Attached files

| file | filename |

|---|---|

| EX-31.2 - China Yongxin Pharmaceuticals Inc. | v177274_ex31-2.htm |

| EX-31.1 - China Yongxin Pharmaceuticals Inc. | v177274_ex31-1.htm |

| EX-21.1 - China Yongxin Pharmaceuticals Inc. | v177274_ex21-1.htm |

| EX-32.1 - China Yongxin Pharmaceuticals Inc. | v177274_ex32-1.htm |

| EX-10.17 - China Yongxin Pharmaceuticals Inc. | v177274_ex10-17.htm |

| EX-10.14 - China Yongxin Pharmaceuticals Inc. | v177274_ex10-14.htm |

| EX-10.13 - China Yongxin Pharmaceuticals Inc. | v177274_ex10-13.htm |

| EX-10.15 - China Yongxin Pharmaceuticals Inc. | v177274_ex10-15.htm |

| EX-10.16 - China Yongxin Pharmaceuticals Inc. | v177274_ex10-16.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

x

ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

¨ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

FOR

THE TRANSITION PERIOD FROM _______ TO ___________

COMMISSION

FILE NO. 000-26293

CHINA

YONGXIN PHARMACEUTICALS INC.

(EXACT

NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

Delaware

|

20-1661391

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

927

Canada Court

City

of Industry, California

|

91748

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

REGISTRANT'S

TELEPHONE NUMBER, INCLUDING AREA CODE: (626) 581-9098

SECURITIES

REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

None.

SECURITIES

REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Common

Stock, $.001 par value

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes

¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. ¨

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes x No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and will

not be contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act:

Large

accelerated filer ¨

Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting

company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

Yes ¨ No x

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o No o

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

sold, or the average bid and asked prices of such common equity, as of the last

business day of the registrant's most recently completed second fiscal quarter:

$1.7 million as of June 30, 2009.

There

were 57,348,923 shares outstanding of registrant's common stock, par value

$0.001 per share, as of March 10, 2010. The shares of the registrant's common

stock are currently quoted on the Over-the-Counter Bulletin Board, or

OTCBB.

Documents

Incorporated by Reference: None.

TABLE

OF CONTENTS

TO

ANNUAL REPORT ON FORM 10-K

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

|

Page

|

||

|

PART

I

|

||

|

Item

1.

|

Business.

|

4

|

|

Item

1A.

|

Risk

Factors.

|

13

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

28

|

|

Item

2.

|

Properties.

|

28 |

|

Item

3.

|

Legal

Proceedings.

|

29 |

|

PART

II

|

||

|

Item

5.

|

Market

For Common Stock and Related Stockholder Matters

|

29 |

|

Item

6.

|

Selected

Financial Data

|

31 |

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

31 |

|

Item

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk.

|

40 |

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

40 |

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and

Financial Disclosure

|

40 |

|

Item

9A.

|

Controls

and Procedures

|

40 |

|

Item

9B.

|

Other

Information

|

41 |

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

42 |

|

Item

11.

|

Executive

Compensation

|

45 |

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and

Management

|

47 |

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

49 |

|

Item

14

|

Principal

Accountant Fees and Services

|

49 |

|

PART

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules.

|

50 |

|

Signatures

|

53 |

2

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this annual report on Form 10-K (“Form 10-K”), includes

some statements that are not purely historical and that are "forward-looking

statements." Such forward-looking statements include, but are not limited to,

statements regarding our company's and our management's expectations, hopes,

beliefs, intentions or strategies regarding the future, including our financial

condition, results of operations, and the expected impact of the share exchange.

In addition, any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words "anticipates,"

"believes," "continue," "could," "estimates," "expects," "intends," "may,"

"might," "plans," "possible," "potential," "predicts," "projects," "seeks,"

"should," "will," "would" and similar expressions, or the negatives of such

terms, may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Form 10-K are based on current

expectations and beliefs concerning future developments and the potential

effects on the parties and the transaction. There can be no assurance that

future developments actually affecting us will be those anticipated. These

forward-looking statements involve a number of risks, uncertainties (some of

which are beyond the parties' control) or other assumptions that may cause

actual results or performance to be materially different from those expressed or

implied by these forward-looking statements, including the

following:

|

Ÿ

|

The

market acceptance of the products we

sell;

|

|

|

Ÿ

|

Problems

that we may face in marketing and distributing the products we

sell;

|

|

|

Ÿ

|

Errors

in business planning attributable to insufficient market size or

segmentation data;

|

|

|

Ÿ

|

Exposure

to product liability and defect

claims;

|

|

|

Ÿ

|

Changes

in the laws of the People's Republic of China that affect our

operations;

|

|

|

Ÿ

|

Any

recurrence of health epidemics and other

outbreaks;

|

|

|

Ÿ

|

Our

ability to obtain and maintain all necessary government certifications

and/or licenses to conduct our

business;

|

|

|

Ÿ

|

Development

of a public trading market for our

securities;

|

|

|

Ÿ

|

Our

inability to raise additional capital when

needed;

|

|

|

Ÿ

|

Problems

with important suppliers and strategic business

partners;

|

|

|

Ÿ

|

The

cost of complying with current and future governmental regulations and the

impact of any changes in the regulations on our operations;

and

|

|

|

Ÿ

|

The

other factors referenced in this Prospectus, including, without

limitation, under the sections entitled "Risk Factors," "Financial

Information," "Management's Discussion and Analysis of Financial Condition

and Results of Operations," and

"Business."

|

These

risks and uncertainties, along with others, are also described above under the

heading "Risk Factors." Should one or more of these risks or uncertainties

materialize, or should any of the parties' assumptions prove incorrect, actual

results may vary in material respects from those projected in these

forward-looking statements. Moreover, we operate in a very competitive and

rapidly changing environment. New risk factors emerge from time to time and we

cannot predict all such risk factors, nor can we assess the impact of all such

risk factors on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained

in any forward looking statements. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under applicable

securities laws.

3

PART

I

Item

1. BUSINESS

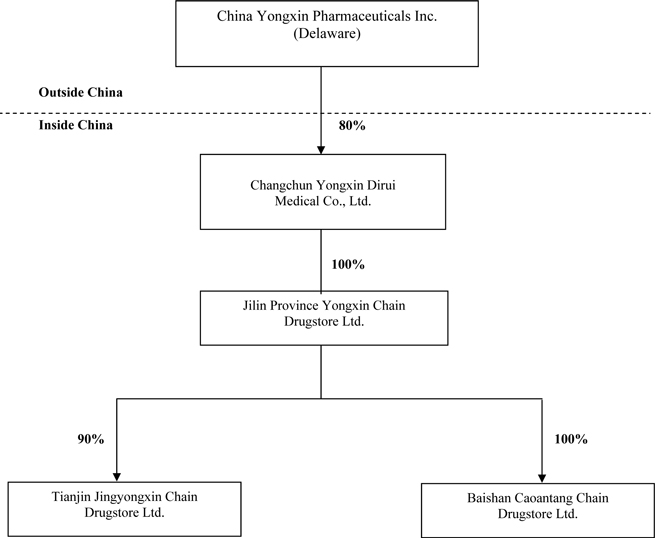

With

respect to this discussion, the terms, "we," "us," "our," and "Company" refer to

China Yongxin Pharmaceuticals Inc. (formerly Digital Learning Management

Corporation) (the “Company"), and its 80%-owned subsidiary, Changchun Yongxin

Dirui Medical Co., Ltd., a company organized under the laws of the PRC

("Yongxin"), and (i) Yongxin's wholly-owned subsidiary Jilin Province Yongxin

Chain Drugstore Ltd., a company organized under the laws of the PRC (“Yongxin

Drugstore”); (ii) Yongxin Drugstore's 90%-owned subsidiary, Tianjin Jingyongxin

Chain Drugstore Ltd., a company organized under the laws of the PRC

(“Jingyongxin Drugstore”); and (iii) Yongxin Drugstore's wholly-owned

subsidiary, Baishan Caoantang Chain Drugstore Ltd., a company organized under

the laws of the PRC (“Caoantang Drugstore”).

