Attached files

| file | filename |

|---|---|

| 8-K - FBL FINANCIAL GROUP, INC. 8-K - FBL FINANCIAL GROUP INC | a6232937.htm |

| EX-99.1 - EXHIBIT 99.1 - FBL FINANCIAL GROUP INC | a6232937ex99-1.htm |

Exhibit 99.2

2009 Annual Report Transcript and Materials

FBL Financial Group, Inc.

Overcoming Adversity

2009 Annual Report

FBL Financial Group, headquartered in West Des Moines, Iowa, is a holding company whose primary operating subsidiaries are Farm Bureau Life Insurance Company and EquiTrust Life Insurance Company. Please access our 2009 Annual Report, Proxy Statement and Form 10-K by clicking on the button below.

Forward-Looking Statements

Certain statements made in this annual report and on this website concerning FBL Financial Group’s prospects for the future are forward-looking statements intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act. These statements generally can be identified by their context, including terms such as “believes,” “anticipates,” “expects,” or similar words.

These statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statement. These risks and uncertainties are detailed in FBL Financial Group’s reports filed with the Securities and Exchange Commission and include, but are not limited to, difficult conditions in financial markets and the economy, lack of liquidity and access to capital, investment valuations, interest rate changes, competitive factors, the ability to attract and retain sales agents and a decrease in ratings. These forward-looking statements are based on assumptions which FBL Financial Group believes to be reasonable; however, no assurance can be given that the assumptions will prove to be correct. These important risks and uncertainties should be considered in evaluating any statement contained herein.

Investors should not place undue reliance upon any forward-looking statements included in this annual report, as they are only as of the date they were posted, March 31, 2010. FBL disclaims any obligation to update forward-looking statements after the date that this annual report is posted. Further, FBL Financial Group assumes no responsibility for any inaccuracies or misstatements which occur as a result of the review of dated material. For FBL Financial Group’s most current information, please reference FBL Financial Group’s current SEC filings, which may be found on FBL Financial Group’s website under Financial Information, SEC Filings (http://www.fblfinancial.com/sec.cfm).

| ACCEPT |

Letter to Shareholders – Jim Hohmann, Chief Executive Officer

Hello. I’m Jim Hohmann, CEO of FBL Financial Group. I’m pleased to address you - my fellow shareholders - in this, my first annual report with FBL.

I think of 2009 as a year of overcoming adversity. FBL is in the business of helping others who face adversity, but in 2009 we also helped ourselves and our company to overcome the significant challenges of the global financial crisis.

I joined FBL Financial Group on April 29, during a turbulent time in the economy – it was a very challenging period. Capital markets were constrained and equity markets were extremely volatile, coming off their lowest point in two decades. I was charged with bringing new strategies and accountabilities to improve our balance sheet, products, operations and distribution.

Early on I identified two top priorities: capital strength and the reinvention of EquiTrust Life.

We focused immediate attention on conserving and strengthening capital. We repositioned our investment portfolio, improved our asset liability position and completed a reinsurance transaction.

The EquiTrust Life reinvention plan is well underway, and we’re developing a consumer-focused life insurance business in cooperation with independent marketing intermediaries. This reinvention embodies innovative strategies, diversified products and more focused attention on our distribution partners and customers.

As I moved through the year, I added a third priority to reorganize and clarify accountabilities around our new value drivers. In September, I announced a redesigned organizational structure for the management of FBL Financial Group. This redesign and these new reporting relationships allow us to build upon our success with more focused accountability in the areas of investment performance, product and risk management, operations and distribution.

Our keen focus on these three priorities has resulted in improved earnings throughout 2009, with net income of $2.31 per share and operating income of $2.98 per share. Substantial book value was restored and increased by 237% and we ended the year with a 20% gain in our stock price. We are very proud of our progress.

Let me share my impressions about FBL Financial Group as a company. First and foremost, I find the caliber of employees and agents to be very high. They truly embody the corporate values of integrity, leadership, accountability, teamwork and passion.

Another observation is around our flagship consumer brand. The Farm Bureau brand is extremely strong in rural America and serves an important niche on the American landscape. Farm Bureau Life provides a solid foundation for our company, with strong people, brand and products.

Our collective efforts in 2009 have enhanced shareholder value, and we have further refined our business strategies around several key priorities to drive value in 2010 and beyond.

We are intent on growing in the coming year, and will drive that through excellent operations, risk management, and products that are competitive and relevant to consumers. There is a tremendous amount of opportunity ahead for FBL. We are poised to move forward, toward greater strength and shared success.

Questions and Answers

- What is FBL Financial Group’s relationship with the Farm Bureau organizations?

- Will you continue the focus on building capital strength in 2010?

- What are your priorities in 2010?

- Could you describe the quality of your investment portfolio?

- What does the EquiTrust reinvention include?

- What are your thoughts on your current financial strength ratings?

Q: What is FBL Financial Group’s relationship with the Farm

Bureau organizations?

A: (Hohmann) We have a

collaborative and supportive relationship with Farm Bureau, and our two

organizations share core values: to improve the financial well-being and

the quality of life for our clients and members. This is the foundation

of Farm Bureau – to serve American farmers and ranchers. Today, Farm

Bureau’s 6.3 million member families come from all walks of life, and we

provide insurance and financial products to those in our 15-state market

territory. We market these products using the "Farm Bureau" name and

"FB" trademarks. In addition to using the Farm Bureau name, we manage

two Farm Bureau property-casualty companies for a management fee.

