sheet data as of December 31, 2009 and the statement of operations and other data for each of (i) the years ended December 31, 2009 and 2008, (ii) the period from June 15 to December 31, 2007 and (iii) the period from January 1 to June 14, 2007 are derived from our consolidated financial statements included elsewhere in this prospectus.

The basic and diluted net income per share and weighted average shares outstanding data for periods including and after June 15, 2007 in the summary consolidated financial and other data table presented below give effect to our corporate reorganization, as described under "Management's Discussion and Analysis of Financial Condition and Results of Operations—Corporate Reorganization and Initial Public Offering."

On June 15, 2007, DLJMB and its co-investors, together with members of our board of directors, our executive officers and other members of management, through STR Holdings LLC, acquired Specialized Technology Resources, Inc. All periods prior to June 15, 2007 are referred to as "Predecessor," and all periods including and after such date are referred to as "Successor." The consolidated financial statements for all Successor periods are not comparable to those of the Predecessor periods.

Our historical results are not necessarily indicative of future operating results. You should read the information set forth below in conjunction with "Selected Historical Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

9

| |

Successor | Predecessor | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year Ended December 31, 2009 |

Year Ended December 31, 2008 |

For the Period from June 15 to December 31, 2007 |

For the Period from January 1 to June 14, 2007 |

||||||||||

| |

(in thousands, except per share and share data) |

|||||||||||||

Statement of Operations Data: |

||||||||||||||

Net sales—Solar |

$ | 149,521 | $ | 182,311 | $ | 52,967 | $ | 25,648 | ||||||

Net sales—Quality Assurance |

115,424 | 106,267 | 56,317 | 39,112 | ||||||||||

Total net sales |

264,945 | 288,578 | 109,284 | 64,760 | ||||||||||

Cost of sales—Solar |

91,213 | 103,717 | 30,068 | 11,875 | ||||||||||

Cost of sales—Quality Assurance |

75,759 | 70,930 | 35,620 | 25,225 | ||||||||||

Total cost of sales |

166,972 | 174,647 | 65,688 | 37,100 | ||||||||||

Gross profit |

97,973 | 113,931 | 43,596 | 27,660 | ||||||||||

Selling, general and administrative expenses |

48,785 | 41,592 | 18,484 | 12,063 | ||||||||||

Provision for bad debt expense |

1,403 | 1,950 | 562 | 384 | ||||||||||

Earnings on equity-method investments |

(317 | ) | (178 | ) | (84 | ) | (46 | ) | ||||||

Transaction costs |

— | — | — | 7,737 | ||||||||||

Operating income |

48,102 | 70,567 | 24,634 | 7,522 | ||||||||||

Interest income |

136 | 249 | 203 | 143 | ||||||||||

Interest expense |

(17,068 | ) | (20,809 | ) | (13,090 | ) | (2,918 | ) | ||||||

Foreign currency transaction loss |

(134 | ) | (1,007 | ) | (76 | ) | (32 | ) | ||||||

Unrealized gain (loss) on interest rate swap |

1,995 | (3,025 | ) | (2,988 | ) | — | ||||||||

Income before income tax expense |

33,031 | 45,975 | 8,683 | 4,715 | ||||||||||

Income tax expense |

10,042 | 17,870 | 4,572 | 3,983 | ||||||||||

Net income |

$ | 22,989 | $ | 28,105 | $ | 4,111 | $ | 732 | ||||||

Other comprehensive income: |

||||||||||||||

Foreign currency translation |

1,063 | (1,805 | ) | 1,451 | 448 | |||||||||

Total comprehensive income |

$ | 24,052 | $ | 26,300 | $ | 5,562 | $ | 1,180 | ||||||

Net income per share data: |

||||||||||||||

Basic |

$ | 0.63 | $ | 0.78 | $ | 0.11 | $ | 0.08 | ||||||

Diluted |

$ | 0.61 | $ | 0.75 | $ | 0.11 | $ | 0.08 | ||||||

Weighted average shares outstanding(1) |

||||||||||||||

Basic |

36,638,402 | 36,083,982 | 35,846,880 | 8,632,893 | ||||||||||

Diluted |

37,514,790 | 37,411,765 | 36,636,433 | 9,134,536 | ||||||||||

Other Data: |

||||||||||||||

Amortization of intangibles |

$ | 11,503 | $ | 11,503 | $ | 6,231 | $ | 50 | ||||||

Capital expenditures |

$ | 17,833 | $ | 35,288 | $ | 10,064 | $ | 3,510 | ||||||

Balance Sheet Data: |

||||||||||||||

Cash and cash equivalents |

$ | 69,149 | ||||||||||||

Total assets |

$ | 645,860 | ||||||||||||

