Attached files

| file | filename |

|---|---|

| EX-21.1 - APOLLO GOLD CORP | v177510_ex21-1.htm |

| EX-31.1 - APOLLO GOLD CORP | v177510_ex31-1.htm |

| EX-31.2 - APOLLO GOLD CORP | v177510_ex31-2.htm |

| EX-32.1 - APOLLO GOLD CORP | v177510_ex32-1.htm |

| EX-23.1 - APOLLO GOLD CORP | v177510_ex23-1.htm |

| EX-10.34 - APOLLO GOLD CORP | v177510_ex10-34.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

(Mark

one)

|

R

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended December 31, 2009

or

|

£

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ____ to ____

Commission

File Number: 001-31593

Apollo

Gold Corporation

(Exact

name of registrant as specified in its charter)

|

Yukon

Territory

|

Not

Applicable

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

5655

S. Yosemite Street, Suite 200

Greenwood

Village, Colorado 80111-3220

(Address

of Principal Executive Offices Including Zip Code)

Registrant’s

telephone number, including area code: (720) 886-9656

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which

Registered

|

|

|

Common

Shares, no par value

|

NYSE

Amex

|

|

|

Toronto

Stock Exchange

|

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes £

No R

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes £

No R

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes R No

£

Indicate

by a check mark whether the registrant has submitted electronically and posted

on its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such filed). Yes £ No

R

Indicate

by a check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. R

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definition of “large accelerated filer”, “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check

one):

|

Large

accelerated filer £

|

Accelerated

filer R

|

|

Non-accelerated

filer £ (do not

check if a smaller reporting company)

|

Smaller

Reporting Company £

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).Yes £

No R

As of

June 30, 2009, the aggregate market value of the registrant’s voting common

stock held by non-affiliates of the registrant was $95,828,992 based upon the

closing sale price of the common stock as reported by the NYSE Amex on that

date.

As of

March 15, 2010, the registrant had 273,080,927 common shares, no par value per

share, outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

Part III

of this Annual Report on Form 10-K is incorporated by reference from the

registrant’s definitive Proxy Statement for its 2010 Annual Meeting of

Shareholders to be filed pursuant to Regulation 14A no later than 120 days after

the close of the registrant’s fiscal year.

TABLE

OF CONTENTS

|

12

|

|||

|

24

|

|||

|

38

|

|||

|

38

|

|||

|

47

|

|||

|

48

|

|||

|

50

|

|||

|

52

|

|||

|

73

|

|||

|

74

|

|||

|

75

|

|||

|

75

|

|||

|

76

|

|||

|

77

|

|||

|

78

|

|||

|

83

|

|||

|

F-1

|

|||

-2-

REPORTING

CURRENCY, FINANCIAL AND OTHER INFORMATION

All

amounts in this Report are expressed in United States (“U.S.”) dollars. Unless

otherwise indicated Canadian currency is denoted as “Cdn$.”

Financial

information is presented in accordance with generally accepted accounting

principles (“GAAP”) in the U.S. (“U.S. GAAP”). Differences between accounting

principles generally accepted in Canada (“Cdn GAAP”) and those applied in the

U.S., as applicable to Apollo Gold Corporation, are discussed in Note 23 to the

Consolidated Financial Statements.

Information

in Part I and II of this report includes data expressed in various measurement

units and contains numerous technical terms used in the gold mining industry. To

assist readers in understanding this information, a conversion table and

glossary are provided below.

References

to “Apollo Gold,” “Apollo,” the “Company,” “we,” “our,” or “us” mean Apollo Gold

Corporation, its predecessors and consolidated subsidiaries, or any one or more

of them, as the context requires.

NON-GAAP

FINANCIAL MEASURES

In this

Annual Report on Form 10-K, we use the terms “cash operating costs,” “total cash

costs,” and “total production costs,” each of which are considered non-GAAP

financial measures as defined in the United States Securities and Exchange

Commission (the “SEC”) Regulation S-K Item 10 and should not be considered in

isolation or as a substitute for measures of performance prepared in accordance

with GAAP. These terms are used by management to assess performance of

individual operations and to compare our performance to other gold

producers.

The term

“cash operating costs” is used on a per ounce of gold basis. Cash operating

costs per ounce is equivalent to direct operating cost as found on the

Consolidated Statements of Operations, less production royalty expenses and

mining taxes but includes by-product credits for payable silver.

The term

“total cash costs” is equivalent to cash operating costs plus production

royalties and mining taxes.

The term

“total production costs” is equivalent to total cash costs plus non-cash costs

including depreciation and amortization.

These

measures are not necessarily indicative of operating profit or cash flow from

operations as determined under GAAP and may not be comparable to similarly

titled measures of other companies. See Item 7, Management’s Discussion and

Analysis of Financial Condition and Results of Operations for a reconciliation

of these non-GAAP measures to our Statements of Operations.

STATEMENTS

REGARDING FORWARD-LOOKING INFORMATION

This

Annual Report on Form 10-K and the documents incorporated by reference in this

report contain forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995, with respect to our financial condition, results

of operations, business prospects, plans, objectives, goals, strategies, future

events, capital expenditures, and exploration and development efforts.

Forward-looking statements can be identified by the use of words such as “may,”

“should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “intends,” “continue,” or the negative of such terms, or other

comparable terminology. These statements include comments

regarding:

-3-

|

|

·

|

plans

for the development of and production at the Black Fox project including,

without limitation, estimates of future production at Black Fox, the

determination to commence underground mining at Black Fox and the timing

thereof, timing and issue of permits, including permits necessary to

conduct phase II of open pit mining at Black Fox, whether the open pit

will provide sufficient feed to the mill , the commissioning of the new

conveyor, the recommissioning of the high pressure screen system and the

expansion of the tailings dam water management system plans for the

further development of the Black Fox

project;

|

|

|

·

|

our

ability to reschedule quarterly principal payments under the Black Fox

project finance facility;

|

|

|

·

|

our

ability to meet our repayment obligations under the Black Fox project

finance facility;

|

|

|

·

|

plans

for and our ability to finance exploration at our Huizopa, Grey Fox, and

Pike River properties;

|

|

|

·

|

the

potential for an open pit minable area at

Huizopa;

|

|

|

·

|

our

ability to repay the convertible debentures issued to RAB Special

Situations (Master) Fund Limited (“RAB”) due August 23,

2010;

|

|

|

·

|

future

financing of projects;

|

|

|

·

|

liquidity

to support operations and debt

repayment;

|

|

|

·

|

the

effect of regulatory compliance on the

Company;

|

|

|

·

|

the

establishment and estimates of mineral reserves and

resources;

|

|

|

·

|

daily

production, mineral recovery rates and mill throughput

rates;

|

|

|

·

|

total

production costs;

|

|

|

·

|

cash

operating costs;

|

|

|

·

|

total

cash costs;

|

|

|

·

|

grade

of ore mined and milled from Black Fox and cash flows

therefrom;

|

|

|

·

|

anticipated

expenditures for development, exploration, and corporate

overhead;

|

|

|

·

|

expansion

plans for existing properties;

|

|

|

·

|

estimates

of closure costs and reclamation

liabilities;

|

|

|

·

|

our

ability to obtain financing to fund our estimated expenditure and capital

requirements;

|

|

|

·

|

factors

impacting our results of operations;

and

|

|

|

·

|

the

impact of adoption of new accounting

standards.

