Attached files

| file | filename |

|---|---|

| EX-23.2 - New Generation Biofuels Holdings, Inc | v178644_ex23-2.htm |

| EX-21.1 - New Generation Biofuels Holdings, Inc | v178644_ex21-1.htm |

| EX-31.1 - New Generation Biofuels Holdings, Inc | v178644_ex31-1.htm |

| EX-23.1 - New Generation Biofuels Holdings, Inc | v178644_ex23-1.htm |

| EX-32.1 - New Generation Biofuels Holdings, Inc | v178644_ex32-1.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

Form 10-K

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2009

Commission

File No. 1-34022

NEW

GENERATION BIOFUELS HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

|

Florida

|

26-0067474

|

|

(State

of Incorporation)

|

(I.R.S.

Employer Identification No.)

|

5850

Waterloo Road, Suite 140

Columbia,

Maryland 21045

(Address

of Principal Executive Offices, Including Zip Code)

(410)

480-8084

(Registrant’s

Telephone Number, Including Area Code)

Securities

Registered Pursuant to Section 12(b) of the Act:

|

(Title of Each Class)

|

(Name of Exchange on Which

Registered)

|

|

Common

Stock, par value $0.001 per share

|

NASDAQ

Capital Market

|

Securities

Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. o Yes x No

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or

Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. x Yes o No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). o Yes o No

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K is not

contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

o Large accelerated

filer o Accelerated

filer

o Non-accelerated

filer x Smaller reporting

company

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). o Yes x No

The

aggregate market value of the Registrant’s Common Stock, par value

$0.001 per share, held by nonaffiliates of the Registrant as of June 30,

2009 was $24,755,104.

As of

March 5, 2010, the number of shares of the Registrant’s Common Stock, par value

$0.001 per share, outstanding was 34,702,436.

DOCUMENTS

INCORPORATED BY REFERENCE:

Portions

of the Company's Proxy Statement for the 2010 Annual Meeting of

Shareholders are incorporated by reference herein as portions of Part III

of this Annual Report on Form 10-K. A definitive copy of the

Proxy Statement will be filed with the SEC within 120 days after the end of

the year covered by this Form 10-K.

TABLE

OF CONTENTS

|

Page

|

||

|

PART I

|

1

|

|

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk

Factors

|

13

|

|

Item 1B.

|

Unresolved

Staff Comments

|

21

|

|

Item 2.

|

Properties

|

21

|

|

Item 3.

|

Legal

Proceedings

|

22

|

|

Item

4.

|

Reserved

|

22

|

|

PART II

|

23

|

|

|

Item 5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

23

|

|

Item 6.

|

Selected

Financial Data

|

24

|

|

Item 7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

24

|

|

Item 7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

30

|

|

Item 8.

|

Financial

Statements and Supplementary Data

|

30

|

|

Item 9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

31

|

|

Item 9A(T).

|

Controls

and Procedures

|

31

|

|

Item 9B.

|

Other

Information

|

32

|

|

PART III

|

33

|

|

|

Item 10.

|

Directors,

Executive Officers and Corporate Governance

|

33

|

|

Item 11.

|

Executive

Compensation

|

33

|

|

Item 12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

33

|

|

Item 13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

33

|

|

Item 14.

|

Principal

Accounting Fees and Services

|

33

|

|

|

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits

and Financial Statement Schedules

|

33

|

|

Signatures

|

35

|

|

|

Index

to Exhibits

|

36

|

|

|

Certifications

|

||

PART

I

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 that involve numerous assumptions,

risks and uncertainties, many of which are beyond our control. Our actual

results could differ materially from those anticipated in such forward-looking

statements as a result of certain factors, including those set forth under the

heading “Risk Factors” beginning on page 13 and elsewhere in this report.

Important factors that may cause actual results to differ from projections

include without limitation:

|

|

·

|

our

lack of operating history;

|

|

|

·

|

our

dependence on additional financing to continue as a going

concern;

|

|

|

·

|

our

inability to generate revenues or profits from sales of our biofuel and to

establish commercial scale production

facilities;

|

|

|

·

|

the

disproportionally higher cost of production relative to units

sold;

|

|

|

·

|

our

ability to fully realize the value of our technology license agreement,

which is our principal asset;

|

|

|

·

|

our

inability to enter into acceptable sublicensing agreements with respect to

our technology or the inability of any sublicensee to successfully

manufacture, market or sell biofuel utilizing our licensed

technology;

|

|

|

·

|

market

acceptance of our biofuel;

|

|

|

·

|

our

inability to compete effectively in the renewable fuels

market;

|

|

|

·

|

governmental

regulation and oversight, including our ability to qualify our biofuel for

certain tax credits and renewable portfolio

standards;

|

|

|

·

|

our

ability to protect our technology through intellectual property

rights;

|

|

|

·

|

unexpected

costs and operating deficits; and

|

|

|

·

|

adverse

results of any material legal

proceedings.

|

All

statements, other than statements of historical facts, included in this report

regarding our strategy, future operations, financial position, estimated revenue

or losses, projected costs, prospects and plans and management objectives

are forward-looking statements. When used in this report, the words

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,”

“project,” “plan” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain

such identifying words. All forward-looking statements are based on information

available at the time the statement was made. We undertake no obligation to

update any forward-looking statements or other information contained in this

report as a result of future events, new developments or otherwise. You should

not place undue reliance on these forward-looking statements. Although we

believe that our plans, intentions and expectations reflected in or suggested by

the forward-looking statements are reasonable, these plans, intentions or

expectations may not be achieved.

As used in this report, the terms

“company,” “we,” “us” and “our” refer to New Generation Biofuels Holdings,

Inc.

ITEM 1. BUSINESS

Our

Business

We produce our biofuels using a

proprietary blending technology that we believe is simpler, cleaner, less

expensive, and less energy intensive than the complex chemical reaction process

used to produce traditional biodiesel. We believe that this technology enables

us to produce biofuels that cost less to produce, use less energy and generate

significantly lower emissions than our competitors. Our technology also gives us

the flexibility to produce our biofuel from multiple feedstocks, which allows us

to use non-edible raw materials in our production process, when desirable. We

believe that these factors will enable us to customize our product to specific

customer requirements and react more quickly to trends in the biofuels

market.

1

During the year ended December 31,

2009, we commenced our principal business operations and have

exited the development stage. Prior to that from our inception, we were a

development stage entity in accordance with the Financial Accounting Standards

Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 915, “Development Stage

Entities.”

We have incurred annual operating

losses since inception and expect to incur substantial operating losses in the

future in connection with the development of our core products. As of

December 31, 2009, we had an accumulated deficit of $50.4

million. The operation and development of our business will require

substantial additional capital by the second quarter of 2010 to fund

our operations, payments due under the exclusive license, the acquisition or

development of manufacturing plants, research and development and other

initiatives including potentially the financing of future

acquisitions.