Through our Chinese subsidiaries, we are engaged in the wholesale

distribution of pharmaceuticals and medical-related products, and the sale and

distribution of pharmaceuticals, health and beauty products, ginseng and herbal

supplements, and other healthcare products through retail operations in the PRC.

Our corporate headquarters are located in City of Industry, California, but the

Company’s distribution operations are based in Changchun City, Jilin Province,

PRC. Substantially all of our employees are located in

China. At December 31, 2009, we had approximately 673 full time

employees, with 90 employees holding pharmaceutical licenses, and 87 of such

licensed pharmacists working at our retail drugstores. Our business

mainly operates in two segments: (i) the wholesale of pharmaceuticals and other

medical-related products and (ii) the operation of retail

drugstores.

HISTORY

AND CORPORATE STRUCTURE

The Company was originally incorporated

in Delaware on February 18, 1999 under the name of FreePCSQuote. On

December 21, 2006, Changchun Yongxin Dirui Medical Co., Ltd, a Chinese

corporation ("Yongxin") and all of the stockholders of Yongxin entered into a

share exchange transaction with the Company. On April 12, 2008, we

entered into a second amended Share Exchange Agreement with Yongxin, effective

November 16, 2007, in which the Company acquired from the original Yongxin

stockholders, and Yongxin stockholders transferred to the Company, 80% of the

equity interest of Yongxin in exchange for the issuance by the Company of an

aggregate of 21,000,000 shares of newly issued common stock and 5,000,000 shares

of Series A Convertible Preferred Stock to the original Yongxin stockholders

and/or their designees (the “Share Exchange Transaction”). The Series

A Convertible Preferred Stock is convertible over a 3 year period, into up to 30

million shares of common stock. For accounting purposes, this Share

Exchange Transaction was accounted for as a reverse merger, since the original

stockholders of Yongxin became the owners of a majority of the issued and

outstanding shares of common stock of the Company, and the directors and

executive officers of Yongxin became the directors and executive officers of the

Company. In connection with the Share Exchange Transaction, we

changed our name to “Nutradyne Group Inc.”

Yongxin was originally established in

1993. Yongxin’s business operations consist of wholesale and retail

sales of pharmaceuticals, medical equipment and other medical-related

products. Yongxin’s operations are based in Changchun City, Jilin

Province, China. In 2004,

Yongxin established Jilin Province Yongxin Chain Drugstore Ltd. (“Yongxin

Drugstore”) with an investment of RMB 2,500,000 (equivalent to $303,000) to

develop a customer-terminal network market. In July 2005, the Company

obtained the franchise rights in Jilin Province from American Medicine Shoppe

(Meixin International Medical Chains) and by then had developed 4 chains of

“Meixin Yongxin.” As of March 3, 2010, Yongxin Drugstore has

developed 21 retail chains drug stores in the name of Yongxin Drugstore which

collectively cover 3,373 M2 of retail space throughout Changchun

city in China. These drugstores sell over-the-counter western and

traditional Chinese medicines and other medical-related

products.

On March 16, 2007, Yongxin Drugstore

entered into various agreements with retail drug stores in Tianjin and

established Tianjin Jingyongxin Chain Drugstore Ltd. (“Jinyongxin Drugstore”)

with an investment of $116,868, in which the Company has 90% ownership of

Jinyongxin Drugstore. Jinyongxin Drugstore is located in Tianjin

City, China. As of March 3, 2010, Jinyongxin Drugstore has developed 26

retail chain drug stores with total retail space of 3,657 M2

throughout Tianjin City in China.

4

On May

15, 2007, Yongxin established Jilin Dingjian Natural Health Products Co., Ltd.

(“Dingjian”) with an investment of $116,868 whereby Yongxin acquired a 90%

ownership interest in Dingjian. The other 10% of Dingjian was held by

an individual named Jianwei Chen. Dingjian was formed under laws of

the People’s Republic of China and is located in Changchun City, Jilin Province.

Dingjian’s products include ginseng products, flower-flavored tea, rare raw

medicine materials and local specialty products. On November 21, 2009, Yongxin

disposed of its entire ownership interest in Dingjian pursuant to an Equity

Transfer Agreement (the “Agreement”) with Sun Shi Wei, an

individual. Pursuant to the Agreement, Yongxin transferred its 90%

ownership interest in Dingjian to Sun Shi Wei. No other consideration

was exchanged. As of the date of this Form 10-K, Yongxin holds no

ownership interest in Dingjian, and is not subject to any of its

liabilities.

On June 15, 2007, Yongxin Drugstore

established Baishan Caoantang Chain Drugstore Ltd. (“Caoantang Drugstore”) with

a total investment of $408,430. Caoantang Drugstore is a wholly-owned

subsidiary of Yongxin Drugstore. As of March 3, 2010, Caoantang

Drugstore operates a chain of 32 retail drugstores that collectively cover 2,804

M2of

retail space and sells over-the-counter western and traditional Chinese

medicines and other medical-related products.

On May 5, 2008, the Company changed its

name from Nutradyne Group, Inc to China Yongxin Pharmaceuticals

Inc.

On March 9, 2009, the Company formally

launched its Electronic Diagnosis System (the “System”), which enables its

customers to remotely receive a medical diagnosis and conveniently purchase

prescription drugs at the store. To date, the Company has installed

20 Systems in its Yongxin chain drugstores, all located in Changchun, Jilin

Province, China.

Since the beginning of 2009, the

Company has also signed 12 exclusive distribution agreements within the Jilin

province with several well known pharmaceutical manufacturers including Tianjin

Smith Kline & French Laboratones Ltd. As of March 3, 2010,

Yongxin has exclusive distribution rights for approximately 96 drugs in Jilin

province. This portfolio is a key component of its long term growth

strategy to leverage the large distribution center and channels established to

drive incremental future revenue growth. These agreements are typically

one year in duration and renewable.

On March 1, 2010, the Company sold its

digital e-learning business including its wholly-owned subsidiary, Digital

Learning Institute Inc., a Delaware corporation (“Digital Learning”); and (i)

Digital Learning’s wholly-owned subsidiary Software Education of America, Inc.,

a California corporation; (ii) Digital Learning’s wholly-owned subsidiary

McKinley Educational Services, Inc., a California corporation; (iii) Digital

Learning’s wholly-owned subsidiary Digital Knowledge Works, Inc., a Delaware

corporation; and (iv) Digital Learning’s wholly-owned subsidiary Coursemate,

Inc., a California corporation (referred to collectively herein as the "Digital

E-learning Business"). The Digital E-learning Business constituted a minimal

portion of our overall business and it has been our intention to divest

ourselves of the Digital E-learning Business to focus on the pharmaceutical

segment of our business.