|

Although

we believe that our plans, intentions and expectations reflected in these

forward-looking statements are reasonable, we cannot be certain that these

plans, intentions or expectations will be achieved. Our actual results could

differ materially from those anticipated in these forward-looking statements as

a result of the risk factors set forth below and other factors described in more

detail in this Annual Report on Form 10-K:

|

|

·

|

unexpected

changes in business and economic conditions, including the recent

significant deterioration in global financial and capital

markets;

|

|

|

·

|

significant

increases or decreases in gold

prices;

|

|

|

·

|

changes

in interest and currency exchange rates including the LIBOR

rate;

|

|

|

·

|

timing

and amount of production;

|

|

|

·

|

unanticipated

grade of ore changes;

|

|

|

·

|

unanticipated

recovery or production problems;

|

|

|

·

|

changes

in operating costs;

|

|

|

·

|

operational

problems at our mining properties;

|

|

|

·

|

metallurgy,

processing, access, availability of materials, equipment, supplies and

water;

|

|

|

·

|

determination

of reserves;

|

|

|

·

|

costs

and timing of development of new

reserves;

|

-4-

|

|

·

|

results

of current and future exploration and development

activities;

|

|

|

·

|

results

of future feasibility studies;

|

|

|

·

|

joint

venture relationships;

|

|

|

·

|

political

or economic instability, either globally or in the countries in which we

operate;

|

|

|

·

|

local

and community impacts and issues;

|

|

|

·

|

timing

of receipt of government approvals;

|

|

|

·

|

accidents

and labor disputes;

|

|

|

·

|

environmental

costs and risks;

|

|

|

·

|

competitive

factors, including competition for property

acquisitions;

|

|

|

·

|

availability

of external financing at reasonable rates or at all;

and

|

|

|

·

|

the

factors discussed in this Annual Report on Form 10-K under the heading

“Risk Factors.”

|

Many of

these factors are beyond our ability to control or predict. These factors are

not intended to represent a complete list of the general or specific factors

that may affect us. We may note additional factors elsewhere in this Annual

Report on Form 10-K and in any documents incorporated by reference into this

Annual Report on Form 10-K. All subsequent written and oral forward-looking

statements attributable to us, or persons acting on our behalf, are expressly

qualified in their entirety by the cautionary statements. Except as required by

law, we undertake no obligation to update any forward-looking statement to

reflect events or circumstances after the date on which it is made or to reflect

the occurrence of anticipated or unanticipated events or

circumstances.

GLOSSARY

OF TERMS

We report

our reserves on two separate standards to meet the requirements for reporting in

both Canada and the United States (“U.S.”). Canadian reporting requirements for

disclosure of mineral properties are governed by National Instrument 43-101 (“NI

43-101”). The definitions given in NI 43-101 are adopted from those given by the

Canadian Institute of Mining Metallurgy and Petroleum. U.S. reporting

requirements for disclosure of mineral properties are governed by SEC Industry

Guide 7. These reporting standards have similar goals in terms of conveying an

appropriate level of confidence in the disclosures being reported, but embody

differing approaches and definitions.

We

estimate and report our resources and reserves according to the definitions set

forth in NI 43-101 and modify and reconcile them as appropriate to conform to

SEC Industry Guide 7 for reporting in the U.S. The definitions for each

reporting standard are presented below with supplementary explanation and

descriptions of the parallels and differences.

|

NI

43-101 Definitions

|

||

|

indicated

mineral resource

|

The

term “indicated mineral resource” refers to that part of a mineral

resource for which quantity, grade or quality, densities, shape and

physical characteristics can be established with a level of confidence

sufficient to allow the appropriate application of technical and economic

parameters, to support mine planning and evaluation of the economic

viability of the deposit. The estimate is based on detailed and reliable

exploration and testing information gathered through appropriate

techniques from locations such as outcrops, trenches, pits, workings and

drill holes that are spaced closely enough for geological and grade

continuity to be reasonably

assumed.

|

-5-

|

inferred

mineral resource

|

The

term “inferred mineral resource” refers to that part of a mineral resource

for which quantity and grade or quality can be estimated on the basis of

geological evidence and limited sampling and reasonably assumed, but not

verified, geological and grade continuity. The estimate is based on

limited information and sampling gathered through appropriate techniques

from locations such as outcrops, trenches, pits, workings and drill

holes.

|

|

|

measured

mineral resource

|

The

term “measured mineral resource” refers to that part of a mineral resource

for which quantity, grade or quality, densities, shape and physical

characteristics are so well established that they can be estimated with

confidence sufficient to allow the appropriate application of technical

and economic parameters to support production planning and evaluation of

the economic viability of the deposit. The estimate is based on detailed

and reliable exploration, sampling and testing information gathered

through appropriate techniques from locations such as outcrops, trenches,

pits, workings and drill holes that are spaced closely enough to confirm

both geological and grade continuity.

|

|

|

mineral

reserve

|

The

term “mineral reserve” refers to the economically mineable part of a

measured or indicated mineral resource demonstrated by at least a

preliminary feasibility study. This study must include adequate

information on mining, processing, metallurgical, economic, and other

relevant factors that demonstrate, at the time of reporting, that economic

extraction can be justified. A mineral reserve includes diluting materials

and allowances for losses that might occur when the material is

mined.

|

|

|

mineral

resource

|

The

term “mineral resource” refers to a concentration or occurrence of

natural, solid, inorganic material or natural solid fossilized organic

material, including base and precious metals, coal and industrial metals

in or on the Earth’s crust in such form and quantity and of such a grade

or quality that it has reasonable prospects for economic extraction. The

location, quantity, grade, geological characteristics and continuity of a

mineral resource are known, estimated or interpreted from specific

geological evidence and knowledge.

|

|

|

probable

mineral reserve

|

The

term “probable mineral reserve” refers to the economically mineable part

of an indicated, and in some circumstances a measured mineral resource

demonstrated by at least a preliminary feasibility study. This study must

include adequate information on mining, processing, metallurgical,

economic, and other relevant factors that demonstrate, at the time of

reporting, that economic extraction can be justified.

|

|

|

proven

mineral reserve1

|

The

term “proven mineral reserve” refers to the economically mineable part of

a measured mineral resource demonstrated by at least a preliminary

feasibility study.

|

-6-

|

qualified

person2

|

The

term “qualified person” refers to an individual who is an engineer or

geoscientist with at least five years of experience in mineral

exploration, mine development, production activities and project

assessment, or any combination thereof, including experience relevant to

the subject matter of the mineral project or technical report and is a

member or licensee in good standing of a professional

association.

|

SEC

Industry Guide 7 Definitions

|

exploration

stage

|

An

“exploration stage” prospect is one which is not in either the development

or production stage.

|

|

|

development

stage

|

A

“development stage” project is one which is undergoing preparation of an

established commercially mineable deposit for its extraction but which is

not yet in production. This stage occurs after completion of a feasibility

study.

|

|

|

mineralized

material3

|

The

term “mineralized material” refers to material that is not included in the

reserve as it does not meet all of the criteria for adequate demonstration

for economic or legal extraction.

