Attached files

Table of Contents

As filed with the Securities and Exchange Commission on March 29, 2010

Registration No.: 333-164575

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VRINGO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 4812 | 20-4988129 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

18 East 16th Street, 7th Floor

New York, New York 10003

(646) 448-8210

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jonathan Medved

Chief Executive Officer

Vringo, Inc.

18 East 16th Street, 7th Floor

New York, New York 10003

(646) 448-8210

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Barry I. Grossman, Esq. David Selengut, Esq. Ellenoff Grossman & Schole LLP 150 East 42nd Street, 11th Floor New York, New York 10017 (212) 370-1300 (212) 370-7889—Facsimile |

Kenneth R. Koch, Esq. Mintz Levin Cohn Ferris Glovsky and Popeo P.C. Chrysler Center 666 Third Avenue New York, New York 10017 (212) 935-3000 (212) 983-3115—Facsimile |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check this box: x

If this Form is being filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if smaller reporting company) |

Smaller reporting company x |

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee (2) | ||||||

| Units, each consisting of one share of common stock, par value $0.01 per share, and two warrants (3) |

$13,800,000 | $983.94 | ||||||

| Shares of common stock included as part of the Units (3) |

— | (4) | ||||||

| Warrants included as part of the Units (3) |

— | (4) | ||||||

| Shares of common stock underlying the Warrants included in the Units (3) |

$30,360,000 | $2,164.67 | ||||||

| Representative’s Unit Purchase Option (3) |

$100 | (4) | ||||||

| Units underlying the Representative’s Unit Purchase Option (“Representative’s Units”) |

$1,320,000 | $94.12 | ||||||

| Shares of common stock included as part of the Representative’s Units (3) |

— | (4) | ||||||

| Warrants included as part of the Representative’s Units (3) |

— | (4) | ||||||

| Shares of common stock underlying the Warrants included in the Representative’s Units (3) |

$2,640,000 | $188.24 | ||||||

| Shares of common stock issuable upon automatic conversion of Convertible Notes (5) |

$4,373,600 | $311.84 | ||||||

| Shares of common stock issuable upon exercise of warrants issuable upon automatic conversion of Convertible Notes (5) |

$9,621,920 | $686.05 | ||||||

| Shares of common stock issuable upon exercise of Special Bridge Warrants (5) |

$2,186,800 | $155.92 | ||||||

| Total |

$64,302,420 | $4,584.78 (6) | ||||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (3) | Offered pursuant to the Registrant’s initial public offering. |

| (4) | No fee pursuant to Rule 457(g). |

| (5) | Represents shares of the Registrant’s common stock being registered for resale that will be acquired upon the conversion of convertible notes issued to the selling securityholders and that may be acquired upon the exercise of certain warrants issued to the selling securityholders named in this registration statement. |

| (6) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

This registration statement contains two forms of prospectus, as set forth below.

| • | Public Offering Prospectus. A prospectus to be used for the initial public offering by the registrant of 2,400,000 units (and an additional 360,000 units which may be sold upon exercise of the underwriters’ over-allotment option) (the “Public Offering Prospectus”) through the underwriters named on the cover page of the Public Offering Prospectus as well as the issuance of the unit purchase option to Maxim Group LLC to purchase such number of units equal to 5% of the units sold in this offering. |

| • | Selling Securityholder Prospectus. A prospectus to be used in connection with the potential resale by certain selling securityholders of up to an aggregate of 795,200 shares of the registrant’s common stock issuable upon conversion of the registrant’s outstanding convertible notes upon the effectiveness of the registration statement of which this prospectus forms a part and 2,385,600 shares of the registrant’s common stock issuable upon the exercise of certain of the registrant’s outstanding warrants (the “Selling Securityholder Prospectus”). |

The Public Offering Prospectus and the Selling Securityholder Prospectus will be identical in all respects except for the following principal points:

| • | they contain different front covers; |

| • | they contain different Use of Proceeds sections; |

| • | a Shares Registered for Resale section is included in the Selling Securityholder Prospectus; |

| • | a Selling Securityholders section is included in the Selling Securityholder Prospectus; |

| • | the Underwriting section from the Public Offering Prospectus is deleted from the Selling Securityholder Prospectus and a Plan of Distribution section is inserted in its place; |

| • | the Legal Matters section in the Selling Securityholder Prospectus deletes the reference to counsel for the underwriters; and |

| • | they contain different back covers. |

The registrant has included in this registration statement, after the financial statements, a set of alternate pages to reflect the foregoing differences between the Selling Securityholder Prospectus and the Public Offering Prospectus.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until after the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 29, 2010

PROSPECTUS

2,400,000 Units

VRINGO, INC.

This is the initial public offering of our units. We are offering 2,400,000 units, with each unit consisting of: (i) one share of common stock and (ii) two warrants. Each warrant entitles the holder to purchase one share of our common stock at a price equal to 110% of the offering price of the units in our initial public offering. Each warrant will become exercisable upon the consummation of our initial public offering and will expire five years after the date of this prospectus.

We expect the initial public offering price of the units to be between $ and $ per unit. Currently, no public market exists for our securities. We intend to apply to have our units listed on the NASDAQ Capital Market under the symbol “VRNGU” on or promptly after the date of this prospectus. Once the securities comprising the units begin separate trading, the units will continue to trade under the symbol “VRNGU” and the common stock and warrants will be listed on the NASDAQ Capital Market under the symbols “VRNG” and “VRNGW,” respectively. The common stock and warrants comprising the units will begin separate trading on or prior to the 90th day after the date of this prospectus. We will issue a press release announcing when such separate trading will begin. No assurance can be given that such listing will be approved.

Investing in our units involves a high degree of risk. You should carefully consider the matters discussed under the section entitled “Risk Factors” beginning on page 11 of this prospectus.

| Per Unit | Total | |||

| Public offering price |

||||

| Underwriter discounts and commissions (1) |

||||

| Proceeds to us (before expenses) |

| (1) | Does not include a corporate finance fee in the amount of 2% of the gross proceeds, or $ per share, payable to Maxim Group LLC, the representative of the underwriters. |

We have granted an over-allotment option to the underwriters, under which they may elect to purchase up to an additional 360,000 units from us at the public offering price, less the estimated underwriting discounts and commissions, within 45 days from the date of this prospectus to cover over-allotments, if any. We have agreed to issue to Maxim Group LLC, the representative of the underwriters, a unit purchase option to purchase such number of units equal to 5% of the units sold in this offering at a price equal to 120% of the price of the units offered in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This is a firm commitment underwriting. The underwriters expect to deliver the units to purchasers on or prior to , 2010.

Maxim Group LLC

The date of this prospectus is , 2010.

