Attached files

| file | filename |

|---|---|

| 8-K - PIMCO HIGH INCOME FUND - PIMCO HIGH INCOME FUND | d8k.htm |

| EX-99.2 - PRESS RELEASE ISSUED BY THE FUND ON MARCH 16, 2010 - PIMCO HIGH INCOME FUND | dex992.htm |

Exhibit 99.1

FOURTH

AMENDED AND RESTATED

BYLAWS

of

PIMCO HIGH INCOME FUND

(Amended and Restated as of March 1, 2010)

ARTICLE 1

Agreement and Declaration of Trust and Principal Office

1.1 Principal Office of the Trust. A principal office of the Trust shall be located in New York, New York. The Trust may have other principal offices within or without Massachusetts as the Trustees may determine or as they may authorize.

1.2 Agreement and Declaration of Trust. These Fourth Amended and Restated Bylaws (the “Bylaws”) shall be subject to the Agreement and Declaration of Trust, as amended or restated from time to time (the “Declaration of Trust”), of PIMCO High Income Fund, the Massachusetts business trust established by the Declaration of Trust (the “Trust”). Capitalized terms used in these Bylaws and not otherwise defined herein shall have the meanings given to such terms in the Declaration of Trust.

ARTICLE 2

Meetings of Trustees

2.1 Regular Meetings. Regular meetings of the Trustees may be held without call or notice at such places and at such times as the Trustees may from time to time determine, provided that notice of the first regular meeting following any such determination shall be given to absent Trustees. A regular meeting of the Trustees may be held without call or notice immediately after and at the same place as the annual meeting of the Shareholders (as defined in the Declaration of Trust).

2.2 Special Meetings. Special meetings of the Trustees may be held at any time and at any place designated in the call of the meeting when called by the Chairman of the Trustees, the President or the Treasurer or by two or more Trustees, sufficient notice thereof being given to each Trustee by the Secretary or an Assistant Secretary or by the officer or the Trustees calling the meeting.

2.3 Notice. It shall be sufficient notice to a Trustee of a special meeting to send notice by mail at least forty-eight hours or by telegram, telex or telecopy or other electronic facsimile transmission method at least twenty-four hours before the meeting addressed to the Trustee at his or her usual or last known business or residence address or to give notice to him or her in person or by telephone at least twenty-four hours before the meeting. Notice of a meeting

need not be given to any Trustee if a written waiver of notice, executed by him or her, before or after the meeting, is filed with the records of the meeting, or to any Trustee who attends the meeting without protesting prior thereto or at its commencement the lack of notice to him or her. Neither notice of a meeting nor a waiver of a notice need specify the purposes of the meeting.

2.4 Quorum. At any meeting of the Trustees a majority of the Trustees then in office shall constitute a quorum. Any meeting may be adjourned from time to time by a majority of the votes cast upon the question, whether or not a quorum is present, and the meeting may be held as adjourned without further notice.

ARTICLE 3

Officers and Chairman of the Trustees

3.1 Enumeration; Qualification. The officers of the Trust shall be a President, a Treasurer, a Secretary, a Chief Compliance Officer and such other officers, if any, as the Trustees from time to time may in their discretion elect. The Trust may also have such agents as the Trustees from time to time may in their discretion appoint. Any officer may but need not be a Trustee or a Shareholder. Any two or more offices may be held by the same person.

3.2 Election. The President, the Treasurer, and the Secretary shall be elected annually by the Trustees. Other officers, if any, may be elected or appointed by the Trustees at the same meeting at which the President, Treasurer and Secretary are elected, or at any other time. If required by the 1940 Act, the Chief Compliance Officer shall be elected or appointed by a majority of the trustees, as well as a majority of the Trustees who are not Interested Persons of the Trust (“Independent Trustees”), and otherwise in accordance with Rule 38a-1 (or any successor rule) under the 1940 Act, as such rule may be amended from time to time (“Rule 38a-1”). Vacancies in any office may be filled at any time.

3.3 Tenure. The Chairman of the Trustees, if one is elected, the President, the Treasurer, the Secretary and the Chief Compliance Officer shall hold office until their respective successors are chosen and qualified, or in each case until he or she sooner dies, resigns, is removed with or without cause or becomes disqualified, provided that, if required by the 1940 Act, any renewal of the Chief Compliance Officer shall be in accordance with Rule 38a-1. Each other officer shall hold office and each agent of the Trust shall retain authority at the pleasure of the Trustees.

3.4 Powers. Subject to the other provisions of these Bylaws, each officer shall have, in addition to the duties and powers herein and in the Declaration of Trust set forth, such duties and powers as are commonly incident to the office occupied by him or her as if the Trust were organized as a Massachusetts business corporation and such other duties and powers as the Trustees may from time to time designate.

3.5 Chairman of the Trustees. There shall be an office of the Chairman of the Trustees, which shall serve of behalf of the Trustees, but shall not be an officer of the Trust. The office of the Chairman of the Trustees may be held by more than one person. Any Chairman of the Trustees shall be elected by a majority of the Trustees, as well as a majority of the

-2-

Independent Trustees if required by the 1940 Act. If required by the 1940 Act, any Chairman of the Trustees shall be an Independent Trustee and may, but need not, be a shareholder. The powers and the duties of the Chairman of the Trustees shall include any and all such powers and duties relating to the operations of the Trustees as, from time to time, may be conferred upon or assigned to such office by the Trustees or as may be required by law, provided that the Chairman of the Trustees shall have no individual authority to act for the Trust as an officer of the Trust. In carrying out the responsibilities and duties of the office, the Chairman of the Trustees may seek assistance and input from other Trustees or Committees of the Trustees, officers of the Trust and the Trust’s investment adviser(s) and other service providers, as deemed necessary or appropriate. The Trustees, including a majority of the Independent Trustees if required by the 1940 Act, may appoint one or more persons to perform the duties of the Chairman of the Trustees, in the event of his absence at any meeting or in the event of his disability.

3.6 President; Vice President. The President shall be the chief executive officer. Any Vice President shall have such duties and powers as may be designated from time to time by the Trustees or the President.

3.7 Treasurer; Assistant Treasurer. The Treasurer shall be the chief financial and accounting officer of the Trust, and shall, subject to the provisions of the Declaration of Trust and to any arrangement made by the Trustees with a custodian, investment adviser, sub-adviser or manager, or transfer, shareholder servicing or similar agent, be in charge of the valuable papers, books of account and accounting records of the Trust, and shall have such other duties and powers as may be designated from time to time by the Trustees or by the President. Any Assistant Treasurer shall have such duties and powers as may be designated from time to time by the Trustees or the President.

3.8 Secretary; Assistant Secretary. The Secretary shall record all proceedings of the Shareholders and the Trustees in books to be kept therefor, which books or a copy thereof shall be kept at the principal office of the Trust. In the absence of the Secretary from any meeting of the Shareholders or Trustees, an Assistant Secretary, or if there be none or if he or she is absent, a temporary secretary chosen at such meeting shall record the proceedings thereof in the aforesaid books. Any Assistant Secretary shall have such duties and powers as may be designated from time to time by the Trustees or the President.

3.9 Chief Compliance Officer. The Chief Compliance Officer shall perform the duties and have the responsibilities of the chief compliance officer of the Trust, including if required by the 1940 Act any such duties and responsibilities imposed by Rule 38a-1, and shall have such other duties and powers as may be designated from time to time by the Trustees.

3.10 Resignations. Any officer may resign at any time by written instrument signed by him or her and delivered to the Chairman of the Trustees, if any, the President or the Secretary, or to a meeting of the Trustees. Such resignation shall be effective upon receipt unless specified to be effective at some other time. Except to the extent expressly provided in a written agreement with the Trust, no officer resigning and no officer removed shall have any right to any compensation for any period following his or her resignation or removal, or any right to damages on account of such removal.

-3-

ARTICLE 4

Committees

4.1 Quorum; Voting. Except as provided below or as otherwise specifically provided in the resolutions constituting a Committee of the Trustees and providing for the conduct of its meetings, a majority of the members of any Committee of the Trustees shall constitute a quorum for the transaction of business, and any action of such a Committee may be taken at a meeting by a vote of a majority of the members present (a quorum being present) or evidenced by one or more writings signed by such a majority. Members of a Committee may participate in a meeting of such Committee by means of a conference telephone or other communications equipment by means of which all persons participating in the meeting can hear each other at the same time and participation by such means shall constitute presence in person at a meeting.

