Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the fiscal year ended December 31, 2009 |

|

|

|

|

|

OR |

||

|

|

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ________ to ________ |

||

Commission file number: 001-33894

|

|

|

MIDWAY GOLD CORP. |

|

(Exact Name of Registrant as Specified in its Charter) |

|

|

|

|

|

British Columbia |

|

98-0459178 |

|

|

||

|

(State of other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

Unit 1 – 15782 Marine Drive |

|

V4B 1E6 |

|

|

||

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

|

(604) 536-2711 |

|

(Registrant’s Telephone Number, including Area Code) |

|

|

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: |

|

|

|

|

|

|

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

|

|

||

|

|

Common Stock, No Par Value |

|

NYSE Amex |

|

|

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: Not Applicable |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No o |

|

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes oNo o |

|

|

|

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No o |

|

|

|

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o |

|

|

|

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “Accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

|

|

|

|

|

|

Large Accelerated Filer o |

Accelerated Filer o |

Non-Accelerated Filer x |

Smaller Reporting Company _ o |

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x |

|

|

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: As of June 30, 2009, the aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant was US$46.9 million based upon the closing sale price of the common stock as reported by the NYSE Amex on June 30, 2009. |

|

|

|

The number of shares of the Registrant’s Common Stock outstanding as of March 26, 2010 was 77,354,997 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2010 Annual Meeting of Shareholders are incorporated by reference to Part III of this Annual Report on Form 10-K.

|

|

|

|

|

TABLE OF CONTENTS |

||

|

|

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 |

|

|

|

|

|

|

PRELIMINARY NOTES |

2 |

|

|

|

|

|

|

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES .. |

4 |

|

|

|

|

|

|

GLOSSARY OF MINING TERMS |

5 |

|

|

|

|

|

|

PART I |

|

9 |

|

|

|

|

|

ITEM 1. |

DESCRIPTION OF BUSINESS |

9 |

|

|

|

|

|

ITEM 1A. |

RISK FACTORS AND UNCERTAINTIES |

14 |

|

|

|

|

|

ITEM 2. |

DESCRIPTION OF PROPERTIES |

23 |

|

|

|

|

|

ITEM 3. |

LEGAL PROCEEDINGS |

44 |

|

|

|

|

|

ITEM 4. |

[RESERVED] |

45 |

|

|

|

|

|

PART II |

|

45 |

|

|

|

|

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

|

|

|

|

|

ITEM 6. |

SELECTED FINANCIAL DATA |

51 |

|

|

|

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS |

|

|

|

|

|

|

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

61 |

|

|

|

|

|

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

62 |

|

|

|

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING |

AND |

|

|

|

|

|

FINANCIAL DISCLOSURE |

62 |

|

|

|

|

|

|

ITEM 9A. |

CONTROLS AND PROCEDURES |

62 |

|

|

|

|

|

ITEM 9B. |

OTHER INFORMATION |

63 |

|

|

|

|

|

PART III |

|

64 |

|

|

|

|

|

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

64 |

|

|

|

|

|

ITEM 11. |

EXECUTIVE COMPENSATION |

64 |

|

|

|

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT RELATED STOCKHOLDER MATTERS |

|

|

|

|

|

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

64 |

|

|

|

|

|

|

|

|

|

ITEM 14. |

PRINCIPAL ACCOUNTING FEES AND SERVICES |

64 |

|

|

|

|

|

PART IV |

|

64 |

|

|

|

|

|

ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

64 |

|

|

|

|

|

SIGNATURES |

68 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

|

|

|

|

|

|

• |

our expected plans of operation to continue as a going concern; |

|

|

|

|

|

|

• |

the establishment and estimates of mineral reserves and resources; |

|

|

|

|

|

|

• |

the grade of mineral reserves and resources; |

|

|

|

|

|

|

• |

anticipated expenditures and costs in our operations; |

|

|

|

|

|

|

• |

planned exploration activities and the anticipated outcome of such exploration activities; |

|

|

|

|

|

|

• |

plans and anticipated timing for obtaining permits and licenses for our properties; |

|

|

|

|

|

|

• |

anticipated closure costs; expected future financing and its anticipated outcome; |

|

|

|

|

|

|

• |

anticipated liquidity to meet expected operating costs and capital requirements; |

|

|

|

|

|

|

• |

estimates of environmental liabilities; |

|

|

|

|

|

|

• |

our ability to obtain financing to fund our estimated expenditure and capital requirements; |

|

|

|

|

|

|

• |

factors expected to impact our results of operations; and |

|

|

|

|

|

|

• |

the expected impact of the adoption of new accounting standards. |

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

|

|

|

|

|

|

• |

risks related to our ability to continue as a going concern; |

|

|

|

|

|

|

• |

risks related to our history of losses and our requirement for additional financing to fund exploration and, if warranted, development of our properties; |

|

|

|

|

|

|

• |

risks related to our lack of historical production from our mineral properties; |

|

|

|

|

|

|

• |

uncertainty and risks related to cost increases for our exploration and, if warranted, development projects; |

|

|

|

|

|

|

• |

uncertainty and risks related to the affect of a shortage of equipment and supplies on our ability to operate our business; |

