Attached files

| file | filename |

|---|---|

| EX-99 - BioElectronics Corp | v179172_ex99.htm |

| EX-5.2 - BioElectronics Corp | v179172_ex5-2.htm |

| EX-5.1 - BioElectronics Corp | v179172_ex5-1.htm |

| EX-10.1 - BioElectronics Corp | v179172_ex10-1.htm |

| EX-31.1 - BioElectronics Corp | v179172_ex31-1.htm |

U.S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 10-K

|

x

|

Annual

report pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

|

For

the fiscal year ended December 31, 2009

|

¨

|

Transition

report pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

|

For

the transition period from

to

.

Commission File Number 021-74972

BIOELECTRONICS

CORPORATION

(Exact name of

registrant as specified in its charter)

|

Maryland

|

52-2278149

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

employer

identification

number)

|

4539

Metropolitan Court

Frederick,

Maryland 21704

(Address

of principal executive offices and zip code)

Phone: 301.874.4890

Fax: 301.874.6935

(Registrant’s

telephone number, including area code)

Securities

registered under Section 12(b) of the Exchange Act:

None.

Securities

registered under Section 12(g) of the Exchange Act:

None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate

by check mark whether the issuer (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the issuer was required to

file such reports), and (2) has been subject to such filing requirements for the

past 90 days. (1) Yes x No ¨ (2) Yes ¨ No x

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.45 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

||

|

Non-accelerated

filer

|

¨ (Do

not check if a smaller reporting company)

|

|

Smaller reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No x

The

aggregate market value of the ordinary shares, $0.001 par value per share

(“Shares”), of the registrant held by non-affiliates on June 30, 2009 was

$26,961,010.

The

Company is authorized to issue 1,500,000,000 Shares. As of March 30, 2010, the

Company has issued and outstanding 1,461,998,871 Shares.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

BIOELECTRONICS

CORPORATION

FORM

10-K

TABLE

OF CONTENTS

|

PART

I

|

||

|

Item

1.

|

Business

|

4

|

|

Item

1A.

|

Risk

Factors

|

13

|

|

Item

1B.

|

Unresolved

Staff Comments

|

13

|

|

Item

2.

|

Properties

|

14

|

|

Item

3.

|

Legal

Proceedings

|

14

|

|

Item

4.

|

(Removed

and Reserved)

|

14

|

|

PART

II

|

||

|

Item

5.

|

Market

for Common Equity and Related Stockholder Matters and Small Business

Issuer Purchases of Equity Securities

|

15

|

|

Item

6.

|

Selected

Financial Data

|

17

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operation

|

17

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

30

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

31

|

|

Item

9.

|

Changes

in and Disagreements With Accountants and Financial

Disclosure

|

31

|

|

Item

9A.

|

Controls

and Procedures

|

31

|

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

35

|

|

Item

11.

|

Executive

Compensation

|

38

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

42

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

44

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

45

|

|

PART

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

46

|

|

Signatures

|

47

|

|

2

The

statements contained in this Report that are not historical facts are

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995 with respect to our financial condition, results

of operations and business, which can be identified by the use of

forward-looking terminology, such as “estimates,” “projects,” “plans,”

“believes,” “expects,” “anticipates,” “intends,” or the negative thereof or

other variations thereon, or by discussions of strategy that involve risks and

uncertainties. Management wishes to caution the reader of the

forward-looking statements that such statements, which are contained in this

Report, reflect our current beliefs with respect to future events and involve

known and unknown risks, uncertainties and other factors, including, but not

limited to, economic, competitive, regulatory, technological, key employee, and

general business factors affecting our operations, markets, growth, services,

products, licenses and other factors discussed in our other filings with the

Securities and Exchange Commission, and that these statements are only estimates

or predictions. No assurances can be given regarding the achievement

of future results, as actual results may differ materially as a result of risks

facing us, and actual events may differ from the assumptions underlying the

statements that have been made regarding anticipated events. Factors

that may cause our actual results, performance or achievements, or industry

results, to differ materially from those contemplated by such forward-looking

statements include, without limitation:

|

|

¨

|

The

availability of additional funds to successfully pursue our business

plan;

|

|

|

¨

|

The

cooperation of industry service partners that have signed agreements with

us;

|

|

|

¨

|

Our ability

to market our services to current and new customers and generate customer

demand for our products and services in the geographical areas in which we

operate;

|

|

|

¨

|

The highly

competitive nature of our

industry;

|

|

|

¨

|

Our ability

to retain key personnel;

|

|

|

¨

|

Our ability

to maintain adequate customer care and manage our churn

rate;

|

|

|

¨

|

Our ability

to maintain, attract and integrate internal management, technical

information and management information

systems;

|

|

|

¨

|

Our ability

to manage rapid growth while maintaining adequate controls and

procedures;

|

|

|

¨

|

The

availability and maintenance of suitable vendor relationships, in a timely

manner, at reasonable cost;

|

|

|

¨

|

General

economic conditions.

|

These

forward-looking statements are subject to numerous assumptions, risks and

uncertainties that may cause our actual results to be materially different from

any future results expressed or implied by us in those statements.

These

risk factors should be considered in connection with any subsequent written or

oral forward-looking statements that we or persons acting on our behalf may

issue. All written and oral forward looking statements made in connection with

this Report that are attributable to us or persons acting on our behalf are

expressly qualified in their entirety by these cautionary

statements. Given these uncertainties, we caution investors not to

unduly rely on our forward-looking statements. We do not undertake any

obligation to review or confirm analysts’ expectations or estimates or to

release publicly any revisions to any forward-looking statements to reflect

events or circumstances after the date of this document or to reflect the

occurrence of unanticipated events. Further, the information about our

intentions contained in this document is a statement of our intention as of the

date of this document and is based upon, among other things, the existing

regulatory environment, industry conditions, market conditions and prices, the

economy in general and our assumptions as of such date. We may change our

intentions, at any time and without notice, based upon any changes in such

factors, in our assumptions or otherwise.

3

PART I

Item 1.

Business.

1. Form and year of

organization: BioElectronics Corporation (“the Company”) was formed as a

Maryland Corporation in April 2000.

2. Description

of the Company’s business as a smaller reporting company.

a. Principal products or services and

their markets: BioElectronics Corporation is the maker of inexpensive,

drug–free, anti-inflammatory medical devices and patches; its primary SIC code

is 3845. The Company's wafer thin patches contain an embedded

microchip and battery that deliver pulsed electromagnetic energy, a clinically

proven and widely accepted anti-inflammatory and pain relief therapy that

heretofore has only been possible to obtain from large, facility-based

equipment. BioElectronics markets and sells its current products

under the brand names ActiPatch®, Allay™, RecoveryRx™ and

HealFast™.

