Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File No. 001-34052

DayStar Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 84-1390053 | |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 2972 Stender Way Santa Clara, California |

95054 | |

| (Address of principal executive offices) | (Zip Code) | |

(408) 907-4600

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.01 par value per share | The NASDAQ Capital Market |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $22,151,541, computed by reference to the last sale price of the common stock on that date as reported by The Nasdaq Capital Market and excludes an aggregate of 5,623,186 shares of the registrant’s common stock held by officers, directors and stockholders that the registrant has concluded are affiliates of the registrant. For purposes of determining whether a stockholder was an affiliate of the registrant at June 30, 2009, the registrant assumed that a stockholder was an affiliate of the registrant at June 30, 2009 if such stockholder (i) beneficially owned 5% or more of the registrant’s common stock, as determined based on public filings, and/or (ii) was an executive officer or director or was affiliated with an executive officer or director of the registrant at June 30, 2009. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

As of March 15, 2010, there were 33,980,612 shares of the registrant’s common stock outstanding.

Table of Contents

Annual Report on Form 10-K

Year Ended December 31, 2009

Table of Contents

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Any statements contained in this report that are not statements of historical fact may be forward-looking statements. When we use the words “anticipates,” “plans,” “expects,” “believes,” “should,” “could,” “may,” “will” and similar expressions, we are identifying forward-looking statements. Forward-looking statements involve risks and uncertainties, which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. These factors include, among others, risks relating to our ability to raise additional funds in the near term to fund our expansion plan and continue our operations; risks related to the development of our copper indium gallium diselenide (“CIGS”) solar photovolatic (“PV”) products and manufacturing processes to produce such products; risks related to delivery of our products to customers, including product reliability, conversion efficiency, customer acceptance and product cost; market acceptance of CIGS; intense competition in the solar energy field; our history of losses; the historical volatility of our stock prices; general market conditions; and other factors referred to in Item 1A—“Risk Factors.”

Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in this Annual Report as a result of new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements that reflect our current expectations about our future results, performance, prospects and opportunities. You should carefully review and consider the various disclosures we make in this report and our other reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks, uncertainties and other factors that may affect our business.

ii

Table of Contents

Overview

We have developed a proprietary thin film deposition technology for solar photovoltaic (“PV”) products. We utilize a proprietary one-step sputter deposition process and have manufactured a commercial scale deposition tool to apply high-efficiency copper indium gallium diselenide (“CIGS”) material over large area glass substrates in a continuous fashion. We intend to integrate this tool with commercially available thin film manufacturing equipment, which will provide us with a critically differentiated manufacturing process to produce low-cost monolithically integrated, CIGS-on-glass modules that address the grid-tied, ground-based PV market.

We believe this proprietary deposition process, when operated at an annual capacity of approximately 100 megawatts, will enable us to achieve a total module manufacturing cost of less than $1.00 per watt. This cost would be competitive with the lowest in the solar PV industry. Using this approach, we have achieved greater than 15% cell efficiencies over large areas on CIGS PV devices, and we believe that this approach will enable us to reach module efficiencies greater than 13%.

We have initiated construction of our initial module production line. To facilitate our entry into the addressable solar PV market, we have entered into a contract with Blitzstrom GmbH, one of the world’s leading thin film solar PV integrators, that commits Blitzstrom to purchase a minimum of 50% of our production through 2011, subject to these products meeting defined performance criteria. We have also signed a Letter of Intent with juwi Solar, who is interested in purchasing up to 25% of our production through 2011.

In October 2007, we completed a follow-on public offering in which we sold 17,250,000 shares of our common stock. Our net proceeds from the offering were approximately $68 million. We have used these proceeds to develop our proprietary deposition process, to build our prototype and commercial scale deposition tools, and to begin installation of our first production line. In the near term, we will require substantial funds beyond our current cash on hand in order to fully build-out our first production line, to commence and support commercial production as currently planned, to fund future operations, and to expand our capacity beyond our first production line.

Strategies

Our goal is to be a leading supplier of solar PV modules by becoming one of the lowest cost-per-watt commercial-scale solar manufacturers. We intend to pursue the following strategies to achieve this goal:

| • | Address the existing solar PV market using monolithic CIGS-on-glass. DayStar’s product strategy targets high-performance, low-cost CIGS-on-glass modules to meet the demands of the large and rapidly growing PV utility market. The CIGS module design is ‘plug-and-play’ compatible with the leading thin film PV module supplier. Utilizing approximately the same form factor, current-to-voltage ratio, weight and components used in existing panels will enable rapid market acceptance by providing compatibility with mounting, wire harnessing and logistics systems currently used in the market. We intend to address the significant unmet demand for solar PV modules by constructing module manufacturing lines using commercially available equipment in conjunction with our proprietary deposition tool to produce CIGS-on-glass modules. |

| • | Pursue strategic partnerships. The financial crisis has adversely affected the ability of companies such as DayStar to raise the capital required to develop its production capabilities. DayStar has embarked on a formal process to form strategic partnerships that will allow us to continue building our production line and assist in future expansions of production capacity. We have engaged a financial advisor to assist us in exploring select strategic transactions. |

1

Table of Contents

| • | Pursue customer relationships. We have a contract with Blitzstrom GmbH that commits Blitzstrom to purchase a minimum of 50% of our production through 2011, subject to these products meeting defined performance criteria. We will continue to work with other industry-leading strategic partners with similar needs and capabilities to generate future sales. We have also signed a Letter of Intent with juwi Solar, who is interested in purchasing up to 25% of our production through 2011. |

| • | Expand production capacity using replicable production facilities. Once we have demonstrated targeted operating metrics, we intend to add manufacturing equipment that would bring our first facility to a nameplate 100MW capacity. Further expansions would replicate the 100MW line in other locations. |

| • | Continue to reduce costs. We have identified specific steps in the manufacturing process that would allow us to reduce both the capital cost and operating cost of production. |

| • | Leverage management’s expertise in direct deposition manufacturing lines. Our management team has a proven track record of process development, production tool development and commercial-scale manufacturing. We plan to leverage their extensive experience in the semiconductor, solar and disk drive industries. We also have equipment engineering expertise in-house with experience in developing and building commercial-scale deposition tools. |

The Photovoltaic Industry

The worldwide demand for electricity is expected to almost double over the next two decades, from 18.0 trillion kilowatt hours in 2006 to 31.8 trillion kilowatt hours in 2030, according to the U.S. Energy Information Administration, or EIA. Additionally, the EIA expects that electricity demand in the United States will increase from 3.9 trillion kilowatt hours in 2006 to 4.8 trillion kilowatt hours in 2030. Historically, the electric power industry has relied on fossil fuels to generate electricity. However, continued reliance on fossil fuels to supply the expanding global demand for electricity creates a number of challenges, including the risks of escalating costs and uncertain supplies of fossil fuels, environmental ramifications of electricity generation from the burning of fossil fuels, escalating costs of new generation and transmission construction, aging generation plants and transmission infrastructure, regulatory impediments to electric infrastructure development and ongoing reliance on foreign sources for domestic energy. These challenges will likely result in escalating costs of wholesale and retail electricity rates.