Total debt |

$ | 240,506 | ||||||||||||

Total stockholders' equity |

$ | 271,270 | ||||||||||||

- (1)

- We have retrospectively adjusted our earnings per share and average shares outstanding for the Successor periods to reflect the conversion of units to shares resulting from the reorganization and conversion. See note 3 to our consolidated financial statements included elsewhere in this prospectus. We have not similarly adjusted our earnings per share for the Predecessor period.

10

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, before making an investment in our company. If any of the following risks actually occurs, our business, results of operations or financial condition may be adversely affected. In such an event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Solar Business

If demand for solar energy in general and solar modules in particular does not continue to develop or takes longer to develop than we anticipate, sales in our Solar business may not grow or may decline, which would negatively affect our financial condition and results of operations.

We expect that a significant amount of the growth in our overall business will come from the sale of encapsulants by our Solar business. Because our encapsulants are used in the production of solar modules, our financial condition and results of operations and future growth are tied to a significant extent to the overall demand for solar energy and solar modules. The solar energy market is at a relatively early stage of development and the extent to which solar modules will be widely adopted is uncertain. Many factors may affect the viability and widespread adoption of solar energy technology and demand for solar modules, and in turn, our encapsulants, including:

- •

- cost-effectiveness of solar modules compared to conventional and non-solar renewable energy

sources and products;

- •

- performance and reliability of solar modules compared to conventional and non-solar renewable energy sources

and products;

- •

- availability and amount of government subsidies and incentives to support the development and deployment of solar energy

technology;

- •

- rate of adoption of solar energy and other renewable energy generation technologies, such as wind, geothermal and biomass;

- •

- seasonal fluctuations related to economic incentives and weather patterns;

- •

- fluctuations in economic and market conditions that affect the viability of conventional and non-solar

renewable energy sources, such as increases or decreases in the prices of fossil fuels and corn or other biomass materials;

- •

- the extent to and shape of, if any, the recovery from the worldwide economic recession, volatility and disruption in the

credit markets that was experienced during 2009, which may slow the growth of the solar industry, may cause our customers to experience a reduction in demand for their products and related financial

difficulties and may adversely impact our Solar business;

- •

- fluctuations in capital expenditures by end users of solar modules, which tend to decrease when the overall economy slows

down;

- •

- the extent to which the electric power and broader energy industries are deregulated to permit broader adoption of solar

electricity generation; and

- •

- the cost and availability of polysilicon and other key raw materials for the production of solar modules.

For example, in 2009, we experienced a decline in our Solar business mainly due to decreased global demand for solar energy as a result of legislative changes, such as the cap in feed-in tariffs in Spain implemented in 2008, the global recession and the worldwide credit crisis.

11

If demand for solar energy and solar modules fails to develop sufficiently, demand for our customers' products as well as demand for our encapsulants will decrease, and we may not be able to grow our business or Solar net sales and our financial condition and results of operations will be harmed.

A significant reduction or elimination of government subsidies and economic incentives or a change in government policies that promote the use of solar energy could have a material adverse effect on our business and prospects.