Table of Contents

VRINGO, INC.

| 1 | ||

| 8 | ||

| 11 | ||

| 23 | ||

| 25 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

30 | |

| 43 | ||

| 56 | ||

| 70 | ||

| 73 | ||

| 75 | ||

| 84 | ||

| 92 | ||

| 92 | ||

| 92 | ||

| F-1 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and are seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial conditions, results of operations and prospects may have changed since that date.

We obtained statistical data, market data and other industry data and forecasts used throughout this prospectus from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

Table of Contents

This summary highlights information contained throughout this prospectus and is qualified in its entirety by reference to the more detailed information and financial statements included elsewhere herein. This summary may not contain all of the information that may be important to you. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. Before making an investment decision, you should read carefully the entire prospectus, including the information under “Risk Factors” beginning on page 11 and our financial statements and related notes thereto.

Unless the context otherwise requires or indicates, when used in this prospectus,

| • | references to “we,” “our,” “us,” “the Company” and “Vringo” refer to Vringo, Inc. and its subsidiary; |

| • | references to “Bridge Notes” refer to the $3.0 million shares of 5% subordinated convertible promissory notes issued to accredited investors in a private placement consummated on December 29, 2009. Upon consummation of this offering, the Bridge Notes will automatically convert into one share of common stock and two warrants at a conversion price equal to the lesser of (i) $3.75 and (ii) 75% of the offering price of the units in this offering; |

| • | references to “Bridge Financing” refer to the sale of the Bridge Notes; and |

| • | references to “Special Bridge Warrants” refer to the additional 795,200 warrants issued to the investors in the Bridge Financing, which are exercisable at $2.75 per share. |

Our Business

We provide a comprehensive platform that allows users to create, download and share mobile entertainment content in the form of video ringtones for mobile phones. We believe that our service represents the next stage in the evolution of the ringtone market from standard audio ringtones to high-quality video ringtones, with social networking capability and integration with web systems. Our solution, which encompasses a suite of mobile and PC-based tools, enables users to create, download and share video ringtones with ease, and provides our business partners with a consumer-friendly and easy-to-integrate monetization platform.

We were incorporated in January 2006 and are still a development stage company. Since inception, we have generated only $20,000 in revenues, which amount includes six months of revenue from our operations in Armenia and $1,000 of revenue from each of our revenue-sharing agreements in Turkey and Malaysia. We have a history of losses since inception, including a net loss of $6.6 million for the year ended December 31, 2009. All of our audited consolidated financial statements since inception have contained a going concern opinion by our auditors, which means that our auditors have substantial doubt about our ability to continue as a going concern.

Our platform combines a downloadable mobile application which works on multiple operating systems and hundreds of handsets, a WAP site, which is a simplified website accessible by a user on a mobile phone, and a website, together with a robust content integration, management and distribution system. As part of providing a complete end-to-end video ringtone platform, we have amassed a library of over 4,000 video ringtones that we provide for our users. We also have developed substantial tools for users to create their own video ringtones and for mobile carriers and other partners to include their own content and deliver it solely to their customers. Our VringForward video ringtone technology allows users to enjoy a rich social experience by sharing video ringtones from our library or which they created.

Until recently, our product has been offered for free to consumers. We are now moving to a paid service model together with mobile carriers and other partners around the world. The initial revenue model for our

1

Table of Contents

service offered through the carriers will generally be a subscription-based model where users pay a monthly fee for access to our service and additional fees for premium content. Our free version is still available in markets where we have not entered into commercial arrangements with carriers or other partners. We have built our platform with a flexible back-end and front-end that is easy to integrate with the back-end systems of mobile carriers and easy to co-brand with mobile carriers. To date, we have filed 23 different patent applications for our platform (none of which have been issued to date) and we continue to create new intellectual property.

We are active in fast growing mobile markets. According to Multimedia Intelligence, the global mobile content market is projected to reach $29 billion by 2012 and Juniper Research projects that the global mobile application market will reach $25 billion in 2014. Our market is a subset of these markets as all forms of ringtones, both audio and video, are popular mobile content items, and our service is available as a mobile application.

We have launched our commercial service with the following four mobile carriers:

| • | Avea Iletisim Hizmetleri A.S., or Avea, a mobile carrier in Turkey with 12.1 million subscribers, of which 8,400 subscribe to our service (launched in November 2009); |

| • | Maxis Mobile Services SDN BHD, or Maxis, a mobile carrier in Malaysia with 11.4 million subscribers, of which 35,000 subscribe to our service (launched in September 2009); |

| • | Vivacell-MTS, or Vivacell, a mobile carrier with 2.0 million subscribers in Armenia, where we have launched our products and services and have 13,400 subscribers, and which is part of the MTS operator group with over 96.0 million global subscribers (launched in June 2009); and |

| • | Emirates Telecommunications Corporation, or Etisalat, a mobile carrier with 7.3 million subscribers in the United Arab Emirates, where we have launched our products and services and have 500 subscribers, and which has more than 94.0 million subscribers worldwide (launched in January 2010). |

We are currently in discussions with several other mobile carriers and we will be pursuing additional agreements with mobile carriers over the next 12 to 24 months.

According to a recent study by the United Nations, there are 4.6 billion global mobile subscribers. The markets in which we have launched our service (Malaysia, Turkey, United Arab Emirates and Armenia) have an estimated 100 million mobile subscribers (including carriers with whom we do not currently have any agreements), which is less than 3% of global subscribers.

Market Overview

The Ringtone Market

Many mobile phone users choose to personalize their mobile phone by changing the standard manufacturer’s ringtone to a ringtone of their choice. Some users select one of the several ringtones installed on the phone by the manufacturer. Since many handsets are now capable of playing conventional digital music files, many mobile users install MP3 and other digital music files as their ringtones to create an even more personalized mobile experience. According to a 2008 study by Ipsos MediaCT, more than one-third of mobile users download ringtones from various sources, and 40% of such users change their ringtones frequently.

Since the early days of mobile phone usage, mobile carriers, mobile media companies and content owners have recognized the sale of ringtones as a source of significant revenues. Ringtones are generally sold as single units or as part of a monthly subscription service in which the user is entitled to a package of ringtones. The ringtone industry was created in 1997 with the first sales of polyphonic ringtones and developed further in 2002 with the creation of the truetone or mastertone.

2

Table of Contents

A significant evolution and innovation in the ringtone business occurred in 2004 with the advent of the ringback tone, which is a tune that the recipient of a call can choose for the caller to hear instead of the standard ring. There has been tremendous growth in ringback tones in recent years. Ringback tones are a network-based service sold by mobile carriers generally on a monthly subscription basis with additional costs for content in some markets. Ringback tones are the first “social ringtones” because users are able to choose the sound that callers will hear when they call the user. According to Multimedia Intelligence, sales in the ringback tone market will triple from 2008 to 2012 to reach $4.7 billion. We are not currently active in the ringback market, but we are studying it closely because we believe its success indicates growing acceptance of social ringtone behavior.

