Attached files

| file | filename |

|---|---|

| EX-23.1 - TALON INTERNATIONAL, INC. | exh23-1.htm |

| EX-21.1 - TALON INTERNATIONAL, INC. | exh21-1.htm |

| EX-32.1 - TALON INTERNATIONAL, INC. | exh32-1.htm |

| EX-31.1 - TALON INTERNATIONAL, INC. | exh31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

[X]

|

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

For

the fiscal year ended December 31, 2009

|

[_]

|

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

Commission

file number 1-13669

TALON

INTERNATIONAL, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

(State

or Other Jurisdiction of Incorporation or Organization)

|

95-4654481

(I.R.S.

Employer

Identification No.)

|

|

21900

Burbank Blvd., Suite 270

|

||

|

Woodland

Hills, California

|

91367

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

(818)

444-4100

(Registrant’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, $.001 par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes

[_] No [X]

Indicate

by check mark if the registration is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.Yes [_] No [X]

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

past 90 days. Yes

[X] No [_]

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes

[_] No [_]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K [_]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer or a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act).

|

Large

accelerated filer [_]

|

Accelerated

filer [_]

|

Non-accelerated

filer [_]

|

Smaller

reporting company [X]

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes [_] No [X]

At June

30, 2009, the aggregate market value of the voting and non-voting common stock

held by non-affiliates of the registrant was $1,513,311.

At March

29, 2010 the issuer had 20,291,433 shares of Common Stock, $.001 par value,

issued and outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

TALON

INTERNATIONAL, INC.

| PART I | Page | ||

|

2

|

|||

|

8

|

|||

|

16

|

|||

|

17

|

|||

|

17

|

| PART II | |||

| 18 | |||

|

20

|

|||

| 21 | |||

|

35

|

|||

|

35

|

|||

| 70 | |||

|

70

|

|||

|

71

|

| PART III | |||

|

71

|

|||

|

75

|

|||

|

86

|

|||

|

88

|

|||

|

89

|

1

Forward

Looking Statements

|

This

report and other documents we file with the SEC contain forward looking

statements that are based on current expectations, estimates, forecasts

and projections about us, our future performance, our business or others

on our behalf, our beliefs and our management’s assumptions. In addition,

we, or others on our behalf, may make forward looking statements in press

releases or written statements, or in our communications and discussions

with investors and analysts in the normal course of business through

meetings, webcasts, phone calls and conference calls. Words such as

“expect,” “anticipate,” “outlook,” “could,” “target,” “project,” “intend,”

“plan,” “believe,” “seek,” “estimate,” “should,” “may,” “assume,”

“continue,” variations of such words and similar expressions are intended

to identify such forward looking statements. These statements are not

guarantees of future performance and involve certain risks, uncertainties

and assumptions that are difficult to predict. We describe our respective

risks, uncertainties and assumptions that could affect the outcome or

results of operations in “Item 1A. Risk Factors.” We have based our

forward looking statements on our management’s beliefs and assumptions

based on information available to our management at the time the

statements are made. We caution you that actual outcomes and results may

differ materially from what is expressed, implied, or forecast by our

forward looking statements. Reference is made in particular to forward

looking statements regarding projections or estimates concerning our

ability to refinance our debt facility or reach an agreement for an

extension or restructuring of our debt with our existing

lender; our business, including demand for our products and

services, mix of revenue streams, ability to control and/or reduce

operating expenses, anticipated gross margins and operating results, cost

savings, product development efforts, general outlook of our business and

industry, international businesses, competitive position, adequate

liquidity to fund our operations and meet our other cash requirements; and

the global economic environment in general and consumer demand for

apparel. Except as required under the federal securities laws

and the rules and regulations of the SEC, we do not have any intention or

obligation to update publicly any forward looking statements after the

distribution of this report, whether as a result of new information,

future events, changes in assumptions, or

otherwise.

|

PART

I

General

Talon

International, Inc. specializes in the manufacturing and distribution of a full

range of apparel accessories including zippers and trim items to manufacturers

of fashion apparel, specialty retailers and mass merchandisers. We

manufacture and distribute zippers under our Talon® brand name to

manufacturers for apparel brands and retailers such as Abercrombie & Fitch,

JC Penney, Wal-Mart, Kohl’s, Juicy Couture and Phillips-Van Heusen, among

others. We also provide full service outsourced trim design, sourcing and

management services and supply specified trim items for manufacturers of fashion

apparel such as Victoria’s Secret, Tom Tailor, Abercrombie & Fitch, American

Eagle, Polo Ralph Lauren, New York and Company, Express, and

others. Under our Tekfit® brand, we develop and

sell a stretch waistband that utilizes a patented technology that we

license from a third party.

We were

incorporated in the State of Delaware in 1997. We were formed to

serve as the parent holding company of Tag-It, Inc., a California corporation,

Tag-It Printing & Packaging Ltd., which changed its name in 1999 to Tag-It

Pacific (HK) LTD, a BVI corporation, Tagit de Mexico, S.A. de C.V., A.G.S.

Stationery, Inc., a California corporation, and Pacific Trim & Belt, Inc., a

California corporation. All of these companies were consolidated under a parent

limited liability company in October 1997. These companies became our

wholly owned subsidiaries immediately prior to the effective date of our initial

public offering in January 1998. In 2000, we formed two wholly owned

subsidiaries of Tag-It Pacific, Inc.: Tag-It Pacific Limited, a Hong

Kong corporation and Talon International, Inc., a Delaware corporation. During

2006 we formed two wholly owned subsidiaries of Talon International, Inc.

(formerly Tag-It Pacific, Inc.): Talon Zipper (Shenzhen) Company Ltd. in China

and Talon International Pvt. Ltd., in India. On July 20, 2007 we changed our

corporate name from Tag-It Pacific, Inc. to Talon International,

Inc. Our website is www.talonzippers.com.

2

Our

website address provided in this Annual Report on Form 10-K is not intended to

function as a hyperlink and the information on our website is not and should not

be considered part of this report and is not incorporated by reference in this

document.

Business

Summary

We

operate our business within three product groups, Talon, Trim and

Tekfit. In our Talon group, we design, engineer, test and

distribute zippers under our Talon trademark and trade

names to apparel brands and manufacturers. Talon enjoys brand

recognition in the apparel industry worldwide. Talon is a 100-year-old

brand, which is well known for quality and product innovation and was the

original pioneer of the formed wire metal zipper for the jeans industry and is a

specified zipper brand for manufacturers in the sportswear and outerwear markets

worldwide. We provide a line of high quality zippers, including a

specialty zipper for kids clothing, for distribution to apparel manufacturers

worldwide, including principally Hong Kong, China, Taiwan, India, Indonesia,

Bangladesh, Mexico and Central America and we have sales and marketing teams in

most of these areas. We have developed joint manufacturing arrangements in

various geographical international local markets to manufacture, finish and

distribute zippers under the Talon brand name. Our

manufacturing partners operate to our specifications and under our quality

requirements, compliance controls and our direct manufacturing and quality

assurance supervision, producing finished zippers for our customers in their

local markets. This operating model allows us to significantly

improve the speed at which we serve the market and to expand the geographic

footprint of our Talon

products. The Talon zipper is promoted both

within our trim packages, as well as a stand-alone product line.

