Attached files

| file | filename |

|---|---|

| 8-K - 8K ROSE OGIS PRESENTATION - NBL Texas, LLC | roseogispres.htm |

1

Rosetta Resources Inc.

RANDY L. LIMBACHER - APRIL 12, 2010

2

Forward-Looking Statements

All statements, other than statements of historical fact, included in this presentation are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are

based upon current expectations and are subject to a number of risks, uncertainties and assumptions, which

are more fully described in Rosetta Resources Inc.'s Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q filed with the Securities and Exchange Commission. These risks, uncertainties and assumptions

could cause actual results to differ materially from those described in the forward-looking statements.

Rosetta assumes no obligation and expressly disclaims any duty to update the information contained herein

except as required by law.

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are

based upon current expectations and are subject to a number of risks, uncertainties and assumptions, which

are more fully described in Rosetta Resources Inc.'s Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q filed with the Securities and Exchange Commission. These risks, uncertainties and assumptions

could cause actual results to differ materially from those described in the forward-looking statements.

Rosetta assumes no obligation and expressly disclaims any duty to update the information contained herein

except as required by law.

Cautionary Statement Concerning Resources

The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves that a company anticipates as of a given date to

be economically and legally producible by application of development projects to known accumulations. We

may use certain terms in this presentation, such as “Risked Project Inventory,” “Project Counts,” “Net Risked

Resources”, “Total Resources”, and “Unrisked Potential” that the SEC's guidelines strictly prohibit us from

including in filings with the SEC. These estimates are by their nature more speculative than estimates of

proved reserves and accordingly are subject to substantially greater risk of actually being realized.

SEC, to disclose only proved, probable and possible reserves that a company anticipates as of a given date to

be economically and legally producible by application of development projects to known accumulations. We

may use certain terms in this presentation, such as “Risked Project Inventory,” “Project Counts,” “Net Risked

Resources”, “Total Resources”, and “Unrisked Potential” that the SEC's guidelines strictly prohibit us from

including in filings with the SEC. These estimates are by their nature more speculative than estimates of

proved reserves and accordingly are subject to substantially greater risk of actually being realized.

3

• Company Overview

• Selective Asset Overview

• Stacked Pay in Sacramento Basin

• Lobo Trend in South Texas

• Niobrara Chalk in DJ Basin

• Eagle Ford Shale in South Texas

• Bakken Shale in Alberta Basin

• 2010 Expectations

Agenda

4

• Rosetta Resources Inc. (NASDAQ: ROSE) was formed in June 2005 to acquire the

domestic oil and natural gas business formerly owned by Calpine Corporation

domestic oil and natural gas business formerly owned by Calpine Corporation

• Headquartered in Houston, Texas

§ Technical and field offices in Denver, CO, Laredo, TX and Rio Vista, CA

• We have grown by developing and exploring unconventional resources in the Lower 48

• Our primary focus areas for exploitation are the Sacramento Basin, the Rocky Mountains and South Texas

• One of our key plays for exploitation is the Eagle Ford Shale in South Texas

• One of our key plays for exploration is the Bakken Shale in the Alberta Basin of Montana

• Today, Rosetta has a high quality, diversified proved asset base

• Proved reserves of 351 Bcfe as of 12/31/2009¹

• 75% proved developed; 85% gas

• 2009 production of 139 MMcfe/d, with increasing percentage of liquids

• 2009 F&D cost of $2.22/Mcfe

• 695,000 net acres (900,000 gross); including approximately 280,000 net acres under exploration option in

Alberta Bakken

Alberta Bakken

• Project count of over 2,600 net identified drilling opportunities

• We have significant potential from low geological risk resource positions

• Total resources of 899 Bcfe²

• Over 61,000 net acres in Eagle Ford Trend of South Texas

• Inception to date, we have drilled 9 horizontal wells and currently have 2 rigs running

• Over 280,000 net acres in Alberta Basin

• Inception to date, we have drilled 3 delineation wells confirming oil present in Banff, Bakken, Three Forks, and Nisku

Company Overview

¹ Estimated proved reserves of 412 Bcfe under prior SEC rules

² Total resources includes net risked Probable and Possible reserves and 86 Bcfe of PUD’s

5

Company Overview (cont.)

