Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 12, 2010

MobileBits Holdings Corporation

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-156062

|

26-3033276

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

1990 Main Street Suite 750

Sarasota, FL 34236

|

|

|

|

(Address of principal executive offices) (Zip Code)

|

||

| (941) 309-5356 | ||

| (Registrant’s telephone number, including area code) | ||

| Bellmore Corporation | ||

| (Former name or former address, if changed since last report) | ||

Copies to:

Gregg E. Jaclin, Esq.

Eric M. Stein, Esq.

Christine Mellili, Esq.

Anslow + Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, New Jersey 07726

(732) 409-1212

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This Current Report on Form 8-K contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assumes no obligation to update any such forward-looking statements

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

2

As more fully described in Item 2.01 below, we entered into a Share Exchange Agreement, dated March 12, 2010 (the “Share Exchange Agreement”) by and among MobileBits Holdings Corp. (“we,” “MBH” or the “Company”), MobileBits Corporation (“MBC”) and the shareholders of MobileBits Corporation (the “MBC Shareholders”) pursuant to which we acquired (the “Merger”) an early stage software development firm targeting its software at the mobile search market. The closing of the transaction (the “Closing”) took place on March 12, 2010 (the “Closing Date”). On the Closing Date, we acquired 100% of the outstanding shares of common stock of MBC (the “MBC Stock”) from the MBC Shareholders. In exchange for the MBC Stock, we issued 2,678,911 shares of our common stock, which represents approximately 87.9% of our issued and outstanding common stock. Additionally, pursuant to the terms of the Share Exchange Agreement, Walter Kostiuk (“Kostiuk”), the principal shareholder of the Company, cancelled a total of 2,000,000 shares of Common Stock. A copy of the Share Exchange Agreement is included as Exhibit 2.1 to this Current Report and is hereby incorporated by reference. All references to the Share Exchange Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

Upon Closing, MBC became a 100% wholly-owned subsidiary of the Company. At the date of the Share Exchange Agreement, Walter Kostiuk owned 2,000,000 shares of MBH which constitutes 84% controlling interest of MBH and 20,000,000 shares of MBC which constitutes a 90.3% controlling interest of MBC. The directors of the Company have approved the Share Exchange Agreement and the transactions contemplated under the Share Exchange Agreement. The directors of MBC have approved the Share Exchange Agreement and the transactions contemplated thereunder.

The Merger transaction is discussed more fully in Section 2.01 of this Current Report. The information therein is hereby incorporated in this Section 1.01 by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

CLOSING OF EXCHANGE AGREEMENT

As described in Item 1.01 above, on March 12, 2010, we acquired 100% of the shares of MBC, an early stage software development company based in Florida. They are focused on software for the mobile search industry. The closing of the transaction took place on March 12, 2010. On the Closing Date, we acquired 100% of the MBC Stock from the MBC Shareholders. In exchange, we issued the 2,678,911 shares of our common stock to the MBC Shareholders, representing approximately 87.9% of the Company’s Common Stock post closing.

At the closing, MobileBits Corporation became a 100% owned subsidiary of the Company. The directors of the Company have approved the Share Exchange Agreement and the transactions contemplated under the Share Exchange Agreement. After the Merger, there are 3,048,911 shares of Common Stock issued and outstanding

MobileBits Corporation (“MBC”) was incorporated in Florida in March 2009. The business was founded by Walter Kostiuk, with the intention of delivering a mobile answer engine to provide relevant answers and mobile advertising to mobile smartphone and cell phone user’s queries.

MBC is a developer and marketer of a proprietary method to deliver answers and advertising to end user questions via search on mobile phones and the internet.

MBC is a technology company focused on providing answers and highly targeted advertising through an automated answer engine via web and mobile smartphone applications. The Company offers a wide range of answers on a broad scope of web-based content.

The Company was a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) immediately before the completion of the Merger. Accordingly, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting the Company’s Common Stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Merger, with such information reflecting the Company and its securities upon consummation of the Merger.

3

BUSINESS

History

MobileBits Corporation (“MBC”) was incorporated in Florida in March 2009. The business was founded by Walter Kostiuk, with the intention of delivering a mobile answer engine to provide relevant answers and mobile advertising to mobile smartphone and cell phone end user questions.

Overview

MBC is a developer and marketer of a proprietary method to deliver answers and advertising to end user questions via search on mobile phones and the internet.

MBC is a technology company focused on providing answers and highly targeted advertising through an automated answer engine via web and mobile smartphone applications. The Company offers a wide range of answers on a broad scope of web-based content.

MobileBits Corporation is at various stages of discussion with a number of mobile handset manufacturers and wireless telecom companies regarding the implementation of its mobile answer engine. To date, however, no agreements have been signed.

MBC currently anticipates the implementation of its business plan will require additional investment capital. The Company hopes to raise $5 million in equity financing in 2010, however, the Company has not raised any money. If we are successful in raising the necessary funds we will use those funds to engage potential customers, to fund product development, to provide working capital, to repay debt and for other corporate purposes.

MBC’s focus is on the mobile economy. Management will place initial efforts on gaining market share within the industry through the distribution of its mobile answer engine application. The company has developed an application for BlackBerry smartphone’s along with a mobile browser version and plans to have an Apple iPhone application available by the end of May 2010. These developments will increase our addressable market to over 200 million phones in the USA. The cost to develop the iPhone application is $15,000. Through the Company’s experiences and discussions with numerous wireless telecoms and handset manufacturers, the Company has decided to focus development resources on launching the mobile answer engine through mobile industry distribution channels to get rapid market share and then have a natural progression to the releases of additional consumer web content. Management believes the speed and ease of deployment of the mobile answer engine application, along with mobile ad revenue, will lead to a rapid penetration of the market. Management further believes that once end-users access web content through the mobile answer engine, retailers will be more inclined to pay higher ad revenues to place their ads in combination with the answers.

