UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

10-K/A

Amendment

No. 1

(Mark One)

| |

|

|

| þ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For Fiscal Year Ended December 31, 2009.

or

| |

|

|

| o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission File Number 001-16249

INTERNET CAPITAL GROUP, INC.

(Exact Name of

Registrant as Specified in Its Charter)

| |

|

|

Delaware

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

23-2996071

(I.R.S. Employer

Identification Number) |

| |

|

|

690 Lee Road, Suite 310, Wayne, PA

(Address of Principal Executive Offices)

|

|

19087

(Zip Code) |

(610) 727-6900

(Registrant’s telephone number, including area code)

| |

|

|

Securities registered pursuant to Section 12(b) of the Act:

Common stock, par value $.001 per share

(Title of Class)

|

|

The NASDAQ Stock Market LLC

(The NASDAQ Global Market)

(Name of Each Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act. Yes

o

No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports) and (2) has been subject to such

filing requirements for the past 90 days. Yes þ No o

Indicate by check mark

whether the registrant has submitted electronically and posted on its corporate

Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to

submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation

S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. Check one:

| |

|

|

|

|

|

|

| Large accelerated filer o |

|

Accelerated filer þ

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act

Rule 12b-2). Yes o No þ

The aggregate market value of the 35,329,064 shares of Common Stock held by non-affiliates of

the registrant as of March 1, 2010 was $237.8 million, based upon the closing price of $6.73 on the

NASDAQ Global Market on June 30, 2009. (For this computation, the registrant has excluded the

market value of all shares of its Common Stock held by its executive officers and

directors; such exclusion shall not be deemed to constitute an admission that any such person is an

“affiliate” of the Registrant.)

As of March 1, 2010, there were 36,423,789 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed

with the Securities and Exchange Commission (the “SEC”) relative to the Company’s 2010 Annual

Meeting of Stockholders (the “Definitive Proxy Statement”) are incorporated by reference into Part III of this Report.

EXPLANATORY NOTE REGARDING THIS FORM 10-K/A

In accordance with Exchange Act Rule 12b-15, Internet Capital Group, Inc. (the “Registrant”) is

filing this Amendment No. 1 to its Annual Report on Form 10-K for the year ended December 31, 2009,

which was initially filed with the Securities and Exchange Commission on March 16, 2010 (the

“Original Filing”), to include audited financial statements of StarCite, Inc. (“StarCite”), a

subsidiary of the Registrant accounted for under the equity method, with respect to the years ended

December 31, 2009, 2008 and 2007 that were not available at the time of the Original Filing, along

with related materials.

This Amendment No. 1 amends Part IV, Item 15, “Exhibits and Financial Statement Schedules,” to

reflect (1) the inclusion of the consolidated financial statements of StarCite as Exhibit 99.2

hereto, (2) the inclusion of the Consent of KPMG LLP regarding the consolidated financial

statements of StarCite as Exhibit 23.3 hereto and (3) the inclusion of updated certifications from

the Registrant’s principal executive officer and principal financial officer as required by

Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, as amended. This Form 10-K/A restates the

Original Filing in its entirety by presenting the relevant text of these amended items, as amended.

Except for the amended information referred to above, this Form 10-K/A continues to describe

conditions as of the date of the Original Filing, and the Registrant has not modified or updated

any other disclosures presented in the Original Filing. Accordingly, except as specifically

referenced herein, this Amendment No. 1 does not restate the Registrant’s financial statements

previously filed in the Original Filing, does not reflect events occurring after the filing of the

Original Filing and does not modify or update those disclosures in the Original Filing affected by

subsequent events. Information not affected by this Amendment No. 1 is unchanged and reflects the

disclosures made at the time of the Original Filing on March 16, 2010.

INTERNET CAPITAL GROUP, INC.

FORM 10-K/A

DECEMBER 31, 2009

INDEX

2

Forward-Looking Statements

Forward-looking statements made with respect to our financial condition and results of operations

and business in this Annual Report on Form 10-K/A (this “Report”) and those made from time to time by

us through our senior management are made pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are based on our

current expectations and projections about future events but are subject to known and unknown

risks, uncertainties and assumptions about us and our partner companies that may cause our actual

results, levels of activity, performance or achievements to be materially different from any future

results, levels of activity, performance or achievements expressed or implied by such

forward-looking statements.

Factors that could cause our actual results, levels of activity, performance or achievements to

differ materially from those anticipated in forward-looking statements include, but are not limited

to, factors discussed elsewhere in this Report and include, among other things:

| |

• |

|

economic conditions generally; |

| |

| |

• |

|

capital spending by our partner companies’ customers; |

| |

| |

• |

|

our partner companies’ collective ability to compete successfully against their

respective competitors; |

| |

| |

• |

|

rapid technological developments in the respective markets in which our partner

companies operate and our partner companies’ collective ability to respond to such changes

in a timely and effective manner; |

| |

| |

• |

|

our ability to deploy capital effectively and on acceptable terms; |

| |

| |

• |

|

our ability to maximize value in connection with divestitures; |

| |

| |

• |

|

our ability to retain key personnel; and |

| |

| |

• |

|

our ability to have continued access to capital and to manage capital resources

effectively. |

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,”

“should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue” or

the negative of such terms or other similar expressions. All forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified in their entirety by the

cautionary statements included in this Report. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new information, future events or

otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events

discussed in this Report might not occur.

3

PART I

Although we refer in this Report to companies in which we have acquired a convertible debt interest

or an equity ownership interest as our “partner companies” and indicate that we have a

“partnership” with these companies, we do not act as an agent or legal representative for any of

our partner companies, we do not have the power or authority to legally bind any of our partner

companies, and we do not have the types of liabilities in relation to our partner companies that a

general partner of a partnership would have.

Overview

Internet Capital Group, Inc. (referred to in this Report as “ICG,” the “Company,” “we,” “our,” or

“us”) was formed on March 4, 1996 and is headquartered in Wayne, Pennsylvania. Since our

inception, we have focused on acquiring and building Internet software and services companies that

improve the productivity and efficiency of their business customers. We call these companies our

“partner companies.”

As of December 31, 2009 and the date of this Report,

we hold ownership interests in 13 companies that we consider our partner companies. Additionally, we hold marketable

securities in other companies, which, as of December 31, 2009 and the date of this Report, consist primarily of

Blackboard, Inc. common stock (NASDAQ: BBBB) (“Blackboard”). The results of operations of our partner

companies are reported within two segments: the “core” reporting segment and the “venture”

(formerly “other holdings”) reporting segment. The core reporting segment includes those

consolidated and equity method partner companies in which ICG owns a principal controlling equity voting interest (53% on average as of December 31, 2009)

and in which ICG’s management takes a very active role in providing strategic direction and management

assistance. We expect to devote relatively large initial amounts of capital to acquire our core partner companies.

