Attached files

Exhibit 13

DIMECO, INC. 2009 ANNUAL REPORT

| The mission of Dimeco, Inc. is the operation of a fully integrated financial services institution through its subsidiary The Dime Bank in a market that is defined by the institution’s ability to provide services consistent with sound, prudent principles and to fulfill the social, economic, moral and political considerations ordinarily associated with a responsible, well-run financial institution. |

F I N A N C I A L H I G H L I G H T S

| (amounts in thousands, except per share data) | 2009 | 2008 | % Increase (decrease) | |||||||

| Performance for the year ended December 31, |

||||||||||

| Interest income |

$ | 24,517 | $ | 28,175 | (13.0%) | |||||

| Interest expense |

$ | 8,750 | $ | 10,665 | (18.0%) | |||||

| Net interest income |

$ | 15,767 | $ | 17,510 | (10.0%) | |||||

| Net income |

$ | 4,402 | $ | 6,401 | (31.2%) | |||||

| Shareholders’ Value (per share) |

||||||||||

| Net income - basic |

$ | 2.82 | $ | 4.17 | (32.4%) | |||||

| Net income - diluted |

$ | 2.79 | $ | 4.05 | (31.1%) | |||||

| Dividends |

$ | 1.44 | $ | 1.32 | 9.1% | |||||

| Book value |

$ | 30.21 | $ | 28.53 | 5.9% | |||||

| Market value |

$ | 33.00 | $ | 38.00 | (13.2%) | |||||

| Market value/book value ratio |

109.2 | % | 133.2 | % | (18.0%) | |||||

| Price/earnings multiple |

11.7 | X | 9.1 | X | 28.6% | |||||

| Dividend yield |

4.36 | % | 3.47 | % | 25.6% | |||||

| Financial Ratios |

||||||||||

| Return on average assets |

.90 | % | 1.43 | % | (37.1%) | |||||

| Return on average equity |

9.58 | % | 15.28 | % | (37.3%) | |||||

| Shareholders’ equity/asset ratio |

8.88 | % | 9.41 | % | (5.6%) | |||||

| Dividend payout ratio |

51.06 | % | 31.65 | % | 61.3% | |||||

| Nonperforming assets/total assets |

1.90 | % | 1.81 | % | 5.0% | |||||

| Allowance for loan loss as a % of loans |

1.53 | % | 1.42 | % | 7.7% | |||||

| Net charge-offs/average loans |

.12 | % | .26 | % | (53.8%) | |||||

| Allowance for loan loss/nonaccrual loans |

83.10 | % | 1,392.1 | % | (94.0%) | |||||

| Allowance for loan loss/nonperforming loans |

64.6 | % | 86.6 | % | (81.8%) | |||||

| Risk-based capital |

11.7 | % | 11.9 | % | (1.7%) | |||||

| Financial Position at December 31, |

||||||||||

| Assets |

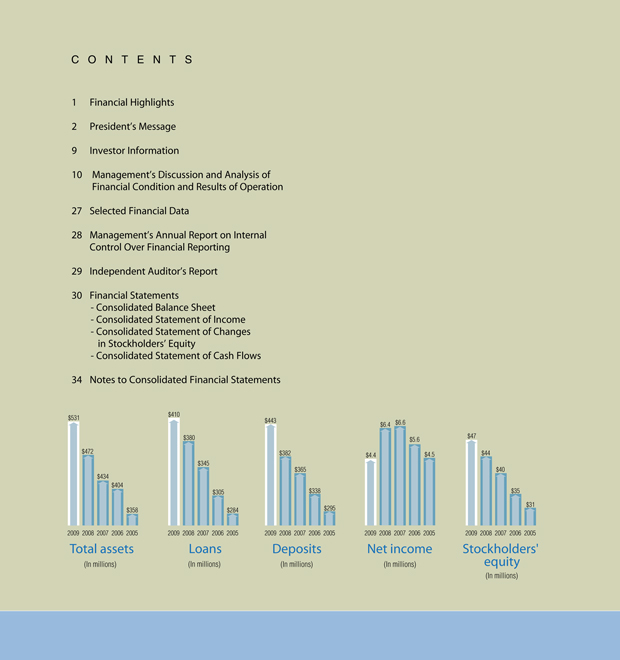

$ | 530,657 | $ | 472,478 | 12.3% | |||||

| Loans |

$ | 410,012 | $ | 380,207 | 7.8% | |||||

| Deposits |

$ | 443,116 | $ | 381,989 | 16.0% | |||||

| Stockholders’ equity |

$ | 47,117 | $ | 44,468 | 6.0% | |||||

Dear Shareholder:

| DIMECO, INC. OFFICERS | THE DIME BANK OFFICERS | |||

| WILLIAM E. SCHWARZ | WILLIAM E. SCHWARZ | MARCIA F. GUBERMAN | ||

| Chairman of the Board | Chairman of the Board | Vice President | ||

| JOHN S. KIESENDAHL | JOHN S. KIESENDAHL | FRANK R. REDINGTON | ||

| Vice Chairman of the Board | Vice Chairman of the Board | Vice President | ||

| GARY C. BEILMAN | JOHN F. SPALL | CHERYL A. SMITH | ||

| President and Chief Executive Officer | Assistant Secretary | Vice President | ||

| MAUREEN H. BEILMAN Chief Financial Officer, Treasurer and Assistant Secretary

PETER BOCHNOVICH Senior Vice President and Assistant Secretary

JOHN F. SPALL Secretary

TDB INSURANCE SERVICES, LLC OFFICERS

GARY C. BEILMAN President

PETER BOCHNOVICH Secretary

MAUREEN H. BEILMAN Treasurer

JOSEPH PIZZO Vice President |

GARY C. BEILMAN President and Chief Executive Officer

MAUREEN H. BEILMAN Chief Financial Officer and Treasurer

PETER BOCHNOVICH Senior Vice President and Assistant Secretary

L. JILL GEORGE Vice President

JOSEPH W. ADAMS Vice President

MARY CAROL CICCO Vice President

RUTH E. DANIELS Vice President

JANETTE M. DAVIS Vice President

THOMAS M. DIDATO Vice President |

JEROME D. THEOBALD Vice President

DEBORAH L. UNFLAT Vice President

MICHELLE E. URBAN Assistant Vice President

CYNTHIA D. BURDICK Bank Security Officer

AMY L. BURKE Community Office Manager

JAN M. HOADLEY Community Office Manager

MARY JANE HUNTER Trust Officer

NANCY M. LAVENDUSKI Loan Officer

MELANIE F. SEAGRAVES Community Office Manager

LINDA S. TALLMAN Secretary | ||

| ||||

I N V E S T O R I N F O R M A T I O N

| CORPORATE HEADQUARTERS P.O. Box 509 820 Church Street Honesdale, PA 18431 570-253-1970 email: dimeco@thedimebank.com www.thedimebank.com

INDEPENDENT AUDITORS S.R. Snodgrass, A.C. 2100 Corporate Drive, Suite 400 Wexford, PA 15090-7647 724-934-0344 www.srsnodgrass.com

LEGAL COUNSEL Malizia Spidi & Fisch, P.C. 901 New York Avenue, N.W. Suite 210 East Washington, DC 20001 202-434-4660 www.malizialaw.com |

TRANSFER AGENT Registrar and Transfer Company 10 Commerce Drive Cranford, NJ 07016 800-368-5948 email: info@rtco.com www.rtco.com

For change of name, address, or to replace lost stock certificates, write or call the securities transfer division.

DIVIDEND REINVESTMENT PLAN The Company offers a plan for stockholders to automatically reinvest their dividends in shares of common stock. There are no brokerage commissions or fees imposed. For more information contact the transfer agent.

ANNUAL MEETING Shareholders are cordially invited to attend the Annual Meeting of Shareholders, which will be held at The Community Room of the Wayne County Chamber of Commerce Building, 303 Commercial Street, Honesdale, PA on Thursday, April 22, 2010 at 2:00 pm. |

FIRMS KNOWN TO HANDLE DIMECO, INC. STOCK TRANSACTIONS Boenning & Scattergood, Inc.* Four Tower Bridge 200 Barr Harbor Drive, Suite 300 West Conshohocken, PA 19428-2979 610-862-5368 or 800-842-8928

Howe Barnes Hoefer & Arnett, Inc.* 21B South Main Street Cohasset, MA 02025 781-383-3350 888-239-4463 www.howebarnes.com

RBC Wealth Management 2101 Oregon Pike Lancaster, PA 17601-9669 717-519-5940 or 866-604-1471

Stifel Nicolaus* 7111 Fairway Drive, Suite 301 Palm Beach Gardens, FL 33418 800-793-7226

* Denotes Market Maker |

9

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATION

This consolidated review and analysis of Dimeco, Inc. (the “Company”) is intended to assist the reader in evaluating the performance of the Company for the years ended December 31, 2009 and 2008. This information should be read in conjunction with the consolidated financial statements and accompanying notes to the consolidated financial statements.

