Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED JANUARY 3, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-31149

California Pizza Kitchen, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

95-4040623 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

6053 West Century Boulevard, 11th Floor

Los Angeles, California 90045-6438

(Address of principal executive offices, including zip code)

(310) 342-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value (title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).* YES ¨ NO ¨

*The registrant has not yet been phased into the interactive data requirements.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 26, 2009, the last trading day of the second fiscal quarter, was approximately $255 million based upon the last sales price reported for such date on the Nasdaq National Market. For purposes of this disclosure, shares of Common Stock held by persons who hold more than 5% of the outstanding shares of Common Stock and shares held by officers and directors of the registrant have been excluded, in that such persons may be deemed to be affiliates. This determination is not necessarily conclusive.

As of March 17, 2010, 24,269,850 shares of the registrant’s Common Stock, $0.01 par value, were outstanding.

Table of Contents

CALIFORNIA PIZZA KITCHEN, INC. AND SUBSIDIARIES

2009 ANNUAL REPORT ON FORM 10-K

INDEX

| Page No. | ||||

| Part I. | ||||

| Item 1. |

3 | |||

| Item 1A. |

12 | |||

| Item 1B. |

17 | |||

| Item 2. |

18 | |||

| Item 3. |

19 | |||

| Item 4. |

19 | |||

| Part II. | ||||

| Item 5. |

20 | |||

| Item 6. |

22 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 | ||

| Item 7A. |

37 | |||

| Item 8. |

37 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

37 | ||

| Item 9A. |

37 | |||

| Item 9B. |

40 | |||

| Part III. | ||||

| Item 10. |

40 | |||

| Item 11. |

40 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

40 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

40 | ||

| Item 14. |

40 | |||

| Part IV. | ||||

| Item 15. |

41 | |||

Table of Contents

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that involve risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expects,” “anticipates,” “intends,” “plans” and similar expressions. Our actual results could differ materially from those discussed in these statements. Factors that could contribute to these differences include those discussed under “Risk Factors” and elsewhere in this report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report.

ASSUMPTIONS USED IN THIS REPORT

Throughout this report, our fiscal years ended January 1, 2006, December 31, 2006, December 30, 2007, December 28, 2008 and January 3, 2010 are referred to as fiscal years 2005, 2006, 2007, 2008 and 2009, respectively. Our fiscal year consists of 52 or 53 weeks and ends on the Sunday closest to December 31 in each year. Our fiscal years typically consist of 52 weeks except for 2009, which was a 53-week year. All prior year final quarters consisted of 13 weeks except for 2009, which included a final quarter of 14 weeks.

PART I.

Overview and Strategy

California Pizza Kitchen, Inc. (referred to herein as the “Company” or in the first person notations “we,” “our,” and “us”) is a leading casual dining restaurant chain with a particular focus on the premium pizza segment. As of March 17, 2010, we own, license or franchise 252 locations in 32 states and 9 foreign countries, of which 205 are company-owned and 47 operate under franchise or license arrangements. During our 25 years of operating history, we have developed a recognized consumer brand and demonstrated the appeal of our concept in a wide variety of geographic areas.

Our objective is to extend our leadership position in the restaurant and premium pizza market by selling innovative, high quality pizzas in addition to creative salads, distinctive pastas and related products and by providing exceptional customer service, thereby building a high degree of customer loyalty, brand awareness and superior returns for our stockholders. To reach these objectives, we plan to increase our market share by expanding our restaurant base in new and existing markets, leveraging our partnerships in non-traditional and retail channels and offering innovative menu items. We also offer the opportunity for guests to enjoy our products off of our premises by taking advantage of our take-out and delivery options and our newly launched Catering program. Our restaurants, which feature an exhibition style kitchen centered around an open flame oven, provide a distinctive, casual dining experience that is family friendly and has broad consumer appeal.

Menu

Our menu development is led by our co-founders and co-Chief Executive Officers (“co-CEOs”), Richard Rosenfield and Larry Flax, who lead our menu development team to continually create menu selections that are innovative and capture distinctive tastes. Our diverse menu focuses on imaginative toppings and showcases tastes and flavors that customers readily identify, but do not typically associate with pizza, pastas or salads. Recognizing the wide appeal of our restaurants, we apply equal focus to creating flavorful offerings that utilize tastes and menu items that guests are familiar with and then adding our distinctive attention to flavor and quality.

3

Table of Contents

From the opening of our first restaurant in Beverly Hills, in 1985, we first applied our innovative approach to creating and defining a new category of pizza—the premium pizza. For example, our signature creation, the Original BBQ Chicken Pizza, utilizes barbecue sauce instead of tomato sauce and adds toppings of barbeque chicken breast, smoked Gouda and mozzarella cheeses, sliced red onion and fresh cilantro. Our Thai Chicken Pizza, another early original creation, is created with a base of spicy peanut-ginger and sesame sauce, and topped with marinated chicken breast, mozzarella cheese, roasted peanuts, green onions, bean sprouts, julienne carrots and fresh cilantro. Other examples of our wide variety of flavors include Jamaican Jerk Pizza, Buffalo Chicken Pizza, Greek Pizza, California Club Pizza, Carne Asada Pizza, Chipotle Chicken Pizza, Shrimp Scampi Pizza and the recently introduced Meat Cravers Pizza and Cheeseburger Pizza.

Our menu is also designed to satisfy customers who seek traditional, American-style tomato sauce-based pizza or authentic, Italian-style Neapolitan pizza. For the traditionalist, we offer a variety of items such as the Mushroom Pepperoni Sausage Pizza, the Italian Tomato & Basil Pizza and The Works Pizza which combines sweet Italian sausage, pepperoni, sautéed mushrooms, mozzarella cheese, green peppers, black olives and our tomato sauce. Our Neapolitan pizzas are prepared on a thin, crisp crust and include our Margherita Pizza with imported Italian tomatoes, fresh mozzarella cheese, fresh basil and parmesan cheese, and our Sicilian Pizza made with spicy marinara sauce, spicy Capicola ham, julienne salami and fontina, mozzarella and parmesan cheeses.

Another competitive strength is the popularity of our salad menu. From the success of our Original BBQ Chicken pizza we were inspired to create such signature salads as The Original BBQ Chicken Chopped salad, which contains chopped lettuce, black beans, sweet corn, jicama, cilantro, basil, crispy corn tortilla chips, and Monterey Jack cheese tossed together in our homemade ranch dressing, and topped with chopped barbecue chicken breast, fresh diced Roma tomatoes and fresh green onions. We also were innovative in updating the Waldorf Chicken Salad with our rendition of this New York City favorite. Our recipe includes fresh field greens, chilled-grilled chicken breast, seedless grapes, Granny Smith apples, candied walnuts, celery and Gorgonzola cheese, topped with our homemade Dijon balsamic vinaigrette or blue cheese dressings. We also offer such innovative salads as the Thai Crunch Salad, Miso Salad with crab and shrimp, and Moroccan Chicken Salad. Among our traditional salad offerings are our Original Chopped Salad, CPK Cobb Salad, and our Classic Caesar Salad.

Our pasta menu has longstanding original favorites such as our Chicken Tequila Fettuccine, Thai Linguini, Kung Pao Spaghetti, and traditional items with our own recipes such as our Tomato Basil Spaghetti, Garlic Cream Fettuccine, and Spaghetti Bolognese.

