Attached files

| file | filename |

|---|---|

| EX-10.C - CONSULTING AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10c.htm |

| EX-10.G - PROXY AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10g.htm |

| EX-10.E - EQUITY PLEDGE AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10e.htm |

| EX-10.F - OPTION AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10f.htm |

| EX-10.A - SHARE PURCHASE AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10a.htm |

| EX-10.D - OPERATING AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10d.htm |

| EX-10.B - SHARE EXCHANGE AGREEMENT - China Lithium Technologies Inc. | piservices8k031910ex10b.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

PART I-CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-53263

Date of Report: March 19, 2010

PI SERVICES, INC.

(Name of Registrant in its Charter)

| Nevada |

41-1559888

|

||

| (State or Other Jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

(Address of principal executive offices)

212-391-2688

(Registrant's telephone number including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.01 | Completion of Acquisition of Assets |

| Item 3.02 | Unregistered Sale of Equity Securities |

| Item 5.02 | Election of Directors; Appointment of Certain Officers; |

| Item 5.06 | Change in Shell Company Status |

On March 19, 2010, PI Services Inc. ("PI Services") acquired (the "Acquisition") all of the outstanding capital stock of Sky Achieve Holdings, Inc., a British Virgin Islands limited liability corporation ("Sky Achieve"), pursuant to a Share Exchange Agreement dated March 4, 2010 (the "Agreement") filed herein as Exhibit 10.b. Sky Achieve has exclusive control over the business of Beijing GuoQiang Global Science & Technology Development Co., Ltd. ("Beijing Guoqiang"), a company organized under the laws of the People's Republic of China, ("PRC'), the relationship of which is generally identified as "entrusted management". Under the relationship, Sky Achieve has the right to receive all revenues obtained by Beijing Guoqiang, but also bears the responsibility for all of the expenses incurred by Beijing Guoqiang. Beijing Guoqiang designs, manufactures and markets Polymer lithium-ion battery modules, lithium-ion battery chargers, lithium-ion battery management systems as well as other lithium-ion battery management devices essential to proper power utilization.

As a result of the Acquisition, PI Services issued 42,134,020 shares of its common stock to the shareholders of Sky Achieve (the "Share Issuance"). Those shares represent 95 % of the outstanding shares of PI Services. Of the 42,134,020 shares issued, 37,920,618 of the shares were issued to Kun Liu, who is the Chief Executive Officer of Sky Achieve and now the Chairman of PI Services. The remaining 4,213,402 shares were issued to Youhua Yu, the Chairman of Sky Achieve. Also on March 19, 2010, Kun Liu (the "Purchaser"), 100% owner of Beijing GuoQiang, purchased from Michael Friess and Sanford Schwartz, the former principal stockholders ("Selling Shareholders") of PI Services pursuant to a Stock Purchase Agreement (the "SPA") dated March 4, 2010. As a result of these transactions, persons associated with Beijing Guoqiang now own securities that represent 96% of the equity in PI Services. The shares issued have not been registered under the Securities Act of 1933, as amended, in reliance upon an exception under Sections 4(2) of said act.

On March 19, 2010, Michael Friess, Sanford Schwartz, and Chloe DiVita, the Company's former officers and directors tendered their resignation as President and CEO, Vice President, and CFO Treasurer, Secretary of the Company, respectively, effective immediately and as Chairman and Directors, which shall take effect on the tenth day following the filing of the Form 14(f) with the Securities Exchange Commission ("SEC") to be mailed out on or about March 26, 2010.

Principal Shareholders

Upon completion of the Acquisition, there were 44,351,600 shares of PI Services common stock issued and outstanding. The following table sets forth information known to us with respect to the beneficial ownership of our common stock as of the date of completion of the

2

Share Exchange for each shareholder who beneficially owns more than 5% of our common stock (on a fully-diluted basis); Kun Liu, our Chairman, each of the members of the Board of Directors; and all of our officers and directors as a group.

| Name and Address of Beneficial Owner(1) |

Amount and Nature of

Beneficial Ownership (2) |

Percentage

of Class |

|||

| Kun Liu |

38,364,134

|

86.5%

|

|||

| You Hua Yu |

4,213,402

|

9.5%

|

|||

| Jijun Zhang |

0

|

0%

|

|||

| Qiang Gu |

0

|

0%

|

|||

| All officers and directors as a group (3 person) |

42,577,536

|

96%

|

(1) The address of each shareholder is 15 West 39th Street Suite 14B, New York, NY 10018

(2) All shares are owned both of record and beneficially.

New Management

Prior to the Acquisition, Michael Friess, Sanford Schwartz, and Chloe Divita were members of the Board of Directors. Upon completion of the Acquisition and as part of the transaction, the Board elected Messrs. Kun Liu, Qiang Fu, and Jijun Zhang as directors and Mr. Liu as the Chairman of the Board (the "Board"). On the same day, Michael Friess, Sanford Schwartz, and Chloe Divita submitted their resignations from the Board, effective ten days after an Information Statement in compliance with SEC Rule 14f-1 is mailed to the shareholders of PI Services. On the same day, the Board also elected Mr. Xin Xu as the Chief Executive Officer, Ms. Chunping Fong as the Chief Financial Officer, Mr. Fang Ai as Chief Technology Officer, Mr. Jijun Zhang as Vice President, and Mr. Chengzhou Xu as the Chief Engineer. The following are the officers and directors of PI Services. The new directors shall take effect on the tenth day following the filing of the Form 14(f) with the Securities Exchange Commission ("SEC") to be mailed out on or about March 26, 2010. :

| Name |

Age

|

Positions with the Company | |

| Kun Liu |

33

|

Chairman, President | |

| Xin Xu |

54

|

Chief Executive Officer | |

| Chunping Fong |

53

|

Chief Financial Officer | |

| Fang Ai |

29

|

Chief Technology Officer | |

| Jijun Zhang |

30

|

Vice President and Director | |

| Qiang Fu |

32

|

Director | |

| Chengzhou Xu |

60

|

Chief Engineer |

3

All directors hold office until the next annual meeting of our shareholders and until their successors have been elected and qualify. We believe that each officer and director has the experience, qualifications, attributes and skills necessary to serve on the Board or as an officer because of his academic background, knowledge in the battery industry and in business generally. Officers serve at the pleasure of the Board of Directors.

