Attached files

| file | filename |

|---|---|

| EX-32.2 - YUHE INTERNATIONAL, INC. | v179189_ex32-2.htm |

| EX-31.1 - YUHE INTERNATIONAL, INC. | v179189_ex31-1.htm |

| EX-31.2 - YUHE INTERNATIONAL, INC. | v179189_ex31-2.htm |

| EX-32.1 - YUHE INTERNATIONAL, INC. | v179189_ex32-1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

|

| For the fiscal year ended December 31, 2009 . |

or

|

¨

|

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

|

For the transition period from

__________ to __________.

Commission

File Number 000-83125

YUHE

INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

87-0569467

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

301

Hailong Street

Hanting

District, Weifang, Shandong Province

The

People’s Republic of China

|

||

|

(Address including zip code of

principal executive offices)

|

||

Registrant’s

telephone number, including area code (86) 536 736 3688

Securities

registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to

Section 12(g) of the Act: Common stock, $0.001 par

value

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. ¨ Yes No x

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or 15(d)

of the Act. Yes ¨ No x

Indicate by check mark whether the

registrant: (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes

x No o

Indicate by check mark if disclosure

of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405

of this chapter) is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “accelerated filer,” “large accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes ¨ No x

The

aggregate market value of voting and non-voting common equity held by

non-affiliates of the registrant as of June 30, 2009, based upon the closing

price of the common stock as reported by the OTC Bulletin Board under the symbol

“YUII” on such date, was approximately $64,461,000.

There were 15,722,180 shares of the registrant’s

common stock issued and outstanding as of March 1, 2010.

YUHE

INTERNATIONAL, INC.

FORM 10-K

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

INDEX

Table

of Contents

|

Page

|

||

|

PART

I

|

||

|

Item 1.

|

Description

of Business

|

2

|

|

Item 1A.

|

Risk

Factors

|

18

|

|

Item 1B.

|

Unresolved

Staff Comments

|

18

|

|

Item 2.

|

Properties

|

19

|

|

Item 3.

|

Legal

Proceedings

|

22

|

|

Item 4.

|

Reserved

|

23

|

|

PART II

|

||

|

Item 5.

|

Market

for Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

|

23

|

|

Item 6.

|

Selected

Financial Data

|

25

|

|

Item 7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

25

|

|

Item 7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

36

|

|

Item 8.

|

Financial

Statements and Supplementary Data

|

36

|

|

Item 9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

37

|

|

Item 9A.

|

Controls

and Procedures

|

38

|

|

Item 9B

|

Other

Information

|

42

|

|

PART

III

|

||

|

Item 10.

|

Directors

and Executive Officers and Corporate Governance

|

42

|

|

Item 11.

|

Executive

Compensation

|

47

|

|

Item 12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

49

|

|

Item 13.

|

Certain

Relationships and Related Transactions

|

51

|

|

Item 14.

|

Principal

Accountant Fees and Services

|

59

|

|

PART IV

|

||

|

Item 15.

|

Exhibits,

Financial Statement Schedules

|

60

|

|

Signatures

|

65

|

|

Use

of Terms

As

used herein, references to “we”, “our”, “us”, and the “Company” refer to Yuhe

International, Inc. and its subsidiaries except in the "Management's Discussion

And Analysis And Results of Operation" below where all historical financial

information prior to March 12, 2008 refers to Weifang Yuhe Poultry Co. Ltd., PRC

Yuhe, which includes the accounts of Weifang Taihong Feed Co. Ltd.,

Taihong.

Forward-Looking

Statement

This

Annual Report on Form 10-K contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934. These statements relate to

future events or the Company’s future financial performance. The Company

has attempted to identify forward-looking statements by terminology including

“anticipates,” “believes,” “expects,” “can,” “continue,” “could,” “estimates,”

“intends,” “may,” “plans,” “potential,” “predict,” “should” or “will” or the

negative of these terms or other comparable terminology. Such statements

are subject to certain risks and uncertainties, including the matters set forth

in this report or other reports or documents the Company files with the

Securities and Exchange Commission from time to time, which could cause actual

results or outcomes to differ materially from those

projected. In evaluating these statements, you should

specifically consider various factors, including the risks outlined in the

section of the Registrant’s prospectus entitled “Risk Factors.” These factors

may cause the Company’s actual results to differ materially from any

forward-looking statement as a result of a number of risks and uncertainties,

including without limitation: (a) limited amount of resources devoted to

expanding the Company’s business plan; and (b) the Company’s failure to

implement its business plan within the time period it originally planned to

accomplish. Although the Company believes that the expectations

reflected in the forward-looking statements are reasonable, the Company cannot

guarantee future results, levels of activity, performance or achievements.

Undue reliance should not be placed on these forward-looking statements which

speak only as of the date hereof. The Company’s expectations are as of the

date this Form 10-K is filed, and the Company does not intend to update any of

the forward-looking statements after the date this Annual Report on Form 10-K is

filed to confirm these statements to actual results or to changes in the

Company’s expectations, unless required by law.

- 1

-

PART

I

ITEM

1. DESCRIPTION

OF BUSINESS.

Overview

Through

the Company’s operating subsidiaries, the Company is a supplier of day-old

chicken raised for meat production, or broilers, in the People’s Republic of

China, the “PRC” or “China”. The Company purchases parent breeding stock from

breeder farms, raises them to produce hatching eggs, and hatches the eggs to

day-old broilers. Currently, the Company has 28 breeder farms with 15 in

operation and two hatcheries with a total annual capacity of 1.2 million sets of

breeders and 120 hatchers through its wholly-owned subsidiary, Weifang Yuhe

Poultry Co. Ltd., “PRC Yuhe”. The remaining 13 breeder farms were purchased in

December 2009 and are undergoing renovations. They are expected to be in full

operation by the third quarter of 2010. The Company’s day-old broilers are

primarily purchased by broiler farms and integrated chicken companies for the

purpose of raising them to market-weight broilers. The Company’s customers are

located in the ten provinces and special municipalities centered around Shandong

Province, which are Jiangsu, Anhui, Henan, Hebei, Jilin, Liaoning, Heilongjiang,

Tianjin, Beijing, and Shanghai. In connection with the Company’s day-old broiler

business, the Company also operates a feed stock company named Weifang Taihong

Feed Co. Ltd., or “Taihong”, whose primary purpose is to supply feed stock to

the Company’s breeders. The Company’s operations are conducted exclusively by

its subsidiaries, PRC Yuhe and Taihong, in China.

The Company’s principal executive

office is located at 301 Hailong Street, Hanting District, Weifang, Shandong

Province, The People’s Republic of China. The Company’s Internet address is

http://www.yuhepoultry.com.

Unless

otherwise noted, all historical information prior to March 12, 2008 refers to

PRC Yuhe and Taihong. Effective on April 4, 2008, the Company amended its

articles of incorporation to effect a 1-for-14.70596492 reverse stock split of

its common stock. For ease of reading, all references to shares will

be based on the post split basis.

History

and Background

First

Growth Investors, Inc.

First

Growth Investors, Inc., “First Growth”, was incorporated under the laws of the

State of Nevada on September 9, 1997. First Growth was formed to buy and sell

vintage wines. Since 2003 First Growth was not engaged in any substantive

business activities or operations prior to the acquisition of Bright Stand

described below.

The

Company entered into a Stock Purchase Agreement, the “Stock Purchase Agreement”,

with Halter Financial Investments, L.P., a Texas limited partnership, “Halter

Financial”, dated as of November 6, 2007, pursuant to which it agreed to sell to

Halter Financial 951,996 shares of its common stock for $425,000.