We have broadened our menu beyond pizza, pastas, and salads, to include specialty entrees, sandwiches, soups, appetizers and desserts, and we strive to bring the same level of creativity and innovation to our entire menu and to offer items that appeal to a variety of tastes.

Our specialty entrees include the new Baja Fish Tacos, Steak Tacos, Wild Caught Mahi Mahi, Chicken Milanese, Pan Sautéed or Ginger Salmon, Chicken Piccata, Blue Crab Cakes and Chicken Marsala.

We also offer a full range of appetizers including our Spinach Artichoke Dip, Avocado Club Egg Rolls, Chicken or Shrimp Lettuce Wraps and Tortilla Spring Rolls and a variety of sumptuous desserts such as Red Velvet Cake, Chocolate Souffle Cake, Key Lime Pie, Apple Crisp, Tiramisu and our new White Chocolate Strawberry Cheesecake.

All of our menu items are prepared to order in our restaurants. This reinforces our customers’ confidence in the freshness and quality of our preparations and allows us to customize any dish to accommodate specific dietary or taste preferences. We are proud that our entire menu is trans-fat free. We recently added such healthy options as multi-grain pasta and honey wheat with whole grain pizza crust.

4

Table of Contents

We recently improved and expanded our wine list to offer a wider variety of premium wines in a reasonable price range. Most of our wines are offered by the glass or by the half glass. We also serve a variety of bottled and tap beers. We serve mixed drinks primarily to complement our menu offerings in all restaurants in which we have liquor licenses.

Our soup menu is entirely vegetarian with such features as our Dakota Smashed Pea and Barley Soup, Sedona Tortilla Soup, Asparagus Soup and the recently introduced Tuscan White Bean Minestrone.

Our sandwiches are offered on focaccia bread and our longstanding favorites such as the Grilled Dijon Chicken and Grilled Chicken Caesar have been complemented by recent additions such as the Cranberry Walnut Chicken Salad and the Chicken Club.

We recently introduced a “Small Cravings” menu to offer our guests the innovative flavors we are know for, but in smaller portions, inviting guests to explore the many tastes our restaurants offer. These items range in price from $3.99 to $6.49. Small Cravings include Asparagus & Arugula Salad, Crispy Artichoke Hearts, Buffalo Chicken, Sweet Corn Tamale Ravioli, White Corn Guacamole & Chips, Mediterranean Plate and a small traditional Wedge Salad with Applewood smoked bacon, chopped egg, fresh diced Roma tomatoes and blue cheese dressing.

We regularly review the sales mix of our menu items and replace lower selling items in each category with new menu items once or twice a year. Because of our ability to quickly adapt our menu, we believe that we are able to meet our customers’ changing tastes and expectations. Our entrees generally range in price from $6.49 to $17.99 and our average dine-in guest check is approximately $14.49, including alcoholic beverages.

Operations

Restaurant Management. We currently have 32 regional directors who report to four regional vice presidents of operations. These regional vice presidents report to our Chief Operating Officer and Chief Financial Officer (“COO and CFO”), Susan M. Collyns. Each regional director oversees from five to nine restaurants and supervises the general manager for each restaurant within his or her area of control. The typical full service restaurant management team consists of a general manager, who oversees the entire operation of the restaurant, a kitchen manager and one to three other managers. Additionally, depending upon the size, location and sales volume of a restaurant, we may also employ another kitchen manager and/or another manager in the dining area. Most of our full service restaurants employ approximately 60 to 80 hourly employees, many of whom work part-time. The general manager of each restaurant is responsible for the day-to-day operation of that restaurant, including hiring, training and development of personnel, as well as operating results. The kitchen manager is responsible for product quality, food costs and kitchen labor costs. Our full service restaurants are generally open Sunday through Thursday from 11:00 a.m. until 10:00 p.m., and on Friday and Saturday from 11:00 a.m. until 11:00 p.m.

Training. We strive to maintain quality and consistency in each of our restaurants through the careful training, development and supervision of personnel and the establishment of, and adherence to, high standards relating to service, food and beverage preparation, maintenance of facilities, quality and safety. We provide all new employees with complete orientation and training for their positions to ensure they are able to meet our high standards. Each location has certified trainers who provide classroom and on-the-job instruction. Employees are certified for their positions by passing a series of tests and evaluations. Our management training program lasts for 10 weeks and is completed in one of our more than 100 certified training restaurants. Management training includes service, kitchen and overall management responsibilities, with intense focus on food preparation, the essence of the California Pizza Kitchen experience. An extensive series of interactive modules and on-line quizzes are used in conjunction with on-the-job training. After spending the first eight weeks in their certified training restaurant, new managers spend the last two weeks of training in their home restaurant, working side-by-side with the general manager. We place a high priority on our continuing management development

5

Table of Contents

programs in order to ensure that qualified managers are available for our future growth. In addition, we have detailed written operating procedures, standards and controls, finance modules, food and service quality assurance systems and safety programs. We regularly hold conference calls, workshops, rollout meetings, tutorials and updates for general managers and regional directors during which they receive financial information and additional training on food preparation, hospitality and other relevant topics. This same information is then communicated to all levels of management through the regional vice presidents and regional directors, ensuring that identical messages are communicated to each manager in our company.

When we open a new restaurant, we provide varying levels of training to each employee as necessary to ensure the smooth and efficient operation of a California Pizza Kitchen restaurant from the first day it opens to the public. Approximately two weeks prior to opening a new restaurant, our dedicated training/opening team travels to the location to begin intensive training of all new employees for that restaurant. Our training team remains on site during the first two weeks of operation. We believe this additional investment in our new restaurants is important since it helps us provide our customers with a quality dining experience from day one. We also make on-site training teams available when our franchisees open new restaurants. After a restaurant has been opened and is operating smoothly, the general manager supervises the training of all new employees. Each region also has one regional training manager who periodically oversees the training processes in each location to ensure our industry-leading training standards are achieved for maximum consistency and brand strength.

Recruiting and Retention. We seek to hire experienced managers and staff. We support our employees by offering competitive wages and benefits, including a 401(k) plan and salary deferral plan, both with a discretionary match, medical insurance for all of our employees, including eligible part-time workers, and discounts on dining.

We attempt to motivate and retain our employees by providing them with structured career development programs for increased responsibilities and advancement opportunities, as well as performance-based bonuses tied to sales, profitability and qualitative measures. Our most successful general managers are eligible for promotion to senior general manager status and are entitled to receive more lucrative compensation packages based on various performance criteria. We believe we also enjoy the recruiting advantage of offering our general managers restaurants that are easier to manage because they are generally smaller than those of our competitors and have hours that typically do not extend late into the night.

Customer Satisfaction. Customer satisfaction is critically important to us. To that end, we solicit and analyze our customers’ opinions through web-based surveying of guests every month, which is a vital tool in our quality control efforts from both a food quality and customer service perspective.

Marketing

Our communication strategy focuses on marketing the California Pizza Kitchen brand through many creative and non-traditional avenues. As one of the pioneers of premium pizza, we continue to benefit from national media attention featuring our co-founders and co-CEOs, Richard Rosenfield and Larry Flax, which we believe provides us with a significant competitive advantage. New restaurant openings, high-profile fundraisers and media events currently serve as the focal point of our public relations and media outreach efforts.

In 2009, we had sponsorship agreements with the Los Angeles Angels of Anaheim and the Los Angeles Kings to promote California Pizza Kitchen at Angel Stadium and STAPLES Center, respectively, and were the exclusive pizza provider at these venues. We expect to continue the arrangements with Angels Stadium and STAPLES Center in 2010.

