Attached files

EXHIBIT 13

Front Row: Carroll E. Shelton, John P. Erb, Robert H. Gilliam Jr., Thomas F. Hall and James E. Burton, IV

Back Row: James P. Kent, Jr., R.B. Hancock, Jr., John L. Waller, A. Willard Arthur,

Michael E. Watson and William F. Overacre

BOARD OF DIRECTORS

| A. Willard Arthur Retired Chairman and Secretary Marvin V. Templeton & Sons, Inc.

James E. Burton, IV President Marvin V. Templeton & Sons, Inc.

John P. Erb Assistant Superintendent Campbell County Schools

Robert H. Gilliam, Jr. President & CEO First National Bank Pinnacle Bankshares Corporation

Thomas F. Hall President George E. Jones & Sons, Inc.

R. B. Hancock, Jr. President & Owner R.B.H., Inc. |

James P. Kent, Jr. Partner Kent & Kent, P.C.

William F. Overacre Broker/Owner RE/MAX 1st Olympic, REALTORS

Carroll E. Shelton Senior Vice President First National Bank Pinnacle Bankshares Corporation

John L. Waller Owner & Operator Waller Farms, Inc.

Michael E. Watson Controller Flippin, Bruce & Porter, Inc. |

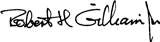

Front Cover: Our new Rustburg branch.

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

Table of Contents

| Page | ||

| Office Locations |

2 | |

| Officers and Managers |

3 | |

| President’s Letter |

4 | |

| Selected Consolidated Financial Information |

6 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

7 | |

| Consolidated Balance Sheets |

27 | |

| Consolidated Statements of Income |

28 | |

| Consolidated Statements of Changes in Stockholders’ Equity and Comprehensive Income |

29 | |

| Consolidated Statements of Cash Flows |

30 | |

| Notes to Consolidated Financial Statements |

32 | |

| Management’s Report on Internal Control Over Financial Reporting |

58 | |

| Report of Independent Registered Public Accounting Firm |

59 | |

| Shareholder Information |

62 and IBC | |

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

First National Bank Office Locations

ALTAVISTA

MAIN OFFICE

622 Broad Street

Altavista, Virginia 24517

Telephone: (434) 369-3000

VISTA OFFICE

1301 N. Main Street

Altavista, Virginia 24517

Telephone: (434) 369-3001

LYNCHBURG

AIRPORT OFFICE

14580 Wards Road

Lynchburg, Virginia 24502

Telephone: (434) 237-3788

TIMBERLAKE OFFICE

20865 Timberlake Road

Lynchburg, Virginia 24502

Telephone: (434) 237-7936

OLD FOREST ROAD OFFICE

3309 Old Forest Road

Lynchburg, Virginia 24501

Telephone: (434) 385-4432

FOREST

FOREST OFFICE

14417 Forest Road

Forest, Virginia 24551

Telephone: (434) 534-0451

AMHERST

AMHERST OFFICE

130 South Main Street

Amherst, Virginia 24521

Telephone: (434) 946-7814

RUSTBURG

RUSTBURG OFFICE

1033 Village Highway

Rustburg, Virginia 24588

Telephone: (434) 332-1742

SMITH MOUNTAIN LAKE

LOAN PRODUCTION OFFICE

74 Scruggs Road, Suite 102

Moneta, Virginia 24121

Telephone: (540) 719-0193

2

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

| Officers of Pinnacle Bankshares Corporation | ||

| Robert H. Gilliam, Jr. |

President, Chief Executive Officer | |

| Carroll E. Shelton |

Senior Vice President | |

| Bryan M. Lemley |

Secretary, Treasurer & Chief Financial Officer | |

| Officers and Managers of First National Bank | ||

| Robert H. Gilliam, Jr. |

President, Chief Executive Officer & Trust Officer | |

| Aubrey H. Hall, III |

Executive Vice President & Chief Lending Officer | |

| Carroll E. Shelton |

Senior Vice President & Chief Credit Officer | |

| Lucy H. Johnson |

Senior Vice President & Data Processing Manager | |

| Bryan M. Lemley |

Vice President, Cashier & Chief Financial Officer | |

| William J. Sydnor, II |

Vice President & Branch Administration Officer | |

| Judith A. Clements |

Vice President & Director of Human Resources | |

| Pamela R. Adams |

Vice President & Loan Operations Manager | |

| Thomas R. Burnett, Jr. |

Vice President & Commercial Lending Officer | |

| James M. Minear |

Vice President & Commercial Real Estate Lending Officer | |

| Tracie A. Robinson |

Vice President & Mortgage Production Manager | |

| Bianca K. Allison |

Vice President & Mortgage Loan Officer | |

| Tony J. Bowling |

Vice President & Network Administrator | |

| Daniel R. Wheeler |

Vice President & Branch Manager (Airport) | |

| Shawn D. Stone |

Vice President & Branch Manager (Main) | |

| John E. Tucker |

Assistant Vice President & Investment Consultant | |

| Albert N. Fariss |

Assistant Vice President, Facilities/Purchasing Manager & Security Officer | |

| Tarry R. Pribble |

Assistant Vice President & Collection and Recovery Manager | |

| Vicki G. Greer |

Assistant Vice President & Financial Analyst | |

| Marian E. Marshall |

Assistant Vice President & Branch Manager (Old Forest) | |

| Vivian S. Brown |

Assistant Vice President & Branch Manager (Forest) | |

| Nancy J. Holt |

Assistant Vice President & Branch Manager (Vista) | |

| Janet H. Whitehead |

Assistant Vice President & Branch Manager (Timberlake) | |

| M. Amanda Ramsey |

Assistant Vice President & Branch Manager (Amherst) | |

| Charlene A. Thompson |

Assistant Vice President & Branch Manager (Rustburg) | |

| Christine A. Hunt |

Internal Auditor | |

| Anita M. Jones |

Loan Production Officer | |

| Dianna C. Hamlett |

Compliance Officer & Bank Secrecy Act Officer | |

| Lisa M. Landrum |

Dealer Finance Loan Officer | |

| Lauren R. Michael |

Training Officer | |

| Barbara H. Caldwell |

Assistant Branch Manager and Loan Officer (Main) | |

| Arin L. Brown |

Retail Business Development Officer (Main) | |

| Doris N. Trent |

Retail Business Development Officer (Vista) | |

| Andria C. Smith |

Retail Business Development Officer (Main) | |

| Courtney M. Woody |

Retail Business Development Officer (Timberlake) | |

| Cathy C. Simms |

Retail Business Development Officer (Airport) | |

| Melissa L. Collins |

Retail Business Development Officer (Forest) | |

| Melissa T. Campbell |

Retail Business Development Officer (Old Forest) | |

| Cynthia I. Gibson |

Bookkeeping Manager | |

| Jennifer L. Edgell |

Investment Consultant | |

3

TO OUR SHAREHOLDERS, CUSTOMERS AND FRIENDS:

Resilience and preservation are operative words to describe the year 2009 for Pinnacle Bankshares, as First National Bank began its second century in business. Efforts of management in 2009 centered around controlling and minimizing the adverse effects on our Company of one of the deepest recessions in our history, a recession that began in late 2007 and one that has dealt a severe blow to the financial services industry. Although the recession has now officially ended, our economy is only slightly above the bottom of a deep trough and the climb out of the trough will be a gradual, lengthy process.

Growth of our Company was intentionally slowed in 2009. Our loan portfolio declined for the year as we focused on reducing the risk in the portfolio and complying with regulatory guidelines regarding concentrations in certain types of credit. Furthermore, we bid less aggressively for deposits in 2009 as we sought to minimize the negative impact of a compressed net interest margin. An overall objective in the growth slowing process has been to maintain our well capitalized position and grow our capital ratios. At the end of the day, the strength of our Company will be measured largely by the level of our capital.

A byproduct of slower growth in 2009 has been improvement in our liquidity position. Throughout a large part of 2008, in a time of more robust growth, we were borrowing money for liquidity purposes to fund the growth. During 2009 our liquidity position has strengthened and we have added minimal risk securities to our investment portfolio in the process. Our improved liquidity position will enable us to be readily responsive to sound lending opportunities provided us in a stronger economy.

The footprint of our Region 2000 franchise was filled in further in 2009 through the opening in February of a new branch in Rustburg, the county seat of Campbell County. Rustburg presents an attractive opportunity in that there is not another community banking option for the businesses and consumers in that area and we are pleased with the reception provided us in this market.