Demand for our encapsulants depends on the continued adoption of solar energy and the resultant demand for solar modules. Demand for our products depends, in large part, on government incentives aimed to promote greater use of solar energy. In many countries in which solar modules are sold, solar energy would not be commercially viable without government incentives. This is because the cost of generating electricity from solar energy currently exceeds, and we believe will continue to exceed for the foreseeable future, the costs of generating electricity from conventional energy sources.

The scope of government incentives for solar energy depends, to a large extent, on political and policy developments relating to environmental and energy concerns in a given country that are subject to change, which could lead to a significant reduction in, or a discontinuation of, the support for renewable energy in such country. Federal, state and local governmental bodies in many of the target markets for our Solar business, including Germany, Italy, Spain, the United States, France, Japan and South Korea, have provided subsidies and economic incentives in the form of feed-in tariffs, rebates, tax credits and other incentives to end users, distributors, system integrators and manufacturers of solar energy products to promote the use of solar energy and to reduce dependency on other forms of energy. These government economic incentives could be reduced or eliminated earlier than anticipated. For example, the German government recently has announced legislation that is expected to reduce feed-in tariffs beginning in the second half of 2010. This announcement has resulted in the pull-in of demand from solar module manufacturers due to increased end-user demand being driven by the incentive to purchase a solar system prior to the expected enactment of the decreased feed-in tariff incentives. As such, we may see atypical Solar sales during the first half of 2010 that may not occur during the second half of 2010. Also, in September 2008, the Spanish parliament adopted new legislation that decreased the feed-in tariff for solar energy by approximately 27% and capped its subsidized PV installations at 500 MW for 2009. This event drove an over-supply of solar module inventory in the supply chain during the first half of 2009 and was one of the main drivers behind our sales volume decline in 2009 compared to 2008.

Moreover, electric utility companies, or generators of electricity from fossil fuels or other renewable energy sources, could also lobby for changes in the relevant legislation in their markets to protect their revenue streams. Reduced growth in or the reduction, elimination or expiration of government subsidies and economic incentives for solar energy, especially those in our target markets, could cause our Solar net sales to decline and harm our business.

Our Solar business is dependent on a limited number of customers, which may cause significant fluctuations or result in declines in our Solar net sales.

The solar module industry is relatively concentrated. As a result, we sell substantially all of our encapsulants to a limited number of solar module manufacturers. We expect that our results of operations will, for the foreseeable future, continue to depend on the sale of encapsulants to a relatively small number of customers. Sales to First Solar accounted for 27.1%, 19.1% and 13.8% of our Solar net sales in the years 2009, 2008 and 2007, respectively. In addition, the top five customers in our Solar segment accounted for approximately 55.0%, 47.0% and 46.0% of our Solar net sales in 2009, 2008 and 2007, respectively. Furthermore, participants in the solar industry, including our customers, are experiencing pressure to reduce their costs. Because we are part of the overall supply chain to our

12

customers, any cost pressures experienced by them may affect our business and results of operations. Our customers may not continue to generate significant Solar net sales for us. Conversely, we may be unable to meet the production demands of our customers or maintain these customer relationships. Also, new entrants into the solar module manufacturing industry, primarily from China, could negatively impact the demand for, and pricing of, our customers' products, which could reduce the demand for our encapsulants. We believe our European customers have lost market share to low-cost module manufacturers, primarily from China, that continue to penetrate the European solar market and whom we do not sell encapsulants to. We have lost market share in the European market due to emerging low-cost solar module manufacturers, primarily from China, and if we are not able to supply encapsulants to these new entrants in the future, we could lose further market share and also face competition from new encapsulant manufacturers.

