Attached files

| file | filename |

|---|---|

| EX-21 - LIHUA INTERNATIONAL INC. | v178648_ex21.htm |

| EX-32.1 - LIHUA INTERNATIONAL INC. | v178648_ex32-1.htm |

| EX-23.1 - LIHUA INTERNATIONAL INC. | v178648_ex23-1.htm |

| EX-31.2 - LIHUA INTERNATIONAL INC. | v178648_ex31-2.htm |

| EX-32.2 - LIHUA INTERNATIONAL INC. | v178648_ex32-2.htm |

| EX-31.1 - LIHUA INTERNATIONAL INC. | v178648_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended December 31,

2009

or

|

¨

|

TRANSITION REPORT UNDER

SECTION13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from _____________ to ________________

Commission

file number 000-52650

LIHUA

INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

14-1961536

|

|

|

(State

or other jurisdiction of

|

||

|

incorporation

or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

c/o

Lihua Holdings Limited

|

||

|

Houxiang

Five-Star Industry District, Danyang City, Jiangsu Province,

PRC

|

212312

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (86) 511

86317399

Securities

registered pursuant to Section 12(b) of the Act: Common Stock, par value

$0.0001 per share

Name of

each exchange on which registered: NASDAQ Capital Market

Securities

registered pursuant to Section 12(g) of the Act: none

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes

¨

No x

Indicate

by check mark whether the registrant (1) has filed all reports required by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

definitions of “ large accelerated filer,” “ accelerated filer” and “ smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes ¨ No

x

The

aggregate market value of the voting stock held by non-affiliates of the

Registrant as of June 30, 2009 was zero.

The

number of shares outstanding of the registrant’s common stock as of March 24,

2010 was 24,857,717.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

LIHUA

INTERNATIONAL, INC.

Annual

Report on Form 10-K for the Year Ended December 31, 2009

2

FORWARD

LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, and Section 21E

of the Securities Exchange Act of 1934. These statements relate to future events

or our future financial performance. We have attempted to identify

forward-looking statements by terminology including “anticipates”, “believes”,

“expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”,

“plans”, “potential”, “predict”, “should” or “will” or the negative of these

terms or other comparable terminology. These statements are only predictions.

Uncertainties and other factors, including the risks outlined under Risk Factors

contained in Item 1A of this Form 10-K, may cause our actual results,

levels of activity, performance or achievements to be materially different from

any future results, levels or activity, performance or achievements expressed or

implied by these forward-looking statements.

A variety

of factors, some of which are outside our control, may cause our operating

results to fluctuate significantly. They include:

|

|

·

|

the

availability and cost of products from our suppliers incorporated into our

customized module design solutions;

|

|

|

·

|

changes

in end-user demand for the products manufactured and sold by our

customers;

|

|

|

·

|

general

and cyclical economic and business conditions, domestic or foreign, and,

in particular, those in China’s copper

industries;

|

|

|

·

|

the

rate of introduction of new products by our

customers;

|

|

|

·

|

the

rate of introduction of enabling technologies by our

suppliers;

|

|

|

·

|

changes

in our pricing policies or the pricing policies of our competitors or

suppliers;

|

|

|

·

|

our

ability to compete effectively with our current and future

competitors;

|

|

|

·

|

our

ability to manage our growth effectively, including possible growth

through acquisitions;

|

|

|

·

|

our

ability to enter into and renew key corporate and strategic relationships

with our customers and suppliers;

|

|

|

·

|

our

implementation of share-based compensation

plans;

|

|

|

·

|

changes

in the favorable tax incentives enjoyed by our PRC operating

companies;

|

|

|

·

|

foreign

currency exchange rates

fluctuations;

|

|

|

·

|

adverse

changes in the securities markets;

and

|

|

|

·

|

legislative

or regulatory changes in China.

|

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Our expectations are as of the date this Form 10-K is filed,

and we do not intend to update any of the forward-looking statements after the

filing date to conform these statements to actual results, unless required by

law.

We file

annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K and proxy and information statements and amendments to reports filed or

furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of

1934, as amended. You may read and copy these materials at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain

information on the operation of the public reference room by calling the SEC at

1-800-SEC-0330. The SEC also maintains a website (http://www.sec.gov) that

contains reports, proxy and information statements and other information

regarding us and other companies that file materials with the SEC

electronically. You may also obtain copies of reports filed with the SEC, free

of charge, via a link included on our website at http://www.lihuaintl.com

3

PART

I

|

ITEM

1.

|

BUSINESS

|

Company

Overview

Business

Overview

We were

one of the first vertically integrated companies in China to develop, design,

manufacture, market and distribute low cost, high quality, alternatives to pure

copper wire, which include copper-clad aluminum wire (“CCA”) and recycled scrap

copper wire. Primarily because of its high electrical conductivity, pure copper

wire is one of the fundamental building blocks in many components in a wide

variety of motorized and electrical appliances such as dishwashers, microwaves

and automobiles. In most instances, our CCA wire and recycled scrap copper rod

and wire products are an excellent, less costly substitute for pure copper wire

products.

We sell

our wire products directly to manufacturers in the consumer electronics, white

goods, automotive, utility, telecommunications and specialty cable industries

and to distributors in the wire and cable industries. Our track record and

reputation for producing high quality products in large quantities has paved the

way for rapid expansion of our customer base. We have approximately 300

customers and no one customer accounts for more than 7% of our sales. The copper

wire industry in China is large and growing, and essentially all of our product

sales are made to domestic customers in China.

Prior to

2009, our business focused primarily on CCA. Our CCA business consists of

acquiring CCA with a line diameter of 2.05 mm from our suppliers as a raw

material, reducing the diameter of the CCA by drawing it and then annealing and

coating it. Our final CCA product typically has diameters from 0.03 mm to 0.18

mm, depending on customer specifications. To meet strong customer demand, we

substantially increased our CCA production capacity from 2,200 tons per annum as

of the end of 2006 to 7,500 tons per annum as of December 31, 2009.

In

addition to our CCA business, in the first quarter of 2009, we began production

of copper rod from recycled scrap copper. The copper rod we produced meets the

national purity standard for pure copper. As of December 31, 2009,

our scrap copper refinery capacity was approximately 25,000 tons per annum. To

the extent our downstream wire-drawing capacity permits, we process our copper

rod into copper wire. Because our output of copper rod exceeds our capacity to

process it into copper wire, we sell our excess copper rod to other wire

manufacturers for further processing. During the nine months ended September 30,

2009, we sold 5,761 tons of copper wire and 8,032 tons of copper rod. We

currently are working to expand our wire drawing capacity so that we can use a

greater proportion of our copper rod rather than selling it to other

manufacturers, thereby increasing our profit margins and overall profitability.

We are exploiting a range of marketing strategies for the copper wire business,

including cross-selling our copper wire to our existing CCA

customers.