|

|

|

probable

reserve

|

The

term “probable reserve” refers to reserves for which quantity and grade

and/or quality are computed from information similar to that used for

proven (measured) reserves, but the sites for inspection, sampling, and

measurement are farther apart or are otherwise less adequately spaced. The

degree of assurance, although lower than that for proven reserves, is high

enough to assume continuity between points of

observation.

|

|

|

production

stage

|

A

“production stage” project is actively engaged in the process of

extraction and beneficiation of mineral reserves to produce a marketable

metal or mineral product.

|

|

|

proven

reserve

|

The

term “proven reserve” refers to reserves for which (a) quantity is

computed from dimensions revealed in outcrops, trenches, workings or drill

holes; grade and/or quality are computed from the results of detailed

sampling and (b) the sites for inspection, sampling and measurement are

spaced so closely and the geologic character is so well defined that size,

shape, depth and mineral content of reserves are

well-established.

|

|

|

reserve

|

The

term “reserve” refers to that part of a mineral deposit which could be

economically and legally extracted or produced at the time of the reserve

determination. Reserves must be supported by a feasibility study done to

bankable standards that demonstrates the economic extraction. (“Bankable

standards” implies that the confidence attached to the costs and

achievements developed in the study is sufficient for the project to be

eligible for external debt financing.) A reserve includes adjustments to

the in-situ tonnes and grade to include diluting materials and allowances

for losses that might occur when the material is

mined.

|

-7-

1

For Industry Guide 7 purposes this study must include adequate

information on mining, processing, metallurgical, economic, and other relevant

factors that demonstrate, at the time of reporting, that economic extraction is

justified.

2

Industry Guide 7 does not require designation of a qualified

person.

3

This category is substantially equivalent to the combined categories of

measured and indicated mineral resources specified in NI 43-101.

Additional

Definitions

|

adularia

|

a

transparent or translucent variety of orthoclase (a monoclinic

feldspar)

|

|

|

alloy

|

a

homogeneous mixture or solid solution of two or more

metals

|

|

|

breccia

|

rock

consisting of angular fragments of other rocks held together by mineral

cement or a fine-grained matrix

|

|

|

call

|

a

financial instrument that provides the right, but not the obligation, to

buy a specified number of ounces of gold or silver or of pounds of lead or

zinc at a specified price

|

|

|

doré

|

unrefined

gold bullion bars containing various impurities such as silver, copper and

mercury, which will be further refined to near pure

gold

|

|

|

electrum

|

an

alloy of silver and gold

|

|

|

epithermal

|

pertaining

to mineral veins and ore deposits formed from warm waters at shallow

depth

|

|

|

fault

|

a

rock fracture along which there has been displacement

|

|

|

feasibility

study

|

a

definitive engineering and economic study addressing the viability of a

mineral deposit taking into consideration all associated technical

factors, costs, revenues, and risks

|

|

|

fold

|

a

curve or bend of a planar structure such as rock strata, bedding planes,

foliation, or cleavage

|

|

|

formation

|

a

distinct layer of sedimentary rock of similar

composition

|

|

|

geotechnical

|

the

study of ground stability

|

|

|

grade

|

quantity

of metal per unit weight of host rock

|

|

|

host

rock

|

the

rock containing a mineral or an ore body

|

|

|

hydrothermal

|

the

products of the actions of heated water, such as a mineral deposit

precipitated from a hot solution

|

|

|

induced

polarization

|

an

exploration method which uses either the decay of an excitation voltage

(time-domain method) or variations in the Earth's resistivity at two

different but low frequencies (frequency-domain

method).

|

-8-

|

Mafic

|

pertaining

to or composed dominantly of the ferromagnesian rock-forming silicates;

said of some igneous rocks and their constituent

minerals

|

|

|

mapping

or geologic mapping

|

the

recording of geologic information such as the distribution and nature of

rock units and the occurrence of structural features, mineral deposits,

and fossil localities

|

|

|

metamorphism

|

the

process by which rocks are altered in composition, texture, or internal

structure by extreme heat, pressure, and the introduction of new chemical

substances

|

|

|

metasediment

|

a

sediment or sedimentary rock that shows evidence of having been subjected

to metamorphism

|

|

|

mineral

|

a

naturally formed chemical element or compound having a definite chemical

composition and, usually, a characteristic crystal form

|

|

|

mineralization

|

a

natural occurrence in rocks or soil of one or more metal yielding

minerals

|

|

|

mining

|

the

process of extraction and beneficiation of mineral reserves to produce a

marketable metal or mineral product. Exploration continues

during the mining process and, in many cases, mineral reserves are

expanded during the life of the mine operations as the exploration

potential of the deposit is realized.

|

|

|

National

Instrument 43-101

|

Canadian

standards of disclosure for mineral projects

|

|

|

open

pit

|

surface

mining in which the ore is extracted from a pit or quarry, the geometry of

the pit may vary with the characteristics of the ore

body

|

|

|

ore

|

mineral

bearing rock that can be mined and treated profitably under current or

immediately foreseeable economic conditions

|

|

|

ore

body

|

a

mostly solid and fairly continuous mass of mineralization estimated to be

economically mineable

|

|

|

outcrop

|

that

part of a geologic formation or structure that appears at the surface of

the earth

|

|

|

petrographic

|

the

systematic classification and description of rocks, especially by

microscopic examinations of thin sections

|

|

|

put

|

a

financial instrument that provides the right, but not the obligation, to

sell a specified number of ounces of gold or of pounds of lead or zinc at

a specified price

|

|

|

pyrite

|

common

sulfide of iron

|

|

|

quartz

|

a

mineral composed of silicon dioxide, SiO2

(silica)

|

-9-

|

reclamation

|

the

process by which lands disturbed as a result of mining activity are

modified to support beneficial land use. Reclamation

activity may include the removal of buildings, equipment, machinery and

other physical remnants of mining, closure of tailings storage facilities,

leach pads and other mine features, and contouring, covering and

re-vegetation of waste rock and other disturbed areas.

|

|

|

reclamation

and closure costs

|

the

cost of reclamation plus other costs, including without limitation certain

personnel costs, insurance, property holding costs such as taxes, rental

and claim fees, and community programs associated with closing an

operating mine

|

|

|

recovery

rate

|

a

term used in process metallurgy to indicate the proportion of valuable

material physically recovered in the processing of ore, generally stated

as a percentage of the material recovered compared to the total material

originally present

|

|

|

SEC

Industry Guide 7

|

U.S.