The venture reporting segment includes partner companies to which we generally devote less capital than we do to

our core companies and, therefore, in which we hold relatively

smaller ownership stakes than we do in our core

companies (24% on average as of December 31, 2009) and have less influence over their strategic direction and

management decisions than we do over those of our core companies. At the end of 2009, ICG began implementing

a shift in its business strategy, under which the Company is focusing on acquiring and holding majority voting

equity stakes in a relatively smaller number of operating companies that would be included in our core segment.

For information regarding the results of operations of our reporting segments, as well as their respective

contributions to ICG's consolidated results of operations, see “Item 7—Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and “Item 8—Financial Statements and Supplementary Data,”

including Note 8, “Segment Information,” to our Consolidated Financial Statements. Such information is

incorporated herein by reference.

Over the past decade, businesses have increasingly looked to realize increased productivity and

efficiency through Internet-based software and services and other services that streamline,

automate or otherwise improve their business processes. Moreover, it is our view that businesses

will rely increasingly on these solutions in times of both economic growth and economic decline.

We believe that these factors create a compelling opportunity for companies that are able to

deliver these solutions and services, thereby expanding their customers’ access to new and existing

customers and suppliers, increasing their customers’ efficiency, reducing their customers’ costs

and/or allowing their customers to focus on their core competencies and outsource their non-core,

non-strategic processes. In some cases, this outsourcing will be to labor-based firms that provide

deep expertise, and in some cases, this outsourcing will be to technology-intensive firms that

provide platforms to automate functions.

4

We feel that the expertise we have developed in connection with our fourteen-year active

involvement with Internet software and services companies allows us to identify companies that are

positioned to succeed and to accelerate the growth of these companies. We intend to continue to expand

our network of partner companies and allocate our financial and human resources to partner

companies that we believe have significant long-term value potential. In particular, we seek to

acquire interests in software as a service (“SaaS”), technology-enabled business process outsourcing

(“BPO”) and Internet marketing companies, which offer solutions that:

| |

• |

|

automate complex workflow processes, with focus on the “white space” between companies; |

| |

| |

• |

|

are comprehensive, meaning that they include software, content data and transaction

capabilities (with content being a long-term differentiator); |

| |

| |

• |

|

have the ability to generate recurring revenue streams and allow their providers to

retain fixed costs; |

| |

| |

• |

|

are delivered to clients through long-term relationships; and |

| |

| |

• |

|

have the potential to evolve into ecosystems. |

After we identify a potential partner company, we negotiate the acquisition of an equity stake in

that company, typically seeking an interest as the principal controlling equity holder. We

generally require representation on the partner company’s board of directors to ensure our ability

to provide active guidance to the partner company. We place an extremely high value on quality,

motivated management teams and, accordingly, seek to structure acquisitions to permit the partner

company’s management and key personnel to retain a meaningful equity stake in the company. During

our negotiations with potential partner companies, we emphasize the value of our network and

resources and our focus on long-term value, which we believe give us a competitive advantage over

other potential funding sources when we seek to acquire partner companies.

Our focus on the software and services markets, particularly SaaS, technology-enabled BPO and

Internet marketing companies and the knowledge base of our partner companies, our management and our Board

of Directors give us valuable experience that we share with our partner companies. Once we acquire

an interest in a partner company, we work to assume an active role in the development and growth of

the company, providing both strategic guidance and operational support. We provide strategic

guidance to our partner companies relating to, among other things, market positioning, business

model and product development, strategic capital expenditures, mergers and acquisitions and exit

opportunities. Additionally, we provide operational support to help our partner companies manage

day-to-day business and operational issues and implement best practices in the areas of finance,

sales and marketing, business development, human resources and legal services. Once a company joins

our partner company network, our collective expertise is leveraged to help position that company to

produce high-margin, recurring and predictable earnings and generate long-term value that we

believe can ultimately be captured for our stockholders through continued ownership by ICG, an initial public offering, or a

strategic sale.

Our Partner Companies

At December 31, 2009, our core partner companies consisted of:

Channel Intelligence, Inc. (“Channel Intelligence”)

Channel Intelligence is a data solutions company that provides innovative suites of services for

manufacturers, retailers and publishers that help consumers work with retailers to find and buy

products, whether they start at retailer sites, manufacturer sites or destination shopping sites,

through the use of Channel Intelligence’s patented optimization technology and data solutions.

5

Freeborders, Inc. (“Freeborders”)

Freeborders is a provider of technology solutions and outsourcing from China. Freeborders provides

industry expertise to North American and European companies in financial services, technology,

retail/consumer goods, manufacturing and transportation and logistics. Freeborders’ offerings help

companies seeking cost-effective technology solutions.

GovDelivery Holdings, Inc. (“GovDelivery”)

GovDelivery is a leading provider of government-to-citizen communication solutions. GovDelivery’s

digital subscription management SaaS platform enables government organizations to provide citizens

with access to relevant information by delivering new information through e-mail mobile text

alerts, RSS and social media channels from U.S. and U.K. government

entities at the national, state and

local levels.

ICG Commerce Holdings, Inc. (“ICG Commerce”)

ICG Commerce is a procurement services provider delivering total procurement cost savings through a

combination of deep expertise and hosted technology. ICG Commerce provides a comprehensive range

of solutions to help companies identify savings through sourcing, realize savings through

implementation of purchase-to-pay automation and drive continuous improvements through ongoing

category management.

Investor Force Holdings, Inc. (“InvestorForce”)

InvestorForce is a financial software company specializing in the development of online

applications for the financial services industry. InvestorForce provides pension consultants and

other financial intermediaries with a Web-based enterprise platform that integrates data management

with robust analytic and reporting capabilities in support of their institutional and other

clients. InvestorForce’s applications provide investment consultants with the ability to conduct

real-time analysis and research into client, manager and market movement and to produce timely,

automated client reports.

Metastorm Inc. (“Metastorm”)

Metastorm is an enterprise software and service provider that enables its customers to turn

business strategies into business processes by fully integrating the work that people do with

software systems that optimize business performance. Metastorm delivers a complete set of scalable

business process management solutions that leverage existing information technology investments to

unite people, processes and technology in a service-based architecture.