With respect to a Valuation Committee of the Trustees, one or more of the Committee members shall constitute a quorum for the transaction of business.

Except as specifically provided in the resolutions constituting a Committee of the Trustees and providing for the conduct of its meetings, Article 2, Sections 2.2 and 2.3 of these Bylaws relating to special meetings shall govern the notice requirements for Committee meetings, except that it shall be sufficient notice to a Valuation Committee of the Trustees to send notice by telegram, telex or telecopy or other electronic means (including by telephone voice-message or e-mail) at least fifteen minutes before the meeting.

ARTICLE 5

Reports

5.1 General. The Trustees and officers shall render reports at the time and in the manner required by the Declaration of Trust or any applicable law. Officers and Committees shall render such additional reports as they may deem desirable or as may from time to time be required by the Trustees.

ARTICLE 6

Fiscal Year

6.1 General. Except as from time to time otherwise provided by the Trustees, the initial fiscal year of the Trust shall end on such date as is determined in advance or in arrears by the Treasurer, and the subsequent fiscal years shall end on such date in subsequent years.

ARTICLE 7

Seal

7.1 General. The seal of the Trust shall, subject to alteration by the Trustees, consist of a flat-faced die with the word “Massachusetts”, together with the name of the Trust and the year of its organization cut or engraved thereon; provided, however, that unless otherwise required by the Trustees, the seal shall not be necessary to be placed on, and its absence shall not impair the validity of, any document, instrument or other paper executed and delivered by or on behalf of the Trust.

-4-

ARTICLE 8

Execution of Papers

8.1 General. Except as the Trustees may generally or in particular cases authorize the execution thereof in some other manner, all deeds, leases, transfers, contracts, bonds, notes, checks, drafts and other obligations made, accepted or endorsed by the Trust shall be executed by the President, any Vice President, the Treasurer or by whomever else shall be designated for that purpose by vote of the Trustees, and need not bear the seal of the Trust.

ARTICLE 9

Issuance of Share Certificates

9.1 Share Certificates. Except as provided in Article 11 hereof, each Shareholder shall be entitled to a certificate stating the number of Shares (as defined in the Declaration of Trust) owned by him or her, in such form as shall be prescribed from time to time by the Trustees. Such certificates shall be signed by the President or any Vice President and by the Treasurer or any Assistant Treasurer. Such signatures may be by facsimile if the certificate is signed by a transfer agent, or by a registrar, other than a Trustee, officer or employee of the Trust. In case any officer who has signed or whose facsimile signature has been placed on such certificate shall cease to be such officer before such certificate is issued, it may be issued by the Trust with the same effect as if he or she were such officer at the time of its issuance.

Notwithstanding the foregoing, in lieu of issuing certificates for Shares, the Trustees or the transfer agent may either issue receipts therefor or may keep accounts upon the books of the Trust for the record holders of such Shares, who shall in either case be deemed, for all purposes hereunder, to be the holders of certificates for such Shares as if they had accepted such certificates and shall be held to have expressly assented and agreed to the terms hereof.

9.2 Loss of Certificates. In case of the alleged loss or destruction or the mutilation of a share certificate, a duplicate certificate may be issued in place thereof, upon such terms as the Trustees shall prescribe.

9.3 Issuance of New Certificates to Pledgee. A pledgee of Shares transferred as collateral security shall be entitled to a new certificate if the instrument of transfer substantially describes the debt or duty that is intended to be secured thereby. Such new certificate shall express on its face that it is held as collateral security, and the name of pledgor shall be stated thereon, who alone shall be liable as a Shareholder and entitled to vote thereon.

9.4 Discontinuance of Issuance of Certificates. Notwithstanding anything to the contrary in this Article 9, the Trustees may at any time discontinue the issuance of share certificates and may, by written notice to each Shareholder, require the surrender of share certificates to the Trust for cancellation. Such surrender and cancellation shall not effect the ownership of Shares in the Trust.

-5-

ARTICLE 10

Shareholders’ Voting Powers and Meetings

10.1 Voting Powers. The Shareholders shall have power to vote only (i) for the election or removal of Trustees as provided in Article IV, Sections 1 and 3 of the Declaration of Trust and Article 11 hereto, (ii) with respect to any Manager or sub-adviser as provided in Article IV, Section 8 of the Declaration of Trust to the extent required by the 1940 Act, (iii) with respect to certain transactions and other matters to the extent and as provided in Article V, Sections 2 and 3 of the Declaration of Trust and Article 11 hereto, (iv) with respect to any termination of this Trust to the extent and as provided in Article IX, Section 4 of the Declaration of Trust and Article 11 hereto (for the avoidance of any doubt, Shareholders shall have no separate right to vote with respect to the termination of the Trust or a series or class of Shares if the Trustees (including the Continuing Trustees) exercise their right to terminate the Trust or such series or class pursuant to clauses (ii) or (y) of Article IX, Section 4 of the Declaration of Trust), (v) with respect to any amendment of the Declaration of Trust to the extent and as provided in Article IX, Section 7 of the Declaration of Trust and Articles 11 and 12 hereto, (vi) to the same extent as the stockholders of a Massachusetts business corporation as to whether or not a court action, proceeding or claim should or should not be brought or maintained derivatively or as a class action on behalf of the Trust or the Shareholders, and (vii) with respect to such additional matters relating to the Trust as may be required by law, the Declaration of Trust, these Bylaws or any registration of the Trust with the Securities and Exchange Commission (or any successor agency) or any state, or as the Trustees may consider necessary or desirable. Each whole Share shall be entitled to one vote as to any matter on which it is entitled to vote and each fractional Share shall be entitled to a proportionate fractional vote, except as otherwise provided in the Declaration of Trust, these Bylaws, or required by applicable law. Except as otherwise provided in the Declaration of Trust or in respect of the terms of a class of preferred shares of beneficial interest of the Trust as reflected in these Bylaws or required by applicable law, all Shares of the Trust then entitled to vote shall be voted in the aggregate as a single class without regard to classes or series of Shares. There shall be no cumulative voting in the election of Trustees. Shares may be voted in person or by proxy. A proxy with respect to Shares held in the name of two or more persons shall be valid if executed by any one of them unless at or prior to exercise of the proxy the Trust receives a specific written notice to the contrary from any one of them. The placing of a Shareholder’s name on a proxy pursuant to telephonic or electronically transmitted instructions obtained pursuant to procedures reasonably designed to verify that such instructions have been authorized by such Shareholder shall constitute execution of such proxy by or on behalf of such Shareholder. A proxy purporting to be executed by or on behalf of a Shareholder shall be deemed valid unless challenged at or prior to its exercise and the burden of proving invalidity shall rest on the challenger. Until Shares of a particular class or series are issued, the Trustees may exercise all rights of Shareholders and may take any action required by law, the Declaration of Trust or these Bylaws to be taken by Shareholders as to such class or series.

10.2 Voting Power and Meetings. Except as provided in the next sentence, regular meetings of the Shareholders for the election of Trustees and the transaction of such other business as may properly come before the meeting shall be held, so long as Common Shares are listed for trading on the New York Stock Exchange, on at least an annual basis, on such day and

-6-

at such place as shall be designated by the Trustees. In the event that such a meeting is not held in any annual period if so required, whether the omission be by oversight or otherwise, a subsequent special meeting may be called by the Trustees and held in lieu of such meeting with the same effect as if held within such annual period. Special meetings of the Shareholders or any or all classes or series of Shares may also be called by the Trustees from time to time for such other purposes as may be prescribed by law, by the Declaration of Trust or by these Bylaws, or for the purpose of taking action upon any other matter deemed by a majority of the Trustees and a majority of the Continuing Trustees to be necessary or desirable. A special meeting of Shareholders may be held at any such time, day and place as is designated by the Trustees. Written notice of any meeting of Shareholders, stating the date, time, place and purpose of the meeting, shall be given or caused to be given by a majority of the Trustees and a majority of the Continuing Trustees at least seven days before such meeting to each Shareholder entitled to vote thereat by leaving such notice with the Shareholder at his or her residence or usual place of business or by mailing such notice, postage prepaid, to the Shareholder’s address as it appears on the records of the Trust. Such notice may be given by the Secretary or an Assistant Secretary or by any other officer or agent designated for such purpose by the Trustees. Whenever notice of a meeting is required to be given to a Shareholder under the Declaration of Trust or these Bylaws, a written waiver thereof, executed before or after the meeting by such Shareholder or his or her attorney thereunto authorized and filed with the records of the meeting, shall be deemed equivalent to such notice. Notice of a meeting need not be given to any Shareholder who attends the meeting without protesting prior thereto or at its commencement the lack of notice to such Shareholder. No ballot shall be required for any election unless required by a Shareholder present or represented at the meeting and entitled to vote in such election. Notwithstanding anything to the contrary in this Section 10.2, no matter shall be properly before any annual or special meeting of Shareholders and no business shall be transacted thereat unless in accordance with Section 10.6 of these Bylaws.