During 2009, our public relations efforts led to coverage on a national level in numerous outlets including the BusinessWeek Magazine, ESPN The Magazine, Los Angeles Times, USA Today, Wall Street Journal, The View, FOX National News and CNBC Power Lunch. In addition, Company representatives were invited to demonstrate our creative menu items on local television programs in over 15 major markets, and the Company

6

Table of Contents

was written about in major daily newspapers from coast to coast. We were recently named the “#1 Most Recommended Casual Dining Chain” restaurant by Zocalo Group and MARC Research, “One of America’s Best 200 Small Companies” by Forbes Magazine, “Best Kids Menu in America” by Restaurant Hospitality Magazine and voted “Best Pizza,” “Best Salads” and “Best American Food” in a Honolulu Advertiser reader’s poll.

We employ a variety of marketing techniques in connection with our new restaurant openings, including charitable fundraising events with invitations to media personalities and community leaders. In addition, we donate 100% of dine-in pizza sales from a designated day immediately following the opening to a local children’s charity. California Pizza Kitchen managers are also encouraged to host fundraising events in their restaurants with local charities.

Our involvement in the community does not end once we have opened a restaurant. In each of the markets in which we operate, we continuously engage in a variety of charitable and civic causes through ongoing in-kind donations. 100% of the proceeds from the sale of California Pizza Kitchen’s three cookbooks are donated to various charities. These cookbooks are sold at our restaurants, through national bookstore chains and through on-line retailers. Additionally, a portion of the proceeds from our premium frozen pizza sales sold at retail outlets are donated to local charities.

In 2008, the CPK Foundation partnered with Starlight Children’s Foundation on a national level to host twenty CPKids Camps each year through 2011 in cities across the country for Starlight children and their families. These camps will give seriously ill children and their families recreational opportunities outside of the hospital environment. In 2009, Starlight Children’s Foundation planned and executed twenty CPKids Camps in cities including Los Angeles, New York, Dallas, Denver, Seattle, San Francisco and San Diego that included outdoor games, crafts, music and performers. Local CPK restaurants provide lunch for all participants and employees volunteer as “Camp Counselors.”

During 2009, a total of approximately $1.0 million was donated to over 1500 local communities and children’s charities across the U.S. directly from our restaurants and through the CPK Foundation.

We conduct consumer research to monitor our customer satisfaction and we also engage, to a limited extent, in paid advertising for individual restaurant locations. Some of the mediums used include digital, billboards, kiosks and newspapers. In 2009, we continued our nationwide Thank You Card promotion, which awarded customers with free meals, discounts and various other prizes. We also utilize a variety of social media platforms including Twitter, Facebook and YouTube. On-going marketing efforts include business-to-business programs, CPKids programs with local schools and children’s organizations, hotel concierges and new resident programs. We utilize a variety of printed materials, including take-out and catering menus, mall employee pizza passes, take-out bag stuffers, check presenter inserts, Be Our Guest cards and electronic gift cards.

In 2009, we spent an aggregate of 1.1% of restaurant sales on marketing efforts. We expect to continue investing approximately 1.0% of restaurant sales in marketing efforts in 2010.

Company-owned Restaurant Expansion Strategy and Site Selection

We expect that full service restaurants will continue to represent the majority of our revenue growth in the near term, and our expansion strategy will focus primarily on further penetrating existing markets. As a result, we anticipate over the next several years that a majority of our new restaurants will be in existing markets. This clustering approach enables us to increase brand awareness and improve our operating and marketing efficiencies. For example, clustering enables us to reduce costs associated with regional supervision of restaurant operations and provides us with the opportunity to leverage marketing costs over a greater number of restaurants. We also believe this approach reduces the risks involved with opening new restaurants given that we better understand the competitive conditions, consumer tastes, demographics and discretionary spending patterns in our existing markets. In addition, our ability to hire qualified employees is enhanced in markets in which we are well known.

7

Table of Contents

We believe that our site selection strategy is critical to our success, and we devote substantial effort to evaluating each potential site at the highest levels within our organization. We identify areas within our target markets that meet our demographic requirements, focusing on daytime and evening populations, shopping patterns, availability of personnel and household income levels. We only consider expanding to new markets that meet our strict demographic criteria. Our site selection criteria are flexible given that we operate restaurants in all types of regional shopping centers, lifestyle centers, entertainment centers, freestanding street locations in commercial and residential neighborhoods, office buildings and hotels. We have several long-standing relationships with major mall developers and owners and are therefore afforded the opportunity to negotiate multiple location deals.

We developed a “new” prototype full service restaurant in fiscal 2004 and have opened 86 new or remodeled restaurants under this format. Including these prototype locations, restaurants built beginning in 1998 and refreshened older locations, more than 90% of our restaurant base now has a warmer ambience environment that achieves higher value scores from guests compared to our original format.

Our locations include seven CPK/ASAP restaurants that compete in the fast casual market. In 2009, the Company began to transition certain company-owned CPK/ASAP locations to logo branding consistent with full service restaurants. We intend to either close or transition the remaining company-owned CPK/ASAP locations into full service restaurants in the future. Our portfolio of restaurants also includes LA Food Show Grill & Bar (“LA Food Show”) with one location in Manhattan Beach, California and one location in Beverly Hills, California.

Unit Level Economics

Typical full service prototype restaurants are approximately 5,800 square feet and have approximately 200 seats. New locations are primarily “inline” rather than “freestanding.” We are building fewer freestanding locations than previously but will continue to build freestanding locations if presented with unique opportunities. Consistent with reduced construction costs and our flexible format, costs on average are less than $2.6 million for inline restaurants. This excludes pre-opening costs, which average approximately $330,000 to $350,000 per restaurant. Full service restaurants opened in fiscal 2009 are approximately 5,600 square feet with approximately 200 seats.

Restaurant Franchise and Licensing Arrangements

As part of our strategy to expand and leverage the California Pizza Kitchen brand, we introduced and franchised the CPK/ASAP concept in 1996. Our franchised CPK/ASAP restaurants are designed specifically for the “grab and go” customer in non-traditional locations and are typically 600 to 1,000 square feet in size with a limited menu and common area seating. The HMSHost Corporation franchisee (“HMSHost”), operates 14 CPK/ASAP restaurants throughout the United States, primarily in airports, and one full service airport location. MGM Mirage operates one full service restaurant in The Mirage in Las Vegas, Nevada. In 2009, CPK opened a new quick-serve location at Hofstra University in Hempstead, New York. This location is the Company’s first location on a college campus and is operated by Compass LCS, LLC, a wholly-owned subsidiary of Compass Group USA, Inc, dba Lackmann Culinary Services.

HMSHost has preferred rights to open new CPK/ASAP restaurants in airports and in travel plazas along toll-roads in North America. However, any location proposed by HMSHost is subject to approval at our sole discretion. Once we have agreed to HMSHost’s development of a CPK/ASAP restaurant in an airport or travel plaza location, our right to license or operate a restaurant ourselves at that location is limited. In fiscal 2006, we agreed to extend our relationship with HMSHost until 2012. Upon approval of additional locations, HMSHost pays an initial franchise fee of $20,000 for each CPK/ASAP restaurant at a new location, $10,000 for each additional CPK/ASAP restaurant at an existing location, and continuing royalties at rates of 5.0% to 5.5% of gross sales. The HMSHost franchise agreement typically terminates at the same time as the HMSHost concessionaire agreement to operate at an airport or mall terminates.

