Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SMITHFIELD FOODS INC | form_8k.htm |

Barclays

Capital 2010

High Yield Bond and

Syndicated Loan Conference

High Yield Bond and

Syndicated Loan Conference

Robert

W. Manly

Executive Vice

President and Chief Financial Officer

Smithfield Foods,

Inc.

March

26, 2010

2

2

2

Forward-Looking

Statements

This

presentation contains “forward-looking” statements within the meaning of the

federal

securities laws. The forward-looking statements include statements concerning the

Company’s outlook for the future, as well as other statements of beliefs, future plans and

strategies or anticipated events, and similar expressions concerning matters that are not

historical facts. The Company’s forward-looking information and statements are subject to

risks and uncertainties that could cause actual results to differ materially from those

expressed in, or implied by, the statements. These risks and uncertainties include the

availability and prices of live hogs, raw materials, fuel and supplies, food safety, livestock

disease, live hog production costs, product pricing, the competitive environment and related

market conditions, hedging risk, operating efficiencies, changes in interest rate and foreign

currency exchange rates, changes in our credit ratings, access to capital, the investment

performance of the Company’s pension plan assets and the availability of legislative funding

relief, the cost of compliance with environmental and health standards, adverse results from

on-going litigation, actions of domestic and foreign governments, labor relations issues,

credit exposure to large customers, the ability to make effective acquisitions and

dispositions and successfully integrate newly acquired businesses into existing operations,

the Company’s ability to effectively restructure portions of its operations and achieve cost

savings from such restructurings and other risks and uncertainties described in the

Company’s Annual Report on Form 10-K for fiscal 2009 and in its subsequent Quarterly

Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward-looking

statements because actual results may differ materially from those expressed in, or implied

by, the statements. Any forward-looking statement that the Company makes speaks only as

of the date of such statement, and the Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information, future events or

otherwise. Comparisons of results for current and any prior periods are not intended to

express any future trends or indications of future performance, unless expressed as such,

and should only be viewed as historical data.

securities laws. The forward-looking statements include statements concerning the

Company’s outlook for the future, as well as other statements of beliefs, future plans and

strategies or anticipated events, and similar expressions concerning matters that are not

historical facts. The Company’s forward-looking information and statements are subject to

risks and uncertainties that could cause actual results to differ materially from those

expressed in, or implied by, the statements. These risks and uncertainties include the

availability and prices of live hogs, raw materials, fuel and supplies, food safety, livestock

disease, live hog production costs, product pricing, the competitive environment and related

market conditions, hedging risk, operating efficiencies, changes in interest rate and foreign

currency exchange rates, changes in our credit ratings, access to capital, the investment

performance of the Company’s pension plan assets and the availability of legislative funding

relief, the cost of compliance with environmental and health standards, adverse results from

on-going litigation, actions of domestic and foreign governments, labor relations issues,

credit exposure to large customers, the ability to make effective acquisitions and

dispositions and successfully integrate newly acquired businesses into existing operations,

the Company’s ability to effectively restructure portions of its operations and achieve cost

savings from such restructurings and other risks and uncertainties described in the

Company’s Annual Report on Form 10-K for fiscal 2009 and in its subsequent Quarterly

Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward-looking

statements because actual results may differ materially from those expressed in, or implied

by, the statements. Any forward-looking statement that the Company makes speaks only as

of the date of such statement, and the Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information, future events or

otherwise. Comparisons of results for current and any prior periods are not intended to

express any future trends or indications of future performance, unless expressed as such,

and should only be viewed as historical data.