Q: Will you continue the focus on building capital strength in

2010?

A: (Brannen) Strengthening our capital base was a

top priority last year, and we benefited from asset repositioning,

strong operating results, a gain from a reinsurance transaction and

enhanced asset liability management. Our Farm Bureau Life company action

level RBC ended 2009 at 441%, clearly exceeding our 350% target, and

EquiTrust Life’s year end company action level RBC ended 2009 at 376%,

also exceeding our target. For 2010 we continue to focus on the

efficient use of capital and plan to maintain a strong capital position

going forward.

Q: What are your priorities in 2010?

A: (Hohmann)

In 2010 we are concentrating on several key areas. We continue work to

optimize our balance sheet and reinvent EquiTrust, but we are also

expanding that agenda to grow both our business and our profits. We

intend to accomplish that by introducing new products, streamlining our

Farm Bureau operations, increasing our agent and customer bases, and

enhancing our cross-sell.

Q: Could you describe the quality of your investment portfolio?

A:

(Brannen) We have a high quality, liquid investment portfolio,

with 94.4% of our fixed maturity securities being investment grade as of

year end. Also, our portfolio contains 11% of commercial mortgage loans,

which were underwritten by FBL’s well-seasoned mortgage loan

specialists. We are confident in our commercial mortgage loan portfolio

and have a long history of low delinquency rates. Our investments are

all managed internally and are well-diversified by individual issue,

industry and asset class. Our strategy in 2009 was to reposition our

investment portfolio by selling lower rated securities and investing

proceeds in higher rated securities. As we upgraded the portfolio’s

quality, we also improved our cash flow management, which enhanced our

asset liability management profile.

Q: What does the EquiTrust reinvention include?

A: (Hohmann)

During 2009 we completed rigorous analysis and defined what we call the

EquiTrust Reinvention. This reinvention embodies innovative strategies,

diversified products, and more focused attention to distribution

partners and target customers. At the same time it builds on the

existing strengths of EquiTrust Life as an organization that is very

nimble and agile, effectively developing products, processing business

and engaging with the distributors. In 2010 EquiTrust Life will

introduce a wealth transfer product. Over time, we plan to expand the

life portfolio to complement a more focused fixed annuity business.

Q: What are your thoughts on your current financial strength

ratings?

A: (Brannen) We are very positive about the

progress we made in 2009 to strengthen our capital base and to improve

our risk position. We believe these actions and improved risk based

capital ratios are consistent with higher ratings and an improved

outlook, so we will continue our strategy of sustained strength as the

right one for restoring our companies’ ratings.