In our

Trim products group, we act as a fully integrated single-source supplier,

designer and sourcing agent of a full range of trim items for manufacturers of

fashion apparel. Our business focuses on servicing all of the trim

requirements of our customers at the manufacturing and retail brand level of the

fashion apparel industry. Trim items include labels, buttons, rivets, printed

marketing material, polybasic, packing cartons and hangers. Trim

items comprise a relatively small part of the cost of most apparel products but

comprise the vast majority of components necessary to fabricate a typical

apparel product. We offer customers a one-stop outsource service for

all trim related matters. Our teams work with the apparel designers

and function as an extension of their staff.

If our

customer is creating a new pair of pants for their fall collection, our Trim

products group will collaborate with them on their design vision, then present

examples of their vision in graphic form for all apparel accessory

components. We will design the buttons, snaps, hang tags, labels,

zippers, zipper pullers and other items. Once our customer selects

the designs they like, our sourcing and production teams coordinate with our

database of manufacturers worldwide to ensure the best manufacturing solution

for the items being produced. The proper manufacturing and sourcing

solution is a critical part of our service. Knowing the best facility

or supplier to ensure timely production, the proper paper finishes, distressing

or other types of material needs or manufacturing techniques to be used is

critical. Because we perform this function for many different global

projects and apparel brands, we have a depth and breadth of knowledge in the

manufacturing and sourcing that our customers cannot achieve, and therefore

offer a significant value to our customers. In addition, because we

are consistently innovating new items, manufacturing techniques and finishes, we

bring many new, fresh and unique ideas to our customers. Once we

identify the appropriate supply source, we create production samples of all of

our designs and products and review the samples with our customers so they can

make a final decision while looking at the actual items that will be used on the

garments. When the customer selects the appropriate items, we are

identified as the sole-source trim supplier for the project, and our customer’s

factories are then required to purchase the trim products from

us. Throughout the garment manufacturing process, we consistently

monitor the timing and accuracy of the production items to ensure the production

items exactly match all samples when delivered to our customer’s apparel

factories.

3

We also

serve as a specified supplier in our zipper and trim products for a variety of

major retail brand and private-label oriented companies. A specified

supplier is a supplier that has been approved for its quality and service by a

major retail brand or private-label company. Apparel contractors

manufacturing for the retail brand or private-label company must purchase their

zipper and trim requirements from a supplier that has been

specified. We seek to expand our services as a supplier of select

items for such customers, to being a preferred or single-source provider of the

entire brand customer’s authorized trim and zipper requirements. Our

ability to offer a full range of trim and zipper products is attractive to brand

name and private-label oriented customers because it enables the customer to

address their quality and supply needs for all of their trim requirements from a

single source, avoiding the time and expense necessary to monitor quality and

supply from multiple vendors and manufacturer sources. Becoming a specified

supplier to brand customers gives us an advantage to become the preferred or

sole vendor of trim and zipper items for all apparel manufacturers contracted

for production for that brand name.

Our teams

of sales employees, representatives, program managers, creative design personnel

and global production and distribution coordinators at our facilities located in

the United States, Europe, and throughout Southeast Asia enable us to take

advantage of and address the increasingly complicated requirements of the large

and expanding demand for complete apparel accessory solutions. We

plan to continue to expand operations in Asia, Europe, and Central America to

take advantage of the large apparel manufacturing markets in these

regions.

Products

Talon Zippers - We offer a

full line of metal, coil and plastic zippers bearing the Talon brand name. Talon zippers are used

primarily by manufacturers in the apparel industry and are distributed through

our distribution facilities in the United States, Europe, Hong Kong, China,

Taiwan, India, Indonesia and Bangladesh and through these designated offices to

other international markets.

We expand

our distribution of Talon zippers through the

establishment of a combination of Talon owned sales,

distribution and manufacturing locations, strategic distribution relationships

and joint ventures. These distributors and manufacturing joint

ventures, in combination with Talon owned and affiliated

facilities under the Talon brand, improve our

time-to-market by eliminating the typical setup and build-out phase for new

manufacturing capacity throughout the world by sourcing, finishing and

distributing to apparel manufacturers in their local

markets. The branded apparel zipper market is dominated by one

company and we have positioned Talon to be a viable global

alternative to this competitor and capture an increased market share

position. We leverage the brand awareness of the Talon name by branding other

products in our line with the Talon name.

Trim - We consider our high

level of customer service as a fully integrated single-source supplier essential

to our success. We combine our high level of customer service within

our Trim solutions with

a history of design and manufacturing expertise to offer our customers a

complete trim solution product. We believe this full-service product

gives us a competitive edge over companies that only offer selected trim

components because our full service solutions save our customers substantial

time in ordering, designing, sampling and managing trim orders from several

different suppliers. Our proprietary tracking and order management

system allows us to seamlessly supply trim solutions and products to apparel

brands, retailers and manufacturers around the world.

We

produce customized woven, leather, synthetic, embroidered and novelty labels and

tapes, which can be printed on or woven into a wide range of fabrics and other

materials using various types of high-speed equipment. As an

additional service, we may provide our customers the machinery used to attach

the buttons, rivets and snaps we distribute.

4

Tekfit - We distribute a

proprietary stretch waistband under our Exclusive License and Intellectual

Property Rights agreement with Pro-Fit Holdings, Limited. The agreement gives us

the exclusive rights to sell or sublicense stretch waistbands manufactured under

the patented technology developed by Pro-Fit for garments, manufactured anywhere

in the world, for sale in the U.S. market and for all U.S. brands for the life

of the patent. We offer apparel manufacturers advanced, patented

fabric technologies to utilize in their garments under the Tekfit name. This

technology allows fabrics to be altered through the addition of stretch

characteristics resulting in greatly improved fit and comfort. Pant

manufacturers use this technology to build-in a stretch factor into standard

waistbands that does not alter the appearance of the garment, but will allow the

waist to stretch out and back by as much as two waist sizes.

Our

efforts to offer this product technology to customers have been limited by a

licensing dispute. As described more fully in Item 3 “Legal

Proceedings” we are in litigation with Pro-Fit related to our

exclusively licensed rights to sell or sublicense stretch waistbands

manufactured under Pro-Fit’s patented technology. The revenues we

derive from the sales of products incorporating the stretch waistband technology

represented only a small portion of our consolidated revenue for the years 2009,

2008 and 2007 as a consequence of this litigation.