The

following diagram illustrates our corporate structure as of the date of this

Form 10-K:

5

IMPORTANT

DISCLOSURES REGARDING OUR CORPORATE STRUCTURE

The

Company owns not all, but eighty percent (80%) of the outstanding equity

interest of Yongxin, a corporate entity organized and existing under the laws of

the PRC, which is a holding company for all other subsidiaries of the

Company. Yongxin Liu and Yongkui Liu individually own 11% and 9% of

Yongxin, respectively. On May 13, 2007, Yongxin Liu, Yongkui Liu and

the Company entered into an Equity Cooperative Joint Venture Contract dated May

13, 2007, pursuant to which Yongxin became an 80% subsidiary and a “joint

venture” under PRC law. At the time of formation, the parties sought

to form a joint venture as opposed to a wholly foreign owned entity (or WFOE),

due to certain PRC laws which made it advantageous for the Company, a

pharmaceutical business, to be constituted and classified as a joint

venture. Yongxin was granted a business license by the Administration

for Industry and Commerce of Changchun City on September 14, 2007, which

recognized and deemed it to be an equity joint venture, with 80% foreign

ownership and 20% domestic (PRC) ownership. Yongxin also

received recognition from, and was registered as an equity joint venture, by the

Jilin Branch of the State Administration of Foreign Exchange (SAFE) on September

20, 2007. Yongxin received MOFCOM certification pursuant to the

PRC’s Regulation for Mergers

with and Acquisitions of Domestic Enterprises by Foreign Investors and

other relevant laws on September 8, 2006.

As a

result of the corporate structure described above, we note several important

implications:

|

|

·

|

The

Company may not be able to exercise absolute control over Yongxin, because

it is not a 100% equityholder of Yongxin. The minority

shareholders, Yongxin Liu and Yonkui Liu, may hold certain minority rights

under PRC corporate law and pursuant to the equity joint venture

agreement, with respect to the control and governance of

Yongxin. Specifically,

Yongxin Liu and Yongkui Liu have the right to jointly appoint a director

and the Company has the right to appoint two

directors. Also,

under the equity joint venture agreement, Mr. Yongxin Liu has a

contractual right to appoint the General Manager of

Yongxin.

|

|

|

·

|

Since

Yongxin Liu is also the Chief Executive Officer and Chairman of the

Company and Yongkui Liu is also the Vice President and former Chief

Financial Officer and director of the Company, this may give rise to a

conflict of interest with the Company and the Company’s

shareholders. While the Company is not aware of any present

situation which involves a conflict of interest, in the future, a conflict

of interest may arise from the fact that Yongxin Liu and Yongkui Liu are

executive officers of the Company, and are also minority equityholders of

Yongxin. If there should ever be a divergence of interest of

the minority equityholders on the one hand, and the Company on the other

hand, Mr. Yongxin Liu and Yongkui Liu would have incentives to act to

protect their minority interests in Yongxin vis-à-vis the majority

controlling interest of the

Company.

|

|

|

·

|

Although

the Company consolidates the financial results of Yongxin and its

subsidiaries for financial reporting purposes, the Company will not

receive 100% of the economic benefit of the income and assets of Yongxin,

and in most cases the Company will receive only 80% of such economic

benefit. For example, if Yongxin were to distribute accumulated

earnings or assets, 20% of such distributed assets would be paid to the

minority equity holders, and 80% would be paid to the

Company.

|

|

|

·

|

For

financial reporting purposes, the Company also accounts for the 20%

interest as a non-controlling interest, which has the effect of lowering

reported earnings per share (as compared to a scenario in which the

Company owns 100% of Yongxin).

|

Please

also review our risk factors for a discussion of these and other factors for

your consideration.

INDUSTRY

China

represents one of the world's largest pharmaceutical markets. With its

population of over one billion people and a rapidly growing economy, China

presents significant potential for the pharmaceutical and retail drugstore

industry. The rise in disposable income of many Chinese residents has resulted

in greater demand and affordability of prescription and over-the-counter

medicines and other personal care products. The increasing population of people

over 65 in China has resulted in a stronger demand for medicines and other

healthcare-related products, because this demographic spends more money on these

products than younger people, on average. As living standards across China

improve and the Chinese population continues to age, we expect the demand for

healthcare-related products to continue to rise. The PRC government

has also recently attempted to regulate the pharmaceutical industry by enacting

a series of regulatory measures that are expected to favor non-hospital

drugstores more than hospital pharmacies.

In China,

consumers can purchase pharmaceutical and other related products at either

hospital pharmacies or non-hospital drugstores, including independent drugstores

and drugstore chains. Because hospital patients usually purchase

prescription medicines at hospital pharmacies, sales by hospital pharmacies have

traditionally accounted for a larger percentage of retail sales of prescription

medicines than non-hospital drugstores. However, most Chinese people

choose to purchase over-the-counter ("OTC"), non-prescription medicines from

non-hospital, retail pharmacies. Retail pharmacies in China include pharmacy

chains, individual stores, retail stores with OTC counters and other retailers

and supermarkets with OTC counters.

6

The

Chinese government owns and operates most of the hospitals throughout

China. The hospitals purchase their supplies of healthcare-related

products from wholesalers and distributors. A hospital's decision to purchase

individual products is typically based on a number of factors, and is sometimes

affected in part by corrupt practices, such as illegal

kickbacks. Recently, the PRC government has stepped-up its efforts to

combat corrupt practices, such as amending its criminal code in 2006 to increase

the penalties for corrupt business practices. We expect the increased

enforcement of such anti-corruption practices will create growth opportunities

for the Company as we can compete for business from hospitals on fair and equal

terms with other suppliers. The PRC Ministry of Health proposed regulations in

March 2007 to require hospitals to permit prescriptions to be filled at

non-hospital pharmacies, which we also expect will increase sales of

prescription medications at our retail drugstores.

Additionally,

reimbursement is available for sales of certain medicines by authorized

pharmacies to participants in the PRC national medical insurance

program. The provincial and municipal authorities responsible for the

administration of the social medical insurance funds to cover such

reimbursements have gradually increased funding in recent years. We

expect the funding to increase significantly in the future, which should help

boost our sales of products eligible for such reimbursements.

RECENT

DEVELOPMENTS

The

current economic conditions may affect our operations since many of our products

are discretionary and we depend to a significant extent upon a number of factors

relating to discretionary consumer spending in China. During economic downturns,

consumers tend to spend less on many of our products, including cosmetics,

organic products and health and nutritional

supplements.

Previously,

management believed that the government would pass certain favorable medical

policies (“National Medical Policy”) in the second half of 2009 to extend

medical insurance coverage to people who live in the rural areas or countryside

of China, which covers approximately 40% of the Chinese population. Management

believes the passage of the National Medical Policy would be highly beneficial

to our sales and operations. However, the National Medical Policy has

not been passed as of the date of the filing of this Form 10-K, and it is

unclear whether this policy will be passed in the near future, if at

all. Due to the uncertainty of the direction of the National Medical

Policy, the Company decided to make certain changes to the operation of its

business in the second half of 2009, including shifting its focus from the

wholesale sector to the retail sector of its business. The

Company will readjust its operations and sales strategy accordingly once the

status of the National Medical Policy becomes clear.