In addition, a significant portion of our outstanding accounts receivable is derived from sales to a limited number of customers. The accounts receivable from our top five Solar customers with the largest receivable balances represented 38.7% and 34.6% of our accounts receivable balance as of December 31, 2009 and December 31, 2008, respectively. Moreover, many solar companies are facing and may continue to face significant liquidity and capital expenditure requirements, and as a result, our customers may have trouble making payments owed to us, which could affect our business, financial condition and results of operations. Any one of the following events may cause material fluctuations or declines in our Solar net sales and have a material adverse effect on our business, financial condition and results of operations:

- •

- reduction, postponement or cancellation of orders from one or more of our significant customers;

- •

- reduction in the price one or more significant solar customers are willing to pay for our encapsulants;

- •

- selection by one or more solar customers of products competitive with our encapsulants;

- •

- loss of one or more significant solar customers and failure to obtain additional or replacement customers; and

- •

- failure of any of our significant solar customers to make timely payment for products.

Our Solar business's growth is dependent upon the growth of our key Solar customers and our ability to keep pace with our customers' growth.

In addition to relying on a small number of customers, we believe we were the primary supplier to each of our top 10 Solar customers in 2009. The future growth and success in our Solar business depends on the ability of such customers to grow their businesses and our ability to meet any such growth, principally through the addition of manufacturing capacity. If our Solar customers do not increase production of solar modules, there will be no corresponding increase in encapsulant orders. Alternatively, in the event such customers grow their businesses, we may not be able to meet their increased demands, which would require such customers to find alternative sources for encapsulants. In addition, it is possible that customers for whom we are the exclusive supplier of encapsulants will seek to qualify and establish a secondary supplier of encapsulants, which would reduce our share with such customers and could increase that customer's pricing leverage. If our Solar customers do not grow their businesses or they find alternative sources for encapsulants to meet their demands, it could limit our ability to grow our business and increase our Solar net sales.

13

Technological changes in the solar energy industry or our failure to develop and introduce or integrate new technologies could render our encapsulants uncompetitive or obsolete, which would adversely affect our business.

The solar energy market is rapidly evolving and competitive and is characterized by continually changing technology requiring continuous improvements in solar modules to increase efficiency and power output and improve aesthetics. This requires us and our customers to continuously invest significant financial resources to develop new solar module technology and enhance existing solar modules to keep pace with evolving industry standards and changing customer requirements and to compete effectively in the future. Our failure to further refine our encapsulant technology and develop and introduce new or enhanced encapsulants or other products, or our competitors' development of products and technologies that perform better or are more cost effective than our products, could cause our encapsulants to become uncompetitive or obsolete, which would adversely affect our business, financial condition and results of operations. Product development activities are inherently uncertain, and we could encounter difficulties in commercializing new technologies. As a result, our product development expenditures in our Solar business may not produce corresponding benefits.

Moreover, we produce a component utilized in the manufacturing of solar modules. New solar technologies may emerge or existing technologies may gain market share that do not require encapsulants as we produce them, or at all. Also, manufacturing methods may emerge that could be more advanced or efficient than our current manufacturing capability. Such changes could result in decreased demand for our encapsulants or render them obsolete, which would adversely affect our business, financial condition and results of operations.

We typically rely upon trade secrets and contractual restrictions, and not patents, to protect our proprietary rights. Failure to protect our intellectual property rights may undermine our competitive position and protecting our rights or defending against third-party allegations of infringement may be costly.

Protection of proprietary processes, methods, documentation and other technology is critical to our business. Failure to protect, monitor and control the use of our existing intellectual property rights could cause us to lose our competitive advantage and incur significant expenses. We typically rely on trade secrets, trademarks, copyrights and contractual restrictions to protect our intellectual property rights and currently do not hold any patents related to our Solar business. However, the measures we take to protect our trade secrets and other intellectual property rights may be insufficient. While we enter into confidentiality agreements with our Solar employees and third parties to protect our intellectual property rights, such confidentiality provisions related to our trade secrets could be breached and may not provide meaningful protection for our trade secrets. Also, others may independently develop technologies or products that are similar or identical to ours. In such case, our trade secrets would not prevent third parties from competing with us.

Third parties or employees may infringe or misappropriate our proprietary technologies or other intellectual property rights, which could harm our business and operating results. Policing unauthorized use of intellectual property rights can be difficult and expensive, and adequate remedies may not be available.