reporting guidelines that apply to registrants engaged or to be engaged in

significant mining operations

|

|

|

sedimentary

rock

|

rock

formed at the earth’s surface from solid particles, whether mineral or

organic, which have been moved from their position of origin and

redeposited

|

|

|

stockwork

|

a

complex system of structurally controlled or randomly oriented

veins

|

|

|

strike

|

the

direction or trend that a structural surface, e.g. a bedding or

fault plane, takes as it intersects the horizontal

|

|

|

strip

|

to

remove overburden in order to expose ore

|

|

|

sulfide

|

a

mineral including sulfur (S) and iron (Fe) as well as other elements;

metallic sulfur-bearing mineral often associated with gold

mineralization

|

|

|

vein

|

a

thin, sheet-like crosscutting body of hydrothermal mineralization,

principally quartz

|

|

|

volcanic

rock

|

originally

molten rocks, generally fine grained, that have reached or nearly reached

the earth’s surface before

solidifying

|

-10-

CONVERSION

FACTORS AND ABBREVIATIONS

For ease

of reference, the following conversion factors are provided:

|

1

acre

|

=

0.4047 hectare

|

1

mile

|

=

1.6093 kilometers

|

|||

|

1

foot

|

=

0.3048 meter

|

1

troy ounce

|

=

31.1035 grams

|

|||

|

1

gram per metric tonne

|

=

0.0292 troy ounce/short ton

|

1

square mile

|

=

2.59 square kilometers

|

|||

|

1

short ton (2000 pounds)

|

=

0.9072 tonne

|

1

square kilometer

|

=

100 hectares

|

|||

|

1

tonne

|

=

1,000 kg or 2,204.6 lbs

|

1

kilogram

|

=

2.204 pounds or 32.151 troy oz

|

|||

|

1

hectare

|

|

=

10,000 square meters

|

|

1

hectare

|

|

=

2.471 acres

|

The

following abbreviations could be used herein:

|

Ag

|

=

silver

|

m

|

=

meter

|

|||

|

Au

|

=

gold

|

m(2)

|

=

square meter

|

|||

|

Au

g/t

|

=

grams of gold per tonne

|

m(3)

|

=

cubic meter

|

|||

|

g

|

=

gram

|

Ma

|

=

million years

|

|||

|

ha

|

=

hectare

|

Oz

|

=

troy ounce

|

|||

|

km

|

=

kilometer

|

Pb

|

=

lead

|

|||

|

km(2)

|

=

square kilometers

|

t

|

=

tonne

|

|||

|

kg

|

=

kilogram

|

T

|

=

ton

|

|||

|

lb

|

|

=

pound

|

|

Zn

|

|

=

zinc

|

Note: All

units in this report are stated in metric measurements unless otherwise

noted.

-11-

PART

I

OVERVIEW

OF APOLLO GOLD

The

earliest predecessor to Apollo Gold Corporation was incorporated under the laws

of the Province of Ontario in 1936. In May 2003, it reincorporated under the

laws of the Yukon Territory. Apollo Gold Corporation maintains its registered

office at 204 Black Street, Suite 300, Whitehorse, Yukon Territory, Canada Y1A

2M9, and the telephone number at that office is (867) 668-5252. Apollo Gold

Corporation maintains its principal executive office at 5655 S. Yosemite Street,

Suite 200, Greenwood Village, Colorado 80111-3220, and the telephone number at

that office is (720) 886-9656. Our internet address is

http://www.apollogold.com. Information contained on our website is not a part of

this Annual Report on Form 10-K.

Apollo is

engaged in gold mining including extraction, and processing, as well as related

activities including exploration and development.

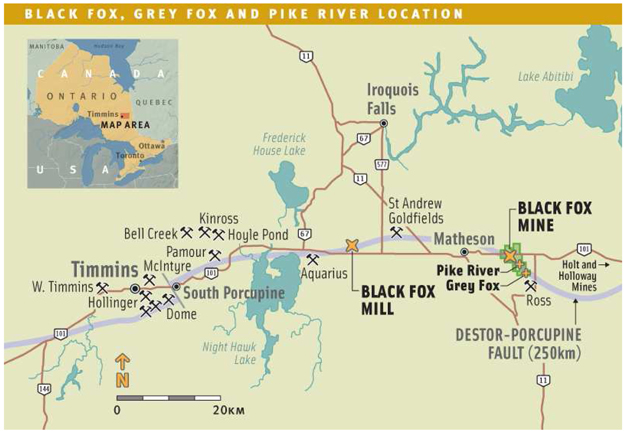

Apollo

owns Black Fox, an open pit and underground mine and mill located near Matheson

in the Province of Ontario, Canada (“Black Fox”). The Black Fox mine site is

situated seven miles east of Matheson and the mill complex is twelve miles west

of Matheson. Mining of ores from the open pit began in March 2009, milling

operations commenced in April 2009, and commercial gold production commenced in

late May 2009. Underground mining at Black Fox is expected to commence in the

second half of 2010. Apollo also owns the adjoining Grey Fox and Pike River

properties, which, together with the Black Fox property, give Apollo a total

land package of 17 square kilometers which extends over a 6.5 km strike of the

Destor-Porcupine Fault Zone.

Apollo

also owns Mexican subsidiaries which own concessions at the Huizopa exploration

project, located in the Sierra Madres in Chihuahua, Mexico. The Huizopa project

is subject to an 80% Apollo/20% Minas de Coronado joint venture

agreement.

The

Company was the operator of the Montana Tunnels mine, a 50% joint venture with

Elkhorn Tunnels, LLC (“Elkhorn”). The Montana Tunnels mine is an open pit mine

and mill which produced gold doré and lead-gold and zinc-gold concentrates. We

ceased production at Montana Tunnels in April 2009 and the mine was placed on

care and maintenance. On February 1, 2010, we sold our wholly owned subsidiary

Montana Tunnels Mining, Inc., which held our 50% interest in the Montana Tunnels

joint venture, to Elkhorn for consideration of certain promissory notes held by

Elkhorn with an outstanding balance of approximately $9.5 million.

See the

disclosure below and Item 2 “Description of Properties” for further information

about our properties.

-12-

BACKGROUND

Apollo

Gold Corporation

The

following chart illustrates Apollo’s operations and principal operating

subsidiaries and their jurisdictions of incorporation. Apollo owns

100% of the voting securities of each subsidiary.

APOLLO GOLD CORPORATION AND ITS

SUBSIDIARIES

(as

of March 16, 2010)

APOLLO

GOLD CORPORATION: NYSE Amex Equities exchange and Toronto Stock

Exchange listed holding company which owns and operates the Black Fox mine and

mill.

APOLLO

GOLD, INC.: Holding company, employs executive officers and furnishes

corporate services to Apollo Gold Corporation and its subsidiaries.

MINE

DEVELOPMENT FINANCE INC.: Provides intercompany loans and other

financial services to its affiliated companies.

MINERA

SOL DE ORO S.A. de C.V.: Holds rights to the Huizopa exploration

property.

MINAS de

ARGONAUTAS, S. de R.L de C.V.: Conducts exploration at the Huizopa

exploration property in Mexico.

Financial

Information

Segmented information is contained in

Note 22 of the “Notes to the Consolidated Financial Statements” contained within

this Annual Report on Form 10-K.

-13-

Products

The Black

Fox mine and mill produce gold doré. The gold contained in the doré

is sold to the counter-parties of the Company’s gold forward sales

contracts. 100% of sales are represented by the sale of gold

doré.

The

table below summarizes the Company’s gold production and average gold prices for

the periods indicated.

|

Production

Summary

|

Year

ended

December

31,

2009

(1)

|

|||

|

Gold

ounces produced

|

52,152 | |||

|

Gold

ounces sold

|

46,016 | |||

|

Average

metals prices

|

||||

|

Gold

– London Bullion Mkt. ($/ounce)

|

$ | 972 | ||

|

|

(1)

|

Black

Fox commenced gold production in late May

2009.

|

Gold

Black Fox

commenced commercial gold production in late May 2009, and produced 52,152

ounces of gold during the year ended December 31, 2009.