- 2

-

Halter

Financial and the then serving members of the Board of Directors of First Growth

entered into arm’s length negotiations regarding the acquisition of Halter

Financial’s ownership interest. The amount paid was based on the business

prospects of First Growth and the perceived value of a control position in

similarly situated publicly-traded shell corporations. The transaction closed on

November 16, 2007. As a result of the transaction, Halter Financial held 951,996

shares, or 87.5% of the Company’s 1,087,994 shares, of common stock then

outstanding following the completion. The 87.5% interest purchased by Halter

Financial was fairly valued at $425,000. Halter Financial advised First Growth

that its purchase price was based on the results of its research into the prices

paid by other groups to acquire control positions in publicly-traded

shell companies similarly situated as First Growth at the time Halter

Financial acquired its position in First Growth. The Stock Purchase Agreement

also required the Company’s Board of Directors to declare and pay a special cash

dividend of $3.088 per share to the Company’s shareholders on November 19, 2007.

Halter Financial did not participate in such dividend. The dividend was payable

to shareholders of record on November 15, 2007, which was prior to the date the

shares were issued to Halter Financial under the Stock Purchase Agreement. The

dividend payment date was November 19, 2007. The dividend was payable to the

Company’s shareholders who held 135,999 shares of the Company’s common stock and

resulted in a total dividend distribution of $420,000. The funds for the

dividend came from the $425,000 proceeds received from the sale of common stock

to Halter Financial. Mr. Richard Crimmins was appointed as an officer and

director of First Growth at the request of Halter Financial as a result of the

change in control transaction whereby Halter Financial became First Growth’s

principal shareholder. Richard Crimmins is neither an officer, director nor

shareholder of Halter Financial. Prior to November 2007, neither Halter

Financial nor its affiliates had a material relationship with any of First

Growth’s shareholders. After Halter Financial became a 87.5% shareholder of

First Growth pursuant to the Stock Purchase Agreement, there was a potential

conflict of interest associated with an affiliate of Halter Financial, HFG

International, Limited, advising Bright Stand about its purchase of a U.S. shell

company, First Growth. Despite this potential conflict of interest, HFG

International, Limited has informed the Company that its advice to Bright Stand

was based on its research results into the prices paid by other groups to

acquire control positions in publicly traded shell companies, which were

similarly situated as First Growth at the time Bright Stand acquired First

Growth.

Bright

Stand International Co., Ltd.

Bright

Stand International Co., Ltd., “Bright Stand”, was incorporated on August 3,

2007 and has a registered capital of $100. Bright Stand did not have any

operating activities from August 3, 2007 (inception) to March 12, 2008. Kunio

Yamamoto, a Japanese citizen, was the sole shareholder of Bright Stand through

March 12, 2008.

Weifang

Yuhe Poultry Co., Ltd.

PRC Yuhe

is the wholly-owned subsidiary of Bright Stand. PRC Yuhe was founded in March

1996 by Gao Zhentao and Sun Haoguo, with each of them owning, respectively, 60%

and 40% of its equity interest. From its formation through its acquisition by

Bright Stand, PRC Yuhe was effectively controlled by Gao Zhentao, the Company’s

chief executive officer. The principal business of PRC Yuhe is breeding poultry,

hatchlings and selling chicken.

- 3

-

Weifang

Taihong Feed Co., Ltd.

Taihong

was founded in May 2003 by Shandong Yuhe Food Group Co., Ltd., “Yuhe Group”, a

PRC company based in Shandong Province, and Gao Zhenbo, the brother of the

Company’s chief executive officer, Gao Zhentao, with Yuhe Group and Mr. Gao

owning, respectively, 56.25% and 43.75% of its equity interest. Yuhe Group is an

entity controlled by the Company’s chief executive officer, Gao Zhentao, and his

brother, Gao Zhenbo. The principal business of Taihong is the production and

sale of feed and feed additives, primarily to PRC Yuhe. On September 14, 2007

Yuhe Group transferred all of its interests in Taihong to PRC Yuhe in a

reorganization of equity interest under common control. The 43.75% equity stake

in Taihong owned by Gao Zhenbo was subsequently transferred to Bright Stand in

the course of the corporate reorganization transactions described

below.

Corporate

Reorganization Transactions

HFG

International, Limited, an affiliate of Halter Financial, was engaged by Bright

Stand to provide consulting services related to Bright Stand’s efforts to

complete a combination transaction with a US domiciled publicly-traded “shell

corporation” and other post transaction matters. HFG International, Limited

introduced Bright Stand to First Growth. There is no correlation between the

decision of Bright Stand to engage HFG International, Limited to provide

consulting services to Bright Stand and the decision of Halter Financial to

acquire a control position in First Growth. After Halter Financial became a

87.5% shareholder of First Growth pursuant to a Stock Purchase Agreement, there

was a potential conflict of interest associated with an affiliate of Halter

Financial, HFG International, Limited, advising Bright Stand about its purchase

of a U.S. shell company, First Growth. Despite this potential conflict of

interest, HFG International, Limited has informed the Company that its advice to

Bright Stand was based on its research results into the prices paid by other

groups to acquire control positions in publicly traded shell companies, which

were similarly situated as First Growth when Bright Stand acquired First Growth.

After a diligence review by counsel for Bright Stand, the principal shareholder

of Bright Stand elected to enter into the exchange transaction contemplated

by the equity transfer agreement filed as Exhibit 10.2 to the

Registration Statement on Form S-1/A filed on December 19, 2008.

Bright

Stand entered into a share transfer agreement with all the existing shareholders

of PRC Yuhe on October 18, 2007 to acquire all the equity of PRC Yuhe with

cash consideration equal to the appraised fair market value of PRC Yuhe in the

amount of RMB 81,450,000, or $11,306,522. The sellers of PRC Yuhe included Yuhe

Group, Mr. Gao Zhentao and Mr. Gao Zhenbo. Bright Stand obtained the approval

from the Shandong Province counterpart of the Ministry of Commerce for this

transaction on November 9, 2007, and the acquisition closed on January 31, 2008.

There is no longer any connection between the Company and Yuhe Group, except

that Gao Zhentao, the Company’s chief executive officer and, his brother Gao

Zhenbo, are shareholders and directors of Yuhe Group. Sun Haoguo does not have

any relationship with Yuhe Group and two of three members of the Supervisory

Board of PRC Yuhe, Zheng Chaoyang is an Administrative Department Officer of

Yuhe Group and Zhang Lishun is an Administrative Department Officer of Yuhe

Group.

Bright

Stand entered into a share transfer agreement with Gao Zhenbo, a former

shareholder of Taihong on October 18, 2007 to acquire 43.75% of the

outstanding equity of Taihong for cash consideration equal to 43.75% of the net

asset value of Taihong in the amount of RMB 2,244,000, or $312,530. The

remaining 56.25% of Taihong is owned by PRC Yuhe. Bright Stand obtained the

approval from the Shandong provincial counterpart of the Ministry of Commerce

for this transaction on November 9, 2007, and the acquisition closed on January

31, 2008.

- 4

-

Effective

March 12, 2008, the Company closed an Equity Transfer Agreement with Bright

Stand and Kunio Yamamoto, a Japanese person, the sole former shareholder of

Bright Stand. Pursuant to the terms of the Equity Transfer Agreement, the

Company acquired all of the outstanding capital stock of Bright Stand from Mr.

Yamamoto in exchange for 8,626,318 shares of the Company’s common stock. At the

closing, Bright Stand became the Company’s wholly-owned subsidiary. Immediately

following the date of the Equity Transfer Agreement, Mr. Yamamoto held 8,626,318

shares of the Company’s common stock. Neither Halter Financial nor Mr. Yamamoto

had any role in identifying the accredited investors who purchased the Company’s

unregistered securities on March 12, 2008.

