Attached files

Table of Contents

Exhibit 13

Table of Contents

Common Shares

Common shares are not traded on any stock exchange. Quotations may be

obtained through the OTC Bulletin Board under the trading symbol FCBS.

Stockholder Inquiries

Communications regarding transfer requirements and lost certificates

should be directed to the transfer agent.

Transfer Agent/Registrar

Registrar and Transfer Company, 10 Commerce Drive,

Cranford, NJ 07016-3572, (800) 368-5948, www.rtco.com

Form 10-K Information

Copies of the First Century Bankshares, Inc. Annual Report to the

Securities and Exchange Commission, Form 10–K, may be obtained by

writing J. Ronald Hypes, Treasurer, First Century Bankshares, Inc.,

P.O. Box 1559, Bluefield, WV 24701.

Annual Meeting

The annual meeting of the stockholders will be held at 3:00 p.m., Tuesday,

April 27, 2010, at the First Century Bank Seminar Center, 525 Federal Street,

Bluefield, West Virginia. All stockholders are cordially invited to attend.

| Letter to the Stockholders | 1 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

2 |

| Consolidated Statements of Financial Condition | 23 |

| Consolidated Statements of Income | 24 |

| Consolidated Statements of Changes in Stockholders’ Equity | 25 |

| Consolidated Statements of Cash Flows | 26 |

| Notes to Consolidated Financial Statements | 27 |

| Management’s Annual Report on Internal Control Over Financial Reporting |

50 |

| Report of Independent Registered Public Accounting Firm | 51 |

| Boards of Directors | 52 |

| Corporate and Bank Officers | 54 |

| First Century Bankshares, Inc. Subsidiary Locations | Back Cover |

Table of Contents

Stockholders

To Our Stockholders, Customers, and Friends:

The directors, officers, and employees of First Century Bankshares, Inc. and its wholly owned subsidiary First Century Bank, N.A. are pleased to present this Annual Report for 2009.

First Century Bankshares, Inc. had earnings of $315,000 for the year which was a significant decrease from the prior year earnings of $3,685,000. On a per share basis, net income decreased to $0.17 from $1.93. This equated to a return on average assets of 0.07% and a return on average equity of 0.76%. Earnings for 2009 were impacted due to a weakened national economy which required additional loan loss provisions, along with significant additional FDIC assessments. Additionally, because of further deterioration of a major credit facility we incurred a specific charge off of $2,750,000 in the fourth quarter. Although these issues made for a very challenging year in 2009, we were pleased that the core earnings of the bank remained relatively stable with the net interest margin as a percentage of average assets essentially unchanged from 2008 to 2009.

It is also important to know that the Company continues to be well capitalized at December 31, 2009, with total risk based capital to risk weighted assets of 13.56% and a Tier 1 leverage ratio of 8.92%. These are well above regulatory requirements to be considered well capitalized of 10% and 5% respectively.

We continued to stay focused on asset quality in 2009. We have always made loans to small businesses and consumers in our markets, and, unfortunately, when economic downturns occur, we experience losses in our loan portfolio. Strong underwriting standards and internal risk rating systems are in place to help manage the credit risk of the portfolio. Timely identification of deterioration allows for proper rating of loans and reserving for potential future losses. External credit review is also in place to help monitor these trends. Even with these systems in place we still anticipate a difficult economy in 2010 and beyond. As our customers experience slower growth and reduced earnings, we would anticipate additional downgrades and reserve requirements within our portfolio. As with most community banks we cannot outperform the local and national economy and its impact on our customers. We are a reflection of the communities we serve.

Management and the Board of Directors have updated our strategic plan to move the Company forward for the next three years. We believe that in these uncertain times that to look further ahead would be difficult. Your leadership team knows that the plan is a living document, and it needs to be reviewed and updated constantly. Within the plan, we look at growth of assets, growth of earnings, and maintaining a fair and consistent dividend. We look for the plan to guide us in providing a fair total return to you over time. Your continued support is greatly appreciated.

As we move forward into 2010 we will commit to keep you fully advised of our progress. Together we can achieve the goals set forth in our strategic plan and move forward as a stronger company ready to serve our shareholders, customers, and employees. I welcome your comments and recommendations as we continue to face unprecedented challenges in the local and national economies.

Sincerely,

R. W. “Buz” Wilkinson

President and Chief Executive Officer

First Century Bankshares, Inc. Page 1

Table of Contents

Discussion and Analysis of Financial Condition and Results of Operations

AVERAGE STATEMENTS OF FINANCIAL CONDITION AND NET INTEREST DIFFERENTIAL

| 2009 | 2008 | 2007 | ||||||||||||||||||||||||||||

| (Dollars in Thousands) | (Dollars in Thousands) | (Dollars in Thousands) | ||||||||||||||||||||||||||||

| ASSETS: | Average Balance |

Interest | Average Rate |

Average Balance |

Interest | Average Rate |

Average Balance |

Interest | Average Rate |

|||||||||||||||||||||

| Interest-bearing deposits with banks |

$ | 5,921 | $ | 48 | 0.81 | % | $ | 6,296 | $ | 165 | 2.62 | % | $ | 1,244 | $ | 64 | 5.14 | % | ||||||||||||

| Securities available for sale and other equity securities: |

||||||||||||||||||||||||||||||

| U. S. Treasury securities |

— | — | — | 746 | 35 | 4.69 | % | 999 | 47 | 4.70 | % | |||||||||||||||||||

| U. S. Government agency securities |

66,627 | 2,771 | 4.16 | % | 75,645 | 3,704 | 4.90 | % | 80,226 | 3,549 | 4.42 | % | ||||||||||||||||||

| Other securities |

1,969 | 39 | 1.98 | % | 3,708 | 131 | 3.53 | % | 3,157 | 165 | 5.23 | % | ||||||||||||||||||

| Total securities available for sale |

68,596 | 2,810 | 4.10 | % | 80,099 | 3,870 | 4.83 | % | 84,382 | 3,761 | 4.46 | % | ||||||||||||||||||

| Securities held to maturity: |

||||||||||||||||||||||||||||||

| State and municipal securities |

18,467 | 705 | 3.82 | % | 17,978 | 686 | 3.82 | % | 15,219 | 592 | 3.89 | % | ||||||||||||||||||

| Other securities |

— | — | — | — | — | — | 32 | 2 | 6.25 | % | ||||||||||||||||||||

| Total securities held to maturity |

18,467 | 705 | 3.82 | % | 17,978 | 686 | 3.82 | % | 15,251 | 594 | 3.89 | % | ||||||||||||||||||

| Federal funds sold |

4,398 | 10 | 0.23 | % | 6,100 | 122 | 2.00 | % | 1,094 | 56 | 5.12 | % | ||||||||||||||||||

| Loans |

296,398 | 16,151 | 5.45 | % | 290,928 | 18,008 | 6.19 | % | 295,451 | 22,363 | 7.57 | % | ||||||||||||||||||

| Total interest-earning assets |

393,780 | $ | 19,724 | 5.01 | % | 401,401 | $ | 22,851 | 5.69 | % | 397,422 | 26,838 | 6.75 | % | ||||||||||||||||

| Allowance for loan losses |

(2,944 | ) | (2,481 | ) | (2,526 | ) | ||||||||||||||||||||||||

| Cash and due from banks—demand |

11,105 | 10,685 | 10,916 | |||||||||||||||||||||||||||

| Bank Premises and equipment—net |

13,968 | 14,434 | 12,408 | |||||||||||||||||||||||||||

| Other assets |

9,026 | 10,556 | 10,377 | |||||||||||||||||||||||||||

| TOTAL ASSETS |

$ | 424,935 | $ | 434,595 | $ | 428,597 | ||||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY: |

||||||||||||||||||||||||||||||

| Interest-bearing demand deposits |

$ | 80,032 | $ | 162 | 0.20 | % | $ | 75,056 | $ | 298 | 0.40 | % | $ | 73,923 | $ | 605 | 0.82 | % | ||||||||||||

| Savings deposits |

56,363 | 150 | 0.27 | % | 56,026 | 357 | 0.64 | % | 56,156 | 598 | 1.06 | % | ||||||||||||||||||

| Time deposits |

172,108 | 4,334 | 2.52 | % | 183,041 | 6,820 | 3.73 | % | 190,391 | 8,610 | 4.52 | % | ||||||||||||||||||

| Total interest-bearing deposits |

308,503 | 4,646 | 1.51 | % | 314,123 | 7,475 | 2.38 | % | 320,470 | 9,813 | 3.06 | % | ||||||||||||||||||

| Short-term debt |

20,627 | 278 | 1.35 | % | 21,560 | 341 | 1.58 | % | 18,203 | 652 | 3.58 | % | ||||||||||||||||||

| Total interest-bearing liabilities |

329,130 | 4,924 | 1.50 | % | 335,683 | 7,816 | 2.33 | % | 338,673 | 10,465 | 3.09 | % | ||||||||||||||||||

| Demand deposits |

52,176 | 54,288 | 45,794 | |||||||||||||||||||||||||||

| Other liabilities |

3,282 | 3,128 | 3,519 | |||||||||||||||||||||||||||

| TOTAL LIABILITIES |

384,588 | 393,099 | 387,986 | |||||||||||||||||||||||||||

| Stockholders’ equity |

40,347 | 41,496 | 40,611 | |||||||||||||||||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ | 424,935 | $ | 434,595 | $ | 428,597 | ||||||||||||||||||||||||

| Average rate paid to fund earning assets |

1.25 | % | 1.95 | % | 2.63 | % | ||||||||||||||||||||||||

| NET INTEREST DIFFERENTIAL |

$ | 14,800 | 3.76 | % | $ | 15,035 | 3.75 | % | $ | 16,373 | 4.12 | % | ||||||||||||||||||