Financial Review – Jim Brannen, Chief Financial Officer

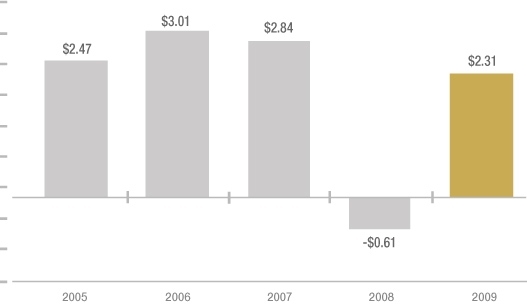

Net income (loss) per common share

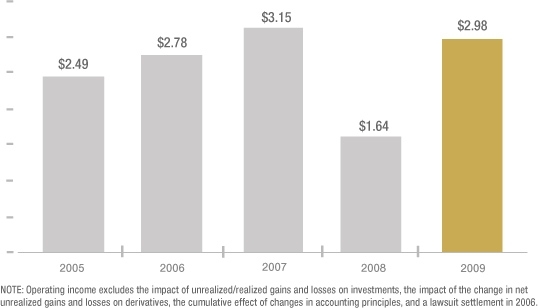

Operating income per

common share

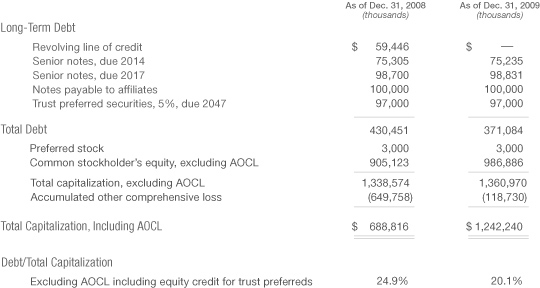

Capitalization

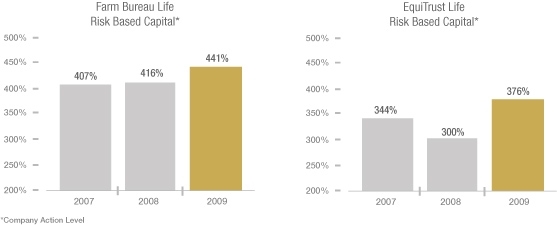

Statutory capital

Book

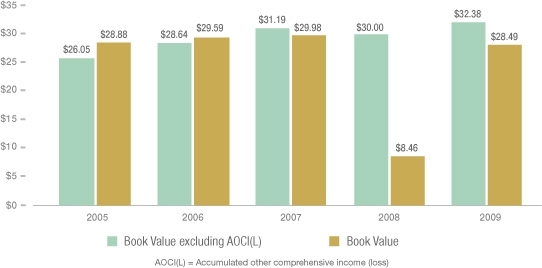

value per common share

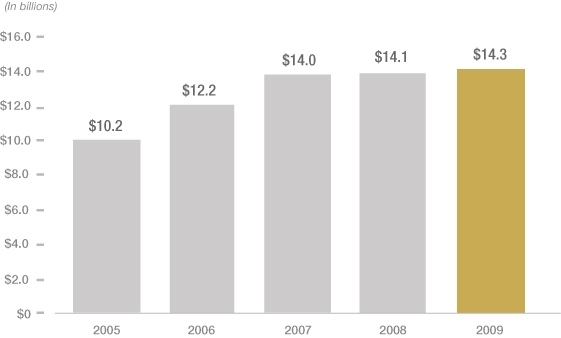

Total assets

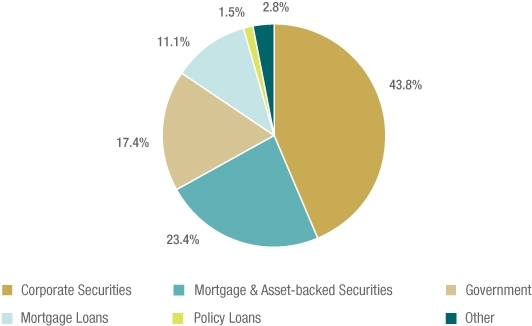

Investments by

type

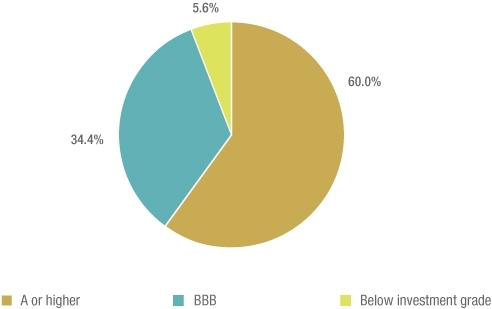

Investments by quality

I’m Jim Brannen, Chief Financial Officer of FBL Financial Group.

2009 was a year of challenge, but also one of progress. We faced challenges in the early months of 2009, with tumbling financial markets causing record unrealized losses in our investment portfolio, and new lows in U.S. treasury rates driving increased surrenders at our EquiTrust Life subsidiary. However, we made much progress in the last three quarters of 2009, with steps we took and are still taking to improve our risk profile, strengthen our capital base and optimize our investment portfolio. Because of these actions, we delivered strong earnings results. We ended 2009 on solid financial footing. I’m confident about the long term success of FBL Financial Group.

Some of the more significant financial metrics are highlighted here. I invite you to click on the metrics to the left to get a better sense for the results of each item. And of course you can find more detailed information in our Form 10-K.

Net income (loss) per common share - This chart illustrates our net income or loss per common share. Despite a rough beginning in 2009, we were able to end the year with solid net income of $69.8 million, or $2.31 per share. The net loss in 2008 reflects realized investment losses from other-than-temporary impairments of bonds in our investment portfolio.

Operating income per common share – After a difficult 2008, our 2009 operating income totaled a solid $90.1 million, or $2.98 per share. This reflects continued strong results from our Farm Bureau Life business, gains due to a reinsurance transaction, the refinement of reserve estimates and higher earnings in our variable segment due to recovering equity markets.

Capitalization - During 2009, much of our attention was focused

on strengthening our capital base and I’m pleased to say that we were

successful with total capitalization increasing to $1.2 billion at year

end 2009 from $689 million at year end 2008. Our debt-to-total

capitalization ratio, with equity credit for our trust preferreds, was

20.1% at year end with securities at cost, a level we’re comfortable

with.

Statutory capital - Our companies are well-capitalized and, despite the challenges in the financial markets during the year, we were able to strengthen our capital position. At year end 2009, Farm Bureau Life had total statutory adjusted capital of $451 million and EquiTrust Life had $442 million. Company action level risk based capital, or RBC, was 441% for Farm Bureau Life and 376% for EquiTrust Life, both improving significantly in 2009 and both exceeding our 350% target. These increases reflect our strong financial results and actions to reposition our investment portfolio, reinsure a closed block of business and restructure our EquiTrust Life product portfolio so that sales are capital neutral.

Book value per common share - Our book value per share is shown

here both with and without accumulated other comprehensive income/loss,

or AOCI(L). For us, AOCI(L) is largely the marking of fixed income

securities to market value. Book value per share as of yearend 2009

increased a remarkable 237% to $28.49. This reflects our strong 2009

financial results and an increase in the market value of investments due

to the recovery of the financial markets and our portfolio repositioning.

Total assets – Assets totaled $14.3 billion at year-end 2009, an increase from $14.1 billion at year-end 2008 and an increase from $10.2 billion at year-end 2005. Spreads earned on this growth in assets was a factor in our increase in both net income and operating income in 2009.

Investments by type – At December 31, 2009, we had

total investments of $11.7 billion. Our investments are managed

internally and are well-diversified by individual issue, industry and

asset class. We manage our credit exposure on an enterprise-wide basis

and have limits in place for each credit exposure. During 2009, we had

several opportunities to reposition a portion of our investment

portfolio, which allowed us to improve the overall portfolio liquidity,

enhance the aggregate credit profile of the portfolio, and further

diversify the overall portfolio across asset classes, sectors and

individual issuers.