| Mr. Kun Liu | Chairman and President 33 Mr. Liu has a Master of Engineering of Industry Engineering Department in Tsinghua University. He is the founder of Beijing Guoqiang and has been the Chairman of the Company since 2007. From 2004 to 2006, he was president in Beijing Ulong Runsheng S&T Development Co.,Ltd. a company engaged in manufacturing related battery products like protected board, charger, etc. From 2002 to 2004, he was general manager in Tianjin Runyi S&T Development Co., Ltd. a company engaged in research and development of power Li-thium batteries. T |

| Mr. Xin Xu | Chief Executive Officer 54. Mr. Xu holds a Bachelor of Engneering graduated from Automation Department of Tsinghua University. He has worked for Beijing Guoqiang since 2008. From 2001 to 2008, he was general manger of Beijing Ruibide Electromechanical New Technology Company. From 1979 to 2000, he was the director of subsurface tool institute of China Oil Exploration Scientific Institute a company engaged in Oil Exploration. |

| Ms. ChunPing Fong | Chief Financial Officer 53. She has a bachelor's degree graduated from Beijing Technology and Business University majored in accounting. Ms. Fong has worked for Beijing Guoqiang since 2008. From 1993 to 1998, she was financial officer and deputy audit officer in Beijing Printing Group a company engaged in printing industry. From 1986 to 1992, she was deputy factory director in Beijing Grand View Garden Industrial Arts Factory a company engaged in industrial art and from 1976 to 1985 she was financial officer in Beijing Machine Factory a company engaged in metallurgy industry. |

| Mr. Fang Ai | Chief Technology Officer 29. Mr. Ai has a Master of Engineering of Electronic Message Engineering System in Beijing Information S&T University. He has worked for Beijing Guoqiang since 2008. From 2007 to 2008, he was business manager in Tongfang Integrated Circuit Co., Ltd. a company engaged in digital information and security system. From 2003 to 2007, he was associate general engineer in Hengxin China Holding Co., Ltd., one of the largest digital television's chip designer and manufacturer in China. |

| Mr. JiJun Zhang | Vice President 30 Mr. Zhang has a Master's degree graduated from Hebei University of Economics & Business in the major of administration management. He has worked for Beijing Guoqiang since 2009. From 2008 to 2009, he was office chief in Beijing Fuqiang Global Consulting Co., Ltd. a consulting company. From 2006 to 2008, he taught at Hebei Normal University. From 2004 to 2005, he was training manager in Beijing JSD Management Consulting Co., Ltd, a company engaged in financial consultation. |

4

| Mr. ChengZhou Xu | Chief Engineer 60. Mr. Xu has a bachelor's degree from Shanghai University of Technology in the major of communication and electronic engineering. He has worked for Beijing Guoqiang since 2007. He worked at Zhejiang Fujitec a company engaged in manufacturing product lines as a general engineer from 2002 to 2003 and was general engineer at Zhejiang Philips a company engaged in electrical wiring industry from 1997 to 2002. He was general engineer at Henan Huaxia Electric Group a company engaged in the manufacture and distribution of electric products. From 1994 to 1996 and general engineer and director in Illumination Company of Hainan Asian Pacific Group a company engaged in research and development of traditional electrical and light power. |

| Qiang Fu | Director, 32. Mr. Fu has been employed since 2003 as the President of Heilongjiang Beijing Guoqiang Science & Technology Development Co., Ltd., which is located in the City of Harbin in The People's Republic of China, and is engaged in the business of developing software and information technology networks. In 1998 Fu Qiang earned a Bachelor's Degree in Business Administration and in 1996 he earned a Bachelor's Degree in Law from a university in China. Mr. Fu is also the Chairman of the Board and CEO of China Digital Animation Development, Inc. a company engaged in the business of digital animation production, financial information services, and cultural productions in China. |

INFORMATION REGARDING THE ACQUIRED COMPANIES

Sky Achieve Holdings, Inc.

Sky Achieve was organized on November 5, 2009 under the laws of British Virgin Islands. It had no business activity from its inception until January 5, 2010. From January 5, 2010, Sky Achieve obtained control over the business of Beijing Guoqiang, the relationship between them being customarily identified as "entrusted management." The relationship is defined by five agreements, each of which has a term of ten years:

| Consulting Services and Operating Agreement.

These two agreements provide that Sky Achieve will be fully responsible

for the management of Beijing Guoqiang, both financial and operational.

Sky Achieve has assumed responsibility for the debts incurred by Beijing

Guoqiang and for any shortfall in its registered capital. In exchange for

these services and undertakings, Beijing Guoqiang pays a fee to Sky Achieve

equal to the net profits of Beijing Guoqiang. In addition, Beijing Guoqiang

pledges all of its assets, including accounts receivable, to Sky Achieve.

Meanwhile, Beijing Guoqiang's shareholders pledged the equity interests

of Beijing Guoqiang to Sky Achieve to secure the payment of the Fee. Proxy Agreement. In this agreement, the shareholder of Beijing Guoqiang granted an irrevocable proxy to the designated person by Sky Achieve to exercise the voting rights and other rights of shareholder. |

5

| Purchase Option Agreement. In this agreement,

the shareholder of Beijing Guoqiang granted to Sky Achieve the right to

purchase all his equity interest in the registered capital of Beijing Guoqiang

or the assets of Beijing Guoqiang. The option may be exercised whenever

the transfer is permitted under the laws of the PRC. The purchase price

shall be equal to the original paid-in price of the Purchased Equity Interest

by the Transferor, unless the applicable PRC laws and regulations require

appraisal of the equity interests or stipulate other restrictions on the

purchase price of equity interests. The agreement also contains covenants

designed to prevent any material change occurring in the legal or financial

condition of Beijing Guoqiang without the consent of Sky Achieve. Equity Pledge Agreement. In this agreement, Beijing Guoqiang shareholder agrees to pledge all its equity interest in Beijing Guoqiang to Sky Achieve as security for the performance of the obligation under the Consulting Services Agreement and the payment of Consulting Services Fees under each agreement. |

Beijing GuoQiang Global Science & Technology Development Co.,Ltd

Beijing Guoqiang is a leading edge lithium-ion battery power technology company that was founded on March 27, 2007 under the laws of the PRC with registered capital of 1 million RMB (US$ 147,058). Beijing Guoqiang designs, manufactures and markets Polymer lithium-ion battery modules, lithium-ion battery chargers, lithium-ion battery management systems as well as other lithium-ion battery management devices essential to proper power utilization ("PLI battery products"). Through years of development, Beijing Guoqiang's lithium-ion battery products have been widely used in electric tools, electric bicycles, electric motorcycles and vehicles, electric bus, electric/hybrid automobiles, golf and tour vehicle, yacht, and other electric products.

PLI battery products produce a relatively high average of 3.8 volts per cell, which makes them attractive in terms of both weight and volume. Additionally, they can be manufactured in very thin configurations and with large footprints. PLI cells can be configured in almost any prismatic shape, and can be made thinner than 0.0195 inches (0.5 mm) to fill virtually any shape efficiently. This combination of power and versatility makes rechargeable PLI batteries particularly attractive for use in consumer products such as portable computers, personal digital assistants (PDA's) and cellular telephones. However, one of the bottleneck problems in the existing lithium-ion battery industry is the battery capacity loss. Through years of efforts in research and development, we developed an efficient battery management system in a way to balance the process of charging and discharging of multiple lithium-ion battery cells and adjust the charging frequency to the change of temperature of the ambient environment. We also incorporated the battery management system in our design of lithium-ion battery module and battery pack.

6

Research & Development is one of the most important strengths of Beijing Guoqiang. The management team of Beijing Guoqiang is attentive to develop its core technologies to satisfy the needs of its customers. As of 2010, we have 2 patents pending in the United States and China reflecting our R&D achievements for the past four years of development.

