Attached files

| file | filename |

|---|---|

| EX-32.1 - ALTERNATE ENERGY HOLDINGS, INC. | v178571_ex32-1.htm |

| EX-21.1 - ALTERNATE ENERGY HOLDINGS, INC. | v178571_ex21-1.htm |

| EX-14.1 - ALTERNATE ENERGY HOLDINGS, INC. | v178571_ex14-1.htm |

| EX-32.2 - ALTERNATE ENERGY HOLDINGS, INC. | v178571_ex32-2.htm |

| EX-31.1 - ALTERNATE ENERGY HOLDINGS, INC. | v178571_ex31-1.htm |

| EX-31.2 - ALTERNATE ENERGY HOLDINGS, INC. | v178571_ex31-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

Annual

Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934 and

|

For

the fiscal year ended December 31, 2009

or

|

¨

|

Transaction

Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

For

the transition period from _________ to _____________

Commission

file number: 000-53451

|

ALTERNATE

ENERGY HOLDINGS, INC.

|

|

(Exact

name of registrant as specified in its

charter)

|

|

Nevada

|

20-5689191

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

incorporation

or organization)

|

Identification

No.)

|

|

911

E. Winding Creek Dr., Suite 150, Eagle, Idaho

|

83616

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (208)939-9311

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

|

Common

Stock, par value $.001 per share

|

|

(Title

of class)

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No

x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes ¨ No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of

the Exchange Act. (Check One).

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

(Do

not check if a smaller reporting company)

|

|||

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No

x

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant was approximately $8,678,984 as of

June 30, 2009 (the last business day of the registrant’s most recently

completed second fiscal quarter), based on the average bid and asked price of

such common equity as quoted by the OTC Bulletin Board on such

date.

The

number of shares outstanding of the registrant’s common stock as of March 31,

2010, was 252,361,674 shares.

TABLE

OF CONTENTS

|

PART

I

|

Page

|

|||

|

ITEM

1

|

Business

|

1

|

||

|

ITEM

1 A

|

Risk

Factors

|

14

|

||

|

ITEM

1 B

|

Unresolved

Staff Comments

|

26

|

||

|

ITEM

2

|

Properties

|

26

|

||

|

ITEM

3

|

Legal

Proceedings

|

26

|

||

|

ITEM

4

|

Submission

of Matters to a Vote of Security Holders

|

26

|

||

|

PART

II

|

||||

|

ITEM

5

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

26

|

||

|

ITEM

6

|

Selected

Financial Data

|

28

|

||

|

ITEM

7

|

Management’s

Discussion and Analysis of Financial Condition and Results Of

operations

|

28

|

||

|

ITEM

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

32

|

||

|

ITEM

8

|

Financial

Statements and Supplementary Data

|

32

|

||

|

ITEM

9

|

Changes

in and Disagreements with Accountants on Accounting and

Financial

|

32

|

||

|

ITEM

9 A

|

Controls

and Procedures

|

32

|

||

|

ITEM

9 B

|

Other

Information

|

33

|

||

|

PART

III

|

||||

|

ITEM

10

|

Directors,

Executive Officers, and Corporate Governance

|

34

|

||

|

ITEM

11

|

Executive

Compensation

|

38

|

||

|

ITEM

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

41

|

||

|

ITEM

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

43

|

||

|

ITEM

14

|

Principal

Accounting Fees and Services

|

43

|

||

|

PART

IV

|

||||

|

ITEM

15

|

Exhibits,

Financial Statement Schedules

|

43

|

||

|

SIGNATURES

|

45

|

|||

i

PART

I

Item

1. Business

The

following is a summary of some of the information contained in this document.

Unless the context requires otherwise, references in this document to “Alternate

Energy Holdings,” “AEHI,” or the “Company” are to Alternate Energy Holdings,

Inc. and its subsidiaries.

Introduction

Alternate

Energy Holdings, Inc. (“AEHI”, or “the Company”) was incorporated in the State

of Nevada, and is a development stage enterprise engaged in the purchase,

optimization and construction of green energy sources, primarily nuclear power

plants. Alternate

Energy Holdings, Inc. was founded by former senior executives of the utility and

finance industries to effectively address several aspects of the “energy

crisis”: dependency on sources of foreign oil, global depletion of

fossil fuel reserves, renewable energy, global warming and power plant

emissions. The Company went public through a reverse merger in

September of 2006, and its common shares are traded on the OTC Bulletin Board

(“AEHI.BB”). Our corporate offices are at 911 E. Winding Creek Dr., Suite 150,

Eagle, ID 83616. We maintain a website at www.alternateenergyholdings.com,

which is not incorporated in and is not a part of this report.

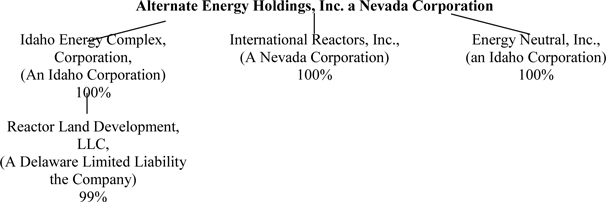

Alternate

Energy Holdings, Inc. consists of four corporate

entities: International Reactors, Inc., Idaho Energy Complex, Reactor

Land Development, LLC and Energy Neutral, Inc. International Reactors

assists developing countries with power generation as well as the production of

potable water. Idaho Energy Complex was formed to oversee a proposed

$10 billion nuclear project near Payette, Idaho, with a backup site near

Hammett, Idaho. Reactor Land Development is engaged in acquiring land

and water rights, permits and licenses, and plant development

rights. Energy Neutral (visit www.energyneutralinc.com)

assists homeowners, businesses and farmers with reducing energy consumption and

reliance on the electrical grid.

AEHI has

taken the initiative to inform the public, media and investors about future

plans and revenue opportunities. The Company’s websites feature

detailed profiles of AEHI’s Board of Directors and management team, as well as

general industry information, company services, corporate relationships and

recent press releases. Furthermore, AEHI has conducted three public

informational meetings about the Idaho Energy Complex and made numerous

presentations to city councils, chambers of commerce and other civic

groups. AEHI has also retained a Boise, Idaho public relations

agency, Alexander and Associates, to assist with local information for the media

and general public, and has hired a full-time public relations director, a

highly respected former news anchor for a local television station.

Business

Strategy

The

Company intends to service the electric power generation industry by acquiring

and developing nuclear plant sites and obtaining licenses for their construction

and operation throughout the United States. The initial proposed

energy complex (which we refer to as “the Project”) is in the State of

Idaho. The Company is an independent power producer and is in the

process of obtaining permits for the site, which will include one or more

nuclear reactors. The Company plans to meet the growing needs of the

marketplace by providing reliable, low cost, large-scale power production on a

national scale and, in addition, offering emerging demand-side and power

management technologies to reduce energy consumption by homes, and commercial

and agricultural businesses.

