Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - US ECOLOGY, INC. | usecology_8k-032410.htm |

Exhibit 99.1

Investor

Presentation March 2010

Safe

Harbor

During

the course of this presentation the Company will be making forward-looking

statements (as such term is defined in the Private Securities Litigation Reform

Act of 1995) that are base d on our current expectations, beliefs and

assumptions about the industry and markets in which American Ecology Corporation

and its subsidiaries operate. Because such statements include risks and

uncertainties, actual Corporation and its subsidiaries operate. Because such

statements include risks and uncertainties, actual results may differ materially

from what is expressed herein and no assurance can be given that the Company

will meet its 2010 earnings estimates, successfully execute its growth strategy,

or declare or pay future dividends. For information on other factors that could

cause actual results to differ materially from expectations, please refer to US

Ecology, Inc.’s (formally known as American Ecology Corporation) December 31,

2009 Annual Report on Form 10K and other reports filed with the Securities and

Exchange Commission. Many of the factors that will determine the Company’s

future results are beyond the ability of management to control or predict.

Participants should not place undue reliance on forward-looking statements,

which reflect management’s views only as of the date hereof. The Company

undertakes no obligation to revise or update any forward-looking statements, or

to make any other forward-looking statements, whether as a result of new

information, future events or otherwise.

Important

assumptions and other important factors that could cause actual results to

differ materially from those set forth in the forward-looking information

include a loss of a major customer compliance with and those set forth in the

forward-looking information include a loss of a major customer, compliance with

and changes to applicable laws and regulations, market conditions and production

rates for the thermal recycling service at our Texas facility, our ability to

replace business from completed Honeywell Jersey City project, access to cost

effective transportation services, access to insurance and other financial

assurances, loss of key personnel, lawsuits, adverse economic conditions

including a tightened credit market, the timing or level of government funding

or competitive conditions, incidents that could limit or suspend specific

operations, our ability to perform under required contracts our willingness or

ability to pay dividends and our ability to integrate any potential

acquisitions.

US

Ecology Vision

Continued

long term growth as the premier hazardous & radioactive materials services

provider in the diverse markets we serve Build on our strong relationships with

customers & regulators by providing safe, cost effective, technically

superior environmental management solutions Empower and align our employees to

actively participate in our success Generate sustainable increases in earnings

per share and cash flow at rates faster than the growth of markets in which we

operate

Investment

Highlights

Unique

set of radioactive & hazardous services and assets Seasoned, committed

Executive management team Strong cash flow business – Investment in

infrastructure fueling organic growth Significant operating leverage once fixed

costs are covered Strong balance sheet with no debt Return on invested capital:

14.3% ttm

Solid

Financials

Market

Cap: $ 296 million* Recent Price: $16.27* 52 Wk. Range: $13.56 $20.42 Shares

Out./Float: 18.2/15.5 million Dividend/Yield :$0.72/4.4% Revenue TTM $13

3million** SG&A % of Revenue 10%** Cash/Investments: $32.7 million ** Term

Debt: 0 Avail. line of credit: $11 million *at 3-15-2010 ** at

12-31-2009

U.S.