The

percentages of total revenue contributed by each of our three primary product

groups for the last three fiscal years are as follows:

|

Year

Ended December 31,

|

|||||||

|

2009

|

2008

|

2007

|

|||||

|

Product

Group Net Revenue:

|

|||||||

|

Talon zipper

|

55.1

|

%

|

59.0

|

%

|

52.2

|

%

|

|

|

Trim

|

44.7

|

%

|

40.6

|

%

|

46.1

|

%

|

|

|

Tekfit

|

0.2

|

%

|

0.4

|

%

|

1.7

|

%

|

|

Design

and Development

Our

in-house creative teams produce products with innovative technology and designs

that we believe distinguish our products from those of our

competitors. We support our skills and expertise in material

procurement and product-manufacturing coordination with product technology and

designs intended to meet fashion demands, as well as functional and cost

parameters. In 2006, we introduced the Talon KidZip® which is a

specialty zipper for children’s apparel engineered to surpass industry

established strength and safety tests, while maintaining the fashion image and

requirements of today’s apparel demands.

Many

specialty design companies with which we compete have limited engineering,

sourcing or manufacturing experience. These companies create products

or designs that often cannot be implemented due to difficulties in the

manufacturing process, the expenses of required materials, or a lack of

functionality in the resulting product. We design products to

function within the limitations imposed by the applicable manufacturing

framework. Using our manufacturing and sourcing experience, we ensure

delivery of quality products and we minimize the time-consuming delays that

often arise in coordinating the efforts of independent design houses and

manufacturing facilities. By supporting our material procurement and

product manufacturing services with design services, we reduce development and

production costs and deliver products to our customers sooner than many of our

competitors. Our development costs are low, most of which are borne

by our customers. Our design teams are based in our California, Ohio

and China facilities.

5

Customers

We have

more than 800 active customers. Our

customers include the designated suppliers of well-known apparel retailers and

brands, such as Victoria’s Secret, Tom Tailor, Abercrombie & Fitch, Polo

Ralph Lauren, Phillips-Van Heusen, American Eagle and Juicy Couture, among

others. Our customers also include contractors for specialty

retailers such as Express and mass merchant retailers such as Wal-Mart, Kohl’s,

Penney’s and Target.

For the

years ended December 31, 2009, 2008 and 2007, our three largest customers

represented approximately 9%, 8% and 9%, respectively, of consolidated net

sales.

Sales

and Marketing

We sell

our principal products through our own sales force based in Los Angeles,

California, various other cities in the United States, Hong Kong, China, India,

Indonesia, Taiwan, and Bangladesh. We contract with outside sales

representatives in Europe, and we develop Central America opportunities through

our U.S. sales force and outside sales representatives. We also employ customer

service representatives who are assigned to key customers and provide in-house

customer service support. Our executives have developed relationships

with our major customers at senior levels. These executives actively

participate in marketing and sales functions and the development of our overall

marketing and sales strategies. When we become the outsourcing vendor

for a customer’s packaging or trim requirements, we position ourselves as if we

are an in-house department of the customer’s trim procurement

operation.

Sourcing

and Assembly

We have

developed expertise in identifying high quality materials, competitive prices

and approved vendors for particular products and materials. This

expertise enables us to produce a broad range of packaging and trim products at

various price points. The majority of products that we procure and distribute

are purchased on a finished good basis. Raw materials, including

paper products and metals used to manufacture zippers, used in the assembly of

our Trim products are available from numerous sources and are in adequate

supply. We purchase products from several qualified material

suppliers.

We create

most product artwork and any necessary dies and molds used to design and

manufacture our products. All other products that we design and sell

are produced by third party vendors or under our direct supervision or through

joint manufacturing arrangements. We are confident in our ability to

secure high quality manufacturing sources. We intend to continue to outsource

production to qualified vendors, particularly with respect to manufacturing

activities that require substantial investment in capital

equipment.

Principally

through our China facilities, we distribute Talon zippers, trim items and

apparel packaging and coordinate the manufacture and distribution of the full

range of our products. Our China facilities supply several

significant trim programs, services customers located in Asia and the Pacific

Rim and sources products for our U.S. and European based

operations.

Intellectual

Property Rights and Licenses

We have

trademarks as well as copyrights, software copyrights and trade names for which

we rely on common law protection, including the Talon

trademark. Several of our other trademarks are the subject of

applications for federal trademark protection through registration with the

United States Patent and Trademark Office, including “Talon”, “Tag-It”, “Kidzip”

and “Tekfit”.

6

We also

rely on our Exclusive License and Intellectual Property Rights agreement with

Pro-Fit to sell our Tekfit stretch waistbands,

which grants us the right to sell or sublicense stretch waistbands manufactured

under patented technology developed by Pro-Fit for garments manufactured

anywhere in the World for the U.S. market and for all U.S.

brands. These license rights are for the duration of the patents and

trade secrets licensed under the agreement. We are in litigation with

Pro-Fit relating to our rights under the agreement, as described more fully

elsewhere in this report.

Seasonality

We

typically experience seasonal fluctuations in sales volume. These

seasonal fluctuations result in sales volume decreases in the first and fourth

quarters of each year due to the seasonal fluctuations experienced by the

majority of our customers. The apparel industry typically experiences

higher sales volume in the second quarter in preparation for back-to-school

purchases and the third quarter in preparation for year-end holiday purchases.

Backlogs of sales orders are not considered material in the industries in which

we compete, which reduces the predictability and reinforces the volatility of

these cyclical buying patterns on our sales volume.

Inventories

In order

to meet the rapid delivery requirements of our customers, we may be required to

purchase inventories based upon projections made by our customers. In these

cases we may carry a substantial amount of inventory on their

behalf. We attempt to manage this risk by obtaining customer

commitments to purchase any excess inventories. These commitments

provide that in the event that inventories remain with us in excess of six to

nine months from our receipt of the goods from our vendors or the termination of

production of a customer’s product line related to the inventories, the customer

is required to purchase the inventories from us under normal invoice and selling

terms. While these agreements provide us some advantage in the

negotiated disposition of these inventories, we cannot be assured that our

customers will complete these agreements or that we can enforce these agreements

without adversely affecting our business operations.

Competition

We

compete in highly competitive and fragmented industries that include numerous

local and regional companies that provide some or all of the products we

offer. We also compete with United States and international design

companies, distributors and manufacturers of tags, trim, packaging products and

zippers. Some of our competitors, including YKK and Avery Dennison Corporation

have greater name recognition, longer operating histories and greater financial

and other resources.

Because

of our integrated materials procurement and assembly capabilities and our

full-service trim solutions, we believe that we are able to effectively compete

for our customers’ business, particularly where our customers require

coordination of separately sourced production functions. We believe

that to successfully compete in our industry we must offer superior product

pricing, quality, customer service, design capabilities, delivery lead times and

complete supply-chain management. We also believe the Talon brand name and the

quality of our Talon

brand zippers will allow us to gain market share in the zipper

industry. The unique stretch quality of our Tekfit waistbands will also

allow us to compete effectively in the market for waistband

components.