Our near-term business strategy

involves the following:

|

|

·

|

Direct

Sales. We are seeking to develop a revenue stream from

direct sales of our biofuel produced at our Baltimore production facility.

Based on existing contracts with our customers, we are seeking to expand

our facility over the next several months. Our longer term

strategy would include construction of additional

plants.

|

|

|

·

|

Technology

Licensing. As a second potential revenue stream, our

business plan contemplates collecting royalties through sublicensing our

proprietary technology where it is more efficient for manufacturers to

produce our biofuel at their own plants rather than requiring production

at our facilities. We are in the process of exploring various technology

licensing relationships.

|

|

|

·

|

Government Tax

Credits. We are also pursuing our eligibility and

qualification for tax credits and other government incentives to

strengthen the competitive position of our biofuel and to otherwise

attempt to take advantage of the U.S. government’s encouragement of

“green” technologies.

|

|

|

·

|

Strategic

Partners. We are seeking arrangements with strategic

partners who would both provide funding and support our efforts to develop

our production capacity and attract

customers.

|

|

|

·

|

Research and

Development. To the extent permitted by our limited

resources, we are continuing to develop our technology and extend it to

fuels with additional applications.

|

Recent

Developments during the Fourth Quarter of 2009 and Early 2010

Significant recent developments include

the following:

|

|

·

|

Completed

41 production runs at our Baltimore production facility through December

2009.

|

|

|

·

|

Produced

209,000 gallons of our biofuel in

2009.

|

|

|

·

|

Blended

our biofuel with #6 Diesel fuel to diversify our product applications and

expand our potential markets.

|

|

|

·

|

On

March 2010, we received the permit to construct approval from the State of

Maryland to expand our Baltimore facility to 25 million

gallons.

|

|

|

·

|

On

March 12, 2010, we executed a non-binding Memorandum of Understanding, or

MOU, with Regent Trend Investment Ltd (soon to be re-named Milestone

Biofuels Limited, or Milestone), a potential strategic partner from China,

under which Milestone would invest $20 million in our equity securities

and we would collaborate with Milestone to form a joint venture to develop

and operate biofuel production plants in the continental United States

with a total aggregate plant capacity of 250 million gallons per year.

Milestone would fund all of the capital requirements for the joint venture

and we would provide the technology and operate the plants. We

would earn a minimum royalty on all sales from the joint venture and would

share in a percentage of profits above the minimum royalty. The MOU

remains subject to a due diligence period of up to 75 days and

negotiation, execution and delivery of definitive agreements acceptable to

both parties and approved by their respective boards of directors. The

investment also may be subject to shareholder approval under the NASDAQ

listing rules. There is no assurance that definitive agreements will be

signed or that the transaction will

close.

|

|

|

·

|

In

February 2010, we entered into an agreement with Ferdinando Petrucci, the

inventor of our proprietary technology, to issue 1,100,000 shares of

common stock and $120,000 in cash in lieu of the $1 million license

payment payable in two equal installments in February and March 2010 to

help conserve cash and strengthen our

liquidity.

|

2

|

|

·

|

In

February 2010, we closed a private placement of 1,890,858 shares of common

stock and warrants to purchase 1,890,858 shares of common stock for total

gross proceeds of approximately $1.3

million.

|

|

|

·

|

In

January 2010, Baltimore City Schools named us in their annual heating fuel

request for proposal. This request for proposal by the Baltimore City

Schools is in conjunction with a proposed 1 year contract with the City of

Baltimore. We previously completed a successful test program with the City

of Baltimore and reached an agreement to proceed with a longer contract to

include the Baltimore City Schools.

|

|

|

·

|

In

December 2009, we closed a registered direct offering of 1,926,250 shares

of common stock and warrants to purchase 577,875 shares of common stock

for total gross proceeds of approximately $1.5

million.

|

|

|

·

|

In

November 2009, we entered into a sales contract, following the purchase

order entered into in July 2009, to supply Fenix Energy with 750,000

gallons of our biofuel per month for 12 months under specified conditions.

In March 2010, as provided in the sales contract, we requested a letter of

credit equivalent to one month’s sales. We have not yet received the

letter of credit which Fenix would need to post to satisfy one of the

conditions to shipment. We also would have to complete

modifications to our Baltimore production facility to be able to make

shipments under this arrangement.

|

|

|

·

|

In

November 2009, we received a letter from NASDAQ that confirms that

we are back in compliance with their shareholders’ equity

requirements for continued listing. However, in December 2009, we received

a letter from NASDAQ that states that we are not in compliance

with the NASDAQ minimum bid price requirement for continued listing and

have until June 2010 to regain

compliance.

|

|

|

·

|

In

October 2009, we signed a letter of intent with Ace Biofuels under which

Ace Biofuels intends to license product formulations, manufacturing

technology and know-how from us with the intent of constructing a biofuel

manufacturing facility and marketing our biofuel in Puerto Rico, subject

to completion of definitive

agreements.

|

Our

Growth Strategy

|

|

·

|

Continue pursuing sales to

large customers through validation of biofuel performance. We are

continuing to work with potential customers regarding sales of our

biofuel. The sales cycle is lengthy, but we continue to

emphasize the fuel characteristics and emissions data regarding our

biofuel. To meet the potential demands of customers

and prospective customers, we will need to develop additional production

capacity.

|

|

|

·

|

Pursue technology sublicensing

opportunities. We plan to pursue a second revenue steam

by collecting royalties through sublicensing our proprietary

technology. In March 2009, we entered into an addendum to our

license agreement to provide for a cross-license with PTJ Bioenergy

Holdings (“PTJ”) for all improvements by us to our proprietary

technology. The royalty payable by PTJ to us for the

cross-licensed technology will equal 5% of PTJ’s revenues outside of our

territory, which under the license agreement includes North America,

Central America and the Caribbean. Additionally, we have entered

into non-binding letters of intent (“LOIs”) with businesses in Puerto Rico

and Canada, which contemplate a payment of a fee per gallon of fuel

produced and sold.

|

|

|

·

|

Power plants that are

constrained by emissions restrictions and eligible for renewable energy

credits. We are marketing our biofuel as a low capital

expenditure solution that would enable customers to meet requirements to

use renewable energy sources and increase the productivity and extend the

useful life of coal and oil power

plants.

|

|

|

·

|

Commercial and industrial

process and space heating customers. These customers

primarily consist of state-owned facilities and privately-owned corporate

manufacturing facilities. Many states have already passed mandates to

utilize renewable energy which will continue to increase

annually. Privately owned corporate manufacturers are also beginning

to concentrate on their responsibilities as a global corporate citizen and

are proactively seeking to lower their greenhouse gas emissions. We

are marketing our biofuel as a fuel alternative to both of these

consumers, including through existing

distributors.