StarCite, Inc. (“StarCite”)

StarCite provides a comprehensive suite of software applications and services to the meeting and

events industry. StarCite helps drive efficiencies and cost savings to both corporate buyers and

suppliers. Corporate, association and third-party meeting buyers rely on StarCite’s enterprise

meeting solutions for workflow, procurement, supply chain management, spend analysis and attendee

management. Thousands of industry suppliers rely on the StarCite online marketplace, supplier

marketing programs and enabling technologies to increase meeting revenues. StarCite’s

international division represents destination management companies and other premier international

travel suppliers, using both technology and traditional means.

WhiteFence, Inc. (“WhiteFence”)

WhiteFence is a Web services provider used by household consumers to compare and purchase essential

home services, such as electricity, natural gas, telephone and cable/satellite television.

WhiteFence reaches customers directly through company-owned websites and through its network of

exclusive channel partners which integrate the Web services applications into their own business

processes and websites.

6

At December 31, 2009, our venture partner companies consisted of:

Acquirgy, Inc. (“Acquirgy”)

Acquirgy specializes in Search Engine Marketing (SEM) and Direct Response Television (DRTV)

services and provides comprehensive account services, as well as creative and production expertise

with integrated multichannel software platforms. SEM services include outsourced paid search

management, SEM Performance Consulting (SEMpcTM) for clients managing search internally

and search engine optimization. DRTV services include comprehensive script-to-screen DRTV

creative, production and media services.

Anthem Ventures Fund, L.P. (“Anthem”)

Anthem provides resources to enhance the development of emerging technology companies by providing

financial investment, operational and management advice, as well as access to a network of

professional relationships.

ClickEquations, Inc. (f/k/a Commerce360, Inc.) (“ClickEquations”)

ClickEquations is a software-based search marketing company that improves paid and organic search

campaign performance for its clients, which include Internet Retailer 500 and Fortune 100

companies. Its proprietary technology uses advanced mathematics and statistical analysis to

optimize campaigns across the entire search chain and deliver improved campaign efficiency and

performance.

GoIndustry-DoveBid plc (“GoIndustry”) (LSE.AIM:GOI)

GoIndustry is a leader in auction sales and valuations of used industrial machinery and equipment.

GoIndustry combines traditional asset sales experience with innovative e-commerce technology and

advanced direct marketing to service the needs of multi-national corporations, insolvency

practitioners, dealers and asset-based lenders around the world.

SeaPass Solutions Inc. (“SeaPass”)

SeaPass

develops and markets processing solutions that enable insurance

carriers, agents and brokers to transmit and receive data in real-time by leveraging existing

systems to interact automatically. With the company’s technology, information accessed in real-time

allows for increased efficiency across all lines of the insurance business.

Concentration of Customer Base and Credit Risk

In each of the years ended December 31, 2009 and 2008, two customers of ICG Commerce, which is a

consolidated core partner company, accounted for more than 10% of our consolidated revenue. The

Hertz Corporation and Kimberly-Clark Corporation each represented approximately 13% and 17% of our

consolidated revenue for the years ended December 31, 2009 and 2008, respectively. Accounts

receivable, including unbilled amounts, from The Hertz Corporation and Kimberly-Clark Corporation as of December 31, 2009

were $1.7 million and $1.5 million, respectively. Accounts

receivable, including unbilled amounts, from the Hertz Corporation and Kimberly-Clark Corporation

as of December 31, 2008 were $2.9 million and $1.4 million, respectively.

7

Competition Facing Our Partner Companies

Competition for information technology and Internet products and services is intense. As the

market for e-commerce continues to grow, we expect that competition will continue to intensify.

Barriers to entry are minimal, and competitors can offer products and services at a relatively low

cost. Our partner companies compete with established information systems and management consulting

firms, as well as with traditional distribution channels and other online providers, for shares of

their customers’ purchasing budgets for information technology and consulting services.

Many companies offer information technology solutions and other solutions that compete with our

partner companies. We expect that additional companies will offer competing solutions in the

future. Furthermore, our partner companies’ competitors may develop information technology and

Internet products or other services that are superior to, or have greater market acceptance than,

the solutions offered by our partner companies. Many of our partner companies’ competitors have

greater brand recognition and greater financial, marketing and other resources than our partner

companies. This may place our partner companies at a disadvantage in responding to their

competitors’ pricing strategies, technological advances, advertising campaigns, strategic

partnerships and other initiatives. If our partner companies are unable to compete successfully

against their competitors, our partner companies may fail.

We may compete with our partner companies to acquire interests in software and services companies

and our partner companies may compete with each other for these opportunities. This competition

may deter companies from partnering with us and may limit our business opportunities.

Employees

Corporate headcount at ICG as of March 1, 2010 was 27. Headcount at our consolidated partner

companies as of March 1, 2010 was 648.

Financial Information About Geographic Areas

Financial information regarding geographic areas is contained in Note 8, “Segment Information,” to

our Consolidated Financial Statements included in “Item 8—Financial Statements and Supplementary

Data” and is incorporated herein by reference.

Availability of Reports and Other Information

Our Internet website address is www.internetcapital.com. Unless this Report explicitly states

otherwise, neither the information on our website, nor the information on the website of any of our

partner companies, is incorporated by reference into this Report.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

all amendments to those reports filed by us with the SEC pursuant to Sections 13(a) and 15(d) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are accessible free of charge

through our website as soon as reasonably practicable after we electronically file those documents

with, or otherwise furnish them to, the SEC.

The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public

Reference Room at 450 Fifth Street, NW, Washington, DC 20549. The public may obtain information on

the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains

an internet site (www.sec.gov) that contains reports, proxy and information statements, and other

information regarding issuers that file electronically with the SEC.

8

Our business involves a number of risks, some of which are beyond our control. You should

carefully consider each of the risks and uncertainties we describe below and all of the other

information in this Report before deciding to invest in our Common

Stock. The risks and uncertainties we

describe below are not the only ones we face. Additional risks and uncertainties about which we

currently do not know or that we currently believe to be immaterial may also adversely affect our

business, financial condition or operating results.

Numerous

external forces, including ongoing weak economic conditions, have

negatively affected our

and our partner companies’ respective businesses, results of

operations and financial condition and continued weak economic

conditions could result in additional declines in our revenues and

operating results.

