Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - NEW PEOPLES BANKSHARES INC | dex32.htm |

| EX-21 - EXHIBIT 21 - NEW PEOPLES BANKSHARES INC | dex21.htm |

| EX-23.1 - EXHIBIT 23.1 - NEW PEOPLES BANKSHARES INC | dex231.htm |

| EX-31.1 - EXHIBIT 31.1 - NEW PEOPLES BANKSHARES INC | dex311.htm |

| EX-31.2 - EXHIBIT 31.2 - NEW PEOPLES BANKSHARES INC | dex312.htm |

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2009

Commission File Number 000-33411

New Peoples Bankshares, Inc.

(Exact name of registrant as specified in its charter)

| Virginia | 31-1804543 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 67 Commerce Drive Honaker, VA |

24260 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (276) 873-7000

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock - $2 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15 (d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K Section 229.405 is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” , “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer |

¨ (Do not check if smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates, based on the last reported sales prices of $10.00 per share on the last business day of the second quarter of 2009 was $88,036,560.00.

The number of shares outstanding of the registrant’s common stock was 10,009,037 as of March 15, 2010.

DOCUMENTS INCORPORATED BY REFERENCE:

Items 10 through 14 are incorporated by reference to the annual proxy statement.

Table of Contents

2

Table of Contents

PART I

| Item 1. | Business |

General

New Peoples Bankshares, Inc. (New Peoples) is a Virginia bank holding company headquartered in Honaker, Virginia. Prior to January 1, 2009, New Peoples was a financial holding company. New Peoples subsidiaries include: New Peoples Bank, Inc., a Virginia banking corporation (the Bank) and NPB Web Services, Inc., a web design and hosting company (NPB Web). In July 2004, NPB Capital Trust I was formed for the issuance of trust preferred securities. In September 2006, NPB Capital Trust 2 was formed for the issuance of trust preferred securities. NPB Financial Services, Inc., an insurance and investment services corporation (NPB Financial) was a subsidiary of New Peoples until January 1, 2009 when it became a subsidiary of the Bank.

The Bank offers a range of banking and related financial services focused primarily on serving individuals, small to medium size businesses, and the professional community. We strive to serve the banking needs of our customers while developing personal, hometown relationships with them. Our board of directors believes that marketing customized banking services enables us to establish a niche in the financial services marketplace where we do business.

The Bank is headquartered in Honaker, Virginia and operates 31 full service offices in the southwestern Virginia counties of Russell, Scott, Washington, Tazewell, Buchanan, Dickenson, Wise, Lee, Smyth, and Bland; Mercer County in southern West Virginia and the eastern Tennessee counties of Sullivan and Washington. The close proximity and mobile nature of individuals and businesses in adjoining counties and nearby cities in Virginia, West Virginia and Tennessee places these markets within our bank’s targeted trade area, as well.

We provide professionals and small and medium size businesses in our market area with responsive and technologically advanced banking services. These services include loans that are priced on a deposit relationship basis, easy access to our decision makers, and quick and innovative action necessary to meet a customer’s banking needs. Our capitalization and lending limit enable us to satisfy the credit needs of a large portion of the targeted market segment. When a customer needs a loan that exceeds our lending limit, we try to find other financial institutions to participate in the loan with us.

Our History

The Bank was incorporated under the laws of the Commonwealth of Virginia on December 9, 1997 and began operations on October 28, 1998. On September 27, 2001, the shareholders of the Bank approved a plan of reorganization under which they exchanged their shares of Bank common stock for shares of New Peoples common stock. On November 30, 2001, the reorganization was completed and the Bank became New Peoples’ wholly owned subsidiary.

In June 2003, New Peoples formed two new wholly-owned subsidiaries, NPB Financial Services, Inc. and NPB Web Services, Inc.

NPB Financial is a full-service insurance and investment firm, dealing in personal and group life, health, and disability products, along with mutual funds, fixed rate annuities, variable annuities, fee based asset management and other investment products through a broker/dealer relationship with UVEST Financial Services, Inc.

NPB Web is an internet web site development and hosting company. It produces custom designed web pages for use on the world wide web and serves as a web site host for customers and non-profit organizations. It also develops the web sites of other New Peoples’ subsidiaries and supplies advertising and marketing expertise for New Peoples.

In July 2004, NPB Capital Trust I was formed to issue $11.3 million in trust preferred securities.

In September 2006, NPB Capital Trust 2 was formed to issue $5.2 million in trust preferred securities.

3

Table of Contents

Location and Market Area

We initially opened with full service branches in Honaker and Weber City, Virginia and in 1999 opened a full service branch in Castlewood, Virginia. During 2000, we opened full service branches in Haysi and Lebanon, Virginia. During 2001, we opened branches in Pounding Mill, Virginia and Princeton, West Virginia. In 2002, we opened branch offices in Gate City, Clintwood, Big Stone Gap, Tazewell and Davenport, Virginia. During 2003, we expanded into Grundy, Dungannon, and Bristol, Virginia. We expanded into Tennessee and opened an office in Bloomingdale, Tennessee in 2003, as well. In 2004, we opened offices in Richlands, Abingdon, and Bristol, Virginia. In 2005 full service branches were opened in Bluefield and Cleveland, Virginia. During 2006, we opened full service branches in Esserville, Pound, and Lee County, Virginia and Jonesborough, Tennessee. During 2007, we opened full service offices in Bland, and Chilhowie, Virginia; and Bramwell, West Virginia. We purchased two operating branches from another bank, including deposits and loans located in Norton and Pennington Gap, Virginia in June 2007. During 2008, we opened one full service office in Bluewell, West Virginia.

In order to open additional banking offices, we must obtain prior regulatory approval which takes into account a number of factors, including, among others, a determination that we have adequate capital and a finding that the public interest will be served.

Internet Site

In March 2001, we opened our internet banking site at www.newpeoplesbank.com. The site includes a customer service area that contains branch and ATM locations, product descriptions and current interest rates offered on deposit accounts. Customers with internet access can access account balances, make transfers between accounts, enter stop payment orders, order checks, and use an optional bill paying service.

Available Information

We file annual, quarterly, and current reports, proxy statements and other information with the Securities and Exchange Commission (the SEC). Our SEC filings are filed electronically and are available to the public over the internet at the SEC’s web site at www.sec.gov. In addition, any document we file with the SEC can be read and copied at the SEC’s public reference facilities at 100 F Street, N.E., Washington, D.C. 20549. Copies of documents can be obtained at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We also provide a link to our filings on the SEC website, free of charge, through our internet website www.npbankshares.com under “Investor Relations.”

Banking Services

General. We accept deposits, make consumer and commercial loans, issue drafts, and provide other services customarily offered by a commercial bank, such as business and personal checking and savings accounts, walk-up tellers, drive-in windows, and 24-hour automated teller machines. The Bank is a member of the Federal Reserve System and its deposits are insured under the Federal Deposit Insurance Act to the limits provided thereunder.

We offer a full range of short-to-medium term commercial and personal loans. Commercial loans include both secured and unsecured loans for working capital (including inventory and receivables), business expansion (including acquisition of real estate and improvements) and purchase of equipment and machinery. Consumer loans may include secured and unsecured loans for financing automobiles, home improvements, education, personal investments and other purposes.