|

|

|

|

|

|

• |

uncertainty and risks related to mining being inherently dangerous and subject to events and conditions beyond our control; |

|

|

|

|

|

|

• |

uncertainty and risks related to our mineral resource estimates being based on assumptions and interpretations; |

|

|

|

|

|

|

• |

risks related to changes in mineral resource estimates affecting the economic viability of our projects; |

|

|

|

|

|

|

• |

risks related to differences in US and Canadian practices for reporting reserves and resources; |

|

|

|

|

|

|

• |

uncertainty and risks related to our exploration activities on our properties not being commercially successful; |

|

|

|

|

|

|

• |

uncertainty and risks related to encountering archeological issues and claims in relation to our properties; uncertainty and |

|

|

|

|

|

|

• |

risks related to fluctuations in gold, silver and other metal prices; risks related to our lack of insurance for certain high-risk activities; |

1

|

|

|

|

|

|

• |

uncertainty and risks related to our ability to acquire necessary permits and licenses to place our properties into production; |

|

|

|

|

|

|

• |

risks related to government regulations that could affect our operations and costs; |

|

|

|

|

|

|

• |

risks related to environmental regulations; |

|

|

|

|

|

|

• |

risks related to land reclamation requirements on our properties; |

|

|

|

|

|

|

• |

risks related to increased competition for capital funding in the mining industry; |

|

|

|

|

|

|

• |

risks related to competition in the mining industry; |

|

|

|

|

|

|

• |

risks related to our possible entry into joint venture and option agreements on our properties; |

|

|

|

|

|

|

• |

risks related to our directors and officers having conflicts of interest; |

|

|

|

|

|

|

• |

risks related to our ability to attract qualified management to meet our expected needs in the future; |

|

|

|

|

|

|

• |

uncertainty and risks related to currency fluctuations; |

|

|

|

|

|

|

• |

risks related to our status as a passive foreign investment company; |

|

|

|

|

|

|

• |

risks related to recent market events and general economic conditions; and |

|

|

|

|

|

|

• |

risks related to our securities. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Item 1A. Risk Factors”, “Item 2. Description of the Business” and “Item 7. Management’s Discussion and Analysis” below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

PRELIMINARY NOTES

Reporting Currency, Financial and Other Information

All amounts in this Annual Report are expressed in Canadian Dollars. Unless otherwise indicated, the United States Dollar is denoted as “US$.”

Financial information is presented in accordance with generally accepted accounting principles (“GAAP”) in the United States (“US GAAP”) which do not differ in any material respects from GAAP in Canada.

Information in Part I and II of this report includes data expressed in various measurement units and contains numerous technical terms used in the gold mining industry. To assist readers in understanding this information, a conversion table and glossary are provided below.

Exchange Rate Information

The table below sets forth the average rate of exchange for the Canadian Dollar at the end of the five most recent calendar years ended December 31. The table also sets forth the high and low rate of exchange for the Canadian Dollar at the end of the six most recent months. For purposes of this table, the rate of exchange means the noon exchange rate as reported by the Bank of Canada on its web site at www.bankofcanada.ca. The table sets forth the number of Canadian Dollars required under that formula to buy one United States Dollar. The average rate means the average of the noon exchange rates on each day of each month during the period as reported by the Bank of Canada.

|

|

|

|

|

|

|

|

|

2009 |

2008 |

2007 |

2006 |

2005 |

|

|

|

|

|

|

|

|

Average for Period |

1.14 |

1.07 |

1.07 |

1.13 |

1.21 |

2

|

|

|

|

|

|

|

|

|

|

Feb |

Jan |

Dec |

Nov |

Oct |

Sept |

|

High for Period |

1.06 |

1.05 |

1.06 |

1.07 |

1.06 |

1.09 |

|

|

|

|

|

|

|

|

|

Low for Period |

1.05 |

1.04 |

1.05 |

1.06 |

1.05 |

1.08 |

The noon rate of exchange on March 26, 2010 as reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars was $1.0285 (US$1.00 = Cdn$0.9723).

Metric Conversion Table

For ease of reference, the following conversion factors are provided:

|

|

|

|

|

|

|

|

|

Metric Unit |

|

U.S. Measure |

|

U.S. Measure |

|

Metric Unit |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 hectare |

|

2.471 acres |

|

1 acre |

|

0.4047 hectares |

|

1 metre |

|

3.2881 feet |

|

1 foot |

|

0.3048 metres |

|

1 kilometre |

|

0.621 miles |

|

1 mile |

|

1.609 kilometres |

|

1 gram |

|

0.032 troy oz. |

|

1 troy ounce |

|

31.1 grams |

|

1 kilogram |

|

2.205 pounds |

|

1 pound |

|

0.4541 kilograms |

|

1 tonne |

|

1.102 short tons |

|

1 short ton |

|

0.907 tonnes |

|

1 gram/tonne |

|

0.029 troy ozs./ton |

|

1 troy ounce/ton |

|

34.28 grams/tonne |

|

|

|

|

|

|

|

|

The following abbreviations are used herein:

|

|

|

|

|

|

Ag |

= silver |

m |

= meter |

|

Au |

= gold |

m(2) |

= square meter |

|

Au g/t |

= grams of gold per tonne |

m(3) |

= cubic meter |

|

g |

= gram |

Ma |

= million years |

|

ha |

= hectare |

Oz |

= troy ounce |

|

km |

= kilometer |

Pb |

= lead |

|

km(2) |

= square kilometers |

T |

= tonne |

|

kg |

= kilogram |

t |

= ton |

|

lb |

= pound |

Zn |

= zinc |

|

m |

= meter |

|

|

3

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES

The mineral estimates in this Annual Report on Form 10-K have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report on Form 10-K and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