We are currently in litigation with a former employee, James P. Galica, in our Solar business and his current employer, JPS Elastomerics Corp., for the misappropriation and theft of our trade secrets. In August 2008, the jury determined that the technology for our polymeric sheeting product line is a trade secret. The jury also determined that our former employee and his current employer had not misappropriated our trade secrets. We have not decided if we will appeal the jury's determination. The jury also found that our former employee had breached his confidentiality agreement with us. Subsequently, the judge determined that JPS and Galica had violated the Massachusetts Unfair and Deceptive Trade Practices Act, finding that the technology for our polymeric sheeting product is a trade

14

secret and that JPS and Galica had misappropriated our trade secrets. The judge awarded us compensatory and punitive damages, attorneys' fees and costs and issued a temporary injunction preventing JPS from manufacturing, marketing or selling the competing products, which are substantially similar to some of our encapsulants. The final amount of damages to be awarded to us, as well as the scope of a permanent injunction, is still pending before the court and will be determined by the presiding judge. JPS has filed a motion for reconsideration of the court's decision that JPS and Galica had violated the Massachusetts Unfair and Deceptive Trade Practices Act. Final judgment will not be entered until these pending matters are resolved. The court has ordered each party to brief the remaining issues. Upon entry of final judgment, JPS will have the right to appeal the judge's ruling, and we will have the right to appeal the jury's verdict. If JPS or Galica is successful on the appeals from both the jury's verdict and the judge's rulings, the result may be a new trial or a final determination that JPS may compete with us by continuing to sell a product that is substantially similar to some of our encapsulants. JPS may also be allowed to compete with us on some encapsulant products based on the court's ruling on the scope and duration of the permanent injunction. Further, in October 2009, counsel to JPS sent our counsel a letter demanding relief under the Massachusetts Unfair and Deceptive Trade Practices Act, the Sherman Antitrust Act, the Massachusetts Antitrust Act and the Lanham Act.

We responded to JPS's letter and have had no further contact with JPS regarding their October 2009 letter. On October 20, 2009, JPS moved for reconsideration of the judgment against them under Massachusetts General Laws, chapter 93A. On November 19, 2009, the Court issued a Memorandum and Order Denying Further Modification of the Preliminary Injunction and Associated Directives. On December 10, 2009, JPS filed a petition for relief in the Massachusetts Appeals Court which the court denied. On December 21, 2009, JPS filed a notice of interlocutory appeal with the Massachusetts Appeals Court. On January 20, 2010, the parties filed a stipulation of dismissal of JPS's notice of interlocutory appeal. On March 25, 2010, the Court scheduled a hearing on permanent injunctive relief, attorney's fees and damages to be held on August 23, 2010.

We face competition in our Solar business from other companies producing encapsulants for solar modules.

The market for encapsulants is highly competitive and continually evolving. We compete with a number of encapsulant manufacturers, some of which are large, global companies with substantial financial, manufacturing and logistics resources and strong customer relationships. If we fail to attract and retain customers for our current and future products, we will be unable to increase our revenues and market share. Our primary encapsulant competitors include Bridgestone Corporation, ETIMEX Primary Packaging GmbH and Mitsui Chemicals, Inc. We also expect to compete with new entrants to the encapsulant market, including those that may offer more advanced technological solutions, possess advanced or more efficient manufacturing capabilities or that have greater financial resources than we do. Further, as the China solar market matures, we expect other encapsulant providers from China and the greater Asian markets will compete with us. Our competitors may develop and produce or may be currently producing encapsulants that offer advantages over our products. A widespread adoption of any of these technologies could result in a rapid decline in our position in the encapsulant market and our revenues and adversely affect our margins.

Our failure to build and operate new manufacturing facilities and increase production capacity at our existing facilities to meet our customers' requirements could harm our business and damage our customer relationships in the event demand for encapsulants increases. Conversely, expanding our production in times of overcapacity could have an adverse impact on our results of operations.

