Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 333-152302

Local Insight Regatta Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-8046735 | |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) | |

| 188 Inverness Drive West, Suite 800 Englewood, Colorado |

80112 | |

| (Address of principal executive offices) | (Zip Code) | |

303-867-1600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| ¨ Large accelerated filer | ¨ Accelerated filer | x Non-accelerated filer | ¨ Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The registrant is a wholly owned indirect subsidiary of Local Insight Media Holdings, Inc. As of June 30, 2009, no shares of the registrant’s voting or non-voting common equity were held by non-affiliates of the registrant.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

| Title of class |

Shares Outstanding at March 31, 2010 | |

| Common Stock, par value $0.01 per share |

195,744.22 |

Table of Contents

2

Table of Contents

Certain Definitions

As used in this annual report, the following terms have the following respective meanings, unless the context requires otherwise:

| • | “Berry ILOB” refers to the Independent Line of Business division of L.M. Berry, substantially all the assets and certain liabilities of which were acquired by The Berry Company from L.M. Berry on April 23, 2008. |

| • | “LEC” or “LECs” refers to a local exchange carrier or local exchange carriers. |

| • | “LEC Customer” refers to a customer of ours that is a LEC or has either been granted the exclusive right to publish directories on behalf of an incumbent LEC or is the exclusive publisher of one or more LEC-branded directories. |

| • | “LIMH” refers to Local Insight Media Holdings, L.P., which owns of record 35.7% of Local Insight Media Holdings. |

| • | “LIMI” refers to Local Insight Media, Inc., an affiliate of Regatta Holdings and a wholly-owned, indirect subsidiary of Local Insight Media Holdings. |

| • | “LIYP” refers to Local Insight Yellow Pages, Inc., a wholly owned subsidiary of Regatta Holdings prior to its merger with and into The Berry Company on June 30, 2009. |

| • | “L.M. Berry” refers to L.M. Berry and Company, a subsidiary of AT&T Inc. |

| • | “Local Insight Media” refers to Local Insight Media, L.P., an affiliate of ours and the successor to Local Insight Media, LLC. |

| • | “Local Insight Media Holdings” refers to Local Insight Media Holdings, Inc., which is the indirect parent of Regatta Holdings and Local Insight Media. |

| • | “our company,” “we,” “our” or “us” refers collectively to Regatta Holdings and its consolidated subsidiaries and their predecessors. |

| • | “Regatta Holdings” refers to Local Insight Regatta Holdings, Inc. |

| • | “The Berry Company” refers to The Berry Company LLC, a wholly-owned subsidiary of Regatta Holdings. |

| • | “WCAS” refers to Welsh, Carson, Anderson & Stowe. |

| • | “Welsh Holdings Group” refers collectively to the Welsh Regatta Group and the Welsh LIM Group. |

| • | “Welsh LIM Group” refers to certain funds affiliated with WCAS which prior to June 20, 2008 indirectly owned approximately 70.5% of Local Insight Media. |

| • | “Welsh Regatta Group” refers to certain funds and individuals affiliated with WCAS which prior to June 20, 2008 indirectly owned 100% of Regatta Holdings. |

| • | “Windstream” refers to Windstream Corporation. |

| • | “Windstream Service Areas” refers to Windstream’s local wireline markets as they existed on December 12, 2006. |

Cautionary Statement Regarding Forward-Looking Statements

This annual report contains forward-looking statements. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plan,” “potential,” “predicts,” “should” or “will” or the negative thereof or other

3

Table of Contents

variations thereon or comparable terminology. In particular, statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance contained in this annual report in Item 1 — “Business,” Item 1A — “Risk Factors” and Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this annual report in Item 1 — “Business,” Item 1A — “Risk Factors,” and Item 7 —“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

| • | expected declines in our revenue; |

| • | our failure to implement our new business model successfully or in accordance with the currently planned schedule; |

| • | the risk that the market for the provision of website development, search engine marketing and internet-based video advertising to small and medium-sized businesses will fail to develop; |

| • | the loss of any of our key LEC Customer agreements; |

| • | our inability to enforce or fully realize our rights under our LEC Customer agreements, including by reason of the bankruptcy of any of the parties to those agreements or certain third parties; |

| • | the declining usage of print Yellow Pages directories or a decrease in the number of businesses that advertise with us; |

| • | the effects of the economic recession and of war, terrorism or catastrophic events; |

| • | increased competition from incumbent and independent Yellow Pages print and internet directory publishers, internet-based local search companies, search engines and other providers of website development and search engine marketing services, as well as other types of media; |

| • | reduced benefits of using the Windstream and other incumbent LEC brand names; |

| • | rapid technological developments and changing preferences in the Yellow Pages publishing and local search industries; |

| • | our dependence on and ability to maintain satisfactory relationships with third party providers of certain essential products, services and technologies; |

| • | the use by small and medium-sized businesses of self-service platforms to meet their online advertising needs; |

| • | the effect of competition in local telephone service on the incumbent LECs’ current leading positions in the markets we serve; |

| • | our inability to enforce the full scope of our rights under non-competition agreements with third parties, including Windstream; |

| • | our inability to purchase media from Google, Yahoo! or Microsoft on commercially reasonable terms; |

| • | disruptions to our operations caused by our conversion to a new process management, billing and collection and production platform and integrating our information technology systems and processes; |

| • | the failure of our Pay4Performance advertising solution to deliver anticipated advertising revenue; |

4

Table of Contents

| • | our inability to realize anticipated savings from our on-going cost optimization efforts; |

| • | failures in the computer and communications systems we rely on; |

| • | the effect of extending credit to small and medium-sized businesses; |

| • | a decline in the performance of third party certified marketing representatives, which coordinate sales of advertising to national accounts, or a decision by these representatives to reduce or end their business with us; |

| • | the loss or impairment of our intellectual property rights; |

| • | the impact of litigation; |

| • | the effects of “opt-out” and “opt-in” legislative initiatives, as well as other changes in, or our failure to comply with, government regulations, including franchising laws, accounting standards, zoning laws, environmental laws and taxation requirements; |

| • | the risk that we may become subject to new or existing sales and use taxes; |

| • | future changes in directory publishing obligations, and additional regulation regarding use of the internet, data and data security; |

| • | the loss of key personnel or turnover among, or our failure to adequately train, our sales representatives; |

| • | the impact of union organizing activity; |

| • | fluctuations in the price or availability of paper; |

| • | risks related to our substantial indebtedness and the Regatta exchange notes; |

| • | the risk that we may be noncompliant with one or more of our financial covenants during 2010 and beyond; |

| • | risks related to the substantial indebtedness of our affiliates; |

| • | the increased risk that our affiliates may be noncompliant with one or more of their financial covenants during 2010 and beyond; |

| • | continued or increased disruption in the credit and equity markets; and |

| • | other risks and uncertainties, including those listed in Item 1A — “Risk Factors.” |

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this annual report are made only as of the date hereof. We do not undertake and specifically disclaim any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments, unless otherwise required by law.

