Attached files

As filed with the Securities and Exchange Commission on April 6 , 2010

Registration No. 333- 164873

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NEXX SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

3559

(Primary Standard Industrial

Classification Code Number)

|

30-0307916

(I.R.S. Employer

Identification Number)

|

900 Middlesex Turnpike, Building # 6

Billerica, Massachusetts 01821

(978) 932-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Thomas M. Walsh

Chief Executive Officer

900 Middlesex Turnpike, Building # 6

Billerica, Massachusetts 01821

(978) 932-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

Copies to:

|

|||

|

Neil H. Aronson

Matthew M. Graber

Gennari Aronson, LLP

First Needham Place

250 First Avenue

Needham, Massachusetts 02494

Telephone (781) 719-9900

Fax (781) 719-9850

|

Andrea C. Johnson

Fraser Milner Casgrain LLP

99 Bank Street

Suite 1420

Ottawa, Ontario, Canada

K1P 1H4

Telephone (613) 783-9600

Fax (613) 783-9690

|

Martin Langlois

Ian Putnam

Stikeman Elliott LLP

5300 Commerce Court West

199 Bay Street

Toronto, Ontario, Canada

M5L 1B9

Telephone (416) 869-5500

Fax (416) 947-0866

|

Richard Raymer

Hodgson Russ LLP

150 King Street

Suite 2309

Toronto, Ontario, Canada

M5H 1J9

Telephone (416) 595-5100

Fax (416) 595-5021

|

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

(Do not check if a

smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Proposed Maximum

Aggregate Offering Price(1)

|

Amount of

Registration Fee(2)

|

||

|

Common Stock, $0.001 par value per share

|

$42,000,000

|

$2,994.60

|

||

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. Includes shares that the underwriters have the option to purchase to cover over-allotments, if any.

|

|

(2)

|

Previously paid. Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Subject to Completion dated April 6 , 2010

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

shares

Nexx Systems, Inc.

Common Stock

This is the initial public offering of common stock by NEXX Systems, Inc. We are offering shares of common stock. The estimated initial public offering price is between $5.20 and $7.00 per share.

Currently, no public market exists for our common stock, and purchasers may not be able to resell common stock purchased under this prospectus. We have applied to list our shares of common stock on the Toronto Stock Exchange (the “TSX”) under the symbol “NXS.” Listing will be subject to fulfilling all of the requirements of the TSX, including distribution of our shares of common stock to a minimum number of public shareholders.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 11.

Neither the Securities and Exchange Commission nor any state or foreign securities commission nor any other regulatory body has approved or disapproved of these securities or passed on the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Share

|

Total

|

|||||||

|

Public offering price

|

$ | $ | ||||||

|

Underwriting discount

|

$ | $ | ||||||

|

Proceeds, before expenses to Company

|

$ | $ | ||||||

We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock (being 15% of the number of shares offered hereby) on the same terms and conditions set forth above. See “Underwriting.”

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2010.

The date of this prospectus is , 2010

TABLE OF CONTENTS

|

Page

|

Page

|

|||

|

Prospectus Summary

|

4 |

Management

|

73 | |

|

The Offering

|

7 |

Executive Compensation

|

84 | |

|

Summary Consolidated Financial Data

|

9 |

Related Person Transactions

|

101 | |

|

Risk Factors

|

11 |

Principal Stockholders

|

105 | |

|

Special Note Regarding Forward-Looking Statements

|

29 |

Description of Capital Stock

|

108 | |

|

Use of Proceeds

|

30 |

Shares Eligible for Future Sale

|

115 | |

|

Dividend Policy

|

30 |

Underwriting

|

119 | |

|

Capitalization

|

31 |

Legal Matters

|

123 | |

|

Dilution

|

32 |

Experts

|

123 | |

|

Selected Consolidated Financial Data

|

34 | Change in Independent Registered Accounting Firm | 124 | |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

36 |

Where You Can Find Additional Information

|

124 | |

|

Business

|

60 |

Glossary of Technical Terms

|

A-1

|

|

|

Index to Financial Statements

|

F-1

|

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with information that is different . We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, prospects, financial condition and results of operations may have changed since that date.

- 2 -

GENERAL MATTERS

Until , 2010, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Unless otherwise specified, all reference to “dollars” or “$” in this prospectus are to United States dollars.

Unless otherwise indicated, all references to “GAAP” in this prospectus are to United States generally accepted accounting principles.

Unless the context indicates otherwise, as used in this prospectus, the terms “the company”, “NEXX”, “we”, “us”, “our” and “our company” refer to NEXX Systems, Inc. and its subsidiary. The NEXX Systems logo is a trademark of NEXX Systems, Inc. All other trademarks and service marks appearing in this prospectus are the property of their respective holders. All rights reserved.

Information contained in, and that can be accessed through, our web site www.nexxsystems.com shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the shares offered hereunder.

This prospectus relates to the offering of securities in the United States only. Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus .

This prospectus includes market and industry data that has been obtained from third party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s knowledge of such industries has been developed through its experience and participation in these industries. While our management believes the third party sources referred to in this prospectus are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. Internally prepared and third party market forecasts, in particular, are estimates only and may be inaccurate, especially over long periods of time. In addition, the underwriters have not independently verified any of the industry data prepared by management or ascertained the underlying estimates and assumptions relied upon by management. Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this prospectus.

- 3 -

PROSPECTUS SUMMARY

The following is a summary of the principal features of this offering and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” beginning on page 11 and the consolidated financial statements and notes to those consolidated financial statements, before making an investment decision.

BUSINESS

Our Company

Rapid change is occurring in the electronics industry. Smart phones and other portable devices will soon offer mobile television services, video calling and traditional broadband content delivered over wireless networks. Consumer purchases of smart phones and other new technologies are driving the demand for increased functionality within smaller product form factors, as well as higher speed and lower power consumption. The advanced semiconductor integrated circuits (“ICs”) providing these functions must be packaged before assembly in products. Typical package size for ICs has decreased ten times over packages of the 1990s, while product speed and capability has increased. This trend is expected to make advanced packaging one of the fastest growing sectors of the semiconductor industry.

