Attached files

EXHIBIT

13

SONESTA

INTERNATIONAL HOTELS CORPORATION

ANNUAL

REPORT 2009

TO OUR

SHAREHOLDERS:

2009 was

a challenging year for the hotel industry and for Sonesta. Due to the

decisions we made and the actions we took, however, the Company is

well-positioned for the future.

Revenue

losses at our three (3) hotels in Boston, Miami and New Orleans in 2009 compared

to 2008 ranged from 3% to 30%. Average daily rates plummeted an

average of 13% at these three properties. Hardest hit was the group

business segment which suffered from the double whammy of the distressed economy

and “the AIG effect”: the reticence of companies to book luxury

hotels lest they be criticized for enjoying junkets at shareholder (or taxpayer)

expense. In our three domestic hotels, group business was off an

average of 32%.

At Royal

Sonesta Hotel Boston, occupancy for 2009 dropped only three (3) percentage

points from 2008, but the average daily rate plunged 20%. The Hotel

relies on corporate group business and the fall-off in demand from this segment

resulted in discounting rates. Overall, revenues were down 21% in

2009 compared to 2008.

While

city-wide conventions in New Orleans were marked by low attendance earlier in

2009, convention attendance appeared to rebound by the end of the year – a

positive sign for the Crescent City. Revenues at Royal Sonesta Hotel

New Orleans totaled $31,679,000, down only 3% from 2008, helped by a strong 2009

fourth quarter. Contributing to the Hotel’s revenues in a tough year

was the opening last March of Irvin Mayfield’s Jazz Playhouse just off the

Hotel’s lobby. The Hotel’s association with Mr. Mayfield, who won a

Grammy at this year’s awards celebration in Los Angeles, has been a great

success for the Hotel.

Of our

domestic hotels, Sonesta Bayfront Coconut Grove suffered the most business-wise

from the economic downturn. Occupancy for the year dropped to 59%

from 71% in 2008, and the Hotel’s ADR fell 18% from 2008. Total

revenues fell 30% from 2008’s total. During 2009, we redesigned the

Hotel’s pool deck, creating an exciting venue where guests can relax and where

the Hotel can host social and business events.

As

announced in September 2009, the Company and its partner, Fortune International,

sold the project we owned together in Key Biscayne, Florida. The

project had stalled due to a combination of lack of financing as the result of

the recession and the glut of unsold condominiums in South

Florida. We agreed with Fortune to test the market in the spring of

last year and, in September, sold the project for $78 million. After

paying off existing debt and sale-related costs, the Company received

approximately $12 million, including reimbursement of $2.7 million we advanced

for project-related costs in 2009 and $9.3 million of net sale

proceeds. All told, the Company effectively sold the Sonesta Beach

Resort property for $71 million: the $60 million we received from

Fortune in April 2005, plus approximately $2 million of additional sale proceeds

over the next 18 months under the terms of our deal, and the $9 million of sale

proceeds we received in September. Included in our 2009 income is a

$42 million pre-tax gain on this transaction.

During

2009, we successfully launched our U.S.-focused franchising

program. Although highly competitive, we believe there are

opportunities to offer the Sonesta brand and marketing system to owners and

operators of hotels that meet our brand criteria and are prepared to implement

our service and operational standards. In January 2010, we introduced

our first franchised property under this program: Sonesta Hotel

Orlando Downtown is a 341-room hotel in Orlando that was formerly flagged as a

Sheraton. We are proud to welcome this hotel into the Sonesta

Collection and expect to add other franchised hotels during 2010.

We were

also pleased to maintain our two franchised properties in St. Maarten in the

Collection. Our contracts for Sonesta Maho Beach Resort & Casino

and Sonesta Great Bay Resort & Casino have been extended for at least five

(5) years. Additionally, both properties will be upgraded, and the

Company is providing a loan of $1,000,000 for this purpose.

In

addition to the franchises in Orlando and St. Maarten, our franchise program in

South America grew by five hotels, from eight properties to thirteen, during

2009 and early 2010. The new properties are located in Valledupar,

Colombia; Cusco, Peru; and Concepcion, Calama, and Osorno, Chile. The

Sonesta hotels in Chile, Colombia and Peru are operated by GHL Hoteles, which is

based in Colombia. The hotels in Brazil are operated by

SuperClubs. (We are pleased to report that the recent earthquake in

Chile resulted in no loss of life at the Sonesta properties there, although

Sonesta Hotel Concepcion suffered some damage.)

Although

2009 proved a particularly challenging year to access hotel opportunities in the

U.S., we did not sit still. In addition to launching our franchising

program and introducing our first franchised hotel, we positioned the Company to

exploit appropriate opportunities. We continue to explore any

opportunities that will add value to our brand and our Company, including

franchises, management opportunities, and acquisitions.

In

February 2010, we completed the refinancing of our Royal Sonesta Hotel

Boston. The existing loan was due to mature in July 2010, but we were

able to lock in a lower interest rate for five (5) years with a Boston-based

bank that will result in interest savings of approximately $700,000 per

year. The Company has provided a $5 million guaranty on the $32

million loan; in addition, we have deposited $5 million in a cash collateral

account with the bank which will be released over a two-year period provided

debt service coverage ratios reach stipulated targets.

If you

would like additional information about Sonesta hotels, resorts, or cruises

please visit our website at Sonesta.com

We

appreciate the continued interest and support of our hotel owners, guests,

partners, employees, and of you, our shareholders.

/s/ Peter J.

Sonnabend

Peter

J. Sonnabend

Executive

Chairman of the Board

/s/ Stephanie Sonnabend

Stephanie Sonnabend

Chief

Executive Officer and President

March 22,

2010

1

SONESTA

INTERNATIONAL HOTELS CORPORATION

5-YEAR

SELECTED FINANCIAL DATA

(In

thousands except for per share data)

|

2009

|

2008

|

2007

|

2006

|

__2005

|

||||||||||||||||

|

Revenues

|

$ | 60,458 | $ | 71,552 | $ | 67,938 | $ | 77,595 | $ | 88,125 | ||||||||||

|

Other

revenues from managed and affiliated

|

||||||||||||||||||||

|

properties

|

4,361 | 8,965 | 18,747 | 21,237 | 14,543 | |||||||||||||||

|

Total

revenues

|

64,819 | 80,517 | 86,685 | 98,832 | 102,668 | |||||||||||||||

|

Operating

income (loss)

|

(951 | ) | 6,671 | 2,228 | (3,829 | ) | (1,905 | ) | ||||||||||||

|

Net

interest expense

|

(2,463 | ) | (1,788 | ) | (1,292 | ) | (1,441 | ) | (2,836 | ) | ||||||||||

|

Other

income(1)

|

41,859 | 574 | 250 |

_49

|

_4,054

|

|||||||||||||||

|

Income

(loss) before income taxes

|

38,445 | 5,457 | 1,186 | (5,221 | ) | (687 | ) | |||||||||||||

|

Income

tax provision (benefit)

|

13,168 | 1,377 | (151 | ) | (1,698 | ) | (5,355 | ) | ||||||||||||

|

Net

income (loss)

|

$ | 25,277 | $ | 4,080 | $ | 1,337 | $ | (3,523 | ) | $ | 4,668 | |||||||||

|

Basic

and diluted net income (loss) pershare of common stock

|

$ | 6.84 | $ | 1.10 | $ | 0.36 | $ | (0.95 | ) | $ | 1.26 | |||||||||

|

Cash

dividends declared

|

$ | 1.00 | $ | 1.35 | $ | 0.20 | $ | 0.20 | $ | 1.10 | ||||||||||

|

Net

property and equipment

|

$ | 34,270 | $ | 35,031 | $ | 37,303 | $ | 38,400 | $ | 72,799 | ||||||||||

|

Total

assets

|

80,731 | 127,040 | 129,591 | 126,428 | 130,619 | |||||||||||||||

|

Long-term

debt including currently payable

portion

|

31,839 | 33,002 | 34,061 | 34,061 | 34,061 | |||||||||||||||

|

Common

stockholders' equity

|

26,653 | 4,126 | 8,547 | 7,371 | 11,865 | |||||||||||||||

|

Common

stockholders' equity

per share

|

7.21 | 1.12 | 2.31 | 1.99 | 3.21 | |||||||||||||||

|

Common

shares outstanding at

end of year

|

3,698 | 3,698 | 3,698 | 3,698 | 3,698 | |||||||||||||||

(1)

Includes pre-tax gain of $41,843,000 from the dissolution of a

development partnership (see Note 3).