To meet these challenges, governments, businesses and consumers increasingly support the development of alternative energy sources, such as solar power, to generate electricity. Various countries have enacted a wide variety of government incentives and mandates to encourage growth in renewable energy markets as providers of these alternative energy sources seek to match the price of traditional fossil fuel sources.

We project the global market for PV solar modules to have a 35% compound annual growth rate through 2012, increasing demand to approximately 12GW worldwide. We expect approximately 7.5GW of global demand in 2010. The high growth is largely driven by government policies, so the largest markets are located in Germany, Spain, Japan, the United States, and Italy where the incentives are most favorable. Although public support for solar subsidies appears to remain positive, the expectation of policy makers is that as the industry develops, costs decline so that solar electricity becomes competitive with conventional electricity sources. Achieving this ‘grid parity’ opens up a much larger market opportunity.

Photovoltaic Systems

The PV effect is the term used to describe the absorption of light and its conversion to electrical power by solar cells. Most commercial solar modules are made of the semiconductor material silicon and have a top and bottom electrical contact to move the electricity out of the solar cell. The functionality of solar cells is determined by its efficiency in converting sunlight into electricity. For every 1,000 watts of sunlight hitting a solar module, most are able to convert this into 60 to 180 watts of electricity.

2

Table of Contents

Solar modules usually consist of individual solar cells connected together, an encapsulant to protect against moisture and other environmental factors, and a sheet of glass for support. The individual solar cells do not require ongoing maintenance and have proven to last over 20 years. New and emerging thin film modules use very thin layers of semiconductor material, typically deposited on glass substrates, where the individual cells are connected through a monolithically integrated process during the deposition steps instead of assembled as individual cells. Solar PV systems are arrangements of solar PV modules connected to determine the total power output of the system. Energy is converted into direct-current, or DC, electricity when sunlight hits a solar PV module. The DC electricity may be routed directly to power a DC load or charge a battery bank. In grid-tied applications, an inverter is used to convert the DC electricity from the solar PV system into alternating current, or AC electricity, which can be interconnected directly to the electric utility grid to power AC appliances. In addition, solar PV systems usually have mounting structures, cable cords to route the power, and circuit protection.

The Cost and Operating Metrics of a PV System

Solar PV module manufacturers price and sell solar PV modules per watt of rated power. Rated power is the solar PV module’s capacity to produce electricity and is measured in watts. A solar PV system producing 2 kilowatts of power for 2 hours generates 4 kilowatt hours of electricity. According to the EIA, in 2001, the average U.S. household consumed approximately 10,656 kilowatt hours of electricity per year.

Cost of a PV System

To calculate the manufacturing cost per watt of a solar PV module, the cost to produce a solar module is divided by the number of sellable watts produced by the solar PV module. The efficiency of the solar PV module in converting sunlight into electricity determines the number of sellable watts. Efficiency is usually a function of the semiconductor material used in the conversion layer, the device structure and the manufacturing process. The semiconductor material generally used in the PV industry employs crystalline silicon technology or thin film technology. Crystalline silicon modules generally have higher conversion efficiencies than thin film solar modules but use approximately 100 times more semiconductor material and are more expensive than thin film production processes. Thin film solar modules manufactured at commercial scale can have a lower manufacturing cost per watt than crystalline silicon solar modules, even though crystalline silicon solar modules have higher conversion efficiencies.

Purchasers of solar PV modules consider not only the rated power but also the quantity of electricity that can be produced and the cost of that electricity. The cost per kilowatt hour of solar electricity is determined by dividing the solar electricity generated over the life of the solar PV system into the total cost of the system. Solar PV modules are usually 50% of the cost of a total solar PV system and have a general use life of approximately 25 years. The other 50% of the cost consists of the mounting structures, equipment and electrical components, known as the balance of system. In calculating the cost per kilowatt hour of solar electricity, many customers also consider the time value of the capital required to purchase and install the system. The price of conventional energy produced by fossil fuels varies considerably by geographic area based on several factors, including the cost of producing and importing energy. The 2009 average retail price of residential electricity in the United States was 11.5 cents per kWh (Source: DOE 2009 Data). To become competitive with traditional sources of electricity, the price per kilowatt hour of solar electricity must approach the retail price of traditional electricity displaced by solar electricity in a given area. Grid parity is therefore, a common objective among competing renewable technologies, with the goal for PV cost set by the United States Department of Energy’s Solar America Initiative to achieve 8-10 cents per kWh by 2015.

Operating Metrics of a PV System

The solar PV industry uses a widely accepted set of standard procedures and conditions known as Standard Test Conditions, to measure and compare the performance of solar modules. These conditions specify a standard temperature, solar irradiance level and angle of the sun, and are used to determine the rated power and conversion efficiency of a solar module.

3

Table of Contents

On a clear day, sunlight provides about 1 kilowatt of power per square meter of the Earth’s surface. Under these conditions, a solar PV module operating at a 10% conversion efficiency will produce 100 watts of power per square meter. If these sunlight conditions persist for one hour, the solar module will generate 100 watt hours, or 0.1 kilowatt hour, of solar electricity. Crystalline silicon solar PV modules had average conversion efficiencies of approximately 14% in 2006. Thin film solar modules in commercial production (2 GW per year in 2009) had average conversion efficiencies that ranged from approximately 6% to approximately 11%.

Solar PV systems generally operate outside of Standard Test Conditions. The location and design of a PV system, time of day and year, temperature and angle of the sun impact the performance of a solar PV system, including conversion efficiency. Therefore to determine the amount of solar electricity any one solar PV system will generate a user must consider not only the Standard Test Conditions power rating of a solar PV module, but also the real world conditions under which the solar PV system will be operating, the design of the solar PV system, and the performance of the solar PV modules and electrical components outside of Standard Test Conditions. Due to these variations, system sizing varies by design and location, but a system with a rated power of 8 to 11 kilowatts would typically be required to produce the 11,040 kWh (Source: DOE 2008 Data) consumed annually by the average U.S. household.

Solar module manufacturers compete with one another in several product performance attributes, including reliability, module cost per watt and levelized cost of electricity (LCOE), meaning the net present value of total life cycle costs of the solar power project divided by the quantity of energy which is expected to be produced over the system’s life.