Market, Industry and Other Data

In this annual report, we rely on and refer to information and statistics regarding the directory publishing industry as well as the general advertising industry and, unless otherwise specified, our market position is based on our revenue rank among public and private directory companies based on public filings with the U.S. Securities and Exchange Commission, or SEC, industry presentations and industry research reports. Where possible, we obtained this information and these statistics from third-party sources, such as independent industry publications, government publications or reports by market research firms, including company research, trade interviews and public filings with the SEC. Additionally, we have supplemented third-party information where necessary with management estimates based on our review of internal surveys, information from our customers and vendors, trade and business organizations and other contacts in markets in which we operate, and our management’s knowledge and experience. However, these estimates are subject to change and are uncertain due

5

Table of Contents

to limits on the availability and reliability of primary sources of information and the voluntary nature of the data gathering process. As a result, you should be aware that industry data included in this annual report, and estimates and beliefs based on that data, may not be reliable. We make no representation as to the accuracy or completeness of such information.

Numerical figures included in this annual report have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

| ITEM 1 | BUSINESS |

Our Company

We are a leading provider of local search advertising products and services, offering our core target market of small and medium-sized businesses, or SMBs, a comprehensive range of lead-generating solutions that enable consumers to efficiently find the products and services they need. Our integrated suite of local advertising solutions encompasses print Yellow Pages as well as a full range of digital advertising products and services designed to establish, maintain and optimize our advertising clients’ online presence.

Our principal operating subsidiary, The Berry Company LLC, or The Berry Company, primarily serves non-major metropolitan areas and rural and certain suburban markets in 42 states. Our comprehensive set of local search advertising solutions consists of five principal product and service offerings, or revenue generating units: (i) print directory advertising; (ii) website development, production and maintenance; (iii) search engine marketing, or SEM (including delivery of local advertisements through major search engines, such as GoogleTM, BingTM and Yahoo!®); (iv) internet Yellow Pages, or IYP, advertising (including through YellowPages.comTM); and (v) internet-based video advertising. In February 2010, we launched Berry LeadsTM, a new business model which we plan to rollout on a market-by-market basis during 2010 and early 2011. Under the new business model, we rely primarily on third parties to develop, fulfill and support our digital advertising products and services. We believe that outsourcing these rapidly evolving technology-oriented functions will enable us to expeditiously bring high-quality solutions to market and to focus on our core strength of sales and marketing.

SMBs constitute a substantial majority of our approximately 260,000 advertising client accounts. We employ a local sales force that utilizes a consultative sales approach focused on collaborating with the advertiser to develop a tailored local advertising plan using our products and services. We believe our local sales force’s access to our client base is a key competitive advantage, enabling us to serve as a “trusted advisor” to our advertising clients, facilitating our efforts to develop and maintain long-term relationships with them and allowing us to effectively sell our suite of advertising solutions. We believe our local sales force’s ability to develop a comprehensive and customized mix of advertising products based on the advertiser’s unique needs and characteristics positions us to capture a significant share of advertiser spending on local search products and services.

We are the fifth largest Yellow Pages directory publisher in the United States based on revenue. In addition to serving as the exclusive official publisher of Windstream-branded print and internet directories in the Windstream Service Areas, we are the largest provider of outsourced print directory sales, marketing, production and related services in the United States. We publish 215 Windstream-branded print directories and 652 print directories on behalf of 133 LEC Customers other than Windstream. We also operate and maintain the WindstreamYellowPages.com website and publish IYP directories on behalf of 32 other LEC Customers. During the year ended December 31, 2009, we published approximately 45,000 IYP advertisements, developed approximately 4,300 websites, sold SEM services to over 3,500 advertisers and created, produced and distributed approximately 140 internet-based video advertisements.

For the year ended December 31, 2009, we generated revenue of $578.1 million. We derive our revenue primarily from the sale of advertising in our print directories. We also generate revenue from our digital

6

Table of Contents

advertising products and services and from other services provided to LEC Customers. We believe these digital products and services will comprise an increasing proportion of our revenue for the foreseeable future. For more complete information concerning our financial results, see Item 6 — “Selected Financial Data,” Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8 — “Financial Statements and Supplementary Data” included elsewhere in this Annual report on Form 10-K.

At December 31, 2009, we employed approximately 1,050 employees, including a local sales force of approximately 375 sales representatives. None of our employees is currently represented by a union.

Our History

Formation of Windstream Yellow Pages. Windstream was formed in July 2006 upon the merger of Alltel Corporation’s wireline telecommunications business (including Alltel Publishing Corporation, or Alltel Publishing) with Valor Communications Group, Inc. Prior to the merger, Alltel Publishing had published Yellow Pages directories for over 20 years, having increased its presence in the industry following its 1993 acquisition of the publishing business of GTE Directories Service Corporation. Following the merger that formed Windstream, Windstream’s directory publishing business was operated by its wholly-owned subsidiary, Windstream Yellow Pages, Inc., or Windstream Yellow Pages.

The Split-Off. On December 13, 2006, Windstream announced that it would split off Windstream Yellow Pages in a tax-free transaction to the Welsh Regatta Group, which we refer to as the Split-Off. Regatta Holdings was formed to hold Windstream Yellow Pages prior to the Split-Off. The Split-Off was consummated on November 30, 2007. The following transactions occurred in connection with the Split-Off:

| • | Windstream contributed all the shares of capital stock of Windstream Yellow Pages to Regatta Holdings. |

| • | Regatta Holdings entered into senior secured credit facilities consisting of : (i) a $20.0 million senior secured revolving credit facility and (ii) a $66.0 million senior secured term loan facility. |

| • | In exchange for the transfer to it of all the shares of capital stock of Windstream Yellow Pages, Regatta Holdings: (i) distributed to Windstream a special cash dividend of $40.0 million; (ii) issued additional shares of Regatta Holdings common stock to Windstream (which, together with the existing shares of Regatta Holdings’ common stock held by Windstream, are referred to as the Regatta Shares); and (iii) distributed $210.5 million aggregate principal amount of 11.00% Senior Subordinated Notes due 2017, or the Regatta senior subordinated notes, to Windstream. |

| • | Following the completion of the transactions described above, Windstream exchanged all the Regatta Shares for an aggregate of 19,574,422 shares of Windstream common stock then held by the Welsh Regatta Group, which shares were then retired. |

| • | Windstream then exchanged the Regatta senior subordinated notes for outstanding Windstream debt held by certain selling security holders. These security holders resold the Regatta senior subordinated notes to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended, or the Securities Act, and to non-U.S. persons under Regulation S under the Securities Act. |

Upon the consummation of the above-described transactions:

| • | The Welsh Regatta Group indirectly owned 100% of Windstream Regatta Holdings, Inc.; |

| • | Windstream Regatta Holdings, Inc.’s name was changed to Local Insight Regatta Holdings, Inc.; and |

| • | Windstream Yellow Pages’ name was changed to Local Insight Yellow Pages, Inc. |

In connection with the Split-Off, LIYP entered into several commercial agreements with Windstream to define our relationship with Windstream with respect to a number of services. In particular, LIYP entered into a

7

Table of Contents

50-year publishing agreement pursuant to which Windstream granted LIYP an exclusive, royalty-free license to publish Windstream-branded directories in the Windstream Service Areas. LIYP also entered into a billing and collection agreement and a tax sharing agreement in connection with the Split-Off. For more information about these agreements, see “Agreements With Windstream” in this Item 1.