8

Table of Contents

As of March 17, 2010, we have seven international franchisees. One international franchisee operates seven full service restaurants with four in Hong Kong, China and one each in Indonesia, Singapore and Malaysia. We have two international franchisees who each operate seven full service restaurants in the Philippines and Mexico, respectively. Our fourth and fifth international franchisees operate one full service restaurant in Japan and Guam, respectively. The sixth international franchisee operates three full service restaurants in South Korea, and a seventh international franchisee operates one full service restaurant in Dubai, United Arab Emirates. In late 2009, the Company entered into an agreement with a new franchisee to expand into India with the first location scheduled to open in 2010.

Our territorial development agreements with our international franchisees grant them the right to operate restaurants in an identified territory subject to meeting development obligations and excluding certain types of locations. Our basic franchise agreement with these franchisees generally requires payment of an initial fee of between $50,000 and $75,000 for a full service restaurant, as well as continuing royalties at a rate of 5.0% of gross revenue. Most of our franchise agreements contain a 10- or 20-year term.

Agreement with Kraft Pizza Company

In 1997, we entered into a trademark license agreement with Kraft Pizza Company (“Kraft”) pursuant to which we have licensed certain of our trademarks and proprietary recipes to Kraft for its use in manufacturing and distributing a line of California Pizza Kitchen premium frozen pizzas in the United States and Canada, including: The BBQ Recipe Chicken, Five-Cheese & Tomato, Garlic Chicken and Mushroom Pepperoni Sausage. In 2005, Kraft introduced the California Pizza Kitchen “Crispy Thin Crust” line with three popular California Pizza Kitchen pizzas: Sicilian, Margherita and White, on a Neapolitan-style crust. In 2006, Kraft expanded the California Pizza Kitchen Crispy Thin Crust line with two new pizzas, the Garlic Chicken and BBQ Recipe Chicken. In 2008, Kraft introduced a line of premium microwaveable “For One” pizzas, including the popular flavors Sicilian and BBQ Recipe Chicken. In March 2009, Kraft launched California Pizza Kitchen Flatbread Melts in four varieties: Chicken & Bacon Club, Chicken Santa Fe, Carne Asada, and Five Cheese & Spinach. In August of 2009 Kraft launched a line of premium products made with no preservatives, artificial flavors, or colors specifically for the natural food channel and Whole Foods Markets. The flavors launched included Tomato, Basil & Mozzarella, Pesto Chicken & Oven Roasted Tomatoes, and Roasted Peppers with Fontina Cheese. Our frozen products are currently sold in 50 states and the District of Columbia at approximately 20,000 points of distribution through select grocers.

We collect royalties based on a tiered schedule. The royalties are calculated as a percentage of wholesale sales of our premium frozen products. We received $7.7 million in royalties in fiscal 2009, an increase of 18% from fiscal 2008. Kraft is also obligated to spend a percentage of net sales on advertising and promotion of California Pizza Kitchen’s licensed products and possesses the first right of refusal on manufacturing and distributing new frozen product lines.

On March 2, 2010, Kraft Pizza Company was purchased by Nestle S.A., which assumed the obligations under the license agreement.

Management Information Systems

All of our restaurants use computerized information technology systems that are designed to improve operating efficiencies, provide field and corporate management timely access to financial and marketing data, reduce restaurant and corporate administrative time and expense, ensure compliance with federal and local legislation, and facilitate an enjoyable guest experience by allowing our guests to customize menu items, food preparation and payment options as desired. Our restaurant systems include a point-of-sale system, a labor scheduling and management application and an inventory usage analysis system. Our systems provide integrated online customer ordering via the Company website and text or mobile-web enabled devices. The data captured by our restaurant level systems include restaurant sales, cash and credit card receipts, quantities of each menu item sold, customer counts, daily labor expense and inventory movement. This information drives in-store reporting

9

Table of Contents

and analysis systems designed to help our management teams run their restaurants efficiently and profitably. Each week, every restaurant prepares a flash profit and loss statement that is compared to other relevant measures such as budget and prior year. Additionally, the information is transmitted to the corporate office on a daily basis for use by our corporate information systems.

In 2009, we deployed a sales performance reporting system. This suite of reports and alerts give operators the ability to effectively view store level metrics about category sales, guest count, check average and guest satisfaction. We also enhanced our “meal break” reporting technologies which allows our operators to track staff meals and breaks on a shift-by-shift basis to better ensure compliance. Our corporate information systems provide management with operating reports that show restaurant performance comparisons against items such as budget, prior year results and other company restaurants. Multiple reporting time frames are available, including current week, current accounting period and year-to-date. These systems allow us to closely monitor restaurant sales, cost of sales, labor expense and other restaurant trends on a daily, weekly and monthly basis. We believe these systems enable both restaurant and corporate management to adequately manage the operation and financial performance of our restaurants. Additionally, we believe the systems are scalable and flexible enough to accommodate or integrate with any technologies necessary to support new initiatives. We are also certified as being in compliance with the Payment Card Industry Data Security Standard requirements for Level 1 merchants.

Purchasing

Our purchasing staff procures all of our food ingredients, products and supplies. We seek to obtain the highest quality ingredients, products and supplies from reliable sources at competitive prices. We continually research and evaluate various food ingredients, products and supplies for consistency and food safety and compare them to our detailed specifications. Specific, qualified manufacturers and growers are then inspected and approved for use. This process is repeated at least once a year. To maximize our purchasing efficiencies and obtain the lowest possible prices for our ingredients, products and supplies, while maintaining the highest quality, our centralized purchasing staff generally negotiates prices based on one of two formats: fixed-price contracts, generally with terms of from one month to one year, or monthly commodity pricing formulas.

In order to provide the freshest ingredients and products, and to maximize operating efficiencies between purchase and usage, each restaurant’s kitchen manager determines its daily usage requirements for food ingredients, products and supplies. The kitchen manager orders accordingly from approved local vendors and our national master distributor. The kitchen manager also inspects all deliveries daily to ensure that the items received meet our quality specifications and negotiated prices. We have competitively priced, high quality alternative manufacturers, vendors, growers and distributors available should the need arise.

Employees

As of January 3, 2010, we have approximately 14,600 employees, including approximately 190 employees located at our corporate headquarters. Our employees are not covered by any collective bargaining agreement. We consider our employee relations to be strong.

Competition

The restaurant industry is intensely competitive. We compete on the basis of the taste, quality and price of food offered, customer service, ambiance, location and overall dining experience. We believe that our concept, attractive price-value relationship and quality of food and service enable us to differentiate ourselves from our competitors. Although we believe we compete favorably with respect to each of these factors, many of our direct and indirect competitors are well-established national, regional or local chains, and some have substantially greater financial, marketing and other resources. We also compete with many other restaurant and retail establishments for site locations and restaurant-level employees. The packaged food industry is also intensely competitive.

10

Table of Contents

Trademarks

Our registered trademarks and service marks include, among others, the word marks “California Pizza Kitchen” and “LA Food Show,” as well as the California Pizza Kitchen and California Pizza Kitchen ASAP logos. We have registered our marks with the United States Patent and Trademark Office. We have registered our most significant trademarks and service marks in many foreign countries. We have also registered our ownership of the Internet domain names “www.cpk.com” and “www.californiapizzakitchen.com.” We believe that our trademarks, service marks and other proprietary rights have significant value and are important to our brand-building efforts and the marketing of our restaurant concepts. We have vigorously protected our proprietary rights in the past and expect to continue to do so. We cannot predict, however, whether steps taken by us to protect our proprietary rights will be adequate to prevent misappropriation of these rights or the use by others of restaurant features based upon, or otherwise similar to, our concept. It may be difficult for us to prevent others from copying elements of our concept and any litigation to enforce our rights will likely be costly.