Expansion and growth of the Company in recent years have resulted in an increase in noninterest expense. A key to future performance will be a leveling off of noninterest expense whereby we can begin to leverage our investment in facilities and people. Illustrative of progress in this direction in 2009 is a reduction in staffing through normal attrition from 120 employees on payroll at the beginning of the year to 110 employees on payroll at the end of the year. Future expansion will be predicated upon identification of a compelling business case for additional offices in an improved economy.

Margin compaction has had a significant impact on our profitability over the last two years. Our net interest margin has declined from 4.02% for 2007 to 3.60% for 2008 to 3.23% for 2009. In an attempt to quantify the impact of the rate environment on our performance, suffice it to say that our earnings have been reduced by more than $1,000,000 in each of the last two years through the decline in net interest income. It is difficult to conceive that our yield on earning assets can decline further. An uptick in interest rates, if and when that may occur, should bode well for future earnings.

4

We continue our aggressive posture, which began in 2008, toward dealing with credit quality issues. Although there have been some exceptions, our primary position has been to accept losses, clean our balance sheet and move on, rather than retain tainted assets on our books in the hope that market values will improve anytime soon. Our provision for loan losses was $2,881,000 in 2008 and $1,530,000 in 2009. Even though asset quality measurements have stabilized as of the end of the 2009, we will continue to encounter and have to deal with nonperforming loans, including the recognition of losses, as long as the weak economy persists.

In addition to addressing our own problems, we are having to fund the problems of the overall commercial banking industry. There were 140 bank failures in 2009 and another 20 banks have failed in the first seven weeks of 2010. These failures have obviously reduced the level of Federal Deposit Insurance Corporation (FDIC) reserves used to pay insured depositors when failures occur. The banking industry itself, not the taxpayer, pays to maintain FDIC reserves. FDIC premiums and assessments expensed by First National Bank amounted to $621,000 in 2009, compared with $77,000 in 2008. This is the single largest line item expense increase impacting our performance for 2009.

In spite of the challenges we are facing, we take some measure of satisfaction in reporting a net profit for 2009 of $351,000, when many of our peers are posting losses. 2009 net income is 15% ahead of net income for 2008.

Total assets grew 3% to $332,210,000 as of December 31, 2009. Net loans outstanding decreased 5% to $265,904,000, while total deposits rose 5% to $302,119,000 at year-end 2009.

Stockholders’ equity ended 2009 at $25,851,000, a 4% increase over 2008. First National Bank continues to be “well-capitalized” according to all regulatory standards. We are pleased that our capital levels are strong without our having accepted U.S. Treasury Department TARP funds.

From a shareholder perspective, there is a strong likelihood that the single most significant event of 2009 was suspension of the cash dividend in the second quarter, a decision made in the interest of aforementioned capital preservation. Reinstatement of some level of dividend payment in 2010 is the top priority for your board and management. Net income progress will be carefully monitored to determine the time at which earnings have recovered sufficiently to warrant resumption of some level of dividend.

Your support through these challenging times has never been more important nor more appreciated. We cherish our rich heritage and our continued strength and stability. We hope you will be able to join us for our Annual Meeting of Shareholders to be held at 11:30 a.m., Tuesday, April 13, 2010 in the Fellowship Hall of Altavista Presbyterian Church, 707 Broad Street, Altavista, Virginia, where we will share more of the Pinnacle Bankshares story.

|

| Robert H. Gilliam, Jr. |

| President and Chief Executive Officer |

February 23, 2010

5

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

Selected Consolidated Financial Information

(In thousands, except ratios, share and per share data)

| Years ended December 31, | ||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

| Income Statement Data: |

||||||||||||||||

| Net interest income |

$ | 10,004 | 10,209 | 10,181 | 9,192 | 7,983 | ||||||||||

| Provision for loan losses |

1,530 | 2,881 | 462 | 339 | 230 | |||||||||||

| Noninterest income |

3,148 | 2,896 | 2,632 | 2,500 | 2,396 | |||||||||||

| Noninterest expenses |

11,171 | 9,846 | 8,524 | 7,825 | 7,166 | |||||||||||

| Income tax expense |

100 | 72 | 1,227 | 1,116 | 876 | |||||||||||

| Net income |

351 | 306 | 2,600 | 2,412 | 2,107 | |||||||||||

| Per Share Data: |

||||||||||||||||

| Basic net income |

$ | 0.24 | 0.21 | 1.76 | 1.65 | 1.44 | ||||||||||

| Diluted net income |

0.24 | 0.21 | 1.75 | 1.64 | 1.43 | |||||||||||

| Cash dividends |

0.10 | 0.60 | 0.60 | 0.55 | 0.49 | |||||||||||

| Book value |

17.41 | 16.78 | 17.95 | 16.66 | 15.91 | |||||||||||

| Weighted-Average Shares Outstanding: |

||||||||||||||||

| Basic |

1,485,089 | 1,485,089 | 1,479,689 | 1,459,007 | 1,458,615 | |||||||||||

| Diluted |

1,485,089 | 1,488,213 | 1,489,377 | 1,471,806 | 1,476,288 | |||||||||||

| Balance Sheet Data: |

||||||||||||||||

| Assets |

$ | 332,210 | 321,243 | 279,913 | 256,421 | 233,490 | ||||||||||

| Loans, net |

265,904 | 279,199 | 232,752 | 207,861 | 181,268 | |||||||||||

| Securities |

20,156 | 13,931 | 19,635 | 24,866 | 29,261 | |||||||||||

| Cash and cash equivalents |

32,060 | 15,926 | 18,344 | 14,586 | 13,814 | |||||||||||

| Deposits |

302,119 | 287,233 | 251,866 | 230,817 | 209,246 | |||||||||||

| Stockholders’ equity |

25,851 | 24,919 | 26,816 | 24,492 | 23,212 | |||||||||||

| Performance Ratios: |

||||||||||||||||

| Return on average assets |

0.11 | % | 0.10 | % | 0.97 | % | 1.00 | % | 0.94 | % | ||||||

| Return on average equity |

1.40 | % | 1.14 | % | 10.17 | % | 10.10 | % | 9.29 | % | ||||||

| Dividend payout |

41.88 | % | 291.50 | % | 34.12 | % | 33.25 | % | 33.93 | % | ||||||

| Asset Quality Ratios: |

||||||||||||||||

| Allowance for loan losses to total loans, net of unearned income and fees |

1.38 | % | 1.40 | % | 0.73 | % | 0.84 | % | 0.83 | % | ||||||

| Net charge-offs to average loans, net of unearned income and fees |

0.65 | % | 0.24 | % | 0.23 | % | 0.04 | % | 0.13 | % | ||||||

| Capital Ratios: |

||||||||||||||||

| Leverage |

8.04 | % | 8.28 | % | 9.54 | % | 9.80 | % | 9.88 | % | ||||||

| Risk-based: |

||||||||||||||||

| Tier 1 capital |

9.50 | % | 9.20 | % | 10.55 | % | 9.92 | % | 10.54 | % | ||||||

| Total capital |

10.75 | % | 10.45 | % | 11.24 | % | 10.64 | % | 11.23 | % | ||||||

| Average equity to average assets |

7.69 | % | 9.14 | % | 9.45 | % | 9.91 | % | 10.07 | % | ||||||

6

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

(in thousands, except ratios, share and per share data)

Cautionary Statement Regarding Forward-Looking Statements

The following discussion is qualified in its entirety by the more detailed information and the consolidated financial statements and accompanying notes appearing elsewhere in this Annual Report. In addition to the historical information contained herein, this Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of management, are generally identifiable by use of words such as “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “may,” “will” or similar expressions. Although we believe our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these plans, intentions, or expectations will be achieved. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain, and actual results, performance or achievements could differ materially from those contemplated. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in: interest rates; declining collateral values, especially in the real estate market; general economic conditions, including continued deterioration in general business and economic conditions and in the financial markets; deterioration in the value of securities held in our investment securities portfolio; the legislative/regulatory climate, including the impact of any policies or programs implemented pursuant to the Emergency Economic Stabilization Act of 2008 (the EESA), the American Recovery and Reinvestment Act of 2009 (the ARRA) or other laws; monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System; the quality or composition of the loan and/or investment portfolios; demand for loan products; deposit flows; competition; demand for financial services in our market area; and accounting principles, policies and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements contained herein. We base our forward-looking statements on management’s beliefs and assumptions based on information available as of the date of this report. You should not place undue reliance on such statements, because the assumptions, beliefs, expectations and projections about future events on which they are based may, and often do, differ materially from actual results. We undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

In addition, we have experienced increases in loan losses during the current economic climate. Continued difficulties in significant portions of the global financial markets, particularly if it worsens, could further impact our performance, both directly by affecting our revenues and the value of our assets and liabilities, and indirectly by affecting our counterparties and the economy generally. Dramatic declines in the residential and commercial real estate markets in recent years have resulted in significant write-downs of asset values by financial institutions in the United States. Concerns about the stability of the U.S. financial markets generally have reduced the availability of funding to certain financial institutions, leading to a tightening of credit, reduction of business activity, and increased market volatility. There can be no assurance that the EESA, the ARRA or other actions taken by the Federal government will stabilize the U.S. financial system or alleviate the industry or economic factors that may adversely affect our business. In addition, our business and financial performance could be impacted as the financial industry restructures in the current environment, both by changes in the creditworthiness and performance of our counterparties and by changes in the competitive landscape.

