Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

x ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the

fiscal year ended December 31, 2009

or

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF

1934

For the

transition period from _______ to _______

Commission

File No.: 333-139008

GREAT

EAST BOTTLES & DRINKS (CHINA) HOLDINGS, INC

(Exact

Name of Registrant as Specified in Its Charter)

|

Florida

|

59-2318378

|

|

(State

or Other Jurisdiction of

|

(I.R.S.

Employer

|

|

Incorporation

or Organization)

|

Identification

No.)

|

203 Hankow Center, 5-15

Hankow Road, Tsimshatsui, Kowloon, Hong Kong

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: 852-2192-4805

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01

per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes x No o

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company.

Large

accelerated filer o Accelerated

filer o Non-accelerated

filer o Smaller

reporting company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No

x

State the

aggregate market value of the common stock held by non-affiliates of the Issuer

on June 30, 2009: $2,850,000

Indicate

the number of shares outstanding of each of the Registrant’s classes of common

stock, as of the latest practicable date: 40,200,000 at March 15,

2010.

Documents

incorporated by reference: None

TABLE

OF CONTENTS

|

Page

|

||

|

ITEM

1.

|

BUSINESS

|

1

|

|

ITEM

1A.

|

RISK

FACTORS

|

11

|

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS

|

19

|

|

ITEM

2.

|

PROPERTIES

|

19

|

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

21

|

|

ITEM

4.

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

21

|

|

ITEM

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

21

|

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

22

|

|

ITEM

7.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

22

|

|

ITEM

7A.

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

26

|

|

ITEM

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

26

|

|

ITEM

9.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

26

|

|

ITEM

9A.(T)

|

CONTROLS

AND PROCEDURES

|

26

|

|

ITEM

9B.

|

OTHER

INFORMATION

|

29

|

|

ITEM

10.

|

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

29

|

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

31

|

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

32

|

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

32

|

|

ITEM

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

35

|

|

ITEM

15.

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES

|

36

|

|

Item

1.

|

Business

|

Introduction

As used

herein, unless the context otherwise requires, “Registrant” and the “Company”

(and “we”, “our” and similar expressions) refer to the business of Great East

Bottles & Drinks (China) Holdings, Inc. (formerly named Jomar Specialties,

Inc.) before the Share Exchange (as hereinafter defined) and Great East Bottles

& Drinks (BVI) Inc. (“GEBD BVI”, formerly known as Citysky Investment

Holdings, Inc.) after the Share Exchange.

We were

incorporated on July 8, 1983 in the business of providing specialty printing

services to the commercial printing industry. Until consummation of

the Share Exchange, our revenue was derived from providing printing services to

other printing businesses.

On March

10, 2008, we entered into a Share Exchange Agreement (the “Share Exchange

Agreement”) with GEBD BVI and Guy A-Tsan Chung (formerly known as Chung A. San

Guy), the sole shareholder of GEBD BVI (the “Shareholder”) to acquire 100% of

the outstanding equity of GEBD BVI from the Shareholder in consideration for

32,460,000 shares of our common stock (the “Share Exchange”). The

Share Exchange was consummated on March 10, 2008.

Subsequent

to the completion of the Share Exchange Agreement, GEBD BVI’s business became

our major business and the Shareholder became our majority shareholder. Our

operating entities produced beverage bottles which mainly are made of PET, a

type of plastic with desirable characteristic for packaging including a clear

and wide range of colors and shapes and tough resistance to heat, moisture and

dilute acid. The operating entities manufacture and sell beverage bottles in

China for bottling of Carbonated Soft Drinks (“CSD”) for world brands including

Coca-Cola and Pepsi.

In

December 2009, we restructured our group so that our subsidiary, HGEP, held our

operating entities GEPNJ and GEPXA. As a result, any operations that we had were

either conducted by HGEP or by its subsidiaries. In December 2009,

HGEP through its subsidiary, acquired a 99.99% interest in three new operating

entities from a company controlled by Mr. Guy Chung. These entities

were United Joy International Limited (“United Joy”), Upjoy Holdings Limited

(“Upjoy”) and Greatgrand Global Limited (“Greatgrand”).

In

exchange for these new operating entities, we transferred shares in a

wholly-owned subsidiary that holds a 15% interest in HGEP to a company

controlled by Mr. Guy Chung. Additionally, we granted another company

controlled by Mr. Guy Chung an option exercisable at $1 to purchase 60% of our

subsidiary GEPI whose sole assets are an 84% interest in HGEP.

We have

assumed for the purposes of this annual report and the financial statements

included herein that the option to acquire a 60% interest in GEPI has been

exercised. As a result, our only assets are our 33.6% interests in

the operating entities described herein.

1

The

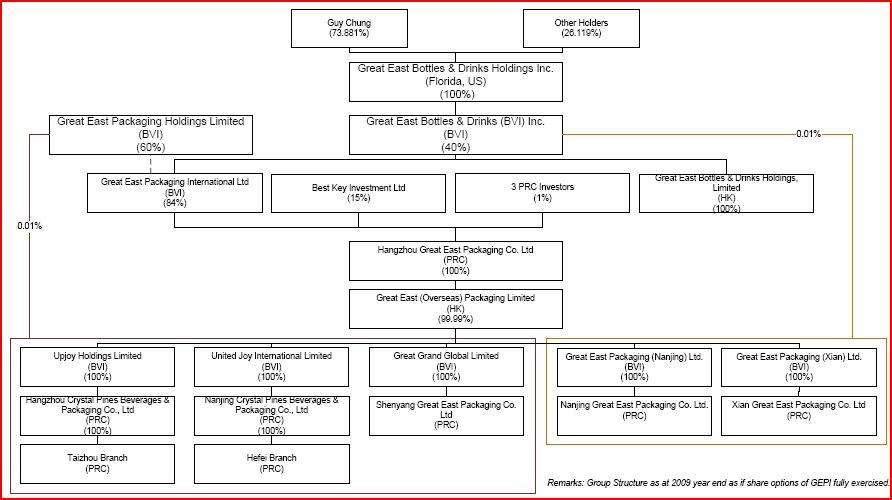

following chart sets out our group structure as of March 15, 2010:

General

Description of Business

Business

Overview

OUR

PRODUCTS

We mainly

produce 3 types of products: PET CSD bottles, PET CSD preforms for CSD bottles

and OEM water bottles. PET (Polyethylene terephthalate) is a thermoplastic

polymer resin of the polyester family. It is widely used as raw

material for synthetic fibers, beverage /food / liquid containers, thermoforming

applications and as engineering resins. PET CSD bottles are completed

bottles ready for CSD bottling while PET CSD preforms are pre-production tubes

made from PET resin that are used in a stretch-blow-molding machine to produce

the final PET bottle

PET CSD

preforms

PET CSD

preforms are pre-production tubes made from PET resin that are used in a

stretch-blow-molding machine to produce the final PET bottle. PET CSD

preforms can be colored green or blue according to customers’ requirements. The

weight of PET CSD preforms determines the volume of the final PET CSD

bottle. Heavier PET preforms are used to produce larger PET CSD

bottles. Sizes of our PET CSD preforms range from 25g to 56g, which

is our customers’ required weight range.

