Attached files

| file | filename |

|---|---|

| EX-32.2 - Oriental Dragon Corp | v179397_ex32-2.htm |

| EX-31.1 - Oriental Dragon Corp | v179397_ex31-1.htm |

| EX-32.1 - Oriental Dragon Corp | v179397_ex32-1.htm |

| EX-31.2 - Oriental Dragon Corp | v179397_ex31-2.htm |

| EX-10.24 - Oriental Dragon Corp | v179397_ex10-24.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL

REPORT UNDER PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

FOR

THE TRANSITION PERIOD FROM ______________ TO

______________

|

Commission

File Number: 000-52133

EMERALD ACQUISITION

CORPORATION

(Exact

name of small business issuer as specified in its charter)

|

Cayman

Islands

|

N/A

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer

Identification

No.)

|

No. 48 South Qingshui

Road

Laiyang

City,

Shandong

265200

People’s Republic of China

(Address

of principal executive offices)

+86 (535)

729-6152

(Registrant’s

telephone number, including area code)

SECURITIES

REGISTERED UNDER SECTION 12(b) OF THE EXCHANGE ACT: NONE

SECURITIES

REGISTERED UNDER SECTION 12(g) OF THE EXCHANGE ACT:

Common

Stock, Par Value $0.001 Per Share

(Title of

Class)

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). YES o NO x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No x

Check

whether the issuer: (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. YES x NO

o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference Part III of this Form 10-K or

any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

o

|

Accelerated

filer

|

o

|

|

|

Non-accelerated

filer

(Do

not check if a smaller reporting company)

|

o

|

Smaller

reporting company

|

x

|

As of the

last business day of the registrant’s most recently completed second fiscal

quarter, there was no public trading market for our common stock.

As of

March 26, 2010, there are 27,491,171 ordinary shares issued and

outstanding.

Documents Incorporated by

Reference:

None.

|

Item

Number and Caption

|

Page

|

|||

|

PART

I

|

||||

|

Item

1.

|

Business

|

1

|

||

|

Item

1A.

|

Risk

Factors

|

14

|

||

|

Item

2.

|

Properties

|

25

|

||

|

Item

3.

|

Legal

Proceedings

|

26

|

||

|

PART

II

|

||||

|

Item

5.

|

Market

for Registrant’s Common Equity, and Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

26

|

||

|

Item

6.

|

Selected

Financial Data

|

27

|

||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

27

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

|

||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

38

|

||

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

|

||

|

Item 9A(T).

|

Controls

and Procedures

|

38

|

||

|

PART

III

|

|

|||

|

Item

10.

|

Directors,

Executive Officers, Promoters and Corporate Governance

|

39

|

||

|

Item

11.

|

Executive

Compensation

|

40

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

41

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

42

|

||

|

Item

14.

|

Principal

Accountant Fees and Services

|

44

|

||

|

PART

IV

|

||||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

44

|

||

|

SIGNATURES

|

46

|

|||

ITEM 1. BUSINESS.

Emerald

Acquisition Corp. (“we” or the “Company”) is the only Laiyang Pear juice

concentrate producer and distributor in the Peoples’ Republic of China, which we

refer to as China or the PRC. We have been granted by the Laiyang

government as the exclusive producer of Laiyang Pear juice concentrate. Our

products are mainly used in pharmaceutical, health supplement, and food and

beverage industries. Laiyang Pear contains 46 kinds of organic acids, vitamin

B1, B2, vitamin C, nicotinic acid, carotene, and minerals such as calcium,

phosphorus and iron. Therefore, the Laiyang Pear juice concentrate we produce is

known for its exceptional taste, nutritional and medical benefits. Our products

are mainly distributed in Shandong, Guangdong, Liaoning and Jiangsu

provinces.

We were

incorporated under the laws of Cayman Islands on March 10, 2006. On

May 31, 2006, we completed a private placement offering by selling 177,500

ordinary shares to 355 offshore private investors for $35,500. On July 18, 2006,

we sold an additional 54,000 shares to 108 offshore private investors for

$10,800. On October 22, 2009, we acquired Merit Times in a reverse acquisition

transaction, which involved a financing transaction and a share exchange

transaction which are more fully described below.

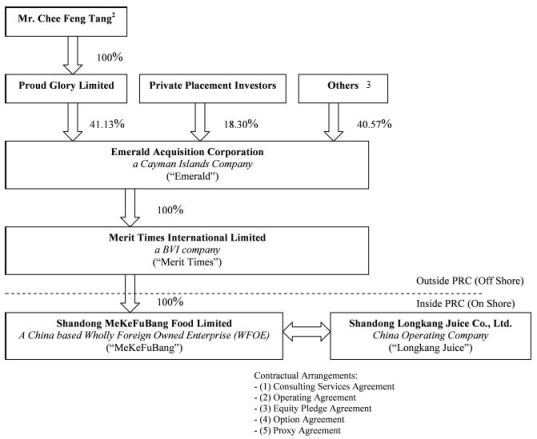

We own

all of the issued and outstanding capital stock of Merit Times International

Limited (“Merit Times”), which in turn owns 100% of the outstanding capital

stock of Shandong MeKeFuBang Food Limited (the “WFOE” or “MeKeFuBang”). On June

10, 2009, MeKeFuBang entered into a series of contractual agreements with

Shandong Longkang Juice Co., Ltd., a limited liability company under the laws of

China (“Longkang Juice”), and its five shareholders, in which MeKeFuBang

effectively assumed management of the business activities of Longkang Juice and

has the right to appoint all executives and senior management and the members of

the board of directors of Longkang Juice. The contractual arrangements are

comprised of a series of agreements, including a Consulting Services Agreement,

Operating Agreement, Proxy Agreement, and Option Agreement, through which

MeKeFuBang has the right to advise, consult, manage and operate Longkang Juice

for an annual fee in the amount of Longkang Juice’s yearly net profits after

tax. Additionally, Longkang Juice’s Shareholders have pledged their rights,

titles and equity interest in Longkang Juice as security for MeKeFuBang to

collect consulting and services fees provided to Longkang Juice through an

Equity Pledge Agreement. In order to further reinforce MeKeFuBang’s rights to

control and operate Longkang Juice, Longkang Juice’s shareholders have granted

MeKeFuBang the exclusive right and option to acquire all of their equity

interests in Longkang Juice through an Option Agreement, which is also known as

Present Incentive Option Agreement as described below.

On June

10, 2009, the Chairman of Longkang Juice, Mr. Zhide Jiang, as a PRC citizen,

entered into a call option agreement, which we refer to as the Original

Incentive Option Agreement, with Mr. Chee Fung Tang, a Hong Kong passport holder

and the Merit Times Shareholders. Under the Original Incentive Option Agreement,

Mr. Jiang shall serve as CEO, director or other officer of Merit Times for a

certain period of time; and in anticipation of Mr. Jiang’s continuance

contributions to the companies including Merit Times and Longkang Juice, if the

companies meet certain thresholds of the revenue conditions, Mr. Jiang shall

have rights and options to be transferred the shares of Merit Times at a nominal

price. In addition, Original Incentive Option Agreement also provides that Mr.

Tang shall not dispose any of the shares of Merit Times without Mr. Jiang’s

consent.