|

|

|

·

|

Expand product lines to

develop new applications. Since many of the advantages of our

biofuel come from their versatility and ability to be customized for

different applications, we intend to continue our research and development

efforts to develop additional applications for commercial use. We

also plan to customize our products to customer specifications and

continue to expand our product line to serve new market segments, such as

blending our biofuel with #6 Oil and co-firing in Coal burning

generators.

|

3

|

|

·

|

Pursue favorable tax and

regulatory policies for our biofuels. On the federal

level, we have partnered with other renewable fuel providers to support

the renewal of the 50 cent per gallon “alternative fuel” tax credit” that

expired on December 31, 2009. An extension of this credit is

included in legislation that has passed the U.S. Senate, and is awaiting

consideration by the U.S. House of Representatives. We have also

been working with federal policymakers in an effort to qualify our fuel

for the $1 per gallon tax credit for “renewable diesel.” In addition,

on both the federal and state level, we are working to qualify our

biofuels as a fuel that receives credit for renewable energy portfolio

standards that require the use of renewable energy sources and/or to

qualify for Federal and state biofuel mandates and

incentives.

|

The

Biofuels Industry and Market Trends

Biofuels

and Feedstocks

Biofuels can be defined generally as

solid, liquid or gas fuels produced from renewable, recently living biological

resources, such as plant biomass. In contrast, fossil fuels are derived

from non-renewable biological material formed from the decayed remains of

prehistoric plants and animals. Biofuels are perceived to have a number of

potential benefits including the ability to reduce greenhouse gas emissions and

environmental pollution, promote energy independence through the growth of

domestic energy sources, increase rural development and establish a sustainable,

renewable future energy supply.

“First generation biofuels,” such as

ethanol or biodiesel, use conventional technologies to produce fuel from crops

high in sugar, such as sugar cane or sugar beets, or high in starch, such as

corn or maize, or from crops containing high amounts of vegetable oil, such as

soybeans or palm oil, or from animal fats. For example, ethanol production

involves fermenting sugars or starches to produce ethyl alcohol, while biodiesel

is produced through a chemical reaction called transesterification to generate a

methyl ester fuel, while yielding glycerin as a by-product. The growth of first

generation biofuels has been criticized because of perceptions that their

feedstocks may divert food from human use and contribute to price increases and

food shortages, particularly in lesser-developed countries.

“Second generation” or “advanced”

biofuels use newer technologies to produce fuel from food crops, non-food plants

and waste vegetable oil sources. We call our biofuel “New Generation

Biofuel” because it can be produced using our less complex, proprietary blending

technology to derive fuels from both food crops like soybeans and non-food

sources such as recycled vegetable oil.

Market

Size and Growth

The

Energy Information Administration (“EIA”) has projected that the use of

alternative fuels, such as ethanol, biodiesel and coal-to-liquid, will increase

substantially as a result of the higher prices projected for traditional fuels

and the support for alternative fuels provided in recently enacted federal and

state legislation. According to a recent report, direct economic output

from the advanced biofuels industry, including capital investment, research and

development, technology royalties, processing operations, feedstock production

and biofuels distribution, is estimated to rise to $5.5 billion in 2012, $17.4

billion in 2016 and $37 billion by 2022.

Government initiatives are expected to

contribute to this growth. For example, the Energy Independence and

Security Act of 2007 increased the minimum production of renewable fuels target

to 36 billion gallons in 2022. Currently, the US produces only 12 billion

gallons of biofuels. According

to a 2008 study performed in connection with the legislation, the economic

impact of increasing renewable fuels production to 36 billion gallons between

2008 and 2022 would include:

|

|

·

|

adding

more than $1.7 trillion to the U.S. gross domestic

product;

|

|

|

·

|

generating

an additional $436 billion of household

income;

|

|

|

·

|

supporting

the creation of as many as 1.1 million new jobs;

and

|

|

|

·

|

generating

$209 billion in new federal tax

receipts.

|

4

The American Clean Energy and

Security Act of 2009 (“ACESA”)

passed the U.S. House of Representatives in June 2009. The bill, among other

things, (i) establishes a federal renewable energy standard; (ii) permits energy

efficiency measures to satisfy part of the renewable energy standard; and (iii)

establishes a cap-and-trade program to reduce greenhouse gas emissions from

various sectors of the economy, including electric and natural gas utilities.

Similar legislation is currently stalled in the U.S. Senate but if a bipartisan

compromise could be reached, it could result in the passage of enforceable

federal standards, such as a cap-and-trade program, governing greenhouse gas

emissions. If ACESA, or similar legislation, were enacted into law,

we believe that affected companies could utilize our biofuel to meet more cost

effectively the new requirements and in less time. We cannot predict

whether this or similar legislation will be enacted or exactly how such

legislation may impact our business.

Trends

in the Biofuels Market

We believe that our biofuels can

benefit from the favorable market trends that are converging to drive growth

across the renewable fuels industry, including:

Global energy supply and

demand. Despite the recent drops in oil prices due to the

global economic recession, we believe that, over the long term, we are still in

a sustained period of high demand for energy, especially for conventional

sources like petroleum-based fuels. We believe that this demand will

continue to pressure oil supplies worldwide and has led to a heightened interest

in developing domestic, alternative, renewable energy sources.

Short-term energy security

risks. Increased trade may carry a risk of heightened

short-term energy insecurity for all consuming countries, as geographic supply

diversity is reduced and reliance grows on vulnerable supply routes, such as the

Middle East. We believe that in developing domestic renewable energy

sources, the United States will be less vulnerable to overseas markets and the

vulnerability associated with those supply routes.

Environmental and sustainability

concerns. Concerns have risen over the growth in greenhouse

gas emissions and potential negative impact on the global environment and

climate change. Unlike fossil fuels, renewable biofuels are

considered to have a lower carbon footprint because the carbon dioxide released

by burning the fuel is balanced by the carbon dioxide absorbed by new plant

growth.

Government incentives and

mandates for renewable fuels. In the pursuit of climate change

initiatives and energy independence, federal and state governments are

increasingly emphasizing the use of renewable fuels. The revised

renewable fuel standard calls for an increase in mandatory biofuel used as

Environmental Protection Agency approved biofuels. As of January

2010, 29 states plus the District of Columbia have enacted renewable portfolio

standards (RPS) that require electric power producers to use renewable sources

to generate electricity. We believe that these government policies

will generate market opportunities for our biofuel.

Food versus fuel

debate. We believe that the “food v. fuel debate” which has

resulted in growing concerns over diversion of food supplies to fuel production

is pressuring first generation biofuel producers to explore alternative,

non-edible feedstocks to produce their fuels . The United Nations noted in

a 2007 report on sustainable bioenergy that “as second generation technologies.

. . become commercially available, this will lessen the possible negative

effects on land and resource competition on food

availability.” We believe that there will be a transition

period for second and future generations of biofuels before non-edible

feedstocks are widely available in sufficient commercial

quantities. There may also be a transition period before these

technologies become more commercially viable. We also believe that

the ability to use various different kinds of feedstocks (both edible and

non-edible) and waste products will provide an advantage to certain biofuels

during this transition period and beyond.