There is

no direct or indirect connection between Mr. Yamamoto and the former

shareholders of PRC Yuhe and Taihong, including Mr. Gao Zhentao, Mr. Gao Zhenbo,

and Mr. Sun Haoguo. The acquisitions of PRC Yuhe and Taihong by Bright Stand

closed on January 31, 2008 after obtaining the relevant approval from the

Shandong Province counterpart of the Ministry of Commerce. There is no direct or

indirect connection between Mr. Yamamoto and the former shareholders of First

Growth. Mr. Yamamoto does not currently have any roles with the Company, except

as the Company’s shareholder. Mr. Gao Zhenbo and Mr. Sun Haoguo do not currently

have any roles with the Company.

Equity

Investment by Private Placement Investors

On March

12, 2008, the Company consummated with 25 accredited investors, the “Investors”,

a private placement of 5,829,018 shares of its common stock for an aggregate

purchase price of approximately $18,000,000. The Investors were (i) Pinnacle

Fund, L.P., (ii) Pinnacle China Fund L.P., (iii) Black River Commodity Select

Fund Ltd., (iv) Black River Small Capitalization Fund Ltd., (v) Marion Lynton,

(vi) Ardsley Partners Fund II, LP, (vii) Ardsley Offshore Fund, Ltd, (viii)

Ardsley Partners Institutional Fund, LP; (ix) Investment Hunter, LLC, (x)

Guerrilla Partners LP, (xi) Hua-Mei 21st Century Partners, LP, (xii) Ruoling

Wang, (xiii) Guli Ping, (xiv) Wu Mijia, (xv) Dehua Qian, (xvi) Southwell

Partners, L.P, (xvii) Westpark Capital, L.P, (xviii) Straus Partners, LP, (xix)

Straus-GEPT Partners, LP, (xx) Atlas Allocation Fund, LP, (xxi) Chestnut Ridge

Partners, LP, (xxii) Ancora Greater China Fund, LP, (xxiii) Kevin B. Halter Jr,

(xxiv) Octagon Capital Partners, and (xxv) Howard H. Lu.

The

agreements the Company entered into with the Investors included a Securities

Purchase Agreement, a Registration Rights Agreement, Make Good Escrow Agreements

and various ancillary agreements and certificates, disclosure schedules and

exhibits in connection therewith. The following is a summary of their material

terms.

Securities Purchase

Agreement

Among

other things, under the Securities Purchase Agreement, Mr. Yamamoto has

delivered a certain number of shares of the Company’s common stock owned by him

to the investors pro-rata in accordance with their respective investment amount

for no additional consideration if: (i) the Company’s after tax net income for

the Company’s fiscal year ended on December 31, 2009 is less than 95% of

$13,000,000; and (ii) the Company’s earnings per share reported in the fiscal

year ending on December 31, 2009 is less than $0.74 on a fully diluted basis,

the “Low Performance Events”. Mr. Yamamoto has placed an aggregate of

3,359,889 shares of common stock, “Make Good Shares”, into an escrow account

pursuant to the terms of the Make Good Escrow Agreement by and among the

Company, Mr. Yamamoto, the Investors and the escrow agent named therein. If the

Company does not achieve the targets in 2009, 50% of the Make Good Shares will

be conveyed to all private placement Investors and Halter Financial pro-rata in

accordance with their respective investment amount for no additional

consideration. If the foregoing Low Performance Events do not occur, all the

Make Good Shares will be transferred to Mr. Yamamoto. As the Company has

achieved its 2008 earnings target, on July 31, 2009, Roth Capital executed a

Form of Release and instructed the Escrow Agent to release 1,679,992 shares of

common stock, the 2008 Make Good Shares, to Mr. Kunio Yamamoto, who received

such shares in or about August, 2009. HFG International Limited also

executed a Form of Release to release 235,196 shares of the Company’s common

stock to Mr. Kunio Yamamoto, who received such shares on or about April 27,

2009.

- 5

-

Covenants: The Securities

Purchase Agreement contains certain covenants on the Company’s part, including

the following:

(a)

Board of Directors.

Within 180 days following the closing, the Company is required to nominate a

minimum of five members to its Board of Directors, a majority of which must be

“independent,” as defined under the Nasdaq Marketplace Rules, and to take all

actions and obtain all authorizations, consents and approvals as are required to

be obtained in order to effect the election of those nominees.

(b)

Chief Financial

Officer. Within 180 days following the closing, the Company is required

to hire a chief financial officer, “CFO”, who is a certified public accountant,

fluent in English and familiar with US GAAP and auditing procedures and

compliance for US public companies.

(c)

Investor Relations

Firm. Within 60 days following the closing, the Company is required to

hire one of the following investor relations firms: CCG Elite, Hayden

Communications or Integrated Corporate Relations.

In

connection with the above three post-closing covenants, the Company has

deposited an aggregate of $1,750,000, $750,000 as board holdback escrow amount,

$750,000 as CFO holdback escrow amount, and $250,000 as investor relations firm

holdback amount, from the gross proceeds of the private placement in the escrow

account pursuant to the Holdback Escrow Agreement by and among the Company, the

investors and the escrow agent named therein. If the Company fails to comply

with any of the above covenants in a timely fashion, it will incur liquidated

damages of 1% on a daily pro-rata basis for any portion of a month of the gross

proceeds of the private placement, or 2% if it suffers a holdback event relating

to Board of Directors or CFO in a 30-day period, to be subtracted from the

holdback escrow fund, until its compliance with such covenants.

The

Company filed a current report on form 8-K on June 13, 2008 with the SEC.

Pursuant to the relevant escrow agreement, the above mentioned $1,750,000 was

released to the Company on or about June 14, 2008.

- 6

-

Registration Rights

Agreement

With

respect to the 5,829,018 shares issued to the investors at closing on March 12,

2008, the Company is required to file a resale registration statement on Form

S-1 or any other appropriate form (i) within 60 days following the closing for

purposes of registering the resale of these shares, (ii) within 15 days with

respect to any additional registration statement, (iii) within 15 days with

respect to any additional registration statements required to be filed due to

SEC Restrictions, (iv) within 30 days following the date on which it becomes

eligible to utilize Form S-3 to register the resale of common stock, or (v)

within 45 days following the date the Make Good Shares are delivered by Mr.

Yamamoto to the investors. Among other things, the Company will be required to

pay the investors liquidated damages if it fails to file a registration

statement by the above filing deadlines or if it does not promptly respond to

comments received from the SEC. The liquidated damages accrue at a rate of 0.5%

per month of the aggregate investment proceeds received from the investors,

capped at 5% of the total investment proceeds. The Company filed a Registration

Statement on Form S-1 on May 12, 2008. On December 29, 2008,

the Company’s Registration Statement was declared effective by the Securities

and Exchange Commission, registering a total of 4,730,251 shares of the

Company’s common stock for re-sale by certain selling shareholders, instead of

5,829,018 shares as contemplated by the registration rights agreement following

the Company’s discussion with the Securities and Exchange

Commission.

Lockup

Agreement

The

Company and Mr. Yamamoto entered into a lockup agreement, pursuant to which Mr.

Yamamoto irrevocably agrees from and after the date of such agreement and

through and including March 12, 2010, that he will not offer, pledge, encumber,

sell, contract to sell, sell any option or contract to purchase, purchase any

option or contract to sell, grant any option, right or warrant to purchase or

otherwise transfer or dispose of, directly or indirectly, or announce the

offering of, any of his shares, including any securities convertible into, or

exchangeable for, or representing the rights to receive, or engage in any short

sales with respect to any security issued by the Company. The Lockup Agreement

may not be waived or amended without the consent of a majority of the holders of

a majority of the shares issued in the private placement.

Name

Change to Yuhe International, Inc., Reverse Stock Split and Migration to

NASDAQ

Effective

April 4, 2008, the Company amended its articles of incorporation to (i) change

its name from “First Growth Investors, Inc.” to “Yuhe International, Inc.”, and

(ii) effect a 1-for-14.70596492 reverse stock split of its common stock. The

Company’s Board of Directors and shareholders approved the name change and the

reverse stock split pursuant to the Nevada Revised Statutes. The number of

authorized shares of common stock remains unchanged at 500 million.