Availability of Reports

Our Internet address is www.cpk.com. At this Internet website we make available, free of charge, our Code of Ethics, proxy statement, annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the Securities and Exchange Commission (“SEC”).

Government Regulation

Our restaurants are subject to licensing and regulation by state and local health, sanitation, safety, fire and other authorities, including licensing and regulation requirements for the sale of alcoholic beverages and food. To date, we have not experienced an inability to obtain or maintain any necessary licenses, permits or approvals, including restaurant, alcoholic beverage and retail licenses. The development and construction of additional restaurants will also be subject to compliance with applicable zoning, land use and environmental regulations. We are also subject to federal and state laws that regulate the offer and sale of franchises and substantive aspects of a licensor-licensee relationship. Various federal and state labor laws govern our relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime, unemployment tax rates, workers’ compensation rates, employment eligibility requirements and sales taxes.

We are subject to federal and state environmental regulations, but these rules have not had a material effect on our operations. Various laws concerning the handling, storage, and disposal of hazardous materials, such as cleaning solvents, and the operation of restaurants in environmentally sensitive locations, may impact aspects of our operations. During fiscal 2009, there were no material capital expenditures for environmental control devices and no such expenditures are anticipated.

Our facilities must comply with the applicable requirements of the Americans with Disabilities Act of 1990 (“ADA”) and related state statutes. The ADA prohibits discrimination on the basis of disability with respect to public accommodations and employment. Under the ADA and related state laws, when constructing new restaurants or undertaking significant remodeling of existing restaurants, we must make the restaurants readily accessible to disabled persons. We must also make reasonable accommodations for the employment of disabled persons.

We have a significant number of hourly restaurant employees that receive tip income. We have elected to voluntarily participate in a Tip Rate Alternative Commitment (“TRAC”) agreement with the Internal Revenue Service. By complying with the educational and other requirements of the TRAC agreement, we reduce the likelihood of potential employer-only FICA assessments for unreported or underreported tips. However, we rely on our staff members to accurately disclose the full amount of their tip income and base our reporting on the disclosures provided to us by such tipped employees.

11

Table of Contents

Deteriorating economic conditions and financial markets are affecting consumer spending and may harm our business and operating results.

During 2010 and possibly beyond, the U.S. and global economies may continue to suffer the consequences of the downturn in economic activity. The restaurant industry is sensitive to changes in general economic conditions, both nationally and locally. Recessionary economic cycles, higher interest rates, higher fuel and other energy costs, inflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could adversely affect the demand for the Company’s products. In addition, the recent turmoil in the financial markets has had an adverse effect on consumer spending patterns. There can be no assurances that government responses to the recessionary conditions will restore consumer confidence and increase consumer spending.

In general, consumers are reducing their discretionary spending and “trading down” in many cases when deciding to spend on consumer goods and dining out. The Company could experience reduced customer traffic or limitations on the prices it can charge for its products, either of which could reduce the Company’s sales and profit margins and have a material adverse affect on the Company’s financial condition and results of operations. Also, economic factors such as those listed above and increased transportation costs, inflation, higher costs of labor, insurance and healthcare, and changes in other laws and regulations may increase the Company’s cost of sales and the Company’s operating, general and administrative expenses, and otherwise adversely affect the financial condition and results of operations of the Company.

Our operations are susceptible to changes in food and supply costs, which could adversely affect our margins.

Our profitability depends, in part, on our ability to anticipate and react to changes in food and supply costs. Our centralized purchasing staff negotiates prices for all of our ingredients and supplies through either contracts (terms of one month up to one year) or commodity pricing formulas. Our national master distributor delivers goods two to three times per week at a set, flat fee per case to all of our restaurants. Our contract with our national master distributor is up for renewal in July 2011, and there can be no guarantee that we will be able to renew this contract at the same or better terms. Furthermore, various factors beyond our control, including adverse weather conditions and governmental regulations, could also cause our food and supply costs to increase. We cannot predict whether we will be able to anticipate and react to changing food and supply costs by adjusting our purchasing practices. A failure to do so could adversely affect our operating results or cash flows.

Changes in consumer preferences, discretionary consumer spending or negative publicity could adversely impact our results.

Our restaurants feature pizzas, pastas, salads and appetizers in an upscale, family-friendly, casual environment. Our continued success depends, in part, upon the popularity of these foods and this style of informal dining. Shifts in consumer preferences away from this cuisine or dining style could materially adversely affect our future profitability. Also, our success depends to a significant extent on numerous factors affecting discretionary consumer spending, including economic conditions, disposable consumer income and consumer confidence. Adverse changes in these factors could reduce customer traffic or impose practical limits on pricing, either of which could materially adversely affect our business, financial condition, operating results or cash flows. Like other restaurant chains, we can also be materially adversely affected by negative publicity concerning food quality, illness, injury, publication of government or industry findings concerning food products served by us, or other health concerns or operating issues stemming from one or more restaurants.

12

Table of Contents

New information or attitudes regarding diet and health could result in changes in regulations and consumer eating habits that could adversely affect our revenues.

Regulations and consumer eating habits may change as a result of new information, increases in disclosure requirements or attitudes regarding diet and health. These changes may include regulations that impact the ingredients and nutritional content of our menu items. In addition, a number of states, counties and cities have enacted menu labeling laws requiring multi-unit restaurant operators to make certain nutritional information available to guests or have enacted legislation prohibiting the sales of certain types of ingredients in restaurants. Efforts have been made to introduce similar legislation at the federal level. The success of our restaurant operations depends, in part, upon our ability to effectively respond to changes in consumer health and disclosure regulations and to adapt our menu offerings to trends in eating habits. If consumer health regulations or consumer eating habits change significantly, we may be required to modify or discontinue certain menu items. To the extent we are unable to respond with appropriate changes to our menu offerings, it could materially affect guest demand for our concepts and have an adverse impact on our revenues.

Approximately 40 percent of our U.S. based restaurants are located in California. As a result, we are highly sensitive to negative economic conditions in that state.

Together with our franchisees, we currently operate a total of 88 restaurants in California (80 are company-owned and 8 are franchised locations). As a result, we are particularly susceptible to adverse trends and economic conditions in California. In addition, given our geographic concentration, negative publicity regarding any of our restaurants in California could have a material adverse effect on our business and operations, as could other regional occurrences such as local strikes, earthquakes or other natural disasters.

Applicable laws or regulations could adversely affect our business, financial position and results of operations if the costs of complying with these laws or regulations prove material or if we fail to comply.

Our business is subject to extensive federal, state and local government regulation in the various jurisdictions in which our restaurants are located, including regulations relating to alcoholic beverage control, public health and safety, and food safety. The failure to obtain and/or retain licenses, permits or other regulatory approvals could delay or prevent the opening and/or continued operation of a restaurant in a particular area. In addition, our failure to comply with applicable laws and regulations could subject us to fines or legal actions, and the costs of compliance with new regulations could be high, in each case potentially resulting in an adverse effect on our business, financial position or results of operations.

Our federal, state and local tax returns may, from time to time, be selected for audit by taxing authorities, which may result in tax assessments or penalties that could have a material adverse impact on our results of operations and financial position.