Dimeco, Inc., headquartered in Honesdale, Pennsylvania, is the one-bank holding company of The Dime Bank (the “Bank”), which is wholly-owned by the Company. TDB Insurance Services, LLC, a limited liability company, offering title insurance services, was formed by the Bank and is owned 100% by the Bank. Both the Company and the Bank derive their primary income from the operation of a commercial bank, including earning interest on loans and investment securities, fees on services performed and providing investment and trust services. The Bank’s main expenses are related to interest paid on deposits and other borrowings along with salary and benefits for employees. The Bank operates six full-service branches in Honesdale, Hawley, Damascus, Greentown and Dingmans Ferry, Pennsylvania, two off-site automatic teller machines, one each in Wayne and Pike County, Pennsylvania and an operations center in Wayne County, Pennsylvania. Principal market areas include Wayne and Pike Counties, Pennsylvania and Sullivan County, New York. The Bank employed 113 full-time employees and 19 part-time employees at December 31, 2009.

FORWARD-LOOKING STATEMENT

This Management Discussion and Analysis section of the Annual Report contains certain forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). In the normal course of business, we, in an effort to help keep our shareholders and the public informed about our operations, may from time to time issue or make certain statements, either in writing or orally, that are or contain forward-looking statements, as that term is defined in the U.S. federal securities laws. Generally, these statements relate to business plans or strategies, projections involving anticipated revenues, earnings, profitability or other aspects of operating results or other future developments in our affairs or the industry in which we conduct business. Forward-looking statements may be identified by reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “expect,” “intend,” “plan,” “estimate” or similar expressions.

Although we believe that the anticipated results or other expectations reflected in our forward-looking statements are based on reasonable assumptions, we can give no assurance that those results or expectations will be attained. Forward-looking statements involve risks, uncertainties and assumptions (some of which are beyond our control), and as a result actual results may differ materially from those expressed in forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include, but are not limited to, the following, as well as those discussed elsewhere herein:

| • | our investments in our businesses and in related technology could require additional incremental spending, and might not produce expected deposit and loan growth and anticipated contributions to our earnings; |

| • | general economic or industry conditions could be less favorable than expected, resulting in a deterioration in credit quality, a change in the allowance for loan and lease losses or a reduced demand for credit or fee-based products and services; |

| • | changes in the interest rate environment could reduce net interest income and could increase credit losses; |

| • | the conditions of the securities markets could change, which could adversely affect, among other things, the value or credit quality of our assets, the availability and terms of funding necessary to meet our liquidity needs and our ability to originate loans and leases; |

| • | changes in the extensive laws, regulations and policies governing financial holding companies and their subsidiaries could alter our business environment or affect our operations; |

| • | the potential need to adapt to industry changes in information technology systems, on which we are highly dependent, could present operational issues or require significant capital spending; |

10

| • | competitive pressures could intensify and affect our profitability, including as a result of continued industry consolidation, the increased availability of financial services from non-banks, technological developments such as the internet or bank regulatory reform; and |

| • | acts or threats of terrorism and actions taken by the United States or other governments as a result of such acts or threats, including possible military action, could further adversely affect business and economic conditions in the United States generally and in our principal markets, which could have an adverse effect on our financial performance and that of our borrowers and on the financial markets and the price of our common stock. |

You should not put undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events except to the extent required by federal securities laws.

NON-GAAP FINANCIAL MEASURES

This annual report contains or references tax-equivalent interest income and yields, which are non-GAAP financial measures. Tax-equivalent interest income and yields are derived from GAAP interest income using an assumed tax rate of 34%. We believe the presentation of interest income and yield on a tax-equivalent basis ensures comparability of interest income and yield arising from both taxable and tax-exempt sources and is consistent with industry practice. Although the Company believes that these non-GAAP financial measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP measures.

CRITICAL ACCOUNTING POLICIES

The Company’s accounting policies are integral to understanding the results reported. The accounting policies are described in detail in Note 1 of the “Notes to Consolidated Financial Statements.” Our most complex accounting policies require management’s judgment to ascertain the valuation of assets, liabilities, commitments and contingencies. We have established detailed policies and control procedures that are intended to ensure that valuation methods are well controlled and applied consistently from period to period. In addition, the policies and procedures are intended to ensure that the process for changing methodologies occurs in an appropriate manner. The following is a brief description of our current accounting policies involving significant management valuation judgments.

Allowance for Loan Losses

Arriving at an appropriate level of allowance for loan losses involves a high degree of judgment. The Company’s allowance for loan losses provides for probable losses based upon evaluations of known and inherent risks in the loan portfolio.

Management uses both historical and current information relating to the loan portfolio, as well as general economic information, in order to determine our estimation of the prevailing business environment. The probability of collection of loans is affected by changing economic conditions and various external factors which may impact the portfolio in ways currently unforeseen. We monitor this information in an effort to assess the adequacy of the allowance for loan losses. The allowance is increased by provisions for loan losses and by recoveries of loans previously charged-off and reduced by loans charged-off. For a full discussion of the Company’s methodology of assessing the adequacy of the reserve for loan losses refer to Note 1 of the “Notes to Consolidated Financial Statements.”

Mortgage Servicing Rights

The Bank originates residential mortgages that are sold in the secondary market. It is the Bank’s normal practice to retain the servicing of these loans, meaning that the customers whose loans have been sold in the secondary market still make their monthly payments to the Bank. As a result of these mortgage loan sales, the Bank capitalizes a value allocated to the servicing rights categorized in other assets and recognizes other income from the sale and servicing of these loans. The capitalized servicing rights are amortized against noninterest income in proportion to the estimated net servicing income over the remaining periods of the underlying financial assets.

11

Capitalized servicing rights are evaluated for impairment periodically based upon the fair value of the rights as compared to amortized cost. The rights are deemed to be impaired when the fair value of the rights is less than the amortized cost. The fair value of the servicing rights is estimated using projected, discounted cash flows by means of a computer pricing model, based on objective characteristics of the portfolio and commonly used industry assumptions.

Deferred Tax Assets

The Company uses an estimate of future earnings to support our position that the benefit of our deferred tax assets will be realized. If future income should prove non-existent or less than the amount of the deferred tax assets within the tax years to which they may be applied, the asset may not be realized and our net income will be reduced. Our deferred tax assets are described further in Note 11 of the “Notes to Consolidated Financial Statements.”

Other than Temporary Impairment of Investments

Investments are evaluated periodically to determine whether a decline in their value is other than temporary. Management utilizes criteria such as the magnitude and duration of the decline, in addition to the reasons underlying the decline, to determine whether the loss in value is other than temporary. The term “other than temporary” is not intended to indicate that the decline is permanent. It indicates that the prospects for a near term recovery of value are not necessarily favorable, or that there is a lack of evidence to support fair values equal to, or greater than, the carrying value of the investment. Once a decline in value is determined to be other than temporary, the value of the security is reduced and a corresponding charge to earnings is recognized.

All dollars are stated in thousands, with the exception of per share numbers.

STATEMENT OF CONDITION

Total assets increased by $58,179 or 12.3% during the year ended December 31, 2009. Loans, investments and cash on hand were the main areas of this growth which was mainly funded by deposits, in particular time deposits.

Cash and cash equivalents increased by $17,294 or 433.1% from December 31, 2008 to December 31, 2009. The primary increase was in interest-bearing deposits in other banks of $13,928. As deposits grew during the year, we placed these funds in loans and investments and maintained liquidity by placing funds in cash or cash equivalents. We monitor cash requirements to assure that we have funds available for loan closings and time deposit maturities which is partially accomplished by keeping funds in accounts with immediate availability. Management attempts to balance interest-bearing deposits and has kept levels of federal funds sold and interest-bearing deposits at what we believe the optimum configuration in this historically low interest rate environment. Therefore balances of interest-bearing deposits are greater due to higher interest rates paid on these balances than earned on money kept in federal funds sold. In addition, we continue to monitor cash on hand, and have been able to maintain lower balances in the branch network, lowering these balances by $317 or 19.0% at the end of 2009 as compared to a year earlier.

