Attached files

| file | filename |

|---|---|

| EX-4.3 - Parabel Inc. | v179026_ex4-3.htm |

| EX-21 - Parabel Inc. | v179026_ex21.htm |

| EX-4.1 - Parabel Inc. | v179026_ex4-1.htm |

| EX-4.2 - Parabel Inc. | v179026_ex4-2.htm |

| EX-32.1 - Parabel Inc. | v179026_ex32-1.htm |

| EX-31.1 - Parabel Inc. | v179026_ex31-1.htm |

| EX-10.4 - Parabel Inc. | v179026_ex10-4.htm |

| EX-31.2 - Parabel Inc. | v179026_ex31-2.htm |

| EX-10.5 - Parabel Inc. | v179026_ex10-5.htm |

| EX-99.1 - Parabel Inc. | v179026_ex99-1.htm |

| EX-10.3 - Parabel Inc. | v179026_ex10-3.htm |

| EX-10.6 - Parabel Inc. | v179026_ex10-6.htm |

| EX-32.2 - Parabel Inc. | v179026_ex32-2.htm |

| EX-10.2 - Parabel Inc. | v179026_ex10-2.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended: December 31, 2009

or

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

File Number: 0 - 24836

PetroAlgae

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation)

|

33-0301060

(IRS Employer Identification No.)

|

|

1901

S. Harbor City Blvd., Suite 300

Melbourne,

FL

|

32901

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 321-409-7500

Securities

registered under Section 12(b) of the Exchange Act:

None

Securities

registered under to Section 12(g) of the Exchange Act:

Common

Stock, $.001 Par Value

(Title of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. YES ¨ NO x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act. YES ¨ NO x

Indicate

by check mark whether the registrant (1) filed all reports required to be filed

by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for

such shorter period that the Registrant was required to file such reports) and

(2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. YES x NO ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in the definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by checkmark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer or a smaller reporting company (as defined in

Exchange Act Rule 12b-2).

|

Large

Accelerated Filer ¨

|

Accelerated

Filer ¨

|

Non-accelerated

filer ¨

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). YES ¨ NO x

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

sold, or the average bid and asked price of such common equity, as of the last

business day of the registrant’s most recently completed second fiscal quarter

was approximately $2,005,144 (250,643 shares at $8.00).

The

number of shares outstanding of the registrant’s common stock as of March 25,

2010 was 106,454,480 shares of common stock, all of one class.

PETROALGAE

INC.

ANNUAL

REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

INDEX

|

2

|

||

|

ITEM

1.

|

Business

|

2

|

|

ITEM

1A.

|

Risk

Factors

|

8

|

|

ITEM

1B.

|

Unresolved

Staff Comments

|

14

|

|

ITEM

2.

|

Properties

|

15

|

|

ITEM

3.

|

Legal

Proceedings

|

16

|

|

ITEM

4.

|

(Removed

and Reserved).

|

17

|

|

PART

II

|

18

|

|

|

ITEM

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

18

|

|

ITEM

6.

|

Selected

Financial Data

|

20

|

|

ITEM

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

21

|

|

ITEM

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

28

|

|

ITEM

8.

|

Financial

Statements and Supplementary Data

|

29

|

|

ITEM

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

47

|

|

ITEM

9A(T).

|

Controls

and Procedures

|

48

|

|

ITEM

9B.

|

Other

Information

|

50

|

|

PART

III

|

51

|

|

|

ITEM

10.

|

Directors,

Executive Officers and Corporate Governance

|

51

|

|

ITEM

11.

|

Executive

Compensation

|

54

|

|

ITEM

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

55

|

|

ITEM

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

56

|

|

ITEM

14.

|

Principal

Accounting Fees and Services

|

57

|

|

59

|

||

|

ITEM

15.

|

Exhibits,

Financial Statement Schedules

|

59

|

-i-

PART

I

|

ITEM

1.

|

BUSINESS

|

General

PetroAlgae

Inc. is a Melbourne, Florida-based Delaware corporation that develops and

commercializes new technologies to grow and harvest micro-crops used as

feedstock to commercial refineries and other energy producers which results in

the production of drop-in fuels. PetroAlgae’s technologies and processes also

result in a high valued protein co-product suitable for animal and potentially

human consumption.

When we

use the terms “PetroAlgae,” “the Company,” “we,” “us” and “our,” we mean the

combined business of PetroAlgae Inc., a Delaware corporation, and PA LLC, a

Delaware limited liability company.

Financial

information concerning our business for each of 2009 and 2008 is set forth in

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations,” the consolidated financial statements and the notes thereto, and

the supplemental financial information, which are in Part II, Items 7, 7A

and 8 of our Annual Report on Form 10-K.

Our

internet address is www.petroalgae.com and the investor section of our web site

is located at https://investor.petroalgae.com/. We make available free of

charge, on the investor section of our web site, annual reports on Form 10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to

those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S.

Securities Exchange Act of 1934 (Exchange Act), as well as proxy statements, as

soon as reasonably practicable after we electronically file such material with,

or furnish it to, the U.S. Securities and Exchange Commission. Also posted on

our web site, and available in print upon request of any shareholder to our

Investor Relations Department, are our certificate of incorporation and by-laws

and our Code of Business Conduct and Ethics governing our directors, officers

and employees. Within the time period required by the SEC, we will post on our

web site any amendment to the Code of Business Conduct and Ethics and any waiver

applicable to any executive officer, director or senior financial officer (as

defined in the Code). Our Investor Relations Department can be contacted at

PetroAlgae Inc., 1901 S. Harbor City Blvd., Suite 300, Melbourne, FL 32901,

telephone: 321-409-7272, email: investorrelations@petroalgae.com.

Cautionary

Statement Pursuant to the U.S. Private Securities Litigation Reform Act of

1995

We have

included or incorporated by reference in this Annual Report on Form 10-K, and

from time to time our management may make, statements that may constitute

“forward-looking statements” within the meaning of the safe harbor provisions of

the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements are not historical facts but instead represent only our beliefs

regarding future events, many of which, by their nature, are inherently

uncertain and outside our control. These statements include statements other

than historical information or statements of current condition and may relate to

our future plans and objectives and results, among other things, as well as

statements about trends in or growth opportunities for our business, in Part II,

Item 7 of this Annual Report on Form 10-K. By identifying these statements for

you in this manner, we are alerting you to the possibility that our actual

results and financial condition may differ, possibly materially, from the

anticipated results and financial condition indicated in these forward-looking

statements. Important factors that could cause our actual results and financial

condition to differ from those indicated in the forward-looking statements

include, among others, those discussed under “Risk Factors” in Part I, Item 1A

of this Annual Report on Form 10-K.

History

PetroAlgae

LLC, now called PA LLC, was founded in 2006 in Melbourne, FL as a private

company focused on developing enabling technologies for the renewable energy

market. In August of 2008, PetroTech Holdings Corp. (“PetroTech Holdings”)

acquired all of the equity in PA LLC held by XL TechGroup, Inc. in exchange for

the release of certain accumulated debt obligations.