Newly

produced PET CSD preforms are stored in warehouses for scheduled PET CSD bottle

blowing process. PET preforms expire three months from their production

date.

PET CSD

bottles

PET CSD

bottles are transformed from PET CSD preforms through a stretch-blow-molding

manufacturing process. PET CSD bottles are popular containers for the

CSD bottling process.

2

Unlike

aluminum cans and glass bottles, PET CSD bottles are applied to medium to large

volume CSD products, i.e., over 500ml. Volume of PET CSD bottles

ranges from 500ml to 2,500ml with PET CSD preforms weights ranging from 25g to

56g, respectively. The shapes of the CSD bottle are designed by the

customers.

Newly

produced PET CSD bottles are stored in warehouses for scheduled CSD bottling

process. The expiry period of PET CSD preforms varies from 15 days to 3 months

from the date produced, depending on the storing conditions such as room

temperature and relative humidity

OEM water

bottles

Some of

the operating entities manufacture OEM water bottles. These operating

entities purchase preforms for OEM water bottles from an unrelated third party

called Guo Zhu Group and then use the preforms to create OEM water bottles in a

process that is similar to the production of the PET CSD bottles. The

operating entities then fill the OEM water bottles with distilled water and

deliver the bottled water to Coca Cola’s distribution centers. The sizes of the

OEM water bottles range from 550ml to 1,500ml.

PET

bottles are suitable for various applications including water, tea drinks, CSD

and other beverages bottling. Our PET CSD bottles and PET CSD

preforms are targeted to CSD application, while our OEM business is targeted to

bottled water application. CSD contains instable carbonate components and

it demands higher quality requirements on PET bottles and PET preforms compared

to those applied to OEM water bottles and bottles for tea

drinks. Thus, CSD applications represent a higher margin segment in

the PET bottles and PET preforms market as it demands a higher quality standard,

and OEM applications represent a lower margin segment.

INDUSTRY

AND MARKET ENVIRONMENT

The

operating entities are part of the plastic packing case and container

manufacturing industry in China. Their existing market is the market for

PET-plastic bottles for beverages in China.

The

Chinese market for the industry has been expanding steadily at double-digit

growth rates for the last several years. While there are no official statistical

data on the industry’s growth, we believe that the market size and market growth

of the industry has increased due to the unit volume sales growth experienced in

these industries that we supply. In particular, we believe that

higher volume growth in plastic-bottled beverages would likely imply a

corresponding similar volume growth in plastic bottles

manufacturing.

OUR MAJOR

CUSTOMERS

Our major

customers are Coca-Cola and Pepsi, the two leading worldwide brands in the CSD

industry. Our company continues to keep good customer relationship with

Coca-Cola and Pepsi and they renewed the contracts with us in 2008. United Joy

and Upjoy also signed agreements with NJBC and HZBC, respectively, for supplying

OEM water bottles.

Coca-Cola

We serve

Coca-Cola through our GEHZ, GENJ, United Joy, Upjoy and Greatgrand production

facilities. GEHZ signed a Coordinated Supply Agreement to serve Coca–Cola

through Hangzhou BC Foods Company Limited (“HZBC”) and GENJ signed a Coordinated

Supply Agreement to serve Coca–Cola through Nanjing BC Foods Company Limited

(“NJBC”). HZBC and NJBC are subsidiaries of Swire Pacific Limited,

which is the CSD bottler for Coca-Cola in China.

3

Terms

HZBC and

NJBC signed four year contracts commencing June 1, 2004 with GEHZ and GENJ,

respectively. Both HZBC and NJBC have indicated that they renewed

their contracts with GEHZ and GENJ, respectively, on June 1, 2008 on similar

terms and conditions. Contracts of United Joy and Upjoy commenced in

2008 and will expire in 2012. Contracts of Greatgrand commenced in

2009 and will expire in 2011.

Raw

material

For PET

CSD bottles, we are not required to purchase PET resin under the contracts and

Coca–Cola has agreed to make special arrangement for us. For

instance, based on GEHZ’s expected production volume, HZBC shall purchase an

adequate amount of PET resin from its approved suppliers, who will then deliver

the PET resin directly to GEHZ. NJBC and GENJ have the same supply

arrangement. For OEM water bottles, we are required to purchase PET

resin for production.

Pricing

We are

obliged to offer Coca-Cola whatever is the lowest price we offer PET CSD bottles

to our other customers with substantially equivalent quality we sold to

Coca-Cola under “the most favor customer” clause. Moreover, we have

to meet the most competitive pricing from other competitors over the market, who

offer PET CSD bottles with substantially equivalent quality we sold to

Coca-Cola.

The price

of PET CSD bottles includes PET CSD bottles blowing, PET CSD preforms

conversion, all packaging materials and pallet, transportation to customers,

value added tax and colorant, but excludes PET resin and label

price. Except for PET resin which we are required to purchase, the

price of OEM water bottles includes the same elements as PET CSD

bottles.

Pepsi

We serve

Pepsi through our GEXN production facilities. GEXN has signed an

Inline Mode Coordinated Supply Agreement (the “Pepsi Agreement”) to serve Pepsi

through Xian Pepsi-Cola Beverage Company Limited, which is a joint venture

company between PepsiCo Investment (China) Ltd. and local food and beverage

companies in Xian.

We

produce PET CSD bottles with capacities ranging from 600ml to 2,500ml with

certain performance criteria including appearance, dimension, weight, fill point

capacity, wall thickness & sectional weights, perpendicularity, burst

resistance, thermal stability, stress crack, top load test, drop impact and

carbonation loss.

The Pepsi

Agreement was renewed on March 18, 2008 and has a term of five years. If we

cannot reach a mutual consent for the renewal of this agreement, Pepsi has the

right to buy back our production line for a price to be determined by 15 years

depreciation without residual value.

Pepsi has

committed a volume guarantee to us of not less than 70% of Pepsi’s annual PET

CSD bottles requirements in Xian province during the terms of the

contract. Pursuant to the terms of the contract, we are obligated to

guarantee a non interrupted supply of our PET CSD bottles to Pepsi.

We must

offer the lowest competitive price to Pepsi. The price includes PET resin, the

tolling fee of PET CSD bottles blowing and value added tax, but excludes

label price, the tolling fee of label and colorant.

4

OUR

PRODUCTION FACILITIES

We own

and operate 8 manufacturing facilities in China: GEHZ, GENJ, GEXN, United Joy,

Upjoy and Greatgrand.

GEHZ

GEHZ is

located at No. 1 Road, Economic & Technological Development Zone, Jiubao

Jianggan District, Hangzhou, China. It is comprised of 2 buildings,

one of which serves as an administration office, production line factory and

warehouse and the other serves as a staff canteen and quality control office.

GEHZ operates one PET CSD bottle production line and four PET CSD preform

production lines.

