Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - TNS INC | a2197217zex-23_1.htm |

| EX-32.1 - EXHIBIT 32.1 - TNS INC | a2197217zex-32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - TNS INC | a2197217zex-31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - TNS INC | a2197217zex-31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2009 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 1-32033

TNS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| DELAWARE (State or Other Jurisdiction of Incorporation or Organization) |

36-4430020 (IRS Employer Identification No.) |

|

11480 COMMERCE PARK DRIVE, SUITE 600, RESTON, VIRGINIA (Address of Principal Executive Offices) |

20191 (Zip Code) |

(703) 453-8300

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve (12) months (or such shorter period that the Registrant was required to file such report) and (2) has been subject to such filing requirements for the past ninety (90) days. Yes ý No o

Indicate by checkmark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of March 10, 2010, 25,977,350 shares of the Registrant's common stock were outstanding. As of June 30, 2009 (the last business day of the Registrant's most recently completed second fiscal quarter), the aggregate market value of such shares held by non-affiliates of the Registrant was approximately $463 million.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive Proxy Statement relating to the 2010 Annual Meeting of Stockholders, filed with the Securities and Exchange Commission, are incorporated by reference in Part III, Items 9 - 13 of this Annual Report on Form 10-K as indicated herein.

TNS, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2009

INDEX

EXPLANATORY NOTE

2

Throughout this report, we refer to TNS, Inc., together with its subsidiaries, as "we," "us," "our," "TNS" or "the Company." LEConnect and the TNS logo are our registered trademarks, and TNSLink, TNSConnect, Synapse, FusionPoint by TNS, Dialect and Secure Trading Extranet are our service marks. This report contains trade names, trademarks and service marks of other companies. We do not intend our use or display of other parties' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of, these other parties.

Forward-Looking Statements

We make forward-looking statements in this report based on the beliefs, expectations, estimates, targets and assumptions of our management and on information currently available to us. Forward-looking statements include information about our possible or assumed future results of operations in "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations" under the headings "Overview," "Results of Operations," and "Liquidity and Capital Resources," and other sections throughout this report. The forward-looking statements are based on current expectations, forecasts and assumptions that are subject to known and unknown risks, uncertainties and other factors, many of which may be beyond our control, that could cause actual results to differ materially from those set forth in, or implied by, the forward-looking statements. The Company has attempted, whenever possible, to identify these forward-looking statements using words such as "may," "will," "should," "projects," "estimates," "expects," "plans," "intends," "anticipates," "believes," and variations of these words and similar expressions. Similarly, statements herein that describe the Company's business strategy, prospects, opportunities, outlook, objectives, plans, intentions or goals are also forward-looking statements.

Forward-looking statements involve risks, uncertainties and assumptions, including risks described below and other risks that we describe from time to time in our periodic filings with the SEC, and our actual results may differ materially from those expressed in our forward-looking statements. We therefore caution you not to rely unduly on any forward-looking statement. The forward-looking statements in this report speak only as of the date of the report, and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. The forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this filing. The forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Sections 27A of the Securities Act and 21E of the Securities Exchange Act of 1934, as amended.

Overview

We are an international data communications company which provides networking, data communications and value added services to many of the world's leading retailers, banks, payment processors, financial institutions and telecommunication firms. Our data communication services enable secure and reliable transmission of time-sensitive, transaction-related information critical to our customers' operations. Our customers outsource their data communications requirements to us because of our substantial expertise, comprehensive customer support and cost-effective services. We provide services to customers in the United States and increasingly to international customers in over 40 countries including Canada and Mexico and countries in Europe, Latin America and the Asia-Pacific region. We currently maintain operations and/or employees in 28 countries.

We provide services through our data network, which is designed specifically for transaction-oriented applications. Our network supports a variety of widely accepted communications protocols and

3

is designed to be scalable, interoperable and accessible by multiple methods, including dial-up, dedicated, wireless, broadband and Internet connections.

In 2009, we reported our operations in four distinct business segments. Our Point-of-Sale Division was focused on the payments industry in North America. Our International Services Division (ISD) was primarily focused on serving payments-related customers outside of North America and, to a much lesser extent, customers within the financial services industry. Our Telecommunication Services Division (TSD) principally served telecommunication customers in North America but has recently started generating revenue outside of North America from certain products. Our Financial Services Division (FSD) served customers in the financial services industry in the United States.

In our Point-of-Sale and ISD divisions, we have over a thousand customers, making us, on the basis of total transactions transmitted, a leading provider of data communications services and other value added services to processors of credit card, debit card and ATM transactions. Within TSD, we operate the largest unaffiliated Signaling System No. 7 network in the United States capable of providing services nationwide, including call signaling and database access services, to the domestic telecommunication industry. We also provide roaming and clearing services to both domestic and international mobile phone operators. In FSD, we are a leading provider of secure data network services to the global financial services industry, connecting over 1,700 financial community end-points located at over 625 distinct financial services companies, representing buy and sell-side institutions, market data and software vendors, exchanges and alternative trading venues.

In each of our divisions, our revenues are generally recurring in nature and we typically enter into multi-year service contracts that require minimum transaction or revenue commitments from our customers.

Our business began operations in 1991 to address the needs of the Point-of-Sale industry in the United States. The strong operating cash flows generated by our business have enabled us to invest in our data network to make our communications services more rapid, secure, reliable and cost efficient. In addition, we have leveraged these investments and used our continued strong operating cash flows to expand our service offerings to related market opportunities in the telecommunications and financial services industries in the United States and abroad. By implementing and executing this strategy, we have grown our revenues every year, from $285,000 for the year ended December 31, 1991, to $474.8 million for the year ended December 31, 2009.

Over recent years our business and the customers to whom we provide services have evolved to become more global in scope. For example, our ISD and Point-of-Sale divisions increasingly provided services to the same customers with the primary difference being the geographic location of the services provided. Driven by the demands of our customers, our Point-of-Sale and ISD sales teams increasingly work together to sell services to global customers in a consistent manner. In recognition of this evolution, at the beginning of 2010 our management team determined it was more appropriate to align the company's business along industry segments on a global basis. Our management team determined it was no longer necessary to have a separate ISD business unit and that it was more appropriate to group the ISD payment related business with the Point-of-Sale Division and to group the ISD financial services business with FSD. In 2010, we reorganized our divisional management structure to reflect this decision to operate the company in three business divisions. The three business divisions will be the telecommunication services division, the payments division and the financial services division. We will begin to report revenues in these three business divisions beginning with the three month period ended March 31, 2010.