Photovoltaic Technologies

There are several different semiconductor technologies used in the solar PV industry. Crystalline silicon, or c-Si, is the dominant technology with greater than 80% market share worldwide. PV modules made with thin films of semiconductors are being increasingly commercialized for use in all market segments.

Crystalline Silicon

Silicon based modules have defined the solar PV industry for the last 30 years, and their development has benefited from significant investment in the integrated circuit industry, which also primarily uses silicon wafers. Silicon PV modules are currently the most efficient solar PV semiconductor material, but require substantial electrical energy and bulk material to manufacture.

The various crystalline silicon solar panel manufacturing processes involve cutting refined, semiconductor-grade silicon ingots into solar wafers, connecting the wafers in series and packaging them into solar panels. From 2003 until 2009, growth in the market for crystalline silicon photovoltaic systems was negatively impacted by the limited availability of refined silicon, the basic feedstock used in their manufacture. High demand from the photovoltaic and microelectronics industries led to a global shortage of silicon, increasing the price of polysilicon, with the spot price of polysilicon climbing from $30 per kilogram, or kg, in 2003 to $463/kg in 2008, according to New Energy Finance. This price increase, combined with other technological factors, created challenges for crystalline silicon systems to produce electricity at a cost that is comparable to those of traditional fossil fuel sources. As manufacturers of silicon have increased factory capacity, prices for silicon have significantly decreased, though they are not back to previous lows. For example, in 2009 the weighted-average polysilicon long-term forward contract price was $78/kg, and the spot price for polysilicon was approximately $65/kg in October 2009, according to New Energy Finance.

4

Table of Contents

Thin Films

Solar cells and solar modules made from certain thin films of semiconductors require less raw material to produce than silicon based PV cells. Recent advances in manufacturing and product commercialization have increased worldwide production of thin film PV to approximately 17% of overall PV production in 2009. Thin film solar PV products typically exhibit the following attributes:

| • | Scalable, low cost manufacturing: Thin film solar PV cells and modules require a structural substrate to support them, such as glass, plastic or metal sheets or foils. Applying the films on these substrates creates a range of manufacturing options that enables continuous and scalable manufacturing. As much of the equipment to process these substrates is used in other industries, the relatively lower capital expenditure required to establish large-volume thin film PV product manufacturing plants enables rapid capacity expansion and lowers the cost per watt of products. |

| • | Lower overall material cost: Thin film PV production uses substantially less semiconductor materials than c-Si production. The result of less raw materials combined with inexpensive substrates and scalable manufacturing techniques have resulted in some thin film technologies achieving costs less than $1.00 per watt in 2008. |

| • | Configurable form factors: Based on the use of a variety of substrates, thin film PV modules can be configured into a number of different form factors to enable a variety of market applications. In particular, flexible thin film modules could enable a new range of products for unique building integrated photovoltaics (BIPV) applications. |

| • | Lower conversion efficiency: Thin film PV technologies are generally less efficient than modules made with c-Si. This attribute can potentially limit their use in area-constrained applications. However, thin film PV technologies do exhibit performance advantages in generating energy in low light level and increased temperature environments. This positions them particularly well for certain geographic applications. |

| • | Limited operating history: Limited operating history has inhibited market acceptance of several types of thin film products. Most thin film PV modules have not been fielded for the average warranty period of typical c-Si modules. |

There are three major thin film technologies in commercial production today:

| • | Amorphous Silicon, or a-Si, has been commercially produced for the longest period of time and has the lowest module conversion efficiency among the three major thin film technologies, but can be produced in a roll-to-roll flexible format, which is gaining popularity in emerging BIPV markets. Amorphous silicon modules were the first thin film module to demonstrate energy production advantages over conventional silicon modules in low or indirect light conditions. |

| • | Cadmium Telluride, or CdTe, has a higher conversion efficiency than a-Si and has demonstrated the lowest manufacturing costs to date, but is only produced in rigid and glass flat plate modules, which has made it most suitable for market segment applications to larger commercial and utility project market segments. |

| • | Copper Indium Gallium diSelenide, or CIGS, has achieved the highest conversion efficiency rates of thin film technologies, but is just now reaching commercial production. CIGS has the ability to be produced on rigid as well as flexible substrates, which enables CIGS products to be used in utility, commercial, residential and BIPV segments. |

Market Segments

The solar electricity industry currently supplies modules used in solar PV systems primarily for grid-connected systems. The off-grid application of PV for remote or developing nations is often cost effective, but the market is small. Grid-connected solar PV systems can supply electricity during daylight hours to offset peak

5

Table of Contents

load demand or displace consumers’ annual electricity consumption from traditional utility sources. Net-metering laws, which require utilities to purchase excess electricity produced by on-grid solar systems, and solar PV system capital and energy rebates are examples of government incentives aimed at grid-connected consumers in parts of the United States, Japan, Europe and elsewhere. Many consumers are seeking to reduce their future electricity costs by purchasing solar PV systems to hedge against future price increases. Government incentives are enabling adoption of PV in advance of the lower costs from new PV technologies, manufacturing economies of scale, and improved infrastructure.

Grid-Connected Markets

Markets for grid-connected PV include large centralized utility power plants (10-100 MW), commercial building roof tops (20kW-10MW), and smaller residential roof tops (1-20 kW).

| • | Centralized utility. PV modules are increasingly being used in large centralized installations with the solar generated electricity being sold directly to the local utility grid for distribution and resale, similar to other fossil fuel power plants. In these applications, the cost of the energy generated in dollars per kilowatt-hour (“$/ kW-hr”) is a more important market driver than other PV technology attributes, such as efficiency, shape, size and weight, or aesthetics. |

| • | Commercial rooftop. Solar PV systems are being installed on the roofs of commercial buildings to offset peak power requirements and lower electricity costs. By using otherwise vacant roof surfaces, businesses can sell their solar power during the day, coincident with typical high time-of-use utility rates. Both system economics ($/kW-hr) and system performance such as module efficiency are important solar PV product attributes in expanding this market. |

| • | Residential rooftop. Individual homeowners form one of the largest markets for grid-connected PV sales. In addition to system economics ($/kW-hr), the aesthetics of the products can play a role in a homeowner’s choice of product. |

Products

DayStar CIGS-on-glass module

We intend to commercialize a monolithically integrated CIGS-on-glass module to meet the demands of readily available solar PV markets. We are working with our customers and development partners to define the final product specifications consistent with their application requirements. Our current target is to produce monolithically integrated CIGS modules on 1.2 m by 0.6 m glass laminate substrates. They will be designed for high-voltage grid-connected utility and commercial market applications. They will be initially designed to meet industry International Electrotechnical Commission (IEC) certifications for distribution into European markets. We have achieved greater than 15% cell efficiencies over large areas on CIGS PV devices, and we believe that this approach will enable us to reach module efficiencies greater than 13% and associated peak power ratings. Other possible configurations may include UL Listing for U.S. sales and modules designed to meet the demands of large commercial rooftop applications in the U.S. market.