Segment

Information

We

operate in one industry segment, the distribution of a full range of apparel

zipper and trim products to manufacturers of fashion apparel, specialty

retailers and mass merchandisers.

7

Financial

Information About Geographic Areas

We sell

the majority of our products for use by U.S. and European based brands,

retailers and manufacturers. The majority of these customers produce

their products or outsource the production of their products in manufacturing

facilities located outside of the U.S. or Europe, primarily in Hong Kong, China,

Taiwan, India, Indonesia, Bangladesh and Central America.

A summary

of our domestic and international net sales and long-lived assets is set forth

in Item 8 of this Annual Report on Form 10-K, Note 1 and Note 12 of the Notes to

Consolidated Financial Statements.

We are

subject to certain risks referred to in Item 1A, “Risk Factors” and Item 3,

“Legal Proceedings”, including those normally attending international and

domestic operations, such as changes in economic or political conditions,

currency fluctuations, foreign tax claims or assessments, exchange control

regulations and the effect of international relations and domestic affairs of

foreign countries on the conduct of business, legal proceedings and the

availability and pricing of raw materials.

Employees

As of

December 31, 2009, we had approximately 177 full-time employees including 24 in

the United States, 58 employees in Hong Kong, 91 employees in the Peoples

Republic of China, 1 in India, 1 in Indonesia, 1 in Taiwan and 1 in Sri

Lanka. Our labor forces are non-union. We believe that we

have satisfactory employee and labor relations.

Corporate

Governance and Information Related to SEC Filings

Our

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K and amendments to those reports filed with, or furnished to,

the Securities and Exchange Commission (“SEC”) pursuant to Section 13(a) or

15(d) of the Securities Exchange Act of 1934 are available free of charge

through our website, www.talonzippers.com

(in the “Investor” section, as soon as reasonably practical after electronic

filing with or furnishing of such material to the SEC). We make available on our

website our (i) shareholder communications policies, (ii) Code of Ethical

Conduct, (iii) the charters of the Audit and Nominating Committees of our Board

of Directors and (iv) Employee Complaint Procedures for Accounting and Auditing

Matters. These materials are also available free of charge in print to

stockholders who request them by writing to: Investor Relations, Talon

International, Inc., 21900 Burbank Boulevard, Suite 270, Woodland Hills,

CA 91367. Our website address provided in this Annual

Report on Form 10-K is not intended to function as a hyperlink and the

information on our website is not and should not be considered part of this

report and is not incorporated by reference in this document.

Several

of the matters discussed in this document contain forward-looking statements

that involve risks and uncertainties. Factors associated with the

forward-looking statements that could cause actual results to differ from those

projected or forecast are included in the statements below. In

addition to other information contained in this report, readers should carefully

consider the following cautionary statements and risk factors.

8

We may not be able to refinance or

extend our debt facility due at June 30, 2010 and if we cannot we will default

on our credit agreement, which would have a material adverse effect on our

liquidity, business and operations and ability to continue as a going

concern.

Our cash

flows from operating activities will not be sufficient to repay our obligations

under the CVC debt facility which will become due and payable in full on June

30, 2010. Accordingly an extension or modification of the CVC debt

will be required prior to the due date or it will be necessary for us to raise

additional debt or equity financing in order to repay the CVC debt. If we cannot

obtain an extension or modification of the CVC debt, or raise additional equity

or debt to satisfy this requirement we will default on our credit agreement and

the lender would have the right to exercise its remedies including enforcement

of its lien on substantially all of our assets.

There

can be no assurance that additional debt or equity financing will be available

on acceptable terms or at all. If we are unable to secure

additional financing, we may not be able to execute our operating plans, or meet

our debt obligations either of which could have a material adverse effect on our

financial condition and results of operations and affect our ability to operate

as a going concern. See Note 2 of the Notes to Consolidated Financial

Statements.

We

will need to raise additional capital or refinance our existing debt structure

to meet our current and long term needs.

We have

historically satisfied our working capital requirements primarily through cash

flows generated from operations. As we continue to expand globally in

response to the industry trend to outsource apparel manufacturing to offshore

locations, our foreign customers, some of which are backed by U.S. brands and

retailers, represent substantially all of our customers. Our

revolving credit facility provides limited financing secured by our accounts

receivable, and our current borrowing capability may not provide the level of

financing we need to continue in or to expand into additional foreign

markets. We are continuing to evaluate non-traditional financing

alternatives and equity transactions to provide capital needed to fund our

expansion and operations.

Even if

we are able to refinance or restructure our existing credit facility, if we

experience greater than anticipated reductions in sales, we may need to raise

additional capital, or further reduce the scope of our business in order to

fully satisfy our future short-term liquidity requirements. If we

cannot raise additional capital or reduce the scope of our business in response

to a substantial decline in sales, we may default on our credit

agreement.

The

extent of our future long-term capital requirements will depend on many factors,

including our results of operations, future demand for our products, the size

and timing of future acquisitions, our borrowing base availability limitations

related to eligible accounts receivable and inventories and our expansion into

foreign markets. Our need for additional long-term financing includes

the integration and expansion of our operations to maximize the opportunities of

our Talon trade name, and the expansion of our operations in Asia, Europe and

Central America. If our cash from operations is less than anticipated or our

working capital requirements and capital expenditures are greater than we

expect, we may need to raise additional debt or equity financing in order to

provide for our operations. We are continually evaluating various

financing strategies to be used to expand our business and fund future growth or

acquisitions. There can be no assurance that additional debt or equity financing

will be available on acceptable terms or at all. If we are

unable to secure additional financing, we may not be able to execute our plans

for expansion and we may need to implement additional cost savings

initiatives.

9

We

may not be able to satisfy the financial covenants in our debt agreements and if

we cannot, then our lender could declare the debt obligations in default, which

would have a material adverse effect on our liquidity, business and

operations.

Our

revolving credit and term loan agreement requires certain covenants, including a

minimum level of EBITDA as discussed in Note 6 of the Notes to Consolidated

Financial Statements. If we fail to satisfy the EBITDA covenant

in three consecutive quarters, the credit agreement will be in default and can

be declared immediately due and payable by the lender.

In

anticipation of not being able to meet required covenants due to various

reasons, we either negotiate for changes in the relative covenants or negotiate

a waiver with the lender. However, our expectations of future

operating results and continued compliance with all debt covenants cannot be

assured and our lender’s actions are not controllable by us. If we

are in default under the loan agreement, all amounts due under the loan

agreement can be declared immediately due and payable and, unless we are able to

secure alternative financing to repay the lender in full, the lender would have

the right to exercise its remedies including enforcement of its lien on

substantially all of our assets. Further, if the debt is placed in

default, we would be required to reduce our expenses, including curtailing

operations and to raise capital through the sale of assets, issuance of equity

or otherwise, any of which could have a material adverse effect on our financial

condition and results of operations and affect our ability to operate as a going

concern. See Note 2 of the Notes to Consolidated Financial Statements regarding

going concern.