4

Business Overview

Point-of-Sale (POS) Opportunity

According to the industry information source The Nilson Report, the four card-based systems of payments—credit, debit, prepaid, and electronic benefits transfer—generated 66.7 billion transactions, or 45.7% of total payments in the United States in 2008, up 6.8% from the previous year. In 2002, these payment types accounted for 30.4% of transaction volume, or 36.7 billion transactions. By 2012, debit card transactions alone are projected to overtake the number of transactions performed using cash in the United States. Along with the growth in electronic transactions, the increase in the number of options for POS device connectivity, which now includes wireless, Internet-based and dial-up access, is adding complexity to retailers and processors running large-scale payment networks. As our scaleable network accepts a wide variety of connectivity types, we believe it is well-suited to deliver mission-critical services to almost any size retailer, bank or processor as requirements for managing network connectivity expand.

POS and off-premise ATM (an automated teller machine at a location other than a branch office of a financial institution) transactions require the two-way transfer of information over a secure, reliable data network. Typically, at POS and off-premise ATM locations where a credit, debit or ATM card is accepted, the customer's account information and transaction amount must be electronically transmitted to a payment processor. The payment processor then electronically communicates with the financial institution that issued the card to determine whether to authorize the transaction. After this determination is made, the processor returns an authorization or rejection response to the POS or ATM terminal.

Financial institutions in the United States and Canada typically outsource the processing of credit and debit card accounts to payment processors who are able to leverage technical expertise and capitalize on economies of scale. Payment processors, in turn, typically have outsourced to third party service providers such as TNS the data networking services used to transport transaction data between the processor's host computers and the POS or ATM terminal.

POS or off-premise ATM terminals access data network connections to payment processors through a variety of methods, the most common of which are dial-up and dedicated, or leased line, services and increasingly include broadband connections. Dial-up access services allow merchants and off-premise ATMs to connect to payment processors by dialing a telephone number each time a transaction is initiated. Wireless access provides the same capability as dial-up access without a physical connection to the POS device or ATM. A leased line is a dedicated connection provided to a merchant or ATM location for the exclusive purpose of connecting the POS terminal or ATM to the payment processor. Dial-up services are less expensive than leased line services as leased line services impose greater fixed monthly communication service charges, making a leased line economically viable only in high-volume merchant or off-premise ATM locations. A broadband connection such as a digital subscriber line, or DSL, or wireless connection is an always-on connection utilized by a merchant or ATM location for various purposes including to connect a POS terminal or ATM to the payment processor. With the introduction of broadband services, merchants and other POS providers have begun to deploy integrated wide-area-network solutions. These solutions include POS services, inventory management and other back-office solutions utilized by merchants.

Outside of the payment processing industry, businesses, such as pre-paid card providers, kiosk operators, loyalty card providers and merchants situated in locations other than brick and mortar stores, such as mobile merchants and merchants on the internet, are expanding their use of electronic transaction processing in an attempt to reduce costs, increase sales through the acceptance of credit and debit cards, and increase the reliability and efficiency of data transmission. As the number of merchants situated in locations other than brick and mortar stores increases, the number of

5

transactions being performed without the cardholder or card present also is increasing, creating a growing need for card-not-present services.

Another significant factor facing the electronic payment processing industry is susceptibility to fraudulent transactions and as the number of electronic payment transactions has increased, the industry's exposure to fraud has increased. Payment processors desire secure and reliable data communications and other transaction related services.

We believe we will be able to increase the number of connections to our network and the number of transactions we transport as these and other industries look to outsource the data communications requirements necessary to transmit transactions securely.

Our POS services

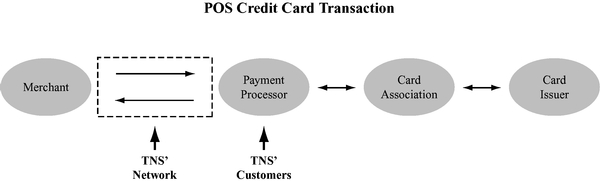

Our POS division markets our data communications services directly to payment processors in the United States, Canada and Mexico. The following chart illustrates the route of a typical card-present POS transaction using our data communications services. The route of a typical off-premise ATM transaction is similar.

We also market our POS data communications services to entities responsible for the transmission of state lottery transactions, federal and state electronic benefits transfer and healthcare transactions as well as directly to select categories of merchants and retailers.

Our private, secure data network was designed specifically to address the data communications requirements of the payment processing industry. Our data communication services provide customized routing technology, built-in redundancy and geographic diversity and are configured to provide fast and reliable call connection and efficient network utilization. Our data network is Payment Card Industry Data Security Standard (PCI DSS) certified and is used to connect a merchant's POS terminal or an off-premise ATM securely to the payment processor's host computer.

Our core service offering is network connectivity which enables the processing of POS transactions. We provide multiple means for the POS terminal or off-premise ATM to access our data network. Merchant POS terminals and off-premise ATMs can connect directly to our network using our dial-up service, which utilizes telephone services obtained from interexchange carriers and local exchange carriers. While our customers primarily choose to access our network using our dial-up services, we are increasingly providing alternative methods of connecting to our network, including fixed broadband, wireless and internet connectivity via our TNSLink product line.

Our wireless payment gateway platform, called Synapse, enables merchants and kiosk machine operators to process credit and other card transactions without the inconvenience and cost of having to connect to a telephone line. The mobile merchant market has been experiencing strong growth in the United States and around the world. Our fixed broadband and wireless service offerings enable merchants to utilize broadband connectivity in their store to transmit data from the POS terminal or

6

ATM to the payment processor. Our services include a proprietary performance monitoring and management information reporting application which is used by our customers to centrally monitor and manage the equipment at their locations.

We configure and provide terminal adapters that enable off-premise ATM operators to convert leased line ATMs to ATMs that use dial-up connections, fixed broadband or wireless service. This allows the ATM operators to avoid the costs associated with the need to replace or refit the ATM. Because our terminal adapters allow the ATM and the payment processor's system to operate as if they are connected by a leased line, off-premise ATM operators retain the functionality and speed of existing leased line ATMs while reducing monthly recurring telecommunications expenses.

In addition to our core network connectivity service offering, we have been investing in several network-related applications that provide value added services for various types of transactions transported over our network. In 2009, we invested in an ATM processing business in Canada, which provides transaction processing and settlement account services to the deployers of ATMs. We also operate a service which delivers card-not-present transactions to the eCommerce industry. We recently established a physical instance of our card-not-present gateway in the United States. Additionally, along with two strategic partners, we now provide end-to-end transaction encryption services for specific POS devices using our network to deliver secure transactions from the terminal all the way through to the processor, enhancing the security of these transactions. As connectivity and network routing become increasingly IP-based, we will work to build value added services within our network with a focus on security, reliability and business intelligence.