Market

price data for the Company’s common stock showing high and low prices by quarter

for each of the last two years is as follows:

|

NASDAQ

Quotations

|

||||||||||||||||

|

2009

|

2008

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First

|

$ | 14.40 | $ | 6.48 | $ | 35.99 | $ | 18.93 | ||||||||

|

Second

|

10.25 | 5.75 | 30.61 | 22.92 | ||||||||||||

|

Third

|

12.69 | 8.00 | 27.97 | 18.78 | ||||||||||||

|

Fourth

|

15.70 | 8.02 | 20.79 | 7.85 | ||||||||||||

The

Company’s common stock trades on the NASDAQ Stock Market under the symbol

SNSTA. As of February 16, 2010 there were 307 holders of record of

the Company’s common stock.

A copy of the Company’s Form 10-K

Report, which is filed annually with the Securities and Exchange Commission, is

available to stockholders. Requests should be sent to the Office of

the Secretary at the Company’s Executive Office. In addition, this

report may be accessed through the link to the SEC’s website on

sonesta.com.

2

|

|

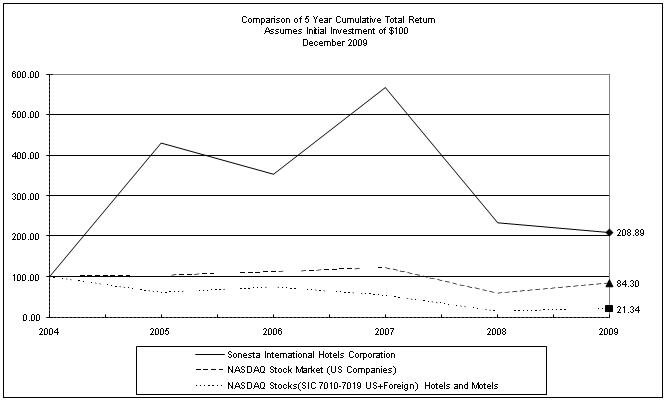

Performance

Graph

|

The

following graph compares the annual percentage change in the cumulative total

stockholder return on the Company’s Common Stock against the cumulative total

return of the NASDAQ Stock Market (US Companies) and the NASDAQ Hotels and

Motels Stocks (SIC 7010-7019) for the five-year period commencing December 31,

2004 and ending December 31, 2009.

3

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL

CONDITION

The

Company's consolidated financial statements include the revenues, expenses,

assets and liabilities of Royal Sonesta Hotel Boston, Royal Sonesta Hotel New

Orleans and the Company’s investment in a partnership which owned the site of

the former Sonesta Beach Resort Key Biscayne. The Boston property is owned by

the Company, and the New Orleans hotel is operated under a long-term lease. The

financial statements also include the Company’s revenues and expenses from the

management of properties in the United States and Egypt, and license fee income

from properties in New Orleans, Louisiana (until October 2008); St. Maarten,

Brazil, Chile, Colombia and Peru.

Results of

Operations

During

2009, the Company recorded net income of $25,277,000, or $6.84 per share,

compared to net income of $4,080,000, or $1.10 per share, during

2008. A reconciliation of the $21,197,000 increase in earnings

follows (in thousands):

|

Gain

from dissolution of development partnership

|

$ | 41,843 | ||

|

Decrease

in operating income Royal Sonesta Boston

|

(3,566 | ) | ||

|

Increase

in operating income Royal Sonesta New Orleans

|

605 | |||

|

Decrease

in income from Management Agreement settlement during 2008

|

(3,279 | ) | ||

|

Increase

in operating loss from management activities

|

(1,382 | ) | ||

|

Decrease

in interest income

|

(780 | ) | ||

|

Other

changes

|

(453 | ) | ||

|

Increase

in pre-tax income

|

32,988 | |||

|

Increase

in tax expense

|

(11,791 | ) | ||

|

Increase

in net income 2009 compared to 2008

|

$ | 21,197 |

|

·

|

In

2009, the Company recorded a pre-tax of gain of $41,843,000, following the

sale of assets by a development partnership in which the Company was a 50%

owner (see Note 3, Investment in Development

Partnership).

|

|

·

|

Royal

Sonesta Hotel Boston experienced a difficult year, during which revenues

declined in excess of $6 million, or 21%, in a very competitive Boston

hotel market. The primary reason for the decline was a decrease

in group and convention business.

|

|

·

|

Revenues

at Royal Sonesta Hotel New Orleans decreased by a modest 3% during the

2009 recession year due to a strong 2009 fourth quarter compared to the

same period a year ago. Operating income increased due to lower

costs and operating expenses and lower rent

expense.

|

|

·

|

During

the 2008 third quarter, the Company recorded pre-tax income of $3,279,000

related to the settlement of a dispute with the owner of Trump

International Sonesta Beach Resort Sunny Isles (see Note

2). The Company terminated the management agreement for this

property effective April 1, 2008.

|

|

·

|

Income

from management activities decreased primarily as a result of lower income

from the Company’s managed properties in Egypt and lower income from

Sonesta Bayfront Hotel Coconut Grove. The Company had no income

from Trump International Sonesta Beach Resort Sunny Isles during 2009 (see

Note 2 – Operations).

|

|

·

|

Interest

income declined due to lower investment returns on the Company’s cash

balances.

|

A

detailed analysis of the revenues and expenses by location follows.

Revenues

The

Company records costs incurred on behalf of owners of managed and affiliated

properties, and expenses reimbursed from managed and affiliated properties, on a

gross basis. The revenues included and discussed in this Management’s

Discussion and Analysis exclude the “other revenues and expenses from managed

and affiliated properties”.

|

TOTAL

REVENUES

(in

thousands)

|

||||||||||||||||

|

NO.

OF

|

||||||||||||||||

|

ROOMS

|

2009

|

2008

|

2007

|

|||||||||||||

|

Royal

Sonesta Hotel Boston

|

400 | $ | 24,462 | $ | 30,778 | $ | 29,377 | |||||||||

|

Royal

Sonesta Hotel New Orleans

|

500 | 31,679 | 32,795 | 31,888 | ||||||||||||

|

Management

and service fees

|

4,317 | 7,979 | 6,673 | |||||||||||||

|

Total

revenues, excluding other revenues from

|

||||||||||||||||

|

managed

and affiliated properties

|

$ | 60,458 | $ | 71,552 | $ | 67,938 | ||||||||||

2009 versus

2008: Total revenues, excluding other revenues from managed

and affiliated properties, were $60,458,000 in 2009 compared to $71,552,000 in

2008, a decrease of $11,094,000. Revenues at Royal Sonesta Hotel

Boston decreased by $6,316,000 in 2009 compared to 2008, representing a 21%

decrease. The Boston hotel market was severely impacted by the

economic recession in 2009. Revenues at Royal Sonesta Hotel New

Orleans declined by a modest 3%, despite the poor economic

conditions. During the 2009 fourth quarter, revenues increased

compared to a year ago, as demand improved in the City of New

Orleans. Revenues from management activities decreased from

$7,979,000 in 2008 to $4,317,000 in 2009. This was primarily the

result of decreased fee income from the Company’s managed operations in Egypt,

and lower fee income from Sonesta Bayfront Hotel Coconut Grove, as well as no

fee income from Trump International Sonesta Beach Resort Sunny Isles, which the

Company stopped operating as of April 1, 2008. In addition, the

Company experienced a decline in income from hotels to which it

licenses the use of its name as well as other corporate activities including

purchasing, training and reservation services. A more detailed

analysis of the revenues by hotel, and of our management income,

follows.