The

Company entered the local land use approval process for the Idaho Energy Complex

in the fourth quarter of 2009, and received initial approval from the Payette

County Planning and Zoning Commission in November 2009. After final

local approval, which is expected to be received in the second quarter of 2010,

the approval process of the Nuclear Regulatory Commission (“NRC”) will begin and

may last as long as three years. The Company plans to finance the

Idaho Energy Complex with a combination of secured debt, Federal government loan

guarantees, unsecured debt and equity and equity-linked securities, subject to

future market conditions. Additionally, the Company is exploring

nuclear plant sites in Colorado, Texas and New Mexico. Subject to

market conditions, the Company would ultimately like to develop and own nuclear

energy complexes throughout the Rocky Mountain region to be able meet power

shortage issues on both coasts.

As the

Idaho Project moves through the extensive regulatory approval process, the

Company is developing other revenue opportunities. The Company is

currently working with China National Nuclear Corporation to develop and build a

desalinization reactor to market to developing countries needing potable water

and electricity. The Company plans to begin to market these reactors in the

second quarter of 2010, initially to Western friendly nations in the Middle

East.

The

Company is also working on an agreement to import a technologically advanced

Korean nuclear reactor into the United States for use in its Idaho and other

domestic nuclear sites. If successful, the agreement will provide for

commissions paid to the Company for Korean reactors sold to any North American

nuclear projects. The Company will also sponsor and assist the Korean

company in navigating through the NRC design approval process.

Industry

Overview

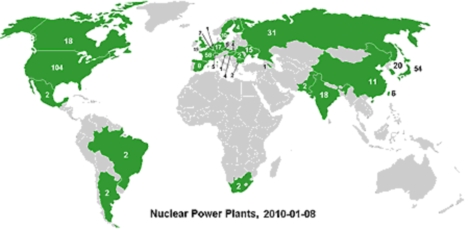

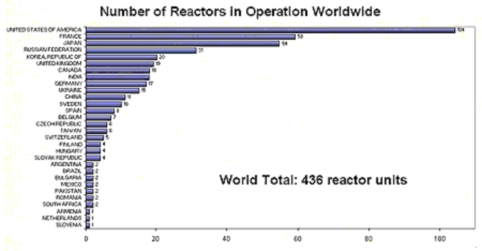

According

to the Nuclear Energy Institute (“NEI”), an independent industry organization,

nuclear power plants provide 15% of the world’s electricity and nearly 20% of

the electricity in the United States. As reported by the NEI, nuclear energy is

the United States’ largest source of emission-free electricity and second

largest source of power. At the present time, 436 nuclear power

plants operate in 31 countries. In the United States, 104 nuclear

power plants are in commercial service. On a global basis, the

collective installed-electric-net-capacity of nuclear power plants is 370

gigawatts, or GW.

2

Nuclear

Power Plants as of 2010-01-08

Number

of Reactors in Operation Worldwide

Another

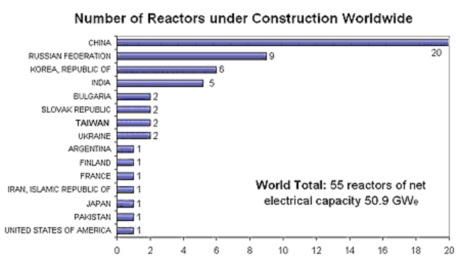

55 plants, with an installed capacity of 51 GW, are under construction in 15

different countries. In addition, on a worldwide basis, 500 plants

are either planned, proposed or under consideration.

3

Number

of Reactors under Construction Worldwide

The last

two power plants built in the United States were the Watts Bar plant, which

began construction in 1973, was completed in 1990, and did not begin commercial

operation until 1996, and the River Bend plant, which was built in 1977 and went

online in 1986. Recently, President Obama announced that his

administration has approved an $8.3 billion loan guarantee to build the first

domestic nuclear power plant at the Southern the Company’s Georgia site in three

decades. The loan guarantee for the new project is to be taken out of

the $54 billion President Obama set aside for nuclear loan guarantees in his

2010 budget, which leaves $46 billion more to be allocated to other nuclear

projects. On February 16, 2010, President Obama said, “… this one

plant will cut carbon pollution by 16 million tons each year when compared to a

similar coal plant. That’s like taking 3.5 million cars off the

road.”

We

believe nuclear energy represents the most “eco-efficient” of all energy sources

because it produces the most electricity in relation to its minimal

environmental impact. In addition, nuclear power plants do not emit

harmful gases, require a relatively small area, do not deplete natural resources

(such as fossil fuels), and effectively mitigate other impacts. As a

result, they cause no adverse effects to water, land, habitat, species or air

resources, rather they improve the habitat per independent

studies).

Additionally, nuclear

power has the lowest production cost and highest capacity factor of the major

sources of electricity. Nuclear is a chief contributor to national

energy security and is not subject to unreliable weather or climate conditions,

unpredictable cost fluctuations, or dependence on foreign

suppliers. Adding to their reliability, nuclear power plants are

designed to operate continuously for long periods of time. They can

run from approximately 540 to 730 days at over 90% reliability before they are

shut down for refueling.

Overall,

worldwide demand for energy is projected to increase 44% between 2006 and 2030,

and as a result there is a renewed interest in nuclear power. A

recent Zogby poll finds 67% of Americans in favor of building new nuclear power

plants and prefer this form of power generation to the presence of coal, natural

gas or oil plants in their communities. NEI polls have found that 84%

of Americans live in close proximity to nuclear power plants favor nuclear

energy, and 90% positively view the plants.

4

We

believe that nuclear power has economic benefits. Economic impact studies show

that construction of a new reactor creates four to five years of jobs for as

many as 5,000 workers, of which 1,000 to 1,500 are direct and indirect permanent

jobs per unit once the plant begins operating. Salaries in the

nuclear industry average about $80,000 per person. Most positions

require only a high school education and some specialized

training. Each plant (unit) creates well over $2.0 billion in gross

domestic product to the local area during construction and over $1.0 billion to

the annual state gross domestic product during operations. In

addition, communities have found that the construction and operation of plants

also improve schools, police and fire services, and medical

facilities.

We

believe that nuclear power is also safe. In the event of an imbalance

in the operations, the sophisticated safety systems of domestic nuclear power

plants are designed to automatically shut down, well before any safety margins

are exceeded. Unscheduled automatic plant shutdowns rarely

occur. Over the years, various improvements in plant maintenance and

training programs have decreased the number of automatic plant shutdowns,

enabling plants to achieve longer continuous runs. Nuclear plants typically

produce power more than 90% of the time, and in August 2007 they posted a 98%

capacity factor, according to the NEI.

The

industry has also undertaken many measures to improve the security of nuclear

power facilities. After the tragic terrorist attack of

September 11, 2001, security forces at U.S. nuclear plants have increased

by one-third, to approximately 8,000 officers. Other incremental

security measures include: extending and fortifying security

perimeters; increasing patrols within security zones; installing new barriers to

protect against vehicle

bombs; installing additional high-tech surveillance

equipment, and strengthening coordination of security efforts with local, state

and federal agencies to integrate their approaches and

responses. Furthermore, the NRC evaluates “force-on-force” drills

between security personnel and contractor teams. Every domestic plant is tested

with mock adversary drills every three years.