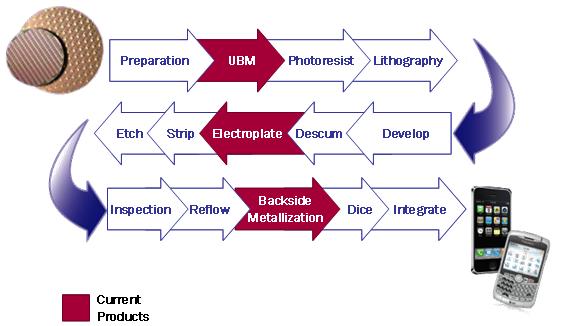

We meet the demand for smaller, high performance packages by designing, manufacturing, selling, installing and servicing highly-engineered semiconductor process equipment that automates the packaging of semiconductor devices. Advanced packaging processes, examples of which include “flip chip,” package on package and emerging three dimensional through silicon vias (“3D TSV”) packaging, enable the packaging of integrated circuits that power this broad range of communications, computing and consumer electronic products. We estimate that the advanced packaging equipment market addressed by our current products was approximately $170 million in 2008 and we expect it to exceed $500 million by 2013.

Our mission is to become the leading equipment provider for wafer level packaging. Our solutions are designed specifically for wafer level packaging and we believe they offer a unique and more efficient process compared to competing technologies. Based on customer surveys, our solutions provide our customers with increased throughput, lower cost of ownership, greater ease of use, greater reliability and lower maintenance, resulting in higher operating profitability for our customers.

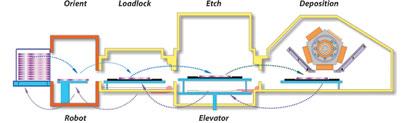

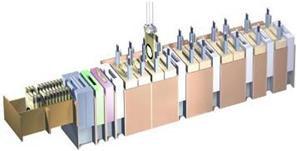

We currently offer two product platforms: Apollo, our second-generation sputter deposition system; and Stratus, an electrochemical plating system. Apollo and Stratus provide complementary solutions for a variety of metal deposition processes used in flip chip and other advanced semiconductor packaging applications. The Apollo advances metal deposition for wafer level packaging and is used for applications including the multiple metal layers under bump metallization (“UBM”), redistribution layers, backside metallization, integrated passive devices (which allow placing numerous components on a single chip) and light emitting diodes. Stratus is used for thicker metallization for through silicon vias, solder bumping, copper pillar, UBM and other advanced packaging applications. These systems enable our customers to produce semiconductor devices with greater functionality at a lower cost. This value proposition is particularly compelling for customers serving the price-sensitive consumer electronics market.

To date, our revenues have been derived from products serving deposition required for flip chips and emerging 3D advanced semiconductor packaging. We are currently focused on advancing our existing product portfolio and have not expanded into other process areas of the integrated circuit manufacturing process to date. Stratus accounted for a majority of our revenues for the years ended December 31, 2007 and 2008 and substantially all of our product revenues during the year ended December 31, 2009. During the year ended December 31, 2009, the Apollo system was redesigned, which caused customers to postpone purchases while they waited for the introduction of the next generation product.

We devote significant resources to programs directed at developing new and enhanced products, as well as new applications for existing products. As a result, we have developed a significant intellectual property portfolio with 11 U.S. patents issued and eight U.S. patents pending. In order to maintain technology leadership , which is evidenced by industry awards received during the past two years, and pursue customer driven opportunities for the application of our core technologies, we plan to continue to invest in research and development, expanding our product offerings in complementary areas where we can leverage our core competencies and technologies.

- 4 -

Our customers include leading semiconductor manufacturers throughout the world, and consist of outsourced assembly and test providers and integrated device manufacturers. Since our inception in 2001, 107 of our systems have been installed with 34 different customers, including some of the leading semiconductor manufacturers, many of whom have purchased multiple systems during the past 24 months. We primarily serve customers through our direct sales force. We also have strategically placed sales offices throughout the United States and in Taiwan and Singapore. Over the last three years, we have expanded our sales presence in Asia, where many of the world’s semiconductor manufacturing facilities are based. We expect international markets, particularly the markets in Asia, to provide most of the opportunities for our products. In addition to direct sales, we have developed indirect sales channels in Europe and in countries such as China, Korea and Japan, where the semiconductor manufacturing industry contains smaller concentrations of customers.

We outsource all of our manufacturing operations, with the exception of completing the final integration and testing in-house for Stratus before shipment to our customers. Our outsourcing strategy is designed to enable us to minimize fixed costs and capital expenditures, gain labor efficiencies and provide us with the flexibility to increase product capacity based on customer demand. We leverage the strengths and skill sets of each of our suppliers to increase manufacturing efficiencies and minimize costs. This strategy also allows us to focus on product differentiation through system design and quality control.

Our Competitive Strengths

Our success is based on the following competitive strengths:

|

•

|

Best-In-Class Products, Service and Support. Our industry leading solutions enable high throughput and yield, low cost of ownership, a smaller footprint, greater reliability, ease of use and low maintenance. Based on the use of multiple NEXX systems in outsourced semiconductor assembly and test providers (“OSATs”) throughout Asia where high output and low cost are critical, the effectiveness of our products has been proven in high-volume production environments globally, enabling us to win multiple industry awards.

|

|

•

|

Technology Leadership. We have extensive experience building and supporting production-proven semiconductor manufacturing equipment. Additionally, we have a significant intellectual property portfolio consisting of 11 U.S. patents issued and eight U.S. patents pending.

|

|

•

|

Scalable, Flexible Platform. Our systems are designed on standard platforms that allow us to configure flexible systems to meet our customers’ specific application and throughput requirements.

|

|

•

|

Outsourced Manufacturing Expertise. We are able to leverage an outsourced manufacturing model that allows us to increase our capacity, minimize fixed costs, leverage our partner’s resources, and reduce manufacturing overhead.

|

Our Strategy

We have identified specific strategic initiatives that are critical to achieving our objectives, including:

|

•

|

Maintain and Expand Technology Leadership. Technology leadership is critical to increasing our competitive win rate, maintaining suitable pricing and building market acceptance.

|

|

•

|

Strengthen our Global Presence. We continue to develop our global presence in order to provide the infrastructure necessary to support our geographically diverse customer base.

|

|

•

|

Leverage Process Technologies across Markets and Applications. We believe our technology and design expertise enables us to offer solutions in other areas of the semiconductor manufacturing process.

|

|

•

|

Broaden our Intellectual Property Portfolio. We intend to continue to broaden our patent portfolio through internal development, strategic relationships and participation in industry consortia.

|

- 5 -

Risk Factors

Our ability to implement our business strategy is subject to numerous risks and uncertainties, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, among others, a history of significant fluctuations in our quarterly results, which could cause volatility in our stock price; our reliance on a small number of customers for a substantial portion of our revenues; reliance on our Stratus product line for a substantial portion of product revenues; cyclicality in the semiconductor industry; the rate of technological change in the semiconductor industry; and the risk that our patents may not adequately protect our present and future products. You should carefully consider all of the information set forth in this prospectus, particularly the “Risk Factors” section prior to deciding to invest in our common stock.