Prior to the fourth quarter of 2008, our manufacturing facilities generally operated at full production capacity, which constrained our ability to meet increased demand from our customers. The future success of our Solar business depends, in part, on our ability to increase production capacity to

15

satisfy any increased demand from our customers. We may be unable to expand our Solar business, satisfy customer requirements, maintain our competitive position and improve profitability if we are unable to build and operate new manufacturing facilities and increase production capacity at our existing facilities to meet any increased demand for our Solar products. For example, if there are delays in our new Malaysian facility achieving target yields and output, we will not meet our target for adding capacity, which would limit our ability to increase encapsulant sales and result in lower than expected Solar net sales and higher than expected costs and expenses. Moreover, we may experience delays in receiving equipment and be unable to meet any increases in customer demand. Failure to satisfy customer demand may result in a loss of market share to competitors and may damage our relationships with key customers.

In addition, due to the lead time required to produce the equipment used in our encapsulant manufacturing process, it can take up to a year to obtain new machines after they are ordered. Accordingly, we are required to order production equipment well in advance of expanding our facilities or opening new facilities and in advance of accepting additional customer orders. If such facilities are not expanded or completed on a timely basis or if anticipated customer orders do not materialize, we may not be able to generate sufficient Solar net sales to offset the costs of new production equipment, which could have an adverse impact on our results of operations. Furthermore, we rely on longer-term forecasts from our Solar customers to plan our capital expenditures. If these forecasts prove to be inaccurate, either we may have spent too much on capacity growth, which could require us to consolidate facilities, in which case our financial results would be adversely affected, or we may have spent too little on capital expenditures, in which case we may be unable to satisfy customer demand, which could adversely affect our business. Furthermore, our ability to establish and operate new manufacturing facilities and expand production capacity is subject to significant risks and uncertainties, including:

- •

- restrictions in the agreements governing our indebtedness that restrict the amount of capital that can be spent on

manufacturing facilities;

- •

- inability to raise additional funds or generate sufficient cash flow from operations to purchase raw material inventory

and equipment or to build additional manufacturing facilities;

- •

- delays and cost overruns as a result of a number of factors, many of which are beyond our control, such as increases in

raw material prices and long lead times or delays with equipment vendors;

- •

- delays or denials of required approvals by relevant government authorities;

- •

- diversion of significant management attention and other resources;

- •

- inability to hire qualified personnel; and

- •

- failure to execute our expansion plan effectively.

If we are unable to establish or successfully operate additional manufacturing facilities or to increase production capacity at our existing facilities, as a result of the risks described above or otherwise, we may not be able to expand our business as planned and our Solar net sales may be lower than expected. Alternatively, if we build additional manufacturing facilities or increase production capacity at our existing facilities, we may not be able to generate sufficient customer demand for our encapsulants to support the increased production levels, which would adversely affect our business and operating margins.

16

Our Solar business is exposed to risks related to running our facilities at full production capacity from time to time that could result in decreased Solar net sales and affect our ability to grow our business in future periods.

Prior to the fourth quarter of 2008, our manufacturing facilities generally operated at full production capacity. If any of our current or future production lines or equipment were to experience any problems or downtime, such as in 2005 when one of our plants was without electricity for five days following a hurricane, we may not be able to shift production to new lines and may not be able to meet our production targets, which would result in decreased Solar net sales and adversely affect our customer relationships. As a result, our per-unit manufacturing costs would increase, we would be unable to increase sales as planned and our earnings would likely be negatively impacted. In addition, when our encapsulant production lines are running at full capacity, they are generally used solely to meet current customers' orders. As such, there is very limited production line availability to test new technologies or further refine existing technologies that are important for keeping pace with evolving industry standards and changing customer requirements and competing effectively in the future. Limitations in our ability to test new products or enhancements to our existing products could cause our encapsulants to become uncompetitive or obsolete, which would adversely affect our business.