Economic

Viability

We

believe that the potential profit for nuclear reactors is

considerable. Based on third-party data provided by globally

recognized experts Constellation Energy and UniStar, each reactor is capable of

annually generating positive earnings before interest, taxes, depreciation and

amortization (“EBITDA”),

assuming no growth. Based on information from

the McKinsey Global Institute and Synapse Energy Economics, carbon credits could

be as much as double the EBITDA for each reactor (thus,

exceeding $2.2 billion annually). Carbon credits produced

by nuclear reactors are over $250 million for a plant this size

today. In addition, more stringent emissions regulations on fossil

fuel plants anticipated to become effective in 2012 in the United States, Europe

and elsewhere may substantially increase EBITDA for each reactor.

Company

Overview

The

Company consists of 4 corporate entities: International Reactors,

Inc., Reactor Land Development, LLC, Energy Neutral, Inc. and Idaho Energy

Complex, Inc.

International

Reactors, Inc.

International

Reactors, a 100% wholly-owned subsidiary of the Company was formed to assist

developing countries with power generation, as well as the production of potable

water. Founded in November 2007 and incorporated in Nevada,

International Reactors seeks to construct commercial nuclear reactors on

oceanfront sites, particularly in Latin America and western-friendly Middle

Eastern countries to co-generate clean energy and desalinate

water. International Reactors believes that advanced nuclear

technology can be used to address electrical energy needs while simultaneously

producing fresh water from ocean intake. The Company is working on an

agreement to produce desalinization reactors in China to market on a worldwide

basis.

5

Idaho

Energy Complex, Inc.

Idaho

Energy, an Idaho corporation and 100% wholly-owned subsidiary of the Company

that was formed in March 2007, is a proposed $10 billion nuclear complex near

Payette, Idaho. Idaho Energy is the manager of Reactor Land, a

Delaware limited liability company that is attempting to obtain permits for the

nuclear facility. Five thousand acres have been dedicated to the

Project, which will provide enough electricity to power Idaho’s growth, as well

as generate income through the sale of power to out-of-state

markets. A secondary site near Hammett, Idaho is also being

considered. The Payette facility will feature a new advanced nuclear

reactor design that does not require large amounts of water for

cooling. Additionally, a plant in Elmore, Idaho will use its excess

heat to produce bio fuels such as ethanol, thereby further reducing its cooling

requirements and providing local farmers with a potential market for their crops

and agricultural waste. The Company plans to build up to six advanced

reactors at Idaho Energy and operate as an Independent Power Production

(“IPP”). The Company has no contracts or made any arrangements for

bio fuel as of the date of this annual report.

Reactor

Land Development, LLC

Reactor

Land, a 99% owned subsidiary of Idaho Energy, is a Delaware limited liability

company. Reactor Land began operations in September 2007, with Idaho

Energy as its manager. Its purpose is to acquire land and water

rights, permits and licenses, development rights and such other properties and

services necessary to develop approved sites in Idaho for one or more nuclear

reactors.

Energy

Neutral, Inc.

Energy

Neutral, a 100% wholly-owned subsidiary of the Company, assists homeowners,

businesses and farmers to operate with minimal or no reliance on the electrical

grid. Energy Neutral’s primary services are: evaluating

homes, businesses and farms for conservation and renewable energy potential;

drafting plans to attain or approach energy neutrality; and working with wind,

conservation and solar suppliers and installers to install products in the

marketplace. Strong demand is anticipated from farmers who must spend large

amounts of money to pump water. Solar and wind energy may be utilized

to make the pumps completely self-sufficient or, for greater reliability, to

augment existing electrical grid or gasoline infrastructure. In

addition, a model home was recently completed in Boise, Idaho to demonstrate a

next-generation “energy neutral” living experience.

According

to the U.S. Energy Information Agency, domestic energy consumption is expected

to increase 30% between 2005 and 2030. In Idaho, which is the site of

the Company’s energy complex, the demand for energy is clear. In the

fall of 2007, two major corporations stated that they could no longer consider

Boise, Idaho as a possible relocation site because the existing utility

infrastructure could not supply sufficient power. At the same time, Idaho ranks

last among the 11 Western states for the number of megawatts it plans to bring

on-line between 2007 and 2011, according to U.S. Energy Information

Administration figures.

The

January 2007 Idaho Energy Plan, which was developed by the Interim Committee on

Energy, Environment and Technology of the Senate and House of Idaho to

investigate the state's energy systems, develop recommendations to achieve

reliable, low-cost energy supply, protect the environment, and promoting

economic growth, states that Idaho is vulnerable to the economic effects of

emissions regulation on the current imported coal power and relicensing of the

state’s hydro plants. The January 2007 Idaho Energy Plan also

notes that Idaho imports 80% of its power from fossil fuel sources and that the

over than $3 billion that Idaho residents spend on energy each year leaves the

state. In all, the proposed Idaho Energy Complex is estimated to

create enough power for about 1.5 million homes, or three times the number of

existing homes in Idaho. The excess power will be sold to the

marketplace, primarily on the West Coast.

6

The

Nuclear Provisions H.R. 6 Energy Policy Act of 2005 has created an ideal market

atmosphere for the development of new plants. The bill provides an

80%/20% loan guarantee for technologies that avoid, reduce or sequester air

emissions, including advanced nuclear plants. Additionally, the

energy bill approved provisions supported by the current administration to

provide 100% of the cost of delays (when delays are beyond the industry’s

control) during construction and at the commencement of

operations. The Company plans to take advantage of prevailing

political sentiment and actively pursues federal loan guarantees for the Idaho

Energy Complex. In his 2010 budget, President Obama set aside $54

billion as nuclear project loan guarantees, but only $8.3 billion of these

guarantees have so far been accessed. Idaho Energy’s management

intends to apply for the maximum amount of guarantees that are available to the

Company under this program.

The

Project - Phase 1

After

three decades, nuclear power is re-emerging as a necessary component of a

well-balanced power generation portfolio. Demand for nuclear plant

sites is growing. Stringent NRC criteria limit the number of

qualified reactor sites. Fourteen companies, including the Company,

have notified the NRC of their intent to file for construction and operating

licenses (“COL”) for 34 new units by the third quarter of 2011. All

the proposed sites, except the Company’s Idaho site and one in Utah, are east of

the Rocky Mountains. We believe the value of attractive sites,

particularly in the Western United States, is expected to rise because of the

following factors:

|

|

·

|

nuclear

generation is very profitable;

|

|

|

·

|

global

experience has reduced construction and operating

costs;

|

|

|

·

|

costs

of electricity from competitive fossil generation plants are rapidly

rising due to emissions problems and market

forces;

|

|

|

·

|

coal

power plants are no longer a viable option due to global warming

concerns;

|

|

|

·

|

hydroelectric

power is in decline as plant relicensing becomes more difficult because of

environmental challenges;

|

|

|

·

|

deregulation

of wholesale electric pricing is expected to enable independently-owned

nuclear plants to realize the full economic advantage of low cost nuclear

power;

|

|

|

·

|

nuclear

generation has gained public

acceptance;

|

|

|

·

|

nuclear

generation has demonstrated that it is a safe, reliable form of

electricity generation a worldwide;

|

|

|

·

|

the

federal government supports nuclear deployment through regulatory changes

and tax benefits;

|

7

|

|

·

|

there

are a limited number of sites that meet licensing and economic criteria

for a nuclear plant;

|

|

|

·

|

licensing

criteria involves low population density, low impact seismic potential

activity and low environmental impact;

and

|

|

|

·

|

economic/infrastructure:

water availability, and ability to serve major markets through existing

transmission, with low construction costs,

etc.

