Attached files

| file | filename |

|---|---|

| EX-31.1 - SECTION 302 CERTIFICATION - NORD RESOURCES CORP | exhibit31-1.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - NORD RESOURCES CORP | exhibit32-1.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - NORD RESOURCES CORP | exhibit31-2.htm |

| EX-23.1 - CONSENT OF MAYER HOFFMAN MCCANN P.C. - NORD RESOURCES CORP | exhibit23-1.htm |

| EX-10.70 - FORBEARANCE AGREEMENT - NORD RESOURCES CORP | exhibit10-70.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10–K

[ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 1–08733

NORD RESOURCES

CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware | 85–0212139 |

| (State or other jurisdiction of incorporation or | (IRS Employer Identification No.) |

| organization) | |

| 1 West Wetmore Road, Suite 203 | |

| Tucson, Arizona | 85705 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (520) 292–0266

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.01 per share

(Title

of class)

Indicate by check mark if the registrant is a well–known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes[ x ]

No

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Exchange Act

[ ] Yes[ x ]

No

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.[ x ] Yes[ ] No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S–K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10–K or any amendment to this Form 10–K.[ ]

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non–accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b–2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non–accelerated filer [ ] (do not check if a smaller reporting company) | Smaller reporting company [ x ] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b–2 of the Exchange Act).

[ ] Yes[ x ] No

- 2 -

The aggregate market value of the registrant’s common stock held by non–affiliates of the registrant as of June 30, 2009, computed by reference to the price at which such stock was last sold on the OTC Bulletin Board ($0.43 per share) on that date, was approximately $23,523,047.

The registrant had 110,520,915 shares of common stock outstanding as of March 15, 2010.

NORD RESOURCES CORPORATION

Form 10–K

- ii -

FORWARD–LOOKING STATEMENTS

The information in this annual report contains forward–looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward–looking statements involve risks and uncertainties, including statements regarding our capital needs, business plans and expectations. Such forward–looking statements involve risks and uncertainties regarding the market price of copper, availability of funds, government regulations, common share prices, operating costs, capital costs, outcomes of ore reserve development and other factors. Forward–looking statements are made, without limitation, in relation to operating plans, property exploration and development, availability of funds, environmental reclamation, operating costs and permit acquisition. Any statements contained herein that are not statements of historical facts may be deemed to be forward–looking statements. In some cases, you can identify forward–looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology.

Forward–looking statements in this annual report include, but are not limited to, statements with respect to the following:

- the timing and possible outcome of pending regulatory and permitting matters;

- the parameters and design of our planned mining facilities on the Johnson Camp Mine;

- our future financial or operating performances and our projects;

- the estimation of mineral reserves and mineralized material;

- the estimation of future copper production

- the timing of exploration, development and production activities and estimated future production, if any;

- estimates related to costs of production, capital, operating and exploration expenditures;

- requirements for additional capital;

- government regulation of mining operations, environmental risks, reclamation and rehabilitation expenses;

- title disputes or claims;

- limitations of insurance coverage;

- the future price of copper or other metals; and

- our expectation that we will be in compliance with the continued listing requirements of the Toronto Stock Exchange when the Continued Listings Committee considers its de-listing decision at a meeting of the Committee scheduled to be held on April 21, 2010.

These forward–looking statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions, including, the risks and uncertainties outlined under the sections titled “Risk Factors”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. If one or more of these risks or uncertainties materialize, or our underlying assumptions prove incorrect, our actual results may vary materially from those expressed or implied by our forward–looking statements anticipated, believed, estimated or expected.

We note, in particular, that the Johnson Camp Mine has limited recent operating history upon which to base estimates of future cash flows and operating costs. These and other estimates or projections (including our expectations with respect to annual copper production from our planned operations at the Johnson Camp Mine) are, to a large extent, based upon the interpretation of geological data obtained from drill holes and other sampling techniques performed in accordance with industry standards by third parties, the methodologies and results of which we have assumed are reasonable and accurate, which results form the basis for, and constitute a fundamental variable in, the feasibility study and technical report completed by Bikerman Engineering & Technology Associates which we have relied on.

1

The sampling data produced by third parties and amounts of metallurgical testing are less extensive than normal and our expected copper recovery rates at the Johnson Camp Mine significantly exceed historical experience at the Johnson Camp property. There is no assurance that we will be able to meet these expectations and projections at an operational level. For further information, you should carefully read and consider the section of this annual report entitled “Risk Factors” beginning on page 4.

We caution readers not to place undue reliance on any such forward–looking statements, which speak only to a state of affairs as of the date made. We disclaim any obligation subsequently to revise any forward–looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward–looking statements contained in this annual report by the foregoing cautionary statements.

PART I

| ITEM 1. | BUSINESS |

Overview

We are a copper mining company and our principal asset is the Johnson Camp property located in Arizona. The Johnson Camp property includes the Johnson Camp Mine, an integrated open pit copper mine and a production facility that uses the solvent extraction, electrowinning (SX–EW) process. The Johnson Camp Mine includes two existing open pits, namely the Burro and the Copper Chief bulk mining pits. As described in more detail below, we commenced production of copper from new ore in February 2009 and achieved commercial copper cathode production from newly-mined ore on April 1, 2009.

Development of Our Business

We acquired the Johnson Camp Mine from Arimetco, Inc. pursuant to a Sales and Purchase Agreement that had been assigned to us in June 1999 by Summo USA Corporation, the original purchaser, following the completion of certain due diligence work by Summo. Although Arimetco had ceased mining on the property in 1997, we, like Arimetco before us, continued production of copper from ore that had been mined and placed on leach pads, and from 1999 to 2003 we (through our then subsidiary Nord Copper Company) produced approximately 4,490,045 pounds of copper cathode.

In August 2003, we placed the Johnson Camp Mine on a care and maintenance program due to weak market conditions for copper at that time. In June 2007 when conditions improved, we began the process of reactivating the Johnson Camp Mine.

In September 2007, Bikerman Engineering & Technology Associates, Inc. completed a technical report for us entitled, “Johnson Camp Mine Project, Feasibility Study, Cochise County, Arizona, USA, Technical Report” (the “Technical Report”), and prepared in accordance with National Instrument 43–101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (as required for us to comply with provincial securities laws in Canada that are applicable to our Company).

In January 2008 we commenced copper cathode production from leaching old leach pads, and during 2008, we produced approximately 2.9 million pounds of copper from residual leaching.

In February 2008, we entered into a long-term cathode sales agreement with Red Kite Master Fund Limited for 100% of the copper cathode production from the Johnson Camp Mine. The agreement runs through December 31, 2012 with renewable extensions by mutual agreement of both parties. Pursuant to the agreement, Red Kite accepts delivery of the cathodes at the Johnson Camp Mine, and pricing is based on the average monthly COMEX price for high–grade copper.

2

In August 2008, we received the Air Quality permit necessary to enable us to complete the construction related to the reactivation of the Johnson Camp Mine.