4

GLOSSARY OF MINING TERMS

We estimate and report our resources and we will estimate and report our reserves according to the definitions set forth in NI 43-101. We will modify and reconcile the reserves as appropriate to conform to SEC Industry Guide 7 for reporting in the U.S. The definitions for each reporting standard are presented below with supplementary explanation and descriptions of the parallels and differences.

|

|

|

|

|

NI 43-101 Definitions |

|

|

|

|

|

|

|

indicated mineral resource |

|

The term “indicated mineral resource” refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be established with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

|

|

|

|

|

inferred mineral resource |

|

The term “inferred mineral resource” refers to that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

|

|

|

|

|

measured mineral resource |

|

The term “measured mineral resource” refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

|

|

|

|

|

mineral reserve |

|

The term “mineral reserve” refers to the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that might occur when the material is mined. |

|

|

|

|

|

mineral resource |

|

The term “mineral resource” refers to a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

5

|

|

|

|

|

opt |

|

Troy ounce per ton |

|

|

|

|

|

probable mineral reserve |

|

The term “probable mineral reserve” refers to the economically mineable part of an indicated, and in some circumstances a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

|

|

|

|

|

proven mineral reserve1 |

|

The term “proven mineral reserve” refers to the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. |

|

|

|

|

|

|

|

|

|

qualified person2 |

|

The term “qualified person” refers to an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization. |

|

|

|

|

|

SEC Industry Guide 7 Definitions |

||

|

|

|

|

|

exploration stage |

|

An “exploration stage” prospect is one which is not in either the development or production stage. |

|

|

|

|

|

|

|

|

|

development stage |

|

A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

|

|

|

|

|

mineralized material |

|

The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

|

|

|

|

|

probable reserve |

|

The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

|

|

|

|

|

production stage |

|

A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. |

|

|

|

|

|

proven reserve |

|

The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

|

|

|

|

|

reserve |

|

The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve |

6

|

|

|

|

|

|

|

determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined. |

1 For Industry Guide 7 purposes this study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

2 Industry Guide 7 does not require designation of a qualified person.

Additional definitions for terms used in this Annual Report filed on Form 10-K.

|

|

|

|

|

Argillite: |

|

Low grade metamorphic clay rich sedimentary rock (shale, mudstone, siltstone). |

|

Block model: |

|

The representation of geologic units using three-dimensional blocks of predetermined sizes. |

|

Breccia: |

|

A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

|

CIM: |

|

Canadian Institute of Mining and Metallurgy. |

|

Cut off or cut-off grade: |

|

When determining economically viable mineral reserves, the lowest grade of mineralized material that qualifies as ore, i.e. that can be mined at a profit. |

|

Diatreme: |

|

Brecciated rock formed by volcanic or hydrothermal eruptive activity, generally in a pipe or funnel like orientation. |

|

EM: |

|

An instrument that measures the change in electro-magnetic conductivity of different geological units below the surface of the earth. |

|

Fault: |

|

A rock fracture along which there has been displacement |

|

Feasibility study: |

|

Group of reports that determine the economic viability of a given mineral occurrence. |

|

Formation: |

|

A distinct layer of sedimentary or volcanic rock of similar composition. |

|

G/t or gpt: |

|

Grams per metric tonne. |

|

Geophysicist: |

|

One who studies the earth; in particular the physics of the solid earth, the atmosphere and the earth’s magnetosphere. |

|

Geotechnical work: |

|

Tasks that provide representative data of the geological rock quality in a known volume. |

|

Grade: |

|

Quantity of metal per unit weight of host rock. |

|

|

|

|

|

Gravity: |

|

A methodology using instrumentation allowing the accurate measuring of the difference between densities of various geological units in situ. |

|

|

|

|

|

Host rock: |

|

The rock containing a mineral or an ore body. |

|

|

|

|

|

Mapping or geologic mapping: |

|

The recording of geologic information such as the distribution and nature of rock units and the occurrence of structural features, mineral deposits, and fossil localities. |

|

Mineral: |

|

A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form. |

|

Mineralization: |

|

A natural occurrence in rocks or soil of one or more metal yielding minerals. |

|

Mining: |

|

The process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized. |

|

National Instrument 43-101: |

|

Canadian standards of disclosure for mineral projects. |

|

Open pit: |

|

Surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body. |

7

|

Ore: |

|

Mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions |

|

Ore body: |

|

A mostly solid and fairly continuous mass of mineralization estimated to be economically mineable. |