Beijing Guoqiang is proud of its environmentally friendly product line. In order to meet the domestic and international market demand, Beijing Guoqiang is constantly upgrading existing products to expand its market share. Beijing Guoqiang is doing the R&D on the lithium battery module groups applied to vehicle ignition power, wireless charging technology, and improved environmentally friendly manufacturing processes for lithium-ion battery modules, as well as improving automated production of lithium-ion battery power systems and chargers.

Our Products

We design, manufacture and market Polymer lithium-ion battery modules, lithium-ion battery chargers, lithium-ion battery management systems as well as other lithium-ion battery management devices essential to proper power utilization. We believe that lithium-ion batteries will play an increasingly important role in facilitating a shift toward cleaner forms of energy. Our batteries and battery systems provide a combination of power, safety and life.

A lithium-ion battery (sometimes abbreviated Li-ion battery) is a type of rechargeable battery in which the cathode (positive electrode) contains lithium. The anode (negative electrode) is generally made of a type of porous carbon. During discharging, the current flows within the battery (when the external circuit is connected) from the anode to the cathode, as in any type of battery: the internal process is the movement of electrons from the anode to the cathode, through the non-aqueous electrolyte and separator diaphragm. Lithium-ion batteries are common in portable consumer electronics because of their high energy-to-weight ratios, lack of memory effect, and slow self-discharge when not in use. In addition to consumer electronics, lithium-ion batteries are increasingly used in defense, automotive, and aerospace applications due to their high energy density.

With its light and self-discharge characteristics, Lithium-ion battery can be formed into a wide variety of shapes and sizes so as to efficiently fill available space in the devices they power. However, such advantages are limited due to the technology difficulties of preserving the energy loss of the battery as a result of the imbalanced charge and discharge of multiple Lithium-ion battery cells. High temperature of the ambient environment will also shorten the life of lithium-ion battery. Through research and development, we developed an efficient battery management system in a way to balance the process of charging and discharging of multiple lithium-ion battery cells and adjust the charging frequency to the change of temperature of the ambient environment. We also incorporated the battery management system in our design of lithium-ion battery module and battery pack. Our products are widely distributed and used in the electric automobiles, motorcycles and bicycles in China.

7

Specifically, our main products include the following:

* Lithium-ion Battery Management System ("BMS")

BMS is the link between rechargeable lithium-ion battery and users. Our BMS is very efficient in monitoring and load balancing battery cells' electricity charging and discharging running or charging, thus extending the life span of the battery pack and battery module we design. We have developed auxiliary battery clamp pressure equalization system, battery maintenance system, and bi-directional current automatic conversion system to address the common battery capacity loss problem in Lion battery industry.

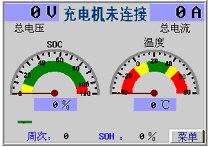

Our BMS has the following functions: real-time detection of the voltage of all single units, multi-point battery temperature and environment temperature, current working status of battery pack, insulation resistance, record of charge and discharge times, assessment over state of charge(SOC) of battery pack, battery malfunction alarm, communication with vehicle-mounted monitoring equipment and transfer battery state to the display, balancing of charge and discharge power, efficiency, electric quantity(AH,WH), dump energy(An,WH,min,Km), flexibly set alarm parameters of upper and lower limits of tension, electric current, electric quantity, communicating with charger and motor controller and thus improving the battery safety, realizing the optimal combination of different battery packs in the module, and etc. Currently, our BMS is widely used in electric automobiles, and the picture below is BMS monitor interface on vehicle-mounted display of the electric automobiles.

|

|

* Lithium-ion battery module

In 2009, we incorporated our BMS technology into our own lithium-ion battery modules known as" lithium magic cube" series. The series include nominal voltage 12V / 36V / 48V with nominal capacity ranging from 5AH to 60AH, and battery cells of Lithium cobalt(III) oxide /ternary materials/ lithium manganate /lithium iron phosphate. Below is the picture of one type of product in the Series.

|

8

Lithium-ion battery module from "lithium magic cube" series Our 10AH and 20AH products from the "lithium magic cube" series only weigh 1/3 of lead-acid battery of the same mechanical appearance and thus they are very popular in electric bicycles and motorcycles. Our 60AH product from the "lithium magic cube" series can realize high voltage and capacity power easily and they can be used in electric automobiles through parallel connections.

The pictures below are the electric car and farm truck powered by our lithium-ion battery modules resulting from our R&D cooperation efforts with a car manufacturer in China.

|

|

| Small electric passenger car | Electric farm truck |

* High-power Lithium-ion battery charger

Beijing Guoqiang is capable of providing high-power lithium-ion plumbous acid /Nickel Cadmium/ silicon energy battery charger charger / charging station, products of above 200W 10KW. In June 2009, our lithium-ion battery charger of 12V 24V 36V 48V obtained European CE certification with certificate number of BST09062243003C-1 and BST09062243003C-2.

Our battery charger products are widely used by one hundred standard vehicles. We can also design and produce customer-made chargers to satisfy the special needs of vehicle manufacturers. Specifically, we have the following series of standard charger products:

(1) 200W 10KW A~K Full-intelligent charger/battery waterproof charger

(2) Programmed intelligent battery charger

Below are the pictures of some of our charger products.

|

|

|

| K-type full-intelligent battery charger, | D-type full-intelligent battery charger, | 9KW programmable battery intelligent charger |

9

Core Technology and R&D

The lithium-ion battery management technology is the core technology in the field of electric vehicles and electric bicycles, while battery management system (BMS) is the key element in battery management. It is vital in safe application and life-time dilation in bunching use of lithium-ion power battery. Through R&D efforts of our technology teams, we have developed a very competitive battery management system capable of real-time monitoring over battery statement in the process of car running or charging, connecting the motor controller and charger through CAN system, and adopting suitable control strategy to achieve high efficiency. We believe that we are currently one of few domestic enterprises in China that master the core technology of lithium-ion battery management system.

We have one patent application pending in the United States and China. The three wire charging system invention provides a safe solution to the automobile using lithium-ion battery module. It includes a digital control voltage feedback multilevel current device to resolve an equilibrium problem of connecting large-capacity lithium-ion batteries in series. The also includes a bidirectional current automatic converter to make a standard two-wire battery charge and discharge system of automobile achieve a three-wire system function of lithium-ion battery. We expect that the approval of the patent will give us an impetus to grow in Lithium-ion battery industry in its application in automobile industry.

Because of the light weight, potential long life cycle, energy-efficient and environmental-friendly characteristics, the lithium-ion battery is a good alternative source of power for the automobile industry. On the other hand, energy loss due to the imbalanced charge and discharge of lithium-ion battery pack, the two-wire system used in existing auto charger system prevent the application of lithium-ion battery in automobile industry. However, we use our innovative approaches which provide good solution to the above technical problems.