The

dermal patch delivery system creates a multitude of new product opportunities

for chronic and acute inflammatory conditions. The market potential

is estimated at $10 billion or 400 million incidents worldwide, according to a

study titled “Report on BioElectronics, Corp. – Sizing the Market Opportunity

and Assessing Possible Outcomes for the Company.” The current market

for medical devices is ⅓ United States, ⅓ Europe, and ⅓ Asia. The

distinctive value proposition of the device is the delivery of drug-free therapy

that reduces pain and inflammation and accelerates healing by 30% to 50% when

compared with the present standard methods of patient care. The

current major applications are:

|

|

·

|

Medical

Surgeries

|

|

|

·

|

Chronic

Wounds

|

|

|

·

|

Oral

Surgeries

|

|

|

·

|

Sprains

and Strains

|

|

|

·

|

Lower

Back Pain

|

|

|

·

|

Chronic

Repetitive Stress Injuries, Heel Pain, Carpal Tunnel, Bursitis,

etc.

|

The

Company manufactures a medical device that reduces inflammation without the use

of drugs, topical ointments, heat or cold therapy. Inflammation

occurs following a variety of insults such as surgery, lacerations of the skin

and soft tissues, sprains and strains, (including those of the low back),

repetitive stress injuries such as plantar fasciitis, carpal tunnel syndrome,

and tennis elbow. The Company has branded its device for many

applications and separated the market for the products into four distinct

segments- retail products designed for consumer use, a women’s health product,

medical professional products and veterinary use products.

4

How

the device works:

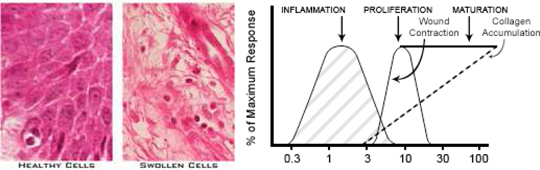

The

body's natural response to soft tissue trauma is a localized inflammatory

reaction. The damaged cells separate to prevent the transmission of infection.

The cells leak fluid and cellular components break down while the cellular

debris causes inflammation, swelling and pain.

This

inflammatory response, which has a physiologic protective action, in fact

creates an environment in which the healing process is actually prolonged

or stalled in chronic wounds.

The

devices use proven medical technology to truncate the body's inflammatory

response (i.e. breaks the cycle of chronic inflammation). It does

this by delivering pulsed electromagnetic energy directly to the affected area

and driving out the edematous fluid along with byproducts of the damaged

tissue. This provides a well-demonstrated and significant overall

improvement in the restorative and recovery process following

injury. As a result the pain associated with soft tissue injury

is often substantially reduced.

The

Retail Products and Market

The

Company has developed distinct retail treatment kits.

Five kits

are marketed as ActiPatch® Therapy for Pain - for Back, Knee, Wrist, Tennis

Elbow, and Heel Pain. The kits are unique to the market as drug free,

anti-inflammatory therapeutic agents that rapidly and safely reduce pain,

swelling and healing times.

5

Each

retail kit is designed for either 360 or 720 hours of use and includes a free

extremity wrap and an unconditional money back guarantee. Priced at

$39.95, the cost benefit of these kits is an overwhelming sales

proposition. These products are currently available in the retail

environment in Canada and Europe.

Women’s

Health Product and Market

The

Allay™ Menstrual Pain Therapy kit addresses dysmenorrhea, the painful monthly

cramps experienced by 40% of women during sometime in their life. The

market for drug-free relief is enormous. Current treatment such as

heat pads and medications such as NSAIDs are not as effective, nor as

safe.

Medical

Professionals Market

The

Company has been marketing to the U.S. medical market for almost three

years. Most of the past sales efforts have centered on plastic

surgery and podiatry. Sales increases have been very slow, partly due

to the lack of clinical evidence, partly due to the lack of a skilled sales

force and partly due to less than desirable product design. In 2008,

the Company redesigned the product line, refocused on the plastic surgery,

Orthopedic and Sports Medicine markets and branded this line under the trademark

name RecoveryRx™. This current product line consists of five distinct

kits:

6

|

|

·

|

Jaw

Surgery Recovery Kit

|

|

|

·

|

General

Surgery Recovery Kit

|

|

|

·

|

Breast

Recovery Kit

|

|

|

·

|

C-Section

Recovery Kit

|

|

|

·

|

Eye

Surgery Recovery Kit

|

Also in

development are products for hernias and other surgeries including Dental and

Oral surgery. Additionally, the medical products are being used and tested for

eye disease, noses surgeries, skin grafts, and wound care. Finally,

the Company recently obtained reimbursement approval from the Maryland state

Medicaid program for kidney compromised patients, and we believe that we can

also obtain reimbursement for cardiovascular and diabetic patients.

The

Veterinary Market

The

Company has a distribution agreement with eMarkets Group of North Caldwell, New

Jersey. The products are marketed under the trade names HealFast and

the HealFast PetPatch. The products are a drug-free therapy for

horses, cats and dogs that reduce swelling and pain, while speeding healing

of muscle and tendon injuries, sores and incisions. There are currently

approximately 162 million companion animals in the United States and about 7

million horses.

7

b. Distribution methods of the

products or services: Most of the sales are through distribution

agreements with companies which sell items on a wholesale basis to retail

outlets, such as drug stores and medical supply outlets.

c. Status of any publicly announced

new product or service: During

2009, our focus was on developing product, obtaining additional domestic and

international distribution channels, conducting market research, completing

additional clinical trials, eliminating debt, and strengthening the balance

sheet. The motivations for continued clinical trials are marketing

enrichment and obtaining additional U.S. Food and Drug Administration (FDA)

approved therapeutic indications for existing and future

products. Securing additional U.S. FDA approval is central to market

entry and product acceptance. Below are listed currently planned or

underway clinical studies:

Plantar Fasciitis (Heel Pain)

Study – Chief Investigator, Joel Brook, D.P.M. – A double-blind

randomized study spanning a 7-day treatment period. Subjects recorded

pain levels using a Visual Analogue Scale (VAS). Subjects also kept a

log of medication taken during the 7-day treatment period. Clinical

data demonstrated a reduction in pain in the active ActiPatch group and a large

clinically significant different in pain medication usage. The active

ActiPatch group took 55% less medication taken than the placebo ActiPatch

group.

Delayed Onset Muscle Soreness

Study – Chief Investigator, Sheena Kong, M.D. - This was an observational

study to evaluate the treatment of Delayed Onset Muscle Soreness

(DOMS). After a vigorous resistance training exercise regiment

designed to induce DOMS, 102 study participants were placed into one of three

groups: 1) a control group; 2) a group that utilized the ActiPatch

device; and 3) a group that received over-the-counter strength acetaminophen in

the form of Extra Strength Tylenol after a vigorous resistance training exercise

regiment designed to induce DOMS. The data yielded by this study

appears to demonstrate that the use of ActiPatch for the treatment of Delayed

Onset Muscle Soreness (DOMS) is both safe and

effective. Additionally, the data yielded by the study appears to

demonstrate that the continuous use of ActiPatch will result in significantly

less DOMS-related pain and muscle soreness compared to a treatment regiment

consisting of an OTC dosage of acetaminophen.