Corporate Information

We were formed as a limited liability company in Delaware in 2001 and converted to a Delaware corporation in 2003 in accordance with the requirements of the Delaware General Corporation Law. Our principal and registered office address is 900 Middlesex Turnpike, Building #6, Billerica, Massachusetts 01821. Our telephone number is 978-932-2000. We have one wholly-owned subsidiary, NEXX Systems Singapore Pte. Ltd., a limited exempt private company formed under the laws of Singapore. Our website address is www.nexxsystems.com. Information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this prospectus.

- 6 -

THE OFFERING

|

Common stock we are offering

|

shares ( shares if the over-allotment is exercised in full)

|

|

Common stock to be outstanding after this offering

|

shares ( shares if the over-allotment is exercised in full) after giving effect to the Capital Reorganization described below

|

|

Over-allotment option

|

We have granted the underwriters an over-allotment option, exercisable for a period of 30 days from the date of the closing of this offering, to purchase up to an aggregate of additional shares of common stock (being 15% of the number of shares offered hereby) on the same terms as set forth above, solely to cover over-allotments, if any, and for market stabilization purposes. If the over-allotment option is exercised in full, the total price to the public will be $ million, the commissions payable to the underwriters will be $ million and the net proceeds to us will be $ million. For additional information see “Underwriting.”

|

|

Use of proceeds after expenses

|

Based on an assumed initial public offering price of $ 6.10 per share, we expect to use approximately $10.0 million of the net proceeds of this offering to fund demonstration units to be placed with potential customers, approximately $10.0 million of the net proceeds to fund the purchase of subassemblies and other inventory, and approximately $5.0 million of the net proceeds to repay outstanding indebtedness. We intend to use the balance of the net proceeds for general corporate purposes. See “Use of Proceeds.”

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus beginning on page 11 for a discussion of factors to consider carefully before deciding whether to purchase shares of our common stock.

|

| Proposed TSX Symbol |

NXS. We have applied to list our shares of common stock on the TSX. Listing will be subject to fulfilling all of the requirements of the TSX, including distribution of our shares of common stock to a minimum number of public shareholders.

|

The number of shares of our common stock to be outstanding after this offering is based on 13,783,201 shares of common stock outstanding as of March 23, 2010 , after giving effect, immediately prior to the completion of this offering, to the Capital Reorganization described below .

Pursuant to an agreement between us and the holders of our outstanding shares of preferred stock and our amended and restated certificate of incorporation that we plan to file immediately prior to the closing of this offering, pursuant to which a capital reorganization will occur, we will effect the following changes in our capital structure (the “Capital Reorganization”):

- 7 -

|

•

|

prior to the reverse stock split described below, the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 88,498,510 shares of our common stock and the conversion of outstanding warrants to purchase shares of our convertible preferred stock into warrants to purchase an aggregate of 4,799,541 shares of our common stock upon the closing of this offering;

|

|

•

|

prior to the reverse stock split described below, the issuance of 30,000,000 shares of our common stock to the holders of shares of our convertible preferred stock and warrants to purchase shares of our convertible preferred stock in exchange for the waiver of certain contractual rights regarding the conversion of all outstanding shares of our convertible preferred stock to shares of common stock upon an initial public offering of our common stock;and

|

|

•

|

a 1 to 10 reverse stock split.

|

The number of shares of our common stock outstanding immediately after this offering, after giving effect to the Capital Reorganization, excludes:

|

•

|

1,081,886 shares of common stock issuable upon the exercise of options outstanding as of March 23, 2010 , with exercise prices ranging from $0.10 to $9.40 per share and a weighted average exercise price of $0.48 per share ;

|

|

•

|

479,941 shares of common stock issuable upon the exercise of warrants to purchase shares of our series B convertible preferred stock and series D convertible preferred stock outstanding as of March 23, 2010 , with exercise prices ranging from $3.80 to $7.98 per share and a weighted average exercise price of $3.96 per share;

|

|

•

|

132,299 additional shares of common stock reserved for future grants under our current stock plan as of March 23, 2010, none of which shares shall be available for grant following the effectiveness of this offering ; and

|

|

•

|

Additional shares of common stock reserved for future grants under our 2010 Stock Incentive Plan, which will become effective upon the effectiveness of this offering; such number of additional shares to equal (a) 15% of the number of shares of our common stock outstanding after this offering, assuming the exercise of all warrants and options to purchase shares of our common stock and the vesting of all restricted stock units outstanding after this offering and including all shares to be reserved under this plan, (b) less 2,083,707 shares currently subject to outstanding options and restricted stock units, grants of shares of restricted common stock, and exercised options.

|

|

•

|

527,500 restricted stock units, each of which entitles the holder to acquire one share of our common stock, issued to our employees and certain outside directors in January 2010.

|

Unless otherwise indicated, all information in this prospectus:

|

•

|

assumes an initial public offering price of $6.10 per share of common stock, the mid-point of the range set forth on the cover page of this prospectus;

|

|

•

|

assumes completion of the Capital Reorganization;

|

|

•

|

assumes no exercise by the underwriters of their option to purchase up to shares of our common stock in this offering to cover over-allotments; and

|

|

•

|

assumes the filing of our amended and restated certificate of incorporation with the Secretary of State of the State of Delaware and the adoption of our amended and restated by-laws immediately prior to the closing of the offering.

|

- 8 -

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables present a summary of certain historical consolidated financial information and pro forma net loss per common share. You should read the following summary financial data in conjunction with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, all included elsewhere in this prospectus. The summary consolidated financial data as of and for the years ended December 31, 2007, 2008 and 2009 has been derived from our audited consolidated financial statements, which are included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