We generally enter into multi-year contracts that usually have minimum transaction or revenue commitments from our POS customers. Our traditional business of providing dial-up connectivity service to POS and off-premise ATMs continues to generate the majority of the revenue of our POS division. For dial-up access services, we typically charge our customers a fixed fee per transaction plus a variable time-based charge for transactions that exceed a specified period of time. Generally, our contracts provide for a reduction in the fixed fee per transaction as our customers achieve higher monthly transaction volumes. We typically charge our customers fixed monthly fees for leased line and broadband services. We also generate POS revenue from usage charges, circuit charges, charges for access to real-time transaction monitoring and charges for ancillary services. For the year ended December 31, 2009, we transmitted approximately 4.9 billion dial POS transactions in North America and generated $76.1 million of revenue in the POS division, which represented 16.0% of our total revenues.

International Service Division (ISD) opportunity

While credit and debit card payments are growing in the United States, the international market for these payment methods is expanding at a greater rate. According to Mercator Advisory Group, between 2007 and 2008 the total number of general purpose credit and debit card transactions outside of the United States increased by 13.7%, to approximately 70.4 billion transactions. Outside of the United States, the regions with the highest transaction volumes in the world were Europe, Asia-Pacific and Latin America, while Middle East/Africa and Latin America experienced the fastest growth in 2008. (© 2009, Mercator Advisory Group, Inc.)

In markets outside of the United States, we believe there are opportunities with the large financial institutions, foreign-based processors and US-based processors increasing their international presence. In several of the countries we currently serve, many financial institutions have historically performed their own processing services for ATM, credit and debit card transactions using outsourced communications services from local telecommunication providers. For these institutions, we believe the redundancy, security and routing intelligence we provide gives us an opportunity to replace these incumbent network providers. Financial institutions in Europe, however, have increasingly outsourced

7

the processing of credit and debit card transactions to payment processors in an effort to leverage technical expertise, reduce costs and capitalize on economies of scale. As part of this trend, several of the largest payment processors based in the United States are increasing their international presence. As they expand into additional international markets, these payment processors will require providers of outsourced data communications services to deal with the complexity of transporting transactions across various network protocols, currencies and message formats.

Internationally we serve more retailers than we do in the United States. One of the key sectors of retail growth continues to be the eCommerce industry. For example, within the United Kingdom it is estimated that eCommerce transactions will account for 21% of all card transactions by 2015, growing from just under 11% in 2008 (Copyright (c) 2010 by Payment Systems Europe Limited). The growing needs of this class of merchant creates opportunities for payment gateway providers. Within the traditional retail market, opportunities exist to migrate merchants to high speed broadband connectivity for payment applications or to enable merchants with the ability to accept payments via wireless point of sale terminals.

Additionally, the growth, automation and globalization of financial markets have led to increased demand for outsourced, secure, reliable data communications services. Banks, mutual funds, pension funds, broker-dealers, alternative trading systems, electronic communications networks, or ECNs, securities and commodities exchanges and other market participants increasingly use data communications services to exchange trading information, distribute research and review trading positions.

Our ISD services

The network technology and services we have developed to serve our customers in the United States are applicable to the data communications needs of payment processing and financial services industries in other countries. Our international services revenues are currently generated primarily through the sale of our POS services. We generate the majority of our international revenues in the United Kingdom, where we are one of the leading providers of data communications and value-added services to the POS industry. We provide services to substantially all of the financial institutions in the United Kingdom which acquire and process credit and debit transactions in the United Kingdom. We also provide services to financial institutions operating ATMs. Within Europe, our services are predominantly related to providing data connectivity to the POS and ATM industries. Within the Asia-Pacific region, we generate revenue from POS and ATM connectivity services and increasingly from our card-not-present gateway services based in Australia.

In addition to our network connectivity services in ISD, we provide card present and card not present payment gateway services to multi-channel merchants as well as card associations which offer services over the Internet. We also provide managed broadband solutions and dial to IP conversion devices to merchants who desire to migrate their payment infrastructure from dial to IP technology as well as payment processing services to ATM owners. Additionally, we provide services to payment processors that are not used by payment processors in the United States. These include settlement and offline polling services which enable merchants to store transaction data until the payment processor retrieves the data after business hours.

We also generate international services revenues through the sale of our FSD services. TNS' international financial services business has experienced steady growth by expanding its presence globally, with a focus on developing business in the Asia-Pacific region. By signing exchanges and ECNs, and offering value-added services such as market-data offerings, we are expanding our financial community of interest over our Secure Trading Extranet. Additionally, TNS has launched a suite of low latency services to capitalize on the opportunity to provide high levels of system efficiency to the securities trading marketplace.

8

We consider a number of factors when evaluating opportunities in international markets, including the regulatory environment of the telecommunications and payments market, consumer use of credit and debit cards, the competitive landscape and the rules applicable to foreign investment. Historically, we typically provided our services internationally through a subsidiary located in the country identified for expansion. Recently, we have decided to expand into new countries by providing services from nearby countries in which we have existing operations. In some instances, we have elected to enter new markets through strategic acquisitions. While we continue to look for opportunities to expand into international markets, we plan to focus our efforts to grow internationally in those countries in which we currently have operations, being Australia, Austria, Bermuda, France, Germany, Hong Kong, India, Ireland, Italy, Japan, Malaysia, New Zealand, Poland, Romania, Singapore, South Korea, Spain, Sweden, Thailand, the Netherlands, Turkey and the United Kingdom. Continued expansion into international markets is an important part of our operating strategy. We currently plan to expand into additional countries in the Asia-Pacific region. We also expect to expand into additional countries in Central Europe as opportunities arise.

For the year ended December 31, 2009, we generated $138.3 million of revenue in the international services division, which represented 29.1% of our total revenues, of which $120.8 million was generated from the sale of our payment-related services and $17.5 million was generated from the sale of our financial service offerings. Our operations in the United Kingdom, France and Australia comprised 68.1% of our international revenues in 2009. For financial information about geographic areas where we do business, please refer to Note 9 of the consolidated financial statements and related notes included in Item 8 of this annual report.