The

ongoing U.S. and global financial and economic uncertainties could negatively

affect our business, results of operations and financial condition.

The

recent financial crisis affecting the global banking system and financial

markets and the going concern threats to financial institutions have resulted in

a tightening in the credit markets; a low level of liquidity in many financial

markets; and extreme volatility in credit, fixed income and equity

markets. Certain apparel manufacturers and retailers, including some

of our customers may experience financial difficulties that increase the risk of

extending credit to such customers. Customers adversely affected by economic

conditions have also attempted to improve their own operating efficiencies by

concentrating their purchasing power among a narrowing group of suppliers. There

can be no assurance that we will remain a preferred supplier to our existing

customers. A decrease in business from or loss of a major customer

could have a material adverse effect on our results of operations and financial

condition.

In

addition, our performance is subject to worldwide economic conditions and their

impact on levels of consumer spending that affect not only the ultimate

consumer, but also retailers, which are served by many of our largest customers.

Consumer spending has remained depressed in early 2010 after deteriorating

significantly in 2008 and 2009, and it may remain depressed or be subject to

further deterioration for the foreseeable future. The worldwide apparel industry

is heavily influenced by general economic cycles. Purchases of fashion apparel

and accessories tend to decline in periods of recession or uncertainty regarding

future economic prospects, as disposable income declines. Many factors affect

the level of consumer spending in the apparel industries, including, among

others: prevailing economic conditions, levels of employment, salaries and wage

rates, energy costs, interest rates, the availability of consumer credit,

taxation and consumer confidence in future economic conditions. During periods

of recession or economic uncertainty, we may not be able to maintain or increase

our sales to existing customers, make sales to new customers, or maintain our

earnings from operations as a percentage of net sales. As a result, our

operating results may be adversely and materially affected by sustained or

further downward trends in the United States or global economy.

10

The

loss of key management and sales personnel could adversely affect our business,

including our ability to obtain and secure accounts and generate

sales.

Our

success has and will continue to depend to a significant extent upon key

management and sales personnel, many of whom would be difficult to

replace. The loss of the services of key employees could have a

material adverse effect on our business, including our ability to establish and

maintain client relationships. Our future success will depend in

large part upon our ability to attract and retain personnel with a variety of

sales, operating and managerial skills. As described above, our

credit facility with CVC becomes due on June 30, 2010, and we will not have

sufficient cash to repay our obligations to CVC. Unless and until we

are able to reach an agreement to refinance or restructure the debt, the

uncertainty created by this situation may make it more difficult to retain our

key management personnel.

The

current global credit crisis has increased our credit risks with vendors and

customers.

We extend

credit to some vendors by supplying them products. If any of these vendors are

unable to honor their commitments to us, due to bankruptcy, cessation of

operations or otherwise, we will likely experience losses on the products we

provided and lose profit margins on the unshipped orders. Most of our customers

are extended credit terms which are approved by us internally. While

we have attempted to cover as much of our credit risks as possible, not all of

our risks can be fully hedged due to the current credit crisis. Such exposure

may translate into losses should there be any adverse changes to the financial

condition of certain customers.

Our operating results in our Tekfit

product group could be adversely affected if we are unsuccessful in resolving a

dispute that now exists regarding our rights under our exclusive license and

intellectual property agreement with Pro-Fit.

Pursuant

to our agreement with Pro-Fit Holdings, Limited, we have exclusive rights in

certain geographic areas to Pro-Fit’s stretch and rigid waistband

technology. We are in litigation with Pro-Fit regarding our rights.

See Item

3, “Legal Proceedings” for discussion of this litigation. Our business in this

product group, and our future results of operations and financial condition

could be adversely affected if we are unable to reach a settlement in a manner

acceptable to us and ensuing litigation is not resolved in a manner favorable to

us. Additionally, we have incurred significant legal fees in this litigation,

and unless the case is settled, we could continue to incur additional legal fees

in increasing amounts to protect our license position.

If

we lose our larger customers or they fail to purchase at anticipated levels, our

sales and operating results will be adversely affected.

Our

results of operations will depend to a significant extent upon the commercial

success of our larger customers. If these customers fail to purchase

our products at anticipated levels, or our relationship with these customers or

the retailers they serve terminates, it may have an adverse effect on our

results because:

|

|

·

|

We

will lose a primary source of revenue if these customers choose not to

purchase our products or services;

|

|

|

·

|

We

may lose the specific nomination of the retailer or

brand;

|

|

|

·

|

We

may not be able to reduce fixed costs incurred in developing the

relationship with these customers in a timely

manner;

|

|

|

·

|

We

may not be able to recoup setup and inventory

costs;

|

|

|

·

|

We

may be left holding inventory that cannot be sold to other customers;

and

|

|

|

·

|

We

may not be able to collect our receivables from

them.

|

11

If

customers default on inventory purchase commitments with us, we will be left

holding non-salable inventory.

We hold

inventories for specific customer programs, which the customers have committed

to purchase. If any customer defaults on these commitments, or

insists on markdowns, we may incur a charge in connection with our holding

non-salable inventory and this would have a negative impact on our operations

and cash flow.

Because we depend on a limited

number of suppliers, we may not be able to always obtain materials when we need

them and we may lose sales and customers.

Lead

times for materials we order can vary significantly and depend on many factors,

including the specific supplier, the contract terms and the demand for

particular materials at a given time. From time to time, we may

experience fluctuations in the prices and disruptions in the supply of

materials. Shortages or disruptions in the supply of materials, or

our inability to procure materials from alternate sources at acceptable prices

in a timely manner, could lead us to miss deadlines for orders and lose sales

and customers.

Our

products may not comply with various industry and governmental regulations and

our customers may incur losses in their products or operations as a consequence

of our non-compliance.

Our

products are produced under strict supervision and controls to ensure that all

materials and manufacturing processes comply with the industry and governmental

regulations governing the markets in which these products are

sold. However, if these controls fail to detect or prevent

non-compliant materials from entering the manufacturing process, our products

could cause damages to our customer’s products or processes and could also

result in fines being incurred. The possible damages and fines could

significantly exceed the value of our products and these risks may not be

covered by our insurance policies.

We operate in an industry that is

subject to significant fluctuations in operating results that may result in

unexpected reductions in revenue and stock price volatility.