Our

markets for our three main product categories overlap to a degree, and are

characterized by their breadth and depth, with a very large number of current

and potential customers for each product category. Copper rod is a

raw material used in wire and cable production. Our pure copper rod,

which is manufactured from recycled scrap copper, competes directly with copper

rod made from “virgin” (e.g. newly mined) pure copper. To date, our

raw material costs for bulk scrap copper have been lower than prices for virgin

pure copper, which provides us with a pricing advantage in the

market. During 2009, we sold copper rod to approximately 100

customers, most of which are producers of smaller diameter copper wire used in

power cables ranging in size from high voltage power transmission cables to

white good applications such as internal wiring in household appliances and

consumer electronics. Our copper wire, which is sold in a variety of

diameters and may have undergone further in-line processing such as coating with

plastic, is sold to many of the same types of end-use customers who purchase

copper wire from our copper rod customers. These include

manufacturers of a wide range of power cables and products that incorporate

wiring, such as household appliances, automobiles, consumer electronics and

telecommunications equipment. Our CCA wire is sold to many of these

manufacturers as well. CCA wire sells at a lower cost per unit of

weight than pure copper wire, due to the relatively lower density of the

aluminum core which makes up most of the volume of CCA wire. Our CCA

wire offers conductivity performance characteristics that are only marginally

below those of pure copper wire, which means they are attractive in a wide

variety of product applications where a slight reduction in conductivity

standard is tolerable (such as most household appliance, automotive, consumer

electronics and telecommunications applications). Examples of

relatively high tolerance product applications where our CCA wire would not

provide an acceptable replacement option for pure copper wire would be

military/space equipment and wiring in nuclear power plants. One low

tolerance product category that requires pure copper wire rather than our less

costly CCA wire is electric motors, which require pure copper wire

windings. The markets for each of our three product lines are growing

rapidly, due both to growing demand in China for all types of basic wire raw

materials and the relative cost advantages our product lines carry over “virgin”

pure copper competitor products.

4

We

believe that we are well positioned to continue capturing further market share

in the copper wire industry. Our copper wire from recycled copper and CCA are

increasingly being accepted as alternatives to pure copper wire in the domestic

Chinese market. As a result, Our sales and net income have increased

substantially during the last three years. We generated sales of $32.5 million,

$50.0 million and $161.5 million for the years ended December 31, 2007, 2008 and

2009, respectively. We achieved net income of $7.7 million, $11.7 million and

$16.8 million for the years ended December 31, 2007, 2008 and 2009,

respectively. In 2009, we had a non-cash charge of $8.8 million,

which resulted from the change in the fair value of the warrants issued to

investors in conjunction with the Company’s issuance of convertible Preferred

Stock in October 2008. Excluding the impact of this non-cash charge, non-GAAP

net income for 2009 was $25.6 million, up 118.7% from the same period last

year.

Our

capacity to sell our copper rod, recycled copper wire products (drawn from

copper rod) and CCA wire products (drawn from larger diameter CCA wire) is

limited by the equipment we have installed to produce these

products. Our copper rod is made from bulk scrap copper, which is

cleaned, purified and smelted in large capacity smelter units. At the

present time we have a single horizontal copper rod extrusion production line,

fed by two smelters, which is capable of producing 25,000 tons of copper rod per

year in total. In 2009 we sold 9,630 tons of copper rod, all of which was

produced on this smelter/extrusion line. As of December 31, 2009, we

operated approximately 80 high speed wire drawing machines, which draw larger

diameter copper rod or CCA rod into much finer diameter wires, with a total

capacity of approximately 7,500 tons per annum of CCA wire and approximately

18,000 tons per annum of copper wire. Certain of these drawing

machines incorporate additional production steps such as coating, annealing or

magnetizing the fine wire produced. These drawing machines are

manufactured to our design and specifications by custom equipment manufacturers

located in China. We are not dependent on any single custom equipment

manufacturer for the fabrication of our drawing lines. We anticipate

that we will add six additional high-capacity drawing machines in the first two

quarters of 2010, all of which will be used to draw copper wire from our copper

rod, and which will increase our annual copper wire production capacity to

25,000 tons. We further anticipate that we will continue to add

drawing machines in the second half of 2010. Depending on anticipated

market demand, we may also add to our smelter/extrusion capacity in the second

half of 2010 or the first half of 2011, so that we can increase our production

volumes of copper rod. Accordingly, we do not anticipate that our

sales will be capacity-constrained in the near future, even if we continue to

experience rapid sales growth.

We

continuously pursue technological innovations and improvements in our

manufacturing processes. We have obtained one utility model patent in China and

have three pending invention patent applications in China related to our

production process. In addition, we have entered into a technology cooperation

agreement with a university in China. We believe that our emphasis on

technological innovations and production efficiency has contributed

significantly to our leading industry position in China and will continue to do

so for the foreseeable future.

Further,

significant barriers to entry make it difficult for newcomers to successfully

compete with our CCA and copper wire businesses. For example, with respect to

CCA, during the process of drawing, annealing and coating CCA, it is

technologically challenging to maintain high quality and maintain the integrity

of copper and aluminum weight and volume distribution without breakage,

especially for finer diameter wires. Our knowledge and experience in

successfully generating high quality CCA fine and super fine wires put us at a

significant advantage over would-be competitors. With respect to pure copper

wire, our proprietary recycling technology offers us a unique ability to produce

high quality pure copper wire from scrap copper. This enables us to

have a lower raw material cost base comparing to pure copper wire produced from

“virgin” pure copper sourced from copper mines. Our experience and technology

allow us to offer products that are, in most instances, superior and more

cost-effective to those that our potential competitors can produce. Because we

are already an approved vendor for many of our customers and qualifying new

vendors can be time-consuming, we believe we are further advantaged vis-à-vis

potential competitors.

5

To

minimize exposure to copper commodity risk exposure, we maintain minimal raw

material inventory. In addition, we charge a fixed dollar processing fee for

most of our products thus enabling us to pass most of the underlying copper

price exposure to our customers, and minimize our exposure to copper price

fluctuation. We confirm raw material purchase orders for scrap copper or CCA

with suppliers for each sales order only when the applicable sales order has

been received. On the other hand, our principal CCA and scrap copper suppliers

usually dedicate portions of their inventories as reserves to meet our

manufacturing requirements. Our most significant supplier of CCA provides

approximately 30% of our CCA raw material needs, but we have built a large

network of reliable suppliers that deliver high quality raw materials, and

accordingly, are not dependent upon any one supplier for our

success.

We

believe that our experienced management team will continue to leverage our

leading technologies and increasing capacity to manufacture, produce, market and

distribute cost-effective, high quality CCA, recycled copper wire and other

alternatives to pure copper wire. If, as anticipated, worldwide demand for

alternatives to pure copper wire grow and we continue to innovate and improve

our processes, we will be well positioned to compete in the copper wire market

on a global scale.

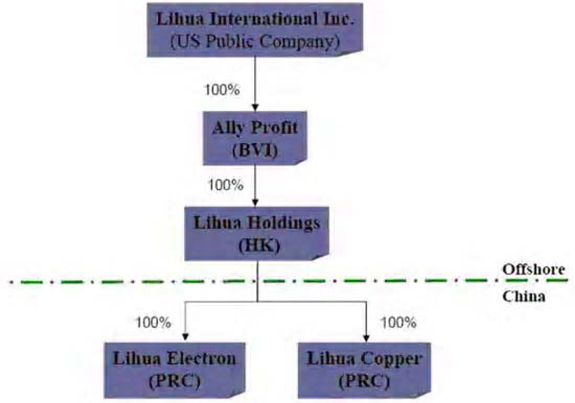

Corporate

Structure

The

following diagram illustrates our corporate structure. All of our

subsidiaries are owned directly.