• Rosetta has substantial operating control of its reserve base

• 87% of proved reserves are operated by Rosetta

• High working interest in properties

• High percentage of legacy acreage is held by production

• Recently acquired acreage is early in term

• Prudent and conservative financial management

• Since 2007, debt to book cap < 40% and debt to LTM EBITDAX < 1.75x

• Maintained > $200MM in liquidity since 2008

• Hedge to protect downside, capital budget activities and key strategic initiatives

• Modest non-core asset sale program to generate cash flow

6

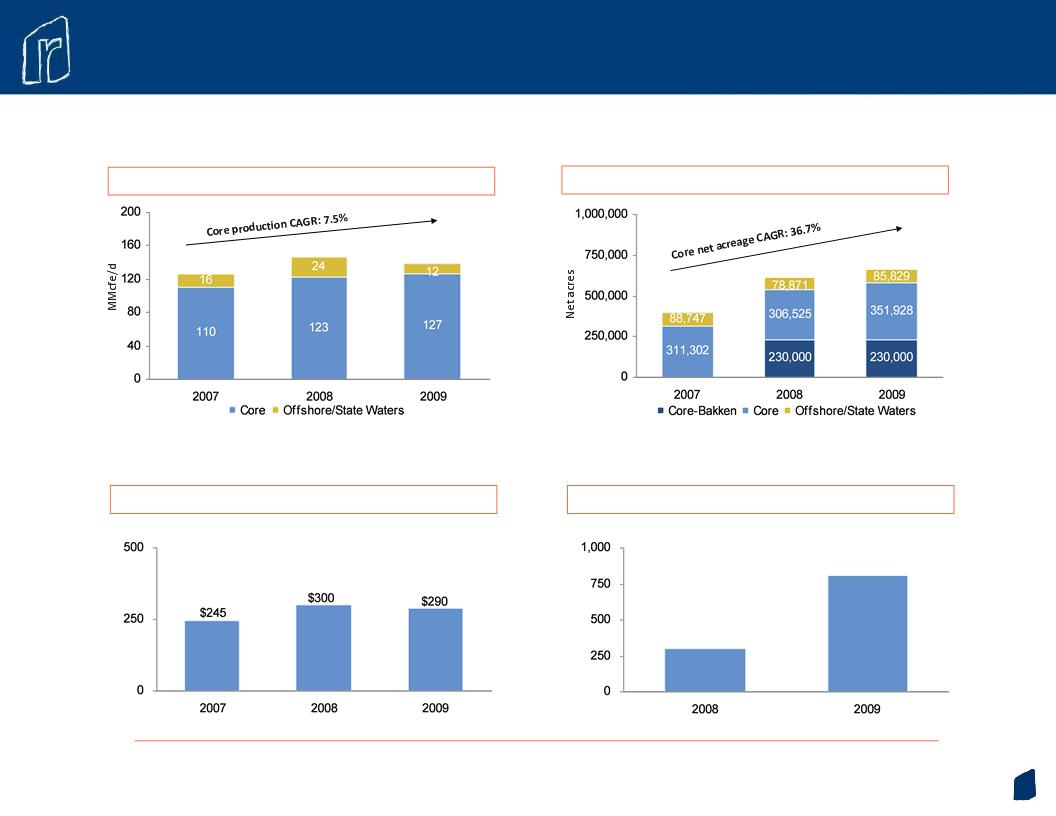

Average Daily Production

Acreage Position

Total Resources¹

125

147

139

400,049

615,396

667,757

299

899

(Bcfe)

¹ Total resources includes net risked Probable and Possible reserves and 86 Bcfe of PUD’s

Total Debt

($MM)