|

The

Site

After a

three-year search, the Company has, through Idaho Energy, located a primary site

(the “Site”) in Payette, Idaho that will cost approximately $15.0 million,

including the acquisition of water rights. This location is well

suited for the licensing, construction and development of a nuclear power

reactor. The Company, through Idaho Energy, has entered into and

executed an agreement to complete the purchase of the site. The

agreement is renewable every 12 months by the parties until the land is approved

for a nuclear plant, at which time the Company will ultimately purchase the

location. In the unlikely event that an approval is not received,

Idaho Energy is not obligated to purchase the land. The features of

the site include:

|

|

·

|

about

5,000 acres near Payette, Idaho near the Payette

River;

|

|

|

·

|

located

near, and has ample rights to, a source of

water;

|

|

|

·

|

a

rural community that is very receptive to the development of a nuclear

power plant;

|

|

|

·

|

ability

to be connected to high voltage transmission lines and the western power

grid;

|

|

|

·

|

NRC

licensable according to the preliminary findings of nuclear siting

experts, and a likely final favorable report for the land acquisition

closing; and

|

|

|

·

|

spacious

enough to accommodate multiple

reactors.

|

The site

for this Project has passed preliminary evaluations by ENERCON, an engineering

firm that grants pre-approval of nuclear plant sites and assists with filing the

NRC application. Idaho Energy’s comprehensive plan change application

was approved in the fourth quarter of 2009 by Payette County planning and zoning

officials. Approval from the NRC is necessary, and combined with the

federal process, will take an estimated three to five years before construction

of the plant commences.

The

Site Development Plan

Converting

approximately 5,000 acres of Idaho farmland into a licensed nuclear reactor site

is a major undertaking. Idaho Energy has commenced the preparatory

stages of the Nuclear Regulatory Commission (NRC) process, which entails local

approval, land and water contacts, and preliminary land evaluations, among other

things, prior to applying for a combined COL for a reactor at the

Site.

Nuclear

Plant Construction Project (Phase 2)

The

Company intends to use a nuclear reactor design that is a Generation 3 Korean

APR 1400 dual unit 2800 MW Light Water Reactor. It contains a hybrid

cooling system that requires minimal amounts of water for

cooling. Management believes that the Generation 3 plant design will

be safe, reliable and economical to build and operate. It is

estimated to produce power for $.02 to $.05 cents per kilowatt-hour, and will be

among the first commercial versions in the Western United

States.

8

Land

Purchase Agreement

There is

an agreement between the Company and the current site owner for the

purchase of the land (the “Land Purchase Agreement”) and a draft agreement for

the water rights and additional land, which is expected to be executed as a

final water rights agreement by the end of March 2010. Once

completed, the agreement will transfer title to Idaho Energy upon constructive

receipt of an approximately $5.0 million cash payment for the land plus $10.0

million for additional land with water rights. The Company

anticipates financing the site acquisition with proceeds from an

offering. The Land Purchase Agreement is subject to satisfactory

completion of the site analysis by ENERCON, and will not be completed until the

land has been fully approved for nuclear plant construction.

Construction

and Operating License Application (“COLA”) and Water Rights

Management

intends to obtain a conditional use permit from Payette County and the COLA from

the Nuclear Regulatory Commission for the site by using either the

services of ENERCON or the reactor supplier. ENERCON has already been conducting

NRC pre-COLA application activities at the site, including the preliminary site

study. A $2.0 million payment will start the

COLA. Furthermore, the Company has obtained a quote of $10.0 million

for additional land with water rights.

Competition

Competition

is intense in the energy market, with the two major sources of power generation

being nuclear and fossil fuel. While nuclear power has high initial

capital costs, it has the lowest production cost and highest capacity factor of

the major sources of electricity, with a production cost of $0.0172 per kilowatt

hour (kWh). According to national data from 2008, without carbon tax

and emission reduction, coal has a production cost of $0.0275/kWh, natural gas

of $0.081 cents/kWh, and petroleum of $0.098 cents/kWh. However,

natural gas, petroleum and coal prices have increased recently due to the rising

prices of fossil fuel and are subject to market price swings.

The

following table, recently developed by the NEI, compares total production costs,

operations and maintenance costs, and fuel costs for generating electricity

among four energy sources: coal, natural gas nuclear and

petroleum. Note that as energy prices have risen, nuclear energy has

become increasingly cost effective in relation to the other

sources.

9

U.S.

Electricity Production Costs and Components

1995 -

2008, in 2008 cents per kWh

|

Total Production Costs

|

Operations & Maintenance Costs

|

Fuel Costs

|

||||||||||||||||||||||||||||||||||||||

|

Year

|

Coal

|

Gas

|

Nuclear

|

Petroleum

|

Coal

|

Gas

|

Nuclear

|

Petroleum

|

Coal

|

Gas

|

||||||||||||||||||||||||||||||

|

1995

|

2.57 | 3.74 | 2.70 | 5.85 | 0.61 | 0.71 | 1.89 | 1.64 | 1.96 | 3.03 | ||||||||||||||||||||||||||||||

|

1996

|

2.42 | 4.57 | 2.53 | 5.95 | 0.54 | 0.70 | 1.80 | 1.36 | 1.88 | 3.87 | ||||||||||||||||||||||||||||||

|

1997

|

2.34 | 4.64 | 2.64 | 5.35 | 0.52 | 0.67 | 1.93 | 1.16 | 1.81 | 3.96 | ||||||||||||||||||||||||||||||

|

1998

|

2.29 | 4.08 | 2.46 | 3.76 | 0.55 | 0.61 | 1.76 | 0.73 | 1.74 | 3.47 | ||||||||||||||||||||||||||||||

|

1999

|

2.21 | 4.39 | 2.22 | 4.52 | 0.52 | 0.51 | 1.58 | 1.03 | 1.68 | 3.88 | ||||||||||||||||||||||||||||||

|

2000

|

2.15 | 7.28 | 2.17 | 6.51 | 0.52 | 0.57 | 1.57 | 0.81 | 1.63 | 6.70 | ||||||||||||||||||||||||||||||

|

2001

|

2.21 | 7.36 | 2.05 | 6.02 | 0.55 | 0.64 | 1.49 | 0.83 | 1.66 | 6.72 | ||||||||||||||||||||||||||||||

|

2002

|

2.19 | 4.70 | 2.03 | 5.76 | 0.56 | 0.66 | 1.50 | 0.93 | 1.63 | 4.05 | ||||||||||||||||||||||||||||||

|

2003

|

2.16 | 6.42 | 1.99 | 6.88 | 0.55 | 0.67 | 1.45 | 1.10 | 1.61 | 5.75 | ||||||||||||||||||||||||||||||

|

2004

|

2.24 | 6.42 | 1.95 | 6.54 | 0.57 | 0.56 | 1.42 | 0.99 | 1.67 | 5.87 | ||||||||||||||||||||||||||||||

|

2005

|

2.43 | 8.00 | 1.87 | 8.96 | 0.57 | 0.53 | 1.38 | 0.97 | 1.86 | 7.47 | ||||||||||||||||||||||||||||||

|

2006

|

2.53 | 6.95 | 1.89 | 10.28 | 0.59 | 0.54 | 1.39 | 1.32 | 1.94 | 6.41 | ||||||||||||||||||||||||||||||

|

2007

|

2.57 | 6.69 | 1.85 | 10.83 | 0.60 | 0.50 | 1.36 | 1.47 | 1.97 | 6.19 | ||||||||||||||||||||||||||||||

|

2008

|

2.75 | 8.09 | 1.87 | 17.26 | 0.55 | 0.55 | 1.37 | 1.69 | 2.20 | 7.54 | ||||||||||||||||||||||||||||||