The PET

CSD bottles production line produces PET CSD bottles with capacities ranging

from 0.5L to 2.5L. It consists of one stretch blow molding machine and one basic

robot labeling machine:

|

1.

|

The

stretch blow molding machine consists of 10 molds with a production

capacity of 12,000 bottles per hour.

|

|

2.

|

The

robot labeling machine model has a production capacity of 18,000 bottles

per hour.

|

GEHZ’s

PET CSD bottles production line is operated as an offline production mode

(“Offline Mode”) Under Offline Mode, PET CSD bottles are blow-molded at GEHZ’s

own production line factory, packed and delivered to Coca–Cola’s manufacturing

plant for their bottle-filling process. Coca–Cola’s manufacturing

plant is located adjacent to GEHZ’s production line factory to ensure timely

delivery of the PET CSD bottles supply and also to minimize transportation

costs.

GENJ

GENJ is

located at 16 Nanjing New & High Technology Industry Development Zone,

Nanjing Jiangsu Province, China. It is comprised of two buildings, one of which

serves as an administration office and the other serves as a production line

factory and warehouse. GENJ operates three PET CSD bottles production lines and

three PET CSD preforms production lines.

The 3 PET

CSD bottles production lines produce PET CSD bottles with capacities ranging

from 500ml to 2,500ml.

One of

GENJ’s PET CSD bottles production lines is operated as an inline production mode

(“Inline Mode”). Under Inline Mode, PET CSD bottles are blow-molded at

Coca-Cola’s manufacturing plant and are then directly fed into Coca-Cola’s

manufacturing production lines via conveyor belts for bottle-filling

process.

Two of

GENJ’s PET CSD bottles production lines are operated under Offline Mode.

Coca-Cola’s manufacturing plant is located adjacent to GENJ’s production line

factory.

Each

production line consists of one stretch-blow-molding machine and one labeling

machine:

GEXN

GEXN is

located at No. 36 Development Road, New Type Industrial Garden High–Tech

Industrial Development Zone, Xian, China. GEXN operates two PET CSD bottles

production lines.

The two

PET CSD bottles production lines produce PET CSD bottles with capacities ranging

from 600ml to 2,500ml. Each production line consists of one stretch-blow-molding

machine and one labeling machine:

5

|

●

The stretch-blow-molding machines have with production capacities of

12,000 bottles (Inline Mode) and 10,000 bottles per hour respectively.

They consist of 10 molds each machine.

|

|

|

● The

labeling machines have a production capacity of 18,000 bottles per hour

each machine.

|

One of

GEXN’s PET CSD bottles production lines is operated under Inline Mode and the

other production line is under Offline Mode. Pepsi’s manufacturing plant is

located adjacent to GEXN’s production line factory.

United

Joy

|

United

Joy has two OEM water

bottle manufacturing facilities located at 6, Feng Huang Lu, Pu Kou

Economic and Development Zone, Nanjing, Jiangsu Province and North Guan Qi

Road, He Fe Economic and Development Zone, He Fe, An Hui

Province. Both are operated under Offline mode, and each has

one OEM water bottle production line with capacity ranging from 550ml to

1,500ml.

|

Upjoy

Upjoy has

two OEM water bottle

manufacturing facilities located at No. 1 Road, Economic &

Technological Development Zone, Jiubao Jianggan District, Hangzhou and Jiang Nan Logistic Centre, Jing

Jiang Nan Lu, Lin Hai, Taizhou. Both are operated under Offline mode,

and each has one OEM water bottle production line with capacity ranging from

550ml to 1,500ml.

Greatgrand

Greatgrand

has a hot fill packaging facility

located in 8 Jia 2, No 7 Jie, Shenyang Economic and Development Zone,

Shenyang. Hot fill packaging is another process adopted in packaging

of beverage such as tea, juice and milk based beverage. The major

difference between hot fill bottles and CSD bottles and OEM water bottles lies

in the top of the bottle as hot fill bottles requires a crystallization

manufacturing process for sustaining the heat involved in the hot fill

process. Greatgrand has one inline hot fill bottles production

lines that produces PET hot fill bottles with capacities ranging from 600ml to

2,500ml that consists of one stretch-blow-molding machine and one labeling

machine:

PRODUCTION

PROCEDURES

Through

eight of our operating facilities , we operate several PET CSD preforms

production lines, several PET CSD bottles production lines, four OEM water

bottle production lines, one hot fill bottle production line (some under Offline

Mode and some under Inline Mode).

PET CSD

preforms

PET CSD

preforms are produced through the injection molding manufacturing process

described below:

|

·

|

PET

CSD preforms molds and changed.

|

|

·

|

PET

resin is transferred from warehouse to the raw materials room

.

|

|

·

|

PET

resin is drawn into the feed hopper through pipeline by

suction.

|

|

·

|

PET

resin is heated, dried and moved into the Injection Molding

machine.

|

6

|

·

|

While

PET resin enters the Injection Molding machine, it is heated above its

transition temperature and move forward in the molds.

|

|

·

|

PET

resin undergoes extreme pressure and is molded into PET CSD

preforms.

|

|

·

|

The

PET CSD preforms are automatically stripped through action of the mold

after cooling.

|

|

·

|

PET

CSD preforms undergo quality check by production team and quality control

department to ensure the quality to achieve customers’

requirement.

|

|

·

|

PET

CSD preforms are packaged and sent to

storage.

|

PET CSD

bottles

PET CSD

bottles are produced through a stretch-blow-molding manufacturing process and

operated under two operations modes, Inline Mode and Offline Mode.

Offline

Mode

The

following are the procedures followed in the Offline Mode:

|

·

|

PET

CSD bottles molds are changed.

|

|

·

|

PET

CSD preforms are transferred from warehouse to a PET CSD preforms

container.

|

|

·

|

PET

CSD preforms are sorted by a sorting machine, which is part of Stretch

Blowing Machine.

|

|

·

|

The

sorting machine screens out those PET CSD preforms of poor

quality.

|

|

·

|

The

PET CSD preforms are transferred to the main body of Stretch Blowing

Machine and are heated (typically by infrared heaters) above their

transition temperature.

|

|

·

|

PET

CSD preforms are blown into bottles using high pressure air and the metal

blow molds.

|

|

·

|

PET

CSD bottles are transferred to the conveyor belt after

cooling.

|

|

·

|

Our

production team and quality control department perform quality check to

ensure the quality of the PET CSD bottles meet Coca-Cola’s or Pepsi’s

quality requirements.

|

|

·

|

PET

CSD bottles are transferred to the labeling machine through conveyor belt

for labeling.

|

|

·

|

Our

production team and quality control department perform quality check on

the labeled PET CSD bottles to ensure the quality meets Coca-Cola’s or

Pepsi’s requirements.

|

|

·

|

Labeled

PET CSD bottles are packed and

stored.

|

Inline

Mode

All

procedures are exactly the same as Offline Mode except: that instead of packing

the labeled PET CSD bottles for storage, the bottles are sent directly to

Coca-Cola’s production line or Pepsi’s production line through a conveyor

belt.

Under

Inline Mode, if we cannot meet the customers’ bottle-filling process schedule,

the labeled PET CSD bottles will not be sent to the customer’s production line

directly, but will be packaged and sent to our storage.

