Attached files

| file | filename |

|---|---|

| 8-K - UNIGENE LABORATORIES INC--FORM 8-K - UNIGENE LABORATORIES INC | d8k.htm |

Unigene Laboratories Inc. Corporate Overview 2010 Exhibit 99.1 |

SAFE

HARBOR STATEMENT Safe Harbor statements under the Private Securities Litigation Reform

Act of 1995: This presentation contains forward-looking statements as defined in

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Such forward-looking statements are

based upon Unigene Laboratories, Inc.’s management’s current expectations,

estimates, beliefs, assumptions, and projections about Unigene's business and industry. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “potential,” “continue,” and variations of these words (or negatives of these words) or similar expressions, are intended to identify

forward-looking statements. In addition, any statements that refer to expectations,

projections, or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. These

forward-looking statements are not guarantees of future performance and are subject

to certain risks, uncertainties, and assumptions that are difficult to predict.

Therefore, our actual results could differ materially and adversely from those

expressed in any forward-looking statements as a result of various risk factors. These risks and uncertainties include the risks associated with the effect of changing economic

conditions, trends in the products markets, variations in Unigene's cash flow, market

acceptance risks, technical development risks and other risk factors detailed in

Unigene's Securities and Exchange Commission filings. |

3 Outline China Joint Venture Introduction to Unigene and its Objectives Unigene Technology Overview Osteoporosis Treatments Site Directed Bone Growth (SDBG) University of London Collaboration Obesity |

4 Introduction to Unigene and its Objectives University of London Collaboration Unigene Technology Overview Osteoporosis Treatments Site Directed Bone Growth Obesity China Joint Venture |

5 Unigene History 1980 1990 2000 Current 1980 Unigene Founded 1987 Unigene Public Offering 1995 Completed cGMP Manu- facturing Facility 2004 Chinese NDA for Fortical Nasal and Injectable 2001 Switzerland Marketing Authorization Forcaltonin® Injection 2005 US NDA Approval for Fortical™ Nasal Spray 2004 IND for Oral PTH 1999 IND for Oral sCT 1999 EU Centralized Marketing Authorization Forcaltonin® Injection 1984 Unigene begins peptide manu- facturing business 1994 Unigene oral peptide technology developed |

6 Peptide Technology Platforms Therapeutic Product Programs Unigene’s Parallel Pathways To Business Success Unigene Dual Business Model Secrapep™ r-DNA Peptide Manufacturing Enteripep™ Solid Dosage Oral Peptide Delivery Nasapep™ Nasal Peptide Delivery Oral PTH analog Oral Calcitonin Osteoporosis Osteoarthritis / Combination Rx (Tarsa) Combination Products (QMUL) Site Directed Bone Growth Obesity Annexin 1 Broad patent portfolio covering platform technologies and therapeutic products |

Licensing technology platforms to multiple pharma partners Portfolio of drug candidates – Internally developed – Out-licensed to partners Peptide API manufacturer for pharma partners Industry acceptance of Unigene technologies as validated peptide delivery and manufacturing platforms Clinical development partnerships Commercialization partnerships for products 7 Unigene’s Mission: To Be an Industry leader in Peptide Therapeutics Industry leader in developing peptide based therapeutics utilizing Unigene’s technologies Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 10 Unigene’s Business Objectives Timeline Current Intermediate term Longer term |

8 Multiple Strategic Partnerships Validates Technologies and Programs Oral PTH Manufacturing and Oral Delivery License Licensing and Clinical Supply Agreement for Recombinant Calcitonin Manufacturing Marketing and Distribution of Fortical ® Nasal Spray in US Joint Venture for Marketing and Distribution of Oral and Nasal calcitonin, PTH and other Biotechnology Products in China, Contract Manufacturing of Peptide/Protein API’s New company formed by three VC groups and Unigene, acquires license to commercialize oral calcitonin product currently in Phase III clinical study Novartis GSK Upsher-Smith SPG Tarsa Therapeutics Inc. |

9 Introduction to Unigene and its Objectives Unigene Technology Overview Osteoporosis Treatments SDBG University of London Collaboration Obesity China Joint Venture |

10 Unigene Technology Platforms Enable Patient Friendly Cost Effective Therapeutic Alternatives Oral Peptide Products PTH Analogs, Calcitonin, Obesity Peptides , Glucose Regulatory Peptides, etc. Enteripep ® Unigene’s proprietary oral peptide delivery technology Secrapep ® Unigene’s proprietary recombinant peptide manufacturing process |

11 Challenges for Oral Peptide Delivery Oral Peptide Delivery with Enteripep ® Unigene’s Enteripep ® Technology Offers An Innovative Solution For Oral Peptide Delivery • Low absorption through the GI tract – Molecules with molecular mass greater than 300 (more than 2-3 amino acids) have

limited bioavailability – Hydrophilic nature of peptides inhibits absorption – Mucosal layer of GI tract binds charged molecules such as peptides, inhibiting

absorption • Degradation of peptide in the digestive tract Enteric coating permits passage through the stomach into the small intestine Organic acid inhibits proteases Absorption enhancer facilitates the uptake of the peptide by a paracellular transport mechanism Absolute bioavailability ranging from 1% to greater than 20% of the bioavailability of IV

infusion, depending upon the peptide |

12 Secrapep ® Recombinant Peptide Manufacturing Secrapep ® Peptide Manufacturing Platform Delivers High Yield and High Product Purity At Low Cost E. coli Expression of Glycine Extended Peptide CHO Expression of -Amidating Enzyme In-vitro Amidation of peptide NH 2 Amidated Therapeutically Active Peptide 97.4 66.2 45.0 31.0 21.5 14.4 6.5 kDa Product of Interest is Secreted Directly into the Culture Medium In-vitro Amidation • Required for peptides that need C-terminal amide for activity • Can enhance bioavailability for non-amidated peptides SDS PAGE of Crude Medium Enriched Starting Material Extracellular yields of 400 to 1300 mg/L Reduced purification steps |

13 Introduction to Unigene and its Objectives Unigene Technology Overview Osteoporosis Treatments SDBG University of London Collaboration Obesity China Joint Venture |

Osteoporosis Overview • Epidemiology • Global Prevalence (2008): 200 million, 80% female • US Prevalence/Incidence (2008): 59 million total, 10 million per year • A large portion of potential patients are undiagnosed or diagnosed well after the

initial development of osteoporosis • ~2/3 of hip fractures are associated with osteoporosis • Market Size • Global osteoporosis market is estimated to be ~$11.1 billion by 2010 • Compound annual growth rate from 2000-2010 of 7.1% • US osteoporosis market is estimated to be ~$7.1 billion by 2010 • Compound annual growth rate from 2000-2010 of 8.4% • Direct cost for treating osteoporosis-related fractures is greater than $48 billion

per year in North America and Europe combined 14 Source: “Osteoporosis Therapeutics: A Global Strategic Business Report” Global Industry

Analysts, Inc. |

15 Current Treatments For Osteoporosis Selective Estrogen Receptor Modulators (SERM) Parathyroid Hormone Evista® (Eli Lilly) Forteo® (Eli Lilly) Products Treatment Class Calcitonin Fortical ® (Upsher Smith) Miacalcin ® (Novartis) Generics Activation of specific estrogen receptors inhibiting bone destruction Bone anabolic agent which stimulates osteoblasts, increasing bone formation Mode of Action Mitigates bone resorption by inhibition of osteoclasts Bisphosphonates Fosamax® (Merck) Boniva® (Glaxo-Roche) Actonel® (WC, SA) Reclast®/Aclasta® (Novartis) Controls bone breakdown and mitigates bone resorption through osteoclast inhibition |

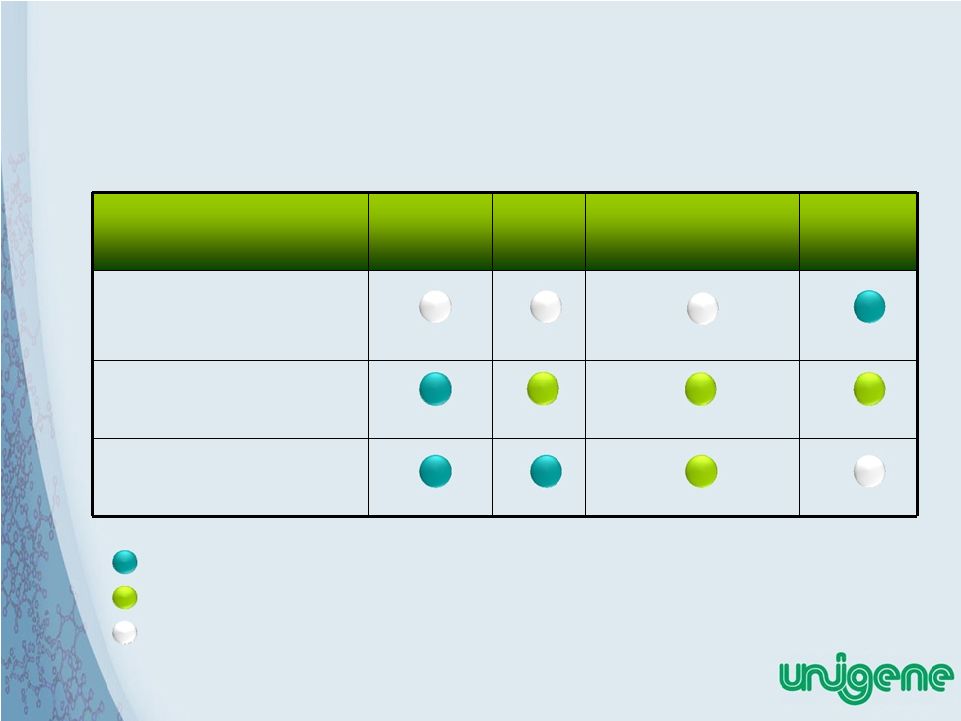

16 Factors Desired For Ideal Osteoporosis Therapy Calcitonin SERM Bis-phosphonates Injectable PTH Deliver high quality bone growth Manageable side effect profiles Easy administration Meets Need Partially Meets Need Fails to Meet Need |

17 Calcitonin |

18 Fortical ® Nasal Spray • Fortical ® Calcitonin-Salmon (rDNA origin) Nasal Spray Received Marketing Approval by the FDA on August 12, 2005 • Fortical ® Nasal Spray is Currently Marketed by Upsher-Smith Laboratories • Fortical sales for year ending Dec 31 2009 were $50.8 Million • Fortical Rx share Dec 2009 was 43% • Unigene Income from Fortical sales in 2009 was $10.9 Million |

19 Novartis/Unigene Oral Calcitonin Collaboration • Oral Calcitonin for Osteoporosis and Osteoarthritis – Novartis’ Phase III study with oral calcitonin for osteoporosis (4,500 patients, 3 years) initiated February 2007, recruiting completed • Estimated filing for regulatory review 2011* – Novartis’ Phase III study with oral calcitonin for knee osteoarthritis (2,000 patients, 2 years) initiated May 2007, recruiting completed – Novartis’ second Phase III study with oral calcitonin for knee osteoarthritis initiated October 2008, recruiting completed • Potentially the first disease-modifying drug for osteoarthritis • Estimated filing for regulatory review 2011* Dec 10, 2009 – After reviewing 1 year safety and efficacy data, an independent Data Monitoring Committee informed Novartis and its partner Nordic Bioscience about their unanimous

recommendation to proceed with the Osteoporosis Phase III Study 2303 and the

Osteoarthritis Phase III Study 2301. * www.novartis.com/research/pharmaceutical-product.shtml

|

20 Oral Calcitonin Licensing Deal With Tarsa Therapeutics – Tarsa Therapeutics, a new pharmaceutical company focused on the development of the

Enteripep® oral sCT program – Exclusive license for Enteripep® Oral sCT granted to Tarsa by Unigene – Tarsa to assume all development and commercialization responsibilities – David Brand, former GSK executive with 30 years pharmaceutical experience, hired as Tarsa’s

CEO – Held senior management positions at GSK in marketing, business development and international

operations Involved in the launch of many products, including Paxil, Kytril, Coreg,

Hycamptin, Requip and Avandia – Assembled a Team of Seasoned Biopharmaceutical Executives to Commercialize the Asset – $24 million in Series A financing from leading healthcare VC firms – Syndicate members are MVM Life Science Partners, Quaker BioVentures and Novo A/S – Unigene’s financial participation – 26% ownership of Tarsa – Unigene received $9 million at close for reimbursement of expenses related to the clinical

study – Milestone payments associated with sales benchmarks – Unigene will receive pass through royalties on sale of product – Unigene holds one Board seat and Unigene’s Vice President of Product Development serves as

Tarsa’s Chief Scientific Officer |

21 Tarsa Therapeutics Development of Unigene’s Oral Calcitonin • Unigene licensed it’s oral calcitonin product to Tarsa Therapeutics in October of 2009 • Tarsa is pursuing 505(b)(2) pathway • Tarsa Therapeutics is managing A global phase III trial called the “ORACAL” study – Compares oral calcitonin to intranasal and placebo in a double blind, non-inferiority study – Trial has completed enrollment and data will be available in spring of 2011 (www.clinicaltrials.gov) • For more information see (www.tarsatherapeutics.com)

|

22 Oral PTH Analog |

23 Limitations of Injectable PTH = The Need For Unigene’s Oral PTH Analog Unigene Oral PTH Solution Injectable PTH Limitations High Patient Cost Difficult Posology Black Box Warning Restrictive Product Label Unigene’s Secrapep™ technology establishes an attractive COGs as well as commercial scalability that will satisfy the needs of oral administration Oral dosing will increase patient acceptance and compliance Potential room temperature stability of tablets would increase convenience to patient Concerns of osteosarcoma with PTH therapy have largely dissipated following several years of market exposure of Lilly’s Forteo. Possibility of new oral product without black box warning The availability of a safe, cost effective oral anabolic therapy could alter the standard of care to bring PTH to the status of a first line therapy for patients with established osteoporosis

|

24 Market Opportunity for Unigene’s Oral PTH Analog |

25 Conclusions from Phase I

Study UGL-OR0901 and Path Forward • The amount of drug measurable in circulating plasma was significantly higher than reported for Forteo ® at the 20 µg marketed dose • The dose variability in this study was significantly reduced compared to previous studies with oral formulations • There were no cardiac events or other serious adverse events reported during the study • The bone anabolic activity of the oral PTH analog will be confirmed in a Phase II clinical study in osteoporotic women measuring lumbar spine BMD and plasma PINP as the primary and secondary endpoints Unigene eligible to receive up to $142 million from GSK in additional milestones through marketing approval |

26 Unigene IP Protection May Create Barriers Against Competitive Entry For More Than A Decade Coverage Region Patent Title Latest Patent Expiry * Based on pending patent applications US/ROW Recombinant expression for PTH Analog 2025 US/ROW Oral delivery of PTH Analog 2028* |

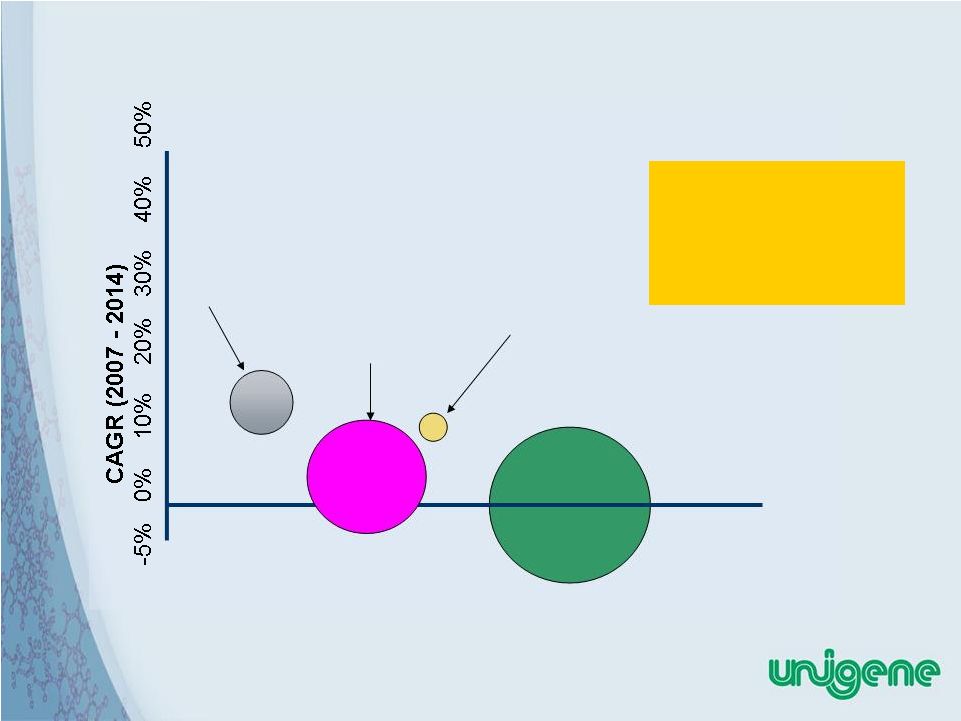

27 Forteo® Revenue Forecast (US) $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Year Revenue U.S. Osteoporosis Market June 26, 2008 Frost & Sullivan Market Engineering The Market For Forteo ® Has Shown Consistent Growth A new entrant, that addresses Forteo ® deficiencies should sharply accelerate PTH adoption and revenue growth |

28 Life Cycle of Osteoporosis Drugs (U.S. Sales) Note: Bubble Diameter Indicates Segment’s 2007 Revenue Size. Infancy Early Growth Late Growth Maturity Segment Life Cycle Stage Calcitonins $286.1 million Parathyroid Hormones $494.1 million SERMS $706.1 million Bisphosphonates $3,366.0 million PTH In Early Growth Stage • Market growth potential • Room for competitive products • Cost advantages can grow market. |

29 PTH Competitive Landscape •High cost to patient •Requires daily injection •Refrigerated storage •Black Box Warning Issues Forteo® - Lilly •Market Leader •IP Protection •Only Anabolic on the US Market Products •No US Presence •Difficult to Manufacture •Only available as injectable Preos ® - NPS/Nycomed •Approved & Marketed in Europe •Seeking US Indication for Hypo- parathyroidism Follow On Products 505(b)(2) ZT-034 - Zelos™ •Initiated Ph 1 trial for Injectable- 10/09 •Initiated Ph 1 trial for Nasal- 01/10 ZP PTH - Zosano Pharma •Transdermal micro needle patch •Completed Ph 2 study- increased hip and spine BMD RF Transdermal Patch- Transpharma/Lilly •Phase 2b 1 year Study Projected completion July 2011 |

30 Osteoporosis Treatments SDBG University of London Collaboration Obesity Introduction to Unigene and its Objectives Unigene Technology Overview China Joint Venture |

31 Obesity Market – Obesity is growing faster than any previous public health issue. If current trends continue, 103 million American adults will be considered obese by 2018. – The U.S. is expected to spend $344 billion on health care costs attributable to obesity in 2018 if rates continue to increase at their current levels. Obesity-related direct expenditures are expected to account for more than 21 percent of the nation’s direct health care spending in 2018. – The U.S. anti-obesity prescription market is expected to grow from $262.3 million in 2005 to $1,774.1 million in 2012 representing a CAGR of 31.4 percent. References: The Future Costs of Obesity: National and State Estimates of the Impact of Obesity on Direct Health Care Expenses A collaborative report from United Health Foundation, the American Public Health Association and Partnership for Prevention

November 2009 U.S. ANTI-OBESITY PRESCRIPTION MARKETS October 2006 Publisher: Frost & Sullivan, |

32 Unigene Commercial Opportunities • Unigene class of peptides are covered by strong composition of matter IP • Amenable to both Enteripep ® and Secrapep ® platform technologies • Oral delivery advantage versus injection for all peptide based products currently in clinical development • Unigene peptides shown to decrease food intake by greater than 50% over placebo in rats • Importance of obesity treatment as unmet medical need is highlighted by Amylin Pharmaceuticals signed $1 billion deal with Takeda ($70 million upfront) for injectable peptide products for obesity |

33 Current Status of Unigene Obesity Peptides • Original anorexigenic peptide (presented at the Keystone 2009 Symposium) was UGP 269 • Several additional peptides, including UGP271, UGP276, and UGP281 have now been synthesized and tested • To date, the peptide with the highest potency is UGP281 Oral delivery studies in beagle dogs are currently ongoing 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.7 12.8 12.9 13.0 Weight Change Following Oral Capsule Administration of sCT or UGP269 in Beagle Dogs No capsule Group 2 UGP269 Placebo No capsule Group 1 0 7 14 21 28 35 No capsule No capsule UGP269 Days Group 1 sCT |

34 IP Position on Unigene Obesity Peptides • Unigene has filed for composition of matter as well as use patents for these peptides. • Unigene also has broad patent coverage on oral delivery of peptides, and on recombinant production and in vitro amidation. Placebo UGP281 Peptide A Days Placebo UGP281 Ppetide A Effect on Food Consumption and Weight of Rats UGP281 has greater efficacy than other peptides in clinical development -80 -60 -40 -20 0 20 -2 -6 -4 -2 0 2 4 0 2 4 6 8 10 12 14 16 |

35 Introduction to Unigene and its Objectives Unigene Technology Overview Osteoporosis Treatments SDBG University of London Collaboration Obesity China Joint Venture |

36 SDBG: A Revolutionary Technology Developed in Collaboration With Dr. Agnès Vignery of Yale University – SDBG technology promotes growth of bone to specific skeletal sites – Spine: as treatment and/or prevention of vertebral crush fractures associated

with osteoporosis – Hip: Prevention of hip fracture in patients at high risk and potential treatment

to accelerate healing – Trauma Fractures: Potential therapy to accelerate fracture repair in non-

union fractures – Novel therapy involving a minimally invasive surgical procedure followed by drug therapy – Bone marrow in targeted bone is removed by irrigation. – Follow-up bone anabolic treatment with bone anabolic therapy for 6 months to 1

year promotes accelerated bone growth to irrigated section as well as

overall benefits to the skeleton – Bone cement can be employed where stabilization of bone is needed and provides a scaffold for new bone growth – Strong IP position on combination therapy, surgical devices and cement Two issued Unigene patents covering combination therapy |

37 Projected Incidence Of Vertebral Crush Fracture (VCF) Treatments, Hip Fractures and Traumatic Non-union Fractures 0 100000 200000 300000 400000 500000 VCF Repair Procedures Hip Fractures Long Bone Non-union Fractures Data collected and prepared from numerous sources by Unigene contracted market research firm |

38 Bone Marrow Irrigation Promotes a Transient Induction in Bone Formation: Anabolic Treatment Augments the Response Control Treated |

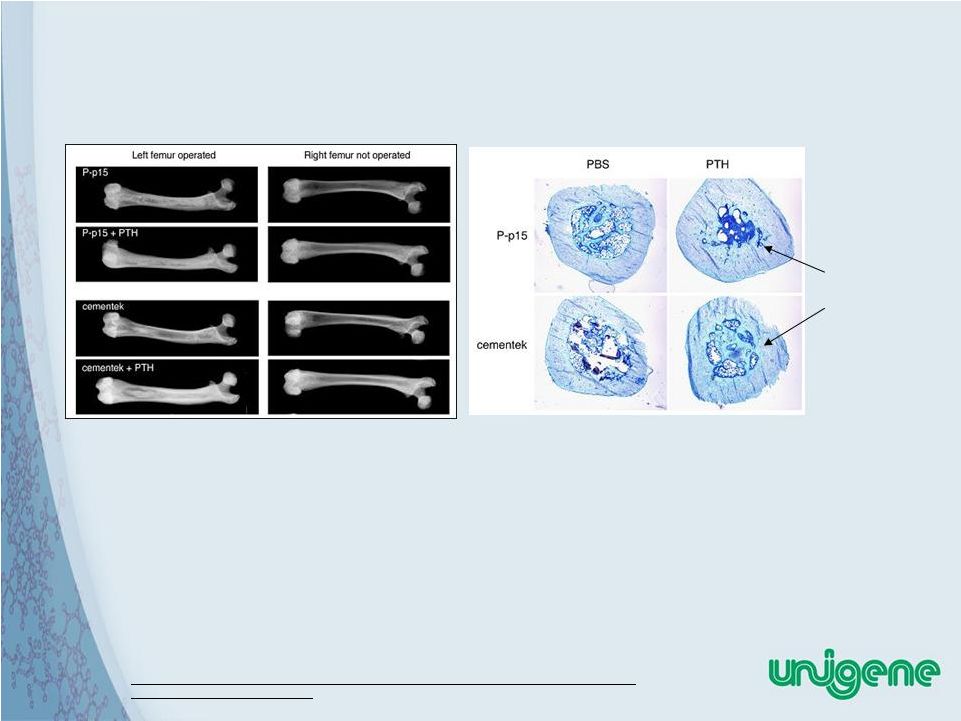

39 Bone Augmentation In Conjunction With Biocompatible Cements* • Proprietary BioCompatible Cement – Cohesiveness – Hardness – Osteo-inductive and conductive – Proper flow characteristics • Combination Of Cement And Anabolic Resulted

In Unexpected Increase In Cortical Bone Thickness Increased cortical bone thickness * Q. Zhang, J. Carlson, HZ. Ke, J. Li, M. Kim, K. Murphy, N. Mehta , J. Gilligan, A Vignery. Dramatic increase in cortical thickness induced by femoral marrow ablation followed by

a three- month treatment with PTH in rats. JBMR Feb 2010, |

40 Unigene Opportunities (Licensing Strategy) • License to large pharmaceutical company – Allows full development of technology – Requires company with presence in medical devices and pharmaceutical products • License to surgical device specialty company – Greater number of potential partners – Unigene has option of holding marketing rights or licensing separately the anabolic therapy |

41 Introduction to Unigene and its Objectives Unigene Technology Overview Osteoporosis Treatments SDBG University of London Collaboration Obesity China Joint Venture |

42 Annexin 1 Peptide In Collaboration With Dr. Mauro Perretti Of Queen Mary College University of London – Annexin 1 (Anx-A1) is one variant of a large group of proteins that bind cell membranes in a calcium-dependent manner. – Some of the anti-inflammatory actions of glucocorticoids have been shown to be due to the up-regulation of Anx-A1 and its receptor (FPRL-1) – Exogenous ANXA1 and N-terminus derived peptides inhibit leukocyte recruitment in several experimental rodent models of rheumatoid arthritis, stroke and myocardial infarct – N-terminal fragments of the Anx-A1 retain the anti- inflammatory potency of the full-length molecule – Analogs of N-terminal fragments currently being developed will provide new composition of matter IP |

43 Annexin 1 Commercial Opportunities – Potential Indications: – Percutaneous Coronary Angiography – Organ Transplantation – Reperfusion Injury • Stroke • Myocardial infarction – Chronic Inflammatory Conditions – Ophthalmic inflammation – Unigene will file for composition of matter IP – Peptides can be manufactured using Secrapep ® technology |

