Attached files

| file | filename |

|---|---|

| EX-4.2 - Granto, Inc. | v179169_ex4-2.htm |

| EX-4.1 - Granto, Inc. | v179169_ex4-1.htm |

| EX-4.3 - Granto, Inc. | v179169_ex4-3.htm |

| EX-4.5 - Granto, Inc. | v179169_ex4-5.htm |

| EX-3.1 - Granto, Inc. | v179169_ex3-1.htm |

| EX-2.1 - Granto, Inc. | v179169_ex2-1.htm |

| EX-4.4 - Granto, Inc. | v179169_ex4-4.htm |

| EX-4.6 - Granto, Inc. | v179169_ex4-6.htm |

| EX-10.2 - Granto, Inc. | v179169_ex10-2.htm |

| EX-10.4 - Granto, Inc. | v179169_ex10-4.htm |

| EX-10.3 - Granto, Inc. | v179169_ex10-3.htm |

| EX-10.7 - Granto, Inc. | v179169_ex10-7.htm |

| EX-10.1 - Granto, Inc. | v179169_ex10-1.htm |

| EX-10.6 - Granto, Inc. | v179169_ex10-6.htm |

| EX-10.5 - Granto, Inc. | v179169_ex10-5.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): March 29, 2010

Commission

File Number: 333-150388

|

Granto,

Inc.

|

|

(Exact

name of registrant as specified in its

charter)

|

|

Nevada

|

98-0655634

|

|

|

(State

or other jurisdiction of incorporation)

|

(IRS

Employer Identification Number)

|

Dongdu

Room 321, No. 475 Huanshidong Road, Guangzhou City, PRC 510075

(Address

of principal executive offices)

011-86-20-8762-1778

(Registrant’s

telephone number, including area code)

16

Monarch Way, Kinnelon, New Jersey 07405

(Former

name or former address if changed since the last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

o

|

Written communication pursuant to

Rule 425 under the Securities Act (17 CFR

230.425)

|

|

o

|

Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

o

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

o

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

EXPLANATORY

NOTE

This Current Report on Form 8-K is

being filed by Granto, Inc. We are reporting the acquisition of a new

business and providing a description of this business and its audited financials

below. In addition, on March 29, 2010 we consummated a private placement to 18

investors for an aggregate gross purchase price of $7,700,000 of our Series A

Preferred Stock, par value $.0001 per share (“Series A Stock”), five-year

warrants to purchase shares of our Common Stock for $3.47 per share and

five-year warrants to purchase shares of our Common Stock for $4.17 per share

pursuant to a Series A Preferred Stock Purchase Agreement (the “Purchase

Agreement”) with such investors (the “Private Placement”). Each share of Series

A Stock will automatically convert into one share of our Common Stock, par value

$.001 per share (“Common Stock”). The conversion ratio is subject to adjustment

to protect the holder of the Series A Stock from dilution in certain

circumstances immediately upon the happening of certain events described

herein.

USE

OF DEFINED TERMS

Except as otherwise indicated by the

context, references in this Report to:

|

|

·

|

"Granto," "the Company," "we,"

"us," or "our," are references to the combined business of Granto, Inc,

and its subsidiary, Rongfu Aquaculture, Inc., and Rongfu Aquaculture,

Inc.’s direct and indirect

subsidiaries.

|

|

|

·

|

"Rongfu" refers to Rongfu

Aquaculture, Inc., a Delaware corporation and our direct, wholly owned

subsidiary, and/or its direct and indirect subsidiaries, as the case may

be;

|

|

|

·

|

"China," "Chinese" and "PRC,"

refer to the People’s Republic of

China;

|

|

|

·

|

"RMB" refers to Renminbi, the

legal currency of China;

|

|

|

·

|

"U.S. dollar," "$" and "US$"

refer to the legal currency of the United

States;

|

|

|

·

|

"Securities Act" refers to the

Securities Act of 1933, as amended;

and

|

|

|

·

|

"Exchange Act" refers to the

Securities Exchange Act of 1934, as

amended.

|

Certain references to ownership and

other rights of the Company in this Current Report include the rights of Foshan

Nanhai Ke Da Heng Sheng Aquatic Co., Ltd. and Hainan Ke Da Heng Sheng,and and

Hainan Ke Da Heng Sheng Aquit Germchit Co., Ltd. which we are attributing to the

Company by virtue of the Contractual Agreements described below.

All of the financial information for

Rongfu for the fiscal year ended December 31, 2009 in this Current Report is

unaudited.

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Share

Exchange Agreement

On March 29, 2010, we entered into a

Share Exchange Agreement with Rongfu, certain stockholders and warrantholders of

Rongfu (the “Rongfu Stockholders”) and a stockholder of Granto (the “Share

Exchange Agreement”). Pursuant to the Share Exchange Agreement, on March

29, 2010, 9 Rongfu Stockholders transferred 100% of the outstanding shares of

common stock and 100% of the warrants to purchase common stock of Rongfu held by

them, in exchange for an aggregate of 18,623,889 newly issued shares of our

Common Stock and warrants to purchase an aggregate of 666,666 shares of our

Common Stock. The shares of our Common Stock acquired by the Rongfu Stockholders

in such transactions constitute approximately 77.4% of our issued and

outstanding Common Stock on a fully-diluted basis giving effect to the share

exchange and the sale of our Series A Stock pursuant to the Purchase Agreement

discussed below, but not including any outstanding purchase warrants to purchase

shares of our common stock, including the warrants issued pursuant to the

Purchase Agreement. In connection with the closing of the Share Exchange

Agreement, the former principal stockholder agreed to and did cancel 1,150,000

of the 1,200,000 shares of Granto, Inc. Common Stock held by her.

The Share Exchange Agreement contains

representations and warranties by us, our former principal stockholder, Rongfu

and the Rongfu Stockholders which are customary for transactions of this type

such as, with respect to Granto, Inc.: organization, good standing and

qualification to do business; capitalization; subsidiaries, authorization and

enforceability of the transaction and transaction documents; financial

condition; valid issuance of stock, consents being obtained or not required to

consummate the transaction; litigation; compliance with securities laws; the

filing of required tax returns; and no brokers used, and with respect to

Rongfu: authorization, capitalization, and title to Rongfu securities

being exchanged. The former principal stockholder has agreed to indemnify

Granto, Inc., Rongfu and the Rongfu Stockholders and their affiliates against

actions, causes of action, suits, claims, losses, costs, penalties, fees,

liabilities and damages, and expenses in connection therewith arising out of or

based on misrepresentations by Granto, Inc. or such stockholder made in the

Share Exchange Agreement and breaches by Granto, Inc. or such stockholder of

covenants in the Share Exchange Agreement.

The foregoing description of the terms

of the Share Exchange Agreement is qualified in its entirety by reference to the

provisions of the Share Exchange Agreement which is included as Exhibit 2.1 of

this Current Report and is incorporated by reference herein.