We are subject to federal, state and local taxes. Significant judgment is required in determining the provision for income taxes. Although we believe our tax estimates are reasonable, if the IRS or other taxing authority disagrees with the positions we have taken on our tax returns, we could face additional tax liability, including interest and penalties. If material, payment of such additional amounts upon final adjudication of any disputes could have a material impact on our results of operations and financial position.

Changes in, or any failure to comply with, applicable labor laws or regulations could adversely affect our business, financial position and results of operations.

Various federal and state labor laws and regulations govern our operations and relationships with employees, including minimum wages, breaks, overtime, fringe benefits, safety, working conditions and citizenship requirements. Changes in, or any failure to comply with, these laws and regulations could subject us to fines or legal actions. Even though we operate our facilities in strict compliance with Bureau of Citizenship

13

Table of Contents

and Immigration Services requirements and the requirements of certain states, some of our employees may, without our knowledge, fail to meet federal citizenship or residency requirements. This could result in a disruption in our work force, sanctions against us and adverse publicity. Significant government-imposed increases in minimum wages, paid or unpaid leaves of absence and mandated health benefits, or increased tax reporting, assessment or payment requirements related to our employees who receive gratuities could be detrimental to the profitability of our restaurants.

We are subject to complaints and litigation that could have an adverse effect on our business.

We are, from time to time, the subject of complaints or litigation from guests alleging food borne illnesses, injuries or other food quality, health or operational concerns. Adverse publicity resulting from these allegations may materially adversely affect our restaurants and brand, regardless of whether the allegations are valid or whether we are liable. We are also subject to complaints or allegations from current, former or prospective employees from time to time. The restaurant industry in California has seen a rise in purported class action lawsuits in recent years, as has the Company. A lawsuit or claim could result in an adverse decision against us that could have a material adverse effect on our business. Additionally, the costs and expense of defending ourselves against lawsuits or claims, regardless of merit, could have an adverse impact on our profitability and could cause variability in our results compared to expectations. Further, defending such claims may divert financial and management resources that would otherwise be used to benefit the future performance of our operations. We also are subject to some states’ “dram shop” statutes. These statutes generally provide a person injured by an intoxicated person with the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person. A settlement or judgment against us under a dram shop statute could have a material adverse effect on our operations.

Failure to maintain our credit facility could have a material adverse effect on our liquidity and financial condition.

The Company has a five-year $150.0 million revolving credit facility that expires in May 2013. The facility contains an uncommitted option to increase, subject to the satisfaction of certain conditions, the maximum borrowing capacity by up to an additional $50.0 million. The credit facility contains certain restrictive and financial covenants, including that the Company maintain a minimum consolidated fixed charge coverage ratio and a maximum lease adjusted leverage ratio. The availability and terms of additional financing are subject to a number of factors, some of which are beyond our control, including credit worthiness. See Note 8 of Notes to Consolidated Financial Statements in Part IV, Item 15 of this report for additional information concerning our credit facility. Our failure to maintain these covenants or the inability to renew the credit facility at maturity could have a material adverse effect on our future results and financial condition.

Our future revenue and earnings per share growth depends in part upon the growth of our royalty, license and franchise revenues, which depend on contract partners we do not control.

Our revenue and earnings per share growth from ancillary sources including license and franchise agreements depend, in part, upon the performance of contract partners acting independently. Adverse events beyond our control, such as quality issues related to a food product or a failure to maintain quality standards at a franchised restaurant, could negatively impact our brand, business and results of operations. The growth of our international franchise business depends in part upon our ability to find and attract quality franchisees. The growth of our domestic franchise business depends on air travel volume, as most of our domestic franchise locations are located in airports. Any events or factors that disrupt business or leisure air travel, including the current recession and threats of terrorist activity, could adversely impact our growth. A decline in ancillary revenues would have a material adverse impact on our growth, profitability and results of operations.

14

Table of Contents

Our growth strategy requires us to open new restaurants at a measured pace. We may not be able to achieve our planned expansion due to factors outside our control, including the current economic environment.

We are pursuing a disciplined growth strategy that, to be successful, depends on our ability and the ability of our franchisees and licensees to open new restaurants and to operate these new restaurants on a profitable basis. Successful expansion depends on numerous factors, many of which are beyond our control, including: the hiring, training and retention of qualified operating personnel, especially managers; competition for restaurant sites; negotiation of favorable lease terms; timely development of new restaurants, including the availability of construction materials and labor; management of construction and development costs of new restaurants; securing required governmental approvals and permits; competition in our markets; and general economic conditions.

Our success depends in part on our ability to locate a sufficient number of suitable new restaurant sites and to open new locations in a timely manner.

A challenge in meeting our growth objectives will be to secure an adequate supply of suitable new restaurant sites. There can be no assurance that we will be able to find and secure sufficient suitable locations for our planned expansion in any future period. Opening newly selected restaurant sites in a timely manner is, and may remain, a challenge. We have experienced, and may continue to experience, delays in opening some of our new restaurants due to delays by landlords and developers in delivery of real estate development projects in which our new sites are located. These delays occur both in the normal course of business and, more recently, due to the weak economic environment and tight credit markets and their negative impact on the commercial real estate market. Delays or failures in opening new restaurants on time could materially adversely affect our business, financial condition, operating results or cash flows.

Landlords or other tenants in the shopping centers and retail areas in which our restaurants are located may experience difficulty as a result of macroeconomic trends or cease to operate, which in turn could negatively affect our business.

In the current adverse economic climate, landlords of properties in which we operate or plan to operate may become insolvent, may be unable to obtain financing, or be otherwise unable to discharge their obligations to us under their financing arrangements or our lease agreements. If our landlords fail to satisfy their obligations to us or cannot operate their businesses in the ordinary course, such failures may result in us delaying openings or terminating leases in these locations. In addition, other tenants at the properties in which we are located or have executed leases may delay their openings, fail to open or may cease operations. Decreases in total tenant occupancy in the properties in which we are located may affect guest traffic at our restaurants. All of these factors could have a material adverse impact on our results of operations.

Our success depends on qualified and available labor, which could slow our growth.

Our success depends, in part, upon our ability to attract, motivate and retain a sufficient number of qualified employees, including restaurant managers, kitchen staff and servers, necessary to keep pace with our expansion schedule. Qualified individuals of the requisite caliber and number needed to fill these positions are in short supply in some areas. Although we have not experienced any significant problems in recruiting or retaining employees, any future inability to recruit and retain sufficient individuals may delay the planned openings of new restaurants. Any such delays or any material increases in employee turnover rates in existing restaurants could have a material adverse effect on our business, financial condition, operating results or cash flows. Additionally, competition for qualified employees could require us to pay higher wages and/or grant awards of equity, to the extent available, to attract a sufficient number of employees, which could result in higher labor costs. Failure to pay higher wages and/or grant awards of equity may prevent us from retaining and attracting qualified employees.

15

Table of Contents

Our restaurant expansion strategy focuses primarily on further penetrating existing markets. This strategy can cause sales in some of our existing restaurants to decline.

In accordance with our expansion strategy, we intend to open new restaurants primarily in our existing markets. Since we typically draw customers from a relatively small radius around each of our restaurants, the sales performance and customer counts for restaurants near the area in which a new restaurant opens may decline due to cannibalization of the existing restaurant’s customer base.

Our expansion into new markets may present increased risks due to our unfamiliarity with those areas.