We

operate in an industry that is subject to significant fluctuations in operating

results from quarter to quarter, which may lead to unexpected reductions in

revenues and stock price volatility. Factors that may influence our

quarterly operating results include:

|

|

·

|

The

volume and timing of customer orders received during the

quarter;

|

|

|

·

|

The

timing and magnitude of customers’ marketing

campaigns;

|

|

|

·

|

The

loss or addition of a major customer or of a major retailer

nomination;

|

|

|

·

|

The

availability and pricing of materials for our

products;

|

|

|

·

|

The

increased expenses incurred in connection with the introduction of new

products;

|

|

|

·

|

Currency

fluctuations;

|

|

|

·

|

Delays

caused by third parties; and

|

|

|

·

|

Changes

in our product mix or in the relative contribution to sales of our

subsidiaries.

|

Due to

these factors, it is possible that in some quarters our operating results may be

below our stockholders’ expectations and those of public market

analysts. If this occurs, the price of our common stock could be

adversely affected. In the past, following periods of volatility in

the market price of a company’s securities, securities class action litigation

has often been instituted against such a company. In October 2005, a securities

class action lawsuit was filed against us. See Item 3, “Legal Proceedings” for a

detailed description of this lawsuit which is now settled.

12

The outcome of any litigation in

which we have been named as a defendant is unpredictable and an adverse decision

in any such matter could have a material adverse effect on our financial

position and results of operations.

We are

defendants in various litigation matters. These claims may divert financial and

management resources that would otherwise be used to benefit our operations.

Although we believe that we have meritorious defenses to the claims made in each

and all of the litigation matters to which we have been named a party and we

intend to contest each lawsuit vigorously, no assurances can be given that the

results of these matters will be favorable to us.

We

maintain product liability and director and officer insurance that we regard as

reasonably adequate to protect us from potential claims; however we cannot

assure you that it will be adequate to cover any losses. Further, the costs of

insurance have increased dramatically in recent years, and the availability of

coverage has decreased. As a result, we cannot assure you that we will be able

to maintain our current levels of insurance at a reasonable cost, or at

all.

Our

customers have cyclical buying patterns which may cause us to have periods of

low sales volume.

Most of

our customers are in the apparel industry. The apparel industry

historically has been subject to substantial cyclical variations. Our

business has experienced, and we expect our business to continue to experience,

significant cyclical fluctuations due, in part, to customer buying patterns,

which may result in periods of low sales usually in the first and fourth

quarters of our financial year. Backlogs of sales orders are not considered

material in the industries in which we compete, which reduces the predictability

and reinforces the volatility of these cyclical buying patterns on our sales

volume.

Our

business model is dependent on integration of information systems on a global

basis and, to the extent that we fail to maintain and support our information

systems, it can result in lost revenues.

We must

consolidate and centralize the management of our subsidiaries and significantly

expand and improve our financial and operating

controls. Additionally, we must effectively integrate the information

systems of our worldwide operations with the information systems of our

principal offices in California. Our failure to do so could result in

lost revenues, delay financial reporting or have adverse effects on the

information reported.

If

we experience disruptions at any of our foreign facilities, we will not be able

to meet our obligations and may lose sales and customers.

Currently,

we do not operate duplicate facilities in different geographic

areas. Therefore, in the event of a regional disruption where we

maintain one or more of our facilities, it is unlikely that we could shift our

operations to a different geographic region and we may have to cease or curtail

our operations. This may cause us to lose sales and

customers. The types of disruptions that may occur

include:

|

|

·

|

Foreign

trade disruptions;

|

|

|

·

|

Import

restrictions;

|

|

|

·

|

Labor

disruptions;

|

|

|

·

|

Embargoes;

|

|

|

·

|

Government

intervention;

|

|

|

·

|

Natural

disasters; or

|

|

|

·

|

Regional

pandemics.

|

13

Internet-based

systems that we rely upon for our order tracking and management systems may

experience disruptions and as a result we may lose revenues and

customers.

To the

extent that we fail to adequately update and maintain the hardware and software

implementing our integrated systems, our customers may be delayed or interrupted

due to defects in our hardware or our source code. In addition, since

our software is Internet-based, interruptions in Internet service generally can

negatively impact our ability to use our systems to monitor and manage various

aspects of our customer’s trim needs. Such defects or interruptions

could result in lost revenues and lost customers.

There

are many companies that offer some or all of the products and services we sell

and if we are unable to successfully compete, our business will be adversely

affected.

We

compete in highly competitive and fragmented industries with numerous local and

regional companies that provide some or all of the products and services we

offer. We compete with national and international design companies,

distributors and manufacturers of tags, packaging products, zippers and other

trim items. Some of our competitors have greater name recognition,

longer operating histories and greater financial and other resources than we

do.

Unauthorized

use of our proprietary technology may increase our litigation costs and

adversely affect our sales.

We rely

on trademark, trade secret and copyright laws to protect our designs and other

proprietary property worldwide. We cannot be certain that these laws

will be sufficient to protect our property. In particular, the laws

of some countries in which our products are distributed or may be distributed in

the future may not protect our products and intellectual rights to the same

extent as the laws of the United States. If litigation is necessary

in the future to enforce our intellectual property rights, to protect our trade

secrets or to determine the validity and scope of the proprietary rights of

others, such litigation could result in substantial costs and diversion of

resources. This could have a material adverse effect on our operating

results and financial condition. Ultimately, we may be unable, for

financial or other reasons, to enforce our rights under intellectual property

laws, which could result in lost sales.

If

our products infringe any other person’s proprietary rights, we may be sued and

have to pay legal expenses and judgments and redesign or discontinue selling our

products.

From time

to time in our industry, third parties allege infringement of their proprietary

rights. Any infringement claims, whether or not meritorious, could

result in costly litigation or require us to enter into royalty or licensing

agreements as a means of settlement. If we are found to have

infringed the proprietary rights of others, we could be required to pay damages,

cease sales of the infringing products and redesign the products or discontinue

their sale. Any of these outcomes, individually or collectively,

could have a material adverse effect on our operating results and financial

condition.

Counterfeit

products are not uncommon in the apparel industry and our customers may make

claims against us for products we have not produced adversely impacting us by

these false claims.

Counterfeiting

of valuable trade names is commonplace in the apparel industry and while there

are industries organizations and federal laws designed to protect the brand

owner, these counterfeit products are not always detected and it can be

difficult to prove the manufacturing source of these

products. Accordingly, we may be adversely affected if counterfeit

products damage our relationships with customers, and we incur costs to prove

these products are counterfeit, to defend ourselves against false claims and to

pay for false claims.

14

During

the second quarter of 2009 it was discovered that certain Chinese factories had

counterfeited Talon

zippers in conjunction with certain of our former employees, and sold

these products to existing and potential customers. We have initiated efforts to

eliminate and prosecute all offenders. Counterfeiting of known quality brand

products is commonplace within China and in particular where retailers limit

their sources to recognized brands such as Talon. The full

extent of counterfeiting of Talon products, its effect on our business

operations and the costs to investigate and eliminate this activity are ongoing

and are generally undeterminable. However based upon evidence available we

believe the impact is not significant to our current overall

operations. We continue to work closely with major retailers to

identify these activities within the marketplace and will aggressively combat

these efforts worldwide to protect the Talon brand.

We

have experienced and may continue to experience major fluctuations in the market

price for our common stock.