Company Overview

Pinnacle Bankshares Corporation, a Virginia corporation (Bankshares), was organized in 1997 and is registered as a bank holding company under the Bank Holding Company Act of 1956, as amended. Bankshares is headquartered in Altavista, Virginia. Bankshares conducts all of its business activities through the branch offices of its wholly owned subsidiary bank, First National Bank (the Bank). Bankshares exists primarily for the purpose of holding the stock of its subsidiary, the Bank, and of such other subsidiaries as it may acquire or establish.

First National Bank currently maintains a total of nine offices to serve its customers. The Main Office and Vista Branch are located in the Town of Altavista, the Airport Branch and Timberlake Branch in Campbell County, the

7

Old Forest Road Branch in the City of Lynchburg, the Forest Branch in Bedford County, the Amherst Branch in the Town of Amherst, the Rustburg Branch in the Town of Rustburg and a Loan Production Office in Franklin County at Smith Mountain Lake. The Bank also maintains an administrative and training facility in the Wyndhurst section of the City of Lynchburg.

A total of one-hundred ten full and part-time staff members serve the Bank’s customers.

With an emphasis on personal service, the Bank today offers a broad range of commercial and retail banking products and services including checking, savings and time deposits, individual retirement accounts, merchant bankcard processing, residential and commercial mortgages, home equity loans, consumer installment loans, agricultural loans, investment loans, small business loans, commercial lines of credit and letters of credit. The Bank also offers a full range of investment, insurance and annuity products through its association with Infinex Investments, Inc. and Banker’s Insurance, LLC. The Bank has two wholly-owned subsidiaries: FNB Property Corp., which holds title to Bank premises real estate; and First Properties, Inc., which holds title to other real estate owned from foreclosures.

The following discussion supplements and provides information about the major components of the results of operations and financial condition, liquidity and capital resources of Bankshares and its subsidiary (collectively the Company). This discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and accompanying notes.

Executive Summary

The Company serves a trade area consisting primarily of Campbell County, northern Pittsylvania County, eastern Bedford County, northern Franklin County, Amherst County and the city of Lynchburg from nine facilities located within the area. In February 2009, the Company opened the Rustburg facility located on Village Highway in the Rustburg Marketplace Shopping Center. This opening will further increase our presence in Campbell County. The Company operates in a well-diversified industrial economic region that does not depend upon one or a few types of commerce.

The Company earns revenues on the interest margin between the interest it charges on loans it extends to customers and interest received on the Company’s securities portfolio net of the interest it pays on deposits to customers. The Company also earns revenues on service charges on deposit and loan products, gains on securities that are called or sold, fees from origination of mortgages, and other noninterest income items including but not limited to overdraft fees, commissions from investment, insurance and annuity sales, safe deposit box rentals, and automated teller machine surcharges. In 2009, net income was adversely affected by decreases in net interest margin and increases in noninterest expense due to the overall growth of the Company. The Company’s revenue generating activities and related expenses are outlined in the consolidated statements of income and consolidated statements of changes in stockholders’ equity and comprehensive income and accompanying notes and in “Results of Operations” below.

The Company generates cash through its operating, investing and financing activities. The generation of cash flows is outlined more fully in the consolidated statements of cash flows and accompanying notes and in “Liquidity and Asset/Liability Management” below.

The Company’s balance sheet experienced a decline in its loan portfolio and growth in its deposit portfolio in 2009. The overall growth of the Company is outlined in the consolidated balance sheets and accompanying notes and the “Investment Portfolio,” “Loan Portfolio,” “Bank Premises and Equipment,” “Deposits” and “Capital Resources” discussions below.

The Company expects minimal loan portfolio growth in 2010, as we continue to monitor our capital ratios. The Company will look to promote community banking in our newer Amherst and Rustburg locations by building relationships with businesses and individuals within each market. While growing, the Company continues to leverage efficiencies from our reporting and imaging systems. The Company is also striving to make our customers’ lives more convenient by offering innovative products and services and providing many channels to bank with us including Internet banking, Internet bill pay, telephone banking, mobile banking, remote deposit capture, debit cards and real-time ATMs. The Company will continue to identify and install convenient products and services in 2010 with the goal to better enhance the customer’s experience with the Company.

8

Overview of 2009 and 2008

Total assets at December 31, 2009 were $332,210, up 3.41% from $321,243 at December 31, 2008. The principal components of the Company’s assets at the end of the year were $32,060 in cash and cash equivalents, $20,156 in securities and $265,904 in net loans. During the year ended December 31, 2009, gross loans decreased 4.80% or $13,608. The Company’s lending activities are a principal source of income. Loans decreased in 2009 as the Company experienced lower demand for credit and employed tighter credit standards.

Total liabilities at December 31, 2009 were $306,359, up 3.39% from $296,324 at December 31, 2008, with the increase reflective of an increase in total deposits of $14,886 or 5.18%. Noninterest-bearing demand deposits increased $4,545 or 16.39% and represented 10.68% of total deposits at December 31, 2009, compared to 9.65% at December 31, 2008. Savings and NOW accounts increased $15,613 or 17.78% and represented 34.24% of total deposits at December 31, 2009, compared to 30.58% at December 31, 2008. Time deposits decreased $5,272 or 3.07% at December 31, 2009 and represented 55.08% of total deposits at December 31, 2009, compared to 59.77% at December 31, 2008. The Company’s deposits are provided by individuals and businesses located within the communities served. The Company had no brokered deposits as of December 31, 2009 and December 31, 2008.

Total stockholders’ equity at December 31, 2009 was $25,851, including $21,306 in retained earnings. At December 31, 2008, stockholders’ equity totaled $24,919, including $21,102 in retained earnings. The increase in stockholders’ equity resulted mainly from an after tax unrealized gain of $660 incurred by the Company’s retirement plan. This unrealized gain is recognized in accumulated other comprehensive net loss.

The Company had net income of $351 for the year ended December 31, 2009, compared to net income of $306 for the year ended December 31, 2008, an increase of 14.71%. The Company’s net income increased primarily due to a decrease in provision for loan loss expense of $1,351 in 2009 compared to 2008. This was partially offset by a decrease in net interest income due to lower margins and lower loan volume. It was also partially offset by an increase in noninterest expense due to the effect of the overall growth of the company on personnel expenses and fixed assets. Management expects some improvement in net income although this could be adversely affected by numerous factors including asset quality. We do expect improvement in our net interest margin in 2010. We expect decreases in noninterest expense, as we anticipate lower personnel and occupancy expense, and some decreases in noninterest income as we expect fewer overdraft and mortgage loan fees.

Profitability as measured by the Company’s return on average assets (ROA) was 0.11% in 2009, compared to 0.10% in 2008. Return on average equity (ROE), was 1.40% for 2009, compared to 1.14% for 2008.

Overview of 2008 and 2007

Total assets at December 31, 2008 were $321,243, up 14.77% from $279,913 at December 31, 2007. The principal components of the Company’s assets at the end of the year were $15,926 in cash and cash equivalents, $13,931 in securities and $279,199 in net loans. During the year ended December 31, 2008, gross loans increased 20.76% or $48,721. The Company’s lending activities are a principal source of income. Loan growth increased in 2008 as the Company experienced strong growth in loans secured by real estate. The Company also added two new lenders which accounted for approximately $24,000 in new loans. The Company also opened a new facility in Amherst which accounted for an additional $4,000 in new loans.