7

OEM water

bottles

PET

preforms used for OEM water bottles are produced exactly the same way as PET CSD

bottles described above. The PET preforms are then processed exactly the same

way as offline mode PET CSD bottles described above except that the OEM water

bottles are filled with distilled water before they are packed and

stored.

Hot fill

bottles

PET

preforms used for hot fill bottle are produced exactly the same way as PET CSD

bottles described above. Hot fill bottles are produced exactly the same way as

inline mode PET CSD bottles described above except that it involves an

additional crystallization manufacturing process for sustaining the heat

involved in the hot fill process.

INTELLECTUAL

PROPERTY

We do not

hold, own or license any patents, trademarks or other intellectual

property.

RESEARCH

AND DEVELOPMENT

We do not

incur or pay any costs in relation to research and development in 2009 as our

products are able to satisfy the existing product specifications from our major

customers.

SEASONALITY

Sales by

the operating entities are subject to seasonality. In general, we

believe sales will be higher in the second and third quarters of the year when

the weather is hot and dry and lower in the first and fourth quarters of the

year when the weather is cold and wet. Sales peak during the months

from June to September.

COMPETITION

There are

a few PET CSD bottle producers that serve international CSD producers and a few

CSD bottlers serving international CSD producers. The demand for high quality

CSD bottles is expected to grow in line with the growth rate of the sales of

international CSD products, which is associated with the strong economic growth

of China.

We

believe that the current competitive environment for the operating entities is

moderate. There are only two PET CSD bottles producers that compete with our

scale in an environment of high industry growth rate. According to our customers

(Coca-Cola in GENJ / GEHZ and Pepsi in GEXN), their expected grow rates for 2009

are both at 10% level. Pepsi is the official sponsor of the World Cup

2010.

Glass

bottles and aluminum cans are common substitutes for PET CSD bottles. We do not,

however believe that glass bottles and aluminum cans would be considered

desirable substitutes for PET CSD bottles by customers for the following

reasons:

|

·

|

Glass

bottles and aluminum cans are for typically for low volume CSD packing

(less than 500ml) while PET bottles are for 500ml up to

2,500ml.

|

|

·

|

Glass

bottles are heavier in weight and incur high transaction costs for

delivery compared to PET CSD

bottles.

|

|

·

|

Aluminum,

the basic raw material for aluminum cans, has doubled its price in the

past six years. Current aluminum price

levels are more expensive than the PET

price.

|

We

believe that the threat of the entry of new competitors into the PET CSD market

is low due to high barriers to entry which include the

following:

8

|

·

|

Production

facilities have to be set up proximate to customers’ CSD bottling

facilities. Because of high transaction costs, every PET CSD bottles

producer has a limited perimeter of serving area.

|

|

·

|

Highly

specialized and expensive production equipment are designated by

customers.

|

|

·

|

International

CSD producers, for example, Coca-Cola & Pepsi, have strict

requirements on PET CSD bottles producer; at this time there are only

a few PET CSD bottles producers who are qualified and capable of serving

the international CSD producers.

|

Although

customer concentration rate is high in the industry, the switching cost for

customers to change vendors is also high as there are only a few PET CSD bottle

producers in China qualified to produce high quality PET CSD bottles and PET CSD

preforms to meet international standards. In addition, there is no current

comparable substitute product for PET CSD bottles.

Due to

low level of competitive rivalry threat and substitute products threat, we

believe competition for the industry should continue to be moderate during the

next 3-5 years.

United

Joy, Upjoy and Greatgrand face similar competitive environments as GEHZ, GENJ

and GEXA.

Major

competitors

We

consider international CSD producers and CSD bottlers serving international CSD

producers to be the target market for the operating entities. There are two

major competitors in the China market competing with the operating entities to

serve the same market. They are Zhuhai Zhongfu Enterprise Co. Ltd.

(“Zhongfu”) and Shanghai Zijiang Enterprise Co. Ltd. (“Zijiang”).

Zhongfu

is a listed company on the Shenzhen Stock Exchange stock symbol 000659.sz.

Zhongfu manufactures and sells PET preforms, PET bottles, and film labels and

has an approximately $282 million in annual revenue and 934

employees. Zhongfu has 30 production facilities throughout China

including Shenzhen, Kunshan, Chengdu, Tianjin and Beijing.

Zijiang

is a listed company on the Shanghai Stock Exchange stock symbol 600210.ss.

Zijiang manufactures PET preforms, PET bottles, bottle caps, plastic bags and

other diversified businesses, including real estate and

hotels. Zijiang has approximately $550 million in annual revenue and

683 employees. Zijiang has production facilities in 15 locations in

China.

REGULATION

Our

company has a policy to comply with all applicable laws and regulations not only

in China but also all countries throughout the world in which we do

business.

The

production in China of the operating entities’ is generally subject to

environmental protection regulations that require all manufacturing industries

to adopt measures to control the disposal of industrial waste, industrial

manufacturing licensing and company licensing laws that regulate the business

scope of companies, taxation laws that require income tax payable to the Chinese

government, and labor laws that restrict maximum work-hours.

9

Environmental

Protection Regulations

The

Environmental Protection Law of China has been developed and implemented by the

Ministry of Environment Protection (the “Ministry”). Since 1984, the

Chinese government has attempted to mitigate its pollution problem amid the

industrialization process. The Ministry has set up subsidiary bureaus throughout

all provinces of China to implement fast-improving measures for environmental

protection. In particular, companies are required to adopt measures to control

pollution engendered by industrial waste, noise, radiation, and vibration. All

companies are required to report to the bureau in their county about the status

of pollutants and the measures adopted to deal with the pollutants. Penalty fees

are levied on companies whose pollutant discharge levels exceed the standards

set by the Ministry. The Ministry also often issues warning notices and fines,

and may mandate temporary suspension of production for installation of pollution

control facilities. In serious cases where the pollution causes physical or

personal damage, the Ministry may impose sanctions, demand compensation to

victims, coerce permanent termination of companies, or sue company owners for

criminal liability.

Our

Company only paid some minimal administrative costs with respect to submitting

environmental reports and other related documents to the Ministry of Environment

Protection in accordance with environmental laws in China. No other substantial

cost was paid relating to compliance with environmental protection laws in

China.

Company

Laws and Regulations

The

Chinese government has promulgated company laws and regulations through its

State Administration for Industry and Commerce. To operate a business in China,

a company has to apply for business and production licenses at the Enterprise

Registration Bureau and/or the Registration Bureau of Foreign-Invested

Enterprise. Such various licenses have to be obtained for companies

manufacturing important industrial products such as plastic bottles and

containers. Application for production licenses requires official tests and

inspections by the government be passed, and maintenance of the licenses require

subsequent regular periodic inspections. Production and product quality is also

monitored by government, through the General Administration of Quality

Supervision, Inspection, and Quarantine of PRC.