Telecommunication Services Division (TSD) Opportunity

Every wireline and wireless telephone call consists of the content of the call, such as the voice, data or video communication, and the signaling information necessary to establish and close the transmission path over which the call is carried. Substantially all telecommunications carriers in the United States and Canada use Signaling System No. 7, or SS7, as the signaling protocol to identify the network route to be used to connect individual telephone calls. SS7 networks are data networks that transport call-signaling information separate from the public switched telecommunication network over which the call content is communicated. Telecommunication service providers require access to an SS7 network connected to the signaling networks of other carriers to be able to provide telecommunication services to their customers. In addition to circuit set-up and tear-down, wireless operators use SS7 signaling to locate and authenticate subscribers, to determine service parameters, and to update location registers.

SS7 networks are also used to retrieve information from centralized databases maintained by telecommunication services providers and other third parties. By accessing this information, telecommunication services providers are able to offer services that enable intelligent network services such as local number portability, line information database, caller identification and toll-free number services, as well as credit card, calling card, third-party billing and collect calling. Companies which provide voice over IP (VoIP) services also use SS7 networks to exchange and maintain subscription and location data on subscribers to support voice and wireless roaming services. Competitive pressures are encouraging telecommunication services providers to develop and offer additional services that utilize the signaling services provided by an SS7 network. For example, wireless carriers offer content delivery such as video and ring tones, short message service, and internet browsing and commerce capabilities.

According to Pyramid Research, the U.S. telecommunications market will reach $406 billion in 2014 with mobile data revenue climbing to $94 billion, surpassing fixed voice during the forecast period. The market for communication services is expected to grow at a compound annual growth rate, or CAGR, of 2.5 percent from year-end 2009 to year-end 2014, with most of the growth being attributed to mobile data and IP-based networks. VoIP is expected to grow from $8 billion in 2008 to $22 billion

9

in 2014. Mobile broadband will be a further source for growth for the U.S. telecommunications market due to growing popularity of unlimited data and mobile broadband plans. Revenue related to mobile broadband access for laptop computers and Internet access for handsets is estimated to grow rapidly at CAGRs of 28 percent and 18 percent, respectively, from 2009 to 2014.

Our TSD Services

At the beginning of 2009, we owned and operated an SS7 network and partnered with other providers to offer services delivered throughout the network. In May, 2009, we acquired the Communications Services Group assets from VeriSign, Inc. As a result of the acquisition, we now operate the largest unaffiliated SS7 network in the United States capable of providing call signaling and database access services nationwide. Our SS7 network is connected with the signaling networks of all of the incumbent local exchange carriers and a significant number of wireless carriers, competitive local exchange carriers, interexchange carriers and voice over IP (VoIP) service providers. We believe that our independence and neutrality enhance our attractiveness as a provider of outsourced SS7 services. Through the acquisition of the Communication Services Group assets we also now own proprietary services such as database and registry services, which include caller-name identification, and roaming and clearing services to wireless carriers. TSD's customer base includes incumbent and competitive local exchange carriers, IP-based communications providers, and mobile operators.

The deployment, operation and maintenance of a nationwide SS7 network connected to all of the major signaling networks and database providers requires significant capital and specific technical expertise. For these reasons, many telecommunication services providers have chosen not to build the networks and applications necessary to satisfy all of their SS7 signaling requirements. Rather, they turn to outsourced SS7 network service providers such as TNS to obtain the call signaling, database access and value-added services critical to their business in an effort to increase speed to market and to remain competitive.

With our SS7 network, we provide switching and transport services throughout the United States as well as in the Caribbean and Latin America. Our SS7 network is connected to the SS7 networks of local exchanges and wireless carriers through various mated pairs of signal transfer points deployed throughout the country. By connecting to our SS7 network, our customers eliminate their need to implement, operate and maintain numerous, complex connections linking their SS7 switches to the signaling networks of other telecommunications carriers. We believe that our SS7 network enables us to offer our data communications services more reliably and cost-effectively than our competitors.

Within our database services, we offer our customers access to databases maintained internally and to those operated by telecommunications carriers and other third parties. These databases are used to provide subscribers with intelligent network services such as local number portability, line information database, caller identification and toll-free number services. These databases also are used to provide the registry services required to route IP-based and mobile messaging services. Our database and registry service includes the following:

- •

- Local number portability databases. Wireline and wireless

telecommunications carriers are required to provide local number portability, a service that enables a subscriber to change service providers within a particular location and keep the same phone

number. Our SS7 network provides access to internally managed databases that host all wireline and wireless number portability data.

- •

- Line information databases. Telecommunications service providers develop and maintain databases that store subscriber information, including names and addresses. This information is necessary to provide enhanced services such as validating subscriber and billing information.

10

- •

- Toll-free databases. Each time a subscriber

calls a toll-free number, the telecommunication services provider must access a national database of toll-free numbers in order to route the call.

- •

- Calling name storage and delivery databases. A

telecommunication services provider must access a database containing the name and other information about the subscriber for the telephone number placing the call in order to offer caller

identification services.

- •

- Validation and fraud control services. Our validation and

fraud control services combine our access to line information databases with our proprietary fraud control technology to provide interexchange carriers, operator services providers and payphone

service providers real-time telephone call billing validation and fraud control services for calling card, credit card, third-party billing and collect calls. Our services assist our

customers in determining whether telephone company calling cards, credit cards, travel and entertainment cards and telephone numbers constitute valid accounts and billable telephone numbers.

- •

- ID Plus. ID Plus gives users access to a telephone name

and address database, which will increase service providers' ability to either discern the identity of a caller or to direct bill for services.

- •

- IP directory services. Our carrier electronic numbering

service enables applications using internet protocols to communicate with consumer devices addressed by telephone numbers. Our registry is populated with information sourced from industry and

regulatory number management systems, along with authoritative data sourced directly from the carriers. Through a query or number lookup, the registry provides accurate

carrier-of-record information and the applicable IP address for a telephone number enabling VoIP calls, data messages, and text messages to be terminated to the proper

location.

- •

- VoIP peering registry services. Our managed VoIP peering services provide advanced routing capabilities, protocol technology and other services to enable VoIP network providers to interconnect their networks with traditional telecommunications networks. With a single interconnection, our VoIP peering services can connect VoIP networks and traditional telecommunications networks anywhere in the world. Domestically, we combine our VoIP peering services with our database access services.

Additionally, we offer a suite of roaming and clearing services to wireless carriers using the ANSI-41 and GSM Mobile Application Part signaling protocols. Our roaming and clearing services allow carriers to provide support for mobile phone customers of other carriers visiting their service area, referred to as roamers, and for their customers when they roam outside their service area. Our service manages signaling conversion and implementation anomalies between different countries to provide activation processing, seamless international roaming, and fraud protection. Our roaming data clearinghouse services facilitate financial settlement between carriers. We provide these services in addition to access to a pre-established international roaming footprint. In addition, we offer roaming services for carriers utilizing third generation packet radio services, or 3GPRS, and code division multiple access, or CDMA, technologies to offer wireless roaming to their subscribers over broadband wireless networks. We also offer a variety of roaming application and value-add services that help wireless operators better manage and maximize the profitability of their roaming operations.