Secondary

energy sources in the United States include hydro (water), wind (which only

produces 1% and has low reliability), and solar power, with the following

production costs:

|

|

•

|

Hydro: $0.0175/kWh

|

|

|

•

|

Wind: $0.145/kWh

|

|

•

|

Solar: $0.23/kWh

|

These

secondary energy suppliers are minor in scope and are significantly more limited

in their operational efficiency, averaging approximately at 25% capacity. While

wind and solar are expanding, they are not suitable base-load-plants that

requires higher level of reliability because they do not stay connected to the

grids. Coal and hydro have limited expansion ability due to new

environmental concerns. Natural gas produces 60% of the carbon

dioxide as the same size coal plant and the current costs are over 10 cents

kWh. Nuclear energy has been endorsed by the United Nations’ study on

global warming and the G-8 leadership.

With the

continually rising demand for cost-effective energy sources in the United

States, the Company anticipates minimal difficulties from its competition as it

works toward the goal of constructing a new nuclear plant. The

Federal incentives mentioned above are intended to reduce the inherently greater

capital costs of nuclear power.

In

addition, Energy Neutral has no competition for its initial focus area of Boise,

Idaho. There are few companies providing services to reduce energy

demand for homes and offices using renewable tools and technology in the United

States.

10

Financings

and Costs

The

Company will develop or acquire businesses to help address domestic energy needs

while trying to improve air quality and mitigate global warming. The

Company intends to undertake stock offerings in the form of public and private

placements to raise sufficient funds to capitalize its four individual

companies. Each subsidiary of the Company will further develop its

own business strategies and self-sustaining operations and, in turn, upstream

profits to the Company in exchange for capital and energy leadership

expertise.

The

Company estimates the cost of operation for its four corporate subsidiaries will

be approximately $750,000 per year. International Reactors is

presently working to market desalinization reactors in Mexico, South America,

the Middle East and Asia. The first desalinization reactor is being

designed and built in China, where the first customers should be able to sign

contracts this summer. The Company is providing funds of

approximately $25,000 per month to this project.

The

Company plans to raise $81.0 million through a private placement for the initial

development of the Idaho Energy Complex. The funds will be used to

purchase land that is under contract and water rights, and to complete the NRC

approval process. At the time of this annual report, $1.0 million has

been raised through the sale of a unit of Reactor Land. Management

believes that local plant site approval will allow the Company to raise

sufficient additional funds.

The

Company is negotiating power purchase agreements and equity ownership stakes

with several major utilities to finance reactor construction

costs. Further, the Company has executed a construction loan letter

for up to $3.5 billion as a result of the loan guarantee provision of the 2005

Energy Act. Mr. Don Gillispie, the Company’s President and Chief

Executive Officer, has invested $500,000, a considerable amount of personal

funds, to seed the start-up and rollout of the Company’s

businesses.

Corporate

History

The

Company was incorporated in the State of Nevada on July 31, 2001, commenced

operations in August 2005 and is a development stage

enterprise. Subsequently, Sunbelt Energy Resources, Inc. was formed

on August 29, 2005 to operate in the alternate energy

industry. Sunbelt has experienced limited operational

activity. In September 2006, Sunbelt acquired Nussential Holdings,

Inc. by exchanging 17,900,000 shares of Sunbelt for 100% or 21,399,998 shares of

the common stock of Nussential Holdings. As a result of the

acquisition, the shareholders of Sunbelt owned a majority of the voting stock of

Nussentials Holdings, and Sunbelt changed its name to Alternate Energy Holdings,

Inc. The transaction was accounted for as a reverse

merger, whereby Alternate Energy Holdings, Inc. was the

acquirer, which resulted in the recapitalization of Alternate Energy Holdings,

Inc. Simultaneously with the reverse merger, Nussentials

Corporation, a wholly-owned subsidiary of Nussentials Holdings, Inc.,

was transferred to Nussential Holdings, Inc. through issuance of

4,252,088 shares of common stock.

11

Government

Regulation

The

Company is subject to risks associated with governmental regulations and legal

uncertainties. The Company is directly or indirectly, regulated by

several authorities, including the Nuclear Regulatory Commission, Environmental

Protection Agency, Idaho Department of Fish and Game, Idaho Department of

Environmental Quality, Idaho Department of Water Resources and, as a public

company, the Securities and Exchange Commission.

The

Atomic Energy Act of 1954, as amended, is the primary United States law on both

the civilian and the military use of nuclear materials. On the

civilian side, it provides for both the development and regulation of the uses

of nuclear materials and facilities in the United States based on the policy

that “the development, use, and control of atomic energy shall be directed so as

to promote world peace, improve the general welfare, increase the standard of

living, and strengthen free competition in private

enterprise.” The Atomic Energy Act requires civilian uses of

nuclear materials and facilities to be licensed, and empowers the Nuclear

Regulatory Commission (“NRC”) to establish by rule or order, and to enforce,

such standards to govern these uses as “the Commission may deem necessary or

desirable in order to protect health and safety and minimize danger to life or

property.” Commission action under the Atomic Energy Act must conform to the

Atomic Energy Act’s procedural requirements, which include an opportunity for

hearings and Federal judicial review in many instances.

The

Environmental Protection Agency (“EPA”) was formed to protect human health and

safeguard the natural environment, such as air, water and land, upon which life

depends. The EPA’s purpose is to ensure that:

|

|

·

|

all

Americans are protected from significant risks to human health and the

environment in which they live, learn and

work;

|

|

|

·

|

national

efforts to reduce environmental risks are based on the best available

scientific information;

|

|

|

·

|

federal

laws protecting human health and the environment are enforced fairly and

effectively;

|

|

|

·

|

environmental

protection is an integral consideration in U.S. policies concerning

natural resources, human health, economic growth, energy, transportation,

agriculture, industry, and international trade, and that these factors are

similarly considered in establishing environmental

policy;

|

12

|

|

·

|

all

parts of society, such as communities, individuals, businesses, and state,

local and tribal governments, have access to accurate information

sufficient to effectively participate in managing human health and

environmental risks;

|

|

|

·

|

environmental

protection contributes to making our communities and ecosystems diverse,

sustainable and economically productive;

and

|

|

|

·

|

the

United States plays a leadership role in working with other nations to

protect the global environment.

|

The Idaho

Department of Fish and Game states that “All wildlife, including all wild

animals, wild birds, and fish, within the state of Idaho, is hereby declared to

be the property of the state of Idaho. It shall be preserved,

protected, perpetuated, and managed. It shall be only captured or

taken at such times or places, under such conditions, or by such means, or in

such manner, as will preserve, protect, and perpetuate such wildlife, and

provide for the citizens of this state and, as by law permitted to others,

continued supplies of such wildlife for hunting, fishing and

trapping.”