Our lending activities are subject to a variety of lending limits imposed by state law. While differing limits apply in certain circumstances based on the type of loan or the nature of the borrower (including the borrower’s relationship to the Bank), in general, the Bank is subject to a loan-to-one borrower limit of an amount equal to 15% of its capital and surplus in the case of loans which are not fully secured by readily marketable or other permissible types of collateral. The Bank voluntarily may choose to impose a policy limit on loans to a single borrower that is less than the legal lending limit.

We obtain short-to-medium term commercial and personal loans through direct solicitation of business owners and continued business from existing customers. Completed loan applications are reviewed by our loan officers. As part of the application process, information is obtained concerning the income, financial condition, employment and credit history of the applicant. If commercial real estate is involved, information is also obtained concerning cash flow after debt service. Loan quality is analyzed based on the Bank’s experience and its credit underwriting guidelines.

4

Table of Contents

Loans by type as a percentage of total loans are as follows:

| December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Commercial, financial and agricultural |

15.56 | % | 15.26 | % | 17.77 | % | 18.34 | % | 20.08 | % | |||||

| Real estate – construction |

9.41 | % | 8.96 | % | 5.63 | % | 6.63 | % | 5.61 | % | |||||

| Real estate – mortgage |

66.02 | % | 67.04 | % | 67.87 | % | 65.18 | % | 64.47 | % | |||||

| Installment loans to individuals |

9.01 | % | 8.74 | % | 8.73 | % | 9.85 | % | 9.84 | % | |||||

| Total |

100.00 | % | 100.00 | % | 100.00 | % | 100.00 | % | 100.00 | % | |||||

Commercial Loans. We make commercial loans to qualified businesses in our market area. Our commercial lending consists primarily of commercial and industrial loans to finance accounts receivable, inventory, property, plant and equipment. Commercial business loans generally have a higher degree of risk than residential mortgage loans, but have commensurately higher yields. Residential mortgage loans generally are made on the basis of the borrower’s ability to make repayment from employment and other income and are secured by real estate whose value tends to be easily ascertainable. In contrast, commercial business loans typically are made on the basis of the borrower’s ability to make repayment from cash flow from its business and are secured by business assets, such as commercial real estate, accounts receivable, equipment and inventory. As a result, the availability of funds for the repayment of commercial business loans may be substantially dependent on the success of the business itself.

Further, the collateral for commercial business loans may depreciate over time and cannot be appraised with as much precision as residential real estate. To manage these risks, our underwriting guidelines require us to secure commercial loans with both the assets of the borrowing business and other additional collateral and guarantees that may be available. In addition, we actively monitor certain measures of the borrower, including advance rate, cash flow, collateral value and other appropriate credit factors.

Residential Mortgage Loans. Our residential mortgage loans consist of residential first and second mortgage loans, residential construction loans, home equity lines of credit and term loans secured by first and second mortgages on the residences of borrowers for home improvements, education and other personal expenditures. We make mortgage loans with a variety of terms, including fixed and floating or variable rates and a variety of maturities.

Under our underwriting guidelines, residential mortgage loans generally are made on the basis of the borrower’s ability to make repayment from employment and other income and are secured by real estate whose value tends to be easily ascertainable. These loans are made consistent with the appraisal policies and real estate lending policies, which detail maximum loan-to-value ratios and maturities.

Construction Loans. Construction lending entails significant additional risks, compared to residential mortgage lending. Construction loans often involve larger loan balances concentrated with single borrowers or groups of related borrowers. Construction loans also involve additional risks attributable to the fact that loan funds are advanced upon the security of property under construction, which is of uncertain value prior to the completion of construction. Thus, it is more difficult to evaluate accurately the total loan funds required to complete a project and related loan-to-value ratios. To minimize the risks associated with construction lending, loan-to-value limitations for residential, multi-family and non-residential construction loans are in place. These are in addition to the usual credit analysis of borrowers. Management feels that the loan-to-value ratios help to minimize the risk of loss and to compensate for fluctuations in the real estate market. Maturities for construction loans generally range from 4 to 12 months for residential property and from 6 to 18 months for non-residential and multi-family properties.

Consumer Loans. Our consumer loans consist primarily of installment loans to individuals for personal, family and household purposes. The specific types of consumer loans that we make include home improvement loans, debt consolidation loans and general consumer lending. Consumer loans entail greater risk than residential mortgage loans do, particularly in the case of consumer loans that are unsecured, such as lines of credit, or secured by rapidly depreciating assets such as automobiles. In such cases, any repossessed collateral for a defaulted consumer loan may not provide an adequate source of repayment of the outstanding loan balance as a result of the greater likelihood of damage, loss or depreciation. The remaining deficiency often does not warrant further substantial collection efforts against the borrower. In addition, consumer loan collections are dependent on the borrower’s continuing financial stability, and thus are more likely to be adversely affected by job loss, divorce, illness or personal bankruptcy. Furthermore, the application of various federal and state laws, including federal and state bankruptcy and insolvency laws, may limit the amount which can be recovered on such loans. A borrower may also be able to assert against the Bank as an assignee any claims and defenses that it has against the seller of the underlying collateral.

5

Table of Contents

Our underwriting policy for consumer loans seek to moderate risk and minimize losses, primarily through a careful analysis of the borrower. In evaluating consumer loans, we require our lending officers to review the borrower’s level and stability of income, past credit history and the impact of these factors on the ability of the borrower to repay the loan in a timely manner. In addition, we maintain an appropriate margin between the loan amount and collateral value.

Other Bank Services. Other bank services include safe deposit boxes, cashier’s checks, certain cash management services, traveler’s checks, direct deposit of payroll and social security checks and automatic drafts for various accounts. We offer ATM card services that can be used by our customers throughout Virginia and other regions. We also offer MasterCard and VISA credit card services through an intermediary. Electronic banking services include debit cards, internet banking, telephone banking and wire transfers.

We do not presently anticipate exercising trust powers, but we are able to provide similar services through our affiliation with UVEST Financial Services, Inc.

Competition

The banking business is highly competitive. We compete as a financial intermediary with other commercial banks, savings and loan associations, credit unions, mortgage banking firms, consumer finance companies, securities brokerage firms, insurance companies, money market mutual funds and other financial institutions operating in the southwestern Virginia, southern West Virginia, and eastern Tennessee market area and elsewhere. Our market area is a highly competitive, highly branched banking market.

Competition in the market area for loans to small businesses and professionals, the Bank’s target market, is intense, and pricing is important. Many of our competitors have substantially greater resources and lending limits than we have. They offer certain services, such as extensive and established branch networks and trust services that we do not expect to provide or will not provide in the near future. Moreover, larger institutions operating in the market area have access to borrowed funds at lower costs than are available to us. Deposit competition among institutions in the market area also is strong. As a result, it is possible that we may pay above-market rates to attract deposits.

While pricing is important, our principal method of competition is service. As a community banking organization, we strive to serve the banking needs of our customers while developing personal, hometown relationships with them. As a result, we provide a significant amount of service and a range of products without the fees that customers can expect from larger banking institutions.