Acquisition of the Berry ILOB. On April 23, 2008, our wholly-owned subsidiary, The Berry Company, acquired substantially all the assets and certain liabilities of the Berry ILOB from L.M. Berry for a total purchase price of approximately $236.7 million (inclusive of adjustments related to working capital). Prior to its acquisition of the Berry ILOB, The Berry Company had no operations.

Combination of Regatta Holdings and Local Insight Media. Prior to June 20, 2008, the Welsh Regatta Group indirectly owned 100% of Regatta Holdings and the Welsh LIM Group (which is comprised of certain funds affiliated with WCAS that are not part of the Welsh Regatta Group) owned approximately 70.5% of Local Insight Media.

Local Insight Media’s operating subsidiaries are CBD Media Finance LLC, or CBD Media, the leading publisher of print and IYP directories in the greater Cincinnati metropolitan area; ACS Media Finance LLC, or ACS Media, the leading publisher of print and IYP directories in the State of Alaska; and HYP Media Finance LLC, or HYP Media, the leading publisher of print and IYP directories in the State of Hawaii. On June 20, 2008, the businesses of Regatta Holdings and Local Insight Media were combined in a transaction pursuant to which:

| • | A new holding company, Local Insight Media Holdings, was established; |

| • | Regatta Holdings became a wholly-owned, indirect subsidiary of Local Insight Media Holdings; |

| • | Local Insight Media became a wholly-owned, indirect subsidiary of Local Insight Media Holdings; and |

| • | The Welsh Regatta Group and the Welsh LIM Group directly or indirectly owned approximately 69.3% and 21.7%, respectively, of Local Insight Media Holdings. |

As a result of this combination, we are controlled by the Welsh Holdings Group. The Welsh Holdings Group directly or indirectly owns 87.5% of Local Insight Media Holdings, our indirect parent. Since its founding in 1979, WCAS has organized 15 limited partnerships with total capital of $20 billion. Since its inception, WCAS has invested in more than 159 companies in its target industries and has funded over 650 follow-on acquisitions. For additional information concerning WCAS and our relationship with WCAS, see Item 1A — “Risk Factors — We are controlled by the Welsh Holdings Group, whose interests as equity holders may conflict with yours as a creditor” and Item 13 — “Certain Relationships and Related Transactions, and Director Independence.”

The Berry Company is party to directory publishing and services agreements with CBD Media, ACS Media and HYP Media. In addition, under the terms of a consulting agreement, our affiliate, Local Insight Media, Inc., or LIMI, provides operational, administrative and other support to us (although that agreement was suspended effective as of January 1, 2009 and remained suspended as of December 31, 2009). For a description of these agreements, see Item 13 — “Certain Relationships and Related Transactions, and Director Independence.”

In November 2008, we completed an offer to exchange all the Regatta senior subordinated notes for 11.00% Series B Senior Subordinated Notes due 2017, or the Regatta exchange notes, which were registered under the Securities Act.

Merger of LIYP into The Berry Company. Between April 23, 2008 and June 30, 2009, LIYP and The Berry Company existed as separate wholly owned subsidiaries of Regatta Holdings. On June 30, 2009, LIYP merged with and into The Berry Company, with The Berry Company surviving the merger and succeeding to all of LIYP’s rights and obligations, including all of LIYP’s publishing agreements and other contracts. We currently do business under the “Berry” brand and have updated our sales and marketing materials accordingly.

8

Table of Contents

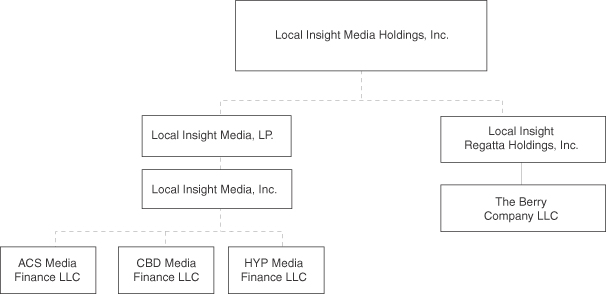

The following chart shows the basic organizational structure for Local Insight Media Holdings’ principal operating companies following the combination with Local Insight Media and LIYP’s merger with and into The Berry Company. Dashed lines indicate indirect holdings through one or more holding companies.

Our Strategy and New Business Model

We believe the increasing importance of the internet, the rapid pace of technological change in digital local search advertising and the proliferation of local advertising alternatives have made it more challenging for SMBs to effectively and efficiently generate leads from potential customers. We believe there exists a significant and long-term opportunity to advise and support SMBs in developing and implementing local search advertising solutions that are customized to meet their specific needs.

Our strategy for pursuing this opportunity combines a suite of high-quality local advertising solutions with a redesigned sales and marketing approach that leverages our local sales force’s access to our client base. We believe our client access is a key competitive advantage, enabling us to serve as a “trusted advisor” to our advertising clients, facilitating our efforts to develop and maintain long-term relationships with them and allowing our sales representatives to collaborate with the advertiser to develop a customized mix of advertising products based on the advertiser’s unique needs and characteristics. We believe our local sales force’s consultative sales approach and “on the ground” presence in the markets we serve also positions us to effectively sell our integrated suite of local advertising solutions to new advertising clients.

Consistent with this strategy, in February 2010 we launched Berry Leads, a new business model which we plan to roll out on a market-by-market basis during 2010 and early 2011. Our new business model is intended to enhance our ability to meet the individual needs of our clients in the markets we serve, enabling them to efficiently and effectively generate leads from multiple sources and platforms.

The key elements of Berry Leads include:

| • | Comprehensive set of high-quality products. Our integrated suite of local search advertising solutions consists of five principal product and service offerings, or revenue generating units: |

| • | Print directory advertising. |

9

Table of Contents

| • | Website development, production and maintenance. |

| • | SEM services aimed at enhancing advertisers’ online lead generation. |

| • | The creation and publication of advertisements in IYP directories. |

| • | The creation and distribution of internet-based video advertisements. |

| • | Strategic outsourcing. Our new business model relies on the expertise of leading third party vendors for certain products, services and technologies. This approach is intended to accelerate our commercial rollout of the new business model in a scalable manner, to minimize our up-front investment and to enable us to offer products and services to our customers that we believe are best-in-class. This approach is also designed to allow us to focus on our core competence of sales and marketing. |

| • | Redesigned sales and marketing approach. Our new business model employs a redesigned sales and marketing approach that comprises the following key elements: year-round contacts with, and sales to, customers; a sophisticated client segmentation and account prioritization model designed to create efficiencies in the sales process and facilitate the development of advertising solutions that meet our clients’ needs; demand creation through various media to generate interest in our products and services; enhanced training and talent management for our sales organization; and high-quality customer service. |

| • | Transparent proof of value. During 2010, we expect to introduce an online Client Dashboard in the markets in which our new business model has been launched. The Client Dashboard has been designed to provide our clients with transparent proof of the value of our services (in terms of website traffic, qualified in-bound calls, click-throughs and emails) and to offer a broad range of performance tracking and account management functionalities. |

| • | Sophisticated technology platforms. Our new business model relies on a media agnostic production platform as well as advanced customer relationship management, or CRM, systems and technologies designed to provide our sales force with timely access to the information they need to establish, maintain and expand client relationships. |

We spent a substantial portion of the year ended December 31, 2009 designing our new business model and planning for its implementation starting in February 2010. Our activities in this regard included conducting research to assess SMB needs and consumer trends in our market areas; developing a detailed go-to-market plan; redesigning our sales and marketing approach; conducting beta trials of our re-designed product and service portfolio; negotiating agreements with third party vendors for certain products, services and technologies for the new business model; designing and starting to implement a comprehensive training program for our local sales force; and designing metrics to track the performance of the new business model.

