Attached files

Exhibit 13

Dear Stockholder,

This past year continued to be a most challenging one for the banking industry, a year filled with an increase in both bank failures and FDIC problem-list banks, which resulted in a depletion of the Deposit Insurance Fund, requiring unprecedented actions from the FDIC in order to restore the fund. The nation’s economy remained mired in a deep recession for most of the year, with unemployment surpassing ten percent, a continued decline in consumer confidence resulting in reduced consumer spending, and sustained stress on the residential mortgage industry, resulting in a decline in real estate values. All of these events had an adverse impact on Botetourt Bankshares, Inc. in 2009.

Your Company recorded net income for the year in the amount of $764,074, a decrease of 36.5% from the previous year’s earnings. Both basic and diluted earnings per share amounted to $0.61 in 2009, compared to $0.97 in 2008. The decline in earnings can be attributed primarily to an increase in FDIC deposit insurance expense during 2009, which amounted to $685,000 for the year, as compared to $143,000 in the prior year. During 2009, banks throughout our nation endured substantial FDIC insurance premium increases as well as an additional special assessment during the year in order to replenish the Deposit Insurance Fund, which was nearly depleted from the increase in bank failures during the year. Additionally, in 2009, the bank’s loan loss provision amounted to $1,790,000, compared to $1,885,000 in 2008. The continued large provision to the reserve for loan losses was appropriate due to an increase in both impaired and non-performing loans, as well as the continued uncertainty of the current economic climate. Actual net charge-offs in 2009 amounted to 0.63% of average total loans, compared to 0.16% of average total loans in 2008.

As a result of the decline in earnings, the quarterly dividend payment to stockholders was reduced to $0.08 per share in November 2009. Your Company’s management and its board of directors recognize the commitment to provide an adequate return on stockholder investment, while at the same time maintaining adequate capital levels which protect the bank’s depositors as well as the Company’s stockholders. This commitment is reflected in the determination of the dividend payment. Both Botetourt Bankshares, Inc. and Bank of Botetourt remain well capitalized according to regulatory standards. The strength of the bank’s capital position allowed the Company to elect not to participate in the U.S. Treasury’s TARP Capital Purchase Program in the fourth quarter of 2008. As an alternative capital-raising measure, a dividend reinvestment program was approved by the stockholders at this past year’s annual stockholder meeting and was instituted in the fourth quarter of 2009. The program has been very well-received, with over 28% of stockholders currently participating, and will provide a steady stream of capital for the Company in the coming years.

Total assets at year-end 2009 amounted to $308,534,573, an increase of 4.8% above 2008. Net loans at December 31, 2009 amounted to $259,998,540, an increase of 2.8% above 2008. Total deposits at December 31, 2009 amounted to $279,839,835, an increase of 5.8% from the prior year. Bank of Botetourt continued to hold the largest market share of deposits of all financial institutions located in Botetourt County, Virginia and gained market share in the three other counties in which our retail offices are located.

In June 2009, Botetourt Bankshares, Inc. was again recognized as one of the top performing community banks in the country by U.S. Banker magazine, ranking 179th among over 1,100 publicly traded financial institutions in the United States, based on a three-year average return on equity. The recognition underscores the strong shareholder value of the Company as well as employee commitment and customer loyalty.

The economic outlook for 2010 remains uncertain at best, although there are signs that economic recovery is underway, especially when observing positive gross domestic product trends in the third and fourth quarters of 2009. However, a full economic recovery will only be sustained with improvement in the employment situation. Both the national and local unemployment rates remain well above normal levels, and a recovery in the housing sector has yet to happen. Inflation appears to be under control, in spite of the massive deficit spending by Congress and injections of reserves into the financial system. As a result, interest rates remain at historic low levels. Despite the many challenges facing the banking industry, your Company is confident that these turbulent times will pass and that both the Company and our nation will be stronger as a result of this experience.