Royal

Sonesta Hotel Boston reported revenues of $24,462,000 during 2009, compared to

$30,778,000 in 2008, representing a $6,316,000, or 21%,

decrease. Room revenues decreased by $4,702,000, due to a 23%

decrease in room revenues per available room (“REVPAR”). The hotel’s

occupancy levels were down by three percentage points compared to 2008, but the

majority of the decline in revenues was due to a reduction in average daily room

rates achieved. The decline in room revenues was due primarily to a

decrease in revenue generated from the group and convention market

segment. Business from this market segment depends heavily on high

levels of corporate spending, which was severely impacted by the economic

recession. The decrease in group and convention business also

effected the hotel’s competitors, which resulted in increased competition for

available transient business. Room nights sold in the transient

market segment actually increased in 2009 compared to 2008, but the hotel had to

discount its rates substantially to capture this additional transient

business. Revenues from other sources, which are primarily from food

and beverage sales, decreased by $1,614,000, or 16%, in 2009 compared to

2008. Banquet revenues, which depend heavily on group and convention

business at the hotel, decreased substantially, but this

4

decrease

was partially offset by an increase in revenue from the hotel’s ArtBar

restaurant, which was renovated during 2008.

Royal

Sonesta Hotel New Orleans reported a decrease in revenues of $1,116,000, or 3%,

to $31,679,000 in 2009. This decrease was entirely due to a

$1,135,000 decrease in room revenues. The hotel’s REVPAR in 2009

decreased by 5%, primarily as a result of a decrease in group and convention

business. Room nights sold to the transient market segment during

2009 equaled those sold in 2008. Revenues from other sources

increased by $19,000 in 2009 compared to 2008. Decreases in banquet

revenues due to the reduced group and convention business was partially offset

by increased revenues from the hotel’s Desire restaurant as well as increased

beverage revenues. The beverage revenue increase was mainly due to

the transformation of the hotel’s main lounge into Irvin Mayfield’s Jazz

Playhouse during early 2009.

Revenues

from management activities decreased from $7,979,000 in 2008 to $4,317,000 in

2009. Management income from the Company’s collection of managed

hotels and cruise ships in Egypt decreased by $1,077,000 in the 2009 period

compared to last year, primarily due to the fact that it did not achieve

stipulated profit levels in two of its resorts which it needs to achieve in

order to earn incentive fees. In general, business levels in Egypt

declined only moderately. Management income from Sonesta Bayfront

Hotel Coconut Grove decreased by $853,000 due to the sharp decline in net

operating income in 2009. The Company is committed to an annual

minimum return payment to the hotel’s owner, and the Company eliminates fees

from its income to the extent net operating income is insufficient to pay this

minimum return. Management income during 2008 included $840,000 from

Trump International Sonesta Beach Resort Sunny Isles. The management

agreement for this resort was terminated by the Company effective April 1,

2008. The remaining decrease in management fee income was primarily

from lower income from two hotels in St. Maarten to which the Company has

licensed the use of its name, and lower income earned from Corporate services,

including purchasing, training and reservation services.

2008 versus

2007: Total revenues, excluding other revenues from managed

and affiliated properties, were $71,552,000 in 2008 compared to $67,938,000 in

2007, an increase of $3,614,000. Revenues at Royal Sonesta Hotel

Boston increased by $1,401,000 in 2008 compared to 2007, representing a 5%

increase. Demand in the Boston hotel market was strong in 2008

through the month of October. Revenues declined during the last two

months of 2008. Revenues at Royal Sonesta Hotel New Orleans in 2008

increased by a modest 3%. Business during the first eight months of

the year was strong, but September 2008 revenues were impacted by Hurricane

Gustav. Revenues during the fourth quarter decreased compared to

2007, due to worsening economic conditions. Revenues from management

activities increased from $6,673,000 during 2007 to $7,979,000 during 2008,

primarily due to an increase in management income from the Company’s collection

of hotels and cruise ships in Egypt. A more detailed analysis of the

revenues by hotel, and of our management income, follows.

Royal

Sonesta Hotel Boston recorded revenues of $30,778,000 during 2008 compared to

$29,377,000 in 2007, representing an increase of $1,401,000, or

5%. This increase was mainly due to an increase of $1,160,000 in room

revenues. Room revenues per available room (“REVPAR”) increased by 6%

in 2008 compared to 2007, mainly due to an increase in occupancy

levels. Demand in Boston was strong through October 2008, which

benefitted the Hotel. The increase in occupancy was entirely from

increased transient rooms business. The increase in non-rooms revenue

of $241,000 was mainly due to increased food and beverage revenues, which

included higher revenues from the hotel’s newly renovated ArtBar.

Revenues

at Royal Sonesta Hotel New Orleans during 2008 totaled $32,795,000 compared to

$31,888,000 during 2007, representing an increase of $907,000, or

3%. In general, hotel business in New Orleans continued to improve

during the first eight months of 2008 from the downturn in business following

Hurricane Katrina in 2005. September revenues, however, were impacted

by Hurricanes Gustav and Ike, and fourth quarter 2008 revenues were affected by

decreased business volumes resulting from worsened economic

conditions. Room revenues increased by $771,000 in 2008 due to a 4%

REVPAR increase which was entirely due to higher average room rates

achieved. Revenues other than rooms increased by $215,000 due to

increased banquet revenues. Revenues from the hotel’s laundry, which

also services third party hotels, decreased by $79,000 in 2008 compared to 2007

due to the loss of revenues from Chateau Sonesta Hotel New Orleans, which was

operated by the Company under a management agreement until October

2007.

Revenues

from management activities increased from $6,673,000 during 2007 to $7,979,000

during 2008, representing an increase of $1,306,000. Of this

increase, $1,146,000 resulted from improved fee income from the Company’s

collection of hotels and Nile River cruise ships in Egypt. Business

in Egypt in 2008 continued to improve, and management income also included fee

income from Sonesta Pharaoh Beach Resort Hurghada, which was added under

management effective January 1, 2008. The remaining increase resulted

from higher income from hotels to which the Company licenses the use of its name

in St. Maarten and South America, partially offset by decreased fee income from

Chateau Sonesta Hotel New Orleans, which the Company stopped operating in

October, 2007, and decreased income from Trump International Sonesta Beach

Resort following the termination by the Company of the management agreement for

this hotel effective April 1, 2008 (see Note 2).

Operating

Income

|

OPERATING

INCOME/(LOSS)

(in

thousands)

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Royal

Sonesta Hotel Boston

|

$ | 1,898 | $ | 5,464 | $ | 4,926 | ||||||

|

Royal

Sonesta Hotel New Orleans

|

749 | 144 | 885 | |||||||||

|

Operating

income from hotels after

management and service

fees

|

2,647 | 5,608 | 5,811 | |||||||||

|

Management

activities and other income

|

(3,598 | ) | (2,216 | ) | (3,583 | ) | ||||||

|

Subtotal

|

(951 | ) | 3,392 | 2,228 | ||||||||

|

Income

from Management Agreement

settlement,

net

|

-- | 3,279 | -- | |||||||||

|

Operating

income (loss)

|

$ | (951 | ) | $ | 6,671 | $ | 2,228 | |||||

2009 versus

2008: The Company recorded an operating loss of $951,000 in

2009 compared to operating income of $6,671,000 in 2008, a decrease of

$7,622,000. During the 2008 third quarter, the Company recorded

pre-tax income of $3,279,000 related to the settlement of a dispute with the

owner of Trump International Sonesta Beach Resort Sunny Isles. The

Company terminated the management agreement for this property effective April 1,

2008. Operating income at Royal Sonesta Hotel Boston decreased by

$3,566,000, primarily due to a 21% decrease in revenues. Operating

income at Royal Sonesta New Orleans increased by $605,000, as decreased

expenses,

5

including

rent expense, more than offset the modest decrease in revenues during

2009. Operating losses from management activities increased from

$2,216,000 in 2008 to $3,598,000 in 2009, primarily due to lower fee income from

the Company’s managed hotels and cruise ships in Egypt, and lower fee income

from Sonesta Bayfront Hotel Coconut Grove and Trump International Sonesta Beach

Resort Sunny Isles. A more detailed discussion of the changes in

operating income by location follows.