Investments by quality –The quality of our portfolio is high with more than 94% of our fixed maturity securities being investment grade. With our portfolio repositioning in 2009, we were able to enhance the aggregate credit profile of the portfolio by reducing our holdings in BBB securities. Without this repositioning, our allocation to BBBs would have grown due to ratings downgrades that were prevalent during 2009. As we move forward in 2010, we’ll continue to focus on improving the quality of our investment portfolio by concentrating new investments on higher rated securities.

About FBL: Company Profile

EquiTrust Life Insurance Company

FBL Financial Group’s

EquiTrust Life Insurance Company subsidiary is national in scope and

sells traditional fixed rate and index annuities through more than

20,000 independent agents. EquiTrust Life is currently undergoing a

reinvention process to diversify its business by product and channel and

expects to introduce its first life insurance product in 2010.

Farm Bureau Life Insurance Company

FBL Financial Group’s Farm

Bureau Life Insurance Company subsidiary has 2,020 exclusive agents and

managers in 15 Midwestern and Western states. Farm Bureau Life, which

originated in 1945, serves the niche marketplace of Farm Bureau members

with a comprehensive line of life insurance and annuity products.

Farm Bureau Property & Casualty Insurance Company

Western

Agricultural Insurance Company

FBL Financial Group manages all

aspects of two Farm Bureau affiliated property-casualty insurance

companies: Farm Bureau Property & Casualty Insurance Company and Western

Agricultural Insurance Company, which operate predominantly in eight

states. FBL Financial Group receives a management fee from these

companies and underwriting results do not impact FBL Financial Group’s

results.

About FBL: Management Team

James E. Hohmann, Chief Executive Officer

James P. Brannen, Chief

Financial Officer, Chief Administrative Officer and Treasurer

Charles

T. Happel, Executive Vice President – Chief Investment Officer

Richard

J. Kypta, Executive Vice President – Farm Bureau Life

David A.

McNeill, Vice President, General Counsel and Secretary

Kevin R.

Slawin, Executive Vice President – Marketing & Distribution

Bruce

A. Trost, Executive Vice President – Operations

Russell J.

Wiltgen, Chief Actuary

Douglas W. Gumm, Vice President – Information

Technology

Thomas L. May, Vice President – EquiTrust

Lori K.

Strottman, Vice President – Human Resources

David T. Sebastian,

Vice President – Strategy & Business Development

Donald J.

Seibel, Vice President – Finance

James E. Hohmann

Chief Executive Officer

James E.

(Jim) Hohmann was named chief executive officer of FBL Financial Group

in January 2010, after eight months as interim CEO. He has more than 30

years of experience in the financial services industry. Prior to FBL

Financial Group, he was president and CEO of Allstate Financial with

executive accountabilities for 15 Allstate affiliates. Prior to that,

Hohmann was president and chief operating officer at Conseco, Inc.;

president and CEO of XL Life and Annuity; and president, Financial

Institutions, for Zurich Kemper Life. He is a Fellow of the Society of

Actuaries and a member of the American Academy of Actuaries. Hohmann

earned a bachelor's degree in mathematics from Northwestern University

and an MBA from the University of Chicago. He is a former member of the

board of directors of the American Council of Life Insurers, and serves

on the board of OMNI Youth Services in Chicago.

James P. Brannen

Chief Financial Officer, Chief

Administrative Officer and Treasurer

James P. (Jim) Brannen,

chief financial officer, chief administrative officer and treasurer of

FBL Financial Group, is a graduate of the University of Iowa with a

major in accounting. He joined FBL in 1991 and held various positions in

the tax and accounting areas prior to being named to vice president -

finance in 2000 and to his current position in 2007. Prior to joining

FBL, Brannen managed corporate tax matters for insurance companies at

Ernst & Young. He is a certified public accountant and is a member of

the American Institute of Certified Public Accountants and the Iowa

Society of Certified Public Accountants. Brannen is also active in

several civic and industry organizations.

Charles T. Happel

Executive Vice President - Chief

Investment Officer

Charles T. (Charlie) Happel is chief

investment officer of FBL Financial Group. He joined the company in 1984

as a Farm Bureau Financial Services agent, moving to the corporate

office in 1986. Over the next 15 years, he held various positions in

investments, as securities analyst and portfolio manager. Happel became

securities vice president in 2001, vice president - investments in

August 2008, and was named chief investment officer in September 2009.

He is a graduate of the University of Northern Iowa and earned an MBA

from Drake University. He is a Chartered Financial Analyst (CFA), and

holds a number of industry designations, including CFP, FLMI, ChFC, CLU,

and CPCU. He is a member of the Iowa Society for Financial Analysts, the

Association for Investment Management and Research (AIMR), Chicago

Municipal Analysts Forum, and the National Federation of Municipal

Analysts (NFMA).