Primary Dysmenorrhea (Menstrual

Pain) Study – Primary Investigator, Barry Eppley, M.D.D.M.D. – This

clinical study was a placebo controlled, double-blind, prospective randomized

trial comparing the efficacy and effectiveness of an active Allay device to an

inactive (placebo) Allay device. The primary outcome measure was

reduction of menstrual pain in comparison with prior baseline

scores. The intensity of pain was measured using a VAS. Of

the active group, 77.1% reported either complete elimination or reduction in

their typical menstrual pain symptoms. Allay was demonstrated to be a safe and

effective drug-free method for the treatment of primary

dysmenorrhea. It may be used as a primary treatment method for those

women with moderate dysmenorrhea who prefer not to take oral

medication. In more severe cases of dysmenorrhea, it could be an

adjuvant treatment to reduce the amount of oral medications needed. Further

controlled clinical studies are needed for further evaluation.

8

d. Competitive business conditions

and the smaller reporting company's competitive position in the industry and

methods of competition: The manufacture, distribution and sale

of medical devices and equipment designed to relieve swelling and pain or to

treat chronic wounds is competitive and some of the Company’s competitors

possess significant product sales, and greater experience, financial resources,

operating history and marketing capabilities than us. For example, Diapulse

Corporation of America, Inc. manufactures and markets devices that are deemed by

the U.S. FDA to be substantially equivalent to some of the Company’s

products. Regenesis Biomedical and Ivivi Technologies also

manufacture and market devices that deliver PEMF therapy. A number of

other manufacturers, both domestic and foreign, and distributors market

shortwave diathermy devices that produce deep tissue heat and may be used for

the treatment of certain of the medical conditions that the Company’s products

are used for. The Company’s products may also compete with pain

relief drugs and pain relief medical devices, as well as other forms of

treatment.

The

Company’s ability to compete effectively with other companies is materially

dependent upon the proprietary nature of its technologies. We rely

primarily on patents and trade secrets to protect our technologies. There can be

no assurance that the Company will not be required to resort to litigation to

protect its patented technologies and other proprietary rights or that we will

not be the subject of additional patent litigation to defend its existing and

proposed products and processes against claims of patent infringement or any

other intellectual property claims. Such litigation could result in

substantial costs, diversion of management's attention, and diversion of Company

resources.

The

Company strives to protect its trade secrets, including the processes, concepts,

ideas and documentation associated with our technologies, through the use of

confidentiality agreements and non-competition agreements with our current

employees and with other parties to whom we have divulged such trade

secrets. If our employees or other parties breach our confidentiality

agreements and non-competition agreements or if these agreements are not

sufficient to protect our technology or are found to be unenforceable, our

competitors could acquire and use information that we consider to be our trade

secrets, and we may not be able to compete effectively. Some of the

Company’s competitors have substantially greater financial, marketing, technical

and manufacturing resources, and we may not be profitable if our competitors are

also able to take advantage of our trade secrets.

The

Company may decide for business reasons to retain certain knowledge that it

considers proprietary as confidential and elect to protect such information as a

trade secret, as business confidential information or as know-how. In

that event, the Company must rely upon trade secrets, know-how, confidentiality

and non-disclosure agreements and continuing technological innovation to

maintain our competitive position. There can be no assurance that others will

not independently develop substantially equivalent proprietary information or

otherwise gain access to or disclose such information.

9

The

Company’s ability to commercially exploit its products must be considered in

light of the problems, expenses, difficulties, complications and delays

frequently encountered in connection with the development of new medical devices

and products. We believe that in order to continue to be competitive,

we need to develop and maintain sufficient market share. Our methods

of competition include continuing our efforts to develop and sell products,

which, when compared to existing products, perform more efficiently and are

available at prices that are acceptable to the market; displaying our products

and providing associated literature at major industry trade shows; and pursuing

alliance opportunities for the distribution of our products. We

further believe that our competitive advantages with respect to our products

include: the clinical efficacy of our technology and products, the benefits of

treatments utilizing our products, which include treatments that are

non-invasive and painless, are free from known side-effects and are not

susceptible to overdose or abuse, do not require special training to implement,

may be applied to any part of the body; and the relevant experience of the

members of our consultants including, among others, Dr. David Genecov, an

internationally recognized surgeon, and Dr. Kenneth McLeoad, a principal

innovator in PEMF technology.

e. Sources and availability of raw

materials and the names of principal suppliers: The raw materials used as

components in Company’s products, mainly bandaging material and electronic

circuit boards, are readily available worldwide. The Company’s manufacturers

work on behalf of many similar companies, and possess additional capacity to

fulfill Company’s anticipated needs.

f. Patents, trademarks, licenses,

franchises, concessions, royalty agreements or labor contracts, including

duration: The rights to the technology and patents supporting the

development of the current product line were acquired by BioElectronics in

2000. Prior to that time, the previous owners of the technology

and patents had invested over $4.65 million in electronic engineering

prototypes, production runs, and in confirming clinical studies. The

Company has been issued U.S. Patent #7551957B2 and has

additional patents pending in the United States and worldwide.

g. Need

for any government approval of principal products or services. If government

approval is necessary and the smaller reporting company has not yet received

that approval, discuss the status of the approval within the government approval

process:

|

|

·

|

The

Company was granted its first approval from the U.S. FDA under a 510(k) in

August 2002. Prior to U.S. FDA approval and the establishment

of its research and development group, PAW, LLC (the family of Andrew

Whelan, President) paid and expensed the cost of

development.

|

10

|

|

·

|

In

December 2004, the Company received ISO and CE (European Common Market)

certification. In 2005, Health Canada approved ActiPatch®

Therapy for the relief of pain in musculoskeletal

complaints.

|

|

|

·

|

In

early 2008, the Company redesigned its product and manufacturing process

and established new disease specific products and distinct medical and

retail product lines. It also shifted its attention to

international sales.

|

Generally

during its history, with regard to its efforts in 2009 and beyond, the Company

cannot assure that it will be successful in obtaining U.S. FDA clearance, and

without such clearance, we will be unable to enter the relief of pain and

discomfort associated with primary dysmenorrhea market in the United

States. There are numerous medications used in the treatment of pain

and discomfort associated with primary dysmenorrhea, and if we receive clearance

to market this product, we intend to offer it as an alternative to such

medications. These commonplace medications have been required to

carry warning labels due to potential dangerous side-effects (and some withdrawn

altogether), as compared to our non-invasive, drug-free alternative device with

no known side-effects.

h. Effect of existing or probable

governmental regulations on the business: After a device is placed on the

market, within the United States, numerous regulatory requirements apply. These

include:

|

|

Ø

|

Quality

System Regulations, or QSR, which require finished device manufacturers,

including contract manufacturers, to follow stringent design, testing,

control, documentation and other quality assurance procedures during all

aspects of the manufacturing

process;

|

|

|

Ø

|

labeling

regulations and U.S. FDA prohibitions against the promotion of products

for uncleared, unapproved or "off-label"

uses;

|

|

|

Ø

|

medical

device reporting regulations, which require that manufacturers report to

the U.S. FDA if their device may have caused or contributed to a death or

serious injury or malfunctioned in a way that would likely cause or

contribute to a death or serious injury if the malfunction of that or a

similar company device were to recur;

and

|

|

|

Ø

|

post-market

surveillance regulations, which apply when necessary to protect the public

health or to provide additional safety and effectiveness data for the

device.

|

The U.S.