-2-

In

December 2008, PetroTech Holdings (i) acquired Dover Glen Inc. ("Dover Glen"), a

shell company listed on the OTC Bulletin Board, (ii) assigned its entire

interest in PA LLC to Dover Glen, and (iii) changed Dover Glen’s name to

PetroAlgae Inc. As a result of the acquisition and assignment, the business of

PA LLC became the sole line of business of PetroAlgae.

PetroAlgae

(as its predecessor Dover Glen) was originally incorporated in the state of

California on April 15, 1988, and it changed its domicile to Delaware on August

12, 2008.

PetroTech

Holdings is owned by Valens U.S. SPV I, LLC, a Delaware limited liability

company (“Valens U.S.”), Valens Offshore SPV I, Ltd., a Cayman Islands limited

company (“Valens SPV I”), Valens Offshore SPV II, Corp., a Delaware corporation

(“Valens SPV II”), Laurus Master Fund, Ltd. (In Liquidation), a Cayman Islands

limited company (the “Fund”), Calliope Capital Corporation, a Delaware

corporation (“CCC”) and PSource Structured Debt Limited, a Guernsey company

(“PSource”). The Fund, CCC and PSource are each managed by Laurus Capital

Management, LLC, a Delaware limited liability company (“LCM”). Valens U.S.,

Valens SPV I and Valens SPV II are each managed by Valens Capital Management,

LLC (“VCM”). Eugene Grin and David Grin, through other entities, are the

controlling principals of LCM and VCM and share sole voting and investment power

over all securities of the Company held by PetroTech Holdings. Eugene Grin and

David Grin disclaim beneficial ownership of the securities of the Company held

by PetroTech Holdings, except to the extent of such person’s pecuniary interest

in PetroTech Holdings, if any.

During

the course of 2009, the Company issued and sold PetroAlgae common stock and

warrants to purchase common stock in a series of private placement transactions,

including:

|

|

·

|

308,813

shares of common stock to Valens U.S. for the purchase price of $8.00

per share, and 5 year warrants to purchase 308,813 shares of PetroAlgae’s

common stock at an exercise price of $15.00 per

share;

|

|

|

·

|

253,687

shares of common stock to Valens SPV I for the purchase price of $8.00 per

share, and 5 year warrants to purchase 253,687 shares of PetroAlgae’s

common stock at an exercise price of $15.00 per

share;

|

|

|

·

|

375,000

shares of common stock to Green Alternative Energy USA, LLC for the

purchase price of $8.00 per share, and a 5 year warrant to purchase

375,000 shares of PetroAlgae’s common stock at an exercise price of $15.00

per share;

|

|

|

·

|

500,000

shares of its common stock to UBS AG for the purchase price of $8.00 per

share, and a 5 year warrant to purchase 500,000 shares of PetroAlgae’s

common stock at an exercise price of$15.00 per

share;

|

|

|

·

|

357,143

shares of common stock to Green Science Energy LLC in return for thirty

percent (30%) of the outstanding equity interests, on a fully diluted

basis, in Green Science Energy LLC, and a 5 year warrant to purchase

357,143 shares of PetroAlgae’s common stock at an exercise price of $15.00

per share, along with an option, which expires on June 30, 2010, to

purchase: (i) 250,000 shares of PetroAlgae’s common stock at an exercise

price of $8.00 per share, and (ii) a warrant to purchase 250,000 shares of

PetroAlgae’s common stock at an exercise price of $15.00 per

share.

|

The

proceeds from these private placements are used for working capital

purposes.

– 3

–

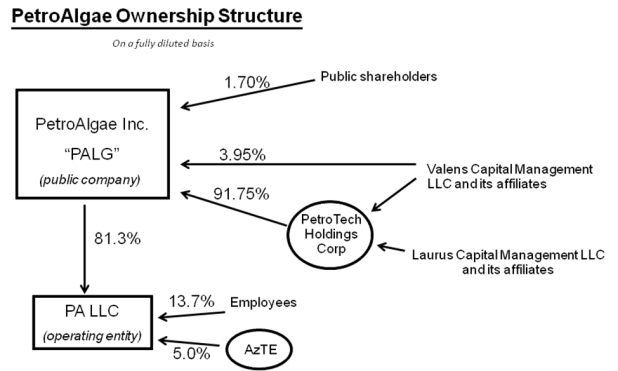

The

diagram below sets forth a simplified presentation of our corporate structure,

as of December 31, 2009, immediately following the transactions described

above.

PetroAlgae

Inc.

Company

Overview

PetroAlgae

develops new technologies to economically grow, harvest and process micro-crops.

The Company’s primary business model is to license this technology to large

customers who will commercially produce this biomass, which in turn is separated

into two co-products 1) renewable fuel feedstock and 2) protein for animal feed

and potentially a human supplement. The renewable fuel product is

intended to be used as a direct feedstock to energy producers, including

existing refineries. In the case of commercial refineries, this is expected to

result in drop-in fuels such as diesel and jet fuel. When used in existing

fermentation facilities, it is expected to directly result in ethanol

production. When used as a feedstock for other energy producers, particularly

power generators, it is a renewable input source for co-firing with fossil

fuels.

PetroAlgae

believes that use of PetroAlgae’s proprietary technology will allow the user to

achieve a greater level of productivity than can be realized with other standard

biomass growing techniques, and believes that this increased growth optimization

is critical to the ability to produce products that can profitably be grown at

commercial commodity scale without requiring subsidies.

In 2009,

the Company completed a working demonstration facility in Florida showing the

Company’s technology, processes and yield, with two reactors of commercial scale

(approximately one hector each). The growth reactors on this site are

designed to be modular to support rapid deployment with a relatively high

predictive cost and productivity. The processing segment of this

facility demonstrates the functionality of the required equipment used to

process the harvested biomass into the products that the Company’s customers

could derive from their licensed systems. For certain segments of

this facility PetroAlgae has obtained independent audits and third-party

verification for product composition, product applications and use, and facility

yields. The Company expects that many more studies and audits will be conducted

to further commercialization efforts.

– 4

–

For this

reason, the Company has attracted a sizable number of prospective customers who

have the capability to license the PetroAlgae technology in return for licensee

fees and royalties.

Market

Background

There is

a pressing worldwide demand for alternative fuel solutions which is both large

and immediate. Predicted future shortages of petroleum oil, and in particular,

of residuum, the heavy fraction of crude, and continued pricing uncertainty in

petroleum oil supply have led to significant growth in the need for biomass

feedstock. Global consumption of petroleum diesel fuel (as one example) exceeds

200 billion gallons annually and continues to grow at a rate that exceeds

improvements in production. The gap between supply and demand is widening and

drove prices during 2008 to historically high levels. Beyond the economic issues

associated with petroleum, there are also significant environmental challenges:

petroleum fuels are non-renewable, produce many pollutants and release large

quantities of carbon dioxide into the atmosphere when burned.

PetroAlgae

is developing a commercial, scalable solution to meet this need through the

commercial-scale production of biomass which can be used as feedstock in

existing refineries to produce drop-in fuel such as diesel and jet fuel.