On August

5, 2009, Mr. Chee Fung Tang, a Hong Kong resident and the sole shareholder of

Proud Glory Limited (a British Virgin Islands company, which became the major

shareholder of Merit Times after Merit Times recapitalized), entered into a new

Incentive Option Agreement, which we refer to as the Present Incentive Option

Agreement, with Mr. Jiang. Pursuant to Present Incentive Option Agreement, the

Original Incentive Option Agreement will be terminated on the effective date of

Present Incentive Option Agreement. The effective date of Present Incentive

Option Agreement is October 22, 2009.

Under the

Present Incentive Option Agreement, Mr. Jiang shall serve as managing director

or other officer of Merit Times for not less than 3 year period of time; and in

anticipation of Mr. Jiang’s continuance contributions to the group including

Merit Times, MeKeFuBang and Longkang Juice, if the group meets certain

thresholds of the revenue conditions, Mr. Jiang shall have rights and options to

be transferred up to 100% shares of Proud Glory Limited at a nominal price

within the next three years (the “Option”). In addition, the Present Incentive

Option Agreement also provides that Mr. Tang shall not dispose any of the shares

of Proud Glory Limited without Mr. Jiang’s consent.

Mr. Chee

Fung Tang owns 10,000 shares, which represent 100% of the issued and outstanding

shares of Proud Glory Limited (the “Option Shares”). Under the terms of the

Present Incentive Option Agreement, the Option shall vest and become exercisable

and Mr. Zhide Jiang shall have the right to receive the Option Shares upon

exercise of the Option subject to the fulfillment of the following

conditions:

1

34% of

the Option Shares subject to the Option shall vest and become exercisable on the

date of fulfillment of the 2009 revenue of a minimum of ¥6,000,000 RMB (equal to

approximately $879,018), 33% of the Option Shares subject to the Option shall

vest and become exercisable on the date of fulfillment of the 2010 revenue of a

minimum of ¥20,000,000 RMB (equal to approximately $2,930,060) and 33% of the

Option Shares subject to the Option shall vest and become exercisable on the

date of fulfillment of the 2011 revenue of a minimum of ¥30,000,000 RMB (equal

to approximately $4,395,090). The Option is exercisable at an exercise price of

$0.10 per share for a period of five years from the date of the

Option.

The

following chart reflects our organizational structure as of the date of this

Form 10-K.

Contractual

Arrangements between MeKeFuBang, Longkang Juice and its

stockholders

Our

relationships with the Longkang Juice and its stockholders are governed by a

series of contractual arrangements between MeKeFuBang, and Longkang Juice, which

is our operating company in the PRC. Under PRC laws, Longkang Juice is an

independent legal person and is not exposed to liabilities incurred by the other

parties. On June 10, 2009, MeKeFuBang entered into a series of

contractual agreements with Longkang Juice and its five shareholders, in which

MeKeFuBang effectively assumed management of the business activities of Longkang

Juice and has the right to appoint all executives and senior management and the

members of the board of directors of Longkang Juice.

Details

of these contractual arrangements are as follows:

(1) Consulting Services

Agreement. Pursuant to the exclusive consulting services agreement

between MeKeFuBang and Longkang Juice, MeKeFuBang has the exclusive right to

provide to Longkang Juice general business operation services, including advice

and strategic planning, as well as consulting services related to the

technological research and development of the Longkang Juice’s products (the

“Services”). Under this agreement, MeKeFuBang owns the intellectual property

rights developed or discovered through research and development, in the course

of providing the Services, or derived from the provision of the Services.

Longkang Juice shall pay a quarterly consulting service fees in Renminbi (“RMB”)

to MeKeFuBang that is equal to all of Longkang Juice’s profits for such

quarter. The term of this agreement is 20 years from June 10, 2009

and may be extended only upon MeKeFuBang’s written confirmation prior to the

expiration of the this agreement, with the extended term to be mutually agreed

upon by the parties.

2

(2) Operating

Agreement. Pursuant to the operating agreement among MeKeFuBang, Longkang

Juice and all shareholders of Longkang Juice, MeKeFuBang provides guidance and

instructions on Longkang Juice’s daily operations, financial management and

employment issues. Longkang Juice shareholders must designate the candidates

recommended by MeKeFuBang as their representatives on the boards of directors of

Longkang Juice. MeKeFuBang has the right to appoint senior executives of

Longkang Juice. In addition, MeKeFuBang agrees to guarantee Longkang Juice’s

performance under any agreements or arrangements relating to Longkang Juice’s

business arrangements with any third party. Longkang Juice, in return, agrees to

pledge their accounts receivable and all of their assets to MeKeFuBang.

Moreover, Longkang Juice agrees that without the prior consent of MeKeFuBang,

Longkang Juice will not engage in any transactions that could materially affect

its assets, liabilities, rights or operations, including, without limitation,

incurrence or assumption of any indebtedness, sale or purchase of any assets or

rights, incurrence of any encumbrance on any of its assets or intellectual

property rights in favor of a third party or transfer of any agreements relating

to its business operation to any third party. The term of this agreement shall

commence from the effective and shall last for the maximum period of time

permitted by law unless terminated early in accordance with certain provision or

by any other agreements reached by all parties, with any extended term to be

mutually agreed upon by the parties. Longkang Juice shall not terminate this

agreement.

(3) Equity Pledge

Agreement. Under the equity pledge agreement between Longkang Juice’s

shareholders and MeKeFuBang, Longkang Juice’s shareholders pledged all of their

equity interests in Longkang Juice to MeKeFuBang to guarantee Longkang Juice’s

performance of its obligations under the consulting services agreement. If

Longkang Juice or its shareholders breaches their respective contractual

obligations, MeKeFuBang, as pledgee, will be entitled to certain rights,

including the right to sell the pledged equity interests. Longkang Juice’s

shareholders also agreed that upon occurrence of any event of default,

MeKeFuBang shall be granted an exclusive, irrevocable power of attorney to take

actions in the place and stead of the Longkang Juice’s shareholders to carry out

the security provisions of the equity pledge agreement and take any action and

execute any instrument that MeKeFuBang may deem necessary or advisable to

accomplish the purposes of the equity pledge agreement. Longkang Juice’s

shareholders agreed not to dispose of the pledged equity interests or take any

actions that would prejudice MeKeFuBang’s interest. The equity pledge agreement

will expire two (2) years after Longkang Juice’s obligations under the

consulting services agreements have been fulfilled.

(4) Option Agreement.

Under the option agreement between Longkang Juice’s

shareholders and MeKeFuBang, Longkang Juice’s shareholders irrevocably granted

MeKeFuBang or its designated person an exclusive option to purchase, to the

extent permitted under PRC law, all or part of the

equity interests in Longkang Juice for the cost of the initial contributions to

the registered capital or the minimum amount of consideration permitted by

applicable PRC law. MeKeFuBang or its designated person has sole discretion to

decide when to exercise the option, whether in part or in full. The term of this

agreement shall last for the maximum period of time permitted by law unless

terminated in accordance with this agreement. As disclosed in the Risk Factors

section on page 15, the acquisition of equity interests in Longkang Juice by us

may be deemed as direct or indirect acquisition of a PRC domestic company by an

offshore company controlled by a PRC natural person, therefore the approval of

PRC Ministry of Commerce is required during the period when Mr. Zhide Jiang has

substantial interest in our company. To date, Mr. Zhide Jiang has not

obtained relevant approval or registration from the PRC government.

(5) Proxy Agreement.