We commenced mining of new ore upon completion of the reactivation work in January 2009, and we commenced production of nominal amounts of copper from newly-mined ore during the testing and development phase of the mine in February and March 2009. We achieved commercial copper cathode production from newly-mined ore on April 1, 2009 and entered the production stage, following substantial completion of the testing and development phase.

We have continued to make substantial progress in ramping up copper production, but the rate of increase has been slower than expected. In late October 2009, the failure of a well casing in a primary water supply well contributed to several months of lower than forecasted flow rates of pregnant leach solution through our SX plant, which in turn have resulted in lower than expected copper production. We believe we have successfully taken measures to address these issues. For example, in early January 2010, we placed two new wells into operation at a capital cost of approximately $400,000. The new wells have resulted in significantly increased flow rates that now are at the levels that we forecasted as necessary to achieve our production targets. With the increase in flow rates of pregnant leach solution to our SX plant, and continual increase in solution grades, we expect copper production to increase to a level to allow for breakeven operational cash flow in April 2010, and to achieve positive operating cash flow in the second quarter of 2010. Our expectations in this regard are premised primarily on our assumption that our copper production levels will continue to rise as predicted, given the measures that we have taken to address the problems we have encountered in our mining and processing operations, and on our assumption that current input costs and copper prices will remain constant over the relevant period, which cannot be assured.

Financing Activities

In June 2008, we entered into an Amended and Restated Credit Agreement with Nedbank Limited, as administrative agent and lead arranger, which provided for a $25 million secured term loan credit facility. All of the funds available under such facility have been used by us to finance the construction, start–up and operation of mining and metal operations at the Johnson Camp Mine. As of December 31, 2009, this facility was fully drawn and the outstanding balance of the credit facility was $23,257,826.

In March 2009, our credit agreement with Nedbank was amended and restated to provide for, among other things, the deferral of certain principal and interest payments until December 31, 2012 and March 31, 2013. While we made the scheduled principal and interest payment that was due on December 31, 2009 in the approximate amount of $2,200,000, we were unable to make the scheduled principal and interest payment that was due on March 31, 2010 in the approximate amount of $2,175,000. Accordingly, our Company and Nedbank have entered into an unconditional forbearance and extension agreement dated March 30, 2010 that allows us a forbearance period of 21 days to negotiate an amendment to the credit agreement as it pertains to the March 31, 2010 payment and other terms therein. If upon the expiration of the 21 day period, we have not been successful in amending the credit agreement, Nedbank will have full authority to exercise its rights under the credit agreement, including the acceleration of the full amount due thereunder.

In addition, in March of 2009, we sold a 2.5% royalty on the mineral production sold from the existing mineral rights at the Johnson Camp Mine for net proceeds of approximately $4,950,000.

3

In November 2009, we completed an unregistered, brokered private placement of 40 million units (the “Units”) for total gross proceeds of $12,000,000. In connection with the offering, which was effected in an offshore transaction pursuant to Rule 903 of Regulation S promulgated under the Securities Act of 1933, as amended, we paid the placement agent a commission equal to $600,000, or 5% of the gross proceeds of the offering. Each Unit, priced at $0.30, consisted of one common share and one common share purchase warrant. Each warrant entitles the holder to purchase one additional common share of our Company at a price of $0.38 per share until June 5, 2012. The proceeds of the offering were used to make debt service payments under the Nedbank credit facility, to purchase approximately $500,000 in additional equipment, to reduce accounts payable, and for general working capital purposes.

In connection with the private placement of the Units, we received an exemption from certain shareholder approval requirements under the rules of the Toronto Stock Exchange (the “TSX”), on the basis of financial hardship. Reliance on this exemption automatically triggered a TSX de-listing review to confirm that we continue to meet the TSX listing requirements. We have been informed by the TSX that the Continued Listings Committee has deferred its de-listing decision until after a meeting of the Committee scheduled to be held on April 21, 2010. We believe that we will be in compliance with the TSX’s continued listing requirements at that time.

Other Operations

The Johnson Camp property includes decorative and structural stone operations, which produce landscape and aggregate rock from the overburden piles at the Johnson Camp Mine. Until January 31, 2009 we leased the landscape and aggregate rock operations to a third party in exchange for sliding scale royalties. Effective February 1, 2009, we commenced managing the landscape rock operation; the aggregate rock operation continues to be leased to a third party.

We do not believe that the landscape and aggregate rock operations are now nor will be material to our financial results of operation in the future.

Incorporation and Principal Business Offices

We were formed under the laws of the State of Delaware on January 18, 1971. Our principal business offices are located at 1 West Wetmore Road, Suite 203, Tucson, Arizona 85705, and our telephone number is (520) 292–0266.

| ITEM 1A. | RISK FACTORS |

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein. We undertake no obligation to update forward looking statements to reflect events or circumstances occurring after the date of such statements.

Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution readers of this annual report that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”. In evaluating us, our business and any investment in our business, readers should carefully consider the following factors.

4

Risks Related to Our Company

We have a history of losses, and our future profitability will depend on the successful operation of the Johnson Camp Mine, which cannot be assured.

We have a history of losses, and expect to incur losses in the future until we have reached full mining operations and production levels at the Johnson Camp Mine.

We had net income of $392,438 for the year ended December 31, 2009, but a net loss of $5,038,374 for the year ended December 31, 2008. As of December 31, 2009, we had a working capital deficiency of $7,652,818. This deficiency includes current liabilities of $15,434,206 representing the current portions of our long term debt, the current portion of derivative contracts and the current portion of deferred revenue.

We commenced production of copper from residual leaching in January 2008, mining of new ore in January 2009, and production of copper from new ore in February 2009. We achieved commercial copper cathode production from newly-mined ore on April 1, 2009 and entered the production stage, following substantial completion of the testing and development phase.

Although we have continued to make substantial progress in ramping up copper production, the rate of increase has been slower than expected. In late October 2009, the failure of a well casing in a primary water supply well contributed to several months of lower than forecasted flow rates of pregnant leach solution through our SX plant, which in turn has resulted in lower-than-expected copper production and operating cash flow. Although we believe that we have successfully taken measures to address these issues, we cannot provide any assurance that we will ramp up to full production or have successful mining and processing operations on the Johnson Camp property in the future.

We are dependent upon the success of the Johnson Camp Mine as a source of future revenue and profits, if any. Even if we should be successful in achieving our planned full copper production rate of 25 million pounds of copper per annum, an interruption in operations of the Johnson Camp Mine may have a material adverse effect on our business.

The reactivation and ramp up of operations at the Johnson Camp Mine, and the development of new mining operations on the Johnson Camp property will continue to require the commitment of substantial resources.

The reactivation and ramp up of operations at the Johnson Camp Mine, and the development of new mining operations on the Johnson Camp property, have required and will continue to require the commitment of substantial resources for operating expenses and capital expenditures. We incurred approximately $43,000,000 in capital costs in the reactivation of the mine, related primarily to the rehabilitation of the solution ponds, refurbishment and a modest expansion of our SX-EW copper production facility, installation of our primary stage crusher, the purchase and installation of two secondary stage crushers, an agglomerator and conveying equipment, and other project-related items.