Overall, the ringtone business has seen little innovation in recent years and we believe it is ready for the next evolution of products and services. We believe the following factors will contribute to the evolution of the ringtone market in the near future:

Mobile video has arrived. Improved handset technology and the availability of high speed data networks have spurred tremendous growth in mobile video consumption and revenues. According to Pyramid Research, the mobile video market will grow five-fold from 2008 to 2014 to 534.0 million global subscribers, representing $16 billion in revenues in the United States alone. Our service is a subset of the mobile video market since video ringtones are essentially mobile video clips that are activated upon receipt of a phone call. As users begin to consume more mobile video content, they will expect their ringtones to consist of more than plain audio.

Mobile social networking is growing exponentially. Mobile phone users are increasingly engaging in social networking on their phones, using services such as Facebook and Twitter. The commercial success of ringback tones demonstrates that users want a social experience as part of their ringtone experience. According to Juniper Research, global revenues for mobile social networking and user-generated content will rocket from $1.8 billion in 2008 to $11.8 billion in 2013. Our platform is a subset of mobile social networking and user-generated content since our VringForward video ringtone technology allows users to enjoy a rich social experience by sharing video ringtones from our library or which they created.

User generated content continues to grow. We believe the growth of user-generated content on sites like YouTube is only at a nascent stage. Furthermore, we believe licensed content may only capture a fraction of the content users are interested in because of the advances in technology that facilitate the creation of user-generated content. Our easy-to-use platform allows users to seamlessly create, edit and share their own user-generated video ringtones.

Consumers are no longer afraid of mobile applications. A mobile application can generally provide users with a much richer experience than a wireless application protocol (WAP)-only experience, which requires a user to navigate the browser on its mobile phone to a specific website. However, for years many users were either hesitant or unable to download most mobile applications due to the complexity of downloading applications or security concerns. That has recently changed as smartphones and data plan penetration have increased substantially and Apple Inc. has provided a very simple user experience for downloading applications through its App Store ® . The success of the App Store ® has led other handset manufacturers and mobile carriers to develop and market their own stores which we believe will accelerate user adoption of mobile applications. We have developed multiple versions of our mobile application, which work on more than 200 handsets, and which provide users with a much richer experience than can be achieved via WAP.

3

Table of Contents

Our Product

Our product consists of four primary components:

| 1. | The Vringo Mobile Application: Our application allows the user to engage in a comprehensive, entertaining, and easy-to-use social video ringtone experience. The application includes many features, such as: |

| • | Ability for users to set their own personal video ringtones and to create their own video ringtone with their cameras; |

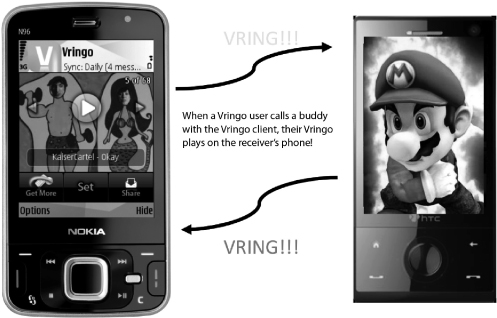

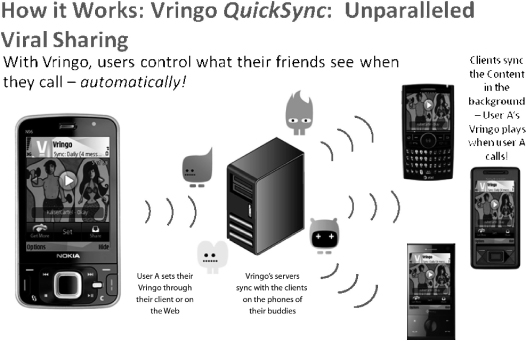

| • | VringForward™ technology, which enables users to share video ringtones with friends. Users may set a default clip for all of their friends or set specific clips for specific friends; |

| • | Gallery-based content browsing of video ringtones; |

| • | Unique “push” technology which allows users to subscribe to content channels and have their video ringtone automatically updated. This may create additional monthly subscription revenue by allowing us to sell various channels of content. Automated delivery ensures users feel they are getting value for their subscription; and |

| • | Compatibility with Symbian, Sony Ericsson, Java, Windows Mobile, Android and Blackberry operating systems. While Windows Mobile, Blackberry and Android do not support video ringtones natively, our development team has enabled our application to work on many of these devices. Such compatibility will require an ongoing effort by our development team to update our application to respond to any modifications of these operating systems and to ensure our application works on new operating systems and handsets. |

| 2. | The Vringo WAP Site: While we support over 200 handsets with our application, our application cannot work on many handsets in the market due to technical limitations of the devices. In order to support a much broader segment of the market, we developed a WAP version of the service that provides a streamlined experience for mobile users who can access the WAP site from browsers on their mobile phones. In particular, this service includes the following features, subject to the handset’s technical capabilities: |

| • | Download and purchase video ringtones; |

| • | Choose a VringForward clip that other users with our application will see when they receive a call from you; and |

| • | Share video ringtones with friends. |

| 3. | The Vringo Website: While video consumption on mobile phones is growing substantially, the vast majority of video browsing and viewing still takes place on the personal computer, or PC. A core component of our product strategy is to allow users to browse and choose their video ringtones on a personal computer from our website (www.vringo.com) and seamlessly deliver content from our website to their mobile phone. Our website includes the following features for users: |

| • | Choose and purchase video ringtones; |

| • | Upload video content stored on their PCs and create personal video ringtones; |

| • | Engage in social behavior such as setting up VringForward, inviting friends to our service and posting clips to Facebook and other social networks; |

| • | Manage their accounts; and |

| • | Automatic synchronization with the mobile application on their phone or WAP account. |

4

Table of Contents

| 4. | The Vringo Studio: The Vringo Studio is an extension of our website that allows users to access video from multiple websites or from their computer and then edit and send these video clips to their mobile phones as customized video ringtones. We are able to create customized versions of the Vringo Studio for specific content partners and mobile carriers that search only a pre-defined set of content. As with our website, the results are seamlessly synchronized with a user’s mobile device. On the Vringo Studio, users may: |

| • | Transform user-generated or other video from the web into personalized video ringtones; |

| • | Import clips into their collection via our application or our WAP site; and |

| • | Share clips via text messaging or email and post clips to social networks. |

Our Strategy

Our goal is to become the leading global provider of video ringtones via our social video ringtone platform. To achieve this goal, we plan to:

Grow our user base through mobile carrier partnerships. We have built our product to easily integrate with mobile carriers. We believe the mobile carrier channel is the most efficient and cost effective channel to grow our user base and to monetize our product. We have launched our service with four mobile carriers in Turkey, Malaysia, Armenia and the United Arab Emirates. We are in discussions with additional mobile carriers and we plan to aggressively pursue additional mobile carriers globally.

