Attached files

| file | filename |

|---|---|

| 8-K - USA TRUCK INC | form8k-03242010.htm |

USA

TRUCK

USA

TRUCK

Forward-Looking

Statement

This

information and the statements made at this conference presentation may

contain

forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements generally may be identified by their use of terms or phrases such as

“expects,” “estimates,” “anticipates,” “projects,” “believes,” “plans,” “intends,”

“may,” “will,” “should,” “could,” “potential,” “continue,” “future,” and terms or

phrases of similar substance. Forward-looking statements are based upon the current

beliefs and expectations of our management and are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified, which could cause

future events and actual results to differ materially from those set forth in,

contemplated by, or underlying the forward-looking statements. Accordingly, actual

results may differ from those set forth in the forward-looking statements. Readers

should review and consider the factors that may affect future results and other

disclosures by the Company in its reports, Annual Report on Form 10-K, and other

filings with the Securities and Exchange Commission. We disclaim any obligation to

update or revise any forward-looking statements to reflect actual results or changes in

the factors affecting the forward-looking information. In light of these risks and

uncertainties, the forward-looking events and circumstances discussed in this

conference presentation might not occur.

forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements generally may be identified by their use of terms or phrases such as

“expects,” “estimates,” “anticipates,” “projects,” “believes,” “plans,” “intends,”

“may,” “will,” “should,” “could,” “potential,” “continue,” “future,” and terms or

phrases of similar substance. Forward-looking statements are based upon the current

beliefs and expectations of our management and are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified, which could cause

future events and actual results to differ materially from those set forth in,

contemplated by, or underlying the forward-looking statements. Accordingly, actual

results may differ from those set forth in the forward-looking statements. Readers

should review and consider the factors that may affect future results and other

disclosures by the Company in its reports, Annual Report on Form 10-K, and other

filings with the Securities and Exchange Commission. We disclaim any obligation to

update or revise any forward-looking statements to reflect actual results or changes in

the factors affecting the forward-looking information. In light of these risks and

uncertainties, the forward-looking events and circumstances discussed in this

conference presentation might not occur.

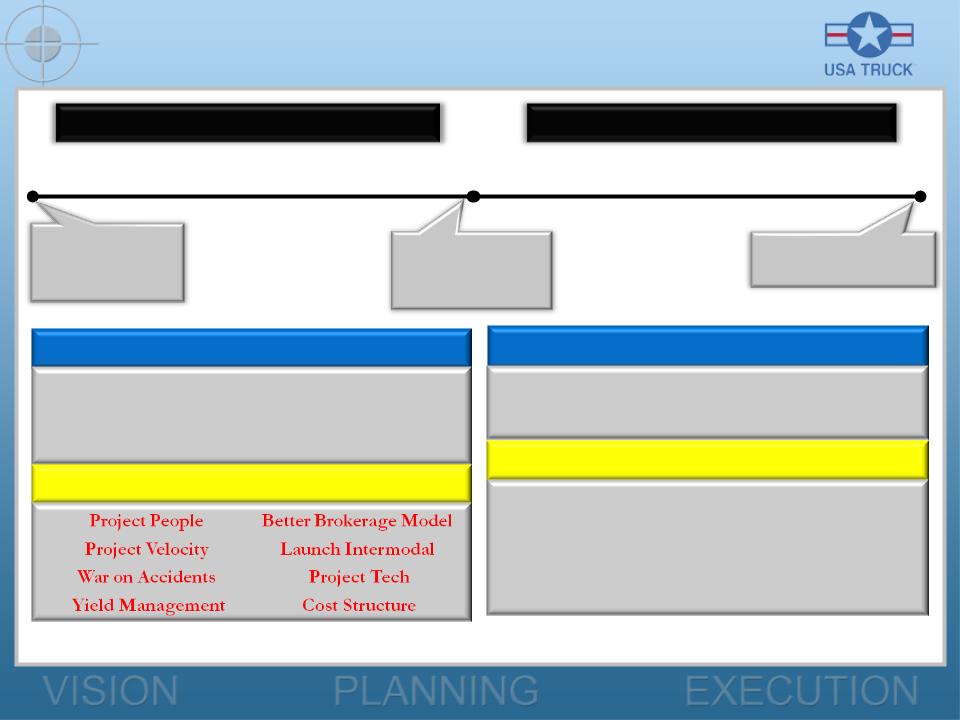

The

VEVA*

Plan

(Unveiled

August 2008)