(all numbers in thousands except per share data)

|

||||||||||||

|

Consolidated Statements of Operations

|

||||||||||||

|

Net Sales

|

$ | 38,192 | $ | 18,330 | $ | 25,702 | ||||||

|

Cost of Sales

|

20,579 | 10,959 | 14,080 | |||||||||

|

Gross Profit

|

17,613 | 7,371 | 11,622 | |||||||||

|

Operating Expenses:

|

||||||||||||

|

Selling, general and administrative

|

8,960 | 7,983 | 7,363 | |||||||||

|

Research and development

|

6,396 | 6,498 | 7,829 | |||||||||

|

Total Operating Expenses

|

15,356 | 14,481 | 15,192 | |||||||||

|

Income/(Loss) from Operations

|

2,257 | (7,111 | ) | (3,570 | ) | |||||||

|

Other Income (Expense):

|

||||||||||||

|

Interest income

|

5 | 22 | 42 | |||||||||

|

Interest expense

|

(1,219 | ) | (1,418 | ) | (1,289 | ) | ||||||

|

Other income (expense)

|

7 | 0 | 5 | |||||||||

|

Unrealized gain (loss) on preferred stock warrant liability

|

170 | (27 | ) | |||||||||

|

Other income (expense) - net

|

(1,037 | ) | (1,423 | ) | (1,242 | ) | ||||||

|

Income (Loss) Before Income Taxes

|

$ | 1,220 | $ | (8,534 | ) | $ | (4,812 | ) | ||||

| Provision for Income Taxes | 29 | — | — | |||||||||

| Net Income (Loss) | $ | 1,191 | $ | (8,534 | ) | $ | (4,812 | ) | ||||

|

Net income (loss) per share attributable to common stockholders

|

||||||||||||

|

- basic

|

$ | 0.08 | $ | (0.58 | ) | $ | (0.33 | ) | ||||

|

- diluted

|

$ | 0.01 | $ | (0.58 | ) | $ | (0.33 | ) | ||||

|

Weighted average number of common shares outstanding

|

||||||||||||

|

- basic

|

14,992 | 14,707 | 14,668 | |||||||||

|

- diluted

|

83,328 | 14,707 | 14,668 | |||||||||

|

Shares used in computing pro forma basic and diluted net loss per common share (unaudited)1

|

14,233 | N/A | N/A | |||||||||

|

Pro forma net income per common share, diluted (unaudited) 1

|

$ | 0.08 | N/A | N/A | ||||||||

|

(1)

|

Pro forma diluted income per share assumes the dilutive effect of the issuance of 30,000,000 shares of our common stock to holders of shares of our redeemable convertible preferred stock and warrants to purchase shares of our redeemable convertible preferred stock in exchange for the waiver of certain contractual rights regarding the conversion of all outstanding redeemable convertible preferred stock to common stock upon an initial public offering and a subsequent 1 to 10 reverse stock split.

|

- 9 -

|

As of December 31, 2009

|

||||||||||||

|

Actual

(audited)

|

Pro Forma(a)

|

Pro Forma as Adjusted(b)

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Consolidated Balance Sheet Data

|

||||||||||||

|

Cash, cash equivalents and available-for-sale securities

|

$ | 4,014 | $ | 7,197 | $ | 26,549 | ||||||

|

Working capital

|

4,383 | 4,383 | 4,383 | |||||||||

|

Total assets

|

24,046 | 24,046 | 46,581 | |||||||||

|

Long-term debt, including current portion

|

4,065 | 4,065 | 0 | |||||||||

|

Redeemable convertible preferred stock

|

35,897 | — | — | |||||||||

|

Total stockholders’ equity (deficit)

|

(30,581 | ) | 5,316 | 35,316 | ||||||||

|

(a)

|

The pro forma consolidated balance sheet data gives effect to the conversion of all outstanding shares of redeemable convertible preferred stock as of December 31, 2009 into 86,123,475 shares of our common stock upon the closing of this offering .

|

|

(b)

|

The pro forma as adjusted consolidated balance sheet data also gives effect to the sale of 4,918,033 shares of our common stock in this offering at an assumed initial public offering price of $6.10 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

|

- 10 -

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the risks described below, together with the other information in this prospectus (including our financial statements and the related notes) before investing in our common stock. If any of the events or developments described below actually occur, our business, operating results or financial condition could be materially adversely affected. This could cause the market price of our common stock to decline, and could cause you to lose all or part of your investment.

Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial.

Risks Related to Our Business and Industry

Our quarterly operating results have varied in the past and will continue to vary significantly in the future, causing volatility in our stock price.

We have experienced and expect to continue to experience significant fluctuations in our quarterly operating results, which may adversely affect our stock price. Some of the factors that may influence our operating results and subject our common stock to price and volume fluctuations include:

|

•

|

demand for products that use semiconductors;

|

|

•

|

changing global economic conditions and worldwide political instability;

|

|

•

|

technological developments in the semiconductor industry;

|

|

•

|

market acceptance of our systems and changes in our product offerings;

|

|

•

|

changes in average selling price and product mix;

|

|

•

|

strategic initiatives by us or our competitors;

|

|

•

|

the gain or loss of significant customers;

|

|

•

|

size and timing of orders from customers;

|

|

•

|

customer cancellations or delays in orders, shipments, and installations;

|

|

•

|

failure to ship an anticipated number of systems in the quarter;

|

|

•

|

product development costs, including research, development, engineering and marketing expenses associated with our introduction of new products and product enhancements;

|

|

•

|

sudden changes in component prices or availability;

|

|

•

|

manufacturing inefficiencies caused by uneven or unpredictable order patterns, reducing our gross margins;

|

|

•

|

costs associated with protecting our intellectual property;

|

|

•

|

the level of our fixed expenses relative to our net sales; and

|

|

•

|

fluctuating costs associated with our international organization and international sales, including currency exchange rate fluctuations.

|

Additionally, during any quarter, a significant portion of our net sales may be derived from the sale of a relatively small number of high priced systems. The selling prices of our systems range from approximately $2 million to in excess of $3 million. Accordingly, a small change in the number and/or mix of systems we sell may cause significant changes in our operating results.

- 11 -

Moreover, variations in the amount of time it takes for our customers to accept our systems may also cause our operating results to fluctuate. The United States Securities and Exchange Commission, (the “SEC”), guidance on the recognition of revenue for sales that involve contractual customer acceptance provisions and product installation commitments provides that the timing of revenue recognition from such sales is subject to the length of time required to achieve customer acceptance after shipment, which could cause our operating results to vary from period to period.

Typically, we do not have long-term contracts with our customers. As a result, our agreements with our customers do not provide any assurance of future sales. In addition, due to possible customer changes in delivery schedules and cancellations of orders, our product order backlog at the beginning of each fiscal quarter may not accurately reflect future sales.

In light of these factors and the highly cyclical nature of the semiconductor industry, we expect to continue to experience significant fluctuations in quarterly and annual operating results. Moreover, many of our expenses are fixed in the short-term, which, together with the need for continued investment in research and development, marketing and customer support, limits our ability to reduce expenses quickly in response to declines in sales, which, in turn, could harm our results of operations and cash flows, causing our operating results to be below the public market analysts’ or investors’ expectations and the market price of our stock to significantly decline.

We have incurred significant net losses in the past, our future revenues are inherently unpredictable, and we may be unable to maintain profitability.