Pursuant to the proxy agreement between the Longkang Juice’s stockholders and

MeKeFuBang, the Longkang Juice stockholders agreed to irrevocably grant a person

to be designated by MeKeFuBang with the right to exercise the Longkang Juice

stockholders’ voting rights and their other rights, including the attendance at

and the voting of Longkang Juice’s stockholders’ shares at stockholders’

meetings (or by written consent in lieu of such meetings) in accordance with

applicable laws and its articles of association, including but not limited to

the rights to sell or transfer all or any of his equity interests of Longkang

Juice, and appoint and vote for the directors and chairman as the authorized

representative of the stockholders of Longkang Juice. The proxy agreement may be

terminated by joint consent of the parties or upon 30-day written

notice.

|

2

|

Mr.

Zhide Jiang is the Executive Director of Proud Glory Limited, which is our

majority shareholder. Pursuant to the Incentive Option Agreement between

Mr. Zhide Jiang and Mr. Chee Fung Tang, the record owner of Proud Glory

Limited, Mr. Zhide Jiang has the right and opportunity to acquire up to

100% equity interest of Proud Glory Limited subject to certain

contingencies as set forth therein within three years starting from

October 22, 2009.

|

|

3

|

It

includes the original shareholders from Emerald Acquisition Corporation

before the share exchange that completed on October 22, 2009, and the

shareholders of Merit Times who received the shares pursuant to the share

exchange for their cash or services provided

previously.

|

3

Acquisition

of Merit Times and Related Financing

On

October 22, 2009, we acquired Merit Times in a reverse acquisition transaction,

which involved a financing transaction and a share exchange transaction. In

accordance with a Share Exchange Agreement dated October 22, 2009, which we

refer to as the Exchange Agreement, by and among us, Merit Times, and the

shareholders of Merit Times (the “Merit Times Shareholders”), we acquired 100%

of the issued and outstanding shares of Merit Times in exchange for 21,333,332

shares or 97.77% of our ordinary shares issued and outstanding after the closing

of the share exchange transaction, thereby making Merit Times our wholly owned

subsidiary. Pursuant to the terms of the Exchange Agreement, Access America

Fund, LP (“Access America”), the principal shareholder of the Company, cancelled

a total of 794,000 ordinary shares of the Company. Further, the prior officers

and directors of the Company resigned and Mr. Zhide Jiang was appointed as the

sole director and officer of the Company.

In the

related financing transaction, on October 22, 2009, and November 2, 2009, we

completed a private placement of investment units (the “Units”) for a total of

$17,011,014, each Unit consisting of fifty thousand (50,000) ordinary shares and

five-year warrants to purchase twenty five thousand (25,000) ordinary shares of

the Company, at an exercise price of $6.00 per share (the “Investor Warrants”).

In the aggregate, we issued 5,670,339 ordinary shares and Investor Warrants to

purchase a total of 2,835,177 ordinary shares in this financing. Grandview

Capital, Inc. (“Grandview”), the lead placement agent, and Rodman & Renshaw,

LLC (“Rodman”), the co-placement agent, were our placement agents (the

“Placement Agents”) in connection with the financing transaction. For the

placement agent services, we paid a cash commission equal to 7% of the aggregate

gross proceeds of the Units sold and issued five-year warrants to purchase

567,035 ordinary shares (“Agent Warrants”, together with the “Investor

Warrants,” collectively refer to as the “Warrants”), which equal 10% of the

number of ordinary shares sold in the above financing transaction, exercisable

at any time at a price equal to $6.00 per share

In

connection with the financing, Proud Glory Limited and the Company entered

into an escrow agreement with the investors in which Proud Glory Limited agreed

to a “make good” obligation and to place into escrow a total of 4,600,000

ordinary shares of the Company. The escrowed shares will become subject to

disbursement to Proud Glory Limited or to the private placement investors based

upon our financial performance in the fiscal years ended 2009 and

2010.

Under the

“make good” arrangement, minimum net income thresholds of $14,000,000 and

$18,000,000 with a 10% allowable variation were established for the 2009 and

2010 fiscal years, respectively. If, in a given fiscal year, the applicable

minimum net income threshold is not met, escrowed shares, on a pro-rata basis,

in an amount equal to the percentage of variation from the net income threshold

times the total number of escrow shares, are required to be disbursed to

the private placement investors. If any escrow shares are distributed to

investors resulting from the Company not attaining the 2009 net income

thresholds, Proud Glory Limited will place an additional amount of shares into

escrow so that the escrow shares total 4,600,000. If the net income

equals or exceeds $12,600,000 in 2009 and $16,200,000 million in 2010, then the

applicable thresholds will be deemed met and all escrow shares will be disbursed

to Proud Glory Limited.

Notwithstanding

the above, Mr. Zhide Jiang is the beneficial owner of the shares held by Proud

Glory Limited. As described above under the corporate structure, on August 5,

2009, Mr. Zhide Jiang entered into an Incentive Option Agreement with Mr. Chee

Fung Tang, the record stockholder of Proud Glory Limited, pursuant to which Mr.

Zhide Jiang shall have rights and options to acquire up to 100% shares of Proud

Glory Limited at nominal price within the next three years if he continues

serving as chief executives of our affiliated companies for no less than three

year period of time and if such companies meet certain thresholds of the revenue

conditions. As a result, if the Company fails to meet the minimum net income

threshold under the “make good” arrangement, Mr. Zhide Jiang’s equity interest

in Proud Glory Limited will be disbursed to the private placement

investors.

Additionally,

our majority shareholder, Proud Glory Limited, of which our sole officer and

director Mr. Zhide Jiang is the managing director (the “Lock-Up Shareholder”),

entered into a Lock-Up Agreement with us whereby the Lock-Up Shareholder agreed

it will not, offer, pledge, sell or otherwise dispose of any ordinary shares or

any securities convertible into or exercisable or exchangeable for ordinary

shares during the period beginning on and including the date of the final

closing of the aforementioned financing transaction for a period of eighteen

(18) months.

Business

Overview

We are a

holding company that operates through our PRC operating company Longkang Juice,

the only producer of Laiyang Pear juice concentrate in the PRC. Longkang Juice

was incorporated as a limited liability company on November 22, 2004 under the

laws of China. As of its incorporation, the name of Longkang Juice was Laiyang

Tianfu Juice Co., Ltd. and it changed its name to Shandong Longkang Juice Co.,

Ltd. on January 14, 2008. We are mainly engaged in developing, producing,

marketing and distributing Laiyang Pear juice concentrate. We are the exclusive

producer of Laiyang Pear juice concentrate as granted by Laiyang government. Our

product, Laiyang Pear juice concentrate, is known for its exceptional taste,

nutritional and medical benefits, and applications in health supplements,

pharmaceuticals, and food and beverage industries. Our products are distributed

in Shandong, Guangdong, Liaoning and Jiangsu provinces in China.

4

Laiyang

Pear juice concentrate is the most significant source of revenue for the

Company. During fiscal year of 2009 and 2008, Laiyang Pear juice concentrate

represented 88.9% and 90.2% of net revenues and 91.1% and 92.6% of sales volume,

respectively. In comparison, apple juice concentrate contributed 8.2% and 10.0%

of revenue in fiscal year 2009 and 2008, while strawberry juice concentrate

contributed 2.9% and 2.8% of revenues, respectively. Apple and Strawberry juices

are mainly produced during the off-season when Laiyang Pear is not being

produced. Laiyang Pear has been registered as a trademark by the Laiyang

city government. Longkang has been granted by the Laiyang government as the

exclusive producer of Laiyang Pear juice concentrate beginning in January 2009

for a period of 30 years. No other producer can use the trademark or enter into

the Laiyang Pear juice concentrate business until the exclusive right of our

company has been expired. While Laiyang Pear juice concentrate will remain

our main source of revenue, we plan to further diversify our product mix and

increase the processing volume of other fruits types such as berries. We

also intend to develop and produce bio animal feed as a byproduct of pear juice

concentrate and fruit puree products to further diversify our product mix and

increase our revenue.