Investment securities available for sale increased $8,028 or 12.2% at December 31, 2009 from balances one year earlier. Balances of U.S. government agency bonds increased $11,568 or 109.6% greater than at December 31, 2008. During the year, we purchased investments in U.S. government agency and tax-exempt municipal bonds while lowering balances of commercial paper. Although we have historically used commercial paper as a favorable source of liquidity since these issues typically mature within a few months of purchase, issues of high quality paper slowed in 2009 and those that were offered frequently paid a lower interest rate than we were able to earn on balances held at the Federal Reserve Bank of Philadelphia. We purchased $16,000 of U.S. government agency step-up bonds during the year which offer the opportunity of higher interest rates in future periods but also contain callable features. These bonds were purchased because they offered higher interest rates than other bonds available at the time and included the opportunity for increased rates in future periods even though we understand that they will be called if market interest rates become lower than the step-up rates of the security. In addition, we purchased $3,996 of U.S. government agency bonds without step-up features which offered favorable interest rates, $2,945 of adjustable rate SBA pool bonds which offer a payment stream as the underlying loans make payments and $1,463 of mortgage backed securities that also have monthly principal payments. We are beginning to increase holdings of bonds which offer monthly principal payments in the portfolio in order to offset the liquidity decline in the investment portfolio since we have not been purchasing the same level of commercial paper as in previous years. Balances of tax-exempt municipal bonds increased $5,556 or 26.3% as these investments continued to offer favorable tax-equivalent interest rates over other offerings at the time purchased.

12

The largest portion of asset growth was centered in loans for 2009. Total loans increased by $29,805 or 7.8%, during the year with loans secured by commercial real estate showed the greatest growth at $25,636 or 11.8% greater than the prior year. The most significant increase was $12,478 in loans to finance children’s summer camps. We continued to originate loans for purchase or improvement of children’s summer camps while maintaining our stringent reviews of each loan in order to maintain the quality of our loan portfolio. Management monitors the concentration levels of loans granted in each industry. Due to reaching the maximum level of loans to the children’s summer camp industry, we originated and sold participations of an additional $9,750 in these loans to other financial institutions in 2009. In addition, $6,158 of loans were granted for acquisition and the associated production of stone quarries. We established several new relationships with customers in the health services profession, resulting in an increase of $4,045 in this business sector. We have continued to originate loans to finance real estate investment with balances of this type loan increasing $3,365 over the previous year end. Loans to borrowers along with principal reductions or pay-offs of loans in various industries account for the remaining changes from December 31, 2008. The loan department has upheld their conservative underwriting guidelines and continued to grant loans for qualified business development. Construction and development loans increased $2,883 or 21.5% at December 31, 2009 as compared to a year earlier. This category represents loans to construct 1 – 4 family residential properties. Loan balances outstanding increase as projects progress toward completion therefore the balances at the end of 2009 were for loans which were closer to completion than balances a year earlier. Balances of home equity lines of credit increased $2,315 or 36.5% during 2009 as homeowners used the equity in their homes to take advantage of historically low interest rates to consolidate other higher costing debt. Our standard policy is to lend up to a total of 80% of a recent appraised home value for residential mortgages. First lien residential mortgage volume was very robust for 2009 with 191 mortgages being closed totaling $29,938. This compares to 91 mortgages closed totaling $14,979 in 2008. The high volume was a result of historically low interest rates creating refinancing opportunities for borrowers. The majority of these originations were sold on the secondary market to avoid the interest rate risk associated with holding long term fixed rates. Consumer loans declined $1,450 or 10.6% which we believe is a direct reflection of the overall reduction in consumer spending being evidenced throughout the United States economy.

The December 31, 2008 balance of $1,955 in other real estate owned declined to $389 at the end of 2009. The largest property in that category, a former automobile dealership carried at $1,566, was sold in the third quarter of 2009 with the Company recognizing a loss of $141. The balance at December 31, 2009 consisted of two residential properties.

In the fourth quarter of 2009, the FDIC mandated that all insured financial institutions prepay an estimate of three years assessments as a means to collect enough cash to meet upcoming liquidity needs to fund future resolutions. We were never required to prepay these assessments in the past therefore the balance of $2,309 at December 31, 2009 was unmatched in 2008.

Other assets increased $2,629 or 56.2% from December 31, 2008 to December 31, 2009. In January 2009, we invested $2,729 to purchase a one third interest in a limited partnership that will own and operate a residential housing project and is expected to generate federal income tax credits over the next ten years. There is a small additional investment required when the project receives their certificate of occupancy which we expect to happen in 2010. Other smaller changes in various assets make up the additional change, no one of which independently is material.

Deposits increased by $61,127 or 16.0% in 2009. Balances of noninterest-bearing deposits increased $2,061 or 5.5% with new relationships developed both through marketing initiatives in all branches and new accounts opened in the Lake Region branch which began operation in December 2008. The greatest contributor to deposit growth came from time deposits which increased $59,379 or 26.3% over balances one year earlier. Of that increase in time deposits, $44,149 was in certificates of deposit greater than or equal to $100. Several public entities in our marketplace contact us for pricing on short term certificates of deposit and we typically are able to accept some of each of these bids. Balances of certificates of deposit at December 31, 2009 included $7,830 more deposits from those entities than we had a year earlier. During 2009 we offered special interest rates on certificates of deposit for 7 months and 9 months in order to attract new customers to all branches but in particular to the Lake Region branch which was opened in December 2008. The special certificate of deposit product attracted many customers who would not necessarily have entered our branches and gave our branch personnel the opportunity to cross sell other products to those customers. We were successful to some degree in cross sells but did also attract special certificate of deposit accounts without cross sells. We have another opportunity to complete those cross sells when those customers come back in to the branches in 2010 upon maturity of the deposit and believe that our staff will open other accounts at that time. We do recognize that this effort will not be completely successful and expect to lose a percentage of those deposits at maturity. Funds were invested in the higher

13

yielding certificates of deposit not only from new customers but also from transfers of funds out of other noninterest-bearing and interest-bearing deposit accounts. We have lowered the interest rates on these specials in 2010 and will monitor the results of that strategy to determine the best course of action as the year unfolds. We have garnered some additional deposits from customers who have signed gas leases for their properties that are in the Marcellus Shale region. This area is expected to offer one of the largest natural gas deposits in the United States and we expect to gather additional deposits as drilling begins and royalties are paid to residents in northern Wayne county and other areas that are part of this geographical territory.

Short-term borrowings declined $5,697 or 34.2% from balances at December 31, 2008. Balances in our Financial Manager account, which is a commercial sweep product, increased $469 or 4.5% over the period. Short-term borrowings at the Federal Home Loan Bank of Pittsburgh (“FHLB”) of $6,166 at the end of 2008 were repaid during the year with no corresponding balance at December 31, 2009. Of these repayments, $3,166 was in overnight borrowings at FHLB and was repaid in January 2009 while $3,000 was the short-term portion of longer term borrowings.

CAPITAL RESOURCES

Stockholders’ Equity of $47,117 at December 31, 2009 represented an increase of $2,649 or 6.0% from the previous year end. Net income of $4,402 was the primary source of this increase, representing earnings per share of $2.82 and a return on average equity of 9.58%. Dividends of $2,244, or $1.44 per share, were returned to shareholders.