As a part of our expansion strategy, we may be opening restaurants in markets in which we have little or no operating experience. These new markets may have different competitive conditions, consumer tastes and discretionary spending patterns than our restaurants in our existing markets. In addition, our new restaurants will typically take several months to reach budgeted operating levels due to problems associated with new restaurants, including lack of market awareness, inability to hire sufficient staff and other factors. Restaurants opened in new markets may never reach expected sales and profit levels, thereby affecting our overall profitability. Although we have attempted to mitigate these factors by paying careful attention to training and staffing needs, there can be no assurance that we will be successful in operating new restaurants on a profitable basis.

Our expansion may strain our infrastructure, which could slow our restaurant development.

We face the risk that our existing systems and procedures, restaurant management systems, financial controls, and information systems will be inadequate to support expansion. We cannot predict whether we will be able to respond on a timely basis to all of the changing demands that our planned expansion will impose on management and these systems and controls. If we fail to continue to improve our information systems and financial controls or to manage other factors necessary for us to achieve our expansion objectives, our business, financial condition, operating results or cash flows could be materially adversely affected.

Our business and growth depend on the contributions of our co-CEOs, COO/CFO and other senior executives.

The success of our business continues to depend on the contributions of our co-founders and co-CEOs, Richard Rosenfield and Larry Flax, our COO and CFO Susan Collyns and certain other senior executives of the Company. The loss of the services of the co-CEOs, COO/CFO or other senior executives could have a material adverse effect on our business and plans for future development.

Our ability to attract and retain qualified management personnel may be harmed if we are unable to offer competitive compensation, including cash and equity awards. Our 2004 Omnibus Incentive Compensation Plan does not contain sufficient authorized shares to permit equity grants at similar levels as in the past. Our ability to offer equity awards in the future may be limited or nonexistent if our shareholders do not approve a new equity incentive plan.

Increases in the minimum wage may have a material adverse effect on our business and financial results.

A number of our employees are subject to various minimum wage requirements. The federal minimum wage increased to $7.25 per hour effective July 24, 2009. Concurrently, many state minimum wage laws also changed whereby an employee is entitled to the greater of the state or federal minimum wage. Approximately 40% of our U.S. based restaurants are located in California where employees receive compensation equal to the California minimum wage, which was $8.00 per hour during fiscal 2009. During 2009, the District of Columbia and 30 states outside of California had minimum wage increases as the result of changes in legislation. Similar increases may be implemented in other jurisdictions in which we operate or seek to operate. These minimum wage increases may increase the cost of labor and subsequently reduce our profitability.

16

Table of Contents

Rising insurance costs could negatively impact profitability.

The rising cost of insurance (workers’ compensation insurance, general liability insurance, health insurance and directors and officers’ liability insurance) could have a negative impact on our profitability. We self-insure a substantial portion of our workers’ compensation and general liability costs and the occurrence of a greater frequency or amount of claims or increase in medical costs could have a negative impact on our profitability. Additionally, health insurance costs in general have risen significantly over the past few years. These increases could have a negative impact on our profitability if we are not able to offset the effect of such increases with plan modifications and cost control measures, or by continuing to improve our operating efficiencies.

Failure to meet market expectations for our financial performance will likely have a negative impact on the market price of our common stock.

If we fail to meet the market’s expectations for our financial performance, particularly with respect to comparable restaurant sales, revenues, operating margins and diluted earnings per share, a decline in the market price of California Pizza Kitchen, Inc. common stock will likely occur.

The market price of our common stock may also be affected by general stock market conditions, including the performance of broad-based stock market indices and exchanges. These conditions may result in stock market volatility, which in turn would likely impact the price of our common stock, as well as a sell-off in our common stock, both of which could be unrelated or disproportionate to changes in our operating performance.

There may be future sales or other dilution of our equity which may adversely affect the market price of our common stock.

We are not restricted from issuing additional common stock or preferred stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or preferred stock or any substantially similar securities. Our Board of Directors is authorized to issue additional shares of common stock and additional classes or series of preferred stock without any action on the part of the stockholders. Our Board of Directors also has the discretion, without stockholder approval, to set the terms of any such classes or series of preferred stock that may be issued, including voting rights, dividend rights and preferences over the common stock with respect to dividends or upon the liquidation, or winding up of our business and other terms. If we issue preferred shares in the future that have a preference over our common stock with respect to the payment of dividends or upon liquidation, dissolution or winding up, or if we issue preferred shares with voting rights that dilute the voting power of our common stock, the rights of our common stockholders or the market price of our common stock could be adversely affected.

Item 1B. Unresolved Staff Comments

None.

17

Table of Contents

Our corporate headquarters are located in Los Angeles, California. We occupy this facility under a lease, which was renewed effective September 1, 2002 and extends until August 2012 with an option to extend for an additional five years thereafter. We lease substantially all of our restaurant facilities, although we own one location each in Atlanta, Georgia; Alpharetta, Georgia; Grapevine, Texas; Scottsdale, Arizona; and Schaumburg, Illinois. A majority of our leases are for 10-year terms and include options to extend the terms. The majority of our leases also include tenant improvement allowances, rent holidays, rent escalation clauses and/or contingent rent provisions.

Current Locations

As presented in the table below, as of March 17, 2010, we own, license or franchise 252 locations in 32 states and 9 foreign countries, of which 205 are company-owned and 47 operate under franchise or license arrangements. We franchise or license our concept to other restaurant operators including: HMSHost, which operates 14 CPK/ASAP restaurants and one full service restaurant; MGM Mirage, which operates one full service restaurant in a Las Vegas hotel-casino; seven international franchisees which currently operate a total of 27 full service restaurants in China, Dubai, Indonesia, Guam, Japan, Malaysia, Mexico, Philippines, Singapore, South Korea. We also have California Pizza Kitchen locations on two college campuses and at two domestic sports and entertainment venues that operate seasonally.