We estimate we will incur an additional $12 to $15 million in capital costs during the next three years, primarily for the development and construction of a new leach pad. We also expect to incur expenses in connection with further exploratory drilling on the Johnson Camp property. In addition, any delay in our planned ramp up to full production may cause an increase in costs for us and could have a material adverse effect on our financial condition or results of operations.

5

Unforeseen conditions may affect our mining and processing efficiency, and we may not be able to execute the leaching operation as planned if we do not maintain proper control of ore grade.

The parameters used in estimating mining and processing efficiency are typically based on testing and experience with previous operations. Various unforeseen conditions can occur that may materially affect the estimates. In particular, unless proper care is taken to ensure that proper ore grade control is employed and that other necessary steps are taken, we may not be able to achieve production forecasts as planned. In addition, our projected production is based on anticipated copper recoveries at the Johnson Camp Mine that are in excess of historical experience, which may result in an overestimation of our mining and processing efficiency if our actual production does not meet our projected production.

We may never achieve our production estimates since they are dependent on a number of assumptions and factors beyond our control.

We have prepared estimates of future copper production; however, we cannot be certain that we will ever achieve these estimates. Our production estimates depend on, among other things: the accuracy of our reserve estimates; the accuracy of assumptions regarding ore grades and recovery rates; ground conditions and physical characteristics of the mineralization, such as hardness and the presence or absence of particular metallurgical characteristics; the accuracy of estimated rates and costs of mining and processing; and our ability to obtain and maintain all necessary permits at all levels of development and production. We are processing the copper mineralization using Leach-SX–EW technology. These techniques may not be as efficient or economical as we project. Our actual production may vary from our estimates if any of these assumptions prove to be incorrect, and we may never achieve our full production target rate of 25 million pounds of copper per annum.

A major increase in our input costs, such as those related to acid, electricity, fuel and supplies, may have an adverse effect on our financial condition.

Our operations are affected by the cost of commodities and goods such as electrical power, sulfuric acid, fuel and supplies. The Technical Report includes an economic analysis of the Johnson Camp Mine based on the mine plan, capital and operating cost estimates current as of the second quarter of 2007. Management prepares its cost and production guidance and other forecasts based on its review of current and estimated future costs. A major increase in any of these costs may have an adverse impact on our financial condition. For example, we expect that sulfuric acid and energy, including electricity and diesel fuel, will represent a significant portion of production costs at our operations, and if the costs increase, we could be negatively affected.

Shortages of sulfuric acid, electricity and fuel, may have an adverse effect on our financial condition.

Sulfuric acid supply for SX–EW projects in the southwestern U.S. is produced primarily as a smelter byproduct at smelters in the southwest U.S. and in Mexico. We have an agreement in place for a broker of acid to supply us with sulfuric acid through the end of 2010. However, we cannot be assured that the broker will be able to provide us with an adequate supply of sulfuric acid without interruptions and we continue to remain subject to market fluctuations in the price of sulfuric acid.

Continuation of our mining production is dependent on the availability of a sufficient water supply to support our mining operations.

Our mining operations require water for mining, ore processing and related support facilities. Production at the Johnson Camp Mine is dependent on continuous maintenance of our water rights. Under Arizona law groundwater outside an active management area may be withdrawn and used for reasonable and beneficial use. The character of the water right - that is groundwater versus surface water - may at some

6

point become at issue and may be subject to adjudication to the extent certain water is determined to be surface water. We are not subject to any such adjudication claims at this time. However, we cannot predict our potential involvement in or the outcome of any adjudication proceedings which may occur impacting our water rights and uses.

Production water for the Johnson Camp Mine is currently supplied from three wells controlled or located on the Johnson Camp property and from two wells located on private land adjacent to our property. In late October 2009, the failure of a well casing in one of our wells that provides make-up water for our leaching operation resulted in several months of below forecasted pregnant leach solution flow rates through our SX plant, and copper production was adversely affected. By early January 2010, we had placed two new wells into operation which have resulted in significantly improved pregnant leach solution flow rates that now are at the levels that we had forecasted as necessary to achieve our production targets. However, it may be necessary to drill additional wells on our property in order to expand our leaching operation. In addition, although some of the wells have been upgraded since 1999, further upgrades may have to be undertaken.

The loss of some or all water rights, in whole or in part, or shortages of water to which we have rights could require us to curtail or shut down mining production or could prevent us from pursuing expansion opportunities.

Our estimates of reserves are inherently subject to error, particularly since we have limited operating history on which to base such estimates. Our actual results may differ due to unforeseen events and uncontrollable factors that can have significant adverse impacts.

The Johnson Camp Mine has limited operating history upon which to base estimates of proven and probable ore reserves and estimates of future cash operating costs. Such estimates are, to a large extent, based upon the interpretation of geological data obtained from drill holes and other sampling techniques performed by third parties, the methodologies and results of which we have assumed - but cannot be assured - are reasonable and accurate. In addition, Bikerman Engineering & Technology Associates derived its estimates of cash operating costs at the Johnson Camp Mine from information provided by our Company. Such information and certain other factors, including anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of the mineral from the ore, comparable facility and equipment operating costs current as of the second quarter of 2007, and anticipated climatic conditions, form the basis for, and constitute fundamental variables in, the Technical Report. Actual cash operating costs and economic returns based upon development of proven and probable ore reserves may differ significantly from those originally estimated. Until reserves are actually mined and processed, the quantity of reserves must be considered as estimates only.

Our estimates of reserves are based in large part on sampling data produced by third parties and on amounts of metallurgical testing that are less extensive than normal. In addition, our expected copper recovery rates at the Johnson Camp Mine exceed historical experience at the property. There is no assurance that we will be able to meet these expectations and projections at an operational level.

Our expectations with respect to copper recovery rates exceed historical experience at the Johnson Camp Mine since we plan to continue to crush the ore to a smaller size with the expectation of higher copper recoveries. In addition, our projections of copper recovery are based on amounts of metallurgical testing that are less extensive than are commonly used in the industry for evaluating copper oxide deposits. Furthermore, our estimates of ore reserves reflect consumption projections for sulfuric acid and other consumable items that were developed using a limited number of samples taken by the former operators of the mine on the Johnson Camp property that may not be representative of the characteristics of the remaining reserves. There is no assurance that we will be able to meet these expectations and projections at an operational level.

7

Copper recovery rates for approximately 15% of our estimated total reserves may be less than optimal due to the presence of copper sulfide mineralization below the elevation of 4,560 feet.