The Company’s capital position at December 31, 2009 as it relates to regulatory guidelines is presented below:

| Dimeco, Inc. | Well-Capitalized | Minimum Requirements | ||||

| Leverage Ratio |

9.47% | 5.00% | 4.00% | |||

| Tier I Capital Ratio |

10.47% | 6.00% | 4.00% | |||

| Total Capital Ratio |

11.73% | 10.00% | 8.00% | |||

LIQUIDITY

The liquidity risk in financial institutions is based upon the institution’s ability to have sources of funds available to meet its needs for the outflow of cash at any specific time. Liquidity begins with cash and cash equivalents, which Dimeco, Inc. defines as cash on hand and in banks, along with overnight investments in federal funds sold. Balances of these accounts totaled $21,287 or 4.0% of total assets at December 31, 2009. This amount is supplemented by various other sources of liquidity. We analyze our liquidity at least quarterly considering cash and cash equivalents along with other sources of liquidity. These sources include principal and interest payments on loans, the opportunity to borrow funds, deposit generation, sales and maturities of investment securities, sales of residential loans in the secondary market, participations of other commercial loans, access to certificates of deposit through a brokered network and operating income. An integral part of this analysis of our liquidity position is our borrowing capacity. The Bank has a credit line of $183,321 at the FHLB with $158,919 available at December 31, 2009. We also have the ability to borrow from the Federal Reserve Bank of Philadelphia discount window and have an agreement with one of our correspondent banks that would allow us to borrow additional funds if needed. Uses of liquidity include origination of loans for addition to our portfolio and to sales in the secondary market, purchases of investment securities, capital projects, operating expenses and payment of dividends. A review of the Consolidated Statement of Cash Flows indicates the sources of funds generated and used during the past three years. The key is to maintain appropriate levels of liquidity to allow for customers’ cash needs from both a lending and deposit perspective, to maintain sufficient cash for operating expenses and to have amounts available to take advantage of earning opportunities as they arise.

Companies in the financial service industry are dependent on their ability to maintain proper levels of short-term and long-term liquidity. Both short-term and long-term liquidity are primarily generated through the methods enumerated above. The Company may also acquire funds by issuance of additional common stock. The primary source of liquidity for the Company has been through origination of deposits both with our ability to maintain current deposits and garner new funds. It continues to be the main source of funds, but has been augmented by the Bank’s ability to borrow from outside sources. The borrowing capacity at the FHLB is viewed as both a long-term and short-term source of liquidity. In the short term, it provides the ability to borrow overnight or for other short-term funds as needed. The FHLB also has long-term funding products which supplement those needs that are longer term in nature.

14

Management believes that the Company has sufficient liquidity to meet both its short-term and long-term needs. We understand that liquidity may be adversely affected by many factors including unexpected deposit outflows, aggressive competitive pricing by other financial intermediaries and other cash requirements. We are aware of our dependence on customers’ deposits to sustain our liquidity levels. We are also aware of customer concerns relating to recent bank failures and constant news reports of uncertainty regarding the banking industry. We have sustained our level of disseminating information regarding our financial position and have continued to reiterate the fact that we did not get involved in subprime lending or risky investments. We believe that the FDIC’s increased insurance levels have assisted us to maintain deposits in light of this increased customer concern of the financial services industry.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk is inherent in the financial services industry, encompassing the risk of loss associated with adverse changes in market interest rates and prices. As an organization, we have placed the management of this risk in the Asset/Liability Committee (“ALCO”). This committee is comprised of ten members including all senior officers, vice presidents representing each product offering, information technology, community banking and marketing. The committee follows guidelines enumerated in the ALCO policy which was developed to achieve earnings consistent with established goals while maintaining acceptable levels of interest rate risk, adequate levels of liquidity and adherence to regulatory mandates. The committee reports to the Board of Directors on at least a quarterly basis.

Asset market risk is most prevalent in the investment and loan portfolios. With interest rates continuing at low levels, it has continued to be difficult to locate and purchase investments with the credit quality required by our guidelines that offer yields that we believe will offer long term benefit for the Company. We continued to purchase well rated tax-exempt municipal bonds along with U.S. government agency bonds as the most appropriate investments available in the market. Management has maintained a portfolio which includes investments in short term commercial paper and U.S. government agencies that contain interest rate step-ups and calls over the life of the bonds along with callable municipal bonds. All investments are held in the available for sale category but management anticipates holding all investments to maturity or call date and has historically not had the need to sell investments for liquidity needs. Interest rates on consumer loans are determined by the Loan Committee and reviewed by the ALCO and are subject to change continually. The committees review local rates along with internal rate guidelines to determine the appropriate interest rates to charge. Commercial loan rates are determined on a case by case basis and are dependent on the characteristics of each loan and borrower. The Loan Committee instituted interest rates with floors on a majority of all new loans originated in 2009 and continues to negotiate the introduction of floor interest rates as revolving lines of credit are reviewed or loan terms are extended. Market risk inherent in loans held for sale has been mitigated by controlling the length of time between origination and sale of these loans. The balance of loans in this category is generally less than $500.

To address credit risk, both the loan portfolio and the investment portfolio have stringent guidelines as to the credit quality of acceptable investments. These guidelines are dictated by the safety and soundness provisions of the regulators which govern the Bank and the Company.

Liability market risk is associated with the adverse affects of our pricing strategies compared to competitors’ pricing strategies. The markets in which we have offices are also served by other financial institutions. If there is not enough flexibility in our pricing models to quickly move interest rates on deposits, we may lose accounts to other financial intermediaries. We have offered special certificate of deposit products at times and at other times borrowed funds from the FHLB at current market rates rather than meet inflated interest rates offered by competitors. We believe that by working within our guidelines we will continue to achieve profitability.

The ALCO is cognizant of the ability of interest rates to adversely affect assets, liabilities, capital, and interest income and expense. In particular, two analytical tools are used to ascertain our ability to manage this market risk. The first is the Statement of Interest Sensitivity Gap. This report matches all interest-earning assets and all interest-bearing liabilities by the time frame in which funds can be reinvested or repriced. The second report is the Analysis of Sensitivity to Changes in Market Interest Rates which is used to determine the affect on income of various shifts in the interest rate environment. Both reports include inherent assumptions in order to process the information. Management is aware that

15

these assumptions affect results and that actual results may differ from the projected results suggested by these tools. These assumptions include an estimate of the maturity or repricing times of deposits, even though all deposits, other than time deposits, have no stated maturity and the reference that interest rate shifts will be parallel, with the rates of assets and liabilities shifting in the same amount in the same time frame. In reality, various assets and various liabilities will react differently to changes in interest rates, with some lagging behind the change and some anticipating the upcoming change and reacting before any actual change occurs. Each tool also suggests that there is a propensity to replace assets and liabilities with similar assets and liabilities rather than taking into consideration management’s ability to reallocate the balance sheet. In addition, the models used do not include any elements to determine how an action by management to increase or decrease interest rates charged on loans or paid on deposits or to increase other borrowings will affect the results of the analysis. Despite these limitations, these analyses are good tools to use in a consistent fashion to assist in the management of the Company. Similar versions of these same reports are used by most financial institutions. Both measurements are as of December 31, 2009.

STATEMENT OF INTEREST SENSITIVITY GAP

| 90 days or less |

>90 days but < 1 year |

1 - 5 years |

>5 years | Total | |||||||||||

| Assets |

|||||||||||||||

| Interest-bearing deposits in other banks |

$ | 17,296 | $ | - | $ | - | $ | - | $ | 17,296 | |||||

| Investment securities |

20,975 | 9,949 | 13,686 | 29,018 | 73,628 | ||||||||||

| Loans (1) (4) |

72,809 | 136,140 | 109,593 | 84,969 | 403,511 | ||||||||||

| Rate sensitive assets |

$ | 111,080 | $ | 146,089 | $ | 123,279 | $ | 113,987 | $ | 494,435 | |||||

| Liabilities |

|||||||||||||||

| Interest-bearing deposits: |

|||||||||||||||

| Interest-bearing demand (2) |

$ | 3,167 | $ | 9,896 | $ | 26,521 | $ | - | $ | 39,584 | |||||

| Money market (3) |

7,001 | 20,590 | 13,589 | - | 41,180 | ||||||||||

| Savings (2) |

2,983 | 9,322 | 24,983 | - | 37,288 | ||||||||||

| Time deposits |

83,558 | 154,578 | 47,241 | - | 285,377 | ||||||||||

| Short-term borrowings |

10,974 | - | - | - | 10,974 | ||||||||||

| Other borrowings |

2,455 | 2,395 | 11,577 | 7,975 | 24,402 | ||||||||||

| Rate sensitive liabilities |

$ | 110,138 | $ | 196,781 | $ | 123,911 | $ | 7,975 | $ | 438,805 | |||||

| Interest sensitivity gap |

$ | 942 | $ | (50,692) | $ | (632) | $ | 106,012 | $ | 55,630 | |||||

| Cumulative gap |

$ | 942 | $ | (49,750) | $ | (50,382) | $ | 55,630 | |||||||

| Cumulative gap to total assets |

.18% | (9.38%) | (9.49%) | 10.48% | |||||||||||

| (1) | Loans are included in the earlier period in which interest rates are next scheduled to adjust or in which they are due. No adjustment has been made for scheduled repayments or for anticipated prepayments. |

| (2) | Interest-bearing demand deposits and savings are segmented based on the percentage of decay method. The decay rates used include 8% “90 days or less,” 25% “ >90 days but <1 year” and 67% “1-5 years.” |

| (3) | Money market deposits are segmented based on the percentage of decay method. The decay rates used include “90 days or less” 17%, “>90 days but < 1 year” 50% and “1-5 years” 33%. |

| (4) | Does not include loans in nonaccrual status, deposit overdrafts, unposted items or deferred fees on loans. |

| (5) | Investments are included in the earlier period in which interest rates are next scheduled to adjust or in which they are due. |