Royal

Sonesta Hotel Boston reported operating income of $1,898,000 during 2009

compared to $5,464,000 during 2008, a decrease of $3,566,000. A

decrease in revenues of $6,316,000 was partially offset by a decrease of

$2,750,000, or 11%, in expenses. Costs and operating expenses

decreased by $1,764,000, primarily due to lower payroll costs. During

2009, the hotel reduced staffing levels in all operating departments, and in

addition eliminated certain management positions. Employee benefit

costs also decreased due to the suspension of matching contributions to the

Company’s 401(k) plan, and the fact that no bonuses were paid to hotel

management for the year 2009. The remaining decrease in expenses was

primarily from lower administrative and general costs, including credit card

commissions, and lower advertising, human resources and maintenance

expenses.

Operating

income at Royal Sonesta Hotel New Orleans increased from $144,000 during 2008 to

$749,000 in 2009. Decreases in revenues of $1,116,000 in 2009 were

more than offset by a decrease in expenses of $1,721,000. The

decrease in expenses was mainly due to lower costs and operating expenses and

rent expense. Costs and operating expenses decreased by $650,000, or

4%, mainly due to lower payroll and benefits costs and lower utility

costs. Rent expense decreased by $959,000. The Company

operates Royal Sonesta Hotel New Orleans under a lease, under which rent payable

to the landlord equals 75% of net cash flow. The savings in rent was

due to lower operating profits, as well as an increase in capital expenditures

in 2009 compared to 2008. Capital expenditures are deducted from cash

flow for rent purposes.

The

Company’s loss from management activities, which is computed after giving effect

to management and marketing fees from owned and leased hotels, increased from

$2,216,000 in 2008 to $3,598,000 in 2009. Revenues from management

activities decreased by $3,662,000, which decrease was partially offset by a

decrease in expenses related to these activities of

$2,280,000. Corporate office costs during 2009 decreased because of

lower employee benefit costs due to the suspension of matching 401(k) plan

contributions, and lower bonus expense. Corporate salaries were

frozen during 2009. In addition, 2008 expenses included an amount of

$720,000 related to an employment agreement with Roger Sonnabend, the Company’s

former Executive Chairman of the Board, who passed away in December

2008. Expenses in 2008 also included legal fees and other costs

related to a hotel project in Miami. The Company started to work on

this project during the summer of 2008 but decided in February 2009 not to

pursue this opportunity. Lastly, the 2008 period included additional

depreciation expense of $567,000 related to accelerated depreciation of an

investment the Company made in Trump International Sonesta Beach Resort Sunny

Isles, following the Company’s termination of the management agreement for this

hotel effective April 1, 2008.

2008 versus

2007: The Company recorded operating income in 2008 of

$6,671,000, compared to operating income of $2,228,000 in 2007, an increase of

$4,443,000. In the 2008 third quarter, the Company recorded pre-tax income of

$3,279,000 related to the settlement of a dispute with the owner of Trump

International Sonesta Beach Resort. The Company terminated the

management agreement for this property effective April 1, 2008 (see Note

2). Operating income at Royal Sonesta Hotel Boston increased by

$538,000 compared to 2007 due to a 5% increase in revenues at this

property. Operating income at Royal Sonesta Hotel New Orleans

decreased by $741,000, mainly due to higher rent expense incurred under the

lease under which the Company operates the hotel. Operating losses

from management activities decreased by $1,367,000 to $2,216,000 in 2008,

primarily due to higher income achieved from the Company’s managed hotels and

cruise ships in Egypt. A more detailed discussion of the changes in

operating income by location follows.

Royal

Sonesta Hotel Boston increased operating income during 2008 by $538,000 to

$5,464,000. Revenues during 2008 increased by $1,401,000, but were

partially offset by a 4% increase in expenses, totaling $863,000. The

expense increase was almost entirely due to a 5% increase in cost and operating

expenses, totaling $624,000. The hotel operated at a higher occupancy

level in 2008 compared to 2007, resulting in increased payroll

expenses. In addition, the hotel incurred higher commissions and

reservations costs, increases in linens and guest supplies expense, as well as

increased employee benefit costs. In December 2008, the hotel

incurred severance expenses related to layoffs following the decline in business

in late 2008.

Operating

income from Royal Sonesta Hotel New Orleans decreased from $885,000 in 2007 to

$144,000 in 2008. Increases in revenues of $907,000 were more than

offset by increased expenses of $1,648,000. The hotel expensed

$303,000 in 2008 for costs incurred during 2006, 2007 and 2008 related to the

potential addition of a spa in the hotel, following its decision to postpone

this project because of the high cost. Rent expense increased by

$1,185,000 in 2008 compared to 2007. The Company operates the hotel

under a lease, and rent is equal to 75% of net cash flow. The rent

increase was due in part to higher operating profits achieved in 2008 compared

to 2007. In addition, the hotel spent less on capital additions in

2008 compared to previous year. Under the lease, capital expenditures

are deducted from cash flow for rent purposes. Excluding the rent

increase and development cost write off, the hotel’s total expenses were

virtually the same in 2008 as in 2007. Costs and operating expenses,

as well as advertising and repairs and maintenance costs, increased slightly,

but this increase was offset by decreased real estate tax expense in 2008 due to

a favorable abatement received from the City of New

Orleans. Operating profits from the hotel’s laundry, which also

services third party hotels, decreased by $266,000 in 2008 compared to

2007. This was in part due to the loss of revenues from Chateau

Sonesta Hotel New Orleans, which was operated by the Company under a management

agreement until October, 2007, as well as increased costs and operating expenses

of the laundry, including utility costs.

The

Company’s loss from management activities, which is computed after giving effect

to management fees from owned and leased hotels, decreased by $1,367,000 to

$2,216,000 in 2008. Revenues increased by $1,306,000, primarily from

increased fee income from the Company’s managed operations in

Egypt. Expenses related to these activities decreased by

$61,000. Corporate expenses in 2008 included $720,000 related to an

employment agreement with Roger Sonnabend, the Company’s former Executive

Chairman of the Board who passed away in December 2008. The 2008

expenses also included approximately $250,000 in costs related to a hotel

project in Miami. The Company started to work on this project during

the summer of 2008, but decided in February 2009 not to pursue this

opportunity. The Company also incurred higher legal costs related to

the negotiation of management agreements for additional hotels, including the

aforementioned project. Expenses in 2007 included $691,000 based on

an employment agreement following the retirement of a long term Company

executive, Mr. Paul Sonnabend. In addition, the Company spent

approximately $265,000 in 2007 on legal and other costs in connection with a

review of the Company’s strategic options to enhance

6

shareholder

value.

Other

Income and Deductions

Interest

expense, which consists entirely of interest paid on the Company’s mortgage loan

secured by Royal Sonesta Hotel Boston, decreased by $105,000 in 2009 compared to

2008 and by $42,000 in 2008 compared to 2007, due to principal payments made on

the loan during these two years.

Interest

income decreased from $1,720,000 in 2007 to $1,182,000 in 2008, and to $402,000

in 2009. The decrease in 2009 was the result of lower income earned

on the Company’s short-term cash investments, due to lower rates of

return. In addition, the 2008 period included interest earned on a

loan to the owner of Sonesta Bayfront Hotel Coconut Grove, which was repaid

during 2008. The decrease in interest income was partially offset by

interest earned on a new loan made to the owners of Sonesta Beach Resort and

Sonesta Club, in Sharm El Sheikh.

During

2009 the Company reported a gain of $41,843,000 following the dissolution of a

development partnership in which the Company owned a 50% limited

interest. The partnership sold the land and improvements formerly

comprising Sonesta Beach Resort Key Biscayne during the 2009 third quarter (see

Note 3, Investment in Development Partnership). Also included in 2009

is a gain of approximately $34,000 on the sale of a condominium unit in Trump

International Sonesta Beach Resort Sunny Isles, which the Company managed until

April 1, 2008. The $576,000 gain on sale of assets in 2008 resulted

primarily from a $422,000 gain on the sale of a co-op unit the Company owned in

New York City to the Company’s Executive Chairman. The sale price was

$700,000. The Company’s Board of Directors approved this

transaction. In addition, the Company realized a gain on the sale of

art in 2008.

Federal,

State and Foreign Income Taxes

During

2009 the Company recorded a tax expense of $13,168,000 on pre-tax income of

$38,445,000. This tax expense is approximately the same as the

statutory federal income tax rate. State tax expense on income

attributed to Louisiana, Florida and Massachusetts was partially offset by

general business tax credits and an adjustment to the gain reported on the Key

Biscayne transaction (see Note 3) which is not subject to tax.