According to a market share report prepared by the Federal Deposit Insurance Corporation (the FDIC), as of June 30, 2009, the most recent date for which market share information is available, the Bank’s deposits as a percentage of total deposits in its major market areas were as follows: Russell County, VA – 29.87%, Scott County, VA – 34.39%, Dickenson County, VA – 23.92%, Tazewell County, VA – 7.87%, Smyth County, VA – 2.26%, Lee County, VA – 6.77%, Buchanan County, VA – 10.74%, Wise County, VA – 10.92%, city of Norton, VA – 22.36%, Bland County, VA – 28.92%, combined Washington County, VA and the City of Bristol, VA – 3.07%, Mercer County, WV – 9.04%, Sullivan County, TN – 0.67%, and Washington County, TN – 0.47%.

Employees

As of December 31, 2009, we had 367 total employees, of which 341 were full-time employees. None of our employees is covered by a collective bargaining agreement, and we consider relations with employees to be excellent.

Supervision and Regulation

General. As a bank holding company, we are subject to regulation under the Bank Holding Company Act of 1956, as amended (“BHCA”), and the examination and reporting requirements of the Board of Governors of the Federal Reserve System (the “Federal Reserve”). We are also subject to Chapter 13 of the Virginia Banking Act, as amended (“Virginia Act”). As a state-chartered commercial bank, the Bank is subject to regulation, supervision and examination by the Virginia State Corporation Commission’s Bureau of Financial Institutions (“BFI”). As a member of the Federal Reserve system, the Bank is also subject to regulation, supervision and examination by the Federal Reserve. Other federal and state laws, including various consumer protection and compliance laws, govern the activities of the Bank, such as the investments that it makes and the aggregate amount of loans that it may grant to one borrower.

6

Table of Contents

The following description summarizes the most significant federal and state laws applicable to New Peoples and its subsidiaries. To the extent that statutory or regulatory provisions are described, the description is qualified in its entirety by reference to that particular statutory or regulatory provision.

The Bank Holding Company Act. Under the BHCA, the Federal Reserve examines New Peoples periodically. New Peoples is also required to file periodic reports and provide any additional information that the Federal Reserve may require. Activities at the bank holding company level are generally limited to:

| • | banking, managing or controlling banks; |

| • | furnishing services to or performing services for its subsidiaries; and |

| • | engaging in other activities that the Federal Reserve has determined by regulation or order to be so closely related to banking as to be a proper incident to these activities. |

Thus, the activities we can engage in are restricted as a matter of law.

With some limited exceptions, the BHCA requires every bank holding company to obtain the prior approval of the Federal Reserve before:

| • | acquiring substantially all the assets of any bank; |

| • | acquiring direct or indirect ownership or control of any voting shares of any bank if after such acquisition it would own or control more than 5% of the voting shares of such bank (unless it already owns or controls the majority of such shares); or |

| • | merging or consolidating with another bank holding company. |

As a result, our ability to engage in certain strategic activities is conditioned on regulatory approval.

In addition, and subject to some exceptions, the BHCA and the Change in Bank Control Act require Federal Reserve approval prior to any person or company acquiring “control” of a bank holding company as defined in the statutes and regulations. These requirements make it more difficult for control of our company to change.

The Virginia Act. As a bank holding company registered with the BFI, we must provide the BFI with information concerning our financial condition, operations and management, among other reports required by the BFI. New Peoples is also examined by the BFI in addition to its Federal Reserve examinations. Similar to the BHCA, the Virginia Act requires that the BFI approve the acquisition of direct or indirect ownership or control of more than 5% of the voting shares of any Virginia bank or bank holding company like us.

Payment of Dividends. New Peoples is a separate legal entity that derives the majority of its revenues from dividends paid to it by its subsidiaries. The Bank is subject to laws and regulations that limit the amount of dividends it can pay. In addition, both New Peoples and the Bank are subject to various regulatory restrictions relating to the payment of dividends, including requirements to maintain capital at or above regulatory minimums. Banking regulators have indicated that banking organizations should generally pay dividends only if the organization’s net income available to common shareholders over the past year has been sufficient to fully fund the dividends and the prospective rate of earnings retention appears consistent with the organization’s capital needs, asset quality and overall financial condition. The FDIC has the general authority to limit the dividends paid by FDIC insured banks if the FDIC deems the payment to be an unsafe and unsound practice. The FDIC has indicated that paying dividends that deplete a bank’s capital base to an inadequate level would be an unsound and unsafe banking practice. . During the year ended December 31, 2009 the Bank declared and paid dividends to New Peoples totaling $500 thousand in order to service debt obligations. However, in October 2009, the Federal Reserve Bank of Richmond (“Richmond FRB”) restricted the Bank from paying dividends to the Company. It is therefore highly unlikely that the Company will pay any dividends at least until the Richmond FRB’s restriction is removed.

As the recession continues to impact asset quality and earnings at financial institutions as the above discussion states, the regulatory authorities have broad discretion to, and may, further restrict the payment of dividends by affected financial institutions and this could impact us.

7

Table of Contents

Capital Requirements. The Federal Reserve has issued risk-based and leverage capital guidelines applicable to banking organizations that it supervises. Under the risk-based capital requirements, the Bank is each generally required to maintain a minimum ratio of total capital to risk-weighted assets (including certain off-balance sheet activities, such as standby letters of credit) of 8%. At least half of the total capital must be composed of “Tier 1 Capital”, which is defined as common equity, retained earnings and qualifying perpetual preferred stock, less certain intangibles. The remainder may consist of “Tier 2 Capital”, which is defined as specific subordinated debt, some hybrid capital instruments and other qualifying preferred stock and a limited amount of the loan loss allowance. These risk-based capital standards attempt to measure capital adequacy relative to the institution’s risk profiles. In addition, each of the federal banking regulatory agencies has established minimum leverage capital requirements for banking organizations. Under these requirements, banking organizations must maintain a minimum ratio of Tier 1 capital to adjusted average quarterly assets of between 3% and 5%, subject to federal bank regulatory evaluation of an organization’s overall safety and soundness. The principal objective of the leverage ratio is to constrain the degree to which an institution may leverage its equity capital base. In sum, the capital measures used by the federal banking regulators are:

| • | the Total Capital ratio, which is the total of Tier 1 Capital and Tier 2 Capital; |

| • | the Tier 1 Capital ratio; and |

| • | the leverage ratio. |

Under these regulations, a bank will be:

| • | “well capitalized” if it has a Total Capital ratio of 10% or greater, a Tier 1 Capital ratio of 6% or greater, a leverage ratio of 5% or greater, and is not subject to any written agreement, order, capital directive, or prompt corrective action directive by a federal bank regulatory agency to meet and maintain a specific capital level for any capital measure; |

| • | “adequately capitalized” if it has a Total Capital ratio of 8% or greater, a Tier 1 Capital ratio of 4% or greater, and a leverage ratio of 4% or greater – or 3% in certain circumstances – and is not well capitalized; |

| • | “undercapitalized” if it has a Total Capital ratio of less than 8%, a Tier 1 Capital ratio of less than 4% - or 3% in certain circumstances; |

| • | “significantly undercapitalized” if it has a Total Capital ratio of less than 6%, a Tier 1 Capital ratio of less than 3%, or a leverage ratio of less than 3%; or |

| • | “critically undercapitalized” if its tangible equity is equal to or less than 2% of average quarterly tangible assets, |

The risk-based capital standards of the Federal Reserve explicitly identify concentrations of credit risk and the risk arising from non-traditional activities, as well as an institution’s ability to manage these risks, as important factors to be taken into account by the agency in assessing an institution’s overall capital adequacy. The capital guidelines also provide that an institution’s exposure to a decline in the economic value of its capital due to changes in interest rates be considered as a factor in evaluating a banking organization’s capital adequacy. Thus, the capital level of a bank can be of regulatory concern even if it is “well-capitalized” under the regulatory formula.