For purposes of this schedule, interest on nonaccrual loans have been included only to the extent reflected in the income statement. However, the nonaccrual loan balance is included in the average amount outstanding. Income on loans includes loan fees of $496,000 in 2009, $257,000 in 2008 and $182,000 in 2007. Average balances of securities available for sale are reported at amortized cost; excludes pretax unrealized gains of $1,563,000 in 2009 and pretax unrealized losses of $461,000 in 2008 and $651,000 in 2007. Interest income on tax exempt securities is shown based on the actual yield.

VOLUME/RATE ANALYSIS

| Increase (Decrease) in Interest | ||||||||||||||||||||||||||||||||||||

| 2009 vs. 2008 | 2008 vs. 2007 | 2007 vs. 2006 | ||||||||||||||||||||||||||||||||||

| (Dollars in Thousands) | (Dollars in Thousands) | (Dollars in Thousands) | ||||||||||||||||||||||||||||||||||

| Due to Change in (1) | Due to Change in (1) | Due to Change in (1) | ||||||||||||||||||||||||||||||||||

| Interest income on: | Volume | Rate | Total | Volume | Rate | Total | Volume | Rate | Total | |||||||||||||||||||||||||||

| Loans |

$ | 318 | $ | (2,175 | ) | $ | (1,857 | ) | $ | (311 | ) | $ | (4,044 | ) | $ | (4,355 | ) | $ | 1,585 | $ | 442 | $ | 2,027 | |||||||||||||

| Securities available for sale and other equity securities |

(513 | ) | (547 | ) | (1,060 | ) | (199 | ) | 308 | 109 | 15 | 466 | 481 | |||||||||||||||||||||||

| Securities held to maturity |

19 | 0 | 19 | 105 | (13 | ) | 92 | 75 | (5 | ) | 70 | |||||||||||||||||||||||||

| Federal funds sold |

(19 | ) | (93 | ) | (112 | ) | 178 | (112 | ) | 66 | 12 | 5 | 17 | |||||||||||||||||||||||

| Interest-bearing deposits with banks |

(6 | ) | (111 | ) | (117 | ) | 196 | (95 | ) | 101 | 52 | (2 | ) | 50 | ||||||||||||||||||||||

| TOTAL INTEREST INCOME |

(201 | ) | (2,926 | ) | (3,127 | ) | (31 | ) | (3,956 | ) | (3,987 | ) | 1,739 | 906 | 2,645 | |||||||||||||||||||||

| Interest expense on: |

||||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits |

15 | (151 | ) | (136 | ) | 7 | (314 | ) | (307 | ) | (16 | ) | 78 | 62 | ||||||||||||||||||||||

| Savings deposits |

2 | (209 | ) | (207 | ) | (1 | ) | (240 | ) | (241 | ) | (27 | ) | 87 | 60 | |||||||||||||||||||||

| Time deposits |

(341 | ) | (2,145 | ) | (2,486 | ) | (303 | ) | (1,487 | ) | (1,790 | ) | 1,139 | 1,218 | 2,357 | |||||||||||||||||||||

| Short-term borrowings |

(14 | ) | (49 | ) | (63 | ) | 87 | (398 | ) | (311 | ) | (28 | ) | 2 | (26 | ) | ||||||||||||||||||||

| TOTAL INTEREST EXPENSE |

(338 | ) | (2,554 | ) | (2,892 | ) | (210 | ) | (2,439 | ) | (2,649 | ) | 1,068 | 1,385 | 2,453 | |||||||||||||||||||||

| NET INTEREST INCOME |

$ | 137 | $ | (372 | ) | $ | (235 | ) | 179 | $ | (1,517 | ) | $ | (1,338 | ) | $ | 671 | $ | (479 | ) | $ | 192 | ||||||||||||||

(1) Changes due to a combination of volume and rate have been allocated proportionally to volume and rate.

Page 2 First Century Bankshares, Inc.

Table of Contents

This narrative will assist you in your analysis of the accompanying consolidated financial statements and supplemental financial information. It should be read in conjunction with the audited consolidated financial statements and the notes that follow, along with the selected financial data presented elsewhere in this report. We are not aware of any market or institutional trends, events or uncertainties that will have or are reasonably likely to have a material effect on the liquidity, capital resources or operations of the Corporation, except as discussed herein. We are also not aware of any current recommendations by any regulatory authorities, which would have such a material effect if implemented.

Forward-looking Statements

This report contains certain forward-looking statements (as defined in the Private Securities Litigation Act of 1995), including certain plans, expectations, goals and projections, which are inherently subject to numerous assumptions, risks and uncertainties. Actual results could differ materially from those contained in or implied by such statements for a variety of factors including but not limited to: changes in economic conditions which may affect our primary market area; rapid movements in interest rates; competitive pressures on product pricing and services; success and timing of business strategies; the nature and extent of governmental actions and reforms; continuing consolidation on the financial services industry; rapidly changing technology; and evolving financial industry standards.

Corporate Structure and Acquisitions

First Century Bankshares, Inc. (“Corporation”) is chartered under the laws of West Virginia and operates as a financial holding company headquartered in Bluefield, WV. We began active operations in March 1984, in a business combination with our then sole subsidiary, The First National Bank of Bluefield. Through a series of acquisitions and consolidations, we now operate one subsidiary bank, First Century Bank, N.A., Bluefield, WV (“FCBNA”). FCBNA is engaged in commercial banking activities that provide a broad menu of financial services to individuals and businesses. FCBNA operates 12 branch offices and 17 ATM locations throughout southern West Virginia and southwestern Virginia.

During 2001, we formed a financial subsidiary, First Century Financial Services, LLC, (“FCFSLLC”). This entity conducts our insurance activities through its investment in the Banker’s Insurance Corporation, a relationship among several community banks, which offers a full range of insurance products and services. Effective December 31, 2009, FCFSLLC resigned from Banker’s Insurance Corporation and ceased conducting insurance activities with that company. We are evaluating various options for the continued utilization of FCFSLLC to provide nontraditional financial services. We believe the expansion of nontraditional financial service offerings to our customers will enhance the Corporation’s performance, and ultimately, shareholder value. FCFSLLC was formed with a minimal capital investment, which is carried at cost and eliminates upon consolidation.

Critical Accounting Policies

Our accounting policies are an integral part to understanding the results reported. Accounting policies are described in detail in Note 1 to the Consolidated Financial Statements. Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, and follow general practices within the

First Century Bankshares, Inc. Page 3

Table of Contents

financial services industry. Our most complex accounting policies require us to make estimates, assumptions and judgments to ascertain the valuation of assets, liabilities, commitments and contingencies reported in our financial statements and accompanying notes. These estimates, assumptions, and judgments are based on information available as of the date of the financial statements; accordingly, as this information changes, the financial statements could reflect different estimates, assumptions, and judgments. Certain policies inherently have a greater reliance on the use of estimates, assumptions, and judgments and as such have a greater possibility of producing results that could be materially different than originally reported.

Allowance for Loan Losses

We maintain, through the provision expense, an allowance for loan losses that we believe to be adequate to absorb probable credit losses inherent in the portfolio. The procedures that we use entail preparation of a loan watch list and assigning each loan a classification. For those individually significant loans where it is determined that it is not probable that the borrower will make all payments in accordance with the original loan agreement, we perform an impairment analysis. The measurement of impaired loans is based on either the fair value of the underlying collateral, the present value of the future cash flows discounted at the historical effective interest rate stipulated in the loan agreement, or the estimated market value of the loan.