Markets

We sell our products and services in 815 markets located in 42 states. Our geographic focus is primarily on non-major metropolitan areas and rural and certain suburban markets. The largest market we serve is the Cincinnati metropolitan area, which is the 24th largest metropolitan area in the United States according to the 2000 U.S. Census.

10

Table of Contents

The following table shows the approximate number of advertising clients we served in our top 20 markets and in all our markets collectively:

| Market |

Approximate Number of Advertising Clients | |

| Cincinnati, Ohio |

14,300 | |

| Oahu, Hawaii (including Honolulu) |

10,900 | |

| Rochester, New York |

10,200 | |

| Hawaiian Neighbor Islands (Big Island, Maui, Kauai, Molokai and Lanai) |

8,900 | |

| Anchorage, Alaska |

7,800 | |

| Lincoln, Nebraska |

7,000 | |

| High Point, North Carolina |

4,600 | |

| Greater Lexington, Kentucky |

4,300 | |

| Cabarrus, North Carolina |

3,600 | |

| Greater Flathead, Montana |

3,500 | |

| La Crosse, Wisconsin |

3,100 | |

| Orange County, New York |

3,100 | |

| Columbia-Jamestown, Missouri |

3,000 | |

| Mohave, Arizona |

2,700 | |

| Fairbanks, Alaska |

2,700 | |

| Dothan, Alabama |

2,500 | |

| Texarkana, Texas |

2,100 | |

| Lorain County, Ohio |

2,000 | |

| Mankato, Minnesota |

2,000 | |

| St. Charles, Missouri |

1,900 | |

| Other markets (795) |

160,000 | |

| Total |

260,200 |

Products and Services

We offer an integrated range of print and digital advertising solutions that generate leads for our core target market of SMBs and enable consumers to efficiently find the products and services they need. Our comprehensive suite of local search advertising solutions consists of the five principal product and service offerings, or revenue generating units: (i) print directory advertising; (ii) website development; production and maintenance; (iii) SEM; (iv) IYP advertising; and (v) internet-based video advertising. These products and service offerings are described below.

Print Directory Advertising. Our print directories are designed to provide potential consumers with easy access to information and advertisers with a cost effective medium to reach potential customers in the geographical area in which the directory is distributed. Each directory generally contains several distinct sections, including: (i) a Yellow Pages section, where information is organized by product or service headings that contain business listings and in-column advertisements; (ii) a White Pages section that lists alphabetically, by last name, the names, addresses, and phone numbers of individuals and businesses in the area served; (iii) a community information section providing reference information about general community services such as government offices, schools and hospitals; and (iv) a coverage map detailing the approximate geographic area covered by the directory.

We are the fifth largest Yellow Pages directory publisher in the United States based on revenue. In addition to serving as the exclusive official publisher of Windstream-branded print and internet directories in the Windstream Service Areas, we are the largest provider of outsourced print directory sales, marketing, production and related services in the United States. We publish 215 Windstream-branded print directories and 652 print

11

Table of Contents

directories on behalf of 133 LEC Customers other than Windstream. During the year ended December 31, 2009, we published 787 print directories. The number of directories published during 2009 is less than the total number of directories we publish because during 2009 the publication life of 80 of our print directories, whose normal 12-month publication life ended during 2009, was extended by three months. As a result of that extension, those 80 directories will publish in 2010 rather than 2009. We expect to revert to a 12-month publication life for all our directories in 2010.

Our print directories are distributed to virtually all businesses and residences in the geographic areas we serve. Our directories are generally well-established in their communities and have a strong local market presence. Substantially all the directories we publish bear the brand of the incumbent LEC in the market in which the directory is distributed. We believe our directories’ affiliation with the incumbent LEC in substantially all the markets we serve provides us with a competitive advantage, allowing our directories to benefit from identification as the “official” directory publisher in those markets.

Yellow Pages Directories. We believe print Yellow Pages directory advertising remains an important component of advertising programs designed to generate local leads. We offer local businesses a basic listing at no charge in the relevant edition of our Yellow Pages directories. This listing generally includes the name, address and telephone number of the business and is included in alphabetical order in the relevant heading. In addition, we offer local advertisers a range of paid advertising options in our Yellow Pages directories, including: listing advertising (enabling an advertiser to have its listing highlighted, set in a bolder typeface or include extra lines of text to convey additional information); in-column advertising (allowing an advertiser to expand its basic alphabetical listing by purchasing advertising space in the column in which the basic listing appears); display advertising (enabling the advertiser to include a wide range of additional information, graphics, photographs and logos using a broad selection of colors, graphics and photo processes); and specialty/awareness products (which allow advertisers to advertise in a variety of high-visibility locations on or in a directory, including on covers, spines and magnets adhered to the front of the directory, in hardstock insert tabs and in “gatefold” advertisements connected to the front cover of the directory).

White Pages Directories. We publish the White Pages sections of our directories under publishing agreements with Windstream and our other LEC Customers. State public utilities commissions generally require incumbent LECs, including Windstream and other incumbent LECs for which we publish directories, to produce White Pages directories to serve their local service area. In addition, Windstream and our other LEC Customers are generally required to publish and distribute White Pages directories under interconnection agreements with other LECs and resellers of local exchange services. Under our LEC Customer contracts (including our publishing agreement with Windstream), we generally publish and distribute, on the LEC’s behalf, White Pages directories to virtually every residence and business with local wireline telephone service in the area. The White Pages sections of our directories list virtually every residence and business in the coverage area and generally include the name, address and phone number of each residence or business. Similar to advertisers in our Yellow Pages section, White Pages advertisers also have the ability to enhance their listings through bolding and highlighting, extra lines for the inclusion of supplemental information and in-column and display advertisements.

Print Directory Services. We provide our LEC Customers a full range of services relating to print directories, including:

| • | Local and national sales. We employ a local sales force, consisting of premises sales representatives and telephone sales representatives to sell print directory advertising. In addition, our national account sales managers represent our products to approximately 150 third-party advertising agents known as certified marketing representatives (“CMRs”), which support national advertisers in connection with the placement of advertisements in multiple Yellow Pages directories throughout the country. |

| • | Advertising design. We provide design services to create in-column and display advertising, as well as specialty items, for advertising clients. |

12

Table of Contents

| • | Advertising inventory control. We track the sale of specialty items available for sale to maintain appropriate inventory levels. |

| • | Advertiser acknowledgement preparation and mailing. Proofs of new and changed display advertisements are generally provided to advertisers prior to a “proof close” cut-off date. |

| • | Quality review. Extensive quality control procedures are followed to minimize printing errors. |

| • | Production. We maintain a classified database of listings relating to the production of our print directories. |

| • | Composition, Printing and Distribution. We manage third party vendors for the composition, printing and delivery of our print directories. |

| • | Production scheduling. We serve in an administrative capacity to schedule dates and reserve space at the composer, printer and delivery agent for directories. |

Website Development, Production and Maintenance. We offer a variety of subscription-based services relating to the development, publication and maintenance of websites. These services are designed to enable clients without a current website presence to establish such a presence quickly, effectively and affordably. For advertising clients that already maintain a website, our services provide an economical solution to upgrade their website and enhance the effectiveness of their online presence.