The

change of the Company’s name and the reverse stock split were reflected in the

Amended and Restated Articles of Incorporation filed on April 4, 2008 with the

Secretary of State of Nevada, a copy of which was attached as Exhibit 3.1 to an

8K filed on April 10, 2008. The name change became effective with NASDAQ’s

Over-the-Counter Bulletin Board at the opening of trading on April 7, 2008,

under the new stock symbol of “YUII.OB”.

- 7

-

On

October 21, 2009, The NASDAQ Stock Market, the “Exchange”, informed the Company

that the Exchange had approved the listing of the Company’s common stock on the

Exchange. The Company’s common stock ceased trading on the

Over-the-Counter Bulletin Board and commenced trading on the Exchange on October

30, 2009 under the trading symbol “YUII”.

Appointment

of Investor Relations Firm

On April

20, 2008, the Company appointed CCG Elite Investor Relations as its investor

relations firm, which was effective on May 1, 2008.

Appointment

of Chief Executive Director

On June

13, 2008, the Company entered into an employment contract with Mr. Gao Zhentao,

the Company’s Chief Executive Officer, “CEO”. The employment agreement was

effective as of March 12, 2008, the date Mr. Gao was appointed CEO, and has an

initial term of three years.

Appointment

of Chief Financial Officer

On June

13, 2008, Mr. Hu Gang was appointed the Chief Financial Officer, “CFO”, of the

Company. The Company has entered into an employment agreement with Mr. Hu,

effective as of June 13, 2008, his appointment date, and has an initial term of

three years.

Appointment

of Directors

On June

13, 2008, the Company appointed the following directors:-

(i)

Mr. Peter Li, aged 44, was appointed Independent Director, chair of the Audit

Committee and member of the Compensation and Nominating Committees;

(ii)

Mr. Liu Yaojun, aged 32, was appointed Independent Director, chair of the

Compensation Committee and member of the Nominating and Audit

Committees;

(iii)

Mr. Greg Huett, aged 46, was appointed Independent Director , chair of the

Nominating Committee and member of the Audit and Compensation Committees;

and

(iv)

Mr. Han Chengxiang, aged 44, was appointed Director and member of the Nominating

Committee.

The

Company filed a current report on form 8-K on June 13, 2008 with the SEC.

Pursuant to the Holdback Escrow Agreement, an aggregate of $1,750,000, $750,000

as board holdback escrow amount, $750,000 as CFO holdback escrow amount, and

$250,000 as investor relations firm holdback amount, was released to the Company

on or about June 14, 2008.

- 8

-

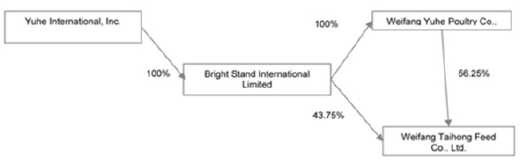

Corporate

Structure

The

Company has an offshore holding structure commonly used by foreign investors

with operations in China. The Company is a Nevada corporation which owns 100% of

the securities of Bright Stand, which in turn owns 100% of the securities of PRC

Yuhe and Taihong.

As of

December 31, 2009, Mr. Kunio Yamamoto was the Company’s significant shareholder:

Mr. Yamamoto owned 48.7%, of the total outstanding shares of the Company’s

common stock.

The

following chart depicts the Company’s organizational structure:

- 9

-

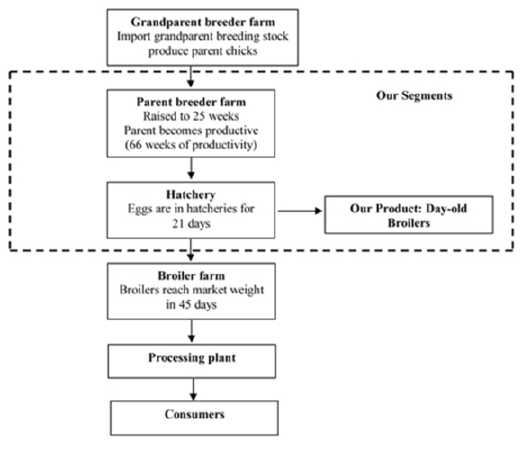

The

Company’s Business: Day-Old Broilers

The

Company’s business is part of the commercial broiler supply chain, which is

illustrated below.

- 10

-

The

figure above illustrates the entire supply chain of broiler chicken. Day-old

broilers are one-day-old broilers that are sold to broiler raisers. Day-old

broilers sold by the Company’s wholly-owned subsidiary, PRC Yuhe, are the

Company’s primary source of revenue.

The

Company purchases parent breeding chicken from grandparent breeder farms and

raises them to maturity. Once these parent breeding chicken have matured, they

produce hatching eggs that the Company incubates and then sells the resulting

day-old broiler chicks to its customers.

Under

normal circumstances, female parent breeder chicken become productive from the

26 th week,

and are no longer commercially productive after the 66th week. Typically a

breeder is capable of producing approximately 167 eggs which will be hatched to

137 broilers over its production lifetime and the breeders are maintained by the

Company for a period of 420 days. The Company sources its parent breeder chicken

from licensed suppliers located in Beijing, and Shandong and Jiangsu provinces

and these suppliers are required to have a vaccination certificate and a breeder

production certificate for the sale of the breeders. The Company’s hatching eggs

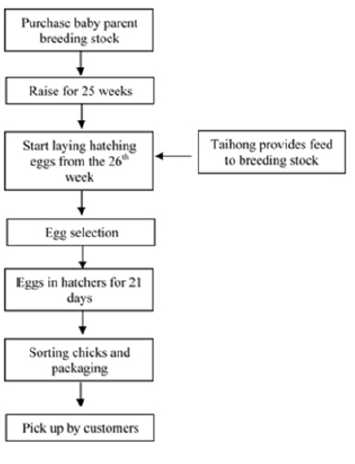

typically must be incubated for a period of 21 days.

The

following figure shows the production timeline in the broiler business. At least

28 weeks usually pass from the Company’s receipt of a day-old parent breeder to

the Company’s sale of the first day-old broilers.

- 11

-

The

Company operates in two elements of the broiler supply chain: day-old broiler

production and feed production. These activities are operated under two separate

subsidiaries, PRC Yuhe and Taihong, respectively.

In 2009,

PRC Yuhe generated 99.3% of the Company’s revenues. Taihong’s sale of

feed to unaffiliated third parties generated 0.7%. Taihong is also the primary

supplier of feed to PRC Yuhe. In addition to selling day-old broilers, the

Company also sells related chicken products, non-productive parent breeders, and

a small amount of feed for livestock and poultry. While the Company produces

substantially all of its inventory of hatching eggs through its own parent

breeders, it occasionally purchases additional hatching eggs from unaffiliated

third parties to meet market requirements.

The

Company provides a 98% guaranteed survival rate by delivering an additional 2%

of its day-old broilers. For example, the Company delivers two additional

day-old broilers to its customers for every order of 100 day-old broilers, the

cost for these two additional broilers has already been included in the

Company’s cost of sales and therefore no further liability needs to be accrued.

Any loss of broiler chicken solely caused by customers is excluded from the

guarantee. Guarantee expense for 2009 was $0. In 2008, the total guarantee

expense was $65,769.

- 12

-

The

Company will provide additional compensation to its customers if the survival

rate falls below 96% after taking into consideration the additional 2% broilers

given out.

According

to paragraph Accounting Standards Codification (“ASC”) Topic 310, a loss

contingency should be accrued for if it is probable that a liability had been

incurred at the date of the financial statements and the amount of loss can be

reasonably estimated. The Company determined that a product liability need not

be accrued for the reporting period because there is only a remote chance that

the survival rate will fall below 96% based on historical experience. In 2008,

$65,769 was recorded as guarantee expense to customers; guarantee expense for

2009 was $0.