Industry

Overview

According

to a report on China’s fruit processing industry issued by Beijing Business

& Intelligence Consulting Co. Ltd. (“BBIC,” and such report is hereinafter

referred to as the “BBIC Report”), an independent market research firm, China’s

fruit processing industry has grown significantly in the past several years. The

total output of fruit processed products in China grew from $16.8 billion in

2005 to $27.5 billion in 2007, representing a compound annual growth rate

(“CAGR”) of 27.94%. The sales value of fruit processed products in China grew

from $17.0 billion in 2005 to $26.1 billion in 2007, representing a CAGR of

27.72%.

BBIC

projected that the total sales value and net income of fruit processed products

in China will reach $37.2 billion and $2.5 billion in 2010, or a growth of

42.52% and 66.67%, respectively, during the four-year period from 2007 to 2010.

The table below sets forth the sales and net income of fruit processing

industry in China from 2005 to 2010 and projected sales and net income of fruit

processing industry in China from 2008 to 2010.

Sales

and Projected Sales and Net Income of Fruit Processing Industry in China,

2005-2010

|

(in Billions of U.S. $)

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||||

|

Sales

|

16.0

|

21.0

|

26.1

|

28.5

|

32.9

|

37.2

|

||||||||||||||||||

|

Net

Income

|

0.9

|

1.2

|

1.5

|

1.8

|

2.2

|

2.5

|

||||||||||||||||||

Source:

2006-2008 Fruit processing industry research report, Beijing Business &

Intelligence Consulting Co. Ltd.

China’s

economy has grown significantly in recent years. According to the National

Bureau of Statistics of China (the “NBS”), China’s gross domestic product (the

“GDP”) has increased from RMB12.0 trillion ($1.6 trillion) in 2002 to RMB25.0

trillion ($3.4 trillion) in 2007. The International Monetary Fund also estimated

that China’s real GDP should grow at an annual growth rate of 10.0% in 2008.

China’s economic growth has resulted in a significant increase in household

disposable income in China. According to the NBS, between 2002 and 2007, urban

household disposable income per capita increased from RMB7,703 ($1,055) to

RMB13,786 ($1,887), or a CAGR of 17.4%, and rural household disposable income

per capita increased from RMB2,476 ($339) to RMB4,140 ($557), or a CAGR of

12.1%. We believe that as GDP and disposable income increase, fruit

processed products will become more affordable and consumers will generally

spend an increasing portion of their disposable income on healthy nutritional

products, such as our premium specialty fruit based products.

With

approximately one quarter of the world’s population, China represents a key

growth driver for the global fruit food market. According to Euromonitor,

an independent research firm, although China is the largest producer of apples,

third largest producer of oranges, and one of the top producers of pears and

peaches in the world, per capita fruit juice consumption in China is currently

well below that of major developed countries.

Due to

low labor costs and an abundant supply of fruit, most notably apples, pears, and

kiwifruit, China is a large fruit juice concentrate producer and the largest

apple juice concentrate producer in the world. The export of fruit products is

also a growing aspect of the fruit processing industry in China. With

improvements in the quality and quantity of the production, marketing, and

transportation technologies, China has strengthened its position in the world

market. According to the BBIC Report, processed fruit export sales are expected

to reach $10.9 billion in 2010, representing a 42.72% growth over that in

2007. Although we do not presently export any of our products, we may

wish to do so in the future.

We

believe that improved living standards and growing household disposable income

have led to greater health awareness among the population. As people

become more affluent, we believe that their spending on quality healthy and

nutritional products, like our products, will increase.

5

Therefore,

we anticipate that China’s fruit concentrate industry will continue to

grow.

Products

We

currently produce three types of fruit juice concentrate: Laiyang Pear, apple

and strawberry with Laiyang Pear juice concentrate accounting for 91.1% of

overall sales volume and 88.9% of total revenue for 2009. We are the

only producer of Laiyang Pear juice concentrate, which is known for its

exceptional taste, nutritional and medical benefits; and applications in health

supplement and pharmaceutical products and mainly used in pharmaceutical and

health supplement industries. The annual sales volume of fruit juice concentrate

for fiscal year 2009 is 35,891 metric tons (“MT”) in China. Our current capacity

is 35,000 tons of fruit juice concentrate with a utilization rate of 95% during

peak seasons and 70% on an annual average. The production season of Laiyang

Pear juice concentrate is from August to February each year.

We have

been granted an exclusive producer license for producing Laiyang Pear juice

concentrate which is issued by Laiyang agriculture committee beginning January

2009 for a period of 30 years.

Current

product portfolio

Laiyang

Pear juice concentrate is the most significant source of revenue for the

Company. During the fiscal year of 2009 and 2008, Laiyang Pear juice concentrate

represented 88.9% and 90.2% of net revenues and 91.1% and 92.6% of sales volume,

respectively. In comparison, apple juice concentrate contributed 8.2% and 10.0%

of revenue in fiscal year 2009 and 2008, while strawberry juice concentrate

contributed 2.9% and 2.8% of revenues, respectively. Apple and

Strawberry are primarily produced during the off-season for Laiyang Pear

production.

Laiyang

Pear juice concentrate uses Laiyang Pear as its main raw material. We have

imported equipment from United States and Europe to produce Laiyang Pear juice

concentrate. The product maintains Laiyang Pear’s nutritional and medical

benefits. Our products are mainly sold to health supplement, pharmaceutical,

food and beverage industries. In 2009 the percentages of our products sold to

such industries are 54%, 35%, 7% and 4% respectively. Due to the climate and

environmental benefits in Laiyang city, the Laiyang Pear only grows in Laiyang

City, Shandong Province in China and has been doing so for over 1600

years.

Laiyang

Pear has high sugar content, mainly fructose, glucose, sucrose and other soluble

sugar, and contains a variety of organic acids, vitamin B1, B2, vitamin C,

nicotinic acid, protocatechuic acid, carotene, and minerals such as calcium,

phosphorus and iron. The fruit is both low in sodium and high in

potassium.

We have

been working with colleges and institutions to study Laiyang Pear producing

technology, and we have developed applications through new technology that

reduces browning of the produce and that helps to maintain Laiyang Pear’s

nutritional and medical benefits by storing the concentrate at a low

temperature. We have also developed a filtration process through which we are

able to achieve higher quality juice concentrate by separating various sediment

substances from the crude juice. After the undesirable sediments are

removed, a clarified crude juice of increased quality and shelf-life is obtained

and turned into juice concentrate. Although our production facilities are

running at full capacity, there is an increasingly high demand for Laiyang Pear

juice extract.

Expanding

Product Mix

We intend

to maintain our leadership in the production of Laiyang Pear juice concentrate,

and at the same time, diversify into other agricultural products to mitigate

risk. Specifically, we intend to increase investment in high margin products,

for example, on average, berry concentrates’ gross margin is approximately 40%;

and to expand fruit selection such as blueberry, raspberry, blackberry, apricot

and yellow peach. We also plan to produce bio animal feed, which is a byproduct

of pear juice concentrate. We are going to add two new production lines for the

juice concentrate and puree, and for the bio animal feed. The

production line for juice concentrate and puree will be imported from Italy by

June 2010. The production line for bio animal fee will be purchased from a

Chinese manufacturer by June 2010. We plan to install and test both production

lines in July and start to produce products in August 2010. These products will

be distributed to the market in September 2010.