We may be subject to claims that we have infringed, misappropriated or otherwise violated the patent or other intellectual property rights of a third party. The outcome of any such claims is uncertain and any unfavorable result could adversely affect our business, financial condition and results of operations.

We may be subject to claims by third parties that we have infringed, misappropriated or otherwise violated their intellectual property rights. These claims may be costly to defend, and we ultimately may not be successful. An adverse determination in any such litigation could subject us to significant liability to third parties (potentially including treble damages), require us to seek licenses from third parties (which may not be available on reasonable terms, or at all), make substantial one-time or ongoing royalty payments, redesign our products or subject us to temporary or permanent injunctions prohibiting the manufacture and sale of our products, the use of our technologies or the conduct of our business. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation. In addition, we may have no insurance coverage in connection with such litigation and may have to bear all costs arising from any such litigation to the extent we are unable to recover them from other parties. Any of these outcomes could have a material adverse effect on our business, financial condition and results of operations.

We generally operate on a purchase order basis with our Solar customers, and their ability to cancel, reduce, or postpone orders could reduce our Solar net sales and increase our costs.

Sales to our Solar customers are typically made through non-exclusive, short-term purchase order arrangements that specify prices and delivery parameters. The timing of placing these orders and the amounts of these orders are at our customers' discretion. Customers may cancel, reduce or postpone purchase orders with us prior to production on relatively short notice. If customers cancel, reduce or postpone existing orders or fail to make anticipated orders, it could result in the delay or loss of anticipated sales, which could lead to excess inventory and unabsorbed overhead costs. Because our encapsulants have a limited shelf life from the time they are produced until they are incorporated into a solar module, we may be required to sell any excess inventory at a reduced price, or we may not be able to sell it at all and incur an inventory write-off, which could reduce our Solar net sales and increase our costs. During the first half of 2009, we experienced postponements and cancellations in orders and, as a result, incurred approximately $1.0 million of inventory write-offs.

17

We may be unable to manage the expansion of our Solar operations effectively.

We expect to expand our existing facilities and add new facilities to meet future demand for encapsulants. We recently completed expansions in our facilities in Connecticut and Spain. The production line qualification on our Malaysian facility has been completed, and we began shipping production quantities of encapsulants from that facility in the third quarter of 2009. To manage the potential growth of our operations, we will be required to improve operational and financial systems, procedures and controls, increase manufacturing capacity and output and expand, train and manage our growing employee base. Furthermore, management will be required to maintain and expand our relationships with our customers, suppliers and other third parties. Our Solar business's current and planned operations, personnel, systems, internal procedures and controls may not be adequate to support our future growth. If we are unable to manage the growth of our Solar business effectively, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures.

Our dependence on a limited number of third-party suppliers for raw materials for our encapsulants and other significant materials used in our process could prevent us from timely delivering encapsulants to our customers in the required quantities, which could result in order cancellations and decreased revenues.

We purchase resin and paper liner, the two main components used in our manufacturing process, from multiple third-party suppliers. If we fail to develop or maintain our relationships with these suppliers or our other suppliers, or if the suppliers' facilities are affected by events beyond our control, we may be unable to manufacture our encapsulants or our encapsulants may be available only for customers in lesser quantities, at a higher cost or after a long delay. We may be unable to pass along any price increases relating to materials costs to our customers, particularly in circumstances in which we have entered into fixed-price contracts with our customers, in which case our margins could be reduced. In addition, we do not maintain long-term supply contracts with our suppliers. Our inventory of raw materials for our encapsulants, including back-up supplies of resin, may not be sufficient in the event of a supply disruption. In 2005, we encountered a supply disruption when one of our resin suppliers had its facilities damaged by a hurricane, and another supplier had a reactor fire at the same time. This forced us to use our back-up supplies of resin. The failure of a supplier to supply materials and components, or a supplier's failure to supply materials that meet our quality, quantity and cost requirements in a timely manner, could impair our ability to manufacture our products to specifications, particularly if we are unable to obtain these materials and components from alternative sources on a timely basis or on commercially reasonable terms. If we are forced to change suppliers, our customers may require us to undertake testing to ensure that our encapsulants meet the customer's specifications.