Numerous external forces, including the state of global financial markets and general economic

conditions, lack of consumer confidence, lack of availability of credit, interest rate and currency

rate fluctuations and national and international political circumstances (including wars and

terrorist acts) have negatively affected our and our partner companies’ respective businesses,

results of operations and financial condition. Our and our partner

companies’ businesses may also be negatively impacted by ongoing weak economic conditions affecting the

banking system, financial markets and financial institutions, which have resulted in a tightening in the

credit markets, a low level of liquidity in many financial markets and extreme volatility in credit

and equity markets. The length of time or severity with which these conditions may persist is

unknown. As a consequence, our and our partner companies’ respective operating results for a

particular period are difficult to predict and, therefore, prior results are not necessarily

indicative of expected results in future periods. In response to current financial conditions, many

customers and potential customers of our partner companies may forgo, delay or reduce technology

and other purchases. In connection with these conditions, our partner companies may experience

reductions in the sales of their products and services, extended sales cycles, difficulties in

collecting (or the inability to collect) accounts receivable, slower adoption of new technologies,

increased price competition and difficulties in obtaining (or the inability to obtain) financing.

The current volatility in the financial markets and overall economic uncertainty increase the risk

that the value of our partner companies and our other assets will be impaired and that the value to

be captured in the future in connection with the disposition of our partner companies will be

significantly lower than we initially expected.

If we are not able to deploy capital effectively and on acceptable terms, we may not be able to

execute our business strategy.

Our strategy includes effectively deploying capital by acquiring interests in new partner

companies. We may not be able to identify attractive acquisition candidates that fit our strategy.

Even if we are able to identify acquisition candidates, we may not be able to acquire interests in

those companies due to an inability to reach mutually acceptable financial or other terms with

those companies or due to competition from other potential acquirers that may have greater

resources, brand name recognition, industry contacts or flexibility of structure than we do. The

recent turmoil in the global economy has caused significant declines and fluctuations in the

valuations of publicly-traded companies and privately-held companies. Uncertainty regarding the

extent to which valuations of companies that fit our acquisition criteria will continue to

fluctuate may affect our ability to accurately value potential acquisition candidates.

Additionally, ongoing weak economic conditions may make it more difficult for us to obtain capital

needed to deploy to new and existing partner companies. If we are unable to effectively deploy

capital to partner companies on acceptable terms, we may not be able to execute on our strategy,

and our business may be adversely impacted.

9

If our partner companies are unable to attract new customers or retain customers, including certain

significant customers, our and our partner companies’ respective businesses, results of operations

and financial conditions could be negatively affected.

Our partner companies may not be able to attract or retain customers due to a variety of reasons,

including increased competition, the unwillingness of customers and potential customers to spend

money on products and services during periods of economic turmoil and uncertainty, insolvency and

the unavailability of credit. If our partner companies are unable to attract new customers or

retain existing customers, our and our partner companies’ respective businesses, results of

operations and financial conditions could be negatively affected.

During the year ended December 31, 2009, two customers of ICG Commerce, The Hertz Corporation and

Kimberly-Clark Corporation, each represented approximately 13% of our consolidated revenue. For

the year ended December 31, 2008, these two customers each represented approximately 17% of our

consolidated revenue. If our partner companies are not able to retain significant customers, such

partner companies and our respective businesses, results of operations and financial positions

could be negatively affected.

The inability of our partner companies’ customers to pay their obligations to them in a timely

manner, or at all, could have an adverse effect on our partner companies.

The financial resources of our partner companies’ customers may be negatively affected by the

continuing economic downturn. As a result, these customers may have inadequate financial resources

to meet all their obligations to our partner companies and may not make payments in a timely manner

or at all. Additionally, if our partner companies’ customers do not have adequate financial

resources, they may attempt to terminate or renegotiate existing contracts with our partner

companies and may refrain from purchasing additional products and services from our partner

companies. These factors may cause our partner companies’ results of operations and financial

condition to be adversely affected.

Our partner companies may not be able to compete successfully.

If our partner companies are unable to compete successfully against their competitors, our partner

companies may fail. Competition for Internet software and services is intense and is expected to

intensify. Our partner companies’ competitors may develop products or services that are superior

to, or have greater market acceptance than, the solutions offered by our partner companies. Many of

our partner companies’ competitors have greater brand recognition and greater financial, marketing

and other resources than our partner companies. This may place our partner companies at a

disadvantage in responding to their competitors’ pricing strategies, technological advances,

marketing campaigns, strategic partnerships and other initiatives.

The Internet software and services industry is characterized by evolving industry standards,

coupled with frequent and related new service and product introductions and enhancements. The

development of new service and product introductions and enhancements in response to evolving

industry standards requires significant time and resources, and our partner companies may not be

able to adapt quickly enough and/or in a cost-effective manner to these changes, and our partner

companies’ failure to do so could adversely affect our partner companies’ businesses, financial

condition and results of operations.

We may compete with some of our partner companies, and our partner companies may compete with each

other, which could deter companies from partnering with us and may limit future business

opportunities.

We may compete with our partner companies to acquire interests in new partner companies, and our

partner companies may compete with each other for business opportunities. This competition may

deter potential acquisition targets from partnering with us and may limit our business

opportunities.

10

Our operations and growth and that of our partner companies could be impaired by limitations on our

and/or their ability to raise capital or borrow money on favorable terms.

We and our partner companies may need to raise additional capital or borrow money in order to

sustain operations or to grow. If we or our partner companies are unable to raise capital or

obtain credit on favorable terms, our ability and the ability of our partner companies to operate

and grow may be impaired. This may require us or our partner companies to take other actions, such

as borrowing money on terms that may be unfavorable, or divesting of assets prematurely to raise

capital. If we or our partner companies need capital and are unable to raise it, then we or they

may need to limit or cease operations.

Adverse changes in economic conditions and reduced information technology spending may adversely

impact our business.

Our and our partner companies’ respective businesses depend on the overall demand for information

technology, and in particular for Internet software and services that improve the productivity of

our customers’ businesses. In addition, the acquisition of our partner companies’ Internet

software and services is often discretionary and may require customers to make significant initial

contributions of capital and other resources. During the recent global financial crisis, business

spending on technology infrastructure decreased dramatically. Continued weak economic conditions

or, even if general economic conditions improve, a reduction in information technology spending,

could adversely impact our business and the businesses of our partner companies in a number of ways

that negatively impact our operating results and financial condition.

Acquisitions by our partner companies could result in operating difficulties, dilution and other

harmful consequences.

As part of their growth strategies, our partner companies have and may continue to strategically

acquire other companies, business and technologies. The process of integrating an acquired

company, business or technology involves numerous risks, including difficulties in the integration

of the operations, technologies, services and products of the acquired company or business and the

diversion of management’s attention from other business concerns. Although we and our partner

companies will endeavor to evaluate the risks inherent in any particular acquisition transaction,

there can be no assurance that we or our partner companies will properly ascertain all such risks.

In addition, acquisitions may result in the incurrence of substantial additional indebtedness and

other expenses for our partner companies; they may also result in potentially dilutive issuances of

a partner company’s equity securities. Accordingly, difficulties encountered with acquisitions may

have a material adverse effect on our or our partner companies’ businesses, financial condition and

results of operations.