| Company-Owned Restaurants (1) |

Franchised/ Licensed Full Service Restaurants |

Franchised ASAP Restaurants |

Campus, Sports & Entertainment Venues (Seasonal) |

Total Locations | ||||||

| Domestic |

||||||||||

| Alabama |

2 | — | — | — | 2 | |||||

| Arizona |

6 | — | 1 | — | 7 | |||||

| California |

80 | — | 6 | 2 | 88 | |||||

| Colorado |

6 | — | — | — | 6 | |||||

| Connecticut |

3 | — | — | — | 3 | |||||

| Florida |

13 | — | 2 | — | 15 | |||||

| Georgia |

6 | — | — | — | 6 | |||||

| Hawaii |

5 | — | — | — | 5 | |||||

| Illinois |

9 | — | — | — | 9 | |||||

| Kansas |

1 | — | — | — | 1 | |||||

| Kentucky |

1 | — | — | — | 1 | |||||

| Louisiana |

1 | — | — | — | 1 | |||||

| Maryland |

4 | — | — | — | 4 | |||||

| Massachusetts |

5 | — | — | — | 5 | |||||

| Michigan |

6 | — | — | — | 6 | |||||

| Minnesota |

3 | — | 1 | — | 4 | |||||

| Missouri |

5 | — | 1 | — | 6 | |||||

| Nebraska |

1 | — | — | — | 1 | |||||

| Nevada |

2 | 2 | — | — | 4 | |||||

| New Jersey |

4 | — | — | — | 4 | |||||

| New Mexico |

1 | — | — | — | 1 | |||||

| New York |

7 | — | — | 2 | 9 | |||||

| North Carolina |

3 | — | 2 | — | 5 | |||||

| Ohio |

3 | — | — | — | 3 | |||||

| Oregon |

2 | — | — | — | 2 | |||||

| Pennsylvania |

3 | — | — | — | 3 | |||||

| Tennessee |

1 | — | — | — | 1 |

18

Table of Contents

| Company-Owned Restaurants (1) |

Franchised/ Licensed Full Service Restaurants |

Franchised ASAP Restaurants |

Campus, Sports & Entertainment Venues (Seasonal) |

Total Locations | ||||||

| Texas |

10 | — | — | — | 10 | |||||

| Utah |

2 | — | 1 | — | 3 | |||||

| Virginia |

6 | — | — | — | 6 | |||||

| Washington |

3 | — | — | — | 3 | |||||

| Wisconsin |

1 | — | — | — | 1 | |||||

| International |

||||||||||

| Dubai, United Arab Emirates |

— | 1 | — | — | 1 | |||||

| Guam |

— | 1 | — | — | 1 | |||||

| Hong Kong, China |

— | 4 | — | — | 4 | |||||

| Indonesia |

— | 1 | — | — | 1 | |||||

| Japan |

— | 1 | — | — | 1 | |||||

| Malaysia |

— | 1 | — | — | 1 | |||||

| Mexico |

— | 7 | — | — | 7 | |||||

| Philippines |

— | 7 | — | — | 7 | |||||

| Singapore |

— | 1 | — | — | 1 | |||||

| South Korea |

— | 3 | — | — | 3 | |||||

| Totals as of March 17, 2010 |

205 | 29 | 14 | 4 | 252 | |||||

We are subject to certain private lawsuits (including purported class action suits), administrative proceedings and claims that arise in the ordinary course of our business. Such claims typically involve claims from guests, employees and others related to operational issues common to the food service industry. A number of such claims may exist at any given time. We could be affected by adverse publicity resulting from such allegations, regardless of whether such allegations are valid or whether we are found to be liable. From time to time, we are also involved in lawsuits with respect to infringements of, or challenges to, our registered trademarks.

19

Table of Contents

PART II.

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is quoted on the Nasdaq National Market (“NASDAQ”) under the symbol “CPKI.” The following table sets forth, for the two most recent fiscal years, the high and low sales prices as reported on NASDAQ:

| High | Low | |||||

| Fiscal 2008: |

||||||

| First Quarter |

$ | 16.00 | $ | 9.32 | ||

| Second Quarter |

$ | 16.91 | $ | 11.67 | ||

| Third Quarter |

$ | 15.92 | $ | 10.56 | ||

| Fourth Quarter |

$ | 15.01 | $ | 5.24 | ||

| Fiscal 2009: |

||||||

| First Quarter |

$ | 14.68 | $ | 8.03 | ||

| Second Quarter |

$ | 17.44 | $ | 12.34 | ||

| Third Quarter |

$ | 17.13 | $ | 12.83 | ||

| Fourth Quarter |

$ | 16.55 | $ | 12.29 | ||

As of March 17, 2010, there were approximately 158 holders of record of our common stock. On March 17, 2010, the last sale price reported on NASDAQ for our common stock was $17.26 per share.

20

Table of Contents

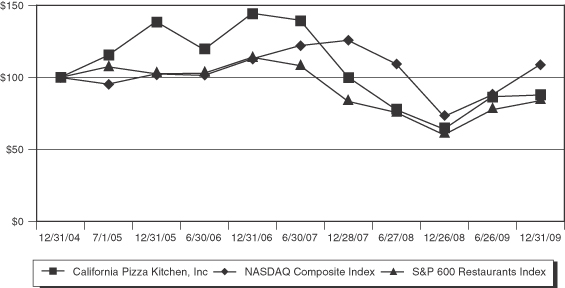

Performance Graph

Set forth below is a line graph comparing the total return on an indexed basis of a $100 investment in our common stock with (a) the NASDAQ Composite and (b) a selected stock list for the period commencing December 31, 2004 through December 31, 2009, the last trading day before our fiscal year end January 3, 2010.

COMPARISON OF CUMULATIVE TOTAL RETURN OF ONE OR MORE

COMPANIES, PEER GROUPS, INDUSTRY INDEXES AND/OR BROAD MARKETS

| Company/Index/ |

12/31/2004 | 7/01/2005 | 12/31/2005 | 6/30/2006 | 12/31/2006 | 6/30/2007 | 12/28/2007 | 6/27/2008 | 12/26/2008 | 6/26/2009 | 12/31/2009 | ||||||||||||||||||||||

| California Pizza Kitchen, Inc. |

$ | 100.00 | $ | 115.43 | $ | 138.99 | $ | 119.47 | $ | 144.81 | $ | 140.08 | $ | 100.16 | $ | 77.53 | $ | 63.84 | $ | 86.53 | $ | 87.71 | |||||||||||

| NASDAQ Composite Index |

$ | 100.00 | $ | 95.32 | $ | 102.40 | $ | 101.39 | $ | 113.01 | $ | 122.20 | $ | 125.97 | $ | 109.48 | $ | 72.69 | $ | 87.80 | $ | 108.88 | |||||||||||

| S&P 600 Restaurants Index |

$ | 100.00 | $ | 107.38 | $ | 102.52 | $ | 102.92 | $ | 114.03 | $ | 108.30 | $ | 83.29 | $ | 75.50 | $ | 59.89 | $ | 77.35 | $ | 83.74 | |||||||||||

Dividend Policy

We currently retain all earnings for the operation and expansion of our business. Any payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements, contractual restrictions contained in our credit agreement, and other factors deemed relevant by our Board. In May 2008, the Company entered into a new five-year revolving credit facility (the “Facility”) with a syndicate of banks. The Facility states that we may declare and pay cash dividends and distributions to our stockholders if we are not in default and if we maintain a maximum lease adjusted leverage ratio of less than 3.5 to 1, as defined in the agreement.

21

Table of Contents

Equity Compensation Plan Information

Information about California Pizza Kitchen’s equity compensation plans at January 3, 2010 was as follows:

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans | ||||

| Equity compensation plans approved by security holders (1) |

5,716,423 | $ | 15.82 | 350,208 | |||

| Equity compensation plans not approved by security holders |

— | — | — | ||||

| Total |

5,716,423 | $ | 15.82 | 350,208 | |||

| (1) | Consists of two California Pizza Kitchen compensation plans: 1998 Stock-Based Incentive Compensation Plan and 2004 Omnibus Incentive Compensation Plan. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

During the fiscal 2009, the Company made no purchases of California Pizza Kitchen, Inc. common stock.

Item 6. Selected Financial Data

The following selected consolidated financial and operating data for each of the five fiscal years preceding the period ended January 3, 2010 are derived from our audited consolidated financial statements. This selected consolidated financial and operating data should be read in conjunction with the consolidated financial statements and accompanying notes, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other financial information included elsewhere in this report.

22

Table of Contents

CALIFORNIA PIZZA KITCHEN, INC. AND SUBSIDIARIES

SELECTED CONSOLIDATED FINANCIAL AND OPERATING DATA

(in thousands, except store data, per share data and operating data)

| Fiscal Year | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Restaurant sales |

$ | 652,185 | $ | 665,616 | $ | 624,324 | $ | 547,968 | $ | 474,738 | ||||||||||

| Royalties from Kraft licensing agreement |