Our Solar gross margins and profitability may be adversely affected by rising commodity costs.

We are dependent on certain raw and other materials, particularly resin and paper, for the manufacture of our encapsulants. In addition, the cost of equipment used to manufacture our encapsulants is affected by steel prices. The prices for resin, paper and steel have been volatile over the past few years and could increase. For example, in 2010 the price of resin has increased. Any increases in the prices for the commodities and equipment we use in our Solar business may adversely affect our gross margins and results of operations, especially where we have entered into fixed-price contracts with our customers.

18

As a supplier to solar module manufacturers, disruptions in any other component of the supply chain to solar module manufacturers may adversely affect our customers and consequently limit the growth of our business and revenue.

We supply a component to solar module manufacturers. As such, if there are disruptions in any other area of the supply chain for solar module manufacturers, it could affect the overall demand for our encapsulants. For example, the increased demand for polysilicon due to the rapid growth of the solar energy and computer industries and the significant lead time required for building additional capacity for polysilicon production led to an industry-wide shortage of polysilicon from 2005 through 2008, which is an essential raw material in the production of most of the solar modules produced by many of our customers. This and other disruptions to the supply chain may force our customers to reduce production, which in turn would decrease customer demand for our encapsulants and could adversely affect our Solar net sales. In addition, reduced orders for our encapsulants could result in underutilization of our production facilities and cause an increase of our marginal production cost. During the first half of 2009, we experienced postponements and cancellations in orders and, as a result, incurred approximately $1.0 million of inventory write-offs.

The sales cycle for our encapsulants can be lengthy, which could result in uncertainty and delays in generating Solar net sales.

The integration and testing of our encapsulants with prospective customers' solar modules or enhancements to existing customers' solar modules requires a substantial amount of time and resources. A Solar customer may need up to one year to test, evaluate and adopt our encapsulants and qualify a new solar module, before ordering our encapsulants. Our Solar customers then need additional time to begin volume production of solar modules that incorporate our encapsulants. As a result, the complete sales cycle for our Solar business can be lengthy. We may experience a significant delay between the time we increase our expenditures for product development, sales and marketing efforts and inventory for our Solar business and the time we generate Solar net sales, if any, from these expenditures. In addition, because we typically do not have long-term commitments from our Solar customers, we must repeat the sales process on a continual basis even for existing customers that develop new solar modules or enhancements to their existing solar modules.

Our Solar business could be adversely affected by seasonal trends and construction cycles.

We may be subject to industry-specific seasonal fluctuations in the future, particularly in climates that experience colder weather during the winter months, such as Germany. For example, in 2009, we experienced a decline in our Solar business mainly due to decreased global demand for solar energy as a result of legislative changes, such as the cap in feed-in tariffs in Spain implemented in 2008, the global recession and the worldwide credit crisis. There are various reasons for seasonality fluctuations, mostly related to economic incentives and weather patterns. In Germany, the construction of solar energy systems is concentrated in the second half of the calendar year, largely due to the annual reduction of the applicable minimum feed-in tariff. Recently, the German government has announced potential legislation that will probably reduce feed-in tariffs in the second half of 2010. This announcement has resulted in the pull-in of demand from solar module manufacturers due to increased end-user demand being driven by the incentive to purchase a solar system prior to the expected enactment of the decreased feed-in tariff incentives. As such, we may see atypical Solar sales during the first half of 2010 that may not occur during the second half of 2010. In the United States, solar module customers will sometimes make purchasing decisions towards the end of the year in order to take advantage of tax credits or for budgetary reasons. In addition, construction levels are typically slower in colder months. Accordingly, our business and results of operations could be affected by seasonal fluctuations in the future.

19

Problems with product quality or product performance, including defects, could result in a decrease in customers and Solar net sales, unexpected expenses and loss of market share.