The Idaho

Department of Environmental Quality (“DEQ”) is a state department created by the

Idaho Environmental Protection and Health Act to ensure clean air, water and

land in the state and protect Idaho citizens from the adverse health impacts of

pollution. As a regulatory agency, DEQ enforces various State

environmental regulations and administers a number of Federal environmental

protection laws including the Clean Air Act, the Clean Water Act, and the

Resource Conservation and Recovery Act. DEQ manages a broad range of

activities including:

|

|

·

|

assessment

of environmental problems;

|

|

|

·

|

oversight

of facilities that generate air, water, and hazardous waste

pollution;

|

|

|

·

|

monitoring

of air and water quality;

|

|

|

·

|

cleanup

of contaminated sites; and

|

|

|

·

|

education,

outreach, and technical assistance to businesses, local government

agencies, and interested citizens.

|

DEQ is

committed to working in partnership with local communities, businesses, and

citizens to identify and implement cost-effective environmental

solutions.

The Idaho

Department of Water Resources serves the people of Idaho and protects their

welfare by making sure that water is conserved and available to sustain Idaho’s

economy, ecosystem and the resulting quality of life. The Department provides a

variety of services for the public, such as water rights research, historical

record reproduction of water rights, drillers’ reports, and dam safety

inspections.

Employees

The

Company and its subsidiaries have 15 full-time employees. In

addition, nine officers and directors provide certain services dedicated to

current corporate and business development activities. In the future,

the officers will devote services on a full-time basis and six independent

directors will serve part-time up to ten hours per week. The

Company’s future success will depend in part on our ability to attract, retain

and motivate highly qualified technical and management personnel for whom

competition is intense. The Company’s employees are not represented

by any collective bargaining unit and the Company believes that its relations

with employees and contractors are good.

13

Item

1A. Risk Factors

FORWARD-LOOKING

STATEMENTS

This

document includes forward-looking statements, including, without limitation,

statements relating to the Company’s plans, strategies, objectives,

expectations, intentions and adequacy of resources. These

forward-looking statements involve known and unknown risks, uncertainties, and

other factors that may cause the Company’s actual results, performance or

achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. These factors include, among others, the following:

ability of the Company to implement its business strategy; ability to

obtain additional financing; the Company’s limited operating history;

unknown liabilities associated with future acquisitions; ability to manage

growth; significant competition; ability to attract and retain talented

employees; future government regulations; and other factors described in this

annual report or in other filings with the Securities and Exchange

Commission. Except as required by federal securities laws, the

Company is under no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise.

General

Business Risk Factors

The

Company is a development stage business, with no revenue to date.

The

Company commenced its operations in August 2005, and is organized as a

corporation under the laws of the State of Nevada. The Company has

only a limited history upon which an evaluation of its prospects and future

performance can be made. The Company’s proposed operations are

subject to all business risks associated with new enterprises. The

likelihood of the Company’s success must be considered in light of the problems,

expenses, difficulties, complications and delays frequently encountered in

connection with the expansion of a business in a competitive industry, including

hiring and retaining skilled employees or contractors; licensing, permitting,

and operating problems; competing with established operators; and unanticipated

location issues or design/engineering problems with the

improvements. During the years ended December 31, 2009 and 2008,

the Company did not recognize any revenues from its operational

activities. It is likely that the Company will sustain more losses in

the future. There can be no assurance that the Company will ever

operate profitably.

The Company may not be able to

implement its expansion strategy as planned, or at all.

The

Company plans to grow our business by investing in new plants and pursuing other

business opportunities. Additional financing may be necessary to

implement these expansion strategies, which may not be accessible or available

on acceptable terms. Any expansion may be financed with additional

indebtedness or by issuing additional equity securities, which would further

dilute shareholders’ interests. In addition, as described below under

“the Company may be adversely affected by environmental, health and safety laws,

regulations and liabilities,” federal and state governmental requirements may

substantially increase our costs, which could have a material adverse effect on

our results of operations and financial position. Any expansion plans

may also result in other unanticipated adverse consequences, such as the

diversion of management’s attention from existing operations.

14

Construction

costs associated with expansion may also increase to levels that would make a

new site too expensive to complete or unprofitable to

operate. Contractors, engineering firms, construction firms and

equipment suppliers also receive requests and orders from other companies and,

therefore, it may become hard or impossible to secure their services or products

on a timely basis or on acceptable financial terms. We may suffer significant

delays or cost overruns as a result of a variety of factors, such as shortages

of workers or materials, transportation constraints, adverse weather, unforeseen

difficulties or labor issues, any of which could prevent commencement of

operations as expected at any new facilities.

The

Company’s success depends on its ability to retain key management

personnel.

Our

success depends in large part on our ability to attract and retain highly

qualified management, in particular upon our CEO, Donald Gillispie. Due to the

specialized nature of our business, it may be difficult to locate and hire

qualified personnel. The loss of services of one of our executive

officers or other key personnel, or our failure to attract and retain other

executive officers or key personnel could have a material adverse effect on our

business, operating results and financial condition. Although we have

been successful in planning for and retaining highly capable and qualified

successor management in the past, there can be no assurance that we will be able

to do so in the future.

The

Company depends upon outside contractors and advisors to supplement its

business.

To

supplement the business experience of its officers and directors, the Company

may be required to employ contractors, accountants, technical experts,

appraisers, attorneys, or other consultants or advisors. The Company’s

management, without any input from shareholders, will make the selection of any

such advisors. Furthermore, it is anticipated that such persons may be engaged

on an “as needed” basis without a continuing fiduciary or other obligation to

the Company. In the event the Company considers it necessary to hire outside

contractors or advisors, they may elect to hire persons who are affiliates, if

they are able to provide the required services.

There

are risks of borrowing by the Company.

If the

Company incurs indebtedness, a portion of its cash flow will have to be

dedicated to the payment of principal and interest on such indebtedness. Typical

loan agreements also might contain restrictive covenants, which may impair the

Company’s operating flexibility. Such loan agreements would also

provide for default under certain circumstances, such as failure to meet certain

financial covenants. A default under a loan agreement could result in

the loan becoming immediately due and payable and, if unpaid, a judgment in

favor of such lender whose rights would be senior to those of shareholders of

the Company. A judgment creditor would have the right to foreclose on

any of the Company’s assets resulting in a material adverse effect on the

Company’s business, operating results or financial condition.

There

are uncertainties with loans.

The

Company may need to obtain loans to fund any activities not funded by private

placement subscriptions. The ability of the Company to obtain future

financing, and the terms of such financing have not yet been

established. The Company does not have any loan commitments. Changes

in interest rates and other terms may also have adverse effect on the Company’s

business, operating results or financial condition.