Series

A Preferred Stock Purchase Agreement

On March 29, 2010 we entered into and

consummated a Series A Preferred Stock Purchase Agreement (the “Purchase

Agreement”) with 18 investors pursuant to which the investors agreed to and did

purchase for an aggregate of $7.7 million an aggregate of (a) 2,768,721 shares

of our Series A Stock, (b) five year warrants (“Series A Warrants”) to purchase

an aggregate of 1,730,451 shares of our Common Stock for $3.47 per share and (c)

five year warrants (“Series B Warrants”) to purchase an aggregate of

1,730,451shares of our Common Stock for $4.17 per share. Each share of Series A

Stock will automatically convert into one share of our Common Stock (subject to

adjustment in certain circumstances to protect the holder against dilution)

immediately upon all of the following being satisfied:

|

|

·

|

a

registration statement covering the resale of the shares of Common Stock

to be issued upon conversion shall have been filed by the Company and

declared effective by the Securities and Exchange Commission (the “SEC” or

the “Commission”), and such registration statement continues to be

effective up through and including the date of the

conversion;

|

|

|

·

|

our

shares of Common Stock are eligible for trading on one of the following

exchanges: the Nasdaq SmallCap Market, the American Stock Exchange, the

New York Stock Exchange, the Nasdaq National Market or the OTC Bulletin

Board;

|

|

|

·

|

the

daily volume weighted average price of the Common Stock for ten

consecutive trading days immediately preceding the conversion is greater

than or equal to $5.56 per share (as adjusted for any stock dividends,

combinations, splits, recapitalizations and the like with respect to such

shares) on the primary trading market on which the Common Stock is then

listed or quoted; and

|

|

|

·

|

the

average daily dollar volume of the Common Stock on the primary trading

market on which the Common Stock is then listed or quoted is greater than

or equal to $100,000 for ten consecutive trading days at any time before

the conversion.

|

Representations

and

Warranties;

Indemnification :

The Purchase Agreement contains representations and warranties by us and the

investors which are customary for transactions of this type such as, with

respect to the Company: organization, good standing and qualification to do

business; capitalization and voting rights; subsidiaries, authorization and

enforceability of the transaction and transaction documents; financial

statements; valid issuance of stock, governmental and third party consents being

obtained or not required to consummate the transaction; litigation; intellectual

property; employee benefits, employment matters; filing of tax returns; full

disclosure; related party transactions; title to property and assets; and no

brokers used, and with respect to the investors: authorization, investment

intent and accredited investor status. The Company has agreed to indemnify the

investors and their affiliates against claims, costs, losses, damages, expenses

and obligations arising out of or based on material misrepresentations by the

Company made in the Purchase Agreement and breaches by the Company of material

covenants in the Purchase Agreement.

Covenants:

The Purchase Agreement contains certain covenants on our part, including the

following:

Registration:

we must file a registration statement covering the resale by the investors of

100% of our shares of Common Stock issuable to the investors upon the conversion

of all of the Series A Stock and exercise of the Series A Warrants and the

Series B Warrants (the “Resale Registration Statement”). The Resale Registration

Statement must be filed with the SEC by May 13, 2010 (within 45 days after the

March 29, 2010 closing date of the Purchase Agreement) and cause the

registration statement to be declared effective by August 26,

2010 (within 150 days after the closing date) or October 25, 2010

(210 days after the closing date), if the SEC determines to give the

registration statement a full review. The Purchase Agreement provides for

liquidated damages of 1% per month of the purchase price of the securities

purchased by the investors (with a cap of 6% of the purchase price in the

aggregate) if the filing or effectiveness of the registration is

delayed beyond the required deadlines or if after effectiveness is declared by

the SEC, effectiveness of the Resale Registration Statement is not

maintained.

Listing:

we have agreed to use our best efforts to list our Common Stock on the American

Stock Exchange, Nasdaq Capital Market, Nasdaq Global Market, Nasdaq Global

Select Market or New York Stock Exchange by March 29, 2011 (within one year

after the closing) If we do not do so by such deadline we are obligated to pay

the investors liquidated damages of .5% of the purchase price per month until

the Common Stock is listed, subject to a cap of 6% of the purchase price in the

aggregate).

Right of

first refusal: Until the second anniversary of the date that the Resale

Registration Statement is declared effective, the investors shall have a right

of first refusal in connection with any offer by the Company of its debt or

equity securities, except in certain limited situations

Appointment

of investor designee to the Company’s Board and approval of CFO: The Company has

agreed to appoint one person designated by certain of the investors as a

director of the Company. The Company has also agreed that such investors shall

have the right to approve the hiring of an English speaking Chief Financial

Officer after the closing.

Delivery of up to

2,768,721 shares of Granto, Inc. Common Stock from Escrow Based on Net Income

and Net Income Per

Share: At the closing, Kelvin Chan, our President and Chief Executive

Officer, delivered to an escrow agent 2,768,721 shares of Granto,

Inc. Common Stock (the “Make Good Escrow Stock”). If our consolidated net

income and net income per share for the year ended December 31, 2009 is less

than $13.0 million and $.54 per share, respectively (the “Fiscal 2009

Performance Threshold”), or our consolidated net income and net income per share

for the fiscal year ending December 31, 2010 is less than $14.8 million and $.62

per share, respectively (the “Fiscal 2010 Performance Threshold”),

then:

|

|

·

|

If

the Company does not achieve at least 50% of either amount set forth in

the Fiscal Year 2009 Performance Threshold, the escrow agent shall

transfer 100% of the escrowed shares to the investors pro rata based on

the number of shares of Series A Stock purchased by the investors under

the Purchase Agreement and still beneficially owned by such investor at

such date;

|

|

|

·

|

If

the Company achieves at least 50%, but less than 100% of either amount set

forth in the Fiscal Year 2009 Performance Threshold, the escrow agent

shall transfer an amount of the escrowed shares to the investors equal to

the product obtained by multiplying (i) two times the shortfall by (ii)

the total number of escrowed shares. Such shares will be

transferred pro rata based on the number of shares of Series A Stock

purchased under the Purchase Agreement by the investors and still

beneficially owned by such investors at such

date.

|

|

|

·

|

If

the Company does not achieve at least 50% of either amount set forth in

the Fiscal Year 2010 Performance Threshold, the escrow agent

shall transfer 100% of the escrowed shares to the investors pro rata based

on the number of shares of Series A Stock purchased by the investors under

the Purchase Agreement and still beneficially owned by such investor at

such date;

|

|

|

·

|

If

the Company achieves at least 50%, but less than 100% of either amount set

forth in the Fiscal Year 2010 Performance Threshold, then the escrow agent

shall transfer an amount of the escrowed shares to the investors equal to

the product obtained by multiplying (i) two times the shortfall by (ii)

the total number of escrowed shares.. Such shares will be transferred pro

rata based on the number of shares of Series A Stock purchased under the

Purchase Agreement by the investors and still beneficially owned by such

investors at such date.

|

For

purposes of the agreement, net income for any period means the consolidated net

income of the Company and its subsidiaries calculated in accordance with United

States generally accepted accounting principles consistently applied, plus, to

the extent such amounts were deducted in the calculation of consolidated net

income, the amount of any non-cash extraordinary charges relating solely to (a)

the release of the shares from escrow or (b) the value of the beneficial

conversion feature of the Series A Stock of the Company issued pursuant to the

Purchase Agreement. Net income for any period shall also not include

any charges or additions to net income of the Company in any period as a result

of any fluctuation in the value of the Company’s Common Stock.

ITEM

2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On March 29, 2010, we completed

the acquisition of Rongfu pursuant to the Share Exchange Agreement. The

acquisition was accounted for as a recapitalization effected by a share

exchange. Rongfu is considered the acquirer for accounting and financial

reporting purposes. The assets and liabilities of the acquired entity have

been brought forward at their book value and no goodwill has been

recognized.

As a result of this transaction, the

Company ceased being a “shell company” as that term is defined in Rule 12b-2

under the Securities and Exchange Act of 1934 (the “Exchange Act”).

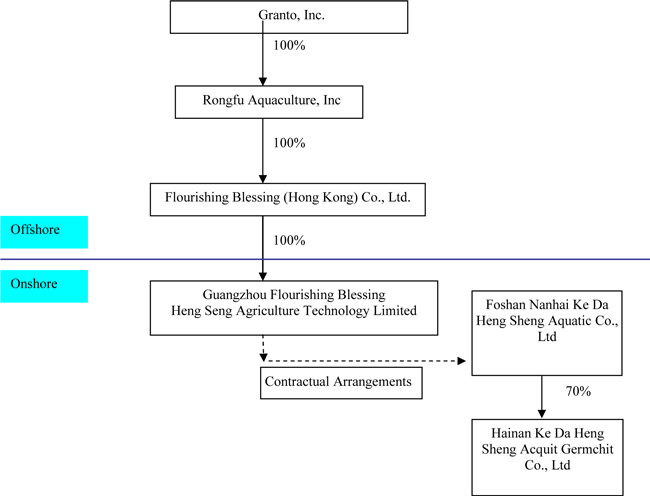

Our

Corporate Structure

As set

forth in the following diagram, following our acquisition of Rongfu, Rongfu

became and currently is our direct, wholly-owned subsidiary.