Historical Performance

7

Pinedale

South Texas

Texas State Waters

GOM

|

Asset Summary

|

|

|

Proved Reserves

|

351 Bcfe

|

|

% Proved Developed

|

75%

|

|

% Gas

|

85%

|

|

Proved PV -10

|

$465MM

|

|

Net Annual Production

|

51 Bcfe

|

|

Net Acreage*

|

667,757

|

|

Total Resources¹

|

899 Bcfe

|

|

Net drilling locations

|

2,480

|

|

Sacramento Basin

|

|

|

Proved Reserves

|

90 Bcfe

|

|

% Proved Developed

|

84%

|

|

% Gas

|

100%

|

|

Proved PV -10

|

$113MM

|

|

Net Annual Production

|

16 Bcfe

|

|

Net Acreage

|

60,269

|

|

DJ Basin

|

|

|

Proved Reserves

|

29 Bcfe

|

|

% Proved Developed

|

89%

|

|

% Gas

|

99%

|

|

Proved PV -10

|

$15MM

|

|

Net Annual Production

|

3 Bcfe

|

|

Net Acreage

|

101,796

|

|

San Juan Basin

|

|

|

Proved Reserves

|

18 Bcfe

|

|

% Proved Developed

|

96%

|

|

% Gas

|

100%

|

|

Proved PV -10

|

$11MM

|

|

Net Annual Production

|

2 Bcfe

|

|

Net Acreage

|

19,773

|

Sacramento Basin

|

Other Areas

|

|

|

Proved Reserves

|

63 Bcfe

|

|

% Proved Developed

|

97%

|

|

% Gas

|

80%

|

|

Proved PV -10

|

$102MM

|

|

Net Annual Production

|

10 Bcfe

|

|

Net Acreage*

|

316,829

|

DJ Basin

Alberta Basin

Eagle Ford

¹ Total resource potential includes net risked Probable and Possible reserves and 86 Bcfe of PUD’s

* Includes 230,000 net acres under exploration option

|

South Texas

(Lobo, Perdido, Olmos)

|

|

|

Proved Reserves

|

108 Bcfe

|

|

% Proved Developed

|

77%

|

|

% Gas

|

81%

|

|

Proved PV -10

|

$180MM

|

|

Net Annual Production

|

20 Bcfe

|

|

Net Acreage

|

116,333

|

|

South Texas (Eagle Ford)

|

|

|

Proved Reserves

|

43 Bcfe

|

|

% Proved Developed

|

4%

|

|

% Gas

|

52%

|

|

Proved PV -10

|

$43MM

|

|

Net Annual Production

|

0.4 Bcfe

|

|

Net Acreage

|

52,757

|

Rosetta Asset Overview

(as of 12/31/2009)

(as of 12/31/2009)