|

Outcrop: |

|

That part of a geologic formation or structure that appears at the surface of the earth. |

|

Porphyry: |

|

An igneous rock characterized by visible crystals in a fine–grained matrix. |

|

Quartz: |

|

A mineral composed of silicon dioxide, SiO2 (silica). |

|

Reclamation: |

|

The process by which lands disturbed as a result of mining activity are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery and other physical remnants of mining, closure of tailings storage facilities, leach pads and other mine features, and contouring, covering and re-vegetation of waste rock and other disturbed areas. |

|

SEC Industry Guide 7: |

|

U.S. reporting guidelines that apply to registrants engaged or to be engaged in significant mining operations. |

|

Sedimentary rock: |

|

Rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited, or chemically precipitated. |

|

Strike: |

|

The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface. |

|

Strip: |

|

To remove overburden in order to expose ore. |

|

|

|

|

|

Vein: |

|

A thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz. |

8

PART I

As used in this Annual Report on Form 10-K (“Annual Report”), references to “Midway,” the “Company,” “we,” “our,” or “us” mean Midway Gold Corp., its predecessors and consolidated subsidiaries, or any one or more of them, as the context requires.

ITEM 1. DESCRIPTION OF BUSINESS

General development of Midway Gold Corp.

Midway Gold Corp. was incorporated under the Company Act (British Columbia) on May 14, 1996, under the name Neary Resources Corporation. On October 8, 1999, Midway changed its name to Red Emerald Resource Corp. On July 10, 2002, it changed its name to Midway Gold Corp. Midway became a reporting issuer in the Province of British Columbia upon the issuance of a receipt for a prospectus on May 16, 1997. The common shares were listed on the Vancouver Stock Exchange (a predecessor of the TSX Venture Exchange) on May 29, 1997. On July 1, 2001, Midway became a reporting issuer in the Province of Alberta pursuant to Alberta BOR#51-501. Midway’s shares are currently listed on the NYSE Amex and Tier 1 of the TSX.V under the symbol “MDW.”

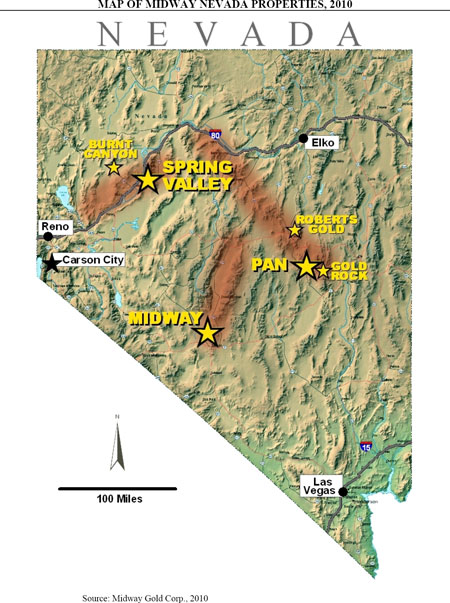

Midway is an exploration stage company engaged in the acquisition, exploration, and, if warranted, development of gold and silver mineral properties in North America. It is our objective to identify mineral prospects of merit, conduct preliminary exploration work, and if results are positive, conduct advanced exploration and, if warranted, development work. Our mineral properties are located in Nevada and Washington. The Midway, Spring Valley, Pan and Golden Eagle gold properties are exploratory stage projects and have identified gold mineralization and the Roberts Creek, Gold Rock and Burnt Canyon projects are earlier stage gold and silver exploration projects.

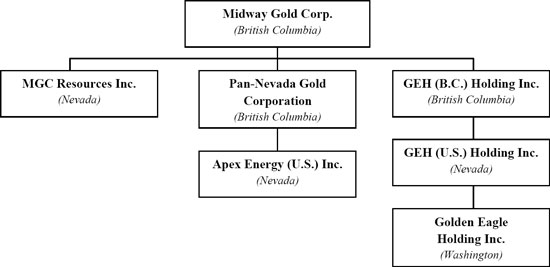

The corporate organization chart for Midway as of the date of this Annual Report is as follows:

Our registered and corporate office in Canada is located at Unit 1 - 15782 Marine Drive, White Rock, B.C. V4B 1E6, and our corporate office phone number is 604-536-2711. Our operations office in the United States is located at 600 Lola Street, Suite 10, Helena, Montana 59601. Our agent for service of process is Dorsey & Whitney LLP, 370 17th Street, Suite 4700 Republic Plaza, Denver, Colorado, 80202, and our registered agent’s phone number is 303-629-3400. We maintain a website at www.midwaygold.com. Information contained on our website is not part of this Annual Report.

9

Financial Information about Segments

Segmented information is contained in note 15 of the “Notes to the Consolidated Financial Statements” contained in the section titled “Item 7. Financial Statements and Supplementary Data” below of this Annual Report and is incorporated herein by reference.

Narrative Description of Business

Midway is focused on exploring and developing high-grade, quality precious metal resources in stable mining areas. Midway’s principal properties are the Spring Valley, Midway and Pan gold and silver mineral properties located in Nevada and the Golden Eagle gold mineral property located in the Washington. Midway owns certain other mineral exploration properties located in Nevada.