10.3 Quorum and Required Vote. Except when a larger quorum is required by any provision of law or the Declaration of Trust or these Bylaws, thirty percent (30%) of the Shares entitled to vote on a particular matter shall constitute a quorum for the transaction of business at a Shareholders’ meeting, except that where any provision of law or the Declaration of Trust or these Bylaws permits or requires that holders of any class or series of Shares shall vote as an individual class or series, then thirty percent (30%) (unless a larger quorum is required as specified above) of Shares of that class or series entitled to vote shall be necessary to constitute a quorum for the transaction of business by that class or series. Any lesser number shall be sufficient for adjournments. Any adjourned session or sessions may be held, within a reasonable time after the date set for the original meeting, without the necessity of further notice. Except when a different vote is required by any provision of law or the Declaration of Trust or these Bylaws, a plurality of the quorum of Shares necessary for the transaction of business at a Shareholders’ meeting shall decide any questions and a plurality of Shares voted shall elect a Trustee, provided that where any provision of law or of the Declaration of Trust or these Bylaws permits or requires that the holders of any class or series of Shares shall vote as an individual class or series, then a plurality of the quorum of Shares of that class or series necessary for the transaction of business by that class or series at a Shareholders’ meeting shall decide that matter insofar as that class or series is concerned.

-7-

10.4 Action by Written Consent. Any action taken by Shareholders may be taken without a meeting if a majority of Shareholders entitled to vote on the matter (or such larger proportion thereof as shall be required by any express provision of law or the Declaration of Trust or these Bylaws) consent to the action in writing and such written consents are filed with the records of the meetings of Shareholders. Such consent shall be treated for all purposes as a vote taken at a meeting of Shareholders.

10.5 Record Dates. For the purpose of determining the Shareholders who are entitled to vote or act at any meeting or any adjournment thereof, or who are entitled to receive payment of any dividend or of any other distribution, the Trustees may from time to time fix a time, which shall be not more than 90 days before the date of any meeting of Shareholders or the date for the payment of any dividend or of any other distribution, as the record date for determining the Shareholders having the right to notice of and to vote at such meeting and any adjournment thereof or the right to receive such dividend or distribution, and in such case only Shareholders of record on such record date shall have the right notwithstanding any transfer of Shares on the books of the Trust after the record date; or without fixing such record date the Trustees may for any of such purposes close the register or transfer books for all or any part of such period.

10.6 Advance Notice of Shareholder Nominees for Trustees and Other Shareholder Proposals. (a) As used in this Section 10.6, the term “annual meeting” refers to any annual meeting of Shareholders as well as any special meeting held in lieu of an annual meeting as described in the first two sentences of Section 10.2 of these Bylaws, and the term “special meeting” refers to all meetings of Shareholders other than an annual meeting or a special meeting in lieu of an annual meeting.

(b) The matters to be considered and brought before any annual or special meeting of Shareholders shall be limited to only such matters, including the nomination and election of Trustees, as shall be brought properly before such meeting in compliance with the procedures set forth in this Section 10.6. Only persons who are nominated in accordance with the procedures set forth in this Section 10.6 shall be eligible for election as Trustees, and no proposal to fix the number of Trustees shall be brought before an annual or special meeting of Shareholders or otherwise transacted unless in accordance with the procedures set forth in this Section 10.6, except as may be otherwise provided in these Bylaws with respect to the right of holders of preferred shares of beneficial interest, if any, of the Trust to nominate and elect a specified number of Trustees in certain circumstances.

(c) For any matter to be properly before any annual meeting, the matter must be (i) specified in the notice of meeting given by or at the direction of a majority of the Trustees and a majority of the Continuing Trustees pursuant to Section 10.2 of these Bylaws, (ii) otherwise brought before the meeting by or at the direction of a majority of the Continuing Trustees (or any duly authorized committee thereof), or (iii) brought before the meeting in the manner specified in this Section 10.6(c) by a Shareholder of record entitled to vote at the meeting or by a Shareholder (a “Beneficial Owner”) that holds Shares entitled to vote at the meeting through a nominee or “street name” holder of record and that can demonstrate to the Trust such indirect ownership and such Beneficial Owner’s entitlement to vote such Shares, provided that the Shareholder was the Shareholder of record or the Beneficial Owner held such Shares at the time the notice provided for in this Section 10.6(c) is delivered to the Secretary.

-8-

In addition to any other requirements under applicable law and the Declaration of Trust and these Bylaws, persons nominated by Shareholders for election as Trustees and any other proposals by Shareholders may be properly brought before an annual meeting only pursuant to timely notice (the “Shareholder Notice”) in writing to the Secretary. To be timely, the Shareholder Notice must be delivered to or mailed and received at the principal executive offices of the Trust not less than forty-five (45) nor more than sixty (60) days prior to the first anniversary date of the date on which the Trust first mailed its proxy materials for the prior year’s annual meeting; provided, however, with respect to the annual meeting to be held in the calendar year 2003, the Shareholder Notice must be so delivered or mailed and so received on or before May 1, 2003; provided further, however, if and only if the annual meeting is not scheduled to be held within a period that commences thirty (30) days before the first anniversary date of the annual meeting for the preceding year and ends thirty (30) days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Annual Meeting Date”), such Shareholder Notice must be given in the manner provided herein by the later of the close of business on (i) the date forty-five (45) days prior to such Other Annual Meeting Date or (ii) the tenth (10th) business day following the date such Other Annual Meeting Date is first publicly announced or disclosed.

Any Shareholder desiring to nominate any person or persons (as the case may be) for election as a Trustee or Trustees of the Trust shall deliver, as part of such Shareholder Notice: (i) a statement in writing setting forth (A) the name, age, date of birth, business address, residence address and nationality of the person or persons to be nominated; (B) the class or series and number of all Shares of the Trust owned of record or beneficially by each such person or persons, as reported to such Shareholder by such nominee(s); (C) any other information regarding each such person required by paragraphs (a), (d), (e) and (f) of Item 401 of Regulation S-K or paragraph (b) of Item 22 of Rule 14a-101 (Schedule 14A) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), adopted by the Securities and Exchange Commission (or the corresponding provisions of any regulation or rule subsequently adopted by the Securities and Exchange Commission or any successor agency applicable to the Trust); (D) any other information regarding the person or persons to be nominated that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitation of proxies for election of Trustees or directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (E) whether such Shareholder believes any nominee is or will be an “interested person” of the Trust (as defined in the Investment Company Act of 1940, as amended) and, if not an “interested person,” information regarding each nominee that will be sufficient for the Trust to make such determination; and (ii) the written and signed consent of the person or persons to be nominated to be named as nominees and to serve as Trustees if elected. In addition, the Trustees may require any proposed nominee to furnish such other information as they may reasonably require or deem necessary to determine the eligibility of such proposed nominee to serve as a Trustee. Any Shareholder Notice required by this Section 10.6(c) in respect of a proposal to fix the number of Trustees shall also set forth a description of and the text of the proposal, which description and text shall state a fixed number of Trustees that otherwise complies with applicable law, these Bylaws and the Declaration of Trust.

-9-

Without limiting the foregoing, any Shareholder who gives a Shareholder Notice of any matter proposed to be brought before a Shareholder meeting (whether or not involving nominees for Trustees) shall deliver, as part of such Shareholder Notice: (i) the description of and text of the proposal to be presented; (ii) a brief written statement of the reasons why such Shareholder favors the proposal; (iii) such Shareholder’s name and address as they appear on the Trust’s books; (iv) any other information relating to the Shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with the solicitation of proxies with respect to the matter(s) proposed pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; (v) the class or series and number of all Shares of the Trust owned beneficially and of record by such Shareholder; (vi) any material interest of such Shareholder in the matter proposed (other than as a Shareholder); (vii) a representation that the Shareholder intends to appear in person or by proxy at the Shareholder meeting to act on the matter(s) proposed; (viii) if the proposal involves nominee(s) for Trustees, a description of all arrangements or understandings between the Shareholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by the Shareholder; and (ix) in the case of a Beneficial Owner, evidence establishing such Beneficial Owner’s indirect ownership of, and entitlement to vote, Shares at the meeting of Shareholders. As used in this Section 10.6, Shares “beneficially owned” shall mean all Shares which such person is deemed to beneficially own pursuant to Rules 13d-3 and 13d-5 under the Exchange Act.