CIGS-on-foil for emerging market opportunities

We have suspended development of our CIGS-on-foil products. These discrete foil cells currently emulate 100 mm by 100 mm silicon wafer cells in form and function. They can be interconnected to build various module voltages depending on the needs of a particular market segment. However the packaging materials that would allow integration into flexible module form factors have not been developed so we have chosen to focus all our current efforts on the development of our CIGS-on-glass modules which we believe is the fastest path to commercialization of our products. If flexible encapsulants become available, we may re-start our development of flexible CIGS modules that could be suited to meet the needs of BIPV markets, where the module serves as a dual-use building material.

6

Table of Contents

Marketing and Distribution

We have an agreement with Blitzstrom GmbH through 2011, which requires Blitzstrom to purchase 50% of the solar PV modules we produce based upon our estimated production through 2011. Blitzstrom may also purchase up to 50% of any additional quantities of solar PV modules that exceed these production estimates. The price paid by Blitzstrom will be based on a five percent discount from the fair market wholesale value for comparable commercially available solar PV modules. We will negotiate further pricing with Blitzstrom for 2010 and 2011. We have also signed a Letter of Intent with juwi Solar, who is interested in purchasing up to 25% of our production through 2011.

The sale of commercial grid-connected solar PV systems, currently the largest market for thin film PV, is subject to direct and indirect regulation by state, federal and foreign governments. These regulations include rules governing energy transmission, safety, reliability, quality and incentives aimed at reducing carbon emissions or increasing renewable sources of energy. We are not directly impacted by these regulations at this point as we are focused on the sales of CIGS-on-glass modules through limited sales agreements with specific commercial system integrators, primarily in Europe.

Research, Development and Engineering

Our future success depends, in part, upon our ability to innovate processing methodologies that create enhanced product characteristics. In addition to optimization of CIGS deposition, we intend to develop processes for other layers in the cell stack that may lead to higher conversion efficiency and lower manufacturing costs.

Our manufacturing technology development roadmap focuses on reducing the cost per watt by reducing the number of steps in manufacturing the modules and by optimizing the materials and processes used in the non-CIGS layers. We have identified development programs for reducing the number of scribing steps needed in the module formation, and for an optimized buffer layer that requires lower capital and processing costs than our current methodology. Additionally, we intend to continue to scale up our proprietary deposition tool to enable production of larger modules with better material usage.

Research and development expenses were $14.7 million for the year ended December 31, 2009 and $17.7 million for the year ended December 31, 2008.

Manufacturing

Our strategy for developing the production line is to focus our development efforts on our proprietary direct deposition sputtering tool, which we believe is critical to making large quantities of CIGS at low costs. Our proprietary deposition tool is custom designed and built. We developed a process that we believe is scalable and allows for continuous processing of high volumes of modules. Most of the tools required in the manufacturing line are commercially available. We have ordered and placed down payments on the remaining equipment required to complete the manufacturing line. Most of this equipment is complete and ready to be shipped to our facility upon completion of final payment.

7

Table of Contents

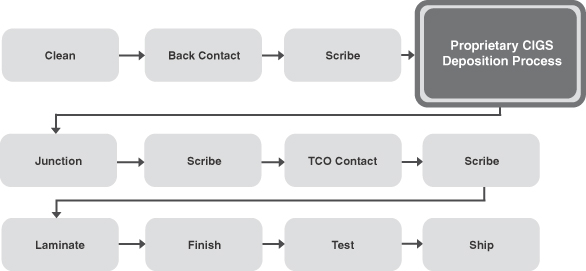

Our manufacturing process for making CIGS modules, which is depicted below, begins with a cleaning step for the glass substrate followed by a sputter deposition of the back contact material. The back contact is scribed to form the initial cell structure, and then the CIGS deposition is accomplished with our proprietary deposition process. The junction partner is deposited on top of the CIGS layer, and the second scribe is accomplished before the final transparent conductive oxide coating is deposited. The monolithic cell structure is completed with the third scribe, a polymer laminate is laid down and the encapsulating glass sheet is bonded to the substrate glass. Electrical leads and junction boxes are added at the finishing step. The completed module is tested and binned by performance.

Raw Materials and Equipment Suppliers

In our manufacturing process, we use several raw materials and components to build our solar PV modules on commercially available processing and automation equipment. We plan to have several suppliers of these materials, components and equipment. Each supplier will undergo a qualification process which may take several months depending on the particular raw material, component or equipment type.

Competition

We expect our primary competition will continue to be from conventional silicon-based solar PV products. Within the solar PV industry, conventional c-Si solar PV manufacturers dominate the market and ultimately create the most competition for our products. In addition, a variety of thin film solar PV technologies are being developed by a number of established and emerging companies. Thin film technologies include amorphous silicon, cadmium telluride and CIGS as well as advanced concepts for both bulk ingot-based and thin film crystalline silicon. These competing technologies may achieve manufacturing costs per watt lower than the cost per watt to manufacture our CIGS solar PV modules.

A number of companies are actively engaged in developing, manufacturing and marketing conventional silicon PV products on a commercial scale. The largest silicon PV suppliers include Suntech, Q-Cells, Sharp Corporation, and Kyocera Corporation, which together supplied one third of the 2009 solar PV market. We believe we will compete favorably with these suppliers on the basis of cost and module efficiencies.

The largest thin film solar PV manufacturer today is First Solar, Inc., which is producing a monolithic cadmium telluride module on a commercial scale and at the industry’s lowest reported costs. In addition, there are a number of smaller thin film manufacturers focusing on cadmium telluride. In amorphous silicon

8

Table of Contents

technologies, there are companies such as Uni-Solar and Sharp pursuing in-house developed technologies, and a number of companies are purchasing turn-key systems from equipment suppliers such as Applied Materials and Oerlikon. CIGS solar PV manufacturers can be subdivided into those that have achieved commercial-scale manufacturing, those that have recently entered the market with limited capacity, and those that are still in development stage. Among commercial-scale manufacturers are Avancis GmbH & Co. KG (a joint venture between the former Shell Solar and St. Gobain, a manufacturer of glass), Würth Solar of Germany, Honda Soltec (a subsidiary of Honda Motor Co., Ltd. ), and Showa-Shell who all manufacture monolithic CIGS modules. New entrants with limited capacity, which came on line at the end of 2008, include Solibro (a subsidiary of Q-Cells), Sulfurcell, Global Solar, and Solyndra. There are several small companies that have announced plans to produce CIGS modules including Ascent Solar, Miasolé, HelioVolt, Nanosolar, Johanna Solar, and SoloPower.