We have two R&D centers: one in Beijing Zhongguancun S&T Park with the most advanced high technology talents in China, and the other in Beijing Technology Development in Haizhou which is the lead in the lithium-ion battery marketing. Our two R&D centers have a senior R&D team of 35 personnel each of whom has strong academic and technology background in different section of Lithium-ion battery industry. Most of our R&D team members have work experiences of over 5 years and have extensive experiences in lithium-ion battery industry. We have also developed long-term and wide cooperation with institutions with expertise in lithium-ion battery industry including the 19th Institute of Chinese Electronic S&T Group, the 15th institute of Chinese Electronic S&T Group, Beijing University of Aeronautics and Astronautics, Beijing University of Information Science and Technology, etc, in the field of power lithium-ion battery.

Our Solution and Strength

The Company is a leader in Lithium-ion battery technology innovation, development and manufacturing in China. Our proprietary technology lead our industry and are in heavy demand in next generation Hybrid and Electric vehicles. Our proprietary Lithium-ion Battery Management System (BMS) widely in use in Electric Cars solves the energy loss and safety issues in lithium-ion vehicle batteries, optimizes power utilization, and realizes the high power need for ignition of car battery, especially in low temperature conditions.

10

* Our Lithium-ion Battery Management System (BMS)

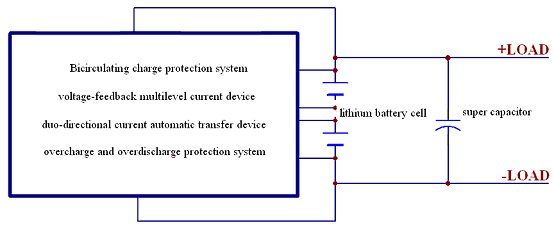

Our lithium-ion BMS as shown in diagram below have the following strength:

(1) Our lithium-ion auto battery design uses clamp pressure diversion device (i.e to use the technology of voltage-stabilizing bypass circuit diffluence to stabilize cell voltage and convert the surplus electric current from constant current source into bypass heat energy) to realize constant-current charger's function of constant current first and then constant pressure.

(2) Our system adopts bi-circulating charge protection system in the charge of lithium-ion auto battery, to solve the energy loss and safety issues in lithium-ion auto battery.

(3)To solve equalization problem in connecting high-capacity lithium-ion battery, we use NC voltage-feedback multilevel electric current, which uses single-circuit battery to equalize the unequal battery in the mode of single charge.

(4) Our lithium-ion BMS uses three-wire system which would automatically shut off charging control circuit when discharging to reduce power consumption of the system.

(5) Our designing of system also have charge and discharge protection system in the battery to prevent against the problems of overcharge, over-discharge, over-temperature and overflow.

(6) To realize high power needed in ignition of car battery especially in the condition of low temperature), we use super capacitor to ignite the electric automobile and balance the charging to provide the power and balance needed to start an electric automobile.

11

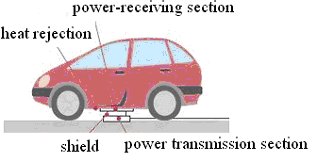

* Wireless Charging Technology

In addition, we are developing proprietary wireless charging technology for Lithium-ion automobile batteries. Wireless charging increases the convenience and user-friendliness of electric cars using electromagnetic induction to charge the battery of batteries. Our current wireless charging system has 5KW of power and the estimated transmission efficiency is over 85%. We expect to launch the wireless recharge products for 5KW 20KW in the third quarter of 2010.Our wireless charging system can be shown as the picture below.

Industry and Market Opportunity

In 2009, China became the world's largest auto maker nation, and the largest automobile market. Global trends for the rising cost of oil, stricter environmental standards and regulations, and support for energy sources that environmentally friendly technology are increasing market demand for technologies that can reduce oil dependence. Also, China has one of the world's most aggressive green energy national agendas.

In the transportation market, we believe the high prices of conventional fuel, greater awareness of environmental issues and government regulation are increasing the demand for Hybrid Engineering Vehicle (HEV), Plug-in Bybrid Engine Vehicle (PHEV) and Electric Vehicle (EV). These vehicles offer improved gas mileage and reduced carbon emissions and may ultimately provide an alternative vehicle that eliminates the need for gasoline engines.

We believe these trends are contributing to the growing demand for advanced battery technologies in the transportation, electric grid services and portable power markets.

According to a leader in global research and market analysis, by 2011 the market demand for power lithium-ion battery in China is projected to reach $15.740 billion. The combination of electric automobiles, including electric passenger car and electric highway passenger car, accounts for over 96% of the total market, with the electric bicycle market accounting for 2.4% of the total.

12

|

2008

|

2011

|

Occupancy

rate of lithium- ion battery |

Battery

demand (10,000) |

Battery

capacity KWH / battery) |

Average

price of battery dollars/ KWH |

Market

capacity ($mil) |

Total

($ mil) |

|

| Highway

passenger car 10,000 |

178

|

214

|

5%

|

11

|

120

|

400

|

5 130

|

|

| Small

passenger car 10,000 |

935

|

1122

|

5%

|

56

|

30

|

600

|

10 100

|

15 740

|

| Bicycle

power battery (10,000) |

8566

|

10279

|

5%

|

514

|

0.18

|

400

|

370

|

|

| Export

of electric tool 10,000) |

16970

|

18667

|

5%

|

933

|

0.024

|

600

|

130

|

Globally four types of companies are mainly involved in the lithium-ion battery industry,

- Major lithium battery manufacturers (such as Sanyo, LG chemistry, LG Chemical, TOSHIBA)

- Innovative high use rechargeable power technology companies (such as A123)

- automobile manufacturers (such as Toyota, Daimler), and

- auto parts manufacturers (such as Continental Group, Magna, Bosch)

Most are Japanese and South Korean companies.

This is a cutting-edge industry with no dominant players yet. We believe our technology and low cost of research and technology will enable us to become a leading company in this industry. Also, the Company is based in China and is a leading provider of power systems for in Hybrid and Electric cars and vehicles in China.

Physical Plants and Production

Currently we have two plants: one located in Beijing for the assembly and quality control of battery modules with the production capacity of 1,000 pieces per day, the other plant is located in Guangzhou with the production capacity of 10,000 chargers per day and 1,000 units of battery management systems and switching power supply per day. The address for the plant in Beijing is Er Bo Zi Industrial Region West 88-A, Changping District, Beijing China, with three production lines.

The address for the plant in Guangzhou is Minyin Technology District 1633, Beitai Rd., Baiyun district, Guangzhou China, with five production lines to produce charger and battery management systems. The total areas for the two plants are approximately 10,000 square meters, and we lease the two spaces. In addition, we also lease two spaces for our R& D centers, one located in Beijing and the other in Hangzhou. The total annual lease for the four spaces are approximately $16,029 (RMB109,000). The lease for the plant in Er Bo Zi, Zhongguancun R&D center, Hangzhou R&D center, and Guangzhou plant will expire in December 2010, November 2010, August 2012, and August 2013, respectively; but we expect to be able to renew these leases.

13

Marketing

At present, we only distribute products to the domestic customers within China. With the development of new technologies and new products, we are actively seeking overseas customers and developing overseas market.