Corporate

Income Taxation

Income

taxes chargeable to companies in China may differ across industries and location

due to differences in preferential tax treatment or subsidies. In general, the

corporate income tax rate has a ceiling of 33%, but foreign-invested companies

shall enjoy preferential rates: full tax exemption applies to the first two

years when the company records profits, and thereafter there is a 50% tax

exemption for the subsequent third to fifth years. Our company belongs to this

foreign-invested category, hence our present and future subsidiaries shall enjoy

the same tax concessions.

Labor

Laws

According

to Chinese Labor Law, the maximum work hours for a labor are 40 hours per week.

Owing to the seasonality factor, the PET CSD bottle production industry has peak

and non-peak seasons throughout the year. During peak seasons, our employees may

have to work for more than 40 hours per week; but during non-peak seasons, our

employees may have to work for less than 40 hours per week. The operating

entities have therefore applied for and have been granted approvals from

relevant government authorities to count the work hours for a labor on yearly

basis instead of weekly basis. As a result, the operating entities have not

violated the maximum work-hour requirement, but at the same time have greatly

improved flexibility of their labor force in coping with the seasonality

problem.

10

Employees

As of

March 1, 2010, the Company and the operating entities had about 713

employees.

The

following table summarizes the employees of GEBD BVI and of GEHZ, GENJ, GEXN,

United Joy, Upjoy Greatgrand and their operations.

|

Department

|

GEBD

BVI

|

GEHZ

|

GENJ

|

GEXN

|

United

Joy

|

Upjoy

|

Great-

grand

|

Total

|

|

CEO

|

1

|

1

|

||||||

|

COO

|

1

|

1

|

||||||

|

CFO

|

1

|

1

|

||||||

|

General

manager

|

1

|

1

|

1

|

1

|

1

|

5

|

||

|

Human

resources and administration

|

3

|

3

|

3

|

6

|

6

|

3

|

24

|

|

|

Storage

and transportation

|

15

|

15

|

15

|

30

|

30

|

15

|

120

|

|

|

Quality

control

|

15

|

18

|

8

|

16

|

16

|

8

|

81

|

|

|

Equipment

maintenance

|

5

|

5

|

5

|

10

|

10

|

5

|

40

|

|

|

Bottle

Blowing

|

40

|

40

|

20

|

40

|

40

|

20

|

200

|

|

|

Preforms

Production

|

40

|

40

|

20

|

40

|

40

|

20

|

200

|

|

|

Sales

& Marketing

|

1

|

1

|

1

|

2

|

2

|

1

|

8

|

|

|

Purchasing

|

1

|

1

|

1

|

2

|

2

|

1

|

8

|

|

|

Finance

|

3

|

3

|

3

|

6

|

6

|

3

|

24

|

|

|

Total

|

3

|

124

|

127

|

77

|

153

|

152

|

77

|

713

|

|

Item

1A.

|

Risk

Factors

|

Risks Related to Our

Business

If

the option to acquire 60% of one of our subsidiaries is exercised, another

person will have a majority interest in all of the operating

entities.

GEPH, an

affiliate of Mr. Guy Chung, our principal shareholder who owns approximately 75%

of our outstanding and issued common stock, has an option for $1 to purchase 60%

of GEPI. GEPI is our subsidiary that holds an 84% interest in

HZGE. HZGE is our subsidiary that owns over 99% of all of our

operating entities, including GEPNJ, GEPXA, United Joy, Upjoy and Greatgrand,

that together generate all of our revenue and compromise substantially all of

our assets. An affiliate of Mr. Guy Chung’s already owns a 15% stake

in GEPI.

If GEPH

exercises its option, our effective ownership of these operating entities would

be reduced from 84% to 33.6%. We have assumed in the preparation of

our audited financial statements that GEPH has exercised the

option. In that instance, we will become a minority shareholder in

all of our current operations and other entities controlled by Mr. Guy Cheung

will hold 64.4 percent of those operations. As a result, we will no

longer have the majority vote regarding the operating entities described herein,

the operations described herein or the assets described herein. If

the interests of the persons who will have majority control of the operating

entities as to management, disposition of assets, the future of the operating

entities or any other matters affecting their results of operations differ from

our interests, our interest may not be protected.

The

operating entities engage in significant transactions with a related party and

in the future such transactions may lead to a conflict of interests

The

operating entities have engaged in significant transactions with companies that

are controlled by our majority shareholder, Mr. Guy Chung, and that have an

effective interest in 65.6% of the operating entities. In the year

ended December 31, 2009, these transactions included

11

|

|

●

|

the

acquisition of significant assets from GEPH with an enterprise value that

we estimate at approximately $9.9

million,

|

|

|

●

|

the

disposition of significant assets to GEPH and another entity controlled by

Mr. Guy Chung with an enterprise value that we estimate at approximately

$9.4 million,

|

|

|

●

|

the

receipt of advances from GEPH totaling $16,431,222 as of December 31,

2009,

|

|

|

●

|

the

advancement of funds to GEPH totaling $16,431,222 as of December 31,

2009,

|

|

|

●

|

the

purchase of preforms for OEM water bottles and other materials from GEPH

totaling $402,466 in the year ended December 31, 2009

and

|

|

|

●

|

sales

to GEPH totaling $1,391,949 in the year ended December 31,

2009.

|

We strive

to make sure any such transactions are either conducted at an arm’s length basis

or, if not on an arm’s length basis, that they are for the benefit of the

operating entities, such as was the case with advances from GEPH being interest

free. However, we cannot guarantee that we were successful in these

efforts or that the interests of our minority shareholders will not conflict

with the interests of our related parties or the controlling shareholder in

these and future transactions. Any such conflicts may not be resolved in the

favor of the minority shareholders.

We

may be classified as an inadvertent investment company.

The

Investment Company Act of 1940 (the "ICA") regulates the activities of an entity

which is deemed to be an ''investment company" under the ICA. The regulations

are extensive, and among other things, impose a restriction on the types of

businesses an investment company can engage in, imposes reporting requirements,

limits leverage and affiliate transactions and imposes limitations on capital

structure and dividend paying ability. An unregistered investment company is

prohibited by the ICA from engaging in any business in interstate

commerce.

Under the

ICA, an entity is generally deemed to be an investment company if the value of

its investment securities (excluding securities of majority-owned subsidiaries)

exceeds 40% of the value of such issuer's total assets (exclusive of government

securities and cash).

If the

GEPH exercises its option to acquire approximately 50.4% of the operating

entities, our equity percentage ownership in the operating entities, including

those that until December 2009 were majority-owned subsidiaries, will be reduced

to approximately 33.6%. Since our interest in the operating entities comprises

substantially all of our assets, we may be deemed to have become an

'inadvertent' investment company under the ICA, even though we are not engaged

in the business of investing, reinvesting or trading in securities and we do not

hold ourselves out as being engaged in those activities.

We are

considering seeking an order from the SEC which will exempt us from being

characterized as an investment company. We may not seek such an order or receive

confirmation of an exemption from the SEC if we do

As long

as we may be an investment company under the ICA but are not registered as such

thereunder, we may have trouble raising money in capital

markets. Additionally, if we do not register as an investment company

under the ICA and do not qualify for an exemption, we could be subject to an

enforcement action by the SEC which could result in the imposition of

significant fines and other penalties.