Our

Strengths

We

believe that the following strengths have contributed to our competitive

position in China:

6

Leading market position and

early-mover advantage. We are one of the leading CCA wire

producers in China, as measured by our current annual superfine wire production

capacity of 7,500 tons. We are targeting to increase our annual CCA wire

production capacity to 10,000 tons by the end of 2010 through internal

expansion.

We

believe we were one of the first companies in China to produce CCA superfine

wire on a commercial scale This early-mover advantage in China coupled with our

reputation for high quality products has enabled us to establish a wide array of

customer and supplier relationships and to expand our relationships with our

existing customers. We have recently launched commercial production of superfine

wires that are manufactured from refined scrap copper and are also in the

process of developing a super-micro-fine wire production

technology.

We

believe we are well positioned to leverage our increasing production scale and

to expand our customer base and product portfolio, to meet China’s growing

demand for cable and wire products.

Proprietary automated and efficient

production facility that can be scaled to meet increased

demand. To cope with surging demand, we have continuously

expanded our production facility in a very rapid way: our production capacity

increased from 2,200 tons per annum in 2006 to 7,500 tons per annum as of

December 31, 2009. We have targeted to increase our annual production capacity

in CCA wire, copper wire, and scrap copper refinery to 10,000, 25,000 and 25,000

tons, respectively, by the end of 2010, and to 15,000, 50,000 and 100,000 tons,

respectively, by the end of 2011. We launched production in our new plant in

March 2009. This new plant occupies about 66,000 square meters and is

six times of the size of our old plant.

Efficient proprietary production

technology. We continually pursue technological improvements

to our manufacturing processes via our strong in-house development teams. We

have obtained one utility model patent for our manufacturing process, and have

three other pending invention patents related to our production processes. In

addition, we have entered into technology cooperation agreements with research

institutes to develop new techniques and processes. Our research and development

(“R&D”) efforts have generated technological improvements that have been

instrumental in controlling our production costs and increasing our operational

efficiency. The combination of our trade secrets and our proprietary production

technology enables us to use lower-cost recycled copper feedstock and to produce

wire with a smaller line diameter.

Rigorous quality control

standards. Consistent with our continuing commitment to

quality, we impose rigorous quality control standards at each stage of our

production process. Since January 2007, our plant has maintained ISO9001:2000, a

certification of quality management systems maintained by the International

Organization of Standardization and administered by certification and

accreditation bodies, which is subject to annual review. For copper magnet wire,

we obtained a National Industrial Production License for copper magnet wire in

January 2009 and satisfied the UL standard in October 2008. According to a test

report dated April 17, 2008, China’s Machinery Industry Quality Supervision and

Test Center For Electrical Material and Special Wire and Cable, a government

inspection and testing agency, recycle copper rod produced by us satisfied the

national standard for electrical copper wire, GB/T3952-1998. We believe these

testing results demonstrate our commitment to producing high-quality products as

well as providing us with a competitive advantage over certain domestic

competitors in the event China implements stricter fuel-quality standards in the

future.

Strong technology improvement and

R&D capabilities. Our technology improvement and R&D

infrastructure includes a team of more than 30 professionals focusing on quality

assurance, equipment maintenance, process maintenance and improvement, and new

product and process R&D. We absorb most of the technology related expenses

in our production costs, and thus have only incurred R&D costs at very low

levels in past years. However, we believe our overall technology-related

spending is greater than many of our China-based competitors. We were granted

one utility model patent and have three pending invention patents relating to

our production process. We believe our knowledge and experience in R&D are

the key reason why we were able to become one of the earliest and leading CCA

manufacturers in China and enabled us the ability to expedite the launch of our

refined superfine copper wire production. In addition, our newly launched scrap

copper refinery operation utilizes a proprietary cleaning solution to cleanse

and refine recycled scrap copper to high purity copper rod product which meets

the national industry standard for pure copper. As a result, we have

been able to take advantage of the emerging market opportunity given the copper

price volatility in recent years.

7

Experienced management and

operations teams with local market knowledge. Our senior

management team and key operating personnel have extensive management skills,

relevant operating experience and industry knowledge. Mr. Zhu, our founder,

Chairman and CEO, has extensive experience managing and operating companies in

the cable and wire industry. We believe our management team’s in-depth knowledge

of the Chinese market will enable us to formulate sound expansion strategies and

to take advantage of market opportunities.

Our

Strategies

We will

continue to strive to be a leading supplier of copper replacement products in

the PRC cable and wire industry, while maximizing shareholder value and pursuing

a growth strategy that includes:

Developing market driven new

products and processes. We consistently pursue technological

improvements to our manufacturing processes and new product development through

our strong in-house technology development team. Our R&D efforts have

generated technological improvements that have been instrumental in controlling

our production costs and increasing our operational efficiency. Our combination

of trade secrets and proprietary production technology enables us to use

lower-cost feedstock and to attain higher product quality. Through innovation

and further production efficiencies, we believe our emphasis on R&D will

enable us to maintain our position as a leading copper replacement product

supplier in the PRC cable and wire industry.

Reliable supplier network for low

cost raw materials. We maintain a long-term supply

relationship with several key suppliers. We believe many of our suppliers prefer

to sell raw materials to us due to our track record for prompt payment as well

as our ability to accept large quantities of raw materials. Our long-standing

supplier relationships provide us with a competitive advantage in China, and we

intend to broaden these relationships to parallel our efforts to increase the

scale of our production facilities, thereby maintaining a diverse supplier

network while leveraging our purchasing power to obtain favorable price and

delivery terms. With the launch of the scrap copper refinery business, we have

also established a scrap copper warehouse in one of the largest scrap metal

markets in China.

Production capacity

expansion. In order to accommodate the rapidly increasing

demand of our products, we have expanded, and plan to continue to expand, our

manufacturing capacity. An increase in capacity has a significant effect on our

results of operations, both in allowing us to produce and sell more products and

achieve higher revenues, and in lowering our manufacturing costs resulting from

economies of scale. We have expanded rapidly since we launched our CCA wire

production in 2006. The following table sets forth information on the historical

development of our production facilities:

|

Plant

1

|

Plant

2

|

||

|

Location

|

Danyang,

Jiangsu

|

Danyang,

Jiangsu

|

|

|

Began

construction

|

March

1999

|

March

2008

|

|

|

Began

production

|

January

2006

|

March

2009

|

|

|

Capacity

as of December, 2009 (metric tons per year)

|

CCA

wire-7,500

|

Copper

refinery-25,000

|

|

|

Copper

wire-18,000

|

|||

|

Site

area (square meters)

|

11,000

|

66,000

|

We

believe our expansion strategy will enable us to benefit from continued growth

in overall copper demand in China. The following sets out our future plan to

ramp up our annual manufacturing capacity:

|

By

the end of

|

||||||||||||

|

2009

|

2010

|

2011

|

||||||||||

|

Copper

wire (MT)

|

18,000 | 25,000 | 50,000 | |||||||||

|

CCA

wire (MT)

|

7,500 | 10,000 | 15,000 | |||||||||

|

Copper

refinery (MT)

|

25,000 | 25,000 | 100,000 | |||||||||

8

Selectively pursue acquisition

opportunities. Although we have not identified a potential

acquisition target(s), we may in the future look to acquire businesses or assets

that may enhance our market position.