Continue to ensure we have broad handset reach. The breadth of our mobile handset coverage will be critical for us to grow our business. Our application already supports over 200 handsets and we diligently certify new mobile handset devices as quickly as possible. Additionally, the WAP version of our service is compatible with almost any device that supports video. We will continue to expand the features available as part of our WAP service.

Enhance our viral and social tools. We believe that there is substantial opportunity to increase the social and viral nature of our product, which will be critical for our growth. We will continue to add features to the product to enhance its viral and social aspects and which enable users to connect with their existing social networks on platforms such as Facebook and Twitter.

Maintain and grow our product and technology leadership. Our technical team is made up of highly regarded industry professionals that continually ensure that our product is on the cutting-edge both in terms of ease of use, functionality and look and feel. We have filed 23 patent applications for our platform (none of which have been issued to date) and we continue to create new intellectual property. We also have enabled our application to work on the Blackberry, Android and Windows Mobile operating systems even though those platforms do not natively support video ringtones. Nevertheless, there is no assurance that our application will continue to work on these operating systems in the future. We plan to continue to allocate technical resources to remain ahead of our competition and provide users with a product that is easy-to-use and cutting-edge.

Build a strong revenue base of recurring monthly subscription revenue. In the ringback tone business, the bulk of revenue generation is subscription-based. We believe this model is appropriate for our product and are initially launching the commercial version of our product as a monthly subscription service with mobile carriers. We are focused on ensuring that our product drives value and limits churn. As the video ringtone market matures, our business model may evolve to capitalize on changes in the market.

Find new forms of distribution. While we are currently focused on the mobile carrier distribution channel, we believe there are other avenues that could be successful distribution channels for us. Specifically, we believe broadcasters and content owners could greatly benefit by promoting our service to their customers by monetizing either their content or leveraging their relationship with advertisers via ads.

5

Table of Contents

Explore monetization through advertising. The visual nature of our service opens up the possibility of incorporating ads in the ringtone. We have had several expressions of interest in an advertisement-funded version of our service and we will explore this model in the future.

Content leadership. We have conducted substantive research of other commercial video ringtone websites and we have not discovered a commercial library with more than 100 video ringtones available for download. Accordingly, we believe our library of more than 4,000 video ringtones is one of the largest commercial video ringtone libraries in the world. We intend to continue to grow our library to enhance our future revenues although in many markets we will rely on our partners to supplement our library with additional locally licensed content.

Risk Factors

Our business is subject to numerous risks as discussed more fully in the section entitled “Risk Factors” beginning on page 11. Principal risks of our business include:

| • | we have generated only losses since inception, which we expect to continue for the foreseeable future; |

| • | we have a limited operating history upon which to base an investment decision; |

| • | our plans depend on us entering into and maintaining content license agreements; |

| • | we are a development stage company with no significant source of income; |

| • | our independent auditors have expressed doubt about our ability to continue our activities as a going concern; |

| • | the continuation of our business is dependent upon raising additional capital; |

| • | our plans depend significantly on entering into distribution arrangements with major mobile carriers and/or other partners; |

| • | we may be subject to litigation or other damages if it is asserted that we or our users are infringing upon the intellectual property rights of third parties; and |

| • | our business may be adversely affected if there are significant shifts in the political, economic and military conditions in Israel and its neighbors. |

Company Information

Our executive offices are located at 18 East 16th Street, 7th Floor, New York, New York 10003 and our telephone number at this location is (646) 448-8210. Our website address is www.vringo.com. The information on our website is not part of this prospectus.

6

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary consolidated financial data set forth below is derived from our consolidated financial statements. The consolidated results of operations for the years ended, and the consolidated balance sheet data as of December 31, 2009 and 2008 and the period from inception through December 31, 2009, are derived from our audited consolidated financial statements included elsewhere in this prospectus. The per share figures in this section are historical and do not give effect to the anticipated 1-for-6 reverse stock split.

It is important that you read this information together with “Management’s Discussion and Analysis of Financial Conditions and Results of Operations,” “Risk Factors” and the financial statements and the notes to the financial statements. The historical results presented below are not necessarily indicative of results to be expected in any future periods.

Consolidated Statements of Operations (in thousands):

| For the Year Ended December 31, |

Cumulative from Inception to December 31, 2009 |

||||||||

| 2009 | 2008 | ||||||||

| Revenue |

20 | — | 20 | ||||||

| Cost of revenue |

31 | — | 31 | ||||||

| Gross margin |

(11 | ) | — | (11 | ) | ||||

| Research and development |

1,975 | 3,110 | 8,384 | ||||||

| Marketing |

1,752 | 2,769 | 6,524 | ||||||

| General and administrative |

1,682 | 1,409 | 4,544 | ||||||

| Operating loss |

5,420 | 7,288 | 19,463 | ||||||

| Finance expense (income), net |

1,058 | 51 | 1,070 | ||||||

| Loss before taxes on income (benefit) |

6,478 | 7,339 | 20,533 | ||||||

| Taxes on income (benefit) |

73 | (7 | ) | (6 | ) | ||||

| Net loss for the period |

6,551 | 7,332 | 20,527 | ||||||

| Basic and diluted net loss per common share |

(2.98 | ) | (3.33 | ) | (9.68 | ) | |||

| Weighted average number of shares used in computing basic and diluted net loss per common share |

2,200,694 | 2,200,694 | 2,121,253 | ||||||

Balance Sheet Data (in thousands):

| December 31, 2009 |

December 31, 2008 |

|||||

| Total current assets |

3,518 | 6,122 | ||||

| Long-term deposit |

12 | 12 | ||||

| Property and equipment, net |

179 | 259 | ||||

| Deferred tax assets—long-term |

80 | 50 | ||||

| Total assets |

3,789 | 6,443 | ||||

| Total current liabilities |

4,523 | 1,281 | ||||

| Total long-term liabilities |

3,498 | 4,171 | ||||

| Total temporary equity |

11,968 | 11,961 | ||||

| Total stockholders’ equity |

(16,200 | ) | (10,970 | ) | ||

| Total liabilities and stockholders’ equity |

3,789 | 6,443 | ||||

7

Table of Contents

| Securities offered: |

2,400,000 units, each unit consisting of: |

| • | one share of common stock; and |

| • | two warrants to purchase common stock. |

| Offering Price: |

$ |

Units:

| Number outstanding before this offering: |

0 |

| Number to be outstanding after this offering: |

2,400,000 |

Common stock:

| Number outstanding before this offering: |

2,631,213 |

| Number to be outstanding after this offering: |

5,031,213 |

Warrants:

| Number outstanding before this offering: |

1,803,455 |

| Number to be outstanding after this offering: |

8,353,610 |

| Exercisability: |

Each warrant included within the unit is exercisable for one share of common stock commencing on the consummation of this offering and expiring at 5:00 p.m., New York City time, on the fifth anniversary of the date of this prospectus. |

| Exercise Price: |

110% of the offering price of the units sold in this offering |

Proposed NASDAQ Capital Market symbols for:

| Units: |

“VRNGU” |

| Common Stock: |

“VRNG” |

| Warrants: |

“VRNGW” |

No assurance can be given that such listing will be approved.