Included are U.S. Government Agency step-up bonds characterized by having tiered interest rates over their life. Due to this feature these securities have been reallocated from their maturity date to their next step-up date. The specific impact of this policy by timeframe is as follows: “90 days or less” increased $2,500, “>90 but < 1 year” increased $7,985, “1-5 years” decreased $4,559 and “>5 years” decreased $5,926. In addition, municipal bonds and corporate bonds with market values of $2,500 and $1,230, respectively, have been reallocated from the “> 5 year” category to the “90 days or less“ because they are variable interest rate bonds, some of which have a put feature. A corporate bond with a market value of $249 was reallocated from “1-5 years” to “90 days or less” because the interest rate reprices quarterly.

16

This report shows the Company to be in an asset sensitive position of $942 in 90 days or less, meaning that there are more assets which will reprice in this period than liabilities. Traditionally management focuses the greatest attention to the net gap of the balance sheet in the second time frame, assets and liabilities which mature in less than or equal to one year. Our statement shows that the Company becomes liability sensitive in this cumulative time frame, with $49,750 of net liabilities repricing in the next twelve months. With interest rates at historic lows, this liability sensitive position offers the opportunity to reprice some liabilities to lower rates but is typically not the ideal position to be in for rising rates. Given the current low interest rate environment, we have seen declines in the interest earned on assets in direct proportion to the market declines. On the liability side, we have been hampered in decreasing interest rates past a minimum of something just above zero. Therefore, as interest rates begin to increase, the assets will certainly increase but liabilities will lag as to increases because we have not been able to decrease them in the same proportion that our standard strategy would have indicated. Management has established a range of sensitivity that we feel depicts prudent banking practice and we manage the balance sheet to be within that range. The most conservative position is perfectly balanced in any time frame.

The following table presents the Company’s potential sensitivity in net interest income, net income and equity value at risk, or the potential of adverse change in the economic value of equity (“EVE”) with rates up or down 100 and 200 basis points. EVE is the present value of assets minus the present value of liabilities at a point in time.

ANALYSIS OF SENSITIVITY TO CHANGES IN MARKET INTEREST RATES

| 100 basis points | 200 basis points | |||||||||||||||||||||||||||

| Up | Down | Up | Down | |||||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | Amount | % | |||||||||||||||||||||

| Net interest income |

$ | 178 | 1.12 % | $ | 482 | 3.04% | $ | 223 | 1.41 % | $ | (1,085) | (6.85)% | ||||||||||||||||

| Net income |

$ | 131 | 3.09 % | $ | 309 | 7.30% | $ | 171 | 4.04 % | $ | (731) | (17.25)% | ||||||||||||||||

| EVE |

$ | (2,274) | (3.97)% | $ | 2,943 | 5.14% | $ | (5,396) | (9.42)% | $ | 6,731 | 11.75 % | ||||||||||||||||

The greatest risk to the Company from an income perspective is an immediate decline in market interest rates of 200 basis points. With a sudden shift of that magnitude we would experience a decline of $731 or 17.25% of net income. With market interest rates at their current levels, we believe that a decline of this magnitude is near impossible. In the EVE measurement, an increase of 200 basis points would affect the Company by lowering equity by $5,396 or 9.42%, a level that is within our established tolerance limits. Management believes that we have the ability to affect the changes in income and equity by taking actions which are not factored in this analysis.

ALLOWANCE FOR LOAN LOSSES

The allowance for loan losses represents the amount that management estimates is adequate to provide for probable losses inherent in the loan portfolio. It is the largest subjective measurement in the financial statements. The balance is derived by charging losses against the allowance while recoveries are credited to it with charges to provision expense providing the amount necessary to maintain the appropriate balance per our analysis. As of December 31, 2009, the balance of the Company’s allowance was $6,253 which represented 1.53% of the loan portfolio at that date.

Given the current national economic condition there has been greater concern regarding higher-risk lending. The Company has no option ARM loans, negative amortizing loans, interest-only loans, subprime loans, or loans with initial teaser rates. We do, however, grant junior lien residential mortgage loans. Balances of these loans were $17,085, or 4.2% of total loans at December 31, 2009. These loans are made for various reasons capitalizing on the borrower’s home equity values for which the loans are typically granted with a maximum loan to value ratio of 80%. In addition, the Company has granted other loans with residential real estate serving as collateral for which the loan to value ratio is greater than 80%. These loans represent less than 1.0% of total loans at December 31, 2009.

Provision expense is based on management’s periodic evaluation of the adequacy of the allowance for loan losses, taking into consideration the overall risk characteristics of the portfolio, our specific loan loss experience, current and projected economic conditions, industry loan experience and other relevant factors. These estimates, including the amounts and timing of future cash flows relating to impaired loans, used to determine the adequacy of the allowance are particularly

17

susceptible to significant change. The total allowance for loan losses is a combination of a specific allowance for identified problem loans, a formula allowance and a qualitative allowance. The specific allowance is determined by measuring impairment based upon the practices outlined in U.S generally accepted accounting standards. These standards prescribe methods to measure impairment and income recognition as well as documenting disclosure requirements. The formula allowance is calculated using two separate methods. First, we apply factors to outstanding loans by type and risk weighting, excluding those loans for which a specific allowance has been determined. These loss factors are determined by management using historical loss information, current economic factors, portfolio concentration analysis, current delinquency ratios and the experience level of the loan officers in conjunction with evaluations of specific loans during the loan review process. The second formula evaluates selected loans on an individual basis and allocates specific amounts to the allowance based on our internal risk assessment. The qualitative portion of the allowance is determined based upon management’s evaluation of a number of factors including: national and local economic business conditions, collateral values within the portfolio, credit quality trends and management’s evaluation of our particular loan portfolio as a whole.

The Company employs an experienced outside professional loan review agency to perform the loan review function. This review places each evaluated loan in a category ranging from prime quality to loss. In order to test the majority of the commercial loan category, a review of loan relationships is performed to include approximately 70% of the average portfolio. Current financial information of the customer, an analysis of loan concentrations, financial ratio comparisons, adherence to payment schedule, regulatory evaluations and peer comparisons are all considered in the loan review procedure. Management evaluates all loans that are not included in the third party loan review process utilizing similar guidelines. After careful evaluation of all factors, a risk rate is assigned and an amount is calculated for each category of reviewed loans. Groups of smaller dollar loans are evaluated as a homogeneous pool with similar factors used to evaluate the appropriateness of the allowance for those loans.

SUMMARY OF LOAN LOSS EXPERIENCE

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Balance January 1, |

$ | 5,416 | $ | 5,392 | $ | 4,469 | $ | 3,973 | $ | 3,172 | |||||

| Charge-offs: |

|||||||||||||||

| Commercial, financial and agricultural |

187 | 139 | 146 | 37 | 106 | ||||||||||

| Real estate-construction |

- | - | - | - | - | ||||||||||

| Real estate-mortgage |

144 | 691 | - | 181 | - | ||||||||||

| Installment loans to individuals |

187 | 178 | 214 | 153 | 200 | ||||||||||

| Total charge-offs |

518 | 1,008 | 360 | 371 | 306 | ||||||||||

| Recoveries: |

|||||||||||||||

| Commercial, financial and agricultural |

- | 6 | 4 | 5 | 46 | ||||||||||

| Real estate-construction |

- | - | - | - | - | ||||||||||

| Real estate-mortgage |

5 | 1 | 19 | 6 | 141 | ||||||||||

| Installment loans to individuals |

50 | 75 | 130 | 71 | 70 | ||||||||||

| Total recoveries |

55 | 82 | 153 | 82 | 257 | ||||||||||

| Net charge-offs |

463 | 926 | 207 | 289 | 49 | ||||||||||

| Additions charged to operations |

1,300 | 950 | 1,130 | 785 | 850 | ||||||||||

| Balance at December 31, |

$ | 6,253 | $ | 5,416 | $ | 5,392 | $ | 4,469 | $ | 3,973 | |||||

| Ratio of net charge-offs during the period to average loans outstanding during the period |