The Company will make extensive use of channel distribution partners as a means of distribution and deployment of its products and has sought out several such companies that have numerous cell phone customers. This strategy allows the channel partner to handle the deployment aspect of the product sale and allows MBC to focus on developing and producing world-class products. There are currently no agreements in place.

Organization & Subsidiaries

As a result of the Share Exchange Agreement, the Company owns 100% of the outstanding common stock of MobileBits Corporation, a Florida corporation which was formed in March 2009. MobileBits Corporation does not have any other subsidiaries.

Products & Services

MBC is a developer and marketer of a proprietary method to deliver answers and advertising to end user questions via search on mobile phones and the internet.

4

MBC is a technology company focused on providing answers and highly targeted advertising through an automated answer engine via web and mobile smartphone applications. The Company offers a wide range of answers on a broad scope of web-based content.

Product

Mobile Answer Engine Application is comprised of 2 components:

|

a)

|

Answer engine server based system delivering relevant answers to questions input through a Natural Language Interface (NLI), the mobile applications, and

|

|

b)

|

Advertising platform that combines answers with targeted retail advertising.

|

We are experiencing an explosion of smartphone sales and with it increased mobile Internet access together with the growth of smarter cell phones and faster wireless networks. Mobile consumers are ever more looking for easy ways to access information while on the go.

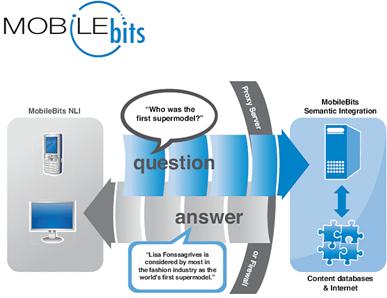

A more intuitive way to search and access content on the Internet through your mobile phone would be to connect to consumer content through a natural language interface (NLI). NLI is a method that allows end users to ask questions rather than to input words into a traditional keyword search engine. MobileBits’ Answer Engine product utilizes this method to simplify access to the broad array of popular consumer information on the web through its proprietary mobile application user interface. In addition, the Company’s product automatically categorizes and connects the appropriate, relevant advertisement to the specific content being searched and viewed.

MBC incorporates linguistic software including ontology comprehension that understands and conceptualizes a query. Once the key elements of the query are analyzed the system categorizes and connects the search engine to the appropriate content source on the web. MBC leverages open source technologies where possible.

The Challenges

One challenge with major search engines today as applied to a mobile phone is they provide links as results to search queries rather than presenting specific answers.

5

The growth of consumer interest in wireless and smartphone handsets has fueled an increased desire to access more and more information from mobile phones. We expect mobile users will not “surf the web” in the same fashion they do online. One reason is the need to perform multiple clicks prevents access to information quickly and easily. Another reason are small screens and limited keypads present on mobile phones. Finally, the mobile consumer is inherently mobile, therefore the time it takes to “surf the web” as we do on PC,s becomes increasing frustrating.

The MobileBits Answer Engine reduces the need to perform multiple clicks to access information. Our Answer Engine enables you to simply ask your question in common language (just as easily as composing an email or a text message) and retrieve the best available answer, automatically.

A revenue challenge facing, content aggregator software providers in online and mobile applications is the inability to effectively match a retailer’s ads with the correct content. This highlights the importance of connecting the correct advertisement with the user content to help drive interest and “Cost Per Click” (CPC) or “Pay Per Click” (PPC) revenue.

Example of a MobileBits search:

Q: What is the cost to fly from Toronto to LA?

In addition to providing the answer, MobileBits will place mobile ads from retailers specifically interested in promoting their product or service to this individual. Relevancy and timeliness will ensure strong “Cost Per Thousand” CPM and CPC revenue..

A typical call to action could be: “Click here to receive 10% off your next flight to LA from Southwest!”

Many of us have been victims of poorly placed ads online. This occurs when you get an ad that has no relevance to your interests at the time. Below is an example of a mismatched ad. In this online example, a user requests information about air disasters and, as you can see, Southwest Airlines is incorrectly matched to this keyword search:

Searching “air disaster” should not yield an Airline advertisement.

With fewer ads being present in mobile due to smaller screens dominating the wireless space, accurate matching is a necessity.

The Solution

The MobileBits Answer Engine addresses the challenges facing keyword search methodology in the mobile industry by solving two main problems:

|

1.

|

Delivering Answers versus Links, thereby reducing clicks on your mobile phone and

|

|

2.

|

Accurately matching ads to interests, therefore potentially increasing user click-through probability on smartphone’s.

|

6

Mobile consumers will be able to easily access a world of information, all from their mobile smart phone – anywhere, anytime.

MobileBits offers unique and broad access to leading web content and delivers “Answers”, not just links.

The MobileBits Answer Engine deliverers answers to your questions automatically. A comparison between MobileBits and a leading keyword search engine demonstrates the advantages we offer:

Q: Who was the first supermodel? (Question asked on June 1, 2009)

|

MobileBits Answer: Lisa Fonssagrives is considered by most in the fashion industry as the world's first supermodel.

|

GOOGLE Answer:

Supermodel - Wikipedia, the free encyclopedia

First-name recognition is a solid indication of supermodel status in the fashion ... Gia Carangihas also been called the first supermodel, as well as Lisa ...

en.wikipedia.org/wiki/Supermodel - 61k - Cached - Similar pages

Janice Dickinson - Wikipedia, the free encyclopedia

Dickinson's claim as being the first supermodel, however, is disputed. ... Gia Carangi has also been called the first supermodel, as well as Lisa ...

en.wikipedia.org/wiki/Janice_Dickinson -175k - Cached - Similar pages

The MobileBits solution is comprised of three separate components:

1. The Mobile Interface: The user interface that allows mobile consumers to input a question or a term in any form. It will be developed in the selected operating system software standards available beginning with Apple iPhone and BlackBerry smartphone's. See the table below on the leading smartphone's today:

Table 3

Worldwide: Smartphone Sales to End Users by Operating System, 4Q08 (Thousands of Units)

|

Market

|

||||||||||||||||||||

|

Share

|

Market

|

Growth

|

||||||||||||||||||

| 4Q08 | 4Q08 | 4Q07 | Share4Q07 | 4Q07-4Q08 | ||||||||||||||||

|

Company

|

Sales

|

(%)

|

Sales

|

(%)

|

(%)

|

|||||||||||||||

|

Symbian

|

17,945.1 | 47.1 | 22,902,5 | 61.3 | -21.6 | |||||||||||||||

|

Research In Motion

|

7,442.6 | 19.5 | 4,024.7 | 10.9 | 84.9 | |||||||||||||||

|

Microsoft windows Mobile

|

4,713.9 | 124 | 4,374 .4 | 11.9 | 7.8 | |||||||||||||||

|

MAC OS X

|

4,079.4 | 10.7 | 1,928.3 | 5.2 | 111.6 | |||||||||||||||

|

Linux

|

3,194.9 | 8.4 | 2,675.9 | 7.3 | 19.4 | |||||||||||||||

|

Palm OS

|

326.5 | 0.9 | 449.1 | 1.2 | -27.3 | |||||||||||||||

|

other OSs

|

436.9 | 1.1 | 411.3 | 1.1 | 6.2 | |||||||||||||||

|

Total

|

38,143.3 | 100.0 | 36,766.1 | 100.0 | 3.7 | |||||||||||||||

Nota: The "Other GSs" category includes sales of Sharp Sidekick devices based on the Danger platform-Source: Gartner (March 2009)

Our application leverages existing wireless internet connections already present on all mobile phones being sold today. The solution will take the form of a thin mobile client (icon or menu item) installable on any leading smartphone. The application features our proprietary, natural language interface (NLI) linked transparently to the mobile Internet Protocol (IP) software where questions and answers are transported to our hosted servers via the wireless network gateways using a Web Services connection (WSDL). The mobile application will be installed through over-the-air (OTA) downloading capabilities.

7

2. Hosted Server Infrastructure (Cloud Computing): The server-based answer service leverages proprietary software connections to strategically selected content in order to provide the greatest likelihood of answers. The solution will include best-of-breed semantic, conceptual and language-based software working together and integrated into our strategic content. Much of the strategic content can be described as unstructured in form and, therefore, difficult to effectively search with traditional keyword technologies. This data integration will be in the form of server software infinitely scalable with the addition of standard dual-core processors on a standard infrastructure. See below:

3. Mobile Ad-matching system: In order to maximize revenue and minimize system costs, the Company will leverage an extension of its semantic ad-matching engine that works in concert with the answer system. Once the natural language question is analyzed and categorized, it is automatically connected to the correct content and an answer is delivered. With the answer, the Company has the capability to add additional, related information including a certain number of mobile ads. These ads can be obtained from any of the available ad inventory companies currently selling mobile ads or the company can create its own partnerships with retailers and advertising agencies to build specific highly targeted and valuable mobile ad campaigns. These mobile ads are then matched to the topic of the questions in order to maximize the greatest Cost Per Thousand (CPM) and/or Cost Per Click (CPC) revenue.

Together, these components constitute the entire mobile “Answer Engine” solution.

Revenue Management

The Company’s answer solution will be available free of charge so not to prevent adoption and usage in the marketplace as well as encourage and enable viral distribution of our solution. Revenue will be driven from local and highly targeted advertising by using the Company’s advertiser software technology maximizing CPM and CPC rates. The Company believes it can increase the CPM and CPC value by ensuring the correct ad is matched to the right content, therefore increasing the probability of user click through. Further, the Company believes its financial model is enhanced by:

|

a)

|

Revenue generated from national and local advertisers that can take advantage of our direct text-messaged connection with the end consumer at the moment a consumer is interested in a particular product or service.

|

|

b)

|

Serving its answers displayed on its website to leading online keyword search engines and generating additional online revenue.

|

8

Market Entry Strategy

MobileBits’ focus is on the mobile economy. Management will place initial efforts on gaining market share within the industry through distribution and revenue share partnerships with handset manufacturers and wireless telecom providers. Through management’s experience at Research In Motion, makers of the BlackBerry smartphone and discussions with wireless industry hardware and network providers, the company has decided to focus deployment attention on launching the MobileBits answer application through industry partners to get rapid market share. Management believes the speed and ease of deployment of the MobileBits answer application, along with aggressive promotions and marketing will lead to a rapid penetration of the market.

The Company will make extensive use of channel distribution partners as a means of distribution and deployment of its products outside the United States including Canada and other English speaking countries to begin. The company has the ability to offer the MobileBits answer application in other languages, growing the companies addressable marketing substantially, and plans to do so in the future with additional funding.

Sales and Marketing Plan for Commercial Carriers

Customers

Although the end users for the MobileBits answer application are the mobile phone consumers, the company plans to create a marketing campaign in addition to its channel distribution strategy to gain market share. Revenue is generated from retailers who are interested in advertising to consumers in the wireless industry. The US mobile advertising market is projected to grow to $3.8 billion in 2010, according to JP Morgan leading analyst Imran Kahn.

Consumer search volumes are anticipated to generate an estimated average of $3.00- $5.00 per month per user. We estimate each distribution partner represent between a few hundred thousand to tens of millions of mobile consumers.

We are at various stages in the sales cycle with a number of major wireless carriers and handset manufacturers around the world. Our plan is to have 3 signed distribution partnerships for the MobileBits Answers application by the end of 2010 growing to 25 by the end of 2012. There are currently no such agreements in place.

Pricing Strategy & Structure

Answer Engine

The MobileBits Answer Engine is free to end users. All answers are free. MobileBits generates revenue by charging either a per ad placement fee based on 1,000 ad placements also generally called CPM (Cost per Thousand) of up to $10 depending on market conditions and/or a Pay Per Click fee of between $0.05 cents to $25.00 also generally known as PPC or CPC.