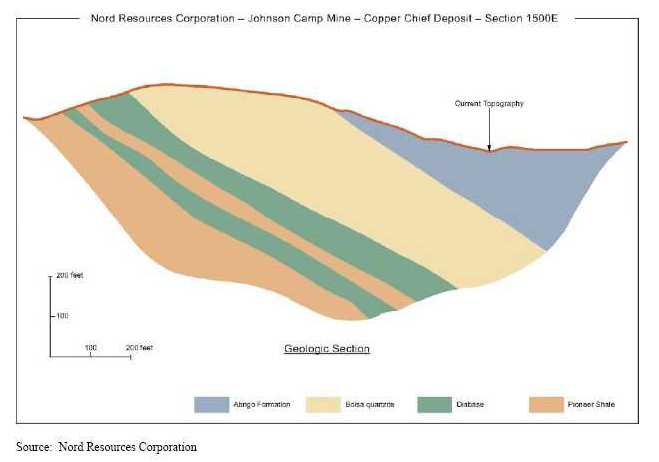

Copper sulfide minerals are not as amenable to heap leach recovery techniques as are copper oxides. Since copper sulfide mineralization is evident below an approximate elevation of 4,560 feet in both the Burro and Copper Chief pits of the Johnson Camp Mine, we caution that copper recovery rates for ore anticipated to be mined below that elevation (estimated at approximately 15% of estimated total ore reserves) may be inhibited. In addition, although the column test on the sample of Abrigo ore (a type of copper bearing host rock at the Johnson Camp Mine) taken from an approximate elevation of 4,620 feet that contained 4.49% sulfides exhibiting good copper recoveries, the leaching of copper from ore mined at this depth may be less than optimal.

We have evaluated the commercial viability of the Johnson Camp Mine based on an estimate of ore reserves that is premised on a geologic resource model and estimate previously prepared that was based largely on drilling, sampling and assay data that had been developed by Cyprus Mines Corporation, Arimetco Inc. and Summo U.S.A. Corporation, the accuracy of which cannot be assured.

We have evaluated the commercial viability of the Johnson Camp Mine based on an estimate of ore reserves contained in the feasibility study. The resource model and estimate previously prepared and used as the basis for the feasibility study is based largely on drilling, sampling and assay data that had been developed by the previous operators of the Johnson Camp Mine, Cyprus and Arimetco, and by Summo. The validity of the estimates assumes the accuracy of the underlying drill hole electronic database.

We and Bikerman Engineering & Technology Associates have conducted limited additional due diligence, such as reviews of historical project geological drill logs and assay certificates, but no additional drilling. Complete accuracy of the drill hole electronic database cannot be assured.

Cyprus, Arimetco and Summo used different approaches to drilling, sampling and assay analysis, with the result that their respective results may not be comparable and thereby increase the risk of an overestimation of ore reserves.

Cyprus Mines Corporation (which owned the Johnson Camp property until 1989, operating under the name Cyprus Johnson Copper Company), Arimetco and Summo each used different approaches to drilling, sampling and assay analysis that may not be comparable to each other. In particular, the soluble copper assay techniques used by Arimetco for ore grade estimation are not directly comparable to the soluble copper assay techniques used by Cyprus. The use of two incomparable approaches by Cyprus and Arimetco may have led to inconsistencies in or the skewing of the data underlying our estimates, thereby increasing the risk of an overestimation of ore reserves at the Johnson Camp Mine, as well as increasing the risk of a material inaccuracy in the feasibility study.

Limited sampling work has been performed at the Johnson Camp Mine, and Bikerman Engineering & Technology Associates concluded that it is therefore not possible at this time to verify the entire drill hole electronic database used for the current resource model and ore reserve estimates. Bikerman Engineering & Technology Associates has largely assumed the reasonableness and accuracy of the drilling, sampling and assay methodologies and data which constitute a fundamental variable input in the feasibility study.

Bikerman Engineering & Technology Associates reviewed the results of limited sampling work undertaken at the Johnson Camp Mine in 2006 by another engineering company. Bikerman Engineering & Technology Associates has concluded that it is not possible for it to verify the entire original drill hole electronic database used for the current mineral resource model and ore reserve estimates. Consequently, Bikerman Engineering & Technology Associates and we have largely assumed the reasonableness and

8

accuracy of the drilling, sampling and assay methodologies and data. Accordingly, there is a risk that results may vary if additional sampling work is undertaken. This, in turn, could adversely impact the current mineral resource model and ore reserve estimates, as well as increase the risk of a material inaccuracy in the feasibility study.

Our estimate of ore reserves at the Johnson Camp Mine is based on total copper assays rather than on acid soluble copper assays and our expectations with respect to copper recovery are based on results of metallurgical testing that may not be duplicated in larger scale tests under onsite conditions or during production. As a result, there is a risk that we may have overestimated the amount of recoverable copper.

Our estimate of ore reserves at the Johnson Camp Mine is based on total copper assays rather than soluble copper assays. A reserve estimate based on total copper is an indirect measurement of copper recovery through leaching. There can be no assurance that metallurgical recoveries in small scale laboratory tests will be duplicated in larger scale tests under onsite conditions or during production. Accordingly, there is a risk that we may have overestimated the amount of recoverable copper.

We may require additional permits and renewals of permits to continue to operate the Johnson Camp Mine, the availability of which cannot be assured.

Although we have secured a number of permits for the restart and operation of the Johnson Camp Mine, we still need to obtain certain additional permits for long term operation of the mine, including an aquifer protection permit. In addition, certain permits will require applications for renewal from time to time during the life of the project and certain permits may be suspended or require additional applications in the event of a significant or substantial change to the Johnson Camp Mine operations or prolonged inactivity. To the extent other approvals are required and not obtained, we may: (i) be prohibited from continuing mining and/or processing operations; (ii) forced to reduce the scale of or all of our mining operations; or (iii) be prohibited or restricted from proceeding with planned exploration or development of mineral properties. For example, we are currently producing copper under an ADEQ Compliance Order. However, we anticipate that we will be required to immediately halt all of our operations at the Johnson Camp Mine if our application for an aquifer protection permit is denied.

We have incurred substantial debt and have granted a security interest in our assets. If we are unable to repay our loans when they become due, the lenders would be entitled to realize upon their security by taking control of all or a portion of our assets.

We are a party to an amended and restated credit agreement dated as of March 31, 2009 with Nedbank Limited, as the administrative agent and lead arranger, which provided a $25,000,000 secured term loan credit facility used by our Company to finance the reactivation of the Johnson Camp Mine. We have delivered a deed of trust, a collateral account agreement and certain other security agreements that grant to the lenders a first priority lien encumbering all of the real and personal property associated with the Johnson Camp property, including all patented mining claims, fee lands and unpatented mining claims in which we have an interest. The lenders would be entitled to realize upon their security interests and seize our assets if we were to be unable to repay or refinance the loans as they become due. In addition, pursuant to the terms of the credit agreement, we are required to meet specified financial tests any time that any loan proceeds remain outstanding under the credit agreement.

While we made the scheduled principal and interest payment that was due under our amended and restated credit agreement with Nedbank on December 31, 2009 in the approximate amount of $2,200,000, we were unable to make the scheduled principal and interest payment that was due on March 31, 2010 in the approximate amount of $2,175,000. Accordingly, our Company and Nedbank have entered into an unconditional forbearance and extension agreement dated March 30, 2010 that allows us a forbearance

9

period of 21 days to negotiate an amendment to the credit agreement as it pertains to the March 31, 2010 payment and other terms therein. If upon the expiration of the 21 day period, we have not been successful in amending the credit agreement, Nedbank will have full authority to exercise its rights under the credit agreement, including the acceleration of the full amount due thereunder and institution of foreclosure proceedings against the security. Any such actions could force us into bankruptcy or liquidation.