The

following factors could cause the market price of our common stock to decrease,

perhaps substantially:

|

|

·

|

The

failure of our quarterly operating results to meet expectations of

investors or securities analysts;

|

|

|

·

|

Adverse

developments in the financial markets, the apparel industry and the

worldwide or regional economies;

|

|

|

·

|

Interest

rates;

|

|

|

·

|

Changes

in accounting principles;

|

|

|

·

|

Intellectual

property and legal matters;

|

|

|

·

|

Sales

of common stock by existing shareholders or holders of

options;

|

|

|

·

|

Announcements

of key developments by our

competitors;

|

|

|

·

|

Changed

perceptions about our ability to renegotiate or replace our credit and

revolving term loan agreement before maturity at June 30, 2010;

and

|

|

|

·

|

The

reaction of markets and securities analysts to announcements and

developments involving our company.

|

If we need to sell or issue

additional shares of common stock or assume additional debt to finance future

growth, our stockholders’ ownership could be diluted or our earnings could be

adversely impacted.

Our

business strategy may include expansion through internal growth, by acquiring

complementary businesses or by establishing strategic relationships with

targeted customers and suppliers. In order to do so or to fund our

other activities, we may issue additional equity securities that could dilute

our stockholders’ value. We may also

assume additional debt and incur impairment losses to our intangible assets if

we acquire another company.

We may not be able to realize the

anticipated benefits of acquisitions.

We may

consider strategic acquisitions as opportunities arise, subject to the obtaining

of any necessary financing. Acquisitions involve numerous risks,

including diversion of our management’s attention away from our operating

activities. We cannot assure you that we will not encounter

unanticipated problems or liabilities relating to the integration of an acquired

company’s operations, nor can we assure you that we will realize the anticipated

benefits of any future acquisitions.

15

Our

actual tax liabilities may differ from estimated tax resulting in unfavorable

adjustments to our future results.

The

amount of income taxes we pay is subject to ongoing audits by federal, state and

foreign tax authorities. Our estimate of the potential outcome of

uncertain tax issues is subject to our assessment of relevant risks, facts and

circumstances existing at that time. Our future results may include favorable or

unfavorable adjustments to our estimated tax liabilities in the period the

assessments are made or resolved, which may impact our effective tax rate and

our financial results.

We have adopted a number of

anti-takeover measures that may depress the price of our common

stock.

Our

stockholders’ rights plan, our ability to issue additional shares of preferred

stock and some provisions of our certificate of incorporation and bylaws and of

Delaware law could make it more difficult for a third party to make an

unsolicited takeover attempt of us. These anti-takeover measures may

depress the price of our common stock by making it more difficult for third

parties to acquire us by offering to purchase shares of our stock at a premium

to its market price.

Insiders own a significant portion

of our common stock, which could limit our stockholders’ ability to influence

the outcome of key transactions.

As of

March 29, 2010, our officers and directors and their affiliates owned

approximately 19.6% of the outstanding shares of our common

stock. The Dyne family, which includes Mark Dyne and Colin Dyne, who

are also our directors, and Larry Dyne who is our President; beneficially owned

approximately 13.4% of the outstanding shares of our common stock at March 29,

2010. Additionally, at March 29, 2010, CVC California, LLC, our

lender, beneficially owned approximately 8.6% of the outstanding shares of our

common stock. As a result, our lender, officers and directors and the

Dyne family are able to exert considerable influence over the outcome of any

matters submitted to a vote of the holders of our common stock, including the

election of our Board of Directors. The voting power of these

stockholders could also discourage others from seeking to acquire control of us

through the purchase of our common stock, which might depress the price of our

common stock.

We

may face interruption of production and services due to increased security

measures in response to terrorism.

Our

business depends on the free flow of products and services through the channels

of commerce. In response to terrorists’ activities and threats aimed

at the United States, transportation, mail, financial and other services may be

slowed or stopped altogether. Extensive delays or stoppages in

transportation, mail, financial or other services could have a material adverse

effect on our business, results of operations and financial

condition. Furthermore, we may experience an increase in operating

costs, such as costs for transportation, insurance and security as a result of

the activities and potential delays. We may also experience delays in

receiving payments

from

payers that have been affected by the terrorist activities. The

United States economy in general may be adversely affected by the terrorist

activities and any economic downturn could adversely impact our results of

operations, impair our ability to raise capital or otherwise adversely affect

our ability to grow our business.

Not

applicable.

16

Our

headquarters are located in the greater Los Angeles area, in Woodland Hills,

California, where we lease approximately 8,800 square feet of administrative and

product development space. In addition to the Woodland Hills

facility, we lease 120 square feet of office space in New York, New York; 1,400

square feet of office space in Columbus, Ohio; 7,000 square feet of warehouse in

Grover, North Carolina; 450 square feet of office in Mt. Holly, North Carolina;

3,400 square feet of warehouse space in Simi Valley, California; 23,809 square

feet of office and warehouse space in Kwun Tong, Hong Kong; 10,168 square feet

of office and showroom space in Shenzhen, China; office space square footage

totaling 4,800 in various other cities in China; 1,000 square feet of

office space in Bangalore, India; and 4,100 square feet of warehouse space in

Santiago, Dominican Republic. The lease agreements related to these properties

expire at various dates through September 2010. The building we owned

in Kings Mountain, North Carolina was sold on October 22, 2008. We believe our

existing facilities are adequate to meet our needs for the foreseeable

future.

In

October 2005, a shareholder class action complaint was filed in the United

States District Court for the Central District of California ("District

Court") against us, Colin Dyne, Mark Dyne, Ronda Ferguson and August F.

Deluca (collectively, the "Individual Defendants" and, together with us, the

"Defendants"). The action was styled Huberman v. Tag-It Pacific, Inc., et

al., Case No. CV05-7352 R(Ex). On January 23, 2006, the District Court

appointed Seth Huberman as the lead plaintiff ("Plaintiff") and in March 2006,

Plaintiff filed an amended complaint alleging that defendants made false and

misleading statements about our financial situation and our relationship with

certain of our large customers. The action was brought on behalf of all

purchasers of our publicly-traded securities during the period from November 13,

2003, to August 12, 2005. In August 2006, Defendants filed denying any material

allegations of wrongdoing. On February 20, 2007, the District Court denied the

Plaintiff class certification and in April 2007, the District Court granted

Defendants’ motion for summary judgment and entered judgment in favor of all

Defendants. On or about April 30, 2007, Plaintiff filed a notice of appeal with

the United States Court of Appeals for the Ninth Circuit and on January 16,

2009, the Ninth Circuit issued instructions to the District Court to

certify a class, and reversed the District Court’s grant of summary

judgment. The District Court thereafter certified a class

and adopted a schedule for the case. On July 31, 2009, the parties

entered into a stipulation of settlement and dismissal of the matter with

prejudice.