Cautionary Note to U.S. Investors – In this Annual Report we use the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource”, which are geological and mining terms as defined in accordance with NI 43-101 under the guidelines adopted by CIM, as CIM Standards in Mineral Resources and Reserve Definition and Guidelines adopted by the CIM. US investors in particular are advised to read carefully the definitions of these terms as well as the “Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates” above.

Spring Valley Property, Pershing County, Nevada

The Spring Valley project is located 20 miles northeast of Lovelock, Nevada. Spring Valley is a diatreme/porphyry hosted gold system covered by gravel. Gold has been intercepted continuously from a depth of 50 to 1400 feet, suggesting a large mineral system.

The Spring Valley project is under an exploration and option to joint venture agreement with Barrick Gold Corporation (“Barrick”). Barrick is funding 100% of the costs to earn an interest in this project.

On March 2, 2009 the Company announced an updated Inferred Resource estimate as at December 31, 2008 of 87,750,000 tons at a grade of 0.021 opt containing 1,835,615 ounces of gold using a cut off grade of 0.006 opt gold using a $715 Lerchs-Grossman Shell. Cautionary Note to U.S. Investors: Please read carefully the section titled “Cautionary Note to U.S. Investors Regarding Reserve and Recourse Estimates” above.

See the section titled “Item 2. Description of Properties” below for additional information.

Midway Property, Nye County, Nevada

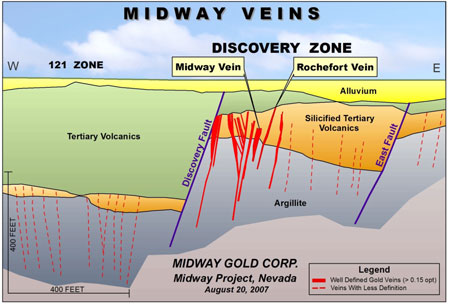

The Midway property is located in Nye County, Nevada, approximately 24 kilometers northeast of the town of Tonopah, 335 kilometers northwest of Las Vegas and 380 kilometers southeast of Reno. It is a high-grade epithermal quartz-gold vein system, on the Round Mountain – Goldfield gold trend. The claims maintained that were formally called the Thunder Mountain project are now consolidated within the Midway project.

An underground decline is being permitted to bulk sample and test a group of high grade veins. Bulk sampling and metallurgical testing will help determine the true grade of the veins, provide a large sample for metallurgical testing and a drill platform to delineate potentially minable material, and move the project toward production.

Midway had hoped to be permitted for the bulk sample in late 2009 or early 2010 however, due to funding constraints and water use issues affecting permitting, the permits will likely not be obtained until 2011 at the earliest.

See the section titled “Item 2. Description of Properties” below for additional information.

10

Pan Gold Project, White Pine County, Nevada

The Pan Gold property is located at the northern end of the Pancake mountain range in western White Pine County, Nevada, approximately 22 miles southeast of Eureka, Nevada, and 50 miles west of Ely, Nevada.

The Pan project is a sediment-hosted gold deposit located along the prolific Battle Mountain/Eureka gold trend. Gold occurs in shallow oxide deposits, along a 2-mile strike length of a faulted anticline. On November 5, 2009 the Company announced an updated resource for the Pan deposit containing 3.22 million short tons grading 0.019 ounces per ton containing 62,100 ounces of gold in the Measured category and 31.43 million short tons grading 0.017 ounces per ton containing 546,600 ounces of gold in the Indicated category for a total of 34.65 million short tons grading 0.018 ounces per ton containing 608,700 ounces of gold in the Measured plus Indicated categories. There was an additional 1.60 million short tons grading 0.017 ounces per ton containing 26,500 ounces of gold in the Inferred category. These were both determined at a 0.006 ounces per ton gold cut-off grade and a $750 per ounce gold price in a Lerchs-Grossman shell. Cautionary Note to U.S. Investors: Please read carefully the section titled “Cautionary Note to U.S. Investors Regarding Mineral Reserve and Resource Estimates” above.

See the section titled “Item 2. Description of Properties” below for additional information.

Golden Eagle Project – Ferry County, Washington

In 2008 the Company purchased a 100% interest in the Golden Eagle property located in Ferry County, Washington from Kinross Gold and Hecla Mining.

The Golden Eagle property hosts a large hot springs gold deposit that is partially covered by glacial gravels. In 1996 a previous operator delineated a potentially open pitable deposit on private ground. Beneath this deposit are several high-grade vein exploration targets. These targets are adjacent to the Republic Knob Hill Mine, which produced high-grade gold, from underground veins, for over 20 years. We will also review options to process sulfide mineralization, hosted in the historic resource in view of newer technologies and the economics afforded by a higher gold price. The ability to explore the deeper targets combined with the possible strategic access to Kinross’ nearby mill is a bonus that could add value to any new oxide ounces discovered on the property.