3

Emerging

As A Global Leader In

Packaged Meats

Packaged Meats

4

Market

Leader: Pork Processing

Pork

Sales:

$9.3 billion

Operating

Profit:

$538.2 million

$538.2 million

•World’s

largest pork

processor

processor

•Sold

approximately

3.1 billion pounds of

packaged meats in

FY09

3.1 billion pounds of

packaged meats in

FY09

•Processed

33 million

hogs in FY09

hogs in FY09

•Sold

approximately

4.5 billion pounds of

fresh pork in FY09

4.5 billion pounds of

fresh pork in FY09

Note:

TTM FY 10 Q3 sales (before eliminations) and operating profit

Source:

United States Industry Data Successful Farming

(%

of U.S. hogs processed)

5

5

5

Smithfield

sold

approximately 3.1

billion pounds of

packaged meats

in fiscal 2009

approximately 3.1

billion pounds of

packaged meats

in fiscal 2009

(%

of Smithfield U.S. packaged meats volume)

6

6

6

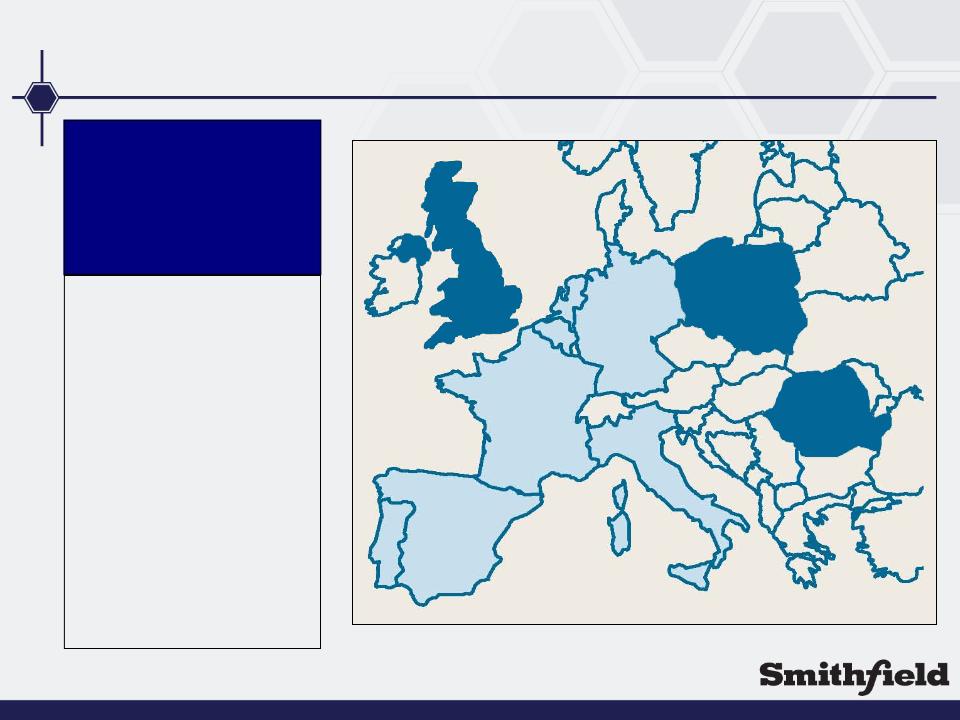

Market

Leadership: International

International

Sales:

$1.2 billion

Operating

Profit:

$39.5 million

$39.5 million

•Subsidiaries

in

Poland, Romania and

the United Kingdom

Poland, Romania and

the United Kingdom

•37%

ownership of

Campofrío Food Group

(public company) with

#1 packaged meats

market share in

France, Spain, The

Netherlands, Belgium

and Portugal

Campofrío Food Group

(public company) with

#1 packaged meats

market share in

France, Spain, The

Netherlands, Belgium

and Portugal

•Joint

ventures in

Mexico and China

Mexico and China

Note:

TTM FY 10 Q3 sales (before eliminations) and operating profit

#1

#1

#1

#1

#1

#1

#1

7

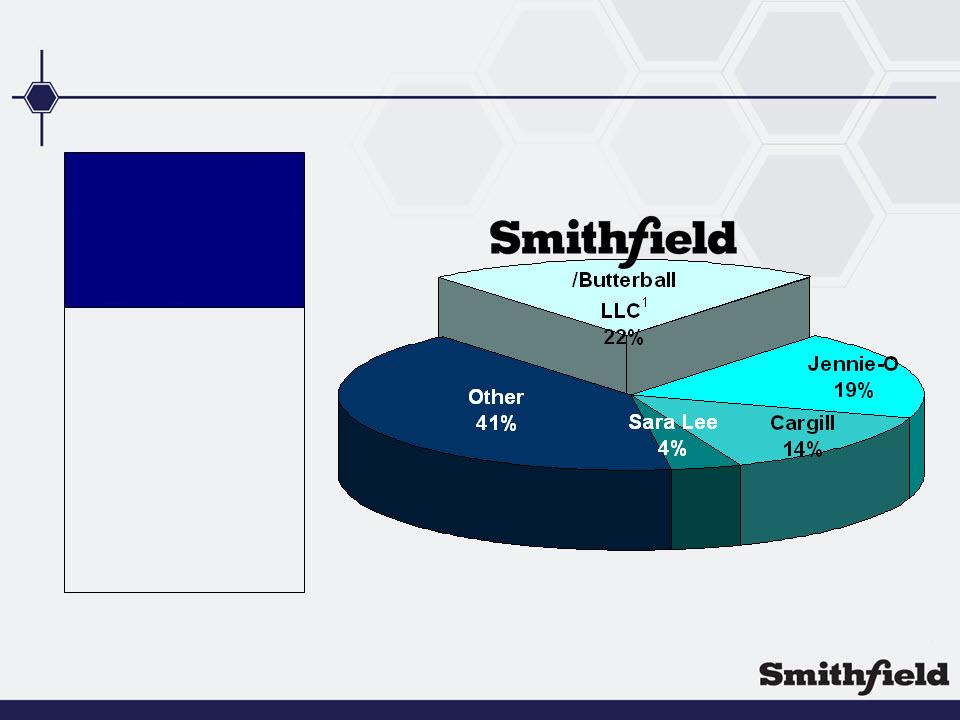

Market

Leader: Turkey Processing

Other

Segment

Sales:

$189 million

Operating

Loss:

$(17.1) million

$(17.1) million

•Butterball

is the

largest turkey

processor in the U.S.

largest turkey

processor in the U.S.

•Segment

comprised

of turkey production

operations, 49%

interest in Butterball

and interest in live

cattle joint venture

operations

of turkey production

operations, 49%

interest in Butterball

and interest in live

cattle joint venture

operations

Note:

TTM FY 10 Q3 sales (before eliminations) and operating profit; includes amounts

related to cattle operations

Source:

United States Industry Data Successful Farming

1 49% owned joint

venture

(%

of U.S. turkeys processed)

8

8

8

Market

Leader: Hog Production

Hog

Production

Sales:

$2.4 billion

Operating

Loss:

$(555.8) million

$(555.8) million

•World’s

largest hog

producer

producer

•Produced

18.7

million hogs in U.S.

in FY09

million hogs in U.S.

in FY09

•Produced

1.7

million hogs in

Poland and Romania

and 1.7 million hogs

at Mexican joint

ventures in FY09

million hogs in

Poland and Romania

and 1.7 million hogs

at Mexican joint

ventures in FY09

Note:

TTM FY 10 Q3 sales (before eliminations) and operating profit

Source:

United States Industry Data Successful Farming

1 The majority of hogs

from Prestage Farms and Goldsboro Hog Farm are sold to Smithfield Foods under

long-term contract

2 Approximate market

shares of Five Producers: Cargill=2%; Iowa Select Farms=2%; The Pipestone

System=1%; Goldsboro

Hog Farm=1%; The Hanor Company=1%; Total=8%

Hog Farm=1%; The Hanor Company=1%; Total=8%

9

The

New Era of Smithfield

10

10

10

The

New Era of Smithfield

• Restructured Pork

Group primed for higher performance

and stability of earnings

and stability of earnings

• Focus on synergies,

efficiency, ROIC and margins

• Increased financial

management with focus on

deleveraging the balance sheet and maintaining strong

liquidity

deleveraging the balance sheet and maintaining strong

liquidity

• Business focus on

maximizing core assets

• Create better

balance of earnings between hog

production and pork processing

production and pork processing

11

11

Pork

Group Restructuring Update

• Streamlined Pork

Group management structure - DONE

• Consolidated seven

IOC’s into three and closed five

processing plants; sixth to close in third quarter - DONE

processing plants; sixth to close in third quarter - DONE

• Merged three fresh

pork sales organizations into two and

consolidated three overseas export teams into one -

DONE

consolidated three overseas export teams into one -

DONE

• Consolidated

manufacturing platform to improve

margins, lower operating costs and increase plant

utilization - DONE

margins, lower operating costs and increase plant

utilization - DONE

• Improved Pork Group

base profitability - IN

PROCESS

12

12

Pork

Group Restructuring Costs/Benefits

$54

million

$34

million

$74

million

$125

million

13

13

13

Pork

Group Restructuring Costs/Benefits

|

|

Capital

requirements |

One

time

expenses |

Non-cash

asset write-off |

Annual

EBT

Improvements |

|

Total

|

$52

million

|

$34

million

|

$74

million

|

$125

million

|

|

Amount

previously

incurred/achieved |

$44

million

|

$28

million

|

$74

million

|

$111

million

|

|

Amount

remaining

after FY 10 Q3 |

$8

million

|

$6

million

|

-

|

$14

million

|

14

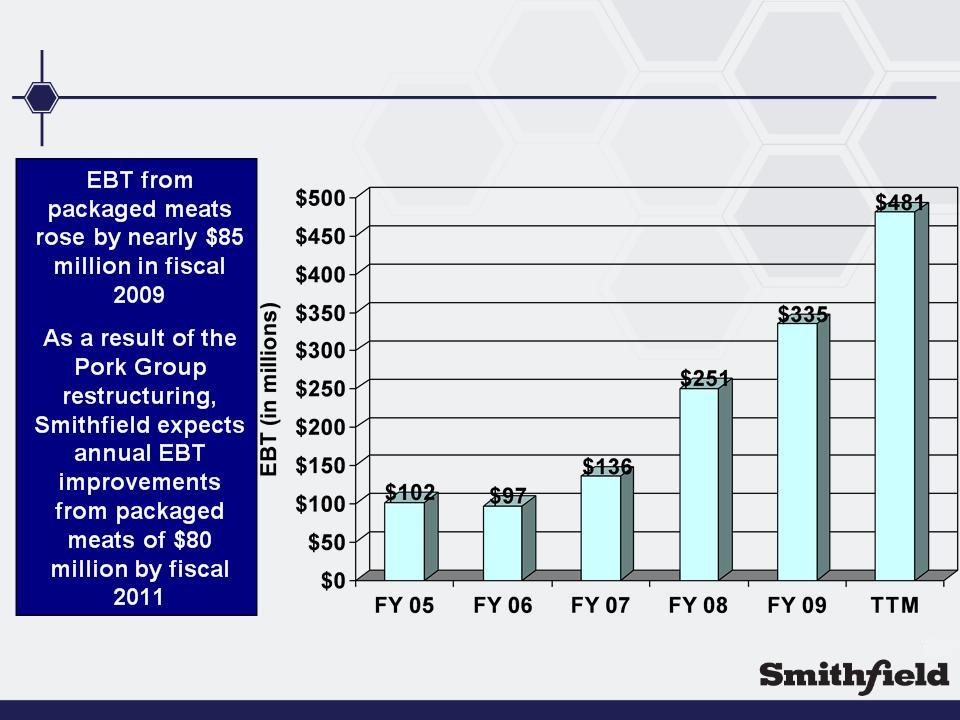

Packaged

Meats Margin Growth

Note:

FY 09 and FY 10 results before restructuring charges

15

Packaged

Meats EBT Growth

Note:

FY 09 and FY 10 results before restructuring charges

16

Packaged

Meats Contribution

Packaged

meats

will continue to

drive pork

segment

earnings

contribution

will continue to

drive pork

segment

earnings

contribution

$5.71

$9.34

$14.32

$15.00

Note:

FY 09 and TTM results exclude impairments mostly related to segment

restructuring. All periods

reflect an apportionment of "Pork Other" consistent with the apportionment recognized for FY 10.

reflect an apportionment of "Pork Other" consistent with the apportionment recognized for FY 10.