The

Day-Old Broiler Industry in China; Competition

The

market for day-old broilers in China is highly fragmented. Shandong Province has

the highest number of day-old broilers in China. The Company’s market share was

approximately 3% in China in 2009 and the Company sold 110,000,000 day-old

broilers in 2009.

Day-old

broilers are very weak physically and need to be transported in closely

controlled temperature conditions during delivery. Therefore, producers of

broiler chicks usually only sell locally or to surrounding areas, which limits

the Company’s current effective sales market and competition to North

China.

Shandong

Minhe Animal Husbandry Co., Ltd., also located in Shandong Province, is one of

the Company’s major competitors for sales of day-old broilers. They are slightly

larger than the Company in terms of their annual day-old broiler production

volume. Another regional competitor of the Company’s is Jilin Deda, which is

located in Jilin Province in north-eastern China and is smaller than the Company

in terms of annual day-old broiler production volume. However, Jilin Deda is an

integrated chicken company, so it does not generally sell day-old broilers to

unaffiliated third parties.

The

Company competes against its competitors based on product quality and its

after-sales services and extensive marketing network. The Company’s “Yuhe” brand

has been named by the Shandong Province Administration of Industry and Commerce

as a “Well Known Brand”. PRC Yuhe was certified as ISO 9001:2000 compliant for

quality management systems.

The

Company has sales representatives in every district of Shandong Province.

Although the Company’s prices are relatively higher than prices of many of its

competitors, the Company typically lowers its price by RMB 0.1 to 0.2 per

day-old broiler in order to attract new customers. The Company is able to sell

its products at a relatively higher price because its products have a good

survival rate and require a shorter period to raise to market size. The

Company’s experience and advance breeding technique contribute to the health and

quality of parent breeders. The Company has a high gross margin because it

focuses on the production of day-old broilers through maintaining the health and

quality of its parent breeders, which involves only a small maintenance cost, to

produce healthy day-old broilers that have a high survival rate and require a

shorter period to raise to market size. The higher the number of day-old

broilers is being produced, the lower the unit cost. As such, the Company is

able to maintain itself as a relative low cost producer while charging

relatively higher prices for its products.

- 13

-

Breeder

Supply

PRC

Yuhe’s suppliers (including distributors of suppliers) in 2009 were as follows:

|

|

|

|

2009

|

||||

|

Suppliers

|

Suppliers of

|

|

Amount

|

|

% of

|

||

|

($

,000)

|

Total

|

||||||

|

Wang

Jianbo

|

Eggs

|

3,649

|

11.99%

|

||||

|

Tang

Xinming

|

Corn

|

2,745

|

9.02%

|

||||

|

Ma

Suping

|

Soybean

|

2,712

|

8.91%

|

||||

|

Gao

Ping

|

Eggs

|

2,589

|

8.51%

|

||||

|

Liu

Dianbao

|

Eggs

|

1,325

|

4.35%

|

||||

|

Xu

Zhenming

|

Eggs

|

1,182

|

3.88%

|

||||

|

Shanghai

Shen De Equipment Co., Ltd.

|

Equipment

|

834

|

2.74%

|

||||

|

Zhang

Chun Mao

|

Coal

|

833

|

2.74%

|

||||

|

Shandong

Yisheng Poultry Co., Ltd.

|

Chicken

breeders

|

704

|

2.31%

|

||||

|

Jiang

Zhaolin

|

Eggs

|

548

|

1.80%

|

||||

|

Total

|

|

17,121

|

56.25%

|

||||

Operations

The main

raw materials needed for the production of the Company’s day-old broilers are

parent breeders, feed, and medicines and vaccines. PRC Yuhe purchases parent

breeders from multiple suppliers. The Company has historically been able to

procure adequate stocks of parent breeders with a 5-8% discount from its

principal suppliers as a result of its eight- to ten-year relationship with them

and the Company’s large, stable orders. The Company purchases its parent

breeders from its long-term suppliers in Shandong Province, Jingsu Province and

Beijing.

Taihong

sells breeder feed to PRC Yuhe at cost, and these supplies have historically

accounted for all of PRC Yuhe’s feed requirements. The main raw materials for

Taihong’s feed are corn, soybean meal and nutritional elements for feed

production. Taihong purchases feed ingredients from numerous sources, but

primarily from wholesalers who collect the feed ingredients directly from

farmers. Taihong’s feed is produced in three separate phases. First, pre-mix

feed is produced from micro-nutritional elements, such as vitamins and minerals.

Second, concentrate feed is mixed by blending pre-mix feed and protein such as

soybean meals. Finally, whole feed is produced by mixing concentrate feed, corn

and soybean meal. Every raw material Taihong uses has more than three suppliers.

Taihong is not a large purchaser in the market for these materials, so to

strengthen its bargaining power, Taihong will sometimes cooperate with other

purchasers to place joint orders. The Company believes that its sources of

supply for these materials are adequate for its present needs and does not

anticipate any difficulty in acquiring these materials in the immediate

future.

In 2009,

the Company began to purchase feed from Shandong Purina Feed Company, a

subsidiary of Cargill. By the end of 2009, about 50% of the Company’s feed is

using Purina products. Based on the contract with Purina, the feed cost will not

be higher than the Taihong feed cost. In the Company’s on-going operation,

Purina will supply the majority of the Company feed, Taihong will supply the

residue part. Taihong will continue to operate as the back-up feed supply

source.

- 14

-

The

Company obtains its medicines from suppliers in Beijing and Shandong, and its

vaccines locally in Harbin, Heilongjiang Province and from foreign companies in

the United States and Israel. Every such material the Company uses has more than

three suppliers.

The

Company considers the health of its flocks to be its primary concern, and as

such, the Company undertakes vaccination programs for its birds. Every breeder

is vaccinated with at least ten types of vaccine, including those against avian

flu. The Company’s birds are raised in enclosed buildings, not in the open where

they would be more prone to exposure to potential disease carriers. The

Company’s breeder farms are also distributed among various locations at least

five kilometers from each other so as to minimize the risks of co-infection.

None of the Company’s birds has been infected with the H5N1 virus, and no cases

of H5N1 have been found in Shandong Province, where the Company’s farms are

located. The Company is also one of the few companies in China to immunize its

embryos using the Inovoject® system provided by Embrex, Inc. The Inovoject®

system would enhance the quality of the day-old broilers and increase their

viability. The system can also improve disease resistance and bird health at the

time when they are placed on the breeder farm. The Company conducted a test

internally and estimated that the survival rate would be 1-2 % lower without

using the Inovoject system. PRC Yuhe was certified as ISO 9001:2000 compliant

for quality management systems on May 8, 2003.

Customers

and Distribution

Through

PRC Yuhe, the Company’s customers are principally comprised of distributors and

end users such as integrated chicken companies, broiler raising companies

and individual broiler raisers. Approximately one hundred percent of the

Company’s total sales are made through third party distributors and thirty-two

percent of the Company’s sales are to five largest distributors. Forty-two

percent of the Company’s sales volume is to distributors with five to ten years

of relationship with us.

The

Company’s reference to “customers” includes both distributors and end users.

However, under the section “Customers and Distribution” in this Report, the

Company’s reference to “customers” includes the Company’s end users only as

the Company is constantly considering increasing and funding its sales network

into new geographic areas in an effort to expand its sales to end

users.

If any

distributor resells the Company’s product, such distributor will make profits

from the resale as well as be entitled to a year end bonus paid by the Company

at the rate of RMB 0.05-0.1 per day-old broiler. The Company sets the price to

third party distributors and end users according to the market price based

on supply and demand and the competitiveness of the market. The Company sets the

price according to its own policies and is not subject to any distributors’

control.