Our website services are available in various packages, designed to serve the individual advertising client’s needs. These packages include websites with as few as 5, or as many as 20 or more, pages and provide for a variety of related features and services, either included in the package or for an additional fee. We currently offer substantially all the features described below in all our markets. However, certain of the product and service features described below are being introduced as part of the commercial introduction of our new business model, which we launched in February 2010 and which we plan to roll out on a market-by-market basis during 2010 and early 2011.

Our website offerings include:

| • | Initial Consultation and Site Design. Information collected by our local sales teams and customer service representatives about the advertiser’s business, including client-specific content, is utilized to tailor the website to address the client’s goals and needs. |

| • | Optimization and Quality Review. Each website is optimized to promote more effective lead generation through improved search engine rankings, and is submitted on an ongoing basis to a variety of national and local search engines. Additionally, each website undergoes a thorough quality review process prior to being published. |

| • | On-Going Support and Modification. Clients receive a package of post-publication support, including basic website design and modification services. These support services encompass both maintenance of the website and other modifications of the website’s contents and design theme. |

| • | Domain Name Registration. In consultation with the client, we obtain, purchase and register a domain name appropriate for the advertiser. |

| • | Webmail. Clients receive multiple e-mail boxes, compatible with Microsoft Outlook, reflecting the selected domain name. |

| • | Managed Hosting. Our website services are provided on a managed hosting platform designed to enable reliable daily operation of the client’s website. Each website package includes a hosting solution that provides secure disk storage, daily backups and a monthly data transfer allotment, and is designed to scale with the client’s needs. |

13

Table of Contents

| • | Unique Telephone Number. Clients may be provided a unique local or 800 number that is forwarded to their business telephone line. Certain information about the calls received through this unique number is tracked and reported to our clients. |

Under our new business model, we rely primarily on Yodle, Inc., or Yodle, and Web.com Group, Inc., or Web.com, two leading providers of website design services, to fulfill our website offerings, which we sell to our clients under the “Berry” brand.

During the year ended December 31, 2009, we developed approximately 4,300 websites.

Search Engine Marketing. We develop online promotional programs designed to cost effectively drive traffic to advertising clients’ websites and increase their visibility in the search result pages of major search engines, such as Google, Bing and Yahoo!. We offer specific digital programs, such as “Guaranteed Clicks” and “Premium SEM,” that are designed to maximize the number of clicks, calls and emails generated by the advertiser’s website based on the advertiser’s budget and advertising goals. We are an authorized reseller of Google AdWords, the Google advertising program that offers “pay-per-click” advertising and website-targeted advertising for both text and banner ads. Google AdWords enables advertisers to reach people searching on Google itself, as well as the Google advertising network, which includes both search sites (such as AOL, Ask.com, Netscape and EarthLink) and content sites (such as the websites of The New York Times, CNN, The Wall Street Journal and Business Week). Our SEM services are offered on a subscription basis. Under our new business model, our SEM services are being fulfilled primarily by Yodle and Web.com and sold to advertising clients under the “Berry” brand. During the year ended December 31, 2009, we sold SEM services to over 3,500 advertisers.

IYP Advertising. We offer subscription-based IYP services to our advertising clients. We are authorized to resell online advertising listings on YellowPages.com, a leading national IYP and local search directory, in all the markets that we currently serve. In connection with this relationship, we have created an integrated production platform that enables seamless distribution of advertiser content to the YellowPages.com network. YellowPages.com, a wholly owned subsidiary of AT&T, is a leading national IYP and local search directory, serving as an online source for comprehensive national and local business information. In addition to providing online exposure to consumer business searches, YellowPages.com distributes video profiles that are posted on YouTube TM. In January 2009, YellowPages.com and SuperPages.com (the IYP and online search directory of SuperMedia, Inc., or SuperMedia) entered into a cross distribution agreement that enables our YellowPages.com advertisers to extend the reach of their online advertisements to SuperPages.com, thereby increasing their ability to generate quality leads. For more information regarding our arrangement with YellowPages.com, see “ — Agreements Entered into in Connection with the Berry ILOB Acquisition.”

In addition to serving as a YellowPages.com reseller, we operate the WindstreamYellowPages.com IYP website, which is marketed to advertisers located primarily in the Windstream Service Areas. We also operate IYP directories on behalf of 32 LEC Customers other than Windstream, including CBD Media (CBYP.com), ACS Media (ACSYellowPages.com), HYP Media (HTYellowPages.com), CenturyTel, Inc., or CenturyTel (CenturyLinkYellowPages.com), and Frontier Communications Corporation, or Frontier (FrontierPages.com). Our IYP directories offer online directory search functionality, providing advertisers the opportunity to extend the reach of their advertising. Our IYP directories offer the easy navigation and convenient features of a high-quality digital publication, such as the ability to search by name, keywords and headings, enabling users to search the content of local Yellow Pages advertisements in the relevant geographic area, thereby increasing the relevance of their search results. Our IYP directories also provide advertisers with valuable online exposure prior to the normal print publishing cycle, enabling advertisements to appear sooner and presenting an opportunity for us to accelerate the collection of online advertising revenue. Where we publish an IYP directory, advertising clients receive a listing in both the IYP directory and the corresponding print directory. Advertising clients also have the ability to purchase priority placements in our IYP directories for an additional charge.

During the year ended December 31, 2009, we published approximately 45,000 IYP advertisements.

14

Table of Contents

Internet-Based Video Advertising. We enable advertisers to create high-quality video advertisements over the internet. Our video services include on-site production of videos and related editing and other post-production services. We also offer services that facilitate the placement of video advertisements on a variety of online distribution platforms, including YellowPages.com, other IYP websites, Google, Bing and Yahoo!. Our video services are designed to optimize our clients’ video advertising to comply with current search engine optimization best practices and to promote more effective lead generation through improved search engine rankings. We are party to agreements with TurnHere, Inc., or TurnHere, and Digital Media Communications, Inc., or DMC, for the fulfillment of our video services and with VideoBloom, Inc., or VideoBloom for search engine optimization support for our video services. Our video services are offered under the “Berry” brand on a subscription basis. During the year ended December 31, 2009, we produced and distributed approximately 140 internet-based video advertisements.

Strategic Vendor Relationships for Digital Products and Services. Under our new business model, we outsource substantially all our digital advertising products and services to third party vendors which we believe to be best-in-class. This approach is intended to accelerate our commercial rollout of our new business model in a scalable manner, to minimize our up-front investment and to offer high-quality products and services to our advertising clients. This approach is also designed to allow us to focus on our core competency of sales and marketing.