We may require additional financing to complete the ramp up of operations at the Johnson Camp Mine, the availability of which cannot be assured.

We may require additional financing to complete the ramp up of operations at Johnson Camp Mine. We also expect to incur an additional $12-$15 million in capital costs during the next three years, primarily for the development and construction of a new leach pad. We also expect to incur expenses in connection with further exploratory drilling on the Johnson Camp property. Our estimated capital costs and operating expenses may change with our actual experience as our mine plan is implemented. We cannot guarantee that we will be able to obtain any additional financing on commercially reasonable terms or at all. If we fail to obtain the necessary financing when needed, we may not be able to execute our mine plan and we may again be forced to place the Johnson Camp Mine on care and maintenance status.

Our indebtedness, as well as the current global recession, disruption in financial markets and lower copper prices generally, could, among other things, impede our access to capital or increase our cost of capital, which would have an adverse effect on our ability to fund our working capital and other capital requirements.

As of December 31, 2009, the outstanding principal and unpaid interest amount of our debt was $23,257,826. The widely reported domestic and global recession, and the unprecedented levels of disruption and continuing illiquidity in the credit markets have had an adverse effect on our operating results and financial condition, and if sustained or worsened, such adverse effects could continue or deteriorate. Disruptions in the credit and financial markets have adversely affected financial institutions, inhibited lending and limited access to capital and credit for many companies, including ours. In addition, copper prices have been highly volatile. Over the past two years copper prices have fluctuated in a range between $1.27/lb to $4.08/lb. On December 31, 2009, the spot price of copper on the LME was $3.33/lb. These conditions have made it difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations and have limited our flexibility to plan for, or react to, changes in our business and the markets in which we operate. If these conditions persist or deteriorate, they could, among other things, make it difficult for us to finance our working capital requirements and service our existing debt.

If future financing is not available to us when required, as a result of limited access to the credit markets or otherwise, or is not available on acceptable terms, we may not have sufficient working capital for our exploration, development and production programs. We may also be unable to take advantage of business opportunities or respond to competitive pressures. Any of these circumstances could have an adverse effect on our operating results and financial condition.

Title to the Johnson Camp property may be subject to other claims.

Although we believe we have exercised commercially reasonable due diligence with respect to determining title to the properties that we own or in which we hold an interest, we cannot guarantee that title to these properties will not be challenged or impugned. The Johnson Camp property may be subject to prior unrecorded agreements or transfers or to native land claims and title may be affected by undetected defects. There may be valid challenges to the title of the Johnson Camp property which, if successful, could impair development and/or operations.

10

The Johnson Camp property consists of 59 patented lode mining claims, 102 unpatented lode mining claims and 617 acres of fee simple lands. The copper processing facilities and the Copper Chief and Burro bulk mining pits that serve as focal points for our mine plan are located on the patented mining claims or fee simple parcels. However, we may in the future mine areas that are on unpatented mining claims. Unpatented mining claims are unique property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the United States General Mining Law, including the requirement of a proper physical discovery of a valuable lode mineral within the boundaries of each claim and proper compliance with physical staking requirements. Also, unpatented mining claims are always subject to possible challenges by third parties or validity contests by the federal government. The validity of an unpatented mining or mill site claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of United States federal and state statutory and decisional law. In addition, there are few public records that definitively determine the issues of validity and ownership of unpatented mining claims.

We do not insure against all risks, and we may be unable to obtain or maintain insurance to cover the risks associated with our operations at economically feasible premiums. Losses from an uninsured event may cause us to incur significant costs that could have a material adverse effect upon our financial condition.

Our insurance will not cover all the potential risks associated with the operations of a mining company. We may also be unable to obtain or maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, we expect that insurance against risks such as environmental pollution or other hazards as a result of exploration and production may be prohibitively expensive to obtain for a company of our size and financial means. We might also become subject to liability for pollution or other hazards for which insurance may not be available or for which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect upon our financial condition and results of operations.

We compete with larger, better capitalized competitors in the mining industry. This may impair our ability to maintain or acquire attractive mining properties, and thereby adversely affect our financial condition.

The mining industry is competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, base and precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all. Consequently, our revenues, operations and financial condition could be materially adversely affected.

We are dependent on our key personnel, and the loss of any such personnel could adversely affect our Company.

Our success depends on our key executives and on certain operating personnel at the Johnson Camp Mine. We face intense competition for qualified personnel, and the loss of the services of one or more of such key personnel could have a material adverse effect on our business or operations. Our ability to manage administration, production, exploration and development activities, and hence our success, will depend in large part on the efforts of these individuals. We cannot be certain that we will be able to retain such personnel or attract a high caliber of personnel in the future.

11

In order to be successful during and after the ramp-up of our operations, we will have to maintain our workforce. We may not be successful in recruiting the necessary personnel, or in managing the new challenges that we will face with any significant growth.

Our mining operations require that we maintain a workforce at the Johnson Camp Mine of approximately 80 employees as well as various contractors. This requirement places substantial demands on our Company and our management. We will be required to retain, motivate and manage our employees. We will also have to adopt and implement new systems in all aspects of our operations. We have no assurance that we will be able to retain and recruit the personnel required to execute our programs or to manage these changes successfully.

The actual costs of reclamation are uncertain, and any additional amounts that we are required to spend on reclamation may have a material adverse effect on our financial condition.

The costs of reclamation included in the feasibility study are estimates only and may not represent the actual amounts which will be required to complete all reclamation activity. It is not possible to determine the exact amount that will be required, and the amount that we will be required to spend could be materially different than current estimates. Reclamation bonds or other forms of financial assurance represent only a portion of the total amount of money that will be spent on reclamation over the life of the Johnson Camp Mine operation. Any additional amounts required to be spent on reclamation may have a material adverse affect on our financial condition and results of operations.

Our directors and officers may have conflicts of interest.

Some of our directors and officers serve currently, and have served in the past, as officers and directors for other companies engaged in natural resource exploration and development, and may also serve as directors and/or officers of other companies involved in natural resource exploration and development in the future. We do not believe that any of our directors and officers currently has any conflicts of interest of this nature.

Certain legislation, including the Sarbanes–Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.

We may be unable to attract and retain qualified officers, directors and members of committees of the board of directors required to provide for our effective management as a result of the recent changes in the rules and regulations that govern publicly–held companies. In particular, the Sarbanes–Oxley Act of 2002 has resulted in a series of rules and regulations by the United States Securities and Exchange Commission (SEC) that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes, together with the risks associated with our business, may deter qualified individuals from accepting these roles.

There are inherent limitations in all control systems, and misstatements due to error or fraud may occur and not be detected.