We intend

to enter into new markets as follows:

Puree Products: Puree

consumption is growing 10% per annum in China. In addition, about half of all

fruit puree consumed in Japan is imported from China. The major customers in

puree products are fruit distributors and baked goods companies. The gross

margin for pear puree, apple puree and strawberry puree are 30%, 25% and 40%

respectively.

Bio Animal Feed: We

have received increased interest for high-quality bio feed after the 2008

scandals with tainted milk products in China. The major customers in bio animal

feed are livestock and poultry companies. If we enter into the bio animal feed

industry, no additional raw materials will be required for us as we can use the

residue from our juice concentrate processing. There is a total of 500,000 MT of

fruit and vegetable waste in Laiyang area.

6

Through

our research with China Agriculture University, Laiyang Pear wastes, as the main

raw material for bio animal feed described above, consist of Laiyang Pear pulp,

Laiyang Pear seeds, and Laiyang Pear stalks which account for 96.2%, 3.1% and

0.7% respectively. They contain various nutritional compositions such as crude

protein, crude fiber, crude fat, non-nitrogen extract, calcium, digestible

energy, metabolizable energy, phosphorus, potassium, iron, manganese, sulfur and

many other mineral substances and trace elements, of which the iron content in

Laiyang Pear wastes is 4.9 times that of corn; lysine, methionine and arginine

content is 1.7 times, 1.2 times and 2.75 times that of corn; vitamin B2 is 3.5

times that of corn, and more than 15% total sugar in nitrogen-free extract.

Other fruit and vegetable wastes, which are rich in sugar, vitamin C and starch,

can also be used as raw materials for bio feed. However, such other raw

materials are required to be fresh, clean and free of debris or

sediment.

We will

use fermenter, inoculated cans, vacuum pumps, fermentation tanks, stainless

steel pumps, ozone machines, laboratories, and laboratory equipments to produce

bio animal feed in accordance with the quality standard “China Feedstuff

Sanitation Standard” and “Chinese Feedstuff Quality Control New Technology

Standard.” The shelf life of the bio animal feed product is 12

months.

The

bio-feed, which we produce through fermenting fruit and vegetable wastes,

utilizes microorganisms and complex enzymes as zymophytes so as to convert the

raw materials into the bio-fermented feed comprised of mycoproteins,

bioactive amino acids of small- peptides, micro-bio-active probiotics

and complex enzymes. The four-strain high-protein bacteria applied for bio

animal feed production can effectively transform the carbohydrates in the fruit

wastes, such as organic acids, tartaric acids and hemicelluloses into various

proteins and accordingly enhance the overall protein content in fruit

wastes. Our bio feed product is also featured with rich content

of nutritional components, various probiotics, over 20

kinds of amino acids, a wide variety of vitamins as well as microelements. It

also contains varied organic acids including oligose, citric acid, tartaric acid

and more.

Modern

medical experts worldwide have proved through scientific research efforts that

amino acids, vitamins, microelements and oligose are all indispensable nutrients

for all animal lives, i.e., protein. Protein is the foundation of life and amino

acids can maintain normal operation of physiological function, antibody and

metabolism of animals. Shortage of protein will result in deteriorating

physique, slower development, weakened immunity, anemia and hypodynamia, up to

edema or fatal threat to life. Vitamins play an important regulatory role in

substance metabolism and help improve the metabolism; microelements can regulate

the homeostasis of animals, benefit metabolism of blood fat and prevent

arteriosclerosis. Oligose is a natural immunopotentiator, whose active

constituents are B-1.3/1.6 glycogen-accumulating organisms and mannitose and

helpful to reproductive assimilation of beneficial bacterium in animal

bodies.

Therefore,

the bio animal feed we intend to produce has higher protein content and nutrient

content than other average feeds. As such, long-term use of bio animal feed will

improve dairy cattle’s immune system and disease resistance.

In

connection with the technology used to produce bio animal feed, we are under

application of a patent with the State Intellectual Property Office of P.R.

China to protect our technology. The application number is 200910015442.2. Such

technology and production method is owned by Zhide Jiang, the Chief Executive

Officer of Longkang Juice.

Features of animal feed

products:

In 2007,

Longkang and China Agriculture University worked together and developed animal

feed production technology by fermenting fruit and vegetable waste. The main

features of animal feed product are:

|

·

|

Low

cost: While the normal feed price is approximately 2500RMB/MT, the price

at which we estimate we can sell our bio-animal feed is approximately

1600RMB/MT. In our production, we can utilize residue from

Laiyang Pear juice concentrate production, therefore there is no

incremental raw material cost for

production.

|

|

·

|

High

milk production: The protein content of our product will be 15% which is

5% higher than normal animal feed. Our research shows that the dairy

cattle have higher milk production after taking the bio-feed

product.

|

|

·

|

Reduced

waste: The residue from production has historically needed to be disposed

of as waste. By utilizing the waste to produce bio-feed, waste

shall be reduced.

|

|

·

|

Improves

dairy cattle’s immune system and disease resistance: Bio-feed can be used

as feed attractant before and after weaning calves in order to support

their immune system.

|

7

Production

Production

facility

Our

primary production facility is located in Laiyang city, Shandong province in

PRC. We have two production lines with combined production capacity of 35,000 MT

and occupy approximately 5,272 acres of plantation fields. One

production line has two pressers from which provide a total capacity of 80MT per

hour with capacities of 20MT per hour and 60MT per hour, respectively. The

enrichment equipment is imported from APV UK with 18MT concentration capacity

per hour. The supporting facilities of plate heat exchanger and tubular

sterilization machine are from Shanghai Beverage Machinery Factory with capacity

of 20MT per hour, and we are also equipped with a vertical filter from Nanjing

Gaoyou filter factory.

Production

process & technology

When we

produce fruit juice concentrate, we usually crush and beat fresh fruits into

mashes, and press fruit mashes until fruit juice comes out. We then mix raw

fruit juice with proper amount of compound enzyme to remove pectin and starch.

Finally, we filter concentrate fruit juice in concentrators to achieve the

target content of soluble solids, acidity and other quality standards. We have

recently adopted a number of new technologies for our production processes. One

example is that we have been introducing a secondary precipitation process which

gives us 10% more juice concentrate from the same input by separating various

sediment substances from the crude juice. After the undesirable

sediments are removed, a clarified crude juice of increased quality and

shelf-life is obtained and turned into juice concentrate. We estimate that this

will reduce costs in the amount of approximately 416RMB/ton. In addition, we

have developed technology that reduces browning of the produce and that helps to

maintain Laiyang Pear’s nutritional and medical benefits by storing the

concentrate at a low temperature.

Quality

Control

We place

primary importance on quality. Our production facility has ISO 9001 and

HACCP series qualifications. We have established a quality control and food

safety management system for the purchase of raw materials, fruit processing,

packaging, storage and distribution. We have also adopted internal quality

standards that we believe are stricter than the standards mandated by the PRC

government.

Specifically,

our requirements for the light transmittance, turbidity, sourness and hygienic

criteria of Laiyang Pear juice concentrate are all higher than the national

standard in PRC. As juice has a high turbidity and low light transmittance, the

acidophilic heat-resistant bacteria in the juice are more likely to reproduce

and metabolize when the juice concentrate is diluted to commodity juice,

producing chemical compound, bromophenesic acid, which worsens the flavor of

juice or even results in white sediment on the bottom of inner package. Our

Laiyang Pear juice concentrate product is free of this problem because it is

produced following the quality requirements higher than the national standard.