Market

data may not always be reliable.

The

Company may have based the market data and certain other information in this

Form 10K on information supplied by governmental agencies, public announcements,

filings related to other developments and similar projects in the same area, and

other third party sources. The Company also relied on other sources believed to

be reliable. The Company has not independently verified any market

information, announcements or filings, which may not be accurate in all material

respects. Accordingly, investors should not rely on such data when

making investment decisions and should keep in mind that market conditions may

change at any time for a variety of reasons.

15

General

economic conditions materially impact the Company.

The

financial success of the Company may be sensitive to adverse changes in general

economic conditions in the United States and the Western United States, such as

recession, inflation, unemployment, and interest rates. Such changing conditions

could reduce demand in the marketplace for the development of nuclear sites

which is the Company’s business. Management believes that the site

developed by the Company will maintain value long-term. Nevertheless,

the Company has no control over these changes.

Real

estate markets are unpredictable.

Real

estate markets are unpredictable and subject to significant cycling

fluctuations. There is no assurance that a down time in the market will not

adversely affect the Company.

There

are many factors beyond the control of the Company.

Projects

for the acquisition and development of real estate are subject to many factors

which are outside the Company’s control. These factors include: general economic

conditions; proximities to utilities and transportation; shortages of labor and

materials and skilled craftsmen; price of materials and competitive products;

and the regulation by federal and state governmental authorities.

We

may need additional financing in the future, which may reduce the value of our

common stock.

The

Company has limited funds and such funds will not be adequate to carry out the

business plan without borrowing significant funds. The ultimate

success of the Company may depend upon its ability to raise additional capital

and securing substantially more financing. The Company has not

investigated the availability, source, or terms that might govern the

acquisition of additional capital and will not do so until it determines a need

for additional financing. If additional capital is needed, there is

no assurance that funds will be available from any source or can be obtained on

terms acceptable to the Company. If additional funds cannot be secured from

other sources, then the Company’s operations will be limited to those that can

be financed with its modest capital.

The

Company lacks revenue history.

The

Company was formed in 2006 for the purpose of developing a proposed nuclear bio

fuels complex in Idaho. The Company has never had any

revenues. The Company is not profitable and the business effort is

considered to be in an early development stage. The Company must be

regarded as a new or development venture with all of the unforeseen costs,

expenses, problems, risks and difficulties to which such ventures are

subject.

16

There

can be no assurance of success or profitability.

There is

no assurance that the Company will ever operate profitably. There is

no assurance that it will generate revenues or profits, or that the value of the

Company’s shares will be increased.

The

Company lacks diversification.

Because

of the limited financial resources that the Company has and due to the nature of

the Project, the Company will not be able to immediately diversify its

operation. The Company’s inability to immediately diversify its activities into

more than one area will subject the Company to economic fluctuations within the

nuclear industry and increases the risks associated with the Company’s

operations. The Company intends to diversify its operations to other

areas, including bio fuels and potable water production, but it cannot provide

any assurances that these activities will happen.

If

the Company borrows money using property as collateral, shareholders could lose

all of their investment, if the property were to be foreclosed.

The terms

of any loan may require payments to be made under the loan

document. Should the Company fail to satisfy the terms of any loan,

any property pledged to secure such loan may be at risk to foreclosure or other

similar process.

Specific

Risk Factors Related to Nuclear Plants

Management

expects that it is unlikely the Company will be the ultimate owner or operator

of any reactor to be built at any Site. The Company’s business plan

is to develop a site that will be suitable for the construction and operation of

a reactor, which will require $3-4 billion in investment, employment of hundreds

of skilled people, and an operating budget of hundreds of millions per

year. Management believes that it is likely that any reactor at the

Site will be owned and operated by a consortium or joint venture of nuclear

reactor suppliers and reactor customers (i.e., electric utilities), while the

Company participating as the site and project developers. Therefore,

management believes the business is not directly subject to the usual risks of

operating a nuclear reactor.

There

are, however, a number of risks specific to the business of developing a nuclear

site as follows:

Development

of the site is subject to many risk factors that are examined in the NRC

permitting process.

The

Company is subject to the general risks facing the nuclear

industry. Because the industry is closely regulated, the Company will

be required to obtain and comply with federal, state and local government

permits and approvals, particularly those from the Nuclear Regulatory Commission

(NRC). Any of these permits or approvals may be subject to denial,

revocation or modification under various circumstances. Failure to

obtain or comply with the conditions of permits or approvals may adversely

affect the business and subject it to penalties and other

sanctions. Although existing licenses are routinely renewed by the

NRC and state regulators, renewal could be denied or jeopardized by various

factors, including the following:

|

|

·

|

natural

disasters, such as earthquakes, floods, volcano eruption,

hurricanes;

|

|

|

·

|

wars,

insurrection, revolutions, acts of

terrorism;

|

|

|

·

|

inability

to obtain or comply with state and local

permits;

|

|

|

·

|

inadequate

multiple point access to the

Site;

|

17

|

|

·

|

inadequate

financial assurances to provide for end of life decommissioning and

decontamination of the Site;

|

|

|

·

|

inability

to obtain adequate connection to the transmission grid, which has economic

as well as safety implications;

|

|

|

·

|

inability

to assure adequate water supplies for steam and cooling because the

Company’s water rights could be lost because of government actions,

extreme drought conditions, or competing economic demands for the

supply;

|

|

|

·

|

environmental

objections; and

|

|

|

·

|

substantial

changes in Government Regulations due to changes in national government

(i.e., political risks).

|

Nuclear

property ownership and development is subject to substantial additional risks

over conventional development.

For

nuclear projects, the risk of conventional real property development is

heightened because the systems for processing approvals for nuclear development

project can be slow, bureaucratic, and not as well-developed or scheduled as

those for more conventional projects. There can be substantial

political influence asserted against nuclear development project approval

without the knowledge of who is behind the opposition. There is no effective

accountability to the process. Nuclear projects are also subject to

compliance with international safety and nuclear non-proliferation

regimes.

Unforeseen

technical or environmental factors could preclude use of the site for power

generation.

There is

a risk that in the licensing process, further investigation and analysis could

discover facts that would preclude development of the Site as planned such as

unknown and unfavorable geological conditions on Site or endangered species

habitat.

Risk

of unforeseen changes in state or local law or government policy, such as a ban

on nuclear or power plant construction.

Development

investments always carry regulatory risk. Local governments can adopt capricious

and arbitrary and expensive rules for which there is no effective appeal or

remedy which can make a development impractical or unprofitable. The Project

will proceed only if state and local governments issue necessary

permits. Management believes these permits can be obtained, but

existing laws and permit standards may change, and necessary permits may not be

available. There can be political instability that causes projects in

design or development to become unfeasible, or that make the local unattractive

to would be purchasers. For example, local governments could place restrictive

conditions on the Site in permits; impose substantial new taxes or development

fees; or introduce a moratorium on buildings or developments.

18

Delays

attributable to special interest interveners in licensing

proceedings.