Our inability to maintain or be able to increase our ownership stakes in partner

companies with significant growth opportunities could negatively impact our ability to execute our strategy.

One of our strategies is to maintain and increase our ownership in those partner companies that we

believe have major growth opportunities such that we would have

consolidated stakes in those

companies. We may not be able to achieve this goal because of limited resources and/or the

unwillingness of such companies and/or the stockholders of such companies to enter into a

transaction that would result in an increase in our ownership stake. Moreover, certain

transactional growth opportunities, such as mergers and consolidations, may arise with respect to

any of these partner companies that would result in potentially dilutive issuances of such partner

companies’ equity securities. In the event that any of these select partner companies enters into

such a transaction, with or without our support, we may have a decreased ability to direct the

policies and affairs of the partner company or the surviving entity following the consummation of

the transaction.

11

If

we do not participate in follow-on financings at our partner companies, our stakes in such

companies will be diluted, which could materially reduce the value of those stakes.

From time to time our partner companies raise capital by issuing and selling additional equity. We

generally have preemptive rights to participate in these follow-on rounds of financing; however, we

may elect not to participate in such rounds or may be required to waive our preemptive rights in

whole or in part so that outside investors can participate. If we do not participate in a

follow-on round of a partner company, our ownership interest in such company will be diluted.

Additionally, in connection with new rounds of financing, our partner companies may issue preferred

stock with liquidation preferences that are senior to existing preferred stock and common stock.

If we do not participate in a follow-on round at a partner company, our ownership stake will

decrease and our rights to receive proceeds in connection with the sale of that partner company

will be diminished, which could result in a material reduction in the value of our stake in that

partner company.

Moreover, in the event that we pay a control premium in connection

with our acquisition of a majority stake in a partner company, we

would not be able to command a similar premium upon the disposition

of that stake if, through dilutive events, the stake becomes a

minority interest.

We may have to buy, sell or retain assets when we would otherwise choose not to buy, sell or retain

in order to avoid registration under the Investment Company Act, which would impact our business

strategy.

Under the Investment Company Act of 1940, as amended (the “Investment Company Act”), a company is

considered to be an investment company if, among other things, it is primarily engaged in the

business of investing, reinvesting, owning, holding or trading in securities. It is not feasible

for us to be regulated as an investment company because the Investment Company Act rules are

inconsistent with our strategy of actively managing, operating and promoting collaboration among

our network of partner companies. On August 23, 1999, the SEC granted our request for an exemption

under Section 3(b)(2) of the Investment Company Act, declaring us to be primarily engaged in a

business other than that of investing, reinvesting, owning, holding or trading in securities. This

exemptive order reduces, but does not eliminate, the risk that we may have to take action to avoid

registration as an investment company. For example, we might be considered to be in violation of

our exemptive order if more than a certain percentage of our total assets consist of, or more than

certain percentages of our income/loss and revenue over the last four quarters is derived from,

ownership interests in companies that we do not primarily control. Because we do not have primary

control of many of our partner companies, changes in the value of our interests in such partner

companies and the income/loss and revenue attributable to such partner companies could subject us

to regulation under the Investment Company Act unless we take precautionary steps. For example, we

may retain interests in partner companies we would otherwise want to sell and we may sell stakes in

non-controlled partner companies that we would otherwise want to retain. In order to ensure that

the requisite percentage of our total assets relates to partner companies that we primarily

control, we may participate in follow-on financings at our controlled partner companies and refrain

from participating in such financings at our non-controlled partner companies. In addition, we may

have to acquire additional income or loss generating majority-owned or controlled interests that we

might not otherwise have acquired and may not be able to acquire “non-controlling” interests in

companies that we would otherwise want to acquire.

Our partner companies could make financial or other business decisions that are not in our best

interests or that we do not agree with, which could impair the value of our partner company

interests.

Although we generally seek to acquire a controlling equity interest and participate in the

management of our partner companies, we may not acquire or maintain a controlling interest in each

partner company. If we lack control or share control in a partner company we may not be able to

control significant financial or other business decisions of such partner company. Management or

other stockholders of a partner company could have economic or business interests or objectives

that are different from ours or disagree with our advice regarding financial or operating

decisions, which could impair the value of our interest, prevent us from monetizing our interest at

a time or at a price that is favorable to us or negatively affect our operating results.

Additionally, our inability to prevent dilution of our ownership interests in a partner company or

our inability to otherwise have a controlling influence over the management and operations of a

partner company could have an adverse impact on our status under the Investment Company Act.

12

We may not be able to extract cash from those partner companies that achieve profitability and may

need to continue to rely on existing cash, liquidity events and additional capital raises to fund

our operations.

We currently rely on existing cash, partner company liquidity events and the issuance and sale of

additional securities in order to fund our operations. One of our goals is to help our partner

companies achieve profitability so that we can access their cash flow.

Moreover, we are focusing on acquiring majority voting stakes in an increasing number of partner companies in part so that we have increased access to the cash flow of our partner companies.

However, even if certain of

our partner companies do meet that goal, we may not be able to access cash generated by such

partner companies to fund our operations due to a number of factors, including the needs of such

companies to reinvest in their own businesses and our inability to control the significant business

or financial decisions of such companies. Our inability to access the cash of our partner

companies could have a negative impact on our operations.

We may be unable to obtain maximum value in connection with the divesture of partner company and

marketable security interests.

From time to time, we may divest of interests in partner companies or marketable securities to

generate cash or for strategic reasons. The timing of such divestures, particularly with respect

to our privately-held partner companies, may not be within our control. If we need to quickly

divest partner company interests to satisfy immediate cash requirements or to avoid registration as

an investment company under the Investment Company Act, we may be forced to sell our assets prior

to canvassing the market or at a time when market conditions valuations are unfavorable. We also

may not be able to identify buyers for certain of our assets, particularly given the difficulty

that potential acquirers may currently face in obtaining financing. Furthermore, in connection

with the sale of a private partner company, we may not receive the full amount of proceeds to which

we would otherwise be entitled under such company’s certificate of incorporation if additional

payments to management and/or other stockholders are made to secure the approval and/or execution

of such transaction. We may be unable to sell our interests in publicly-traded companies at

then-quoted market prices, if at all, because low trading volumes of these companies may limit our

ability to sell a significant amount of such companies’ stock in the open market. Registration and

other requirements under applicable securities laws may also adversely affect our ability to

dispose of our interests on a timely basis. Based on the foregoing factors, when we divest of an

interest in a partner company or a marketable security, we may not receive maximum value for that

asset and the realizable value of our interest in such asset may ultimately be lower than the

carrying value currently reflected in our consolidated financial statements and/or the expectations

our investors or securities analysts.