| Trading commencement and separation of common stock and warrants: |

The units will begin trading on or promptly after the date of this prospectus. Each of the common stock and warrants will begin trading separately on or prior to the 90th day after the date of this prospectus. We will issue a press release announcing when such separate trading will begin. |

8

Table of Contents

Following the date that the common stock and warrants begin trading separately, the units will continue to be listed for trading and any securityholder may elect to break apart a unit and trade the common stock and warrants separately or as a unit. Even if the component parts of the units are broken apart and traded separately, the units will continue to be listed as a separate security, and consequently, any subsequent securityholder owning common stock and warrants may elect to combine them together and trade them as a unit. Securityholders will have the ability to trade our securities as a unit until such time as the warrants expire.

| Use of Proceeds: |

Our current estimate of the use of the net proceeds of this offering, which we expect to be approximately $10,300,000, is as follows: $750,000 for capital expenditures, $2,500,000 for cost of revenue, $2,000,000 for research and development, $2,200,000 for sales and marketing and $2,850,000 for general corporate purposes, including working capital and repayment of a portion of our loan facility. We will, however, have broad discretion over the use of proceeds of this offering and the estimates may change over time. |

| Risk Factors: |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our units. |

Except as otherwise set forth in this prospectus, the share information above and elsewhere in this prospectus is based on 2,631,213 shares of common stock outstanding on December 31, 2009 and also:

| • | gives retroactive effect to a 1-for-6 reverse stock split effective immediately prior to the consummation of this offering (except as to the disclosure in the financial statements); |

| • | assumes an initial offering price of $5.00, the mid-point of the $4.00 to $6.00 price range for this offering; |

| • | reflects the exchange of all of our outstanding preferred stock into 1,469,231 shares of common stock upon the closing of this offering and termination of outstanding warrants held by holders of our Series B Convertible Preferred Stock to purchase 200,245 shares of common stock; |

| • | reflects the automatic conversion of the Bridge Notes into an aggregate of 795,200 shares of common stock upon the closing of this offering; |

| • | assumes that the underwriters do not exercise their over-allotment option to purchase up to an additional 360,000 units; and |

| • | assumes that the representative of the underwriters does not exercise its unit purchase option. |

The share information in this prospectus does not include:

| • | 282,927 shares of common stock issuable upon the exercise of stock options outstanding as of December 31, 2009 at a weighted average exercise price of $2.60 per share and 20,000 shares of common stock issuable upon exercise of outstanding warrants with an exercise price of $1.50; |

| • | 1,590,400 shares of common stock issuable upon exercise of warrants to be issued to the investors in the Bridge Financing, upon conversion of the Bridge Notes, with an exercise price of $5.50; |

9

Table of Contents

| • | 795,200 shares of common stock issuable upon exercise of the Special Bridge Warrants, with an exercise price of $2.75; |

| • | 55,664 shares of common stock issuable upon exercise of warrants issued to the placement agent in connection with the Bridge Financing with an exercise price of $3.75; |

| • | 482,346 shares of common stock issuable upon exercise of warrants issued to the lead investors in connection with the Bridge Financing with an exercise price of $0.01; |

| • | 250,000 shares of common stock issuable upon exercise of warrants issued to our senior lenders in connection with the Bridge Financing with an exercise price of $2.75; |

| • | 1,843,469 shares of common stock issuable upon the exercise of stock options issuable to management in connection with this offering with an exercise price of $0.01; |

| • | 1,843,469 shares of common stock issuable upon the exercise of stock options issuable to management in connection with this offering with an exercise price of $5.50; |

| • | 4,800,000 shares of common stock issuable upon the exercise of warrants underlying the units sold in this offering; |

| • | 1,080,000 shares of common stock issuable upon exercise in full of the over-allotment option by the underwriters; and |

| • | 360,000 shares of common stock issuable upon exercise of the unit purchase option issued to the underwriters in connection with this offering with an exercise price of $6.00. |

10

Table of Contents

An investment in our securities involves a high degree of risk and should not be made by anyone who cannot afford to lose his or her entire investment. You should consider carefully the following risks, together with all other information contained in this prospectus, before deciding to invest in our securities. If any of the following events or risks actually occurs, our business, operating results and financial condition would likely suffer materially and you could lose all or part of your investment.

We have a limited operating history upon which to base an investment decision.

We were formed in January 2006 and have a limited operating history. As a result, there is very limited historical performance upon which to evaluate our prospects for achieving our business objectives. Our prospects must be considered in light of the risks, difficulties and uncertainties frequently encountered by development stage entities.

To date, we have generated only losses, which are expected to continue for the foreseeable future.

For the years ended December 31, 2009 and 2008, we incurred a net loss of approximately $6.6 million and $7.3 million, respectively, and used cash in operations of approximately $4.9 million and $7.3 million, respectively, in connection with the development of our software for mobile phones and the operations of our subsidiary. As of December 31, 2009, we had unrestricted cash and cash equivalents of approximately $0.7 million and an accumulated deficit of approximately $20.5 million. We expect our net losses and negative cash flow to continue for the foreseeable future, as we continue to develop our platform, launch our service with new mobile carriers and begin to develop additional products. We cannot assure you that our net losses and negative cash flow will not accelerate and surpass our expectations nor can we assure you that we will ever generate any net income or positive cash flow. Furthermore, we might not have sufficient liquidity to meet our obligations to our suppliers and creditors.

We are a development stage company with no significant source of income and our independent auditors have expressed doubt about our ability to continue our activities as a going concern and the continuation of our business is dependent on us raising additional capital.

We were incorporated in January 2006 and are still a development stage company. Our operations are subject to all of the risks inherent in development stage companies which do not have significant revenues or operating income. Our potential for success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with a new business, especially technology start-up companies. We cannot provide any assurance that our business objectives will be accomplished. All of our audited consolidated financial statements since inception have contained a statement by our auditors that raises substantial doubt about us being able to continue as a going concern unless we are able to raise additional capital. Our financial statements do not include any adjustment relating to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might be necessary should our operations cease.

The continuation of our business is dependent upon us raising additional financing. The issuance of additional equity securities by us could result in a substantial dilution to our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If we should fail to continue as a going concern, you may lose the value of your investment in our securities.