Revenue Share

MobileBits plans to share CPM and/ PPC, CPC revenue with wireless industry carriers and handset manufacturers in exchange for broad distribution to mobile phone subscribers - called a customer acquisition fee.

Competition

The search industry and many third party companies have developed software systems to try to address the needs of the mobile industry. Many have applied a human call center approach to deliver mobile answers and others have created detailed software menu applications to access consumer content. Accordingly, there is a great opportunity to bridge the gap between the capabilities of current technology offerings and the consumer demands of the mobile industry.

9

Mobile content applications using a drill down menu software approaches are limited to the amount of information is available to a mobile consumer. Some solution providers extend their current desktop application via keyword search engines like Google and Yahoo! and provide many search results presented in links to websites where the mobile consumer must click to mobile to connect to these websites and look for relevant information. Still others leverage costly call centers and humans to perform the categorization and search function manually in an effort to deliver rich data access and reduce the number of clicks on a mobile phone.

Each of these solutions offers varying degrees of assistance to a mobile consumer looking to find specific information while on the go. However, a number of these solutions are not easy to operate and/or may incur additional costs to the mobile consumers. As an example KGB’s service uses a human call center and charges $0.99 per question in addition to carrier texting fees that may apply.

In conclusion, there are two aspects of the competitive solutions which clearly indicate strongly that MobileBits is the only solution which can provide mobile end users with a cost effective and automatic way to get answers to the most commonly asked questions and interests. Firstly, none of these products can offer a low cost method of asking a question and automatically, without human intervention and cost receive a relevant result. Secondly, none of the current automated software solutions can offer mobile consumers answers to a wide range of content on the web.

Intellectual Property

MobileBits technology system is a proprietary answer engine for the mobile industry that is comprised of systems and mathematical algorithms capable of generating significant improvements in search capabilities and results. In addition, MobileBits integrates this intellectual property into a unique end to end mobile application. This includes mobile applications, answer engine module, advertising module, location based services (LBS) and wireless download functionality via mobile internet or SMS services. In aggregate, this capability is entirely proprietary with all intellectual property belonging to MobileBits and MobileBits plans to file certain patent applications to further protect its intellectual property.

MobileBits has begun the process to apply for trademark protection that it may use in the commercial marketplace including the name “MobileBits”. We have engaged a trademark law firm that has performed searches for our trademark. We expect to secure the trademark for MobileBits by end of June 2010. The cost expected is $4,000.

Properties

MobileBits maintains its corporate office at 1990 Main Street Suite 750, Sarasota, Florida 34236. The offices are currently leased on a yearly renewable contract. The company pays rent of $13,000 per year.

Employees

MobileBits currently has a team of 3 full time people managing day to day operations related to business, accounting, legal, marketing and IR plus 9 contracted people and/or firms, of whom 4 are directly linked to product development, and 5 are working on various corporate, product development and deployment initiatives.

Management expects the Company will grow to 25 people by the end of 2010, with 15 directly involved in development activities. Employee growth will occur in conjunction with customer acquisition and will coincide with our product development roadmap.

10

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

OUR LIMITED OPERATING HISTORY MAY NOT SERVE AS AN ADEQUATE BASIS TO JUDGE OUR FUTURE PROSPECTS AND RESULTS OF OPERATIONS.

We have a relatively limited operating history. Such limited operating history makes it difficult for investors to evaluate our business and future operating results. There can be no assurance that we will be able to obtain or sustain profitable operations or that we will even generate significant revenues. An investor in our securities must consider the risks, uncertainties, and difficulties frequently encountered by companies in new and rapidly evolving markets. The risks and difficulties we face include:

|

•

|

MobileBits Answer engine could fail or its performance may not meet our or potential mobile end user expectations.

|

|

•

|

The sales cycle for contemplated distribution partnership to acceleration broad usage which directly affect revenue may be long and the adoption rates are unknown, thus it may take longer for us to achieve meaningful revenue or meet our projections.

|

|

•

|

The company may not be able to continue funding itself prior to generating revenue.

|

THE DEVELOPMENT OF OUR PRODUCTS MAY BE SLOWER THAN PROJECTED.

The development of our products and services and the implementation of such products may take longer than expected. Any delay in product availability affects the company’s revenue forecasts.

OUR TECHNOLOGY IS UNPROVEN.

We are an early stage company, bringing to market an advanced and unproven technology. At this stage, we have not achieved end user or distribution partner acceptance of our product and there is no certainty that this can be achieved. Failure to achieve customer acceptance could result in the loss of your investment. You should consider and evaluate our prospects in light of the risks and uncertainty frequently encountered by early stage companies in rapidly evolving markets characterized by rapid technological change, changing customer needs, evolving industry standards and frequent introductions of new products and services.

OUR BUSINESS IS AFFECTED BY MANY CHANGING ECONOMIC AND OTHER CONDITIONS BEYOND OUR CONTROL.

The financial success of the Company’s operations may be sensitive to adverse changes in general economic conditions, such as inflation, unemployment, and the cost of borrowing. These changes could cause the cost of the Company’s products to rise faster than it can raise prices. The Company has no control over any of these changes.

WE MAY BE UNABLE TO RETAIN KEY MANAGEMENT PERSONNEL.

Our management and employees can terminate their employment at any time, and the loss of the services of one or more of our executive officers or other key employees, including Mr. Kostiuk, could have a material adverse impact on our business. We may be unable to locate and secure and retain talented and qualified employees to implement our plan. If we are unable to attract and retain the necessary technical, sales and other personnel on a cost-effective basis, our business operations and financial performance could be adversely affected.

11

THE SEVERE GLOBAL ECONOMIC DOWNTURN HAS RESULTED IN VERY WEAK RISK INVESTMENT ENVIROMENT WHICH COULD HAVE A SIGNIFICANT NEGATIVE IMPACT ON US.