The fuels are called “drop-in” because they are functionally identical to

the petroleum based versions they supplement, and hence, drop-in to the existing

infrastructure (pipeline, tankers, etc.). PetroAlgae’s system is designed to

provide quality feedstocks at prices which compete directly with petroleum

residuum, with a production system that is operational in a much shorter time

frame than other natural or synthetic methods of biomass production. The

Company’s production processes are intended to be sustainable and

resource-efficient. When these development processes are optimized,

significantly less land would be required than most biofuel feedstocks. Since

arable land is not required, farm land and rain forests do not need to be

negatively impacted.

PetroAlgae’s

technology also produces a high quality protein as a co-product which is

suitable as an ingredient in animal feed and potentially human food. Currently,

the availability of protein (especially in developing countries) that meets cost

and nutrition requirements is lacking. A parallel problem in the food market is

the growing concern of pesticides from conventionally grown protein sources that

remain in feed to animals are then transferred to human food products. The

annual market for animal feed is estimated by PetroAlgae to be approximately

$15-20 billion dollars and is projected to grow at a compounded annual growth

rate of 28% (as estimated by FAOSTAT).

Business

Development

PetroAlgae’s

business model is primarily based on licensing and/or joint ventures with

partners who will share both the risk and the reward. As the proprietor of the

technologies and processes, PetroAlgae assumes the development risk and

optimizes its production processes. Licensing and joint venture partners will

assume the costs of capital equipment at their sites. Profits will then be

shared between parties through payments to PetroAlgae in the form of milestone

payments during construction, licensing fees, and royalties thereafter. We

believe partners are interested in this model for the following

reasons:

|

|

·

|

First,

we believe we have the highest likelihood of being the first to achieve

commercial success in the marketplace due to the technical progress made

to date.

|

|

|

·

|

Second,

we believe we are the most likely to be producing biomass at an

economically viable rate as evidenced by the production results already

realized.

|

|

|

·

|

Third,

we intend to provide deployment processes to partners as part of the

licensing agreements which further reduces deployment risk for our

partners.

|

With this

business model, revenues and profit sharing generated by PetroAlgae would

consist of a combination of upfront payments, licensing fees, milestone payments

and royalties, and in some cases, sharing of profits. Royalties would be earned

by PetroAlgae from the sale of biocrude and protein from the licensee to the

marketplace.

– 5

–

Our

commercialization strategy focuses on maximizing licensing opportunities

worldwide based on the licensee’s need for a solution and ability to implement

PetroAlgae’s technology. This includes discussions with hundreds of potential

licensees spanning 40 countries whose combined needs for large-scale biomass

production are significant.

Since

inception, we have been subject to tax by both federal and state taxing

authorities. Until the respective statutes of limitations expire, we are subject

to income tax audits in the jurisdictions in which we operate. We are no longer

subject to U.S. federal tax examinations for fiscal years prior to 2005, and we

are not subject to audits prior to the 2005 fiscal year for the state

jurisdiction.

While

sales cycles for large licensing deals are traditionally long, the market’s

growing acceptance of our technology continues to increase as reflected by the

successful signing of a number of non-binding Memorandums of Understanding

(“MOU”) from among many qualified business discussions. Under the

MOUs, PetroAlgae and the potential licensee agree to negotiate a final license

contract. However, key contract terms set forth in the MOU may change

pending final negotiations and the negotiations may not always result in a final

contract.

In March

2009, PetroAlgae entered into a Master Licensing Agreement with GTB Power

Enterprise Ltd. to construct and operate at least ten separate 5,000 hectares

(12,355 acres) license units for the production of micro-crop biomass in

China. Recently the Company entered into a MOU with CECIC Chongqing

Industry Co., Ltd (CECIC-CQ), an operating subsidiary of the China Energy

Conservation Investment Corporation (CECIC), the state owned company which has

completed over 3,000 energy conservation projects in

China. This MOU contemplates that the Master License Agreement

for China held by GTB Power Enterprise Ltd. would be transferred to CECIC, or

that CECIC would otherwise become PetroAlgae’s exclusive licensee in China in

conjunction with the termination of the license with GTB Power Enterprise

Ltd. Our intent, in support of the foregoing, is to accelerate

PetroAlgae’s penetration of China’s renewable energy market.

In

December 2009, PetroAlgae signed an MOU

intended to result in the license of the Company’s technology to a large

conglomerate in Indonesia. This prospect’s various businesses cover a range of

activities including palm oil, property development, leisure and agriculture.

The MOU contemplates that this group would initially build a partial license

unit to demonstrate the commercial viability of producing renewable fuels in

Indonesia with the remaining portion of the full license unit 5,000 hectares to

follow.

In

November 2009, PetroAlgae entered into an MOU with Indian Oil Corporation

Limited (“IOCL”), a Fortune 500 company and one of the largest commercial

enterprises in India, to potentially license PetroAlgae’s technology. Under the

terms of the MOU, IOCL would build a pilot facility to demonstrate the

commercial viability of producing renewable fuels from micro-crops in India.

Upon achieving success, the pilot facility would be expected to lead to the

deployment of a licensed unit for large-scale production of renewable fuels by

IOCL.

Technology

and Intellectual Property

PetroAlgae

has made significant progress in 2009 with respect to its

technology. The Company’s biomass has been, and continues to be,

tested for suitability as a coker feedstock for existing petroleum

refineries. Independent pilot-scale testing indicates that the biomass can

be practically processed in the coker, and that the resulting fuel yields are

sufficient to economically compete with residuum (the current feedstock used in

fuel production).

In

December 2009, PetroAlgae entered into an MOU which contemplates a strategic

partnership with Foster Wheeler USA Corporation, a global leader in energy

engineering solutions, to develop and co-market end-to-end market solutions for

the large-scale production of green renewable gasoline, diesel, and jet fuel in

existing petroleum refineries. Foster Wheeler USA Corporation is also

providing PetroAlgae access to commercial cokers for future conversion

testing.

– 6

–

In

complement to the development in the coker application, recent and ongoing

combustion tests indicate that the biomass could be an effective renewable

drop-in offset in coal-fired power plants and boilers.

With

regard to PetroAlgae’s protein co-product, several

significant advances have also occurred during the course of the year. First,

third party laboratory testing has confirmed a favorable amino acid profile as

compared with soy protein, the current industry standard. The amino

acid profile is an important price driver for the sale of protein. Second,

recent animal feed trials of PetroAlgae’s protein in poultry demonstrate that

digestibility is comparable to concentrated soy protein. In addition, in

November 2009, the Company’s protein was successfully cleared by the Indonesian

Ministry of Agriculture as an approved raw material to be used and/or imported

for use as an ingredient in animal feed.

In

anticipation of this progress, PetroAlgae has implemented an aggressive strategy

to secure its intellectual property. This strategy comprises pursuing

patent protection, intentionally guarding trade secrets and implementing

remotely-controlled security devices. The Company’s technology and

processes include, but are not limited to optimized nutritional schemes, light

management, selective harvesting, and distinct extraction processes. In addition

to the intellectual property strategy, we have pursued trademarks designed to

protect our marketing and branding efforts. To accomplish its technical success,

PetroAlgae bolsters its own development efforts by utilizing third-party

technology contributors where appropriate.