Disposal Market Overview

Historically

3.5M tons/year Down in 2009 due to economy – Base Business: Recurring waste

streams from industrial base Lower manufacturing output in 2009 produced lower

waste volumes–Must take market share to grow Event Business: Discrete cleanups

Private/discretionary clean‐ups continue

to be deferred & delayed –Uncertain when normal conditions will

return Government clean‐ups moving

forward but slower than anticipated

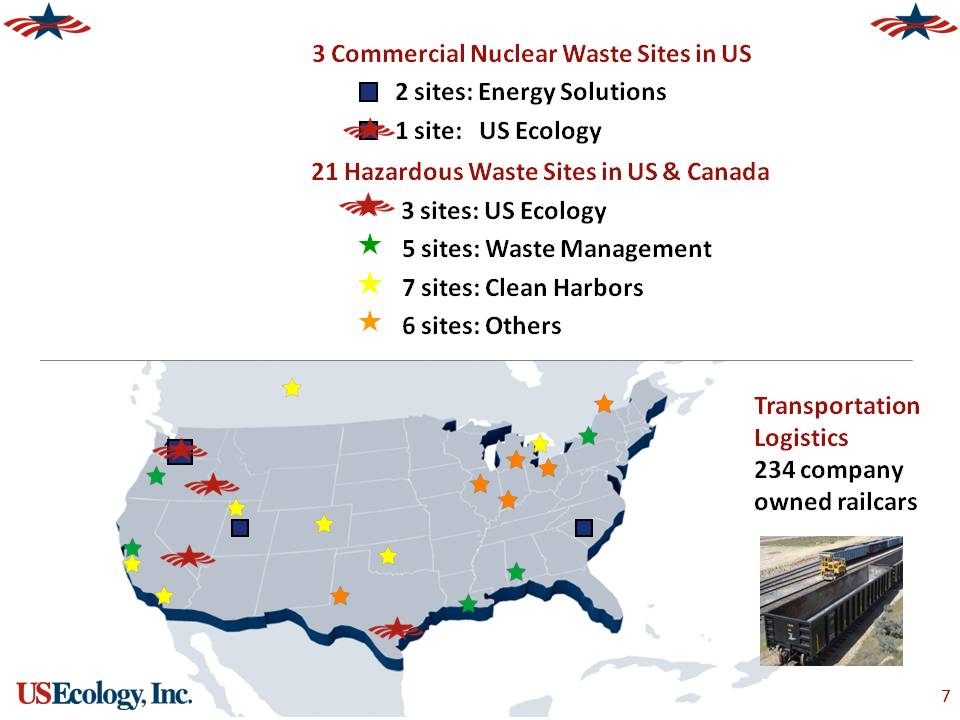

3

Commercial Nuclear Waste Sites in US 2 sites: Energy Solutions 1 site: American

Ecology 21 Hazardous Waste Sites in US & Canada 3 sites: American Ecology 5

sites: Waste Management 7 sites: Clean Harbors 6 sites: Others Transportation

Logistics 234 company owned railcars

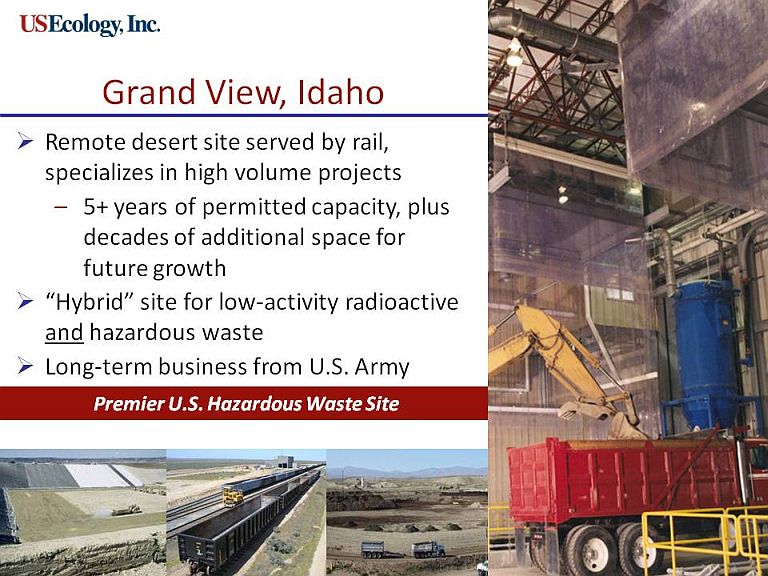

GrandView,

Idaho

Remote

desert site served by rail, specializes in high volume projects–5+ years of

permitted capacity, plus decades of additional space for future growth “Hybrid”

site for low activity radio active and hazardous waste and hazardous waste

Long-term business from U.S. Army Corps of Engineers through~2021 Premier U.S.