The regulators may take various corrective actions with respect to a financial institution considered to be capital deficient. These powers include, but are not limited to, requiring the institution to be recapitalized, prohibiting asset growth, restricting interest rates paid or dividends, requiring prior approval of capital distributions by any bank holding company that controls the institution, requiring divestiture by the institution of its subsidiaries or by the holding company of the institution itself, requiring new election of directors, and requiring the dismissal of directors and officers. As discussed above, in October 2009 the Richmond FRB imposed a prohibition on the Bank paying dividends to preserve capital. Bank holding companies can be called upon to boost their subsidiary bank’s capital and to partially guarantee the institution’s performance under its capital restoration plan. If this occurs, capital which otherwise would be available for holding company purposes, including possible distributions to shareholders, would be required to be downstreamed to one or more subsidiary bank. In this respect, the Richmond FRB also notified New Peoples that we must defer dividends on our trust preferred issuances. As of December 31, 2009, the Bank was “well capitalized,” with a Total Capital ratio of 10.59%; a Tier 1 Capital ratio of 9.76%; and a leverage ratio 7.40%.

8

Table of Contents

Other Safety and Soundness Regulations. There are a number of obligations and restrictions imposed on bank holding companies and their bank subsidiaries by federal law and regulatory policy that are designed to reduce potential loss exposure to the depositors of such depository institutions and to the FDIC insurance funds in the event that the depository institution is insolvent or is in danger of becoming insolvent. For example, the Federal Reserve requires a bank holding company to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so otherwise. These requirements can restrict the ability of bank holding companies to deploy their capital as they otherwise might.

Interstate Banking and Branching. Banks in Virginia may branch without geographic restriction. Current federal law authorizes interstate acquisitions of banks and bank holding companies without geographic limitation. Bank holding companies may acquire banks in any state without regard to state law except for state laws requiring a minimum time a bank must be in existence to be acquired. The Virginia Act generally permits out of state bank holding companies or banks to acquire Virginia banks or bank holding companies subject to regulatory approval. These laws have the effect of increasing competition in banking markets.

Monetary Policy. The commercial banking business is affected not only by general economic conditions but also by the monetary policies of the Federal Reserve. The Federal Reserve’s monetary policies have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. In view of unsettled conditions in the national and international economy and money markets, as well as governmental fiscal and monetary policies their impact on interest rates, deposit levels, loan demand or the business and earnings of the Bank is unpredictable.

Federal Reserve System. Depository institutions that maintain transaction accounts or nonpersonal time deposits are subject to reserve requirements. These reserve requirements are subject to adjustment by the Federal Reserve. Because required reserves must be maintained in the form of vault cash or in a non-interest-bearing account at, or on behalf of, a Federal Reserve Bank, the effect of the reserve requirement is to reduce the amount of the institution’s interest-earning assets.

Transactions with Affiliates. Transactions between banks and their affiliates are governed by Sections 23A and 23B of the Federal Reserve Act. These provisions restrict the amount and provide conditions with respect to loans, investments, transfers of assets and other transactions between New Peoples and the Bank.

Loans to Insiders. The Bank is subject to rules on the amount, terms and risks associated with loans to executive officers, directors, principal shareholders and their related interest.

Community Reinvestment Act. Under the Community Reinvestment Act, depository institutions have an affirmative obligation to assist in meeting the credit needs of their market areas, including low and moderate-income areas, consistent with safe and sound banking practice. The Community Reinvestment Act emphasizes the delivery of bank products and services through branch locations in its market areas and requires banks to keep data reflecting their efforts to assist in its community’s credit needs. Depository institutions are periodically examined for compliance with the Community Reinvestment Act and are periodically assigned ratings in this regard. Banking regulators consider a depository institution’s Community Reinvestment Act rating when reviewing applications to establish new branches, undertake new lines of business, and/or acquire part or all of another depository institution. An unsatisfactory rating can significantly delay or even prohibit regulatory approval of a proposed transaction by a bank holding company or its depository institution subsidiaries. A bank holding company will not be permitted to become a financial holding company and no new activities authorized under the GLBA (see below) may be commenced by a holding company or by a bank financial subsidiary if any of its bank subsidiaries received less than a “satisfactory” rating in its latest Community Reinvestment Act examination. The Bank received a rating of “Satisfactory” at its last Community Reinvestment Act performance evaluation, as of August 3, 2009.

Other Laws. Banks and other depository institutions also are subject to numerous consumer-oriented laws and regulations. These laws, which include the Truth in Lending Act, the Truth in Savings Act, the Real Estate Settlement Procedures Act, the Electronic Funds Transfer Act, the Equal Credit Opportunity Act, the Fair and Accurate Credit Transactions Act of 2003 and the Fair Housing Act, require compliance by depository institutions with various disclosure and consumer information handling requirements. These and other similar laws result in significant costs to financial institutions and create potential liability for financial institutions, including the imposition of regulatory penalties for inadequate compliance.

Gramm-Leach-Bliley Act of 1999. The Gramm-Leach-Bliley Act of 1999 (“GLBA”) covers a broad range of issues, including a repeal of most of the restrictions on affiliations among depository institutions, securities firms and insurance companies.

9

Table of Contents

For example, the GLBA permits unrestricted affiliations between banks and securities firms. It also permits bank holding companies to elect to become financial holding companies, which can engage in a broad range of financial services, including securities activities such as underwriting, dealing, investment, merchant banking, insurance underwriting, sales and brokerage activities. In order to become a financial holding company, a bank holding company and all of its affiliated depository institutions must be well-capitalized, well-managed and have at least a satisfactory Community Reinvestment Act rating. We converted to bank holding company status on January 1, 2009 from “financial holding company.” We believe we adequately provide the products and services our customers currently need or want as a bank holding company.

Essentially GLBA removed many of the limitations on affiliations between commercial banks and their holding companies and other financially related business that had been in place since the Depression. Recently, this effect of GLBA has been the subject of controversy and cited as one of the causes of the financial services crisis. Accordingly, legislation restoring some of the limitations removed by GLBA is a possibility. Any such change would not materially affect us.

The GLBA also provides that the states continue to have the authority to regulate insurance activities, but prohibits the states in most instances from preventing or significantly interfering with the ability of a bank, directly or through an affiliate, to engage in insurance sales, solicitations or cross-marketing activities.

USA Patriot Act. The USA Patriot Act provides for the facilitation of information sharing among governmental entities and financial institutions for the purpose of combating terrorism and money laundering. Regulatory authorities must consider the effectiveness of a financial institution’s anti-money laundering activities, for example, its procedures for effective customer identification, when reviewing bank mergers and acquisitions. Various other laws and regulations require the Bank to cooperate with governmental authorities in respect to counter-terrorism activities. Although it does create a reporting obligation and cost of compliance for the Bank, the USA Patriot Act has not materially affected New Peoples’ products, services or other business activities.