Your Company’s management team and your board of directors remain committed to “Taking Care of You,” the Company’s mission of professionally and personally serving our customers, employees, stockholders and communities. Thank you for your continued support of Botetourt Bankshares, Inc. and community banking.

Sincerely,

H. Watts Steger, III Chairman & CEO

G. Lyn Hayth, III

President, Bank of Botetourt

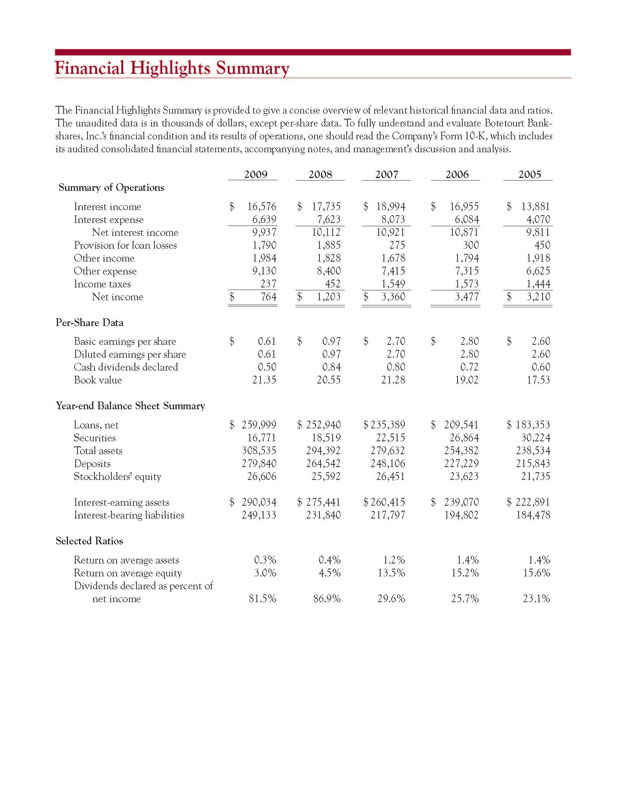

Financial Highlights Summary

The Financial Highlights Summary is provided to give a concise overview of relevant historical financial data and ratios. The unaudited data is in thousands of dollars, except per-share data. To fully understand and evaluate Botetourt Bank-shares, Inc.’s financial condition and its results of operations, one should read the Company’s Form 10-K, which includes its audited consolidated financial statements, accompanying notes, and management’s discussion and analysis.

2009 2008 2007 2006 2005

Summary of Operations

Interest income $ 16,576 $ 17,735 $ 18,994 $ 16,955 $ 13,881

Interest expense 6,639 7,623 8,073 6,084 4,070

Net interest income 9,937 10,112 10,921 10,871 9,811

Provision for loan losses 1,790 1,885 275 300 450

Other income 1,984 1,828 1,678 1,794 1,918

Other expense 9,130 8,400 7,415 7,315 6,625

Income taxes 237 452 1,549 1,573 1,444

Net income $ 764 $ 1,203 $ 3,360 3,477 $ 3,210

Per-Share Data

Basic earnings per share $ 0.61 $ 0.97 $ 2.70 $ 2.80 $ 2.60

Diluted earnings per share 0.61 0.97 2.70 2.80 2.60

Cash dividends declared 0.50 0.84 0.80 0.72 0.60

Book value 21.35 20.55 21.28 19.02 17.53

Year-end Balance Sheet Summary

Loans, net $ 259,999 $ 252,940 $ 235,389 $ 209,541 $ 183,353

Securities 16,771 18,519 22,515 26,864 30,224

Total assets 308,535 294,392 279,632 254,382 238,534

Deposits 279,840 264,542 248,106 227,229 215,843

Stockholders’ equity 26,606 25,592 26,451 23,623 21,735

Interest-earning assets $ 290,034 $ 275,441 $ 260,415 $ 239,070 $ 222,891

Interest-bearing liabilities 249,133 231,840 217,797 194,802 184,478

Selected Ratios

Return on average assets 0.3% 0.4% 1.2% 1.4% 1.4%

Return on average equity 3.0% 4.5% 13.5% 15.2% 15.6%

Dividends declared as percent of net income 81.5% 86.9% 29.6% 25.7% 23.1%

Board of Directors

S J Carter Photography

Sitting – Joyce R. Kessinger, H. Watts Steger, III, G. Lyn Hayth, III, F. Lindsey Stinnett