$18.11

17

Source:

IRI Total US Food 52 WE 12/06/09; FreshLook Market Total US Food 52 WE 11/22/09;

Turkey = Whole Bird

|

|

Category

|

|||

|

|

Size1

|

Growth2

|

||

|

Packaged

Lunchmeat

|

741.1

|

-2.5%

|

11.1%

|

2

|

|

Deli

Meats

|

685.2

|

+2.6%

|

13.3%

|

1

|

|

Turkey

|

631.9

|

+0.8%

|

20.7%

|

1

|

|

Bacon

|

604.1

|

+7.2%

|

18.4%

|

1

|

|

Smoked

Hams

|

544.0

|

+10.6%

|

55.0%

|

1

|

|

Cooked Dinner

Sausage

|

361.8

|

-1.2%

|

17.0%

|

2

|

|

Breakfast

Sausage

|

341.3

|

+0.7%

|

7.7%

|

3

|

|

Smoked

Pork

|

161.8

|

-3.5%

|

49.5%

|

1

|

|

Value Added

Ham Cuts

|

58.8

|

+3.4%

|

27.9%

|

1

|

|

Frozen

Meatballs

|

57.2

|

+2.2%

|

24.2%

|

1

|

|

BBQ

Meats

|

30.4

|

+3.9%

|

21.4%

|

2

|

Smithfield

brands

drive 19.5% of the

5 billion+ pounds

sold across its

key growth

categories

drive 19.5% of the

5 billion+ pounds

sold across its

key growth

categories

Smithfield

brands

are ranked 1st or

2nd in 10 leading

consumer

packaged meats

categories

are ranked 1st or

2nd in 10 leading

consumer

packaged meats

categories

Leading

position in key consumer categories

18

18

18

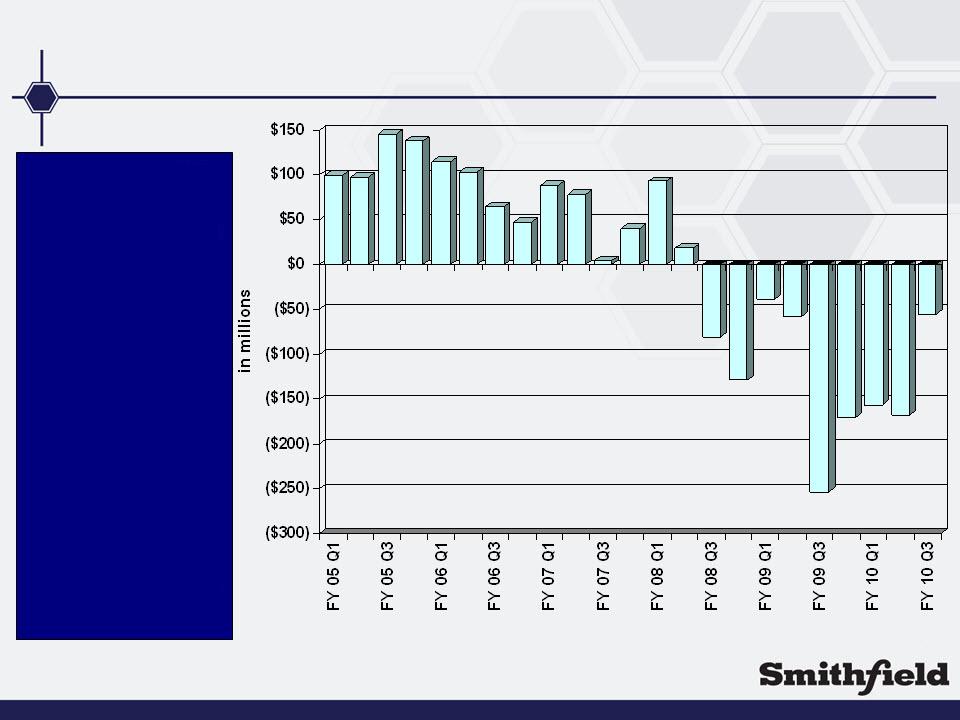

Hog

Production Operating Profit (Loss)