We believe a significant market

opportunity exists for our biofuel in three target market segments that consume

approximately 15 billion gallons of fuel per year:

|

|

·

|

Power Generation.

The power generation sector consumed approximately 2.2 billion

gallons per year of distillate and residual fuel oils, according to the

estimates available from the Energy Information

Administration. This sector includes “peaking” power plants

eligible for government renewable energy credits and constrained by

emissions limitations.

|

|

|

·

|

Commercial and

Industrial. This sector consumes approximately 6.4 billion

gallons of distillate and residual fuel oil per year that could switch to

our biofuels, according to the estimates available from the

Energy Information Administration. This segment includes large

institutional customers like state government buildings, hospitals and

sewage treatment facilities that are taking a leadership role in reducing

greenhouse gases.

|

5

|

|

·

|

Marine.

According to the estimates available from the

Energy Information Administration, diesel fuel consumption in the

marine market is approximately 6.3 billion gallons per year and includes

commercial and private boats, such as pleasure craft, fishing boats,

tugboats, and ocean-going vessels, including vessels operated by oil

companies. This sector is exploring renewable fuels due to tighter

emissions standards and restrictions on cruise liners idling in

port.

|

Our

Products

Product

Formulas

We

presently offer two biofuel product families with different formulations, made

from different feedstocks and having different performance characteristics to

meet the diverse needs of our customers:

|

|

1)

|

Classic. Our “Classic” biofuel

formula is made using plant oil, water and a proprietary additive

package. Classic represents our lowest cost product offering for

various diesel fuel applications.

|

|

|

2)

|

Ultra HF. Our “Ultra HF” biofuel

formula is made using plant oil and a premium selection of additives.

Ultra HF, while being more expensive than Classic, offers most of the same

favorable characteristics while having the advantage of a higher flash

point.

|

We believe that our ability to offer a

selection of biofuels with different performance characteristics gives us

greater ability to meet customer demand than is the case with many other biofuel

manufacturers. This customization enables us to offer potential customers

biofuels responsive to their specific requirements.

Key

Advantages of our Biofuels

Customer

usage and test burn results have shown that our biofuel is ready to use in

industrial applications without mixing or blending with other fuels, equipment

modification or substantial loss of performance. We believe that

our biofuels can serve as a complete fuel replacement wherever distillate or

residual fuel oils are used today. This feature gives us the flexibility to

deliver biofuels directly to the end user customers or to license the technology

to customers for manufacturing our biofuels for themselves, without relying on

distributors or other intermediaries. However, we also have the flexibility

to blend our biofuels with other fuels, such as diesel, depending on the needs

of the customer.

Another

key characteristic of our biofuels is its lower pour point. The pour point of a

fluid is the temperature at which dissolved solids are no longer completely

soluble and the fluid begins to solidify. The pour point of a fluid is the

lowest temperature at which it will pour or flow under prescribed

conditions. It is a rough indication of the lowest temperature at which the

fluid is readily pumpable. The pour point for some of our biofuels (B100

soybean based, for example) is less than 0 degrees Fahrenheit while that of

conventional biodiesel is 32 degrees Fahrenheit.

Our

biofuels also have certain environmental advantages. They are renewable

“carbon neutral” fuels with minimal net carbon dioxide emissions. We have

demonstrated reductions in nitrogen oxide emissions of 40% or more in utility

scale combustion turbine applications and industrial boilers when compared to

diesel and biodiesel. Furthermore, as a crop based fuel, our biofuels have

virtually no sulfur emissions.

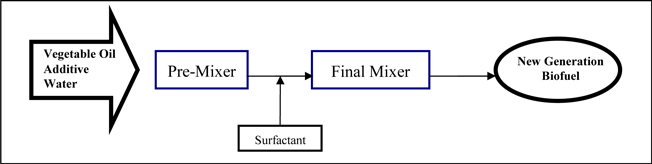

We produce our biofuels using a

blending process that is much simpler than the complex chemical reaction process

used to produce traditional biodiesel. Our technology combines water with

commonly available additives to produce a mixture. The mixture is then combined

with a plant oil or animal fat feedstock and a surfactant to produce our

biofuel. By contrast, conventional biodiesel is produced utilizing a chemical

reaction known as transesterification. In this process, plant oil reacts

with an esterifying agent, usually an alcohol such as methanol or ethanol, to

form two principal products: a methyl ester, which is the biodiesel product, and

glycerin, a low value by-product that requires disposal. The chemical reaction

can be undertaken with or without a catalyst, but typically requires the input

of additional energy to drive the reaction. Our biofuel blending production

process requires a lower input of additional energy to produce the biofuel

and does not result in a glycerin by-product.

6

Traditional Biodiesel

Production Process

Source:

National Biodiesel Board

New Generation Biofuel

Production Process

Our

simpler production process enables biofuels to be produced in smaller

manufacturing plants than is typical for biodiesel. The smaller facility and

less equipment translate into lower capital expenditures per million gallons for

the production facility, a potentially significant cost

advantage. This cost advantage in turn should give us more

flexibility to locate production facilities closer to major

customers. Our production process also requires less energy input

than more complex chemical reactions, making our production process more energy

efficient. Our biofuel production process produces no significant

by-products, wastes, emissions or discharges, unlike many biodiesel fuels, which

again reduces the cost of production and increases efficiency. Compared to

conventional biodiesel production methods, we believe that this proprietary

blending technology is cleaner and less expensive because it is substantially

less complex, less capital and energy intensive and produces fewer disposable

by-products.

We have established a research and

development group, headed by our Chief Technology Officer, Dr. Andrea Festuccia,

which is based in Rome, Italy. Utilizing input from test burns and

existing customers, Dr. Festuccia has worked to optimize our product and improve

its performance to meet certain customer specifications. The

improvements and modifications in the last year have included successfully

blending our biofuel with #2 and #6 Diesel fuel, increasing the energy content,

increasing the flash point and expanding the number of feedstocks we can use to

produce our biofuel. We spent $475,013 on research and development in 2009 and

$1,086,723 in 2008. The decrease in research and development expenses in 2009 is

primarily the result of the beginning of commercial production of our fuel and

conducting fewer test burns which were used extensively during our development

stage to evaluate additional customized fuel formulations using our proprietary

blending technology.

7

Raw

Materials and Principal Suppliers

Due to

the flexibility of our biofuel technology, we are able to utilize multiple

feedstocks without materially changing our production process or substantially

increasing operating costs, although use of different feedstocks will change

certain characteristics of the fuels. We expect that this flexibility

will enable us to opportunistically source our raw materials to adjust to supply

and demand imbalances and price volatility in the vegetable oil and other

commodities markets.