(d) For any matter to be properly before any special meeting, the matter must be specified in the notice of meeting given by or at the direction of a majority of the Trustees and a majority of the Continuing Trustees pursuant to Section 10.2 of these Bylaws. In the event the Trust calls a special meeting for the purpose of electing one or more Trustees, any Shareholder may nominate a person or persons (as the case may be) for election to such position(s) as specified in the Trust’s notice of meeting if and only if the Shareholder provides a notice containing the information required in the Shareholder Notice to the Secretary required with respect to annual meetings by Section 10.6(c) hereof, and such notice is delivered to or mailed and received at the principal executive office of the Trust not later than the close of business on the tenth (10th) day following the day on which the date of the special meeting and of the nominees proposed by the Trustees to be elected at such meeting are publicly announced or disclosed.

(e) For purposes of this Section 10.6, a matter shall be deemed to have been “publicly announced or disclosed” if such matter is disclosed in a press release reported by the Dow Jones News Service, Associated Press or comparable national news service, in a document publicly filed by the Trust with the Securities and Exchange Commission, or in a Web site accessible to the public maintained by the Trust or by its investment adviser or an affiliate of such investment adviser with respect to the Trust.

-10-

(f) In no event shall an adjournment or postponement (or a public announcement thereof) of a meeting of Shareholders commence a new time period (or extend any time period) for the giving of notice as provided in this Section 10.6.

(g) The person presiding at any meeting of Shareholders, in addition to making any other determinations that may be appropriate to the conduct of the meeting, shall have the power and duty to (i) determine whether a nomination or proposal of other matters to be brought before a meeting and notice thereof have been duly made and given in the manner provided in this Section 10.6 and elsewhere in these Bylaws and the Declaration of Trust and (ii) if not so made or given, to direct and declare at the meeting that such nomination and/or such other matters shall be disregarded and shall not be considered. Any determination by the person presiding shall be binding on all parties absent manifest error.

(h) Notwithstanding anything to the contrary in this Section 10.6 or otherwise in these Bylaws, unless required by federal law, no matter shall be considered at or brought before any annual or special meeting unless such matter has been approved for these purposes by a majority of the Continuing Trustees and, in particular, no Beneficial Owner shall have any rights as a Shareholder except as may be required by federal law. Furthermore, nothing in this Section 10.6 shall be construed as creating any implication or presumption as to the requirements of federal law.

ARTICLE 11

Statement Creating Five Series of Auction Rate Cumulative Preferred Shares

Auction Rate Cumulative Preferred Shares, Series M: 7,200 preferred shares of beneficial interest, par value $0.00001 per share, liquidation preference $25,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) thereon, is hereby designated “Auction Rate Cumulative Preferred Shares, Series M.” Each share of Auction Rate Cumulative Preferred Shares, Series M (sometimes referred to herein as “Series M Preferred Shares”) may be issued on a date to be determined by the Board of Trustees of the Trust or pursuant to their delegated authority; have an Initial Dividend Rate and an Initial Dividend Payment Date as shall be determined in advance of the issuance thereof by the Board of Trustees of the Trust or pursuant to their delegated authority; and have such other preferences, voting powers, limitations as to dividends, qualifications and terms and conditions of redemption as are set forth in these Bylaws. The Series M Preferred Shares shall constitute a separate series of preferred shares of beneficial interest of the Trust, and each share of Series M Preferred Shares shall be identical.

Auction Rate Cumulative Preferred Shares, Series T: 7,200 preferred shares of beneficial interest, par value $0.00001 per share, liquidation preference $25,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) thereon, is hereby designated “Auction Rate Cumulative Preferred Shares, Series T.” Each share of Auction Rate Cumulative Preferred Shares, Series T (sometimes referred to herein as “Series T Preferred Shares”) may be issued on a date to be determined by the Board of Trustees of the Trust or pursuant to their delegated authority; have an Initial Dividend Rate and an Initial Dividend Payment Date as shall be determined in advance of the issuance thereof by the Board of Trustees

-11-

of the Trust or pursuant to their delegated authority; and have such other preferences, voting powers, limitations as to dividends, qualifications and terms and conditions of redemption as are set forth in these Bylaws. The Series T Preferred Shares shall constitute a separate series of preferred shares of beneficial interest of the Trust, and each share of Series T Preferred Shares shall be identical.

Auction Rate Cumulative Preferred Shares, Series W: 7,200 preferred shares of beneficial interest, par value $0.00001 per share, liquidation preference $25,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) thereon, is hereby designated “Auction Rate Cumulative Preferred Shares, Series W.” Each share of Auction Rate Cumulative Preferred Shares, Series W (sometimes referred to herein as “Series W Preferred Shares”) may be issued on a date to be determined by the Board of Trustees of the Trust or pursuant to their delegated authority; have an Initial Dividend Rate and an Initial Dividend Payment Date as shall be determined in advance of the issuance thereof by the Board of Trustees of the Trust or pursuant to their delegated authority; and have such other preferences, voting powers, limitations as to dividends, qualifications and terms and conditions of redemption as are set forth in these Bylaws. The Series W Preferred Shares shall constitute a separate series of preferred shares of beneficial interest of the Trust, and each share of Series W Preferred Shares shall be identical.

Auction Rate Cumulative Preferred Shares, Series TH: 7,200 preferred shares of beneficial interest, par value $0.00001 per share, liquidation preference $25,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) thereon, is hereby designated “Auction Rate Cumulative Preferred Shares, Series TH.” Each share of Auction Rate Cumulative Preferred Shares, Series TH (sometimes referred to herein as “Series TH Preferred Shares”) may be issued on a date to be determined by the Board of Trustees of the Trust or pursuant to their delegated authority; have an Initial Dividend Rate and an Initial Dividend Payment Date as shall be determined in advance of the issuance thereof by the Board of Trustees of the Trust or pursuant to their delegated authority; and have such other preferences, voting powers, limitations as to dividends, qualifications and terms and conditions of redemption as are set forth in these Bylaws. The Series TH Preferred Shares shall constitute a separate series of preferred shares of beneficial interest of the Trust, and each share of Series TH Preferred Shares shall be identical.

Auction Rate Cumulative Preferred Shares, Series F: 7,200 preferred shares of beneficial interest, par value $0.00001 per share, liquidation preference $25,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) thereon, is hereby designated “Auction Rate Cumulative Preferred Shares, Series F.” Each share of Auction Rate Cumulative Preferred Shares, Series F (sometimes referred to herein as “Series F Preferred Shares”) may be issued on a date to be determined by the Board of Trustees of the Trust or pursuant to their delegated authority; have an Initial Dividend Rate and an Initial Dividend Payment Date as shall be determined in advance of the issuance thereof by the Board of Trustees of the Trust or pursuant to their delegated authority; and have such other preferences, voting powers, limitations as to dividends, qualifications and terms and conditions of redemption as are set forth in these Bylaws. The Series F Preferred Shares shall constitute a separate series of preferred shares of beneficial interest of the Trust, and each share of Series F Preferred Shares shall be identical.