In addition, the market for initial public offerings has experienced significant weakness in

connection with recent market volatility. If this market is weak, we may not be able to capture

stockholder value by taking our partner companies public.

Our accounting estimates with respect to the ultimate recoverability of our basis in our partner

companies could change materially in the near term.

Our accounting estimates with respect to the useful life and ultimate recoverability of our

carrying basis, including goodwill, in our partner companies could change in the near term, and the

effect of those changes on our consolidated financial statements could be significant. During the

years ended December 31, 2009 and 2008 we recorded impairment charges of $5.4 million and $23.2

million, respectively. It is possible that a significant write-down or write-off of our carrying basis in our partner companies, including goodwill, may be required in the future, or that a significant

loss will be recorded in the future upon the sale of one or more partner companies. Any write-down

or write-off of this type could cause a decline in the price of our Common Stock.

13

Our stock price has been volatile in the past and may continue to be volatile in the future.

Our stock price has historically been volatile. This volatility may continue in the future,

particularly in light of the current uncertainty about global economic conditions.

The following factors, among others, may add to our Common Stock price’s volatility:

| |

• |

|

general economic conditions, such as a recession or interest rate or currency rate

fluctuations; |

| |

| |

• |

|

the reluctance of enterprises to increase spending on new products or services; |

| |

| |

• |

|

actual or anticipated variations in our quarterly results and those of our partner

companies; |

| |

| |

• |

|

changes in the market valuations of our partner companies and other similar

companies; |

| |

| |

• |

|

conditions or trends related to Internet software and services companies; |

| |

| |

• |

|

changes in our financial estimates and those of our partner companies by securities

analysts; |

| |

| |

• |

|

new products or services offered by us, our partner companies and their

competitors; |

| |

| |

• |

|

announcements by our partner companies and their competitors of technological

innovations; |

| |

| |

• |

|

announcements by us, our partner companies or our competitors of significant

acquisitions, strategic partnerships or joint ventures; |

| |

| |

• |

|

additional sales or repurchases of our securities; and |

| |

| |

• |

|

additions to or departures of our key personnel or the key personnel of our partner

companies. |

Many of these factors are beyond our control. These factors may decrease the market price of our

Common Stock.

Fluctuations in our quarterly results may adversely affect our stock price.

We expect that our quarterly results will fluctuate significantly due to many factors, including:

| |

• |

|

the acquisition of interests in partner companies; |

| |

| |

• |

|

the operating results of our partner companies; |

| |

| |

• |

|

sales of our ownership interests in our partner companies, which could cause us to

recognize gains or losses under applicable accounting rules; |

| |

| |

• |

|

significant fluctuations in the financial results of Internet software and services

companies generally; |

| |

| |

• |

|

changes in estimated quarterly equity losses or income; |

| |

| |

• |

|

changes in our methods of accounting for our partner company interests, which may

result from changes in our ownership percentages of our partner companies; |

| |

| |

• |

|

the pace of development or a decline in growth of the Internet software and

services markets; and |

| |

| |

• |

|

competition for the goods and services offered by our partner companies. |

If our operating results in one or more quarters do not meet securities analysts’ or investors’

expectations, the price of our Common Stock could decrease.

14

Fluctuations in the price of the common stock of our publicly-traded holdings may affect the price

of our Common Stock.

Currently, we hold stock of Blackboard and GoIndustry, each of which is a publicly-traded entity.

Fluctuations in the price of the common stock of Blackboard, GoIndustry or any other

publicly-traded holdings we may hold from time to time are likely to affect the price of our Common Stock. The price of these

publicly-traded companies’ common stock has been highly volatile. As of December 31, 2009, the

market value of our interest in these publicly-traded companies was $79.4 million, which was based

upon a $45.39 per share closing price for Blackboard and a $0.02 per share closing price for

GoIndustry. The results of operations and, accordingly, the price of the stock of Blackboard and

GoIndustry may be adversely affected by the occurrence of the risk factors contained in this

Report. In addition, the results of operations and stock price of Blackboard may be adversely

affected by the risk factors in Blackboard’s SEC filings, which are publicly available at

www.sec.gov, and the results of operations and common stock price of GoIndustry may be adversely

affected by the factors set forth in GoIndustry’s submissions on the AIM market of the London Stock

Exchange, which are publicly available at www.londonstockexchange.com.

We have had a general history of operating losses and expect continued operating losses in the foreseeable future.

We have had significant operating losses and, excluding the effect of any future non-operating

gains, such as from the sale of interests in partner companies, we expect to continue incurring

operating losses in the future. As a result, we may not have sufficient resources to expand or

maintain our operations in the future. We can give no assurances as to when or whether we will

achieve profitability, and if we ever have profits, we may not be able to sustain them.

Certain of our partner companies have a limited operating history and may never be profitable.

Certain of our partner companies have limited operating histories. As a result, they have only

short operating histories to aid in assessing future prospects. Additionally, certain of our

partner companies have significant historical losses and may never be profitable. Many of our

partner companies have incurred substantial costs to develop and market their products and expand

operations, have incurred net losses and cannot fund their cash needs from operations. Operating

expenses of these companies could increase in the foreseeable future as they continue to develop

products, increase sales and marketing efforts and expand operations.

The loss of our or our partner companies’ executive officers or other key personnel or our or our

partner companies’ inability to attract additional key personnel could disrupt our business and

operations.

If one or more of our executive officers or key personnel, or our partner companies’ executive

officers or key personnel, including highly trained information technology personnel, were unable

or unwilling to continue in their present positions, or if we or our partner companies were unable

to hire qualified personnel, our business and operations could be disrupted and our operating

results and financial condition could be seriously harmed.

15

Our partner companies’ success depends on the integrity of their systems and infrastructure.

Interruptions in their information systems may adversely affect their businesses.

To succeed, our partner companies’ systems and infrastructure must perform well on a consistent

basis. From time to time, our partner companies may experience occasional system interruptions

that make some or all of their systems or data unavailable or prevent them from providing services,

which could adversely affect their businesses. Moreover, as traffic to their various websites and

the related number of uses and customers increase and the number products and services that they

introduce continues to grow, they will need to upgrade their systems, infrastructure and

technologies generally to facilitate this growth. If our partner companies do not do so or if they

experience inefficiencies and/or operational failures in connection with current or future

upgrades, third parties with which they do business may not be able to access their services on an

intermittent or prolonged basis and the quality of experience that users and customers encounter

with their products and services generally could diminish. The occurrence of any of these events

could adversely affect their businesses, financial condition and results of operations.