On June 25, 2009 the Company announced an Indicated Resource estimate as at May 1, 2009 of 31,900,000 tons at a grade of 0.055 opt containing 1,769,000 ounces of gold. There is an additional Inferred Resource estimate of 5,100,000 tons at a grade of 0.038 opt containing 194,000 ounces of gold. Both resources estimates made at May 1, 2009 used a cut off grade of 0.02 opt gold and a $750 Lerchs-Grossman shell. Cautionary Note to U.S. Investors: Please read carefully the section titled “Cautionary Note to U.S. Investors Regarding Mineral Reserve and Resource Estimates” above.

See the section titled “Item 2. Description of Properties” below for additional information.

Roberts Gold, Gold Rock, Burnt Canyon Projects

The Roberts Gold is a sediment-hosted gold deposit located on the Battle Mountain/Eureka gold trend. Midway developed a new target concept in 2008 using geophysics and surface exploration, concluding that volcanic rocks of the Northern Nevada rift may cover favorable host rocks in a gravel fill area. The Company is seeking a joint venture partner for this project.

In the center of the Gold Rock property, lies the Easy Junior Mine, which when it was an operating mine reportedly produced approximately 2.9Mt 0.026 opt gold (74,945 ounces gold contained, 52,560 ounces gold poured). The mine was shut down in 1994, due to lower gold prices. This is a sediment hosted gold system in highly prospective host rocks within a 14 square mile land position along the Battle Mountain-Eureka gold trend. A historic database of 794 holes containing 269,446 feet of drilling was acquired in 2008 outlining continuous gold in drill holes along 9,200 feet of length along the anticline that was mined in part by the Easy Junior mine. Surface work, geophysics and historic data have identified a number of exploration targets, on this prospective land package. In 2008, 11 RC drill holes (3,525 feet) were drilled on the Anchor target, south of the Easy Junior Mine. Five holes found strongly

11

anomalous gold in the Pilot formation, a regionally favorable host rock. A review of the historic gold deposit is planned and additional target and data compilation for the property is in progress. The concept of advancing this project in tandem with the Pan Gold deposit is being investigated and if feasible will be combined as the Gold Pan project.

The 2008 surface exploration and geophysics program on the Burnt Canyon project identified targets in this volcanic hosted epithermal system. Disseminated gold identified in rock chip and soil sampling at five different areas have been selected as drill targets. The project lies between high grade veins in the Seven Troughs district and the Wildcat disseminated gold deposit to the north. The Company is seeking a joint venture partner for this project.

See the section titled “Item 2. Description of Properties” below for additional information.

Employee relations

As of December 31, 2009, we had 9 employees, including 4 full-time employees at our principal executive office in Helena, Montana and 3 full-time employees based in Nevada and 1full-time employee who resides in Colorado. Our chairman and CEO, works from his home office in California.

Reclamation

We generally are required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and re-vegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts are conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Government Regulation

Mining operations and exploration activities are subject to various national, state, provincial and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required in conducting our exploration and other programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in the United States. There are no current orders or directions relating to us with respect to the foregoing laws and regulations. For a more detailed discussion of the various government laws and regulations applicable to our operations and potential negative effects of these laws and regulations please see the section heading “Item 1A.—Risk Factors” below.

Environmental Regulation

Our mineral projects are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

Changes to current local, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

During 2009, there were no material environmental incidents or material non-compliance with any applicable environmental regulations. We estimate that we will not incur material capital expenditures for environmental control facilities during the current fiscal year.

12

Gold Price History

The price of gold is volatile and is affected by numerous factors all of which are beyond our control such as the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the US dollar and foreign currencies, changes in global and regional gold demand, and the political and economic conditions of major gold-producing countries throughout the world.

The following table presents the high, low and average afternoon fixed prices in U.S. dollars for gold per ounce on the London Bullion Market over the past five years:

|

|

|

|

|

|

|

|

|

Year |

|

High |

|

Low |

|

Average |

|

|

|

|

||||

|

2005 |

|

537 |

|

411 |

|

445 |

|

2006 |

|

725 |

|

525 |

|

603 |

|

2007 |

|

841 |

|

608 |

|

695 |

|

2008 |

|

1,011 |

|

713 |

|

872 |

|

2009 |

|

1,212 |

|

810 |

|

972 |

|

2010 (to March 26, 2010) |

|

1,153 |

|

1,058 |

|

1,109 |

Data

Source: www.kitco.com

Seasonality

Seasonality in Nevada and Washington is not a material factor to the Company’s operations for its projects. Certain surface exploration work may need to be conducted when there is no snow on the ground but it is not a material issue for the Company.

Competition

We compete with major mining companies and other natural mineral resource companies in the acquisition, exploration, financing and development of new prospects. Many of these companies are larger and better capitalized than we are. There is significant competition for the limited number of gold acquisition and exploration opportunities. Our competitive position depends upon our ability to successfully and economically explore, acquire and develop new and existing mineral prospects. Factors that allow producers to remain competitive in the market over the long term include the quality and size of their ore bodies, costs of operation, and the acquisition and retention of qualified employees. We also compete with other mining companies for skilled mining engineers, mine and processing plant operators and mechanics, geologists, geophysicists and other technical personnel. This could result in higher turnover and greater labor costs.