The world is facing a global recession. This could affect our ability to continue raising capital and enter into and fulfill terms of agreements with our industry partners. The Company’s ability to complete financing to implement its business plan on any terms is uncertain. We may not be able to raise sufficient financing to affect our business plan and deliver products and services that are accepted by customers. If we cannot find adequate capital on reasonable terms, investors will face a significant risk of losing their investments in their entirety.

WE ARE HIGHLY DEPENDENT ON TECHNOLOGY

Our business and our results of operations is highly dependent on technology our business faces many technology related risks, including, among others:

|

•

|

Infringements of our intellectual property could adversely affect our ability to compete. Our patents applications may be rejected in hold or in part in the United States or in other jurisdictions around the world.

|

|

•

|

We may have to defend ourselves against claims of intellectual property infringement, which could be very expensive for us and harm our business and financial condition.

|

|

•

|

We may be a party to lawsuits in the course of our business. Litigation can be expensive, lengthy, and disruptive to normal business operations. Moreover, the results of complex legal proceedings are difficult to predict. An unfavourable resolution of a particular lawsuit could have a material adverse effect on our business, operating results, or financial condition.

|

OUR ABILITY TO CONTINUE AS A GOING CONCERN IS UNCERTAIN.

Our audited financial statements for the period from March 24, 2009 (inception) through October 31, 2009 includes a paragraph that explains that we have incurred substantial losses. This factor raises substantial doubt about our ability to continue as a going concern. This going concern uncertainty may make it difficult for us to raise additional debt or equity financing necessary to continue our business operations.

Risks Associated with Our Securities

OUR COMMON STOCK IS QUOTED ON THE OTC BULLETIN BOARD WHICH MAY HAVE AN UNFAVORABLE IMPACT ON OUR STOCK PRICE AND LIQUIDITY.

Our Common Stock is quoted on the OTC Bulletin Board. The OTC Bulletin Board is a significantly more limited market than the New York Stock Exchange or Nasdaq system. The quotation of our shares on the OTC Bulletin Board may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

12

THERE IS LIMITED LIQUIDITY ON THE OTCBB.

When fewer shares of a security are being traded on the OTCBB, volatility of prices may increase and price movement may outpace the ability to deliver accurate quote information. Due to lower trading volumes in shares of our Common Stock, there may be a lower likelihood of one’s orders for shares of our Common Stock being executed, and current prices may differ significantly from the price one was quoted at the time of one’s order entry.

OUR COMMON STOCK IS THINLY TRADED, SO YOU MAY BE UNABLE TO SELL AT OR NEAR ASKING PRICES OR AT ALL IF YOU NEED TO SELL YOUR SHARES TO RAISE MONEY OR OTHERWISE DESIRE TO LIQUIDATE YOUR SHARES.

Currently, our Common Stock is quoted in the OTC Bulletin Board market and the trading volume we will develop may be limited by the fact that many major institutional investment funds, including mutual funds, as well as individual investors follow a policy of not investing in OTC Bulletin Board stocks and certain major brokerage firms restrict their brokers from recommending OTC Bulletin Board stocks because they are considered speculative, volatile and thinly traded. The OTC Bulletin Board market is an inter-dealer market much less regulated than the major exchanges and our Common Stock is subject to abuses, volatility and shorting. Thus, there is currently no broadly followed and established trading market for our Common Stock. An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded there.

The trading volume of our Common Stock has been and may continue to be limited and sporadic. As a result of such trading activity, the quoted price for our Common Stock on the OTC Bulletin Board may not necessarily be a reliable indicator of its fair market value. Further, if we cease to be quoted, holders would find it more difficult to dispose of our Common Stock or to obtain accurate quotations as to the market value of our Common Stock and as a result, the market value of our Common Stock likely would decline.

OUR COMMON STOCK IS SUBJECT TO PRICE VOLATILITY UNRELATED TO OUR OPERATIONS.

The market price of our Common Stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our Common Stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our Common Stock.

OUR COMMON STOCK ARE CLASSIFIED AS A “PENNY STOCK” AS THAT TERM IS GENERALLY DEFINED IN THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, TO MEAN EQUITY SECURITIES WITH A PRICE OF LESS THAN $5.00. OUR COMMON STOCK WILL BE SUBJECT TO RULES THAT IMPOSE SALES PRACTICE AND DISCLOSURE REQUIREMENTS ON BROKER-DEALERS WHO ENGAGE IN CERTAIN TRANSACTIONS INVOLVING A PENNY STOCK.

We will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our Common Stock, which in all likelihood would make it difficult for our stockholders to sell their securities.

Rule 3a51-1 of the Securities Exchange Act of 1934 establishes the definition of a “penny stock,” for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our Common Stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person’s account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

• the basis on which the broker or dealer made the suitability determination, and

• that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

13

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of MobileBits Corporation for the period ended March 24, 2009 (inception) to October 31, 2009, should be read in conjunction with the Selected Financial Data, MobileBits Corporations’ financial statements, and the notes to those financial statements that are included elsewhere in this Form 8-K. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this Form 8-K. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

COMPANY OVERVIEW

MobileBits Corporation (“MBC”) was incorporated in Florida in March 2009. The business was initiated with the intention of becoming a leading provider of mobile answers and to provide relevant advertising to mobile smartphone and cell phone user’s through an opt in format.

MBC is a developer and marketer of proprietary method to deliver answers and advertising to end user question via search on mobile phones and the internet.

MBC is a global technology company focused on providing answers and highly targeted advertising through an automated answer engine via web and mobile smartphone applications. The Company offers a wide range of answers on a broad scope of web-based content.

MBC is at various stages of discussion with a number of mobile handset manufacturers and wireless telecom companies worldwide and implementation and channel partners regarding the implementation of its mobile answer engine.