Privacy and Fair Credit Reporting. Financial institutions, such as the Bank, are required to disclose their privacy policies to customers and consumers and require that such customers or consumers be given a choice (through an opt-out notice) to forbid the sharing of nonpublic personal information about them with nonaffiliated third persons. The Bank also requires business partners with whom it shares such information to have adequate security safeguards and to abide by the redisclosure and reuse provisions of applicable law. In addition to adopting federal requirements regarding privacy, individual states are authorized to enact more stringent laws relating to the use of customer information. To date, Virginia has not done so. These privacy laws create compliance obligations and potential liability for the Bank

Sarbanes-Oxley Act. The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) is intended to increase corporate responsibility, provide enhanced penalties for accounting and auditing improprieties by publicly traded companies and to protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities law. The changes required by the Sarbanes-Oxley Act and its implementing regulations are intended to allow shareholders to monitor the performance of companies and their directors more easily and effectively.

The Sarbanes-Oxley Act generally applies to all domestic companies, such as New Peoples, that file periodic reports with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended. The Sarbanes-Oxley Act includes significant additional disclosure requirements and expanded corporate governance rules and the SEC has adopted extensive additional disclosures, corporate governance provisions and other related rules pursuant to it. New Peoples has expended, and will continue to expend, considerable time and money in complying with the Sarbanes-Oxley Act.

Emergency Economic Stabilization Act of 2008. EESA was enacted in response to the financial crises affecting the banking system and financial markets. Pursuant to the EESA, the U.S. Treasury was given the authority to, among other things, purchase up to $700 billion of mortgages, mortgage-backed securities and certain other financial instruments from financial institutions for the purpose of stabilizing and providing liquidity to the U.S. financial markets.

Pursuant to EESA, the Department of the Treasury implemented the Troubled Asset Relief Program Capital Purchase Program (the “TARP Capital Purchase Program”) under which the Treasury agreed to make $250 billion of capital available to U.S. financial institutions in the form of preferred stock (from the $700 billion authorized by the EESA). Numerous requirements have been imposed on TARP participating financial institutions, particularly requirements related to executive compensation. We did not elect to apply to participate in TARP.

10

Table of Contents

American Recovery and Reinvestment Act of 2009. The ARRA was enacted on February 17, 2009. The ARRA includes a wide variety of programs intended to stimulate the economy and provide for extensive infrastructure, energy, health, and education needs. In addition, the ARRA imposes certain new executive compensation and corporate governance obligations on all current and future TARP Capital Purchase Program recipients until the institution has redeemed the preferred stock, which TARP Capital Purchase Program recipients are now permitted to do under the ARRA without regard to the three year holding period and without the need to raise new capital, subject to approval of its primary federal regulator. Because we did not participate in TARP, we are not affected by these requirements.

Federal Deposit Insurance Corporation. The Bank’s deposits are insured by the Deposit insurance Fund, as administered by the FDIC, to the maximum amount permitted by law. The maximum deposit insurance amount per depositor has been increased from $100,000 to $250,000 until December 31, 2013. Due to the increased number of bank failures resulting from the credit crisis and severe recession, FDIC premiums have materially increased and are likely to increase further. This is a significant expense for us and is likely to continue to be. Additionally, the FDIC has established its Temporary Liquidity Guarantee Program (“TLGP”). Under the transaction account guarantee program of the TLGP, the FDIC fully guarantees, until June 30, 2010, all non-interest-bearing transaction accounts, including NOW accounts with interest rates of 0.5 percent or less and IOLTAs (lawyer trust accounts). Under TLGP’s Debt Guarantee Program, TLGP guaranteed all senior unsecured debt of insured depository institutions or their qualified holding companies issued between October 14, 2008 and June 30, 2009 with a stated maturity greater than 30 days. Institutions were required to opt-out of the TLGP if they did not wish to participate. We elected to participate in the transaction account guarantee program of the TLGP, but opted out of the debt guarantee program.

Future Regulatory Uncertainty. Because federal and state regulation of financial institutions changes regularly and is the subject of constant legislative debate, New Peoples cannot forecast how regulation of financial institutions may change in the future and impact its operations. Although Congress in recent years has sought to reduce the regulatory burden on financial institutions with respect to the approval of specific transactions, New Peoples fully expects that the financial institution industry will remain heavily regulated in the near future and that additional laws or regulations may be adopted further regulating specific banking practices.

| Item 1A. | Risk Factors |

Difficult market conditions have adversely affected our industry.

Continued declines in the housing market over the past year after the previous dramatic declines, with falling home prices and increasing foreclosures, unemployment and under-employment, have negatively impacted the credit performance of real estate related loans and resulted in significant write-downs of asset values by financial institutions. These write-downs, initially of asset-backed securities but spreading to other securities and loans, have caused many financial institutions to seek additional capital, to reduce or eliminate dividends, to merge with larger and stronger institutions and, in some cases, to fail. Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional investors have reduced providing funding to borrowers, including to other financial institutions. This market turmoil and tightening of credit have led to an increased level of commercial and consumer delinquencies, lack of consumer confidence, increased market volatility and widespread reduction of business activity generally. The resulting economic pressure on consumers and lack of confidence in the financial markets adversely affects our business and results of operations. Market developments may affect consumer confidence levels and may cause further adverse changes in payment patterns, causing increases in delinquencies and default rates, which may impact our charge-offs and provision for credit losses. A worsening of these conditions would likely exacerbate the adverse effects of these difficult market conditions on us and others in the financial institutions industry.

Recent levels of market volatility are unprecedented.

The capital and credit markets experienced volatility and disruption although this appears to have stabilized. In 2009, the volatility and disruption reached unprecedented levels. In some cases, the markets have produced downward pressure on stock prices and credit availability for certain issuers without regard to those issuers’ underlying financial strength. If these levels of market disruption and volatility return, there can be no assurance that we will not experience an adverse effect, which may be material, on our ability to access capital and on our business, financial condition and results of operations.

11

Table of Contents

Liquidity is important to financial institutions and market conditions as well as regulatory actions could adversely affect us in this respect.

The ability of a financial institution to make loans, return funds to its depositors as required and to meet its funding commitments depends to a large measure on a stable deposit base and access to other sources for borrowing such as advances from the Federal Home Loan Bank of Atlanta, overnight federal funds, repurchase agreements and other credit sources. The factors discussed above, the performance of New Peoples in the difficult economic environment and the actions of regulatory authorities in response to these conditions may result in diminished access by us to these liquidity sources, in turn affecting our ability to fund our regular business activities.

The soundness of other financial institutions could adversely affect us.

Our ability to engage in routine funding transactions could be adversely affected by the actions and commercial soundness of other financial institutions. Financial services institutions are interrelated as a result of trading, clearing, counterparty or other relationships. We have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial industry. As a result, defaults by, or even rumors or questions about, one or more financial services institutions, or the financial services industry generally, have led to market-wide liquidity problems and could lead to losses or defaults by us or by other institutions. Many of these transactions expose us to credit risk in the event of default of our counterparty or client. In addition, our credit risk may be exacerbated when the collateral held by us cannot be realized upon or is liquidated at prices not sufficient to recover the full amount of the financial instrument exposure due us. There is no assurance that any such losses would not materially and adversely affect our results of operations.

The impact on us of recently enacted legislation, in particular the Emergency Economic Stabilization Act of 2008 and American Recovery and Reinvestment Act of 2009 and their implementing regulations, and actions by the FDIC, cannot be predicted at this time.