Gold

revenue is derived from the sale of refined gold in the form of doré

bars. Because doré is an alloy consisting primarily of gold but also

containing silver and other metals, bars are sent to refiners to produce bullion

that meets the required market standard of 99.99% pure gold. Under

the terms of our refining contracts, the bars are refined for a fee, and our

share of the refined gold and the separately recovered silver is paid to

us.

Gold

Uses

Gold has

two primary uses: product fabrication and bullion

investment. Fabricated gold has a variety of end uses, including

jewelry, electronics, dentistry, industrial and decorative uses, medals,

medallions and official coins. Gold investors purchase gold bullion,

official coins and high-carat jewelry.

Gold

Supply

The

worldwide supply of gold consists of a combination of new production from mining

and existing stocks of bullion and fabricated gold held by governments,

financial institutions, industrial organizations and private

individuals.

Gold

Price Volatility

The price

of gold is volatile and is affected by numerous factors beyond our control such

as the sale or purchase of gold by various central banks and financial

institutions, inflation or deflation, fluctuation in the value of the US dollar

and foreign currencies, global and regional demand, and the political and

economic conditions of major gold-producing countries throughout the

world.

-14-

The

following table presents the high, low and average afternoon fixing prices for

gold per ounce on the London Bullion Market over the past ten

years:

|

Year

|

High

|

Low

|

Average

|

|||||||||

|

2000

|

313 | 264 | 279 | |||||||||

|

2001

|

293 | 256 | 271 | |||||||||

|

2002

|

349 | 278 | 310 | |||||||||

|

2003

|

416 | 320 | 364 | |||||||||

|

2004

|

454 | 375 | 409 | |||||||||

|

2005

|

537 | 411 | 445 | |||||||||

|

2006

|

725 | 525 | 604 | |||||||||

|

2007

|

841 | 608 | 696 | |||||||||

|

2008

|

1,011 | 713 | 872 | |||||||||

|

2009

|

1,213 | 810 | 972 | |||||||||

|

2010*

|

1,153 | 1,058 | 1,107 | |||||||||

* Through

February 28, 2010

Refining

Process

We have

an agreement with Johnson Matthey to refine gold doré produced at Black Fox to a

final finished product. Johnson Matthey receives a fee for each ounce

of gold doré it refines.

Mineral

Reserves

Our

proven and probable mineral reserves are estimated in conformance with

definitions set out in National Instrument 43-101 (“NI 43-101”) and on a basis

consistent with the definition of proven and probable mineral reserves set forth

in SEC Industry Guide 7. See our “Glossary of

Terms.”

Since we

report our mineral reserves to both NI 43-101 and SEC Industry Guide 7

standards, it is possible for our reserve estimates to vary between the

two. Where such a variance occurs it will arise from the differing

requirements for reporting mineral reserves set forth by the different reporting

authorities to which we are subject. No reconciliation between

NI 43-101 and SEC Industry Guide 7 is included for Black Fox as there

are no material differences.

On April

14, 2008, we filed a NI 43-101 Technical Report, which was prepared to a

bankable standard (“bankable feasibility study”). A bankable

feasibility study is a comprehensive analysis of a project’s economics (+/- 15%

precision) used by the banking industry for financing purposes. The

table below summarizes the Black Fox total mineral reserve. The

mineral reserves shown in the table below were calculated based on a gold price

of $650 per ounce.

Black

Fox Probable Reserve Statement as of December 31, 2008

|

Mining Method

|

Cutoff Grade

Au g/t

|

Tonnes

(000)

|

Grade

Au g/t

|

Contained

Au Ounces

|

||||||||||||

|

Open

Pit

|

1.0 | 4,350 | 5.2 | 730,000 | ||||||||||||

|

Underground

(1)

|

3.0 | 2,110 | 8.8 | 600,000 | ||||||||||||

|

Total

Probable Reserves

|

1,330,000 | |||||||||||||||

(1) Underground reserves assume 95% mining recovery 17% planned dilution and 5% unplanned dilution at 0 grams per tonne grade.

-15-

The

estimated reserves presented above were reduced by mining of 632,000 ore tonnes

from the Black Fox mine, including 425,000 tonnes at a grade of 3.7 grams per

tonne (“gpt”) producing 46,621 ounces of gold from the Black Fox mill, with

further 5,531 ounces of gold produced from toll processing in 2009.

There was

no updated estimation of mineral reserves for the year ended December 31, 2009.

This was due mainly to the Company undertaking in late 2009 a comprehensive mine

plan re-modeling with tighter constraints and review of the 2010 mine plan as

well as the life of mine plan to address the grade variability issue of a

certain type of Black Fox ore, which had resulted in an over-projection of grade

in part of the open pit ore. This lower grade negatively impacted 2009 gold

production, which was lower than expected. The revised mine plan is expected to

be completed by the end of the first quarter of 2010. Independent professional

mining consultants and our staff determined that the new mine plan requires

reconciliation of production against the plan forecasts over the rest of 2010.

This will be in conjunction with a continuous improvement effort, benefitted by

the mine operating in its first full year of production at a steady state of

2,000 tonnes of ore per day. Such assessment will provide more accurate

information regarding mining costs, cut-off grade, and other parameters in the

estimation of mineral reserves at the end 2010.

It is

expected that the average gold grade of the open pit portion of reserves will

decrease from the December 31, 2008 reserve estimate grade due to the

anticipated lowering of the average grade in the certain type of ore in the open

pit and the addition of more low grade tonnes than originally estimated.

However, the change in the overall tonnage and contained ounces of open pit

reserves will reflect the net effect of any negative adjustment and possible

increments from the anticipated underground exploration drilling for resource

and reserve additions. The comprehensive review included remodeling of the

underground portion of reserves and found less variance (i.e. more consistency)

against the 2008 feasibility study. The anticipated start-up of underground

mining during 2010 will also provide actual production data for reconciliation

purposes in the estimation of mineral reserves for the year ended December 31,

2010.

The

Company expects to report updated estimated mineral reserves for 2010 in the

first quarter of 2011, and on an annual basis thereafter.

Employee

Relations

As of

December 31, 2009, we had approximately 219 employees, including 9 employees at

our principal executive office in Greenwood Village, Colorado, 21 employees at

Montana Tunnels and 189 employees at Black Fox.

Competition

We

compete with major mining companies and other natural mineral resource companies

in the acquisition, exploration, financing and development of new mineral

prospects. Many of these companies are larger and better capitalized than we

are. There is significant competition for the limited number of gold acquisition

and exploration opportunities. Our competitive position depends upon our ability

to successfully and economically acquire, explore, and develop new and existing

mineral prospects. Factors that allow producers to remain competitive in the

market over the long term include the quality and size of their ore bodies,

costs of operation, and the acquisition and retention of qualified employees. We

also compete with other mining companies for skilled mining engineers, mine and

processing plant operators and mechanics, geologists, geophysicists and other

technical personnel. This could result in higher employee turnover and greater

labor costs.