If we

determine that we are an investment company under the ICA, we will register as

such under the ICA. Such registration will be an expensive

proposition that will require a diversion of management’s

resources. If we become an investment company, our ability to engage

in certain actions will be restricted and the value of your investment could be

affected as a result.

12

We may not successfully integrate our

recent acquisitions into the group.

We

recently acquired an interest in United Joy, Upjoy, Greatgrand and their

operations. Failure to integrate those holdings into our group

structure may cause us to lose out on cost savings from expected synergies, lead

to additional costs, increase our liabilities or alienate our key

customers.

The

operating entities expansion strategy may not be proven successful.

One of

the key strategies of our operating entities is to aggressively expand

production capacity. They will need to engage in various forms of capacity

expansion activities at corporate level, and of production activities at

operational level in order to carry out those plans. Therefore, the operations

are subject to all of the risks inherent in the unforeseen costs and expenses,

challenges, complications and delays frequently encountered in connection with

the formation of any new business, as well as those risks that are specific to

the bottled water industry in general. Despite their best efforts, they may

never overcome these obstacles to financial success. We cannot assure you that

the efforts will be successful or result in revenue or profit, or that investors

will not lose their entire investment.

Results

of operations may fluctuate due to seasonality.

Sales of

the operating entities are subject to seasonality. For example, sales of bottled

water are typically higher in summer time in coastal cities while the sales

remain constant through out the entire year in some inland cities. In general,

we believe sales will be higher in the second and third quarters of the year

when the weather is hot and dry, and lower in the fourth and first quarters of

the year when the weather is cold and wet. Sales peak during the months from

June to September. Sales can also fluctuate during the course of a financial

year for a number of other reasons, including weather conditions and the timing

of advertising and promotional campaigns. As a result of these reasons,

operating results may fluctuate. In addition, the seasonality of results may be

affected by other unforeseen circumstances, such as production interruptions.

Due to these fluctuations, comparison of sales and operating results between the

same periods within a single year, or between different periods in different

financial years, are not necessarily meaningful and should not be relied on as

indicators of performance.

Increases

in raw material prices that may not be passed along to customers would reduce

profit margins

The

principal raw materials used in production, is subject to a high degree of price

volatility caused by external conditions like price fluctuations of PET raw

materials-the byproducts of oil, which account for a significant portion of

product cost. We cannot guarantee that the price of the raw materials will be

stable in the future. Price changes to raw materials may result in unexpected

increases in production, packaging and distribution costs, and the operating

entities may be unable to increase the prices our final products to offset these

increased costs to customers for instance, Pepsi, and therefore may suffer a

reduction to our profit margins. We do not currently hedge against changes in

raw material prices.

The

operating entities face increasing competition from both domestic and foreign

companies, which may affect market share and profit margin.

The PET

bottles industry in China is highly competitive, and we expect it to continue to

become even more competitive. The ability of the operating entities to compete

against these enterprises depends, to a significant extent, on the ability to

distinguish the products of the operating entities from those of competitor by

providing high quality products at reasonable prices that appeal to consumers.

Some competitors may have been in business longer than the operating entities,

may have substantially greater financial and other resources than the operating

entities have and may be better established in their markets. Competitors in any

particular market may also benefit from raw material sources or production

facilities that are closer to such markets, which provide them with competitive

advantages in terms of costs and proximity to consumers.

13

We cannot

assure you that current or potential competitors will not provide products

comparable or superior to those the operating entities provide or adapt more

quickly than the operating entities do to evolving industry trends or changing

market requirements. It is also possible that there will be significant

consolidation in the PET bottle industry among competitors, alliances may

develop among competitors and these alliances may rapidly acquire significant

market share. Furthermore, competition may lead competitors to substantially

increase their advertising expenditures and promotional activities or to engage

in irrational or predatory pricing behavior. We also cannot assure you that

third parties will not actively engage in activities, whether legal or illegal,

designed to undermine the brand name of the operating entities and product

quality or to influence consumer confidence in those products. Increased

competition may result in price reductions, reduced margins and loss of market

share, any of which could materially adversely affect profit margin. We cannot

assure you that the operating entities will be able to compete effectively

against current and future competitors.

The

operating entities inability to diversify may subject us to economic

fluctuations within our industry.

Our

limited financial resources reduce the likelihood that we will be able to

diversify our holdings into other operations. Our probable inability to

diversify our holdings into activities in more than one business area will

subject us to economic fluctuations within the bottled water industry and

therefore increase the risks associated with our operations.

The

operating entities are subject to environmental laws and regulations in the PRC.

Changes in the existing laws and regulations or additional or stricter laws and

regulations on environmental protection in China may result in significant

capital expenditures, and we cannot assure that the operating entities will be

able to comply with any such laws and regulations.

The

operating entities carry on business in an industry that is subject to PRC

environmental protection laws and regulations. These laws and regulations

require enterprises engaged in manufacturing and construction that may cause

environmental waste to adopt effective measures to control and properly dispose

of waste gases, waste water, industrial waste, dust and other environmental

waste materials, as well as fee payments from producers discharging waste

substances. Fines may be levied against producers causing pollution. If failure

to comply with such laws or regulations results in environmental pollution, the

administrative department for environmental protection can levy fines. If the

circumstances of the breach are serious, it is at the discretion of the central

government of the PRC including all governmental subdivisions to cease or close

any operation failing to comply with such laws or regulations. There can also be

no assurance that operation will fail to comply with such laws or regulations.

There can also be no assurance that the PRC government will not change the

exiting laws or regulations or impose additional or stricter laws or

regulations, compliance with which may cause us to incur significant capital

expenditure, which we may be unable to pass on to our customers through higher

prices for our products. In addition, we cannot assure that we will be able to

comply with any such laws and regulations.

The

operating entities depend on a few key customers, the loss of any of which could

cause a significant decline in our revenues.

Coca-Cola

and Pepsi accounted for80% and 15%, respectively, of the operating entities’ net

revenue in 2009 and 70% and 12%, respectively, of our net revenue in

2008. The loss of either of these customers or a significant

reduction in sales to either of these customers would materially adversely

affect our profitability.

Supplying

PET bottles to beverage and service companies constitutes a major portion of the

revenue of the operating entities. Any delays in delivery may affect sales,

damage long-term relationship with clients, and even incur penalty.

Sales

made to beverage and service companies account for a large portion of the total

sales of the operating entities. Recently, their production capacity is at more

than 95%. If we failed in deliver the goods to those companies on time, we may

run into a risk of damaging our long-term relationship with the

client.

14

We

may not successfully manage our growth.

Our

success will depend upon the expansion of the operating entities and the

effective management of their growth, which will place a significant strain on

our management and administrative, operational, and financial resources. To

manage this growth, we must expand the facilities of the operating entities,

augment their operational, financial and management systems, and hire and train

additional qualified personnel. Our ability to manage these changes will be

significantly reduced if we lose our controlling interest in the operating

entities through GEPH’s exercise of the option to acquire an interest over 50%

of the operating entities. If we are unable to manage growth of the operating

entities effectively, our business would be harmed.