Domestic sales

Currently, we sell our products to our customers through the entering of sales contracts. Our customers include hybrid and electric vehicle manufacturers, power tool and consumer electronics manufacturers, E-bikes conversion providers, etc. Through three years of cooperation, we have developed good business relationship with these customers. Each year, we entered into sales contracts with each of our customers to provide them our products of lithium-ion battery packs, battery management systems, and chargers. During the three months ended December 31, 2009, our sales to Guangzhou Chuangxin Power Tech Ltd represents 10.10% of the sales.

Our future marketing strategy includes:

* Maintaining our sales contracts with our existing Hybrid and Electric vehicle manufacturers, power tool and consumer electronics manufacturers, and E-bikes conversion providers;

* Extending our sales efforts in three marketing centers of Lithium-ion battery industry in China: the Jingjintang area centered in Beijing area, Zhujiang Delta centered in Guangdong province located in the southeast China, and Changjiang Delta centered in Shanghai area;

* Developing local sales distributors to sell our own branded lithium-ion battery products;

* Expanding our cooperation with government agency in China, including the efforts to participating government-subsidized projects;

China has over 120-million E-bikes on its streets. It is expected to institute new rules limiting the weight and speed of E-bikes and those that exceed the new limits will be treated as motorcycles requiring an operator license, insurance, and road restrictions. Also, motorcycles are banned in many cities in China. A demand for lighter E-bikes and E-bike conversion from the heavier lead-acid batteries to Lithium-ion is expected to emerge as the new regulations are implemented.

The Lithium-ion battery module pack is superior to the common lead-acid battery, with less pollution, larger capacity, longer service life, and lighter weight. The new regulations will accelerate the general to replace lead-acid battery with Lithium-ion batteries.

Overseas sales

We will expand to overseas markets with our manufacturing partners, particularly in E-bikes, electric scooters, hybrid and electric cars. The Company will expand its lithium-ion battery business as a cost-effective, reliable power solution supplier to hybrid and electronic vehicle manufacturers and consumer electronics manufacturers.

14

Raw Material and Suppliers

One of our significant costs are of Lithium-ion cells. Heilongjiang ZhongQiang Power-Tech Co., Ltd ("Heilongjiang Zhongqiang") is our major supplier providing 96.4% of our lithium-ion battery cell requirements during the six months ended December 31, 2009. Through years of cooperation, we have developed a good business relationship with Heilongjiang Zhongqiang. We have entered into supply contracts with Heilongjiang Zhongqiang since 2007. The contracts are renewable each year. We believe that we are able to access abundant supply of lithium-ion cells through our relationship with Heilongjiang Zhongqiang. In the event that Heilongjiang Zhongqiang cannot provide a sufficient supply to us, we believe that we can find alternative suppliers in the market with similar pricing. The major lithium-ion cell manufacturers in the market of China include Tianjin Lishen Battery Joint Stock Co., Ltd, China TCL Corporations, and BYD Company Limited.

Our Strategy

Our goal is to utilize our materials, science, expertise, our battery and battery systems engineering expertise and our manufacturing process technologies to provide advanced battery solutions. We intend to pursue the following strategies to attain this goal:

| • Pursue

markets and customers where our technology creates a competitive advantage.

We will continue to focus our efforts in markets where customers place a

premium on high-quality batteries, innovation and differentiated performance.

• Partner with industry leaders in China to adapt and commercialize our products to meet the requirements of our target markets. In each of our target markets, our joint development and supply agreements with industry-leading companies in China provide us insight into the performance requirements of that market, allow us to share product development costs and position our products to serve as a key strategic element for our partners' success. • Remain on the forefront of innovation and commercialization of new battery and system technologies. We believe that our battery design technologies provide us with a competitive advantage, and we intend to continue to innovate in materials science and product design. • Reduce costs through manufacturing improvements, supply chain efficiencies, innovation in materials and battery technologies. We believe that we can lower our battery and battery system costs by improving our manufacturing performance, lowering our raw material procurement costs, improving our inventory and supply chain management and through further materials science and battery innovation that can help reduce our need for expensive control and electronic components. |

Employees

Beijing Guoqiang has 282 employees, including 22 managerial personnel as well as 35 technology R&D personnel, 50 people in the 57 managerial and technological personnel have bachelor degrees or above, 20 have master's degrees or above.

15

Environmental Law Compliance

When our production plant was constructed, it was designed to comply with these environmental laws by directly disposing of the waste water to a nearby sewage treatment plant for further processing. Since our production plant was built to comply with these environmental laws, we are not required to pay for any ongoing fees to the sewage treatment plant, nor has there been any material effects on our capital expenditures, earnings and competitive position.

Since China does not have additional environmental regulations dealing with climate change that apply to our operations, we have not planned material capital expenditures for environmental control facilities or changes in our business practices specific to climate change.

Management's Analysis of Financial Statements

The accounting effect of the Entrusted Management Agreements entered into on January 05, 2010 is to cause the balance sheets and financial results of Beijing Guoqiang for the years ended June 30, 2009 and 2008 to be consolidated with those of Sky Achieve, with respect to which Beijing Guoqiang is now a Variable Interest Entity ("VIE").

As a wholly-owned subsidiary of PI Services, the consolidated financial statements of Sky Achieve, Inc. will be further consolidated with the financial statements of PI Services in future filings. For that reason, the financial statements of Beijing Guoqiang and Sky Achieve have been filed with this Report, and the discussion below concerns the financial condition and results of operations of Sky Achieve and Beijing Guoqiang.

Result of Operations

Six Months and Three Months Ended December 31, 2009 and 2008

We commenced our operations in March of 2007 producing battery chargers, battery management systems and battery modules, and have grown to achieve a significant position in the Chinese Lithium-ion Battery industry. During the six months ended December 31, 2009, we realized a total revenue of $7,707,041, an increase of $2,965,850 or 62.6% compared to that of $ 4,741,191 during the six months ended December 31, 2008. Likewise, our revenue for the three months ended December 31, 2009 was $3,505,473, an increase of $1,159,886 or 49.4% compared to $2,345,587 during the three months ended December 31, 2008. The increase was attributable to our success of marketing of our lithium-ion battery management system and battery module products. We expect to continue our growth during the next two quarters of 2010.

Our cost of sales during the six months and three months ended December 31, 2009 were $5,445,920 and $2,294,508, respectively, compared to $3,398,692 and $1,695,606 during the same periods of 2008. The increase in the cost of sales was proportional to the increase in our revenues during the periods under review. As a result, our profit margin during the three months ended December 31, 2009 increased to 34.5%, compared to 27.7% during the three months ended December 31, 2008. Similarly, our profit margin during the six months ended December 31, 2009 was 29.3%, compared to 28.3% during the six months ended December 31, 2008.

16

In accordance with our significant increase of revenues, our operating expenses during the six and three months ended December 31, 2009 were $525,344 and $306,701 respectively, compared to $301,532 and $154,398 during the six and three months ended December 31, 2008. The increase in expenses was attributable to our expanded manufacture, sales and R&D efforts.