MBC currently anticipates the implementation of its business plan will require additional investment capital. The Company aims to complete $5.0 million in equity financing in 2010. The funds will be used to engage potential customers, to fund product development, for working capital purposes, repayment of debt and for other corporate purposes.

14

MBC’s focus is on the mobile economy. Management will place initial efforts on gaining market share within the industry through the distribution of its mobile answer engine application. Through the Company’s experiences and discussions with numerous wireless telecoms and handset manufacturers, the Company has decided to focus development attention on launching the mobile answer engine through channel distributors to get rapid market share and then have a natural progression to the releases of additional consumer web content. Management believes the speed and ease of deployment of the mobile answer engine application, along with mobile ad revenue share will lead to a rapid penetration of the market. Management further believes that once end-users access web content through the mobile answer engine retailers will be more inclined to pay higher ad fees to place their ads in combination with the answers.

The Company will make extensive use of channel partners as a means of distribution and deployment of its products and has sought out several such companies that have numerous cell phone customers. This strategy allows the channel partner to handle the deployment aspect of the product sale and allows MBC to focus on developing and producing world-class products.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board (“FASB”) issued an update of Accounting Standards Codification 105, “Generally Accepted Accounting Principles” (“ASC 105”) which establishes the FASB Accounting Standards Codification TM (the “ASC”). The ASC is the sole source of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. The ASC superseded all then-existing non-SEC accounting and reporting standards. All other non-grandfathered, non-SEC accounting literature not included in the ASC is no longer authoritative. While the ASC did not change GAAP, it introduced a new structure that reorganized the GAAP pronouncements into accounting topics. All content of the ASC carries the same level of authority. The ASC is effective for our financial statements as of October 31, 2009. There was no effect of adoption of this standard on the financial statements.

In May 2009, the FASB issued ASC 855, “Subsequent Events,” which modifies the definition of subsequent events and requires disclosure of the date through which an entity has evaluated subsequent events and the basis for that date. These requirements became effective for us on June 15, 2009. There was no effect of adoption of this standard on the financial statements.

The Company evaluated all events and transactions that occurred after October 31, 2009 through March 15, 2010, the date the Company issues these financial statements. During this period, the Company did not have any material events other than as disclosed in Note 9.

MobileBits does not expect that any other recently issued accounting pronouncements will have a significant impact on the financial statements of the Company.

15

Development stage company

On March 24, 2009 (the inception date), the Company commenced its global technology activities. As of October 31, 2009, the Company has not produced a sustainable positive cash flow from operations. Accordingly, the Company’s activities have been accounted for as those of a “Development Stage Enterprise” as set forth in ASC 915, “Development Stage Entities.” Among the disclosures required by ASC 915 are that the Company’s financial statements be identified as those of a development stage company. In addition, the statements of operations, changes in stockholders equity and cash flows are required to disclose all activity since the Company’s date of inception.

The Company will continue to prepare its financial statements and related disclosures in accordance with ASC 915 until such time that the Company’s operations generate significant revenues.

Website

Website development is recorded at cost and amortized on the straight-line method over its estimated useful life. Expenditures for normal maintenance are charged to expense as incurred.

Stock compensation

MobileBits follows ASC 718, “Compensation - Stock Compensation” as interpreted by SEC Staff Accounting Bulletin No. 107 for financial accounting and reporting standards for stock-based employee compensation plans. It defines a fair value based method of accounting for an employee stock option or similar equity instrument. There were 150,000 options were granted from inception through October 31, 2009.

16

PLAN OF OPERATION

The Company is a development stage company and has not earned any revenue from its inception in 2009. The Company expects to commence earning revenue once its answer engine development is complete. The Company expects to achieve first revenues in 2010.

Prior to January 14, 2010, our specific goal was to attract a client base that will have steady orders of nutritional supplements throughout the year. However, our business plan failed and we were forced to look for an acquisition target. On January 14, 2010, we found such target and entered into a material agreement and stock purchase agreement with Walter Kostiuk, Chief Executive Officer of MobileBits Corporation. Pursuant to the Share Exchange Agreement, Mr. Kostiuk changed our business plan to become a global technology company focused on providing answers and highly targeted advertising through an automated answer engine via web and mobile smartphone applications. The Company will offer a wide range of answers on a broad scope of web-based content.

Over the next twelve months, we intend to build our business plan and enter into strategic partnership agreements to develop our technology and increase the number of users that utilize our technology.

LIQUIDITY AND CAPITAL RESOURCES

The Company has yet to fully commercialize its technologies and consequently has incurred significant losses since its inception. At October 31, 2009, the Company’s deficit accumulated during the development stage was approximately $438,093, and the Company had utilized cash in operating activities of $239,985. The Company has funded theses losses and cash flows through the sale of equity securities.

These factors raise substantial doubt about the ability of the Company to continue as a going concern . There can be no assurance that the Company will have adequate capital resources to fund planned operations or that any additional funds will be available to the Company when needed, or if available, will be available on favorable terms in the amounts required by the Company. If the Company is unable to obtain adequate capital resources to fund operations, it may be required to delay, scale back or eliminate some or all of its operations, which may have a material adverse effect on the Company’s business, results of operations and ability to continue as a going concern. These financial statements do not include any adjustments that might result from the outcome of these uncertainties.

In this regard, management is planning to raise necessary additional funds through loans and additional sales of its common stock. There is no assurance that the Company will be successful in raising additional capital. The Company hopes to raise $5 million to $10 million from equity in 2010, which will be used to fund operations and provide working capital. Should the Company be unable to raise this amount of capital its operating plans will be limited to the amount of capital that it can access.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements.