Other classified loans are categorized and allocated appropriate reserves. We also reserve for other loans more than 90 days past due that were not considered in the aforementioned procedures. We segregate the remaining portfolio into consumer, commercial and residential real estate loans, and apply the historical net charge off percentage of each category to the current amount outstanding in those categories. Additionally, as part of this analysis we include such factors as concentrations of credit, collateral deficient loans, volume and trends in delinquencies, loan portfolio composition, loan volume and maturity of the portfolio, national and local economic conditions and the experience, ability and depth of lending management and staff.

Pensions

We have a defined benefit pension plan covering substantially all employees with at least nine months of service who are at least 20½ years of age. Pension expense is determined by an actuarial valuation based on assumptions that are evaluated annually as of December 31, the measurement date for pension obligations. The most significant assumptions are the long-term expected rate of return on plan assets, the discount rate used to determine the present value of the pension obligations, and the weighted-average rate of expected increase in future compensation levels. We review these assumptions with the plan actuaries and modify them as necessary to reflect current market conditions as well as anticipated long-term market conditions.

Page 4 First Century Bankshares, Inc.

Table of Contents

Balance Sheet Analysis

Loans

AMOUNTS OF LOANS OUTSTANDING

| December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| (Dollars in Thousands) | |||||||||||||||

| Commercial, financial and agricultural |

$ | 39,798 | $ | 44,966 | $ | 46,599 | $ | 49,111 | $ | 44,721 | |||||

| Real estate–construction and development |

17,051 | 25,074 | 18,339 | 8,832 | 11,654 | ||||||||||

| Real estate–mortgage |

208,570 | 204,686 | 209,221 | 213,185 | 181,551 | ||||||||||

| Installment loans to individuals |

20,947 | 21,894 | 22,787 | 21,515 | 19,806 | ||||||||||

| TOTAL LOANS OUTSTANDING |

$ | 286,366 | $ | 296,620 | $ | 296,946 | $ | 292,643 | $ | 257,732 | |||||

MATURITY SCHEDULE OF LOANS

| Remaining maturity at December 31, 2009 | ||||||||||||

| (Dollars in Thousands) | ||||||||||||

| 1 Year or Less |

1 to 5 Years |

After 5 Years |

Total | |||||||||

| Commercial, financial and agricultural |

$ | 29,689 | $ | 7,662 | $ | 2,447 | $ | 39,798 | ||||

| Real estate–construction and development |

12,501 | 3,046 | 1,504 | 17,051 | ||||||||

| Real estate–mortgage |

38,879 | 99,177 | 70,514 | 208,570 | ||||||||

| Installment loans to individuals |

2,954 | 14,900 | 3,093 | 20,947 | ||||||||

| TOTAL |

$ | 84,023 | $ | 124,785 | $ | 77,558 | $ | 286,366 | ||||

| With predetermined interest rates |

$ | 62,180 | $ | 114,907 | $ | 48,119 | $ | 225,206 | ||||

| With floating interest rates |

21,843 | 9,878 | 29,439 | 61,160 | ||||||||

| TOTAL |

$ | 84,023 | $ | 124,785 | $ | 77,558 | $ | 286,366 | ||||

Our primary goal is to meet the credit needs of the retail and commercial customers in our primary markets of southern West Virginia and southwestern Virginia. Total loans decreased approximately $10,254,000, or 3.5%, in 2009, following a 0.1% decrease of $326,000 in 2008. Competition in our market is very aggressive for the acquisition of new loans as new, quality loan opportunities are not prevalent. Our participation loan portfolio of approximately $44,000,000 remained level for the year. However, loan demand was down during 2009 in all of our local markets. We continued to adhere to our philosophy of not retaining long-term fixed-rate commitments in order to better manage our interest rate risk. In order to provide consumers with a long term option for home financing, we originate and sell mortgages to the Federal National Mortgage Association (Fannie Mae). During 2009 we originated and sold approximately $50,281,000 in long-term mortgages, which was higher than our traditional production, due to the low interest rate environment. At December 31, 2009, the loan portfolio comprised 76.3% of total interest-earning assets as compared to 75.3% of total interest-earning assets at December 31, 2008, and contributed 81.9% of total interest income in 2009, and 78.8% in 2008.

During 2009, our emphasis continued to be on strong, small to mid-sized companies with known management and excellent financial stability. Most of the commercial loans in the portfolio have variable rates of interest. Additionally, we continued to make loans available in our expanded retail marketplace. We also continued to develop relationships with other

First Century Bankshares, Inc. Page 5

Table of Contents

community banks to seek loan participation opportunities outside of our existing footprint. Consistent with our philosophy on relationship banking, most of our borrowers are also depositors and utilize other banking services. The average yield of the loan portfolio decreased to an average rate of 5.45% in 2009 compared to 6.19% in 2008. Earnings reflect pressure on the net interest margin arising from the rapid reduction in interest rates by the Federal Reserve near the end of 2008 that resulted in lower interest income from our variable rate loans. Additionally, during 2009 we implemented interest rate floors in pricing our variable rate loans in order to establish a baseline of income from any given loan.

Our commercial loan portfolio is generally diversified and geographically dispersed within the region. At December 31, 2009, we had concentrations of $21,258,000, or 53.9% of stockholders’ equity in loans to lessors of residential property, $18,529,000, or 47.0% of stockholders’ equity in loans to lessors of nonresidential property and $11,711,000, or 29.7% of stockholders’ equity in loans to land subdividers and developers. These concentrations are diversified by geography throughout the Mid-Atlantic region. There are no other concentrations of lines of business or industry that represent greater than 25% of stockholders’ equity. Within each specific industry, our borrowers are diversified as to specialty, service or other unique feature of the overall industry. A substantial portion of our customers’ ability to honor their contractual commitment is largely dependent upon the economic health of the respective industry within the overall economic environment of southern West Virginia and southwestern Virginia, which traditionally has been less volatile than many areas of the country. During 2009, our local markets began to see negative effects of the national economy, particularly in the consumer housing markets.

The consumer portion of our loan portfolio consists of both secured and unsecured loans made to individuals and families for various reasons including the purchase of automobiles, home improvements, educational expenses and other worthwhile purposes. We continue to carefully monitor the consumer sector during this period of economic downturn. Rising unemployment and a deepening recession will usually result in higher delinquency rates and other deterioration in this sector. Recent national trends in delinquency and foreclosures do not appear to be as prevalent in our markets as in some other parts of the country. However, we continue to monitor this sector and the local residential housing sector for indications of further deterioration.

Commitments to extend credit are agreements to lend to a customer provided there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require the payment of a fee. Since many of the commitments are expected to expire without being drawn upon, the total amount of commitments does not necessarily represent future cash requirements. We had outstanding commitments to extend credit of approximately $49,883,000 at December 31, 2009, and $52,623,000 at December 31, 2008. This included $9,284,000 and $9,525,000 of commitments at December 31, 2009 and 2008, respectively, for our overdraft protection product. This also included unfunded loan commitments and unused lines of credit totaling $36,326,000 at December 31, 2009 and $38,661,000 at December 31, 2008. Additionally, standby letters of credit totaled $4,273,000 at December 31, 2009, and $4,437,000 at December 31, 2008. Financial standby letters of credit are conditional commitments that we issue to guarantee the financial performance of a customer to a third party. Those guarantees are primarily used to support public and private borrowing arrangements.

Page 6 First Century Bankshares, Inc.

Table of Contents

The following table details the amount and expected maturities of significant commitments as of December 31, 2009. Further discussion of these commitments is included in Notes 13 and 14 to the Consolidated Financial Statements.

COMMITMENTS

| One Year or Less |

One to Years |

Three to Years |

Over Five Years |

Total | |||||||||||

| Unused lines of credit | (Dollars in Thousands) | ||||||||||||||

| Home equity lines |

$ | 91 | $ | 147 | $ | 628 | $ | 3,232 | $ | 4,098 | |||||

| Commercial real estate, construction and |

16,494 | 132 | 869 | 3,615 | 21,110 | ||||||||||

| Other unused commitments |

20,402 | — | — | — | 20,402 | ||||||||||

| Financial standby letters of credit |

4,273 | — | — | — | 4,273 | ||||||||||

NONPERFORMING ASSETS AND LOAN LOSS ANALYSIS

| Years Ended December 31, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||