FDA has broad post-market and regulatory enforcement powers. The

Company is subject to unannounced inspections by the U.S. FDA to determine the

Company’s compliance with the QSR and other regulations, and these inspections

include the manufacturing facilities of BioElectronics

Corporation. Our location has been registered with the U.S. FDA as a

Medical Device establishment. Such registration is renewable

annually, and although we do not believe that the registration will fail to be

renewed by the U.S. FDA, there can be no assurance of such

renewal. The failure of the Company to obtain any annual renewal

would have a material adverse effect on us.

11

Failure

to comply with applicable regulatory requirements can result in enforcement

action by the U.S. FDA or the Department of Justice, which may include any of

the following sanctions, among others:

|

|

Ø

|

fines,

injunctions and civil penalties;

|

|

|

Ø

|

mandatory

recall or seizure of our products;

|

|

|

Ø

|

operating

restrictions and partial suspension or total shutdown of

production;

|

|

|

Ø

|

refusing

our requests for 510(k) clearance or pre-market approval of new products

or new intended uses;

|

|

|

Ø

|

withdrawing

510(k) clearance or pre-market approvals that are already granted;

and

|

|

|

Ø

|

criminal

prosecution.

|

The U.S.

FDA also has the authority to require us to repair, replace or refund the cost

of any medical device that has been manufactured for us or distributed by

us. If any of these events were to occur, they could have a material

adverse effect on our business. We also are subject to a wide range

of federal, state and local laws and regulations, including those related to the

environment, health and safety, land use and quality assurance. We

believe that we are in complete compliance with these laws and regulations as

currently in effect, and our compliance with such laws will not have a material

adverse effect on our capital expenditures, earnings and competitive and

financial position.

The

primary regulatory environment in Europe is that of the European Union, which

consists of 27 countries encompassing most of the major countries in

Europe. Three member states of the European Free Trade Association

have voluntarily adopted laws and regulations that mirror those of the European

Union with respect to medical devices. Other countries, such as

Switzerland, have entered into Mutual Recognition Agreements and allow the

marketing of medical devices that meet European Union requirements.

The

European Union has adopted numerous directives and European Standardization

Committees have promulgated voluntary standards regulating the design,

manufacture, clinical trials, labeling and adverse event reporting for medical

devices. Devices that comply with the requirements of a relevant

directive will be entitled to bear a CE conformity marking (which stands for

Conformite Europeenne),

indicating that the device conforms with the essential requirements of the

applicable directives and, accordingly, can be commercially distributed

throughout the member states of the European Union, the member states of the

European Free Trade Association and countries which have entered into a Mutual

Recognition Agreement. The method of assessing conformity varies

depending on the type and class of the product, but normally involves a

combination of self-assessment by the manufacturer of the product and a

third-party assessment by a Notified Body, an independent and neutral

institution appointed by a country to conduct the conformity

assessment. This third-party assessment may consist of an audit of

the manufacturer's quality system and specific testing of the manufacturer's

device. An assessment by a Notified Body in one member state of the

European Union, the European Free Trade Association or one country which has

entered into a Mutual Recognition Agreement is required in order for a

manufacturer to commercially distribute the product throughout these

countries. ISO 9001 and ISO 13845 certifications are voluntary

harmonized standards. Compliance establishes the presumption of

conformity with the essential requirements for a CE Marking.

12

i. Estimate of the amount spent during

each of the last two fiscal years on research and development activities, and if

applicable, the extent to which the cost of such activities is borne directly by

customers: The Company’s R&D costs have been minimal. New

product research and development is done by in-house engineers and a consulting

biophysicist

j. Number of total employees and number

of full-time employees: Currently, the Company employs 9 full time staff

members and contracts for consulting services with an additional 3

persons. None of the Company’s employees are represented by unions or

collective bargaining agreements. We believe that our relationships

with our employees are good.

3. Reports to security

holders. The following will be disclosed in any registration statement

the Company files under the Securities Act of 1933:

i.

Though not required to deliver an annual report to security holders, the Company

will voluntarily send an annual report, which will include audited financial

statements;

ii.

The Company has voluntarily agreed to become a reporting company with the

Securities and Exchange Commission and subject to its reporting requirements,

including the filing of periodic reports and any other required

information;

iii.

That the public may read and copy any materials file by the Company with the

Commission at the SEC's Public Reference Room at 100 F Street, NE., Washington,

DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. State

that the public may obtain information on the operation of the Public Reference

Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an

Internet site that contains reports, proxy and information statements, and other

information regarding issuers that file electronically with the Commission and

state the address of that site (http://www.sec.gov). The Company maintains its

own website at http://www.BIELCorp.com, where it will also post this

information.

Item

1A. Risk Factors. The Company is not required to provide the

information required by this Item because the Company is a smaller reporting

company.

Item

1B. Unresolved Staff Comments. The Company is not required to

provide the information required by this Item because the Company is a smaller

reporting company.

13

Item

2. Properties. The Company’s principal corporate office is located

at 4539 Metropolitan Court, Frederick, Maryland 21704 where it leases

approximately 3,000 square feet. The Company uses approximately 1,600

square feet for its production and packaging facility and 1,400 square feet for

its executive offices. The approximate rental amount is $5,800 per

month. The lease term expires in 2011.

Item 3.

Legal Proceedings.

The

Company and Andrew Whelan, President & CEO are defendants in a lawsuit

brought by a plaintiff who is seeking damages arising from a breach by the

Company of certain alleged oral contractual obligations. The

plaintiff claims that, pursuant to these alleged obligations, he would have been

entitled to receive common stock from the Company as compensation for rendering

certain services to the Company. The matter was submitted to

arbitration at which the plaintiff prevailed and a judgment was entered against

BioElectronics Corporation, PAW, LLC and Andrew Whelan in the amount of

$1,217,919.10. The Company and Mr. Whelan have filed a Petition to

Vacate Arbitration Award. As of this date, there has been no ruling

on the motion. The Company believes the plaintiff’s claims to be

without merit and the arbitrator’s decision to have been possible only by a

manifest disregard of the law. The Company intends to defend the

lawsuit and pursue any counterclaims vigorously.

Item

4 (Removed and Reserved). Not applicable.

14

PART II

Item 5. Market for

Registrant’s Common equity, Related Stockholder Matters and Issuer Purchases of

equity Securities.