We and our partner companies may be subject to litigation proceedings or government regulation that

could harm our respective businesses.

We and our partner companies may be subject to legal claims involving stockholder, consumer,

competition and other matters. Litigation is subject to inherent uncertainties, and unfavorable

rulings could occur. An unfavorable ruling could include monetary damages or, in cases for which

injunctive relief is sought, an injunction prohibiting one of our partner companies from performing

a critical activity, such as selling its software and services. If we or one of our partner

companies were to receive an unfavorable ruling in a litigation matter, our and our partner

companies’ respective businesses, financial condition and results of operations could be materially

harmed. Even if legal claims brought against us or our partner companies are without merit,

defending lawsuits may take significant time, be expensive and divert our or our partner companies’

management attention from other business concerns.

Our partner companies’ software and services offerings are subject to government regulation

domestically and internationally in many areas, including regulation of the Internet regarding user

privacy, telecommunications, data protection and online content. The application of these laws and

regulations to our partner companies’ businesses is often unclear and sometimes may conflict.

Compliance with these regulations may involve significant costs or require changes in business

practices that result in reduced revenue. Noncompliance could result in monetary penalties being

imposed on our partner companies or orders that our partner companies cease performing a critical

activity, such as selling their software and services.

We have implemented certain anti-takeover provisions that could make it more difficult for a third

party to acquire us.

Provisions of our amended certificate of incorporation and bylaws, as well as provisions of

Delaware law, could make it more difficult for a third party to acquire us, even if doing so would

be beneficial to our stockholders. Our amended certificate of incorporation provides that our

board of directors may issue preferred stock without stockholder approval and also provides for a

staggered board of directors. We are subject to the provisions of Section 203 of the Delaware

General Corporation Law, which restricts certain business combinations with interested

stockholders. Additionally, we have a rights agreement which has the effect of discouraging any

person or group from beneficially owning more than 15% of our outstanding Common Stock unless our

board has amended the plan or redeemed the rights. The combination of these provisions may inhibit

a non-negotiated merger or other business combination.

|

|

|

| ITEM 1B. |

|

Unresolved Staff Comments |

None.

16

The location and general description of our properties as of March 1, 2010 are as follows:

Corporate Offices

Our corporate headquarters are located at 690 Lee Road, Suite 310 in an office facility located in

Wayne, Pennsylvania, where we lease approximately 11,000 square feet.

Partner Company Properties

Our consolidated partner companies lease approximately 128,229 square feet of office,

administrative, sales and marketing, operations and data center space, principally in Georgia,

Minnesota, New York, Pennsylvania, Texas and Washington, D.C. in the United States and

administrative offices in China, India and the United Kingdom.

|

|

|

| ITEM 3. |

|

Legal Proceedings |

In May and June 2001, certain of the Company’s present directors, along with the Company, certain

of its former directors, certain of its present and former officers and its underwriters, were

named as defendants in nine class action complaints filed in the United States District Court for

the Southern District of New York. The plaintiffs and the putative classes they seek to represent

include present and former stockholders of the Company. The complaints generally allege violations

of Sections 11 and 12 of the Securities Act of 1933, as amended (the “Securities Act”), and

Rule 10b-5 promulgated under the Exchange Act, based on, among other things, the dissemination of

statements allegedly containing material misstatements and/or omissions concerning the commissions

received by the underwriters of the initial public offering and follow-on public offering of the

Company as well as failure to disclose the existence of purported agreements by the underwriters

with some of the purchasers in these offerings to buy additional shares of the Company’s stock

subsequently in the open market at pre-determined prices above the initial offering prices. The

plaintiffs seek for themselves and the alleged class members an award of damages and litigation

costs and expenses. The claims in these cases have been consolidated for pre-trial purposes

(together with claims against other issuers and underwriters) before one judge in the Southern

District of New York federal court. In April 2002, a consolidated, amended complaint was filed

against these defendants which generally alleges the same violations and also refers to alleged

misstatements or omissions that relate to the recommendations regarding the Company’s stock by

analysts employed by the underwriters. In June and July 2002, defendants, including the Company

defendants, filed motions to dismiss plaintiffs’ complaints on numerous grounds. The Company’s

motion was denied in its entirety in an opinion dated February 19, 2003. In July 2003, a committee

of the Company’s Board of Directors approved a proposed settlement with the plaintiffs in this

matter, which was preliminarily approved by the District Court overseeing the litigation in

February 2005. A final fairness hearing on the settlement was held on April 24, 2006. On December

5, 2006, however, the Second Circuit Court of Appeals reversed the certification of plaintiff

classes in six actions related to other issuers that had been designated as test cases with respect

to the non-settling defendants in those matters (the “Focus Cases”) and made other rulings that

drew into question the legal viability of the claims in the Focus Cases. The Court of Appeals

later rejected the plaintiffs’ request that it reconsider that decision. As a result, on June 25,

2007, the District Court approved a stipulation and order terminating the proposed settlement.

While the Court of Appeals decision did not automatically apply to the case against the Company,

the defendants moved for, and the Court granted, an order that would apply the decision to all

cases, including the consolidated action against the Company. On August 14, 2007, the plaintiffs

filed an amended “master” complaint containing allegations purportedly common to all defendants in

all actions and filed amended complaints containing specific allegations against the six issuer

defendants in the Focus Cases. In addition, on September 27, 2007, the plaintiffs again moved to

certify classes in each of the Focus Cases. The defendants in the Focus Cases moved to dismiss the

amended complaints. Rulings on both the motion to certify the Focus Cases as class actions and to

dismiss those cases remain outstanding. The District Court has approved a stipulation extending the

time within which the plaintiffs must file amended pleadings containing specific allegations

against the other issuer defendants, including the Company, and the time within which those

defendants must move, answer or otherwise respond to those specific allegations.

17

On April 2, 2009, the plaintiffs filed a motion for preliminary approval of a proposed global

settlement of all claims asserted in the coordinated class action securities litigation on behalf

of the class plaintiffs in the respective actions against the various issuer and underwriter

defendants, including all claims asserted against the Company. The motion further seeks

certification of settlement classes as to each action against the defendants, including the

Company. The Company has assented to the proposed settlement, which does not require any monetary

contribution from the Company and would be funded by various underwriter defendants and

the defendants’ insurers. On June 10, 2009, the District Court granted preliminary approval of the

proposed settlement and of the form of notice of the proposed settlement to be provided to members

of the proposed settlement class. The District Court scheduled a hearing for September 10, 2009 to

determine whether to approve the proposed settlement.