| Average amount of loans outstanding |

$ | 296,398 | $ | 290,928 | $ | 295,451 | $ | 274,300 | $ | 253,621 | ||||||||||

| Allowance for loan losses: |

||||||||||||||||||||

| Balance at beginning of the year |

2,690 | 2,455 | 2,555 | 2,661 | 2,900 | |||||||||||||||

| Loans charged off |

||||||||||||||||||||

| Commercial, financial and agricultural |

3,038 | — | 12 | 111 | 105 | |||||||||||||||

| Real estate–construction and development |

310 | — | 92 | — | — | |||||||||||||||

| Real estate–mortgage |

302 | 113 | 33 | 132 | 424 | |||||||||||||||

| Installment loans to individuals |

296 | 302 | 283 | 342 | 232 | |||||||||||||||

| TOTAL LOANS CHARGED OFF |

3,946 | 415 | 420 | 585 | 761 | |||||||||||||||

| Loan recoveries |

||||||||||||||||||||

| Commercial, financial and agricultural |

— | 45 | — | 40 | 15 | |||||||||||||||

| Real estate–mortgage |

48 | 78 | 64 | 244 | 40 | |||||||||||||||

| Installment loans to individuals |

73 | 78 | 90 | 115 | 33 | |||||||||||||||

| TOTAL LOAN RECOVERIES |

121 | 201 | 154 | 399 | 88 | |||||||||||||||

| Net loans charged off |

(3,825 | ) | (214 | ) | (266 | ) | (186 | ) | (673 | ) | ||||||||||

| Provision for loan losses |

5,460 | 449 | |

166 |

|

80 | 434 | |||||||||||||

| BALANCE AT END OF THE YEAR |

$ | 4,325 | $ | 2,690 | $ | 2,455 | $ | 2,555 | $ | 2,661 | ||||||||||

| Ratio of net loans charged off to average loans outstanding |

1.29 | % | 0.07 | % | 0.09 | % | 0.07 | % | 0.27 | % | ||||||||||

| Provision for loan losses as a percent of loans |

1.84 | % | 0.15 | % | 0.06 | % | 0.03 | % | 0.17 | % | ||||||||||

| Allowance at year end as a percent of loans |

1.51 | % | 0.91 | % | 0.83 | % | 0.87 | % | 1.03 | % | ||||||||||

| Nonperforming assets (at year end) |

||||||||||||||||||||

| Nonaccrual |

$ | 6,780 | $ | 5,614 | $ | 1,211 | $ | 1,605 | $ | 2,173 | ||||||||||

| Past–due ninety days or more and still accruing |

1,461 | 553 | 711 | 397 | 517 | |||||||||||||||

| Troubled debt restructurings |

989 | 311 | 198 | 272 | 133 | |||||||||||||||

| Other real estate owned |

2,578 | 203 | 135 | 517 | 316 | |||||||||||||||

| TOTAL NONPERFORMING ASSETS |

$ | 11,808 | $ | 6,681 | $ | 2,255 | $ | 2,791 | $ | 3,139 | ||||||||||

| Nonperforming assets/total loans |

4.1 | % | 2.3 | % | 0.8 | % | 1.0 | % | 1.2 | % | ||||||||||

| Nonperforming assets/total assets |

2.9 | % | 1.6 | % | 0.5 | % | 0.7 | % | 0.8 | % | ||||||||||

ALLOCATION OF THE ALLOWANCE FOR LOAN LOSSES

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||||||||

| Amount | Percent of Loans in Each Category to Total Loans |

Amount | Percent of Loans in Each Category to Total Loans |

Amount |

Percent of Loans in Each Category to Total Loans |

Amount | Percent of Loans in Each Category to Total Loans |

Amount | Percent of Loans in Each Category to Total Loans |

|||||||||||||||||||||

| Commercial, financial and agricultural |

$ | 752 | 13.90 | % | $ | 463 | 15.16 | % | $ | 523 | 15.69 | % | $ | 569 | 16.78 | % | $ | 495 | 17.35 | % | ||||||||||

| Real estate–construction and development |

939 | 5.95 | % | 382 | 8.45 | % |

|

76 |

6.18 |

% |

|

19 |

3.02 |

% |

|

15 |

4.52 |

% | ||||||||||||

| Real estate–mortgage |

2,094 | 72.83 | % | 1,402 | 69.01 | % | 1,471 | 70.46 | % | 1,463 | 72.85 | % | 1,422 | 70.45 | % | |||||||||||||||

| Installment loans to individuals |

508 | 7.32 | % | 426 | 7.38 | % | 348 | 7.67 | % | 361 | 7.35 | % | 484 | 7.68 | % | |||||||||||||||

| Unallocated |

32 | N/A | 17 | N/A | 37 | N/A | 143 | N/A | 245 | N/A | ||||||||||||||||||||

| TOTAL |

$ | 4,325 | 100.00 | % | $ | 2,690 | 100.00 | % | $ | 2,455 | 100.00 | % | $ | 2,555 | 100.00 | % | $ | 2,661 | 100.00 | % | ||||||||||

First Century Bankshares, Inc. Page 7

Table of Contents

Nonperforming assets, including nonaccrual loans, loans past-due 90 days or more, restructured loans and other real estate owned, increased $5,127,000, or 76.7%, from December 31, 2008 to December 31, 2009, following an increase of $4,426,000, or 196.3% for 2008. Nonperforming assets as a percentage of total assets increased from 1.6% at December 31, 2008 to 2.9% at December 31, 2009. The increase in nonperforming assets during 2009 underscores management’s concerns that the deteriorating national economy is having a negative impact on the Company’s local markets which had been insulated from many of the factors that resulted in higher unemployment and overall credit deterioration in other parts of the country. We continue to monitor our loan portfolio in light of recent declining economic conditions. Management is focusing efforts to evaluate the Company’s commercial real estate exposure to determine the potential impact on future earnings should conditions in this sector continue to deteriorate.

The increase in nonperforming assets also reflects efforts we made to more timely identify problem credits. Our policy is to discontinue the accrual of interest on loans that are past due more than 90 days, unless those loans are well collateralized and in process of collection. We may also classify loans that are on a current payment status or past due less than 90 days as nonaccrual if the repayment of principal or interest is in doubt. Nonaccrual loans were $6,780,000 at December 31, 2009, compared with $5,614,000 at December 31, 2008. Our holdings of other real estate owned increased to $2,578,000 at December 31, 2009, compared with $203,000 at December 31, 2008. This increase was primarily due to the acquisition of a group of convenience store properties from one borrower totaling $1,892,000. Other real estate owned is recorded at fair value less estimated selling costs.

We maintain an allowance for loan losses that we believe to be adequate to absorb probable credit losses inherent in the portfolio. We are committed to the early recognition of problem loans, and to an appropriate and adequate level of allowance. During 2009, we monitored our loan portfolio with enhanced scrutiny in order to identify potential deterioration. The allowance for loan losses was 1.51% of year-end loans at December 31, 2009 and 0.91% at December 31, 2008. The estimation of the adequacy of the allowance for loan losses is the most significant estimate that we determine. Different amounts could result under different conditions or assumptions.

We use an independent third-party firm to enhance our loan review function. This process includes a thorough evaluation of our credit administration systems and personnel. The objective is to have an effective loan review system that provides us with information that will produce a more focused and effective approach in managing credit risk inherent in the loan portfolio. As a part of this process, we use a system of loan grades to further support the adequacy of the loan loss allowance. Loans are categorized into one of nine loan grades with grades 1 through 5 representing various levels of acceptable loans and grades 6 through 9 representing various levels of credit deterioration.

In addition to the review of credit quality through the credit review process, we construct a comprehensive allowance analysis for the loan portfolio at least quarterly. The procedures that we use entail preparation of a loan “watch” list and assigning each loan a classification. We perform an impairment analysis for those individually significant loans where it is determined that it is not probable that the borrower will make all payments in accordance with the original loan agreement. Specific reserves are recorded on impaired loans of $279,000 and $186,000 at December 31, 2009 and 2008, respectively. Other classified loans are categorized and allocated appropriate reserves. Other loans more than 90 days

Page 8 First Century Bankshares, Inc.

Table of Contents

past due that have not been considered in these procedures are assigned a classification of Substandard and are reserved for accordingly.

We segregate the remaining portfolio into consumer, commercial, commercial real estate, both owner and nonowner occupied, and residential real estate loans. The historical net charge off percentage of each category is applied to the current amount outstanding in that category. Also, we review concentrations of credit, classes of loans and pledged collateral to determine the existence of any deterioration. In addition, we consider volume and trends in delinquencies and nonaccrual loans, the loan portfolio composition, loan volume and maturity of the portfolio, national and local economic conditions and the experience, ability and depth of our lending management and staff.

Our methodology used to determine an estimate for the reserve for unfunded lending commitments is inherently similar to the methodology used in calculating the allowance for loan losses adjusted for factors specific to binding commitments, including the probability of funding and exposure at the time of funding. The reserve for unfunded lending commitments is included in other liabilities with increases or decreases included in noninterest expense. The reserve for unfunded lending commitments was $10,000 at December 31, 2009 and 2008, respectively. Estimates may change at some point in the future.