The

Company is constantly considering increasing and funding its sales network into

new geographic areas. The Company expects to purchase new facilities to

generate sufficient production capacity and expand roughly at the same rate

as it expects to increase its sales network. The Company shall fund the

cost of increasing its sales network internally as it recruits more sales

representatives. The Company considers that costs of acquiring new

production facilities and its ability to raise capital for expansion at a

particular time can affect its geographical expansion and sales. The Company

also considers that shortage of labor would also affect its geographical

expansion and sales. The impact of labor shortage can be immediate and

longer-term. The Company is monitoring the availability of professionals and

experienced workers to meet its production demand.

- 15

-

The

Company anticipates that it will use a penetration pricing strategy when first

entering a new geographic area. Historically, the Company’s penetration price

has been RMB 0.1 to RMB 0.2 per bird lower than its list price, which was still

higher than the prevailing market price in the market the Company was seeking to

enter.

For the

remaining feed produced by Taihong that is not sold to PRC Yuhe, Taihong retains

sales agents in various key locations to sell the feed. Because Taihong’s excess

feed production is not large, its feed is sold primarily in Shandong

Province.

As a part

of the Company’s after-sales service and customer relations initiative, the

Company regularly visits its customers to educate them on broiler-raising

techniques, conducts regular training courses and provides them with a 24-hour

help line. The Company also provides guarantees to its customers that the

survival rate of its day-old broilers will be not less than 98% within one week

of their delivery.

The table

below sets out the Company’s top ten major direct customers. Sales to PRC Yuhe’s

major end users in 2009 and 2008 were as follows:

|

|

|

2009

|

|||

|

Customers

|

|

Amount

|

|

% of

|

|

|

|

|

($ ,000)

|

|

Total

|

|

|

Wei

Yunchao

|

5,067

|

10.71%

|

|||

|

Wang

Jianbo

|

3,733

|

7.89%

|

|||

|

Li

Chuanwang

|

3,096

|

6.55%

|

|||

|

Jia

Deliang

|

1,926

|

4.07%

|

|||

|

Tian

Liqiu

|

1,261

|

2.67%

|

|||

|

Geng

Naiwei

|

983

|

2.08%

|

|||

|

Chen

Shiwen

|

946

|

2.00%

|

|||

|

Yang

Lunhao

|

939

|

1.99%

|

|||

|

Wang

Yaocheng

|

902

|

1.91%

|

|||

|

Song

Fuquan

|

892

|

1.89%

|

|||

|

Total

|

19,744

|

41.75%

|

|||

Employees

As of

December 31, 2009, PRC Yuhe and Taihong had 1,230 full-time employees. Among

these full-time employees, 120 employees, who are key technical and operational

personnel, have directly signed employment contracts with the Company. The

remaining employees who are unskilled workers have signed their employment

contracts with Weifang Chuangfu Labor Co., Ltd., an outside labor contracting

company that provides employees to meet the Company’s staffing needs. The

Company compensates the employees of Weifang Chuangfu Labor Co., Ltd. directly

for the services that these employees render to it and pays Weifang Chuangfu

Labor Co., Ltd. a yearly service fee. Bright Stand has no

employees.

- 16

-

R&D

and Intellectual Property

PRC Yuhe

and Taihong have not made any R&D expenditure in the last two fiscal

years.

PRC Yuhe

is the registered owner of two PRC trademarks consisting of the stylized Chinese

characters “Yu He” and accompanying logo in live agricultural products. The

registration period is ten years and the expiry dates for the two trademarks are

October 27, 2015 and April 6, 2010, respectively. In the PRC, trademark

registrations can be indefinitely renewed for ten-year periods. As the

registrant of these two trademarks, PRC Yuhe has the exclusive legal right to

use each trademark within the PRC on the goods for which it is registered. PRC

Yuhe has the right to prevent others from using a confusingly similar mark on

any good which is similar to any of those for which these two trademarks are

registered. Through a license agreement with PRC Yuhe, Taihong has the license

to use the same trademarks. PRC Yuhe and Taihong have no other patents,

trademarks, other licenses, franchises, concessions or royalty agreements. The

Company does not consider “Yu He” to be a consumer brand because it is not well

recognized by customers who purchase chickens in retail food markets, although

this brand is recognized by end users who raise broilers to market size for sale

to customers, retail food markets and restaurants.

Environmental

Laws

The

Company’s breeders farms are located in rural areas where there are no specific

requirements imposed on the Company by relevant environmental protection

agencies. Fecal wastes are treated and converted by the Company to fertilizers

and sold to farmers. PRC Yuhe and Taihong have never been penalized by any

environmental protection agencies. The Company therefore does not incur any

significant environmental law compliance costs.

Governmental

Approvals

The

production activities of PRC Yuhe and Taihong are primarily regulated by the

Farming Bureau of Shandong Province. Under relevant laws and regulations, both

PRC Yuhe and Taihong must obtain relevant production permits from the Farming

Bureau of Shandong Province to carry out their respective businesses. In

addition, PRC Yuhe, as a company engaging in the breeder business, must obtain

an immunization certificate from the local Farming Bureau in Weifang City. PRC

Yuhe’s breeder production permit from the Animal Husbandry Bureau of Shandong

Province is valid from August 5, 2008 to August 4, 2011. The immunization

certificate from the local farming bureau in Weifang City was issued on November

10, 2005 and does not have an expiry date. Taihong’s feed production permit was

issued on December 12, 2007 and is valid for a period of three

years.

Generally,

the primary breeder stock is imported and the import volume is closely

controlled by the PRC government. The Company has not seen an increasing trend

of the import volume.

- 17

-

PRC Yuhe

is currently entitled to an exemption from Chinese enterprises income tax, or

“EIT”, because it has been recognized as “a national leading agricultural

enterprise”. In accordance with the relevant regulations regarding the tax

exemption, PRC Yuhe is tax-exempt as long as it continues to be recognized as

“the national leading agricultural enterprise”. On January 31, 2008, the Chinese

operating subsidiaries PRC Yuhe and Taihong were acquired by Bright

Stand.

On March

16, 2007, the National People’s Congress of China enacted a new tax law, or “the

New Tax Law”, whereby both FIEs and domestic companies will be subject to a

uniform income tax rate of 25%. On November 28, 2007, the State Council of China

promulgated the Implementation Rules. Both the New Tax Law and the

Implementation Rules have become effective on January 1, 2008 and provide tax

exemption treatment for enterprises engaged in agricultural industries, such as

farming, foresting, fishing and animal husbandry. As an enterprise engaged in

the farming industry, the Company is eligible for relevant exemption treatment

and does not need to pay company income tax. In 2008, the local tax authorities

informed the Company that it is eligible for relevant preferential tax

treatment. However, any decision by relevant tax authorities in the future that

the Company is not eligible for tax exemption treatment may materially and

adversely affect its profits, business and financial performance.

Seasonality

The

Company’s operating results and operating cash flows historically have been

subject to seasonal variations. Demand for the Company’s day-old broilers

generally decreases in May and June. Since the Company’s ultimate clients are

mostly farmers and the second quarter is their busy season for reaping, farmers

have little idle time to raise broilers during these months.

Another

low season for the Company’s products is from the second half of December to the

first half of January, which the Company believes is caused by a Chinese

cultural taboo on animal slaughter during the Chinese New Year holiday, which

occurs between late January and early February. Because it usually takes

approximately 45 days for a day-old broiler to reach market weight, the Company

experiences reduced demand for its day-old broilers during the period from 30 to

60 days prior to the Chinese New Year holiday period. In addition, since most

farmers are likely to rest during the Chinese New Year holiday, rather than

work, February would be another low season for the Company’s products.

ITEM

1A. RISK FACTORS.

Not

applicable.

ITEM

1B. UNRESOLVED STAFF COMMENTS.

Not

Applicable.