Available information

We make available, free of charge, on or through our Internet website, at www.midwaygold.com, links to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our internet address is www.midwaygold.com. Our code of business conduct and ethics is located on our website. To the extent permitted, we intend to post on our website any amendments to, or waivers from, our code of business conduct and ethics. Our internet website and the information contained therein or connected thereto are not incorporated into this Annual Report on Form 10-K.

13

ITEM 1A. RISK FACTORS AND UNCERTAINTIES

Risks related to Midway’s business

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in our common shares.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common shares may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

Estimates of mineralized material are forward-looking statements inherently subject to error. Unforeseen events and uncontrollable factors can have a significant impact on mineralized material estimates and actual results may differ from estimates.

There is substantial doubt about our ability to continue as a going concern.

Our auditor’s report on our 2009 consolidated financial statements includes an additional explanatory paragraph that states that our recurring losses from operation raise substantial doubt about our ability to continue as a going concern. The Company’s consolidated financial statements for the year ended December 31, 2009 have been prepared on the basis that the Company is a going concern, which contemplates the realization of its assets and the settlement of its liabilities in the normal course of operations. The ability of the Company to continue as a going concern is uncertain and dependent upon obtaining the financing necessary to meet its financial commitments and to complete the development of its properties and/or realizing proceeds from the sale of one or more of the properties. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. As at December 31, 2009, the Company had cash and cash equivalents of $1,740,322, working capital of $1,472,127 and has accumulated losses of $56,267,603 since inception.

Management anticipates that the minimum cash requirements to fund its proposed exploration program and continued operations will exceed the amount of cash on hand at December 31, 2009. Accordingly, the Company does not have sufficient funds to meet planned expenditures over the next twelve months, and will need to seek additional debt or equity financing to meet its planned expenditures. The Company plans to file a shelf-registration in the United States and Canada as soon as practicable after March 31, 2010 pursuant to which the Company subsequently intends to conduct equity offerings in 2010. There is no assurance that the Company will be able to raise sufficient cash to fund its future exploration programs and operational expenditures. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

We have a history of losses and will require additional financing to fund exploration and, if warranted, development.

In the fiscal year ended December 31, 2009, we had losses of 2,642,176 and we have had accumulated losses of $56,267,603 since inception.

We have not commenced commercial production on any of our mineral properties. We have no revenues from operations and anticipate we will have no operating revenues until we place one or more of our properties into production. All of our properties are in the exploration stage, which means that we have known mineral reserves on our properties. We currently do not have sufficient funds to fully complete exploration and development work on any of our properties, which means that we will be required to raise additional capital, enter into joint venture relationships or find alternative means to finance placing one or more of our properties into commercial production, if warranted. If the Company fails to raise additional funds it will curtail its activities and may risk being unable to maintain its interests in its mineral properties.

14

Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration, and, development or production on one or more of our properties and any properties we may acquire in the future or even a loss of property interests. This includes our leases over claims covering the principal deposits on our properties, which may expire unless we expend minimum levels of expenditures over the terms of such leases. We cannot be certain that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable or acceptable to us. Future financings may cause dilution to our shareholders.

We have no history of producing metals from our mineral properties.

We have no history of producing metals from any of our properties. Our properties are all exploration stage properties in various stages of exploration. Our Midway, Spring Valley, Pan and Golden Eagle properties are exploratory stage exploration projects with identified gold mineralization, and our Roberts Creek, Burnt Canyon and Gold Rock projects are each early stage exploration projects. Advancing properties from exploration into the development stage requires significant capital and time and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

|

|

|

|

|

|

• |

completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient gold reserves to support a commercial mining operation; |

|

|

|

|

|

|

• |

the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities; |

|

|

|

|

|

|

• |

the availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required; |

|

|

|

|

|

|

• |

the availability and cost of appropriate smelting and/or refining arrangements, if required; |

|

|

|

|

|

|

• |

compliance with environmental and other governmental approval and permit requirements; |

|

|

|

|

|

|

• |

the availability of funds to finance exploration, development and construction activities, as warranted; |

|

|

|

|

|

|

• |

potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities; and |

|

|

|

|

|

|

• |

potential increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies. |

The costs, timing and complexities of exploration, development and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if warranted, development, construction and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establish mining operations or profitably producing metals at any of our properties.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of production.

15

Mining and resource exploration is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business and plans.

Mining and mineral exploration involves various types of risks and hazards, including:

|

|

|

|

|

|

• |

environmental hazards; |

|

|

|

|

|

|

• |

power outages; |

|

|

|

|

|

|

• |

metallurgical and other processing problems; |

|

|

|

|

|

|

• |

unusual or unexpected geological formations; |

|

|

|

|

|

|

• |

flooding, fire, explosions, cave-ins, landslides and rock-bursts; |

|

|

|

|

|

|

• |

inability to obtain suitable or adequate machinery, equipment, or labor; |

|

|

|

|

|

|

• |

metals losses; and |

|

|

|

|

|

|

• |

periodic interruptions due to inclement or hazardous weather conditions. |

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to us or to other companies within the mining industry. We may suffer a material adverse effect on our business if we incur losses related to any significant events that are not covered by our insurance policies.