The programs established or to be established under the EESA, ARRA and Troubled Asset Relief Program may have adverse effects upon us. We may face increased regulation of our industry. Compliance with such regulation may increase our costs and limit our ability to pursue business opportunities. Also, participation in specific programs may subject us to additional restrictions. The affects of participating or not participating in any such programs and the extent of our participation in such programs cannot reliably be determined at this time.

Because there is no market for New Peoples common stock, your ability to readily sell any shares you hold is doubtful.

Our stock is not listed on a stock market, and we have no intention of listing it. If you want to sell shares of our stock, you will need to find a buyer and negotiate the price.

Changes in interest rates could have an adverse effect on our income particularly if we have a period of general inflation.

Our profitability depends to a large extent upon our net interest income. Net interest income is the difference between interest income on interest-earning assets, such as loans and investments, and interest expense on interest-bearing liabilities, such as deposits and borrowings. Our net interest income will be adversely affected if market interest rates change so that the interest we pay on deposits and borrowings increases faster than the interest we earn on loans and investments. Changes in interest rates also affect the value of our loans. An increase in interest rates could adversely affect borrowers’ ability to pay the principal or interest on existing loans or reduce their desire to borrow more money. This may lead to an increase in our nonperforming assets or a decrease in loan originations, either of which could have a material and negative effect on our results of operations. Interest rates are highly sensitive to many factors that are partly or completely outside of our control, including governmental monetary policies, domestic and international economic and political conditions and general economic conditions such as inflation, recession, unemployment and money supply. Fluctuations in market interest rates are neither predictable nor controllable and may have a material and negative effect on our business, financial condition and results of operations.

We have a high concentration of loans secured by real estate and the downturn in the real estate market should it deepen or be extended, could result in additional losses and materially and adversely affect business, financial condition, results of operations and future prospects further.

A significant portion of our loan portfolio is dependent on real estate. In addition to the financial strength and cash flow characteristics of the borrower in each case, we often secure loans with real estate collateral. At December 31, 2009, approximately 75.42% of our loans have real estate as a primary or secondary component of collateral. The real estate collateral in each case provides an alternate source of repayment in the event of default by the borrower and may deteriorate in value during the time the credit is extended. Further adverse changes in the economy affecting values of real estate generally or in our primary markets specifically could significantly impair the value of our collateral and result in further under-collateralization in our portfolio. In such a case, it would be likely that we would be required to increase our provision for loan losses, beyond current provisions, which would negatively affect our results of operations. Liquidation of collateral securing a loan to satisfy the debt during a period of reduced real estate values diminishes our ability to recover fully on defaulted loans by foreclosing and selling the real estate collateral and we would be more likely to suffer losses on defaulted loans. These circumstances could adversely affect our current profitability and financial condition.

12

Table of Contents

If we need additional capital in the future to support our business or to respond to regulatory requirements, we may not be able to obtain it on terms that are favorable. This could negatively affect our performance and the value of our common stock.

While our current business strategy calls for future growth, general economic, market or regulatory conditions impact this strategy. Our ability to raise capital through the sale of additional securities will depend primarily upon our financial condition and the condition of financial markets. To the extent future growth, our performance as affected by the recession, or regulatory requirements dictate the need for us to obtain additional capital, it is likely we may have to obtain additional capital on terms that are disadvantageous to our existing shareholders.

We rely heavily on our management team and the unexpected loss of any of those personnel could adversely affect our operations; we depend on our ability to attract and retain key personnel.

We are a customer-focused and relationship-driven organization. We expect our future growth to be driven in a large part by the relationships maintained with our customers by our executives and senior lending officers. From time to time we enter into employment agreements with certain of our executives. The existence of such agreements, however, does not necessarily assure that we will be able to continue to retain the services of such executives. The unexpected loss of any of our key employees could have a material adverse effect on our business and possibly result in reduced revenues and earnings.

Our reputation as a safe and sound financial institution is an important factor in our success and could be damaged by circumstances some of which we do not control.

We, like all financial institutions, have an important stake in our good reputation among customers, investors and other constituencies. Damage to our reputation can occur under many circumstances. Some of these we can control and some, like litigation or regulatory actions, we cannot fully control. For example, as a result of our most recent examination, the Bank anticipates entering into a formal agreement with its primary regulators. These types of occurrences could adversely affect our business and negatively impact our reputation.

Additional provisions for our allowance for loan losses may adversely affect our results of operations.

We maintain an allowance for loan losses that we believe is a reasonable estimate of known and inherent losses in our loan portfolio. Through a periodic review and consideration of the loan portfolio, management determines the amount of the allowance for loan losses by considering general market conditions, credit quality of the loan portfolio, the collateral supporting the loans and performance of our customers relative to their financial obligations with us. While we added substantially to our allowance for loan losses in 2009 in response to the continued deterioration of the economy, the amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates, that may be beyond our control, and these losses may exceed our current estimates even though we made a substantial increase in our loan loss reserve in 2009. Rapidly growing loan portfolios are, by their nature, unseasoned. As a result, estimating loan loss allowances is more difficult, and may be more susceptible to changes in estimates, and to losses exceeding estimates, than more seasoned portfolios. Although we believe the allowance for loan losses is a reasonable estimate of known and inherent losses in our loan portfolio, we cannot fully predict such losses or that our loan loss allowance will be adequate in the future. Excessive loan losses could have a material impact on our financial performance. Due to the severe recession, we expect to make additions to our loan loss reserve levels which may affect our short-term earnings.

13

Table of Contents

Federal and state regulators periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan charge-offs, based on judgments different than those of our management. Any increase in the amount of our provision or loans charged-off as required by these regulatory agencies could have a negative effect on our operating results.

Lack of seasoning of our loan portfolio may increase the risk of credit defaults in the future, which would adversely affect our financial condition and results of operation.

Although we have experienced lenders who are familiar with their customer base, some of our loans are too new to have exhibited signs of weakness. In addition, recent expansions into new markets increase credit risk. In general, new loans do not begin to show signs of credit deterioration or default until they have been outstanding for some period of time, a process referred to as “seasoning.” As a result, a portfolio of older loans will usually behave more predictably than a newer portfolio, although there can be no assurance that more seasoned loans will be of higher quality or perform better. Because a portion of our loan portfolio is relatively new and the economic recovery continues to be slow, the current level of delinquencies and defaults may not be representative of the level that will prevail, which may be significantly higher than current levels. A higher rate of delinquencies or defaults on loans could cause us to increase our provision for loan losses and otherwise negatively affect our financial condition, results of operations and financial prospects.

Our profitability may suffer because of rapid and unpredictable changes in the highly regulated environment in which we operate.

We are subject to extensive supervision by several governmental regulatory agencies at the federal and state levels. These agencies examine financial and bank holding companies and commercial banks, establish capital and other financial requirements and approve new branches, acquisitions or other changes of control. Our ability to establish new banks or branches or make acquisitions is conditioned on receiving required regulatory approvals from the applicable regulators. Recently enacted, proposed and future banking legislation and regulations have had, and will continue to have, or may have a significant impact on the financial services industry. These regulations, which are intended to protect depositors and not our shareholders, and the interpretation and application of them by federal and state regulators, are beyond our control, may change rapidly and unpredictably and can be expected to influence our earnings and growth. Such changes could subject us to additional costs, limit the types of financial services and products we may offer, increase the ability of non-banks to offer competing financial services and products, and/or assist competitors that are not subject to similar regulation, among other things. Failure to comply with laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties and damage to our reputation, which could have a material adverse effect on our business, financial condition and results of operation.