Our expected future growth will place a significant strain on our management, systems and resources.

Our business was formed in January 2006 and has grown quickly. In order to execute our business strategy, we will need to continue to experience growth, which will place a significant strain on our systems, processes,

11

Table of Contents

resources, management and other infrastructure and support mechanisms. To manage the anticipated growth of our operations, we will be required to:

| • | Improve existing and implement new operational, financial and management information controls, reporting systems and procedures; |

| • | Establish relationships with additional vendors and strategic partners and maintain existing relationships; and |

| • | Hire, train, manage and retain additional personnel. |

To the extent we are unable to assemble the personnel, controls, systems, procedures and relationships necessary to manage our future growth, if any, management resources may be diverted, and our opportunity for success may be limited.

If we are unable to enter into or maintain distribution arrangements with major mobile carriers and/or other partners and develop and maintain strategic relationships with such mobile carriers and/or other partners, we will be unable to distribute our products effectively or generate significant revenue.

Our strategy for pursuing a significant share of the video ringtone market is dependent upon establishing distribution arrangements with major mobile carriers and other partners. We need to develop and maintain strategic relationships with these entities in order for them to market our service to their end users. While we have entered into agreements with certain partners pursuant to which our service may be made available to their end-users, such agreements are not exclusive and generally do not obligate the partner to market or distribute our service. In addition, a number of our distribution agreements allow the mobile carrier to terminate its rights under the agreement at any time and for any reason upon 30 days notice. We are dependent upon the subsequent success of these partners in performing their responsibilities and sufficiently marketing our service. We cannot provide you any assurance that we will be able to negotiate, execute and maintain favorable agreements and relationships with any additional partners, that the partners with whom we have a contractual relationship will choose to promote our service or that such partners will be successful and/or will not pursue alternative technologies.

If we are unsuccessful in entering into and maintaining content license agreements, our revenues will be negatively affected.

The success of our service is dependent upon our providing end-users with content they desire. An important aspect of this strategy is establishing licensing relationships with third party content providers that have desirable content. Content license agreements generally have a fixed term, may or may not include provisions for exclusivity and may require us to make significant minimum payments. We have entered into approximately 35 content license agreements with various content providers, none of which require us to make significant minimum payments. While our business is not dependent on any particular content license agreement, there is no assurance that we will enter into a sufficient number of content license agreements or that the ones that we enter into will be profitable and will not be terminated early.

We may not be able to generate revenues from certain of our prepaid mobile customers.

We currently operate in markets that have a high percentage of prepaid mobile customers. Many of these users may not have a sufficient balance in their prepaid account when their free trial ends and we bill them to cover the charges for subscribing to our service. As a result, the subscriber numbers that we periodically disclose may not generate revenues at the expected level.

We are dependent on mobile carriers and other partners to make timely payments to us.

We will receive our revenue from mobile carriers and other distribution partners who may delay payment to us, dispute amounts owed to us, or in some cases refuse to pay us at all. Many of these partners are in markets where we may have limited legal recourse to collect payments from these partners. Our failure to collect payments owed to us from our partners will have an adverse effect on our business and our results of operations.

12

Table of Contents

We may not be able to continue to maintain our application on all of the operating systems which we currently support.

Our application is compatible with various mobile operating systems including the Symbian, Sony Ericsson, Java, Windows Mobile, Android and Blackberry operating systems. While Windows Mobile, Blackberry and Android do not support video ringtones natively, our development team has enabled our application to work on many devices which utilize these operating systems. Since these operating systems do not support video ringtones natively, any significant changes to these operating systems by their respective developers may prevent our application from working properly or at all on these systems. If we are unable to maintain our application on these operating systems or on any other operating systems, users of these operating systems will not be able to use our application, which could adversely affect our business and results of operations.

We operate in the digital content market where piracy of content is widespread.

Our business strategy is partially based upon users paying us for access to our content. If users believe they can obtain the same or similar content for free via other means including piracy, they may be unwilling to pay for our service. Additionally, since our own clips do not have any copy protection, they can theoretically be distributed by a paying user to a non-paying user without any additional payment to us. If users or potential users obtain our content or similar content without payment to us, our business and results of operations will be adversely affected.

Major network failures could have an adverse effect on our business.

Major equipment failures, natural disasters, including severe weather, terrorist acts, acts of war, cyber attacks or other breaches of network or information technology security that affect third-party networks, transport facilities, communications switches, routers, microwave links, cell sites or other third-party equipment on which we rely, could cause major network failures and/or unusually high network traffic demands that could have a material adverse effect on our operations or our ability to provide service to our customers. These events could disrupt our operations, require significant resources to resolve, result in a loss of customers or impair our ability to attract new customers, which in turn could have a material adverse effect on our business, results of operations and financial condition.

Our data is hosted at a remote location. Although we have full alternative site data backed up, we do not have data hosting redundancy. Accordingly, we may experience significant service interruptions, which could require significant resources to resolve, result in a loss of customers or impair our ability to attract new customers, which in turn could have a material adverse effect on our business, results of operations and financial condition.

In addition, with the growth of wireless data services, enterprise data interfaces and Internet-based or Internet Protocol-enabled applications, wireless networks and devices are exposed to a greater degree to third-party data or applications over which we have less direct control. As a result, the network infrastructure and information systems on which we rely, as well as our customers’ wireless devices, may be subject to a wider array of potential security risks, including viruses and other types of computer-based attacks, which could cause lapses in our service or adversely affect the ability of our customers to access our service. Such lapses could have a material adverse effect on our business and our results of operations.

Our business depends upon our ability to keep pace with the latest technological changes, and our failure to do so could make us less competitive in our industry.

The market for our products and services is characterized by rapid change and technological change, frequent new product innovations, changes in customer requirements and expectations and evolving industry

13

Table of Contents

standards. Products using new technologies or emerging industry standards could make our products and services less attractive. Furthermore, our competitors may have access to technology not available to us, which may enable them to produce products of greater interest to consumers or at a more competitive cost. Failure to respond in a timely and cost-effective way to these technological developments may result in serious harm to our business and operating results. As a result, our success will depend, in part, on our ability to develop and market product and service offerings that respond in a timely manner to the technological advances available to our customers, evolving industry standards and changing preferences.

Our inability to identify, hire and retain qualified personnel would adversely affect our business.

Our continued success will depend, to a significant extent, upon the performance and contributions of our senior management and upon our ability to attract, motivate and retain highly qualified management personnel and employees. We depend on our key senior management to effectively manage our business in a highly competitive environment. If one or more of our key officers join a competitor or form a competing company, we may experience interruptions in product development, delays in bringing products to market, difficulties in our relationships with customers and loss of additional personnel, which could significantly harm our business, financial condition, operating results and projected growth.