We have incurred significant net losses in the past. Our operating results for future periods are subject to numerous uncertainties, and there can be no assurance that we will be able to maintain the profitability that we achieved during the third quarter of the year ended December 31, 2009 . It is possible that in future quarters our operating results will decrease from the previous quarter or fall below the expectations of securities analysts and investors. In this event, the trading price of our common stock could significantly decline.

We derive a substantial portion of our revenues from a small number of customers, and our business may be harmed by the loss of any one significant customer.

In the year ended December 31, 2009, two customers accounted for approximately 48% of our net sales, with customer A accounting for 33% and customer B accounting for 15% of such sales. In the year ended December 31, 2008, four customers accounted for approximately 66% of our net sales, with customer A accounting for 14%, customer C accounting for 19%, customer D accounting for 18% and customer E accounting for 16% of such sales. Because there are a limited number of large companies operating in the highly concentrated, capital intensive semiconductor industry, we expect that we will continue to depend on a relatively small number of large companies for a significant portion of our net sales. Although the composition of the group of largest customers may change from year to year, the loss of, or a significant curtailment of purchases by, one or more of our key customers or the delay or cancellation of a large order could cause our net sales to decline significantly, which would harm our business, financial condition, results of operations and cash flows. Similarly, delays in payments by large customers could have a significant impact on our cash flows.

- 12 -

Cyclicality in the semiconductor industry has historically led to substantial variations in demand for our products and caused our operating results to vary.

The semiconductor industry historically has been highly cyclical in nature and has experienced significant downturns, often in connection with, or in anticipation of, declines in general economic conditions. These downturns have been characterized by diminished product demand, production overcapacity, high inventory levels and accelerated erosion of average selling prices. Our business depends upon the capital spending of semiconductor manufacturers, which, in turn, depends upon the current and anticipated market demand for semiconductors and products using semiconductors. Our operating results are, therefore, subject to significant variation due to these business cycles, the timing, length and volatility of which are difficult to predict.

During downturns, the semiconductor equipment industry typically experiences a more pronounced percentage decrease in revenues than the semiconductor industry in general. A prolonged downturn can seriously affect our net sales, gross profit and results of operations. In addition, it is critical to appropriately align our cost structure with prevailing market conditions during a downturn to minimize its effect on our operations, and in particular, to continue to maintain our core research and development programs. If we are unable to align our cost structure in response to a downturn on a timely basis, or if such implementation has an adverse impact on our business, our financial condition, results of operations and cash flows may be more negatively affected than our competitors during such a period.

Conversely, during an upturn or periods of increasing demand for semiconductor manufacturing equipment, we may not have sufficient manufacturing capacity and inventory to meet customer demand. During an upturn we may be unable to predict the sustainability of a recovery, if any, and/or the industry’s rate of growth in such a recovery, both of which will be affected by many factors. If we are unable to effectively manage our resources and production capacity during an industry upturn, there could be a material adverse effect on our competitive position and market share, and on our business, financial condition, results of operations and cash flows.

Rapid technological change in the semiconductor industry could make our products obsolete and requires substantial research and development expenditures and responsiveness to customer needs.

We operate in an industry that is subject to evolving industry standards, rapid technological changes and changes in customer demands, and the rapid introduction of new, higher performance systems with shorter product life cycles. Our products and processes must address changing customer needs in a range of materials, such as copper and aluminum, and ever-smaller device features, while maintaining our focus on manufacturing efficiency and product reliability. Introductions of new products by us or our competitors could adversely affect sales of our existing products and may cause these existing products and related inventories to become obsolete or unmarketable, or otherwise cause our customers to defer or cancel orders for existing products. We therefore devote a significant portion of our personnel and financial resources to research and development (“R&D”) programs and we seek to maintain close relationships with our customers in order to remain responsive to their product and manufacturing process needs. For the year ended December 31 , 2009, 16.7% of our revenues were used to support research and development, including application engineering costs to demonstrate customer solutions.

Although, historically, we have had adequate funds from operations to devote to research and development, there can be no assurance that we will have funds available, and in sufficient quantities, in the future for such R&D activities. Moreover, there can be no assurance that we will be successful in selecting, developing, manufacturing and marketing new products, or in enhancing our existing products. If we do not continue to gain market acceptance for our new technologies and products, develop and introduce improvements in a timely manner in response to

- 13 -

changing market conditions and customer requirements, or remain focused on R&D efforts that will translate into greater revenues, our competitive position and our business could be seriously harmed.

There can be no assurance that revenue from future products or product enhancements will be sufficient to recover our investments in R&D. To ensure the functionality and reliability of our future product introductions or product improvements, we incur substantial R&D costs early in development cycles, before we can confirm the technical feasibility or commercial viability of a product or product improvement. Our success depends in part on our ability to accurately predict evolving industry standards, to develop innovative solutions and improve existing technologies, to win market acceptance of our new and advanced technologies and to manufacture our products in a timely and cost-effective manner.

Any significant delay in releasing new systems could adversely affect our reputation, give a competitor a first-to-market advantage or allow a competitor to achieve greater market share. If new products have reliability or quality problems, we could experience reduced orders, higher manufacturing costs, delays in collecting accounts receivable or additional service obligations and warranty expenses could rise, all of which would affect our gross margins. Any of these events could materially and adversely affect our business, financial condition or results of operations.

We have experienced periods of rapid growth and decline in operating levels, and if we are not able to successfully manage these significant fluctuations, our business, financial condition and results of operations could be significantly harmed.

We have experienced periods of significant growth and decline in net sales. For example, our revenues dropped from $25.7 million in the year ended December 31, 2007 to $18.3 million in the year ended December 31, 2008, but have since increased to $ 38.2 million for the year ended December 31, 2009. If we are unable to effectively manage periods of rapid decline or sales growth, our business, financial condition, results of operations and cash flows could be significantly harmed.

Our deferred revenue and orders backlog might not result in future net sales.

Revenue recognition guidance from the SEC requires that revenue and the associated profit from the sale of newly introduced systems, systems sales into new customer environments and substantive installation obligations that are subject to contractual customer acceptance provisions are deferred until the customer has acknowledged its acceptance of the system. If the system does not meet the agreed specifications and the customer refuses to accept the system, the deferred revenue and associated deferred profit will not be realized and we may be required to refund any cash payments previously received from the customer, which may harm our business, financial condition, results of operations and cash flows.

- 14 -

Order backlog does not necessarily include all sales needed to achieve net revenue expectations for a subsequent period. We schedule the production of our systems based in part upon order backlog. Due to possible customer changes in delivery schedules and cancellations of orders, our backlog at any particular date is not necessarily indicative of actual sales for any succeeding period. In addition, while we evaluate each customer order to determine qualification for inclusion in backlog, there can be no assurance that amounts included in backlog will ultimately result in future sales. A reduction in backlog during any particular period, or the failure of our backlog to result in future sales, could harm our business, financial condition, results of operations and cash flows.