8

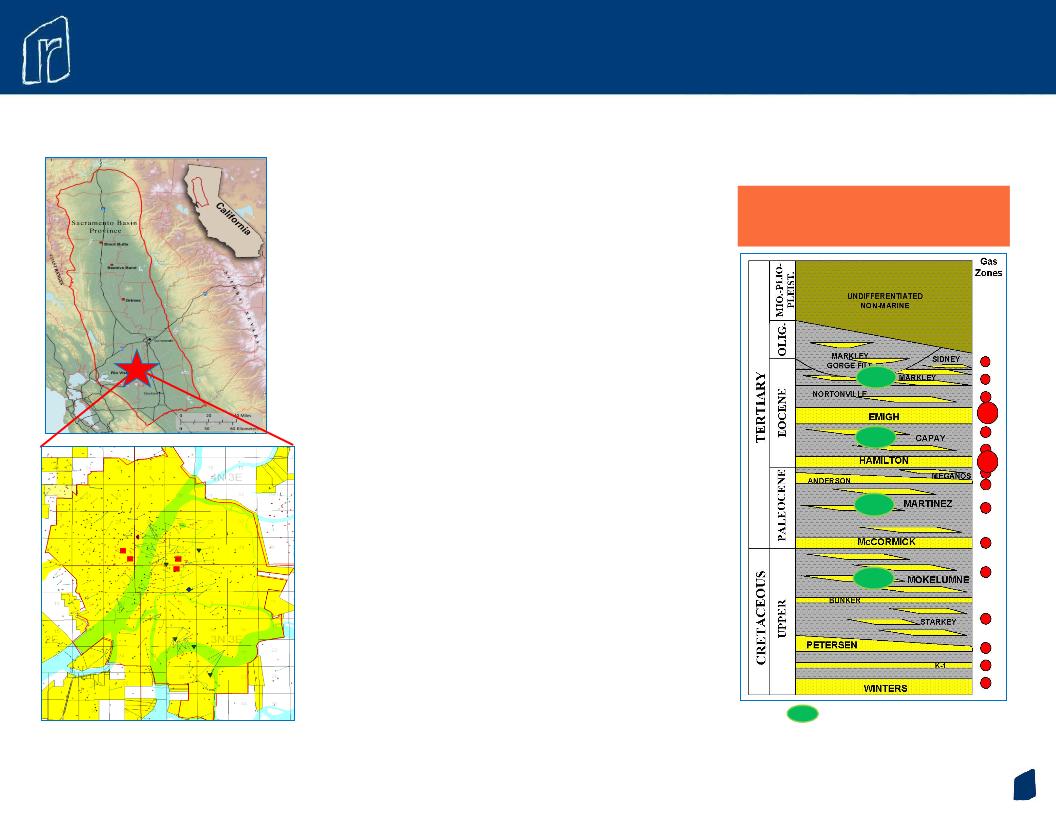

• Discovered in 1936

• One of California’s most prolific

natural gas fields

natural gas fields

• 16 known producing horizons in the

basin

basin

• 3.7 Tcfe produced to date

• Rio Vista Field is the largest onshore

natural gas field in California

natural gas field in California

• Rio Vista Field is one of the 15 largest

natural gas fields in the United States

natural gas fields in the United States

• Region has established natural gas

gathering and pipeline infrastructure

gathering and pipeline infrastructure

Asset Overview

Sacramento Basin: General Description

Sacramento Basin: General Description

Depth Range

2,500 - 13,000’