-12-

11.1 Definitions. (a) Unless the context or use indicates another or different meaning or intent, in Article 11 of these Bylaws the following terms have the following meanings, whether used in the singular or plural:

“‘AA’ Financial Composite Commercial Paper Rate” on any date means (i) (A) the Interest Equivalent of the 7-day rate (in the case of a Dividend Period which is a 7-Day Dividend Period or shorter), the 30-day rate (for Dividend Periods greater than 7 days but fewer than or equal to 31 days), the 60-day rate (for Dividend Periods greater than 31 days but fewer than or equal to 61 days) and the 90-day rate (for Dividend Periods greater than 61 days but fewer than or equal to 91 days) on commercial paper on behalf of issuers whose corporate bonds are rated AA by S&P, or the equivalent of such rating by another Rating Agency, as announced by the Federal Reserve Bank of New York for the close of business on the Business Day immediately preceding such date; and (B) for Dividend Periods greater than 91 days but fewer than 184 days, the rate described in clause (ii) below; or (ii) if the Federal Reserve Bank of New York does not make available such a rate, or with respect to Dividend Periods greater than 91 days but fewer than 184 days, then the arithmetic average of the Interest Equivalent of such rates on commercial paper placed on behalf of such issuers, as quoted on a discount basis or otherwise by the Commercial Paper Dealers to the Auction Agent for the close of business on the Business Day immediately preceding such date (rounded to the next highest one-thousandth (0.001) of 1%). If any Commercial Paper Dealer does not quote a rate required to determine the “AA” Financial Composite Commercial Paper Rate, such rate shall be determined on the basis of the quotations (or quotation) furnished by the remaining Commercial Paper Dealers (or Dealer), if any, or, if there are no such Commercial Paper Dealers, by the Auction Agent. For purposes of this definition, (A) “Commercial Paper Dealers” shall mean (1) Citigroup Global Markets Inc. and Merrill Lynch, Pierce, Fenner & Smith Incorporated; (2) in lieu of any thereof, its respective affiliate or successor; and (3) in the event that any of the foregoing shall cease to quote rates for commercial paper of issuers of the sort described above, in substitution therefor, a nationally recognized dealer in commercial paper of such issuers then making such quotations selected by the Trust, and (B) “Interest Equivalent” of a rate stated on a discount basis for commercial paper of a given number of days’ maturity shall mean a number equal to the quotient (rounded upward to the next higher one-thousandth (0.001) of 1%) of (1) such rate expressed as a decimal, divided by (2) the difference between (x) 1.00 and (y) a fraction, the numerator of which shall be the product of such rate expressed as a decimal, multiplied by the number of days in which such commercial paper shall mature and the denominator of which shall be 360.

“Accountant’s Confirmation” has the meaning set forth in Section 11.7(c) of these Bylaws.

“Affiliate” means any Person known to the Auction Agent to be controlled by, in control of, or under common control with, the Trust.

-13-

“Agent Member” means a member of the Securities Depository that will act on behalf of a Beneficial Owner of one or more Preferred Shares or on behalf of a Potential Beneficial Owner.

“Applicable Percentage” has the meaning set forth in Section 11.10(a)(vi) of these Bylaws.

“Applicable Rate” means the rate per annum at which cash dividends are payable on the Preferred Shares for any Dividend Period.

“Approved Price” means the “fair value” as determined by the Trust in accordance with the valuation procedures adopted from time to time by the Board of Trustees of the Trust and for which the Trust receives a mark-to-market price (which, for the purpose of clarity, shall not mean Market Value) from an independent source at least semi-annually.

“Auction” means a periodic operation of the Auction Procedures.

“Auction Agent” means Deutsche Bank Trust Company Americas unless and until another commercial bank, trust company or other financial institution appointed by a resolution of the Board of Trustees of the Trust or a duly authorized committee thereof enters into an agreement with the Trust to follow the Auction Procedures for the purpose of determining the Applicable Rate and to act as transfer agent, registrar, dividend disbursing agent and redemption agent for the Preferred Shares.

“Auction Date” has the meaning set forth in Section 11.10(a)(i) of these Bylaws.

“Auction Procedures” means the procedures for conducting Auctions set forth in Section 11.10 of these Bylaws.

“Bank Loans” means direct purchases of, assignments of, participations in and other interests in (a) any bank loan or (b) any loan made by an investment bank, investment fund or other financial institution, provided that such loan under this clause (b) is similar to those typically made, syndicated, purchased or participated by a commercial bank or institutional loan investor in the ordinary course of business.

“Beneficial Owner” means a customer of a Broker-Dealer who is listed on the records of that Broker-Dealer (or, if applicable, the Auction Agent) as a holder of Preferred Shares or a Broker-Dealer that holds Preferred Shares for its own account.

“Broker-Dealer” means any broker-dealer, or other entity permitted by law to perform the functions required of a Broker-Dealer pursuant to Section 11.10 of these Bylaws, that has been selected by the Trust and has entered into a Broker-Dealer Agreement with the Auction Agent that remains effective.

“Broker-Dealer Agreement” means an agreement between the Auction Agent and a Broker-Dealer pursuant to which such Broker-Dealer agrees to follow the procedures specified in Section 11.10 of these Bylaws.

-14-

“Business Day” means a day on which the New York Stock Exchange is open for trading and which is not a Saturday, Sunday or other day on which banks in New York City are authorized or obligated by law to close.

“Closing Transactions” has the meaning set forth in Section 11.8(a)(i) of these Bylaws.

“Commercial Paper Dealers” has the meaning set forth in the definition of “‘AA’ Financial Composite Commercial Paper Rate.”

“Common Shares” means the shares of beneficial interest designated as common shares, par value $0.00001 per share, of the Trust.

“Cure Date” has the meaning set forth in Section 11.4(a)(ii) of these Bylaws.

“Date of Original Issue” means, with respect to any Preferred Share, the date on which the Trust first issues such share.

“Declaration of Trust” means the Amended and Restated Agreement and Declaration of Trust of the Trust dated April 8, 2003, as from time to time amended and supplemented.

“Deposit Securities” means cash and portfolio securities rated at least A2 (having a remaining maturity of 12 months or less), P-1, VMIG-1 or MIG-1 by Moody’s or A (having a remaining maturity of 12 months or less), A-1+ or SP-1+ by S&P.

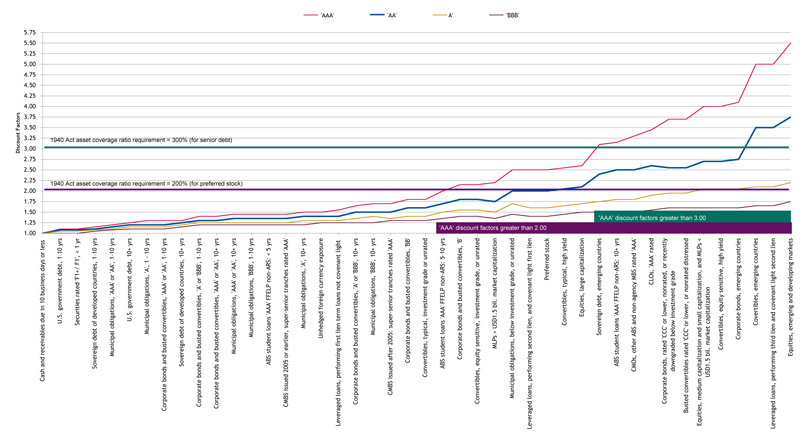

“Discount Factor” means a Moody’s Discount Factor (if Moody’s is then rating the Preferred Shares) or a discount factor included in the calculations used by another Rating Agency then rating the Preferred Shares for purposes of determining such Rating Agency’s rating on the Preferred Shares, as applicable, provided that this term shall not apply with respect to Fitch Ratings or its rating on the Preferred Shares.

“Discounted Value” of any asset of the Trust means the quotient of the Market Value of an Eligible Asset divided by the applicable Discount Factor, provided that with respect to an Eligible Asset that is currently callable, the Discounted Value will be equal to the quotient as calculated above or the call price, whichever is lower, and that with respect to an Eligible Asset that is prepayable, the Discounted Value will be equal to the quotient as calculated above or the par value, whichever is lower.

“Dividend Payment Date,” with respect to Preferred Shares, has the meaning set forth in Section 11.2(b)(i) of these Bylaws.

“Dividend Period” means the Initial Dividend Period, any 7-Day Dividend Period and any Special Dividend Period.

“Eligible Asset” means a Moody’s Eligible Asset (if Moody’s is then rating the Preferred Shares) and/or any asset included in the calculations used by another Rating Agency then rating the Preferred Shares for purposes of determining such Rating Agency’s rating on the Preferred Shares, as applicable, provided that this term shall not apply with respect to Fitch Ratings or its rating on the Preferred Shares.

-15-

“Existing Holder” means a Broker-Dealer, or any such other Person that may be permitted by the Trust, that is listed as the holder of record of Preferred Shares in the Share Books.

“Extension Period” has the meaning set forth in Section 11.2(c)(iii) of these Bylaws.

“FHLB, FNMA and FFCB Debentures” has the meaning set forth in paragraph (viii) of the definition of “Moody’s Eligible Assets.”

“Fitch Covered Forward Commitment” has the meaning set forth in Section 11.8(f) of these Bylaws.