Our LEConnect data services provide telecommunication services providers with a fast and reliable method of transmitting billing and collection data to and from local exchange carrier data centers over our secure IP networks. Our LEConnect data service minimizes the data transmission errors and time lags associated with a traditional billing and collection system, which requires numerous interexchange carriers and information service providers to send billing data on magnetic data tapes to local exchange carriers. We also offer short message service offload services, which allow telecommunication services

11

providers to avoid the incurrence of additional costs, relieve message congestion and preserve network capacity by offloading short message traffic from SS7 signaling networks to our IP networks.

We generally enter into multi-year contracts with our telecommunication services customers, many of whom agree to minimum volume commitments. We charge fixed monthly fees for SS7 network services, LEConnect services, and VoIP peering services and per-message fees for our database access, call validation, and roaming and clearing services. For the year ended December 31, 2009, we generated $213.0 million of revenue in the telecommunication services division, which represented 44.8% of our total revenues.

As demands for services other than voice continue to grow, we believe there are a number of additional factors that contribute favorably to ongoing demand for our network and other services:

- •

- Despite marketing focus on newer technologies, SS7 presently remains the signaling protocol of choice for many operators.

With the large size of the installed base in legacy circuit-switched SS7 networks, we believe that the evolution to IP communications will be gradual.

- •

- Service providers with a purely next-generation network must terminate traffic on traditional networks using

SS7. We believe these service providers will continue to require SS7 and intelligent database interoperability services into the foreseeable future.

- •

- The growth of mobile data services requires interoperability between mobile operators' radio networks, private IP

networks, and the public Internet. We believe TNS' database and registry services enable the exchange and accurate routing of mobile data communications between these networks.

- •

- Mobile and IP-based communication service providers participate in the porting of telephone numbers, which complicates the

accurate and efficient routing of communications data. We believe TNS' database and registry services resolve these complexities on behalf of service providers.

- •

- Competition between service providers has made delivering services in the most cost-efficient manner critical. For this reason, communication service providers are looking for flexible product offerings which decrease investments in legacy infrastructure, achieve economies of scale and increase speed to market. We believe TNS' business model fits strategically in this increasingly competitive environment.

We believe our network will continue to play a critical role in delivering necessary intelligence for communication service providers to maintain a sustainable market position. Furthermore, we believe that significant opportunities exist for service providers and mobile operators with the technical and commercial strategies to capitalize on the convergence of communications networks. Accordingly, TNS' strategy is to deliver network-based intelligence and infrastructure services that enhance the service distribution capabilities of telecommunication service providers.

Financial Services Division (FSD) Opportunity

The securities trading and investment management industry is increasingly requiring high-speed, reliable, secure data communications services to communicate information among industry participants, including commercial banks, mutual funds, pension funds, broker-dealers, alternative trading systems (ATS), electronic communications networks (ECN's) and securities and commodities exchanges. Transaction volume in the global equity markets has increased rapidly over the past decade. During the same period, the emergence of new electronic trading venues such as ECN's and ATS and regulatory requirements such as the shift to decimalization have placed increasing emphasis on trading and cost efficiencies. To meet these needs, market participants use outsourced data communications services that provide industry participants with access to other participants through a single, managed access point

12

on the service provider's network. These services allow participants to cost-effectively connect to each other to conduct time-sensitive transactions and communicate real-time information.

Our FSD Services

Our fast, private, secure and reliable IP data networks are designed specifically to address the data and voice communications requirements of the financial services industry. TNS connects over 1,700 financial community end-points located at over 625 distinct financial services companies, representing buy and sell-side institutions, market data and software vendors, exchanges and alternative trading venues. Our IP network services allow our customers to access multiple financial services companies through a single network connection, thereby eliminating the need for costly dedicated institution-to-institution leased line connections. Additionally, these services facilitate secure and reliable communications between financial services companies by supporting multiple communications standards and protocols, including the Financial Information eXchange (FIX) protocol. Our network has over 134 points of presence and provides services to customers in 30 countries across the Americas, Europe and the Asia Pacific region, with connections to endpoints in many more. Our financial services customers may have one or more access points to our IP network, depending on the location of their offices and other factors.

We refer to our primary financial service offering as our Secure Trading Extranet. Our Secure Trading Extranet service links financial services companies through our IP network. Through a single network connection, a customer can communicate with any other entity connected to our IP network. Given the large number of industry participants connected to our network, including commercial banks, mutual funds, pension funds, broker-dealers, alternative trading systems, electronic communications networks, multilateral trading facilities and securities and commodities exchanges, a single customer can use its connection to our IP network to conduct seamless, real-time electronic trading and access a variety of content including news, research and market data.

We generate financial services revenue primarily from monthly recurring fees based on the number of customer connections to and through our IP network. For the year ended December 31, 2009, we generated $47.7 million of revenue in the financial services division, which represented 10.1% of our total revenues.

The growth of electronic trading continues to present opportunities for our financial services division. There is increasing demand for low latency market data feeds and higher bandwidth connectivity to improve the effectiveness of buy-side, sell-side, and exchange customers. Along with the increasing bandwidth demands, we continue to see opportunities to expand upon our global community of interest. This community consists of stock exchanges and other trading venues such as multilateral trading facilities, or MTFs, as well as buy-side and sell-side organizations that wish to connect with one another and also receive low latency market data.

Our Strengths

We believe our competitive strengths include:

Recurring revenues and strong operating cash flows. Our established customer base enables us to generate high levels of recurring revenues and strong operating cash flows. Our business model is based upon the number of transactions we transport and the number of connections to our networks. We typically enter into multi-year service contracts that usually have minimum transaction or revenue commitments from our customers. We believe that our recurring revenues and strong operating cash flows will enable us to continue to invest in the development of new products and services and to continue to expand internationally.

13

Established customer base. We have an established customer base of leading industry participants in each division and have experienced limited customer turnover. For the year ended December 31, 2009, we provided payment-related services to more than 1,000 customers. In addition, for the year ended December 31, 2009, we provided services to more than 800 telecommunication services providers and to more than 625 financial services companies. Internationally we generate revenue in over 40 countries and provide services to some of the largest financial institutions, wireless operators and other services providers in those countries and neighboring countries. Through our established customer relationships, we have developed an extensive knowledge of each of our customer's industries. We believe that our knowledge and experience enhance our ability to deliver new and timely data communications services and solutions.