Thomas L. May

Vice President – EquiTrust

Thomas

L. (Tom) May is vice president, EquiTrust, a subsidiary of FBL Financial

Group. May joined FBL in 2002 as alliance marketing vice president. He

served as vice president, sales and marketing of the EquiTrust Life

Strategic Business Unit from its inception in 2003 until assuming his

current position in September 2009. Prior to joining FBL, May held

positions in actuarial, marketing and finance areas at Equitable Life of

Iowa and Central Life Assurance Company. May was part of the management

team of USG Annuity & Life, a start up annuity operation launched in

1990, eventually becoming executive vice president and chief marketing

officer. May earned a bachelor's degree in mathematics from the

University of Nebraska in Lincoln and a master's degree in actuarial

science. He is a Fellow of the Society of Actuaries and a member of the

American Academy of Actuaries.

David A. McNeill

Vice President, General Counsel and

Secretary

David A. McNeill, vice president, general counsel and

secretary of FBL Financial Group, joined FBL’s legal department in 1989.

He held various positions in the legal department before being named to

his current position in 2009. Prior to joining FBL, McNeill was in

private practice as an attorney in the Des Moines law firm of Davis,

Hockenberg, Wine, Brown, Koehn & Shors (now Davis Brown) and an attorney

with Miller & Sanford law firm (now Lathrop & Gage) in Springfield,

Missouri. McNeill also held several editorial positions before receiving

his law degree. McNeill received his Juris Doctorate degree, with

honors, from Drake University Law School in 1985 and his bachelor's

degree from Simpson College in 1979. McNeill is the companies'

representative to the Federation of Iowa Insurers, and serves as a

director of the Kansas Life & Health Insurance Guaranty Association and

the Colorado Life and Health Insurance Protection Association.

Kevin R. Slawin

Executive Vice President – Marketing &

Distribution

Kevin R. Slawin, executive vice president – marketing

& distribution, joined FBL Financial Group in October 2009. He is

responsible for all aspects of the organization's marketing and

distribution functions including business development, brand management,

sales management and agent recruiting and retention. Slawin has more

than 30 years of experience in the financial services industry. Over the

past 14 years, he has held a number of senior management positions at

Allstate Financial including CEO, Allstate Bank; senior vice president,

operations and technology; and senior vice president, chief financial

officer. Most recently, he served as president, distribution. Slawin

holds a Masters of Management degree from the J. L. Kellogg Graduate

School of Management at Northwestern University and a BS degree in

accounting from Indiana University. Slawin serves on the board of

directors of the Insurance Market Standards Association (IMSA).

Bruce A. Trost

Executive Vice President – Operations

Bruce

A. Trost was named executive vice president – operations of

FBL Financial Group in September, 2009. Trost joined FBL in 2004 and was

responsible for FBL's managed property-casualty companies from

2004-2009. Prior to FBL, Trost was the executive vice president and

chief executive officer of Nodak Mutual Insurance Company, Fargo, North

Dakota. Trost began his Farm Bureau insurance career in 1976 with

COUNTRY Insurance Company in Illinois. He held various positions

including Illinois state claims manager, returning in 1999 as vice

president of the property casualty companies. He was with United Farm

Family Mutual Insurance Company from 1994-1999. Trost holds a bachelor's

degree in business from Southern Illinois University. He also completed

various insurance and advanced management courses through the Wharton

School of Business, Drake University, IBM, and the American Educational

Institute, where he received a Senior Claims Law Associate designation.

Russell J. Wiltgen

Chief Actuary

Russell J. Wiltgen

joined FBL Financial Group as chief actuary in February, 2010. He is

responsible for actuarial matters and enterprise risk management.

Wiltgen comes to FBL Financial Group with nearly 30 years of experience

in the financial services, with expertise in strategic business

planning, risk management, product development and management,

distribution expansion and field engagement. Prior to joining FBL, he

was with the UNIFI Companies in Lincoln, and where he most recently

served as vice president-individual annuity product management. He also

worked for the Mutual of Omaha Companies for 17 years where he held

various actuarial management positions including vice president and

chief product actuary risk life. Wiltgen holds a bachelor's degree in

actuarial science from the University of Iowa. He is a Fellow of the

Society of Actuaries and a member of the American Academy of Actuaries.

Richard J. Kypta

Executive Vice President – Farm Bureau Life

Richard

J. (Rich) Kypta is executive vice president – Farm Bureau Life. He

joined the company in August 2007 and served as senior vice president

and general counsel through March 2008. Kypta also served as the

secretary of FBL Financial Group through April 2009. Prior to joining

FBL, Kypta held a number of legal, finance, and operations positions

within Aviva USA Corporation and Aegon Insurance Group. He started his

career with the public accounting firm of PricewaterhouseCoopers. Kypta

holds a BS degree from Georgetown University, an MS degree from Johns

Hopkins University and a J.D. degree from the University of Maryland's

School of Law. He is a certified public accountant; a member of the

American Institute of Certified Public Accountants, American Bar

Association and Maryland State Bar Association; and a Fellow of the Life

Management Institute. Kypta currently serves as a director of the Iowa

and Wyoming Life and Health Guaranty Associations and as a trustee of

the Hospice of Central Iowa Foundation.

Douglas W. Gumm

Vice President – Information Technology

Douglas

W. (Doug) Gumm is vice president – information technology

for FBL Financial Group, Inc. He is responsible for the company’s data

center operations, local and wide-area network services, database

administration, desktop computing, help desk support, information

security and application development. Gumm joined FBL Financial Group,

Inc. in 1999 as information systems vice president and was named vice

president – information technology in 2001. Gumm has 35

years of management experience in information systems. Before joining

FBL, he worked in several capacities at Principal Financial Group. He is

the current chair of the Technology Association of Iowa executive

committee, first past chair of the PCIAA Technology Committee and past

president of the Iowa CIO Forum.