Market

for Securities

The

Company’s common stock currently trades via PinkSheets at http://www.OTCMarkets.com,

under the symbol BIEL. The high and low closing price for each

quarterly period of our last two fiscal years is listed below:

|

High

|

Low

|

|||||||

|

Fiscal 2008

|

||||||||

|

1

st

Quarter

|

$

|

0.054

|

$

|

0.0255

|

||||

|

2

nd

Quarter

|

0.045

|

0.02

|

||||||

|

3

rd

Quarter

|

0.0224

|

0.006

|

||||||

|

4

th

Quarter

|

0.0125

|

0.0037

|

||||||

|

Fiscal 2009

|

||||||||

|

1

st

Quarter

|

$

|

0.0045

|

$

|

0.001

|

||||

|

2

nd

Quarter

|

0.049

|

0.0011

|

||||||

|

3

rd

Quarter

|

0.12

|

0.021

|

||||||

|

4

th

Quarter

|

0.103

|

0.04

|

||||||

|

*

|

The

quotations reflect inter-dealer prices, without mark-up, mark-down or

commission and may not represent actual

transactions.

|

Penny

Stock Considerations

The

Company’s shares will be "penny stocks" as that term is generally defined in the

Securities Exchange Act of 1934 to mean equity securities with a price of less

than $5.00. Our shares thus will be subject to rules that impose sales practice

and disclosure requirements on broker-dealers who engage in certain transactions

involving a penny stock.

Under the

penny stock regulations, a broker-dealer selling a penny stock to anyone other

than an established customer or accredited investor must make a special

suitability determination regarding the purchaser and must receive the

purchaser's written consent to the transaction prior to the sale, unless the

broker-dealer is otherwise exempt. Generally, an individual with a net worth in

excess of $1,000,000 or annual income exceeding $100,000 individually or

$300,000 together with his or her spouse is considered an accredited investor.

In addition, under the penny stock regulations the broker-dealer is required

to:

15

|

*

|

Deliver,

prior to any transaction involving a penny stock, a disclosure schedule

prepared by the Securities and Exchange Commissions relating to the penny

stock market, unless the broker-dealer or the transaction is otherwise

exempt;

|

|

|

|

|

*

|

Disclose

commissions payable to the broker-dealer and our registered

representatives and current bid and offer quotations for the

securities;

|

|

|

|

|

*

|

Send

monthly statements disclosing recent price information pertaining to the

penny stock held in a customer's account, the account's value and

information regarding the limited market in penny stocks;

and

|

|

*

|

Make

a special written determination that the penny stock is a suitable

investment for the purchaser and receive the purchaser's written agreement

to the transaction, prior to conducting any penny stock transaction in the

customer's account.

|

Because

of these regulations, broker-dealers may encounter difficulties in their attempt

to sell shares of our common stock, which may affect the ability of selling

stockholders or other holders to sell their shares in the secondary market and

have the effect of reducing the level of trading activity in the secondary

market. These additional sales practice and disclosure requirements could impede

the sale of our securities, if our securities become publicly traded. In

addition, the liquidity for our securities may be decreased, with a

corresponding decrease in the price of our securities. Our shares in all

probability will be subject to such penny stock rules and our stockholders will,

in all likelihood, find it difficult to sell their securities.

Holders

As of

December 31, 2009, the Company had 16,011 holders of record of its common

stock.

Securities

as Compensation

The

Company effected multiple transactions using its Common Stock as compensation in

2009, 2008 and 2007 to non-employees pursuant to consulting services agreements.

These issuances were made in reliance upon Section 4(2) of the Securities

Act of 1933. The mandated tabular disclosure is contained in Item 12,

infra, and an

explanatory schedule is contained in Item 15, infra.

Dividends

The

Company has not declared any cash dividends on our common stock since its

inception and do not anticipate paying such dividends in the foreseeable future.

We plan to retain any future earnings for use in our business. Any decisions as

to future payments of dividends will depend on our earnings and financial

position and such other facts, as the board of directors deems

relevant.

16

Recent

Sales of Unregistered Securities

In years

of 2007, 2008 and 2009, the Company sold unregistered securities, the proceeds

of which were used for day-to-day operating capital, by filing Form D Notice of

Sale of Securities Pursuant to Regulation D, Section 4(6) and/or Uniform Limited

Offering Exemption with the Securities and Exchange Commission. There was no

underwriter related to the transactions, nor any commissions paid. A

schedule of these series of transactions is provided in exhibit contained in

Item 15, infra.

Item

6. Selected Financial Data. The

Company is not required to provide the information required by this Item because

the Company is a smaller reporting company.

Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

This

Form 10-K may contain forward-looking statements within the meaning of

Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements involve a number of risks

and uncertainties including, without limitation, those identified under

Item 1A. “Risk Factors” and elsewhere in this Form 10-K. We undertake no

obligation to revise any forward-looking statements in order to reflect events

or circumstances that may arise after the date of this report. Readers are urged

to carefully review and consider the various disclosures made in this report and

in our other filings with the SEC that attempt to advise interested parties of

the risks and factors that may affect our business.

INTRODUCTION

We are

the maker of inexpensive, drug–free, anti-inflammatory medical devices and

patches. Our wafer thin patches contain an embedded microchip and

battery that deliver pulsed electromagnetic energy, a clinically proven and

widely accepted anti-inflammatory and pain relief therapy that heretofore has

only been possible to obtain from large, facility-based equipment. We

market and sell our products under the brand names ActiPatch®, Allay™,

RecoveryRx™ and HealFast™.

During

2009, our focus was on developing product, obtaining additional domestic and

international distribution channels, conducting market research, completing

additional clinical trials, eliminating debt, and strengthening the balance

sheet. The motivations for continued clinical trials

are marketing enrichment and obtaining additional U.S. Food and Drug

Administration (FDA) approved therapeutic indications for existing and future

products. Securing additional U.S. FDA approval is central to market

entry and product acceptance.

Our

customers include pharmacies, supermarkets, physicians, direct response

television and distributors. Plastic surgery is the only domestic

market segment with current U.S. FDA market clearance. Consequently,

until additional clearances are received from the U.S. FDA, domestic sales are

restricted primarily to medical providers, and the majority of sales will be

located outside the United States. As of December 31, 2009, we have

established distribution agreements with distributors in Korea, Singapore,

Malaysia, Canada, Columbia, Italy, Scandinavia, Saudi Arabia, Japan, Benelux,

the Balkans, Austria, Australia, China and South America. The

international market is expected to further expand going forward and to

eventually constitute two-thirds of our total sales.

17

MAJOR

GOALS, SIGNIFICANT ACTIVITIES AND RESULTS DURING 2009

BioElectronics’

operational plan is centered on marketing oriented functions. We

believe our product set is very strong, our quality is very high, our

ISO-certified production capabilities are extensive, and our Company is

structured for accelerated growth. Over the past 24 months, the

Company has significantly strengthened its product lines, improved product

quality, created new packaging, and redesigned marketing materials. During the

year ended December 31, 2009, we reduced our level of debt, improved our cash

position and significantly reduced our overhead

expenses. We believe we now have a robust product line

with strong features and functions and are taking further actions to strengthen

our balance sheet and establish profitable operations.