“Fitch Criteria” means the Closed-End Fund Criteria Report issued by Fitch Ratings entitled “Closed-End Fund Debt and Preferred Stock Rating Criteria” dated August 17, 2009 and attached to these Bylaws as Exhibit 1, which is hereby incorporated by reference into and made a part of these Bylaws. The Trust may, but is not required to, amend or restate the Fitch Criteria from time to time, through an amendment or restatement of Exhibit 1 or otherwise, to reflect revised criteria issued by Fitch Ratings by resolution of the Board of Trustees of the Trust and without shareholder approval.

“Fitch Net OC” has the meaning given to such term in the Fitch Criteria to be consistent with a AAA rating of the Preferred Shares by Fitch Ratings, and shall be calculated with respect to the Trust in accordance with the applicable formula and related guidance provided in the Fitch Criteria and by Fitch Ratings (including with respect to discount factors, if any, or other treatment to be applied with respect to securities or other assets held by the Trust which are not specifically referenced in the Fitch Criteria), and the good faith determinations of the Trust or its agents of the Fitch Net OC and related interpretations of the Fitch Criteria shall be conclusive and binding on all parties.

“Fitch Net OC Test” means an asset coverage test with respect to the Preferred Shares that shall be satisfied as of a particular date or time if the Trust has Fitch Net OC in excess of one-hundred percent (100%) as of such date or time.

“Fitch Preferred Shares Asset Coverage” means, as of a particular date or time, sufficient asset coverage with respect to the Preferred Shares such that the Trust is satisfying both the (i) Fitch Total OC Test and the (ii) Fitch Net OC Test as of such date or time.

“Fitch Ratings” means Fitch, Inc., doing business as Fitch Ratings, or its successors.

“Fitch Preferred Shares Asset Coverage Report” means, with respect to Fitch Preferred Shares Asset Coverage, a report including the information to be provided to Fitch as called for in the second bullet under “Investment Manager Review – Surveillance” in the Fitch Criteria.

-16-

“Fitch Total OC” has the meaning given to such term in the Fitch Criteria to be consistent with a AAA rating of the Preferred Shares by Fitch Ratings, and shall be calculated with respect to the Trust in accordance with the applicable formula and related guidance provided in the Fitch Criteria and by Fitch Ratings (including with respect to discount factors, if any, or other treatment to be applied with respect to securities or other assets held by the Trust which are not specifically referenced in the Fitch Criteria), and the good faith determinations of the Trust or its agents of Fitch Total OC and related interpretations of the Fitch Criteria at any time and from time to time shall be conclusive and binding on all parties.

“Fitch Total OC Test” means an asset coverage test with respect to the Preferred Shares that shall be satisfied as of a particular date or time if the Trust has Fitch Total OC in excess of one-hundred percent (100%) as of such date or time.

“Holder” means a Person identified as a holder of record of Preferred Shares in the Share Register.

“Independent Accountant” means a nationally recognized accountant, or firm of accountants, that is, with respect to the Trust, an independent public accountant or firm of independent public accountants under the Securities Act and serving as such for the Trust.

“Initial Dividend Payment Date” means, with respect to a series of Preferred Shares, the initial dividend payment date with respect to the Initial Dividend Period as determined by the Board of Trustees of the Trust or pursuant to their delegated authority with respect to such series.

“Initial Dividend Period” has the meaning set forth in Section 11.2(c)(i) of these Bylaws.

“Initial Dividend Rate” means, with respect to a series of Preferred Shares, the rate per annum applicable to the Initial Dividend Period for such series of Preferred Shares.

“Interest Equivalent” has the meaning set forth in the definition of “‘AA’ Financial Composite Commercial Paper Rate.”

“Lien” means any material lien, mortgage, pledge, security interest or security agreement of any kind.

“Long Term Dividend Period” means a Special Dividend Period consisting of a specified period of one whole year or more but not greater than five years.

“Mandatory Redemption Price” means $25,000 per Preferred Share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) to (but not including) the date fixed for redemption.

“Market Value” of any asset of the Trust shall be the market value thereof determined by a Pricing Service. The Market Value of any asset shall include any interest accrued thereon. A Pricing Service shall value portfolio securities at the quoted bid prices or the mean between the quoted bid and asked prices or the yield equivalent when quotations are not readily available. Securities for which quotations are not readily available shall be valued at fair value as

-17-

determined by a Pricing Service using methods which include consideration of: yields or prices of securities of comparable quality, type of issue, coupon, maturity and rating; indications as to value from dealers; and general market conditions. A Pricing Service may employ electronic data processing techniques and/or a matrix system to determine valuations. In the event a Pricing Service is unable to value a security, the security shall be valued at the lower of two bid quotations obtained by the Trust from dealers who are members of the Financial Industry Regulatory Authority, Inc. and who make a market in the security, at least one of which shall be in writing. If two bid quotations are not readily available for any securities, such securities shall be valued in good faith at fair value pursuant to procedures approved by the Board of Trustees of the Trust. Futures contracts and options are valued at the closing prices for such instruments established by the exchange or board of trade on which they are traded, or if market quotations are not readily available, are valued at fair value in good faith pursuant to procedures approved by the Board of Trustees of the Trust. All other assets will be valued at fair value on a consistent basis using methods determined in good faith by the Board of Trustees of the Trust.

“Maximum Applicable Rate,” with respect to Preferred Shares, has the meaning set forth in Section 11.10(a)(vi) of these Bylaws.

“Moody’s” means Moody’s Investors Service, Inc. or its successors.

“Moody’s Discount Factor” means, for purposes of determining the Discounted Value of any Moody’s Eligible Asset, the percentage determined as follows. The Moody’s Discount Factor for any Moody’s Eligible Asset other than the securities set forth below will be the percentage provided in writing by Moody’s.

(i) Corporate debt securities: The percentage determined by reference to the rating on such asset with reference to the remaining term to maturity of such asset, in accordance with the table set forth below.

| Term to Maturity of Corporate Debt Security |

Aaa | Aa | A | Baa | Ba | B | Below B and Unrated1 |

||||||||||||||

| 1 year or less |

109 | % | 112 | % | 115 | % | 118 | % | 137 | % | 150 | % | 250 | % | |||||||

| 2 years or less (but longer than 1 year) |

115 | 118 | 122 | 125 | 146 | 160 | 250 | ||||||||||||||

| 3 years or less (but longer than 2 years) |

120 | 123 | 127 | 131 | 153 | 168 | 250 | ||||||||||||||

| 4 years or less (but longer than 3 years) |

126 | 129 | 133 | 138 | 161 | 176 | 250 | ||||||||||||||

| 5 years or less (but longer than 4 years) |

132 | 135 | 139 | 144 | 168 | 185 | 250 | ||||||||||||||

| 7 years or less (but longer than 5 years) |

139 | 143 | 147 | 152 | 179 | 197 | 250 | ||||||||||||||

| 10 years or less (but longer than 7 years) |

145 | 150 | 155 | 160 | 189 | 208 | 250 | ||||||||||||||

| 15 years or less (but longer than 10 years) |

150 | 155 | 160 | 165 | 196 | 216 | 250 | ||||||||||||||

| 20 years or less (but longer than 15 years) |

150 | 155 | 160 | 165 | 196 | 228 | 250 | ||||||||||||||

| 30 years or less (but longer than 20 years) |

150 | 155 | 160 | 165 | 196 | 229 | 250 | ||||||||||||||

| Greater than 30 years |

165 | 173 | 181 | 189 | 205 | 240 | 250 |

| 1 | Unless conclusions regarding liquidity risk as well as estimates of both the probability and severity of default for the Trust’s assets can be derived from other sources as well as combined with a number of sources as presented by the Trust to Moody’s, securities rated below B by Moody’s and unrated securities, which are securities rated by neither Moody’s, S&P nor Fitch Ratings, are limited to 10% of Moody’s Eligible Assets. If a corporate debt security is unrated by Moody’s, S&P and Fitch Ratings, the Trust will use the percentage set forth under “Below B and Unrated” in this table. Ratings assigned by S&P or Fitch Ratings are generally accepted by Moody’s at face value. However, adjustments to face value may be made to particular categories of credits for which the rating by S&P and/or Fitch Ratings does not seem to approximate a Moody’s rating equivalent. |

-18-

The Moody’s Discount Factors presented in the immediately preceding table will also apply to Moody’s Eligible Assets that are FHLB, FNMA and FFCB Debentures and to rated TRACERs and TRAINs, whereby the ratings in the table will be applied to the underlying securities and the Market Value of each underlying security will be its proportionate amount of the Market Value of the TRACER or TRAIN, provided that the Moody’s Discount Factors determined from the table shall be multiplied by a factor of 120% for purposes of calculating the Discounted Value of TRAINs. The Moody’s Discount Factors presented in the immediately preceding table will also apply to corporate debt securities that do not pay interest in U.S. dollars or euros, provided that the Moody’s Discount Factor determined from the table shall be multiplied by a factor of 110% for purposes of calculating the Discounted Value of such securities.