In addition, the higher the sourness, the higher the content of vitamin C and

other nutrients would be, which is beneficial to the human body. By

implementing quality criteria higher than the national standard, we make our

products more competitive in the market.

High

quality raw materials are crucial to the production of quality fruit products.

Therefore, we rigorously examine and test fresh fruits arriving at our plant.

Any fruits that fail to meet our quality standard will be rejected. We perform

routine product inspections and sample testing at our production facility and

adhere to strict hygiene standards. All of our products undergo inspection at

each stage of the production process, as well as post production inspections and

final checking before distribution for sales. Products in storage or in the

course of distribution are also subject to regular quality testing.

Raw

Materials and Suppliers

Laiyang

Pear, iron drums and coal are our major raw materials.

Our

headquarters and manufacturing facilities are strategically located in close

proximity to the Laiyang Pear orchards on the Jiaodong Peninsula, providing easy

access to the only supply of Laiyang Pear in the world. We maintain effective

costs through cooperative agreements with local farmers and through receiving

government support.

There are

two kinds of cooperative agreements: (i) five years cooperative agreements with

local farmers pursuant to which Longkang Juice shall send technical managers to

these local farmers for technical guidance and follow-up service during the

production process. Thereafter, Longkang Juice shall purchase all the qualified

Laiyang Pear from contract farmers at the higher of (a) the minimum guarantee

price of 750 RMB per ton (equal to approximately $110 per ton) or (b) the market

price. If Longkang Juice and the contract farmers have cooperated for more than

5 years, the unit price of the qualified raw fruits will increase approximately

$3.4 per ton; and (ii) five years cooperative agreements with local farmers

pursuant to which Longkang Juice subcontracts the orchards to these farmers for

1200 RMB per mu (equal to approximately $1055 per acre) each year. In connection

with the minimum guaranteed price paid to farmer at the time of the purchase, we

do not have any other price guarantees to adjust the price of previously

purchased pears. In addition, the Laiyang government exempted agriculture and

forestry specialty tax on us of 260 RMB per mu (equal to approximately $228 per

acre). This is conditioned on that we shall implement our development plan, as

describe below, to develop an additional 3,295 acres of Laiyang Pear plantation

per year. By doing so, we will actively help to increase the income of local

farmers and boost the development of the Laiyang Pear industry.

8

We have

also secured our supply of Laiyang Pear by acquiring land use rights to 500

acres of Laiyang Pear orchards with plans to acquire additional land use rights

in the future to develop green-certified products. These supply arrangements

provide us with advantages in terms of product quality, and stability and

reliability of delivery.

Green

certified products in China refer to a specific mode of production, identified

by the specialized agencies, licensing the use of clean green food logo safety

trademark on high-quality and nutritious food. Green certified products have two

standards: AA-and A grade. AA grade refers to the process of food production

that does not use any harmful synthetic substances; A-grade refers to the

production process that allows limited use of qualified synthetic substances. In

short, green certified products are safe, healthy and nutritious.

The

Laiyang Pear has a history of nearly 1,600 years of known production. The oldest

Laiyang Pear tree still producing the pears is more than 400 years

old. The fields for growing Laiyang Pear total approximately 82,372

acres, and result in total production of approximately 1.5 million tons of

Laiyang Pear. Longkang has contracted fields of approximately 5,272

acres. Longkang currently uses approximately 350,000 tons of Laiyang Pear, which

is approximately 23% of the total Laiyang Pear production. In addition, in 2009,

the China Agriculture Ministry decided to develop 164,745 acres of Laiyang Pear

plantations which will be managed by the Laiyang city government. Laiyang city

government will implement such order by developing 16,475 acres of Laiyang Pear

plantation each year, among which Longkang Juice will develop our own plantation

amounting to 3,295 acres each year, so as to ensure enough raw materials to

increase capacity. Thus, we plan to develop 3,295 acres of Laiyang Pear

plantation per year. We are therefore confident that there will be enough raw

materials to meet the increased capacity for our company following the

expansion.

Other

main suppliers are Qixia Fangyuan Co., Ltd, Laiyang Dali Co., Ltd, Yingwei Yu,

Zuwei Jiang, and Lijun Wang.

|

·

|

Qixia Fangyuan Co.,

Ltd. is located at Qixia

Industrial Zone. It produces 400,000 iron drums every year, of which we

need about 120,000 drums to package the juice concentrate products. The

iron drums are produced in accordance with international standards and we

have had no quality or supply problems with this company in the last few

years.

|

|

·

|

Laiyang Dali Co., Ltd.

is located in Laiyang city and it supplies coal throughout the year. We

signed a long term contract with Laiyang Dali Co., Ltd. for approximately

20,000 tons of coal per year. There have been no quality problems with

this company in the last few years.

|

|

·

|

Yingwei Yu, Zuwei Jiang and

Lijun Wang have been working in the fruit buying and transportation

business for many years. They have many branch stations which allow us to

harvest a high volume of pears during harvest season. They have

specialists and equipment required to test the quality of our

pears.

|

Research

& Development

Our

research and development activities are driven by changing consumer tastes and

preferences, the need to develop high margin product segments, adapting to

healthy lifestyle demands, utilizing all components of the raw materials, and

growing demand for green products.

There are

40 skilled food specialists in our company which guarantees the product quality

as well as possibility of new product development. We also work with outside

institutions to get their support. For instance, in 2005, through the

efforts of the experts from South Korea/Italy and the Chinese Research Institute

of Fruit as well as our specialists, issues such as the difficulty of storage of

Laiyang Pear; the issue of Laiyang Pear easily turning brown and the issue

that Laiyang Pears were difficult to transport were all resolved, which made

Laiyang Pear juice concentrate successfully produced.

In recent

years, we continue to work with third party institutions and research institutes

for technical support and cooperation. We established long-term relationships

with the China Agricultural University; Laiyang Agricultural College; Shandong

Institute of Light Industry and China Research Institute of Fruit, so that we

can timely update and achieve better understanding in technology, information

and human resource for the China and international markets.

We also

invested in advanced laboratory equipment, including chromatography, precision

scales, spectrophotometer, high-speed centrifuges, small tube sterilization

machine, membrane filter and relevant equipment of fruit juice production

testing, as well as the sterile laboratories which can be used for precise

analysis in comprehensive study.

9

Below are

the summaries of our current research projects:

We

cooperate with Laiyang Agricultural College commencing from January 2005 to work

on a research project regarding Laiyang Pear juice decolorization to develop

natural honey. The project was completed in December 2009 and the total cost of

the project was $1,025,055.

In 2006,

we entered into an agreement Project of High Tech Bio Feed Stuff from Fruit and

Vegetable Waste with China Agriculture College. The research began in January

2006 and was completed at December 2009. The project cost

$879,000. We use vacuum pump and a set of straw, a set of steam

warming pipe, stainless steel pump and a set of straw, 4 of high intensity

plastic, one piece of cover (the size depends on the size of fermentation pond),

ozone developer, 4 of long sensor thermometer, fermentation tank, a set of

pre-processing machinery, a set of lab facility and conduct the research at the

laboratory of China Agriculture College. All the production of this research

project will belong to our company. In connection with the technology used to

produce bio animal feed, we are under application of a patent with the State

Intellectual Property Office of P.R. China to protect our technology. The

application number is 200910015442.2. Such technology and production method is

owned by Zhide Jiang, the Chief Executive Officer of Longkang

Juice.