A general global economic downturn may negatively affect our customers and their ability to purchase our products.

Disruptions in the financial markets have had and may continue to have an adverse effect on the U.S. and world economies, which could negatively impact business spending patterns. The current limitations on credit in financial markets could adversely affect the ability of some of our customers and suppliers to obtain financing for significant purchases and operations and could result in a decrease in or cancellation of orders for our products, increased price competition and increased demand for customer financing. Although we generally have not experienced material cancellations of orders, significant customers could seek to cancel or delay orders in the future. While in some cases we have contractual protections against such cancellations or requests for delayed shipments, there is no assurance that we can collect amounts due under those provisions.

We face substantial competition from several competitors and if we do not compete effectively with these competitors our market share could decline.

We face substantial competition in the semiconductor equipment industry, from both potential new market entrants and established competitors. Many of our customers and potential customers are relatively large companies that require global support and service for their semiconductor manufacturing equipment. Many of our competitors and potential competitors have significantly greater financial, technical, marketing and/or service resources than us and/or have greater geographical reach to existing and prospective customers. Many of these companies also have a larger installed base of products, longer operating histories or greater name recognition than we do. On December 21, 2009, Applied Materials, Inc., the largest company in the semiconductor capital equipment industry, announced that it had completed the acquisition of Semitool, Inc., an established competitor, through a cash tender offer. Other competitors include Ebara Corporation, OC Oerlikon Corporation AG, Tegal Corp., ULVAC, Inc., Novellus Systems Inc. (“Novellus”) and Electroplating Engineers of Japan Ltd. Our larger competitors have more extensive infrastructures, which could place us at a disadvantage when competing for the business of global semiconductor device manufacturers. In addition, our competitors may be able to respond more quickly than us to changes in end-user requirements and devote greater resources to the enhancement, promotion and sale of their products.

To maintain or capture a position in the market, we must develop new and enhanced systems and introduce them at competitive prices on a timely basis, while managing our R&D, product and warranty costs. Semiconductor manufacturers incur substantial costs to install and integrate capital equipment into their production lines. This increases the likelihood of continuing relationships with chosen equipment vendors, including our competitors, and the difficulty of penetrating new customer accounts.

We expect our competitors to continue to improve the design and performance of their products. We cannot assure you that our competitors will not develop enhancements to, or future generations of, competitive products that will offer superior price, performance and/or cost of ownership features, or that new processes or technologies will not emerge that render our products less competitive or obsolete.

- 15 -

Our Stratus product line accounts for a substantial portion of current and anticipated sales.

Our Stratus product accounted for a majority of our product revenues for the years ended December 31, 2007 and 2008 and substantially all of our product revenues for the year ended December 31, 2009 . We expect revenues from Stratus to continue to account for a majority of our revenues for the foreseeable future. Accordingly, if the Stratus product line was adversely affected by its own performance, price or total cost of ownership, or the availability, functionality and price of competing products and technologies, that could have a material adverse impact on our business, financial condition, results of operations and cash flows.

If we are required to change our pricing models to compete successfully, our margins and operating results may be adversely affected.

Due to intense competitive conditions in the semiconductor equipment industry, we may have to, from time to time, selectively reduce prices on our systems in order to protect our market share, and competitive pressures may necessitate further price reductions. Periodically, our competitors announce the introduction of new products or lower prices. These announcements could affect our customers’ decisions to purchase our systems, the prices we can charge for our systems and the level of discounts we may have to grant our customers. Any such changes would reduce our margins and could adversely affect our operating results.

We may be adversely affected by credit risk.

We are exposed to credit risk for accounts receivable in the event that counterparties do not meet their payment obligations. Although we believe our significant customers are financially sound, we attempt to mitigate our credit risk, to the extent possible, by performing credit reviews and seeking customer deposits and letters of credit in certain circumstances. Both economic and geopolitical uncertainty can influence the ultimate collectability of these receivable amounts. Failure to collect outstanding receivables could have a material adverse effect on our business, results of operations and financial condition.

We are exposed to risks associated with outsourcing activities, which could result in supply shortages that could affect our ability to meet customer needs.

We outsource the manufacture of our sputter deposition equipment and our Stratus sub-assemblies, which enables us to focus on development, quality assurance and sales while allowing us to control our fixed overhead and capital equipment expenditures by minimizing manufacturing costs. Although we make reasonable efforts to ensure that third party providers will perform to our standards, our reliance on suppliers and subcontractors limits our control over manufacturer defects, delivery schedules and the ability to meet customer demand when faced with product shortages. Defects in workmanship, unacceptable yields and manufacturing disruptions may impair our ability to manage inventory and cause delays in shipments and cancellation of orders that may adversely affect our relationships with current and prospective customers and enable competitors to penetrate our customer accounts. In addition, third party providers may prioritize capacity for larger competitors or increase prices to us, which may adversely affect our profitability and our ability to respond to pricing pressures from competitors and customers.

Our growth and ability to meet customer demands depend in part on our ability to obtain from our suppliers timely deliveries of equipment and subassemblies for the manufacture and support of our products. Although we make reasonable efforts to ensure that such equipment is available from multiple suppliers, certain key parts may be obtained only from a single source or from limited sources. For instance, we outsource the manufacture of our sputter deposition systems exclusively to one supplier; however, if this supplier is unable to honor any order we place with it, we have the right to use this provider or other suppliers as we choose for orders for products

- 16 -

referenced in such orders going forward. As a result of limited sources of supply, our supply channels may be vulnerable to disruption. Any such disruption to or termination of our supplier relationships might result in a prolonged inability to secure adequate supplies at reasonable prices or of acceptable quality, and may adversely affect our ability to bring new products to market and deliver them to customers in a timely manner. As a result, our business, revenues and operations may be adversely affected.

We are subject to the risks of operating internationally and derive the vast majority of our revenues from outside North America.