Hazardous Waste Site

Robstown,

Texas

Adding

New Infrastructure and Disposal Space for Growth in 2010–Adding expanded

treatment and drum handling capacity – Constructing additional land

fill cell 10+ years of permitted capacity Serving the Gulf Coast Oil & Gas

Market

Texas

Hydrocarbon Recycling Recycles refinery tank bottoms, cracking catalyst &

other oilbearing wastes –Industrial reuse of catalyst– Used oil resold into

market Key advantage: Internalize costs of recycling residuals ash & liquids

Building market share despite increased competition in 2009

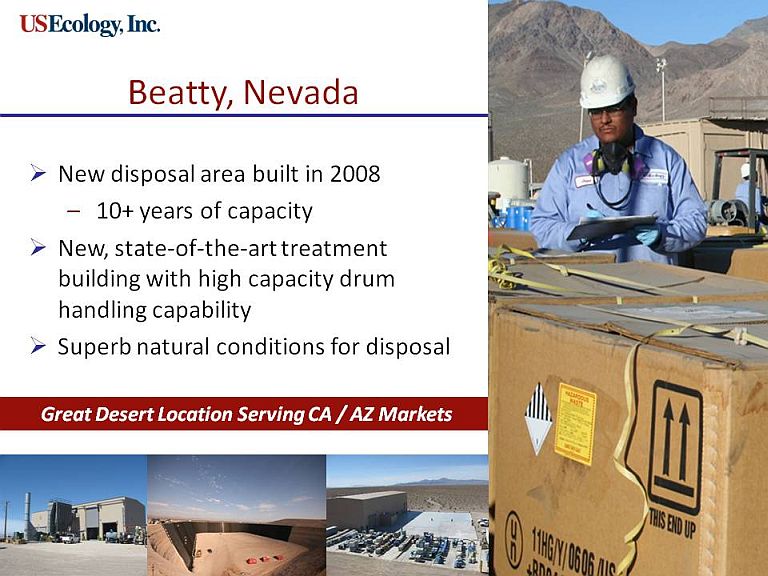

Beatty,

Nevada

New

disposal area built in 2008 –10+ years of capacity New, state of the art

treatment building with high capacity drum handling capability Superb natural

conditions for disposal Great Desert Location Serving CA/AZ Markets

Richland,

Washington Regulated monopoly for low level radio-active waste in 8 western

states Naturally occurring radio-active material at free market pricing 20+

years of capacity Steady, Rate Regulated Earnings

Longer-term

Industry Opportunities

American

Recovery & Reinvestment Act of 2009 – $100 million extra to Army Corps

FUSRAP Program –$800 million extra to EPA Superfund & underground storage

tank programs – Main benefit expected in 2010 & 2011 (timing and impact

difficult to predict) Proposals to reinstate lapsed Superfund excise tax on

industry FY 2010 EPA budget largest in agency’s history – Heightened enforcement

should drive more mandated cleanups Private Sector Commercial Real Estate –

Dependent on recovery of real estate market

Growth

Strategy Overview

Drive

volume through pricing, bundled services and packaging of unique

permit/treatment capabilities Expand waste handling infrastructure and treatment

options Modify facility permits to support entry into new markets Develop new

services to attract new customers Aggressively manage cost structure Maximize

operating leverage inherent to business Execute on our disciplined acquisition

strategy

Disciplined

Acquisition Strategy

Key

targets are RCRA Hazardous and Radioactive Treatment, Storage and Disposal

Facilities (TSDFs) Attractive Deals: – Consistent with our vision and mission –

Leverage our core competencies – Increase geographic reach and footprint –

Provide existing services to new customers Provide new services to existing