Organizational

History of Rongfu Aquaculture, Inc. and Subsidiaries

Rongfu Aquaculture, Inc. was

incorporated in Delaware on January 13, 2009. Pursuant to a Share Exchange

Agreement, dated as of December 29, 2009 (the “December 2009 Agreement”), all of

the shareholders of Flourishing Blessing (Hong Kong) Co., Ltd., a Hong Kong

corporation (“Flourishing HK”), exchanged all of the outstanding shares of

Flourishing HK for shares of common stock of Rongfu and Rongfu became the owner

of 100% of the outstanding capital stock of Flourishing HK.

Flourishing HK owns 100% of the capital

stock of Guangzhou Flourishing Blessing Heng Seng Agriculture Technology Limited

(“Guangzhou Flourishing”). Guangzhou Flourishing is a wholly foreign-owned

enterprise, or “WFOE,” under the laws of the PRC by virtue of its status as a

wholly-owned subsidiary of a non-PRC company, Flourishing HK. In

connection with the closing of the December 2009 Agreement, Guangzhou

Flourishing entered into and consummated a series of agreements (the

“Contractual Agreements”), with Chen Zhisheng and Foshan Nanhai Ke Da Heng Sheng

Aquatic Co., Ltd. (“Nanhai Ke Da Heng Sheng”). Under the Contractual

Agreements, Guangzhou Flourishing agreed to assume control of the operations and

management of Nanhai Ke Da Heng Sheng in exchange for a management fee equal to

Nanhai Ke Da Heng Sheng’s earnings before taxes. As a result, the business of

Nanhai Ke Da Heng Sheng and Hainan Ke Da Heng Sheng Aquit Germchit

Co., Ltd., a PRC corporation (“Hainan Ke Da Heng Sheng”) , 70% of the

outstanding stock of which is owned by Nanhai Ke Da Heng Sheng, will

be conducted by Guangzhou Flourishing. We anticipate that Nanhai Ke Da Heng

Sheng and Hainan Ke Da Heng Sheng will continue to be the contracting parties

under their customer contracts, bank loans and certain other assets until such

time as those may be transferred to Guangzhou Flourishing.

Nanhai Ke Da Heng Sheng was formed in

the PRC on April 30, 2003 as a limited liability company (a company solely owned

by a natural person). Hainan Ke Da Heng Sheng was formed in the PRC on August 6,

2007 as a limited liability company. Guangzhou Flourishing was incorporated in

the PRC on January 9, 2009 as a wholly owned foreign

enterprise.

The

following is a summary of the material terms of each of the Contractual

Agreements, the English translation of each of which is annexed hereto as an

exhibit. All references to the Contractual Agreements and other agreements in

this Current Report are qualified, in their entirety, by the text of those

agreements. Certain references to ownership and other rights of the Company in

this Current Report include the rights of Nanhai Ke Da Heng Sheng and Hainan Ke

Da Heng Sheng, which we are attributing to the Company by virtue of the

Contractual Agreements.

Entrusted

Management Agreement. Pursuant to the entrusted management agreement

among Nanhai Ke Da Heng Sheng, Chen Zhisheng, a director of the Company and the

owner of 100% of the outstanding stock of Nanhai Ke Da Heng Sheng, and Guangzhou

Flourishing (the "Entrusted Management Agreement"), Nanhai Ke Da Heng

Sheng and Chen Zhisheng agreed to entrust the operations and management of

Nanhai Ke Da Heng Sheng to Guangzhou Flourishing Under the Entrusted

Management Agreement, Guangzhou Flourishing will manage Nanhai Ke Da

Heng Sheng ‘s operations and assets, control all of Nanhai Ke Da Heng Sheng ‘s

cash flow through an entrusted bank account, will be entitled to Nanhai Ke Da

Heng Sheng ‘s earnings before taxes as a management fee, and will be obligated

to pay all Nanhai Ke Da Heng Sheng’s payables and expenses, operating expenses,

payment of employee salaries and the purchase price for assets. The Entrusted

Management Agreement will remain in effect until Guangzhou

Flourishing acquires all of the assets or equity of Nanhai Ke Da Heng

Sheng (as more fully described below under “Exclusive Option Agreement”). We

anticipate that Nanhai Ke Da Heng Sheng and Hainan Ke Da Heng Sheng will

continue to be the contracting parties under their customer contracts, bank

loans and certain other assets until such time as those may be transferred to

Guangzhou Flourishing.

Shareholders’

Voting Proxy Agreement. Under the shareholders' voting proxy agreement

among Chen Zhisheng and Guangzhou Flourishing, Chen Zhisheng irrevocably and

exclusively appointed the members of Guangzhou Flourishing’s board of directors

as his proxies to vote on all matters that require approval by the shareholders

of Nanhai Ke Da Heng Sheng.

Exclusive

Option Agreement. Under the exclusive option agreement among Chen

Zhisheng, Guangzhou Flourishing and Nanhai Ke Da Heng Sheng (the “Exclusive

Option Agreement”), Chen Zhisheng has granted Guangzhou Flourishing an

irrevocable and exclusive purchase option (the “Option”) to acquire Nanhai Ke Da

Heng Sheng’s equity and Nanhai Ke Da Heng Sheng has granted Guangzhou

Flourishing an Option to purchase Nanhai Ke Da Heng Sheng’s assets and business,

but only to the extent that the acquisition does not violate limitations imposed

by PRC law on such transactions. The consideration for the exercise of the

Option is to be determined by the parties and memorialized in future, definitive

agreements setting forth the kind and value of such consideration. To the extent

that Chen Zhisheng receives any of such consideration, the Option requires him

to transfer (and not retain) the same to Guangzhou Flourishing.

Shares

Pledge Agreement. Under the shares pledge agreement among Chen Zhisheng,

Guangzhou Flourishing and Nanhai Ke Da Heng Sheng (the "Share Pledge

Agreement"), Chen Zhisheng has pledged to Guangzhou Flourishing all of the

equity interests in Nanhai Ke Da Heng Sheng, including the proceeds thereof, to

guarantee all of Nanhai Ke Da Heng Sheng ‘s rights and benefits under the other

Contractual Agreements. Prior to termination of the Share Pledge Agreement, the

pledged equity interests cannot be transferred without Guangzhou Flourishing’s

prior written consent.

DESCRIPTION

OF BUSINESS

Overview

Through its subsidiaries and the

Contractual Agreements, Rongfu Aquaculture, Inc. (the “Company”) is engaged in

commercial freshwater aquaculture in the PRC. Aquaculture is the cultivation

(“farming”) of fish under controlled conditions (as contrasted with the

harvesting of fish in the wild). The Company cultivates its fish in fresh water

(not marine (salt water) or brackish environments), sells fish and fish fry

(juvenile fish) and also acts as a dealer of freshwater fish (generating trading

profits from the purchase of fish from third party farmers and the immediate

re-sale of such fish to wholesalers and processors).

During the fiscal year ended December

31, 2009 (“fiscal 2009”) the Company sold more than 27,000 tons of adult fish to

frozen fish processors and wholesalers in Guangdong Province and Hainan

Province, People’s Republic of China (“PRC”) and the Company sold approximately

360 million fry to distributors, which in turn sold such fry to other farmers to

cultivate.

Based on unaudited information,

approximately 74.0% of the Company’s revenues for fiscal 2009 were from the sale

of adult fish farmed by the Company, approximately 13.7% of the Company’s 2009

revenues were from the re-sale of fish purchased by the Company from farmers and

approximately 12.3% of the Company’s 2009 revenues were generated from the sale

of fish fry. Approximately 67.9% of the Company’s net income for fiscal 2009 was

from the cultivation and sale of adult fish, approximately 30.3% of the

Company’s 2009 net income were from the breeding, incubation and sale of fish

fry and approximately 1.8% of the Company’s 2009 net income was profit from the

Company’s trading of freshwater adult fish. According to China Agriculture

Magazine, the Company is currently the largest seller of tilapia fry in the PRC

and the Company believes that it is also one of the three largest sellers of

adult tilapia in the PRC.