The final hearing was held on September 10, 2009. On October 5, 2009, the District Court granted

final approval of the proposed global settlement, subject to the rights of the parties to appeal

the settlement within 30 days of such approval. Pursuant to the terms of the approved settlement,

the Company is not required to make any monetary contribution to fund the required settlement

payments, which are being funded by various underwriter defendants and the defendants’ insurers.

On or about October 23, 2009, three members of the settlement class who had been shareholders of an

issuer other than the Company filed a petition seeking leave to appeal the District Court’s final

approval to the Second Circuit Court of Appeals on an interlocutory basis. No judicial ruling or

action has been taken on the motion. On or before November 6, 2009, three notices of appeal were

filed with respect to the District Court’s order granting final approval of the global settlement.

No further action has been taken with respect to such notices. On December 14, 2009, the District

Court entered a final judgment approving and giving effect to the global settlement as it related

to the consolidated actions against the Company. The final judgment created a settlement class of

plaintiffs comprised of persons who purchased or otherwise acquired the common stock and call

options of the Company during the period of August 4, 1999 through December 6, 2000, provided for

the distribution of settlement proceeds to the members of the class and approval of attorneys’ fees

to class counsel consistent with the terms of the global settlement, barred prosecution of all

settled claims by members of the class and their representatives, released the defendants and other

protected persons from such claims and dismissed all claims against the Company and other

defendants in the consolidated amended action with prejudice. No notices of appeal have been filed

with respect to the December 14, 2009 final judgment.

|

|

|

| ITEM 4. |

|

(Removed and Reserved) |

18

PART II

|

|

|

| ITEM 5. |

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities |

Market Information. Our Common Stock is currently traded on the NASDAQ Global Market under the

symbol “ICGE.” The price range per share reflected in the table below is the highest and lowest

sale price for our Common Stock as reported by the NASDAQ Global Market during each quarter period

of our two most recent fiscal years.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2009 |

|

|

2008 |

|

| |

|

March 31 |

|

|

June 30 |

|

|

Sept. 30 |

|

|

Dec. 31 |

|

|

March 31 |

|

|

June 30 |

|

|

Sept. 30 |

|

|

Dec. 31 |

|

| |

|

(1st) |

|

|

(2nd) |

|

|

(3rd) |

|

|

(4th) |

|

|

(1st) |

|

|

(2nd) |

|

|

(3rd) |

|

|

(4th) |

|

High |

|

$ |

5.95 |

|

|

$ |

6.85 |

|

|

$ |

8.62 |

|

|

$ |

8.43 |

|

|

$ |

11.82 |

|

|

$ |

11.35 |

|

|

$ |

9.84 |

|

|

$ |

8.00 |

|

Low |

|

$ |

3.25 |

|

|

$ |

3.85 |

|

|

$ |

6.17 |

|

|

$ |

5.76 |

|

|

$ |

7.66 |

|

|

$ |

7.71 |

|

|

$ |

6.79 |

|

|

$ |

3.04 |

|

Holders. As of March 1, 2010, there were approximately 818 holders of record of our Common Stock,

although there is a much larger number of beneficial owners.

Dividends. We have never declared or paid cash dividends on our capital stock and we do not intend

to pay cash dividends in the foreseeable future. We plan to retain any earnings for use in the

operation of our business and to fund future growth.

19

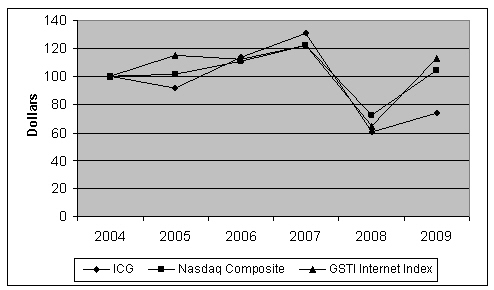

Stock Performance Graph

The following graph shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or

otherwise subject to the liabilities under that section, and shall not be deemed to be incorporated

by reference into any filing of the Company under the Securities Act or the Exchange Act.

The following graph presents a comparison of the Company’s stock performance with that of the

NASDAQ Composite Index and the Goldman Sachs Technology Internet Index from December 31, 2004 to

December 31, 2009.

COMPARISON OF CUMULATIVE TOTAL RETURN* SINCE DECEMBER 31, 2004

AMONG INTERNET CAPITAL GROUP, INC.,

THE NASDAQ COMPOSITE INDEX AND

THE GSTI INTERNET INDEX

| |

|

|

| * |

|

$100 invested at closing prices on December 31, 2004 in ICG shares or in a

stock index, including reinvestment of dividends. |

20

Issuer Purchases of Equity Securities

In 2008, the Company announced the approval by its Board of Directors of a share repurchase program

under which the Company could repurchase, from time to time, up to $25 million of shares of its

Common Stock in the open market, in privately negotiated transactions or pursuant to trading plans

meeting the requirements of Rule 10b5-1 under the Exchange Act. The table below contains

information relating to the repurchases of Company Common Stock that occurred during the year ended

December 31, 2009 and through the date of the filing of this Report.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Total Number of |

|

|

Approximate Dollar |

|

| |

|

|

|

|

|

|

|

|

|

Shares Purchased as |

|

|

Value That May Yet |

|

| |

|

|

|

|

|

|

|

|

|

Part of Publicly |

|

|

Be Purchased |

|

| |

|

Total Number of |

|

|

Average Price Paid |

|

|

Announced |

|

|

Under the |

|

| Monthly Period |

|

Shares Purchased(1) |

|

|

per Share(2) |

|

|

Program(1) |

|

|

Program |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchased as of 12/31/08 |

|

|

1,948,158 |

|

|

$ |

4.75 |

|

|

|

1,948,158 |

|

|

$ |

15.7 million |

|

1/1/09 to 1/31/09 |

|

|

25,042 |

|

|

$ |

3.98 |

|

|

|

25,042 |

|

|

$ |

15.6 million |

|

2/1/09 to 2/28/09 |

|

|

67,200 |

|

|

$ |

3.96 |

|

|

|

67,200 |

|

|

$ |

15.4 million |

|

3/1/09 to 3/31/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

4/1/09 to 4/30/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

5/1/09 to 5/31/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

6/1/09 to 6/30/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

7/1/09 to 7/31/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

8/1/09 to 8/30/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

9/1/09 to 9/30/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

10/1/09 to 10/31/09 |

|

|

0 |

|

|

|

— |

|

|

|

0 |

|

|

$ |

15.4 million |

|

11/1/09 to 11/30/09 |

|

|