.12% | .26% | .06% | .10% | .02% | ||||||||||

| Allowance for loan loss as a % of loans outstanding |

1.53% | 1.42% | 1.56% | 1.46% | 1.40% | ||||||||||

18

Included in the footnotes to the financial statements are schedules which include the total loans which were past due 90 days or more or in nonaccrual and/or impaired status. At December 31, 2009, $7,418 of loans were classified as impaired. Included in that balance are three loans to one borrower totaling $1,751 for which all payments have been made and were not delinquent at December 31, 2009. These loans were placed in impaired status due to cash flow concerns that their financial statements do not show evidence of the ability to make all future payments. The company has been able to make payments due to financial contributions of the principals who have substantial assets which would allow them to continue to finance cash shortfalls until the company has the ability to make all payments in accordance with the loan agreement. Also included in impaired loans are $1,861 to customers who have been slow making payments but for which we believe we have sufficient collateral value and, therefore didn’t record any specific allowance on those loans. We had one relationship including four loans totaling $3,806 that did not made any payments in 2009. We have commenced foreclosure proceedings on the collateral but do not expect the sheriff sale until sometime in the first half of 2010. Our allowance calculation for these loans added $1,103 to the allowance at December 31, 2009. At December 31, 2008, there was one loan in impaired status with a balance of $267. The level of loans past due 90 days or more and still accruing interest at December 31, 2009 was $2,152. The majority of these loans are secured by real estate and management does not believe that we have any one loan that would have a material charge to the allowance for loan loss. Loans in nonaccrual status were $7,522 at December 31, 2009 with the majority of those loans also classified as impaired as of the balance sheet date. The majority of these loans were secured by real estate and in the process of collection. Due to the current economic climate, we have experienced a noticeably longer timeframe for loans to be in an adverse position before we are able to take ownership of the assets. Local government agencies responsible to enforce the collection process have experienced a large backlog due to the increase in legal collection actions and have not increased their staffing due to their own budgetary issues. We continue to proceed with collection efforts but expect that those actions may take a minimum of one year until these conditions improve.

OFF-BALANCE SHEET ARRANGEMENTS

In the normal course of business, the Company engages in a variety of financial transactions that in accordance with generally accepted accounting principles are not recorded on its consolidated financial statements. These off-balance sheet arrangements primarily consist of loan commitments, letters of credit and unused lines of credit, including commercial lines for the financing needs of our customers. These off-balance sheet arrangements involve, to varying degrees, elements of credit, interest rate, and liquidity risk. During the year ended December 31, 2009, the Company did not engage in any off-balance sheet transactions reasonably likely to have a material effect on its consolidated financial condition, results of operations or cash flows.

RESULTS OF OPERATIONS

2009 Compared to 2008

Net income for the year ended December 31, 2009 was $4,402, a decline of $1,999 or 31.2% from a year earlier. The Company encountered several obstacles to performing at the same level in 2009 as it had in 2008. With interest rates remaining at the same low levels as the year 2008 ended, interest spread was compressed. The FDIC increased its assessment rates for insured financial institutions during the year. In addition, economic conditions made it more difficult for our customers to make timely payments on some loans, driving our delinquency levels higher which resulted in an increase in nonaccrual loans and the provision for loan loss. Offsetting some of those issues, we were able to begin new relationships in all of our branches by offering deposit products at historically low interest rates. We also improved our technological position by instituting new delivery methods and outsourcing computer processing to a third party which we believe will position the Company for the future growth and prosperity. Although net income dropped in 2009, the income level of the Bank represented returns in the top third of similar sized banks in the United States. The following discussion will address each area of the income statement.

19

Net Interest Income

This discussion regarding net interest income should be read in conjunction with the schedule Distribution of Assets, Liabilities and Stockholders’ Equity: Interest Rates and Interest Differential and Rate/Volume Analysis of Changes in Net Interest Income.

Net interest income declined $1,743, or 10.0% ($1,409 or 7.9% on a tax-equivalent basis), as interest income declined at a faster rate than interest expense. The decline in interest income reflects the continued downward re-pricing of our interest-earning assets. Reflecting these same factors, our interest rate spread and net interest margin narrowed to 3.34% and 3.60%, respectively from 3.76% and 4.19%, respectively, in 2008.

Interest income declined $3,658 or 13.0% ($3,324 or 11.7% on a tax-equivalent basis) in 2009 as compared to 2008. Interest and fees earned on loans declined $3,076 or 12.1% in 2009 as compared to 2008. The average interest rate earned on loans declined by 1.27% in 2009 as compared to 2008. We had 77% of our loan portfolio invested in variable interest rate loans and we continued to see loans reprice downward in 2009. We typically offer to fix the interest rate on new loans for two to three years at the outset of projects in order to offer customers the ability to project stable cash flows; during 2009 we continued to see interest rates adjust downward as those loans reached their interest reprice date. We still have many loan relationships to reprice in 2010 and expect that interest income may be impacted by approximately $400 if interest rates remain constant.

Simultaneously, as we purchased investments, the interest rates available for new bonds were offered at lower rates than were available in our existing investment portfolio, resulting in a decrease of $842 or 41.4% in taxable interest income investments. The average balance of taxable investments declined by $10,865 due to our inability to purchase qualified commercial paper or corporate bonds as bonds matured throughout 2009. The rates we were able to earn on bonds to replace matured bonds carried lower market rates. We did invest in more tax-exempt bonds throughout 2008 and 2009, thereby increasing the average balance of those investments by $9,684 from 2008 to 2009, resulting in an increase in tax- equivalent interest income of $500 or 54.3%.

As a result of lower market interest rates in each interest-bearing liability account, interest expense declined by $1,915 or 18.0% in 2009 as compared to 2008. This decrease in expense was accomplished in spite of an average increase of $37,232 or 10.2% in interest-paying liabilities. Savings accounts increased $1,961 or 5.7% on average while the average rate paid for those deposits declined by 21 basis points in 2009 as compared to 2008. These changes resulted in a net decline of $66 in expense with the rate attributable for $76 decline and additional balances adding $10 to the expense. Interest-bearing demand deposits declined $5,936 or 6.9% as customers either used the funds for routine business and personal expenses or transferred the balances to higher interest rate products during 2009. The expense related to these deposits decreased $545 due primarily to a decline of $471 in relation to lower average interest rates paid for these deposits. Time deposits showed the greatest average balance growth of $32,739 or 15.7% during 2009 with the majority of the growth in short term special certificates of deposit. Many higher interest rate certificate of deposit accounts matured in 2009 and were reinvested in these lower interest rate special certificate of deposit accounts. In spite of this growth in the average balances, expense for time deposits decreased $1,361 with a decline of $2,654 related to lower average rates and an increase of $1,293 related to the higher average balance of these deposits. Local competition continued to offer interest rates much higher than national average rates for deposits and, in order to maintain relationships with our customers, we also paid a higher rate than the national average. We expect to further lower rates on certificates of deposit gradually as interest rates remain flat and expect to be slower to increase those rates as market rates move upward. Average balances of other borrowed funds increased $8,606 or 44.6% primarily due to borrowings made during 2008. During 2009, we borrowed $1,850 but repaid $4,746 to decrease the year-end balance of these borrowings. The expense related to these borrowings increased $172 with the primary element being additional expense of $413 related to higher average balances and an offset of $241 related to a decline of 87 basis points in the average rate paid for the borrowings. In an effort to increase profitability, management has continued to offer programs aimed at attracting as many noninterest-bearing deposits as possible and will continue with this effort.