The Company operates 13 adult fish

breeding farms, covering a total area of 8,249 mu (a mu is a measure of land

area used in China equivalent to approximately 1/6 of an acre). Three of the

Company’s farms are located in Hainan Province, two in the town of Wenchang and

one in Nanling. The other 10 farms are located in Guangdong Province in the

towns or villages of Nanhai, Qinyuan, Taishan, Yangdong and Gaoyao. 9

of the farms consist of a series of man-made ponds dug to a depth of

approximately 2 meters with a surface area of 10-20 mu. A pond can be dug in two

days and is filled with fresh filtered water from local sources. Each pond is

outfitted with one or more oxygen aeration machines which float on the surface

and one or more feeding machines which provide food to the fish twice per day.

The aeration machines provide oxygen to the fish and enable the natural removal

of fish wastes so that the water does not become toxic for the

fish.

4 of the Company’s farms are each

comprised of a single lake created by damming a river. Oxygen aeration equipment

is not needed since the lakes have a much larger area than the ponds dug by the

Company. The land on which the farms are located is leased by the Company from

the village under leases for terms of 4 to 30 years.

For additional information concerning

the location and area of each of the Company’s fish farms and the terms under

which the real estate for each farm is leased, see “Description of Property”

herein.

In addition to its adult fish breeding

farms, the Company operates a breeding farm in Wenchang, Hainan Province in

which tilapia fry are produced from brood stock. (The warm climate in Hainan is

more conducive to the breeding of tilapia fry than the climate in Guangdong

Province.) The tilapia fry breeding farm in Wenchang covers an area of

approximately 1,800 mu. The Company breeds snakehead and crucian carp fry at its

facility in Nanhai.

At its facility in Nanhai (at which the

Company also maintains a fish clinic), the Company also has constructed and

maintains concrete tanks with a surface area of approximately 8,000 square

meters containing approximately 40 compartments where the Company incubates

tilapia, snakehead and crucian carp fry for approximately 10-25 days after such

fry is initially produced or purchased by the Company. Most of the tilapia fry

breeded by the Company in Wenchang is promptly flown by commercial air carrier

to Guangzhou (which is approximately 300 miles from Nanhai) and thereafter

transported by automobile to Nanhai. The Company also maintains an approximately

4,500 square meter incubation tank in Wenchang for tilapia fry that it will

incubate and sell in Hainan Province.

The

incubation tanks in Nanhai and Wenchang are lined with concrete as compared to

the Company’s adult fish breeding ponds and lakes, which are not. The concrete

lining of the incubation tank enables the Company to maintain better water

quality for the fry in the tank and also makes it easier for the small fry to be

seen and caught when it is time to harvest them. After the incubation period the

Company sells approximately 95% of the fry to distributors.

Based on unaudited information,

approximately 46.2% of the Company’s revenues from the sale of Company grown

adult fish in fiscal 2009 were from the sale of tilapia, approximately 20.2% was

from the sale of grass carp, approximately 9.5% was from the sale of snakehead,

approximately 8.8% was from the sale of bighead and the balance of the Company’s

revenues from the sale of Company grown adult fish during fiscal 2009 were from

sales of other varieties of freshwater fish, including catfish, bream, black

carp and crucian carp.

Based on unaudited information,

approximately 69.1%, 18.8% and 12.1% of the Company’s revenues during fiscal

2009 from sales of fish fry were from the sale of tilapia, snakehead and crucian

carp fry, respectively. The Company does not breed or incubate fry of the other

adult fish that it cultivates. Rather, it purchases the fry for such fish from

distributors.

In conjunction with Professor Sifa Li

and his team from Shanghai Fisheries University, during the period from 2006 to

2009 the Company developed a strain of Nile tilapia called “New Jifu” which has

received the approval and recommendation the PRC Ministry of Agriculture. New

Jifu tilapia is fatty and fleshy, relatively fast growing (taking 4 to 5 months

to grow to a saleable size), disease resistant and suitable to be raised in a

warm climate such as that of Hainan Province. The Company currently sells

approximately 17,000 tons of tilapia per year, approximately 60% of which is of

the New Jifu variety and 40% of which is oreochromis tilapia. Oreochromis

tilapia are more tolerant of lower temperatures, which enables the fish to be

cultivated in northern climates. However, such tilapia are slower to grow to a

saleable size, limiting production to at most three crops in two

years.

The Company sells approximately 90% of

its tilapia to the owners of 28 processing plants in Guangdong and Hainan

Provinces. The processors generally require that the tilapia be of a standard

weight of .75 kilograms. (Because of such weight requirement, the Company

generally sells most of its tilapia in the fourth quarter since the growing

season of approximately 6 months commences in March of each year.) The

processors freeze the tilapia and sell the frozen product for distribution

domestically in China and internationally. The balance of the Company’s tilapia,

as well as all of the other fish the Company sells, is sold under the Company’s

Hengshen brand name to fish brokers located in wholesale markets in Guangdong,

Hainan, Fujian and Xinjiang Provinces which brokers in turn market

the fresh fish nationwide in China though other wholesalers or at retail. In

2009 the top ten customers (including processors and wholesalers) for the

Company’s adult fish accounted for approximately 80% of the Company’s total

sales of adult fish. Hainan Ahe Food, Yangshi Frozen Fish Processing Factory and

Jiahong Frozen Fish Processing Factory accounted for 21%, 12% and 10%,

respectively, of total purchases from the Company of adult fish in

2009.

The Company is developing technology to

breed new strains of yellow catfish and California perch and anticipates making

sales of the fry of such fish strains in 2010. The Company is constructing a

facility in Nanhai, to breed fry. The Company anticipates that the total cost of

the facility will be approximately $500,000 and it anticipates completing the

facility in May 2010. This facility consists of a one-floor building with a

floor area of approximately 6,000 square meters, for the breeding of

new type of fry. The Company also intends to use some of the proceeds from the

March 2010 sale of its Series A Stock and Warrants described in Item 1.01 of

this Current Report to increase both the production capacity of and productivity

at its breeding farms, to develop new breeds of fry and to change its business

model in certain respects.

For example, instead of selling most of

its snakehead fry to distributors which in turn sell the fry to local third

party farmers, the Company intends to retain such third party farmers as

subcontractors to grow adult snakehead from fry supplied directly to them by the

Company. In such new business model the farmers will receive a fixed payment

from the Company for their service and, the Company will supply at its own cost

or reimburse the farmer for fish food and medicines. The Company anticipates

that this business model will generate greater profits to the Company than would

be the case if the Company merely sold snakehead fry to distributors because the

model will substantially increase the ability of farmers to cultivate high

quality fish and therefore substantially increase the Company’s capacity to

produce adult fish. The Company may also use this cooperative farmer business

model grow and sell other fish in addition to snakehead.

Farming

Operations

The various steps in the process of

producing adult fish for sale are described below:

Brood

stock production

The Company currently owns

approximately 400 to 600 male-female pairs of tilapia brood stock

(“grandparent fish”), of which 200-300 pair are of the “New Jifu”

strain and 200-300 pair are oreochromis tilapia. Grandparent fish are either

purchased by the Company or developed from ancestors by the Company in

conjunction with breeding experts such as personnel in academic institutions.

The grandparent fish are held at the Company’s headquarters in

Nanhai. Grandparent fish generally produce offspring (“parent fish”)

for a period of 5 to 8 years and each pair of grandparent fish generally will

produce approximately 600 pair of parent fish per year.

Parent

fish production

The parent tilapia are maintained at

the Company’s facility in Wenchang, Hainan Province. The warm climate in Hainan

Province is conducive to the production of tilapia fry. (The parent generation

of the other fish that the Company cultivates are maintained at the Company’s

facility in Nanhai.) The Company owns approximately 80,000 parent fish (one male

fish for each three female fish) of the New Jifu strain. The New Jifu parent

fish generally produce approximately 6,000-8,000 offspring (fry) per year for a

period of three years. The Company has a capacity to produce approximately 500

million “New Jifu” fry per year. The Company has a capacity to produce

approximately 300 million oreochromis tilapia fry per year.