Intellectual Property

Our success depends, in part, on our ability to maintain and protect our proprietary technology and to conduct our business without infringing on the proprietary rights of others. We rely primarily on a combination of patents, trademarks, copyrights and trade secrets, as well as employee and third party confidentiality agreements to safeguard our intellectual property. Our intellectual property consists of our proprietary deposition process and our related tool set designs.

Employees

As of February 28, 2010, we had 41 employees, including 39 full-time and two part-time employees. From time to time we employ individuals, primarily manufacturing personnel, through employment agencies. None of our employees are covered by collective bargaining agreements with us. We believe our relations with employees are good.

Corporate Information

DayStar Technologies, Inc., a Delaware corporation, was incorporated in February 1997. We completed our initial public offering in February 2004. Our principal executive offices are located at 2972 Stender Way, Santa Clara, California 95054, and our telephone number is (408) 907-4600. Our website is located at www.daystartech.com. The information available on or that can be accessed through our website is not incorporated by reference into and is not a part of this Annual Report on Form 10-K and should not be considered to be part of this report.

Availability of Information

We make available through our website (http://www.daystartech.com), free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Commission.

The public may read and copy any materials we file with the Commission at the Commission’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. DayStar files electronically with the Commission and the Commission maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission.

9

Table of Contents

You should carefully consider the risks, uncertainties and other factors described below because they could materially and adversely affect our business, financial condition, operating results and prospects and could negatively affect the market price of our common stock. Also, you should be aware that the risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that we do not yet know of, or that we currently believe are immaterial, may also impair our business operations and financial results. Our business, financial condition or results of operations could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

In assessing these risks, you should also refer to the other information contained in or incorporated by reference to this Annual Report on Form 10-K, including our financial statements and the related footnotes.

In order to continue operations, we require immediate and substantial additional capital beyond our current cash on hand.

In order to continue operations, including development efforts utilizing our pre-production line, build-out our initial manufacturing line and commencement of commercial shipments of our product, we require immediate and substantial additional capital beyond our current cash on hand. To date, we have been unable to raise significant additional capital or complete an agreement with an investor or strategic partner. Although we continue to seek strategic investors or partners, in light of our current cash position, we have implemented a significant reduction in our workforce during 2009 and may in the near term be forced to cease or substantially curtail operations. An inability to raise additional funding in the very near term may cause us to file a voluntary petition for reorganization under the United States Bankruptcy Code, liquidate assets, and/or pursue other such actions that could adversely affect future operations.

Our independent auditor’s report expresses doubt about our ability to continue as a going concern, which may make it more difficult and expensive for us to raise additional capital.

The report of our independent registered public accounting firm relating to our financial statements as of December 31, 2009 and for the year then ended, stated that there is substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to take advantage of raising capital through securities offerings, debt financing, or partnerships. Management is focusing on raising capital through any one or more of these options. Such opinion from our outside auditors may make it more difficult and expensive to for us to raise additional capital. If we are unable to obtain such financing we may not be able to continue our operations, which would have an adverse effect on our stock price and significantly impair our prospects. There can be no assurance that any of management’s plans will be successfully implemented.

We have incurred net losses since our inception and anticipate continued net losses as we execute our commercialization plan.

Since our inception, we have incurred net losses, including net losses of $25.0 million and $26.3 million for the years ended December 31, 2009 and 2008, respectively, and have incurred negative cash flows from operations. As a result of ongoing losses, we had an accumulated deficit of approximately $122.0 million as of December 31, 2009. We expect to continue to incur significant losses as we enter commercialization and expand our manufacturing capacity and may never achieve or maintain profitability. We expect to continue to make significant capital expenditures and anticipate that our expenses will increase to the extent we continue to develop our manufacturing technologies, build manufacturing lines, establish our sales and distribution network, implement internal systems and infrastructure and hire additional personnel.

10

Table of Contents

As we do not expect to become profitable until after we expand capacity beyond our initial manufacturing line, if ever, we will be unable to satisfy our obligations solely from cash generated from operations. If, for any reason, we are unable to make required payments under our obligations, one or more of our creditors may take action to collect their debts. If we continue to incur substantial losses and are unable to secure additional financing, we could be forced to discontinue or curtail our business operations; sell assets at unfavorable prices; refinance existing debt obligations on terms unfavorable to us; or merge, consolidate or combine with a company with greater financial resources in a transaction that may be unfavorable to us.

Current and future litigation against us may be costly and time consuming to defend, and the outcome of current litigation could affect our ability to operate at our Newark, California location.

We are sometimes subject to legal proceedings and claims that arise in the course of our business. Litigation may result in substantial costs and may divert management’s attention and resources, which may seriously harm our business, overall financial condition, and operating results. In addition, legal claims that have not yet been asserted against us may be asserted in the future. See Item 3 “Legal Proceedings” of this Annual Report on Form 10-K for further information regarding pending litigation.

As described in Item 3 “Legal Proceedings” of this Annual Report on Form 10-K, on September 9, 2009, BMR-Gateway Blvd., LLC (the “Landlord”), filed an unlawful detainer action against us alleging damages in the amount of $838,078 and seeking to recover possession of the premises we occupy at our Newark, California location. In December 2009, we negotiated a settlement in that action. We have until June 1, 2010, to cure all alleged defaults under the lease (which the Landlord alleges include failure to pay rent and failure to remove various mechanic’s liens recorded against the property), provided the Landlord has not delivered us a 15-day notice of its intention to terminate the Lease (the “Termination Notice”). If the Landlord provides us with a Termination Notice, we must vacate the premises within 30 days from the date of the Termination Notice. If we are forced to vacate those premises, we could incur substantial costs to relocate to a new facility and lose valuable research and development time to facilitate starting up the new manufacturing line.

The lease for our Santa Clara facility ends on March 31, 2010. If we are unable to extend that lease, we will have to relocate our research and development activities which could cause delays in our current product development plans.

As previously reported, the lease for our Santa Clara research and development center and corporate headquarters ends on March 31, 2010. We are currently seeking either an extension of that lease or an alternative location for these activities. However, at this time we do not believe the landlord will grant us an extension. If we cannot successfully negotiate an extension of our current lease or timely find an alternate location, we may have to temporarily cease our development efforts until we find a new location for these activities.

Our common stock may be delisted from the Nasdaq Capital Market.