Total liabilities at December 31, 2008 were $296,324, up 17.08% from $253,097 at December 31, 2007, with the increase reflective of an increase in total deposits of $35,367 or 14.04%. Noninterest-bearing demand deposits increased $487 or 1.79% and represented 9.65% of total deposits at December 31, 2008, compared to 10.82% at December 31, 2007. Savings and NOW accounts increased $12,962 or 17.31% and represented 30.58% of total deposits at December 31, 2008, compared to 29.73% at December 31, 2007. Time deposits increased $21,918 or 14.64% at December 31, 2008 and represented 59.77% of total deposits at December 31, 2008, compared to 59.45% at December 31, 2007.

9

Total stockholders’ equity at December 31, 2008 was $24,919 compared to $26,816 at December 31, 2007.

The Company had net income of $306 for the year ended December 31, 2008, compared to net income of $2,600 for the year ended December 31, 2007, a decrease of 88.23%. The Company’s net income decreased primarily due to an increase in provision for loan loss expense of $2,419 in 2008 compared to 2007 as classified and nonperforming loans increased in the second half of 2008. The decrease in net income was also due to the increase in noninterest expense due to the effect of the overall growth of the Company on personnel expenses and fixed assets. 2008 net income was also affected by the 400 basis point decrease in the prime and federal fund rates during 2008 as interest-earning assets repriced faster than interest-bearing liabilities.

Profitability as measured by the Company’s ROA was 0.10% in 2008, compared to 0.97% in 2007. Another key indicator of performance, the ROE, was 1.14% for 2008, compared to 10.17% for 2007.

Results of Operations

Net Interest Income. Net interest income represents the principal source of earnings for the Company. Net interest income is the amount by which interest and fees generated from loans, securities and other interest-earning assets exceed the interest expense associated with funding those assets. Changes in the amounts and mix of interest-earning assets and interest-bearing liabilities, as well as their respective yields and rates, have a significant impact on the level of net interest income. Changes in the interest rate environment and the Company’s cost of funds also affect net interest income.

The net interest spread decreased to 2.85% for the year ended December 31, 2009 from 3.11% for the year ended December 31, 2008. Net interest income was $10,004 ($10,097 on a tax-equivalent basis) for the year ended December 31, 2009, compared to $10,209 ($10,325 on a tax-equivalent basis) for the year ended December 31, 2008, and is attributable to interest income from loans, federal funds sold and securities exceeding the cost associated with interest paid on deposits and other borrowings. In 2009, our loans repriced at lower rates more rapidly than did our deposits in the declining rate environment, causing our interest rate spread to decrease. The Bank’s yield on interest-earning assets for the year ended December 31, 2009 was ninety-four basis points lower than the year ended December 31, 2008 due to higher yielding assets being replaced by lower yielding ones in 2009 and repricing of existing assets. The Bank’s cost of funds rate on interest-bearing liabilities in 2009 was sixty-eight basis points lower compared to 2008.

The net interest spread decreased to 3.11% for the year ended December 31, 2008 from 3.44% for the year ended December 31, 2007. Net interest income was $10,209 ($10,325 on a tax-equivalent basis) for the year ended December 31, 2008, compared to $10,181 ($10,345 on a tax-equivalent basis) for the year ended December 31, 2007, and is attributable to interest income from loans, federal funds sold and securities exceeding the cost associated with interest paid on deposits and other borrowings. In 2008, our loans repriced at lower rates more rapidly than did our deposits in the declining rate environment, causing our interest rate spread to decrease. The Company’s yield on interest-earning assets for the year ended December 31, 2008 was seventy basis points lower than the year ended December 31, 2007 due to higher yielding assets being replaced by lower yielding ones in 2008 and repricing of existing assets. The Company’s cost of funds rate on interest-bearing liabilities in 2008 was thirty seven basis points lower compared to 2007.

In an effort to stimulate economic activity, the Federal Reserve has pushed interest rates to exceptionally low levels. As a result, the Company’s net interest margins declined from 2007 to 2008, and again from 2008 to 2009 as our interest-earning assets repriced faster than our interest-bearing liabilities. The Company attempts to conserve net interest margin by product pricing strategies, such as attracting deposits with longer maturities when rates are relatively low and attracting deposits with shorter maturities when rates are relatively high, all depending on our funding needs. Many economic forecasts of interest rates predict that interest rates will continue to remain at historically low levels for much of 2010. The Company expects its net interest margin to improve slightly in 2010 as we expect interest-bearing liabilities to reprice slightly faster than interest-earning assets. While there is

10

no guarantee of how rates may change in 2010, the Company will price products that are competitive in the market, allow for growth and strive to maintain the net interest margin as much as possible. The Company also continues to strive to find new sources of noninterest income to combat the effects of volatility in the interest rate environment.

The following table presents the major categories of interest-earning assets, interest-bearing liabilities and stockholders’ equity with corresponding average balances, related interest income or interest expense and resulting yield and rates for the periods indicated.

ANALYSIS OF NET INTEREST INCOME

| Assets | Years ended December 31, | ||||||||||||||||||||||||

| 2009 | 2008 | 2007 | |||||||||||||||||||||||

| Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

|||||||||||||||||

| Interest-earning assets: |

|||||||||||||||||||||||||

| Loans (2)(3) |

$ | 274,710 | 16,622 | 6.05 | % | 263,924 | 17,615 | 6.67 | % | 222,412 | 16,748 | 7.53 | % | ||||||||||||

| Investment securities: |

|||||||||||||||||||||||||

| Taxable |

11,351 | 470 | 4.14 | % | 13,041 | 622 | 4.77 | % | 17,178 | 831 | 4.84 | % | |||||||||||||

| Tax-exempt (4) |

4,046 | 273 | 6.75 | % | 4,910 | 324 | 6.60 | % | 5,910 | 386 | 6.53 | % | |||||||||||||

| Interest-earning deposits |

16,907 | 33 | 0.20 | % | 261 | 6 | 2.30 | % | 87 | 4 | 4.60 | % | |||||||||||||

| Federal funds sold |

5,564 | 11 | 0.20 | % | 4,689 | 104 | 2.22 | % | 11,496 | 554 | 4.82 | % | |||||||||||||

| Total interest-earning assets |

312,578 | 17,409 | 5.57 | % | 286,825 | 18,671 | 6.51 | % | 257,083 | 18,523 | 7.21 | % | |||||||||||||

| Other assets: |

|||||||||||||||||||||||||

| Allowance for loan losses |

(3,766 | ) | (1,912 | ) | (1,802 | ) | |||||||||||||||||||

| Cash and due from banks |

2,123 | 5,171 | 5,132 | ||||||||||||||||||||||

| Other assets, net |

13,749 | 8,618 | 7,792 | ||||||||||||||||||||||

| Total assets |

$ | 324,684 | 298,702 | 268,205 | |||||||||||||||||||||

| Liabilities and Stockholders’ equity | Years ended December 31, | |||||||||||||||||||||

| 2009 | 2008 | 2007 | ||||||||||||||||||||

| Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||

| Savings and NOW |

$ | 97,233 | 1,264 | 1.30 | % | 79,298 | 1,170 | 1.48 | % | 73,171 | 1,403 | 1.92 | % | |||||||||

| Time |

171,293 | 6,044 | 3.53 | % | 160,613 | 7,055 | 4.39 | % | 143,769 | 6,771 | 4.71 | % | ||||||||||

| Other borrowings |

740 | 4 | 0.54 | % | 5,150 | 110 | 2.14 | % | 60 | 4 | 6.67 | % | ||||||||||

| Federal funds purchased |

— | — | — | 408 | 11 | 2.70 | % | — | — | — | ||||||||||||

| 269,266 | 7,312 | 2.72 | % | 245,469 | 8,346 | 3.40 | % | 217,000 | 8,178 | 3.77 | % | |||||||||||

| Noninterest-bearing liabilities: |

||||||||||||||||||||||

| Demand deposits |

25,883 | 25,169 | 24,631 | |||||||||||||||||||

| Other liabilities |

4,580 | 774 | 1,240 | |||||||||||||||||||

| 299,729 | 271,412 | 242,871 | ||||||||||||||||||||

| Stockholders’ equity |

24,955 | 27,290 | 25,334 | |||||||||||||||||||

| 324,684 | 298,702 | 268,205 | ||||||||||||||||||||

| Net interest income |

10,097 | 10,325 | 10,345 | |||||||||||||||||||

| Net interest margin (5) |

3.23 | % | 3.60 | % | 4.02 | % | ||||||||||||||||

| Net interest spread (6) |

2.85 | % | 3.11 | % | 3.44 | % | ||||||||||||||||

| (1) | Averages are daily averages. |

| (2) | Loan interest income includes amortization of loan fees of $67 in 2009, amortization of loan fees of $24 in 2008 and amortization of loan fees of $23 in 2007. |

| (3) | For the purpose of these computations, non-accrual loans are included in average loans. |

| (4) | Tax-exempt income from investment securities is presented on a tax-equivalent basis assuming a 34% U.S. Federal tax rate for 2009, 2008 and 2007. |

| (5) | The net interest margin is calculated by dividing net interest income by average total interest-earning assets. |

| (6) | The net interest spread is calculated by subtracting the interest rate paid on interest-bearing liabilities from the interest rate earned on interest-earning assets. |