Within 3 days after the tilapia fry is

first produced, using commercial air carrier transportation, the Company

transports the fry produced in Hainan to the Company’s facility in Nanhai,

Guangdong Province where the tilapia fry are incubated for up to 20 days before

being sold to distributors of moved by the Company to one of its adult breeding

farms. The Company also purchases fry for the growing of the other fish (except

tilapia) it grows. The Company also incubates snakehead and crucian carp fry at

its Nanhai facility.

Adult

fish production

Approximately 95% of the fry produced

by the Company are sold to distributors and 5% of the fry are raised to adults

by the Company. The Company cultivates the fry it does not sell at one of the 13

adult fish breeding farms the Company maintains. The fry are transported to such

farms from the Nanhai incubation facility by Company trucks. The Company

generally sells its tilapia when the tilapia has grown to a weight of 0.75 kg as

that is the size desired by the Company’s frozen fish processor customers. For

New Jifu , it takes 5 to 6 months to reach 0.75 kilograms (‘kg”) and for

oreochromis tilapia it takes about 7 to 8 months to reach 0.75kg. The

Company generally raises its grass carp and snakehead to weights of .50kg or

more (up to as much as 5 kg) before sale of such fish to wholesalers. The larger

the weight the longer the fish takes to grow. The Company may therefore

cultivate fish for a year or more before sale.

Approximately 80-85% of the variable

costs of producing adult fish is the cost of fish food. The other variable costs

include medicine and the cost of fry for those fish for which the Company does

not breed its own fry. The other significant costs borne by the Company in its

operations are of the rental of farmland, salaries of production personnel and

utilities and transportation costs.

Fish

clinic and educational services

At its Nanhai facility, the Company

maintains a clinic supported by the Agriculture Bureau of Guangdong Province.

Farmers may bring diseased fish to the clinic where Company personnel as well as

experts from the Agriculture Bureau (who are periodically present at the clinic

or available for consultation by telephone or internet) can diagnose problems

and determine courses of treatment.

At such facility the Company also

offers free classes to train farmers in the cultivation of fish. Classes are

generally given for three days twice a month. The Company’s cost for providing

such training is approximately $7,500 per year.

By offering such clinical services and

free training, the Company has been able to build a database of approximately

100,000 farmers who are or may become interested in purchasing fry, who may

become subcontractors for the Company in growing fry to adult fish or who may

sell fish to the Company for immediate resale by the Company to tilapia

processors or wholesalers.

Trading

Operations

The Company acts as an intermediary in

the sale of fish to tilapia processors and fish wholesalers. Such entities place

orders with the Company which the Company fills by dealing with farmers in the

Company’s data base. The processors and wholesalers rely on the Company, rather

than dealing directly with farmers, due to the Company’s reputation for quality

and the Company’s contacts with numerous sources of supply, which serve to

reduce the administrative costs of the processor or wholesaler. The Company

generally arranges for transactions, pays the farmer, assists the processor,

wholesaler and farmer in delivery operations (the cost of transportation is

generally borne by the processor of wholesaler) and receives payment from the

processor or wholesaler at a mark up over the Company’s purchase cost

(approximately 10% of the sales price).

Industry

Background

Aquaculture is the science, art, or

practice of cultivating and harvesting aquatic organisms, including fish,

mollusks, crustaceans, aquatic plants, and algae such as seaweed. Operating in

marine, brackish, and freshwater environments, aquaculture provides food for

people and in smaller amounts supplies fish for stocking lakes, bait for

fishing, and live specimens for home aquariums. According to a recent study by

the World Food and Agriculture Organization (“FAO”) published on March 2,

2009, world fisheries production reached a new high of 143.6 million metric

tons in 2006, including farmed and ocean caught product. The contribution of

aquaculture to the world fisheries production in 2006 was 51.7 million tons

of fish, which was 36 percent of world fisheries production in 2006, up from 3.6

percent in 1970. Global aquaculture accounted for 6 percent of the fish

available for human consumption in 1970. In 2006 global aquaculture accounted

for 47 percent of the fish available for human consumption according to the FAO.

The FAO report also describes that over half of the global aquaculture in 2006

was freshwater finfish. Based on the FAO’s projections, it is estimated that in

order to maintain the current level of per capita consumption, global

aquaculture production will need to reach in excess of 80 million tons of

fish by 2050.

Also according to the FAO, in 2006

China contributed approximately 67% of the total quantity and 49% of the total

value of worldwide aquaculture production. In China, approximately 90% of fish

production comes from aquaculture.

China has a long history of

aquaculture. However, large-scale production only began after the founding of

the PRC in 1949. More recently, after China opened up to the outside world in

the 1980's, the sector has been growing dramatically, becoming one of the

fastest growing sectors among the agriculture industries in China. In 2003 China

registered a total amount of 30.28 million tons of farmed fish, accounting for

64.34% of national fishery production . China’s total aquaculture production is

dominated by carp raised in inland ponds for local consumption. The four major

carp species — silver carp, grass carp, common carp, and bighead carp — account

for more than one third of world aquaculture production — nearly all of it in

China

China’s aquatic production for 2009 is

forecast to have reached 49.5 metric tons (“MMT”), an increase of

approximately two percent from the estimated 48.6 MMT of production

in 2008. China remains the world’s largest aquaculture producer. The rise in

aquatic production is attributed to the country’s rapid economic growth, rising

disposable incomes and greater consumption of aquatic products, together with

strong growth of aquatic exports. While official statistics are not yet

available, the 2008 aquatic production is estimated to have increased by

approximately two percent over the 47.5 MMT of production in 2007. According to

China’s Ministry of Agriculture (“MOA”), aquatic production for the first five

months of 2008 reached 15.6 MMT, up more than four percent over the previous

year to date figure. MOA expected a normal production growth for the remainder

of 2008. Industry sources also showed that total aquatic production in the first

eight months of 2008 reached 26.5 MMT, up three percent over the previous year.

The production growth is mainly attributable to freshwater production at 12.5

MMT, up seven percent over the same period in 2007, while sea catch production

stood at 6.9 MMT, down more than two percent. Another official media source

reported that total aquatic production for 2008 is expected to have reached 48.9

MMT and the total freshwater aquatic production reached 17.4 MMT as of the end

of October 2008. The devastating winter storms that hit south China from January

through February of 2008 had some impact on aquaculture production. However,

official data on damage is not available. Some industry sources reported losses

of more than 4,000 MT of tilapia and 48 million tilapia fingerlings in Guangdong

and Hainan provinces. MOA reported that the industry quickly

recovered.

Inland aquaculture is very important

part of China fishery industry. Freshwater aquaculture is carried out in fish

ponds, lakes, reservoirs, canals, pens, cages, and paddy fields. Freshwater

aquaculture production is dominated by finfish, particularly silver, grass and

other carps. Pond culture is the most important source of inland

aquaculture, with an estimated share of 73.9% in 1996. More than 4.5

million Chinese farmers are engaged in aquaculture, more than the rest of the

world combined.

In 2005, according to the American

Tilapia Association (“ATA”), tilapia production worldwide was second in volume

to carp, and it is projected by the ATA that tilapia will become the most

important aquaculture crop in the 21st

century. Commercial production of tilapia has become popular in many countries

around the world. Touted as the “new white fish” to replace the depleted ocean

stocks of cod, pollock, and hake, world tilapia production continues to rise and

at least 100 countries currently raise tilapia, with the PRC being the largest

producer. The American Tilapia Association further reports that world production

of tilapia products reached approximately 2.5 million metric tons in 2007,

of which China produced the dominant share of 45.0 percent.

The species of tilapia most commonly

grown as food fish in aquacultures are Nile tilapia, blue tilapia and Mozambique

tilapia). Today, hybrids of these species – sometimes with genetic material from

other species as well – are popular as well. Over 95 percent of the global

tilapia supply is imported to the United States where tilapia is an appreciated

food fish. The United States has its own domestic production as well, but it is

much too small to satisfy consumer demands. The rising standard of living and

fast-changing lifestyle in China have resulted in dramatically increasing

domestic demand for processed frozen Tilapia products.