- 18

-

ITEM

2. PROPERTIES

Land use

rights are carried at cost and amortized on a straight-line basis over the

period of rights of 50 years commencing from the date of acquisition of

equitable interest. According to the laws of PRC, the Chinese government owns

all of the land in the PRC. Companies or individual are authorized to possess

and use the land only through land usage rights approved by the PRC

government.

Facilities

Except

for its breeder farms, PRC Yuhe owns buildings/fixtures and land use rights of

all the other lands used for its operations. Taihong leases all the land and

buildings used for its operations from PRC Yuhe.

PRC Yuhe

owns the land use rights to five parcels of land in Weifang, Shandong Province,

totaling approximately 155,956 square meters. PRC Yuhe has obtained from the

relevant governmental authorities the Land Use Right Certificates of these five

parcels of land. PRC Yuhe has also obtained Building Ownership Certificates for

all the buildings and fixtures erected on those aforementioned five parcels of

land. The first parcel comprises 25,040 square meters and is the location of

hatchery factory No 1 operated by PRC Yuhe. The second parcel of property

comprises 31,450 square meters and is the location of the Company’s corporate

headquarters and living quarters for the Company’s staff. The third parcel

comprises 21,470 square meters which, together with all the buildings erected on

it, has been leased to Taihong for its operation of the feed mill. The exclusive

rights to use each of the foregoing three parcels of land are valid for a period

of 50 years and will expire in 2052 and 2053. The fourth parcel of property

comprises 24,636 square meters and is the location of hatchery factory No 2

operated by PRC Yuhe. The exclusive rights to use the fourth parcel of land are

valid for a period of 50 years and will expire in 2057. The fifth

parcel of property comprises of 53,360 square meters and the Company is in the

process of applying for a land use certificate

PRC Yuhe

has recently purchased in December 2009 13 breeder farms covering a total area

of 37 hectares (560 mu) and acquired all the ground buildings thereon and the

land use rights thereto for 36 years. It already paid 80% of the

purchase price on or before December 31, 2009 and will pay the remaining balance

within 2 months after formal delivery of these farms, which is expected to take

place in March 2010. It will apply to obtain the relevant Land Use

Right Certificates and the Building Ownership Certificate for these 13 breeder

farms in due course.

As to the

other 13 breeder farms, Yuhe PRC does not directly own land or land use rights

for these breeder farms, but leases approximately 374,000 square meters of land

to house these farms. PRC Yuhe has built on the leased land various buildings to

house its breeder farms. These buildings are considered temporary

structures. Because PRC Yuhe does not own these lands for these 13

breeder farms, it did not apply for and was not granted the Land Use Right

Certificate and Building Ownership Certificate for these breeder farm lands it

leased and the buildings it has erected on the leased land. However, PRC Yuhe

has the right to use the breeder farm lands as specified in the Lease Agreement,

which typically last about twenty to forty years. During the term of the

relevant Lease Agreement, all the buildings and fixtures erected by PRC Yuhe on

the leased breeder farm lands are protected by PRC law and PRC Yuhe can freely

dispose of them.

- 19

-

As of

December 31, 2009, both PRC Yuhe and Taihong are not covered by any insurance.

It is the Company’s understanding that other large agricultural factory entities

in China in the same industry are not covered by insurance as well. The Company

would like to insure both day-old broilers and parent breeders, which are its

main asset; however, such insurance policies are not available in

China.

As of

December 31, 2009, the Group had capital commitment amounting to $19,632,305 in

relation to the construction cost, land acquisition and farm acquisition for PRC

Yuhe and the Group paid deposits of $1,568,907 related to these commitments and

recorded under Deposits paid for acquisition of long term

assets. Further details are set out in the financial

statements.

The

following is a summary of some of the Company’s investment in acquisition of

land and farm construction as of December 31, 2009.

Land for

Hatchery Farm No. 3

On June

10, 2008, PRC Yuhe entered into an agreement with Shandong Meiweite Food Ltd.

and purchased land use rights for 45 years to an area covering 26,666 square

meters. According to the agreement, the total consideration for the

sale and purchase is RMB 10 million, or approximately equivalent to $1.5

million, and a sum of RMB 9 million, or approximately equivalent to $1.3

million, has been paid according to the terms of such agreement. PRC Yuhe will

manage and utilize the land to build a new hatchery, bringing the total number

of hatchery farms to three by the end of May 2010.

Purchase

of Breeding Farms Nos. 3 & 4

On June

7, 2008, PRC Yuhe entered into an agreement with Shandong Anrui Poultry Feed

Ltd. and purchased land and the building on it for a total consideration of RMB

17 million, or approximately $2.5 million, and a sum of RMB 16 million, or

approximately $2.4 million, has been paid according to the terms of such

agreement. PRC Yuhe will utilize this facility as one of its breeding

farms without the need to pay for lease payments after such agreement was

signed. PRC Yuhe will have avoided annual lease payments of $500,000.

The capacity of this breeding farm is 100,000 sets of parent

breeders.

Construction

of Breeding Farm No. 1

On August

15, 2008, PRC Yuhe completed construction work and facilities to set up the

southern farm of breeding farm No 1. On August 30, 2008, PRC Yuhe

purchased 100,000 sets of parent breeders and began to feed. By the end of

December 2008, PRC Yuhe has spent RMB 29 million, approximately equivalent to

$4.5 million, to build breeding farm No 1. The breeding farm can be split

into the southern and the northern regions. The northern farm construction

work and facilities have been set up by the end of February 2010. The

capacity of the northern factory is 130,000 sets of parent

broilers. The residual payment is RMB 6 million, approximately

equivalent to $0.9 million, for the building and facilities; and RMB 4.9

million, approximately equivalent to $0.72 million, in machinery and is

scheduled to be paid progressively from March 2010.

- 20

-

Construction

of Breeding Farm Nos. 2, 3, 5, 6, 7

On

December 6, 2008, PRC Yuhe entered into a construction agreement with a

contractor to build and renovate five of its breeding farms for a total

consideration of RMB2.6 million, approximately equivalent to $380,000. The

construction has been completed at the end of October 2009. The

residual scheduled payment is RMB600,000, approximately equivalent to $87,750,

and is scheduled to be paid by the end of March 2010.

Construction

of Steel Structural Surface for Hatchery Farm No. 3

On

December 10, 2008, PRC Yuhe entered into a construction agreement with a

contractor to build the steel structure for its hatchery farm No. 3 for a total

consideration of RMB3.9 million, approximately equivalent to $570,410. The

estimated completion date of construction is postponed to May 2010 because of

the cold weather and construction will start once the weather is getting

warm. The residual scheduled payment is RMB2 million, approximately

equivalent to $292,520 and is scheduled to be paid two months after completion

of construction.

Construction

of Breeding Farm and Steel Structural Surface

On June

23, 2009, PRC Yuhe entered into two construction agreements with contractors to

build part of the above breeding farms and construct the steel structure for a

total consideration of RMB 6,112,300, approximately equivalent to $893,980, and

RMB5,887,800, approximately equivalent to $861,140, respectively. The

constructions have been completed as of December 31, 2009. As of

December 31, 2009, the Company has paid RMB5,340,000, approximately equivalent

to $781,020, and RMB5,140,000, approximately equivalent to $751,770,

respectively to these two suppliers. The residual scheduled payments

are RMB772,300, approximately equivalent to $112,960, and RMB747,800,

approximately equivalent to $109,370, and are scheduled to be paid in May

2010.