Our net revenues attributable to customers outside North America as a percentage of our total net revenues were approximately 73% for the year ended December 31, 2007, 89% for the year ended December 31, 2008 and 69% for the year ended December 31 , 2009. We expect net sales outside the U.S. to continue to represent the vast majority of our future net sales. Because virtually all of our international sales are denominated in U.S. dollars, if the U.S. dollar rises in value in relation to foreign currencies, our systems will become more expensive to customers outside the U.S. and less competitive with systems produced by competitors outside the U.S., which could negatively impact our international sales. Our products are controlled goods for U.S. export control purposes. While we have implemented an export control compliance program, if the measures we have taken or will take in the future to comply with the U.S. export control regime are insufficient, we may be subject to significant penalties and/or restrictions on our ability to export our products. In addition, sales to customers outside the U.S. are subject to other risks, including:

|

•

|

exposure to currency fluctuations;

|

|

•

|

political and economic instability, public health crises, acts of war or terrorism;

|

|

•

|

natural disasters, such as earthquakes, noting that many semiconductor foundries are located in geologically unstable areas of the world;

|

|

•

|

unexpected changes in regulatory requirements;

|

|

•

|

difficulties in collecting accounts receivables;

|

|

•

|

tariffs and other market barriers;

|

|

•

|

positions taken by United States governmental agencies regarding possible national commercial and/or security issues posed by international business operations;

|

|

•

|

potentially adverse tax consequences;

|

|

•

|

inadequate protection or enforcement of our intellectual property and other legal rights in foreign jurisdictions;

|

|

•

|

difficulties in managing foreign sales representatives and distributors; and

|

|

•

|

difficulties in staffing and managing foreign branch operations and providing prompt and effective field support to our customers outside the U.S.

|

Any of these factors may have a material adverse effect on our business, financial condition or results of operations. Moreover, because we derive a substantial portion of our revenues from customers in Asia, any negative economic developments, legal or regulatory changes, terrorism or geo-political instability there, including the possible outbreak of hostilities or epidemics involving Singapore, China, Taiwan, Korea or Japan, could result in the cancellation or delay by certain significant customers of orders for our products. Any such occurrence could adversely affect our business, financial condition or results of operations, and our continuing expansion in Asia renders us increasingly vulnerable to such risks.

- 17 -

Variations in the amount of time it takes for us to sell our systems may cause fluctuations in our operating results, which could cause our stock price to decline.

Variations in the length of our sales cycles could cause our net sales, and thus our business, financial condition, results of operations and cash flows, to fluctuate widely from period to period and, in turn, cause our stock price to decline. Our customers generally take a long time to evaluate many of our products before committing to a purchase, during which time we may expend substantial funds and management effort educating them regarding the uses and benefits of our systems. The length of time it takes us to make a sale depends upon many factors, including:

|

•

|

the efforts of our sales force and our independent sales representatives and distributors;

|

|

•

|

the complexity of our customers’ fabrication processes;

|

|

•

|

the internal technical capabilities and sophistication of the customer; and

|

|

•

|

decisions on capital spending by our customers.

|

Because of the number of factors influencing our sales cycle, the period between our initial contact with a potential customer and the time at which we recognize revenue from our customer, if ever, varies widely in length. Our sales cycle typically ranges from several months to 18 months or more. Occasionally our sales cycle can be even longer, particularly with our international customers and new technologies. The subsequent build cycle, or the time it takes us to build a product to customer specifications after receiving an order, typically ranges from nine to 16 weeks. During these cycles, we commit substantial resources to our sales efforts in advance of receiving any revenue, and we may never receive any revenue from a customer despite our sales efforts.

When a customer purchases one of our systems, that customer often evaluates the performance of the system for a lengthy period before considering the purchase of more systems. The number of additional products a customer may purchase from us, if any, depends on many factors, including the customer’s capacity requirements. The period between a customer’s initial purchase and subsequent purchases, if any, often varies, and variations in length of this period could cause further fluctuations in our business, financial condition, results of operations, cash flows, and possibly our stock price.

If we deliver systems with defects, our credibility may be harmed, sales and market acceptance of our systems may decrease and we may incur liabilities associated with those defects.

Our products are complex and, accordingly, they may contain defects or errors, particularly when first introduced, that we may not discover until after a product has been released and used by our end-customers. Defects and errors in our products could materially and adversely affect our reputation, result in significant costs to us, delay planned release dates and impair our ability to sell our products in the future. The costs we incur correcting any product defects or errors may be substantial and could adversely affect our operating margins.

Defects could also lead to commercial and/or product liability as a result of lawsuits against us or against our customers. In many of our customer contracts, we have agreed to product liability indemnities without limitation on our liability. Because our product and commercial liability insurance policies currently provide only limited coverage per claim, in the event of a successful product liability and/or commercial claim, we could be obligated to pay damages that may not be covered by insurance or that are significantly in excess of our insurance limits.

While we plan to continually test our products for defects and errors and work with customers through our post-sales support services to identify and correct defects and errors, defects or errors in our products may be found in the future.

- 18 -

Failure of our products to gain market acceptance would adversely affect our financial condition and our ability to provide customer service and support.

Our growth prospects depend upon our ability to gain customer acceptance of our products and technology, which, in turn, depends upon numerous factors, including compatibility with existing manufacturing processes and products, perceived advantages over competing products and the level of customer service available to support such products. Moreover, manufacturers often rely on a limited number of equipment vendors to meet their manufacturing equipment needs. As a result, market acceptance of our products may be limited to the extent potential customers currently use a competitor’s manufacturing equipment. There can be no assurance that growth in sales of new products will continue or that we will be successful in obtaining broad market acceptance of our systems and technology.

We expect to spend a significant amount of time and resources to develop new products and refine existing products. In light of the long product development cycles inherent in our industry, these expenditures will be made well in advance of the prospect of deriving revenue from the sale of any new systems. Our ability to commercially introduce and successfully market any new products is subject to a wide variety of challenges during this development cycle, including start up delays, design defects and other matters that could delay the introduction of these systems to the marketplace. The failure of any of our new products to achieve market acceptance would prevent us from recouping research and development expenditures and would harm our business, financial condition, results of operations and cash flows.

If we require additional capital in the future, it may not be available, or if available, may not be on terms acceptable to us.

We believe that our cash and cash equivalents, including the net proceeds of this offering, cash flows from operations and cash available from a revolving credit facility we entered into in December 2006, as subsequently amended, will be sufficient to meet our cash needs for working capital and capital expenditures for at least the next 12 months. We may, however, require additional financing to fund our operations in the future. Although we expect existing debt financing arrangements and cash flows generated from operating activities to be sufficient to fund operations at the current and projected levels in the future, there is no assurance that our operating plan will be achieved. Therefore, we may need to take actions to reduce costs, seek alternative financing arrangements or pursue additional placements of our common stock.

A significant contraction in the capital markets, particularly in the technology sector, may make it difficult for us to raise additional capital in the future, if and when it is required, especially if we are unable to maintain profitability. If adequate capital is not available to us as required, or is not available on favorable terms, our shareholders may be subject to significant dilution in their ownership if we raise additional funds through the issuance of equity securities, or we could be required to significantly reduce or restructure our business operations.