Tilapias are also among the easiest and

most profitable fish to farm. This is due to their omnivorous diet, mode of

reproduction (the fry do not pass through a planktonic phase), tolerance of high

stocking density, and rapid growth.

The simplest system for raising fish is

in ponds or irrigation ditches. Fry are put into a pond and fed until they reach

market size. The fish are caught, either by draining the pond or by using large

nets. Food can be from natural sources—commonly zooplankton feeding on pelagic

algae, or benthic animals, such crustaceans and mollusks. Tilapia species feed

directly on phytoplankton, making higher production possible.

There are a number of factors that

determine the amount of fish that any given pond can produce. The first is the

size of the pond, which determines the amount of water available for the fish,

which in turn determines the amount of oxygen available for the fish. If there

are too many fish in the pond, there will not be enough oxygen, and the fish

will become stressed and begin to die. Another factor is the capacity of the

pond to digest waste from the fish and the uneaten feed. The waste that is toxic

to fish is mostly in the form of ammonia, nitrites, and nitrates.

The pond environment provides natural

ways to eliminate waste. For example, in one waste processing cascade, the

initiating bacteria convert available ammonia to available nitrites, which a

second bacteria converts to the available nitrates that plants and algae consume

as a growth nutrient. The viable density of fish in a pond is determined by the

balance between the amount of waste generated and natural processes for waste

elimination. If the fish release too much waste into the pond, the natural

processes cannot keep up and the fish will become stressed.

Fish density can be increased if fresh

water can be introduced to the pond to flush out wastes or if the pond can be

aerated, either with compressed air or mechanically by using paddle wheels.

Adding oxygen to the water not only increases the amount of oxygen in the water

available for the fish, it also improves the processes involved in removing the

wastes.

Advantages of pond culture include its

simplicity, and relatively low labor requirements (apart from the harvesting of

the fish). It also has low energy requirements. A major disadvantage is that the

farm operation is more dependent on weather and other natural factors that are

beyond the farmer’s control. Another disadvantage concerns the marketing of the

fish. Generally, ponds are only harvested when most of the fish are at market

size. This means the farmer has many fish to market at the same time, requiring

a market that can absorb large quantities of fish at a time and still give a

good price to the farmer. Usually this means there is a need for some kind of

processing and large-scale marketing, with several fish farms in the same area

to provide the processing plant with a constant supply of fish. If this kind of

marketing infrastructure is not available, then it is difficult for the fish

farmer.

Raw

Materials and Suppliers

Approximately 80-85% of the cost of

sales of fish is for fish food. The balance is for fish medicine and the cost of

fry for fish for which the Company does not breed its own fry. The Company

purchases over 90% of its food for the feeding of adult fish from Ke Da Heng

Sheng Fish Food Factory, a company which is wholly owned by the sister of the

Company’s Chairman, Zhisheng Chen. The Company also purchases over 60% of its

food for the feeding of fry from Ke Da Heng Sheng Fish Food Factory. In 2009 the

Company spent approximately $11.9 million and $334,000 for the purchase of adult

and fry food, respectively.

Marketing,

Sales, and Distribution

The Company has a staff of 13 employees

who take orders and provide customer service to processors and wholesalers in

assigned geographical areas. The Company sells fry to approximately 110

distributors, sells tilapia to 28 frozen tilapia processors and sells fish to

approximately 50-60 fish brokers in wholesale markets.

The Company promotes its Hengshen brand

to farmers by advertisements in newspapers and magazines. The purpose of such

promotion is to attract potential purchasers of fry, as well as potential

subcontractors for the Company in growing snakehead and also potential sources

for the Company’s fish trading operations. The Company also conducts free

training sessions for farmers to build a database for the same

purposes.

Employees

As of March 19, 2010 Rongfu had 155

full-time employees, including 39 management and supervisory personnel, 84

production workers, 13 sales and marketing personnel and 19 technological

support, training and operations personnel. Over 100 of the Company’s

employees hold at least a junior college degree. The Company also had 65

part-time employees, of which 53 were interns from various colleges. Interns are

not paid but Rongfu gives interns a subsidy in a nominal amount and provides

food and housing for such interns without charge.

Seasonality

Approximately 50% of the Company’s

sales of fry are made in the second quarter as fish produce most of the fry in

March of each year. The Company’s sale of fry are lowest in the fourth quarter .

The Company’ s sales of adult fish are greatest in the fourth quarter. The first

quarter is the next busiest. Sales of grown fish follow the pattern of fry

production in the spring and then a six month growing season to maturity and

sale.

Competition

There are more than 2 million fish

farmers in the PRC. Most farmers grow fish on a small scale. The Company

believes its sales place it in the top 10 producers in the PRC. The Company

competes against the small fish farmers, but believes it has advantages over

most of its competition by virtue of its capital, technology and research and

development. The Company competes against smaller scale breeding farms in the

sale of fry.

Research

and Development

The Company has its own technicians to

research fish growing technologies, including methods to grow fish faster,and to

maintain water quality and use appropriate fish foods. The Company maintains a

big database for fish diseases and cures for the most commonly raised

fishes.

Intellectual

Property

The Company does not own any

patents.

In conjunction with Professor Sifa Li

and his team from Shanghai Fisheries University, from 2006 the Company developed

a new strain of tilapia called “New Jifu” which has received the

approval and recommendation the PRC Ministry of Agriculture. Based on the

agreement between Professor Li and Nanhai Ke Da Heng Sheng Heng Sheng, Nanhai Ke

Da Heng Sheng may exclusively use the technology of “New Jifu” in Hainan

Province and use the technology on a non-exclusive basis elsewhere.

Nanhai Ke Da Heng Sheng has a trademark

“Ke Da Heng Sheng” registered with the PRC Trademark bureau. The term of the

trademark is from October 28, 2004 to October 27, 2014.

Regulation

According to the Law of the PRC on the

Prevention and Control of Water Pollution, effective on June 1, 2008, to engage

in the aquaculture industry, a business owner shall be responsible for

protecting the waters and the ecological environment. As a food processing

business , the Company must be in compliance with the Food Safety Law of the

PRC, effective on June 1, 2009, which lists several enforceable mandatory

standards as food safety standards. Based on the law, an aquaculture business

should have suitable production and management facility to protect aquatic food

from being harmfully affected.

According to Regulations of Quality and

Safety of Aquaculture of the Ministry of Agriculture, effective on September 1,

2003, water used in aquaculture should be consistent with requested standards of

Ministry of Agriculture. Aquaculture can not violate relevant national or local

specifications of cultivation, which include equipment placement, sales of

farmed aquatic products, as well as the use of feed materials and aquaculture

drugs.

Additionally, the aquaculture industry

is also subject to the control and management of the Fishery Law of the PRC, the

Management Methods of Pollution-Free Agriculture Products, and the Aquatic

Germchit Managing Regulations.