We have

several major goals to continue the advancement of its business operations,

including: 1) completing additional clinical trials; 2) obtaining

additional U.S. FDA and international product market clearances; 3) continuing

to build our four primary brands; 4) building domestic distribution, including

direct response television commercials and drug/grocery store-based

distribution; and 5) continuing to expand our already growing international

distribution network.

Completion

of Clinical Trials

We have

been aggressively pursuing the completion of several clinical

trials. Our heel/foot clinical trial was recently conducted in

October 2009 yielding a strong product advocacy and 100%

safety. Future additional clinical trials include: cesarean section

recovery, breast augmentation recovery, and menstrual pain and cramping

associated dysmenorrhea. Our international distribution groups

also sponsored other clinical trials. Upon completion of these

studies, the data may be used in U.S. FDA submissions and to support our

marketing claims both domestically and abroad.

Additional

U.S. Government FDA and International Regulatory Body Filings

Our

product is currently classified as a high risk, Class III device. We

have U.S. FDA market clearance for the treatment of edema following

blepharoplasty. We have filed two additional 510(k) market clearance

applications for “relief of musculoskeletal pain” and “relief of menstrual cycle

pain and discomfort” for over-the-counter sales. Even though the U.S.

FDA is reluctant to give us over-the-counter clearance for a Class III device,

we are currently pursuing both reclassification and approval of the pending

applications. As we expand internationally, we are required to and do

obtain additional market clearance in each country.

18

Continue

to Build Our Four Primary Markets

We

augmented our marketing team in 2009 with two experienced Brand Managers to help

build our brands. In the

coming months, we plan to add additional brand management staff to further

assist our marketing efforts.

Because

BioElectronics has only limited U.S. FDA clearance of its products, mass

distribution to direct consumers in the United States is

prohibited. We believe U.S. FDA clearance for some of our products is

forthcoming, and thus, we are currently in the process of identifying and

building a domestic distribution network.

Continued

Expansion of Our Already Growing International Distribution Network

BioElectronics

has made steady, significant progress in building an international distribution

network. Due to the Company obtaining over-the-counter sales approval

for its products in Canada, Europe and other markets, it has had regular

interest from international distribution companies to market and

distribute the product lines. Our strategy has been to partner

with distributors that have the experience and financial ability to place our

products into the consumer goods retail sales channels. We have seen

success in executing this strategy relative to Canada, Western Europe and

Italy. As retail distribution is a core strategy, the Company is

regularly in negotiations with existing and future distributors, and hopes to

sign additional contracts with qualified distributors in Asia, Europe,

South/Central America and Australia.

As part

of its intent to regularly expand the distribution of its products,

BioElectronics in 2009 expanded its television presence around the world via the

international Direct Response Televisions (DRTV) campaign. To

establish its DRTV program, the Company has developed

television materials produced by leading companies it has retained

(Schulberg Media Works for English-speaking markets, and RC Productions for

Hispanic markets) for both the Actipatch Back Pain product and the Allay

Menstrual Pain Therapy product. Subsequently, the commercials are

extremely helpful with establishing partnerships with major DRTV companies to

test our products in many countries. The Company contracted with

TeleDEPOT in Latin America, where it completed a very successful test in some of

the countries. In Canada, we are partnering with Northern Response,

one of the world’s largest DRTV companies. Northern Response is also

looking for further opportunities in six additional international locations that

show interest in our products. The Canadian test is scheduled to

begin on April 5, 2010. In Australia and New Zealand, Brand

Developers will test the Back Pain commercial.

Other

Issues Relative to Plan of Operations

Cash

Requirements - BioElectronics is currently in a strong current asset position

with its current assets significantly exceeding current liabilities, yielding a

current ratio well above one. As is typical for most growth

companies, BioElectronics may, in the future, need to raise additional funds to

finance its working capital requirements. It is unknown at this time

how much, if any, additional funds will be needed to execute our business plan,

as it is highly dependent upon our sales growth trajectory over the coming

quarters.

19

Research

and Development – Our technologies are already highly developed and many of our

products are currently on the international market. We are designing

several new products based on our core technologies with developmental costs

being financed through normal cash flows.

Expected

Purchase or Sale of Plant and Significant Equipment - BioElectronics does not

anticipate any major purchases or sales of plant or significant

equipment.

Expected

Changes in the Number of Employees - We are currently recruiting new talent, and

it is expected the majority of our hiring will focus on marketing personnel,

although our support and manufacturing staff will also be

expanded. Our hiring plans are dependent upon revenue growth rates

over the coming quarters.

RESULTS

OF OPERATIONS

Our

principal activity, to sell and market in the U.S. retail market, has not yet

commenced due to the lack of U.S. FDA approval for our

product. As a result, we consider ourselves a development stage

entity in accordance with FASB Accounting Standards Codification Topic 915,

“Development Stage Enterprise”, and accordingly present, in our financial

statements, the results of operations and other disclosures for the company for

the period from our inception, April 10, 2000, to December 31,

2009.

Year

Ended December 31, 2009 Compared to Year Ended December 31, 2008

Revenue. Revenue

from operations for the years ended December 31, 2009 and 2008 amounted to

approximately $1,146,000 and $717,000, respectively, an increase of $429,000 or

60% over the prior year. The following table summarizes the company’s

domestic, international and veterinary (related party) revenues earned during

the years ended December 31, 2009 and 2008:

|

For

the Years Ended December 31,

|

||||||||||||||||

|

2009

|

2008

|

|||||||||||||||

|

Amounts

|

Percentage

|

Amounts

|

Percentage

|

|||||||||||||

|

Domestic

|

$ | 263,815 | 23 | % | $ | 254,927 | 36 | % | ||||||||

|

International

|

610,785 | 53 | % | 461,828 | 64 | % | ||||||||||

|

Veterinary

|

271,047 | 24 | % | - | - | |||||||||||

| $ | 1,145,647 | 100 | % | $ | 716,755 | 100 | % | |||||||||

International

sales increased by approximately $149,000 or 32% in 2009 from 2008 as a result

of new distributorship agreements signed in 2009 and increased sales through

agreements signed in prior years. Revenues from international

sales for the year ended December 31, 2009 include $150,000 of sales related to

a bill and hold transaction. The units will be shipped in 2010 to

help meet the distribution 2010 purchase obligation.

20

Veterinary

revenues of $271,047 were recorded in connection with a distribution agreement

signed on February 9, 2009 with eMarkets, a company owned and controlled by a

member of the board of directors and sister of our

president. The agreement provides for eMarkets to be the

exclusive distributor of our veterinary products to customers in certain

countries outside of the United States for a period of three

years. The specialized veterinary products sold to eMarkets

include approximately $216,000 of revenues related to bill and hold transactions

and for which the related product is expected to be delivered during the fourth

quarter of 2010.