Thereafter,

total settlement proceeds of $5.75 million were paid in full by our

insurers without any contribution from us or individual defendants. On

December 7, 2009, the Court gave final approval to the settlement and the

case was dismissed with prejudice per the terms of the

settlement.

On April

16, 2004, we filed suit against Pro-Fit Holdings, Limited in the U.S. District

Court for the Central District of California – Tag-It Pacific, Inc. v. Pro-Fit

Holdings, Limited, CV 04-2694 LGB (RCx) -- asserting various contractual

and tort claims relating to our exclusive license and intellectual property

agreement with Pro-Fit, seeking declaratory relief, injunctive relief and

damages. It is our position that the agreement with Pro-Fit gives us

exclusive rights in certain geographic areas to Pro-Fit’s stretch and rigid

waistband technology. We also filed a second civil action against Pro-Fit

and related companies in the California Superior Court which was removed to the

United States District Court, Central District of California. In the

second quarter of 2008, Pro-Fit and certain related companies were placed into

administration in the United Kingdom and filed petitions under Chapter 15 of

Title 11 of the United States Code. As a consequence of the chapter 15

filings, all litigation by us against Pro-Fit has been stayed. We

have incurred significant legal fees in this litigation, and unless the case is

settled or resolved, may continue to incur additional legal fees in order to

assert its rights and claims against Pro-Fit and any successor to those assets

of Pro-Fit that are subject to our exclusive license and intellectual property

agreement with Pro-Fit and to defend against any counterclaims.

17

We

currently have pending various other claims, suits and complaints that arise in

the ordinary course of our business. We believe that we have

meritorious defenses to these claims and that the claims are either covered by

insurance or, after taking into account the insurance in place, would not have a

material effect on our consolidated financial condition if adversely determined

against us.

PART

II

Common

Stock

Our

common stock has been quoted on the OTC Bulletin Board under the symbol “TALN”

since December 28, 2007. The following table sets forth the high and

low sales prices for the Common Stock as reported by the OTC Bulletin Board

during the periods indicated. Over-the-counter market quotations reflect

inter-dealer prices, without retail mark-up, mark-down or commission, and may

not necessarily represent actual transactions.

|

High

|

Low

|

|||

|

Year

ended December 31, 2009

|

||||

|

1st

Quarter.

|

$ 0.14

|

$0.06

|

||

|

2nd

Quarter

|

|

0.20

|

0.07

|

|

|

3rd

Quarter

|

0.11

|

0.05

|

||

|

4th

Quarter

|

0.09

|

0.05

|

||

|

Year

ended December 31, 2008

|

||||

|

1st

Quarter.

|

$ 0.50

|

$0.22

|

||

|

2nd

Quarter

|

0.38

|

0.19

|

||

|

3rd

Quarter

|

0.29

|

0.10

|

||

|

4th

Quarter

|

0.25

|

0.10

|

||

On March

26, 2010 the closing sales price of our common stock as reported on OTC Bulletin

Board was $0.13 per share. As of March 26, 2010, there were 23 record

holders of our common stock and approximately 81.6% of our outstanding shares

are held by brokers and dealers.

Dividends

We have

never paid dividends on our common stock. We are restricted from

paying dividends under our senior secured credit facility. It is our

intention to retain future earnings for use in our business.

Performance

Graph

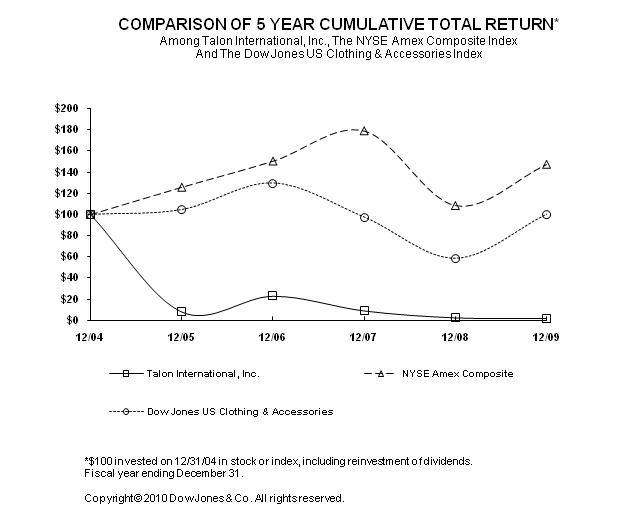

The

following graph sets forth the percentage change in cumulative total stockholder

return of our common stock during the period from December 31, 2004 to December

31, 2009, compared with the cumulative returns of the American Stock Exchange

Market Value (U.S. & Foreign) Index and The Dow Jones U.S. Clothing &

Accessories Index. The comparison assumes $100 was invested on

December 31, 2004 in our common stock and in each of the foregoing

indices. The stock price performance on the following graph is not

necessarily indicative of future stock price performance.

18

| Cumulative Total Return | |||||||

|

12/04

|

12/05

|

12/06

|

12/07

|

12/08

|

12/09

|

||

|

Talon

International, Inc.

|

100.00

|

8.00

|

22.89

|

9.00

|

2.44

|

2.00

|

|

|

AMEX

Composite

|

100.00

|

125.80

|

150.40

|

178.95

|

108.56

|

147.27

|

|

|

Dow

Jones US Clothing & Accessories

|

100.00

|

104.43

|

129.44

|

97.40

|

58.68

|

100.09

|

|

The

information under this “Performance Graph” subheading shall not be deemed to be

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

or otherwise subject to the liabilities of such section, nor shall such

information or exhibit be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as shall be expressly set

forth by specific reference in such a filing.

19

The

following selected financial data is not necessarily indicative of our future

financial position or results of future operations and should be read in

conjunction with Item 7, “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and the Consolidated Financial Statements

and Notes thereto included in Item 8, “Financial Statements and Supplementary

Data” of this Annual Report on Form 10-K.

|

(In thousands except per share

data)

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

Consolidated

Statement of Operations Data:

|

||||||||||||||||||||

|

Talon

zippers net sales

|

$ | 21,341 | $ | 28,429 | $ | 21,160 | $ | 17,005 | $ | 13,594 | ||||||||||

|

Trim

net sales

|

17,274 | 19,537 | 18,689 | 22,503 | 24,788 | |||||||||||||||

|

Tekfit

net sales

|

61 | 205 | 681 | 9,317 | 8,949 | |||||||||||||||

|

Total

net sales

|

$ | 38,676 | $ | 48,171 | $ | 40,530 | $ | 48,825 | $ | 47,331 | ||||||||||

|

Income

(loss) from operations (1)

|

$ | 289 | $ | (5,962 | ) | $ | (3,171 | ) | $ | 1,331 | $ | (27,098 | ) | |||||||

|

Net

income (loss)

|

$ | (2,693 | ) | $ | (8,359 | ) | $ | (4,922 | ) | $ | 309 | $ | (29,538 | ) | ||||||

|

Net

income (loss) per share – basic

|