We are now subject to the ongoing internal control provisions of Section 404 of the Sarbanes–Oxley Act of 2002. These provisions provide for the identification of material weaknesses in internal controls over financial reporting, which is a process to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with accounting principles generally accepted in the United States of America. Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our internal controls and disclosure controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a

12

control system must reflect the fact that there are resource constraints and the benefit of controls must be relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, in our Company have been detected. These inherent limitations include the realities that judgments in decision–making can be faulty and that breakdowns can occur because of simple errors or mistakes. Further, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management override of the controls. The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may be inadequate because of changes in conditions, such as growth of the company or increased transaction volume, or the degree of compliance with the policies or procedures may deteriorate. Because of inherent limitations in a cost–effective control system, misstatements due to error or fraud may occur and not be detected.

In addition, discovery and disclosure of a material weakness, by definition, could have a material adverse impact on our financial statements. If we are unable to assert that our internal control over financial reporting are adequate, certain customers or suppliers may be discouraged from doing business with us, cause downgrades in our debt ratings leading to higher borrowing costs and affect how our stock trades. This could, in turn, negatively affect our ability to access public debt or equity markets for capital. Further, such an occurrence could make it more difficult for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage and/or to incur substantially higher costs to obtain the same or similar coverage. It could also make it more difficult for us to attract and retain qualified personnel to serve on our board of directors, on committees of our board of directors, or as executive officers.

Our officers and directors, and four shareholders holding 5% or more of our common stock, hold a significant amount of our issued and outstanding stock which may limit non–affiliated stockholders to influence corporate matters.

On November 5, 2009, we completed an unregistered, brokered private placement of 40 million units for total gross proceeds of $12,000,000. Each unit consisted of one common share and one common share purchase warrant exercisable until June 5, 2012. Upon completion of the private placement, Ross Beaty, acting through a wholly-owned holding company, and Riaz Shariff acquired 34,250,000 and 5,750,000 common shares, respectively, representing approximately 31% and 5.2%, respectively, of the outstanding common shares of our Company on a post-closing basis. Under rules promulgated by the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, Mr. Beaty and Mr. Shariff are also considered to beneficially own the 34,250,000 and 5,750,000 common shares that are issuable upon exercise of the warrants forming part of their respective units, which together with their outstanding common shares, represent approximately 47.3% and 9.9%, respectively, of our Company’s issued and outstanding common shares (assuming non-exercise of certain outstanding options, warrants and other rights to acquire shares of our common stock).

In addition, we have two other shareholders who, according to reports filed by them under the Securities Exchange Act of 1934, as amended, beneficially own 7.9% and 6.1%, respectively, of our issued and outstanding common stock (assuming non-exercise of certain outstanding options, warrants and other rights to acquire shares of our common stock held by persons other than the relevant officer, director or 10% shareholder).

As of March 15, 2010, our officers and directors as a group beneficially own approximately 14.6% of our issued and outstanding common stock (assuming non-exercise of certain outstanding options, warrants and other rights to acquire shares of our common stock).

13

These factors may limit the ability of our non-affiliated stockholders to influence corporate matters.

Future sales of our common stock may depress our stock price thereby decreasing the value of your investment.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of common stock.

The securities markets in the United States and Canada have experienced a high level of price and volume volatility recently, and the market price of our securities has also experienced wide fluctuations. There can be no assurance that continual fluctuations in our share price will not occur.

Recently, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, including ours, has experienced wide fluctuations in price which have not necessarily been related to operating performance, underlying asset values or prospects. There can be no assurance that fluctuations in our share price will not continue to occur during the foreseeable future.

If we fail to obtain a listing on an established stock exchange, you may be subject to U.S. federal income tax on the disposition of your securities.

We believe that we currently are a “United States real property holding corporation” under Section 897(c) of the Internal Revenue Code, referred to as a USRPHC, and that there is a substantial likelihood that we will continue to be a USRPHC. Generally, gain recognized by a Non–U.S. Holder on the sale or other taxable disposition of common stock should be subject to U.S. federal income tax on a net income basis at normal graduated U.S. federal income tax rates if we qualify as a USRPHC at any time during the 5–year period ending on the date of the sale or other taxable disposition of the common stock (or the Non–US. Holder’s holding period for the common stock, if shorter). Under an exception to these rules, if the common stock is “regularly traded on an established securities market,” the common stock should be treated as stock of a USRPHC only with respect to a Non–U.S. Holder that held (directly or under certain constructive ownership rules) more than 5% of the common stock during the 5–year period ending on the date of the sale or other taxable disposition of the common stock (or the Non–US. Holder’s holding period for the common stock, if shorter). There can be no assurances that the common stock will be “regularly traded on an established securities market”.

Our reliance on the financial hardship exemption from certain stockholder approval requirements of the Toronto Stock Exchange in connection with our recent $12,000,000 private placement triggered an automatic TSX de-listing review. We cannot give any assurance that we will be found to be in compliance with continued listing requirements when the TSX completes its review, failing which our common stock will be delisted from the TSX.

In connection with our $12,000,000 private placement of 40 million Units in November, 2009, we received an exemption from certain shareholder approval requirements under the rules of the Toronto Stock Exchange (the “TSX”), on the basis of financial hardship. Reliance on this exemption automatically triggered a TSX de-listing review to confirm that we continue to meet the TSX listing requirements. We have been informed by the TSX that the Continued Listings Committee has deferred its de-listing decision until after a meeting of the Committee scheduled to be held on April 21, 2010. Although we believe that we will be in compliance with the TSX’s continued listing requirements at that time, there is no assurance that the review will be determined in our favor, in which event our common stock will be delisted from the TSX.

14

We have not obtained a tax opinion to the effect that there has not been a change of control either during the time preceding the completion of our unregistered special warrant offering in September 2007, immediately following conversion of the special warrants into the underlying shares of common stock and warrants, or in relation to our unregistered $12 million unit offering that closed in November 2009. If a change in control is deemed to have occurred, our Company may not be able to fully utilize our net operating loss carry forwards.

At December 31, 2009, our Company had federal and state net operating loss carry forwards of approximately $79,600,000 and $15,500,000, respectively. We believe that for the purposes of section 382 of the Internal Revenue Code, a change of control occurred on or before November 5, 2009. However, we have not obtained a formal tax opinion to that effect. If any change of control is deemed to have occurred – for example, either during the time preceding the completion of our unregistered special warrant offering in September 2007, immediately following conversion of the special warrants into the underlying shares of common stock and warrants, or immediately following the completion of our unregistered $12 million unit offering in November 2009 – or if a change of control occurs at any time in the future, our Company’s ability to fully utilize its net operating loss carry forwards in computing its taxable income will be limited to an annual maximum of the value of our Company just prior to the change in control multiplied by the long term tax exempt rate.

Broker–dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the penny stock rules. This could severely limit the market liquidity of the shares.