The above mentioned revolving credit facility currently provides for up to $6.0 million in borrowings. In addition, the credit facility contains financial covenants that must be met for the availability of funds and is secured by a lien on substantially all our assets . There is no assurance that this facility will be sufficient to meet our needs or that in the future we will be able to meet the requirements of these covenants so that the funds are available for borrowing. In the event that we default on the terms of this credit facility, the lender would have a claim on the assets or our business, including our intellectual property.

- 19 -

Our ability to recruit and retain management and other qualified personnel is crucial to our ability to develop, market, sell and support our products and services.

Our ability to compete in the highly competitive semiconductor equipment industry depends in large part upon our ability to attract and retain highly qualified managerial, technical, sales and marketing personnel. Competition for such personnel can be intense, and we cannot provide assurance that we will be able to attract or retain highly qualified personnel in the future. Stock options and other equity compensation comprise a significant component of our compensation of key employees, and, if our share price declines, it may be difficult to recruit and retain such individuals. In addition, the number of stock options and other equity incentives available for grant is limited, which may limit our ability to use equity incentives as a means to recruit and retain key employees.

Despite our efforts to retain valuable employees, members of our management, technical, sales and marketing teams may terminate their employment with us on short notice. While we have employment agreements with certain of our employees, these employment agreements provide for at-will employment, which means that any of our employees could leave our employment at any time, with or without notice. The loss of the services of any of our executive officers or other key employees or our inability to identify, hire, train and retain such persons could have a material adverse effect on our business, results of operations and financial condition.

Our ability to manage the integration of potential acquisitions and the potential disposition of product lines and technologies creates risks.

In the future, we may make acquisitions of complementary companies, products or technologies, or reduce or dispose of certain product lines or technologies that no longer fit our long-term strategies. Managing an acquired business, disposing of product technologies or reducing personnel entails numerous operational and financial risks, including:

|

•

|

diversion of management’s attention;

|

|

•

|

disruption to our ongoing business;

|

|

•

|

failure to retain key acquired personnel;

|

|

•

|

difficulties in integrating acquired operations, technologies, products or personnel or separating existing business or product groups;

|

|

•

|

unanticipated expenses, events or circumstances;

|

|

•

|

assumption of disclosed and undisclosed liabilities;

|

|

•

|

amortization of acquired intangible assets; and

|

|

•

|

difficulties in maintaining customer relations.

|

If we do not successfully address these risks or any other problems encountered in connection with an acquisition or disposition, such a transaction could have a material adverse effect on our business, results of operations and financial condition. In addition, if we proceed with an acquisition, our available cash may be used to complete the transaction, diminishing our liquidity and capital resources, or shares may be issued, which could cause significant dilution to our existing shareholders.

- 20 -

Risks Related to Legal Uncertainty

If the protection of our proprietary rights is inadequate, our business could be harmed.

We place a strong emphasis on the technically innovative features of our products and, where available, we generally seek patent protection for those features. We currently hold 11 U.S. patents, some with pending foreign counterparts, have eight U.S. patent applications pending, and intend to file additional patent applications as we deem appropriate. There can be no assurance that patents will issue from any of our pending applications or that existing or future patents will be sufficiently broad to protect our technology. There is also no guarantee that any patents we hold will not be challenged, invalidated or circumvented, or that the patent rights granted will provide competitive advantages to us, as our competitors may develop similar or superior technology based on inventions not covered by our patents or without infringing our patents. In addition, we rely on trade secret protection for our technology, in part through confidentiality agreements with our employees, consultants and third parties. These agreements could be breached and we may not have adequate remedies for any such breach. In any case, others may come to know about or determine our trade secrets through a variety of methods.

Now, and in the future, litigation may be necessary to enforce patents issued to us, to protect trade secrets or know-how owned by us or to defend ourselves against claimed infringement of the rights of others and to determine the scope and validity of the proprietary rights of others. Any such litigation could cause us to accrue substantial cost or divert our management or resources, which by itself could have a material adverse effect on our financial condition, results of operations and cash flows. Further, adverse determinations in such litigation could result in our loss of proprietary rights, subject us to significant liabilities and damages to third parties, require us to seek licenses from third parties or prevent us from manufacturing or selling our products, any of which could harm our business, financial condition, results of operations and cash flows.

In addition, the laws of certain foreign countries do not protect our intellectual property to the same extent as the laws of the United States and many U.S. companies have encountered substantial problems in protecting their proprietary rights against infringement in such countries, some of which are countries in which we have sold and continue to sell systems. For example, in many countries other than the United States, the public disclosure of an invention prior to the filing of a patent application for the invention would invalidate the ability of a company to obtain a patent. Similarly, in contrast to the United States, where the contents of patent applications may remain confidential during the patent prosecution process in certain cases, the contents of a patent application may be published before a patent is granted, which provides competitors an advanced view of the contents of applications prior to the establishment of patent rights. For these and other reasons, we have not filed patent applications in these countries to the same extent that we file in the United States and, therefore, we are at risk that our competitors in these countries may independently develop similar technology or duplicate our systems. If we fail to adequately protect our intellectual property in these countries, it would be easier for our competitors to sell competing products in those countries.

If we are sued for infringing intellectual property rights of third parties, it will be costly and time consuming, and an unfavorable outcome in that litigation would have a material adverse effect on our business.

Our commercial success depends upon our ability and the ability of our collaborators to develop, manufacture, market and sell our products and use our proprietary technologies without infringing the proprietary rights of third parties. Numerous U.S. and foreign issued patents and pending patent applications that are owned by third parties exist in the fields in which we and our collaborators are developing products. Some of these patents may grant very broad protections to their owners. As the semiconductor and semiconductor equipment industries expand and more

- 21 -

patents are issued, the risk increases that our potential products may give rise to claims of infringement of the patent rights of others. There may be issued patents of third parties of which we are currently unaware that may be infringed by our products. Because patent applications can take many years to issue, there may be currently pending applications that may later result in issued patents that our products may infringe.

There is a substantial amount of litigation involving patent and other intellectual property rights in the semiconductor and semiconductor equipment industries generally and we may be exposed to, or threatened with, future litigation by third parties alleging that our products infringe their intellectual property rights. We may become subject to these claims either directly or through indemnities against these claims that we routinely provide to our customers and channel partners. In many of our customer agreements we do not have a limit on our liability for such claims and therefore a successful claim could result in significant liability to us. We have received a few claims from third parties asserting infringement and other claims, and may receive other such claims in the future. If a third party claims that we or our collaborators infringe its intellectual property rights, we may face a number of issues, including, but not limited to: