Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 27, 2009

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 333-116843

SOLO CUP COMPANY

(Exact name of registrant as specified in its charter)

| Delaware | 47-0938234 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 150 South Saunders Road, Suite 150, Lake Forest, Illinois | 60045 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 847/444-5000

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of March 25, 2010, 100 shares of Common Stock, $0.01 par value, were outstanding. There is no trading market for the common stock of the registrant. No shares of the registrant were held by non-affiliates.

Table of Contents

i

Table of Contents

| Item 1. | Business. |

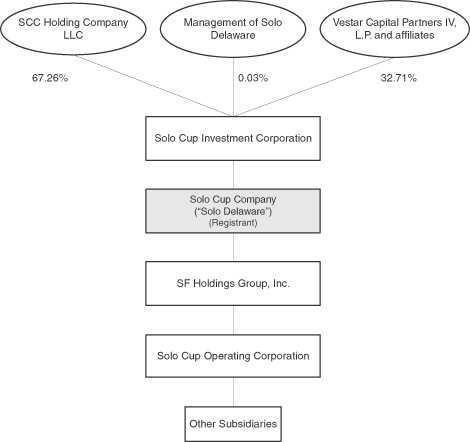

Solo Cup Company (“Solo Delaware”) was incorporated in Delaware in January 2004 to be the holding company for Solo Cup Company, an Illinois corporation (“Solo Illinois”), and its subsidiaries, and for SF Holdings Group, Inc. and its subsidiaries, including Sweetheart Cup Company Inc. Effective February 22, 2004, Solo Illinois became a wholly owned subsidiary of Solo Delaware, and Solo Delaware acquired 100% of the outstanding capital stock of SF Holdings. Prior to these transactions, Solo Delaware had no operations other than in connection with its formation and the authorization of the transactions described above.

Solo Illinois was established in 1936. Sweetheart Cup Company’s operating history dated back to the founding of a predecessor company in 1911. In September 2005, Sweetheart Cup Company changed its name to Solo Cup Operating Corporation, and in October 2005, Solo Illinois merged with and into Solo Cup Operating Corporation, with Solo Cup Operating Corporation as the surviving entity. As a result of these transactions, Solo Delaware is a holding company, the material assets of which are 100% of the capital stock of SF Holdings. SF Holdings owns 100% of the capital stock of Solo Cup Operating Corporation.

Solo Delaware is a wholly owned subsidiary of Solo Cup Investment Corporation, a Delaware corporation. SCC Holding Company LLC, a Delaware limited liability company, owns 67.26%, Vestar Capital Partners IV, L.P. and certain of its affiliates own 32.71%, and management of Solo Delaware owns the remaining 0.03%, of Solo Cup Investment Corporation as of March 15, 2010.

In this annual report, the terms “we,” “us” and “our” refer to Solo Delaware and its direct and indirect subsidiaries. Our fiscal year is the 52- or 53-week period ending on the last Sunday in December, except that our fiscal year 2005 ended on January 1, 2006. Our fiscal quarters for 2009 were the thirteen weeks ended March 29, June 28, September 27 and December 27, 2009.

1

Table of Contents

Overview of Business

We are a leading producer and marketer of single-use products used to serve food and beverages in the home, quick-service restaurants, and other foodservice settings. We distribute our products globally and have served our industry for more than 70 years. We manufacture and supply a broad portfolio of single-use products, including cups, lids, food containers, plates, bowls, portion cups, cutlery and straws, with products available in plastic, paper, foam, post-consumer recycled content and annually renewable materials. We are recognized for our customer service, and our products are known for their quality, reliability and consistency. Our products are marketed primarily under the Solo® brand, as well as Jack Frost®, Trophy® and Bare™ by Solo. We are one of the leading suppliers of branded single-use cups, plates and bowls in the United States. We also provide a line of products to select customers under private label brands.

We currently operate 15 manufacturing facilities and 13 distribution centers, some of which are combined with a manufacturing facility at a single location, in North America, the United Kingdom and Panama.

We generated approximately $1.5 billion of net sales for fiscal year 2009. Financial information about our two business segments – North America and Europe – is disclosed in Note 19 to our consolidated financial statements included in Item 8 of this annual report.

Products

We produce a broad range of plastic, paper and foam single-use products used to serve food and beverages. Our plastic products include a wide range of cups, lids, food containers, plates, bowls, cutlery and portion cups, as well as food packaging containers. Our paper products include cups, plates, bowls, portion cups and food containers. Our foam products include cups, plates and bowls. Our plastic, paper and foam products are offered in a variety of sizes, designs and colors, and at a range of price points. We also offer an Eco-forward™ product line called Bare by Solo, which includes products made with recycled plastic or paper, compostable products made with wax, plant-based polylactic acid (PLA) or sugarcane, and products made with other renewable resources.

Customers

We serve two primary customer groups: (1) foodservice distributors and operators, referred to collectively in this annual report as foodservice customers; and (2) retailers of consumer products, referred to in this annual report as consumer customers.

Foodservice

Approximately 81% of our net sales for fiscal year 2009 were to foodservice customers, including:

| • | foodservice distributors, including broadline distributors, such as Sysco Corporation, U.S. Foodservice, Inc., Gordon Food Service and Foodservices of America Inc., and specialty distributors, such as Bunzl plc, Network Services Company and UniPro Foodservice, Inc.; and |

| • | foodservice operators, such as Starbucks Corporation, Dunkin’ Donuts, McDonald’s Corporation, YUM! Brands, Inc., Panera Bread Company, ARAMARK Corporation and Sodexo. |

We believe we have strong relationships with our foodservice customers due to our broad array of product offerings, longstanding leadership in the industry and demonstrated capability in product quality, innovation, graphics and customer service.

We sell our products to foodservice customers through our regionally organized, in-house direct sales force, national account direct sales force and, to a lesser extent, select broker networks. We also maintain direct selling relationships with several of our major national accounts for which we provide direct customer service and tailored products for specific customer requirements. Our distributor-customers’ stocking decisions are based on demand from foodservice operators. Consequently, our direct and national account sales force focuses on maintaining both a service-oriented supplier relationship with distributors and on driving end-market demand from foodservice operators by offering a breadth of high-quality products. Our sales force works closely with distributors and their customers to develop unique product offerings and promotional programs.

Consumer

Sales to consumer customers accounted for approximately 19% of our net sales for fiscal year 2009 and are made through various outlets, including:

| • | grocery stores, such as Publix Super Markets, Inc., The Kroger Co. and Albertson’s, Inc.; |

| • | mass merchandisers, such as Target Corporation and Wal-Mart Stores, Inc.; |

| • | warehouse clubs, such as Costco Wholesale Corporation and BJ’s Wholesale Club, Inc.; |

2

Table of Contents

| • | value channel stores, such as Dollar General Corporation, Family Dollar Stores Inc., ALDI Inc. and Sav-A-Lot Foods Inc.; and |

| • | other retail outlets, such as drug and party stores. |

We sell to a diverse group of consumer customers primarily through regional broker networks. In the case of some of our larger consumer customers, such as Costco Wholesale Corporation, we maintain a direct supplier relationship through our in-house direct sales force. Our sales and marketing strategy for consumer customers is designed to support our strong brand names and private label product offerings and includes integrated marketing programs that consist of a combination of in-store, online, television, print and product-placement brand enhancement activities.

Any backlog of orders we may have with our foodservice or consumer customers is not material.

Seasonality

Historically, we have experienced fluctuations in sales by season. We have higher sales volume in the warmer months and realize the majority of our net cash flows from operations during the last nine months of the year. Typically, during the first quarter we build inventory to meet demand in the warmer months. Sales for such periods reflect the high seasonal demands of the summer months when outdoor and away-from-home consumption increases.

Raw Materials

In recent years, including 2009, our industry has experienced volatility in raw material and energy pricing. The principal raw materials we use are various types of resins for our plastic operations and paperboard for our paper operations. The resins include polystyrene, polypropylene and polyethylene terephthalate, or PET. We purchase resins from large petrochemical and resin producers. Resin prices are influenced by other input prices, such as crude oil, natural gas, benzene, ethylene, propylene and paraxylene, as well as availability of supply and changes in demand.

The principal raw material used in our paper operations is solid bleached sulfate paperboard. We purchase coated and uncoated board from a variety of large and small paperboard manufacturers. Paper prices are driven by global supply and demand as well as input costs for energy, fiber, chemicals, polyethylene and transportation.

We believe we have good relationships with our major raw material suppliers. For 2009, our overall supply of raw materials was adequate, and for 2010, we believe it will remain adequate.

Our raw material costs make up a significant portion of our cost of goods sold. Although we generally enter into one- to three-year supply contracts with a number of our raw material suppliers, we continue to have exposure to changes in raw material prices. Historically, we have not hedged our exposure to fluctuations in raw material prices.

Manufacturing

Our manufacturing strategy is to reduce costs through continuous process improvements and innovation, while meeting our customers’ needs and maintaining our standard for quality. We employ many different technologies and strategies to supply a wide product line, including working with third parties to supply manufacturing capability in instances where expertise or economies of scale are not available in-house. We manufacture and supply various products in plastic, paper and foam. Our flexibility and expertise in these technologies enable us to respond quickly to customer needs.

The primary processes that we use to manufacture our products are as follows:

| • | Plastic cups, lids, plates and bowls and foam plates. We use plastic extrusion to convert plastic resin from pellets to a flat extruded sheet. Using a thermoforming process, we convert the extruded sheet into the final product. We then add graphics based on customer specifications and package our products in various quantities depending on customer requirements. We have the capability to use a large variety of resins, including polystyrene, polypropylene and PET. |

| • | Paper cups, plates and food containers, and foam cups. We emboss or print graphics on paperboard according to customer requirements and feed the paperboard through machines that cut, form or fold the material into the final product. Thin wall foam cups are formed using a process similar to paper cups. |

| • | Plastic Cutlery. We utilize injection molding machines to manufacture plastic cutlery. We melt plastic pellets and then inject the molten resin into molds. The parts are automatically cooled, trimmed and ejected from the machines. We then individually wrap or package the product in bulk. We can make our plastic cutlery products with polypropylene or polystyrene. |

3

Table of Contents

Distribution

Our self-managed distribution centers in North America are located in proximity to major population centers, generally consolidating the output of our manufacturing operations. As a result of this strategy, we are able to offer a broad range of products from our distribution centers and provide value to our customers, as we can react to their demand more rapidly and they can carry less inventory. Our foreign subsidiaries operate out of owned or leased warehouses and manage the related distribution and transportation networks.

Competition

We compete in the single-use foodservice products industry. The industry encompasses a wide variety of products, including single-use cups, lids, plates, bowls, containers, cutlery and straws. These products are manufactured from plastic and paper raw materials, such as coated and uncoated paperboard, polystyrene, polypropylene and PET, emerging bio-resins such as PLA, and renewable resources such as sugarcane.

The single-use foodservice products industry is extremely competitive and highly fragmented. We compete for customers based on brand reputation, quality, cost, customer service, breadth of product offering, product differentiation, innovation, marketing programs and value. Our competitors include large multinational companies as well as regional manufacturers. Some of our competitors compete across many of our product lines, while most compete with only some of our products. A few of our competitors are integrated in the manufacturing of single-use foodservice products and related raw materials, which reduces their costs for these materials and gives them greater access to these materials in periods of short supply. Our products also compete with metal, glass and other packaging materials, as well as plastic packaging materials made through different manufacturing processes. We also face competition from foreign competitors who are entering regional U.S. markets in some product categories and are aggressively trying to differentiate their product offerings based on price.

Intellectual Property

We rely on a combination of trade secrets, confidentiality agreements, patents, trademarks, copyrights, licenses, and contractual provisions, as well as various intellectual property and unfair competition laws to protect our intellectual property and other proprietary rights. We own a number of patents and trademarks, which vary in duration depending upon when the application was filed or granted. We believe that, in the aggregate, the rights under our patents and trademarks are generally important to our business; however, no single right is material to our business. Litigation may be necessary to enforce our intellectual property rights and protect our proprietary information, or to defend against claims by third parties related to our intellectual property, and could result in substantial costs and diversion of our resources. Even if our proprietary rights are enforceable, others may be able to design around our patents or independently develop products and processes equivalent to our proprietary and confidential information.

Research and Development

Our research and development strategy has three goals: (1) create innovative, value-added products and packaging that target both new and existing customers; (2) differentiate our products in the marketplace; and (3) explore the use of alternative substrates to create new products and market opportunities and enhance our overall market position. We continue to develop, test and sample new and recycled raw materials for use in paper and plastic products, including those derived from renewable resources. In 2009, we continued our significant investments in manufacturing lines for our core product categories, as well as in support of new products developed in conjunction with our customers.

International

Our international operations consist of operating subsidiaries in the United Kingdom, Canada, Panama and Mexico, as well as international export sales originating in the United States and at our international subsidiaries. Approximately 20% of our net sales for fiscal year 2009 were generated outside of the United States. International operations are subject to additional risks inherent in conducting business outside the United States, such as changes in currency exchange rates, price and currency exchange controls, import restrictions, nationalization and other restrictive governmental actions, as well as volatile economic, social and political conditions in some countries.

4

Table of Contents

Employees

As of December 27, 2009, we had approximately 6,800 employees worldwide, including approximately 5,600 in the United States. Approximately 5,300, or 78%, of our total employees worldwide were hourly employees, and approximately 700, or 13%, of those hourly employees were covered by collective bargaining agreements. We currently have collective bargaining agreements in effect at our facilities in Scarborough, Ontario, Canada; Cuautitlan, Mexico; Springfield, Missouri; Augusta, Georgia; and Juan Diaz, Panama. These agreements cover all hourly-paid production, maintenance and distribution employees at each such facility and contain standard provisions relating to, among other things, management rights, grievance procedures, strikes and lockouts, seniority and union rights. The current expiration dates of the Scarborough, Cuautitlan, Springfield, Augusta, and Juan Diaz agreements are November 30, 2010, December 31, 2010, February 28, 2011, March 31, 2012, and June 30, 2013, respectively. Other than the agreements described above, no employees currently are covered by collective bargaining agreements. We believe that we have good relationships with our employees.

Environmental Regulation

In the normal course of business, we are required to comply with federal, state, foreign and local environmental and occupational health and safety laws and regulations, including those governing emissions of air pollutants, discharges of waste and storm water, and the handling, use, treatment, storage and disposal of, or exposure to, hazardous substances. Historical capital and operating expenditures deemed necessary to remain in compliance have not had a material impact on our financial position. We believe that we are in material compliance with applicable standards and regulations of the various regulatory agencies.

The federal Clean Air Act requires the phase-out of specified refrigerant compounds. Although we are grandfathered in, we must upgrade or retrofit the air conditioning and chilling systems we currently use during the next few years. We have decided to replace units as they become inefficient or unserviceable, and we do not believe that the costs associated with such replacement will be material to our business, financial condition, results of operations or cash flows.

Some of our facilities contain asbestos. We monitor such asbestos on an ongoing basis and maintain and/or remove it as appropriate to prevent the release of friable asbestos. We do not believe the costs associated with this program will be material to our business, financial condition, results of operations or cash flows.

We have received a number of requests for information or notifications of potential liability under the Comprehensive Environmental Response, Compensation and Liability Act of 1980, or CERCLA, regarding the investigation or cleanup of environmental contamination at third-party sites. We have no reason to believe that the final outcome of these matters will have a material adverse effect on our business, financial condition, results of operations or cash flows; however, we can give you no assurance about the ultimate effect, if any, of such matters on us.

Available Information

Our Internet website is www.solocup.com. We are an electronic filer and make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to our reports filed or furnished pursuant to Section 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such materials with, or furnish such materials to, the Securities and Exchange Commission, or SEC. You may read and copy any materials we file with the SEC at its Public Reference Room at 100 F Street, NE., Washington, DC 20549. Information relating to the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains our annual, quarterly and current reports, and other information that we file electronically with the SEC.

5

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K, including without limitation the statements found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 below, contain forward-looking statements. The words “anticipate,” “intend,” “plan,” “estimate,” “believe,” “expect,” “predict,” “potential,” “project,” “could,” “will,” “should,” “may,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All statements in this report other than statements of historical fact, including statements regarding our business strategy, future operations, financial position, prospects, plans and objectives, as well as information concerning industry trends and expected actions of third parties, are forward-looking statements. All forward-looking statements speak only as of the date on which they are made. Such statements reflect our current assumptions concerning future events and are subject to a number of risks and uncertainties, many of which are outside our control and could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the factors listed in “Risk Factors” in Item 1A below. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, to reflect actual results or changes in factors or assumptions affecting such forward-looking statement.

| Item 1A. | Risk Factors. |

Set forth below and elsewhere in this annual report are risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report and in other documents we file with the SEC. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impact our business. Any or all of these risks could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our ability to meet our cash requirements and service our debt is impacted by many factors that are outside our control, including the current global recession and restricted credit markets.

Our future operating performance is dependent on many factors, some of which are beyond our control, including prevailing economic, financial and industry conditions. The sales of our products are primarily dependent on the discretionary income of consumers. If global economic conditions continue to adversely affect employment rates and consumer discretionary spending, our sales could continue to decline or become increasingly concentrated in lower-margin products, and our business, financial condition, results of operations or cash flows could be adversely affected.

The impact of the global recession and credit crisis on our suppliers and customers is also unpredictable, outside of our control and may create additional risks for us, both directly and indirectly. The inability of our raw material suppliers to access financing or the insolvency of one or more of our raw material suppliers, could lead to disruptions in our supply chain, which could adversely affect our sales or increase our costs. Our suppliers may require us to pay cash in advance or obtain letters of credit for their benefit as a condition to selling us their products and services. A number of restaurant chains and consumer product retailers have sought bankruptcy protection. If more than one of our principal customers filed for bankruptcy, our sales could be adversely affected and our ability to collect outstanding accounts receivable from any such customer could be limited. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, results of operations or cash flows.

Our operating performance is dependent on our continued ability to access funds under our asset-based revolving credit facility and Canadian credit facility, maintain sales volumes, drive profitable growth, realize cost savings and generate cash from operations. The financial institutions that fund our asset-based revolving and Canadian credit facilities are also being affected by the volatility in the credit markets. If one or more of those institutions cannot fulfill one of our revolving credit requests, then our operations may be adversely affected. If we cannot borrow under one of our credit facilities because a lender is unable to fund requested amounts, we do not have a sufficient borrowing base or we otherwise are unable to comply with the terms and conditions under the applicable credit facility, or if we do not meet our cost, sales or growth initiatives within the time frame we expect, our business, financial condition, results of operations and cash flows could be materially adversely affected.

A material decline in our cash flows also could cause us to fail to pay interest or principal when due under our asset-based revolving or Canadian credit facility, the indenture for our senior secured or senior subordinated notes or under our other debt agreements. A payment default or a default under any of the other covenants in our debt agreements could restrict or terminate our access to borrowings and materially impair our ability to meet our obligations as they come due. If we do not comply with our payment or other covenants under our debt agreements and we do not obtain a waiver or amendment that otherwise addresses that non-compliance, the lenders who participate in our asset-based revolving and Canadian credit facilities may accelerate payment of all amounts outstanding under the credit facilities, which amounts would immediately become due and payable, together with accrued interest. Such an acceleration would cause a default under the indentures governing our senior secured and senior subordinated notes, under our lease agreement with iStar SCC Financial Distribution Centers LLC covering six of our facilities and under other agreements that provide us with access to funding. Our ability to generate sufficient cash flow to service our debt and meet our other needs, or a default of any of the covenants under our debt agreements, may require us to reduce expenditures that we deem necessary to our business, refinance all or a portion of our debt or obtain additional financing. We cannot assure you that any refinancing of this kind would be possible or that any additional financing could be obtained on acceptable terms or at all. The inability to refinance existing debt or obtain additional financing could have a material adverse effect on our business, financial condition, results of operations and cash flows, and on our ability to meet our obligations under our credit facilities, indentures and other agreements as they become due. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” in Item 7 of this annual report.

6

Table of Contents

Our significant level of debt could limit cash flows available for our operations, adversely affect our financial health and prevent us from fulfilling our obligations under our credit facilities, indentures and other debt agreements.

We have a significant amount of debt. As of December 27, 2009, we had total debt of $636.1 million, which included $325.0 million of our 8.5% senior subordinated notes, $294.3 million of our 10.5% senior secured notes (reflecting $300.0 million in aggregate principal amount less $5.7 million of unamortized original issue discount), $15.0 million of borrowings under our asset-based revolving credit facility, $0.4 million of borrowings under our Canadian credit facility and $1.4 million of capital lease obligations. We also had additional borrowing capacity, subject to borrowing base limitations and other specified terms and conditions, of $172.5 million under our asset-based revolving credit facility and $15.3 million under our Canadian credit facility, in each case after taking into account outstanding letters of credit.

Our significant level of debt could have important consequences for our business, including:

| • | requiring that we use a large portion of our cash flows to pay principal and interest on borrowings under our credit facilities, our senior secured and senior subordinated notes and our other debt, which would reduce the availability of cash to fund working capital, capital expenditures, research and development and other business activities; |

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | restricting us from making strategic acquisitions or exploiting business opportunities; |

| • | making it more difficult for us to satisfy our obligations under the credit facilities, the senior secured and senior subordinated notes and our other debt; |

| • | placing us at a competitive disadvantage relative to competitors that have less debt; and |

| • | limiting our ability to borrow additional monies in the future to fund working capital, capital expenditures, research and development and other business activities. |

We may be able to incur significant additional debt that could further exacerbate the risks associated with our substantial leverage.

We may incur additional debt in the future. Although the indentures governing our senior secured and senior subordinated notes and the terms of our asset-based revolving and Canadian credit facilities contain restrictions on our incurrence of additional debt, these restrictions are subject to a number of qualifications and exceptions, and we could incur significant additional debt. As of December 27, 2009, we had available capacity, subject to borrowing base limitations and other specified terms and conditions, of $187.8 million under our asset-based revolving and Canadian credit facilities, in each case after taking into account outstanding letters of credit. If we incur additional debt, the risks described above under “Our significant level of debt could limit cash flows available for our operations, adversely affect our financial health and prevent us from fulfilling our obligations under our credit facilities, indentures and other debt agreements” would intensify.

Covenant restrictions under our debt agreements may limit our ability to operate our business.

The indentures governing our senior secured and senior subordinated notes, the agreements governing our asset-based revolving and Canadian credit facilities and the agreements governing our other existing debt contain covenants that may restrict our ability to finance future operations or capital needs or to engage in other business activities, which restrictions include, among other things, limitations on our ability to:

| • | incur additional debt or issue preferred and other specified classes of stock; |

| • | create liens; |

| • | pay dividends, make investments or make other restricted payments; |

| • | sell assets; |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| • | enter into transactions with affiliates; and |

| • | designate subsidiaries as unrestricted under specified agreements governing our indebtedness. |

7

Table of Contents

In addition, if our available capacity under the asset-based revolving credit facility falls below a specified level (the greater of (a) $15,000,000 or (b) 15% of the lesser of our borrowing base or the aggregate amount of commitments under the facility), we will be required to maintain a Fixed Charge Coverage Ratio (as defined in the facility) of 1.1 to 1 for a trailing twelve-month period.

A breach of any of these covenants would result in a default under the loan agreements governing our asset-based revolving and Canadian credit facilities and under the indentures governing our senior secured and senior subordinated notes. If an event of default under the loan agreement governing our asset-based revolving or Canadian credit facility, the indenture governing our senior secured or senior subordinated notes or our other debt agreements, all amounts outstanding under those agreements could be declared immediately due and payable, together with accrued interest. If all or a portion of our debt were accelerated, we cannot assure you that we would have access to sufficient funds or other assets to pay amounts due.

Failure to maintain our credit ratings could limit our access to the capital markets, adversely affect the cost and terms upon which we are able to obtain additional financing and negatively impact our business.

Although we believe existing cash, funds generated by operations and amounts available under our asset-based revolving credit facility will collectively provide adequate resources to fund our ongoing operating requirements, we may be required to seek additional financing to compete effectively. In light of difficulties in the financial markets, there can be no assurance that we will be able to maintain our credit ratings. We have experienced downgrades in the past and may experience further downgrades. Failure to maintain these credit ratings could, among other things, limit our access to the capital markets and adversely affect the cost and terms upon which we are able to obtain additional financing, including any financing from our suppliers, which could negatively affect our business.

We could be adversely affected by raw material availability and pricing or a shortage of supply due to supplier financial difficulties, natural disasters or other causes.

Our principal raw materials include polystyrene, polypropylene, PET and coated and uncoated paperboard. There are currently a limited number of polystyrene suppliers, and periods of short supply may occur if one or more suppliers’ operations are materially affected by financial difficulties, natural disasters or other factors. To the extent that our supply of raw materials becomes restricted and we cannot locate or substitute adequate alternative sources, our business, financial condition, results of operations and cash flows may be materially adversely affected.

In addition, prices for our raw materials fluctuate. When raw material prices decline, we face increased pressure from our customers to reduce our selling prices for products containing that raw material. When raw material prices increase, our selling prices have historically also increased, although often with a time lag. A number of factors affect the impact that raw material price changes have on us, including the underlying cause of price changes (e.g., natural disasters, weather conditions or general economic conditions), the level of our inventories at the time of price changes, the specific timing and frequency of price changes and the lead and lag time that generally accompany the implementation of both raw material price changes and subsequent selling price changes. If raw material prices increase and we are unable to pass the price increases on to our customers or there is a significant time lag in any selling price increases that we are able to implement, our profitability may be adversely affected, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. We have not historically employed hedging strategies to limit our exposure to fluctuations in raw material prices on any meaningful level.

Our ability to successfully operate is dependent on the availability of energy and fuel at anticipated prices.

Sustained increases in global energy prices, particularly for crude oil and electricity, at prices greater than we have anticipated could have a material adverse impact on our operations if we are unable to pass through such increases to our customers in a timely manner. Increases in crude oil prices particularly impact our transportation and production costs and the price we pay for some raw materials. Global energy prices are determined by many factors that are beyond our control and unpredictable. Consequently, we cannot predict whether global energy prices will remain at their current levels, and we cannot predict the impact that these prices will have on our business, financial condition, results of operations or cash flows.

8

Table of Contents

We operate in a highly competitive environment and may not be able to compete successfully.

The single-use foodservice products industry is extremely competitive and highly fragmented. We compete for customers based on brand reputation, quality, cost, customer service, breadth of product offering, product differentiation, innovation, marketing programs and value. A few of our competitors are integrated in the manufacturing of single-use foodservice products and related raw materials, which reduces their costs for these materials and gives them greater access to the materials in periods of short supply. Our current or potential competitors may offer products at a lower price or products and services that are superior to ours. In addition, our competitors may be more effective and efficient in integrating new technologies or emerging raw materials to meet changing consumer demands or legislative mandates. Our success depends upon successful research, development and engineering efforts to utilize emerging and legislatively mandated raw materials, our ability to expand or modify our manufacturing capacity and the extent to which we are able to convince customers and consumers to accept our new products. If we fail to successfully innovate, introduce, market, manufacture and differentiate our products from those of our competitors, our ability to maintain or expand our net sales and to maintain or enhance our industry position or profit margins could be adversely affected. This, in turn, could materially adversely affect our business, financial condition, results of operations or cash flows.

Our products also compete with products that incorporate metal, glass, reusables and other packaging materials. If we are unable to react timely to changing consumer demands, legislative mandates and competitive conditions that favor those or other competing products, we may experience lower prices, sales volume and gross margins, and a reduced ability to attract and retain customers.

Our operations and products are subject to environmental and governmental regulations that could adversely affect our business, financial condition, results of operations or cash flows.

Our operations are subject to comprehensive and frequently changing federal, state, local and foreign environmental and occupational health and safety laws and regulations. These laws and regulations include the federal Food, Drug and Cosmetic Act, which regulates materials that have direct contact with food, and laws governing the use of specified raw materials in our products, emissions of air pollutants, discharges of waste and storm water, and the handling, use, treatment, storage and disposal of, or exposure to, hazardous substances. We are presently, and may in the future be, subject to liability for the investigation and remediation of environmental contamination, including contamination caused by other parties, at properties that we own or operate or formerly owned or operated, and at other properties where we or our predecessors arranged for the disposal of hazardous substances. As a result, we are involved from time to time in administrative and judicial proceedings and inquiries relating to environmental matters. Any present or future investigations, future clean up costs or remedial efforts relating to environmental matters could entail material costs or otherwise result in material liabilities. Under environmental laws applicable to our operations and our properties, we are required to obtain various environmental permits granted by federal, state, local and foreign authorities. There are various risks associated with noncompliance with these permits, including cessation of our operations at the noncompliant facilities and significant fines and penalties.

We cannot predict what environmental legislation or regulations will be enacted in the future, how existing or future laws or regulations will be administered or interpreted or affect the use of our products, or what environmental conditions may be found to exist at our facilities or at third-party sites for which we are liable. Enactment of stricter laws or regulations, stricter interpretation of existing laws and regulations or the requirement to undertake the investigation or remediation of currently unknown environmental contamination at our own or third-party sites may require us to make additional expenditures, some of which could be material.

The single-use foodservice products industry is subject to evolving federal, state, local and foreign legislation and regulations affecting the types of raw materials we may use in our products. Some of the legislation and regulations are designed to reduce solid waste and litter by requiring, among other things, that manufacturers pay for the disposal of products they create or use raw materials that are recyclable, biodegradable or compostable. Other legislation and regulations are intended to promote health and safety by prohibiting, or requiring the disclosure of, the use of specified materials. The legislation passed to date has not had a material adverse effect on our operations; however, if we are unable to procure or substitute raw materials that meet the requirements of future environmental legislation or regulations, our sales may decline in those localities where such laws and regulations have been adopted. Proposed legislation could increase our operating costs as a result of any fees imposed on manufacturers of foodservice products for the disposal of products that are not recyclable or compostable and could increase the cost of our products by prohibiting the use of traditional raw materials and requiring the use of emerging materials that are more expensive. Proposed legislation and regulations also could lower demand for products that include, or are associated with, materials that are the focus of health and safety legislation or regulations.

9

Table of Contents

Our international operations expose us to risks related to conducting business in multiple jurisdictions outside the United States.

Our international operations consist of operating subsidiaries in four countries, as well as international export sales originating in the United States and at our international facilities. The international scope of our operations may lead to volatile financial results and difficulties in managing our business. We generated approximately 20% of our net sales outside the United States during fiscal year 2009. International sales and operations are subject to a number of risks, including the following:

| • | exchange rate fluctuations and limitations on currency convertibility; |

| • | import limitations and export control restrictions; |

| • | social and political turmoil, corruption and civil unrest; |

| • | restrictive governmental actions, such as the imposition of trade quotas and restrictions on transfers of funds; |

| • | changes in non-U.S. labor laws and regulations affecting our ability to hire, retain or dismiss employees; |

| • | violations of U.S. or local laws, including the U.S. Foreign Corrupt Practices Act; |

| • | compliance with multiple and potentially conflicting laws and regulations; |

| • | preference for locally-branded products, and laws and business practices favoring local competition; |

| • | less effective protection of intellectual property; |

| • | difficulties and costs of staffing, managing and accounting for foreign operations; and |

| • | unfavorable business conditions or economic instability in any particular country or region. |

Our exposure to risks associated with currency exchange rate fluctuations results primarily from translation exposure associated with the preparation of our consolidated financial statements, as well as from transaction exposure associated with generating revenues and incurring expenses in different currencies. While our consolidated financial statements are reported in U.S. dollars, the financial statements of our foreign subsidiaries are measured using the local currency as the functional currency and translated into U.S. dollars by applying an appropriate exchange rate. As a result, fluctuations in the exchange rate of the U.S. dollar relative to the local currencies in which our foreign subsidiaries report could cause significant fluctuations in our consolidated results. We record sales and expenses in a variety of currencies. While our expenses with respect to foreign operations are generally denominated in the same currency as the corresponding sales, we have transaction exposure to the extent our receipts and expenditures are not offsetting in any currency. Moreover, the costs of doing business abroad may increase as a result of adverse exchange rate fluctuations. In addition, we may lose customers if exchange rate fluctuations, currency devaluation or economic crises increase the local currency price of our products or reduce our customers’ ability to purchase our products. If we are unable to manage the operational challenges associated with our international activities, our business, financial condition, results of operations or cash flows could be materially adversely affected.

In the event of a catastrophic loss of one of our key manufacturing facilities, our business would be adversely affected.

While we manufacture our products in a number of diversified facilities and maintain insurance covering our facilities, including business interruption insurance, a catastrophic loss of the use of all or a portion of one of our key manufacturing facilities due to accident, weather conditions, natural disaster or otherwise, whether short- or long-term, could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We are controlled by the stockholders of Solo Cup Investment Corporation, the interests of which may conflict with the interests of holders of our senior secured and senior subordinated notes.

All of our outstanding capital stock is owned by our parent company, Solo Cup Investment Corporation. Holders of SCC Holding’s voting interests control 100% of the outstanding common stock of Solo Cup Investment Corporation, and affiliates of Vestar hold 99.9% of Solo Cup Investment Corporation’s outstanding convertible participating preferred stock, or SCIC preferred stock, with the remaining balance of the SCIC preferred stock held by members of our management.

The SCIC preferred stock is currently convertible at any time, at the option of the holders, into 32.71% of the common stock of Solo Cup Investment Corporation. The SCIC preferred stock is entitled to vote on all matters, voting together with the holders of common stock as a single class. In December 2006, Vestar, in its capacity as the significant shareholder of SCIC preferred stock, became entitled to appoint a majority of the director positions of Solo Delaware and Solo Cup Investment Corporation pursuant to a stockholders’ agreement dated as of February 27, 2004, as amended, among Vestar, Solo Cup Investment Corporation, SCC Holding, Solo Delaware and various other parties. If Vestar receives a bona fide offer from a third party to purchase (whether by stock purchase, merger or otherwise) at least 80% of Solo Delaware’s common stock, SCC Holding has agreed at Vestar’s request to vote in favor of such offer.

10

Table of Contents

The interests of SCC Holding and the holders of SCIC preferred stock, including Vestar, could conflict with the interests of holders of our senior secured and senior subordinated notes. For example, if we encounter financial difficulties or are unable to pay our debts as they mature, the interests of these indirect equity holders might conflict with the interests of a holder of our notes. Solo Cup Investment Corporation’s stockholders may also have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in their judgment, could enhance their equity investments, even though the transactions might involve risks to a holder of our senior secured or senior subordinated notes. In addition, SCC Holding and Vestar, or any of their affiliates, may in the future own businesses that directly compete with our business. While we are subject to specified provisions of the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated thereunder, these provisions do not require us to have independent directors.

The loss of one or more of our principal customers could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We have a number of large customers that account for a significant portion of our net sales. For fiscal year 2009, our five largest customers represented approximately 30% of our net sales, with no one customer accounting for more than 9% of our net sales. The loss of one or more of our large customers could have a material adverse effect on our business, financial condition, results of operations or cash flows. In line with industry practice, we generally do not enter into long-term sales agreements with customers.

We may undertake acquisitions or divestitures and consequently face potential integration, management diversion and other risks.

We may make acquisitions or divestitures in the future. Any future acquisitions or divestitures could be of significant size and may involve U.S. or international parties. To acquire and integrate a separate organization or significant new assets or to divest a portion of our business would divert management attention from other business activities. This diversion, together with other difficulties we may encounter in integrating an acquired business or selling a portion of our business, could have a material adverse effect on our business, financial condition, results of operations or cash flows. In connection with future acquisitions, we may assume undisclosed liabilities of the businesses we acquire. These liabilities could materially adversely affect our business, financial condition, results of operations or cash flows.

We may not be able to adequately protect our intellectual property and other proprietary rights.

We rely on a combination of trade secrets, confidentiality agreements, patents, trademarks, copyrights, licenses, and contractual provisions, as well as various intellectual property and unfair competition laws to protect our intellectual property and other proprietary rights. Such measures may not provide adequate protection and may not prevent our competitors from gaining access to our intellectual property and proprietary information or independently developing technologies that are substantially equivalent or superior to our technology, which could harm our competitive position and could have a material adverse effect on our business, financial condition, results of operations or cash flows. Furthermore, we cannot give you any assurance that any pending patent application or trademark application made by us will result in an issued patent or registered trademark, or that any issued or registered patents or trademarks will not be challenged, invalidated, circumvented or rendered unenforceable.

Litigation may be necessary to enforce our intellectual property rights and protect our proprietary information, or to defend against claims by third parties related to our intellectual property. Any litigation or claims brought by or against us, whether successful or not, could result in substantial costs and diversion of our resources, which could have a material adverse effect on our business, financial condition, results of operations or cash flows. Any intellectual property litigation or claims against us could result in the loss or compromise of our intellectual property and proprietary rights, subject us to significant liabilities, require us to seek licenses on unfavorable terms, if available at all, prevent us from manufacturing or selling products or require us to redesign, relabel or, in the case of trademark claims, rename our products, any of which could have a material adverse effect on our business, financial condition, results of operations or cash flows. We are currently a defendant in a case involving the patent marking statute as applied to certain patent markings on our products. This case was resolved in our favor on summary judgment, and it is currently on appeal at the U.S. Court of Appeals for the Federal Circuit. We believe that the plaintiff’s claims are without merit and we will continue to vigorously defend ourselves on appeal.

Financial market conditions have had a negative impact on the return of plan assets for our pension plans, which may require additional funding and negatively impact our cash flows.

Certain U.S., Canadian and European hourly and salaried employees are covered by our defined benefit pension plans. Between December 31, 1987 and March 31, 2001, the majority of the U.S. plans were frozen to new participants. Our pension expense and required contributions to our pension plan are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets and the actuarial assumptions we use to measure the defined benefit pension plan obligations. Due to the significant financial market downturn that started in 2008 and continued into 2009, the funded status of our pension plans has declined and actual asset returns were below the assumed rate of return used to determine pension expense. Our pension plans were underfunded by approximately $29.3 million and $26.1 million, as of December 27, 2009 and December 28, 2008, respectively. If plan assets continue to perform below expectations, future pension expense and funding obligations will increase, which could have a negative impact on our cash flows from operations, decrease borrowing capacity and increase interest expense. Moreover, under the Pension Protection Act of 2006, it is possible that continued losses to asset values may necessitate accelerated funding of U.S. pension plans in the future to meet minimum federal government requirements.

11

Table of Contents

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties. |

We own, lease and operate manufacturing and distribution facilities in North America, Panama and the United Kingdom. The table below provides summary information regarding our material manufacturing, distribution and office properties that are currently in operation. We believe these properties are being used, and are adequate, for their intended purposes and are well-maintained. A number of our owned properties are mortgaged as collateral under the indenture governing our senior secured notes and under our asset-based revolving credit facility. The table below does not reflect our manufacturing facilities in Belen, New Mexico and Highland Park, Illinois that we closed in 2009. Our Belen facility is currently under contract for sale, and we are currently seeking a buyer for our Highland Park facility. The table also does not reflect our undeveloped land parcel in Chicago, Illinois, which we are also actively marketing for sale. In December 2009, we moved our executive offices from Highland Park, Illinois to a new, leased facility in Lake Forest, Illinois. The table below reflects this leased facility.

| Facilities | ||||||||

| Location |

Function |

Owned/ Leased |

Size (Approximate Square Footage) | |||||

| California |

Rialto | Distribution Center | Leased | 882,230 | ||||

| Georgia |

Augusta | Manufacture | Leased | 364,000 | ||||

| Conyers | Manufacture | Leased | 367,000 | |||||

| Social Circle | Distribution Center | Leased | 1,300,716 | |||||

| Idaho |

Twin Falls | Manufacture | Owned | 130,000 | ||||

| Illinois |

Chicago | Manufacture | Leased | 820,000 | ||||

| Lake Forest | Executive Office | Leased | 133,218 | |||||

| University Park | Distribution Center | Leased | 1,555,720 | |||||

| Urbana | Manufacture | Leased | 269,000 | |||||

| Maryland |

Federalsburg | Manufacture | Leased | 405,000 | ||||

| Hampstead | Distribution Center | Leased | 1,034,470 | |||||

| Owings Mills (2 facilities) | Manufacture/Distribution Center | Owned | 1,703,292 | |||||

| Massachusetts |

North Andover | Manufacture | Leased | 248,500 | ||||

| Missouri |

Springfield | Manufacture | Owned | 941,000 | ||||

| Oklahoma |

Ada | Manufacture | Owned | 267,000 | ||||

| Texas |

Dallas | Manufacture/Distribution Center | Leased | 1,220,000 | ||||

| Grand Prairie | Distribution Center | Leased | 603,354 | |||||

| Washington |

Sumner | Distribution Center | Leased | 401,076 | ||||

| Non-US |

Mississauga, Ontario, Canada | Distribution Center/Office | Leased | 262,087 | ||||

| Toronto, Ontario, Canada | Manufacture/Distribution Center | Owned | 285,000 | |||||

| Cuautitlan, Mexico (4 facilities) |

Manufacture/Distribution Center | 1 Owned/ 3 Leased (1) |

98,425 | |||||

| Panama (2 facilities) |

Manufacture/Distribution Center | 1 Owned/ 1 Leased |

359,773 | |||||

| United Kingdom (5 facilities) |

Manufacture/Distribution Center | Leased (2) | 287,000 | |||||

| (1) | Excludes a lease for a warehouse that expires on April 1, 2010 and will not be renewed. |

| (2) | At one of these facilities we own a building on leased land. |

We also utilize a small number of third-party warehouses on a pay for use basis.

12

Table of Contents

| Item 3. | Legal Proceedings. |

We are involved in various claims and legal actions arising from time to time in the ordinary course of business. We establish reserves for claims and actions when it is probable that we will incur a loss and such loss is capable of being estimated. While we cannot predict the outcome of these claims and actions with certainty, we believe that based on our current assessment of the facts and circumstances we are not a party to any pending legal proceeding, the ultimate disposition of which would have a material adverse effect on our business, financial position, results of operations or cash flows.

| Item 4. | Reserved. |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

There is no public trading market for Solo Delaware’s common stock. Solo Cup Investment Corporation is the owner of record of all of the common stock of Solo Delaware. We do not have any equity compensation plans under which Solo Delaware securities may be issued.

Since our formation in January 2004, we have not paid dividends on Solo Delaware’s common stock and we do not anticipate paying cash dividends in the foreseeable future. In addition, our bank credit facilities and the indentures governing our senior secured and senior subordinated notes restrict our ability to pay dividends on Solo Delaware’s common stock.

13

Table of Contents

| Item 6. | Selected Financial Data. |

The following table sets forth our selected historical consolidated financial data. You should read the information in this table in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this annual report and our consolidated financial statements, including the related notes, included in Item 8 of this annual report.

| (In millions) |

Year Ended December 27, 2009 |

Year Ended December 28, 2008 |

Year Ended December 30, 2007 |

Year Ended December 31, 2006 |

Year Ended January 1, 2006 |

|||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 1,502.6 | $ | 1,847.0 | $ | 2,110.1 | $ | 2,124.0 | $ | 2,073.8 | ||||||||||

| Cost of goods sold |

1,296.2 | 1,599.2 | 1,859.7 | 1,921.4 | 1,835.5 | |||||||||||||||

| Gross profit |

206.4 | 247.8 | 250.4 | 202.6 | 238.3 | |||||||||||||||

| Selling, general and administrative expenses |

150.1 | 159.6 | 203.6 | 216.4 | 219.7 | |||||||||||||||

| Impairment of goodwill |

17.2 | — | — | 228.5 | — | |||||||||||||||

| Loss (gain) on asset disposals |

9.0 | 22.6 | (8.5 | ) | 4.4 | (6.4 | ) | |||||||||||||

| Operating income (loss) |

30.1 | 65.6 | 55.3 | (246.7 | ) | 25.0 | ||||||||||||||

| Interest expense, net |

63.1 | 61.6 | 79.8 | 75.3 | 61.1 | |||||||||||||||

| Prepayment penalty |

— | — | 1.3 | — | — | |||||||||||||||

| Loss on debt extinguishment |

2.5 | — | 4.0 | — | — | |||||||||||||||

| Reclassification of unrealized loss on cash flow hedges to interest expense |

9.1 | — | — | — | — | |||||||||||||||

| Foreign currency exchange (gain) loss, net |

(2.6 | ) | 14.1 | (4.1 | ) | (6.9 | ) | 4.1 | ||||||||||||

| Other (income) expense, net |

— | — | (0.2 | ) | 0.1 | — | ||||||||||||||

| Loss from continuing operations before income taxes |

(42.0 | ) | (10.1 | ) | (25.5 | ) | (315.2 | ) | (40.2 | ) | ||||||||||

| Income tax (benefit) provision |

(6.3 | ) | 2.1 | (19.5 | ) | 56.3 | (14.8 | ) | ||||||||||||

| Loss from continuing operations |

(35.7 | ) | (12.2 | ) | (6.0 | ) | (371.5 | ) | (25.4 | ) | ||||||||||

| (Loss) income from discontinued operations, net of income tax provision |

— | (0.7 | ) | (0.1 | ) | (2.9 | ) | 5.6 | ||||||||||||

| Gain on sale of discontinued operations, net of income tax provision |

— | 0.8 | 77.2 | — | — | |||||||||||||||

| Net (loss) income |

$ | (35.7 | ) | $ | (12.1 | ) | $ | 71.1 | $ | (374.4 | ) | $ | (19.8 | ) | ||||||

| Balance Sheet Data (1)(2) : |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 30.0 | $ | 57.5 | $ | 33.6 | $ | 26.4 | $ | 12.1 | ||||||||||

| Total assets |

987.4 | 1,073.8 | 1,203.2 | 1,556.1 | 1,857.5 | |||||||||||||||

| Total debt, including current maturities |

636.1 | 718.2 | 759.0 | 1,150.1 | 1,043.3 | |||||||||||||||

| Total shareholder’s equity |

18.2 | 31.3 | 88.5 | 9.2 | 382.2 | |||||||||||||||

| Other Financial Data (2) : |

||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 137.9 | $ | 131.9 | $ | 95.6 | $ | (51.5 | ) | $ | 2.0 | |||||||||

| Net cash (used in) provided by investing activities |

(65.6 | ) | (68.4 | ) | 305.6 | (33.8 | ) | (30.2 | ) | |||||||||||

| Net cash (used in) provided by financing activities |

(101.1 | ) | (40.3 | ) | (394.9 | ) | 99.8 | 24.5 | ||||||||||||

| Capital expenditures |

71.8 | 79.7 | 49.0 | 60.5 | 52.4 | |||||||||||||||

| Depreciation and amortization |

70.0 | 77.7 | 95.3 | 101.2 | 104.5 | |||||||||||||||

| (1) | Balance sheet data is as of the last day of the relevant fiscal year. |

| (2) | Balance sheet data and other financial data include our continuing and discontinued operations. See Note 3 of our audited consolidated financial statements included in Item 8 of this annual report. |

14

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Executive Summary

We are a leading producer and marketer of single-use products used to serve food and beverages in the home, quick-service restaurants, and other foodservice settings. We manufacture and supply a broad portfolio of single-use products, including cups, lids, food containers, plates, bowls, portion cups, cutlery and straws, with products available in plastic, paper, foam, post-consumer recycled content and annually renewable materials. We serve two primary customer groups, foodservice and consumer. Sales to foodservice customers accounted for approximately 81% of our net sales in 2009. Sales to consumer customers accounted for the remaining 19%.

Raw materials – In recent years, including 2009, our industry has experienced volatility in raw material and energy pricing. Resin prices are influenced by other input prices such as crude oil, natural gas, benzene, ethylene, propylene and paraxylene, as well as availability of supply and changes in demand. The price of benzene, ethylene and propylene rose significantly throughout 2009.

The principal raw material used in our paper operations is solid bleached sulfate paperboard. Paper prices are driven by global supply and demand as well as input costs for energy, fiber, chemicals, polyethylene and transportation. Although paper prices rose throughout 2008 and the first half of 2009, they stabilized in the last part of the year.

Energy prices – The volatility of global energy prices affects our transportation and production costs. Historically, we have been able to partially mitigate the effect of higher energy-related costs with productivity, utilization of equipment and efficiency improvements. During 2009, we experienced lower transportation and energy costs compared to 2008.

Economic recession – The global economic recession that started late in 2008 and continued in 2009 had a significant impact on our 2009 operating results. The environment in which we do business has quickly changed. Consumers are managing their discretionary spending more conservatively and our customers are managing their businesses differently. As a result, during 2009 we continued to experience a decline in sales volume, although the rate of decline was not as significant as in the fourth quarter of 2008 and moderated in the fourth quarter of the year. We believe the decline was driven by a variety of external factors such as consumers eating out less frequently and higher unemployment rates, both of which tended to contract the market for our foodservice operators. Lower consumer discretionary spending translated into a smaller consumer market, as did a shift from national brands to private label products, which are traditionally offered at lower prices.

Refinancing transactions – In July 2009, we refinanced our debt by issuing $300.0 million of 10.5% senior secured notes due in 2013 and by entering into a new asset-based revolving credit facility providing for borrowings of up to $200.0 million, subject to borrowing base limitations and other specified terms and conditions. We used the initial borrowings under our asset-based revolving credit facility, together with the net proceeds from the issuance of our senior secured notes, to retire our first lien credit facility. As a result, we have no principal payments due on our outstanding debt until November 2013.

Operational improvements – In 2009, we continued our focus on identifying and implementing operational improvements to reduce our controllable costs. Our continued efforts to optimize our supply chain through a consolidated footprint resulted in the closure of two manufacturing facilities during the first half of the year. The impact of these consolidation activities on our 2009 financial statements included approximately $12 million in cost of goods sold related to equipment transfers, ramp-down costs at the closing facilities and start-up expenses at the receiving plants. We continue to evaluate opportunities that may offer further cost structure improvements.