Our indirect parent, Local Insight Media Holdings, has entered into a number of strategic vendor relationships relating to our portfolio of digital advertising products and services, including:

| • | Master service agreements with Yodle and Web.com, two leading providers of website design services, covering fulfillment of our website development and SEM service offerings. |

| • | A master subscription agreement with Salesforce.com, inc., or SFDC, providing us with access to that company’s customer relationship management, or CRM, platform and tools. |

| • | A Local Advertising Reseller Agreement with YellowPages.com, or YPC. |

| • | An agreement with Bluewolf Group LLC covering the implementation and customization of SFDC’s CRM platform and tools. |

| • | Agreements with TurnHere and DMC for the fulfillment of high-quality video advertisements for placement on the internet. |

| • | An agreement with VideoBloom, Inc. for search engine optimization support for our video services. |

| • | Agreements with BTS USA and Cerebyte, Inc. for sales training and execution support in connection with the implementation of our new business model. |

Delivery of Transparent Results. In recent years, our SMB clients have expressed an increasing level of interest in receiving information that measures the results of their local advertising expenditures (in terms of leads delivered) and in tying the compensation they pay us to the leads we deliver. During the course of 2009, we commercially introduced Pay4Performance, a performance-based advertising solution under which advertising clients pay only for qualified inbound phone calls delivered from the client’s print Yellow Pages and, in certain larger markets, IYP advertisements. As of December 31, 2009, we offered Pay4Performance in 37 of our markets. We plan to introduce Pay4Performance in 35 additional markets during 2010. At present, Pay4Performance is marketed primarily to clients who would otherwise cancel or significantly decrease their existing advertising program, or to SMBs that have not previously advertised in our print Yellow Pages directories.

During 2010, we expect to introduce an online Client Dashboard in the markets in which our new business model has been launched. The Client Dashboard has been designed to provide advertising clients with up-to-date data to measure the performance of our products and services, including information regarding website traffic,

15

Table of Contents

qualified in-bound calls, leads delivered from print advertising, click-throughs and emails. The Client Dashboard has also been designed to enable clients to manage and modify their services online. We intend to enhance the Client Dashboard portal over time to offer additional performance tracking and account management functionality.

Sales and Marketing

The marketing of local search advertising services is primarily a direct sales business which involves both servicing existing accounts and developing new client relationships. We sell advertising to both local and national advertisers. Renewing clients comprise our core advertiser base. For the year ended December 31, 2009, our revenue renewal rate among local advertisers was approximately 77% and our account retention rate among local advertisers was approximately 75%. We believe our high revenue renewal and account retention rates reflect the importance of our print directories to our local advertising clients, for whom Yellow Pages directory advertising has historically been, in many cases, the primary or only form of advertising.

Local Sales. At December 31, 2009, our sales force consisted of approximately 375 sales representatives. Our premises sales force works locally throughout our markets to facilitate the establishment of long-term relationships with local advertisers and to stimulate account and revenue renewal rates.

Our local sales force is divided into two principal groups:

| • | Premises sales representatives (approximately 48% of our sales force). These sales representatives interact with clients in person and generally focus on high-revenue clients with whom the sales representative typically interacts on a face-to-face basis at the client’s place of business. |

| • | Telephone sales representatives (approximately 52% of our sales force). These sales representatives interact with clients by telephone and generally focus on smaller clients with whom the sales representative typically interacts over the telephone. |

Utilizing a consultative sales approach focused on collaborating with the advertiser to develop a tailored local advertising plan, members of our sales force sell our entire portfolio of local advertising products and services. Premises sales and telephone sales personnel operating out of 21 offices across the country sell our range of print and digital advertising solutions on behalf of our LEC Customers. We assign either premises representatives or telephone sales representatives to local advertising clients (and potential clients) based on an assessment of the amount of the client’s actual local advertising spend or (under our new business model) the client’s expected local advertising spend.

Our sales force is supported by a client marketing and field execution team, which is responsible for field marketing, account management, digital sales and relationships with our LEC Customers. Our sales force is also supported by product development and management, market research, pricing, data analytics, advertising and public relations functions. These functions are generally centralized and coordinated with local sales management to develop market plans and products tailored to the client base in local markets.

We believe the client access afforded by our sales force is a key competitive advantage for us, enabling us to serve as a “trusted advisor” to our advertising clients. We believe the size, local presence, local market knowledge and experience of our sales force enables us to develop and maintain long-standing relationships with advertisers, which, in turn, promotes a high rate of client renewal and overall satisfaction. In turn, we believe these relationships allow us to respond to market needs and to effectively and efficiently introduce and sell our suite of advertising solutions in the markets we serve. In addition, we believe our local sales force’s consultative sales approach and “on the ground” presence in the markets we serve positions us to effectively sell our integrated suite of local advertising solutions to new advertising clients.

16

Table of Contents

National Sales. National advertising is usually placed by national or large regional chains, such as rental car companies, insurance companies and pizza delivery businesses, each of which generally purchases advertising in numerous directories. The sale of advertising to national accounts generated approximately 13.3% of our revenue for the year ended December 31, 2009. Third party CMRs handle substantially all the sales and marketing process for national advertisers, including the design of the advertisements, the placement of advertisements in directories and provision of billing services. CMRs place advertisements with directory publishers selected by their clients on a national basis. Some CMRs are stand-alone companies while others are divisions of larger, more diversified advertising agencies. The national advertiser pays the CMR, which then pays us after deducting its commission. We have relationships with approximately 150 CMRs, of which the top 20 account for approximately 79% of our national advertising revenue. We employ six national account sales representatives who are dedicated to national sales.

Training. New sales representatives receive approximately four weeks of training immediately upon joining the organization. This initial training is comprised of in-market self paced learning (guided by a learning facilitator and team leader) and classroom training on sales techniques, our portfolio of products and services, best sales practices, customer care and ethics. Following classroom training, new representatives participate in a six week post-training program during which they begin to contact actual clients, working together with an experienced sales person. Following their completion of the formal training program, new sales representatives continue to receive ongoing support from a learning facilitator and participate in additional learning modules. In addition, our training program provides all our sales representatives with access to on-going training, field coaching, mentoring and other opportunities to improve their sales skills.

As part of the planning for the commercial introduction of our new business model, we redesigned our training process to ensure that our entire sales organization is retrained in best sales practices and all the components of our new integrated portfolio of products and services. During 2010 and early 2011, we plan to require all our director-level and manager-level sales employees and all our sales representatives to complete an intensive five day sales execution program that is designed to train participants on the re-designed product and service portfolio, systems, tools, resources and sales practices incorporated into our new business model. For up to 25 days following completion of the five day program, participants will have access to continued learning resources in order to more effectively apply their newly learned skills. In addition, we have adopted a learning tool that is aimed at improving market management and the sales execution process. This learning tool is also designed to enable sales managers to provide sales representatives with “just in time” feedback on opportunities to enhance their performance.