The

operating entities may experience material disruptions to

manufacturing.

The

operating entities operate facilities in compliance with applicable rules and

regulations and take measures to minimize the risks of disruption at their

facilities. A material disruption at one of those facilities could

prevent them from meeting customer demand, reduce sales and/or negatively impact

financial results. Any of such manufacturing facilities, or any

machine within an otherwise operational facility, could cease operations

unexpectedly due to a number of events including:

|

·

|

unscheduled

maintenance outages;

|

|

·

|

prolonged

power failures;

|

|

·

|

an

equipment failure;

|

|

·

|

disruptions

in the transportation infrastructure, including roads, bridges and

railroad tracks;

|

|

·

|

fires,

floods, earthquakes or other catastrophes; and

|

|

·

|

other

operational problems.

|

We

rely on key executive officers. Their knowledge of our business and technical

expertise would be difficult to replace.

We were

founded in 1994 by Mr. Guy A-Tsan Chung. Since then, Mr. Stetson

Chung, the son of Guy A-Tsan Chung, and our senior management team have

developed the operating entities into a large scale PET bottle production group.

Stetson Chung, together with other senior management, has been key to the

group’s strategy and has been fundamental to its achievements to date. The

successful management of the operating entities depends, to a considerable

extent, on the services of Stetson Chung and other senior management. The loss

of the services of any key management employee or failure to recruit a suitable

or comparable replacement could have a significant impact upon our ability to

manage the operating entities and our business and future growth may be

adversely affected.

The

ownership of our common stock is concentrated and one stockholder is able to

exercise significant influence over all matters requiring stockholder approval

and over the operating entities.

Guy

A-Tsan Chung currently owns 73.88% of our outstanding common stock. As a result,

Guy A-Tsan Chung will be able to continue to exercise significant influence over

all matters requiring stockholder approval, including the election of directors

and approval of mergers, acquisitions and other significant corporate

transactions. In addition, this concentration of stock ownership may have the

effect of delaying or preventing a change in control of our

Company.

In

addition to his 73.88 interest in our outstanding common stock, Mr. Guy Chung

has a controlling interest in an entity that has a 15% interest in the operating

entities and has a controlling interest in an entity that may acquire a 50.4%

interest in the operating entities.

15

We

are subject to the reporting requirements of federal securities laws, which can

be expensive.

We are a

public reporting company in the U.S. and, accordingly, subject to the

information and reporting requirements of the Exchange Act and other federal

securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The

costs of preparing and filing annual and quarterly reports, proxy statements and

other information with the SEC and furnishing audited reports to stockholders

will cause our expenses to be higher than they would be if we remained a

privately-held company.

Our

compliance with the Sarbanes-Oxley Act and SEC rules concerning internal

controls may be time consuming, difficult and costly.

It may be

time consuming, difficult and costly for us to develop and implement the

internal controls and reporting procedures required by

Sarbanes-Oxley. We may need to hire additional financial reporting,

internal controls and other finance staff in order to develop and implement

appropriate internal controls and reporting procedures. If we are unable to

comply with Sarbanes-Oxley’s internal controls requirements, we may not be able

to obtain the independent accountant certifications that Sarbanes-Oxley Act

requires publicly-traded companies to obtain.

There

is not now, and there may not ever be, an active market for our common

stock.

There

currently is no market for our common stock. Further, although our common stock

may be quoted on the OTC Bulletin Board, trading of our common stock has been,

and may continue to be, extremely sporadic. For example, several days may pass

before any shares may be traded. We cannot assure you that a more active market

for the common stock will develop.

Because

we became public by means of a “reverse merger”, we may not be able to attract

the attention of major brokerage firms.

Additional

risks may exist since we will become public through a “reverse merger.”

Securities analysts of major brokerage firms may not provide coverage of us

since there is little incentive to brokerage firms to recommend the purchase of

our common stock. We cannot assure you that brokerage firms will want to conduct

any secondary offerings on behalf of our company in the future.

We

cannot assure you that the common stock will become liquid or that it will be

listed on a securities exchange.

We would

like to list our common stock on the American Stock Exchange or the NASDAQ

Capital Market as soon as practicable. However, we cannot assure you that we

will be able to meet the initial listing standards of either of those or of any

other stock exchange, or that we will be able to maintain any such listing.

Until the common stock is listed on an exchange, we expect that it would be

eligible to be quoted on the OTC Bulletin Board, another over-the-counter

quotation system, or in the “pink sheets.” In those venues, however, an investor

may find it difficult to obtain accurate quotations as to the market value of

the common stock. In addition, if we failed to meet the criteria set forth in

SEC regulations, various requirements would be imposed by law on broker-dealers

who sell our securities to persons other than established customers and

accredited investors. Consequently, such regulations may deter broker-dealers

from recommending or selling the common stock, which may further affect its

liquidity. This would also make it more difficult for us to raise additional

capital.

There

may be issuances of shares of preferred stock in the future.

Although

we currently do not have preferred shares outstanding, the board of directors

could authorize the issuance of a series of preferred stock that would grant

holders preferred rights to our assets upon liquidation, the right to receive

dividends before dividends would be declared to common stockholders, and the

right to the redemption of such shares, possibly together with a premium, prior

to the redemption of the common stock. To the extent that we do issue preferred

stock, the rights of holders of common stock could be impaired thereby,

including without limitation, with respect to liquidation.

16

We

have never paid dividends.

We have

never paid cash dividends on our common stock and do not anticipate paying any

for the foreseeable future.

Our

common stock is considered a “penny stock.”

The SEC

has adopted regulations which generally define “penny stock” to be an equity

security that has a market price of less than $5.00 per share, subject to

specific exemptions. The market price of our common stock is less than $5.00 per

share and therefore is a “penny stock.” Broker and dealers effecting

transactions in “penny stock” must disclose certain information concerning the

transaction, obtain a written agreement from the purchaser and determine that

the purchaser is reasonably suitable to purchase the securities. These rules may

restrict the ability of brokers or dealers to sell our common stock and may

affect your ability to sell shares. In addition, if our common stock is quoted

on the OTC Bulletin Board as anticipated, investors may find it difficult to

obtain accurate quotations of the stock, and may find few buyers to purchase

such stock and few market makers to support its price.

Risks relating to doing

business in China

Substantially

all of our business assets are located in China, and substantially all of our

sales is derived from China. Accordingly, our results of operations, financial

position and prospects are subject to a significant degree to the economic,

political and legal development in China.

The

operating entities derive a substantial portion of sales from China

Substantially

all sales by the operating entities are generated from China. We anticipated

that sales of the operating entities’ products in China will continue to

represent a substantial proportion of our total sales in the near future. Any

significant decline in the condition of the PRC economy could adversely affect

consumer buying power and reduce consumption of their products, among other

things, which in turn would have a material adverse effect on our business and

financial condition.

The

ability to implement planned development depends on many factors, including the

ability to receive various governmental permits.