Recompletion Targets

9

2009 recomplete

2010 recomplete

Recompletion Program

By Year

By Recovery

Rio Vista, California

Recompletion Program - Year End 2009

Date

Asset Overview

Sacramento Basin: Low Cost Success

Sacramento Basin: Low Cost Success

10

Rosetta acreage

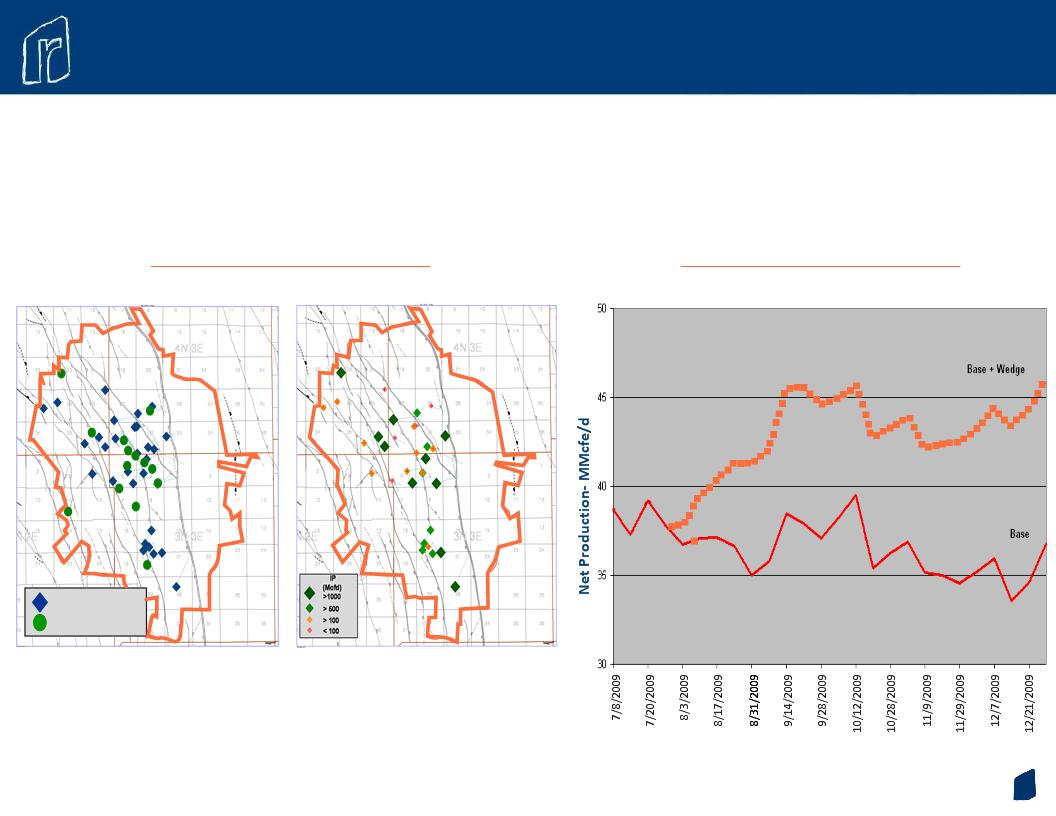

• We have approximately 90,000 net acres

in the South Texas Lobo Trend

in the South Texas Lobo Trend

• 255 operated producing wells and 470

square miles of 3-D seismic data

square miles of 3-D seismic data

• Currently re-mapping SCR using new 3-D

data received in-house late in 12/09

data received in-house late in 12/09

• Majority of acreage is 100% owned and

operated; working interest ranges from

50% to 100%

operated; working interest ranges from

50% to 100%

• In 2009 we drilled 21 successful wells in

the Lobo Trend

the Lobo Trend

• For the year ended 12/31/09, average net

daily production was 44.1 MMcfe/d

daily production was 44.1 MMcfe/d

Asset Overview

South Texas: Lobo Trend

South Texas: Lobo Trend

11

Asset Overview

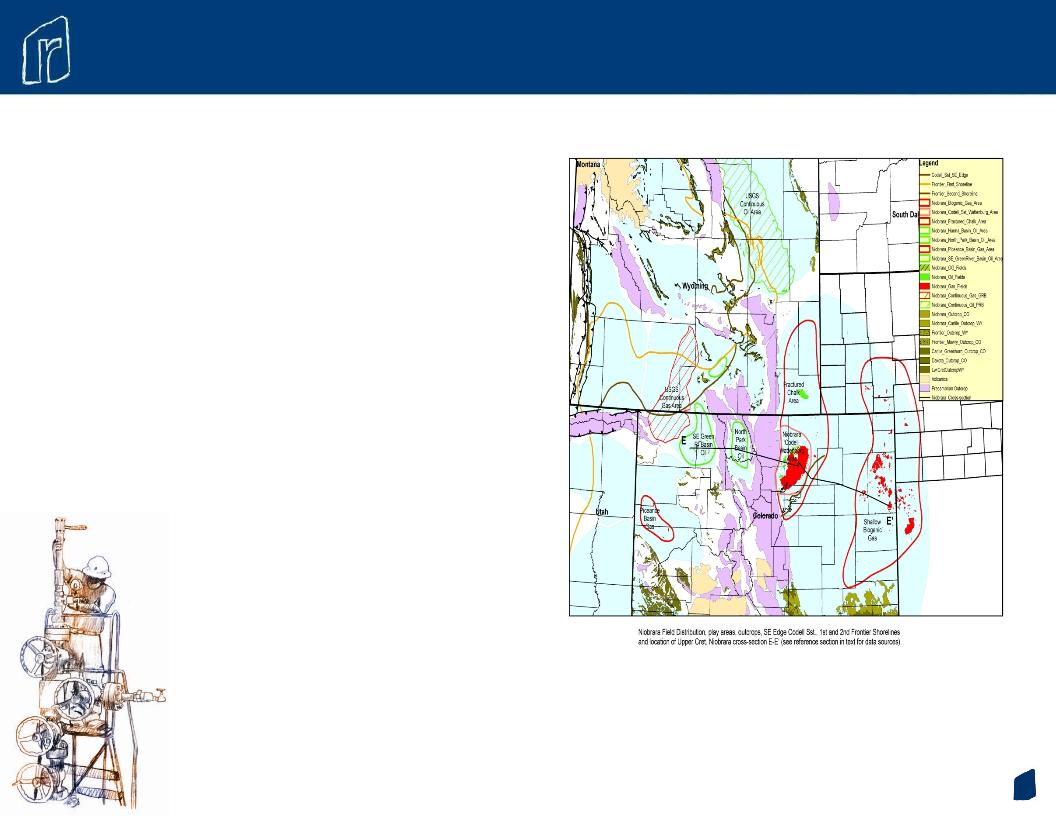

DJ Basin: Niobrara Chalk Play

DJ Basin: Niobrara Chalk Play

• We have approximately 100,000 net

acres

acres

• 154 square miles of 3-D seismic data

• In the low commodity prices during

2009, we chose not to drill and focused

our efforts on resource assessment

2009, we chose not to drill and focused

our efforts on resource assessment

• Commenced a 105-well drilling program

in the first quarter of 2010

in the first quarter of 2010

12

12/31/2006

12/31/2007