Securities

SECURITIES

The following table shows the carrying values of securities at the respective periods, which is fair value for available for sale securities and amortized cost for securities held to maturity:

| December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| (Dollars in Thousands) | |||||||||

| Securities available for sale: |

|||||||||

| U.S. Government securities |

$ | — | $ | — | $ | 1,009 | |||

| U. S. Government agency securities |

35,638 | 42,004 | 63,195 | ||||||

| U. S. Government agency mortgage-backed securities |

25,202 | 29,878 | 16,588 | ||||||

| Other securities |

— | 967 | 1,971 | ||||||

| TOTAL SECURITIES AVAILABLE FOR SALE |

$ | 60,840 | $ | 72,849 | $ | 82,763 | |||

| Securities held to maturity: |

|||||||||

| State, county and municipal securities |

$ | 19,076 | $ | 17,286 | $ | 18,156 | |||

| TOTAL SECURITIES HELD TO MATURITY |

$ | 19,076 | $ | 17,286 | $ | 18,156 | |||

MATURITIES OF SECURITIES

The following table shows the contractual maturities of debt securities at December 31, 2009 and the weighted average yields of such securities:

| Within One Year |

After One But Within Five Years |

After Five But Within Ten Years |

After Ten Years | Total | ||||||||||||||||||||||||||

| Amount | Yield | Amount | Yield | Amount | Yield | Amount | Yield | Amount | Yield | |||||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||||||||

| Securities available for sale: |

||||||||||||||||||||||||||||||

| U. S. Government agency securities |

$ | 2,021 | 4.03 | % | $ | 22,138 | 3.34 | % | $ | 11,479 | 3.30 | % | $ | — | 0.00 | % | $ | 35,638 | 3.37 | % | ||||||||||

| U. S. Government agency mortgage-backed securities |

— | 0.00 | % | 4,159 | 4.86 | % | 12,741 | 4.35 | % | 8,302 | 4.33 | % | 25,202 | 4.43 | % | |||||||||||||||

| TOTAL SECURITIES AVAILABLE FOR SALE |

$ | 2,021 | 4.03 | % | $ | 26,297 | 3.58 | % | $ | 24,220 | 3.85 | % | $ | 8,302 | 4.33 | % | $ | 60,840 | 3.81 | % | ||||||||||

| Securities held to maturity: |

||||||||||||||||||||||||||||||

| State, county and municipal securities |

$ | 1,270 | 6.89 | % | $ | 6,410 | 6.03 | % | $ | 6,234 | 5.58 | % | $ | 5,162 | 6.04 | % | $ | 19,076 | 5.94 | % | ||||||||||

| TOTAL SECURITIES HELD TO MATURITY |

$ | 1,270 | 6.89 | % | $ | 6,410 | 6.03 | % | $ | 6,234 | 5.58 | % | $ | 5,162 | 6.04 | % | $ | 19,076 | 5.94 | % | ||||||||||

Yields on tax-exempt obligations have been computed based on tax equivalent yield.

First Century Bankshares, Inc. Page 9

Table of Contents

During 2009, securities, our second largest category of assets, decreased by $10,219,000 or 11.3%. At December 31, 2009, securities comprised 21.3% of total interest-earning assets compared to 22.9% of total interest-earning assets at December 31, 2008. The composition of our securities portfolio reflects our investment strategy of maximizing portfolio yields subject to risk and liquidity considerations. The primary objective of our investment strategy is to maintain an appropriate level of asset liquidity and provide us with a tool to assist in controlling and managing our interest rate position while at the same time producing appropriate levels of interest income. In order to maintain liquidity and flexibility, we categorize most investments in the available for sale portfolio. We typically purchase U.S. Government agency securities in order to maintain the maximum liquidity of the portfolio. We have not purchased any of the preferred stocks or private label mortgage products that have resulted in impairment charges for other financial companies. We believe that the potential for increased loan demand as we expand our market footprint requires maintaining adequate liquidity in the securities portfolio.

The remaining securities, primarily state, county and municipal obligations comprise the held to maturity portfolio. Net unrealized gains in the held to maturity portfolio amounted to approximately $340,000 at December 31, 2009, compared to $158,000 at December 31, 2008. The held to maturity portfolio increased to $19,076,000 at December 31, 2009, from $17,286,000 at December 31, 2008. State and municipal securities contained no individual issues in excess of 10% of stockholders’ equity.

Net gains of $138,000 were recognized in 2009 from the sale of available for sale securities. For much of 2009, the Federal Reserve purchased agency mortgage backed securities as part of its economic stimulus efforts. This resulted in prices for these securities being artificially high compared to more normalized pricing. When the Federal Reserve announced in December of 2009 that it would be stopping this program in 2010, we sold a limited number of agency mortgage backed securities in order to retain some of these higher prices. No gains or losses were realized from the sale of securities in 2008.

At December 31, 2009, we held no investments having continuous unrealized loss positions for more than 12 months. We did not recognize any other-than-temporary impairment in 2009 or 2008.

Deposits

Deposits, our major source of funds, decreased approximately $7,711,000 in 2009, following a decrease of $4,724,000 in 2008. Noninterest-bearing deposits decreased $8,050,000 in 2009, following an increase of $8,693,000 in 2008. This decrease in noninterest-bearing deposits demonstrates the effect of normal fluctuations within our commercial depositor base. The average rate paid on interest-bearing deposits in 2009 was 1.51% and 2.38% in 2008. Strong competition for deposits exists in our primary market among commercial banks, savings banks, thrift institutions, credit unions, mutual funds, brokerage houses, insurance companies, and certain national retailers. Despite this intense competition, we continue to evaluate pricing strategies that will insure the long-term benefit of maintaining market share without sacrificing profitability.

Page 10 First Century Bankshares, Inc.

Table of Contents

AVERAGE DEPOSITS

| 2009 Average |

2008 Average |

2007 Average | ||||||||||||

| Amount | Rate | Amount | Rate | Amount | Rate | |||||||||

| (Dollars in Thousands) | ||||||||||||||

| Noninterest–bearing demand deposits |

$ | 52,176 | N/A | $ | 54,288 | N/A | $45,794 | N/A | ||||||

| Interest–bearing demand deposits |

80,032 | 0.20% | 75,056 | 0.40% | 73,923 | 0.82% | ||||||||

| Savings deposits |

56,363 | 0.27% | 56,026 | 0.64% | 56,156 | 1.06% | ||||||||

| Time deposits |

172,108 | 2.52% | 183,041 | 3.73% | 190,391 | 4.52% | ||||||||

| TOTAL AVERAGE DEPOSITS |

$ | 360,679 | 1.29% | $ | 368,411 | 2.03% | $366,264 | 2.68% | ||||||

There are no foreign offices. Average balances are computed on daily balances.

MATURITIES OF TIME CERTIFICATES OF DEPOSIT OF $100,000 OR MORE

| December 31, 2009 | |||

| (Dollars in Thousands) | |||

| Under 3 months |

$ | 17,060 | |

| 3 to 6 months |

12,625 | ||

| 6 to 12 months |

14,915 | ||

| Over 12 months |

8,378 | ||

| TOTAL CERTIFICATES OF DEPOSIT OF $100,000 OR MORE |

$ | 52,978 | |

SHORT-TERM BORROWED FUNDS

| December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| (Dollars in Thousands) | |||||||||

| Federal funds purchased and securities sold under agreements to repurchase |

$ | 15,241 | $ | 22,632 | $ | 27,682 | |||

| Other borrowed funds |

26 | 26 | 26 | ||||||

| TOTAL BORROWED FUNDS |

$ | 15,267 | $ | 22,658 | $ | 27,708 | |||

The approximate average interest rates, average amounts outstanding, and maximum amounts outstanding at any month-end for federal funds purchased and securities sold under agreements to repurchase are as follows:

| 2009 | 2008 | 2007 | |||||||

| (Dollars in Thousands) | |||||||||

| Average interest rates at December 31 |

1.71% | 1.25% | 3.38% | ||||||

| Maximum amounts outstanding at any month-end |

$ | 22,546 | $ | 24,778 | $ | 27,682 | |||

| Average daily amount outstanding |

$ | 20,601 | $ | 21,534 | $ | 18,177 | |||

| Weighted average interest rates |

1.34% | 1.58% | 3.58% | ||||||

The weighted average interest rates are calculated by dividing the annual interest expense by the related average daily amounts outstanding.

Capital Resources

We decreased the total per share dividend for 2009 to $0.96 per share from the $1.11 per share paid in 2008. Cash dividends paid to stockholders during 2009 totaled $1,827,000 and $2,116,000 in 2008. For the fourth quarter of 2009, we reduced the regular dividend to $0.15 per share from the previous level of $0.27 per share. This was a reflection of the lower earnings environment for the quarter and the decline in trading prices for our stock.