We

have commenced the process of procuring raw materials for production of our

biofuel but have not made any significant commitments or procurements at this

point. We have determined that while we can produce our biofuels from such

different feedstocks as soybeans, canola, palm, sunflower, cottonseed, mustard

seed, jatropha, recycled vegetable oil and animal fats, our principal raw

materials in the near term will be plant oils and animal fats. We expect to

source our raw materials through a variety of sources, including:

|

|

·

|

Domestic

and global plant oils producers;

|

|

|

·

|

Animal

fats producers and processors;

|

|

|

·

|

Commodity

brokers;

|

|

|

·

|

Recycled

oil collectors; and

|

|

|

·

|

Spot

market suppliers.

|

Production

Facilities

In February 2009, we completed

construction of a 5 million gallon per year capacity production facility in

Baltimore, Maryland and in April 2009, we began shipping our first commercial

product that was made in this facility. The facility can be expanded in the

future to produce up to 50 million gallons of second-generation biofuel a

year. To complement this production facility, we have leased

approximately 6 million gallons of storage tank capacity and related terminal

facilities. Atlantic Terminalling is providing on-site logistics

services, including the receipt of feedstocks, shipping of finished product and

truck loading and unloading facilities. We are in the process of

negotiating to settle various issues under our lease and terminaling services

agreement by reducing rent payments, relinquishing unneeded equipment and

modifying other commercial terms in return for making certain

payments.

We are continuing to explore additional

ways of acquiring manufacturing facilities without having to fund the entire

cost ourselves, including other joint ventures with third parties such as

utilities, independent power producers, sublicensees or other strategic partners

or through project-based financing. To acquire manufacturing plants we would

need to identify suitable facilities that can be cost-effectively modified for

our needs, negotiate acceptable purchase or lease agreements and finance any

such acquisitions and capital improvements. Unless we acquire

existing plants, we may need to obtain government permits and other regulatory

approvals (including environmental, zoning and construction permits), which

could cause delays and/or add significant cost.

Sublicensing

Business

Strategy. Our exclusive license allows us to sublicense our

proprietary technology in North America, Central America and the Caribbean, and

our business plan contemplates, as a second potential revenue stream, the

collection of royalties through sublicensing our proprietary technology. We

expect to pursue sublicenses where it is more efficient for manufacturers to

produce our biofuel at their own plants, rather than requiring production at our

proposed facilities. In 2009, we took steps to execute this strategy by signing

non-binding letters of intent (“LOIs”) with businesses in Puerto Rico and Canada

that are evaluating sublicensing our technology to construct biofuel

manufacturing facilities and marketing and selling our biofuel under the “New

Generation” brand name. These LOIs contemplated payment to us of a

fee per gallon of fuel produced and sold. We are continuing to

explore sublicensing opportunities both domestically and

internationally.

8

Competition

The

markets for our biofuels are highly competitive. We compete with

petroleum-based fuels, with other biofuels like biodiesel or ethanol, and with

other forms of alternative energy like wind and solar.

Currently,

the cost of producing most alternative fuels forces many manufacturers to

operate at a significant competitive disadvantage compared to petroleum-based

fuels. Producers of alternative fuels generally depend upon government support,

including tax credits and various incentives, upon the willingness of customers

to pay a premium for renewable non-petroleum fuels and upon government mandates

to use specified minimum amounts of renewable fuels, which amounts increase each

year. Our ability to compete with petroleum-based fuels depends

significantly on our ability to qualify for the various tax credits and other

government incentives.

Also

relevant to our ability to compete with petroleum-based fuels is the cost of

adapting equipment to use alternative fuels. Since the vast majority

of fuels currently consumed are petroleum-based, most consumers have equipment

designed for consumption of those fuels, and alternative fuel suppliers often

experience a second cost disadvantage – the expense of adapting the equipment to

accommodate alternative fuels. We believe the ability of our biofuels

to serve as a direct fuel replacement for distillate or residual fuel oils that

requires no significant plant modifications improves our ability to

compete.

Within

the alternative fuels market, the manufacture, marketing and sale of biofuels

and other alternative fuels is highly competitive and highly fragmented. Such competition could

be intense and could drive up the costs of feedstocks, plant construction,

attracting and retaining qualified engineers, chemists and other key employees,

as well as other operating expenses. Additionally, new companies are constantly

entering the market.

We

believe our ability to compete successfully in the biofuel production industry

will depend on several factors, including the following:

|

|

·

|

advantages

of our production process, including cost and efficiency

factors;

|

|

|

·

|

fuel

performance characteristics, including the ability of our biofuels to be

used as a complete fuel replacement for distillate or residual fuel oils

and our ability to customize our products to meet a customer’s

requirements;

|

|

|

·

|

feedstock

flexibility, particularly the ability to avoid using edible feedstocks in

our production process;

|

|

|

·

|

overall

demand for biofuels as a result of governmental incentives and

legislation; and

|

|

|

·

|

continued

technological innovation.

|

Tax

Credits and Other Government Support

Since our

fuel and other alternative and renewable fuels generally cost more to produce

per unit of energy than petroleum-based fuels or coal, we and other producers of

alternative fuels will be dependent upon government support to make our fuels

cost competitive. This support generally takes the form of tax credits, payments

or other incentives or mandates.

50 cent per gallon

“alternative fuel” tax credit. The 50 cent per gallon credit applicable

to our fuel, when mixed with diesel, kerosene or other taxable fuel and sold at

the retail level, expired on December 31, 2009, along with biodiesel and

other alternative fuel tax credits. Congress is expected to pass in the coming

months a tax extenders bill which will extend (effective retroactive to January

1, 2010) through the end of 2010 or beyond many expired tax provisions, but we

cannot assure you if or when the tax credit applicable to our fuel will be

extended.

9

$1 per gallon tax credit for

biodiesel and “renewable diesel.” We are not currently eligible for the

$1 per gallon federal tax credit currently afforded biodiesel and “renewable

diesel.” We have been engaged in an effort to convince Congress to amend

the tax code definitions to make our biofuel eligible for the same tax credit

provided to biodiesel. In late 2008, the biodiesel tax credit

definitions were amended such that we may qualify for the $1 per gallon tax

credit with appropriate guidance from the U.S. Department of the

Treasury. Until such guidance is issued, however, we will not be

eligible for the $1 per gallon credit available to biodiesel. In

addition, the biodiesel tax credit (and renewable diesel) expired on December

31, 2009.

Intellectual

Property

We

acquired the rights to our proprietary technology through an exclusive license

agreement with the inventor of the technology, Ferdinando Petrucci, in March

2006. Under the license agreement, we have been granted a perpetual, exclusive

license to make, use and exploit certain chemical additives for use in making

biofuel and related know-how. Our exclusive license extends to North

America, Central America and the Caribbean, and we have a right of first offer

for any other territories worldwide (other than Italy and Paraguay, which are

reserved to the inventor). As of March 15, 2010, our license agreement has

remaining payments of $1.0 million per year during each of the next four years,

with the next payment of $1.0 million due in February 2011.