Regulation concerning consumer privacy may adversely affect our business.

Certain technologies that we currently support, or may in the future support, are capable of collecting personally-identifiable information. We anticipate that as mobile telephone software continues to develop, it will be possible to collect or monitor substantially more of this type of information. A growing body of laws designed to protect the privacy of personally-identifiable information, as well as to protect against its misuse, and the judicial interpretations of such laws, may adversely affect the growth of our business. In the United States, these laws could include the Federal Trade Commission Act, the Electronic Communications Privacy Act, the Fair Credit Reporting Act and the Gramm-Leach Bliley Act, as well as various state laws and related regulations. In addition, certain governmental agencies, like the Federal Trade Commission, have the authority to protect against the misuse of consumer information by targeting companies that collect, disseminate or maintain personal information in an unfair or deceptive manner. In particular, such laws could limit our ability to collect information related to users or our services, to store or process that information in what would otherwise be the most efficient manner, or to commercialize new products based on new technologies. The evolving nature of all of these laws and regulations, as well as the evolving nature of various governmental bodies’ enforcement efforts, and the possibility of new laws in this area, may adversely affect our ability to collect and disseminate or share certain information about consumers and may negatively affect our ability to make use of that information. If we fail to successfully comply with applicable regulations in this area, our business and prospects could be harmed.

Consumer avoidance of services which collect, store or use personally-identifiable data could adversely affect our business.

Consumer sentiment regarding privacy issues is constantly evolving. Such consumer sentiment may affect the buying public’s interest in our current or future service offerings. In some areas, consumer groups and individual consumers have already begun to vigorously lobby against, or otherwise express significant concern over, the collection, storage and/or use of personally-identifiable information. Accordingly, privacy concerns of consumers may influence mobile carriers to refrain from offering products that could harm the overall mobile telephone industry. Moreover, strong consumer attitudes often precipitate new regulations like the ones described above. If we fail to successfully monitor and consider the privacy concerns of consumers, our business and prospects would be harmed.

We have not been subject to Sarbanes-Oxley regulations and we, therefore, may lack the financial controls and safeguards now required of public companies.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC, or the Sarbanes-Oxley Act, we will be required, beginning with our fiscal year ending December 31, 2011, to

14

Table of Contents

include in our annual report our assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year ending December 31, 2011. Furthermore, our independent registered public accounting firm will be required to report separately on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting. We do not have the internal infrastructure necessary to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act. We expect to incur additional expenses and expend management’s time as a result of performing the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements. There can be no assurance that there are no significant deficiencies or material weaknesses in the quality of our financial controls.

We will incur significant increased costs as a public company and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. SEC and NASDAQ Capital Market rules and regulations impose heightened requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel will devote a substantial amount of time to these compliance initiatives. We may also need to hire additional finance and administrative personnel to support our compliance requirements. Moreover, these rules and regulations will increase our legal and financial costs and make some activities more time-consuming.

In addition, as described above, we will be required to maintain effective internal controls over financial reporting and disclosure controls and procedures pursuant to the Sarbanes-Oxley Act. Our testing, and the subsequent testing by our independent registered public accounting firm, may reveal deficiencies or material weaknesses in our internal controls over financial reporting. Our compliance with Section 404 of the Sarbanes-Oxley Act will require that we incur substantial accounting expense and expend significant management effort. We currently do not have an internal audit group and we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. If we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies or material weaknesses in our internal controls over financial reporting, the market price of our securities could decline and we could be subject to sanctions or investigations by the NASDAQ Capital Market, SEC or other regulatory authorities, which would require additional financial and management resources.

If we are not able to adequately protect our intellectual property, we may not be able to compete effectively.

Our ability to compete depends in part upon the strength of our proprietary rights in our technologies, brands and content. We rely on a combination of U.S. and foreign patents, copyrights, trademark, trade secret laws and license agreements to establish and protect our intellectual property and proprietary rights. The efforts we have taken to protect our intellectual property and proprietary rights may not be sufficient or effective at stopping unauthorized use of our intellectual property and proprietary rights. In addition, effective trademark, patent, copyright and trade secret protection may not be available or cost-effective in every country in which our services are made available through the Internet. There may be instances where we are not able to fully protect or utilize our intellectual property in a manner that maximizes competitive advantage. If we are unable to protect our intellectual property and proprietary rights from unauthorized use, the value of our products may be reduced, which could negatively impact our business. Our inability to obtain appropriate protections for our intellectual property may also allow competitors to enter our markets and produce or sell the same or similar products. In addition, protecting our intellectual property and other proprietary rights is expensive and diverts critical managerial resources. If any of the foregoing were to occur, or if we are otherwise unable to protect our intellectual property and proprietary rights, our business and financial results could be adversely affected.

15

Table of Contents

If we are forced to resort to legal proceedings to enforce our intellectual property rights, the proceedings could be burdensome and expensive. In addition, our proprietary rights could be at risk if we are unsuccessful in, or cannot afford to pursue, those proceedings.

We also rely on trade secrets and contract law to protect some of our proprietary technology. We have entered into confidentiality and invention agreements with our employees and consultants. Nevertheless, these agreements may not be honored and they may not effectively protect our right to our un-patented trade secrets and know-how. Moreover, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets and know-how.

The possibility of extensive delays in the patent issuance process could effectively reduce the term during which a marketed product is protected by patents.

We may need to obtain licenses to patents or other proprietary rights from third parties. We may not be able to obtain the licenses required under any patents or proprietary rights or they may not be available on acceptable terms. If we do not obtain required licenses, we may encounter delays in product development or find that the development, manufacture or sale of products requiring licenses could be foreclosed. We may, from time to time, support and collaborate in research conducted by universities and governmental research organizations. We may not be able to acquire exclusive rights to the inventions or technical information derived from these collaborations, and disputes may arise over rights in derivative or related research programs conducted by us or our collaborators.

If we or our users infringe on the intellectual property rights of third parties, we may have to defend against litigation and pay damages and our business and prospects may be adversely affected.

If a third party were to assert that our products infringe on its patent, copyright, trademark, right of publicity, right of privacy, trade secret or other intellectual property rights, we could incur substantial litigation costs and be forced to pay substantial damages. Third-party infringement claims, regardless of their outcome, would not only consume significant financial resources, but would also divert our management’s time and attention. Such claims or the lack of available access to certain sites or content could also cause our customers or potential customers to purchase competitors’ products if such competitors have access to the sites or contents that we are lacking or defer or limit their purchase or use of our affected products or services until resolution of the claim. In connection with any such claim or litigation, our mobile carriers and other partners may decide to re-assess their relationships with us, especially if they perceive that they may have potential liability or if such claimed infringement is a possible breach of our agreement with such mobile carrier. If any of our products are found to violate third-party intellectual property rights, we may have to re-engineer one or more of our products, or we may have to obtain licenses from third parties to continue offering our products without substantial re-engineering. Our efforts to re-engineer or obtain licenses could require significant expenditures of time and money and may not be successful. Accordingly, any claims or litigation regarding our infringement of intellectual property of a third party by us or our users could have a material adverse effect on our business and prospects.