Strengthening our relationships with

key customers and diversifying our customer base. We intend to

strengthen our existing relationships with key customers while further expanding

our customer base. We plan to continue providing high-quality and

cost-competitive products to our existing customers and use our existing

customer network and strong industry reputation to expand geographically to

strategic locations across China. We plan to increase our sales service

personnel to further expand our supplier and customer base and to provide

increased coverage of the market. To assist our efforts, we intend to continue

to use customer feedback to improve our service quality and strengthen our

long-term customer base.

Manufacturing

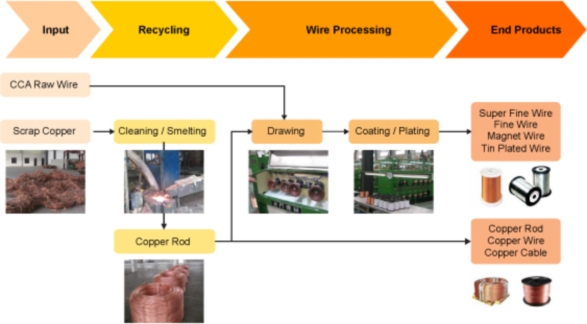

Process

Copper

recycling and wire processing

Our

copper recycling pre-treatment phase utilizes our proprietary cleaning

technology with respect to which we have applied for an invention patent. The

process involves manually or mechanically sorting, stripping, shredding and

magnetically separating the scrap copper. The scrap copper is then compacted and

pre-treated with numerous chemicals. Following the pre-treatment phase, the

metal is smelted and fire refined in a furnace. The furnace refining process

commences with loading the furnace with the pre-treated metal, smelting it, and

then refining and reducing it. Thereafter, the molten copper is continually belt

cast and further treated, and the copper rod is ultimately wound into bundles

for further processing or sale.

Our fine

and superfine wire drawing process utilizes either our recycled copper rod or

CCA and involves drawing the wire to the desired final diameter. Whether using

recycled copper rod or CCA, the drawing process entails multiple steps,

including heat treating, annealing, baking, cooling, quenching and spooling, as

may be necessary to achieve the desired wire diameter and other customer

specifications. The CCA drawing process, however, is more complex than the

process for using recycled copper rod, and utilizes our proprietary trade

secrets to ensure that the wire maintains the original bimetallic bond from the

raw material. The fine or superfine wire is either sold to customers or is

coated and further processed to become magnet wire.

The

following illustration is a simplified outline of our process:

9

Products

Copper

Clad Aluminum (CCA)

CCA is an

electrical conductor consisting of an outer sleeve of copper that is

metallurgically bonded to a solid aluminum core. This structure is set out in

the following CCA illustration:

Note: The

illustration is not drawn to scale.

Over the

past five years, CCA has become a viable and popular alternative to pure copper

wire. In comparison with solid copper wire, CCA raw material costs are generally

35% to 40% lower per ton. CCA and pure copper raw materials are purchased based

on weight. Since aluminum accounts for approximately eighty six percent (86%) by

volume of CCA wire, each ton of CCA wire can yield 2.5 times the length of each

ton of solid copper wire. Our CCA products are a cost effective substitute for

pure copper wire in a wide variety of applications such as wire and cable,

consumer electronic products, white goods, automotive parts, utility

applications, telecommunications, and specialty cables.

We

produce CCA wire with the line diameter in the range of 0.03 mm to 0.18 mm. We

produce and distribute wire in the following forms:

|

|

·

|

Fine

wire. Fine wire is sold to smaller wire manufacturers

for further processing; and

|

|

|

·

|

Magnet

wire. Magnet wire can be fine or super fine and is the

basic building block of a wide range of motorized appliances and is mainly

used for its electrical

conductivity.

|

|

|

·

|

Tin plated

wire. Tin plated wire is mainly used for the

transmission of audio and visual

signals.

|

10

We

produce in accordance with customer orders and we customize our products based

on customer specifications. Customer specifications vary depending on the end

use of the CCA wire, but are primarily determined based upon two measurements,

the thickness of the copper layer on the aluminum core and the diameter of the

CCA wire.

Copper

Rod

In March

2009, we launched the manufacturing of copper rod from our newly acquired

continuous production system for fire refining, melting and rod casting. We use

scrap copper as the raw material to manufacture and sell copper rods. In

addition, we produce cable and copper magnet wire from copper rods.

The

following table has set out the end uses of copper rod based wire

products:

Cable

|

|

·

|

Used

for:

|

|

|

·

|

telephone

drop wire and conductors;

|

|

|

·

|

electric

utilities; transmission lines, grid wire, fence and structured

grounds;

|

|

|

·

|

industrial

drop wire, magnet wire, battery cables, automotive wiring harnesses;

and

|

|

|

·

|

electronics:

radio frequency shielding

|

Magnet

wire

|

|

·

|

Used

in:

|

|

|

·

|

electronic

motors, transformers, water pumps, automobile meters, energy, industrial,

commercial, and residential

industries.

|

Quality

Control

We apply

rigorous quality control standards and have implemented safety procedures at all

phases of our production process. Since January 2007, our plant has maintained

ISO9001:2000, a certification of quality management systems maintained by the

International Organization of Standardization and administered by certification

and accreditation bodies.

Quality

assurance efforts have been made on various lines of products in the following

ways:

|

|

·

|

Copper magnet

wire. We strictly follow the mandatory national product

standard in China, and obtained National Industrial Production License for

copper magnet wire in January 2009 and satisfied UL standards in October

2008.

|

|

|

·

|

Scrap copper

refinery. According to a test report dated April 17,

2008 of China’s Machinery Industry Quality Supervision and Test Center For

Electrical Material and Special Wire and Cable, a government inspection

and testing agency, our copper rods satisfied the national standard for

electrical copper wire,

GB/T3952-1998.

|

|

|

·

|

CCA wire. We

strictly follow the industry recommended

standards.

|

We

believe the testing results we have obtained demonstrate our commitment to

producing high-quality products and provide us with a competitive advantage over

certain domestic competitors in the event China implements stricter quality

standards in the future.

11

Raw

Materials and Suppliers

We

primarily use CCA wire with a line diameter of 2.05 mm, produced by our

bimetallic wire suppliers, to manufacture superfine CCA wire. Our raw material

procurement policy is to use only long-term suppliers who have demonstrated

quality control, reliability and maintain multiple supply sources so that supply

problems with any one supplier will not materially disrupt our operations. In

order to avoid copper price volatility exposure, we do not maintain raw material

inventory. We confirm raw material purchase orders with suppliers only when the

relevant sales orders are received. On the other hand, our principal suppliers

usually dedicate portions of their inventories as reserves to meet our

manufacturing requirements. Suppliers are generally paid with a credit term of

30 days.

For our

scrap copper refinery, we primarily use No. 2 scrap copper in our production of

two types of recycled copper: cable and magnet wire. We purchase the materials

through dealers and the scrap metal market. We have recently established a scrap

copper raw material warehouse in one of China’s largest scrap metal markets.