In April

2006, we filed a U.S. provisional patent application on behalf of the inventor

and directed to the technology covered by our license. In April 2007, we filed a

patent application under the Patent Cooperation Treaty which claimed the benefit

of the U.S. provisional application and in September 2008 we filed national

applications in the United States and certain foreign countries. Until patent protection

is granted, we must rely on trade secret protection, which requires reasonable

steps to preserve secrecy. Therefore, we require that our personnel, contractors

and sublicensees not disclose the trade secrets and confidential information

pertaining to the technology. In addition, trade secret protection does not

provide any barrier to a third party “reverse engineering” fuel made with the

technology, to the extent that the technology is readily ascertainable by proper

means. Neither the patent, if it issues, nor trade secret protection will

preclude third parties from asserting that the technology, or the products we or

our sub-licensees commercialize using the technology, infringes upon their

proprietary rights.

Government

Regulations

Environmental

Regulations . Our business is subject to environmental risks and hazards

and we are subject to environmental regulation implemented and/or imposed by a

variety of international conventions as well as federal, state, provincial, and

municipal laws and regulations. Environmental laws restrict and prohibit spills,

discharges and emissions of various substances produced in association with

biofuel manufacturing operations. Environmental laws also require that

manufacturing plants are operated, maintained and decommissioned in such a way

that satisfies applicable regulatory authorities. Environmental permitting of

biofuel manufacturing facilities varies with the characteristics of individual

plants and by state. Our biofuel is manufactured using a process that is

believed to yield little, if any wastes, emissions or discharges.

Compliance

with environmental laws can require significant expenditures and a violation may

result in the imposition of fines and penalties, some of which may be material.

Environmental legislation is evolving in a manner we expect may result in

stricter standards and enforcement, larger fines and liability, as well as

potentially increased capital expenditures and operating costs. Compliance with

environmental laws may cause us to limit our production, significantly increase

the costs of our operations and activities, or otherwise adversely affect our

financial condition, results of operations, and/or prospects.

Clean Air Act. We

intend to market our biofuel as a new class of biofuel for power generation,

commercial and industrial heating and marine use. In order to be

legally marketable as a fuel for on-road motor applications, our biofuel must be

registered with the Environmental Protection Agency (EPA) and comply with the

EPA’s rigorous emissions, durability, and health effects regulations promulgated

to implement Section 211 of the Clean Air Act. Under these regulations, a

company registering a fuel must conduct extensive testing on a variety of in-use

motor vehicle engines.

Section

211 of the Clean Air Act generally does not apply to using our biofuel in a

stationary source, such as utility power generation applications or

institutional/commercial heating fuel, or in certain marine applications. There

may, however, be federal or state requirements applicable to emissions from

individual furnaces, boilers, and similar equipment. As a practical matter,

market acceptance of our biofuel may be limited until we can demonstrate that

(i) our biofuel is comparable to conventional fuels from an energy content and

emissions perspective as well as handling and storage perspectives, and

(ii) that our biofuel is compatible with existing heating systems or power

generation systems and other combustion systems. To date, we have only

demonstrated the foregoing in commercially available systems on a very

limited basis. In addition, certain initial testing indicated that

our biofuel may require further development so that its viscosity is more stable

under certain temperature conditions.

10

We also

are evaluating the regulatory requirements for using our fuel in motor vehicle

applications in our territory outside the United States.

Company

History

We are a

Florida corporation that was initially organized as Wireless Holdings, Inc.

in June 2003. Our Delaware subsidiary, New Generation Biofuels, Inc,

formerly H2Diesel, Inc., was formed in February 2006 to acquire the exclusive

license to commercialize the proprietary technology used to produce our

biofuel. Through a reverse merger transaction in October 2006,

H2Diesel became a subsidiary of public company Wireless Holdings, Inc., which we

eventually renamed New Generation Biofuels Holdings, Inc. in March

2008. Since September 2008, our common stock has been listed on

the NASDAQ Capital Market (“NASDAQ”) under the ticker symbol

“NGBF.”

Employees

We have

twelve employees, all of whom are full time employees. We expect to increase the

number of employees as we implement our business objectives and expand our

management team. None of our employees are represented by a labor union or

covered by a collective bargaining agreement. We believe that our relations with

our employees are good.

11

|

Name

|

Age

|

Position

|

||

|

Lee

S. Rosen

|

56

|

Chairman

of the Board

|

||

|

Cary

J. Claiborne

|

49

|

President,

Chief Executive Officer, Chief Financial Officer and

Director

|

||

|

David

H. Goebel

|

50

|

Chief

Operating Officer

|

||

|

Andrea

Festuccia

|

38

|

Chief

Technology Officer

|

||

|

Phillip

J. Wallis

|

46

|

Chief

Marketing Officer

|

||

|

Connie

Lausten, P.E.

|

42

|

Vice

President, Regulatory and Legislative Affairs

|

||

|

Philip

R. Cherry, Jr.

|

47

|

Vice

President, Engineering and

Operations

|

The

following is a description of the business experience of each of our executive

officers:

Lee S. Rosen, Chairman of

the Board

Mr. Rosen is the founder

of H2Diesel, Inc., our wholly owned subsidiary (now known as New Generation

Biofuels, Inc.) and has served as the Chairman of our Board since October 2006.

Mr. Rosen has been involved in the financial and securities brokerage industry

since 1980 and has worked as a broker dealer with a number of

firms.

Cary J. Claiborne,

President, Chief Executive Officer, Chief Financial Officer and a

Director

Mr. Claiborne became our President,

Chief Executive Officer and a Director in March 2009 and continues to serve as

our Chief Financial Officer. Prior to joining New Generation Biofuels

in December 2007, Mr. Claiborne served as the Chief Financial Officer of Osiris

Therapeutics, a publicly traded Biotech company from 2004 to 2007. From 2001 to

2004, Mr. Claiborne was the Vice President, Financial Planning and Analysis at

Constellation Energy. Mr. Claiborne earned an MBA in Finance from Villanova

University and a BA in business administration from Rutgers

University.

David H. Goebel, Jr., Chief

Operating Officer

Mr.

Goebel has served as our Chief Operating Officer since July 2009. Mr.

Goebel previously served as our Vice President of Global Sourcing and Supply

Chain since September 2007 and previously worked at MeadWestvaco, a packaging

solutions and products company, as the acting Vice President of Supply

Chain/Director of Customer Service. He was responsible for redesigning the

corporate order-to-cash processes, strategizing organizational and process

changes in capacity planning, demand forecasting, inventory management/

operations, logistics/distribution, and customer service. Additionally, for

nearly 20 years, Mr. Goebel worked at ExxonMobil and its predecessor, Mobil

Corporation, in many different leadership capacities including manufacturing,

engineering, supply chain, operations, marketing, and sales. Mr. Goebel holds a

bachelor of science degree in microbiology from University of Minnesota along

with graduate studies at both the University of Texas at Dallas and Northeastern

University.