Well-positioned to continue international growth. The network technology and data communications products and services we have developed to serve customers in the United States, Europe and the Asia-Pacific region are applicable to the data communications needs of the payment processing and financial services industries in other countries. We believe that our data communications services and technologies, our technical expertise and our customer relationships with the largest domestic payment processors and global financial institutions strategically position us to take advantage of substantial international opportunities. We have grown our international revenues from $33.1 million for the year ended December 31, 2002 to $138.3 million for the year ended December 31, 2009.

Highly customized data network. We operate a highly customized global network designed and configured for the transmission of time-sensitive data. Our network supports multiple communications protocols and access methods and, as a result, is able to support a wide variety of applications. The flexibility and scalability of our network and our technical expertise allow us to rapidly add new data communications services to our existing offerings in response to emerging technologies with limited service disruptions or capital expenditures. We also believe our ability to leverage our fixed cost base provides us with significant economies of scale, resulting in a competitive advantage.

Substantial experience in our target markets. The nine members of our executive management team have on a combined basis more than 130 years experience in the transaction services and telecommunications industries as well as experience managing large, multinational corporations, and on average have been employees of the company for more than six years. We have focused on creating data communications services for developing and established markets. We believe this gives us an understanding of the unique needs and risks of our target markets and provides us with a competitive advantage over larger service providers that have a broader market perspective. We also believe our extensive experience provides us with a competitive advantage over service providers of similar or smaller size.

Proven acquisition strategy. Our management team has augmented the growth of our business by successfully identifying and integrating strategic acquisitions. We have made a number of acquisitions that have accelerated the growth of each of our service divisions. For example, we acquired the assets of VeriSign's Communications Services Group (CSG) in 2009, to increase our market share in call signaling and intelligent database services as well as to expand our product offerings with the addition of wireless roaming and clearing and IP registry services. We also acquired Dialect Payment Technologies in 2007 to provide Internet payment gateway services to our customers throughout the world.

Our Strategy

Our objective is to continue to grow our business and enhance our position as a leading provider of outsourced business-critical data communications services enabling secure and reliable transmission

14

of time-sensitive information for our transaction processing, telecommunications and financial services customers. Key elements of our strategy include:

Focus on key geographies. We continue to focus our efforts and resources to expand our business in six countries and their surrounding areas in which we already have operations. These countries are Australia, France, Italy, Spain, the United Kingdom and the United States. We believe concentrating our efforts in this way will enable us to grow our business in these geographic markets as well as in adjacent countries, enabling us to generate growth with less capital investment.

Continue to expand our customer base. We believe our experience, existing customer relationships and our ability to consistently deliver secure and reliable data communications services will enable us to expand our customer base in domestic and international markets. For example, in our POS and international services divisions we intend to expand our service offerings to certain customer segments in the traditional and Internet-based retail industry, focusing on selling our broadband managed connectivity solutions and our managed payment services, such as card-not-present gateway services. In our financial services division, we will continue to increase the scope of services and leverage our existing customer base of over 625 financial services companies to acquire new customers. Our recent acquisition of the assets of CSG expanded our product offerings and we anticipate this will help us acquire new customers.

We intend to continue to leverage our customer relationships and technical expertise to provide our POS and financial offerings internationally. Additionally, during 2009, we started to expand our telecommunications services division presence outside of the U.S., adding several new international wireless customers with our roaming and clearing product. We are increasing our focus on expanding our TSD business outside the U.S., focusing on opportunities in and around the countries in which we have an existing presence.

Develop new product and service offerings. We will continue to expand our service offerings to address new markets for secure and reliable transmission of time-sensitive information. We continue to enhance our broadband services to payment processors, financial institutions and merchants in connection with the global POS industry's adoption of new technologies. We are currently offering internet payment gateway services to POS customers in the Asia-Pacific region and the United Kingdom and we intend to begin serving the United States and Western Europe this year. In our telecommunication services division we are deploying data communications services to cable companies allowing them to deploy VoIP network services without incurring the capital expenses of building an SS7 network. Additionally, we are working on several new products within TSD, leveraging our existing technology platforms and focusing on revenue-generating products for our customers.

Increase sales to existing customers. We will continue our efforts to further expand our existing customer relationships to increase business domestically and abroad. For example, we intend to encourage: our domestic and international POS customers to increase their number of connections to our networks and to transmit a greater percentage of their transaction volume with us; our telecommunication services customers to increase the number of signaling routes they establish through our SS7 network and to increase the amount of data we store on their behalf in our databases; and our financial services customers to connect more endpoints and virtual connections to, and use greater bandwidth on, our data network.

Our longstanding relationships with our customers provides us with an opportunity to increase the sales we make to our existing customers as they and we expand internationally. Within POS, our domestic processing customers are looking for growth outside the United States, opening up several new opportunities for cross-border routing of transactions. In TSD, our CSG acquisition gave us several new products and services, such as database and registry services, roaming and clearing and short messaging services, that we can now offer to our legacy customers on a stand-alone basis or as a

15

bundled service. We also provide managed services to legacy CSG customers, helping them control network costs as they start to focus on building next-generation IP-based networks. We believe we have an opportunity to sell broadband POS services along the business chain to new customers currently using the services of our existing TSD customers. We also believe our telecommunication customers will be interested in our managed payment services such as our card-not-present platform. We intend to work closely with our customers to increase our knowledge of their businesses and technical requirements in an effort to identify additional sales opportunities.

Pursue strategic acquisitions. We will continue to seek opportunities to acquire businesses that expand our range of services, provide opportunities to increase our customer base and enter into new domestic and international markets. We will need to use operating cash flows or additional financing to pursue our strategy. In May 2009 we acquired the CSG assets for $230.7 million. We funded the transaction through a new $230.0 million term loan facility as part of the May 2009 Credit Facility.

Our Network

We operate a highly-customized data network specifically designed and configured for the transmission of time-sensitive data. Our diverse data network architecture supports a variety of widely-accepted communications protocols and is accessible through a variety of methods, including dial-up, leased line, wireless and secure Internet connections. We have designed our data network to be scalable and to allow easy adoption of new access technologies. The hardware utilized in our network is installed at 134 points of presence worldwide, 50 of which are in North America. We connect these points of presence with digital circuits leased from multiple telecommunication services providers. In addition, our network control centers allow us to administer our network and enable us to monitor our customers' transactions in real time.