Cost of Goods Sold and Gross

Margin. Costs of goods sold for the years ended

December 31, 2009 and 2008 amounted to approximately $390,000 and $509,000,

respectively. Gross margin increased from approximately 29% of

sales for the year ended December 31, 2008 to approximately 66% for the year

ended December 31, 2009. The increase was the result of higher

sales prices per unit, lower production costs (which arose primarily from

improvements in productivity) and a substantially lower defect

rate. We expect gross margins on our products to be in the range of

66% to 70% of sales in the future, depending on product mix and sales prices.

This gross margin range is consistent with other medical device and

pharmaceutical companies.

General and Administrative

Expense. For the year ended December 31, 2009, general

and administrative expenses amounted to approximately $904,000 as compared to

$2,040,000 in 2008, a decrease of $1,136,000 or 56% over the prior

year. The decrease in general and administrative expenses in

2009 was primarily driven by reduced consulting expenses.

General

and administrative expenses of approximately $904,000 for the year ended

December 31, 2009 included approximately $147,000 in sales support

expenses, approximately $34,000 in consulting expense, approximately $15,000 in

depreciation and approximately $709,000 in other general and administrative

expenses.

General

and administrative expenses of approximately $2,040,000 for the year ended

December 31, 2008, consisted of approximately $439,000 in sales support

expenses, approximately $551,000 in consulting expense, approximately $15,000 in

depreciation and $1,035,000 in other general and administrative

expenses.

Interest Expense. Interest

expense decreased to approximately $111,000 for the year ended December 31,

2009 from $192,000 in the comparable period in 2008. The

decrease in interest expense was attributed to the payoff of senior secured

convertible notes, during the year ended 2009.

Net Loss. Net

losses decreased from approximately $2,024,000 during 2008 to approximately

$260,000 during 2009. Losses were minimized primarily due to a

significant increase in sales and reduction in costs.

21

Year

Ended December 31, 2008 Compared to Year Ended December 31, 2007

Revenue. Revenue

from operations for the years ended December 31, 2008 and 2007 were

approximately $717,000 and $603,000, respectively, an increase of $114,000 or

19% over the prior year. The following table summarizes the company’s

domestic and international revenues earned during the years ended December 31,

2008 and 2007:

|

For

the Years Ended December 31,

|

||||||||||||||||

|

2008

|

2007

|

|||||||||||||||

|

Amounts

|

Percentage

|

Amounts

|

Percentage

|

|||||||||||||

|

Domestic

|

$ | 254,927 | 36 | % | $ | 232,871 | 39 | % | ||||||||

|

International

|

461,828 | 64 | % | 370,239 | 61 | % | ||||||||||

| $ | 716,755 | 100 | % | $ | 603,110 | 100 | % | |||||||||

The

primary contributor to the increase in revenue is continued expansion of

international and domestic markets.

Cost of Goods Sold and Gross

Margin. Costs of goods sold for the years ended

December 31, 2008 and 2007 were approximately $509,000 and $170,000,

respectively. Gross margin decreased from 72% for the year ended

December 31, 2007 to 29% for the year ended December 31, 2008, as a result of

higher production costs which arose primarily from improvements in product

design and packaging.

General and Administrative

Expense. For the year ended December 31, 2008, general

and administrative expenses amounted to approximately $2,040,000 as compared to

$1,818,000 in 2007, an increase of $222,000 or 12% over the prior

year. The slight increase in general and administrative expenses in

2008 was primarily driven by the increase in sales support expenses and payroll

expense related to the hiring of vice president in international

sales.

General

and administrative expenses of approximately $2,040,000 for the year ended

December 31, 2008 consisted of approximately $439,000 in sales support

expenses, approximately $551,000 in consulting expense, approximately $15,000 in

depreciation and $1,035,000 in other general and administrative

expenses.

General

and administrative expenses of approximately $1,818,000 for the year ended

December 31, 2007 consisted of approximately $343,000 in sales support

expenses, approximately $543,000 in consulting expense, approximately $19,000 in

depreciation and approximately $912,000 in other general and administrative

expenses.

Interest Expense. Interest

expense decreased to approximately $192,000 for the year ended December 31,

2008 from $588,000 in the comparable period in 2007. The increase in interest

expense was primarily attributable to the amortization of discount on warrants

of approximately $351,000, as related to the senior convertible notes

agreement. Such expense was fully amortized by the end of December

31, 2007.

22

Net Loss. Net

losses increased slightly from approximately $2,003,000 during 2007 to

approximately $2,024,000 during 2008. This slight increase is due to

lower gross margin and higher general and administrative expenses.

LIQUIDITY

AND CAPITAL RESOURCES

Our

sources of funds are primarily cash flows from financing

activities. We raise funds for our operations by borrowing on notes,

agreements with third parties and related parties, and selling equity in the

capital markets. We are still operating as a development stage

company, in which we are devoting substantially all of our present efforts to

developing our business. For every year since our inception, we

have generated negative cash flow from operations. At

December 31, 2009, our cash and cash equivalents were approximately

$296,000. Since the end of fiscal 2008, the increase of

approximately $241,000 in our cash and cash equivalents resulted

primarily from the issuance of related party notes payable during the

year.

Since our

inception on April 10, 2000, the majority of our financing has been provided by

the Company’s founders including the CEO, certain board members, and their

immediate family and associates. As of December 31, 2009, all

of the Company’s financing was provided by these related parties through

long-term notes payable. We present these notes payable as

long-term liabilities in our financial statements, as the holders of these notes

(who are related parties) have no current intention to pursue repayment of these

amounts.

At

December 31, 2009, we had positive working capital of approximately $1,026,000

as compared to negative working capital of approximately $1,164,000 at December

31, 2008. The negative working capital at December 31, 2008 arose due

to the low level of current assets (which was the result of low level of sales

and higher expenses to that date), and balances due to suppliers (reported as

accounts payable and accrued expenses) and under our senior secured notes

payable. The senior secured convertible notes were repaid and

converted to equity in 2009.

On

January 1, 2005, we entered into an unsecured revolving convertible promissory

note agreement (“the Revolver”) with IBEX, LLC (“IBEX”) a related party, for a

maximum limit of $2,000,000, with interest at the Prime Rate plus 2%, and all

accrued interest and principal due on or before January 1, 2015, whether by the

payment of cash or by conversion into shares of our common

stock. The Revolver is convertible at various conversion prices

based on the VWAP for the 10 trading days preceding the date of

conversion. IBEX, LLC is a limited liability company, whose President

is the daughter of the President of the Company. As of December 31,

2009, an amount of approximately $1,288,000 was drawn from the

Revolver.