Standing – Edgar K. Baker, Tommy L. Moore, D. Bruce Patterson, John B. Williamson, III, Gerald A. Marshall

Senior Management

S J Carter Photography

Jennifer S. Theimer, Andrew T. Shotwell, Vicky M. Wheeler, H. Watts Steger, III, G. Lyn Hayth, III, Michelle A. Alexander, P. Duaine Fitzgerald

Officers

H. Watts Steger, III

Chairman & CEO

Vicky M. Wheeler

Senior Vice President Branch Administration

George E. Honts, IV

Vice President Commercial Lending

Tammy S. Talbott

Assistant Vice President & Branch Manager

Shelley M. Martin

Branch Manager

G. Lyn Hayth, III

President

Barbara G. Anderson

Vice President

Compliance & Training

Garland L. Humphries

Vice President Credit Administration

Karen R. Thrasher

Assistant Vice President & Branch Manager

Deborah W. Plogger

Manager, Rockbridge Title Services, LLC

Michelle A. Alexander

Senior Vice President Chief Financial Officer

Duane L. Burks

Vice President Retail Development Officer

Cindy K. Pierson

Vice President Bank Operations

Stephanie L. White

Assistant Vice President & Branch Manager

Stephanie D. Ponton

Branch Manager

P. Duaine Fitzgerald

Senior Vice President Financial Services

Brenda G. DeHaven

Vice President Internal Auditor

Kathy M. Caldwell

Assistant Vice President Commercial Lender

Jason M. Bishop

Human Resources Officer

Paula A. Rhodes

Operations Officer

Andrew T. Shotwell

Senior Vice President Bank Operations

Linda R. Doolittle

Vice President Business Development

Cari J. Humphries

Assistant Vice President Marketing Officer

Cindy H. Bower

Branch Manager

Amanda L. Robinson

Financial Advisor

Jennifer S. Theimer

Senior Vice President Chief Risk Officer

Marty R. Francis

Vice President Commercial Lending

Paul M. Murphy

Assistant Vice President Credit Analyst

Edna W. Hazelwood

Branch Manager

Debbie K. Thurman

Mortgage Loan Officer

Paula E. Bussey

Branch Manager

Tina M. Simpson

Branch Manager

Employees

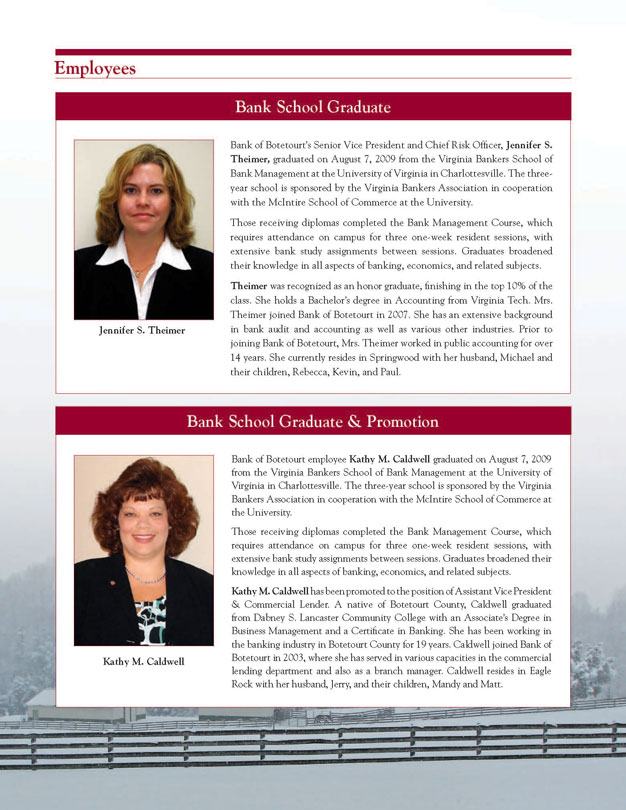

Bank School Graduate

Jennifer S. Theimer

Bank of Botetourt’s Senior Vice President and Chief Risk Officer, Jennifer S. Theimer, graduated on August 7, 2009 from the Virginia Bankers School of Bank Management at the University of Virginia in Charlottesville. The three-year school is sponsored by the Virginia Bankers Association in cooperation with the McIntire School of Commerce at the University.

Those receiving diplomas completed the Bank Management Course, which requires attendance on campus for three one-week resident sessions, with extensive bank study assignments between sessions. Graduates broadened their knowledge in all aspects of banking, economics, and related subjects. Theimer was recognized as an honor graduate, finishing in the top 10% of the class. She holds a Bachelor’s degree in Accounting from Virginia Tech. Mrs. Theimer joined Bank of Botetourt in 2007. She has an extensive background in bank audit and accounting as well as various other industries. Prior to joining Bank of Botetourt, Mrs. Theimer worked in public accounting for over 14 years. She currently resides in Springwood with her husband, Michael and their children, Rebecca, Kevin, and Paul.