11

As discussed above, the Company’s net interest income is affected by the change in the amounts and mix of interest-earning assets and interest-bearing liabilities, referred to as “volume change,” as well as by changes in yields earned on interest-earning assets and rates paid on deposits and other borrowed funds, referred to as “rate change.” The following table presents, for the periods indicated, a summary of changes in interest income and interest expense for the major categories of interest-earning assets and interest-bearing liabilities and the amounts of change attributable to variations in volumes and rates.

| Years ended December 31, | |||||||||||||||||||

| 2009 compared to 2008 Increase (decrease) |

2008 compared to 2007 Increase (decrease) |

||||||||||||||||||

| Volume | Rate | Net | Volume | Rate | Net | ||||||||||||||

| Interest earned on interest-earning assets: |

|||||||||||||||||||

| Loans (1) |

$ | 772 | (1,765 | ) | (993 | ) | 2,217 | (1,350 | ) | 867 | |||||||||

| Investment securities: |

|||||||||||||||||||

| Taxable |

(75 | ) | (77 | ) | (152 | ) | (197 | ) | (12 | ) | (209 | ) | |||||||

| Tax-exempt (2) |

(58 | ) | 7 | (51 | ) | (66 | ) | 4 | (62 | ) | |||||||||

| Interest-earning deposits |

27 | — | 27 | 1 | 1 | 2 | |||||||||||||

| Federal funds sold |

24 | (117 | ) | (93 | ) | (235 | ) | (215 | ) | (450 | ) | ||||||||

| Total interest earned on interest-earning assets |

690 | (1,952 | ) | (1,262 | ) | 1,720 | (1,572 | ) | 148 | ||||||||||

| Interest paid on interest-bearing liabilities: |

|||||||||||||||||||

| Savings and NOW |

198 | (104 | ) | 94 | 132 | (365 | ) | (233 | ) | ||||||||||

| Time |

516 | (1,527 | ) | (1,011 | ) | 669 | (385 | ) | 284 | ||||||||||

| Federal funds purchased |

(11 | ) | — | (11 | ) | 11 | — | 11 | |||||||||||

| Other borrowings |

(57 | ) | (49 | ) | (106 | ) | 107 | (1 | ) | 106 | |||||||||

| Total interest paid on interest- bearing liabilities |

646 | (1,680 | ) | (1,034 | ) | 919 | (751 | ) | 168 | ||||||||||

| Change in net interest income |

$ | 44 | (272 | ) | (228 | ) | 801 | (821 | ) | (20 | ) | ||||||||

| (1) | Non-accrual loans are included in the average loan totals used in the calculation of this table. |

| (2) | Tax-exempt income from investment securities is presented on a tax equivalent basis assuming a 34% U.S. Federal tax rate. |

Provision for Loan Losses. The provision for loan losses is based upon the Company’s evaluation of the quality of the loan portfolio, total outstanding and committed loans, previous loan losses and current and anticipated economic conditions. The amount of the provision for loan losses is a charge against earnings. Actual loan losses are charges against the allowance for loan losses.

The Company’s allowance for loan losses is maintained at a level deemed adequate to provide for known and inherent losses in the loan portfolio. No assurance can be given that unforeseen adverse economic conditions or other circumstances will not result in increased provisions in the future, or that the allowance for loan losses will be adequate for actual losses. Additionally, regulatory examiners may require the Company to recognize additions to the allowance based upon their judgment about information available to them at the time of their examinations.

The provisions for loan losses for the years ended December 31, 2009, 2008 and 2007 were $1,530, $2,881 and $462, respectively. The provision for loan losses increased substantially in 2008 as management recognized weaknesses in the loan portfolio due to declining economic conditions, declining collateral values and an increased risk of some customer’s ability to service their loans due to job losses. While the provision for loan losses decreased 46.9% from 2008 to 2009, the provision for loan losses for 2009 was still substantially higher than 2007, due to continuing pressures on loan performance in 2009. The Company saw an increase in its loans past due over 30 days as a percentage of its total loan portfolio from 1.70% at the end of 2008 to 2.01% at the end of 2009. Within 2009, the Company saw improvement in loans past due over 30 days, with such loans declining from 2.40% at June 30, 2009 to 2.01% at year end. Also, the Company’s nonperforming loans increased from $2,912 on December 31, 2008 to $4,017 on December 31, 2009 but improved greatly from the end of the first quarter of 2009 when nonperforming loans totaled $6,804. The Company expects to continue to see weaknesses in its loan portfolio in 2010 and is working to minimize its losses from non-accrual and past due loans. See “Allowance for Loan Losses” for further discussion.

12

Noninterest Income. Total noninterest income for the year ended December 31, 2009 increased $252 or 8.70% to $3,148 from $2,896 in 2008. The Company’s principal source of noninterest income is service charges and fees on deposit accounts, particularly transaction accounts, fees on sales of mortgage loans, and commissions and fees from investment, insurance, annuity and other bank products. The increase in 2009 is primarily attributable to an increase in the volume of mortgage loan sales. Mortgage loan fees increased $286 for the year ended December 31, 2009, compared to 2008.

Total noninterest income for the year ended December 31, 2008 increased $264 or 10.03% to $2,896 from $2,632 in 2007. The Company’s principal source of noninterest income is service charges and fees on deposit accounts, particularly transaction accounts, fees on sales of mortgage loans, and commissions and fees from investment, insurance, annuity and other bank products. The increase in 2008 is primarily attributable to an increase in service charges on deposits and loan accounts and mortgage loan fees. Service charges on deposit accounts increased $81 and service charges on loan accounts increased $111 and mortgage loan fees increased $57 for the year ended December 31, 2008, compared to 2007.

Noninterest Expense. Total noninterest expense for the year ended December 31, 2009 increased $1,325 or 13.46% to $11,171 from $9,846 in 2008. The increase in noninterest expense is attributable a $544 increase in FDIC premiums, and increase in commissions paid on mortgage loan and investment sales and an increase in fixed asset costs due to the growth of the Company. A $135 increase in the cost of foreclosures led to an increase in other expenses.

Total noninterest expense for the year ended December 31, 2008 increased $1,322 or 15.51% to $9,846 from $8,524 in 2007. The increase in noninterest expense is attributable to the effect of overall growth of the Company on personnel expenses and fixed asset costs as the Company added key personnel at our Smith Mountain Lake loan production office and our new Rustburg facility. The Company has added eight new branches and a loan production facility to its operations since June 1999. Other expenses that contributed to the increase in other expense was a $28 increase in telephone expense, a $57 increase in loan fees paid, a $30 increase in training and education and a $18 increase in indirect loan chargebacks.

Income Tax Expense. Applicable income taxes on 2009 earnings amounted to $100, resulting in an effective tax rate of 22.17% compared to $72, or 19.05% in 2008. The effective tax rate for 2009 is a function of the higher net income earned and the effects of interest earned on tax-exempt securities.

Applicable income taxes on 2008 earnings amounted to $72, resulting in an effective tax rate of 19.05% compared to $1,227, or 32.06% in 2007. The effective tax rate for 2008 is a function of the lower net income earned and the effects of interest earned on tax-exempt loans.

Liquidity and Asset/Liability Management

Effective asset/liability management includes maintaining adequate liquidity and minimizing the impact of future interest rate changes on net interest income. The responsibility for monitoring the Company’s liquidity and the sensitivity of its interest-earning assets and interest-bearing liabilities lies with the Investment Committee of the Bank which meets at least quarterly to review liquidity and the adequacy of funding sources.

Cash Flows. The Company derives cash flows from its operating, investing and financing activities. Cash flows of the Company are primarily used to fund loans and purchase securities and are provided by the deposits and borrowings of the Company.