Raw

Materials

The

company uses primarily 4 categories of raw materials in its pilot demonstration

facility, micro-crop species, fertilizer, water, and naturally available

elements such as sunlight and CO2. The

micro-crops are natural and indigenous to the Florida region. The Company grows

the crops on site from small cultures to large quantities used to inoculate the

Company’s commercial-scale bioreactors. Water is sourced locally and

recycled. Fertilizer is readily available and optimized with other

readily available micronutrients that are used commonly in

agriculture. Similar processes and use of raw materials will be

applied with each customer, applicable to their specific geographic

location.

Competition

As the

world searches for viable petroleum replacements, biofuels have attracted

significant interest. At first glance, biofuels in general appear to have very

desirable characteristics such as being renewable, sustainable and

environmentally friendly. However, many current biofuel feedstocks do

not meet these criteria. Although many crops are renewable, many also happen to

be staples of the food supply. Thus, there is now serious competition for both

the food and fuel industries. Further compounding the problem is the fact that

yields for other plant-based crops are very low, whereas demand for fuel is very

high. Using traditional feedstocks, there is not enough available land to

satisfy the projected mandated demand. Furthermore, efforts to create additional

crop land have had a very damaging effect on the environment. For example, in

certain countries, tropical rainforests are being burned so that palm

plantations can be expanded.

The

micro-crop based solution from PetroAlgae has potential to successfully address

all of these issues. Not surprisingly, there are many new entrants in the algae

and micro-crop market, some of whom have started to build demonstration

facilities and sign preliminary agreements with potential customers. Of the

approximately 200 algae/micro-crop companies (worldwide), the overwhelming

majority are focused on the production of biodiesel/ethanol specifically, rather

than drop-in fuels that can utilize existing refining and pipeline

infrastructure. A small subset of these companies indicates an

understanding of the drop-in-fuel approach as well as the advantage in providing

a new protein source rather than depleting the current

food-supply. Moreover, no competitors, to our knowledge, have

demonstrated economic feasibility at commercial scale without depending on

government subsidies.

Employees

PetroAlgae

has been successful in recruiting experienced, cross-disciplined professionals

to develop the company to date. The Company employed 113 full-time individuals

as of December 31, 2009. During 2010, PetroAlgae anticipates continued growth

and is planning to appropriately build out its human infrastructure necessary to

accomplish the Company’s goals as it is successful in obtaining customer license

projects. This includes, but is not limited to, sustaining aggressive

research and development and continuing the business efforts of developing and

supporting potential and secured licensees.

– 7

–

|

ITEM

1A.

|

RISK

FACTORS

|

We

face a variety of risks that are substantial and inherent in our business,

including market, liquidity, credit, operational, legal and regulatory risks.

The following are some of the more important factors that could affect our

business and should be considered carefully. In addition, these statements

constitute our cautionary statements under the Private Securities Litigation

Reform Act of 1995.

Risks

Related to Our Business

We

may be unable to solve technical and engineering challenges that would make the

production of micro-crops systems non-scalable at economically attractive

metrics.

Although

we have successfully built a pilot scale demonstration facility, and have

extracted small field scale quantities of biocrude and protein for technical

validation, the fully automated commercial design and engineering of a larger

production system is still under design and cost-analysis. The risk

exists that the completion of this process design and engineering may face

delays, failures, or unexpected costs and that we may not be able to

successfully design a scalable, cost-effective system for the growth and

harvesting of micro-crops. Even in the event that we are able to design and

engineer a complete micro-crop production system, the risk exists that once a

licensee begins to scale up and replicate such a system, unforeseen factors and

issues may arise which makes any such system uneconomical, thus causing

additional delays or outright failure.

We

face significant challenges in successfully and rapidly scaling-up a pilot

facility.

Additional

capital expenditures are required for the micro-crop production facility. We

will need to successfully scale-up the pilot facility to produce larger

quantities and measure production yields. The risk exists that failure to

successfully scale-up the demonstration facility will result in new technical

hurdles and/or delayed commercialization efforts.

We,

or our potential licensees, may be unable to deploy our system at

scale.

To date,

neither PetroAlgae nor its existing licensee has constructed a facility

utilizing PetroAlgae’s proprietary system of growing and harvesting micro-crops

on the commercial scale currently anticipated (i.e. 5000 hectares per

unit). Therefore, it has yet to be proven whether PetroAlgae’s system

may be deployed on a full commercial scale or operate in a commercially viable

manner. Additionally, it is unknown whether key performance metrics,

such as (by way of example) growth and production rates, may be maintained at a

full scale commercial level. While PetroAlgae intends to be actively involved in

the construction of the facilities by PetroAlgae’s licensees, and only license

its technology to potential licensees which it believes can effectively build

and operate facilities utilizing its system, such licensees may ultimately lack

the expertise or the resources, or otherwise be unable, to do so.

We

may be unable to acquire and/or retain licensees.

PetroAlgae’s

main source of revenue will be in the form of licensing fees and royalties from

its future licensees. Therefore, obtaining new licensees is critical for

PetroAlgae’s continued growth and operation. There is a risk that PetroAlgae

will be unable to acquire and/or retain licensees due to (by way of example) the

proposed licensing fees, royalties, capital expenditures or technical

feasibility of the PetroAlgae micro-crop system. For example, the

growth from the PetroAlgae micro-crop production system and the relevant

processes and methodologies being considered for operating the system may not

yield a result that is commercially attractive to potential licensees (on a

single unit cost compared to competitive products or otherwise), or to potential

licensees in certain targeted markets. Our micro-crop production system requires

large fixed capital costs, which could render the system cost prohibitive for

potential licensees, or potential licensees in certain target markets. Failure

to secure licensees in a timely manner could have a material adverse effect on,

or cause us to cease, our continued operations.

– 8

–

Our

licensing methodology may not be accepted by potential licensees.

Our

revenue projections are based on a model for licensing agreements which may not

be accepted by our potential licensees. Specifically, without

limitation, potential licensees may be unwilling to pay the projected licensing

fees prior to or during construction of the PetroAlgae system and/or full

commercial deployment of such system. While one licensee has agreed to do so, it

is unknown whether future licensees would be so willing, or even whether the

existing licensee will be able to fulfill its payment obligations. Therefore,

even if we are successful at attracting new licensees for our system, we may not

realize revenue from such licensees in the form or time frame we currently

anticipate. Even if licensees execute licensing agreements in the form currently

anticipated, there is no guarantee that such licensees will make payments in the

time frame to which they may agree. If potential licensees are unwilling or

unable to pay as anticipated, the projected timing of our revenues and incoming

cash flows could have a material adverse effect on, or cause us to cease, our

continued operations.

Licensees

who are or have been retained may be unable to perform their obligations to

PetroAlgae.