* We call our strategic

plan Vision for Economic Value-Added, or VEVA

1.0

x Book Value

2

% ROC

98%

OR

3.0

x Book Value

10%

ROC

89%

OR

4.0

x Book Value

<

89% OR

PHASE

I - Earn Cost of Capital

PHASE

II - Earnings Growth

RESULTS

WE WILL NEED

Position

for L-T Growth

Improved

Earnings Consistency

Earn

Our Cost of Capital

RESULTS

WE WILL NEED

Sustained

Earnings Growth > 10%

Positive

Economic Value Added

HOW

WE’LL DO IT

HOW

WE’LL DO IT

Intermodal

Growth

Brokerage

Growth

Niche

Dedicated Launch

General

Freight Acquisitions

Share

Repurchases/Dividends

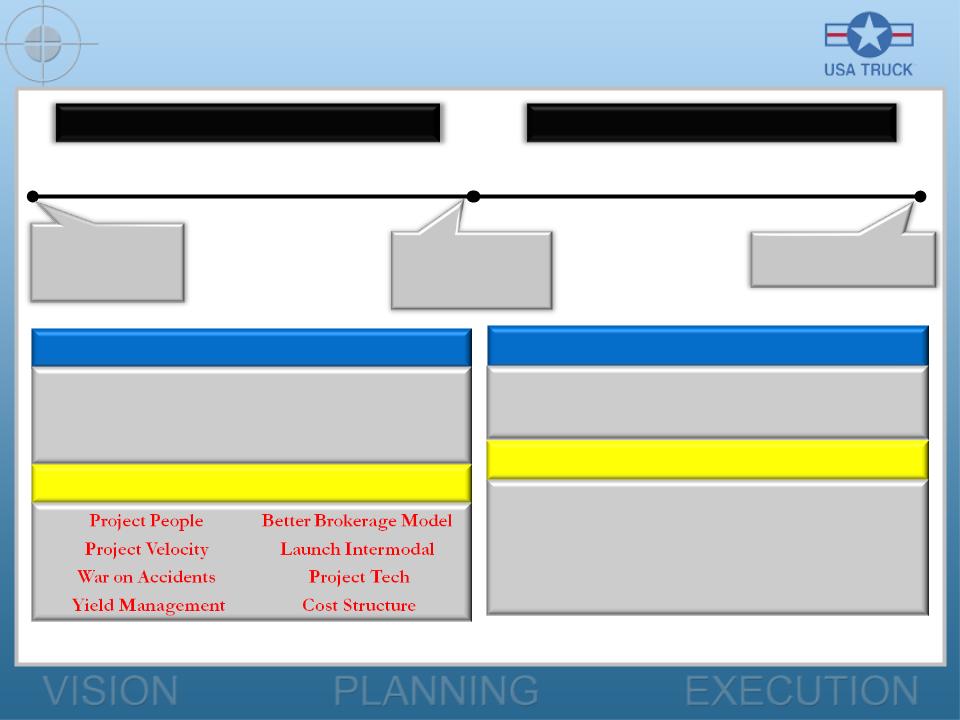

Project

People

2007

Peer Average (Our Original Goal)

3.9:1

2007

USA Truck

3.2:1

4.0:1

2009

USA Truck

Driver

to Non-Driver Ratio

Non-Drivers

-176

or -22%

2007

2007

2009

2009

Improvement

Improvement

Project

Velocity

Length of

Haul

784

599

-

24%

Velocity (Fleet

Turns Per Week)

2.4

3.0

+

25%

2007

2007

2009

2009

Improvement

Improvement

War

on Accidents

DOT

Accidents Per Million Miles

1.1

0.8

-

27%

Total Accidents

Per Million Miles

9.6

8.5

-

11%

Insurance

& Claims (% Revenue)