12/31/2008

1/01/2006

12/31/2009

Dec. 2009: 11.3 MMcf/d

Well count: 173

Asset Overview

DJ Basin: Efficient Production Growth

DJ Basin: Efficient Production Growth

13

Asset Overview

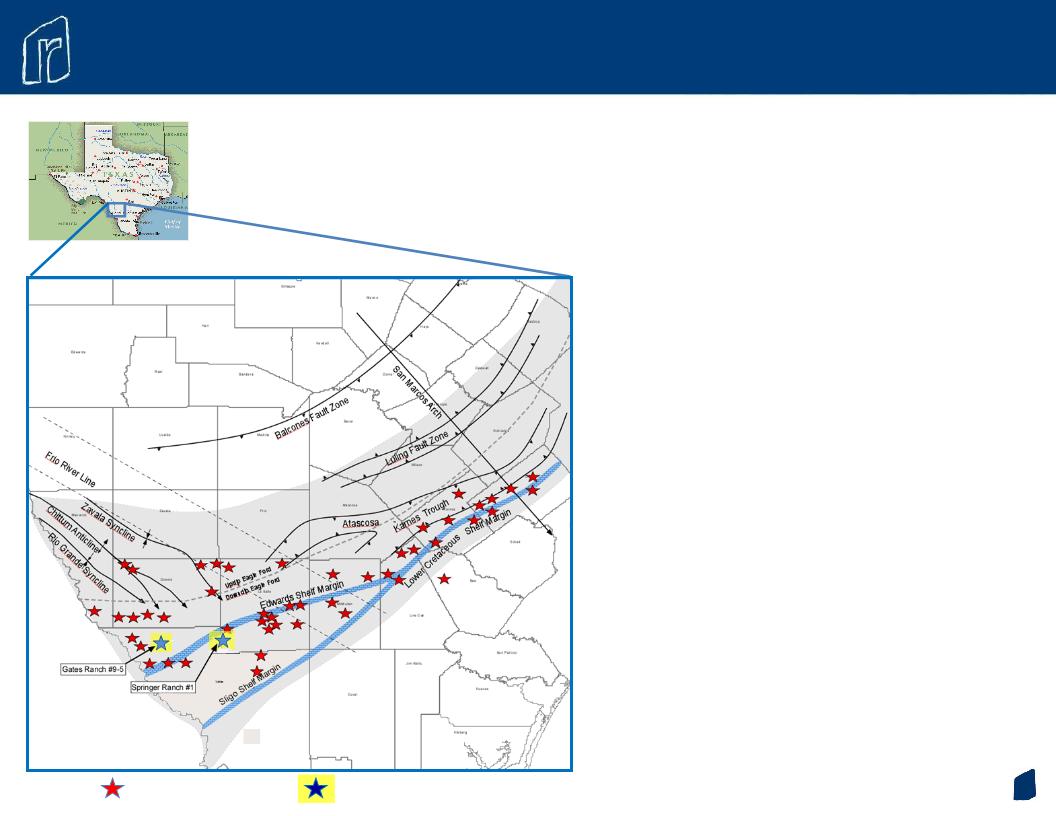

South Texas: Eagle Ford Shale Play

South Texas: Eagle Ford Shale Play

14

Initial Rosetta Wells

Industry Activity

• We have accumulated approximately

67,000 gross and 61,000 net acres

67,000 gross and 61,000 net acres

• Average working interest of 90-100%

• At year-end 2009, we had drilled and

completed 2 horizontal wells

completed 2 horizontal wells

• For the quarter ended 12/31/09 our

average net daily production was 4.3

MMcfe/d

average net daily production was 4.3

MMcfe/d

• 2010 to date: we have drilled or spud 9

horizontal wells

horizontal wells

• Currently, we have 2 drilling rigs running

Asset Overview

South Texas: Eagle Ford Shale Play

South Texas: Eagle Ford Shale Play

15

Gates Ranch Area¹

• Areal extent

• 9 miles N/S & 9 miles E/W

• 29,500 net acres

• Rosetta Resources operated

• 100% WI

• 75% NRI

• Unrisked original resource in place

• 11.3 Tcfe @ 245 Bcfe per section

• Unrisked EUR potential

• 160 acre development

• 185 net well locations

• 555 net Bcfe @ 4 Bcfe gross EUR

• 5% recovery of resource-in-place

• 80 acre development

• 369 net well locations

• 1.1 net Tcfe @ 4 Bcfe gross EUR

• 10% recovery of resource-in-place

¹ Includes a 3,600 net acre lease 8 miles to the North

Asset Overview

South Texas: Eagle Ford Shale Play

South Texas: Eagle Ford Shale Play

16

Asset Overview