DESCRIPTION

OF PROPERTY

Set forth below is a table containing

certain information concerning the location and are of each of the Company’s

fish farms and the terms under which such properties are leased.

|

Name of

Farm

|

Area

(Mu)/(Square

Meters)

|

Location

|

Landlord

|

Tenant

|

Lease

Commencement

Date

|

Lease

Expiration

Date

|

Rent per Year ($)

|

||||||||||

|

Lugang

Pond

|

251.99/167,994.17

|

Eastern

Xianlu Road,

Nanhai,

Guangdong

|

Lu’er

Villager Group of Lugang Village

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

1/1/2006

|

12/31/2010

|

$ | 25,940.15 | |||||||||

|

Lugang

Pond

|

85.00/56,666.95

|

Hengling,

Shagang

village,

Nanhai,

Guangdong

|

Xuehao

Tu

|

Nanhai

Keda

Hengsheng

Aquiculture Co., Ltd.

|

1/1/2006

|

12/31/2012

|

$ | 16,750 | |||||||||

|

Lugang

Pond

|

98.00/65,333.66

|

Xianliao

Village,

Nanhai,

Guangdong

|

Santuan

Villager Group of Xianliao Village of Heshun Town

|

Nanhai

Keda

Hengsheng

Aquiculture

Co.,Ltd.

|

1/1/2002

|

12/31/2011

|

$ | 11,529.41 | |||||||||

|

Nanzhou

Pond

|

71.33/47,553.57

|

Jianshui,Tantou,

Nanhai,

Guangdong

|

Sanhong

Village Economic Cooperative of Xianliao Village of Heshun

Town

|

Nanhai

Keda

Hengsheng

Aquiculture Co., Ltd.

|

1/1/2005

|

12/31/2014

|

$ | 13,426.82 | |||||||||

|

Nanzhou

Pond

|

803.04/535,362.68

|

Dapu,

Nanhai,

Guangdong

|

Xianliao

Village of Heshun Town

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

1/1/2005

|

12/312014

|

$ | 101,560.94 | |||||||||

|

Wan

Qing Yang

|

734.65/489,769.12

|

Eastern

Gongyong,

Wanqingyang,

Heshun

Town,

Nanhai

|

Tangcun

Group Co., Ltd. of Nanhai District

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

2/11/2004

|

2/10/2015

|

$ | 71,304.26 | |||||||||

|

Qingyuan

Artificial Lake

|

500.00/333,335

|

Laohuchong

Artificial Lake,

Qingyuan,

Guangdong

|

Zhishen

Luo

|

Nanhai

Keda

Hengsheng

Aquiculture Co., Ltd.

|

3/1/2006

|

12/31/2013

|

$ | 33,823.53 | |||||||||

|

Taishan

Artificial

Lake

|

1,000.00/666,670

|

Guanchong

Artificial Lake,

Shenjing

Town,

Taishan,

Guangdong

|

Weiqiang

Fan, Weiqiang Hu

|

Nanhai

Keda

Hengsheng

Aquiculture Co., Ltd.

|

10/20/2005

|

12/31/2016

|

1,691.18 | ||||||||||

|

Yangdong

Artificial

Lake

|

2,500.00/1,666,675

|

Shawan

Artificial Lake,

Yangdong

County,

Guangdong

|

Huazhan

Zhuo

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

1/13/2007

|

12/31/2014

|

$ | 5,698.53 | |||||||||

|

Gaoyao

Artificial

Lake

|

30.00/20,000.1

|

Shangdong

Village,

Baizhu

Town,

Gaoyao

City,

Guangdong

|

Xinlong

Villager Group of Shangdong village committee of Baizhu Town

in Gaoyao City

|

Nanhai

Keda

Hengsheng

Aquiculture Co., Ltd.

|

1/10/2007

|

1/10/2013

|

$ | 5,264.71 | |||||||||

|

Hainan

Adult Fish Pond

|

375.00/250,001.25

|

Fupo

Village,

Baoluo

Town,

Wenchang

City,

Hainan

|

Jianzhong

Fan

|

Nanhai

Keda

Hengsheng

Aquiculture Co., Ltd.

|

2/28/2005

|

2/28/2015

|

$ | 24,816.18 | |||||||||

|

Hainan

Adult

Fish

Pond

|

200.00/133,334

|

Nanling

Artificial Lake,

Hainan

|

Maoshan

Village Economic Cooperative of Wengtian Town in Wenchang

City

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

1/12/2005

|

1/11/2020

|

$ | 514.71 | |||||||||

|

Hainan

Adult

Fish

Pond

|

1,600.00/1,066,672

|

Wenglong

Artificial Lake,

Wenchang,

Hainan

|

People’s

Government of Wengtian Town of Wenchang City

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

1/1/2005

|

12/31/2035

|

$ | 5,882.35 | |||||||||

|

Wenchang

Fish Fry Pond

|

1,800.00/1,200,006

|

Wenchang,

Hainan

|

Kuangshan

Group of Shandong Province

|

Nanhai

Keda Hengsheng Aquiculture Co., Ltd.

|

10/13/2006

|

12/15/2018

|

$ | 44,117.65 | |||||||||

|

10,049.01/6699373.50

|

2,463,778.80/362,320.41 | ||||||||||||||||

The Company leases from Guangzhou

Chuangshi Trading Co., Ltd approximately 50 square meters of administrative

office space at No.329 Qingnian Road 301-17, Economic Development District,

Guangzhou City, PRC for a monthly rental of 3,000 RMB for a three year term

expiring in January 2012. The rental includes water, electricity and

administrative fees. The Company also leases from Guangzhou Dongdu Big World

Co., Ltd. approximately 240 square meters of office space at Dongdu Room 321,

No.475 Huanshidong Road, Guangzhou City, PRC for a monthly rental of 16,500 RMB

for a three year term expiring on December 15, 2012. The rental includes water,

electricity and administrative fees. Nanhai Ke Da Heng Sheng leases from Tangcun

Group Co., Ltd. approximately 11,307 square meters of office space used for its

headquarters for an annual rental of 484,869 RMB for a ten year term expiring

February 10, 2015. Hainan Ke Da Heng Sheng leases from Shandong Kuangshan Group

approximately 720,000 square meters of land (including a building located on the

land which covers an area of 8,170 square meters) for an annual rental of 50,000

RMB for a 15 year term expiring December 31,2018.

The Company believes that the foregoing

properties are adequate for its present needs.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF RESULTS OF OPERATION ANF

FINANCIAL

CONDITION

The following discussion and analysis

of the consolidated financial condition and results of operations should be read

in conjunction with the consolidated financial statements and related notes of

Rongfu Aquaculture,, Inc. appearing elsewhere in this report. This discussion

and analysis contains forward-looking statements that involve risks,

uncertainties and assumptions. Actual results may differ materially from those

anticipated in these forward-looking statements.

Overview

The Company is engaged in commercial

freshwater aquaculture in the PRC. It sells fish and fish fry and also acts as a

freshwater fish dealer (generating trading profits from the purchase of fish

from third party farmers and the immediate sale of such fish to

wholesalers).

During the fiscal year ended December

31, 2009 (“fiscal 2009”) the Company sold more than 27,000 tons of

adult fish to frozen fish processors and wholesalers in Guangdong Province and

Hainan Province, PRC and sold approximately 360 million fry to distributors,

which in turn sold such fry to other farmers to cultivate.

Approximately 74.0% of the Company’s

revenues for fiscal 2009 were from the sale of adult fish farmed by the Company,

approximately 13.7% of the Company’s 2009 revenues were from the re-sale of fish

purchased by the Company from farmers and approximately 12.3% of the Company’s

2009 revenues were generated from the sale of fish fry. Approximately 67.9% of

the Company’s net income for fiscal 2009 was from the cultivation and sale of

adult fish, approximately 30.3% of the Company’s 2009 net income were from the

breeding, incubation and sale of fish fry and approximately 1.8% of the

Company’s 2009 net income was profit from the Company’s trading of freshwater

adult fish. According to China Agriculture Magazine, the Company is currently

the largest seller of tilapia fry in the PRC and the Company believes that it is

also one of the three largest sellers of adult tilapia in the PRC.

The Company operates 13 adult fish

breeding farms, covering a total area of 8,249 mu Three of the Company’s farms

are located in Hainan Province, two in the town of Wenchang and one in Nanling.

The other 10 farms are located in Guangdong Province in the towns or villages of

Nanhai, Qinyuan, Taishan, Yangdong and Gaoyao. 9 of the farms consist

of a series of man-made ponds. Each pond is outfitted with one or more oxygen

aeration machines which float on the surface and one or more feeding machines

which provide food to the fish twice per day. The aeration machines provide

oxygen to the fish and enable the natural removal of fish wastes so that the

water does not become toxic for the fish.

4 of the Company’s farms are each

comprised of a single lake created by damming a river. Oxygen aeration equipment

is not needed since the lakes have a much larger area than the ponds dug by the

Company. The land on which the farms are located is leased by the Company from

the village under leases for terms of 4 to 30 years.