We believe that our network provides the following important benefits to our customers:

Our network is designed specifically to address the data communications needs of our diverse customer base. Our data network supports multiple communications protocols and includes customized hardware, software and value- added features developed by us or by vendors to our specifications. The following is a description of the various protocols we operate within our network:

- •

- IP. Internet protocol, or IP, is a communications

technology that routes outgoing data messages and recognizes incoming data messages. Our secure domestic and international IP infrastructure provides the services offered by our financial services

division, the broadband services offered by our POS division and the LEConnect data services offered by our telecommunication services division. We also use our IP infrastructure for our internal

processes, such as accounting functions and network monitoring and management. We have designed and implemented this with a high level of system redundancy, dynamic routing and sophisticated security

and authorization technologies.

- •

- X.25. X.25 is a communications protocol used to transmit

packets of data. Our domestic and international X.25 protocol transports our customers' POS transactions and is used to provide the validation services offered by our telecommunication services

division. This protocol is designed to provide fast call connection times, a high level of system redundancy, dynamic rerouting, wide geographic coverage and value-added features, at a low cost per

transaction. Customers may access our X.25 infrastructure using various methods, including dial-up services, leased line services, wireless services, satellite services and secure internet

connections.

- •

- SS7. SS7 is a communications protocol used to transmit signaling information to establish and close the transmission path over which a telephone call is routed. Our domestic SS7-based infrastructure sets up, routes and terminates the transactions transmitted through the services offered by our POS division. It also provides the call signaling services and database access services offered by our telecommunication services division. Our SS7 infrastructure is accessed using dedicated SS7 links provided by local exchange carriers and interexchange carriers.

16

Our network is reliable, redundant and secure. We believe we have configured the major components of our network to eliminate any single point of failure. The reliability of our data network is enhanced significantly because we have deployed our network with redundant hardware installed at geographically diverse facilities connected by multiple telecommunications carriers. Our facilities are deployed with battery back-up and emergency generator power systems. We coordinate the physical routing of the digital circuits connecting our facilities with multiple telecommunication service providers to ensure the availability of diverse paths for routing any transaction or data, thereby enhancing network reliability. Due to such physical diversity, minor outages or failures typically do not require the immediate intervention of our technicians. We are able to respond quickly to service problems because the network monitoring, management and troubleshooting systems we use permit our network control centers to correct problems remotely. Our data network contains industry standard firewalls and protections, and security is further enhanced by limiting access. Our network is PCI DSS certified.

Our IP and X.25 protocols incorporate several customized, value-added features that distinguish our services and performance from our competitors. We believe that various value-added features we have developed permit our POS customers accessing our data network through dial-up services to process a greater volume of transactions than other dial-up service providers.

These features include:

- •

- the use of equipment that supports and converts transaction data delivered to our data network in multiple protocols and

message formats into the protocols employed by our data network, thereby eliminating the need for our customers to incur the high costs associated with reprogramming POS terminals and host computers

and performing continuous network enhancements and software upgrades, and

- •

- real-time call tracking, which enables us to quickly resolve host, terminal or network problems experienced by

our customers and to recommend to our customers ways to improve their systems, and

- •

- the ability to convert message protocols within our network, allowing acquiring organizations to bring various transaction

types with various message formats into their processing hosts without having to make costly changes within their own infrastructure, and

- •

- a secure Internet-based transaction monitoring system, which permits our customers to monitor the status of their transactions in real-time using the Internet.

Our network can accommodate growth in our business. Our network is deployed with sufficient capacity to accommodate significant growth in transaction volumes without incurring delays relating to the provisioning and deployment of additional hardware and telecommunications circuits. We have also designed the network so that we may easily increase capacity as necessary.

Our network operations centers continuously monitor and manage our network. We provide 24-hour, seven days a week network control coverage domestically through our network control centers located in Reston, Virginia and Overland Park, Kansas and internationally through our network control centers located in Sheffield, England and Sydney, Australia. Each of these network control centers serves as the backup network control center for the other control center. Our network control centers are staffed with skilled technicians experienced with the services we offer. Our network control centers remotely monitor the components of our data network and manage our network using sophisticated network management tools we have either developed internally or licensed from others.

Customers

As of December 31, 2009, we provided our payment-related services to more than 1,000 customers. In addition, as of December 31, 2009, we provided services to more than 800 telecommunication

17

services providers and more than 625 financial services companies. Historically we have experienced limited customer turnover. We believe this is a result of our strong relationships with our customers and is one of our strengths. Maintaining these relationships is critical to our long-term success.

For the year ended December 31, 2009, we derived approximately 15.7% of our total revenues from our five largest customers. No customer accounted for more than 10% of our total revenues for the year ended December 31, 2009. We typically enter into multi-year service contracts with our customers with minimum commitments. Under some of our contracts, once the customer has met its minimum commitment on an annual or contract term basis, the customer is no longer obligated to purchase services from us. The contracts with our five largest customers contain minimum transaction or revenue commitments on an annual or contract term basis. The contracts with our five largest customers expire from 2010 to 2011.

Sales and Marketing

In 2009, we sold our services directly to customers through geographically dispersed sales teams. In North America, we had a specialized sales team for each of our POS and telecommunication service divisions, and globally we had a specialized sales team for our financial services division. In our international services division, our sales teams were organized geographically with each team responsible for selling all of our services in the country in which the team is based and, in some cases, proximate countries. Our international sales teams are based in Australia, France, Germany, Hong Kong, India, Ireland, Italy, Japan, Poland, Romania, Singapore, South Korea, Spain, Thailand, Turkey, and the United Kingdom. Generally, each sales team includes a managing director or sales manager, account representatives, business development personnel, sales engineers and customer service representatives experienced in the industries of our customers and the services we offer. In connection with our decision to align the Company's business along global industry lines, we currently have global, specialized sales teams for our telecommunication services division, payments division and financial services division.

Our business development groups based in North America and Europe are focused on selling large service-based solutions to our largest customers and prospects. They work closely with the divisional sales teams to provide in-depth industry and solution capabilities to our customers.

Our sales teams work to establish and maintain relationships with customers by identifying a customer's need for our services and promoting our secure, reliable, efficient, competitively priced services. We also pursue opportunities to customize our solutions to meet the requirements of large customers.

When a customer initially purchases services from us, the customer typically purchases some, but not all, of the services we offer. Our sales teams then strive to increase the services purchased by existing customers and to expand the range of services we provide to our customers. Our sales teams consult with our customers to identify the new business-critical services we may provide.

Our global marketing group works with our sales teams around the world and the product group to promote interest in our services and to generate new sales prospects. In addition they ensure that any news associated with the company is distributed in a timely manner to all of the company's stakeholders.