We are dependent upon dividends paid by FCBNA to fund dividends to the stockholders and to cover other operating costs. Our board of directors considers historical financial performance, future prospects, and anticipated needs for capital in formulating the divi -

First Century Bankshares, Inc. Page 11

Table of Contents

dend payment policy. Future dividends are dependent upon our financial results, capital requirements and general economic conditions.

One of our primary objectives is to maintain a strong capital position. Stockholders’ equity decreased $1,909,000 or 4.6% in 2009. This decrease resulted primarily from a decrease in retained earnings of $1,512,000. Additionally, during 2009 we did not repurchase any treasury shares through our stock repurchase program. At December 31, 2009, we had approval to repurchase 9,572 shares of the Corporation’s common stock. We will continue to evaluate capital utilization to provide the most long-term value for our shareholders.

Risk-based capital regulations require all banks and bank holding companies to have a minimum total risk-based capital ratio of 8% with half of the capital composed of core capital. Conceptually, risk-based capital requirements assess the risk of a financial institution’s balance sheet and off-balance sheet commitments in relation to its capital. Under the guidelines, capital strength is measured in two tiers which are used in conjunction with risk adjusted assets in determining the risk-based capital ratios. Our Tier I capital, which consists of stockholders’ equity, adjusted for certain intangible assets, amounted to $36,790,000 at December 31, 2009, or 12.31% of total risk-weighted assets, compared to $38,143,000 at December 31, 2008, or 12.42% of total risk-weighted assets. Tier II capital, or supplementary capital, includes capital components such as qualifying allowance for loan losses, and can equal up to 100% of an institution’s Tier I capital with certain limitations. Our Tier II capital amounted to $3,734,000 at December 31, 2009, or 1.25% of total risk-weighted assets, compared to $2,700,000 at December 31, 2008, or 0.88% of total risk-weighted assets. Our total consolidated risk-based capital was $40,524,000 at December 31, 2009, or 13.56% of total risk-weighted assets, compared to $40,843,000, or 13.30% of total risk-weighted assets as of December 31, 2008. Additionally, risk-based capital guidelines require that we maintain a minimum leverage ratio (Tier I capital divided by average adjusted total consolidated assets) of 4%, which may be increased for institutions with higher levels of risk or that are experiencing or anticipating significant growth. We have not been advised by any regulatory agency of any additional specific minimum leverage ratio applicable to us. As of December 31, 2009 and 2008, the Corporation’s leverage ratio was 8.92% and 8.93% respectively; therefore, we exceeded all current minimum capital requirements.

As a result of the strong capital position of the Corporation, along with other general concerns for government intervention in the day-to-day operations of the Corporation, we chose to not participate in the U.S. Government’s Treasury Asset Repurchase Program (TARP) or the Capital Purchase Program (CPP).

Page 12 First Century Bankshares, Inc.

Table of Contents

Asset and Liability Management and Interest Rate Sensitivity

Our income stream is subject to risk resulting from interest rate fluctuations to the extent there is a difference between the amount of our interest-earning assets and the amount of our interest-bearing liabilities that are prepaid, withdrawn, mature or reprice in specified periods. The goal of asset and liability management is to maintain high quality and consistent growth of net interest income with acceptable levels of risk to changes in interest rates.

Interest rate sensitivity varies with different types of interest-earning assets and interest-bearing liabilities. Overnight federal funds, on which rates change daily, and loans that are tied to the prime rate differ considerably from long-term securities and fixed rate loans. Similarly, time deposits of $100,000 and over, NOW accounts and money market deposit accounts are much more interest rate sensitive than passbook savings accounts and other interest-bearing liabilities. We use a number of tools to measure interest rate risk, including simulating net interest income under various rate scenarios, monitoring the change in present value of the asset and liability portfolios under the same rate scenarios and monitoring the difference or gap between rate sensitive assets and liabilities over various time periods.

We have traditionally priced our commercial loans with variable rates tied to the prime rate of interest. With the dramatic reduction in the prime rate at the end of 2008, we implemented interest rate floors during 2009 on new and renewed commercial loans. This allowed us to retain a portion of our interest income, but will delay the repricing opportunities for these loans until the prime rate rises above the floor rates on the loans. Also, with the potential for rising interest rates, our customers are requesting fixed rate commitments for new and renewed loans. See the Analysis of Interest Rate Sensitivity Table for more information regarding our risk to changes in interest rates.

We continue to monitor asset/liability gap positions, while incorporating more sophisticated risk measurement tools, including simulation modeling which calculates expected net interest income based on projected interest-earning assets, interest-bearing liabilities and interest rates. Using simulation modeling allows us to evaluate earnings and capital at risk due to significant changes in interest rates. We monitor exposure to the effect of an instantaneous change in rates of 200 basis points up or down over the same period. As of December 31, 2009 and 2008, simulation indicated the impact of a 200 basis point increase in rates would result in an increase in net interest income of 4.9% and 6.2%, respectively. A 200 basis point decline in rates would result in a decrease in net interest income from an unchanged rate environment of 9.0% and 10.4%, respectively, at December 31, 2009 and 2008. These changes fall within our policy limits for the maximum negative impact to net interest income from a change in interest rates. Because of the historically low interest rate environment, we also evaluate various scenarios to determine the impact of more significant changes in interest rates.

First Century Bankshares, Inc. Page 13

Table of Contents

ANALYSIS OF INTEREST RATE SENSITIVITY

An analysis of interest rate sensitivity as of December 31, 2009, is shown below.

| Months |

Years |

Totals | |||||||||||||||||

| Less Than 3 | 3 – 12 | 1 – 5 | Over 5 | ||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||

| Investment securities |

$ | 1,362 | $ | 1,929 | $ | 31,113 | $ | 47,147 | $ | 81,551 | |||||||||

| Federal funds sold and interest-bearing |

7,425 | — | 0 | — | 7,425 | ||||||||||||||

| Loans |

119,908 | 56,272 | 94,282 | 15,904 | 286,366 | ||||||||||||||

| Interest-earning assets |

128,695 | 58,201 | 125,395 | 63,051 | 375,342 | ||||||||||||||

| Time deposits |

49,835 | 86,900 | 31,010 | — | 167,745 | ||||||||||||||

| Other interest-bearing deposits |

60,956 | 30,478 | 45,593 | — | 137,027 | ||||||||||||||

| Other interest-bearing liabilities |

10,110 | 131 | 5,000 | 26 | 15,267 | ||||||||||||||

| Interest-bearing liabilities |

120,901 | 117,509 | 81,603 | 26 | 320,039 | ||||||||||||||

| Interest sensitivity gap |

$ | 7,794 | $ | (59,308 | ) | $ | 43,792 | $ | 63,025 | $ | 55,303 | ||||||||

| Cumulative interest sensitivity gap |

$ | 7,794 | $ | (51,514 | ) | $ | (7,722 | ) | $ | 55,303 | |||||||||

| Ratio of interest-earning assets to |

1.06 | x | 0.50 | x | 1.54 | x | 2425.04 | x | |||||||||||

| Ratio of cumulative interest sensitivity |

2.08 | % | (13.72 | )% | (2.06 | )% | 14.73 | % | |||||||||||

Liquidity Management

Liquidity management involves our ability to meet the cash flow requirements of depositors wanting to withdraw funds or borrowers needing assurance that sufficient funds will be available to meet their credit needs. To ensure that we are positioned to meet immediate and future cash demands, we rely on liquidity analysis, knowledge of business trends over past economic cycles and forecasts of future conditions.

Liquidity can best be demonstrated by an analysis of cash flows. Our primary source of cash flows is from operating activities. Operating activities provided $4,389,000 of liquidity for the year ended December 31, 2009, compared to $5,215,000 in 2008. The principal elements of these operating flows are net income, increased for significant non-cash expenses for the provision for loan losses and depreciation and amortization.

In 2009, cash flows from financing activities decreased $16,929,000, primarily due to decreases in deposits of $7,711,000 and short-term borrowings of $7,391,000. We allowed for measured reductions in these items because of lower loan demand. We still maintained pricing structures to retain longer term customer relationships.

A secondary source of liquidity comes from investing activities, principally the maturities of investment securities. With the low interest rate environment during 2009, maturities and calls of investment securities were $50,282,000, compared to $56,656,000 in 2008. This rapid flow of liquidity allowed us to reallocate a portion of the available for sale portfolio into municipal securities which provided more relative value at various purchasing opportunities during the year. As of December 31, 2009, we had approximately $13,323,000 of investment securities that had scheduled maturities within 36 months. Payments from mortgage-backed securities in excess of this amount will provide additional cash flow for reinvestment.

Page 14 First Century Bankshares, Inc.