8.0%

6.4%

-

160 bps

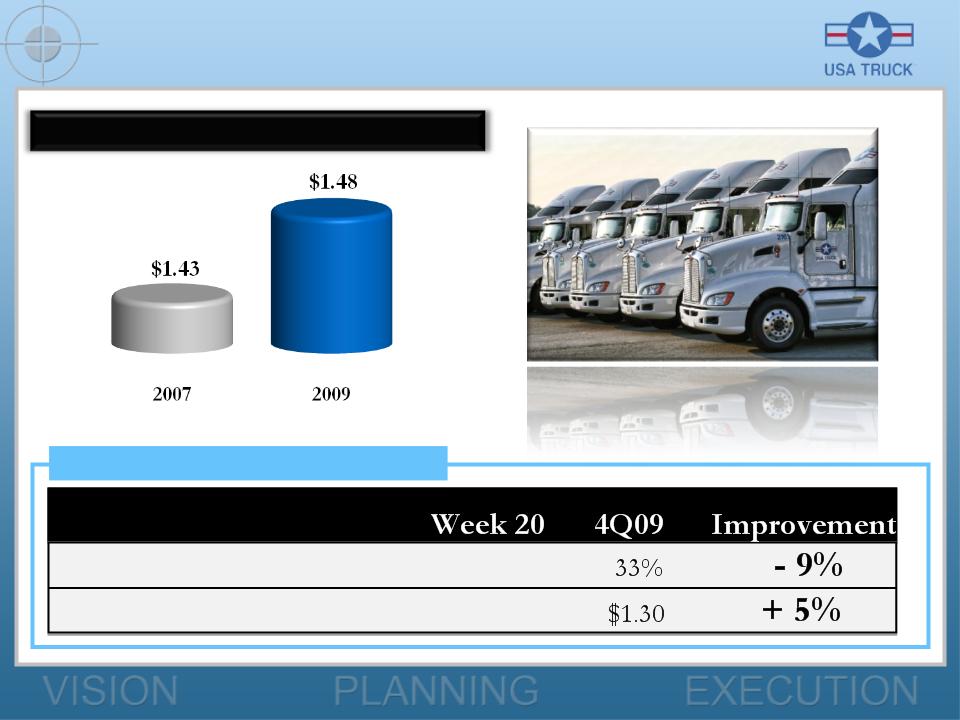

Yield

Management

% of

Outbound Loads

Trucking Revenue

Per Loaded Mile

Backhaul

Management Example

42%

$1.24

Trucking

Revenue Per Loaded Mile

2007

2007

2009

2009

Improvement

Improvement

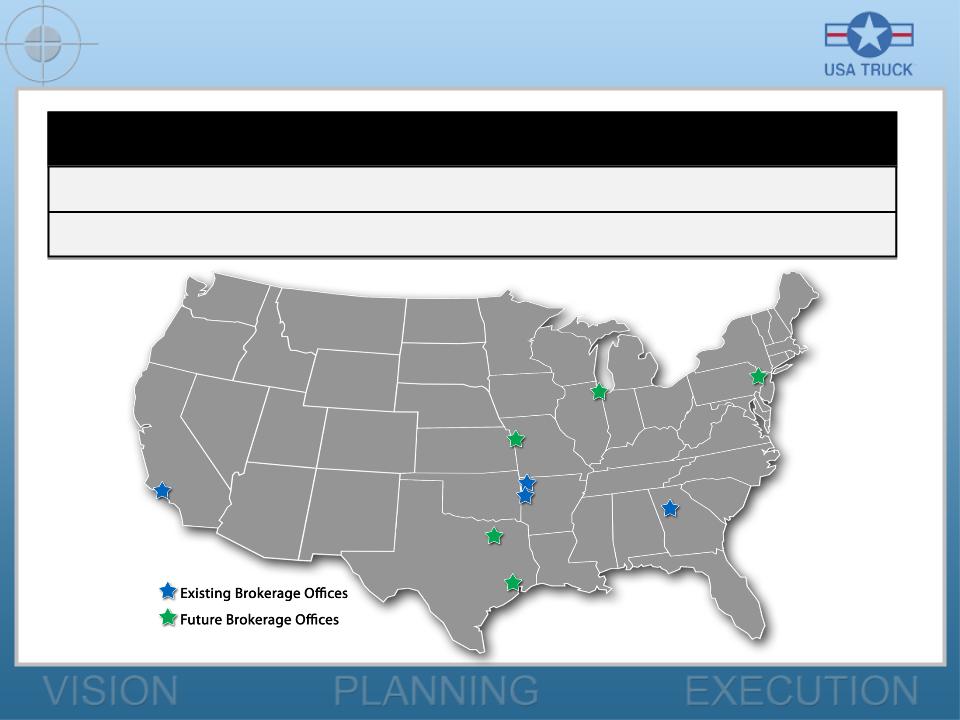

Improve

Brokerage Model

Brokerage

Employees

10

30

+

200%

Gross Profit Per

Week (thousands)

$34.6

$48.7

+

41%

Launch

Intermodal Model

Load

Count

+133%

Project

Tech

Business

Intelligence

Corporate

Website

Customer

Relationship Management

Lane

Analysis

Operational

Decision Support

Modernizing

Our Technology Infrastructure

Accounts

Receivable

Brokerage

Operations

Intermodal

Operations

Pricing

Other

Strategic Initiatives

2007

2007

2009

2009

Improvement

Improvement

Fixed Costs Per

Month (millions)

$10.2

$9.4

-

9%

Owner-Operator

Tractors

153

+

303%

Company-Owned

Tractors

2,461

2,185

-

11%

The

VEVA*

Plan

(Unveiled

August 2008)