In the

1970’s and 1980’s, special interest groups opposed to nuclear plant construction

intervened in federal and state licensing proceedings. They were

sometimes joined by community groups, state and local governmental

agencies. While these opponents were rarely successful on the merits,

the interventions produced delays and regulatory changes that adversely affected

the economics of capital-intensive nuclear construction and led to the

cancellation of several projects. Management is already proactively engaged with

government and interest groups in Idaho to manage this risk.

Delays

attributable to queuing at the NRC with other applications ahead of Idaho Energy

in the licensing process.

The NRC

has had virtually no new reactor licensing activity in the last 25

years. Now there are proposals for as many as 30 to 35 new

reactors. If these are all filed in the next 3 to 5 years, the NRC

may be overwhelmed. Meritorious applicants may have to wait their

turn, with potential adverse impacts on schedule and Project

economics.

Inability

to raise equity capital sufficient to take the project through the licensing

process.

Management

estimates that that cost of obtaining licenses and permits needed for the

Project will total $50.0 million. Delays and unforeseen technical issues could

raise the cost of that process, and additional capital may be required to

complete it. The additional investment and the delay would reduce

investor returns even if all needed permits are eventually issued.

Inability

to acquire materials and technical and professional help.

The NRC

licensing process is highly technical, and a number of reactors will be applying

for licenses in the next three years. Experienced nuclear talent has

become relatively scarce in the United States and the Company may be competing

with huge companies and utilities to get the talent it needs to get its reactor

licensed and built. Also, the domestic nuclear infrastructure has

declined in the last two decades and the talent pool is reduced and certain

long-lead components may be expensive or difficult to obtain on

schedule.

A

nuclear incident anywhere in the world could revive nuclear plant

opponents.

While

there is a global renaissance underway for nuclear energy, its current popular

support could evaporate quickly. It has been 30 years since the Three

Mile Island accident and 20 years since Chernobyl. These events are

gone from the memory of most citizens, but a new incident could reawaken old

fears and raise public opposition. Public opposition could lead to

political opposition and failure of regulatory agencies to grant necessary

permits and licenses.

The

federal government could fail to fulfill its obligation to manage spent fuel at

yucca mountain or elsewhere.

Virtually

all nuclear plants currently store spent fuel at the reactor site. By law, all

spent fuel in the US is the property of the United States

government. After a number of years, it is expected that the spent

fuel, will be transported by the government to the Yucca Mountain long-term

geological depository, or to a reprocessing facility. If the United

States Government fails to fulfill its obligations, uncertainty about spent fuel

management could delay start up of the plant, premature closure, or alternative

plans for on-site storage.

19

Competitive

sites or generation sources could offer electric utilities lower prices, or

regulatory policy could force utilities to buy power from favored alternative

energy sources, regardless of their economics.

Management

believes that the chosen reactor design will be very competitive in a free

market where its competitors are fossil- or renewable-fueled State regulators

may force utilities to buy from renewable or other favored technologies,

locations, or sources, regardless of cost, and to the detriment of the

Project.

There are

alternative sites in the region that could be developed for nuclear

reactors. However, with demand for electric power growing in the

west, the competition is to secure the scarce good sites, and the Company has

secured a good Site. Management believes that the Company’s proposed

property is geologically and demographically well located. However, there is the

possibility that other sites will be developed for nuclear or coal

plants. If, there should be growth of competitive nuclear plants in

the West, margins will drop for the Project. However, all the new

plants that are planned will be needed to provide reliable power for the western

US in the decades to come. Likewise, these competitors could be

better capitalized than the Company, which could give them a significant

advantage with respect to bringing low cost low emission plants on line

sooner.

Competing

development projects could saturate the market and thereby diminish the resale

value of the Company’s land. As of March 31, 2010, the Company does

not expect significant competition from other generation site development

projects. In the future, however, the Company will have no control

over other competitive projects, if such develop.

Weather

interruptions also impact the Company’s business.

Activities

of the Company may be subject to periodic interruptions due to weather

conditions. Weather-imposed restrictions during certain times of the

year on roads accessing properties could adversely affect the ability of the

Company to develop such properties or could increase the costs of construction

because of delays.

Specific

Risks Related to Idaho Energy and to The Biofuel Industry

Competition

from other sources of fuel may adversely affect Idaho Energy’s ability to market

biofuel.

Although

the price of fuel has increased over the last several years and continues to

rise, fuel prices per gallon remain at levels below or equal to the price of

biofuel. In addition, other more cost-efficient domestic alternative fuels may

be developed and displace bio fuel as an environmentally-friendly alternative to

petroleum-based products. If fuel prices do not continue to increase

or a new fuel is developed to compete with bio fuel, it may be difficult to

market bio fuel, which could result in the loss of revenues.

Idaho

Energy’s business in biofuels will be sensitive to feedstock prices, which could

increase production costs and decrease revenues

The

principal raw materials used in the production of bio fuel are commodities that

are subject to substantial price variations due to factors beyond our

control. Commodity prices are determined from minute to minute based

on supply and demand and can be highly volatile. As more producers

enter the bio fuel business, competition for available feedstock supplies is

expected to increase. There can be no assurances that our hedging

activities will effectively insulate us from future commodity price volatility

or that the value of the feedstock we use will not exceed the value of the

electricity we generate. In the event that we are unable to pass

increases in the price of raw materials to our customers, our operating results

will suffer. We cannot predict the future price of our bio fuel

feedstock and any material price increases will adversely affect Idaho Energy’s

operating performance.

20

Reliance

upon third parties for raw material supply may hinder Idaho Energy’s ability to

profitably produce biofuel.

In

addition to being dependent upon the availability and price of feedstock supply,

Idaho Energy will be dependent on relationships with third parties, including

feedstock suppliers. Momentum must be successful in establishing

feedstock agreements with third parties. Assuming that Idaho Energy

can formalize feedstock purchase contracts, those suppliers could still

interrupt Idaho Energy’s supply by not meeting their obligations under the

contracts. If, because of market conditions, Idaho Energy is forced into a

competitive environment or procurement of raw soy oil, animal fats and other

feedstock or Idaho Energy is unable to obtain adequate quantities of feedstock

at economical prices, Idaho Energy’s business model could be unsustainable

resulting in a significant reduction in the results of operations.

Automobile

manufacturers and other industry groups have expressed reservations regarding

the use of biofuel, which could affect Idaho Energy’s ability to market its

biofuel.

Because

it is a relatively new product, the research of bio fuel use in automobiles and

its effect on the environment is ongoing. Some industry groups and

standards, including the World Wide Fuel Charter, have recommended that blends

of no more than 5% bio fuel be used for automobile fuel due to concerns about

fuel quality, engine performance problems and possible detrimental effects of

biodiesel on rubber components and other parts of the

engine. Although some manufacturers have encouraged the use of

biodiesel fuel in their vehicles, cautionary pronouncements by others may affect

Idaho Energy’s ability to market its product. In addition, studies have shown

that nitrogen oxide emissions from pure biodiesel increase by

10%. Nitrogen oxide is the chief contributor to ozone or smog. New

engine technology is available and is being implemented to eliminate this

problem. However, these emissions may decrease the appeal of our product to

environmental groups and agencies who have been historic supporters of the bio

fuels industry.

There