(ii) Preferred stock: The Moody’s Discount Factor for preferred stock shall be (A) for preferred stocks issued by a utility, 155%; (B) for preferred stocks of industrial and financial issuers, 209%; and (C) for auction rate preferred stocks, 350%.

(iii) Short-term instruments: The Moody’s Discount Factor applied to short-term portfolio securities, including without limitation corporate debt securities, Short Term Money Market Instruments and municipal debt obligations, will be (A) 100%, so long as such portfolio securities mature or have a demand feature at par exercisable within the Moody’s Exposure Period; (B) 115%, so long as such portfolio securities do not mature within the Moody’s Exposure Period or have a demand feature at par not exercisable within the Moody’s Exposure Period; and (C) 125%, if such securities are not rated by Moody’s, so long as such portfolio securities are rated at least A-1+/AA or SP-1+/AA by S&P and mature or have a demand feature at par exercisable within the Moody’s Exposure Period. A Moody’s Discount Factor of 100% will be applied to cash.

-19-

(iv) U.S. Government Securities and U.S. Treasury Strips:

| Remaining Term to Maturity |

U.S. Government Securities Discount Factor |

U.S. Treasury Strips Discount Factor |

||||

| 1 year or less |

107 | % | 107 | % | ||

| 2 years or less (but longer than 1 year) |

113 | 115 | ||||

| 3 years or less (but longer than 2 years) |

118 | 121 | ||||

| 4 years or less (but longer than 3 years) |

123 | 128 | ||||

| 5 years or less (but longer than 4 years) |

128 | 135 | ||||

| 7 years or less (but longer than 5 years) |

135 | 147 | ||||

| 10 years or less (but longer than 7 years) |

141 | 163 | ||||

| 15 years or less (but longer than 10 years) |

146 | 191 | ||||

| 20 years or less (but longer than 15 years) |

154 | 218 | ||||

| 30 years or less (but longer than 20 years) |

154 | 244 |

(v) Rule 144A Securities: The Moody’s Discount Factor applied to Rule 144A Securities for Rule 144A Securities whose terms include rights to registration under the Securities Act within one year and Rule 144A Securities which do not have registration rights within one year will be 120% and 130%, respectively, of the Moody’s Discount Factor which would apply were the securities registered under the Securities Act.

(vi) Bank Loans: The Moody’s Discount Factor applied to senior Bank Loans (“Senior Loans”) shall be the percentage specified in the table below opposite such Moody’s Loan Category:

| Moody’s Loan Category |

Discount Factor | ||

| A |

118 | % | |

| B |

137 | % | |

| C |

161 | % | |

| D |

222 | % | |

| E |

222 | % |

(vii) Asset-backed and mortgage-backed securities: The Moody’s Discount Factor applied to asset-backed securities shall be 131%. The Moody’s Discount Factor applied to collateralized mortgage obligations, planned amortization class bonds and targeted amortization class bonds shall be determined by reference to the weighted average life of the security and whether cash flow is retained (i.e., controlled by a trustee) or excluded (i.e., not controlled by a trustee), in accordance with the table set forth below.

| Remaining Term to Maturity |

Cash Flow Retained | Cash Flow Excluded | ||||

| 3 years or less |

133 | % | 141 | % | ||

| 7 years or less (but longer than 3 years) |

142 | 151 | ||||

| 10 years or less (but longer than 7 years) |

158 | 168 | ||||

| 20 years or less (but longer than 10 years) |

174 | 185 |

-20-

The Moody’s Discount Factor applied to residential mortgage pass-throughs (including private-placement mortgage pass-throughs) shall be determined by reference to the coupon paid by such security and whether cash flow is retained (i.e., controlled by a trustee) or excluded (i.e., not controlled by a trustee), in accordance with the table set forth below.

| Coupon |

Cash Flow Retained | Cash Flow Excluded | ||||

| 5% | 166 | % | 173 | % | ||

| 6% | 162 | 169 | ||||

| 7% | 158 | 165 | ||||

| 8% | 154 | 161 | ||||

| 9% | 151 | 157 | ||||

| 10% | 148 | 154 | ||||

| 11% | 144 | 154 | ||||

| 12% | 142 | 151 | ||||

| 13% | 139 | 148 | ||||

| adjustable | 165 | 172 |

The Moody’s Discount Factor applied to fixed-rate pass-throughs that are not rated by Moody’s and are serviced by a servicer approved by Moody’s shall be determined by reference to the table in the following paragraph (relating to whole loans).

The Moody’s Discount Factor applied to whole loans shall be determined by reference to the coupon paid by such security and whether cash flow is retained (i.e., controlled by a trustee) or excluded (i.e., not controlled by a trustee), in accordance with the table set forth below.

| Coupon |

Cash Flow Retained | Cash Flow Excluded | ||||

| 5% | 172 | % | 179 | % | ||

| 6% | 167 | 174 | ||||

| 7% | 163 | 170 | ||||

| 8% | 159 | 165 | ||||

| 9% | 155 | 161 | ||||

| 10% | 151 | 158 | ||||

| 11% | 148 | 157 | ||||

| 12% | 145 | 154 | ||||

| 13% | 142 | 151 | ||||

| adjustable | 170 | 177 |

(viii) Municipal debt obligations: The Moody’s Discount Factor applied to municipal debt obligations shall be the percentage determined by reference to the rating on such asset and the shortest Exposure Period set forth opposite such rating that is the same length as or is longer than the Moody’s Exposure Period, in accordance with the table set forth below (provided that, except as provided in the following table, any municipal obligation (excluding any short-term municipal obligation) not rated by Moody’s but rated by S&P shall be deemed to have a Moody’s rating which is one full rating category lower than its S&P rating):

| Exposure Period |

Aaa1 | Aa1 | A1 | Baa1 | Other2 | (V)MIG-13 | SP-1+4 | Unrated5 | ||||||||||||||||

| 7 weeks |

151 | % | 159 | % | 166 | % | 173 | % | 187 | % | 136 | % | 148 | % | 225 | % | ||||||||

| 8 weeks or less but greater than seven weeks |

154 | 161 | 168 | 176 | 190 | 137 | 149 | 231 | ||||||||||||||||

| 9 weeks or less but greater than eight weeks |

158 | 163 | 170 | 177 | 192 | 138 | 150 | 240 |

| 1 | Moody’s rating. |

-21-

| 2 | Municipal debt obligations not rated by Moody’s but rated BBB by S&P. |

| 3 | Municipal debt obligations rated MIG-1 or (V)MIG-1, which do not mature or have a demand feature at par exercisable in 30 days and which do not have a long-term rating. |

| 4 | Municipal debt obligations not rated by Moody’s but rated SP-1+ by S&P, which do not mature or have a demand feature at par exercisable in 30 days and which do not have a long-term rating. |

| 5 | Municipal debt obligations rated less than Baa3 or not rated by Moody’s and less than BBB or not rated by S&P, not to exceed 10% of Moody’s Eligible Assets. |

(ix) Structured Notes: The Moody’s Discount Factor applied to Structured Notes will be (A) in the case of a corporate issuer, the Moody’s Discount Factor determined in accordance with paragraph (i) under this definition, whereby the rating on the issuer of the Structured Note will be the rating on the Structured Note for purposes of determining the Moody’s Discount Factor in the table in paragraph (i); and (B) in the case of an issuer that is the U.S. government or an agency or instrumentality thereof, the Moody’s Discount Factor determined in accordance with paragraph (iii) under this definition.