Since

last year, the Company has added products with higher profit margins to our

operations to increase our gross profit, including cosmetics and certain health

and nutritional products such as vitamins and

supplements. Management believes that the addition of such products

has increased our overall gross profit in 2009 and will increase our gross

profit margin for the next few years.

MARKET

FOCUS

Our business operates in two

segments: the wholesale distribution of pharmaceuticals and other

pharmacy-related products and the operation of retail drugstores. Prior to

November 2009, we operated another business known as Dingjian which cultivated

and processed ginseng. However, we transferred our ownership with all of its

assets and liabilities to an individual pursuant to an Equity Transfer Agreement

dated November 21, 2009. The following table reflects the revenue

contribution percentage from each of our business operations for the years ended

December 31, 2009, 2008 and 2007, respectively:

|

For the Years Ended

|

||||||||||||

|

December 31, 2009

|

December 31, 2008

|

December 31, 2007

|

||||||||||

|

Wholesale

Operations

|

70.08

|

%

|

81.6

|

%

|

84

|

%

|

||||||

|

Retail

Drugstore Operations

|

29.2

|

%

|

18.4

|

%

|

16

|

%

|

||||||

|

Ginseng

Processing and Manufacturing Operations

|

N/A

|

*

|

*

|

|||||||||

|

Total

Revenues

|

100

|

%

|

100

|

%

|

100

|

%

|

||||||

* less

than one percent.

Prior

to November 2009, we operated and owned 90% of another business known as

Dingjian which cultivated and processed ginseng. On November 21, 2009, Yongxin

transferred its 90% ownership interest in Dingjian to an individual pursuant to

an Equity Transfer Agreement. As of the date of this Form 10-K, we

hold no ownership interest in Dingjian.

7

WHOLESALE

OPERATIONS

Through

Yongxin, we engage in the wholesale distribution of pharmaceutical products,

medical products and equipment, herbal and nutritional supplements and cosmetics

to over 3,500 customers, which include hospitals, large clinics and retail

pharmacies. Yongxin has received the State Food and Drug

Administration approval and Good Supply Practices, or GSP,

certification.

We

opened our Logistics Center in January 2005 in Jilin Province which contains a

storage area of over 43,000 square meters, where we have the ability to store

our pharmaceutical inventory at various temperatures. The Logistics

Center is able to process over 30,000 orders per day from our customers and our

retail outlets.

Our

wholesale business has relationships with over 760 pharmaceutical

and pharmacy product manufacturers throughout

China. Typically, we enter into master agreements with our suppliers

at the beginning of each year, which provide the general terms, prices and

conditions for transactions for the supplier's products over the

year. We then enter into separate purchase agreements each time we

actually purchase products from a supplier. When we purchase the products from

our suppliers, we take title to the items and book them as

inventory. We then distribute the products to our wholesale

customers.

RETAIL

OPERATIONS

We

provide our retail drugstore customers with convenient and professional pharmacy

services. Each of our stores is staffed with a licensed pharmacist

and a staff trained to provide pharmacy services to our customers. Additionally,

we sell an assortment of other merchandise in our stores, including traditional

Chinese medicines, health and natural products, skin care products and

cosmetics. Our stores typically carry over 8,000 different types of

products. We frequently review and update the selection of products available in

our stores in response to changing consumer preferences.

In July

2005, Yongxin signed an agreement with American Medicine Shoppe International

("AMS") to become AMS' exclusive agent for AMS in the Jilin Province and to

develop a drug store franchise system under license from AMS within the Jilin

Province. We operate 4 drugstores pursuant to our relationship with

AMS under the "Meixin Yongxin" name.

Sales

made to retail customers are made by cash or debit or credit cards, or by

medical insurance cards under the PRC national medical insurance

program. We obtain reimbursement from the relevant government social

security bureaus, for sales made to eligible participants in the PRC national

medical insurance program on a monthly basis. As of March 1, 2010, 29

of our drugstores were designated stores under the PRC national medical

insurance program.

We

currently procure the merchandise for our stores from over 1,500 suppliers,

including both manufacturers and wholesalers. For the years ended

December 31, 2009, 2008 and 2007, our largest five suppliers accounted for

6.91%, 8.5% and 8.2% of our total purchases, respectively. We believe

that the products we carry in our stores are readily available from multiple

sources and do not anticipate any difficulties in continuing to procure such

products.

MARKETING

AND SALES

We have a

staff of approximately 150 employees dedicated to marketing and sales who design

our advertising campaigns and regional promotional activities. We

generate business by marketing directly to hospitals, retail drugstores and

medical clinics in China. Additionally, we advertise our business and

products to consumers through marketing activities and print advertisements in

newspapers to promote our brand and the other products available for sale in our

stores. In 2009 and 2008, we spent approximately $132,264 and

$26,124, respectively, on advertising.

8

RESEARCH

AND DEVELOPMENT

The

only significant research and development we conducted was in the cultivation

and processing of ginseng under Dingjian. The Company has not

conducted any significant research and development since we disposed of our

ownership interest in Dingjian in November 2009.

QUALITY

CONTROL

We

have stringent quality control systems that are implemented by more than 195

company-trained staff members, which represents approximately a third of our

total employees, to ensure quality control over our products, services and

production processes. The quality of the products we offer is of utmost

importance to our Company. Each of

our suppliers also has its own quality control program pursuant to the rules and

regulations under the Good Manufacture Practice (“G.M.P”) mandated by the World

Health Organization.

We

conduct random quality control testing of the products procured from our

suppliers in our wholesale and retail operations. We replace suppliers that do

not pass our quality inspections. Additionally, we monitor the

services provided in our drugstores by sending inspectors to observe the quality

of services provided by our drugstore pharmacists and staff.

Our

quality control procedures at our facilities are designed to maintain quality

standards and execute the following functions at our facilities:

|

|

·

|

setting

internal controls and regulations for

products;

|

|

|

|

|

|

·

|

implementing

sampling systems and sample files;

|

|

|

|

|

|

·

|

maintaining

quality of equipment and

instruments;

|

|

|

|

|

|

·

|

auditing

production records to ensure delivery of quality

products;

|

|

|

|

|

|

·

|

evaluating

the quality of products; and

|

|

|

|

|

|

·

|

articulating

the responsibilities of the quality control

staff.

|

COMPETITION

The

pharmaceutical distribution and retail drugstore industries in China are

fragmented and intensely competitive. While our primary competition

currently comes from other retail drugstore chains and drugstores, we face

increasing competition from discount and convenience stores and supermarkets for

our non-pharmaceutical products and services. We compete for

customers based on store location, selection of products and our brand

name.

Many of

our competitors are more established than we are, and have significantly greater

financial, technical, marketing and other resources than we

do. Additionally, many of them have greater name recognition and

larger customer bases than we do. These competitors may be able to

respond more quickly to changing consumer preferences and new business

opportunities than we do. Moreover, competition is expected to

increase due to the expected consolidation of the drugstore industry and new

store openings by our competitors. Our major competitors include:

China Nepstar Chain Drugstore Ltd., Shenzhen Accord Pharmacy Co., Ltd., Shenzhen

Associate Pharmacy Co., Ltd., Guangzhou Pharmaceutical Company, Jianmin Chain

Drugstore, Guangzhou Caizhilin Chain Drugstore, Liaoning Chengda Co., Ltd.,

Hangzhou Wulin Drugstore Co., Ltd. and Ningbo Siming Dayaofang Co.,

Ltd.