-16-

Regulatory

Environment

Our

mining exploration, development and production activities are subject to

extensive regulation at the federal, provincial and local levels in the

countries in which we operate. These regulations relate to, among other things,

prospecting, development, mining, production, exports, taxes, labor standards,

occupational health, waste disposal, protection of the environment, mine safety,

hazardous substances and other matters. These laws are continually changing and,

in general, are becoming more restrictive. We have made, and expect to make in

the future, significant expenditures to comply with such laws and regulations.

Changes to current local, state or federal laws and regulations in the

jurisdictions where we operate could require additional capital expenditures and

result in an increase in our operating and/or reclamation costs. Although we are

unable to predict what additional legislation, if any, might be proposed or

enacted, additional regulatory requirements could impact the economics of our

projects.

For more

information regarding the regulations to which we are subject and the risks

associated therewith, see Item 1A “Risk Factors.”

Recent

Developments

Letter

of Intent with Linear Gold Corp.

General. On March 9,

2010, Apollo and Linear Gold Corp. (“Linear”) entered into a binding letter of

intent (the “Letter of Intent”) pursuant to which it is expected that (i) the

businesses of Apollo and Linear would be combined by way of a court-approved

plan of arrangement (the “Arrangement”) pursuant to the provisions of the Canada Business Corporations Act

(“CBCA”) and (ii) Linear would subscribe for approximately 62,500,000

common shares (the “Purchased Shares”) of Apollo at a price of Cdn$0.40 per

common share for aggregate proceeds of Cdn$25.0 million (the “Private

Placement”).

Structure. As set

forth in the Letter of Intent, pursuant to the Arrangement:

|

|

·

|

each

outstanding Linear common share will be exchanged for 5.4742 Apollo common

shares (the “Exchange Ratio”);

|

|

|

·

|

each

outstanding common share purchase warrant of Linear (the “Linear

Warrants”) will be exchanged for common share purchase warrants of Apollo

(the “Apollo Warrants”) on the basis of the Exchange Ratio and the

exercise price of the Linear Warrants will be adjusted as provided for in

the certificates representing the Linear

Warrants;

|

|

|

·

|

each

outstanding option to purchase a Linear common share (the “Linear

Options”) granted under Linear’s Stock Option Plan will be exchanged for

options of Apollo (the “Apollo Options”) granted under Apollo’s Stock

Option Plan on the basis of the Exchange Ratio and the exercise price of

the Linear Options will be adjusted on the same basis as the exercise

price of the Linear Warrants; provided that current employees of Linear

holding Linear Options whose employment is terminated in connection with

the Arrangement will have their Linear Options exchanged for Apollo

Options which shall expire on the earlier of: (i) the current expiry date

of the corresponding Linear Options; and (ii) the first anniversary of the

date of completion of the Arrangement, regardless of whether such

employees are otherwise “eligible persons” under the terms of the Apollo

Stock Option Plan or applicable Toronto Stock Exchange (the “TSX”) rules;

and

|

|

|

·

|

each

outstanding Apollo Option held by current directors of Apollo that will

not continue to be directors of Apollo upon completion of the Arrangement

would be amended to provide that such Apollo Options shall expire on the

earlier of: (i) the current expiry date of such Apollo Options; and (ii)

the first anniversary of the date of completion of the Arrangement,

regardless whether such directors are “eligible persons” under the terms

of the Apollo Stock Option Plan or applicable TSX

rules.

|

-17-

Upon

consummation of the Arrangement, Linear would become a wholly owned subsidiary

of Apollo and the shareholders of Linear immediately prior to the Arrangement

are expected to own approximately 42.9% of the outstanding common stock of

Apollo (calculated on a fully-diluted basis).

Board of Directors and other

Matters. Upon

consummation of the Arrangement, the Letter of Intent contemplates

that:

|

|

·

|

Apollo

and Linear will agree on a new name for Apollo;

and

|

|

|

·

|

The

Board of Directors of Apollo would consist of seven directors, which would

be composed of (i) Wade Dawe (the current President and Chief Executive

Officer of Linear), who would be nominated as the Chairman of the Board of

Directors, (ii) four current Apollo board members or Apollo nominees,

(iii) one Linear nominee and (iv) one nominee who shall be a technical

person mutually agreed upon by Apollo and

Linear.

|

Definitive Business

Combination Agreement. The Letter of Intent contemplates that Linear and

Apollo will enter into a definitive arrangement agreement (the “Definitive

Agreement”) governing the Arrangement on or before March 31, 2010 to implement

the Arrangement to provide for the business combination of Linear and

Apollo.

Support Agreements.

The Letter of Intent provides that it is a condition to Apollo proceeding with

the Arrangement that all directors and officers of Linear enter into support

agreements (the “Linear Support Agreements”) under which they agree to vote in

favor of the Arrangement all of the Linear common shares currently owned or

controlled by them, being an aggregate of 3,415,887 Linear common shares

representing, in aggregate, approximately 6.21% of the outstanding Linear common

shares (calculated on a fully-diluted basis). In addition, the Letter of Intent

provides that it is a condition to Linear proceeding with the Arrangement that

all directors and officers of Apollo enter into support agreements (the “Apollo

Support Agreements” and, together with the Linear Support Agreements, the

“Support Agreements”) under which they agree to vote in favor of the Arrangement

all of the Apollo common shares currently owned or controlled by them, being an

aggregate of 3,736,273 Apollo common shares representing, in aggregate,

approximately 1.0% of the outstanding Apollo common shares (calculated on a

fully-diluted basis).

The

Support Agreements will include the typical covenants, including, but not

limited to, covenants that the subject shareholders will:

|

|

·

|

immediately

cease and terminate existing discussions, if any, with respect to any

potential business combination involving, Linear or Apollo, as the case

may be, or any material part of their respective assets (in the case of

Linear, a “Linear Proposal” or, in the case of Apollo, an “Apollo

Proposal”) and will not make, solicit, assist, initiate, encourage or

otherwise facilitate any inquiries, proposals or offers from any person

(other than as contemplated by the Letter of Intent) relating to any

Linear Proposal or Apollo Proposal, as the case may be, or participate in,

any discussions or negotiations regarding any information with respect to

any Linear Proposal or Apollo Proposal, as the case may

be;

|

|

|

·

|

not

sell, transfer or encumber in any way any of the subject shareholder’s

shares or securities convertible into such shares or restrict such

shareholder’s right to vote any of its shares, other than pursuant to the

Arrangement; and

|

-18-

|

|

·

|

vote

all the subject shareholder’s shares against any proposed action, other

than in connection with the Arrangement in respect of any amalgamation,

merger, sale of Linear’s or Apollo’s, as applicable, or their respective

affiliates’ or associates’ assets, take-over bid, plan of arrangement,

reorganization, recapitalization, shareholder rights plan, liquidation or

winding-up of, reverse take-over or other business combination or similar

transaction involving Linear or Apollo, as the case may be, or any of its

subsidiaries; (a) which would reasonably be regarded as being directed

towards or likely to prevent or delay the successful completion of the

Arrangement or an alternative transaction, or (b) which would reasonably

be expected to result in a material adverse effect with respect to Linear

or Apollo, as the case may be.

|

In

addition, pursuant to the Letter of Intent, each of Linear and Apollo would

agree to use its reasonable best efforts to obtain similar support agreements

from significant institutional shareholders.