In 2008,

the Company recorded a net tax provision of $1,377,000 on its pre-tax income of

$5,457,000. The Company was able to take substantial credits for

foreign taxes paid in 2008, and for foreign taxes paid in prior years which had

been carrying forward. In addition, the Company benefited from

current and prior year’s general business credits, including work opportunity

tax credits related to Hurricane Katrina. The Company also recorded a

state income tax benefit of $216,000 for Massachusetts taxes resulting from

changes enacted in tax laws during 2008. These changes include

conforming to federal entity classification rules and adopting a unitary method

of taxation.

Liquidity

and Capital Resources

The

Company had cash and cash equivalents of approximately $35 million at December

31, 2009. As of that date, the majority of these funds were held in

money market mutual funds and non-interest bearing bank accounts.

In

September 2009 the Company received $12,076,000 in connection with the sale by a

partnership, in which the Company owned a 50% limited partnership interest, of

the land and improvements formerly comprising Sonesta Beach Resort Key

Biscayne. This payment included the repayment of advances made by the

Company to the partnership during 2009 of $2,664,000 and, in addition,

$9,412,000 for its share of the sale proceeds of the assets (see Note 3,

Investment in Development Partnership).

During

2009, the Company paid dividends totaling $1.25 per share

($4,623,000). In 2008, the Company paid dividends totaling $1.20 per

share ($4,438,000).

The

Company contributed $934,000 and $1,280,000 to its Pension Plan in 2009 and

2008, respectively.

In

December 2009, the Company agreed to loan $1,000,000 to the owners of two hotels

in St. Maarten, to which the Company licenses the use of its

name. The Company expects to fund this loan during 2010.

In August

2009, the Company loaned a total of $1,363,000 to the owner of Sonesta St.

George Hotel Luxor and Sonesta St. George I Cruise Ship, which are both managed

by the Company. The loan consisted of cash advances of $500,000 and a

conversion of receivables for fees and expenses due to the Company from the

hotel and the ship. The proceeds of the loan helped fund improvements

to the Luxor hotel, including additional rooms and meeting

facilities. The hotel’s owner also agreed to an extension of the

management agreement by 5 years.

In

February 2010, the Company refinanced the mortgage loan secured by Royal Sonesta

Hotel Boston. The existing loan in the principal amount of

$31,645,000, which was to mature in July 2010, was replaced by a $32 million

loan. The Company paid a 1% fee at closing, and incurred legal and

other costs related to the new loan. The interest rate on the new,

5-year loan is 6.4%, compared to 8.6% on the loan which was

refinanced. The annual interest savings as a result of the lower

interest rate is approximately $700,000. As part of the security for

the new loan, the Company agreed to fund a restricted cash collateral account in

the amount of $5 million (see Note 5 – Borrowing Arrangements).

The

Company operates Sonesta Bayfront Hotel Coconut Grove, in Miami, which is a

condominium hotel that opened in April 2002. Under its agreements,

the Company is committed to fund net operating losses, and to provide the

hotel’s owner with a minimum annual return ($419,000 during 2009), adjusted

annually by increases in the Consumer Price Index (“CPI”). The

management agreement can be terminated by the hotel’s owner if the Company fails

to cure shortfalls against a minimum target return ($978,000 during 2009),

adjusted annually by increases in the CPI. The hotel’s 2008 net

operating profit was sufficient to cover the owner’s target return and the

Company’s fees from the hotel of $1,039,000. In 2009, the hotel’s net

operating profit fell short of the target return but was sufficient to cover the

minimum annual return and fees to the Company totaling $150,000. The

Company has decided not to fund the owner’s target return for 2009, and notified

the owner of same in January 2010. As a result, the owner had the

right to terminate the management agreement provided it sent the Company a

termination notice on or before March 3, 2010, but the hotel’s owner did not

exercise this right. (While the hotel’s owner has claimed that the

notice deadline was extended beyond March 3, 2010, the Company has advised the

owner of its position that the deadline has passed.) In October 2008,

the Company received $2,627,000 in connection with the repayment of a loan made

to the owner of the hotel for initial furniture, fixtures and equipment and

pre-opening expenses.

The

Company made a loan of $500,000 to the owner of Sonesta Beach Resort Sharm El

Sheikh in January 2010, to help finance the construction of additional hotel

rooms and facilities. In January 2008, the Company agreed to convert

approximately $1.6 million of receivables for fees and expenses from the two

hotels it manages in

7

Sharm El

Sheikh, Egypt into a five-year loan. This was part of a transaction

which also included the extension until 2024 of the management agreement for

Sonesta Club Sharm El Sheikh, which otherwise would have expired at the end of

2009. In return, the Company agreed to pay $500,000, which payment

was made by reducing outstanding receivables from Sonesta Club.

Company

management believes that its present cash balances will be more than adequate to

meet its cash requirements for 2010 and for the foreseeable future.

As of

December 31, 2009, the Company’s fixed contractual obligations were as follows

(in thousands):

|

YEAR

|

||||||||||||||||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

Thereafter

|

Total

|

||||||||||||||||||||||

|

Long-Term

Debt Obligations

|

$ | 2,725 | $ | 2,569 | $ | 2,569 | $ | 2,569 | $ | 2,569 | $ | 29,582 | $ | 42,583 | ||||||||||||||

|

Operating

Leases

|

737 | 625 | 291 | 104 | -- | -- | 1,757 | |||||||||||||||||||||

|

Total

|

$ | 3,462 | $ | 3,194 | $ | 2,860 | $ | 2,673 | $ | 2,569 | $ | 29,582 | $ | 44,340 | ||||||||||||||

The

Company’s hotels also have certain purchase obligations, primarily for

maintenance and service contracts. These are not included in the

contractual obligations since the amounts committed are not material, and

because the majority of these contracts may be terminated on relatively short

notice.

8

Economic

Outlook

The

economic recession affected the Company’s business during 2009. Hotel

business depends heavily on economic activity, and the Company’s U.S. hotels

were impacted in 2009 both from lower consumer demand as well as diminished

corporate spending. The Company’s Boston and New Orleans hotels

depend heavily on corporate groups and conventions, and reduced corporate

spending has a significant negative impact on these market

segments. The expectation for 2010 is that revenues will show modest

growth, at best, which in turn will mean that hotel profits will remain

depressed. During 2009, the Company froze salaries and cut employee

benefits. For 2010, only modest increases were

awarded. The refinancing of the mortgage loan secured by Royal

Sonesta Hotel Boston will result in annual interest savings of approximately

$700,000 starting in February 2010.

It is

impossible to predict the extent of the impact of the continued poor economic

conditions on the Company’s 2010 results. The Company has adequate

cash resources to continue operations, and meet its foreseeable

needs.

Critical

Accounting Policies and Estimates

The

consolidated financial statements are prepared in accordance with accounting

principles generally accepted in the United States, which require the Company to

make estimates and assumptions. The Company believes that of its significant

accounting policies, the following may involve a higher degree of judgment and

complexity.

|

·

|

Revenue

recognition – a substantial portion of our revenues result from the

operations of our owned and leased hotels. These revenues are

recognized at the time that lodging and other hotel services are provided

to our guests. Certain revenues, principally those

relating to groups using lodging and banquet facilities, are billed

directly to the customers. These revenues are subject to

credit risk, which the Company manages by establishing allowances for

uncollectible accounts. If management establishes

allowances for uncollectible accounts that are insufficient, it will

overstate income, and this will result in increases in allowances for

uncollectible accounts in future periods.

Management,

license and service fees represents fee income from hotels operated under

management agreements, and license fees from hotels to which the Company

has licensed the use of the “Sonesta” name. Management fees

include base fees and marketing fees, which are generally based on a

percentage of gross revenues, and incentive fees, which are generally

based on the hotels’ profitability. These fees are typically

based on revenues and income achieved during each calendar

year. Incentive fees, and management fees of which the receipt

is based on annual profits achieved, are recognized throughout the year on

a quarterly basis based on profits achieved during the interim periods

when our agreements provide for quarterly payments during the calendar

years they are earned, and when such fees would be due if the management

agreements were terminated. As a result, during quarterly

periods, fee income may not be indicative of eventual income recognized at

the end of each calendar year due to changes in business conditions and

profitability. License fees are earned based on a percentage of

room revenues of the hotels.