Table of Contents

We also have access to additional sources of liquidity through the Federal Reserve System, through our membership in the Federal Home Loan Bank system and through correspondent bank relationships. As of December 31, 2009, FCBNA had a maximum borrowing capacity exceeding $150,000,000 through the Federal Home Loan Bank of Pittsburgh. These funds can be made available with various maturities and interest rate structures. As a member, we are required to own stock in the Federal Home Loan Bank of Pittsburgh. The amount of stock we own is based on the amount of outstanding borrowings at any given point in time. Borrowings are also collateralized by a blanket lien by the Federal Home Loan Bank on its member’s qualifying assets. At December 31, 2009, FCBNA owned $1,252,500 of stock and had nothing outstanding on our overnight repo account. We had no other outstanding advances from the Federal Home Loan Bank of Pittsburgh as of December 31, 2009.

During 2009, our primary correspondent bank failed and was taken over by the FDIC. We were able to secure federal funds lines of credit from two other correspondent banks totaling $8,600,000 to replace the line that we had with the failed institution. We had a small equity position, carried at cost, in our previous correspondent of approximately $168,000 that we wrote off during 2009 through noninterest expense.

As a member of the Federal Reserve System, we have access to funding through the Federal Reserve Bank of Richmond. The Federal Reserve has traditionally required its members to exhaust other sources of liquidity before seeking advances, however, during 2008 and 2009 the Federal Reserve became more of a liquidity provider for the banking system. Any borrowings from the Federal Reserve Bank of Richmond would require us to pledge assets of FCBNA as collateral. We had no outstanding borrowings from the Federal Reserve Bank of Richmond at December 31, 2009.

Income Statement Analysis

Earnings Overview

Net income for the two years ended December 31, 2009 and 2008, was $315,000 and $3,685,000, respectively. On a per share basis, diluted net income was $0.17 in 2009 compared to $1.93 in 2008. Return on average equity was 0.76% in 2009 compared to 8.96% in 2008. Return on average assets for the year ended December 31, 2009 was 0.07% compared to 0.85% in 2008. Earnings for 2009 reflect the impact of the weakness in the national economy on the housing sector, requiring additional loan loss provisions, along with significant additional FDIC assessments during the year. Additionally, the further deterioration of a major credit facility resulted in a $2,750,000 specific charge off in the fourth quarter related to this loan. Core earnings of the bank remained relatively stable with the net interest margin as a percentage of average assets essentially unchanged from 2008.

A summary of the significant factors influencing our results of operations and related ratios is included in the following discussion.

Earnings Per Share

The Earnings Per Share Table summarizes the principal sources of changes in earnings per share for 2009. For further details on the computation of earnings per share, refer to Note 9 of the Notes to Consolidated Financial Statements, presented elsewhere in this report.

First Century Bankshares, Inc. Page 15

Table of Contents

EARNINGS PER SHARE

| Net income per share — 2008 |

$ | 1.93 | ||

| Increase (decrease) due to change in: |

||||

| Net interest income |

(.08 | ) | ||

| Provision for loan losses |

(1.89 | ) | ||

| Other operating income |

.22 | |||

| Personnel expense |

(.06 | ) | ||

| Other expense |

.05 | |||

| Net income per share — 2009 |

$ | 0.17 |

Net Interest Income

The major portion of our earnings is derived from net interest income, which is the interest income on interest-earning assets less the interest expense on interest-bearing liabilities. During 2009 net interest income decreased $235,000 or 1.6%. This followed an 8.2% decrease in 2008. Net interest income resulted in a net interest margin to earning assets ratio of 3.76% for 2009, compared with 3.75% for 2008.

For the year ended December 31, 2009, interest income decreased $3,127,000, or approximately 13.7%, compared to a decrease of $3,987,000, or 14.9% for 2008. Interest on loans decreased $1,857,000 or 10.3% during 2009. Interest on securities increased $1,041,000, or 22.8% for 2009, following an increase of 201,000, or 4.6% for 2008. Interest income reflects a yield on average earnings assets of 5.01% for 2009, compared with 5.69% for 2008.

The decrease in interest income was accompanied by a decrease in interest expense of $2,892,000 or 37.0% for 2009. This followed a decrease in interest expense of $2,649,000, or 25.3% for 2008. Interest expense reflects a cost on average interest-bearing liabilities of 1.50% for 2009, compared with 2.33% for 2008.

Net interest income is affected by many factors, but most significantly by the prevailing interest rates during the period, the spread between the various sources and uses of funds, and by changes in the volume of various assets and liabilities. Earnings reflect pressure on the net interest margin arising from the rapid reduction in interest rates by the Federal Reserve in 2008 that resulted in lower interest income from our variable rate loans. We did implement a pricing strategy that created interest floors on our variable rate loans. We are continuing this strategy as we have renewals and other opportunities to reprice loans. This reduction was not completely offset by lower interest expense as many certificates of deposit remained at previously higher rates, pending the opportunity to renew. Additionally, as previously mentioned, reinvestment opportunities in the investment portfolio were not readily available at comparable rates as the maturing or called security.

Provision for Loan Losses

The most significant impact on our earnings in 2009 was our provision for loan losses of $5,460,000. This was a $5,011,000 increase in the provision for loan losses from 2008. The provision for loan losses as a percentage of average loans was 1.84% for 2009, compared with 0.15% for 2008. Charge-offs increased $3,531,000 during 2009. As previously mentioned, we incurred a specific charge off of $2,750,000 related to one borrower that we

Page 16 First Century Bankshares, Inc.

Table of Contents

had been working with for several quarters while the borrower was attempting to bring a new product to market. When it became apparent that this effort was going to continue beyond our ability to forebear, we took the charge off and began more direct and aggressive collection efforts. Additionally, recoveries of previous charge-offs were down $80,000, or 39.8% in 2009. The ratio of net charge offs to average loans outstanding was 1.29% for 2009, compared with 0.07% for 2008. Additional reserves in excess of net charge-offs of $1,635,000 were added to the allowance for loan losses in 2009. This reflects further weakness in our borrowers’ abilities to manage through this economic downturn and the impact that has on our methodology in determining the adequacy of the allowance for loan losses.

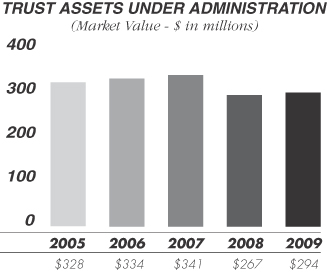

Noninterest Income and Expense

Noninterest income net of securities gains and losses increased $499,000 or 10.4%, following an $8,000 or 0.2% increase in 2008. The largest component of noninterest income is service charges on deposit accounts. These fees increased approximately $77,000 or 4.2% in 2009, following a decrease of $40,000 or 2.1% in 2008. Fierce competition exists in our local markets for “free checking” type products. However, the income from our overdraft protection product grew during 2009 as customer usage increased and we increased our per occurrence fee slightly during the year. The second largest component of noninterest income is fees from fiduciary activities. Fees from fiduciary activities decreased $22,000, or 1.4%, during 2009 after being relatively flat in 2008. The fluctuations in fiduciary fees are attributed to the timing of the receipt of fees from estate settlements, growth of assets under management and changes in overall investment performance. We also experienced additional noninterest income from higher mortgage originations sold to Fannie Mae, and we recognized a gain of $279,000 from the previously mentioned resignation from Bankers Insurance Corporation.

Noninterest expense increased $895,000, or 6.5% in 2009, following a 1.4% decrease in 2008. The most significant increase in noninterest expense was for FDIC insurance premiums and special assessments. Our total expense for FDIC insurance was $890,000 in 2009 compared with $55,000 in 2008. We anticipate these higher levels of FDIC premiums for some time as the fund must rebuild its reserves due to the significant number of bank failures that occurred in 2009 and may continue for some time into the future. Personnel expense is the largest component of noninterest expense. Personnel expense increased 2.6% in 2009, following a decrease of 2.0% in 2008. All of the increase in personnel expense for 2009 is attributed to higher net periodic benefit cost associated with our defined benefit pension plan. For a complete discussion of our employee benefit programs, refer to Note 11 of the Notes to Consolidated Financial Statements, presented elsewhere in this report. Premises and equipment expense decreased 5.7% in 2009 as we did not establish any new branch facilities during the year or make any significant purchases of equipment in an effort to control overall expenses.

Income Taxes

With significantly lower earnings in 2009, our income tax provision resulted in a net tax benefit of $123,000 compared to income tax expense of $2,011,000 in 2008. This reflected an effective income tax rate of (64.1%) for 2009 and 35.3% for 2008. Income taxes computed at the statutory rate are reduced primarily by interest earned on state and municipal

First Century Bankshares, Inc. Page 17

Table of Contents

obligations. For a complete discussion of the Corporation’s tax position, refer to Note 12 of the Notes to Consolidated Financial Statements, presented elsewhere in this report.