MANAGEMENT

The following table sets forth the names, ages, and positions of our new executive officers and directors. Executive officers are elected annually by our Board of Directors. Each executive officer holds his office until he resigns, is removed by the Board, or his successor is elected and qualified. Directors are elected annually by our stockholders at the annual meeting. Each director holds his office until his successor is elected and qualified or his earlier resignation or removal.

|

NAME

|

AGE

|

POSITION

|

||

|

Walter Kostiuk

|

43

|

President, Chief Executive Officer and Director

|

17

Walter Kostiuk, 43, Chief Executive Officer, Chief Financial Officer, Chairman

Mr. Kostiuk has more than fifteen years experience in the Wireless Data and Semantic Software industries. His past experience includes growing early-stage technology companies, highlighted by leadership roles with some of the most successful technology companies in the world today including Research in Motion (“RIM”) beginning in 1999. During his six year career at RIM, Kostiuk was a founding member of the BlackBerry applications strategy & division.

In 2005, Mr. Kostiuk participated in the startup successes of AskMeNow™, an early provider of human-based mobile question & answer solutions, where he negotiated several wireless carrier and manufacturer distribution deals in both Canada and the U.S including Rogers Wireless and Alltel Wireless (now Verizon Wireless). Mr. Kostiuk’s business development efforts supported a peak corporate valuation of approximately one hundred and fifty million dollars ($150,000,000) in 2006.

Most recently, Mr. Kostiuk held an executive leadership role at Expert System, a global leader in Enterprise Semantic Intelligence solutions, where he was directly responsible for the mobile enterprise search strategy and business in 2008. While there, Mr. Kostiuk was successful in securing a contract with Research in Motion, resulting in the deployment of a mobile self-help search solution called BlackBerry Answers™.

Through his efforts at Expert System, Mr. Kostiuk’s applications have been awarded the 2009 GSM Mobile Global Award as well as the 2009 CTIA Finalist Award for Emerging Technology and the Superstar Award from MobileVilliage.

Family Relationships

None.

Related Party Transactions

Except for the Merger discuss herein, there are no other related party transactions reportable under Item 5.02 of Form 8-K and Item 404(a) of Regulation S-K.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers have been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, or has been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without sanction or settlement. Except as set forth in our discussion below in “Certain Relationships and Related Transactions,” none of our directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Code of Ethics

We currently do not have a code of ethics that applies to our officers, employees and directors, including our Chief Executive Officer and senior executives, however, we intend to adopt one in the near future.

Conflicts of Interest

Certain potential conflicts of interest are inherent in the relationships between our officers and directors, and us.

From time to time, one or more of our affiliates may form or hold an ownership interest in and/or manage other businesses both related and unrelated to the type of business that we own and operate. These persons expect to continue to form, hold an ownership interest in and/or manage additional other businesses which may compete with ours with respect to operations, including financing and marketing, management time and services and potential customers. These activities may give rise to conflicts between or among the interests of us and other businesses with which our affiliates are associated. Our affiliates are in no way prohibited from undertaking such activities, and neither we nor our shareholders will have any right to require participation in such other activities.

Further, because we intend to transact business with some of our officers, directors and affiliates, as well as with firms in which some of our officers, directors or affiliates have a material interest, potential conflicts may arise between the respective interests of us and these related persons or entities. We believe that such transactions will be effected on terms at least as favorable to us as those available from unrelated third parties.

18

With respect to transactions involving real or apparent conflicts of interest, we have adopted policies and procedures which require that: (i) the fact of the relationship or interest giving rise to the potential conflict be disclosed or known to the directors who authorize or approve the transaction prior to such authorization or approval, (ii) the transaction be approved by a majority of our disinterested outside directors, and (iii) the transaction be fair and reasonable to us at the time it is authorized or approved by our directors.

EXECUTIVE COMPENSATION

MOBILEBITS EXECUTIVE COMPENSATION SUMMARY

Summary Compensation Table

The following table sets forth all cash compensation paid by the Company, for the period from March 24, 2009 (inception) to October 31, 2009. The table below sets forth the positions and compensations for each officer and director of the Company.

|

Name and Principal

Position

|

Year

|

Salary

|

Bonus

($)

|

Stock

Award

($)

|

Option

Award

($)

|

Non-Equity

Incentive Plan

Compensation

Earnings ($)

|

Non-Qualified

Deferred

Compensation

Earnings ($)

|

All other

Compensation

($)

|

Total

($)

|

||||||||||

| Walter Kostiuk, CEO | 2009 | 168,000 | 72,000 | - | - | - | - | - |

240,000

|

Outstanding Equity awards at Fiscal Year End

As of the end of the last fiscal year, there were no outstanding equity awards. However, as of the Closing of the Merger, there were 250,000 options that were previously issued to executives of MBC that we have now adopted and can be exercised into shares of MobileBits Holdings Corporation common stock.

Director Compensation

Our directors will not receive a fee for attending each board of directors meeting or meeting of a committee of the board of directors. All directors will be reimbursed for their reasonable out-of-pocket expenses incurred in connection with attending board of director and committee meetings.

Certain Relationships and Related Transactions

We will present all possible transactions between us and our officers, directors or 5% stockholders, and our affiliates to the Board of Directors for their consideration and approval. Any such transaction will require approval by a majority of the disinterested directors and such transactions will be on terms no less favorable than those available to disinterested third parties.

PRINCIPAL STOCKHOLDERS

Pre-Combination

The following table sets forth certain information regarding our Common Shares beneficially owned on March 12, 2010, for (i) each stockholder known to be the beneficial owner of 5% or more of the outstanding Common Shares of the Company, (ii) each executive officer and director, and (iii) all executive officers and directors as a group, on a pro forma basis prior to the Closing of the Combination and Offering.

19

|

Name and Address

|

Amount and Nature of

Beneficial Ownership

|

Percentage of Class (1)

|

||||||

|

Walter Kostiuk

4751 Travini Circle #103

Sarasota, Florida 34235

|

2,000,000 | 84.38 | % | |||||

|

All executive officers and directors as a group

|

2,000,000 | 84.38 | % | |||||

|

(1)

|

Based on 2,370,000 shares outstanding prior to the close of the Merger.

|

Post-Combination

The following table sets forth certain information regarding our Common Shares beneficially owned on the Closing Date, for (i) each stockholder known to be the beneficial owner of 5% or more of the outstanding Common Shares of the Company, (ii) each executive officer and director, and (iii) all executive officers and directors as a group.