PetroAlgae’s

main source of revenue will be in the form of licensing fees and royalties from

its future licensees. Although PetroAlgae has signed its first licensing

agreement, PetroAlgae has yet to realize revenue from such licensee beyond the

initial payment as a master licensee. If PetroAlgae does not begin to

realize revenues from licensee, or obtain new licensees, it may have a material

adverse effect on our revenues, our operations, or may cause us to cease

operations altogether.

The

market may not accept the products produced by our micro-crop production

system.

The

biomass produced by our micro-crop production system produces two primary

products, biocrude (feedstock) and protein. These products will be

sold by licensees into existing markets and it is expected that oil prices and

protein prices will fluctuate. If they were to drop significantly, this may have

an effect on the licensee’s expected profitability or their ability to secure

end-customers. These products may also require industry and/or regulatory

testing in the country in which they are produced and/or sold. This

may have an effect on the licensee’s ability to secure end customers and

potentially, PetroAlgae’s licensing fees and royalties. It has yet to be proven

that potential buyers for specific products produced by our system, including

without limitation refineries and feed companies, would ultimately purchase

these products produced by licensees of the PetroAlgae

system. Failure to establish such a market or any significant

reduction in a licensee’s profitability may result in failure to pay PetroAlgae

the projected licensing fees and royalties. Any of these may have a material

adverse effect on our revenues and results of operations, or cause us to cease

operations altogether.

We

are dependent upon funding from our principal shareholder.

To date,

we have been dependent upon funding from PetroTech Holdings and its affiliates.

If available capital is expended, PetroTech Holdings and its affiliates may be

unable to continue to fund the Company as PetroTech Holdings and its affiliates

(including without limitation those funds currently managed by Valens Capital

Management, LLC), may not have the necessary resources

available. Moreover, PetroTech Holdings and its affiliates may simply

be unwilling to continue to provide funding to the Company given the amount of

funds contributed to date. In such case, the Company may need to

enter into agreements under less favorable terms, or borrow funds at higher

interest rates and under less favorable terms and conditions than historically

obtained from PetroTech Holdings and its affiliates. There is no

certainty as to whether any new funding source would even be available. If

funding is not available when needed, or is available only on unfavorable terms,

we may be unable to implement our development plan, enhance our existing

business, complete acquisitions or otherwise take advantage of business

opportunities or respond to competitive pressures, any of which could have a

material adverse effect on our production, revenues and results of operations,

or cause us to cease operations altogether.

We

may be unable to fully enforce our intellectual property in certain

countries.

We are

partially dependent on the enforceability of our intellectual property rights.

We expect to expand the use of our technology into countries that may not

provide adequate legal remedies in the event of a violation of the Company’s

technology. Although the Company has taken measures to secure the appropriate

patents and methods to protect trade secrets, we may not be able to fully

execute our business plan and/or may face significant competition if we fail to

adequately protect our processing technology. Lack of enforceability may lead to

significantly lower licensing fees which could have a material adverse effect on

our operations.

– 9

–

We

may not be able to recruit and retain the necessary specialist and experienced

individuals.

PetroAlgae

currently relies on key individuals in the management and operation of its

business. In order to continue the research and design of the

PetroAlgae production system and move to larger commercial scaling and

deployment, it will be necessary for us to recruit a significant number of

additional qualified individuals including experienced management and specific

subject-matter experts. Additionally, technical support personnel will be needed

to support the licensees when we begin to commercially scale worldwide. Any

inability to retain key employees or obtain the appropriate resources through

hiring, outsourcing or through other contractors could delay or impair our

ability to achieve successful results.

We

have a history of losses and there is no guarantee we will achieve positive cash

flow.

PetroAlgae

has a history of operating losses since inception. The Company expects losses to

continue and does not expect positive cash flow from operations in the near

term. There is no guarantee that the Company will achieve cash flow positive

operations prior to expending its available capital.

We

may not be able to rapidly switch our industry-focus.

“Biofuel”

is a general term and comprises a wide variety of technologies that could be

considered “green” technologies. For the foreseeable future, we expect to be

completely focused specifically on the production and marketing of micro-crops

that produce a feedstock for the fuel industry and proteins for the animal and

human feed markets. Accordingly, an industry shift away from green feedstocks or

the emergence of new competing products may reduce the demand for our products.

The risk remains that we may be unable to shift our business focus to other

technologies/products rapidly to respond to any drastic shifts in the

industry.

If

a competitor were to achieve a technological breakthrough, our operations and

business could be negatively impacted.

There

currently exist a number of businesses that are pursuing the use of algae,

bacteria and other micro-crops and other methods for creating biomass and/or

alternative fuels. Should a competitor achieve an R&D, technological or

biological breakthrough where production costs are significantly reduced, or if

the costs of similar competing products were to fall substantially, we may have

difficulty attracting licensees. Additionally, competition from other

technologies considered “green technologies” could lessen the demand for our

products. Furthermore, competitors may have access to larger resources (capital

or otherwise), that propel their progress in the market place, resulting in a

negative impact on PetroAlgae’s business. Any of these competitive forces may

inhibit our ability to attract and/or retain licensees and there is no guarantee

that we could sustain our expected licensing fees or royalties on an on-going

basis. This could have a material adverse effect on, or cause us to cease, our

operations.

– 10

–

Minority

shareholder interest in PA LLC (which is the operating entity of PetroAlgae

Inc.) could materially affect the operation of the Company or investment in the

Company.

Our

operations are currently conducted through PA LLC. We own an approximate 81.3%

ownership interest in the membership interests of PA LLC. Other than membership

interests issued as part of our employee compensation plans, Arizona Science

& Technology Enterprises, LLC ("AZTE") owns the remaining membership

interests in PA LLC. The operating agreement of PA LLC provides AZTE with

anti-dilution protection and other minority investor rights (including consent

rights over certain corporate actions, such as mergers between PA LLC and any

other entity if PetroAlgae Inc. would not own a majority of the voting power of

the resulting entity) which could have the effect of impairing our ability to

operate the business if we do not secure the cooperation of AZTE. If this were

to happen, any investment in PetroAlgae Inc. could materially

suffer.

We

may be sued or become a party to litigation

While we

have no knowledge of any threatened litigation matters, we may be subject to

lawsuits from time to time arising in the ordinary course of our business. We

may be forced to incur costs and expenses in connection with defending ourselves

with respect to such litigation and the payment of any settlement or judgment in

connection therewith if there is an unfavorable outcome. The expense of

defending litigation may be significant. The amount of time to resolve lawsuits

is unpredictable and defending ourselves may divert management’s attention from

the day-to-day operations of our business, which could adversely affect our

business, results of operations and cash flows. In addition, an unfavorable

outcome in any such litigation could have a material adverse effect on our

business, results of operations and cash flows.

None

of the directors of the Company are independent directors.

All of

the members of the board of directors of the Company have a direct or indirect

material financial relationship with the Company and are also currently either

employed or engaged by the Company, PetroTech Holdings, or affiliates thereof.

These relationships may interfere with the ability of the directors to exercise

independent judgment with respect to the Company.

Risks

Related to Our Common Stock

The

market price of our common stock is likely to be highly volatile and subject to

wide fluctuations.