Bank School Graduate & Promotion

Kathy M. Caldwell

Bank of Botetourt employee Kathy M. Caldwell graduated on August 7, 2009 from the Virginia Bankers School of Bank Management at the University of Virginia in Charlottesville. The three-year school is sponsored by the Virginia Bankers Association in cooperation with the McIntire School of Commerce at the University.

Those receiving diplomas completed the Bank Management Course, which requires attendance on campus for three one-week resident sessions, with extensive bank study assignments between sessions. Graduates broadened their knowledge in all aspects of banking, economics, and related subjects.

Kathy M. Caldwell has been promoted to the position of Assistant Vice President

& Commercial Lender. A native of Botetourt County, Caldwell graduated from Dabney S. Lancaster Community College with an Associate’s Degree in Business Management and a Certificate in Banking. She has been working in the banking industry in Botetourt County for 19 years. Caldwell joined Bank of Botetourt in 2003, where she has served in various capacities in the commercial lending department and also as a branch manager. Caldwell resides in Eagle Rock with her husband, Jerry, and their children, Mandy and Matt.

Employees

Promotion

Jason M. Bishop

Jason M. Bishop has been promoted to the position of Human Resources Officer. A Botetourt County native, Bishop is a graduate of Roanoke College with a bachelor’s degree in Business Administration. Bishop previously worked in the insurance industry prior to joining Bank of Botetourt in 2004. As a Bank of Botetourt employee, Bishop has served as a head teller, consumer banker and human resources assistant. He currently resides in Troutville with his wife, Shannon.

Promotion

Duane L. Burks has been promoted to the position of Vice President & Retail Development Officer for Bank of Botetourt’s 10 retail office locations. A Galax native, Burks attended Emory & Henry College, where he studied Business Management. He is also a 2008 graduate from the Virginia Bankers School of Bank Management at the University of Virginia in Charlottesville. Burks joined Bank of Botetourt in 2004 and has been in banking for over 16 years. He resides with his wife, Sherrye, and their children, Kaitlin and Karley, in Daleville.

Duane L. Burks

Retirement

Jean N. Johnson

Jean N. Johnson, data processor at Bank of Botetourt’s Operations Center, retired on January 15, 2010. A native of Alleghany County, Johnson began her banking career in 1990 when she joined Bank of Botetourt as a bookkeeper. Johnson was later promoted to proof operator and then computer operator and has served in Bank of Botetourt’s Operations Center for the past 19 years. Johnson has been instrumental in the training of many Operations staff members throughout her tenure at Bank of Botetourt. After her retirement, Johnson hopes to read, travel and spend time with her family. Johnson currently resides in Buchanan with her husband, Oris (Kenny) Johnson, Jr. She also has two children in the area, Angela and Allen.