The Bank’s ability to pay dividends is subject to regulatory limitations which, to the extent we require such dividends in the future, affects our ability to pay our obligations and pay dividends.

We are a separate legal entity from the Bank and our other subsidiaries and we do not have significant operations of our own. We currently depend on the Bank’s cash and liquidity as well as dividends paid by it to us to pay our operating expenses. As discussed above, in October 2009, the Richmond FRB imposed a restriction which prevents the Bank from paying dividends to us. This adversely impacts the Company because these dividends were a major source of the Company’s income. At the same time the Richmond FRB notified us that we must defer dividends on our trust preferred issues since the source for these payments was the dividends from the Bank. While we anticipate that these restrictions will be eliminated when capital ratios improve, until then the inability to receive dividends from the Bank could adversely affect our financial condition, results of operations, cash flows and prospects.

14

Table of Contents

Our business is subject to various lending and other economic risks that adversely impact our results of operations and financial condition.

Changes in economic conditions, particularly the current and prolonged economic slowdown, hurts our business. Our business is directly affected by political and market conditions, broad trends in industry and finance, legislative and regulatory changes, changes in governmental monetary and fiscal policies and inflation, all of which are beyond our control. We have already been adversely affected by these factors. We are in technical default under the terms of our line of credit with a correspondent bank. This loan is secured by our stock in the Bank. Current conditions make it more difficult for us to replace this line of credit or cure the default. Failure to do so could have a materially negative impact on us. A continuing deterioration in economic conditions, in particular within our geographic region, could result in the following consequences intensifying any of which could further hurt our business materially:

| • | loan delinquencies may increase further; |

| • | problem assets and foreclosures may increase further; |

| • | demand for our products and services may decline further; and |

| • | collateral for loans made by us may decline in value further, in turn reducing a client’s borrowing power, and reducing the value of assets and collateral associated with our loans held for investment. |

Although our market area is somewhat economically diverse, in certain areas the local economies are more reliant upon agriculture and coal mining. To the extent an economic downturn disproportionately affected these two industries, the above-described negative effects could be exacerbated.

The downturn in the real estate market has hurt our business and absent a recovery will continue to do so. Our business activities and credit exposure are concentrated in Virginia, West Virginia and Tennessee and at December 31, 2009, approximately 75.42% of our loans have real estate as a primary or secondary component of collateral. As such, the downturn in this regional real estate market hurts our business because of the geographic concentration within this regional area. If there is a further decline in real estate values in our local markets, the collateral for our loans will provide less security. As a result, our ability to recover on defaulted loans by selling the underlying real estate would be diminished, and we would be more likely to suffer losses on defaulted loans. In addition, we would be required to add to our loan loss reserve which negatively impacts earnings.

We face strong competition from other financial institutions, financial service companies and other organizations offering services similar to those offered by us and our subsidiaries, which could hurt our business.

Our business operations are centered primarily in Virginia, West Virginia, and Tennessee. Increased competition within this region may result in reduced loan originations and deposits. Ultimately, we may not be able to compete successfully against current and future competitors. Many competitors offer the types of loans and banking services that we offer. These competitors include other savings associations, national banks, regional banks and other community banks. We also face competition from many other types of financial institutions, including finance companies, brokerage firms, insurance companies, credit unions, mortgage banks and other financial intermediaries. In particular, the Bank’s competitors include other state and national banks and major financial companies whose greater resources may afford them a marketplace advantage by enabling them to maintain numerous banking locations and to mount extensive promotional and advertising campaigns.

Additionally, banks and other financial institutions with larger capitalization and financial intermediaries not subject to bank regulatory restrictions have larger lending limits and are thereby able to serve the credit needs of larger clients. These institutions, particularly to the extent they are more diversified than us, may be able to offer the same loan products and services that we offer at more competitive rates and prices. If we are unable to attract and retain banking clients, we may be unable to continue the Bank’s loan and deposit growth and our business, financial condition and prospects may be negatively affected.

We may be adversely affected by economic conditions in our markets.

Our banking operations are located primarily in the Virginia counties of Buchanan, Dickenson, Lee, Russell, Scott, Smyth, Tazewell, Washington, and Wise, the West Virginia county of Mercer and the Tennessee counties of Sullivan and Washington. Because our lending is concentrated in this market, we will be affected by the general economic conditions in the area. Changes in the economy may influence the growth rate of our loans and deposits, the quality of the loan portfolio and loan and deposit pricing. A significant further decline in general economic conditions caused by inflation, recession, unemployment or other factors beyond our control would have an additional impact on the demand for banking products and services generally, which could negatively affect our financial condition and performance. We also have lending exposure in the Coastal Carolina market which has been particularly impacted by the real estate recession. Additional declines in this market could adversely affect us further.

15

Table of Contents

Failure to maintain effective systems of internal and disclosure control could have a material adverse effect on our results of operation and financial condition.

Effective internal and disclosure controls are necessary for us to provide reliable financial reports and effectively prevent fraud and to operate successfully as a public company. If we cannot provide reliable financial reports or prevent fraud, our reputation and operating results would be harmed. As part of our ongoing monitoring of internal control we may discover material weaknesses or significant deficiencies in our internal control as defined under standards adopted by the Public Company Accounting Oversight Board, or PCAOB, that require remediation. Under the PCAOB standards, a “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. We have in the past discovered, and may in the future discover, areas of our internal controls that need improvement. As discussed in Item 9A. Controls and Procedures, we identified certain material weaknesses as a result of our assessment of internal controls over financial reporting. These material weaknesses related to the need to update classification codes for real estate and construction loans and the maintenance of an effective control environment. We have taken the remedial actions discussed in Item 9A and have determined that the identified material weaknesses have been remediated. Even so, we are continuing to work to improve our internal controls. We cannot be certain that these measures will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. Any failure to maintain effective controls or to timely effect any necessary improvement of our internal and disclosure controls could, among other things, result in losses from fraud or error, harm our reputation or cause investors to lose confidence in our reported financial information, all of which could have a material adverse effect on our results of operation and financial condition.

| Item 1B. | Unresolved Staff Comments |

As of March 15, 2010, there were no unresolved comments from the staff of the SEC with respect to any of New Peoples’ periodic or current reports.

| Item 2. | Properties |

At December 31, 2009, the Company’s net investment in premises and equipment in service was $35.0 million. Our main office and operations center is located in Honaker, Virginia. This location contains a full service branch, and our administration and operations center.

The Bank owns 28 of its 31 full service branches. The owned properties in Virginia are located in Abingdon, Big Stone Gap, Bluefield, Bland, Bristol, Castlewood, Chilhowie, Clintwood, Gate City, Grundy, Haysi, Honaker, Jonesville, Lebanon, Norton, Pennington Gap, Pound, Pounding Mill, Richlands, Tazewell, and Weber City. Offices in Princeton, West Virginia and Bloomingdale and Jonesborough, Tennessee are also owned by the Bank.

The Bank has three operating lease arrangements of varying lengths. These full service branches are located in Bramwell, West Virginia and in Cleveland and Davenport, Virginia.

We believe that all of our properties are maintained in good operating condition and are suitable and adequate for our operational needs.

| Item 3. | Legal Proceedings |

In the course of operations, we may become a party to legal proceedings. We are not aware of any material pending or threatened legal proceedings.

| Item 4. | Reserved |

16

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

(a) Market Information

The Bank acts as the transfer agent for New Peoples. At present, there is no public trading market for our common stock. Trades in our common stock occur sporadically on a local basis.