The Company’s operating activities for the year ended December 31, 2009 resulted in net cash provided from operating activities of $766 compared to net cash provided from operating activities of $2,968 in 2008. The decrease is primarily attributable to the cash paid for noninterest expenses of $10,589. This was $902 higher than 2008 due to higher personnel expenses, fixed asset costs and FDIC insurance premiums in 2009. Offsetting this was cash received for income taxes totaled $353 in 2009 compared to cash paid of $1,087 in 2008. Also offsetting this was cash received from net interest income of $9,754, which was $555 lower than the net interest received in 2008 as a result of a decrease in loan volume and interest received. Cash received from noninterest income in 2009 was $2,675 lower than the noninterest income amount received in 2008. Management expects

13

any future potential decreases in the Company’s cash provided by operating activities to be offset through changes in deposit pricing strategies and continued focus on improving the efficiency of the Company’s operations.

The Company’s cash flows from investing activities for the year ended December 31, 2009 resulted in net cash provided of $4,629, compared to net cash used in investing activities of $45,864 in 2008. The increase is primarily attributable to an $11,080 decrease in cash used to make loans to customers as the Company decreased its gross loans by 4.80% from 2008 to 2009 as compared to a 20.76% increase from 2007 to 2008. The Company experienced more paydowns, maturities and sales of available-for-sale mortgage-backed securities in 2009. The Company expects a lower volume of paydowns in available-for-sale mortgage-backed securities in 2010 due to fewer mortgage-backed securities in the investment portfolio.

Net cash provided by financing activities for the year ended December 31, 2009 was $10,739, compared to net cash provided by financing activities of $40,478 in 2008. The decrease in net cash provided is primarily attributable to a decrease in time deposits from 2008 to 2009 compared to 2007 to 2008. The Company also repaid a note payable to the Federal Home Loan Bank. The Company had success in attracting demand, savings and NOW deposits in 2009.

The Company’s operating activities for the year ended December 31, 2008 resulted in net cash provided from operating activities of $2,968, compared to net cash provided from operating activities of $3,773 in 2007. The decrease is primarily attributable to the cash paid for noninterest expenses of $9,687. This was $1,940 higher than 2007 due to higher personnel expenses and fixed asset costs in 2008. Also, the Company’s cash paid for income taxes totaled $1,087 in 2008 compared to $1,019 in 2007. Partially offsetting this was cash received from net interest income of $10,309, which was $125 higher than the net interest received in 2007 as a result of an increase in loan volume and interest received of $387 and cash received from noninterest income in 2008 that was $1,081 higher than the noninterest income amount received in 2007.

The Company’s cash flows from investing activities for the year ended December 31, 2008 resulted in net cash used of $45,864, compared to net cash used in investing activities of $20,332 in 2007. The increase is primarily attributable to a $24,209 increase in cash used to make loans to customers as the Company increased its gross loans by 20.76% from 2007 to 2008 as compared to 11.83% from 2006 to 2007. The Company experienced fewer paydowns and maturities of available-for-sale mortgage-backed securities.

Net cash provided by financing activities for the year ended December 31, 2008 was $40,478, compared to net cash provided by financing activities of $20,317 in 2007. The increase in net cash provided is primarily attributable to the higher net increase in deposits from 2007 to 2008 compared to 2006 to 2007. The Company had success in attracting all different types of deposits to fund the growth in the loan portfolio.

Liquidity. Liquidity measures the ability of the Company to meet its maturing obligations and existing commitments, to withstand fluctuations in deposit levels, to fund its operations, and to provide for customers’ credit needs. Liquidity represents an institution’s ability to meet present and future financial obligations through either the sale or maturity of existing assets or the acquisition of additional funds from alternative funding sources.

The Company’s liquidity is provided by cash and due from banks, federal funds sold, investments available-for-sale, managing investment maturities, interest-earning deposits in other financial institutions and loan repayments. The Company’s ratio of liquid assets to deposits and short-term borrowings was 16.37% as of December 31, 2009 as compared to 9.16% as of December 31, 2008. The Company sells excess funds as overnight federal funds sold to provide an immediate source of liquidity. Federal funds sold at December 31, 2009 was $2,008 as compared to $9,178 at December 31, 2008. The decrease in federal funds sold in 2009 was primarily related to retaining excess funds in our Federal Reserve account which began paying interest in 2009. Cash and due from banks of $30,052, which includes funds in our Federal Reserve account, as of December 31, 2009 was $23,304 higher when compared to December 31, 2008 due to the lack of loan demand. The Company expects to deploy some of this cash into securities in 2010 as we expect loan growth to be minimal in 2010.

14

The level of deposits may fluctuate significantly due to seasonal business cycles of depository customers. Levels of deposits are also affected by convenience of branch locations and ATMs to the customer, the rates offered on interest-bearing deposits and the attractiveness of noninterest-bearing deposit offerings compared with the competition. Similarly, the level of demand for loans may vary significantly and at any given time may increase or decrease substantially. However, unlike the level of deposits, management has more direct control over lending activities and maintains the level of those activities according to the amounts of available funds. Loan demand may be affected by the overall health of the local economy, loan rates compared with the competition and other loan features offered by the Company.

As a result of the Company’s management of liquid assets and its ability to generate liquidity through alternative funding sources, management believes that the Company maintains overall liquidity that is sufficient to satisfy its depositors’ requirements and to meet customers’ credit needs. Additional sources of liquidity available to the Company include its capacity to borrow funds through correspondent banks and the Federal Home Loan Bank. The total amount available for borrowing to the Company for liquidity purposes was $63,920 on December 31, 2009.

The Company obtains sources of funds through growth in deposits, scheduled payments and prepayments from the loan and investment portfolios and retained earnings growth, and may purchase or borrow funds through the Federal Reserve’s discount window. The Company also has sources of liquidity through three correspondent banking relationships. The Company uses its funds to fund loan and investment growth. Excess funds are sold daily to other institutions. The Company had one borrowing with the Federal Home Loan Bank during 2008 with a principal balance of $5,000 with a variable interest rate. Principal payments in the amount of $5,000 were made in 2009 leaving a principal balance of $0 on December 31, 2009. The Company also has a $5,000 holding company line of credit with a correspondent bank for bank capital purposes with an outstanding balance of $2,000 on December 31, 2009 as compared to $1,000 on December 31, 2008.

Contractual Obligations

The Company has entered into certain contractual obligations including long-term debt and operating leases. The table does not include deposit liabilities entered into in the ordinary course of banking. Operating Leases include leases of our Amherst facility, Timberlake and Wyndhurst facilities. Also included are contractual leases for offsite ATMs and postage machinery. The following table summarizes the Company’s contractual obligations as of December 31, 2009.

| Pinnacle Bankshares Line of Credit |

2011 | $ | 2,000 | ||

| Operating Leases |

|||||

| 2010 | $ | 230 | |||

| 2011 | $ | 150 | |||

| 2012 | $ | 139 | |||

| 2013 | $ | 141 | |||

| 2014 | $ | 141 | |||

| After 2014 | $ | 2,151 | |||

Interest Rates

While no single measure can completely identify the impact of changes in interest rates on net interest income, one gauge of interest rate sensitivity is to measure, over a variety of time periods, the differences in the amounts of the Company’s rate-sensitive assets and rate-sensitive liabilities. These differences or “gaps” provide an indication of the extent to which net interest income may be affected by future changes in interest rates. A “positive gap” exists when rate-sensitive assets exceed rate-sensitive liabilities and indicates that a greater volume of assets than liabilities will reprice during a given period. This mismatch may enhance earnings in a rising interest rate environment and may inhibit earnings in a declining interest rate environment. Conversely, when rate-sensitive liabilities exceed rate-sensitive assets, referred to as a “negative gap,” it indicates that a greater volume of liabilities than assets will reprice during the period. In this case, a rising interest rate environment may inhibit earnings and a declining interest rate environment may enhance earnings. The cumulative one-year gap as of December 31, 2009 was $(25,459), representing 7.66% of total assets. This negative gap falls within the parameters set by the Company.

15

The following table illustrates the Company’s interest rate sensitivity gap position at December 31, 2009.

| 1 year | 1-3 years | 3-5 years | 5-15 years | |||||||

| ASSET/(LIABILITY): |

||||||||||

| Cumulative interest rate sensitivity gap |

$ | (25,459 | ) | 39,205 | 21,221 | 43,930 | ||||

As of December 31, 2009, the Company was liability-sensitive in periods up to one year and was asset-sensitive beyond one year. The foregoing table does not necessarily indicate the impact of general interest rate movements on the Company’s net interest yield, because the repricing of various categories of assets and liabilities is discretionary and is subject to competition and other pressures. As a result, various assets and liabilities indicated as repricing within the same period may reprice at different times and at different rate levels. Management attempts to mitigate the impact of changing interest rates in several ways, one of which is to manage its interest rate-sensitivity gap. In addition to managing its asset/liability position, the Company has taken steps to mitigate the impact of changing interest rates by generating noninterest income through service charges, and offering products that are not interest rate-sensitive.