20

DISTRIBUTION OF ASSETS, LIABILITIES AND STOCKHOLDERS’ EQUITY;

INTEREST RATES AND INTEREST DIFFERENTIAL

| 2009 | 2008 | 2007 | ||||||||||||||||||||||

| Average Balance (3) |

Revenue/ Expense |

Yield/ Rate |

Average Balance (3) |

Revenue/ Expense |

Yield/ Rate |

Average Balance (3) |

Revenue/ Expense |

Yield/ Rate | ||||||||||||||||

| ASSETS |

||||||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||

| Loans, net of unearned (1)(2)(4) |

$ | 387,767 | $ | 22,530 | 5.81% | $ | 359,119 | $ | 25,442 | 7.08% | $ | 324,706 | $ | 26,107 | 8.04% | |||||||||

| Investment securities: |

||||||||||||||||||||||||

| Taxable (5) |

37,090 | 1,194 | 3.22% | 47,955 | 2,036 | 4.25% | 61,604 | 3,249 | 5.27% | |||||||||||||||

| Exempt from federal income tax (2) |

24,116 | 1,421 | 5.89% | 14,432 | 921 | 6.38% | 9,105 | 552 | 6.05% | |||||||||||||||

| Interest-bearing deposits in other banks |

3,971 | 12 | .30% | 911 | 22 | 2.41% | 605 | 30 | 4.96% | |||||||||||||||

| Federal funds sold |

2,549 | 7 | .27% | 3,505 | 67 | 1.91% | 3,946 | 201 | 5.09% | |||||||||||||||

| Total interest-earning assets/ interest income |

455,493 | 25,164 | 5.52% | 425,922 | 28,488 | 6.69% | 399,966 | 30,139 | 7.54% | |||||||||||||||

| Cash and due from banks |

4,947 | 5,395 | 5,577 | |||||||||||||||||||||

| Premises and equipment |

11,099 | 8,127 | 5,743 | |||||||||||||||||||||

| Other assets, less allowance for loan losses |

20,245 | 8,534 | 7,802 | |||||||||||||||||||||

| Total Assets |

$ | 491,784 | $ | 447,978 | $ | 419,088 | ||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||

| Savings |

$ | 36,446 | $ | 116 | .32% | $ | 34,485 | $ | 182 | .53% | $ | 33,176 | $ | 246 | .74% | |||||||||

| Demand - interest-bearing |

80,369 | 533 | .66% | 86,305 | 1,078 | 1.25% | 80,333 | 1,828 | 2.28% | |||||||||||||||

| Time deposits |

241,220 | 6,882 | 2.85% | 208,481 | 8,243 | 3.95% | 200,886 | 9,403 | 4.68% | |||||||||||||||

| Short-term borrowings |

15,488 | 122 | .79% | 15,626 | 237 | 1.52% | 13,538 | 349 | 2.58% | |||||||||||||||

| Other borrowed funds |

27,889 | 1,097 | 3.93% | 19,283 | 925 | 4.80% | 16,410 | 775 | 4.72% | |||||||||||||||

| Total interest-bearing liabilities/ interest expense |

401,412 | 8,750 | 2.18% | 364,180 | 10,665 | 2.93% | 344,343 | 12,601 | 3.66% | |||||||||||||||

| Noninterest-bearing deposits |

40,489 | 38,014 | 33,530 | |||||||||||||||||||||

| Other liabilities |

3,936 | 3,887 | 3,526 | |||||||||||||||||||||

| Total Liabilities |

445,837 | 406,081 | 381,399 | |||||||||||||||||||||

| Stockholders’ Equity |

45,947 | 41,897 | 37,689 | |||||||||||||||||||||

| Total Liabilities and Stockholders’ Equity |

$ | 491,784 | $ | 447,978 | $ | 419,088 | ||||||||||||||||||

| Net interest income/interest spread |

$ | 16,414 | 3.34% | $ | 17,823 | 3.76% | $ | 17,538 | 3.88% | |||||||||||||||

| Margin Analysis: |

||||||||||||||||||||||||

| Interest income/earning assets |

$ | 25,164 | 5.52% | $ | 28,488 | 6.69% | $ | 30,139 | 7.54% | |||||||||||||||

| Interest expense/earning assets |

8,750 | 1.92% | 10,665 | 2.50% | 12,601 | 3.15% | ||||||||||||||||||

| Net interest income/earning assets |

$ | 16,414 | 3.60% | $ | 17,823 | 4.19% | $ | 17,538 | 4.38% | |||||||||||||||

| Ratio of average interest-earning assets to average interest-bearing liabilities |

113.47% | 116.95% | 116.15% | |||||||||||||||||||||

| (1) | Nonaccrual loans are not included. |

| (2) | Income on tax-exempt assets is calculated on a taxable equivalent basis using a federal income tax rate of 34%. (3) Average balances are calculated using daily balances. |

| (3) | Average balances are calculated using daily balances. |

| (4) | Interest on loans includes fee income. |

| (5) | Includes equity investments in FHLB and ACBB for 2007, 2008. In 2009 FHLB paid no dividend and the investment was moved to other assets for that year. |

Certain amounts for prior years have been reclassified in order to conform to current presentation.

21

RATE/VOLUME ANALYSIS OF CHANGES IN NET INTEREST INCOME

| 2009 Compared to 2008 | 2008 Compared to 2007 | |||||||||||||||||

| Total Variance |

Caused by | Total Variance |

Caused by | |||||||||||||||

| Rate(1) | Volume | Rate(1) | Volume | |||||||||||||||

| Interest income: |

||||||||||||||||||

| Loans (gross) |

$ | (2,912) | $ | (4,940) | $ | 2,028 | $ | (665) | $ | (3,432) | $ | 2,767 | ||||||

| Investment securities: |

||||||||||||||||||

| Taxable |

(842) | (380) | (462) | (1,213) | (493) | (720) | ||||||||||||

| Exempt from federal income tax (2) |

500 | (118) | 618 | 369 | 46 | 323 | ||||||||||||

| Interest-bearing deposits |

(10) | (84) | 74 | (8) | (23) | 15 | ||||||||||||

| Federal funds sold |

(60) | (42) | (18) | (134) | (112) | (22) | ||||||||||||

| Total interest-earning assets |

(3,324) | (5,564) | 2,240 | (1,651) | (4,014) | 2,363 | ||||||||||||

|

Interest expense: |

||||||||||||||||||

| Savings |

(66) | (76) | 10 | (64) | (74) | 10 | ||||||||||||

| Interest-bearing checking |

(545) | (471) | (74) | (750) | (886) | 136 | ||||||||||||

| Time deposits |

(1,361) | (2,654) | 1,293 | (1,160) | (1,516) | 356 | ||||||||||||

| Short-term borrowings |

(115) | (113) | (2) | (112) | (166) | 54 | ||||||||||||

| Other borrowed funds |

172 | (241) | 413 | 150 | 14 | 136 | ||||||||||||

| Total interest-bearing liabilities |

(1,915) | (3,555) | 1,640 | (1,936) | (2,628) | 692 | ||||||||||||

| Net change in net interest income |

$ | (1,409) | $ | (2,009) | $ | 600 | $ | 285 | $ | (1,386) | $ | 1,671 | ||||||

| (1) | Changes in interest income or expense not arising solely as a result of volume or rate variances are allocated to rate variances due to the interest sensitivity of assets and liabilities. |

| (2) | Income on interest-earning assets is calculated on a taxable equivalent basis using a federal income tax rate of 34%. |

Provision for Loan Losses

The provision for loan losses for 2009 was $1,300, representing an increase of $350 or 36.8% over this expense in 2008.

Management analyzes the characteristics of the loan portfolio through the calculation of the allowance for loan loss and determines the appropriate balance for the allowance. The balance is funded through provision expense after adjustments for loans charged off and recoveries of loans that were charged off in previous periods. The net balance of loans charged off during 2009 was $463 compared to $926 in 2008. The calculation of the appropriate balance in the allowance for loan loss results in an acceptable range for the allowance.

Noninterest Income

Noninterest income increased $194 or 5.2% in 2009 as compared to 2008 primarily due to the sale of mortgage loans. Service charges on deposit accounts are the largest contributor to noninterest income with income of $1,497 for 2009. Fees charged in relation to overdrafts on checking accounts were $1,385 in 2009, a decrease of $137 or 9.0% less than the previous year. We believe that consumers are taking a more active role in managing their finances and using the overdraft protection feature of their deposit account less frequently. We did not increase the fee charged per use for this privilege from 2008 to 2009. In addition, we eliminated minimum balance fees on many of our checking accounts in 2009 in an effort to increase market penetration for this important funding liability. By eliminating those fees, we saw a decline of $29 or 34.0% in fees earned in 2009 as compared to 2008. We are willing to accept lower minimum balance fees in order to be more competitive for new deposits and to effectively compete with other institutions in our markets.