The

Company records the reimbursement of certain expenses incurred on behalf

of managed and affiliated properties, and the costs incurred on behalf of

owners of managed properties on a “gross” basis in revenues and

costs. These costs relate primarily to payroll and benefit

costs of managed properties in which the Company is the

employer.

|

|

·

|

Impairment

of long lived assets – the Company monitors the carrying value of its

owned properties and its investment in development property from the

perspective of accounting rules relating to impairment. A

requirement to assess impairment would be triggered by so called

“impairment indicators”. For us, these might include low rates

of occupancy, operating costs in excess of revenues, or maturing mortgages

for which there were no suitable refinancing

options. Impairment also needs to be considered with respect to

costs incurred for new hotel investments or development opportunities that

are under study. The Company monitors these costs on a

quarterly basis and if a pending project is no longer considered to be

viable, the cost is charged against income. If the Company

estimates incorrectly or misjudges the impairment indicators, it may

result in the Company failing to record an impairment charge, or recording

a charge which may be inaccurate.

|

|

·

|

Pension

Benefits – the Company maintains a defined benefit plan for eligible

employees, which was frozen effective December 31,

2006. Costs and liabilities are developed from

actuarial valuations. In these valuations are assumptions

relating to discount rates, expected return on assets and employee

turnover. Differences between assumed amounts and actual

performance will impact reported amounts for the Company’s pension

expense, as well as the liability for future pension

benefits.

|

|

·

|

Sonesta

Bayfront Hotel Coconut Grove – the Company operates a condominium hotel

under a management agreement, under which it is committed to fund net

operating losses, and provide the owner with minimum annual returns

($419,000 during 2009), adjusted annually by increases in the Consumer

Price Index. In addition, the management agreement may be

subject to termination if the Company elects not to cure shortfalls

against a minimum target return ($978,000 during 2009), adjusted annually

by increases in the Consumer Price Index. Under its agreements,

the Company is entitled to management and marketing fees based on

revenues, and incentive fees based on profits. In case the

aforementioned annual minimum returns and minimum target returns are not

met, the Company’s policy is to eliminate management and marketing fees

from its revenues. If the amount of the shortfall exceeds the

fee income, the Company will book the additional amount as an

administrative and general expense.

|

|

·

|

Trump

International Sonesta Beach Resort - until April 2008, the

Company operated a condominium hotel in Sunny Isles Beach,

Florida. The hotel opened in April 2003. Under

the management agreement, the Company was entitled to management and

marketing fees based on the hotel’s revenues, and incentive fees based on

the hotel’s net operating income. The Company was obligated to advance

funds for operating losses and to provide a minimum annual return of

$800,000 to the hotel’s owner, starting as of November 1,

2004. From the opening in April 2003 until November 1,

2004, the Company was obligated to advance 50% of any net operating

losses. Amounts advanced under these obligations were subject

to repayment, without interest, out of future profits in excess of the

aforementioned minimum return. During the years the minimum

returns were not earned, the Company eliminated the fee income earned from

the property from its revenues. If the amounts of the

shortfalls exceeded the total fee income, the Company reflected such

excess amounts either as long-term receivables and advances on its balance

sheet, or recorded an expense equal to the amount advanced. The

Company exercised its right to terminate the management agreement

effective April 1, 2008, and receive back advances it made under the

agreement totaling $7,031,000. In October

2008,

|

9

|

following

the settlement of a dispute, the Company received $5,002,000 in connection

with the termination of the management agreement, which included the

repayment of advances and the payment of fees which were not previously

recorded. The Company had invested in the furniture, fixtures

and equipment of the non-guestroom areas of the hotel, an amount of

$2,268,000. This was included in other long-term assets, and

was being amortized over the 10-year initial term of the management

agreement. As a result of the decision to terminate the

agreement, the Company accelerated the depreciation of the long-term asset

during the 2007 fourth quarter.

|

|

·

|

Accounting

for 2005 Asset Transfer – in April 2005, the Company completed the

transfer of the land and improvements of Sonesta Beach Key Biscayne to a

development partnership, of which the Company was a 50%

partner. At that time, the Company received non-refundable

proceeds of approximately $60 million, and was entitled to a priority

return of an additional $60 million from the sale proceeds of residential

condominium units to be constructed on the site. Since the

Company had a continuing involvement in the ownership of the development,

the initial gain was being deferred. In 2009, the development

partnership sold its assets and the Company realized the previously

deferred gain (see Note 3 – Investment in Development

Partnership).

|

10

Quantitative

and Qualitative Disclosure of Market Risk

The

Company is exposed to market risk from changes in interest rates. As

of December 31, 2009 the Company used fixed rate debt to finance the ownership

of Royal Sonesta Boston. In February 2010, the loan was replaced with

a new $32 million loan that has a variable interest rate based on LIBOR, but the

Company has entered into an interest rate swap agreement that provides for a

6.4% fixed interest rate for the term of the loan. The table that

follows summarizes the Company’s fixed rate debt obligations, and presents the

fair value of the debt based on current prevailing interest rates for similar

financing. This information should be read in conjunction with Note 5 —

Borrowing Arrangements.

Short and

Long Term Debt (in thousands) maturing in:

|

YEAR

|

||||||||||||||||||||||||||||||||

|

2010

|

2011

|

2012

|

2013

|

2014

|

Thereafter

|

Total

|

Fair Value

|

|||||||||||||||||||||||||

|

Fixed

rate

|

$ | 594 | $ | 563 | $ | 600 | $ | 639 | $ | 681 | $ | 29,118 | $ | 32,195 | $ | 32,195 | ||||||||||||||||

|

Average

interest rate

|

6.5 | % | 6.4 | % | 6.4 | % | 6.4 | % | 6.4 | % | 6.4 | % | ||||||||||||||||||||

Selected

Quarterly Financial Data

Following

are selected quarterly financial information for the years ended December 31,

2009 and 2008.

|

(in

thousands except for per share data)

|

||||||||||||||||

|

2009

|

||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

|||||||||||||

|

Revenues

|

$ | 13,103 | $ | 16,497 | $ | 14,517 | $ | 16,341 | ||||||||

|

Other

revenues from managed and

|

||||||||||||||||

|

affiliated

properties

|

1,221 | 1,082 | 1,045 | 1,013 | ||||||||||||

|

Total

revenues

|

14,324 | 17,579 | 15,562 | 17,354 | ||||||||||||

|

Operating

income (loss)

|

(2,400 | ) | 363 | 148 | 938 | |||||||||||

|

Net

income (loss)

|

(2,212 | ) | (109 | ) | 27,379 | 219 | ||||||||||

|

Net

income (loss) per share

|

$ | (0.60 | ) | $ | (0.03 | ) | $ | 7.41 | $ | 0.06 | ||||||

|

2008

|

||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

|||||||||||||

|

Revenues

|

$ | 17,798 | $ | 20,422 | $ | 16,398 | $ | 16,934 | ||||||||

|

Other

revenues from managed and

|

||||||||||||||||

|

affiliated

properties

|

5,117 | 1,346 | 1,286 | 1,216 | ||||||||||||

|

Total

revenues

|

22,915 | 21,768 | 17,684 | 18,150 | ||||||||||||

|

Operating

income (loss)

|

80 | 2,730 | 4,411 | (550 | ) | |||||||||||

|

Net

income (loss)

|

90 | 1,506 | 2,792 | (308 | ) | |||||||||||

|

Net income

(loss) per share

|

$ | 0.02 | $ | 0.41 | $ | 0.76 | $ | (0.09 | ) | |||||||

11

Fourth

Quarter Results

Revenues

|

TOTAL

REVENUES

(in

thousands)

|

||||||||||||

|

NO.