Lori K. Strottman

Vice President – Human Resources

Lori

Strottman joined the companies in 1986 and has served in a number of

human resources capacities over the past 24 years. She was director of

corporate recruitment and employment from 1995 until 2003, when she when

she became employment services vice president. She was named to her

current position in March 2010. Strottman graduated from the University

of Northern Iowa with a bachelor's degree in management (human resources

emphasis). She has earned numerous human resources and insurance

industry designations including Senior Professional Human Resources

(SPHR), Certified Employee Benefits Specialist (CEBS), Group Benefits

Administrator (GBA), Certified Compensation Professional (CCP) and

Fellow Life Management Institute (FLMI). She is past president of the

Society for Human Resource Management's central Iowa chapter and

continues to serve the organization as a board member.

David T. Sebastian

Vice President – Strategy & Business

Development

David T. Sebastian was named vice president -

strategy and business development in June of 2008, having served as vice

president in various sales and marketing capacities since joining FBL

Financial Group in 2004. Sebastian was a consultant to the companies on

sales, marketing and business matters beginning in 1995. Prior to

joining FBL Sebastian was an independent consultant to clients in

financial services, professional services, manufacturing, consumer

products and education for more than 20 years.

Donald J. Seibel

Vice President – Finance

Donald

J. Seibel, vice president – finance, joined FBL in 1996 to help lead

accounting efforts necessary for FBL Financial Group’s initial public

offering. He became GAAP accounting vice president in 1998 and vice

president − accounting in 2002 and was named to his current position in

2007. Prior to joining FBL, Seibel worked for 11 years at public

accounting firm Ernst & Young. He is responsible for departments

providing financial and tax reporting for FBL, investor relations,

employee benefits and certain corporate services. Seibel holds a

bachelor’s degree in accounting from Iowa State University, is a

certified public accountant, and holds the Fellow Life Office Management

Institute (FLMI) certification. Seibel is a board member of the Iowa

Society of CPAs and is active in civic organizations.

About FBL: Board of Directors

Craig A. Lang, Chairman of the Board

Craig A. Lang is the

chairman of the board and chair of the Executive Committee. He has been

a director of the Iowa Farm Bureau Federation since 1992. In December

2001 he was elected president of the Iowa Farm Bureau Federation and

director and president of its subsidiary, Farm Bureau Management

Corporation. In 2003 Lang was elected to the board of directors of the

American Farm Bureau Federation. He is also a director of FB BanCorp. He

served as the Iowa governor's appointed chairman of the Grow Iowa Values

Fund, within the Iowa Department of Economic Development, in 2003 and

2006. Lang was named a member of the Iowa Board of Regents in April

2007. Lang is the lead director of Iowa Telecom, and chairman of its

Compensation Committee. Lang has farmed since 1973 in partnership with

his father and brother on 1,200 acres near Brooklyn, Iowa.

Steve L. Baccus

Steve L. Baccus was named a Class B director

in May 2002 after being named president of the Kansas Farm Bureau. He is

also chairman of the board of directors of Farm Bureau Property &

Casualty and a director of Farm Bureau Life, EquiTrust Life, Western Ag

and FB BanCorp. In 2004 Baccus was elected to the board of directors of

the American Farm Bureau Federation. His family farm in Ottawa County,

Kansas produces wheat, milo, soybeans, sunflower and irrigated corn.

Baccus earned bachelor’s and master’s degrees in psychology from

Washburn University and Chapman College, respectively.

Roger K. Brooks

Roger K. Brooks was named a Class A director

in May 2009, filling a board vacancy. Brooks is the retired chief

executive officer and chairman of AmerUs Group. He retired from AmerUs

in 2005, after nearly 50 years of service. Brooks has served on numerous

community boards and is a member of the Iowa Insurance Hall of Fame and

Iowa Business Hall of Fame. He is also a Fellow of the Society of

Actuaries. Brooks graduated magna cum laude with a bachelor's degree in

mathematics from the University of Iowa. He also participated in

Stanford University's Executive Program.

Jerry L. Chicoine

Jerry L. Chicoine, Class A director since

1996, is the lead director of the independent directors, vice chairman

of the board, and serves on the Executive Committee and the Management

Development and Compensation Committee. Chicoine retired effective

January 1, 2001 as chairman and chief executive officer of Pioneer

Hi-Bred International, Inc. He had served in those capacities since

1999, and was Pioneer's executive vice president and chief operating

officer since 1997. From 1988 to 1997 he had served as senior vice

president and chief financial officer. He was named a director of

Pioneer Hi-Bred in March 1998. He was named Outstanding CPA in Business

and Industry by the Iowa Society of CPAs in 1998. He was a partner in

the accounting firm of McGladrey & Pullen from 1969 to 1986 and also

holds a law degree. He is a member of the Board of Directors of several

non-public companies, including Ruan Holdings, The Weitz Company and

Bankers Trust Company N.A. of Phoenix.