Andrea Festuccia, PhD, Chief

Technology Officer

Dr.

Festuccia has served as Chief Technology Officer since April 2006. Currently,

Dr. Festuccia is Partner, Technical Director and member of the Board of

Directors of IGEAM S.r.l. (since February 2009), a private Italian company with

about 100 employees engaged in consulting environmental and safety problems

where he has worked since June 1999. Prior to his current position with IGEAM

S.r.l., Dr. Festuccia was the Director of the B.U. “Environment and Territory”

at IGEAM S.r.l. Dr. Festuccia was Adjunct Professor of General and Inorganic

Chemistry with the University of “La Tuscia” of Viterbo from 1999 to 2000. Dr.

Festuccia was a former Technical Director and member of the Board of Directors

of 3TI Progetti Italia (from July 2004 to January 2009). Dr. Festuccia is

currently an external consultant with the University “La Sapienza” of Rome, a

position that he has held since 2001. He also worked as an external expert for

the Minister of Foreign Affairs of Italy-Farnesina from 2002-2004 and as

Technical Director of Ecosystems S.r.l. from 2002 to present. He is the Chairman

of the Board of Directors of OPT SENSOR, a private Italian company dealing with

R&D for electronic equipments to measure chemical/physical parameters, a

spin-off company of University “La Sapienza” of Rome. He is also the CEO of

BART-Biotechnology and Recovery Technologies, a small private Italian company

engaged in biotechnology. In October 1996, he received a degree in chemical

engineering and subsequently, in 2007, his doctor of philosophy degree in

chemical engineering from the University of Rome - “La Sapienza”.

Mr. Wallis joined us in January 2008.

Mr. Wallis served as Manager, Regional Sales and Solutions for Asia Pacific and

Africa at the Chevron Corporation from September 2001 to December 2006 and as

Process Documentation Team Lead, Chevron Supply Trading from December 2006 to

January 2008.

12

Connie Lausten, P.E., Vice

President, Regulatory and Legislative Affairs

Ms.

Lausten joined the management team as Vice President of Legislative and

Regulatory Affairs in May 2007. From 2003 to 2007, Ms. Lausten served as Manager

of Federal Affairs for National Grid USA, one of the world’s largest utilities.

Ms. Lausten also has served at the Federal Energy Regulatory Commission and in

the United States House of Representatives on the Government Reform Committee,

Subcommittee for Energy Policy, Natural Resources and Regulatory Affairs. Ms.

Lausten is a Licensed Professional Engineer and received a Master of Science and

a Bachelor of Science degree in Mechanical Engineering from the University of

Minnesota.

Philip R. Cherry, Jr. Vice

President, Engineering and Operations

Mr.

Cherry has served as Vice President of Engineering and Operations since June

2008. Mr. Cherry was previously employed by the ethanol producer VeraSun from

2007 through May 2008 as Director of Operations where he was responsible for the

commissioning, initial operation and annual maintenance shutdowns of a fleet of

ethanol facilities. Prior to joining VeraSun, Mr. Cherry worked for U.S.

BioEnergy providing contract management to ethanol facility owners. Mr. Cherry

was also with The O-H Group from 2003 through 2006, providing project management

and technical consulting services to renewable fuel producers. Additionally, for

nine years Mr. Cherry worked for Mobil Oil Corporation in a variety of process

and scientific roles. Mr. Cherry holds a Bachelor of Science degree in Chemistry

from Chapman University. He is a member of the American Chemical Society, ASTM

International, and the California Biomass Collaborative.

Other

Information

News and

information about New Generation Biofuels is available on our website, www.newgenerationbiofuels.com.

In addition to news and other information about our company, we have provided

access through this site to our filings with the Securities and Exchange

Commission as soon as reasonably practicable after we file or furnish them

electronically.

We have

also provided access on our website to our Code of Business Conduct and Ethics,

the charters of our Audit, Compensation and Nominating Committees and other

corporate governance documents. Copies of these documents are available to any

shareholder upon written request made to our corporate secretary at our

corporate headquarters at 5850 Waterloo Road, Suite 140, Columbia, Maryland

21045, Attn: Corporate Secretary. In addition, we intend to disclose on our

website any changes to or waivers for executive officers from our Code of

Business Conduct and Ethics.

ITEM 1A. RISK FACTORS

Our

business faces many risks. If any of the events or circumstances described in

the following risks actually occur, our business, financial condition or results

of operations could suffer, and the trading price of our common stock could

decline. Some of the risks described below may apply to more than just the

subsection in which we grouped them for the purpose of this presentation. You

should consider all of the following risks, together with all of the other

information in this Annual Report on Form 10-K, before deciding to invest in our

securities.

13

Risks

Related to Our Business

Our

existing financial resources will only provide financing through mid-May 2010,

and we will need to raise additional capital to continue our business, which

could be particularly challenging in the near term under current financial

market conditions.

The report of our independent

registered public accounting firm for the year ended December 31, 2009 contains

an explanatory paragraph which states that we have incurred negative cash flows

from operations since inception and are dependent upon future financing and,

based on our operating plan and existing working capital deficit, this raises

substantial doubt about our ability to continue as a going concern. Based on our

current estimates, we anticipate that our existing financial resources will be

adequate to permit us to continue to conduct our business through mid May 2010,

and we will need to control costs and raise additional capital to continue our

business beyond May 2010. Accordingly, we will need to complete a financing in

the second quarter of 2010. As of December 31, 2009, we have incurred a net loss

of $14.4 million and negative cash flows from operating activities of $7.1

million. As of December 31, 2009, we had approximately $0.6 million of available

cash and approximately $1.5 million of accounts payable and accrued expenses. In

February 2010, we closed a private placement of common stock for total gross

proceeds of approximately $1.3 million. In addition, under the

license agreement with the inventor of our proprietary technology, we are

required to pay $1.0 million per year over the next four years, with the next $1

million due in February 2011. We are in the process of negotiating to settle

various issues under our site lease and terminaling services agreement for our

Baltimore production facility by reducing rent payments, relinquishing unneeded

equipment and modifying other commercial terms of the agreements in return for

making certain payments. If we are unable to raise additional capital, we will

not be able to continue our business. We cannot ensure that additional funding

will be available or, if available, that it can be obtained on terms and

conditions we will deem acceptable. Any additional funding derived from the sale

of equity securities is likely to result in significant dilution to our existing

shareholders and may require shareholder approval, which cannot be

assured.

We

are an early stage company with a limited operating history, which makes us a

speculative investment.

We are an early stage company that is

commercializing our exclusive licensing rights to proprietary technology to

manufacture biofuel that we acquired in early 2006. Since then, we have been

engaged in organizational activities, including developing our business plan,

hiring key management, optimizing product performance, developing our production

facility, raising capital, conducting test burns with potential customers,

entering into initial sales contracts, delivering initial fuel orders to

customers and exploring sublicensing opportunities. We recorded our first sales

in the fourth quarter of 2008. We currently have twelve employees.