RETURN ON EQUITY AND ASSETS

| December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| Percentage of net income to: |

|||||||||

| Average stockholders’ equity |

0.76 | % | 8.96 | % | 11.79 | % | |||

| Average total assets |

0.07 | % | 0.85 | % | 1.10 | % | |||

| Percentage of dividends declared per common share to net income per common share |

564.71 | % | 57.51 | % | 45.83 | % | |||

| Percentage of average stockholders’ equity to average total assets |

9.49 | % | 9.55 | % | 9.48 | % | |||

The Effects of Inflation and Changing Prices

Our company is affected by inflation in several ways, but not to the same extent as a company that makes large capital expenditures or has a large investment in inventory. Our asset and liability structure is primarily monetary in nature and, therefore, its financial results are more affected by changes in interest rates than by inflation. However, the actions of the Federal Reserve Board indicate that interest rate management will continue to be the primary tool used to curtail inflationary pressures. Inflation does affect our noninterest expense, such as personnel expense and the cost of services and supplies. These increases must be offset to the extent possible, by increases in noninterest income and by controlling noninterest expense.

Accounting, Legislative and Regulatory Matters

In June 2009, the Accounting Standards Codification (the “Codification”) became FASB’s officially recognized source of authoritative accounting principles for non-governmental entities in the preparation of financial statements in conformity with general accepted accounting principles. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative guidance for SEC registrants. All guidance contained in the Codification carries an equal level of authority. All non-grandfathered, non-SEC accounting literature not included in the codification is superseded and deemed non-authoritative. The “Codification” became effective for the financial statements ending September 30, 2009.

In April 2009, new authoritative guidance under FASB ASC Topic 820 “Fair Value Measurements and Disclosures” was issued. ASC Topic 820 affirms that the objective of fair value when the market for an asset is not active is the price that would be received to sell the asset in an orderly transaction, and clarifies and includes additional factors for determining whether there has been a significant decrease in market activity for an asset when the market for that asset is not active. ASC Topic 820 requires an entity to base its conclusion about whether a transaction was not orderly on the weight of the evidence. FASB ASC Topic 820 also amended prior guidance to expand certain disclosure requirements. The Company adopted the provisions of ASC Topic 820 as of June 30, 2009 and the adoption of ASC Topic 820 did not have a significant impact on the Company’s financial statements.

Page 18 First Century Bankshares, Inc.

Table of Contents

Further new authoritative guidance (Accounting Standards Updated No 2009-5) under ASC Topic 820 provides guidance for measuring the fair value of a liability in circumstances in which a quoted price in an active market for the identical liability is not available. In such instances, a reporting entity is required to measure fair value utilizing a valuation technique that uses (i) the quoted price of the identical liability when traded as an asset, (ii) quoted prices for similar liabilities or similar liabilities when traded as assets, or (iii) another valuation technique that is consistent with the existing principles of ASC Topic 820, such as an income approach or market approach. ASC Topic 820 also clarifies that when estimating the fair value of a liability, a reporting entity is not required to include a separate input or adjustment to other inputs relating to the existence of a restriction that prevents the transfer of the liability. ASC Topic 820 was effective for the Company’s financial statements beginning October 1, 2009 and did not have a significant impact on the Company’s financial statements.

In April 2009, new authoritative guidance under FASB ASC Topic 825 “Financial Instruments” was issued. ASC Topic 825 amends prior guidance to require an entity to provide disclosures about fair value of financial instruments in interim financial information and requires those disclosures in summarized financial information at interim reporting periods. Under ASC Topic 825, a publicly traded company shall include disclosures about the fair value of its financial instruments whenever it issues summarized financial information for interim reporting periods. In addition, entities must disclose, in the body or in the accompanying notes of its summarized financial information for interim reporting periods and in its financial statements for annual reporting periods, the fair value of all financial instruments for which it is practicable to estimate that value, whether recognized or not recognized in the statement of financial position, as required by ASC Topic 825.

In April 2009, new authoritative guidance under FASB ASC Topic 320 “Investments-Debt and Equity Securities” was issued. ASC Topic 320 (i) changes existing guidance for determining whether an impairment is other than temporary to debt securities and (ii) replaces the existing requirement that the entity’s management assert it has both the intent and ability to hold an impaired security until recovery with a requirement that management assert: (a) it does not have the intent to sell the security; and (b) it is more likely than not it will not have to sell the security before recovery of its cost basis. Under ASC Topic 320, declines in the fair value of held-to-maturity and available-for-sale securities below their cost that are deemed to be other than temporary are reflected in earnings as realized losses to the extent the impairment is related to credit losses. The amount of the impairment related to other factors is recognized in other comprehensive income. The Company adopted the provisions of ASC Topic 320 and the adoption did not have a material effect on the Company’s financial statements.

In May 2009, new authoritative guidance under FASB ASC Topic 855 “Subsequent Events” was issued. ASC Topic 855 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or available to be issued. ASC Topic 855 defines (i) the period after the balance sheet date during which a reporting entity’s management should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements (ii) the circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements, and (iii) the disclosures an entity should make about events or transactions that occurred after the balance sheet date. ASC Topic 855 became effective for the Company during the second quarter of 2009 and did not have a significant impact on the Company’s financial statements.

First Century Bankshares, Inc. Page 19

Table of Contents

The Company evaluated subsequent events through the date on which the financial statements were issued. As a result, no subsequent events were recognized.

In August 2009, the FASB issued ASU 2009-05, “Measuring Liabilities at Fair Value”, to amend ASC Topic 820 to clarify how entities should estimate the fair value of liabilities. The amendments to this update include clarifying guidance for circumstances in which a quoted price in an active market is not available, the effect of the existence of liability transfer restrictions, and the effect of quoted prices for the identical liability, including when the identical liability is traded as an asset. The amended guidance on measuring liabilities at fair value is effective for the first interim or annual reporting period beginning after August 28, 2009. The Company is currently evaluating the impact that adoption of the amendments in this update will have on its consolidated financial statements.

In December 2009, the FASB issued ASU 2009-16, “Accounting for Transfers of Financial Assets”, to amend ASC Topic 860, “Transfers and Servicing”, for the issuance of FASB Statement No. 166, “Accounting for Transfers of Financial Assets—an amendment of FASB Statement No. 140.” The amendments in this update eliminate the exceptions for qualifying special-purpose entities from the consolidation guidance and the exception that permitted sale accounting for certain mortgage securitizations when a transferor has not surrendered control over the transferred financial assets. In addition, the amendments require enhanced disclosures about the risks that a transferor continues to be exposed to because of its continuing involvement in transferred financial assets. The amendments in this update are the result of FASB Statement No. 166 and are effective for annual reporting periods beginning after November 15, 2009 and interim and annual reporting periods thereafter. Adoption of the amendments in this update will have no impact on the Company’s financial position or results of operations.

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2010-06, “Improving Disclosures about Fair Value Measurements,” to amend FASB Accounting Standards Codification (“ASC”) Topic 820, “Fair Value Measurements and Disclosures.” The amendments in this update require more robust disclosures about (1) the different classes of assets and liabilities measured at fair value, (2) the valuation techniques and inputs used, (3) the activity in Level 3 fair value measurements, and (4) the transfers between Levels 1, 2, and 3. The new disclosures and clarifications of existing disclosures are effective for interim and annual reporting periods beginning December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Adoption of the amendments in this update will have no impact on the Company’s financial position or results of operations.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies are not expected to have a material impact on the Company’s financial position, results of operations and cash flows.

Per Share Data by Quarter

The common stock of the Corporation is quoted on the NASD OTC Bulletin Board under the trading symbol FCBS. The Per Share Data By Quarter Table shows the approximate high and

Page 20 First Century Bankshares, Inc.

Table of Contents

low bid as reported by the transfer agent and market makers for 2009 and 2008. Also presented below are the dividends paid for those respective years. The number of stockholders of record on December 31, 2009, was 451 and outstanding shares totaled 1,903,120.

PER SHARE DATA BY QUARTER

| Market Quotations | ||||||||||||||||||

| Dividends | 2009 | 2008 | ||||||||||||||||

| Quarter | 2009 | 2008 | High | Low | High | Low | ||||||||||||

| First Quarter |

$ | 0.27 | $ | 0.27 | $ | 18.50 | $ | 13.50 | $ | 25.75 | $ | 22.00 | ||||||

| Second Quarter |

0.27 | 0.27 | 15.95 | 12.50 | 23.90 | 18.50 | ||||||||||||

| Third Quarter |

0.27 | 0.27 | 19.99 | 15.25 | 21.00 | 18.60 | ||||||||||||

| Fourth Quarter |

0.15 | 0.30 | 17.34 | 13.70 | 19.75 | 14.70 | ||||||||||||

Trust Asset Responsibility