Tim H. Gill

Tim H. Gill, Class A director since 2004, has

served as president and chief executive officer of Montana Livestock Ag

Credit, Inc. since 1986. The company specializes in agricultural finance

throughout the state of Montana, underwrites long term real estate loans

and has its own investment offerings. Gill is on the finance committee

of Montana Stockgrowers; a trustee and finance chairman of the Montana

Stockgrowers Research and Education Foundation; a member of the tax and

credit committee of the National Cattlemen's Beef Association; a

director and past chairman of the Montana Council on Economic Education;

a director of the Carroll College Athletic Association, and past

chairman of the Animal Bio-Science Committee for Montana State

University College of Agriculture. He is chair of the Class A Nominating

and Governance Committee.

Robert H. Hanson

Robert H. Hanson, Class A director since

2004, served as investment banker with Merrill Lynch, Pierce Fenner &

Smith in New York from 1965 to 1989, since 1972 as a vice president,

specializing in providing corporate finance services to the regulated

utilities and telecommunications industries. In 1990 he relocated to

Cody, Wyoming, where he was employed by Dean Witter Reynolds, Inc. as an

account executive, and later by D.A. Davidson & Co., as vice president

and office manager of that firm's Cody office. In 1993 he joined GST

Telecommunications, Inc., initially as senior vice president–corporate

development, and subsequently as chief financial officer, retiring from

those positions in 1999. Hanson is a past member of the Wyoming

Telecommunications Council and current president of the Boys & Girls

Club of Park County, Wyoming. In addition, he is a director and trustee

of two national conservation organizations, for which he has the

responsibility for financial and investment management. Hanson is a

graduate of Yale University. He is chair of the Finance Committee.

Craig D. Hill

Craig D. Hill was elected a Class B director in

February 2007 and previously served as a Class B director from 2002 to

2004. He is vice president of the Iowa Farm Bureau Federation and has

served on its Board of Directors since 1989. He has served on the boards

of Farm Bureau Life from 1989 to 2007, Property & Casualty since 1989,

and also serves on the boards of Western Agricultural and Crop1

Insurance. Hill farms 1,000 acres of row crops and has a swine operation

near Milo, Iowa.

James E. Hohmann

James E. (Jim) Hohmann was named chief

executive officer of FBL Financial Group in January 2010, after eight

months as interim CEO. He has more than 30 years of experience in the

financial services industry. Prior to FBL Financial Group, he was

president and CEO of Allstate Financial with executive accountabilities

for 15 Allstate affiliates. Prior to that, Hohmann was president and

chief operating officer at Conseco, Inc.; president and CEO of XL Life

and Annuity; and president, Financial Institutions, for Zurich Kemper

Life. He is a Fellow of the Society of Actuaries and a member of the

American Academy of Actuaries. Hohmann earned a bachelor's degree in

mathematics from Northwestern University and an MBA from the University

of Chicago. He is a former member of the board of directors of the

American Council of Life Insurers, and serves on the board of OMNI Youth

Services in Chicago.

Paul E. Larson

Paul E. Larson, Class A director since 2004, is

the chair of the Audit Committee. He has been named by the Board of

Directors as one of our "Audit Committee financial experts." He retired

in 1999 as president of Equitable Life of Iowa and its subsidiary, USG

Annuity and Life, after 22 years with the companies. Larson holds both a

law degree and a certified public accountant designation. He was named

Outstanding CPA in Business and Industry by the Iowa Society of CPA's in

1999, and inducted into the American Institute of CPA's Business and

Industry Hall of Fame in 2000. He is a member of the Board of Directors

of non-public companies Wellmark, Inc., GuideOne Mutual Insurance

Company and GuideOne Specialty Mutual Insurance Company. He was also a

board member of EquiTrust Mutual Funds (which is managed by one of our

subsidiaries), where he was chair of the Audit Committee and the

committee's financial expert. He resigned from the EquiTrust Mutual

Funds board upon election to the FBL Financial Group board in 2004.

Edward W. Mehrer

Edward W. Mehrer, Class A director since

2004, is currently a member of the board of directors, and the audit and

compensation committees of NovaStar Financial. He served as interim

chief executive officer of CyDex, Inc., a drug delivery company, from

late 2002 to mid 2003, and as its chief financial officer from November

1996 to December 2003. Prior to joining CyDex in 1996, Mehrer was

executive vice president and chief financial and administrative officer

of Marion Merrell Dow and a director and member of its executive

committee. From 1976 to 1986, Mehrer served as partner-in-charge of

audit and accounting for KPMG Peat Marwick in Kansas City, Missouri. The

Board of Directors has named him as one of our “Audit Committee

financial experts.”

Keith R. Olsen

Keith R. Olsen has served as a Class B director

since May 2007. He previously served as a Class B director from 2002 to

2004. He is chairman of the Class B Nominating Committee. Olsen was

elected president of the Nebraska Farm Bureau Federation in 2002, and

has been a member of its Board of Directors since 1992. He was elected

to the Board of Directors of the American Farm Bureau Federation in

2004. He is also a director of Farm Bureau Life, Farm Bureau Property &

Casualty, and Western Agricultural Insurance Company. In February 2003

he became a director of Blue Cross-Blue Shield of Nebraska. Olsen holds

a Bachelor of Science in Agricultural Economics and has farmed 3,000

acres in southwest Nebraska for more than four decades.