customers – Help solve customer waste problem or issue Be accretive in the short

term

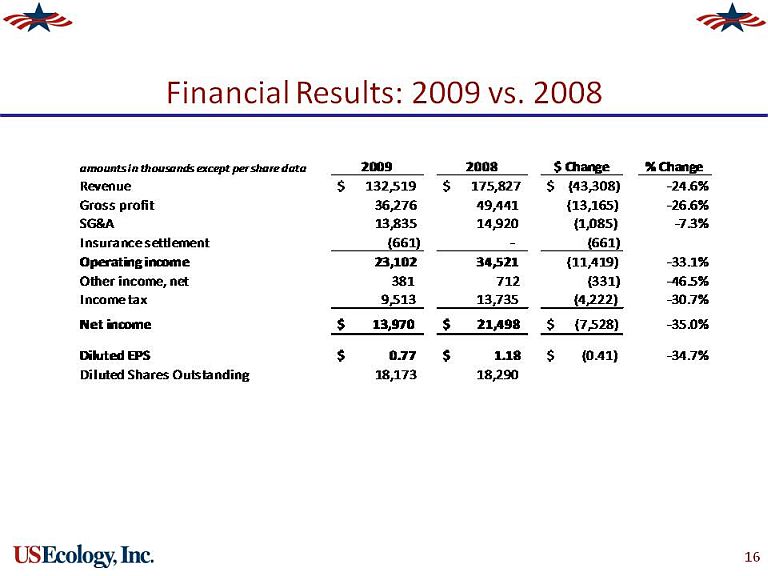

Financial

Results: 2009 vs.2008

amounts

in thousands except per share data Revenue Gross profit SG&A Insurance

settlement Operating income Other income, net Income tax Net income Diluted EPS

Diluted Shares Outstanding 2009 2008 $ Change % Change $132,519 36,276 13 835

(661) 23,102 381 9,513 $13,970 $0.77 18,173 $175,827 49,441 14,920 - 34,521

712,13,735 $21,498 $1.18 18,290 $(43,308) (13,165) (1,085) (661) (11,419) (331(

(4,222) $(7,528) $(0.41) -24.6% -26.6% -7.3% -33.1% -46.5% -30.7% -35.0%

-34.7%

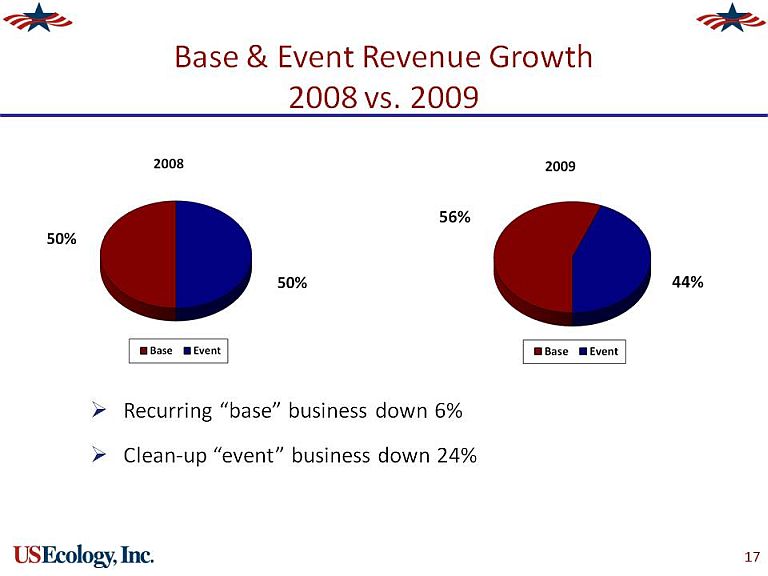

Base &

Event Revenue Growth 2008 vs. 2009 Recurring base business down 6% Cleanup

“event” business down 24% 2008 50% 2009 56% 44%

2009

Overview Total Revenue: $133 million 2009, down from $176 million 2008 Treatment

& disposal revenue down 15% – $9 million contribution from Texas thermal

recycling – Transportation revenue down 36% Recurring “Base” business down 6%

(56% of revenue) –Expanded customer base positions us well for recovery “Event”

business down 24% (44% of revenue) Completion of large event jobs, fewer

replacement opportunities Treatment & disposal margin of 45% reflects

reduced leverage SG&A: 10% of revenue Operating Income: $23 million Net

Income: $0.77 per diluted share; $0.52 eps when excluding Honeywell and

insurance proceeds

Honeywell

Impact on 2009 $0.77 $0.52 $0.57 $0.67 $0.90 0 $80 0.$70 0. $60 0. $50 $0.40

$0.30 $0.20 $0.10 $0.00 2009 EPS as reported, 2009 EPS, without

Honeywell and Insurance Proceeds 2010 EPS Forecast, low end of range, 2010 EPS

Forecast, high end of range

2010

Business Outlook Estimated 2010 earnings from $0.57 to $0.67 per diluted share

Represents growth of 10% to 29% over 2009 when excluding Honeywell contributions

($0.23) and favorable impacts from an insurance settlement ($0.02) Factors

driving guidance:‒Expect challenging economy delaying private “Event” clean up

opportunities through first half of 2010, recovering slowly in second half ‒

Competition for thermal recycling waste streams continues, keeping pressure on

price and volumes‒ “Base” business expected to grow slowly throughout 2010 ‒ US

Army Corps expected to return to pre 2009 levels on additional stimulus

funding