On September 15, 2009, we received notice from the Listing Qualifications Department of the Nasdaq Stock Market indicating that, for the last 30 consecutive business days, the bid price for our common stock had closed below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Capital Market under Nasdaq Listing Rule 5450(a)(1). The notification letter states that we will be afforded 180 calendar days, or until March 15, 2010, to regain compliance with the minimum bid price requirement. In order to regain compliance, shares of our common stock must maintain a minimum bid closing price of at least $1.00 per share for a minimum of ten consecutive business days. On March 16, 2010, Nasdaq provided written notification to us that our common stock failed to meet the continued listing requirements. We already had an appeal scheduled for a delisting notice related to our failure to hold an annual meeting in 2009 and in that hearing on March 11, 2010 addressed a plan of compliance for both the failure to hold an annual meeting and the anticipated receipt of the delisting notice related to the minimum bid price requirement. We expect to hear from the Nasdaq hearings panel regarding our proposed plan of compliance approximately 30 to 45 days after our hearing date. There can be no assurance that our plan will be deemed acceptable and that we will be able to maintain our Nasdaq listing.

11

Table of Contents

The delisting of our common stock would adversely affect the market liquidity for our common stock, the per share price of our common stock and impair our ability to raise capital that may be needed for future operations. Delisting from the Nasdaq Capital Market could also have other negative results, including, without limitation, the potential loss of confidence by customers and employees, the loss of institutional investor interest and fewer business development opportunities. If our common stock is not eligible for quotation on another market or exchange, trading of our common stock could be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate quotations for the price of our common stock, and there would likely also be a reduction in our coverage by security analysts and the news media, which could cause the price of our common stock to decline further.

Reduced growth in or the reduction, elimination or expiration of government subsidies, economic incentives and other support for on-grid solar electricity applications could reduce demand for our solar modules, and adversely impact our operating results.

We believe that the near-term growth of the market for on-grid applications, where solar energy is used to supplement the electricity a consumer purchases from the utility network, depends significantly on the availability and size of government subsidies and economic incentives. Federal, state and local governmental bodies in many countries, most notably Germany, Italy, Spain, France, the United States, Canada, China, India, Australia, Greece and Portugal have provided subsidies in the form of feed-in tariffs, rebates, tax incentives and other incentives to end-users, distributors, systems integrators and manufacturers of photovoltaic products. Many of these jurisdictions, including the majority of U.S. states and numerous European Union countries, have adopted renewable portfolio standards in which the government requires jurisdictions or regulated utilities to supply a portion of their total electricity from specified sources of renewable energy, such as solar, wind and hydroelectric power. Many of these government incentives expire, phase out over time, require renewal by the applicable authority or may be amended. A summary of recent developments in some of the major government subsidy programs follows. We expect the feed-in tariff in Germany and certain other core markets to be reduced earlier than previously expected, and such reductions could reduce demand and/or price levels for our solar modules.

German feed-in tariffs will be adjusted earlier than previously expected, and any downwards adjustment could reduce demand for our solar modules. Currently, our initial customers are in Germany and thus recently proposed changes to German feed-in tariffs could significantly impact the demand for our solar modules and the results of our future operations. A reduction in the PV feed-in tariff is currently under discussion and will most likely come into effect in the second or third quarter of 2010. The amount of the FiT reductions are expected to vary among roof-mounted applications, non-agricultural land free field applications and agricultural land free field applications. A significant reduction in the FiT for agricultural land free field applications in particular would likely cause a significant decline in demand for PV solar systems on agricultural land in Germany and contribute to a migration toward roof mounted applications and non-agricultural land free field applications. Overall, reductions in the German feed-in tariffs, including any potential further reductions, could result in a significant decline in demand and price levels for photovoltaic products in Germany, which could have a material adverse effect on our business, financial condition or results of operations.

In France, a new decree effective January 2010 provides for lower feed-in tariffs for all applications (including, as in Germany, varying reductions for rooftop applications and free field applications) while introducing, among other things, a departmental bonus which makes free field projects in the northern regions of France more attractive. The new decree does not have an expiry date, but can be amended at any time.

In Italy, the current legislation provides that the existing feed-in tariff will be in effect until the expiration of a 14 month transition period that will begin once 1.2GW of photovoltaic systems are installed under the existing feed-in tariff. It is expected that the Italian government will propose and enact a new feed-in tariff before the end of 2010. Current proposals reflect significant FiT reductions, particularly for ground mounted applications. We cannot be certain of the level of such new feed-in tariff.

12

Table of Contents

In Spain, the current legislation is scheduled to be reviewed by January 1, 2012; however, an earlier FiT adjustment is possible.

In the United States, California has been the state where the majority of solar installations and solar power module and system sales have taken place during the past five years. The state of California’s RPS goal of 33% of electricity from renewable sources by 2020, currently in the form of an executive order from the Governor’s office, is the most significant RPS program in the United States in magnitude and is contributing to the expansion of the utility-scale solar systems market in that state. However, the continued effectiveness of this RPS program could be negatively impacted if the RPS goal is not passed by the CA legislature and signed into law.

The American Recovery and Reinvestment Act of 2009 provides for certain measures intended to benefit on-grid solar electricity generation and other renewable energy initiatives, including (1) a cash grant in lieu of the 30% federal investment tax credit for solar installations that are placed into service during 2009 and 2010 or that begin construction prior to December 31, 2010 and are placed into service by January 1, 2017, and (2) a 50% bonus depreciation for installations placed in service during 2009. Various legislation has been proposed to extend or enhance the 30% grant in lieu of the tax credit as well as bonus depreciation. However, enactment of the extension or enhancement of such incentives is highly uncertain. The failure to extend or enhance these programs may reduce tax equity availability (in the case of the grant expiration) which may adversely affect our ability to arrange financing for utility-scale projects and may otherwise adversely affect the attractiveness of the U.S. solar market.

In China, governmental authorities have not adopted a feed-in tariff policy and currently award solar projects through either a project tendering process or bi-lateral negotiations. While the solar industry generally anticipates that China will adopt a solar feed-in tariff, there is no guarantee this will occur in a timely manner or at all or that any feed-in tariff will be economically viable. Without a feed-in tariff, the size and attractiveness of China’s solar market may be limited.

In Australia, the large-scale solar industry is in its infancy, and despite several encouraging government funded initiatives to promote large-scale solar generation, it is uncertain whether such programs can be successfully executed.

In 2009, India announced its National Solar Mission, which includes a goal of installing 20GW of solar by 2022. India is expected to announce a feed-in tariff for the first phase of the National Solar Mission in 2010. There is no guarantee that India will maintain its current 20GW by 2022 goal or adopt the required policies to meet that goal, without which, the size and attractiveness of India’s solar market may be limited.

Emerging subsidy programs may require an extended period of time to attain effectiveness because the applicable permitting and grid connection processes associated with these programs can be lengthy and administratively burdensome.