* We call our strategic

plan Vision for Economic Value-Added, or VEVA

1.0

x Book Value

2

% ROC

98%

OR

3.0

x Book Value

10%

ROC

89%

OR

4.0

x Book Value

<

89% OR

RESULTS

WE WILL NEED

Position

for L-T Growth

Improved

Earnings Consistency

Earn

Our Cost of Capital

RESULTS

WE WILL NEED

Sustained

Earnings Growth > 10%

Positive

Economic Value Added

HOW

WE’LL DO IT

HOW

WE’LL DO IT

Intermodal

Growth

Brokerage

Growth

Niche

Dedicated Launch

General

Freight Acquisitions

Share

Repurchases/Dividends

PHASE

I - Earn Cost of Capital

PHASE

II - Earnings Growth

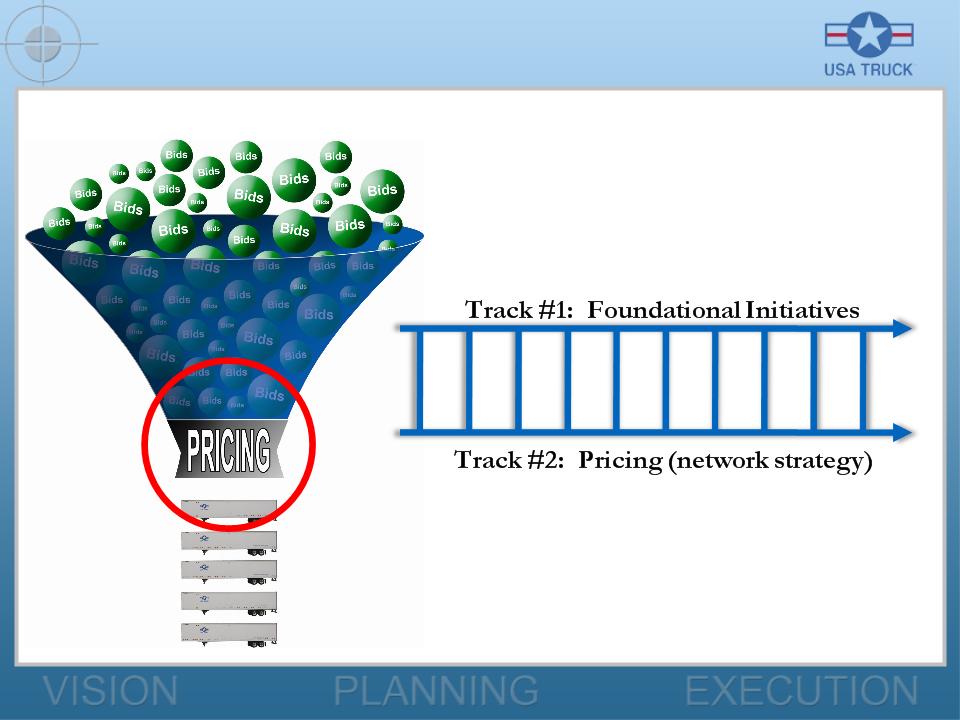

Ineffective

Pricing

Base

Revenue per Total Mile*

*

Asset-based operations only

Source: SEC Documents and USA Truck, Inc.

Source: SEC Documents and USA Truck, Inc.

Year

Ended December 31, 2008