Customer Service. Based in Dayton, Ohio, our customer service organization is responsible for providing ongoing support to our advertisers, LEC Customers, sales force and third party vendors. The support provided by our customer services organization includes responding to billing inquiries, resolution of service and fulfillment issues relating to our products and services, reviewing and resolving client claims and providing outbound assistance for our Pay4Performance program. The customer service organization also monitors and reports on key indicators of client satisfaction, with the objective of helping to optimize our overall operational and financial performance. In addition, the customer service organization works closely with cross-departmental teams to identify opportunities to enhance our clients’ experience, improve lead generation and deliver a greater return on our clients’ investment in our local advertising products and services.

Customers

Advertising Clients. As of December 31, 2009, we had approximately 260,000 advertising client accounts. SMBs are our core target market, constituting a substantial majority of our client advertising accounts. The sale of advertising to local and national clients generated approximately 82.5% and 13.3%, respectively, of our revenue for the year ended December 31, 2009. The remainder of our revenue was generated from additional services provided to LECs and from fees derived from other sources.

17

Table of Contents

Our revenue is not materially concentrated in any individual client industry segment. The breadth of our advertising client base substantially reduces category concentration risk. During the year ended December 31, 2009, no single account generated more than 0.3% of revenue, and our top 10 clients represented approximately 1.3% of our revenue. Additionally, during those same periods, our top 10 print Yellow Pages advertising headings accounted for approximately 19.4% of our revenue and no single print Yellow Pages advertising heading category represented more than approximately 4.9% of our revenue. We believe this lack of client concentration lessens the impact on us of adverse developments in our advertising clients’ industries, even if all companies within a particular industry scale back on their advertising expenditures.

LEC Customers. All our LEC Customers are incumbent LECs (or have either been granted the exclusive right to publish directories by an incumbent LEC or are the exclusive publisher of LEC-branded directories), except for one LEC Customer which is a competitive LEC. All 133 of our directory publishing agreements cover the publication of print Yellow Pages directories and 32 contracts cover the provision of IYP and other digital advertising services. Our contracts with our LEC Customers average two to three years in length, other than our publishing agreement with Windstream, which expires in 2057.

The table below shows certain information about our contracts with our seven largest LEC Customers.

| LEC Customer |

Description |

Number of directory titles published |

Circulation of directory titles (in thousands) |

Approximate Number of Advertising Clients | ||||

| Windstream |

Incumbent LEC operating in 21 states | 215 | 3,745 | 66,000 | ||||

| ACS Media |

Leading directory publisher in Alaska | 10 | 896 | 10,000 | ||||

| CBD Media |

Leading directory publisher in the Cincinnati metropolitan area | 18 | 2,007 | 14,300 | ||||

| HYP Media |

Leading directory publisher in Hawaii | 11 | 2,228 | 14,000 | ||||

| CenturyTel |

Incumbent LEC operating in 33 states | 219 | 4,021 | 56,900 | ||||

| Frontier |

Incumbent LEC operating in 24 states | 142 | 818 | 53,200 | ||||

| TDS Telecom |

Incumbent LEC operating in 36 states | 101 | 729 | 10,600 |

We do not pay any compensation to Windstream under our publishing agreement with Windstream. With respect to our other LEC Customer contracts, we are generally compensated for our services on a commission basis, consisting of a base commission and, in some cases, incentive compensation. For more information about our publishing agreement with Windstream, see “— Agreements With Windstream — Publishing Agreement” below.

ACS Media, CBD Media and HYP Media are all wholly-owned, indirect subsidiaries of Local Insight Media. For a description of our contracts with these companies, see Item 13 — “Certain Relationships and Related Transactions, and Director Independence.” ACS Media is the exclusive publisher of the “official” print directories of Alaska Communications Systems Group Inc., the largest LEC in Alaska. CBD Media is the exclusive publisher of “Cincinnati Bell Directory”-branded yellow pages in the greater Cincinnati metropolitan area. HYP Media is the exclusive publisher of the “official” print directories of Hawaiian Telcom, Inc., the incumbent LEC in Hawaii.

The term of our directory service agreement with CenturyTel continues through May 1, 2012 (subject to automatic renewals for successive one-year terms unless either party notifies the other of its decision not to so

18

Table of Contents

extend the term of that agreement). The directories published under our directory services agreement with CenturyTel include all the directories in CenturyTel’s local wireline markets as they existed on May 1, 2007. In July 2009, CenturyTel and Embarq Corporation, or Embarq (another LEC that is not a customer of ours), announced that they had completed a previously announced merger. The combined company does business as CenturyLink. Although CenturyTel’s merger with Embarq does not affect our directory service agreement with CenturyTel, that agreement does not cover any of the Embarq-branded directories published in the local wireline markets owned by Embarq prior to its merger with CenturyTel (and which are now part of the combined CenturyLink operation).

The term of our master publishing agreement with Frontier continues through December 31, 2010 (subject to an automatic one-year extension unless either party notifies the other of its decision not to so extend the term of that agreement). We have commenced negotiations with Frontier regarding a renewal of our directory publishing agreement with that company. Those negotiations may not be successful. The directories published under our directory services agreement with Frontier include all the directories in Frontier’s local wireline markets as they existed on November 13, 2008. In May 2009, Frontier announced that it had signed a definitive agreement with Verizon Communications Inc., or Verizon (another LEC that is not a customer of ours), under which Frontier will acquire approximately 4.8 million access lines in 14 states from Verizon. That acquisition has not yet been consummated. Although Frontier’s transaction with Verizon does not affect our master publishing agreement with Frontier, that agreement does not cover any of the Verizon-branded directories published in the local wireline markets covered by the transaction between Frontier and Verizon.

The termination or nonrenewal of our agreements with CenturyTel or Frontier in accordance with their stated terms or otherwise, or the failure by CenturyTel or Frontier to satisfy their obligations under the agreements to which each is a party, would negatively impact our revenue and could materially harm our business.

Our directory publishing agreement with TDS Telecom will expire upon the publication of all TDS directories published through December 31, 2010. TDS Telecom has informed us that they will not renew their directory agreement with us. We do not believe the non-renewal of our directory publishing agreement with TDS Telecom will have a material adverse effect on our business, financial condition or results of operations.

Agreements With Windstream

In connection with the Split-Off, we entered into a number of agreements with Windstream that define our ongoing relationship with Windstream. Certain of these agreements are summarized below.

Publishing Agreement. Under a publishing agreement dated as of November 30, 2007, Windstream granted us the royalty-free right to be the exclusive official directory publisher of listings and classified advertisements of telephone customers in the Windstream Service Areas. Windstream also granted us an exclusive, royalty-free license for the term of the publishing agreement to use the Windstream trademark in connection with its directory products and related marketing materials in the Windstream Service Areas and to use the WindstreamYellowPages.com domain name in connection with the exercise of our rights under the publishing agreement. Under the publishing agreement, Windstream must purchase not less than an aggregate of $1.4 million of advertising per year through November 30, 2012. Windstream has agreed that during the term of the publishing agreement, it will not sell directory products in the Windstream Service Areas or in those areas in which it published directory products for other LECs as of November 30, 2007. The publishing agreement will remain in effect until November 30, 2057 and will automatically renew for additional one-year terms unless either Windstream or we provide 12 months’ notice of termination. Either party may terminate this agreement prior to its expiration in the event of a material breach of the agreement by the other party that is not cured within 90 days of notice of such breach.