(x) REITs:

(a) Common stock and preferred stock of REITs and other real estate companies:

| Discount Factor 1,2 | |||

| Common stock of REITs |

154 | % | |

| Preferred stock of REITs |

|||

| with senior implied or unsecured Moody’s (or Fitch Ratings) rating |

154 | % | |

| without senior implied or unsecured Moody’s (or Fitch Ratings) rating |

208 | % | |

| Preferred stock of other real estate companies |

|||

| with senior implied or unsecured Moody’s (or Fitch Ratings) rating |

208 | % | |

| Without senior implied or unsecured Moody’s (or Fitch Ratings) rating |

250 | % |

| 1 | A Discount Factor of 250% will be applied if dividends on such securities have not been paid consistently (either quarterly or annually) over the previous three years, or for such shorter time period that such securities have been outstanding. |

| 2 | A Discount Factor of 250% will be applied if the market capitalization (including common stock and preferred stock) of an issuer is below $500 million. |

(b) Debt securities of REITs and other real estate companies:

| Moody’s Rating Category | ||||||||||||||||||||||||

| Term to Maturity |

AAA | AA | A | BAA | BA | B | CAA | NR1 | ||||||||||||||||

| 1 year |

109 | % | 112 | % | 115 | % | 118 | % | 119 | % | 125 | % | 225 | % | 250 | % | ||||||||

| 2 year |

115 | % | 118 | % | 122 | % | 125 | % | 127 | % | 133 | % | 225 | % | 250 | % | ||||||||

| 3 year |

120 | % | 123 | % | 127 | % | 131 | % | 133 | % | 140 | % | 225 | % | 250 | % | ||||||||

| 4 year |

126 | % | 129 | % | 133 | % | 138 | % | 140 | % | 147 | % | 225 | % | 250 | % | ||||||||

| 5 year |

132 | % | 135 | % | 139 | % | 144 | % | 146 | % | 154 | % | 225 | % | 250 | % | ||||||||

| 7 year |

139 | % | 143 | % | 147 | % | 152 | % | 156 | % | 164 | % | 225 | % | 250 | % | ||||||||

| 10 year |

145 | % | 150 | % | 155 | % | 160 | % | 164 | % | 173 | % | 225 | % | 250 | % | ||||||||

| 15 year |

150 | % | 155 | % | 160 | % | 165 | % | 170 | % | 180 | % | 225 | % | 250 | % | ||||||||

| 20 year |

150 | % | 155 | % | 160 | % | 165 | % | 170 | % | 190 | % | 225 | % | 250 | % | ||||||||

| 30 year |

150 | % | 155 | % | 160 | % | 165 | % | 170 | % | 191 | % | 225 | % | 250 | % | ||||||||

| 1 | If a security is unrated by Moody’s but is rated by Fitch Ratings, a rating two numeric ratings below the rating by Fitch Ratings will be used (e.g., where the rating is AAA, a Moody’s rating of Aa2 will be used; where the rating by Fitch Ratings is AA+, a Moody’s rating of Aa3 will be used). If a security is unrated by either Moody’s or Fitch Ratings, the Trust will use the percentage set forth under “NR” in this table. |

-22-

(xi) Convertible securities (including convertible preferred stock): (1) For Convertible securities having a Delta between 0.4 and 0.0, the Moody’s Discount Factor shall be 100% of the Moody’s Discount Factor applied to non-convertible corporate debt securities (i.e. using the Moody’s Discount Factors found in the subsection (ii) of this definition), (2) for convertible securities having a Delta between 0.8 and 0.4, the Moody’s Discount Factor shall be 192% for securities rated Baa or above and 226% for securities rated Ba and below, and (3) for convertible securities having a Delta between 1.0 and 0.8, the Moody’s Discount Factor shall be 195% for securities rated Baa or above and 229% for securities rated Ba and below; provided, however, that for any unrated convertible security, the Moody’s Discount Factor shall be 250%.1,2

| 1 | Unless conclusions regarding liquidity risk as well as estimates of both the probability and severity of default for applicable Trust assets can be derived from other sources as well as combined with a number of sources as presented by the Trust to Moody’s, unrated fixed-income and convertible securities, which are securities that are not rated by any of Moody’s, S&P or Fitch Ratings, are limited to 10% of Moody’s Eligible Assets for purposes of calculations related to the Preferred Shares Basic Maintenance Amount. If a convertible security is not rated by any of Moody’s, S&P or Fitch Ratings, the Trust will consider the security unrated for the purposes of the discounts discussed above. Ratings assigned by S&P and/or Fitch Ratings are generally accepted at face value. However, adjustments to face value may be made to particular categories of credits for which the ratings by S&P and/or Fitch Ratings do not seem to approximate a Moody’s rating equivalent. Split-rated securities assigned by S&P and Fitch Ratings (i.e., these Rating Agencies assign different rating categories to the security) will be accepted at the lower of the two ratings. |

| 2 | Discount factors are for 7-week exposure period. |

For the purposes of determining such discount factors, “Delta”, which is intended to express the change in the price of the convertible security per unit of change in the price of the common stock into which the convertible security is convertible, shall be the number provided by Merrill Lynch, Pierce, Fenner and Smith, Incorporated or such other provider as the Trust shall determine from time to time. The Trust shall use commercially reasonable efforts to update such Delta figures monthly.

Upon conversion to common stock, the Discount Factors applicable to common stock will apply:

| Common Stocks(1) |

Large-Cap | Mid-Cap | Small Cap | ||||||

| 7 week exposure period |

200 | % | 205 | % | 220 | % |

| (1) | Market cap for Large-cap stocks are $10 billion and up, Mid-cap stocks range between $2 billion and $10 billion, and Small-cap stocks are $2 billion and below. ” |

-23-

“Moody’s Eligible Assets” means

(i) cash (including interest and dividends due on assets rated (A) Baa3 or higher by Moody’s if the payment date is within five Business Days of the Valuation Date, (B) A2 or higher if the payment date is within thirty days of the Valuation Date, and (C) A1 or higher if the payment date is within the Moody’s Exposure Period) and receivables for Moody’s Eligible Assets sold if the receivable is due within five Business Days of the Valuation Date, and if the trades which generated such receivables are (A) settled through clearing house firms or (B) (1) with counterparties having a Moody’s long-term debt rating of at least Baa3 or (2) with counterparties having a Moody’s Short Term Money Market Instrument rating of at least P-1;

(ii) Short Term Money Market Instruments so long as (A) such securities are rated at least P-1, (B) in the case of demand deposits, time deposits and overnight funds, the supporting entity is rated at least A2, or (C) in all other cases, the supporting entity (1) is rated A2 and the security matures within one month, (2) is rated A1 and the security matures within three months or (3) is rated at least Aa3 and the security matures within six months; provided, however, that for purposes of this definition, such instruments (other than commercial paper rated by S&P and not rated by Moody’s) need not meet any otherwise applicable S&P rating criteria;

(iii) U.S. Government Securities and U.S. Treasury Strips;

(iv) Rule 144A Securities;

(v) Senior Loans and other Bank Loans approved by Moody’s;

(vi) Corporate debt securities if (A) such securities are rated Caa or higher by Moody’s; (B) such securities provide for the periodic payment of interest in cash in U.S. dollars or euros, except that such securities that do not pay interest in U.S. dollars or euros shall be considered Moody’s Eligible Assets if they are rated by Moody’s or S&P; (C) for securities which provide for conversion or exchange into equity capital at some time over their lives, the issuer must be rated at least B3 by Moody’s and the discount factor will be 250%; (D) for debt securities rated Ba1 and below, no more than 10% of the original amount of such issue may constitute Moody’s Eligible Assets; (E) such securities have been registered under the Securities Act or are restricted as to resale under federal securities laws but are eligible for resale pursuant to Rule 144A under the Securities Act as determined by the Trust’s investment manager or portfolio manager acting pursuant to procedures approved by the Board of Trustees, except that such securities that are not subject to U.S. federal securities laws shall be considered Moody’s Eligible Assets if they are publicly traded; and (F) such securities are not subject to extended settlement.

-24-

Notwithstanding the foregoing limitations, (x) corporate debt securities not rated at least Caa by Moody’s or not rated by Moody’s shall be considered to be Moody’s Eligible Assets only to the extent the Market Value of such corporate debt securities does not exceed 10% of the aggregate Market Value of all Moody’s Eligible Assets; provided, however, that if the Market Value of such corporate debt securities exceeds 10% of the aggregate Market Value of all Moody’s Eligible Assets, a portion of such corporate debt securities (selected by the Trust) shall not be considered Moody’s Eligible Assets, so that the Market Value of such corporate debt securities (excluding such portion) does not exceed 10% of the aggregate Market Value of all Moody’s Eligible Assets; and (y) corporate debt securities rated by neither Moody’s nor S&P shall be considered to be Moody’s Eligible Assets only to the extent such securities are issued by entities which (i) have not filed for bankruptcy within the past three years, (ii) are current on all principal and interest in their fixed income obligations, (iii) are current on all preferred stock dividends, and (iv) possess a current, unqualified auditor’s report without qualified, explanatory language.