23

Additionally,

on August 1, 2009, we entered into a convertible promissory note agreement with

IBEX, for $519,920, with simple interest at 8% per annum. All accrued

interest and principal are due on or before August 31, 2011, whether by the

payment of cash or by conversion into shares of our common stock. The

promissory note is convertible equal to the quotient of (i) a sum equal to the

entire outstanding principal and interest, divided by (ii) the conversion price

of $0.019 per share.

Net Cash Used In Operating

Activities. Net cash used in operating activities amounted to

approximately $1,363,000, $521,000 and $1,335,000 in the years ended December

31, 2009, 2008 and 2007, respectively.

Net cash

used in operating activities of approximately $1,363,000 in the year ended

December 31, 2009 was primarily because of the increase in trade and other

receivables of approximately $333,000, decrease in accrued expenses of

approximately $216,000, decrease in accounts payable of approximately $181,000,

increase in due from related party of approximately $165,000, and increase in

inventory of approximately $136,000. Non-cash reconciling items

mainly include stock-based compensation expense of approximately $243,000 and

adjustment to related party notes payable of approximately

$266,000.

Net cash

used in operating activities of approximately $521,000 in the year ended

December 31, 2008 was primarily because of the decrease in trade and other

receivables of approximately $130,000, increase in accrued expenses of

approximately $261,000, decrease in inventory of approximately $126,000, and

increase in customer deposits of approximately $119,000. Non-cash

reconciling items mainly include stock-based compensation expense of

approximately $400,000 and approximately $247,000 increase in related party

notes payable for services rendered.

Net cash

used in operating activities of approximately $1,335,000 in the year ended

December 31, 2007 was primarily because of the increase in inventory of

approximately $128,000 and decrease in accounts payable of approximately

$148,000. Non-cash reconciling items mainly include amortization of

non-cash debt issuance costs of approximately $351,000, non-cash interest

related to convertible notes payable of approximately $205,000 and increase in

related party notes payable for services rendered of approximately

$309,000.

Net Cash Used in Investing

Activities. We did not make any significant investments in fixed or other

long-term assets during the years ended December 31, 2009, 2008, and 2007 and

therefore, did not have any substantial cash flows from investing

activities.

Net Cash Provided by Financing

Activities. Net cash provided by financing activities amounted to

approximately $1,604,000 and $547,000 in the years ended December 31, 2009 and

December 31, 2008, respectively.

During

the year ended December 31, 2009, the Company generated $2,597,860 in cash

from financing activities through the issuance of notes payable to

related parties (amounting to $1,725,360) and the sale of common shares to

investors (amounting to $872,500). The proceeds received from

these activities were used to repay certain notes payable (amounting to

$994,025) and to fund operations during the year.

24

During

the year ended December 31, 2008, the company generated $547,021 in cash from

financing activities through the issuance of notes payable to related parties

(amounting to $461,371) and the sale of common shares to investors (amounting to

$198,250). The funds received were used to repay certain

notes payable (amounting to $112,600) and to fund operations.

Net cash

provided by financing activities for the year ended December 31, 2008 was

approximately $547,000 compared to approximately $1,243,000 in

2007. The decrease of approximately $696,000 was primarily because of

the reduction in proceeds obtained from related party notes payable by

approximately $501,000.

Going

concern. The Company’s financial statements have been

prepared on a going concern basis which contemplates the realization of assets

and the liquidation of liabilities in the ordinary course of

business. We have incurred substantial losses from operations in 2009

and prior years, including a net loss of $259,977 for the year ended December

31, 2009. The Company also has an accumulated deficit as of December 31, 2009 of

$10,644,490.

We are

currently looking for additional financing to provide funds for operations and

complete our developmental activities. However, we can provide no

assurance that we will be able to obtain financing on reasonable terms and at

sufficient levels to enable us to complete developmental activities, receive

U.S. FDA approval and develop sufficient sales revenue and achieve profitable

operations. Until sufficient financing has been received to

complete our developmental activities, there exists substantial doubt as to our

ability to continue as a going concern. Our auditors have

issued an opinion for the year ended December 31, 2009, which states that

there is substantial doubt about our ability to continue as a going

concern.

OBLIGATIONS

AND CONTRACTUAL COMMITMENTS

The

following table reflects our current contractual commitments as of

December 31, 2009:

|

Payments Due by Period

|

||||||||||||||||||||

|

Total

|

2010

|

2011-2012

|

2013-2014

|

Thereafter

|

||||||||||||||||

|

Operating

leases

|

$ | 120,030 | $ | 60,895 | $ | 55,096 | $ | 4,039 | $ | — | ||||||||||

|

Long-term

liabilities (1)

|

1,824,176 | — | 536,222 | — | 1,287,954 | |||||||||||||||

|

Total

contractual obligations

|

$ | 1,944,206 | $ | 60,895 | $ | 591,318 | $ | 4,039 | $ | 1,287,954 | ||||||||||

|

(1)

|

These

liabilities represent the Revolver loan and the convertible promissory

note with IBEX.

|

25

At

December 31, 2009, we had available a $2,000,000 revolving credit facility

with approximately $1,288,000 balance with IBEX, a related party. For additional

information regarding our credit facility and operating leases, see Notes 7 and

12, respectively, of our financial statements.

CRITICAL

ACCOUNTING POLICIES AND ESTIMATES

Critical

Accounting Policies and Estimates

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates

and assumptions that affect the amounts reported in the consolidated financial

statements and accompanying notes. Our estimates and assumptions are based upon

a combination of historical information and various other assumptions believed

to be reasonable under the particular circumstances. Actual results could differ

from those estimates. Certain of the accounting policies which most impact our

consolidated financial statements and that require management to make difficult,

subjective or complex judgments are described below. See also “Note

2. Summary of Significant Accounting Policies,” to our consolidated financial

statements included in Item 15 of this Annual Report on Form 10-K.

Development

Stage Company

We devote

substantially all of our present efforts to developing our business. One of our

principal operations, to sell and market in the U.S. retail market, has not yet

commenced as of December 31, 2009 pending U.S. FDA clearance

approval. All losses accumulated since inception have been considered

as part of our development stage activities. Costs of start-up activities,

including organizational costs, are expensed as incurred.

Revenue

Recognition

We

recognize revenue when evidence of an arrangement exists, such as the presence

of an executed sales agreement, pricing is fixed and determinable, collection is

reasonably assured and shipment has occurred or title of the goods has been

transferred to our buyers. Payment is due on a net basis in 30

days. If the customer is deemed not credit worthy, payment in advance

is required. Our agreement with customers includes a right of

return. An allowance for returns has been provided for the years

ended December 31, 2009, 2008 and 2007. Defective units are replaced

at the request of the customer.

26

We enter

into bill and hold arrangements from time-to-time with certain distributors,

pursuant to which of our products are purchased by our distributor for shipment

at a later date. We recognize revenue on bill and hold arrangements

when the following 7 criteria have been met: 1) the risk of

ownership has passed to the buyer; 2) the buyer has made a fixed commitment to

purchase the goods, preferably in writing; 3) the buyer, and not the seller, has