Our common stock currently constitutes “penny stock”. Subject to certain exceptions, for the purposes relevant to us, “penny stock” includes any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share. Rules 15g–1 through 15g–9 promulgated under the United States Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on certain brokers–dealers who engage in certain transactions involving a “penny stock.” In particular, a broker–dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse), must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker–dealer or the transaction is otherwise exempt. A broker–dealer is also required to disclose commissions payable to the broker–dealer and the registered representative and current quotations for the securities. Finally, a broker–dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

The additional sales practice and disclosure requirements imposed upon broker–dealers may discourage broker–dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

In the event that an investment in our shares is for the purpose of deriving dividend income or in expectation of an increase in market price of our shares from the declaration and payment of dividends, the investment will be compromised because we do not intend to pay dividends.

We have never paid a dividend to our shareholders and we intend to retain our cash for the continued development of our business. In addition, pursuant to the terms of our credit agreement with Nedbank, we are restricted from paying dividends or making distributions on shares of our common stock. Accordingly, we do not intend to pay cash dividends on our common stock in the foreseeable future. As a result, a return on investment will be solely determined by the ability to sell the shares in the secondary market.

15

Risks Related to Our Industry

The feasibility of our mine plan is based on certain assumptions about the sustainability of the current price of copper. We may be adversely affected by fluctuations in copper prices.

Copper prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand (including that related to housing), and the political and economic conditions of copper producing countries throughout the world. The aggregate effect of these factors on copper price is impossible to predict. Because mining operations are conducted over a number of years, it may be prudent to continue mining for some periods during which cash flows are temporarily negative for a variety of reasons, including a belief that the low price is temporary and/or the greater expense incurred in closing an operation permanently. The value and price of our common shares, our financial results, and our exploration, development and production activities may be significantly adversely affected by declines in the price of copper and other metals.

In addition to adversely affecting our share price, financial condition and exploration, development and mining activities, declining metal prices can impact operations by requiring a reassessment of reserve estimates and the commercial feasibility of a particular project. Significant decreases in actual or expected copper prices may mean that a mineral resource which was previously classified as a “reserve” will be uneconomical to produce and may have to be restated as a resource. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays in development or may interrupt operations, if any, until the reassessment can be completed.

Our operations involve the exploration, development and production of copper and other metals, with the attendant risks of damage to or loss of life or property and legal liability.

Our operations are subject to all the hazards and risks normally encountered in the exploration, development and production of copper and other base or precious metals, including unusual and unexpected geologic formations, seismic activity, pit–wall failures, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and legal liability.

Government regulation impacting the mining industry may adversely affect our business and planned operations.

Our mining, processing, development and mineral exploration activities, if any, are subject to various laws governing prospecting, mining, development, production, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. New rules and regulations may be enacted or existing rules and regulations may be applied in such a manner as to limit or curtail our exploration, production or development. Amendments to current laws and regulations governing operations and activities of exploration, development mining and milling or more stringent implementation of these laws could have a material adverse effect on our business and financial condition and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production (assuming we achieve production) or require abandonment or delays in development of new mining properties.

Certain groups opposed to mining may interfere with our efforts to reactive the Johnson Camp Mine.

In North America there are organizations opposed to mining, particularly to open pit mines such as the Johnson Camp Mine. Although we intend to comply with all environmental laws and permitting

16

obligations in conducting our business, there is still the possibility that those opposed to the operation of the Johnson Camp Mine will attempt to interfere with the operation of the Johnson Camp Mine, whether by legal process, regulatory process or otherwise. Such interference could have an impact on our ability to operate the Johnson Camp Mine in the manner that is most efficient or appropriate or at all, and any such impact would have a material adverse effect on our financial condition and results of operations.

Our operations are subject to environmental risks and environmental regulation. Our failure to manage such risks or comply with such regulation will potentially expose us to significant liability.

All phases of our operations are subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner that we anticipate will require stricter standards and enforcement, increased fines and penalties for non–compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes, if any, in environmental regulation may adversely affect our operations, if any. Environmental hazards may exist on the Johnson Camp property or on properties that we hold or may acquire in the future that are unknown to us at present and that have been caused by previous or existing owners or operators of the properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Our failure to contain or adequately deal with hazardous materials may expose us to significant liability for which we are not insured.

Production, if any, at the Johnson Camp Mine involves the use of hazardous materials. Should these materials leak or otherwise be discharged from their containment systems, we may become subject to liability for hazards or cleanup work that are not covered by our insurance.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

We are a smaller reporting company as defined by Rule 12b–2 of the Exchange Act and are not required to provide the information required under this item.

| ITEM 2. | PROPERTIES |

A glossary of Technical Terms appears at page 89.

Johnson Camp Property

Technical Report

Unless stated otherwise, information of a technical or scientific nature related to the Johnson Camp property is summarized or extracted from the Technical Report. The Technical Report is also referred to as a feasibility study in this annual report. Management’s plans, expectations and forecasts related to our Johnson Camp property are based on assumptions, qualifications and procedures which are set out only in

17

the full Technical Report. The Technical Report was filed electronically on November 13, 2007, on the System for Electronic Document Analysis and Retrieval (commonly, known as “SEDAR”), and is publicly available on the Internet at www.sedar.com, under our Company’s profile.

Description and Location

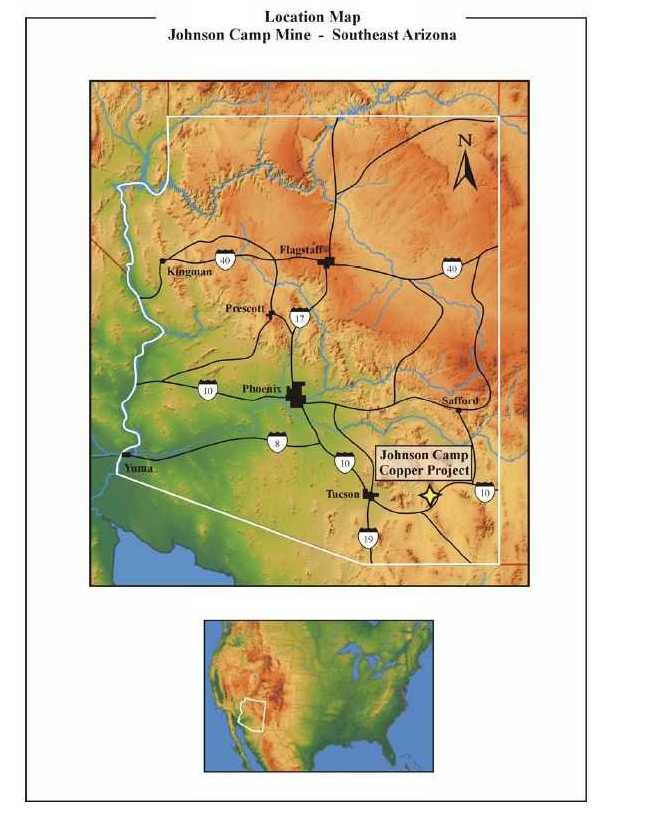

We currently have one development property, the Johnson Camp property, which is located in Cochise County, approximately 65 miles (105 kilometers) east of Tucson, in Cochise County, Arizona, one mile north of the Johnson Road exit off of Interstate Highway 10 between the towns of Benson and Willcox in all or parts of Sections 22, 23, 24, 25, 26, 27, 35 and 36, Township 15 South, Range 22 West. (See Figure 1: Location Map).