Our net income during the six months ended December 31, 2009 was $1,301,234, an increase of $526,673 or 68% compared to $774,561 during the six months ended December 31, 2008. Similarly, our net income during the three months ended December 31, 2009 was $677,599, an increase of $308,936 or 83.8% compared to $368,663 during the three months ended December 31, 2008. We expect to continue our rapid growth in the coming quarters and our net income for the future will also continue to increase steadily.

Years Ended June 30, 2009 and 2008

We commenced our operations in March of 2007 producing battery charger, battery management system and battery module. We experienced a rapid growth since then. Within one year of development, we realized $6,791,445 revenues during the year ended June 30, 2008. During the year ended June 30, 2009, our revenue grew significantly by 61.4% or 4,171,482 to $ 10,962,927, compared to the fiscal year of 2008. The increase was attributable to our success in the development of our core technology and products, business marketing strategy and the expansion of our customer base.

Just as our revenue grew significantly from fiscal year of 2008 to 2009, our cost of sales for the periods increased from $4,488,749 to $7,989,327, yielding a gross margin for the year ended June 30, 2009 of 27.1%

Our operating expenses during the year ended June 30, 2009 were $669,652, a slight decrease of 49,680 compared to $719,332 during the year ended June 30, 2008. The reduction in operating expenses despite the significant increase in our revues during the periods under review was primarily due to the reduction in our R&D expenses in the fiscal year of 2009 compared to the start-up R&D expenses in the year of 2008.

Out net income for the year ended June 30, 2009 was $1,722,687, an increase of $540,899 or 45.8% compared to $1,181,788 during the year ended June 30, 2008. We expect to continue our rapid growth in the next fiscal year and our net income for the future will also continue to increase steadily.

Liquidity and Capital Resources

After our shareholders made the initial contribution of our registered capital, the growth of our business has been funded, primarily, by the revenues resulted from our business operations. As a result, at December 31, 2009, we had no long term debts.

Our working capital at December 31, 2009 totaled $4,000,609, an increase of $1,313,289 or 48.9% from our $2,687,320 in working capital as of June 30, 2009. As at December 31, 2009, we also doubled our cash to $ 896,012, compared to $407,333 at June 30, 2009, as a result of our first three years of business operation.

17

Included in our December 31, 2009 working capital was $4,220,786 recorded as accounts receivable. Trade accounts receivable stated at net realizable value, net of allowances for doubtful accounts and sales returns. The allowance for doubtful accounts is established based on the management's assessment of the recoverability of accounts and other receivables. We determine the allowance based on historical write-off experience, customer specific facts and current crisis on economic conditions. While we believe that we can collect the amount, it does limit the liquidity of our asset base.

Our business plan contemplates that we intend to increase our production capacity of lithium-ion battery module to 3,000 per day, charger to 10,000 per day, and BMS to 4,000 per day. Implementation of this plan will require significant funds. The funds are needed in order to:

| • | Improve and upgrade our R&D center including purchase of more advanced research equipments and hiring of key technical talents in lithium-ion industry; | |

| • | Improve and expand our manufacture facilities including purchase of new machinery and equipment and construction of new workshops; | |

| • | Develop regional distributors for the development of our own branded products; and | |

| • | Implement an advertising and marketing program adequate to assure us of substantial market presence. |

Our plan is to sell a portion of our equity in order to obtain the necessary funds, which will dilute the equity share of our existing shareholders. To date, however, we have received no commitment from any source for funds.

Off-Balance Sheet Arrangements

Neither PI Services, Sky Achieve, or Beijing Guoqiang nor any of the companies has any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on their financial condition or results of operations.

Risk Factors That May Affect Future Results

Investing in our common stock involves a significant degree of risk. You should carefully consider the risks described below together with all of the other information contained in this Report, including the financial statements and the related notes, before deciding whether to purchase any shares of our common stock. If any of the following risks occurs, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

Our business and growth will suffer if we are unable to hire and retain key personnel that are in high demand.

Our future success depends on our ability to attract and retain highly skilled engineers, technical, marketing and customer service personnel, especially qualified personnel for our operations in China. Qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. Therefore we may not be able to successfully attract or retain the personnel we need to succeed.

18

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

We are designing and developing new technology. We rely on a combination of copyright and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Unauthorized use of our technology could damage our ability to compete effectively. In China, monitoring unauthorized use of our products is difficult and costly. In addition, intellectual property law in China is less developed than in the United States and historically China has not protected intellectual property to the same extent as it is protected in other jurisdictions, such as the United States. Any resort to litigation to enforce our intellectual property rights could result in substantial costs and diversion of our resources, and might be unsuccessful.

The demand for batteries in the transportation and other markets depends on the continuation of current trends resulting from dependence on fossil fuels.

We believe that much of the present and projected demand for advanced batteries in the transportation and other markets results from the recent increases in the cost of oil, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternate forms of energy, as well as the belief that climate change results in part from the burning of fossil fuels. If the cost of oil decreased significantly, the outlook for the long-term supply of oil to the United States improved, the government eliminated or modified its regulations or economic incentives related to fuel efficiency and alternate forms of energy, or if there is a change in the perception that the burning of fossil fuels negatively impacts the environment, the demand for our batteries could be reduced, and our business and revenue may be harmed.

If we are unable to develop, manufacture and market products that improve upon existing battery technology and gain market acceptance, our business may be adversely affected. In addition, many factors outside of our control may affect the demand for our batteries and battery systems.

We are researching, developing, manufacturing and selling lithium-ion batteries and battery systems. The market for advanced rechargeable batteries is at a relatively early stage of development, and the extent to which our lithium-ion batteries will be able to meet our customers' requirements and achieve significant market acceptance is uncertain. Rapid and ongoing changes in technology and product standards could quickly render our products less competitive, or even obsolete if we fail to continue to improve the performance of our battery chemistry and systems. Other companies that are seeking to enhance traditional battery technologies have recently introduced or are developing batteries based on nickel metal-hydride, liquid lithium-ion and other emerging and potential technologies. These competitors are engaged in significant development work on these various battery systems. One or more new, higher energy rechargeable battery technologies could be introduced which could be directly competitive with, or superior to, our technology. The capabilities of many of these competing technologies have improved over the past several years. Competing technologies that outperform our batteries could be developed and successfully introduced, and as a result, there is a risk that our products may not be able to compete effectively in our target markets. If our battery technology is not adopted by our customers, or if our battery technology does not meet industry requirements for power and energy storage capacity in an efficient and safe design our batteries will not gain market acceptance.

19

In addition, the market for our products depends upon third parties creating or expanding markets for their end-user products that utilize our batteries and battery systems. If such end-user products are not developed, if we are unable to have our products designed into these end user products, if the cost of these end-user products is too high, or the market for such end-user products contracts or fails to develop, the market for our batteries and battery systems would be expected similarly to contract or collapse. Our customers operate in extremely competitive industries, and competition to supply their needs focuses on delivering sufficient power and capacity in a cost, size and weight efficient package. The ability of our customers to adopt new battery technologies will depend on many factors outside of our control. For example, in the automotive industry, we depend on our customers' ability to develop HEV, PHEV and EV platforms that gain broad appeal among end users.