Smithfield

has

proactively

reduced the size

of its sow herd

by 13% in an

effort to return

hog production

to normalized

levels of

profitability

proactively

reduced the size

of its sow herd

by 13% in an

effort to return

hog production

to normalized

levels of

profitability

Hog

production

losses

moderated

significantly in

the third quarter

of fiscal 2010

losses

moderated

significantly in

the third quarter

of fiscal 2010

19

19

19

U.S.

Sow Herd Reduction

Smithfield

will

produce

approximately 1.4

million fewer

market hogs in

fiscal 2010 and

approximately 2.2

million fewer

market hogs

annually thereafter

produce

approximately 1.4

million fewer

market hogs in

fiscal 2010 and

approximately 2.2

million fewer

market hogs

annually thereafter

20

Exports

21

U.S.

Pork Exports 2000 vs. 2008

2008

2000

1.3

billion pounds; 7

million hogs; 7% of

U.S. production

million hogs; 7% of

U.S. production

22

Financial

Management

23

23

23

Restructuring

the Balance Sheet

• Reduced total

debt

• Removed

risk

– Covenant

– Liquidity

– Maturities

24

24

24

Restructured

$2 Billion In Debt

|

|

Size

|

Maturity

|

|

Asset-Based

Revolving

Credit Facility |

$1.0

billion

|

July

2012

|

|

Senior

Secured Notes

|

$625

million

|

July

2014

|

|

Senior

Secured Notes

|

$225

million

|

July

2014

|

|

Term

Loan Maturity

Extension |

$200

million

|

October

2013

|

New

credit facility

contains no

currently

applicable

maintenance

covenants

contains no

currently

applicable

maintenance

covenants

Estimated

quarterly interest

expense is $65-70

million

quarterly interest

expense is $65-70

million

Note:

New credit facility requires that fixed charge coverage ratio must be at least

1.1

to 1.0 if availability is less than $120 million. The Company does not expect that

availability will be below that threshold through fiscal year 2010.

to 1.0 if availability is less than $120 million. The Company does not expect that

availability will be below that threshold through fiscal year 2010.

25

25

25

Improving

Liquidity

Smithfield

continues to

improve liquidity

and has reduced

net debt in excess

of $1 billion since

fiscal 2009

continues to

improve liquidity

and has reduced

net debt in excess

of $1 billion since

fiscal 2009

Note:

Amounts reflect unused borrowing capacity under U.S. credit facility at quarter

end plus invested and liquid

cash

cash

26

26

Long-Term

Debt Maturities

Smithfield

has no

significant debt

maturities until

fiscal 2012

significant debt

maturities until

fiscal 2012

27

27

Total

Debt to Total Capitalization

Note:

FY 10 Pro forma debt is net of short-term cash

investments

28

Conclusion

29

29

29

Where

do we go from here?

• De-emphasize

domestic hog production

• Devote additional

resources to marketing

• Concentrate on

packaged meat capabilities

• Continue to search

for international value added

opportunities

opportunities

30

30

30

Conclusion

• Pork Group

profitability is already benefitting from

restructuring plan and will increase in fiscal 2011

restructuring plan and will increase in fiscal 2011

• Packaged meats

business performing at record levels

• Continuing to

maintain very strong liquidity position,

reduce debt and strengthen the balance sheet

reduce debt and strengthen the balance sheet

• Hog production

results are improving as a result of herd

reductions

reductions

• Company continues to

position the overall business for

much stronger earnings

much stronger earnings