OF

|

||||||||||||

|

ROOMS

|

2009

|

2008

|

||||||||||

|

Royal

Sonesta Hotel Boston

|

400 | $ | 6,324 | $ | 7,344 | |||||||

|

Royal

Sonesta Hotel New Orleans

|

500 | 8,685 | 7,884 | |||||||||

|

Management

and service fees

|

1,332 | 1,706 | ||||||||||

|

Total

revenues, excluding other revenues from

managed

and affiliated properties

|

$ | 16,341 | $ | 16,934 | ||||||||

Total

revenues, excluding other revenues from managed and affiliated properties,

during the fourth quarter of 2009 were $16,341,000 compared to $16,934,000

during the fourth quarter of 2008, a decrease of $593,000.

Royal

Sonesta Hotel Boston reported fourth quarter 2009 revenues of $6,324,000

compared to $7,344,000 in the fourth quarter of 2008, representing a $1,020,000,

or 14%, decrease. Economic conditions continued to effect the demand

for hotel rooms in the Boston market during the fourth quarter. The

decrease was almost entirely due to an $883,000 decrease in room revenues,

resulting from an 18% decrease in room revenue per available room

(“REVPAR”). The hotel’s occupancy levels during the fourth quarter of

2009 were actually slightly higher compared to 2008, but the hotel’s average

daily room rates declined substantially. The hotel’s group and

convention business continued to decline during the 2009 fourth

quarter. Lack of corporate group and convention business has created

strong competition for transient business, which led to a decline in room rates

from this market segment. Revenues from other sources declined by

$137,000 in the 2009 fourth quarter due to a decrease in banquet revenues,

resulting from the decrease in group and convention business.

Royal

Sonesta Hotel New Orleans reported 2009 fourth quarter revenues of $8,685,000,

which represented an increase of $801,000 compared to 2008 fourth quarter

revenues of $7,884,000. Demand in New Orleans improved during the

2009 fourth quarter, resulting in a $486,000 increase in room revenues, due to a

10% REVPAR increase. This increase was entirely due to higher

occupancy levels. Business from both the group and convention as well

as the transient market segments were up during the 2009 fourth

quarter. Revenues from other sources increased by $315,000, which

included increased banqueting and beverage sales.

Revenues

from management activities decreased from $1,706,000 in the 2008 fourth quarter

to $1,332,000 during the 2009 fourth quarter, a decrease of

$374,000. This was mainly due to a $250,000 decrease in fee income

from the Company’s managed hotels in Egypt. Profit levels at two of

the Company’s resorts in Egypt fell short of thresholds which the hotels need to

achieve in order for the Company to earn incentive fees.

Operating

Income

|

OPERATING

INCOME (LOSS)

(in

thousands)

|

||||||||

|

2009

|

2008

|

|||||||

|

Royal

Sonesta Hotel Boston

|

$ | 676 | $ | 1,257 | ||||

|

Royal

Sonesta Hotel New Orleans

|

388 | (373 | ) | |||||

|

Operating

income from hotels after

management and service

fees

|

1,064 | 884 | ||||||

|

Management

activities and other

income

|

(126 | ) | (1,434 | ) | ||||

|

Operating

income (loss)

|

$ | 938 | $ | (550 | ) | |||

The

Company reported operating income of $938,000 during the fourth quarter of 2009,

compared to an operating loss of $550,000 in the fourth quarter of

2008.

Operating

income at Royal Sonesta Hotel Boston decreased from $1,257,000 in the fourth

quarter of 2008 to $676,000 during the fourth quarter of 2009, a $581,000

decrease. Revenues during the fourth quarter decreased by $1,020,000,

which decrease was partially offset by a $439,000, or 7%, decrease in

expenses. Costs and operating expenses decreased by $188,000, due to

a decrease in payroll and employee benefits costs. In addition,

expenses for administrative and general, sales and marketing, human resources,

and depreciation decreased compared to last year.

Royal

Sonesta Hotel New Orleans reported operating income of $388,000 in the 2009

fourth quarter, an improvement of $761,000 compared to the $373,000 operating

loss in the fourth quarter of 2008. Revenues increased by $801,000 in

the 2009 period, which increase was partially offset by a very slight $40,000

increase in overall expenses. Modest increases in costs and operating

expenses, sales and marketing expense and maintenance costs were partially

offset by decreases in administrative and general expenses. During

the 2008 fourth quarter, the hotel expensed $303,000 for costs incurred during

2006, 2007 and 2008 related to the potential addition of a spa in the hotel,

following its decision to postpone this project indefinitely because of the high

costs.

Operating

loss from management activities, which is computed after giving effect to

management and marketing fees from owned and leased hotels, decreased from

$1,434,000 during the fourth quarter of 2008 to $126,000 during the 2009 fourth

quarter. Decreases in revenues from these activities of $374,000 were

more than offset by a decrease in expenses of $1,682,000 during the 2009 fourth

quarter. The reduction in corporate costs was entirely due to a

decrease in administrative and general expenses. During the 2008

fourth quarter, administrative and general expense included an amount of

$720,000 related to an employment agreement with Roger Sonnabend, the Company’s

former Executive Chairman of the Board, who passed away in December

2008. Expenses in 2008 also included legal fees and other costs

related to a hotel project in Miami. The Company incurred these costs

during 2008 but decided in early 2009 not to pursue this

opportunity. During the 2009 fourth quarter, the Company reversed an

expense totaling $376,000 related to Sonesta Bayfront Hotel Coconut

Grove. During the first nine months of 2009, the Company provided for

the cost to cure a target return under the contract for this

hotel. In January 2010, the Company decided not to cure this target

return for the 2009 calendar year (see also Note 2,

Operations). Administrative and general expenses in the 2009 quarter

were also lower compared to 2008 due to decreases in employee benefits costs,

following the suspension of matching 401(k) contributions starting in April

2009, and due to lower bonus expense.

12

SONESTA

INTERNATIONAL HOTELS CORPORATION

CONSOLIDATED

STATEMENTS OF OPERATIONS

For the

years ended December 31, 2009 and 2008

(in

thousands, except for per share data)

|

2009

|

2008

|

|||||||

|

Revenues:

|

||||||||

|

Rooms

|

$ | 35,215 | $ | 41,052 | ||||

|

Food and beverage

|

16,209 | 17,519 | ||||||

|

Management, license and service

fees

|

4,302 | 7,956 | ||||||

|

Parking, telephone and

other

|

4,732 | 5,025 | ||||||

| 60,458 | 71,552 | |||||||

|

Other

revenues from managed and affiliated properties

|

4,361 | 8,965 | ||||||

|

Total

revenues

|

64,819 | 80,517 | ||||||

|

Costs

and expenses:

|

||||||||

|

Costs and operating

expenses

|

28,009 | 30,819 | ||||||

|

Advertising and

promotion

|

5,688 | 5,608 | ||||||

|

Administrative and

general

|

12,363 | 14,405 | ||||||

|

Human resources

|

904 | 1,191 | ||||||

|

Maintenance

|

3,395 | 3,549 | ||||||

|

Rentals

|

4,486 | 5,392 | ||||||

|

Property taxes

|

1,385 | 1,358 | ||||||

|

Depreciation and

amortization

|

5,179 | 5,838 | ||||||

| 61,409 | 68,160 | |||||||

|

Other expenses from managed and

affiliated properties

|

4,361 | 8,965 | ||||||

|

Total

costs and expenses

|

65,770 | 77,125 | ||||||

|

Income

from Management Agreement settlement, net

|

-- | 3,279 | ||||||

|

Operating

income (loss)

|

(951 | ) | 6,671 | |||||

|

Other

income (deductions):

|

||||||||

|

Interest expense

|

(2,865 | ) | (2,970 | ) | ||||

|

Interest income

|

402 | 1,182 | ||||||

|

Foreign exchange

loss

|

(16 | ) | (2 | ) | ||||

|

Gain on sales of assets and

dissolution of development partnership

|

41,875 | 576 | ||||||

| 39,396 | (1,214 | ) | ||||||

|

Income

before income taxes

|

38,445 | 5,457 | ||||||

|

Income

tax expense

|

13,168 | 1,377 | ||||||

|

Net

income

|

$ | 25,277 | $ | 4,080 | ||||

|

Basic

and diluted income per share

|

$ | 6.84 | $ | 1.10 | ||||

|

Dividends

per share

|

$ | 1.00 | $ | 1.35 | ||||

|

Weighted

average number of shares outstanding

|

3,698 | 3,698 | ||||||

See

accompanying notes to consolidated financial statements.