Scrap copper is generally purchased with cash on delivery terms. We believe that

we will have access to an adequate supply of scrap copper on satisfactory

commercial terms due to the numerous scrap dealers located throughout Guangdong

Province in the PRC.

For each

of the fiscal years ended December 31, 2007, 2008 and 2009 our five largest

suppliers accounted for 100%, 100% and 74% of our total purchases, respectively,

and our single largest supplier accounted for 26.8%, 46.5% and 20.3% of our

total purchases, respectively. We believe that we will have access to

and an adequate supply of raw material on satisfactory commercial terms. In

2009, our top five suppliers are as following:

|

|

·

|

Qingyuan

Zhongbian Metal Co., Ltd.

|

|

|

·

|

Shanghai

Jingsheng Metal Co., Ltd.

|

|

|

·

|

Guangfeng

Recycling Metal Co., Ltd.

|

|

|

·

|

Hailiang

Metal Trading Co., Ltd.

|

|

|

·

|

Nanhai

Zhengjing Metal Co., Ltd.

|

Sales,

Marketing and Distribution

Chinese

domestic market sales account for a majority of our revenue. We target our sales

efforts primarily in the coastal provinces of Guangdong, Fujian, Zhejiang,

Jiangsu and Shanghai areas, where the majority of our customers are located. We

have a sales staff of approximately 30 employees. We maintain 9 sales offices in

China, including 3 in Guangdong, 3 in Zhejiang, 1 in Fujian, 1 in Shandong, and

1 in Anhui. We participate in industry expositions in which we showcase our

products and services and from which we obtain new customers.

We have a

small fleet of trucks that deliver merchandise to customers located within three

hours from our production facilities. Alternatively, we contract with

independent third-party trucking companies to deliver our products when

necessary.

Customers

We sell

our products in China either directly to manufacturers or through distributors

in the wire and cable industries and manufacturers in the consumer electronics,

white goods, automotive, utility, telecommunications and specialty cable

industries. For 2007, 2008 and 2009, we did not have any single customer which

accounted for over 10% of our total revenue.

For the

year ended December 31, 2007, 2008 and 2009, our five largest customers

accounted for 14.5%, 20.2% and 6.9% of our total sales, respectively, and the

single largest customer accounted for 3.0%, 6.6% and 1.6% of our total sales,

respectively. We generally extend unsecured credit for 30 days to large or

established customers with good credit history. Management reviews its accounts

receivable on a regular basis to determine if the allowance for doubtful

accounts is adequate at each quarter-end.

12

Competition

China is

the world’s largest producer and market for cable and wire. Our sales are

predominantly in the PRC, and as a result, our primary competitors are PRC

domestic companies. To a lesser degree we face competition from international

companies.

We

believe being located in China provides us with a number of competitive factors

within our industry, such as:

|

|

·

|

Pricing. A

producer’s flexibility to control pricing of products and the ability to

use economies of scale to secure competitive pricing

advantages;

|

|

|

·

|

Technology. A

producer’s ability to manufacture products efficiently, utilize low-cost

raw materials, and to achieve better production quality;

and

|

|

|

·

|

Barriers to

entry. A producer’s technical knowledge, access to

capital, local market knowledge and established relationships with

suppliers and customers to support the development of commercially viable

production facilities.

|

Competition

in the bimetallic industry, particularly in China, can be characterized by rapid

growth and a concentration of manufacturers. We believe we differentiate

ourselves by being an early mover in the industry, and by offering superior

product quality, timely delivery and better value. We believe we have the

following advantages over our competitors:

|

|

·

|

the

performance and cost effectiveness of our

products;

|

|

|

·

|

our

ability to manufacture and deliver products in required volumes, on a

timely basis, and at competitive

prices;

|

|

|

·

|

superior

quality and reliability of our

products;

|

|

|

·

|

our

after-sale support capabilities, from both an engineering and an

operational perspective;

|

|

|

·

|

excellence

and flexibility in operations;

|

|

|

·

|

effectiveness

of customer service and our ability to send experienced operators and

engineers as well as a seasoned sales force to assist our customers;

and

|

|

|

·

|

overall

management capability.

|

Research

and Development

Our

superfine wire manufacturing technology was developed and refined in-house by

our technology improvement and R&D team. This team comprises over 30

professionals focusing on quality assurance, equipment maintenance, process

maintenance and improvement, and new product and process R&D.

We absorb

most of the development technology related expenses in our production costs, and

thus have only reported R&D costs at very low levels in the past years. For

each the fiscal years ended December 31, 2007, 2008 and 2009, we reported

R&D costs of $56,143, $60,041 and $141,258. However, we believe our overall

technology development related spending is greater than many of our China-based

competitors.

We

believe our commitment to, and knowledge and experience in, R&D are the key

reasons why we were one of the earliest and leading CCA wire manufacturers. This

expertise has enabled us to expedite the launch and expansion of our superfine

copper wire production. Therefore, we were able to take advantage of the market

opportunity that emerged as a result of the recent copper price

volatility.

We plan

to continue our R&D efforts, to maintain and strengthen our leading position

in China, and to expand into new products and markets. We are currently

developing a super-micro-fine CCA wire with line diameter below 0.025 mm, which

is used for cell phones, micro-electronic motors, micro-transformers, relays and

audiophones. We are in the process of conducting laboratory testing on these

products.

13

On

December 18, 2006, Lihua Electron entered into a long term technology

cooperation agreement (the “Long Term Technology Cooperation Agreement”) with

China Jiangsu University whereby Jiangsu University and Lihua Electron agreed to

enter into future technology project agreements and establish a “Co-Lab Center

of Jiangsu University-Danyang Lihua Electron Co. Ltd.”, which is the Research

Centre and Training Centre for Jiangsu University’s students. The Long Term

Technology Cooperation Agreement commenced on January 1, 2007 and terminates on

December 31, 2011. In connection with the Long Term Technology Cooperation

Agreement, on February 1, 2008, we entered into a technology project agreement

with China Jiangsu University for research on copper plating aluminum. Under

this agreement, we will pay all research expenses. As of the date hereof, we

have not made any such payments. Jiangsu University has agreed to develop the

technology, however, the agreement specifies that any intellectual property that

arises from the research will belong to both parties.

Intellectual

Property

Our

manufacturing processes are based on technology substantially developed in-house

by our R&D and engineering personnel. We rely on a combination of patent,

trade mark, domain names and confidentiality agreements to protect our

intellectual property. We require all members of our senior management and our

key R&D personnel to sign agreements with us which stipulate, among other

things, confidentiality obligations and restrictions on the assignment of

intellectual property.

We were

granted a utility model patent (patent no.: ZL 2008 2 0034139.8) by the State

Intellectual Property Office of the PRC for our “Oxygen-free copper rod pressure

cut off device,” effective as of April 16, 2008. The term of this patent is 10

years from the effective date. We have no foreign patents. We currently have the

following three invention patent applications in China pending:

|

Name

of IP right

|

Application

Number

|

Company

|

Date

of Application

|

Status

of Application

|

||||

|

1.

The production process for copper clad aluminum magnet

wire

|

200710131529.7

|

Lihua

Electron

|

September

4, 2007

|

Patent

pending

|

||||

|

2.