Conditions to Consummation

of Arrangement. The Letter of Intent provides that each party’s

obligation to proceed with the Arrangement is subject to customary conditions

precedent, including without limitation conditions relating to (i) material

accuracy of representations and warranties as of the effective date of the

Arrangement, (ii) material compliance with covenants, (iii) the absence of any

material adverse change, (iv) absence of certain actions, suits, proceedings or

objection or opposition before any governmental or regulatory authority, (v)

absence of material breaches under the Letter of Intent, (vi) approval of the

securityholders of Linear and Apollo of the transactions set forth in the Letter

of Intent for which their approval is required under applicable law, (vii)

approval Superior Court of Justice of Ontario (the “Court”) of the Arrangement,

(viii) obtaining all material consents, waivers, permissions and approvals

necessary to complete the Arrangement by or from relevant third parties and (ix)

holders of not more than 5% of each of the issued and outstanding Linear common

shares and Apollo common shares shall have exercised rights of dissent in

relation to the Arrangement.

Securityholder

Approval. The Arrangement will be subject to the approval of holders of

not less than 66 2/3% of the Linear common shares and of a majority of the

Apollo common shares held by disinterested shareholders voted at special

meetings of shareholders that will be called to approve the

Arrangement.

Non-Solicitation. The

Letter of Intent includes mutual agreements by each of Linear and Apollo to

immediately cease, and not to solicit or initiate discussions concerning, any

alternative transactions to the proposed Arrangement. However, each of Linear

and Apollo may take certain specified actions in response to an unsolicited

alternative transaction that the board of directors of such party deems to be a

“superior proposal” meeting the requirements set forth in the Letter of Intent.

The Letter of Intent also provides that each of Apollo and Linear have certain

other customary rights in respect of alternative transactions, including a right

to match competing offers in certain circumstances.

Break Fee. If either

Linear or Apollo terminates the Letter of Intent or the Definitive Agreement and

abandons the Arrangement prior to closing for any reason (other than as a result

of the failure of a condition to such party’s obligation to close contained in

the Letter of Intent or the Definitive Agreement not being satisfied, other than

a failure to obtain the required approval of such party’s shareholders (as

described above)), such terminating party shall pay to the other party an amount

equal to Cdn$4,000,000.

Covenants relating to

Operation of Business.

Pursuant to the Letter of Intent, each party agrees that during the

period from the date of execution of the Letter of Intent and ending on the

earlier of the consummation of the Arrangement or the termination of the Letter

of Intent, except as required by law or as otherwise expressly permitted or

specifically contemplated by the Letter of Intent, it shall conduct its business

only in the usual and ordinary course of business and consistent with past

practice and it shall use all reasonable commercial efforts to maintain and

preserve its business, assets and advantageous business relationships. In

addition, during such period, each party agrees to restrictions with respect to,

among other things, (i) amending its constating documents, (ii) dividends,

distributions, issuances, redemptions, repurchases or reclassifications of its

capital stock, (iii) adopting a plan of liquidation or resolutions providing for

its liquidation, dissolution, merger, consolidation or reorganization, (iv)

sales, pledges or disposition of its assets, (v) capital expenditures, (vi)

asset acquisitions, (vii) business acquisitions, (viii) indebtedness, (ix)

material contract rights, (x) entry into or termination of hedges or other

financial instruments or transactions, (xi) employee and director compensation,

(xii) changes to employee plans and (xiii) maintenance of insurance

policies.

-19-

Other. The Letter of

Intent also provides that, among other things:

|

|

·

|

Management

terminations, buyouts and severance payments will be paid out to Linear

management and staff on closing of the Arrangement in accordance with

management contracts and common law amounts and are expected to total

approximately Cdn$3,400,000;

|

|

|

·

|

Prior

to the completion of the Arrangement, Apollo shall purchase and maintain

director and officer liability “run-off” insurance for the benefit of the

former directors and officers of Linear for a period of not less than six

(6) years following the completion of the Arrangement, with coverage of

not less than Cdn$10,000,000, with respect to claims arising from facts or

events that occurred on or before the closing of the Arrangement,

including with respect to the

Arrangement;

|

|

|

·

|

Apollo

will pay the fees and expenses of Linear in connection with the Private

Placement up to a maximum of Cdn$50,000;

and

|

|

|

·

|

Customary

representations and warranties from each of Apollo and

Linear.

|

Termination of Letter of

Intent. The Letter of Intent may be terminated (i) by mutual written

consent of each of Apollo and Linear; (ii) by a party which accepts, recommends,

approves or enters into an agreement to implement a “superior proposal” (as

defined in the Letter of Intent) after having complied with the terms of the

Letter of Intent (provided that concurrently with any such termination, the

terminating party shall have paid the Cdn$4,000,000 break fee described above

following which the payor party shall have no further liabilities arising

hereunder other than for a breach of any section of the Letter of Intent); and

(iii) by either party if the Definitive Agreement is not executed by each of the

parties on or before 5:00 pm (Toronto time) on March 31, 2010 (provided that

concurrently with any such termination, the terminating party shall have paid

the Cdn$4,000,000 break fee described above following which the payor party

shall have no further liabilities arising hereunder other than for a breach of

any section of the Letter of Intent).

Subscription

Agreement with Linear in respect of Private Placement

Concurrently

with the execution of the Letter of Intent, Apollo and Linear entered into a

subscription agreement providing for the Private Placement (the “Subscription

Agreement”). Pursuant to the Letter of Intent and the Subscription Agreement,

the closing of the Private Placement is subject to customary conditions

precedent, including conditions relating to: (i) receipt of all necessary stock

exchange approvals, (ii) delivery by Apollo of customary corporate and

securities law opinions and title opinions, (iii) each of Macquarie Bank Limited

and RMB Australia Holdings Limited (which we sometimes refer to herein as the “

Project Facility Banks”) shall have entered into a support agreement, in form

and substance satisfactory to Linear, pursuant to which each Project Facility

Bank agrees, among other things, to support and vote in favor of the

Arrangement; and (iv) each of the Project Facility Banks shall have entered into

a lock-up agreement, in form and substance satisfactory to Linear, pursuant to

which each Bank agrees, among other things, not to, directly or indirectly,

exercise or offer, sell, contract to sell, lend, swap, or enter into any other

agreement to transfer the economic consequences of any of the common shares or

common share purchase warrants of Apollo held by them until December 31, 2010.

The closing of the Private Placement is expected to occur on or before March 19,

2010.

-20-

The

Subscription Agreement includes other covenants, representations and warranties

customary for transactions of this type. The Private Placement will be conducted

in reliance on the exemption from registration contained in Regulation S of the

U.S. Securities Act of 1933, as amended.

The

Arrangement is expected to close on or before July 2, 2010.

As part

of the Arrangement, the Apollo common shares expected to be issued to Linear in

the Private Placement will be cancelled without any payment. The Private

Placement will not be conditioned on the completion of the Arrangement. If the

Arrangement is not completed for any reason, Apollo has agreed to, upon the

request of Linear, file a registration statement with the United States

Securities and Exchange Commission to register the resale of the Apollo common

shares by Linear in the United States.