MAJOR

CUSTOMERS

Our major

customers include government owned and operated hospitals, large clinics and

other retailers. No single customer accounted for 10% or more of the Company’s

net sales during the years ended December 31, 2009, 2008 and

2007. Our top five customers accounted for approximately 14.7%, 15%

and 13.9% of our net sales generated for the years ended December 31, 2009, 2008

and 2007, respectively. None of our directors, their associates or

any significant stockholder of the Company has any interest in any of our five

largest customers.

9

INTELLECTUAL

PROPERTY

Prior

to November 2009, we had four registered trademarks in China, which included

Longlife, Zinuo, Yongxintang, Gaoliyuan , under our subsidiary

Dingjian. However, since the discontinuation of Dingjian business

operation in November 2009, we no longer own any intellectual

property.

GOVERNMENT

REGULATIONS

As

a business operating in the PRC, we are subject to various regulations and

permit systems promulgated by the PRC government. These regulations

cover many of our products, including herbal products, over-the-counter

medicines and prescription medications.

Pharmaceutical

Product Distribution

We

sell and distribute pharmaceuticals, health and beauty products, dietary and

herbal supplements, and other healthcare products. Pharmaceuticals,

which have certain identified medical functions and are designed to treat a

specific illnesses or symptoms, can be available by prescription only or

over-the-counter and require the approval of China's State Food and Drug

Administration ("SFDA") before they can be sold. The herbal products

we sell, also known as dietary supplements or nutritional supplements, are

basically prophylactic or preventive in nature and are available

over-the-counter, and, in China, only require approval of the local government

for their production.

We

are subject to the Drug Administration Law of China, which governs the

licensing, manufacturing, marketing and distribution of pharmaceutical products

in China and sets penalties for violations of the law. Distributors of

pharmaceutical products are required to obtain permits from the appropriate

provincial or county level SFDA where the pharmaceutical distribution enterprise

is located. The granting of such permits is subject to an inspection

of a distributor's facilities, warehouses, hygienic environment, quality control

systems, personnel and equipment. Such permits have five year terms

and distributors must apply for renewal no later than six months prior to the

expiration date of the permit. We have a wholesale pharmaceutical

distribution permit which expires in March 2015. Each of our retail

locations also has a pharmaceutical distribution permit, which expire on various

dates. We do not have a permit to manufacture pharmaceutical

products.

Additionally, under the

Supervision and Administration Rules on Pharmaceutical Product Distribution

disseminated by the SFDA on January 31, 2007, and effective May 1, 2007, a

pharmaceutical product distributor is accountable for its procurement and sales

activities and is liable for the actions of its employees or agents in

connection with their conduct of distribution on behalf of the

distributor. Retail distributors may not sell prescription

pharmaceutical products, or Tier A over-the-counter pharmaceutical products,

listed in the national or provincial medical insurance catalogues without a

certified in-store pharmacist being present.

Foreign

Ownership of Wholesale or Retail Pharmaceutical Businesses in China

Under

current PRC law on foreign investment, foreign companies are allowed to

establish or invest in wholly-owned foreign enterprises or joint ventures that

engage in wholesale or retail sales of pharmaceuticals in

China. These regulations limit the number and size of retail pharmacy

outlets that a foreign investor may establish. If a foreign investor owns more

than 30 outlets that sell a variety of branded pharmaceutical products sourced

from different suppliers, the foreign investor's ownership interests in the

outlets are limited to 49.0%.

Nutritional

Supplements and Other Food Products

Distributors

of nutritional supplements and other food products must obtain a food hygiene

certificate from the appropriate provincial or local health regulatory

authorities pursuant to the PRC Food Hygiene Law and Rules on Food Hygiene

Certification. In order to obtain a certificate, a distributor's

facilities, warehouses, hygienic environment, quality control systems, personnel

and equipment are subject to inspection. Food hygiene certificates

are valid for four years, and must be renewed within six months prior to their

expiration.

10

The

Chinese Food Sanitation Law promulgates food sanitation standards. In

the PRC, only products manufactured at Government Good Manufacturing Practice

("GMP") certified facilities are available for sale in China. The

China Food and Drug Administration conducts the GMP inspections.

Good

Supply Practice Standards

We

are required to operate in accordance with Good Supply Practice (the "GSP")

standards that regulate wholesale and retail pharmaceutical product

distributors. The GSP standards ensure the quality of distribution of

pharmaceutical products in China. Pursuant to applicable GSP

standards, we must implement strict controls on the distribution of our

pharmaceutical products, including those concerning staff qualifications,

distribution premises, warehouses, inspection equipment and facilities,

management and quality control. Additionally, we are subject to

inspections organized by the local drug regulatory department of the people's

government of the province, autonomous region or municipality directly under the

PRC central government. We received a GSP Certificate from the Jilin

Province State Food and Drugs Administration Bureau with a term of five years,

which expired at the end of 2008. Such GSP Certificate was renewed at

the end of 2008 for another five year term, which shall expire at the end of

2013.

Insurance

Catalogue

Pursuant to the Decision of the

State Council on the Establishment of the State Basic Medical Insurance System

for Urban Employees and the Implementation Measures for the Administration of

the Scope of Medical Insurance Coverage for Pharmaceuticals for Urban Employees,

the Ministry of Labor and Social Security in China established the Insurance

Catalogue, in which the retail prices of certain pharmaceutical products are

listed and subject to price controls in the form of fixed prices or price

ceilings by the Chinese government. Manufacturers and distributors

are not permitted to set or change the retail price for any price-controlled

product above the applicable price ceiling or deviate from the applicable fixed

price imposed by the PRC government. The prices of other medicines

that are not subject to price controls are determined by the pharmaceutical

manufacturers, subject, in certain cases, to providing notice to the provincial

pricing authorities.

The Price Control Office of the NDRC, as well as provincial and

regional price control authorities, set the retail prices of products that are

subject to price controls. The wholesale price of the pharmaceutical

products subject to the price controls are generally determined by the set

retail price. The maximum prices of such medicine products are published by the

state and provincial administration authorities from time to time. Only the

pharmaceutical product manufacturer can apply for an increase in the retail

price of the product. While all of our pharmaceutical products are

subject to price controls, because our products are priced below the price

control level, price controls currently do not affect our sales of these

products.

The

medicines included in the Insurance Catalogue are selected by the Chinese

government authorities based on various factors including treatment

requirements, frequency of use, effectiveness and price. Medicines

included in the Insurance Catalogue are subject to price controls by the Chinese

government. The Insurance Catalogue is revised every two years. In connection

with each revision, the relevant provincial drug authority collects proposals

from relevant enterprises before organizing a comprehensive

appraisal. The SFDA then makes the final decision on any revisions

based on the preliminary opinion suggested by the provincial drug

administration.

The Insurance Catalogue is

divided into Parts A and B. The medicines included in Part A are

designated by the Chinese governmental authorities for general

application. Local governmental authorities may not adjust the

content of medicines in Part A. Although the medicines included in Part B are

designated by Chinese governmental authorities in the first instance, provincial

level authorities may make limited changes to the medicines included in Part B,

resulting in some regional variations in the medicines included in Part B from

region to region.