The financial results for 2009 include:

| • | an 18.6% decrease in net sales compared to 2008, driven by a 16.3% decrease in sales volume; |

| • | a 16.7% decrease in gross profit from 2008; however, gross margin, or gross profit as a percentage of net sales, increased to 13.7% compared to 13.4% in 2008; |

| • | $137.9 million of cash flows generated from operating activities for our continuing operations compared to $132.6 million in 2008; |

| • | a decrease in capital expenditures to $71.8 million compared to $79.7 million in 2008; and |

| • | an $82.1 million reduction in outstanding debt to $636.1 million from $718.2 million as of the end of 2008, driven by cash flows from operations and sales of excess assets. |

15

Table of Contents

Results of Operations for Fiscal Years 2009, 2008 and 2007

| 2009 vs. 2008 | 2008 vs. 2007 | |||||||||||||||||||||||||

| Fiscal Year | Favorable / (Unfavorable) | |||||||||||||||||||||||||

| (In millions) |

2009 | 2008 | 2007 | $ | % | $ | % | |||||||||||||||||||

| Net sales |

$ | 1,502.6 | $ | 1,847.0 | $ | 2,110.1 | $ | (344.4 | ) | (18.6 | ) | $ | (263.1 | ) | (12.5 | ) | ||||||||||

| Cost of goods sold |

1,296.2 | 1,599.2 | 1,859.7 | 303.0 | 18.9 | 260.5 | 14.0 | |||||||||||||||||||

| Gross profit |

206.4 | 247.8 | 250.4 | (41.4 | ) | (16.7 | ) | (2.6 | ) | (1.0 | ) | |||||||||||||||

| Selling, general and administrative expenses |

150.1 | 159.6 | 203.6 | 9.5 | 6.0 | 44.0 | 21.6 | |||||||||||||||||||

| Impairment of goodwill |

17.2 | — | — | (17.2 | ) | * | — | — | ||||||||||||||||||

| Loss (gain) on asset disposals |

9.0 | 22.6 | (8.5 | ) | 13.6 | 60.2 | (31.1 | ) | * | |||||||||||||||||

| Operating income |

30.1 | 65.6 | 55.3 | (35.5 | ) | (54.1 | ) | 10.3 | 18.6 | |||||||||||||||||

| Interest expense, net |

63.1 | 61.6 | 79.8 | (1.5 | ) | (2.4 | ) | 18.2 | 22.8 | |||||||||||||||||

| Prepayment penalty |

— | — | 1.3 | — | — | 1.3 | * | |||||||||||||||||||

| Loss on debt extinguishment |

2.5 | — | 4.0 | (2.5 | ) | * | 4.0 | * | ||||||||||||||||||

| Reclassification of unrealized loss on cash flow hedges to interest expense |

9.1 | — | — | (9.1 | ) | * | — | — | ||||||||||||||||||

| Foreign currency exchange (gain) loss, net |

(2.6 | ) | 14.1 | (4.1 | ) | 16.7 | * | (18.2 | ) | * | ||||||||||||||||

| Other income, net |

— | — | (0.2 | ) | — | — | (0.2 | ) | * | |||||||||||||||||

| Loss from continuing operations before income taxes |

(42.0 | ) | (10.1 | ) | (25.5 | ) | (31.9 | ) | (315.8 | ) | 15.4 | 60.4 | ||||||||||||||

| Income tax (benefit) provision |

(6.3 | ) | 2.1 | (19.5 | ) | 8.4 | * | (21.6 | ) | * | ||||||||||||||||

| Loss from continuing operations |

(35.7 | ) | (12.2 | ) | (6.0 | ) | (23.5 | ) | (192.3 | ) | (6.2 | ) | (103.3 | ) | ||||||||||||

| Loss from discontinued operations, net of income tax provision of $0 and $3.0 |

— | (0.7 | ) | (0.1 | ) | 0.7 | * | (0.6 | ) | * | ||||||||||||||||

| Gain on sale of discontinued operations, net of income tax provision of $0 and $17.7 |

— | 0.8 | 77.2 | (0.8 | ) | * | (76.4 | ) | (99.0 | ) | ||||||||||||||||

| Net (loss) income |

$ | (35.7 | ) | $ | (12.1 | ) | $ | 71.1 | $ | (23.5 | ) | * | $ | (83.2 | ) | * | ||||||||||

| * | Not meaningful |

Our fiscal year is the 52- or 53-week period ending on the last Sunday in December. Our fiscal year 2009 ended on December 27, 2009, fiscal year 2008 ended on December 28, 2008, and fiscal year 2007 ended on December 30, 2007. Each was a 52-week period.

Fiscal Year 2009 Compared to Fiscal Year 2008

Net sales

Net sales decreased by $344.4 million, or 18.6%, to $1,502.6 million for fiscal year 2009 compared to $1,847.0 million for fiscal year 2008. The decrease in net sales reflects a 16.3% decrease in sales volume, a 2.1% decrease resulting from foreign currency fluctuations and a slight decrease in average realized sales price compared to the prior year.

Lower sales volumes resulted from the continued softness in demand across the industry, competition in the marketplace and our strategic initiatives. Approximately half of the decrease in sales volume reflects our decision to de-emphasize specified product categories, such as straws and stirrers, which are high-volume commodity products, and other strategic decisions made during 2008 and 2007 to improve commercial arrangements and to exit certain unfavorable relationships. The other half of the decrease reflects the continuing global economic recession, which resulted in a significant contraction in the market for our products and an increasingly competitive marketplace.

The slight decrease in average realized sales price reflects lower pricing during 2009, as a result of lower raw material costs and consumer demand, which were in part due to the impact of the global economic recession. The impact of lower pricing was partially offset by a favorable shift in our product mix.

16

Table of Contents

Gross profit

Gross profit decreased by $41.4 million, or 16.7%, to $206.4 million for fiscal year 2009 from $247.8 million for fiscal year 2008. Gross profit declined by approximately $80 million as a result of lower sales and production volume for our U.S. operations, by approximately $14 million due to the results of our international subsidiaries, which decline was partially driven by foreign currency fluctuations, and by $4 million in connection with the resolution of a contractual dispute during the first quarter of 2009. The decline in gross profit was partially offset by lower operating costs for our U.S. operations of approximately $32 million, driven by the benefit of a consolidated manufacturing footprint (net of related consolidation costs) and lower distribution costs, and an increase of approximately $25 million in the difference between sales prices and raw material costs for our U.S. operations, mostly realized during the first half of the year due to the lag in timing between the decline in raw material costs and the subsequent decrease in sales prices.

As noted above, gross profit includes costs related to the consolidation of our production facilities, which were approximately $12 million in 2009 and $15 million in 2008. In both years, these consolidation costs included equipment transfers, ramp-down costs at the closing facilities and start-up expenses at the receiving plants. In 2008, the consolidation costs also included severance at the closing facilities.

Gross margin, or gross profit as a percentage of net sales, was 13.7% in 2009 versus 13.4% in 2008. The increase in gross margin was primarily driven by a favorable shift in product mix, and to a lesser extent, an increase in the difference between sales prices and raw material costs.

Selling, general and administrative expenses