Acquisition

of 13 breeder farms

On

December 24, 2009, PRC Yuhe entered into an agreement to purchase thirteen

breeder farms at a total consideration of RMB103,870,000, approximately

equivalent to $15,191,891. As of December 31, 2009, PRC Yuhe has paid

80% of the total consideration, or RMB 83,000,000, approximately equivalent to

$12,139,472. The remaining balance will be paid within two months after formal

delivery of the farms, expected in early Oct 2010. The farms cover a total area

of 37 hectares (560 mu), for which PRC Yuhe acquired all the ground buildings as

well as the land use rights for 36 years. The purchase price also includes

in-house breeding facilities which supply feed, water and air to the parent

breeders. PRC Yuhe expects to spend RMB17,000,000, approximately equivalent to

$2,490,000 for renovation.

Purchase

of Land Use Right, Building and Facilities

On December 26, 2009, PRC Yuhe entered

into an agreement with Yejiazhuangzi Villagers Commission to purchase the land

use rights for 50 years of a 5.3 hectare (80 mu) parcel of land for RMB18.0

million, approximately equivalent to $2,632,657, which was paid at the end of

2009. PRC Yuhe also paid an additional RMB2 million, approximately equivalent to

$292,517 for a building and other facilities within the area. The construction

of this new breeder farm commenced in February 2010 and is expected to finish by

the second quarter of 2010. The total capital expenditure for construction and

equipment is expected to be approximately RMB17 million, approximately

equivalent to $2,486,000.

- 21

-

Construction

of Breeding Farm No. 1 northern region

On March

1, 2010, PRC Yuhe completed construction work and facilities of breeding farm

no. 1 northern region. This breeder farm covers an area of 20.6 acres

(125 mu) and has capacity for 130,000 parent breeders.

Equipment Leasing and Rental

Arrangement

On

November 11, 2008, PRC Yuhe entered into equipment leasing agreement and

property rental agreement, collectively, the “Agreements”, with Shandong

Nongbiao Purina Feed Co., Ltd., “Shandong Nongbiao Purina”. Shandong Nongbiao

Purina will construct a feed production facility on a property leased from PRC

Yuhe and become the exclusive feed supplier for PRC Yuhe. Pursuant to the terms

and conditions of the Agreements, Shandong Nongbiao Purina will lease certain

equipment for feed production from, and install them at the premises owned by

PRC Yuhe. The lease term for both the equipment leasing agreement and property

rental agreement is 10 years. After completion of the feed production facility,

the lease term commenced on July, 2009 when the production

began. Shandong Nongbiao Purina shall pay to PRC Yuhe an annual

rental payment for the leased land, premises and facilities of RMB 1,500,000,

approximately equivalent to $219,390. As at December 31, 2009, rental

payment of $109,695, approximately equivalent to RMB750,000, has been received

from Shandong Nongbiao Purina. The rent payable by Shandong Nongbiao

Purina under the rental agreement will be offset against the prepaid equipment

rental costs of RMB10,000,000, approximately equivalent to

$1,462,290. As at December 31, 2009, Shandong Nongbiao Purina

advanced USD1,040,340, approximately equivalent to RMB7,113,000, to PRC Yuhe as

rental payment and was recorded as advances from customers.

In

connection with the execution of the Agreements, Shandong Yuhe Food Group Co.,

Ltd., “Yuhe Group”, a PRC company based in Shandong Province, would be the

guarantor of PRC Yuhe for RMB 4,500,000, approximately equivalent to $658,000,

for the first five years and for RMB 3,000,000, approximately equivalent to

$439,000, for the next five years. No guarantee fee is required according to the

above Agreements.

ITEM

3. LEGAL PROCEEDINGS.

Neither

the Company nor any of its direct or indirect subsidiaries is a party to, nor is

any of its property the subject of, any legal proceedings other than ordinary

routine litigation incidental to their respective businesses. There are no

proceedings pending in which any of the Company’s officers, directors, promoters

or control persons are adverse to it or any of the Company’s subsidiaries or in

which they are taking a position or have a material interest that is adverse to

it or any of its subsidiaries.

Neither

the Company nor any of its subsidiaries is a party to any administrative or

judicial proceeding arising under federal, state or local environmental laws or

their Chinese counterparts.

- 22

-

ITEM

4. RESERVED.

PART

II

ITEM

5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES.

Market

Information

Prior to

its migration for trading in Nasdaq, the Company’s common stock was quoted under

the symbol, “YUII.OB” on the OTC Bulletin Board. Trading in the common stock in

the over-the-counter market had been limited and sporadic and the quotations set

forth below were not necessarily indicative of actual market conditions. The

following sets forth high and low bid price quotations for each calendar quarter

during the last two fiscal years that trading occurred or quotations were

available. All prices reflect inter-dealer prices without retail mark-up,

mark-down, or commission and may not necessarily reflect actual transactions.

The following share prices are quoted on OTC Bulletin Board trading system and

Nasdaq. The high and low sales prices for the periods presented have

not been adjusted to reflect the 1: 14.70596492 reverse stock split effected on

April 4, 2008.

On

October 21, 2009, The NASDAQ Stock Market, the “Exchange”, informed the Company

that the Exchange had approved the listing of the Company’s common stock on the

Exchange. The Company’s common stock has ceased trading on the

Over-the-Counter Bulletin Board and commenced trading on the Exchange on October

30, 2009 under the trading symbol “YUII”.

|

High*

|

Low*

|

|||||||

|

2008

– Quarter Ended:

|

||||||||

|

March

31, 2008

|

0.47

|

0.47

|

||||||

|

June

30, 2008

|

6.13

|

2.25

|

||||||

|

September

30, 2008

|

8.50

|

2.05

|

||||||

|

December

31, 2008

|

6.50

|

4.00

|

||||||

|

2009

– Quarter Ended:

|

||||||||

|

March

31, 2009

|

4.00

|

0.31

|

||||||

|

June

30, 2009

|

4.10

|

1.81

|

||||||

|

September

30, 2009

|

6.30

|

3.20

|

||||||

|

December

31, 2009

|

9.69

|

5.44

|

||||||

|

*

|

Source:

Yahoo Finance

|

- 23

-

The most

recent market trade of the Company’s common stock occurred on March 26, 2009 at

the price of $9.25 per share.

As

of December 31, 2009, there were 15,722,180 shares

outstanding.

Securities

Authorized for Issuance under Equity Compensation Plans

The

Company has not reserved any securities for issuance under any equity

compensation plan, as it currently has not adopted any equity compensation

plan.

Dividend

Policy

Prior to

the Company’s entering into the Equity Transfer Agreement, none of Bright Stand,

PRC Yuhe or Taihong has declared any dividends.

The

Company entered into a Stock Purchase Agreement, the “Stock Purchase Agreement”,

with Halter Financial Investments, L.P., a Texas limited partnership, “Halter

Financial”, dated as of November 6, 2007, pursuant to which it agreed to sell to

Halter Financial 951,996 shares of its common stock for $425,000. The

transaction closed on November 16, 2007. As a result of the transaction, Halter

Financial held 951,996 shares, or 87.5% of the Company’s 1,087,994 shares, of

common stock then outstanding following the completion of all matters referred

to above. The Stock Purchase Agreement also required the Company’s Board of

Directors to declare and pay a special cash dividend of $3.088 per share to the

Company’s shareholders on November 19, 2007. Halter Financial did not

participate in such dividend. The dividend was payable to shareholders of record

on November 15, 2007, which was prior to the date the shares were issued to

Halter Financial under the Stock Purchase Agreement. The dividend payment date

was November 19, 2007. The dividend was payable to the Company’s shareholders

who held 135,999 shares of the Company’s common stock and resulted in a total

dividend distribution of $420,000. The funds for the dividend came from the

$425,000 proceeds received from the sale of common stock to Halter

Financial.

Any

future determination as to the declaration and payment of dividends on the

Company’s common stock will be made at the discretion of the Company’s board of

directors out of funds legally available for such purpose. The Company is under

no contractual obligations or restrictions to declare or pay dividends on its

common stock. In addition, the Company currently has no plans to pay such

dividends. However, even if it wishes to pay dividends, because its cash flow is