Production technology of copper clad magnesium aluminum

wire

|

200810023487.X

|

Lihua

Electron

|

April

16, 2008

|

Patent

pending

|

||||

|

3.

A copper cleaning solution

|

200810023488.4

|

Lihua

Copper

|

April

16, 2008

|

Patent

pending

|

|

|

·

|

We

are currently using the trademark “Lihua” for all our

products. We have applied to register the trademarks “Mei

Lihua” in China

|

|

|

·

|

We

are not aware of any material infringement of our intellectual property

rights.

|

Insurance

We

maintain various insurance policies to safeguard against risks and unexpected

events. In protecting against work-related casualties and injuries, we purchase

accidental injury insurance policies for our employees. In addition, we provide

social security insurance including pension insurance, unemployment insurance,

work related injury insurance and medical insurance for our employees. We also

maintain insurance for our plants, machinery, equipment, inventories and motor

vehicles. We do not have product liability insurance for our products. All of

our products have met the relevant regulatory requirements under PRC laws and we

have not been subject to any material fines or legal action involving product

non-compliance.

Our

Employees

As of

December 31, 2009, we had approximately 308

employees, all of whom except one are located in the PRC. Of our

employees, approximately 68%

work in manufacturing. The remainder of employees includes engineers, sales and

administrative personnel. As a matter of Company policy, we seek to maintain

good relations with our employees at all locations. We believe our relationship

with our employees is good.

Industry

and Market Overview

Cable

and Wire Market

According

to International Cablemakers’ Federation, China is the world’s largest cable

& wire producer. The following chart illustrates China’s historical industry

leading position in global and wire production from

2003 – 2007:

14

Source:

International Cablemakers’ Federation, 2009

Magnet

Wire Market

Magnet

wire represents a sub-category in the cable and wire industry. Magnet wire is an

insulated copper or aluminum electrical conductor used in motors, transformers

and other electromagnetic equipment. When wound into a coil and energized,

magnet wire creates an electromagnetic field. This effect can be used for a

variety of purposes, such as energy generation and transformation, which has

made magnet wire a basic building block of motorized appliances, automobiles,

industrial machinery, residential and commercial heating, ventilating, air

conditioning and refrigeration (HVACR) systems, computers, telephones, cell

phones, and televisions.

According

to a publicly available report by Gobi International, a provider of statistical

market research reports and forecasts on insulated wire and cable, in 2006

global consumption of magnet wire was more that $10 billion. The report also

indicated that China has the largest demand for magnet wire in the world, and

forecasted demand is expected to grow by 38.3% from 2007 to 2012, the highest

among all major economies.

The

growth in China’s magnet wire market has significantly outpaced the global

market since 2000. According to Beijing Kaiboxin Enterprise Consulting Company

Ltd (“Kaiboxin”), a China based provider of industry research reports and

forecasts, from 2000 to 2005, the global demand for magnet wire increased at a

CAGR of 3%, while that of China increased at 17% during the same period. In 2005

China accounted for approximately 29% of the worldwide market, and it is

expected to account for 48% of the global market share in 2015.

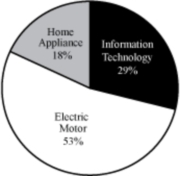

The

following charts indicate the historical and projected growth of the Chinese

magnet wire market. As evidenced in the charts, the information technology

sector is projected to experience the largest percentage growth through 2015. On

a historical basis, in 2005, the electric motor sector represented the largest

sub-sector with 53% of the overall market.

China’s Magnet Wire

Market

|

Projected

Growth by Sector

|

2005

Share of Total Demand

|

|

|

|

Source:

Kaiboxin, 2007

15

Copper

Copper

ranks third in the world consumption of metals after iron and aluminum. Copper’s

chemical, physical and aesthetic properties make it attractive for many

applications including electronics and communications, construction,

transportation, and industrial equipment. The chief commercial use of copper is

based on its electrical conductivity which is second only to that of silver

among all metals. About three quarters of total consumption is accounted for by

electrical uses, including power transmission and generation, building wiring,

telecommunication, and electrical and electronic products.

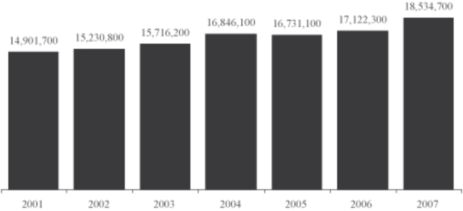

According

to International Copper Study Group (“ICSG”), world refined copper consumption

grew from 14.9 million metric tons (“Mt”) in 2001 to 18.5 million Mt in 2007, a

CAGR of 3.7%, as indicated by the following chart:

16

World Copper

Consumption

(Metric

Tons)

Source:

Copper Development Association Inc., 2008

However,

ICSG projected copper consumption to be 18.25 million Mt in 2008 and 18.9

million Mt in 2009, with production projected be 18.4 Mt in 2008 and 19.2 Mt in

2009. This resulted in a supply surplus in 2008 of 109,000 Mt, and the surplus

is projected to increase to 277,000 Mt in 2009.

The

following chart indicates the major global refined copper consuming nations in

the world in 2006, as determined by ICSG. China ranked the largest in the world

with a market share of 22%:

Major Copper Consuming

Nations, 2006

Source:

Copper Development Association Inc., 2008

According

to ICSG, in 2006, China consumed 627,000 more tons of refined copper than it

produced from primary sources. The shortfall in production was satisfied through

recycling of scrap copper as well as copper imports, which are more expensive

due to freight costs. We believe that the continued urbanization of China should

continue to drive strong copper consumption within China in the

future.

17

The

dynamics of constrained supply and growing Chinese demand, as well as the

resulting price surge, has contributed to the continued search for cost

effective alternatives to pure copper. Manufacturers in the cable and wire

industry have begun pursuing and adopting alternative technologies, including

the use of scrap copper and cheaper metal aluminum.

Scrap

Copper

The

secondary copper recovery process is comprised of pyro-metallurgical processes,

which are generally technologically mature. This recovery process is divided

into four separate operations: scrap pre-treatment, smelting, alloying, and

casting. Pre-treatment includes the cleaning and consolidation of scrap in

preparation for smelting. Smelting consists of heating and treating the scrap

for separation and purification of specific metals. Alloying involves the

addition of other metals to copper to obtain desirable qualities characteristic

of the combination of metals. In the casting process, the molten metal is poured

into molds for being turned into different shapes.

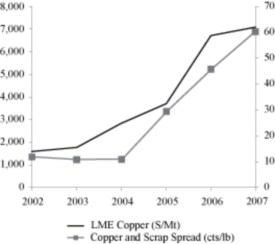

According

to ICSG, secondary refined copper accounted for approximately 15.2% of refined

copper production in 2007. A price spread between refined copper and scrap

copper, reflecting the profit for the recycling process, fluctuates in relation

to the movement of copper prices, as well as scrap consumption. The following

charts illustrate that the price spread increased steadily together with the

copper price and worldwide secondary refined production during 2004 to

2007:

|

Copper

Price vs. Price Spread

|

||

|

between

Copper and Scrap

|

Worldwide

Secondary Refined Production

|

|

|

|

|

|

Source:

LME, ICSG

|

Source:

ICSG

|

China is

a net importer of copper and has deficient copper reserves. In recent years,

China has significantly grown its refining capacity. To meet increased demand,

China has been importing raw materials including scrap copper to fill the gap.