The figures for our resources are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralization figures presented in this Annual Report and in our filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

|

|

|

|

|

|

• |

these estimates will be accurate; |

|

|

|

|

|

|

• |

resource or other mineralization estimates will be accurate; or |

|

|

|

|

|

|

• |

this mineralization can be mined or processed profitably. |

Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

Because we have not completed feasibility studies on any of our properties and have not commenced actual production, mineralization estimates, including resource estimates, for our properties may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The resource estimates contained in this report have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold, silver or other commodities may render portions of our mineralization and resource estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability determinations we reach. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our share price and the value of our properties.

16

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Our reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report reserves and resources in accordance with Canadian practices. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred resources, which are generally not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves.

Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place tonnage and grade without reference to unit measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in this report, or in the documents incorporated herein by reference, may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

Our exploration activities on our properties may not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to identify mineral deposits on our existing properties and other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently nonproductive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold, silver and other commodity exploration is determined in part by the following factors:

|

|

|

|

|

|

• |

the identification of potential mineralization based on surficial analysis; |

|

|

|

|

|

|

• |

availability of government-granted exploration permits; |

|

|

|

|

|

|

• |

the quality of our management and our geological and technical expertise; and |

|

|

|

|

|

|

• |

the capital available for exploration and development work. |

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our securities and the ability to raise future financing.

We may encounter archaeological issues and claims relating to our Midway property, which may delay our ability to conduct further exploration or developmental activities or could affect our ability to place the property into commercial production, if warranted

Our exploration and development activities may be delayed due to the designation of a portion of the Midway property as a site of archaeological significance. A cultural inventory of the Midway project has identified a prehistoric site associated with a dune field in the Ralston Valley, adjacent to the Midway property. An intensive cultural and geomorphologic inspection was conducted of the project area to determine archaeologically significant areas. Techniques and methods used during the inventory were sufficient to identify most cultural resources and features in the area. Should sufficient mineral resources be identified on the Midway property, a complete archaeological inventory and evaluation would be required, including the possibility of curating the site.

17

Our Midway property is in close proximity to a municipal water supply, which may delay our ability to conduct further exploration or developmental activities or could affect our ability to place the property into commercial production, if warranted

The Midway property lies within a basin from which the town of Tonopah obtains its municipal water supply. To date, Midway’s exploration activities have not been restricted due to the proximity of the activities to this basin. As Midway’s exploration and development activities expand, there is an increased risk that the activities may interfere with the water supply. As part of the mining development work on the Midway property, Midway completed a hydrologic review of the basin and will establish a strategy for preventing exploration and development activities from interfering with the water supply. Any damage to, or contamination of, the water supply caused by Midway’s activities could result in Midway incurring significant liability. We cannot predict the magnitude of such liability or the impact of such liability on our business, prospects or financial condition. Midway has applied for water right permits in the Ralston Basin, which is currently under protest by the town of Tonopah. Midway is currently negotiating with the town about any future pumping of water in the basin. Midway is currently reviewing and negotiating dewatering options with the town of Tonopah that would be agreeable and beneficial for both parties. If Midway were not able to secure dewatering rights for the Midway project, the project may be restricted and could affect our ability to place the property into commercial production, if warranted.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold and other metals and minerals produced from our mineral properties. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

|

|

|

|

|

|

• |

expectations with respect to the rate of inflation; |

|

|

|

|

|

|

• |

the relative strength of the U.S. dollar and certain other currencies; |

|

|

|

|

|

|

• |

interest rates; |

|

|

|

|

|

|

• |

global or regional political or economic conditions; |

|

|

|

|

|

|

• |

supply and demand for jewelry and industrial products containing metals; and |

|

|

|

|

|

|

• |

sales by central banks and other holders, speculators and producers of gold and other metals in response to any of the above factors. |

We cannot predict the effect of these factors on metal prices. Gold prices quoted in US dollars have fluctuated during the last several years. The price of gold (London Fix) has ranged from $810 to $1,212 per ounce during calendar 2009, closing at $1,087on December 30, 2009; from $712 to $1,011 per ounce during calendar 2008 to close on December 31, 2008 at $870 per ounce and from $608 to $842 per ounce during calendar 2007, to close on December 31, 2007 at $836.

A decrease in the market price of gold and other metals could affect the commercial viability of our properties and our anticipated development of such properties in the future. Lower gold prices could also adversely affect our ability to finance exploration and development of our properties.

We do not maintain insurance with respect to certain high-risk activities, which exposes us to significant risk of loss

Mining operations generally involve a high degree of risk. Hazards such as unusual or unexpected formations or other conditions are often encountered. Midway may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it cannot maintain insurance at commercially reasonable premiums. Any significant claim would have a material adverse effect on Midway’s financial position and prospects. Midway is not currently covered by any form of environmental liability insurance, or political risk insurance, since insurance against such risks (including liability for pollution) is prohibitively expensive. Midway may have to suspend operations or take cost interim compliance measures if Midway is unable to fully fund the cost of remedying an environmental problem, if it occurs.

18