Electric utility companies or generators of electricity from fossil fuels or other renewable energy sources could also lobby for a change in the relevant legislation in their markets to protect their revenue streams.

Reduced growth in or the reduction, elimination or expiration of government subsidies and economic incentives for on-grid solar energy applications, especially those in our target markets, could materially and adversely affect our business, financial condition and results of operations.

Existing regulations and policies and changes to these regulations and policies may present technical, regulatory and economic barriers to the purchase and use of solar PV products, which may significantly reduce demand for our solar modules.

The market for electricity generation products is heavily influenced by foreign, federal, state and local government regulations and policies concerning the electric utility industry, as well as policies promulgated by electric utilities. These regulations and policies often relate to electricity pricing and technical interconnection of

13

Table of Contents

customer-owned electricity generation. In the United States and in a number of other countries, these regulations and policies have been modified in the past and may be modified again in the future. These regulations and policies could deter end-user purchases of photovoltaic products and investment in the research and development of photovoltaic technology. For example, without a mandated regulatory exception for photovoltaic systems, utility customers are often charged interconnection or standby fees for putting distributed power generation on the electric utility grid. If these interconnection standby fees were applicable to PV systems, it is likely that they would increase the cost to our end-users of using PV systems which could make them less desirable, thereby harming our business, prospects, results of operations and financial condition. In addition, electricity generated by PV systems mostly competes with expensive peak hour electricity, rather than the less expensive average price of electricity. Modifications to the peak hour pricing policies of utilities, such as to a flat rate for all times of the day, would require PV systems to achieve lower prices in order to compete with the price of electricity from other sources.

We anticipate that our solar modules and their installation will be subject to oversight and regulation in accordance with national and local ordinances relating to building codes, safety, environmental protection, utility interconnection and metering and related matters. It is difficult to track the requirements of individual states and design equipment to comply with the varying standards. Any new government regulations or utility policies pertaining to our solar modules may result in significant additional expenses to us, our resellers and their customers and, as a result, could cause a significant reduction in demand for our solar modules.

An increase in interest rates or lending rates or tightening of the supply of capital in the global financial markets could make it difficult for end-users to finance the cost of a PV system and could reduce the demand for our solar modules and/or lead to a reduction in the average selling price for photovoltaic modules.

Many potential end-users of our products depend on debt financing to fund the initial capital expenditure required to purchase and install a PV system. As a result, an increase in interest rates or lending rates could make it difficult for our end-users to secure the financing necessary to purchase and install a PV system on favorable terms, or at all and thus lower demand for our solar modules. Due to the overall economic outlook, our end-users may change their decision or change the timing of their decision to purchase and install a PV system. In addition, we believe that a significant percentage of our potential end-users install PV systems as an investment, funding the initial capital expenditure through a combination of equity and debt. An increase in interest rates and/or lending rates could lower an investor’s return on investment in a PV system, or make alternative investments more attractive relative to PV systems, and, in each case, could cause these end-users to seek alternative investments. A reduction in the supply of project debt financing or tax equity investments could reduce the number of solar projects that receive financing and thus lower demand for solar modules.

We are a development company, have not generated any revenue from operations and currently have no commercial products.

We have not generated any revenue from operations and currently have no commercial products. Commercializing our products depends on a number of factors, including the following:

| • | successfully scaling up and implementing our first commercial-scale CIGS sputter deposition tool; |

| • | completing the build-out of our initial production line; and |

| • | completing, refining and managing our supply chain and distribution channel. |

The completion of these tasks as necessary to commence commercialization will require significant additional funding. In addition, our technology uses our proprietary deposition process, and there may be technical barriers to the development of our products and processes. Development of tools and our manufacturing processes may not succeed or may be significantly delayed. Our products will be produced through a manufacturing process that we have not yet constructed or tested on a commercial scale. If we fail to successfully

14

Table of Contents

develop our thin film manufacturing process or incur significant delays in development, we will be unable to commercialize our products. This would materially and adversely affect our business and financial condition. If adequate funds are not available, we may have to delay development or commercialization of our products, license to third parties the rights to commercialize products or technologies that we would otherwise seek to commercialize or cease operations. Any of these factors could harm our business and financial condition.

Our products have never been sold on a commercial basis, and we do not know whether they will be accepted by the market.

Our products, if developed, may not achieve market acceptance. The development of a successful market for our proposed products and our ability to sell our products at a lower cost per watt than our competition may be adversely affected by a number of factors, many of which are beyond our control, including the following:

| • | our failure to produce solar PV modules that compete favorably against other solar modules on the basis of price, quality, performance and warranted lifetime; |

| • | competition from conventional energy sources and alternative distributed generation technologies, such as wind energy; |

| • | our failure to develop and maintain successful relationships with distributors, system integrators and other resellers, as well as strategic partners; |

| • | the failure of system integrators to build projects suited for the type of solar PV modules we intend to produce; |

| • | our products may experience problems with product quality or performance; and |

| • | our ability to achieve solar PV module certification requirements. |

The failure of our proposed products to gain market acceptance would materially and adversely affect our business and financial condition.

We have no experience manufacturing CIGS solar PV products on a commercial scale.

To date, we have focused primarily on research, development and small-scale manufacturing. As a company, we have no experience manufacturing any product on a commercial scale. In addition, all our pilot production has been limited to CIGS on foil, while our initial commercial production line will manufacture CIGS-on-glass modules. We have internally developed the necessary sputtering capabilities and built a prototype and commercial scale tool for the deposition of the CIGS material in our manufacturing process. Failure to integrate this tool into the manufacturing process and to scale up our proprietary deposition tool would materially and adversely affect our business and financial condition.

We may not reach profitability if PV technology is not suitable for widespread adoption or sufficient demand for solar PV modules does not develop or develops slower than we anticipate.

The solar energy market is at a relatively early stage of development and the extent to which solar PV modules will be widely adopted is uncertain. If our CIGS solar PV products prove unsuitable for widespread adoption or demand for our CIGS solar PV products fails to develop sufficiently, we may be unable to grow our business or generate sufficient revenue from operations to reach profitability. In addition, demand for solar modules in our targeted markets may not develop or may develop to a lesser extent than we anticipate. Many factors may affect the viability of widespread adoption of solar PV technology and demand for our CIGS solar PV products, including the following:

| • | performance and reliability of solar modules and thin film technology compared with conventional and other non-solar renewable energy sources and products; |

| • | cost-effectiveness of solar modules compared with conventional and other non-solar renewable energy sources and products; |

15

Table of Contents

| • | availability of government subsidies and incentives to support the development of the solar PV industry; |

| • | success of other renewable energy generation technologies, such as hydroelectric, wind, geothermal, solar thermal, concentrated PV and biomass; |

| • | fluctuations in economic and market conditions that affect the viability of conventional and non-solar renewable energy sources, such as increases or decreases in the price of oil and other fossil fuel; |

| • | fluctuations in capital expenditures by end-users of solar modules, which tend to decrease in slower economic environments, periods of rising interest rates, or a tightening of the supply of capital; and |

| • | deregulation of the electric power industry and the broader energy industry. |

Furthermore, many solar PV cell and module manufacturers are growing and the market could reach a point where supply exceeds demand. As a result, we may be unable to sell our products at attractive prices, or for a profit.