Patients

purchasing medicines included in Part A are entitled to reimbursement of the

costs of such medicines from the social medical fund in accordance with relevant

regulations in China. Patients purchasing medicines included in Part

B are required to pay a predetermined proportion of the costs of such

medicines.

For

fiscal years 2008 and 2007, approximately 24% of all the medicines distributed

by Yongxin were covered and reimbursable under the Insurance Catalogue issued by

the Chinese governmental authorities. However, the Insurance

Catalogue was revised in 2009 to include more categories and types of

medicines. As a result of these revisions, approximately 95.8% of all

the medicines distributed by Yongxin became listed in the Insurance Catalogue

during the fiscal year ended December 31, 2009, and management attributes part

of the Company’s increased revenues to these catalogue revisions. The

revenues attributable to sales of products covered under the Insurance Catalogue

during the fiscal years ended December 31, 2009, 2008 and 2007, represented

61.7%, 35% and 35%, respectively, of our total revenues for those

periods.

11

PRC

National Medical Insurance Program

Eligible

participants in the PRC national medical insurance program, mainly consisting of

urban residents, can purchase medicines in an authorized pharmacy by presenting

their medical insurance cards if the medicines purchased are included in the

national or provincial medical insurance catalogues. Authorized pharmacies can

generally either sell medicine on credit and obtain reimbursement from relevant

government social security bureaus on a monthly basis, or accept payments from

the participants at the of the purchase, and the participants in turn obtain

reimbursement from relevant government social security bureaus.

Purchases

of Tier A pharmaceutical products are generally fully reimbursable, except for

certain Tier A pharmaceutical products that are only reimbursable to the extent

the medicine is used the purposes stated in the Insurance Catalogue. Only a

portion of purchases of Tier-B pharmaceutical are reimbursable; participants

purchasing Tier B pharmaceutical products must make a co-payment which is not

reimbursable. Participants have varying amounts in their individual

accounts, which vary based on the contributions made by the participants and his

or her employer. Different regions in China have different requirements

regarding the caps of reimbursements in excess of the amounts in the individual

accounts.

Pharmaceutical

Product Advertisement

The

Standards for Examination and Publication of Advertisements of Pharmaceutical

Products and Rules for Examination of Advertisement of Pharmaceutical Products,

promulgated by the PRC State Administration of Industry and Commerce and the

SFDA, prevents the deceptive and misleading advertising of pharmaceutical

products. These regulations prohibit the advertisement of certain pharmaceutical

products and mandate that prescription pharmaceuticals only be advertised in

certain authorized medical magazines upon obtaining proper approval from the

local provincial level food and drug administration.

Environmental

Regulations

The

major environmental regulations applicable to us include the PRC Environmental

Protection Law, the PRC Law on the Prevention and Control of Water Pollution and

its Implementation Rules, the PRC Law on the Prevention and Control of Air

Pollution and its Implementation Rules, the PRC Law on the Prevention and

Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control

of Noise Pollution.

We

have not been named as a defendant in any legal proceedings alleging violation

of environmental laws and have no reasonable basis to believe that there is any

threatened claim, action or legal proceedings against us that would have a

material adverse effect on our business, financial condition or results of

operations due to any non-compliance with environmental laws. To the

best knowledge of our management, we have been in full compliance with

environmental protection regulations during at least the past three

years.

Tax

Pursuant

to the Provisional Regulation of China on Value Added Tax ("VAT") and their

implementing rules, all entities and individuals that are engaged in the sale of

goods, the provision of repairs and replacement services and the importation of

goods in China are generally required to pay VAT at a rate of 17.0% of the gross

sales proceeds received, less any deductible VAT already paid or borne by the

taxpayer. Further, when exporting goods, the exporter is entitled to

a portion of or all the refund of VAT that it has already paid or

borne

12

Foreign

Currency Exchange

Under

the PRC foreign currency exchange regulations applicable to us, the Renminbi is

convertible for current account items, including the distribution of dividends,

interest payments, trade and service-related foreign exchange

transactions. Conversion of Renminbi for capital account items, such

as direct investment, loan, security investment and repatriation of investment,

however, is still subject to the approval of the PRC State Administration of

Foreign Exchange (“SAFE”). Foreign-invested enterprises may only buy,

sell and/or remit foreign currencies at those banks authorized to conduct

foreign exchange business after providing valid commercial documents and, in the

case of capital account item transactions, obtaining approval from SAFE. Capital

investments by foreign-invested enterprises outside of China are also subject to

limitations, which include approvals by the Ministry of Commerce, SAFE and the

State Reform and Development Commission.

Dividend

Distributions

Under

applicable PRC regulations, foreign-invested enterprises in China may pay

dividends only out of their accumulated profits, if any, determined in

accordance with PRC accounting standards and regulations. In addition,

foreign-invested enterprises in China are required to set aside at least 10.0%

of their after-tax profit based on PRC accounting standards each year to its

general reserves until the accumulative amount of such reserves reach 50.0% of

its registered capital. These reserves are not distributable as cash

dividends. The board of directors of a foreign-invested enterprise

has the discretion to allocate a portion of its after-tax profits to staff

welfare and bonus funds, which may not be distributed to equity owners except in

the event of liquidation. To date, we have not paid any dividends and we have no

plans to pay any dividends in the foreseeable future.

EMPLOYEES

Substantially

all of our employees are located in China. At March 1, 2009, we had

approximately 673 full time employees, with 90 employees holding pharmaceutical

licenses, and 87 of such licensed pharmacists working at our retail

drugstores. There are no collective bargaining contracts covering any

of our employees. We believe our relationship with our employees is

good.

Yongxin is required to contribute a

portion of its employees' total salaries to the Chinese government's social

insurance funds, including medical insurance, unemployment insurance and job

injuries insurance, and a housing assistance fund, in accordance with relevant

regulations. In the last three years, Yongxin contributed

approximately $174,006, $174,567 and $61,918 for the years ended December 31,

2009, 2008 and 2007, respectively. We expect the amount of Yongxin's

contribution to the government's social insurance funds to increase in the

future as Yongxin expands its workforce and

operations.

ITEM

1A. RISK FACTORS

Any

investment in our securities involves a high degree of risk. Potential investors

should carefully consider the material risks described below and all of the

information contained in this Form 10-K before deciding whether to purchase any

of our securities. Our business, financial condition or results of operations

could be materially adversely affected by these risks if any of them actually

occur. The shares of our common stock are currently quoted on the

Over-the-Counter Bulletin Board, or OTCBB under the symbol "CYXN." If and when

our securities are traded, the trading price could decline due to any of these

risks, and an investor may lose all or part of his or her investment. Some

of these factors have affected our financial condition and operating results in

the past or are currently affecting us. This report also contains

forward-looking statements that involve risks and uncertainties. Our actual

results could differ materially from those anticipated in these forward-looking

statements as a result of certain factors, including the risks faced described

below and elsewhere in this Form 10-K.

RISKS

RELATED TO OUR BUSINESS

THE

PURCHASE OF MANY OF OUR PRODUCTS IS DISCRETIONARY, AND MAY BE PARTICULARLY

AFFECTED BY ADVERSE TRENDS IN THE GENERAL ECONOMY; THEREFORE CHALLENGING

ECONOMIC CONDITIONS WILL MAKE IT MORE DIFFICULT FOR US TO GENERATE

REVENUE.