In

addition, we cooperate with Fruit Research Institute of China commencing from

January 2005 to work on a research project regarding abstract preservatives and

oil from seeds and waste from after juice concentrate production for use in

cosmetic skin care products and natural preservatives. The project was completed

in December 2009 and the total cost of the project was $585,745.

Together

with Fruit Research Institute of China, we also worked on a research project

regarding secondary precipitation to increase production yield of Laiyang Pear

juice concentrate commencing from January 2005 and ending in December 2009. The

total cost of the project was $585,745.

On March

1, 2010, we entered into a cooperative R&D contract with the Preclinical

Medicine Research Laboratory of Shandong Medicine Academy to develop the

applications of immunoregulation and antitumor effects of Laiyang Pear juice

concentrate. This R&D project is expected to be completed by early 2012 and

the total cost of the project is $732,500.

Marketing,

Sales & Distribution

Currently,

our products are only sold in the PRC, and we utilize distributors for the sale

of our products. We have a total of seven (7) distributors, some of which are

also the end users of the product. Our customers pick up the products from our

factory directly using refrigerated trucks.

We

anticipate beginning to sell our products through direct sales to the

pharmaceuticals and health supplement manufacturers in the second half year of

2010, and we have begun direct marketing to the end users. In our direct

marketing efforts, we have collected information lists about potential end users

who are mainly in the pharmaceutical or healthcare industry. We have contacted

these potential end users to introduce our products, and free samples are sent

upon request. Once we negotiate purchase terms and execute the contract with the

customer, our factories will begin producing with customer specifications. We

intend to visit our major customers periodically to make sure that they are

satisfied with our product and service.

Customer

Concentration

The

Company’s customers are in the health supplement, pharmaceutical, fruit juice,

and other food product industries in Shandong, Guangdong, Liaoning and Jiangsu

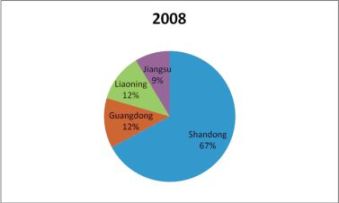

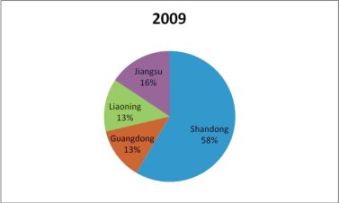

provinces in the PRC. Below is a chart indicates the geographic distribution in

2008 and 2009:

|

|

10

Currently

we have seven (7) customers. Our customers and sales for 2009 & 2008 are as

follows:

|

Customers

|

2009(US)

|

2008(US)

|

Applied

Market

|

||||||

|

Shandong

Zhanhua Haohua Fruit Juice Co., Ltd.

|

$

|

10,887,161

|

$

|

17,344,300

|

This

customer uses juice concentrate as an ingredient in their own beverage

products.

|

||||

|

Qingdao

Dongxu Xinshen Trading Co.

|

14,121,668

|

11,878,235

|

This

customer sells juice concentrate to Chinese medicine and juice beverage

suppliers.

|

||||||

|

Yantai

Jinyuan Food Co., Ltd.

|

11,504,347

|

11,415,522

|

This

customer uses juice concentrate as a sweetener for their export

products.

|

||||||

|

Xintai

Hengxin Trading Co.

|

11,775,909

|

9,180,354

|

This

customer sells to bakery, candy, fruit juice and other

producers.

|

||||||

|

Guangzhou

Huaqing Trading Co., Ltd.

|

10,584,740

|

9,111,255

|

This

customer sells to food additive, fruit juice and export

companies.

|

||||||

|

Dandong

Jinwang Trading Limited

|

10,757,553

|

8,787,622

|

This

customer distributes to pharmaceutical and health supplement

manufacturers.

|

||||||

|

Dongtai

Hongda Company

|

12,928,518

|

6,413,590

|

This

customer distributes to pharmaceutical and health supplement

manufacturers.

|

||||||

According

to our development strategies, in 2009 we modulated the sales policies to

emphasize and enhance sales strength to the customers in the pharmaceutical and

health supplement industries, so as to increase the revenue proportion

of the customers that produce end-products in pharmaceutical and

health supplement industries versus those in the food and beverage

industries. We plan to increase the revenue percentage in the

pharmaceutical and health supplement industries to more than 90% by the end of

2010.

Due to

the higher profit margin as well as more pricing power of our product sold to

pharmaceutical and health supplement industries and on the other hand, the

limitation of our production capacity, we negotiated with our customers to

accept the adjusted supply proportion for different industries. As a

result, as compared with the year ended December 31, 2008, for the year ended

December 31, 2009 our sales to Shandong Zhanhua Haohua Fruit Juice Co., Ltd.,

which mainly use our products for food and beverage products, decreased

significantly by 59.3%, whereas the sales to Qingdao Dongxu Xinshen Trading Co.,

Dandong Jinwang Trading Limited, and Dongtai Hongda Company, which mainly use

our products for pharmaceutical and healthy supplement products and are our most

important sales targets, increased significantly by 18.9%, 22.4% and

101.6%, respectively.

Overall,

54% of our products are sold to health supplement companies, 35% to Chinese

medicine companies, 7% to fruit juice producers and 4% to food

producers.

Pursuant

to our sales contracts with the above customers, in 2008 and 2009, our Laiyang

Pear juice concentrate were sold from $2,570 to $2,710 per ton and primarily, we

receive a cash payment when the products are delivered to the customers. We also

entered into supplemental agreement with certain customers that, as a sales

incentive, we provided our customers a 1% sales revenue rebate if our customers

made their orders in first quarter of 2009 and paid us within three months after

the sales were made. We do not plan to offer such rebate again in the

future.

Growth

Strategy

We are

committed to enhancing profitability and cash flows through the following

strategies:

Increase

production capacity.

Our existing two production lines have been running at close to

full capacity while the market demand for our existing products keeps

increasing. We also have an abundant supply of source fruits to support

the expansion of our business. We plan to add one new production line for the

processing of juice concentrate and puree products by June 2010: the production

capacity of this new production line will be 30 MT per hour. This

production line will include raw material transfer and fruit crushing

facilities; a primary and secondary presser system; puree/juice purification

system; filtration system; concentration system; steam cleaning system; aseptic

packing system, etc. We also plan to add a refrigerated warehouse to store our

products.

Further

strengthen our raw materials procurement network. We believe that a

secure supply of principal raw materials is crucial to our future success.

Hence, we intend to further strengthen our existing cooperative relationship

with existing local farmers and contract growers. Currently, we have 5,272 acres

(6.4% of the overall field area of the Laiyang Pear in Laiyang city) of

cooperative plantation according to cooperative agreements with contract

farmers. In addition, we have exclusive land leases from the Laiyang city

government of approximately 500 acres of land and will continue to expand

our plantation fields. These land leases all have a thirty (30) year term and

executed in either 2007 or 2008 for a price range from 1121 RMB to 1206 RMB per

mu (equal to approximately $985 to $1060 per acre) per year. We aim

to produce our own Laiyang Pear, to maintain the quality of the Laiyang Pear and

to reduce raw material costs.

Further expand

our distribution network to increase the prevalence of our products

nationwide.

Our current sales depend heavily on our regional distributors and

their network. To support our rapid growth in sales, we plan to further expand

our distribution network by adding more new distributors in the next few years.

In addition, we also plan to expand upon our customer base by developing new

relationships with end users in markets we have not yet penetrated.