The

market price of our common stock and the market prices for securities of

biotechnology companies in general, are expected to be highly volatile. The

following factors, in addition to the other risk factors described, and the

potentially low volume of trades in our common stock, may have a significant

impact on the market price of our common stock, some of which are beyond our

control: announcements of technological innovations and discoveries by us or our

competitors; developments concerning any research and development,

manufacturing, and marketing collaborations; new products or services that we or

our competitors offer; actual or anticipated variations in operating results and

expenses; the initiation, conduct and/or outcome of intellectual property and/or

litigation matters; conditions or trends in our industry; regulatory

developments in the United States and other countries; changes in the economic

performance and/or market valuations of other biofuel companies; our

announcement, or competitors’ announcements, of significant acquisitions,

strategic partnerships, joint ventures or capital commitments; additions or

departures of key personnel; dilution caused by our issuance of additional

shares of common stock and other forms of equity securities, which we expect to

make in connection with future capital financings to fund operations and growth,

to attract and retain valuable personnel and in connection with future strategic

partnerships with other companies; changes in expectations as to our business,

prospects, financial condition, and results of operations; significant sales of

our common stock, including sales by selling stockholders and by future

investors in any future offerings we may make to raise additional capital;

changes in the accounting methods used in or otherwise affecting our industry;

changes in the valuation of similarly situated companies, both in our industry

and in other industries; fluctuations in interest rates and the availability of

capital in the capital markets; and global unrest, terrorist activities, and

economic and other external factors.

– 11

–

The stock

market in general has recently experienced relatively large price and volume

fluctuations. In particular, market prices of securities of biofuel companies

have experienced fluctuations that often have been unrelated or disproportionate

to the operating results of these companies. Continued market fluctuations could

result in extreme volatility in the price of the common stock, which could cause

a decline in the value of the common stock. Price volatility may be worse if the

trading volume of the common stock is low.

These and

other factors are largely beyond our control, and the impact of these risks,

singly or in the aggregate, may result in material adverse changes to the market

price of our common stock and our results of operations and financial

condition.

Future

sales of common stock or the issuance of securities senior to the common stock

or convertible into, or exchangeable or exercisable for, common stock could

materially adversely affect the trading price of the common stock, and our

ability to raise funds in new equity offerings.

Future

sales of substantial amounts of our common stock or other equity-related

securities in the public market or privately, or the perception that such sales

could occur, could adversely affect prevailing trading prices of our common

stock and could impair our ability to raise capital through future offerings of

equity or other equity-related securities. We can make no prediction as to the

effect, if any, that future sales of shares of common stock or equity-related

securities, or the availability of shares of common stock for future sale, will

have on the trading price of our common stock.

It

is not anticipated that there will be an active public market for the common

stock in the near term and shareholders may have to hold common stock for

an indefinite period of time.

Although

our common stock is eligible for trading on the OTCBB, there currently is not an

active public or other trading market for the common stock, and we cannot assure

that any market will develop or be sustained. It is not anticipated that there

will be an active public market for the common stock in the near term

and shareholders may have to hold their common stock for an indefinite

period of time. As of December 31, 2009, PetroTech Holdings was the record owner

of 100,000,000 shares of our common stock, which represented approximately

91.75% of the total voting power of the Company on a fully-diluted basis.

Because our common stock is expected to be thinly traded, shareholders

cannot expect to be able to liquidate their investment in case of an emergency

or if they otherwise desire to do so. It may be difficult to

for shareholders to resell a large number of your shares of common stock in

a short period of time or at or above their purchase price.

Because

PetroAlgae became public by means of an assignment into a public shell, it may

not be able to attract the attention of major brokerage firms.

There may

be risks associated with PetroAlgae becoming public through an assignment into a

public shell. Securities analysts of major brokerage firms may not provide

coverage of the company since there is no incentive for brokerage firms to

recommend the purchase of our common stock. No assurance can be given that

brokerage firms will, in the future, want to conduct any secondary offerings on

our behalf.

Because

of the concentration of voting power in our Company, the ability of a

shareholder to influence the management of the Company will be extremely

limited.

Because

of the concentration of voting power in our Company, the ability of a

shareholder to influence the management of the Company may be extremely limited.

As of December 31, 2009, total securities of the Company held by PetroTech

Holding, Valens SPV I and Valens U.S. represent approximately 95.7% of the total

voting power of the Company on a fully-diluted basis. As a

result, the ability of a shareholder to influence the management of the

Company may be extremely limited.

– 12

–

There

are no automated systems for negotiating trades on the OTCBB and it is possible

for the price of a stock to go up or down significantly during a lapse of time

between placing a market order and its execution, which may affect trades

in our securities.

Because

there are no automated systems for negotiating trades on the OTCBB, they are

conducted via telephone. In times of heavy market volume, the limitations of

this process may result in a significant increase in the time it takes to

execute investor orders. Therefore, when investors place market orders, an order

to buy or sell a specific number of shares at the current market price, it is

possible for the price of a stock to go up or down significantly during the

lapse of time between placing a market order and its execution.

Our

stock may be considered a “penny stock” if it trades below $5.00 per

share.

As of

December 31, 2009, our common stock trades in excess of $5.00 per share, but

there can be no assurance that this price will be maintained in the future. If

the trading price of our common stock falls below $5.00 per share, trading in

our common stock will be subject to the requirements of Rule 15g-9 under the

Securities Exchange Act of 1934. Under this rule, broker-dealers who recommend

low-priced securities to persons other than established customers and accredited

investors must satisfy special sales practice requirements. The broker-dealer

must make an individualized written suitability determination for the purchaser

and receive the purchaser’s written consent prior to the

transaction.

SEC

regulations also require additional disclosure in connection with any trades

involving a “penny stock,” including the delivery, prior to any penny stock

transaction, of a disclosure schedule explaining the penny stock market and its

associated risks. In addition, broker-dealers must disclose commissions payable

to both the broker-dealer and the registered representative and current

quotations for the securities they offer. The additional burdens imposed upon

broker-dealers by such requirements may discourage broker-dealers from

recommending transactions in our securities, which could severely limit the

liquidity of our securities and consequently adversely affect the market price

for our securities. In addition, few broker-dealers are likely to undertake

these compliance activities. Other risks associated with trading in penny stocks

could also be price fluctuations and the lack of a liquid market.

We

do not anticipate payment of dividends, and investors will be wholly dependent

upon the market for the common stock to realize economic benefit from their

investment.

Holders

of our common stock will only be entitled to receive those dividends that are

declared by our Board of Directors out of retained earnings. We do not expect to

have retained earnings available for declaration of dividends in the foreseeable

future. There is no assurance that such retained earnings will ever materialize

to permit payment of dividends to shareholders. Our Board of Directors will

determine future dividend policy based upon our results of operations, financial

condition, capital requirements, reserve needs and other

circumstances.

A

portion of our cash flow must be used to service our debt obligations, and we

are vulnerable to interest rate fluctuations.