The current general economic recession

and crisis and any continuing unfavorable economic conditions may affect the

success of our operations since many of our products are discretionary and we

depend to a significant extent upon a number of factors relating to

discretionary consumer spending in China. These factors include

economic conditions and perceptions of such conditions by consumers, employment

rates, the level of consumers' disposable income, business conditions, interest

rates, consumer debt levels, availability of credit and levels of taxation in

regional and local markets in China where we sell our products. There

can be no assurance that consumer spending on many of our products, including

cosmetics, organic products and health and nutritional supplements, will not be

adversely affected by changes in general economic conditions in China and

globally.

13

THE

SUCCESS OF OUR BUSINESS DEPENDS ON OUR ABILITY TO MARKET AND ADVERTISE THE

PRODUCTS WE SELL EFFECTIVELY.

Our ability to establish effective

marketing and advertising campaigns is key to our success. Our

advertisements promote our corporate image, our merchandise and the pricing of

such products. If we are unable to increase awareness of our company

and our products, we may not be able to attract new customers. Our

marketing activities may not be successful in promoting our products or pricing

strategies or in retaining and increasing our customer base. We

cannot assure you that our marketing programs will be adequate to support our

future growth, which may result in a material adverse effect on our results of

operations.

WE

MAY BE UNABLE TO IDENTIFY AND RESPOND EFFECTIVELY TO SHIFTING CUSTOMER

PREFERENCES, AND WE MAY FAIL TO OPTIMIZE OUR PRODUCT OFFERING AND INVENTORY

POSITION.

Consumer preferences in the drugstore

industry change rapidly and are difficult to predict. The success of

our business depends on our ability to predict accurately and respond to future

changes in consumer preferences, carry the inventory demanded by customers,

deliver the appropriate quality of products, price products correctly and

implement effective purchasing procedures. We must optimize our

product selection and inventory positions based on consumer preferences and

sales trends. If we fail to anticipate, identify or react

appropriately to changes in consumer preferences and adapt our product selection

to these changing preferences, we could experience excess inventories, higher

than normal markdowns or an inability to sell our products, which, in turn,

could significantly reduce our revenue and have a material adverse effect on our

business, financial condition and results of operations.

IF

WE FAIL TO MAINTAIN OPTIMAL INVENTORY LEVELS, OUR INVENTORY HOLDING COSTS COULD

INCREASE OR CAUSE US TO LOSE SALES, EITHER OF WHICH COULD HAVE A MATERIAL

ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF

OPERATIONS.

While we must maintain sufficient

inventory levels to operate our business successfully and meet our customers'

demands, we must be careful to avoid amassing excess

inventory. Changing consumer demands, manufacturer backorders and

uncertainty surrounding new product launches expose us to increased inventory

risks. Demand for products can change rapidly and unexpectedly,

including the time between when the product is ordered from the supplier to the

time it is offered for sale. We carry a wide variety of products and

must maintain sufficient inventory levels of our products. We may be

unable to sell certain products in the event that consumer demand

changes. Our inventory holding costs will increase if we carry excess

inventory. However, if we do not have a sufficient inventory of a

product to fulfill customer orders, we may lose orders or customers, which may

adversely affect our business, financial condition and results of

operations. We cannot assure you that we can accurately predict

consumer demand and events and avoid over-stocking or under-stocking

products.

IF WE ARE UNABLE TO MANAGE THE

DISTRIBUTION OF OUR PRODUCTS AT OUR LOGISTICS CENTER, WE MAY BE UNABLE TO MEET

CUSTOMER DEMAND.

Substantially all of our products are

distributed to our stores and our wholesale customers through our "Logistics

Center" located in our "Logistics Plaza" in Changchun, PRC. The

efficient operation and management of this facility is essential in order for us

to meet customer demands. Our business would suffer if we do not

successfully operate this distribution facility or if the operation of this

facility was disrupted for any reason, including disruptions caused by natural

disasters. Our failure to manage this facility properly could result

in higher distribution costs, excess or insufficient inventory, or an inability

to fulfill customer orders, each of which could result in a material adverse

effect on our results of operations.

14

DUE

TO THE GEOGRAPHIC CONCENTRATION OF OUR SALES IN THE NORTHEAST REGION OF CHINA,

OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION ARE SUBJECT TO FLUCTUATIONS IN

REGIONAL ECONOMIC CONDITIONS.

A significant percentage of our total

sales are made in the northeast region of China, particularly in Jilin

province. For the years ended December 31, 2009, 2008 and 2007,

approximately 86%, 85% and 80% of revenues, respectively, were generated from

this area. Our concentration of sales in this area heightens our

exposure to adverse developments related to competition, as well as economic and

demographic changes in this region. Our geographic concentration

might result in a material adverse effect on our business, financial condition

or results of operations in the future.

CERTAIN

DISRUPTIONS IN SUPPLY OF AND CHANGES IN THE COMPETITIVE ENVIRONMENT FOR OUR

PRODUCTS MAY ADVERSELY AFFECT OUR PROFITABILITY.

We carry a broad range of merchandise

in our stores, including pharmaceuticals, traditional Chinese medicines, herbal

and nutritional supplements and cosmetics. A significant disruption

in the supply of these products could decrease inventory levels and sales, and

materially adversely affect our business and financial

results. Shortages of products or interruptions in transportation

systems, labor strikes, work stoppages, war, acts of terrorism or other

interruptions or difficulties in the employment of labor or transportation in

the markets in which we purchase products may adversely affect our ability to

maintain sufficient inventories of our products to meet consumer

demand. If we were to experience a significant or prolonged shortage

of products from any of our suppliers and could not procure the products from

other sources, we would be unable to meet customer demand, which, in turn, would

adversely affect our sales, margins and customer relations.

OUR

OPERATIONS WOULD BE MATERIALLY ADVERSELY AFFECTED IF THIRD-PARTY CARRIERS WERE

UNABLE TO TRANSPORT OUR PRODUCTS ON A TIMELY BASIS.

All of our products are shipped through

third party carriers. If a strike or other event prevented or

disrupted these carriers from transporting our products, other carriers may be

unavailable or may not have the capacity to deliver our products to our

customers and to our retail stores. If adequate third party sources

to ship our products were unavailable at any time, our business would be

materially adversely affected.

THE

MARKET FOR OUR PRODUCTS AND SERVICES IS VERY COMPETITIVE AND, IF WE CANNOT

EFFECTIVELY COMPETE, OUR BUSINESS WILL BE HARMED.

The industries in which we operate are

highly fragmented and very competitive. We compete with local

drugstores and with large foreign multinational companies that offer products

that are similar to ours. Some of these competitors have larger local

or regional customer bases, more locations, more brand equity, and substantially

greater financial, marketing and other resources than we have. As a result, our

competitors may be in a stronger position to respond quickly to potential

acquisitions and other market opportunities, new or emerging technologies and

changes in customer tastes. We cannot assure you that we will be able

to maintain or increase our market share against the emergence of these or other

sources of competition. Failure to maintain and enhance our competitive position

could materially adversely affect our business and prospects.