11

Continue to

diversify our product portfolio to satisfy different customer

preferences.

We currently produce three

types of fruit juice concentrate: Laiyang Pear, apple and strawberry. We

constantly evaluate our products and seek to adapt to changing market conditions

by updating our products to reflect new trends in consumer preferences. We

have finished research and development for our new product berries. We also

intend to develop and produce bio animal feed as byproduct of pear juice

concentrate and fruit puree products to further diversify our product mix and

increase our revenue. We will analyze the market trends and customer preference

to decide which products to be launched.

Create brand

awareness. We believe that as

we continue our expansion efforts we will be able to increase brand awareness

among consumers and among the pharmaceutical and medical community. In addition,

as Laiyang Pear has been registered as a trademark by the Laiyang government,

and we have been authorized as the exclusive producer of Laiyang Pear juice

concentrate until January 2039, we plan to work with other product manufacturers

to include the “Laiyang Pear” trademark on products that include our Laiyang

Pear juice concentrate. This may develops Laiyang Pear into a brand name and

increase our sales.

Competition

Our main

product is Laiyang Pear juice concentrate and we face little direct competition

due to the following reasons: we are the only producer of Laiyang Pear juice

concentrate. Laiyang Pear only grows on both sides of Five Dragon River in

Laiyang city due to unique climate and environmental factors. The Laiyang Pear

trademark is a registered trademark of the Laiyang city government. We have been

granted by the Laiyang government as the exclusive producer of Laiyang Pear

juice concentrate beginning in January 2009 for a period of 30 years. No other

producer can use the trademark or enter into the Laiyang Pear juice concentrate

business until the exclusive rights held by the Company have

expired. Additionally, we are authorized to use the trademark and can

develop our brand name as the exclusive producer.

There are

no other producers of Laiyang Pear juice concentrate, however, there are

currently a number of well-established companies producing other kinds of fruit

concentrate that compete directly with our product offerings, and some of those

competitors have significantly more financial and other resources than we

possess. We anticipate that our competitors will continue to improve their

products and to introduce new products with competitive price and performance

characteristics. Therefore, we plan to enter into puree market and bio animal

feed industry to diverse the market risk to our current products.

Competitive

Advantages

We

believe that our success to date and potential for future growth can be

attributed to a combination of our strengths, including the

following:

Only Laiyang Pear

juice concentrate producer in China. We are the only Laiyang Pear

juice concentrate producer in China and we enjoy a strong geographic advantage

due to its proximity to the Laiyang Pear growing orchards. The use of premium

quality raw materials provides our products with a high concentration of fruit.

“Laiyang Pear” as a trademark has been registered by the Laiyang city

government. We have been granted by the Laiyang government as the exclusive

producer of Laiyang Pear juice concentrate beginning January 2009 for a period

of 30 years. No other producer can use the trademark or enter into the Laiyang

Pear juice concentrate business until the exclusive right of our company has

been expired.

Established raw

material procurement network. We are in a location in the

temperate zone with the ideal climate condition for fruit farming, especially

apples and Laiyang Pears. It is also ideal for transporting to other parts of

China as well as for exporting overseas. It has traditionally been a major fruit

production area and the key fruit farming and processing base for Chinese as

well as international companies. In Laiyang City alone, the current apple

plantation is about 86,580 hectare with annual production of 3 Million MT and

Laiyang Pear plantation of 33,300 hectare with the annual production of 1.5

million metric tons (“MT”). We also have our own dedicated plantation for

Laiyang Pear of 5,772 acres with annual yield of 105,000 MT. We maintain

effective costs through cooperative agreements with local farmers of the Laiyang

Pear in Laiyang city. We have also secured our supply of Laiyang Pear mainly

through contract growers, and to a lesser degree, through purchase from the open

market. In addition, we have exclusive land leases from the Laiyang city

government and have started growing our own orchards with plans to expand in the

future to develop green-certified products. These supply chain arrangements

provide us with advantages in terms of product quality, and stability and

reliability of delivery.

Emphasis on

quality control and food safety. We emphasize quality

and safety and have quality control and food safety management systems for all

stages of our business, including raw materials sourcing, production, packaging

and storage of our products. We apply and adhere to internal quality

standards that we believe are stricter than the PRC national standards. Our

processing facility possesses ISO9001 and HACCP series

qualifications.

12

Intellectual

Property

To date,

we do not have any trademark registration for our technologies. However, we rely

on trade secret protection and confidentiality agreements to protect our

proprietary information and know-how and have entered into non-disclosure

agreements with certain of our key employees and executives to protect our trade

secrets. In connection with the technology used to produce bio animal feed, we

are under application of a patent with the State Intellectual Property Office of

P.R. China to protect our technology. The application number is 200910015442.2.

Such technology and production method is owned by Zhide Jiang, the Chief

Executive Officer of Longkang Juice.

Regulation

The food

industry, of which fruit based products form a part, is subject to extensive

regulation in China. This following summarizes the most significant PRC

regulations governing our business in China.

Food

Hygiene and Safety Laws and Regulations

As a

producer of food products in China, we are subject to a number of PRC laws and

regulations governing food safety and hygiene, including:

|

·

|

the

PRC Product Quality Law;

|

|

|

·

|

the

PRC Food Hygiene Law;

|

|

·

|

the

Implementation Rules on the Administration and Supervision of Quality and

Safety in Food Producing and Processing Enterprises (trail

implementation);

|

|

|

·

|

the

Regulation on the Administration of Production Licenses for Industrial

Products;

|

|

·

|

the

General Measure on Food Quality Safety Market Access

Examination;

|

|

|

·

|

the

General Standards for the Labeling of Prepackaged

Foods;

|

|

·

|

the

Standardization Law;

|

|

|

·

|

the

Regulation on Hygiene Administration of Food

Additive;

|

|

·

|

the

Regulation on Administration of Bar Code of Merchandise;

and

|

|

|

·

|

the

PRC Metrology Law.

|

These

laws and regulations set out safety and hygiene standards and requirements for

various aspects of food production, such as the use of additives, production,

packaging, handling, labeling and storage, as well as facilities and equipment.

Failure to comply with these laws and regulations may result in confiscation of

our products and proceeds from the sales of non-compliant products, destruction

of our products and inventory, fines, suspension of production and operation,

product recalls, revocation of licenses, and, in extreme cases, criminal

liability.

Environmental

Regulations

We are

subject to various governmental regulations related to environmental protection.

The major environmental regulations applicable to us include:

|

·

|

the

Environmental Protection Law of the PRC;

|

|

|

·

|

the

Law of PRC on the Prevention and Control of Water

Pollution;

|

|

·

|

Implementation

Rules of the Law of PRC on the Prevention and Control of Water

Pollution;

|

|

|

·

|

the

Law of PRC on the Prevention and Control of Air

Pollution;

|

|

·

|

Implementation

Rules of the Law of PRC on the Prevention and Control of Air

Pollution;

|

|

|

·

|

the

Law of PRC on the Prevention and Control of Solid Waste Pollution;

and

|

|

·

|

the

Law of PRC on the Prevention and Control of Noise

Pollution.

|

We have

obtained all permits and licenses required for production of our products and

believe we are in material compliance with all applicable laws and

regulations.

Environment

Protection

Our

manufacturing facilities are subject to various pollution control regulations

with respect to noise, water and air pollution and the disposal of waste and

hazardous materials. We are also subject to periodic inspections by local

environmental protection authorities. We have sewage treatment