44 Combination Products With Salmon Calcitonin |

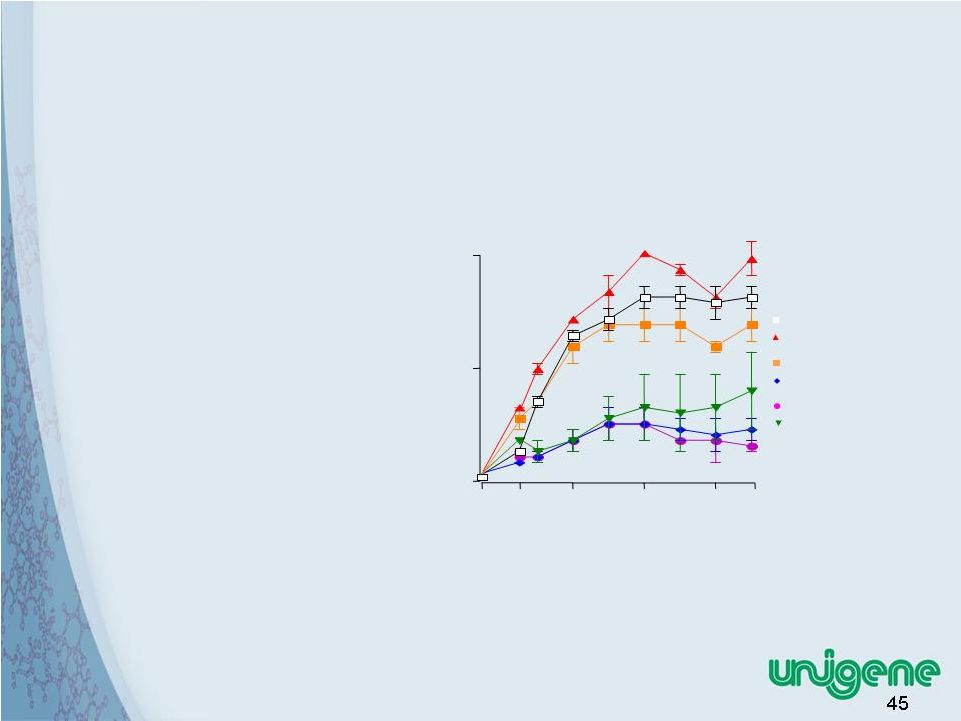

45 Calcitonin Plus Low Dose Glucocorticoid Dramatically Reduces Inflammation • Calcitonin combination reduces glucocorticoid dose by 5 fold in rat inflammation model • Reduces side effects of chronic glucocorticoid therapy • Enables chronic use of glucocorticoid for rheumatoid arthritis and other inflammatory conditions Clinical Score (units) 0 10 20 11 13 16 20 24 26 Time post-CIA (days) control sCT (2 µg/kg/day) sCT+Pred (3 mg/kg/day) sCT+Pred (0.6 mg/kg/day) Pred (3 mg/kg/day) Pred (0.6 mg/kg/day) |

46 Introduction to Unigene and its Objectives Unigene Technology Overview Osteoporosis Treatments SDBG Obesity / Satiety Annexin China Joint Venture |

47 Unigene Biotechnology Co. (China) – Joint venture of Unigene and SPG of China – 45% owned by Unigene Laboratories Inc. – Groundbreaking April 2008 – Exterior construction completed – Goal to be operationally compliant with FDA and ICH guidelines – Manufacturing – Bacterial fermentation (expansion suites) – Tablet manufacturing – Liquid fill suites |

48 Unigene Biotechnology Co. (China) • China Represents One of the Fastest Growing Pharmaceutical Markets in the World • CSPC is One of the Most profitable Pharmaceutical Companies in China • Listed on the Hong Kong Stock Exchange • Principally Owned by Lenovo Holdings • Near Term Market Opportunity Under Chinese NDA for: – Oral and Nasal sCT products – PTH (Injectable and Nasal) • Developing Peptides for Diabetes – Exenatide and Others • Opportunity for Small Molecule Generics • Contract Peptide API Manufacturing for Big Pharma |