Black

Fox Financing Agreement

On

February 20, 2009, we entered into a $70.0 million project financing agreement

(which we sometimes refer to herein as the “Project Facility”) with the

Macquarie Bank Limited and RMB Australia Holdings Limited (which we sometimes

refer to herein as the “Project Facility Banks”) and RMB Resources Inc. (which

we sometimes refer to herein as the “Agent”), as agent for the Project Facility

Banks. By June 2, 2009, the Company had borrowed the total amount of the $70.0

million available under the Project Facility.

As a result of lower than planned gold

production, during the third quarter of 2009 a “review event” as defined in the

Project Facility was triggered. The occurrence of a review event allows the

Banks to review the Project Facility and determine if they wish to continue with

the Project Facility. In addition, we were unable to make (i) the first

scheduled repayment of $9.3 million due on September 30, 2009 under the Project

Facility (the “First Repayment”), (ii) the second scheduled repayment of $6.0

million due on December 31, 2009 (the “Second Repayment”) and (iii) the

requirement to fund the associated debt service reserve account (the “Funding

Obligation”) also due on September 30, 2009. Through three separate deferrals,

the last of which was granted on February 25, 2010, the Banks agreed to defer

the First Repayment, the Second Repayment and the Funding obligation until March

31, 2010.

In connection with the Letter of Intent

executed with Linear, on March 9, 2010, the Project Facility Banks executed and

delivered a consent letter (which we sometimes refer to herein as the “Consent

Letter”), which was agreed to and accepted by each of Apollo and Linear,

pursuant to which the Project Facility Banks and the Agent agreed, subject to

the terms and conditions contained in the Consent Letter:

|

|

·

|

to

consent to the Arrangement (the

“Consent”);

|

|

|

·

|

prior

to the earliest to occur of (i) the date on which the Agent determines,

acting reasonably, that the Arrangement has been terminated or will not be

completed, (ii) March 31, 2009, if the Definitive Agreements in respect of

the Arrangement have not been executed by such date, or (iii) September

30, 2010, not to make demand, accelerate payment or enforce any security

or any other remedies upon an “event of default” or a “review event” under

the Project Facility unless and until the occurrence of certain “override

events” set forth in to the Consent Letter (which “override events” are

primarily related to breaches of certain covenants and provisions of the

Consent Letter and the Project Facility) (the “Standstill Provisions”);

and

|

-21-

|

|

·

|

to

amend certain provisions of the Project Facility, including without

limitation the following revised repayment

schedule:

|

|

Repayment Date

|

Repayment Amount

|

|||

|

The

earlier of two business days following completion of the Private Placement

and March 19, 2010

|

$ | 10,000,000 | ||

|

The

earlier of July 2, 2010 and the date that is two business days following

the consummation of the Arrangement

|

$ | 10,000,000 | ||

|

The

earlier of September 30, 2010 and the date on which the proceeds from any

one or more equity raisings following the consummation of the Arrangement

equals $10,000,000

|

$ | 10,000,000 | ||

|

December

31, 2010

|

$ | 5,000,000 | ||

|

The

remaining repayment dates between March 31, 2011 and March 31, 2013 to be

agreed between Apollo and the Agent by no later than September 30, 2010 to

reflect the “cashflow model” (as defined under the Project Facility) that

is approved by the Agent. In the absence of agreement between Apollo and

the Agent by September 30, 2010. “secured moneys” (as defined under the

Project Facility) shall be due and payable on December 31,

2010.

|

$ | 35,000,000 | ||

The Project Facility Banks’ agreement

to the Consent and the Standstill Provisions is subject to a number of

conditions, including without limitation (i) delivery of the Apollo Support

Agreement (as defined above)in connection with the Letter of Intent in a form

and substance satisfactory to the Agent, (ii) prior approval by the Project

Facility Banks of press releases and other public statements regarding the

Arrangement that refer to the Project Facility Banks, (iii) the Agent, acting

reasonably, approving the Definitive Agreements and such Definitive Agreements

being executed by no later than March 31, 2010, (iv) the Agent, acting

reasonably, being satisfied that the completion of the Arrangement will not

cause a breach or default under any “project documents” (as defined in the

Project Facility), (v) the Agent, acting reasonably, being satisfied that the

Arrangement will not have any material negative tax implications for Apollo,

Linear and each of their direct or indirect subsidiaries, (vi) the Agent being

satisfied, acting reasonably, that, immediately following completion of the

Arrangement and after making the payment of $10,000,000 contemplated by the

second row in the repayment schedule set forth above, Apollo having restricted

cash on hand of not less than Cdn$10,000,000, (vii) no amendment to the

Definitive Agreements, no representation in the Definitive Agreements being

untrue, no breach of any material covenant and no waiver of any material

condition precedent in the Definitive Agreements, and (viii) at completion of

the Arrangement, the Agent, acting reasonably, being satisfied regarding

indebtedness and encumbrances of Linear and its direct and indirect

subsidiaries.

Extension

of Maturity Date for February 2007 Convertible Debentures held by

RAB

On

February 23, 2007, the Company concluded a private placement pursuant to which

it sold $8,580,000 aggregate principal amount of convertible debentures due

February 23, 2009 (the “Convertible Debentures”). As originally issued, each

$1,000 principal amount of the Convertible Debentures was convertible at the

option of the holder into 2,000 of the Company’s common shares, at any time

until February 23, 2009. Additionally, each $1,000 principal amount of the

Convertible Debentures included 2,000 common share purchase warrants entitling

the holder thereof to purchase one of the Company’s common shares at an exercise

price of $0.50 per share, which such warrants originally expired on February 23,

2009 (the “Warrants”).

-22-

On

February 16, 2009, the Company and RAB Special Situations (Master) Fund Limited

(”RAB”), which owns $4,290,000 aggregate principal amount of Convertible

Debentures and 8,580,000 Warrants, entered into an agreement (the “First

Amending Agreement”) pursuant to which RAB agreed to extend the maturity date of

its Convertible Debentures to February 23, 2010 (the “RAB Convertible

Debentures”). In consideration for the foregoing, the Company (i) issued

2,000,000 common shares of the Company to RAB, (ii) extended the maturity date

of the Warrants issued to RAB to February 23, 2010 (the “RAB Warrants”) and

(iii) reduced the exercise price of the RAB Warrants from $0.50 to $0.25. The

Company filed a Form 8-K with the SEC on February 19, 2009 disclosing the terms

of the First Amending Agreement.

On

February 26, 2010, the Company and RAB entered into a third amending agreement

(the “Third Amending Agreement”) (which amended and restated in its entirety a

second amending agreement entered into on February 23, 2010) pursuant to which

RAB agreed to further extend the maturity date of the RAB Convertible Debentures

to August 23, 2010 and, in consideration therefor, the Company agreed to repay

the $772,200 of accrued interest through February 23, 2010 on the RAB

Convertible Debentures in cash and agreed to issue to RAB (i) 800,000 common

shares of the Company and (ii) 2,145,000 common share purchase warrants (the

“New Warrants”), which New Warrants entitle RAB to purchase one of the Company’s

common shares at an exercise price of $0.50 per share at any time before 5:00

p.m. (Toronto time) on February 23, 2011.

Purchase

of Duffy Promissory Note

On March

12, 2010, the Company, Calais Resources Colorado, Inc. (“Calais Colorado”),

Calais Resources, Inc. (“Calais Resources” and, together with Calais Colorado,