According to China Metals Information Network, China’s importation of scrap

copper increased significantly to 5.58 million Mt in 2007 from 2.5 million Mt in

2000. China’s government has also established industrial policies to encourage

the use of scrap copper. In 2007 the import duty on scrap copper in China,

historically 1.5%, was removed. In China’s 11th Five-Year

(2006 – 2010) Plan it encouraged the greater use of scrap metals to

help alleviate a shortfall in supplies and set the target consumption of

secondary copper at 35% of total national copper consumption.

Copper

Clad Aluminum (“CCA”) Wire

CCA

bimetallic materials are an ideal substitute for pure copper, a major raw

material component of magnet wire, and a prime alternative to satisfy China’s

demand. Bimetallic materials have been in existence for decades, but until

recently they have only been selectively adopted due to higher production costs

and historically low copper prices. However, as the price of copper increased in

recent years, companies have started to use CCA bimetallic materials as an

alternative.

18

CCA wire

is the wire composed of an inner aluminum core and outer copper cladding. CCA

wire has a significant cost advantage over copper because its main constituent,

aluminum is a cheaper metal. In addition to the cost advantages, the properties

of CCA wire include:

|

|

·

|

Lighter

than pure copper wire;

|

|

|

·

|

Higher

conductivity and strength than pure aluminum wire;

and

|

|

|

·

|

Better

solderability than aluminum, due to the lack of an oxide layer which

prevents solder adhesion when soldering bare

aluminum.

|

However,

CCA wire has a high fabrication cost, as the cladding process is more complex

than conventional wire-drawing. As a result, developed economies have not widely

used CCA.

As a

result of the changes in the market conditions in recent years, Chinese

companies perceived a potential market opportunity and installed capacity for

production of CCA wire. This has in turn resulted in improvements in the

production process and made increased production volumes of CCA wire available

from China. As a result of the increased production capacity, China has become

leading global supplier in CCA market.

Our

Corporate History and Background

From the

date of our incorporation until October 31, 2008, we were a “blank check”

company with nominal assets. We were originally incorporated in the State of

Delaware on January 24, 2006 under the name of Plastron Acquisition Corp. for

the purpose of raising capital to be used to merge, acquire, or enter into a

business combination with an operating business.

Ally

Profit was incorporated in the British Virgin Islands on March 12, 2008 under

the Business Companies Act, 2004. In June 2008, Ally Profit became the parent

holding company of a group of companies comprised of Lihua Holdings, a company

organized under the laws of Hong Kong and incorporated on April 17, 2008, which

is the 100% shareholder of each of Lihua Electron and Lihua Copper, each a

limited liability company organized under the existing laws of the Peoples

Republic of China. Lihua Electron and Lihua Copper were incorporated on December

30, 1999 and August 31, 2007, respectively. We changed our name from Plastron

Acquisition Corp. to Lihua International, Inc. on September 22,

2008.

On

September 4, 2009, the Company’s common stock began trading on the NASDAQ

Capital Market under the symbol LIWA.

As of

March 1, 2010, details of the subsidiaries of the Company are as

follows:

|

Subsidiaries’ names

|

Domicile and date of

incorporation

|

Paid-up

capital

|

Effective

ownership

|

Principal activities

|

|||||

|

Ally

Profit Investments Limited (“Ally

Profit”)

|

British

Virgin Islands March 12, 2008

|

|

$100

|

100

|

% |

Holding

company of other subsidiaries

|

|||

|

Lihua

Holdings Limited (“Lihua

Holdings”)

|

Hong

Kong

April 17, 2008

|

HK$100

|

100

|

% |

Holding

company of other subsidiaries

|

||||

|

Danyang

Lihua Electron Co., Ltd. (“Lihua

Electron”)

|

People’s

Republic of China (“PRC”)

December 30, 1999

|

$8,200,000

|

100

|

% |

Manufacturing

and sales of bimetallic composite conductor wire such as copper clad

aluminum (CCA) wire and enameled CCA wire.

|

||||

|

Jiangsu

Lihua Copper Industry Co., Ltd. (“Lihua

Copper”)

|

PRC

August 31, 2007

|

$15,000,000

|

100

|

% |

Manufacturing

and sales of refined copper.

|

19

Government

Regulation

Overview

Manufacturing

Our

manufacturing operations are subject to numerous laws, regulations, rules and

specifications relating to human health and safety and the environment. These

laws and regulations address and regulate, among other matters, wastewater

discharge, air quality and the generation, handling, storage, treatment,

disposal and transportation of solid and hazardous wastes and releases of

hazardous substances into the environment. We are in compliance with all

material respects of such laws, regulations, rules, specifications and have

obtained all material permits, approvals and registrations relating to human

health and safety and the environment. In addition, third parties and

governmental agencies in some cases have the power under such laws and

regulations to require remediation of environmental conditions and, in the case

of governmental agencies, to impose fines and penalties. We make capital

expenditures from time to time to stay in compliance with applicable laws and

regulations.

Environmental

Matters

Given the

nature of our business, we generate waste water, exhaust fumes and noise during

our production process. We have implemented a comprehensive set of environmental

protection measures to treat emissions generated during our production process

to minimize the impact of our production process on the environment. These

measures include the following:

|

|

·

|

Waste

water. Waste water processed by our facilities meets the

Chinese standard for discharge. To conserve water resources, we also

recycle and reuse waste water generated during our production process,

which decreases our consumption of water and reduces the discharge of

waste water into the environment;

|

|

|

·

|

Exhaust

fumes. We generate exhaust fumes during our production

process. Exhaust fumes generated during our production process are

filtered to reduce dust, sulfur dioxide, total suspended particulate,

nitrogen oxide and organic elements. In each case, exhaust fumes are

treated to comply with national air quality standards;

and

|

|

|

·

|

Noise. We

generate noise through the operation of our heating, ventilation and

pumping systems. We typically reduce the noise generated by these

activities to a range of 60 decibels to 80 decibels by employing various

noise reduction measures that comply with applicable

law.

|

M&A

Rules

On August

8, 2006, six PRC regulatory agencies, namely, the PRC Ministry of Commerce, or

MOFCOM, the State Assets Supervision and Administration Commission, or SASAC,

the State Administration for Taxation, the State Administration for Industry and

Commerce, the China Securities Regulatory Commission, or CSRC, and SAFE jointly

adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by

Foreign Investors, or the M&A Rule, which became effective on September 8,

2006. According to Rule 55 of the M&A rules and Guidance Manual on

Administration of Entry of Foreign Investment issued by the Department of

Foreign Investment Administration of the Ministry of Commerce in December 2008,

conversion of a joint venture to a wholly foreign owned enterprise by way of

equity transfer from a Chinese party to a foreign party, shall not be subject to

the M&A rules, and the M&A rules are only applicable to acquisitions of

a domestic enterprise or its assets by a foreigner.

20

We have

been advised by our PRC counsel that the M&A Rule did not apply to the June

2008 restructuring or subsequent share exchange transaction. The restructuring

did not require CSRC approval because we were not a special purpose vehicle

formed or controlled by PRC Operating Companies or PRC individuals, we were

owned or substantively controlled by foreigners, and conversion of our operating

entities from a joint venture to a wholly foreign owned enterprise was not and

is not subject to the M&A rules.