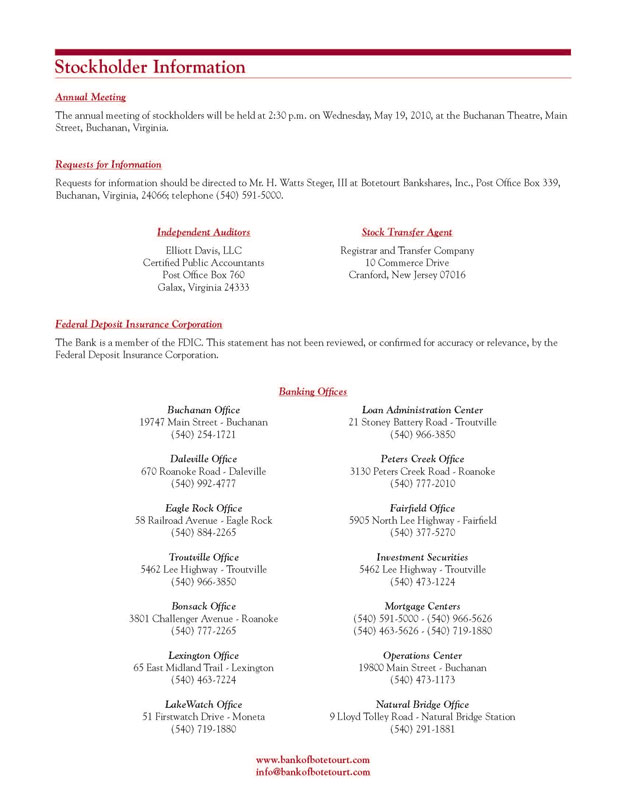

Stockholder Information

Annual Meeting

The annual meeting of stockholders will be held at 2:30 p.m. on Wednesday, May 19, 2010, at the Buchanan Theatre, Main Street, Buchanan, Virginia.

Requests for Information

Requests for information should be directed to Mr. H. Watts Steger, III at Botetourt Bankshares, Inc., Post Office Box 339, Buchanan, Virginia, 24066; telephone (540) 591-5000.

Independent Auditors

Elliott Davis, LLC

Certified Public Accountants

Post Office Box 760

Galax, Virginia 24333

Stock Transfer Agent

Registrar and Transfer Company

10 Commerce Drive

Cranford, New Jersey 07016

Federal Deposit Insurance Corporation

The Bank is a member of the FDIC. This statement has not been reviewed, or confirmed for accuracy or relevance, by the Federal Deposit Insurance Corporation.

Banking Offices

Buchanan Office

19747 Main Street—Buchanan

(540) 254-1721

Daleville Office

670 Roanoke Road—Daleville

(540) 992-4777

Eagle Rock Office

58 Railroad Avenue—Eagle Rock

(540) 884-2265

Troutville Office

5462 Lee Highway—Troutville

(540) 966-3850

Bonsack Office

3801 Challenger Avenue—Roanoke

(540) 777-2265

Lexington Office

65 East Midland Trail—Lexington

(540) 463-7224

LakeWatch Office

51 Firstwatch Drive—Moneta

(540) 719-1880

Loan Administration Center

21 Stoney Battery Road—Troutville

(540) 966-3850

Peters Creek Office

3130 Peters Creek Road—Roanoke

(540) 777-2010

Fairfield Office

5905 North Lee Highway—Fairfield

(540) 377-5270

Investment Securities

5462 Lee Highway—Troutville

(540) 473-1224

Mortgage Centers

(540) 591-5000—(540) 966-5626

(540) 463-5626—(540) 719-1880

Operations Center

19800 Main Street—Buchanan

(540) 473-1173

Natural Bridge Office

9 Lloyd Tolley Road—Natural Bridge Station

(540) 291-1881

www.bankofbotetourt.com

info@bankofbotetourt.com