WE

MAY NOT BE SUCCESSFUL IN COMPETING WITH OTHER WHOLESALERS AND DISTRIBUTORS OF

PHARMACEUTICAL PRODUCTS IN THE TENDER PROCESSES FOR THE PURCHASE OF MEDICINES BY

STATE-OWNED AND STATE-CONTROLLED HOSPITALS.

Our

wholesale business sells various pharmaceutical products to hospitals owned and

controlled by government authorities in the PRC. Government owned

hospitals purchase pharmaceutical products by using collective tender

processes. During a collective tender process, a hospital establishes

a committee of recognized pharmaceutical experts, which assesses bids submitted

by pharmaceutical manufacturers. The hospitals may only purchase

pharmaceuticals that win in collective tender processes. The

collective tender process for pharmaceuticals with the same chemical composition

must be conducted at least annually, and pharmaceuticals that have won in the

collective tender processes previously must participate and win in the

collective tender processes in the following period before hospitals may make

new purchases. If we are unable to win purchase contracts through the

collective tender processes in which we decide to participate, we will lose

market share to our competitors, and our sales and profitability will be

adversely affected.

15

COUNTERFEIT

PRODUCTS SOLD IN CHINA COULD NEGATIVELY IMPACT OUR REVENUES, BRAND REPUTATION,

BUSINESS AND RESULTS OF OPERATIONS.

Our products are also subject to

competition from counterfeit pharmaceuticals, which are pharmaceuticals

manufactured without proper licenses or approvals and are fraudulently

mislabeled with respect to their content and/or

manufacturer. Counterfeit pharmaceuticals are generally sold at lower

prices than authentic products due to their low production costs, and in some

cases are very similar in appearance to authentic

products. Counterfeit pharmaceuticals may or may not have the same

chemical content as their authentic counterparts. Although the PRC

government has recently been increasingly active in policing counterfeit

pharmaceuticals, there is a lack of effective counterfeit pharmaceutical

regulation control and enforcement systems in China. The

proliferation of counterfeit pharmaceuticals has grown in recent years and may

continue to grow in the future. Despite our implementation of quality

controls, we cannot assure you that we would not be distributing or selling

counterfeit products inadvertently. Any accidental sale or

distribution of counterfeit products can subject our company to fines,

administrative penalties, litigation and negative publicity, which could

negatively impact our revenues, brand reputation, business and results of

operations.

THE

RETAIL PRICES OF SOME OF OUR PRODUCTS ARE SUBJECT TO PRICE CONTROLS BY THE PRC

GOVERNMENT, WHICH MAY AFFECT BOTH OUR REVENUES AND NET INCOME.

The laws of the PRC permit the PRC

government to fix and adjust prices of certain pharmaceutical products,

including many of those listed in the Insurance Catalogue. Through

these price controls, the government can fix retail prices and set retail price

ceiling for certain of the pharmaceutical products we

sell. Additionally, the PRC government may periodically adjust the

retail prices of these products downward in order to make pharmaceuticals more

affordable to the general Chinese population. While our sales of

pharmaceutical products are not affected by the price controls because we

currently sell such products at prices below the price control level, we cannot

guarantee that our sales of these products will not be affected in the future,

as price controls may be increased or may affect additional

products. To the extent that we are subject to price controls, our

revenue, gross profit, gross margin and net income will be affected because the

revenue we derive from our sales will be limited and we may have limited ability

to control our costs. Further, if price controls affect both our

revenue and costs, our ability to be profitable and the extent of our

profitability will be effectively subject to determination by the applicable

regulatory authorities in the PRC. Any future price controls or price

reductions may reduce our revenue and profitability and have a material adverse

effect on our financial condition and results of operations.

IF

WE DO NOT COMPLY WITH THE APPLICABLE PRC LAWS AND REGULATIONS CONTROLLING THE

SALE OF MEDICINES UNDER THE PRC NATIONAL MEDICAL INSURANCE PROGRAM, WE MAY BE

SUBJECT TO FINES AND OTHER PENALTIES.

Persons eligible to participate in the

PRC National Medical Insurance Program can buy medicines that have been included

in the Insurance Catalogue using a medical insurance card in an authorized

pharmacy. The applicable PRC government social security bureau then

reimburses the pharmacy. PRC law also forbids pharmacies from selling

goods other than pre-approved medicines when purchases are made with medical

insurance cards. While we have established procedures to prevent our

drugstores from selling unauthorized goods to customers who make purchases with

medical insurance cards, we cannot assure you that these procedures will be

properly followed at all times in all of our stores. Violations of

this prohibition by any of our drugstores may result in the revocation of such

drugstore’s status as an authorized pharmacy. Additionally, we could

be subject to other fines or other penalties, and to negative publicity, which

could damage our company's reputation and have a material adverse effect on our

results of operations.

THE

REQUIRED CERTIFICATES, PERMITS, AND LICENSES RELATED TO OUR OPERATIONS ARE

SUBJECT TO GOVERNMENTAL CONTROL AND RENEWAL AND FAILURE TO OBTAIN RENEWAL WILL

CAUSE ALL OR PART OF OUR OPERATIONS TO BE TERMINATED.

We are subject to various PRC laws and

regulations pertaining to our wholesale and retail operations. We

have attained certificates, permits, and licenses required for the operation of

a pharmaceutical distributor and retailer. We cannot assure you that

we will have all necessary permits, certificates and authorizations for the

operation of our business at all times. Additionally, our

certifications, permits and authorizations are subject to periodic renewal by

the relevant government authorities. We intend to apply for renewal

of these certificates, permits and authorizations prior to their

expiration. During the renewal process, we will be re-evaluated by

the appropriate governmental authorities and must comply with the then

prevailing standards and regulations which may change from time to

time. In the event that we are not able to renew the certificates,

permits and licenses, all or part of our operations may be

terminated. Furthermore, if escalating compliance costs associated

with governmental standards and regulations restrict or prohibit any part of our

operations, it may adversely affect our operations and

profitability.

16

WE

MAY SUFFER AS A RESULT OF PRODUCT LIABILITY CLAIMS, PERSONAL INJURY CLAIMS OR

DEFECTIVE PRODUCTS.

Our pharmacies are exposed to risks

inherent in the packaging and distribution of pharmaceutical and other

healthcare products, such as with respect to improper filling of prescriptions,

labeling of prescriptions, adequacy of warnings, and the unintentional

distribution of counterfeit drugs. Furthermore, the applicable laws, rules and

regulations require our in-store pharmacists to offer counseling, without

additional charge, to our customers about medication, dosage, delivery systems,

common side effects and other information the in-store pharmacists deem

significant. Our in-store pharmacists may also have a duty to warn customers

regarding any potential negative effects of a prescription drug if the warning

could reduce or negate these effects and we may be liable for claims arising

from advice given by our in-store pharmacists. Further, we may sell products

which inadvertently have an adverse effect on the health of

individuals. Product liability claims may be asserted against us with

respect to any of the products we sell and as a retailer, we are required to pay

for damages for any successful product liability claim against us, although we

may have the right under applicable PRC laws, rules and regulations to recover

from the relevant manufacturer for compensation we paid to our customers in

connection with a product liability claim. Any product liability claim, product

recall, adverse side effects caused by improper use of the products we sell or

manufacturing defects may result in adverse publicity regarding us and the

products we sell, which would harm our reputation. If we are found

liable for product liability claims, we could be required to pay substantial

monetary damages. Furthermore, even if we successfully defend