Fixed

rate borrowings may have their fair market value adversely impacted from changes

in interest rates. Floating rate borrowings will lead to additional interest

expense if interest rates increase. PetroAlgae enters into loan arrangements

when needed. At December 31, 2009, the principal balance on the Company’s

outstanding long-term notes was $35.5 million, of which $17.8 million was

outstanding at a floating rate of 2% over the prime interest rate and $17.7

million was outstanding at a fixed rate of 12%. Our borrowings are

subject to interest rate risk. Changes in economic conditions could

result in higher interest rates, thereby increasing our interest expense and

reducing our funds available to make payments of interest and principal on the

notes and for capital investment, operations or other purposes.

– 13

–

|

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS

|

Not

applicable.

– 14

–

|

ITEM

2.

|

PROPERTIES

|

Melbourne

Corporate Headquarters

Our

corporate headquarters are located in Melbourne, Florida. The headquarters house

the executive and administrative offices, as well as the finance, business

development, operations and information technology departments. It also includes

meeting space and PetroAlgae’s computer network and communications

infrastructure. This is a

sublease agreement that can be terminated with 30 day written

notice.

Kennedy

Space Center Space Life Sciences Lab

PetroAlgae

leases approximately 1000 square feet of laboratory and controlled-environment

space in the Kennedy Space Center Life Sciences Laboratory. The facility has

broad analysis capabilities for chemistry, molecular biology, microscopy and

microbiology. The controlled environmental chambers allow PetroAlgae to control

and manipulate environmental parameters such as climate, temperature, day/night

cycles and seasonal cycles to simulate growing conditions for research purposes

as well as to understand other climates throughout the world. PetroAlgae

benefits from access to NASA engineering, scientific and analytical expertise

available through the Kennedy Space Center Life Sciences Laboratory. This is

an annual agreement that can be terminated with 90 day written notice. The

current lease expires Sept. 30, 2010.

Gateway

Research Lab Facility

PetroAlgae

has built a state-of-the-art laboratory in Melbourne, Florida designed for

chemical analyses, culture storage, backup inoculum growth, bench top research

experiments and fast turnaround analysis of field samples. In addition, the lab

has complete analysis capabilities. This is a

three year lease agreement which expires Sept. 30, 2010.

Fellsmere

Field-Scale R&D Facility

PetroAlgae

has constructed its primary field-scale development facility for the PetroAlgae

production process in Fellsmere, Florida (approximately 40 miles from

Melbourne). The facility provides demonstration-scale live processing of all

portions of the PetroAlgae process as well as indoor and outdoor empirical

testing, and laboratory analysis. It also houses the personnel that develop, run

and maintain the facility. This is

an annual agreement with a five year renewal option. The renewal/expiration date

is July 1, 2010.

– 15

–

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

There are

no material pending legal proceedings to which PetroAlgae is a party or any of

its property is the subject.

– 16

–

|

ITEM

4.

|

(REMOVED

AND RESERVED).

|

– 17

–

PART

II

|

ITEM

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

Our

common stock is quoted on the OTC Bulletin Board under the symbol “PALG.” As of

March 20, 2010, we had 670 stockholders of record of our common

stock.

The

following table sets forth, for the quarters indicated, the high and low sales

prices per share of the Company’s common stock.

|

Sales Price

|

||||||||

|

High

|

Low

|

|||||||

|

Fiscal 2008:

|

||||||||

|

Third

Quarter(1)

|

$ | 1.01 | $ | 0.005 | ||||

|

Fourth

Quarter

|

$ | 7.00 | $ | 0.25 | ||||

|

Fiscal 2009:

|

||||||||

|

First

Quarter

|

$ | 10.00 | $ | 2.00 | ||||

|

Second

Quarter

|

$ | 11.00 | $ | 2.65 | ||||

|

Third

Quarter

|

$ | 40.00 | $ | 8.00 | ||||

|

Fourth Quarter

|

$ | 24.95 | $ | 15.00 | ||||

(1) Our common stock was initially quoted on the OTCBB (under the symbol “VOXQ” of a predecessor company) on July 25, 2008.

On March

29, 2010, the last reported sales price for the Company’s common stock on the

OTC Bulletin Board was $22.50 per share.

Dividends

The

holders of shares of our common stock are entitled to dividends out of funds

legally available when and as declared by our board of directors. We have never

declared or paid cash dividends. Our board of directors does not anticipate

declaring a dividend in the foreseeable future.

– 18

–

Equity

Compensation Plan

The

following table summarizes information as of December 31, 2009, relating to the

Company’s equity compensation plan pursuant to which grants of options,

restricted stock, or other rights to acquire shares may be granted from time to

time.

|

Plan Category

|

Number of securities to

be issued upon

exercise price of

outstanding options,

warrants and rights (a)

|

Weighted-average

exercise price of

outstanding options,

warrants and rights (b)

|

Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column

(a) (c)

|

|||||||||

|

Equity

Compensation plans approved by security holders

(1)

|

1,117,500 | $ | 8.48 | 2,882,500 | ||||||||

|

Equity

Compensation plans not approved by security holders

|

— | — | — | |||||||||

|

Total

|

1,117,500 | $ | 8.48 | 2,882,500 | ||||||||

(1)

Represents the Petroalgae Inc. 2009 Equity Compensation Plan.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Island Stock Transfer, 100

Second Avenue, South, Suite 104N, St. Petersburg, Florida 33701, telephone (727)

289-0010, facsimile (727) 289-0069.

Issuer

Repurchases

There

were no issuer repurchases by the registrant or any affiliate purchaser during

the fiscal year ended December 31, 2009.

– 19

–

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

Not applicable.

– 20

–

|

ITEM

7.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

The

following discussion contains forward-looking statements that involve numerous

risks and uncertainties, such as statements of our plans, objectives,

expectations, and intentions. Our actual results could differ materially from

those anticipated in the forward-looking statements. Factors that could cause or

contribute to these differences include those discussed in this report under

“Risk Factors,” as well as those discussed elsewhere in this report. You should

read the following discussion and analysis in conjunction with the Company’s

financial statements and related notes, each included elsewhere in this

report.

Overview

PetroAlgae

is a development stage company which is demonstrating, and commercializing for

license, new technologies to grow and harvest micro-crops that produce renewable

feedstocks for the petroleum industry and protein for the feed/food industries.

This is intended to result in fuels that are functionally interchangeable to

petroleum based and other transportation fuels. The corporate strategy is to

select the most suitable microorganism for each specific location (indigenous to

the region) and application, and then apply PetroAlgae’s distinct proprietary

processes to scale its growth rate (productivity) from that of a microorganism

to that of a high output-producing micro-crop. Micro-crops include algae,

diatoms, micro-angiosperms, cyanobacters and other small fuel and food-producing

organisms with extremely rapid growth potential.

Through

third-party testing, PetroAlgae has received encouraging, positive results for

the feedstock when used in test-cokers and when co-fired with coal directly as a

fuel source. These results have led to key collaborations with

industry expert FosterWheeler.We look forward to continued development with

Foster Wheeler and anticipate future collaborations with other key industry

entities.