Mortgage loan originations were much stronger in 2009 than in the previous year and by selling the majority of those loans in the secondary market we were able to increase earnings on those sales by $448 or 292.8%. The majority of the loan originations were for refinances of mortgages not only from loans which we had previously originated but also from those that were previously originated by mortgage brokers, many of whom have either gone out of business or severely limited their operations as the economy deteriorated.

Investment security losses were $142, an increase of $114 or 407.1% in 2009 than in 2008. In the first quarter of 2009, we recognized a loss of $27 on an equity investment in a financial institution that was merged with another institution.

22

In the third quarter of 2009 we sold a corporate bond which had declined in credit quality and market value and partially offset this loss with the sale of two municipal bonds that had an increase in market value, with the net effect of those sales recognizing a net loss of $22 on these sales. In addition, we recognized a loss of $93 on the reorganization of the issuer of a corporate bond that was held in the corporate bond portfolio.

Brokerage commissions declined $117 or 19.0% in 2009 as compared to 2008. Declines in the market values of customers’ equity positions negatively affected the earnings of the investments department as their fee income is partially based on a percentage of the market value of customers’ investment portfolios. In addition, this department saw lower initial interest in customers’ willingness to invest in the stock market during this volatile economic period. We believe that activity will improve for this department in correlation to improvement in the national economy.

Other income increased $119 or 12.2% in 2009 over income in 2008. This category includes many sources of other than interest related items. The most notable of these was an increase of $62 or 17.2% in interchange fees related to the use of debit cards by our customers. In recent years management decided to offer debit cards to nearly all deposit customers with no internal fee attached to usage of the cards, thereby dramatically increasing the number of debit cards issued. We earn a small fee each time a customer uses the credit option for point of sale transactions and have seen a large increase in this income due to this strategy. Smaller changes in various income categories accounted for the remaining increased income.

Noninterest Expense

Salaries and employee benefits decreased $93 or 1.5% in 2009 as compared to 2008. Salaries and wages increased $174 or 3.9% in 2009 over the previous year and were mainly due to percentage wage increases. We tried to maintain staffing rather than hire additional staff as our income level declined during the year. Payroll incentives declined $330 or 82.7% in 2009 as compared to 2008 since these incentives are based on predetermined goals that were not attained in 2009. A 2% across the board incentive was approved for employees in 2009 as a portion of the goals set for the year were attained and management recognized that economic conditions hampered attainment of some goals. Employee benefits expense continued to increase during 2009 with $87 or 9.1% higher costs than the previous year. The primary increase was associated with an increase in the cost of medical insurance per employee along with a greater number of employees becoming eligible for benefits. Contributions to employees’ 401(k) plans decreased $54 or 17.9% in 2009 as compared to 2008 due to the level of profit sharing declining by 2%. The level of employer matching did not change but due to lower net income for the Company, the Board of Directors felt it appropriate to grant a smaller profit sharing benefit for the year. Smaller changes on other payroll expenses accounted for the remaining difference in 2009 as compared to 2008.

Occupancy expense increased $216 or 24.8% in 2009 as compared to 2008 due primarily to the added expenses of operating an additional branch during 2009. The Lake Region branch opened in December 2008 so we recognized the expense of operating that facility for the entire year 2009 as compared to one month in 2008.

Furniture and equipment expense increased $49 or 9.4% in 2009 as compared to 2008 with the primary component of the increase related to operation of the Lake Region branch for the entire year.

Data processing expenses increased $305 or 85.0% due to management’s decision to outsource this function in March 2009. By shifting this function we were able to utilize personnel for other electronic banking functions while offering the ability to grow the Company without capacity concerns.

The FDIC insurance assessment for 2009 increased $642 or 279.1% more than in 2008 as that federal agency needed additional funds to weather the economic storm of bank closings and the costs related to those closings. The sudden downturn in the national economy in 2008 resulted in an unprecedented number of bank closings in 2009, leading the FDIC to increase assessments in order to bring the insurance fund’s reserve ratio to the statutorily mandated minimum of 1.15% of insured deposits.

Other expense increased $174 or 7.8% from 2008 to 2009. This category encompasses all remaining expenses associated with the operation of a financial services company. The largest category of increase is in loss on the sale of other real estate which was $144 in 2009 as compared to $27 in 2008. In taking this loss, we were able to put $1,892 of assets back into the interest-earning category and cease to incur additional expenses in relation to ownership of those properties. Those ownership expenses were $63 in 2009 as compared to $18 of expenses in 2008. Telephone expenses

23

were $37 or 17.8% greater in 2009 than the previous year due to the addition of lines for the Lake Region branch and additional usage of all lines for the year. To partially offset those increases we curtailed some other operating expenses in 2009. The largest decline in expenses was in travel and entertainment expense. Travel expense to conferences and seminars was limited in 2009 while replacing several daily courier runs between offices serving to decrease this expense by $55 or 54.4% than in the previous year. The remaining increase was due to smaller changes in various other accounts, none of which are material alone.

Income Taxes

Income taxes decreased $1,194 or 43.5% primarily due to the decline in income before income taxes of $3,193 or 34.9% from 2008 to 2009 but also due to an increase in tax-exempt investments and loans during 2008 and 2009 which served to lower the effective tax rate to 26.1% from 30.1% in 2008.

2008 Compared to 2007

Net income for the year ended December 31, 2008 was $6,401, a decline of $211 or 3.2% from a year earlier. The year 2008 presented us with interest rate challenges greater than we have experienced in previous years. In addition, several expenses were higher due to increased operating costs in conjunction with the opening of our sixth branch in December 2008. The following discussion will address each area of the income statement.

Net Interest Income

Net interest income was $17,510, an increase of $160 or .9% over 2007 as declining interest rates reduced our cost of funds more rapidly than our interest income. This discussion regarding net interest income should be read in conjunction with the schedule Distribution of Assets, Liabilities and Stockholders’ Equity: Interest Rates and Interest Differential and Rate/Volume Analysis of Changes in Net Interest Income.

Interest income declined $1,776 or 5.9% ($1,651 or 5.5% on a tax-equivalent basis) in 2008 as compared to 2007 with interest rates decreasing throughout the year, ending with a total decline of 4.00% in the prime rate of interest at year end. Interest and fees earned on loans decreased $665 or 2.6% as these rates declined over the period. As can be seen in the above report, the average balances of loans increased by $34,413 or 10.6% while the average rate received on the portfolio declined to 7.08% from 8.04% one year earlier. The ratio of variable or adjustable rate loans included in our loan portfolio was 74.4% at December 31, 2008, with the majority of these loans tied to changes in the prime rate of interest. Most loans have a spread to the prime rate of between 25 and 250 basis points but lag actual market changes for up to two years. We expect to continue to see a decline in the average rates earned on the loan portfolio as the variable rate loans hit their repricing date and other loans mature and are replaced by loans at current market rates.

Interest earned on taxable investment securities declined $1,213 or 37.3% in 2008 as compared to 2007. The average balance of taxable investment securities, which declined $13,649 or 22.2%, contributed to a decrease of $720 of income. Declines in market interest rates contributed to the remainder of the decrease in taxable investment income since at the end of 2007 we had 55.5% of debt securities invested in short-term commercial paper with maturities of less than 90 days as compared to 31.4% of the these securities at the end of 2008. We have historically used these investments to complement our liquidity needs while receiving a better rate of interest as compared to other short-term investments. In light of credit quality issues that emerged during 2008 with many issuers of commercial paper, we decreased balances of these investments and increased investment in short-term highly rated corporate bonds, longer term municipal securities and in U.S. government agency bonds. This strategy increased the average balance of tax-exempt obligations of states and political subdivisions by $5,327 or 58.5% which accounted for $323 greater tax-equivalent income in 2008 while slightly higher interest rates added $46 to this income category.

Interest expense declined by $1,936 or 15.4% in 2008 as compared to 2007. Lower market interest rates accounted for $2,628 of the decrease with greater balances offsetting that decline by $692, resulting in total interest expense of $10,665 in 2008. Although we were not able to mirror changes in market interest rates throughout the year, we have decreased interest rates in every category by an average of 73 basis points. It was not possible to decrease the rates on lower costing liabilities in direct proportion to market rate declines because our rates were lower than the total rate of decline. In this regard, we will continue to see tightening of interest rate spread because rates are at historical lows. Management has been diligent in trying to attract as many noninterest-bearing deposits as possible and is continuing with this effort for 2009.

24

Provision for Loan Losses