In addition to its adult fish breeding

farms, the Company operates a breeding farm in Wenchang, Hainan Province in

which tilapia fry are produced from brood stock.

At its facilities in Nanhai (at which

the Company’s fish clinic is also located) and Wenchang, the Company also has

constructed and maintains concrete tanks where the Company incubates tilapia.

The Company also incubates snakehead and crucian carp fry in its tank in Nanhai.

After the incubation period the Company sells approximately 95% of the fry to

distributors.

Based on unaudited information,

approximately 45.9% of the Company’s revenues from the sale of Company grown

adult fish in fiscal 2009 were from the sale of tilapia, approximately 21.2% was

from the sale of grass carp, approximately 9.6% was from the sale of snakehead,

approximately 8.3% was from the sale of bighead and the balance of the Company’s

revenues from the sale of adult fish during fiscal 2009 were from sales of other

varieties of freshwater fish, including catfish, bream, black carp and crucian

carp.

Based on unaudited information,

approximately 77.6%, 15.9% and 6.5% of the Company’s revenues during fiscal 2009

from sales of fish fry were from the sale of tilapia, snakehead and crucian carp

fry, respectively. The Company does not incubate fry of the other adult fish

that it cultivates. Rather it purchases the fry for such fish from

distributors.

In conjunction with Professor Sifa Li

and his team from Shanghai Fisheries University, during the period from 1994 to

2006 the Company developed a strain of Nile tilapia called “New Jifu” which has

received the approval and recommendation the PRC Ministry of Agriculture. The

Company currently produces approximately 17,000 tons of tilapia per year,

approximately 60% of which is of the New Jifu variety and 40% of which is

oreochromis tilapia.

The Company sells approximately 90% of

its tilapia to the owners of 28 processing plants in Guangdong and Hainan

Provinces. The processors generally require that the tilapia be of a standard

weight of .75 kiligrams. (Because of such weight requirement, the Company

generally sells most of its tilapia in the fourth quarter since the growing

season of approximately 6 months commences in March of each year.) The

processors freeze the tilapia and sell the frozen product for distribution

domestically in China and internationally. The balance of the Company’s tilapia,

as well as all of the other fish the Company sells, is sold under the Company’s

Hengshen brand name to fish brokers located in wholesale markets in Guangdong

Province, Hainan Province, Fujian, Xinjiang Province etc. which in turn market

the fresh fish nationwide in China though other wholesalers or at

retail.

Comparison

of three and nine months ended September 30, 2009 and September 30,

2008

Results of Operations and

Business Outlook

The Company’s consolidated financial

information for the three and nine months ended September 30, 2009 and September

30, 2008 should be read in conjunction with its consolidated financial

statements and the notes thereto.

The following table presents the

Company’s consolidated net sales for its lines of business for the three and

nine months ended September 30, 2009 and 2008, respectively:

|

Three Months Ended September 30,

|

Nine Months Ended

September 30,

|

|||||||||||||||||||||

|

|

2009

|

2008

|

%

Change

|

2009

|

2008

|

% Change

|

||||||||||||||||

|

Farm

growing

|

2,230,948

|

1,205,637

|

85.0

|

% |

13,407,185

|

9,494,466

|

41.2

|

% | ||||||||||||||

|

Breeding

|

837,051

|

1,136,934

|

|

-26.4

|

% |

4,369,794

|

6,032,124

|

-27.6

|

% | |||||||||||||

|

Trading

|

1,695,651

|

1,836,352

|

-7.7

|

% |

3,954,948

|

3,727,727

|

6.1

|

% | ||||||||||||||

|

Consolidated

|

$

|

4,763,650

|

$

|

4,178,923

|

14.0

|

% |

$

|

21,731,927

|

$

|

19,254,317

|

12.9

|

% | ||||||||||

Three

Months Ended September 30, 2009 as Compared to three Months Ended September 30,

2008

Net sales for the three months ended

September 30, 2009 were $4,763,650, an increase of $584,728 or 14%, when

compared to the same period in 2008. Such increase is mainly attributed to the

increase in sales of adult fish, which increased $1,025,311 while the sales of

fish fry decreased $299,883 compared to the same period of 2008, when the cold

weather caused the death rate of adult fish increased significantly and

stimulated the sales of fish fry on consequence. Cost of goods sold for the

three months ended September 30, 2009 were $3,135,757, an increase of $746,998

or 31.3%, when compared to the same sales period of the prior year. This was

primarily due to the increase of cost of adult fish farming. Gross

profit for the three months ended September 30, 2009 was $1,627,893, a decrease

of $162,271or -9.1%, when compared to the same period in 2008. The main reason

that the Company’s gross profit decreased was because the sales of fish fry,

which contributed higher gross margin, decreased compared to the same period of

the prior year, while the cost of farming adult fish increased compared to the

same period of the prior year. Therefore the increase of gross profit generated

by the adult fish farming business did not cover the decrease in gross profit

from the fish fry business.

Selling, general and administrative

expenses for the three months ended September 30, 2009 were $529,896, an

increase of $64,398 or 13.8%, when compared to the same period in 2008, mainly

due to an increase in selling expense for the adult fish growing business and

the increased general and administrative expenses of the Company

Income from operations for the three

months ended September 30, 2009 was $1,097,997, a decrease of $226,669 or 17.1%,

when compared to the same period in 2008, primarily due to the decrease of gross

profit and increased general and administrative expenses of the

Company

Interest income for the three months

ended September 30, 2009 was $14,670, a decrease of $4,977 or 25.3%, when

compared to the same period in 2008. Interest expense for the three months ended

September 30, 2009 was $86,652, an increase of $72,631or 518.0%, when compared

to the same period in 2008. This is primarily because the Company increased its

bank loans in the first three months of 2009. Other expense for the three months

ended September 30, 2009 was $334 as compared to other expense of $13,537 for

same period in 2008.

The provision for income taxes for the

three months ended September 30, 2009 was $67,667, an increase of 32,893 or

94.6%, as compared to a provision for income taxes of $34,774 for the three

months ended September 30, 2008, which was due to the increase of profit before

tax in adult fish farming business. Because the Company’s fish fry breeding

business enjoys the income tax free policy, the decrease of profit before tax

generated from fish fry business did not affect the Company’s provision for

income tax for the three months ended September 30, 2009.

Net income for the three months ended

September 30, 2009 was $958,014, a decrease of $323,967 or 25.3%, when compared

to the same period in 2008, primarily due to increases in cost of

sales, interest expense and provision for income tax.

Nine

Months Ended September 30, 2009 as Compared to Nine Months Ended September 30,

2008

Net sales for the nine months ended

September 30, 2009 were $21,731,927, an increase of $2,477,610 or 12.9%, when

compared to the same period in 2008. Such increase was mainly attributed to the

increase in sales of adult fish, which increased $3,912,718, due to the

enhancement of breeding capacity. For the nine months ended September 30, 2009,

the sales of fish fry decreased $1,662,329 compared to the same period of the

prior year. Sale of fry was high in 2008 because the cold winter in

Southern China killed some grown fish and farmers needed to re-grow their fish

and as a result purchased more fry in the later months of 2008. .In 2009, the

sale of fry was back to normal levels. Cost of goods sold for the nine months

ended September 30, 2009 were $13,323,764, an increase of $3,117,785 or 30.5%,

when compared to the same sales period of the prior year, which consisted of an

increase of $2,903,482 for breeding adult fish, an increase of $240,969 for

trading business, and a decrease of $26,666 for breeding fish

fry. Gross profit for the nine months ended September 30, 2009

was $8,408,163, a decrease of $640,175 or 7.1%, when compared to the same period

in 2008. The main reason for the decrease of gross profit for the nine months

ended September 30, 2009 was a decrease of $1,635,664 in gross profit from sales

of fish fry, while the gross profit from sales of adult fish increased

$1,009,236 compared to the same period of last year. The gross margin of fish

fry is much higher than the gross margin of adult fish, therefore the decrease

of sales of fish fry significantly effect the Company’s gross margin for the

nine months ended September 30, 2009

Selling, general and administrative