We will rely on third-party suppliers for most of our manufacturing equipment.

We will rely on third-party suppliers for most of our manufacturing equipment. The failure of our suppliers to supply manufacturing equipment in a timely manner or on commercially reasonable terms could delay our commercialization and expansion plans and otherwise disrupt our production schedule or increase our manufacturing costs. Further, our orders with certain of our suppliers may represent a very small portion of their total business. As a result, they may not give priority to our business, leading to potential delays in or cancellation of our orders. If any single-source supplier were to fail to supply our needs on a timely basis or cease providing us key components, we would be required to locate and contract with substitute suppliers. We may have difficulty identifying a substitute supplier in a timely manner and on commercially reasonable terms. If this were to occur, our business would be harmed.

If our manufacturing equipment, some of which will be customized and sole sourced, fails or our equipment suppliers fail to perform under their contracts, we could experience production disruptions and be unable to satisfy our contractual requirements.

Some of our manufacturing equipment will be customized to our production lines based on designs or specifications that we provide the equipment manufacturers, which then undertake specialized processes to manufacture the custom equipment. As a result, the equipment will not be readily available from multiple vendors and would be difficult to repair or replace if it were to become damaged or non-functional. If any piece of equipment fails, we would not be able to manufacture our products.

The failure to achieve target yields, product qualities or target costs of our CIGS solar PV products could materially and adversely affect our business and financial condition.

We may not be able to achieve our desired manufacturing yields, product qualities and cost targets for our CIGS solar PV products, which could prevent us from becoming profitable. If we cannot achieve our targeted production yields and unit costs or if we experience difficulties in our manufacturing process, such as capacity constraints, quality control problems or other disruptions, we may not be able to manufacture our products at acceptable costs, which would eliminate our ability effectively to enter the market. If we cannot reduce our costs through economies of scale, improvements in manufacturing processes and engineering design, or technology maturation, our business and financial condition could be materially and adversely harmed. In addition, we will need to ensure our solar PV module products will receive certain industry certifications. Failure to receive these certifications will harm our financial condition and limit our ability to market and sell our product.

16

Table of Contents

If we experience significant delays, cost overruns and technical difficulties in establishing commercial manufacturing capacity in California, our business and financial condition could be materially and adversely harmed.

If we are unable to complete the installation of equipment in our California manufacturing facility and build-out our initial production line, we will not be able to execute our commercialization plans and we may never achieve profitability. The build-out of our manufacturing facility and construction of our initial manufacturing line is subject to significant risks, including risks of delay, equipment problems, cost overruns and other start-up and operating difficulties. If we experience any of these or similar difficulties, we may be unable to complete our manufacturing line and our business and financial condition could be materially and adversely harmed.

We depend on one customer, Blitzstrom GmbH, for a substantial percentage of our anticipated future revenue.

We anticipate that a substantial percentage of our future revenue will be derived under a contract with one customer, Blitzstrom GmbH, or Blitzstrom. We will be vulnerable to a substantial decline in anticipated revenue if we lose Blitzstrom as a customer for any reason or if Blitzstrom were to reduce, delay or cancel its orders for any reason. Any such events could have a material adverse effect on our business and financial condition. Any loss of business with Blitzstrom will be particularly damaging unless we are able to diversify our customer base and substantially expand sales to other customers.

We will need to expand our manufacturing capacity beyond our initial production line in order to achieve industry competitive targets and to achieve profitability.

Even if we are successful in commencing commercial shipments from our initial production line, our current plan contemplates the expansion of our capacity to 100MW in order to commercialize at sufficient scale to achieve industry competitive cost per watt targets and profitability. The build out of this capacity will require substantial additional capital. A wide variety of factors relating to our company and external conditions could adversely affect our ability to secure funding to expand our manufacturing capacity and the terms of any funding that we secure. Particularly given the current market conditions, we cannot provide assurance that such financing will be available on terms favorable to us, or at all.

The failure to manage our anticipated growth effectively could materially and adversely affect our business and financial condition.

The commercialization of our technology would place a significant strain on our managerial, financial and personnel resources. To reach our goals, we must successfully recruit, train, and manage new employees; develop our manufacturing capabilities; integrate new management and employees into our overall operations; and establish improved financial and accounting systems, controls and reporting systems. We will be competing with other solar, semiconductor and display manufacturers for individuals with this expertise. If we fail to manage the expansion of our business effectively, it could materially and adversely affect our business and financial condition.

Our management team has limited experience working together and its failure to work together effectively could materially and adversely affect our business and financial condition.

Our executive officers and key employees have worked together for a limited period of time. If our management team cannot successfully work together or fails to develop a thorough understanding of our business on a timely basis, it could materially and adversely affect our business and financial condition. Further, we intend to transition from a development company to a revenue generating company by building a manufacturing line and commercializing our product. Our future success depends on our management team’s ability to establish a manufacturing line and commercialize our product. If we cannot do so, we will be unable to expand our business, decrease our cost per watt, maintain our competitive position, satisfy our contractual obligations or reach profitability.

17

Table of Contents

If we lose key personnel, or are unable to attract and retain necessary talent, we may be unable to develop or commercialize our products under development.

We are highly dependent on Mr. Magnus Ryde, our Chief Executive Officer, and Mr. Robert Weiss, our Chief Technology Officer. Mr. Ryde has over 25 years of experience in the semiconductor industry. Mr. Weiss has over 25 years of experience in thin film technology development and manufacturing. In the case of the loss of either of these key executives, we may be unable to find a suitable replacement with comparable knowledge or experience.

In addition, our future success will depend, in part, upon our ability to attract and retain highly skilled employees, including management, technical and sales personnel. Competition for such skilled personnel is intense, and the loss of services of a number of key individuals, or our inability to hire new personnel with the requisite skill sets, could materially harm our business and results of operations. These issues would be magnified if any of our key personnel went to work for competitors. In addition, we may not be able to successfully assimilate these employees or hire qualified personnel to replace them.

If we are unable to adequately protect our intellectual property, our competitors and other third parties could produce products based on our intellectual property, which would substantially impair our ability to compete.