In

accordance with PRC laws and regulations, the operating entities are required to

maintain various licenses and permits in order to operate at each production

facility including, without limitation, hygiene permits and industrial products

production permits. The operating entities are required to comply with

applicable hygiene and food safety standards in relation to production

processes. Failure to pass these inspections, or the loss of or suspend some or

all of production activities, could disrupt their operations and adversely

affect our business.

Changes

in the policies of the Chinese government could have a significant impact upon

the ability to sustain growth and expansion strategies.

Since

1978, the PRC government has promulgated various reforms of its economic system

and government structure. These reforms have resulted in significant economic

growth and social progress for China in the last two decades. Many of the

reforms are unprecedented or experimental, and such reforms are expected to be

modified from time to time. Although we can not predict whether changes in

China’s political, economic and social conditions, laws, regulations and

policies will have any materially adverse effect on the operating entities’

current or future business, results of operation or financial

condition.

The

operating entities’ ability to continue to expand business depends on a number

of factors, including general economic and capital market conditions in China

and credit availability from banks and other lenders in China. Recently, the PRC

government has implemented various measures to control the rate of economic

growth and tighten its monetary policies. Slower economic growth rate may in

turn have an adverse effect on the ability to sustain the growth rate

historically achieved due to the aggregate market demand for consumer goods like

bottled water.

17

Fluctuation

in the value of the RMB may have a material adverse effect on your

investment.

The value

of RMB against the U.S. dollar and other currencies may fluctuate and is

affected by, among other things, changes in political and economic

conditions. The operating entities’ revenues and costs are mostly

denominated in RMB. Any significant fluctuation in value of RMB may

materially and adversely affect our cash flows, revenues, earnings and financial

position, and the value of our stock in U.S. dollars. For example, an

appreciation of RMB against the U.S. dollar would make any new RMB denominated

investments or expenditures more costly, to the extent that the operating

entities need to convert U.S. dollars into RMB for such purposes. In

addition, the depreciation of significant U.S. dollar denominated assets could

result in a charge to our income statement and a reduction in the value of the

assets of the operating entities.

We

must comply with the Foreign Corrupt Practices Act.

We are

required to comply with the United States Foreign Corrupt Practices Act, which

prohibits U.S. companies from engaging in bribery or other prohibited payments

to foreign officials for the purpose of obtaining or retaining

business. Foreign companies, including some of our competitors, are

not subject to these prohibitions. Corruption, extortion, bribery,

pay-offs, theft and other fraudulent practices occur from time-to-time in

mainland China. If our competitors engage in these practices, they

may receive preferential treatment from personnel of some companies, giving our

competitors an advantage in securing business or from government officials who

might give them priority in obtaining new licenses, which would put us at a

disadvantage. Although we inform our personnel that such practices

are illegal, we can not assure you that our employees or other agents will not

engage in such conduct for which we might be held responsible. If our

employees or other agents are found to have engaged in such practices, we could

suffer severe penalties.

Failure

to comply with the State Administration of Foreign Exchange regulations relating

to the establishment of offshore special purpose companies by PRC residents may

adversely affect the operating entities.

On

October 21, 2005, the State Administration of Foreign Exchange issued a new

public notice which became effective on November 1, 2005. The notice requires

PRC residents to register with the local State Administration of Foreign

Exchange branch before establishing or controlling any company, referred to in

the notice as a “special purpose offshore company”, outside of China for the

purpose of capital financing. PRC residents who are shareholders of a special

purpose offshore company established before November 1, 2005 were required to

register with the local State Administration of Foreign Exchange Branch. Our

beneficial owners need to comply with the relevant the State Administration of

Foreign Exchange requirements in all material respects in connection with our

investments and financing activities. If such beneficial owners fail to comply

with the relevant the State Administration of Foreign Exchange requirements,

such failure may subject the beneficial owners to fines and legal sanctions and

may also adversely affect our business operations.

Because

assets and operations of the operating entities are located outside the United

States and a majority of our officers and directors are non-United States

citizens living outside of the United States, investors may experience

difficulties in attempting to enforce judgments based upon United States federal

securities laws against us and our directors. United States laws and/or

judgments might not be enforced against us in foreign

jurisdictions.

All of

our holdings are held through a subsidiary corporation organized and located

outside of the United States, and all the assets of our subsidiary and the

operating entities are located outside the United States. In addition, all of

our officers and directors are foreign citizens. As a result, it may be

difficult or impossible for U.S. investors to enforce judgments made by U.S.

courts for civil liabilities against the operating entities or against any of

our individual directors or officers. In addition, U.S. investors should not

assume that courts in the countries in which our subsidiary is incorporated or

where the assets of our subsidiary or the operating entities are located (i)

would enforce judgments of U.S. courts obtained in actions against us or our

subsidiary based upon the civil liability provisions of applicable U.S. federal

and state securities laws or (ii) would enforce, in original actions,

liabilities against us or our subsidiary based upon these laws.

18

The

legal system in China has inherent uncertainties that may limit the legal

protections available in the event of any claims or disputes with third

parties.

The legal

system in China is based on written statutes. Prior court decisions may be cited

for reference but have limited precedential value. Since 1979, the central

government has promulgated laws and regulations dealing with economic matters

such as foreign investment, corporate organization and governance, commerce,

taxation and trade. As China’s foreign investment laws and regulations are

relatively new and the legal system is still evolving, the interpretation of

many laws, regulations and rules is not always uniform and enforcement of these

laws, regulations and rules involve uncertainties, which may limit the remedies

available in the event of any claims or disputes with third parties. In

addition, any litigation in China may be protracted and result in substantial

costs and diversion of resources and management attention.

The

Chinese government exerts substantial influence over the manner in which we the

operating entities must conduct their business activities.

The

operating entities depend on their relationships with the local governments in

the province in which they operate. The Chinese government has

exercised and continues to exercise substantial control over virtually every

sector of the Chinese economy through regulation and state

ownership. Operations in China may be harmed by changes in its laws

and regulations, including those relating to taxation, environmental

regulations, land use rights, property and other matters. We believe

that the operating entities are in material compliance with all applicable legal

and regulatory requirements. However, the central or local governments of these

jurisdictions may impose new, stricter regulations or interpretations of

existing regulations that would require additional expenditures and efforts on

our part to ensure our compliance with such regulations or

interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to

return to a more centrally planned economy or regional or local variations in

the implementation of economic policies, could have a significant effect on

economic conditions in China or particular regions thereof, and could require us

to divest ourselves of any interest we then hold in Chinese

properties.

We

may have difficulty establishing adequate management, legal and financial

controls in the PRC.

The PRC

historically has been deficient in Western style management and financial

reporting concepts and practices, as well as in modern banking, computer and

other control systems. We may have difficulty in hiring and retaining a

sufficient number of qualified employees to work in the PRC. As a result of

these factors, we may experience difficulty in establishing management, legal

and financial controls, collecting financial data and preparing financial

statements, books of account and corporate records and instituting business

practices that meet Western standards. We concluded that our internal controls

over financial reporting were not effective as of the periods for our annual

reports for the fiscal years December 31, 2008 and 2009.