Suppliers

The operation of our networks depends upon the capacity, reliability and security of services provided to us by a limited number of telecommunication service providers. We have no control over the operation, quality or maintenance of those services or whether the vendors will improve their

18

services or continue to provide services that are essential to our business. In addition, telecommunication service providers may increase the prices at which they provide services.

Some key components we use in our networks are available only from a limited number of suppliers. The number of available suppliers of components for our X.25 networks is particularly limited. The Company has entered into long term contracts with two vendors for the provision of network equipment and the maintenance of hardware and software utilized on our network.

Competition

POS division. Our POS division competes on the basis of industry expertise, network service quality and reliability, transaction speed, value-added features, customer support and cost-efficiency. The primary competitors for our POS division's dial-up services are interexchange carriers such as Verizon Business Solutions, an operating unit of Verizon Communications, Inc., AT&T Corp, and Hypercom Corporation. The carriers typically do not aggressively pursue transaction-oriented business as a stand-alone service but rather offer it in conjunction with other products and services. The primary competitors of our POS division's counter-top integration and broadband connectivity services are Cybera, Inc. and broadband access providers such as MegaPath Networks, Inc. The primary competitor of our POS division's wireless services is APRIVA.

Telecommunication services division. Our telecommunication services division competes on the basis of industry expertise, network service quality and reliability, transaction speed, customer support, cost-efficiency and value-added services. The primary competitors of our telecommunication services division include telecommunication carriers such as Verizon Communications, Inc. and AT&T Corp., Syniverse Technologies, Inc., and TARGUSinfo.

Financial services division. Our financial services division competes on the basis of access to multiple financial services companies, security, support services, cost-efficiency and discrete service offerings. The primary competitors of our financial services division are other private communications networks and telecommunications carriers including AT&T Corp. and BT Group PLC, providers of quote terminals and market data services such as Bloomberg, Reuters and Thomson Financial, and other network service providers such as SAVVIS, Inc.

International services division. Our international services division competes on a similar basis as our POS and financial services divisions. Primary competitors of our international services division's POS services are incumbent telephone companies in the geographic location, such as BT Group PLC in the United Kingdom, France Telecom in France, Telecom Italia in Italy, Telefonica in Spain and Telstra in Australia. The primary competitor of our processing services in the United Kingdom is Avantra.

Government Regulation

The Federal Communications Commission, or FCC, retains general regulatory jurisdiction over the sale of interstate telecommunications services. We believe that TNS' services in general are properly characterized as "information" or "enhanced" services rather than "telecommunications services." Providers of information services are not required to maintain a certificate of public convenience and necessity with the FCC, to contribute directly to the Universal Service Fund, to file tariffs with the FCC, or to comply with any of the other FCC regulations applicable to telecommunications carriers. The application of the "information" and "telecommunications" categories to particular services and activities is an evolving standard with no bright lines of demarcation. TNS continues to monitor its businesses to ensure that its services remain properly characterized for regulatory purposes.

Further, the FCC has found information (or enhanced) services to be inherently interstate in nature. In addition, nearly all TNS services cross state boundaries and are thus interstate offerings. Consequently, our services are not subject to state public utility commission regulation.

19

The only "telecommunications service" within our business is provided by our wholly-owned subsidiary, TNS Transline LLC. TNS Transline is subject to regulatory oversight by the FCC due to its provision of interstate telecommunications services. TNS Transline complies with all regulatory registration and payment obligations mandated by the FCC. As a "non-dominant" carrier, however, TNS Transline is not required to file tariffs or submit to other forms of "dominant" carrier regulation. Further, TNS Transline provides exclusively interstate telecommunications services and thus is not subject to state public utility commission regulation of its services. State regulators may regulate purely intrastate telecommunications services and may regulate mixed intrastate/interstate telecommunications services to the extent their regulation does not impede federal policies. We do not believe that we currently are subject to state regulations for our existing services, and we believe that, even if we were subjected to state regulation, we could obtain all necessary approvals.

Even though we provide unregulated services, federal and state regulations can affect the costs of business for us and our competitors by changing the rate structure for access services purchased from local exchange carriers to originate and terminate calls. Under the Telecommunications Act of 1996 ("the 1996 Act"), the FCC implemented rules and regulations known as Access Charge Reform to reform the system of interstate access charges. The FCC's implementation of these rules increased some components of our costs for access while decreasing others. The FCC is currently considering additional rulemaking proceedings concerning this intercarrier compensation scheme, and we currently cannot predict whether any rule changes will be adopted or the impact these rule changes might have on our access charges if they are adopted. Recent and pending decisions of the FCC and state regulatory commissions may limit the availability and increase pricing used by our suppliers to provide telecommunication services to us. We cannot predict whether the rules will change or, if they do, whether the changes will increase the cost or availability of services we purchase from our suppliers.

In connection with the regulated telecommunications services of our subsidiary, TNS Transline, we are required to pay directly into the Federal Universal Service Fund. The monies generated by Federal Universal Service Fund surcharges are used to help provide affordable telecommunication services throughout the country, including to consumers in high-cost areas, low-income consumers, eligible schools and libraries and rural healthcare providers. In addition, the third party telecommunications service suppliers for our information services are obligated to contribute directly to the Federal Universal Service Fund. Our telecommunications service suppliers, in turn, recover the cost of their contribution obligations by imposing surcharges on us and our competitors based upon a percentage of their interstate and international end-user telecommunications revenues. If the Federal Universal Service Fund surcharges increase, our telecommunications service suppliers will pass those increased surcharges on to us. We in turn will pass those potential increased Federal Universal Service Fund surcharges on to our customers to the extent permitted under our contracts with them. The United States Congress and the FCC are considering modifying the way in which Federal Universal Service Fund charges are calculated, including considering whether to assess universal service charges on a flat-fee basis, such as a per-line, per-telephone number or per-account charge. We currently cannot predict whether Congress will mandate or the FCC will adopt changes in the calculation of Federal Universal Service Fund contributions or whether these changes, if adopted, would increase our Federal Universal Service Fund surcharges. If the FCC implements any legislation, adopts any proposal or takes any administrative action that increases our Federal Universal Service Fund surcharges, our network operating costs will increase. In addition, if the FCC implements any legislation, adopts any proposal, or takes any administrative action that increases our supplier's Federal Universal Service Fund obligations, these telecommunications service suppliers may seek to pass through cost-recovery charges to us, which would result in an increase in our cost of network services, an increased cost which the Company may or may not be able to pass on to our customers.

20

Intellectual Property