The

M&A rules also require offshore companies formed for overseas listing

purposes through acquisitions of PRC domestic companies and controlled by PRC

Operating Companies or individuals to obtain the approval of the CSRC prior to

the public listing of their securities on an overseas stock exchange. On

September 21, 2006, pursuant to the New M&A Rules and other PRC Laws, the

CSRC published on its official website relevant guidance with respect to the

listing and trading of PRC domestic enterprises’ securities on overseas stock

exchanges (“Related Clarifications”), including a list of application materials

regarding the listing on overseas stock exchanges by special purpose vehicles.

However, the CSRC currently has not issued any definitive rule concerning

whether the transactions effected by the overseas listing would be subject to

the New M&A Rules and Related Clarifications. Article 238 of the PRC

Securities Law also provides that any domestic enterprise that directly or

indirectly issues any securities abroad or lists its securities abroad for

trading shall be subject to the approval of the securities regulatory authority

under the State Council according to the relevant provisions of the State

Council.

The

M&A rules do not have express provisions in terms of penalties for failure

to obtain CSRC approval prior to the public listing of our securities. However,

there are substantial uncertainties regarding the interpretation, application

and enforcement of the above rules, and CSRC has yet to promulgate any written

provisions or formally to declare or state whether the overseas listing of a

PRC-related company similar to ours is be subject to the approval of CSRC. Any

violation of these rules could result in fines and other penalties on our

operations in China, restrictions or limitations on remitting dividends outside

of China, and other forms of sanctions that may cause a material and adverse

effect to our business, operations and financial conditions.

Foreign Investment in PRC

Operating Companies

The

Foreign Investment Industrial Catalogue jointly issued by MOFCOM and the

National Development and Reform Commission (“NDRC”) in 2007 classified various

industries/business into three different categories: (i) encouraged for foreign

investment; (ii) restricted to foreign investment; and (iii) prohibited from

foreign investment. For any industry/business not covered by any of these three

categories, they will be deemed industries/business permitted to have foreign

investment. Except for those expressly provided restrictions, encouraged and

permitted industries/business are usually 100% open to foreign investment and

ownership. With regard to those industries/business restricted to or prohibited

from foreign investment, there is always a limitation on foreign investment and

ownership. The reason that our business is not subject to limitation on foreign

investment and ownership is as follows:

(i) our

business falls under the class of “manufacturing of materials for processing

beryllium copper straps, lines, pipes and rods”, which is open to 100% foreign

investment and ownership;

(ii) our

business does not fall under the industry categories that are restricted to, or

prohibited from foreign investment; and

(iii)

whether a business is subject to foreign investment restriction is subject to

interpretation by MOFCOM and/or the NDRC, restructuring of each of our operating

entities into a wholly foreign owned enterprise, each of which has been approved

by the local MOFCOM, can also directly evidence no limitation on foreign

investment and ownership to our business.

Share

Exchange

Restructuring

In June

2008, Magnify Wealth, a British Virgin Islands holding company, which was 100%

owned by Mr. Chu, developed the Restructuring. At that time, Magnify Wealth was

the parent company and sole shareholder of Ally Profit, which was the parent

company and sole shareholder of Lihua Holdings. The Restructuring was

accomplished in two steps. The first step was the PRC Subsidiary Acquisition.

After the PRC Subsidiary Acquisition, the second step was for Magnify Wealth to

enter into and complete a share exchange transaction with a US public reporting

company, whereby the US company would acquire Ally Profit, Lihua Holdings and

the PRC Operating Companies.

21

PRC Subsidiary

Acquisition

The PRC

Subsidiary Acquisition was structured to comply with PRC M&A Laws. Under PRC

M&A laws, the acquisition of PRC Operating Companies by foreign companies

that are controlled by PRC citizens who are affiliated with the PRC Operating

Companies, is strictly regulated and requires approval from MOFCOM. However,

such restrictions do not apply to foreign entities controlled by foreign

persons. These restrictions apply only at the time that PRC Operating Companies

are acquired by a foreign entity. In our case, this was July 10, 2008 when the

PRC Operating Companies were acquired by Lihua Holdings, which was ultimately

beneficially owned by Mr. Chu, a Hong Kong citizen, as the sole shareholder of

Magnify Wealth.

Lihua

Holdings acquired 100% of the equity interests in the PRC Operating Companies

from companies owned by our current CEO, Mr. Zhu, and the Minority Shareholders

of the PRC Operating Companies. In addition to being the sole shareholder of

Magnify Wealth, Mr. Chu was also a 45.46% owner of Lihua Electron, prior to the

consummation of the PRC Subsidiary Acquisition. The aggregate consideration

payable by Lihua Holdings to the shareholders of Lihua Electron was $2,200,000,

and the aggregate consideration payable by Lihua Holdings to the shareholders of

Lihua Copper was $4,371,351.

The Share

Transfer Agreement enables Mr. Zhu to receive consideration for selling his

interest in the PRC Operating Companies to Lihua Holdings by allowing him to

earn back an indirect interest in the PRC Operating Companies without violating

PRC laws. At the time of the PRC Subsidiary Acquisition, Mr. Zhu did not have

any equity interest in Lihua Holdings. As a PRC citizen, Mr. Zhu would not have

been permitted to immediately receive shares in Lihua Holdings or in Magnify

Wealth in exchange for his interests in the PRC Operating Companies. Subject to

registering with SAFE prior to the exercise and issuance of the Option Shares

under the Share Transfer Agreement, which is an administrative task, there is no

prohibition under PRC laws for Mr. Zhu to earn an interest in Magnify Wealth

after the PRC Subsidiary Acquisition was consummated, in compliance with PRC

laws. Pursuant to the original terms of the Share Transfer Agreement, Mr. Chu

granted to Mr. Zhu the option to purchase all of the 3,000 ordinary shares of

Magnify Wealth then held by Mr. Chu at the nominal price of $1.00 per share. The

Option Shares would vest and become exercisable upon the PRC Operating Companies

attaining consolidated net income performance targets for fiscal 2008, 2009, and

2010 of $8 million (“2008 Target”), $11 million and $14 million respectively. If

each performance target is met, 25% of the Option Shares would vest and become

exercisable forty-five days after December 31, 2008, 25% of the Option Shares

would vest and become exercisable forty-five days after December 31, 2009 and

the remaining 50% of the Option Shares would vest and become exercisable forty

five days after December 31, 2010. However, on March 7, 2009, Mr. Zhu and Mr.

Chu entered into an amendment to the Share Transfer Agreement whereby alternate

conditions for the achievement of the performance targets were agreed. Under the

amended agreement as long as the audited consolidated net income of Lihua

Electron and Lihua Copper for fiscal 2008 was 10% or more higher than the 2008

Target (“Alternate Performance Target”) regardless of whether the performance

targets for 2009 and 2010 are met or not, the Option Shares would vest and

become exercisable. Mr. Zhu would then be able to exercise the Option Shares in

the same percentages and on the same dates as per the original agreement. Since

our consolidated net income for 2008 was $11,701,879, which achieved the