Effects of Inflation

The effect of changing prices on financial institutions is typically different from other industries as the Company’s assets and liabilities are monetary in nature. Interest rates are significantly impacted by inflation, but neither the timing nor the magnitude of the changes is directly related to price level indices. Impacts of inflation on interest rates, loan demand and deposits are not reflected in the consolidated financial statements.

Investment Portfolio

The Company’s investment portfolio is used primarily for investment income and secondarily for liquidity purposes. The Company invests funds not used for capital expenditures or lending purposes in securities of the U.S. Government and its agencies, mortgage-backed securities, and taxable and tax-exempt municipal bonds, corporate securities or certificates of deposit. Obligations of the U.S. Government and its agencies include treasury notes and callable or noncallable agency bonds. The mortgage-backed securities include mortgage-backed security pools that are diverse as to interest rates. The Company has not invested in derivatives.

Investment securities available-for-sale as of December 31, 2009 totaled $19,105, an increase of $7,679 or 67.21% from $11,426 as of December 31, 2008. Investment securities held-to-maturity decreased to $1,051 as of December 31, 2009 from $2,505 as of December 31, 2008, a decrease of $1,454 or 58.04%. Securities increased in 2009 as funds from loan payoffs, security maturities, calls and pay downs were used to buy additional bonds and kept as cash as loan demand diminished and credit standards were tightened in 2009.

The following table presents the composition of the Company’s investment portfolios as of the dates indicated.

| Available-for-Sale | December 31, | ||||||||||||

| 2009 | 2008 | 2007 | |||||||||||

| Amortized cost |

Fair value |

Amortized cost |

Fair value |

Amortized cost |

Fair value | ||||||||

| U.S. Treasury securities and obligations of U.S. Government corporations and agencies |

$ | 11,532 | 11,580 | 2,031 | 2,040 | 2,647 | 2,657 | ||||||

| Obligations of states and political subdivisions |

4,728 | 4,839 | 4,891 | 4,973 | 6,142 | 6,178 | |||||||

| Corporate securities |

1,000 | 1,003 | 999 | 974 | 2,498 | 2,474 | |||||||

| Mortgage-backed securities – government |

1,514 | 1,573 | 3,339 | 3,389 | 4,132 | 4,101 | |||||||

| Other securities |

110 | 110 | 50 | 50 | 50 | 50 | |||||||

| Total available-for-sale |

$ | 18,884 | 19,105 | 11,310 | 11,426 | 15,469 | 15,460 | ||||||

16

| Held-to-Maturity | December 31, | ||||||||||||

| 2009 | 2008 | 2007 | |||||||||||

| Amortized cost |

Fair value |

Amortized cost |

Fair value |

Amortized cost |

Fair value | ||||||||

| Obligations of states and political subdivisions |

$ | 1,051 | 1,078 | 2,505 | 2,575 | 4,175 | 4,213 | ||||||

| Total held-to-maturity |

$ | 1,051 | 1,078 | 2,505 | 2,575 | 4,175 | 4,213 | ||||||

The following table presents the maturity distribution based on fair values and amortized costs of the investment portfolios as of the dates indicated.

INVESTMENT PORTFOLIO – MATURITY DISTRIBUTION

| December 31, 2009 | ||||||||

| Available-for-Sale | Amortized Cost |

Fair Value |

Yield | |||||

| U.S. Treasury securities and obligations of U.S. |

||||||||

| Government corporations: |

||||||||

| Within one year |

$ | |||||||

| After one but within five years |

6,122 | 6,114 | 3.22 | % | ||||

| After five years through ten years |

5,410 | 5,466 | 4.46 | % | ||||

| Obligations of states and political subdivisions (1): |

||||||||

| Within one year |

465 | 468 | 5.64 | % | ||||

| After one but within five years |

3,046 | 3,169 | 5.65 | % | ||||

| After five years through ten years |

230 | 226 | 7.00 | % | ||||

| After ten years |

987 | 976 | 5.16 | % | ||||

| Corporate securities: |

||||||||

| After one but within five years |

1,000 | 1,003 | 4.23 | % | ||||

| Mortgage-backed securities – government |

1,514 | 1,573 | 4.48 | % | ||||

| Other securities (2) |

110 | 110 | — | |||||

| Total available-for-sale |

$ | 18,884 | 19,105 | |||||

| Held-to-Maturity |

||||||||

| Obligations of states and political subdivisions (1): |

||||||||

| Within one year |

250 | 256 | 4.61 | % | ||||

| After one but within five years |

801 | 822 | 4.85 | % | ||||

| Total held-to-maturity |

$ | 1,051 | 1,078 | |||||

| (1) | Obligations of states and political subdivisions include yields of tax–exempt securities presented on a tax-equivalent basis assuming a 34% U.S. Federal tax rate. |

| (2) | Equity securities are assumed to have a life greater than ten years. |

Loan Portfolio

The Company’s net loans were $265,904 as of December 31, 2009, a decrease of $13,295 or 4.76% from $279,199 as of December 31, 2008. This decrease resulted primarily from decreased volume of real estate loan originations during 2009. The Company’s ratio of net loans to total deposits was 88.01% as of December 31, 2009 compared to 97.20% as of December 31, 2008.

Typically, the Company maintains a ratio of loans to deposits of between 80% and 100%. The loan portfolio primarily consists of commercial, real estate (including real estate term loans, construction loans and other loans secured by real estate), and loans to individuals for household, family and other consumer expenditures. However, the Company adjusts its mix of lending and the terms of its loan programs according to market conditions and other factors. The Company’s loans are typically made to businesses and individuals located within the Company’s market area, most of whom have account relationships with the Bank. There is no concentration of

17

loans exceeding 10% of total loans that is not disclosed in the categories presented below. The Company has not made any loans to any foreign entities including governments, banks, businesses or individuals. Commercial and construction loans in the Company’s portfolio are primarily variable rate loans and have little interest rate risk.

The Company had no option adjustable rate mortgages, subprime loans or loans with teaser rates and similar products as of December 31, 2009. Junior lien mortgages totaled of $26,055 as of December 31, 2009 with a specific allowance for loan loss calculation of $368. The Company had interest only loans totaling $1,365 as of December 31, 2009. Residential mortgage loans with a loan to collateral value ratio exceeding 100% were $1,830 as of December 31, 2009.

The following table presents the composition of the Company’s loan portfolio as of the dates indicated.

LOAN PORTFOLIO

| December 31, | ||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

| Real estate loans: |

||||||||||||||||

| Residential real estate |

$ | 116,259 | 117,806 | 75,579 | 68,540 | 55,936 | ||||||||||

| Commercial real estate |

81,219 | 86,915 | 92,102 | 72,797 | 53,039 | |||||||||||

| Loans to individuals for household, family and other consumer expenditures |

50,097 | 54,329 | 46,834 | 46,360 | 44,369 | |||||||||||

| Commercial and industrial loans |

21,589 | 23,820 | 19,909 | 21,694 | 28,659 | |||||||||||

| All other loans |

612 | 514 | 240 | 454 | 935 | |||||||||||

| Total loans, gross |

269,776 | 283,384 | 234,664 | 209,845 | 182,938 | |||||||||||

| Less unearned income and fees |

(149 | ) | (216 | ) | (192 | ) | (214 | ) | (162 | ) | ||||||

| Loans, net of unearned income and fees |

269,627 | 283,168 | 234,472 | 209,631 | 182,776 | |||||||||||

| Less allowance for loan losses |

(3,723 | ) | (3,969 | ) | (1,720 | ) | (1,770 | ) | (1,508 | ) | ||||||

| Loans, net |

$ | 265,904 | 279,199 | 232,752 | 207,861 | 181,268 | ||||||||||

Commercial Loans. Commercial and industrial loans accounted for 8.00% of the Company’s loan portfolio as of December 31, 2009 compared to 8.41% as of December 31, 2008. Such loans are generally made to provide operating lines of credit, to finance the purchase of inventory or equipment, and for other business purposes. Commercial loans are primarily made at rates that adjust with changes in the prevailing prime interest rate, are generally made for a maximum term of five years (unless they are term loans), and generally require interest payments to be made monthly. The creditworthiness of these borrowers is reviewed, analyzed and evaluated on a periodic basis. Most commercial loans are collateralized with business assets such as accounts receivable, inventory and equipment. Even with substantial collateralization such as all of the assets of the business and personal guarantees, commercial lending involves considerable risk of loss in the event of a business downturn or failure of the business.