Along

with the feedstock for the petroleum industry, a complementary co-product

produced from these micro-crops, is a high-quality protein. The proteins

has been, and continues to be tested as an ingredient in animal feed with

encouraging, positive results in composition, purity and suitability as an

animal feed ingredient. In fact, the Company has received its first

clearance (in Indonesia), to use the protein product for animal feed. We

anticipate more clearances to follow and will be seeking top-tier strategic

alliances in this market.

The

Company completed its pilot demonstration system in Florida. This site serves as

a pilot, with commercial-scale bioreactors that demonstrate end-to-end

processing from biomass growth, harvesting, dewatering, and through the

processing and drying of both protein and biomass feedstock from which

transportation fuels could then be produced. Utilizing commercial-scale

bioreactors, this site generates significant quantities of biomass, along with

representative products under measured production disciplines. These materials

are used for testing and customer samples, which management expects will provide

analytical results to further support the value proposition to our potential

license partners.

As the

Company is successful in developing these technologies, the Company will

continue to sell licenses for these technologies to partners in specific

geographic regions, for a specified area of production. The sales cycle for

these units can take many months while the license partners evaluate the

effectiveness and economics of applying this technology to their region. The

Company will assist in the deployment of this technology to licensees with

modular bioreactor systems that can be built and operated cost-effectively on a

very large commercial scale. Sizes of these licensed units will vary, but is

expected to be approximately 5,000 hectares (12,355 acres) per

“unit”.

The

Company previously announced, in March 2009, its first license agreement with

GTB Power Enterprise Ltd. for multiple system deployments in China. In December

2009, PetroAlgae entered into a strategic MOU with CECIC Chongqing Industry Co.,

Ltd (CECIC-CQ), an operating subsidiary of the China Energy Conservation

Investment Corporation (CECIC). This MOU contemplates that the Master

License Agreement for China held by GTB Power Enterprise Ltd. would be

transferred to CECIC, or that CECIC would otherwise become PetroAlgae’s

exclusive licensee in China in conjunction with the termination of the license

agreement with GTB Power Enterprise Ltd.. Our intent, in support of the

foregoing, is to accelerate PetroAlgae’s penetration of China’s renewable energy

market.

– 21

–

At the

end of 2009 we entered into a Master License Agreement with Green Science Energy

LLC for the use of our proprietary technology to produce biofuels in Egypt. This

agreement generated $4 million in cash flow for PetroAlgae.

In the

coming year, it is the goal of management to continue to sign multiple MOUs from

the current business development pipeline and convert a portion of these into

signed contracts. As contracts are signed, it is expected that initial pilot

deployments will immediately follow.

PetroAlgae

has incurred losses since inception of operations on June 22, 2006 and has an

accumulated deficit of $58,860,269 as of December 31, 2009. PetroAlgae’s losses

have resulted principally from its continued research and development expenses

and construction of a multi-acre pilot demonstration system.

As a

development stage company, we expect continued progress commercializing our

proprietary technologies and that in 2010 we will continue to realize early

license fees from customers. While we strive to maintain proper cost and

spending controls, our expenditures through the fourth quarter of 2009 reflect

the operation of the demonstration pilot system and increases in marketing and

business development expenses as the Company continues to prepare for customer

deployment. It is management’s expectation that operating expenses

will increase modestly in 2010 to accommodate growing activity in business

development, commercial deployment and establishing infrastructure.

Results

of Operations

In

December 2009, PetroAlgae received its initial receipt of customer licensee

fees, however the recognition of these fees as revenues for the Company are

expected to begin in 2010. In general, the Company expects to record and

recognize revenue when persuasive evidence of an arrangement exists, services

have been rendered or product delivery has occurred.

Twelve

Months Ended December 31, 2009 Compared to Twelve Months Ended December 31,

2008

Total Costs and Expenses

increased $20.0 million (or 118%) primarily due to an increase in personnel

costs, consulting costs, and an increase in activity of research and development

as the Company continues to grow its operations.

Research and Development

Expenses. Total research and development expenses increased $ 10.2

million (or 94%) to $21 million for the twelve months ended December 31, 2009,

from $10.9 million in the comparable period in 2008. The development costs

include the research and experimentation of the various system components and

for 2009 the design and construction of the commercial scaled pilot system for

customer demonstration. During the period from inception to August 1, 2008, a

portion of the Company’s research and development activities were provided by XL

TechGroup for support services and recorded as related party expenses separate

from direct and third party expenses. The portion of related party research and

development expenses were NIL and $468,000 for the periods ending December

31, 2009 and 2008, respectively.

General and Administrative

Expenses. Total general and administrative expenses increased $4.5

million (or 94%) to $9.3 million for the twelve months ended December 31, 2009

from $4.8 million in the comparable period in 2008. General and administration

expenses include the Company’s business development, information technology, and

intellectual property management. During the period from inception to August 1,

2008, a portion of the Company’s general and administration activities were

provided by XL TechGroup for support services and recorded as related party

expenses separate from direct and third party expenses. The portion of related

party general and administration expenses were NIL and $1.7 million for the

periods ending December 31, 2009 and 2008, respectively.

– 22

–

Depreciation. Depreciation

expense increased $870,000 (or 323%) to $1.14 million for the twelve months

ended December 31, 2009 from $269,000 for the comparable period in 2008. The

increase was due to the addition of more laboratory equipment, computer

equipment, furniture, and leasehold improvements equipment during the twelve

months of 2009 compared with the comparable period of 2008.

Interest Expense. Interest

expense on PetroAlgae’s debt outstanding under its note with PetroAlgae Inc

(PetroTech Holdings Corp. assumed the note from XL TechGroup in August 2008, and

PetroAlgae Inc assumed the note from PetroTech Holdings Corp in December 2008)

increased to $2.6 million (or 117%) for the twelve months ended December 31,

2009 from $1.2 million for the comparable period in 2008.

Liquidity

and Capital Resources

At

December 31, 2009 PetroAlgae had $4.7 million in cash and cash

equivalents.

Net cash

used in operating activities was $25 million and $11.8 million in 2009 and 2008,

respectively. This was primarily attributed to expenditures used to fund

PetroAlgae’s research and product development activities and building its

operational and business development efforts.

Net cash

used in investing activities, purchase of capital assets was $2.2 million and

$.8 million for the years ended December 31, 2009 and 2008, respectively. The

fluctuations from period to period are due to the continued growth and

expansion, primarily in the construction of its demonstration

facility.

Net cash

provided by financing activities was $21.5 million in 2009, and $22.9 million in

2008 which consisted of advances from our principal lender and the sale of

common shares for cash.

PetroAlgae’s

contractual payment obligations as of December 31, 2009 are as

follows:

|

Total

|

Less than

1 year

|

1-3 years

|

3-5 years

|

More than

5 years

|

||||||||||||||||

|

Operating

lease for facilities

|

$ | 135,552 | $ | 135,552 | $ | — | — | — | ||||||||||||

|

Total

|

$ | 135,552 | $ | 135,552 | $ | — | — | — | ||||||||||||

PetroAlgae

has primarily financed its operations through loans or the sale of equity