13

SONESTA

INTERNATIONAL HOTELS CORPORATION

CONSOLIDATED

BALANCE SHEETS

December

31, 2009 and 2008

(in

thousands, except for per share data)

|

2009

|

2008

|

|||||||

|

ASSETS

|

||||||||

|

Current

assets:

|

||||||||

|

Cash and cash

equivalents

|

$ | 35,557 | $ | 37,463 | ||||

|

Restricted cash

|

-- | 175 | ||||||

|

Accounts and notes

receivable:

|

||||||||

|

Trade, less allowance of $70 ($59

in 2008) for doubtful accounts

|

5,092 | 5,407 | ||||||

|

Other, including current portion

of long-term receivables andadvances

|

1,242 | 1,001 | ||||||

|

Total accounts and notes

receivable

|

6,334 | 6,408 | ||||||

|

Inventories

|

623 | 628 | ||||||

|

Current deferred tax

assets

|

476 | 462 | ||||||

|

Prepaid expenses and other

current assets

|

1,242 | 2,163 | ||||||

|

Total current

assets

|

44,232 | 47,299 | ||||||

|

Long-term

receivables and advances

|

1,354 | 992 | ||||||

|

Deferred

tax assets

|

-- | 9,049 | ||||||

|

Investment

in development partnership (see Note 3)

|

-- | 33,666 | ||||||

|

Property

and equipment, at cost:

|

||||||||

|

Land and land

improvements

|

2,102 | 2,102 | ||||||

|

Buildings

|

25,721 | 25,610 | ||||||

|

Furniture and

equipment

|

30,859 | 30,150 | ||||||

|

Leasehold

improvements

|

9,109 | 8,785 | ||||||

|

Projects in

progress

|

64 | 472 | ||||||

| 67,855 | 67,119 | |||||||

|

Less accumulated depreciation and

amortization

|

33,585 | 32,088 | ||||||

|

Net property and

equipment

|

34,270 | 35,031 | ||||||

|

Other

long-term assets

|

875 | 1,003 | ||||||

| $ | 80,731 | $ | 127,040 | |||||

See

accompanying notes to consolidated financial statements.

14

SONESTA

INTERNATIONAL HOTELS CORPORATION

CONSOLIDATED

BALANCE SHEETS

|

2009

|

2008

|

|||||||

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Current

liabilities:

|

||||||||

|

Current portion of long-term

debt

|

$ | 594 | $ | 1,163 | ||||

|

Accounts payable

|

2,887 | 3,747 | ||||||

|

Advance deposits

|

1,103 | 1,281 | ||||||

|

Accrued income

taxes

|

327 | 402 | ||||||

|

Accrued

liabilities:

|

||||||||

|

Salaries and

wages

|

1,278 | 1,772 | ||||||

|

Rentals

|

3,741 | 4,787 | ||||||

|

Interest

|

236 | 244 | ||||||

|

Pension and other employee

benefits

|

2,064 | 1,612 | ||||||

|

Other

|

1,028 | 862 | ||||||

| 8,347 | 9,277 | |||||||

|

Total current

liabilities

|

13,258 | 15,870 | ||||||

|

Long-term

debt

|

31,245 | 31,839 | ||||||

|

Deferred

gain (see Note 3)

|

-- | 64,481 | ||||||

|

Pension

liability, non-current

|

6,554 | 9,338 | ||||||

|

Other

non-current liabilities

|

1,082 | 1,386 | ||||||

|

Deferred

tax liabilities

|

1,939 | -- | ||||||

|

Commitments

and contingencies (see Note 7)

|

||||||||

|

Stockholders’

equity:

|

||||||||

|

Common stock:

|

||||||||

|

Class A, $.80 par

value

|

||||||||

|

Authorized--10,000

shares

|

||||||||

|

Issued – 6,102 shares at stated

value

|

4,882 | 4,882 | ||||||

|

Retained

earnings

|

35,734 | 14,155 | ||||||

|

Treasury shares – 2,404, at

cost

|

(12,053 | ) | (12,053 | ) | ||||

|

Accumulated other comprehensive

loss

|

(1,910 | ) | (2,858 | ) | ||||

|

Total stockholders’

equity

|

26,653 | 4,126 | ||||||

| $ | 80,731 | $ | 127,040 | |||||

15

SONESTA

INTERNATIONAL HOTELS CORPORATION

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS’ EQUITY

|

|

For

the years ended December 31, 2009 and

2008

|

|

|

(in

thousands, except for per share

data)

|

|

Common

Shares Outstanding

|

Class

A Common Stock

|

Treasury

Shares at Cost

|

Retained

Earnings

|

Accumulated

Other Comprehensive Income (Loss)

|

Total

Stockholders’

Equity

|

||||||||||||||||

|

3,698

|

Balance

January 1, 2008

|

$ | 4,882 | $ | (12,053 | ) | $ | 15,068 | $ | 650 | $ | 8,547 | |||||||||

|

--

|

Cash

dividends declared on common stock ($1.35 per share)

|

-- | -- | (4,993 | ) | -- | (4,993 | ) | |||||||||||||

|

--

|

Net

income

|

-- | -- | 4,080 | -- | 4,080 | |||||||||||||||

|

--

|

Pension

plan, actuarial loss recognized

|

-- | -- | -- | (3,508 | ) | (3,508 | ) | |||||||||||||

|

3,698

|

Balance

December 31, 2008

|

4,882 | (12,053 | ) | 14,155 | (2,858 | ) | 4,126 | |||||||||||||

|

--

|

Cash

dividends declared on common stock ($1.00 per share)

|

-- | -- | (3,698 | ) | -- | (3,698 | ) | |||||||||||||

|

--

|

Net

income

|

-- | -- | 25,277 | -- | 25,277 | |||||||||||||||

|

--

|

Pension

plan, actuarial gain recognized

|

-- | -- | -- | 948 | 948 | |||||||||||||||

|

3,698

|

Balance

December 31, 2009

|

$ | 4,882 | $ | (12,053 | ) | $ | 35,734 | $ | (1,910 | ) | $ | 26,653 | ||||||||

SONESTA

INTERNATIONAL HOTELS CORPORATION

CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

|

|

For

the years ended December 31, 2009 and

2008

|

|

|

(in

thousands)

|

|

2009

|

2008

|

|||||||

|

Net

income

|

$ | 25,277 | $ | 4,080 | ||||

|

Other

comprehensive income (loss), net of tax:

|

||||||||

|

Pension

Plan, actuarial income (loss) recognized

|

948 | (3,508 | ) | |||||

|

Comprehensive

income

|

$ | 26,225 | $ | 572 | ||||

See

accompanying notes to consolidated financial statements.

16

SONESTA

INTERNATIONAL HOTELS CORPORATION

CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the

years ended December 31, 2009 and 2008

(in

thousands)

|

2009

|

2008

|

|||||||

|

Cash

provided (used) by operating activities

|

||||||||

|

Net income

|

$ | 25,277 | $ | 4,080 | ||||

|

Adjustments to reconcile net

income to net cash

|

||||||||

|

provided (used) by operating

activities

|

||||||||

|

Depreciation and amortization of

property and equipment

|

5,179 | 5,838 | ||||||

|

Other amortization and non-cash

expenses

|

92 | 262 | ||||||

|

Deferred federal and state income

tax provision

|

11,994 | 353 | ||||||

|

Gain on sales of assets and

dissolution of development

partnership

|

(41,875 | ) | (576 | ) | ||||

|

Changes in assets and

liabilities

|

||||||||

|

Restricted cash

|

175 | 1,526 | ||||||

|

Accounts and notes

receivable

|

(44 | ) | (39 | ) | ||||

|

Inventories

|

5 | (21 | ) | |||||

|

Prepaid expenses and

other

|

(146 | ) | 71 | |||||

|

Accounts payable

|

64 | (1,301 | ) | |||||

|

Advance deposits

|

(178 | ) | (1,655 | ) | ||||

|

Income taxes

|

953 | (223 | ) | |||||

|

Accrued

liabilities

|

(2,474 | ) | (319 | ) | ||||

|

Cash provided (used) by