Real Estate Loans. Real estate loans accounted for 73.20% of the Company’s loan portfolio as of December 31, 2009 compared to 72.24% as of December 31, 2008. The Company makes commercial real estate term loans that are typically secured by a first deed of trust.

As of December 31, 2009, 58.87% of the real estate loans were secured by 1-4 family residential properties. Of these 1-4 family residential property loans, 8.29% were construction loans, 30.31% were home equity lines of credit, 55.75% were closed end loans secured by a first deed of trust and 5.65% were closed end loans secured by a second deed of trust.

As of December 31, 2009, 41.13% of the real estate loans were secured by commercial real estate. Of the total commercial real estate loans as of December 31, 2009, 31.05% were acquisition and development loans, 9.68% were secured by farmland, 44.93% were secured by owner occupied commercial real estate and 14.34% were secured by non-owner occupied commercial real estate typically 1st and 2nd deeds of trust.

Real estate lending involves risk elements when there is lack of timely payment and/or a decline in the value of the collateral. While both commercial and residential real estate values in the Company’s market declined in 2008, values have stabilized in 2009. The Company is still, however, seeing evidence of some borrowers being

18

strained in their ability to service loans. This has resulted in a higher number of loan impairments in 2009 and may result in future impairments in 2010. The Company continuously monitors the local real estate market for signs of weakness that could decrease collateral values.

Installment Loans. Installment loans are represented by loans to individuals for household, family and other consumer expenditures with typical collateral such as automobile titles. Installment loans accounted for 18.57% of the Company’s loan portfolio as of December 31, 2009 compared to 19.17% as of December 31, 2008.

Loan Maturity and Interest Rate Sensitivity. The following table presents loan portfolio information related to maturity distribution of commercial and industrial loans and real estate construction loans based on scheduled repayments at December 31, 2009.

| Due within one year |

Due one to five years |

Due after five years |

Total | ||||||

| Commercial and industrial loans |

$ | 17,819 | 2,963 | 807 | 21,589 | ||||

| Real estate – construction |

9,640 | — | — | 9,640 | |||||

The following table presents the interest rate sensitivity of commercial and industrial loans and real estate construction loans maturing after one year or longer as of December 31, 2009.

INTEREST RATE SENSITIVITY

| Fixed interest rates |

$ | 3,768 | |

| Variable interest rates |

2 | ||

| Total maturing after one year |

$ | 3,770 | |

Restructured Loans. The Company had no restructured loans at December 31, 2009 and 2008.

Nonperforming Assets. Interest on loans is normally accrued from the date a disbursement is made and recognized as income as it is earned. Generally, the Company reviews any loan on which payment has not been made for 90 days for potential nonaccrual. The loan is examined and the collateral is reviewed to determine loss potential. If the loan is placed on nonaccrual status, any prior accrued interest that remains unpaid is reversed. Loans on nonaccrual status amounted to $2,619, $2,292 and $634 as of December 31, 2009, 2008 and 2007, respectively. Interest income that would have been earned on nonaccrual loans if they had been current in accordance with their original terms and the recorded interest that was included in income on these loans was not significant for 2009, 2008 or 2007. There were no commitments to lend additional funds to customers whose loans were on nonaccrual status at December 31, 2009. Three foreclosed properties totaling $461 were on hand as of December 31, 2009 compared to $300 as of December 31, 2008 and $0 as of 2007.

The current recession which began in the second half of 2008 has led to an increase in the Company’s nonperforming assets when compared to 2007 levels. Some commercial borrowers have struggled to service their loans due to the difficult business climate, lower revenues, tightening of credit markets and difficulties in moving their product. Some noncommercial borrowers have experienced job losses and other economic challenges, as well. We expect nonperforming assets to maintain current levels in 2010 as the recession continues. The Company will continue to monitor the situation and take steps necessary to mitigate losses in its loan portfolio, such as increased early monitoring of its portfolio to identify “problem” credits and continued counseling of customers to discuss options available to them.

The following tables present information with respect to the Company’s nonperforming assets and nonaccruing loans 90 days or more past due by type as of the dates indicated.

19

NONPERFORMING ASSETS

| December 31, | |||||||

| 2009 | 2008 | 2007 | |||||

| Nonaccrual loans |

$ | 2,619 | 2,292 | 634 | |||

| Loans 90 days or more past due |

1,398 | 620 | 156 | ||||

| Foreclosed properties |

461 | 300 | — | ||||

| Total nonperforming assets |

$ | 4,478 | 3,212 | 790 | |||

Nonperforming assets totaled $4,478 or 1.35% of total assets as of December 31, 2009, compared to $3,212 or 1.00% as of December 31, 2008 and $790 or 0.28% as of December 31, 2007. The following table presents the balance of accruing loans 90 days or more past due by type as of the dates indicated.

ACCRUING LOANS 90 DAYS OR MORE

PAST DUE BY TYPE

| December 31, | |||||||

| 2009 | 2008 | 2007 | |||||

| Loans 90 days or more past due by type: |

|||||||

| Real estate loans |

$ | 1,283 | 546 | 149 | |||

| Loans to individuals |

84 | 41 | 7 | ||||

| Commercial loans |

31 | 33 | — | ||||

| Total accruing loans 90 days or more past due |

$ | 1,398 | 620 | 156 | |||

Allowance for Loan Losses. The Company maintains an allowance for loan losses which it considers adequate to cover the risk of losses in the loan portfolio. The allowance is based upon management’s ongoing evaluation of the quality of the loan portfolio, total outstanding and committed loans, previous charges against the allowance and current and anticipated economic conditions. The allowance is also subject to regulatory examinations and determinations as to adequacy, which may take into account such factors as the methodology used to calculate the allowance. The Company’s management believes that as of December 31, 2009, 2008 and 2007, the allowance was adequate. The amount of the provision for loan losses is a charge against earnings. Actual loan losses are charged against the allowance for loan losses.

Management evaluates the reasonableness of the allowance for loan losses on a monthly basis and adjusts the provision as deemed necessary using regulatory approved methodology. Management uses historical loss data by loan type as well as current economic factors in its calculation of allowance for loan loss. Management also uses qualitative factors such as changes in lending policies and procedures, changes in national and local economies, changes in the nature and volume of the loan portfolio, changes in experience of lenders and the loan department, changes in volume and severity of past due and classified loans, changes in quality of the Bank’s loan review system, the existence and effect of concentrations of credit and external factors such as competition and regulation in its allowance for loan loss calculation. Each qualitative factor is evaluated and applied to each type of loan in the Company’s portfolio and a percentage of each loan is reserved as allowance. A percentage of each loan is also reserved according to the loan type’s historical loss data. Larger percentages of allowance are taken as the risk for a loan is determined to be greater. As of December 31, 2009, the allowance for loan losses totaled $3,723 or 1.38% of total loans, net of unearned income and fees, compared to $3,969 or 1.40% of total loans, net of unearned income and fees, as of December 31, 2008. The provision for loan losses for the years ended December 31, 2009 and 2008 was $1,530 and $2,881, respectively. Net charge-offs for the Company were $1,776 and $632 for the years ended December 31, 2009 and 2008, respectively. The ratio of net loan charge-offs during the period to average loans outstanding for the period was 0.65% and 0.24% for the years ended December 31, 2009 and 2008, respectively.

As of December 31, 2008, the allowance for loan losses totaled $3,969 or 1.40% of total loans, net of unearned income and fees compared to $1,720 or 0.73% of total loans, net of unearned income and fees as of December 31, 2007. The provision for loan losses for the years ended December 31, 2008 and 2007 was $2,881 and $462, respectively. Net charge-offs for the Company were $632 and $512 for the years ended December 31, 2008 and 2007, respectively. The ratio of net loan charge-offs during the period to average loans outstanding for the period was 0.24% and 0.23% for the years ended December 31, 2008 and 2007, respectively.

20

At the end of 2008 the Company deemed it prudent to make a special provision in excess of $2,000 to the allowance for loan losses, over and beyond the regular monthly loss provision, after reviewing nonperforming and potential problem loans, the general economic climate and declining collateral values.