Many other factors outside of our control may also affect the demand for our batteries and battery systems and the viability of widespread adoption of advanced battery applications, including:

| • | performance and reliability of battery power products compared to conventional and other non-battery energy sources and products; | |

| • | success of alternative battery chemistries, such as nickel-based batteries, lead-acid batteries and conventional lithium-ion batteries and the success of other alternative energy technologies, such as fuel cells and ultra capacitors; | |

| • | end-users' perceptions of advanced batteries as relatively safe and reliable energy storage solutions, which could change over time if alternative battery chemistries prove unsafe or become the subject of significant product liability claims and negative publicity is generated on the battery industry as a whole; | |

| • | cost-effectiveness of our products compared to products powered by conventional energy sources and alternative battery chemistries; | |

| • | availability of government subsidies and incentives to support the development of the battery power industry; | |

| • | fluctuations in economic and market conditions that affect the cost of energy stored by batteries, such as increases or decreases in the prices of electricity; | |

| • | continued investment by the federal government and our customers in the development of battery powered applications; | |

| • | heightened awareness of environmental issues and concern about global warming and climate change; and | |

| • | regulation of energy industries. |

Adverse business or financial conditions affecting the automotive industry may have a material adverse effect on our development and marketing partners and our battery business.

Adverse business or financial conditions affecting individual automotive manufacturers or the automotive industry generally, including potential bankruptcies, as well as market disruption that could result from future consolidation in the automotive industry, could have a material adverse effect on our business. Automotive manufacturers may discontinue or delay their planned introduction of HEVs, PHEVs or EVs as a result of adverse changes in their financial condition or other factors. Automotive manufacturers may also seek alternative battery systems from other suppliers which may be more cost-effective or require fewer modifications in standard manufacturing processes than our products. We may also experience delays or losses with respect to the collection of payments due from customers in the automotive industry experiencing financial difficulties.

20

We are dependent on one major supplier for our raw materials. In the event we are no longer able to secure raw materials from this supplier and are unable to find alternative sources of supply at similar or more competitive rates, our operations and profitability will be adversely affected.

For the production of our lithium-ion battery modules and management systems, we rely on our major supplier Heilongjiang Zhongqiang Energy Technology Development Limited for 94% of the lithium-ion battery cell supply. Although we believe that we are able to find substitute suppliers easily in China such as Tianjin Lishen Battery Joint Stock Co., Ltd, China TCL Corporations, and BYD Company Limited, in the event that we are unable to find alternative sources of supply at similar or more competitive rates, our business and operations will be adversely affected.

Most of our assets are located in China, any dividends or proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our assets are predominantly located inside China. Under the laws governing Foreign-invested Entities in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency's approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment or liquidation.

We have limited business insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products, and do not, to our knowledge, offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations. Moreover, while business disruption insurance is available, we have determined that the risks of disruption and cost of the insurance are such that we do not require it at this time. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of our resources.

Our operations are in China, and we are subject to significant political, economic, legal and other uncertainties (including, but not limited to, trade barriers and taxes that may have an adverse effect on our business and operations.

We manufacture all of our products in China and substantially all of the net book value of our total fixed assets is located there. However, we sell our products to customers outside of China as well as domestically. As a result, we may experience barriers to conducting business and trade in our targeted markets in the form of delayed customs clearances, customs duties and tariffs. In addition, we may be subject to repatriation taxes levied upon the exchange of income from local currency into foreign currency, as well as substantial taxes of profits, revenues, assets or payroll, as well as value-added tax. The markets in which we plan to operate may impose onerous and unpredictable duties, tariffs and taxes on our business and products. Any of these barriers and taxes could have an adverse effect on our finances and operations.

21

Environmental compliance and remediation could result in substantially increased capital requirements and operating costs.

Our operating entity, Beijing Guoqiang, is subject to numerous Chinese provincial and local laws and regulations relating to the protection of the environment. These laws continue to evolve and are becoming increasingly stringent. The ultimate impact of complying with such laws and regulations is not always clearly known or determinable because regulations under some of these laws have not yet been promulgated or are undergoing revision. Our consolidated business and operating results could be materially and adversely affected if Beijing Guoqiang were required to increase expenditures to comply with any new environmental regulations affecting its operations.

We may be required to raise additional financing by issuing new securities with terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock.

We may require additional financing to fund future operations, develop and exploit existing and new products and to expand into new markets. We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage ownership of our current shareholders will be reduced, and the holders of the new equity securities may have rights superior to those of the holders of shares of common stock, which could adversely affect the market price and the voting power of shares of our common stock. If we raise additional funds by issuing debt securities, the holders of these debt securities would similarly have some rights senior to those of the holders of shares of common stock, and the terms of these debt securities could impose restrictions on operations and create a significant interest expense for us.

We do not intend to pay any cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in our common stock must come from increases in the fair market value and trading price of our common stock.

We have never paid a cash dividend on our common stock. We do not intend to pay cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in our common stock must come from increases in the fair market value and trading price of our common stock.

Our international operations require us to comply with a number of U.S. and international regulations.

We need to comply with a number of international regulations in countries outside of the United States. In addition, we must comply with the Foreign Corrupt Practices Act, or FCPA, which prohibits U.S. companies or their agents and employees from providing anything of value to a foreign official for the purposes of influencing any act or decision of these individuals in their official capacity to help obtain or retain business, direct business to any person or corporate entity or obtain any unfair advantage. Any failure by us to adopt appropriate compliance procedures and ensure that our employees and agents comply with the FCPA and applicable laws and regulations in foreign jurisdictions could result in substantial penalties or restrictions on our ability to conduct business in certain foreign jurisdictions. The U.S. Department of The Treasury's Office of Foreign Asset Control, or OFAC, administers and enforces economic and trade sanctions against targeted foreign countries, entities and individuals based on U.S. foreign policy and national security goals. As a result, we are restricted from entering into transactions with certain targeted foreign countries, entities and individuals except as permitted by OFAC which may reduce our future growth.

22

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

Our principal operating subsidiary, Beijing Guoqiang, is considered a foreign invested enterprise under PRC laws, and as a result is required to comply with PRC laws and regulations. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in China. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business and the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation.

Our business development, future performance, strategic plans, and other objectives would be hindered if we lost the services of our Chairman.

Kun Liu is the Chairman of our operating subsidiary, Beijing Guoqiang. Mr. Liu is responsible for strategizing not only our business plan but also the means of financing it. Mr. Liu has also, from time to time, provided his personal funds to meet the working capital needs of Beijing Guoqiang. If Mr. Liu were to leave Beijing Guoqiang or become unable to fulfill his responsibilities, our business would be imperiled. At the very least, there would be a delay in the development of Beijing Guoqiang until a suitable replacement for Mr. Liu could be retained.

The capital investments that we plan may result in dilution of the equity of our present shareholders.