The high and low bids known to us of our common stock for each quarter in the past two years are set forth in the table below. These bids are obtained through inquiry by our stock transfer agent of shareholders transferring stock. Other transactions may have occurred at prices about which we are not aware.

| 2009 | 2008 | |||||||||||

| High | Low | High | Low | |||||||||

| 1st quarter |

$ | 12.00 | $ | 9.00 | $ | 15.00 | $ | 10.00 | ||||

| 2nd quarter |

12.00 | 10.00 | 13.00 | 6.00 | ||||||||

| 3rd quarter |

12.00 | 6.56 | 13.00 | 8.68 | ||||||||

| 4th quarter |

10.00 | 4.66 | 12.50 | 9.00 | ||||||||

The most recent sales price of which management is aware was $6.99 per share on March 8, 2010.

(b) Holders

On March 15, 2010, there were approximately 4,405 shareholders of record.

(c) Dividends

On September 12, 2007, we issued a 13 for 10 stock split effected in the form of a stock dividend to all shareholders of record on September 4, 2007. We have never declared a cash dividend. The declaration of dividends in the future will depend on our earnings and capital requirements and compliance with regulatory mandates. We are subject to certain restrictions imposed by the reserve and capital requirements of federal and Virginia banking statutes and regulations. Additionally, we intend to follow a policy of retaining earnings, if any, for the purpose of increasing net worth and reserves in light of the unsettled nature of the current economy. So long as the restriction imposed by the FRB Richmond on the Bank’s ability to pay dividends to the Company remains, the Company is unlikely to have the resources with which to pay a dividend. As a result, we do not anticipate paying a dividend on our common stock in 2010. See Note 16 and Note 23 of the Notes to the Consolidated Financial Statements for further discussion of dividend limitations and capital requirements.

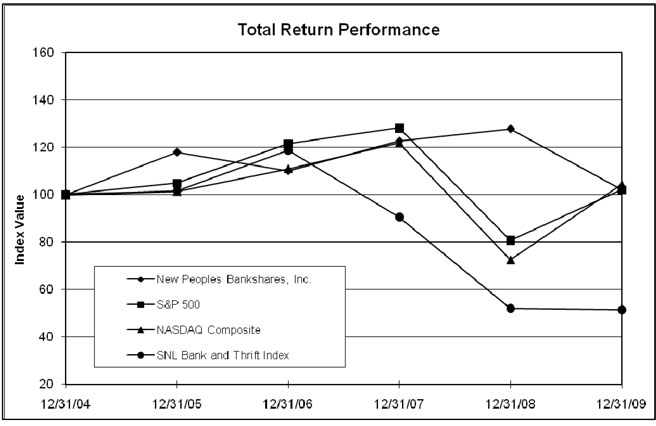

(d) Stock Performance Graph

There currently is not a public trading market for the Company’s Common Stock. The Company, however, is frequently informed of the sales price at which shares of Common Stock are exchanged in privately negotiated transactions. Because shares of Common Stock are not listed or traded on an exchange or in the over-the-counter market, the Company cannot be certain that the prices at which such shares have historically sold are not higher than the prices that would prevail in an active market where securities professionals participate. As a result, the comparisons presented in the following graph do not reflect similar market conditions.

17

Table of Contents

The following graph compares the Company’s cumulative shareholder return on its Common Stock, assuming an initial investment of $100 and reinvestment of all dividends, with the cumulative return on the S&P 500, the NASDAQ Composite, and SNL Securities Bank and Thrift Index using the same assumptions, as of December 31 st of each year since December 31, 2004.

New Peoples Bankshares, Inc.

| Period Ending | ||||||||||||

| Index |

12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | ||||||

| New Peoples Bankshares, Inc. |

100.00 | 117.86 | 110.00 | 122.57 | 127.68 | 102.14 | ||||||

| S&P 500 |

100.00 | 104.91 | 121.48 | 128.16 | 80.74 | 102.11 | ||||||

| NASDAQ Composite |

100.00 | 101.37 | 111.03 | 121.92 | 72.49 | 104.31 | ||||||

| SNL Bank and Thrift Index |

100.00 | 101.57 | 118.68 | 90.50 | 52.05 | 51.35 | ||||||

Source: SNL Financial LC, Charlottesville, VA

18

Table of Contents

| Item 6. | Selected Financial Data |

The following consolidated summary sets forth selected financial data for us for the periods and at the dates indicated. The selected financial data has been derived from our audited financial statements. The following is qualified in its entirety by the detailed information and the financial statements included elsewhere in this Form 10-K.

| For the Years Ended December 31, | ||||||||||||||||||||

| (Amounts in thousands, except per share data) |

2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

| Income Statement Data | ||||||||||||||||||||

| Gross interest income |

$ | 50,188 | $ | 52,317 | $ | 51,447 | $ | 41,280 | $ | 30,507 | ||||||||||

| Gross interest expense |

18,563 | 23,095 | 25,738 | 19,393 | 11,279 | |||||||||||||||

| Net interest income |

31,815 | 29,222 | 25,709 | 21,887 | 19,228 | |||||||||||||||

| Provision for possible loan losses |

12,841 | 1,500 | 3,840 | 1,277 | 1,130 | |||||||||||||||

| Non-interest income |

5,449 | 6,162 | 4,651 | 3,460 | 2,822 | |||||||||||||||

| Non-interest expense |

29,847 | 27,231 | 23,674 | 19,805 | 16,710 | |||||||||||||||

| Net income (loss) |

(3,686 | ) | 4,737 | 2,870 | 3,090 | 2,723 | ||||||||||||||

| Per Share Data and Shares Outstanding (1) | ||||||||||||||||||||

| Net income (loss), basic |

(0.37 | ) | 0.47 | 0.29 | 0.31 | 0.27 | ||||||||||||||

| Net income (loss), diluted |

(0.37 | ) | 0.46 | 0.28 | 0.30 | 0.26 | ||||||||||||||

| Cash dividends |

— | — | — | — | — | |||||||||||||||

| Book value at end of period |

4.66 | 5.03 | 4.54 | 4.25 | 3.93 | |||||||||||||||

| Tangible book value at period end |

4.21 | 4.56 | 4.06 | 4.25 | 3.93 | |||||||||||||||

| Period-End Balance Sheet Data |

||||||||||||||||||||

| Total assets |

857,910 | 807,898 | 765,951 | 635,819 | 527,770 | |||||||||||||||

| Total loans |

763,570 | 721,174 | 682,260 | 569,198 | 468,045 | |||||||||||||||

| Total allowance for loan losses |

(18,588 | ) | (6,904 | ) | (6,620 | ) | (4,870 | ) | (3,943 | ) | ||||||||||

| Total deposits |

760,714 | 705,688 | 657,033 | 572,187 | 462,692 | |||||||||||||||

| Shareholders’ equity |

46,619 | 50,323 | 45,249 | 42,346 | 38,964 | |||||||||||||||

| Performance Ratios |

||||||||||||||||||||

| Return on average assets |

(0.44 | )% | 0.61 | % | 0.42 | % | 0.54 | % | 0.56 | % | ||||||||||

| Return on average shareholders’ equity |