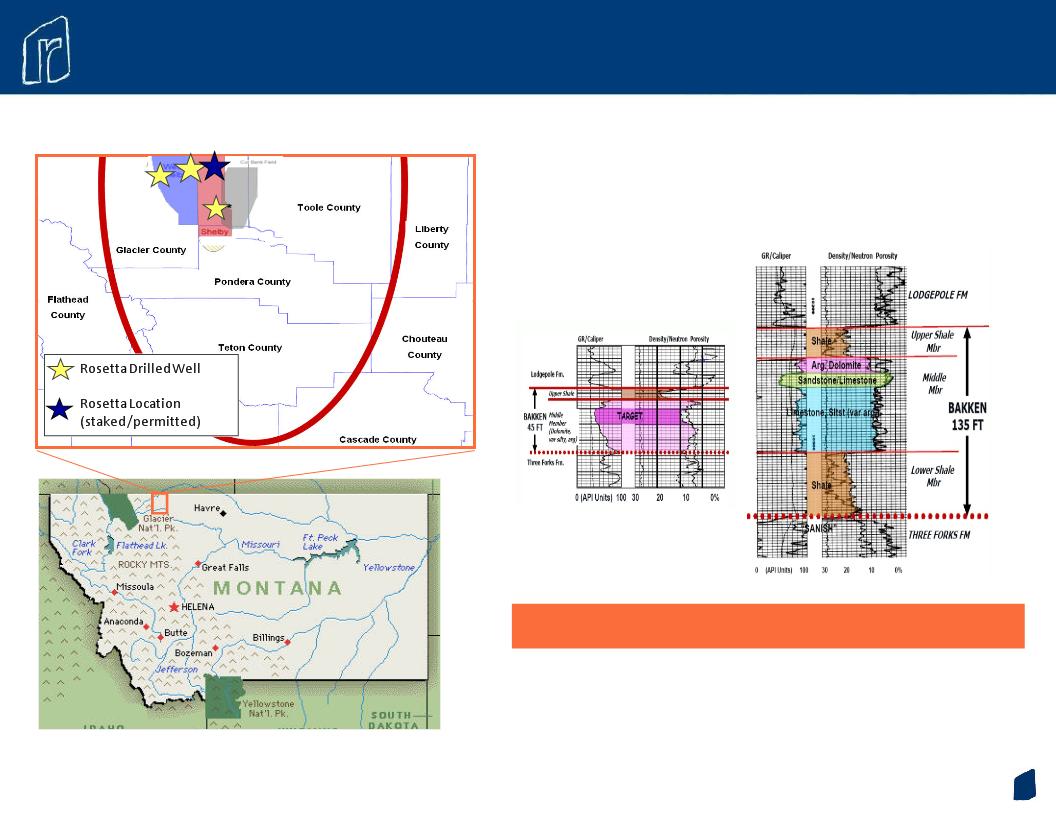

Alberta Basin: Bakken Play

Alberta Basin: Bakken Play

17

Cut

Bank

Bank

Williston Basin Analogs

Elm Coulee

Nesson Anticline

Alberta Basin Bakken Shale

Early Mover into a Williston Basin Analog Play

Early Mover into a Williston Basin Analog Play

18

• Alberta Basin Bakken specifics

• The Bakken is a Devonian Shale oil play located in

northwestern Montana

northwestern Montana

• Williston Basin analog

• Depths ranging from 4,500’ to 7,500’ TVD

• Over-pressured reservoirs

• Rosetta’s current Bakken position:

• 280,000 undeveloped net acres

• 13 - 15 MMBoe per square mile of resource in place

• Rosetta’s assessment to date:

• Drilled 3 exploratory delineation wells

• 2 wells on strike 28 miles apart

• 1 well 8 miles downdip

• Confirmed significant oil hydrocarbons in place

• Banff (Lodgepole)

• Bakken

• Three Forks

• Nisku

• Planned continued resource assessment in 2010

Asset Overview

Alberta Basin Bakken: Establishing Commerciality

Alberta Basin Bakken: Establishing Commerciality

19

Financial Strategy

• Conservative and disciplined approach to financial management

• Actively manage and monitor use of debt

• Debt to book cap < 40%

• Debt to EBITDAX < 1.75x

• Maintain high level of liquidity throughout cycles

• Selective hedging program with 55,000 MMBtu/d hedged in

2H’10 and 50 MMBtu/d hedged in 2011

2H’10 and 50 MMBtu/d hedged in 2011

1 Adjusted for the high yield offering

20

• High quality, geographically diverse asset base

• High percentage of production in premium markets

• Legacy asset base requires low levels of capital to maintain core production;

approximately $100MM per year

approximately $100MM per year

• 880 Bcfe of total resource that can be produced at a favorable cost

• Operate 87% of proved reserves

• Contiguous positions in basins facilitate low cost development

• High drilling success rate

• Skilled unconventional driller, utilizing similar proven technology across entire

resource base

resource base

High degree of

operational

control

operational

control

Diversified

asset base

asset base

Experienced

management

team

management

team

• Experienced management team with an average of 30 years of industry

experience and a proven track record in asset plays that are key to Rosetta’s

strategy

experience and a proven track record in asset plays that are key to Rosetta’s

strategy

• Proven technical and land personnel with ability to leverage new and

developing technological resources

developing technological resources

Key Investment Considerations

21

Rosetta Resources

What to expect in 2010…

What to expect in 2010…

• Disciplined Capital Spending

• $280 million capital program

• High return / high value programs receive majority of funding

• Production Growth

• Annual production rate of 145 to 155 MMcfe/d

• Reserve Growth

• Double digit reserve replacement rate

• Inventory Growth

• Continued resource assessment of all core assets

• Continued development of the Eagle Ford

• Continued delineation and assessment of the Alberta Bakken

• Continued identification and capture of new assets with upside

22