We intend to raise a large portion of the funds necessary to implement our business plan by selling equity in our company. At present we have no commitment from any source for those funds. We cannot determine, therefore, the terms on which we will be able to raise the necessary funds. It is possible that we will be required to dilute the value of our current shareholders' equity in order to obtain the funds. If, however, we are unable to raise the necessary funds, our growth will be limited, as will our ability to compete effectively.

23

We may have difficulty establishing adequate management and financial controls in China.

The PRC has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected of a United States public company. If we cannot establish such controls, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards.

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors, on committees of our board of directors or as executive officers.

As a public company, we are required to comply with rules and regulations of the SEC, including expanded disclosure, accelerated reporting requirements and more complex accounting rules. This will continue to require additional cost management resources. We will need to continue to implement additional finance and accounting systems, procedures and controls as we grow to satisfy these reporting requirements. In addition, we may need to hire additional legal and accounting staff with appropriate experience and technical knowledge, and we cannot assure you that if additional staffing is necessary that we will be able to do so in a timely fashion. If we are unable to complete the required annual assessment as to the adequacy of our internal reporting or if our independent registered public accounting firm is unable to provide us with an unqualified report as to the effectiveness of our internal controls over financial reporting in the future, we could incur significant costs to become compliant.

Our financial results may be affected by mandated changes in accounting and financial reporting.

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America. These principles are subject to interpretation by the Securities and Exchange Commission and other regulatory institutions responsible for the promulgation and interpretation of securities rules and accounting policies. A change in these policies may have a significant effect on our reported results and may even retroactively affect previously reported transactions.

24

Capital outflow policies in China may hamper our ability to pay dividends to shareholders in the United States.

The PRC has adopted currency and capital transfer regulations. These regulations require that we comply with complex regulations for the movement of capital. Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange. We may be unable to obtain all of the required conversion approvals necessary for our operations, and Chinese regulatory authorities may impose greater restrictions on the convertibility of the RMB in the future. Because most of our future revenues will be in RMB, any inability to obtain the requisite approvals or any future restrictions on currency exchanges will limit our ability to pay dividends to our shareholders.

Currency fluctuations may adversely affect our operating results.

Beijing Guoqiang generates revenues and incurs expenses and liabilities in Renminbi, the currency of the PRC. However, as a Variable Interest Entity ("VIE") of PI Services, it will report its financial results in the United States in U.S. Dollars. As a result, our financial results will be subject to the effects of exchange rate fluctuations between these currencies. From time to time, the government of China may take action to stimulate the Chinese economy that will have the effect of reducing the value of Renminbi. In addition, international currency markets may cause significant adjustments to occur in the value of the Renminbi. Any such events that result in a devaluation of the Renminbi versus the U.S. Dollar will have an adverse effect on our reported results. We have not entered into agreements or purchased instruments to hedge our exchange rate risks.

All of our assets are located in China. So any dividends or proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our assets are located inside China. Under the laws governing FIEs in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency's approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment or liquidation.

PI Services is not likely to hold annual shareholder meetings in the next few years.

Management does not expect to hold annual meetings of shareholders in the next few years, due to the expense involved. The current members of the Board of Directors were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, the shareholders of the Company will have no effective means of exercising control over the operations of the Company.

25

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the People's Republic of China do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

We may be affected by global climate change or by legal, regulatory, or market responses to such change.

Concern over climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting greenhouse gas (GHG) emissions. For example, proposals that would impose mandatory requirements on GHG emissions continue to be considered by policy makers in the territories that we operate. Laws enacted that directly or indirectly affect our production, distribution, packaging, cost of raw materials, fuel, ingredients, and water could all impact our business and financial results.

Executive Compensation

None of the former officers and directors of PI Services received any compensation for their respective services rendered to the Company during the past three fiscal years. None of such person remains an officer effective on March 19, 2010 or director of PI Services effective on the tenth day following the filing of the Form 14(f) with the SEC to be mailed out on or about March 26, 2010.

The table below sets forth the compensation (including salary, bonuses and other compensation) paid by Beijing Guoqiang to Kun Liu for his services to Beijing Guoqiang during the years ending June 30, 2009, 2008 and 2007. No payments were made by Beijing Guoqiang to Fu Qiang nor Jinjun Zhang, the other two directors. All payments were made in Renminbi, and are calculated in this table at the Renminbi - Dollar exchange rate as of March 11, 2010. There was no officer of Beijing Guoqiang whose salary and bonus for services rendered during the six months ended December 31, 2009 exceeded $100,000.

| Name |

Year

|

Salary

|

|

| Kun Liu |

2009

|

$17,647

|

|

|

2008

|

$17,647

|

||

|

2007

|

$17,647

|

Employment Agreements

All of our officers and directors serve on an at-will basis.

26

Related Party Transactions

In July 2007, the Company issued 354,797 shares of its common stock to former shareholders of the Company (including 157,575 shares issued to 5 former directors of the Company) in consideration for the cancellation of $94,500 of convertible debt. On September 30, 2007 the Company issued 540,000 shares of its common stock to two former directors and officers of the Company for a $6,116 cash payment. During the year ended December 31, 2008 the two former directors and officers of the Company advanced the Company an additional $13,884 in exchange for 1,233,984 additional shares of common stock following the increase in the Company's authorized capital effective January 12, 2009. The shares were issued on January 31, 2009.

In the year of 2010, 2009, 2008 and 2007, Beijing Guoqiang entered into supply contracts with Heilongjiang Zhongqiang, our major supplier providing 96.4% of our lithium-ion battery cell requirements during the six months ended December 31, 2009. One of our directors, Fu Qiang's father, Mr. Zhiguo Fu, is the CEO of Advanced Battery Technologies, Inc., which has exclusive control over the business of Heilongjiang Zhongqiang through entrusted management agreements. We believe that the terms of the supply contracts are fair as to our company and the prices of the lithium-ion battery cells are comparable to those produced by other lithium-ion battery cell manufacturers.

Beijing Guoqiang obtained a loan from its major stockholder - Mr. Kun Liu. As of June 30, 2008, the loan was $541,410 bearing no interest and due on demand. As of June 30, 2009, the outstanding loan from Mr. Kun Liu was $381, 334.

Director Independence

None of the member of our Board of Directors are independent, as "independent" is defined in the rules of the NASDAQ Stock Market.

Description of Securities

The Board of Directors of PI Services is authorized to issue 780,000,000 shares of Common Stock, $.001 par value per share, of which 44,351,500 shares are outstanding. The Board of Directors is also authorized to issue 20,000,000 shares of Preferred Stock, $.001 par value, none of which are outstanding.

Common Stock. Holders of the Company are entitled to one vote for each share in the election of directors and in all other matters to be voted on by the stockholders. There is no cumulative voting in the election of directors. Holders of Common Stock are entitled to receive such dividends as may be declared from time to time by the Board of Directors with respect to the Common Stock out of funds legally available therefore and, in the event of liquidation, dissolution or winding up of the Company, to share rateably in all assets remaining after payment of liabilities. The holders of Common Stock have no pre-emptive or conversion rights and are not subject to further calls or assessments. There are no redemption or sinking fund provisions applicable to the Common Stock.

27