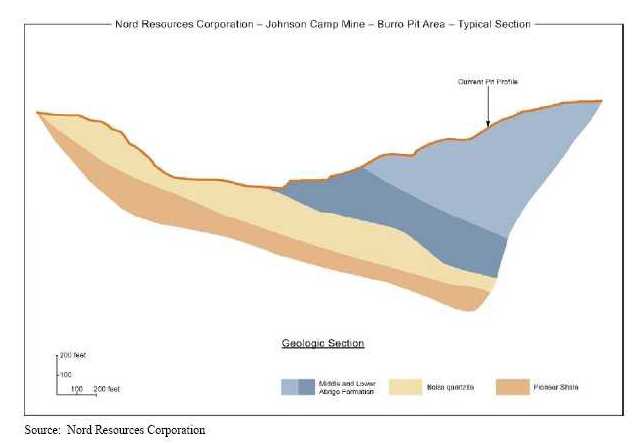

The Johnson Camp project currently includes: two open pits; one waste dump; three heap leach pads; a crushing, agglomeration and conveying system; a SX–EW processing plant; and ancillary facilities. The Burro Pit is larger than the Copper Chief Pit and contains 60% of the project reserves. The Burro Pit is located east of the SX–EW process plant. The Copper Chief Pit is located approximately 2,000 feet northwest of the Burro Pit.

The existing heap leach pads are located west of the open pits. The leach pads are divided into two major sections with solution collection facilities downstream of the first pad and downstream of pads two and three. A new leach pad is planned for future use and is anticipated to be located north of the Burro Pit and northeast of the Copper Chief Pit. The mine waste dump is located immediately to the east of the Burro Pit.

18

Figure 1: Location Map

19

Titles

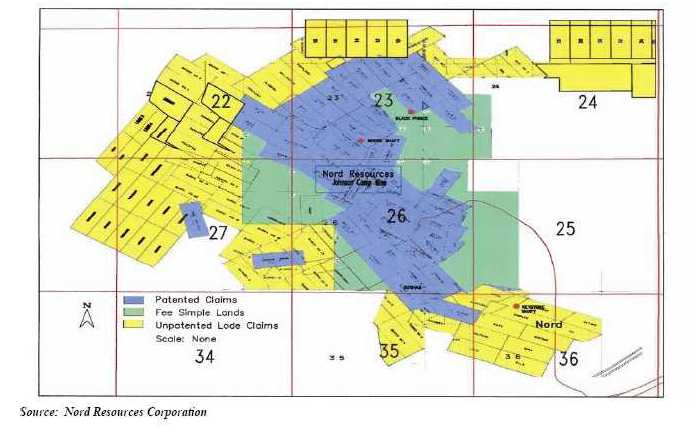

The Johnson Camp property consists of 59 patented lode mining claims, 102 unpatented lode mining claims and 617 acres of fee simple lands. (See Figure 2: Johnson Camp Land Status Map). The patented claims comprise approximately 871 acres and the unpatented claims comprise approximately 1,604 acres. Thus, the Johnson Camp property covers approximately 3,092 acres. All of the claims are contiguous, and some of the unpatented mining claims overlap. We keep the unpatented mining claims in good standing by paying fees of $13,250 per year to the United States Federal Government. We keep the fee simple and patented claims in good standing by paying property taxes and claims filing fees of approximately $35,000 per year. The copper processing facilities and the Copper Chief and Burro open pits that serve as focal points for our mine plan are located on the patented mining claims or the fee simple lands.

We are the owner of the Johnson Camp property and the owner or holder of the claims. We are allowed to mine, develop and explore the Johnson Camp property, subject to the required operating permits and approvals, and in compliance with applicable federal, state and local laws, regulations and ordinances. We believe that all of our claims are in good standing.

Our patented mining claims give us title to the patented lands and no further assessment work must be done; however, taxes must be paid. We have full mineral rights and surface rights on the patented lands. Unpatented mining claims give us the exclusive right to possess the ground (surface rights) covered by the claim, as well as the right to develop and exploit valuable minerals contained within the claim, so long as the claim is properly located and validly maintained. Unpatented mining claims however, may be challenged by third parties and the United States government. (See “Risk Factors – Risks Related to Our Company”).

20

Figure 2: Johnson Camp Land Status Map

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access to the Johnson Camp property is via Interstate Highway 10 and by gravel road. Due to its location just one mile north of Interstate Highway 10, the Johnson Camp property provides excellent access for transportation and delivery of bulk supplies and shipment of copper cathodes.

The Johnson Camp Mine is located on the eastern slope of the Little Dragoon Mountains. The average elevation of the property is approximately 5,000 feet above sea level. The climate of the region is arid, with hot summers and cool winters. Freezing is rare at the site. Historically, the Johnson Camp Mine was operated throughout the year with only limited weather interruptions.

Vegetation on the property is typical of the upper Sonoran Desert and includes bunchgrasses and cacti. Higher elevations support live oak and juniper, with dense stands of pinyon pine common on north–facing slopes.

The existing facilities include the SX-EW processing plant, an administrative and engineering office and warehouse, laboratory, truck shop, core storage building, plant mechanical shop, and various used vehicles, pumps and other equipment. The newly constructed crushing, conveying and stacking system include the following: One 42x65 inch gyratory crusher, conveyors feeding a 40,000 ton (10,000 ton live) coarse ore stockpile, three feeders and a conveyor that feeds two 6x20-foot screens, conveyor feeding a 100-ton surge bin, two conveyors feeding two H6800 hydrocone secondary crushers, conveyor feeding a 40,000 ton fine ore stockpile, three feeders and a conveyor feeding a 10x35-foot agglomerator, an approximate 3,000 foot overland conveyor feeding a stacking system that includes twenty-one 100-foot grasshopper conveyors and a 150-foot radial tele-stacker.

21

The SX-EW processing plant was refurbished and expanded to handle solution from the new crushed and stacked ore and is comprised of a solvent extraction plant, an electrowinning tank house, a tank farm and four solution storage ponds. The solvent extraction plant consists of four extraction mixer-settlers and two strip mixer-settlers, and has a capacity of 2,500 to 5,000 gallons per minute depending if the circuit is in a series or parallel configuration. The electrowinning tank house consists of 88 electrowinning cells that can produce up to 25 million pounds per year. The tank farm, located in front of the tank house, is used for intermediate storage of electrolyte. The four solution storage ponds have a total capacity of approximately 18 million gallons. A new automated cathode stripping machine has been installed to strip copper cathodes from the stainless steel blanks.

The plant also includes a new cell house crane, a new boiler and associated heat exchanger, a new set of electrolyte filters, a clay filter press, and an upgrade to the transformer/rectifier, new pumper-mixers, and a sulfuric acid storage tank.