Third party infringement claims could also significantly limit our Vringo Studio product and the content available in our content library. Our Vringo Studio tool allows users to access video from multiple sites on the web or from their computer and then edit and send these video clips to their mobile phones as customized video ringtones. These websites could choose to block us from accessing their content for violating their terms of service by allowing users to download clips or for any other reason, which could significantly limit the availability of content in the Vringo Studio. Additionally, while we employ special software that seeks to determine whether a clip is copyrighted or otherwise restricted, it is not feasible for us to determine whether users of Vringo Studio own or acquire appropriate intellectual property permissions to use each clip before it is downloaded. Therefore, we require users of the Vringo Studio to certify that they have the rights to use the content which they desire to send to their phone. Additionally, while the majority of the clips in our content

16

Table of Contents

library are either licensed by us directly or are public domain or creative commons, our content library contains certain clips which we have not licensed from the content owner. As a result, we may receive cease-and-desist letters, or other threats of litigation, from website hosts and content owners asserting that we are infringing on their intellectual property or violating the terms and conditions of their websites. In such a case, we will remove or attempt to obtain licenses for such content or obtain additional content from other websites. However, there is no assurance that we will be able to enter into license agreements with content owners. Consequently, we may be forced to remove a portion of our content from our library and significantly limit the availability of content in the Vringo Studio. This would negatively impact our user experience and may cause users to cancel our service and make our service less attractive to our partners.

Our ownership is concentrated among a small number of stockholders and if our principal stockholders, directors and officers choose to act together, they may be able to control our management and operations, which may prevent us from taking actions that may be favorable to you.

Our ownership is concentrated among a small number of stockholders, including our founders, directors, officers, Warburg Pincus Private Equity Fund IX, L.P. (“Warburg”) and entities related to these persons. Upon the completion of this offering, our founders and Warburg will beneficially own approximately 8.7% and 16.7%, respectively, of our voting interest. Our officers and directors (excluding our founders) will beneficially own approximately 4.6% of our voting interest upon completion of the offering. Accordingly, these stockholders, acting together, will have the ability to exert substantial influence over all matters requiring approval by our stockholders, including the election and removal of directors and any proposed merger, consolidation or sale of all or substantially all of our assets. In addition, they could dictate the management of our business and affairs. This concentration of ownership could have the effect of delaying, deferring or preventing a change in control of us or impeding a merger or consolidation, takeover or other business combination that could be favorable to you.

If an active, liquid trading market for our securities does not develop, you may not be able to sell your shares quickly or at or above the initial offering price.

Although we intend to apply to list our securities on the NASDAQ Capital Market, as of the date of this prospectus, there is currently no market for our securities. An active and liquid trading market for our securities may not develop or be sustained following this offering. You may not be able to sell your shares quickly or at or above the initial offering price if trading in our stock is not active. The initial public offering price may not be indicative of prices that will prevail in the trading market. See “Underwriting” for more information regarding the factors that will be considered in determining the initial public offering price.

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

The initial offering price of our units is substantially higher than the net tangible book value per share of our common stock immediately after this offering. Therefore, if you purchase our units in this offering, you will incur an immediate dilution of $3.30 (or 66%) in net tangible book value per share from the price you paid, based upon the initial public offering price of $5.00 per unit. The exercise of outstanding options and warrants and the public warrants will result in further dilution in your investment. In addition, if we raise funds by issuing additional securities, the newly issued securities may further dilute your ownership interest.

The sale of a substantial number of shares by our securityholders may have an adverse effect on the market price of our common stock.

In connection with this offering, we are registering the resale of 3,180,800 shares of our common stock held by investors who participated in the Bridge Financing. In addition, certain of our other stockholders may require us to register the resale of their shares of common stock subsequent to the consummation of this offering. If they

17

Table of Contents

exercise their registration rights with respect to all of their beneficially owned shares of common stock as of the date of this prospectus, then there will be an additional 1,090,117 shares of common stock eligible for trading in the public market.

In addition, we have agreed to issue to Maxim Group LLC a unit purchase option to purchase a number of units equal to 5% of the units sold in this offering. Maxim Group LLC is entitled to require us to register the resale of the shares of common stock included in such units and the shares of common stock underlying the warrants included in such units. If Maxim Group LLC exercises its registration rights with respect to all of such shares of common stock, then there will be an additional 360,000 shares of common stock eligible for trading in the public market. If our securityholders sell all of the foregoing shares, the market price of our common stock may be adversely affected.

We may allocate net proceeds from this offering in ways with which you may not agree.

Our management will have broad discretion in using the proceeds from this offering and may use the proceeds in ways with which you may disagree. We are not required to allocate the net proceeds from this offering to any specific investment or transaction and, therefore, you cannot determine at this time the value or propriety of our application of the proceeds. Moreover, you will have not have an opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use our proceeds. We may use the proceeds for corporate purposes that do not immediately enhance our prospects for the future or increase the value of your investment. As a result, you and other stockholders may not agree with our decisions. See “Use of Proceeds” for additional information.

Future sales of our shares of common stock by our stockholders could cause the market price of our common stock to drop significantly, even if our business is performing well.

After this offering (and assuming exchange of all preferred stock and the conversion of the Bridge Notes), we will have 5,031,213 shares of common stock issued and outstanding, excluding shares of common stock issuable upon exercise of options or warrants. This number includes 2,400,000 shares of common stock included in the units we are selling in this offering, which may be resold in the public market immediately. The remaining 2,631,213 shares will become available for resale in the public market as shown in the chart below.

| Number of Restricted Shares/Percentage of Total Shares Outstanding After Offering |

Date of Availability for Resale into the Public Market | |

| 1,191,628/24% |

Non-affiliate shares will be eligible for sale following their release from the lock-up agreement these stockholders have with the underwriters. | |

| 1,439,585/29% |

Affiliate shares will be eligible for sale, from time to time, following their release from the lock-up agreement these stockholders have with the underwriters. | |

At any time and without public notice, the underwriters may, in their sole discretion, release all or some of the securities subject to their lock-up agreements. As shares saleable under Rule 144 are sold after the closing of this offering or as restrictions on resale end, the market price of our stock could drop significantly if the holders of restricted shares sell them or are perceived by the market as intending to sell them. This decline in our stock price could occur even if our business is otherwise performing well. For more detailed information, please see “Share Eligible for Future Sale” and “Underwriting—Lock-up Agreements”.