During the year

ended December 31, 2009, we commenced our principal business operations and

have exited the development stage. Prior to that from our inception, we were a

development stage entity.

Accordingly, we have limited relevant operating history upon which you can

evaluate our performance and prospects. You should consider our prospects in

light of the inherent risks, expenses and difficulties encountered by companies

in the early stage of development, particularly companies in new and evolving

markets such as the renewable fuels industry. Such risks include technology

risks, capital requirements, lack of market acceptance of our products, failure

to establish business relationships, competitive disadvantages against larger

and more established companies and regulatory matters.

We

have a history of losses, deficits and negative operating cash flows and will

likely continue to incur losses for the foreseeable future which may impede our

ability to achieve our business objectives.

We expect

to incur operating losses and continued negative cash flows for the foreseeable

future as we invest in sales and marketing, research and development and

production facilities to achieve our business objectives. We may not achieve or

sustain profitability on a quarterly or annual basis in the future. To be

profitable, we will have to significantly increase our revenues and reduce our

costs. Future revenues and profits, if any, will depend upon various factors

such as those discussed here, many of which are beyond our control. If we are

unable to increase our revenues, reduce costs or achieve profitability, we may

have to reduce or terminate our operations.

Sufficient

customer acceptance for our biofuel may never develop or may take longer to

develop than we anticipate, and as a result, our revenues and profits, if any,

may be insufficient to fund our operations.

Sufficient

markets may never develop for our biofuel, may develop more slowly than we

anticipate or may develop with economics that are not favorable for us. The

development of sufficient markets for our biofuel at favorable pricing may be

affected by cost competitiveness of our biofuel, customer reluctance to try a

new product and emergence of more competitive products. Because we only recently

began manufacturing our biofuel, potential customers may be skeptical about

product stability, supply availability, quality control and our financial

viability, which may prevent them from purchasing our biofuel or entering into

long-term supply agreements with us. We cannot estimate or predict whether a

market for our biofuel will develop, whether sufficient demand for our biofuel

will materialize at favorable prices, or whether satisfactory profit margins

will be achieved. If such pricing levels are not achieved or sustained, or if

our technologies and business approach to our markets do not achieve or sustain

broad acceptance, our business, operating results and financial condition will

be materially and adversely impacted.

14

Our

ability to produce and distribute our biofuel on a commercially sustainable

basis is unproven, and until we can prove our technology, we likely will not be

able to generate or sustain sufficient revenues to continue operating our

business.

While

producing biofuel from vegetable oils or animal fats is not a new technology,

the technologies we are pursuing for our biofuel production have never been

utilized on a commercially sustainable basis. Our biofuel, while intended as a

new class of biofuel for power generation, commercial and industrial heating and

marine use, may never achieve technical or commercial viability. All of the

tests and sales that we have conducted to date with respect to our technology

have been performed in a limited scale environment, and the same or similar

results may not be obtainable at competitive costs on a large-scale commercial

basis.

We have

conducted multiple test burns of our biofuel products with potential customers.

However, others may need to replicate these tests before our biofuel becomes

commercially acceptable. We have never utilized our technology under the

conditions or in the volumes that will be required for us to be profitable and

cannot predict all of the difficulties that may arise. Our technology may

require further research, development, regulatory approvals, environmental

permits, design and testing prior to commercialization. Accordingly, our

technology and our biofuel may not perform successfully on a commercial basis

and may never generate any profits.

We

likely will not be able to generate significant revenues until we can

successfully validate our product performance with customers and operate our

manufacturing facility on a commercial scale.

To date,

we have generated a small amount of revenues on sales of limited quantities of

our biofuel. Revenue generation could be impacted by any of the

following:

|

|

·

|

delays

in demonstrating the technological advantages or commercial viability of

our proposed products;

|

|

|

·

|

problems

with our commercial scale production plant, including delays in upgrading

the plant, technical staffing, permitting or other operational

issues;

|

|

|

·

|

inability

to interest early adopter customers in our products;

and

|

|

|

·

|

inability

to obtain cost effective supplies of vegetable oil and

feedstocks.

|

Any

planned manufacturing plants may not achieve projected capacity or efficiency,

and we may not be able to sell our biofuel generated at these plants at prices

that will cover our costs. Potential customers may require lengthy or complex

trials or long sampling periods before committing to significant orders for our

products.

The

current credit and financial market conditions may exacerbate certain risks

affecting our business.

Due to the continued disruption in the

financial markets arising from the global recession in 2008 and the slow pace of

economic recovery, many of our potential customers are unable to access capital

necessary to accommodate the use of our biofuel. Many are operating under

austerity budgets that limit their ability to invest in infrastructure necessary

to use alternative fuels and that make it significantly more difficult to take

risks with new fuel sources. As a result, we may experience increased

difficulties in convincing customers to adopt our biofuel as a viable

alternative at this time.

We

may not be able to generate revenues from sublicensing our

technology.

Our

exclusive perpetual license allows us to sublicense our proprietary technology

in North America, Central America and the Caribbean, and our business plan

includes, as a second potential revenue stream, the collection of royalties

through sublicensing our proprietary technology. To date, we do not have any

revenues from sublicenses and have only entered into one sublicense, with Global

Energy Holdings Group, Inc. (formerly Xethanol Corporation, “Global Energy”). It

is extremely unlikely that Global Energy will be able to perform its obligations

under the sublicense. Since Global Energy sold its remaining 5,301,300 shares of

our common stock that it owned in March 2009 and filed for bankruptcy in

November 2009, we are re-evaluating our agreements with Global Energy and may

engage in discussions to modify or terminate them. We likely will need to

continue proving the viability of our technology before we can obtain any

additional sublicense agreements, and we cannot assure you that we will be able

to do so. Companies to which we grant sublicenses may not be able to produce,

market and sell enough biofuel to pay us royalty fees or they may default on the

payment of royalties. We may not be able to achieve profitable operations from

collecting royalties from the sublicensing of our proprietary technology.

15

The

strategic relationships upon which we may rely are subject to

change.

Our

ability to successfully test our technology, to develop and operate

manufacturing plants and to identify and enter into commercial arrangements with

customers or sublicensees will depend on developing and maintaining close

working relationships with industry participants. These relationships will need

to change and evolve over time, as we enter different phases of development. Our

strategic relationships most often are not yet reflected in definitive

agreements, or the agreements we have do not cover all aspects of the

relationship. Our success in this area also will depend on our ability to select

and evaluate new strategic relationships and to consummate transactions. Our

inability to identify suitable companies or enter into and maintain strategic

relationships may impair our ability to grow. The terms of relationships with

strategic partners may require us to incur expenses or undertake activities we

would not otherwise be inclined to incur or undertake in order to maintain these