Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PECO ENERGY CO | d8k.htm |

| EX-99.1 - PRESS RELEASE - PECO ENERGY CO | dex991.htm |

PECO

Electric and Gas Distribution Rate Cases March 31, 2010 Exhibit 99.2 |

2 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, that are subject to risks

and uncertainties. The factors that could cause actual results to differ

materially from these forward-looking statements include those discussed

herein as well as those discussed in (1) Exelon’s 2009 Annual Report on

Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations and

(c) ITEM 8. Financial Statements and Supplementary Data: Note 18; and (2)

other factors discussed in filings with the Securities and Exchange Commission (SEC) by Exelon Corporation and PECO Energy Company (Companies). Readers are cautioned not to place undue reliance on these forward-looking statements, which

apply only as of the date of this presentation. None of the Companies

undertakes any obligation to publicly release any revision to its

forward-looking statements to reflect events or circumstances after the

date of this presentation. |

3 Electric Distribution Service – Rate Case Filing Summary Rate Base $3,236 million Capital Structure / Metrics: - Common Equity 53.18% - Return on Equity (ROE) 11.75% - Return on Rate Base (ROR) 8.95% - Requested Revenue Increase $316 million 2011 Proposed electric distribution price increase (1) 6.94% (as a % of overall bill) (1) Excluding Alternative Energy Portfolio Standards (AEPS) and Default Service Surcharge. • Filing Docket # R-2010-216-1575 available on Pennsylvania Public Utility Commission (PAPUC) website or www.peco.com/know First electric distribution rate case since 1989 Act 129 Energy Efficiency & Smart Meter costs recovered separately via

rider Basis for revenue requirement is 2010 Budget

with pro-forma adjustments Rates will be effective January 1,

2011 Key Components of Rate Case Filing: |

4 Gas Delivery Service – Rate Case Filing Summary Rate Base $1,100 million Capital Structure / Metrics: - Common Equity 53.18% - Return on Equity (ROE) 11.75% - Return on Rate Base (ROR) 8.95% - Requested Revenue Increase $44 million 2011 Proposed gas price increase 5.28% (as a % of overall bill) Last gas rate case in 2008 Basis for revenue requirement is 2010 Budget with pro-forma adjustments Rates will be effective January 1, 2011 Key Components of Rate Case Filing: • Filing Docket # R-2010-216-1592 available on PAPUC website or www.peco.com/know |

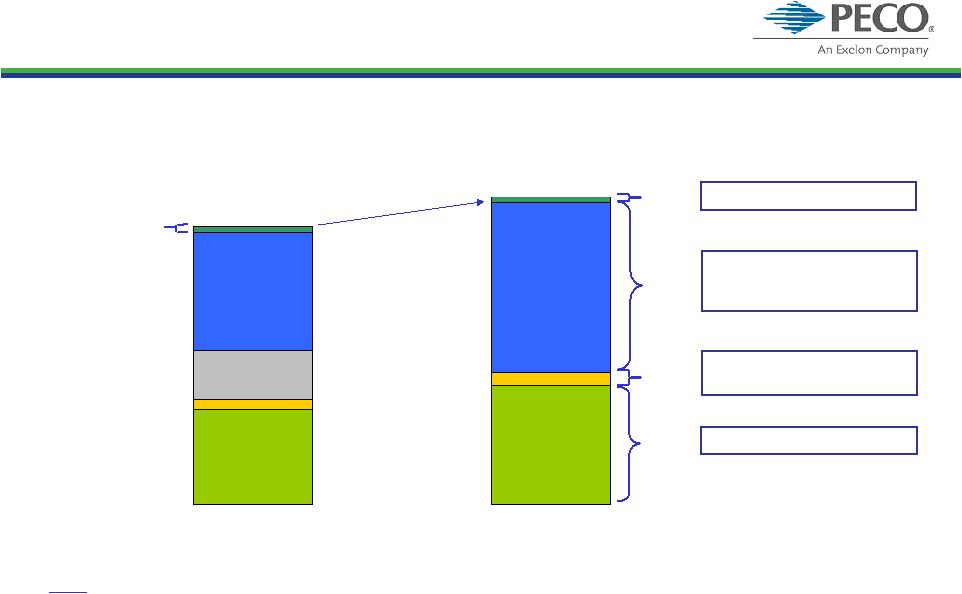

5 5.03 6.26 6.23 0.51 0.70 2.57 9.01 Electric Residential Rate Increases 2010 to 2011 January 1, 2011 January 1, 2010 Total = 14.7¢ Unit Rates (¢/kWh) Proposed Total Bill Increase ~11 % Total = 16.3¢ AEPS ~0.6% Default Service Surcharge Mechanism based on results of first two procurements ~1.2% Transmission

surcharge mechanism

~1.3% Energy /

Capacity Competitive Transition Charge Transmission Distribution Distribution rate case ~8.2% 0.38 Energy Efficiency Surcharge Breakdown of 2010 to 2011 ~11% Increase (On Total Bill) Notes: • Rates effective January 1, 2010 include Act 129 Energy Efficiency surcharge of 2%.

• Act 129 Smart Meter surcharge will be calculated following approval of PECO’s Smart

Meter Plan expected in 2Q10. The Smart Meter surcharge, which

will likely be effective 3Q10, is expected to be less than 1% and is not expected to increase until 2Q/3Q of 2011. As a result, the Smart Meter surcharge will have a minimal impact on rate increases effective January 1, 2011.

• Low income discounted rates were subsidized in the Power Purchase Agreement in 2010 and

will be recovered through distribution rates in 2011. 0.29

|

6 Electric and Gas Rate Case Filings - Tentative Schedule Filed – March 31, 2010 Opposing Parties’ Testimony – June 2010 Rebuttal Testimony – July 2010 Hearings – August 2010 Administrative Law Judge (ALJ) Orders – October 2010 Final Order Expected – December 2010 New Rates Effective – January 1, 2011 Note: Dates are based on typical approach to rate cases but the PAPUC will set the actual schedule. Expect actual schedule to be set at pre-hearing with ALJ around mid-May.

|