19

Table of Contents

The termination or nonrenewal of our publishing agreement with Windstream in accordance with its stated terms or otherwise, or the failure by Windstream to satisfy its obligations under the publishing agreement, could have a material adverse effect on our business, financial condition and results of operations.

Billing and Collection Agreement. We entered into a billing and collection agreement with Windstream at the closing of the Split-Off. The billing and collection agreement covers our clients for whom Windstream is the provider of local telephone service. Under this agreement, Windstream bills our client and collects amounts due for our publishing services applying its then-current collection procedures. Under the billing and collection agreement, on a semi-monthly basis, Windstream must remit to us the amounts it has billed on our behalf, less a per bill fee and an allowance for bad debt. The billing and collection agreement will remain in effect until November 30, 2010 and may thereafter be renewed for two additional one-year terms, unless we provide Windstream with 60 days’ prior notice of our intention not to renew it. Either party may terminate the billing and collection agreement prior to its expiration date in the event of a material breach of the agreement by the other party that is not cured within 30 days of notice of such breach.

Agreements Entered into in Connection with the Berry ILOB Acquisition

In connection with our acquisition of the Berry ILOB, we entered into a number of commercial agreements with L.M. Berry and its affiliates, including the agreements summarized below.

| • | Intellectual Property Agreement and License Agreement. Pursuant to an intellectual property agreement dated as of April 23, 2008, AT&T Inc. assigned and transferred to us certain trademarks, including “The Berry Company,” certain domain names, including www.TheBerryCompany.com, and certain software that is used exclusively in the conduct of the Berry ILOB business. In addition, AT&T Inc. granted us a non-exclusive, royalty-free license to use certain patents owned by AT&T Inc. and certain other intellectual property owned by L.M. Berry that is used in the conduct of the Berry ILOB business. |

| • | Local Advertising Reseller Agreement. Pursuant to a local advertising reseller agreement dated as of April 23, 2008, YellowPages.com LLC, or YPC, authorized us (together with our affiliates), on an exclusive basis in Alaska, Hawaii, the Cincinnati, Ohio metropolitan area, the Rochester, New York metropolitan area and the Lincoln, Nebraska metropolitan area and on a non-exclusive basis in all the other markets we serve, to: (i) offer and sell YellowPages.com advertising listings to local account clients; (ii) purchase YellowPages.com advertising listings to appear on the YellowPages.com website and network as a result of user searches; and (iii) offer and sell YellowPages.com advertising listings as national or statewide online advertising to appear on the YellowPages.com website and network as a result of user searches. The local advertising reseller agreement has subsequently been amended to extend the scope of the non-exclusive territory to all the geographic areas served by us. Under the local advertising reseller agreement, we are obligated to pay a percentage of our monthly net revenue in respect of YellowPages.com advertising listings sold. If we fail to make certain minimum payments with respect to the exclusive territory, our exclusive authorization will terminate and become a non-exclusive authorization for the remainder of the term of this agreement. We also received a 10-year, non-exclusive license to use the YellowPages.com trademark in connection with its activities under this agreement. The term of the local advertising reseller agreement is 10 years. Upon the expiration of the initial term, the local advertising reseller agreement will automatically renew for successive one-year periods unless either party provides the other party with a notice of termination at least 60 days prior to the end of the then-current term. Either party may terminate this agreement prior to its expiration in the event of a material breach of the agreement by the other party that is not cured within 30 days of notice of such breach. |

Publishing, Production and Distribution

The publishing cycle of a typical directory includes several stages beginning with sales and marketing to clients followed by compilation, printing and distribution. The length of time to complete sales and marketing,

20

Table of Contents

production and printing depends on the size of the directory’s revenue base. The length of time to complete the distribution stage depends on the size of the market area and number of households and businesses in the local area. The production, printing and distribution cycles are typically much shorter than the sales cycle for a particular book.

Contract entry and advertising creation processes occur immediately upon receipt of a sales contract. Before a directory goes into the book compilation stage, the directory is fully sold. Therefore, substantially all future revenue is known prior to printing and distribution. Although our directories are generally viewed as annual publications, the actual interval between publications may vary. During 2009, we extended the normal 12-month publication life of 236 of our print directories by three months, as a result of which 80 of those directories will publish in 2010 rather than 2009. We expect to revert to a 12-month publication life for all our directories in 2010. The publication schedule is periodically adjusted to accommodate new books. The distribution dates of each directory may change depending on market, economic and competitive conditions, considerations relating to production optimization as well as staffing levels required to achieve individual revenue goals.

Set forth below are descriptions of the major stages of the publication, compilation, printing and distribution process:

| • | Sales and Marketing. The sales cycle of a directory varies based on the size of the revenue base and can range from a few weeks to six months. In the months prior to publication, the sales force approaches potential new clients. Potential new clients may be either newly-formed or existing businesses in the area which did not purchase advertising in the most recent edition of a directory. The sales force also contacts existing clients and encourages them to renew and upgrade the size of their advertisements and to purchase other products in our portfolio. |

| • | Book Compilation. Sales typically cease two months prior to publication, at which time we stop accepting additional clients. Once a directory has closed, pre-press activities commence. Pre-press activities include accuracy checks, finalizing graphics, proofing the advertisements with the client and paginating the directories. We outsource the majority of the finished graphics work relating to our print directories to a third party vendor, Macmillan India Ltd. |

| • | Printing. Third party vendors print and bind all our directories. In July 2008, Local Insight Media Holdings entered into 10-year printing agreements with World Color Press Inc. (formerly known as Quebecor World (USA) Inc.), or World Color, and Des Plaines Printing, LLC, or Des Plaines. These agreements cover all our directories. In January 2010, Quad/Graphics, Inc., or Quad/Graphics, announced that it had agreed to acquire World Color. That acquisition has not yet closed. Quad/Graphics’ acquisition of World Color does not affect our printing agreement with World Color. |

| • | Distribution. Once the directories are printed and bound, they are either placed directly in the U.S. mail system at the printing plants or are freighted to a distribution location near the directory area. Distribution is outsourced to two third party vendors: Directory Distributing Associates, Inc., or DDA, and Market Distribution Specialists, Inc., or MDS. Depending on the circulation and size of the directory, distribution times range from one to four weeks. |

The contract data used to build the directories is stored and used to create new advertising contracts for the next issue of the directory. These contracts are printed at the appropriate time and allocated to the sales representatives using guidelines established for each market, which starts the directory cycle again.

We are in the process of migrating from our legacy process management, billing and collection and production system to a software platform supplied by 3L Media AB, or 3L. The 3L system is media agnostic, allowing us to publish advertising to a variety of different platforms. We expect implementation of this system will allow us to better manage every aspect of our publishing cycle, from initial sales calls through production of our print and digital products. The conversion to the 3L software platform is expected to be substantially completed by the end of 2010 and fully completed by the end of the first quarter of 2011. Upon completion of the

21

Table of Contents

3L software platform implementation, we will have substantially reduced the number of our process management systems. In addition, we expect the implementation of this system will allow us to further improve our operational efficiency and benefit from the associated cost savings.

Billing and Credit Control