Quarter

Ended December 31, 2009

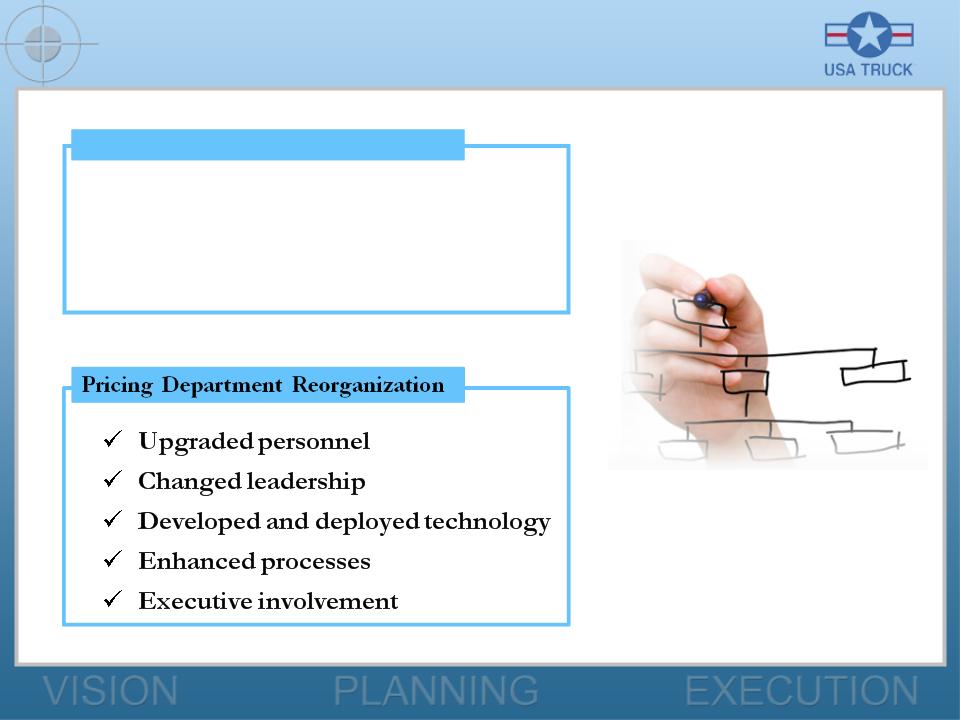

What

Are We Doing About It?

Implementing

the Spider Web

ü 20%

+ expansion

ü Doubled

field representation

ü Upgraded

1/3 of personnel

Sales

Department Reorganization

2009

2009

Spider

Web

Network

Network

Spider

Web

Network

Network

Potential

Potential

Improvement

Improvement

Implementing

the Spider Web

+

1¢ Net RPM ≈ 75 bps

≈

$0.14

EPS annually

Quarterly

Base Revenue > $85 mm ≈

65%

O.R.

Operating

Model Leverage

Length of

Haul

599

450

- 500

-

25%

Trucking Revenue

per Loaded Mile

$1.48

$1.65 -

$1.70

+

15%

Average Weekly

Load Volume

6,871

10,000-11,000

+

60%

Lanes

4,600

1,400

-

70%

Compliance with

Spider Web

38%

≈100%

+

62%

Why

Invest In USA Truck?

USA

TRUCK

USA

TRUCK