Kevin G. Rogers

Kevin G. Rogers has served as a Class B

director since February 2008. He has been president of the Arizona Farm

Bureau Federation since 2004. He also serves on the board of American

Farm Bureau Federation and its executive committee, the National Cotton

Council, the Cotton Board (treasurer) and is a member of the USDA's Air

Quality Task Force. Rogers is also a director of Farm Bureau Life and

Farm Bureau Property & Casualty Insurance Company, and president and a

director of Western Agricultural Insurance Company. His family farms

7,000 acres in the Phoenix metropolitan area.

John E. Walker

John E. Walker, Class A director since 1996, is

the chair of the Management Development and Compensation Committee. He

retired January 1, 1996 from Business Men's Assurance (BMA), Kansas

City, Missouri, where he had been the managing director of Reinsurance

Operations since 1979. He had been a member of the Board of Directors of

BMA for 11 years prior to his retirement, and a member of its executive

committee.

Company Timeline

Early 1900s

When county and state Farm Bureaus began forming

in the years around World War I, farming was becoming increasingly

complex and capital intensive, a trend that has continued and

intensified. Unfortunately, given their urban market focus, few

insurance companies at that time understood the unique needs of farmers.

1939

The Iowa Farm Bureau Federation formed its own company to

meet the needs of its farmer members. Farm Bureau Mutual Insurance Company

began by offering auto insurance, and expanded into farm liability

products and fire protection.. By the early 1960s, it was a full line

multi-state casualty insurer.

1945

FBL's principal subsidiary, Farm Bureau Life Insurance

Company (originally known as Iowa Life Insurance Company) was organized

on October 30, 1944 and opened for business on January 24, 1945. From

the beginning, Farm Bureau Life experienced record-breaking growth.

During its charter period, more than 9,000 applications were received

for $22 million of life insurance volume. In its first year of

operation, $29 million was issued, a record for life insurance companies.

1949

A record was set when Farm Bureau Life achieved $100

million of life insurance in force in just 56 months. Several other

state Farm Bureaus recognize the opportunity to provide expanded

services to members through insurance products while achieving economies

of scale. Farm Bureau Life was invited to offer its products in states

other than Iowa, expanding into Nebraska in 1951 and Minnesota in 1954.

1971

The company introduced the sale of its mutual funds.

Today these funds are managed by FBL's subsidiary, EquiTrust Investment

Management Services.

1984

Farm Bureau Life acquired Utah Farm Bureau Insurance

Company and Utah Farm Bureau Life. In 1988, Utah Farm Bureau Life was

merged into Farm Bureau Life. The assets of Utah Farm Bureau Insurance

Company were dividended up to its parent company and it was dissolved in

1998.

1987

Farm Bureau Life expanded into South Dakota at the

request of the South Dakota Farm Bureau Federation. South Dakota Farm

Bureau Mutual became a managed operation until it was merged into Farm

Bureau Mutual in 1999.

1993

In 1993, Farm Bureau Life became the majority owner of

Rural Security Life, which was formed in 1949 by the Wisconsin Farm

Bureau Federation. Rural Security Life was merged into Farm Bureau Life

in 1994.

1994

In January, the shareholders of Farm Bureau Life

Insurance Company and Western Farm Bureau Life Insurance Company approve

a plan to consolidate operations. Western Farm Bureau Life operated in

Arizona, Colorado, Idaho, Montana, New Mexico, Oklahoma, North Dakota

and Wyoming. Western Farm Bureau Life was merged into Farm Bureau Life

in 1999.

1995

FBL Financial Group entered into a variable product

strategic alliance with Kansas Farm Bureau Life Insurance Company

allowing FBL variable products to be sold in Kansas through Kansas Farm

Bureau Life's agency force.

1996

FBL Financial Group began managing Western Agricultural

Insurance Company (Arizona) and Western Farm Bureau Mutual Insurance

Company (New Mexico).

1996

FBL Financial Group went public at a split-adjusted

initial public offering price of $8.75. Today FBL Financial Group is

traded on the New York Stock Exchange under the ticker symbol FFG.

1997

EquiTrust Life was purchased by FBL in 1997 as a shell

company to underwrite business outside of FBL's niche Farm Bureau

marketplace.

2001

FBL expanded its core marketing territory to 15 states

through the acquisition of Kansas Farm Bureau Life Insurance Company.

FBL entered into coinsurance agreements with National Travelers Life

Company and American Equity Investment Life Insurance Company.

2003

Farm Bureau Mutual Insurance Company merged with the

Nebraska Farm Bureau Insurance Company and Farm Bureau Mutual Insurance

Company of Kansas. FBL, which still manages Farm Bureau Mutual, now

manages property-casualty operations in eight states.

2009-10

In 2009, Farm Bureau Mutual Insurance Company formed a

mutual holding company named Farm Bureau Mutual Holding Company. Farm

Bureau Mutual Insurance Company was renamed Farm Bureau Property &

Casualty Insurance Company, effective January 1, 2010.

Today

FBL Financial Group is a holding company whose primary

operating subsidiaries are Farm Bureau Life Insurance Company and

EquiTrust Life Insurance Company. FBL Financial Group underwrites,

markets and distributes life insurance, annuities and mutual funds to

individuals and small businesses. In addition, FBL manages all aspects

of two Farm Bureau affiliated property-casualty insurance companies for

a management fee.