As of the date of filing, we have 3,048,911 shares of Common Stock outstanding and 0 shares of preferred stock outstanding.

|

Name and Address

|

Amount and Nature of

Beneficial Ownership

|

Percentage of Class (1)

|

||||||

|

Walter Kostiuk

4751 Travini Circle #103

Sarasota, Florida 34235

|

2,380,952 | 78.09 | % | |||||

|

All executive officers and directors as a group

|

2,380,952 | 78.09 | % | |||||

|

(1)

|

Based on 3,048,911 shares of Common Stock issued and outstanding after the close of the Combination.

|

DESCRIPTION OF SECURITIES

The Company is authorized to issue 100,000,000 Common Shares, par value $0.001 and 10,000,000 shares of preferred stock, par value $0.001. Immediately prior to the Merger, 2,370,000 Common Shares were issued and outstanding and 0 shares of preferred stock was issued and outstanding. Immediately following the Merger, there were 3,048,911 shares of Common Stock issued and outstanding.

(a) Common Shares. Each outstanding share of common stock entitles the holder thereof to one vote per share on all matters. Our bylaws provide that elections for directors shall be by a plurality of votes. Stockholders do not have preemptive rights to purchase shares in any future issuance of our common stock. Upon our liquidation, dissolution or winding up, and after payment of creditors and preferred stockholders, if any, our assets will be divided pro-rata on a share-for-share basis among the holders of the shares of common stock.

20

The holders of shares of our common stock are entitled to dividends out of funds legally available when and as declared by our board of directors. Our board of directors has never declared a dividend and does not anticipate declaring a dividend in the foreseeable future. Should we decide in the future to pay dividends, as a holding company, our ability to do so and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions. In the event of our liquidation, dissolution or winding up, holders of our common stock are entitled to receive, ratably, the net assets available to stockholders after payment of all creditors and preferred stockholders.

(b) Preferred Stock.

Our board of directors has the authority, within the limitations and restrictions in our amended articles of incorporation, to issue 10,000,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting any series or the designation of any series, without further vote or action by the stockholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in our control without further action by the stockholders. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of Common Stock, including voting rights, of the holders of Common Stock. In some circumstances, this issuance could have the effect of decreasing the market price of the Common Stock. Prior to Closing, there were no shares of preferred stock outstanding. We currently have no plans to issue any shares of preferred stock.

LEGAL PROCEEDINGS

Currently there are no outstanding judgments against the Company or any consent decrees or injunctions to which the Company is subject or by which its assets are bound and there are no claims, proceedings, actions or lawsuits in existence, or to the Company’s knowledge threatened or asserted, against the Company or with respect to any of the assets of the Company that would materially and adversely affect the business, property or financial condition of the Company, including but not limited to environmental actions or claims. However, from time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

Item 3.02 Unregistered Sales of Equity Securities.

Pursuant to the Share Exchange Agreement, on March 12, 2010, we issued 2,678,911 common shares to the MBC Shareholders in exchange for 100% of the MBC Stock. Such securities were not registered under the Securities Act. These securities qualified for exemption under Section 4(2) of the Securities Act since the issuance of securities by us did not involve a public offering. The offering was not a “public offering” as defined in Section 4(2) due to the insubstantial number of persons involved in the deal, size of the offering, manner of the offering and number of securities offered. We did not undertake an offering in which we sold a high number of securities to a high number of investors. In addition, these shareholders had the necessary investment intent as required by Section 4(2) since they agreed to and received share certificates bearing a legend stating that such securities are restricted pursuant to Rule 144 of the Securities Act. This restriction ensures that these securities would not be immediately redistributed into the market and therefore not be part of a “public offering.” Based on an analysis of the above factors, we have met the requirements to qualify for exemption under Section 4(2) of the Securities Act for this transaction.

Item 4.01 Changes in Registrant’s Certifying Accountant.

On March 12, 2010, our Board of Directors terminated Berman & Company, P.A. (“Berman”) as the independent registered public accounting firm of the Company, and engaged the independent registered public accounting firm, GBH CPAs, PC to serve as the Company’s independent auditors. Pursuant to Item 304(a) of Regulation S-K under the Securities Act of 1933, as amended, and under the Securities Exchange Act of 1934, as amended, the Company reports as follows:

21

|

(a)

|

(i)

|

Berman was terminated as our independent registered public accounting firm effective on March 12, 2010.

|

|

(ii)

|

For the two most recent fiscal years ended July 31, 2009 and 2008, Berman’s report on the financial statements did not contain any adverse opinions or disclaimers of opinion, and were not qualified or modified as to uncertainty, audit scope, or accounting principles, other than for a going concern.

|

|

|

|

(iii)

|

The termination of Berman and engagement of GBH CPAs, PC were approved by the Company’s Board of Directors.

|

|

(iv)

|

The Company and Berman did not have any disagreements with regard to any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure for the audited financials for the fiscal years ended July 31, 2009 and 2008, and subsequent interim periods ended October 31 and January 31, 2010 and through the date of dismissal, which disagreements, if not resolved to the satisfaction of Berman, would have caused it to make reference to the subject matter of the disagreements in connection with its reports.

|

|

|

(v)

|

During our fiscal years ended July 31, 2009 and 2008, and subsequent interim periods ended October 31, 2009 and January 31, 2010 and through the date of dismissal, the Company did not experience any reportable events.

|

|

|

(b)

|

(i) |

On March 12, 2010, the Company engaged GBH CPAs, P.C. to serve as its independent registered public accounting firm.

|

|

(ii)

|

Prior to engaging GBH CPAs, PC., the Company had not consulted GBH CPAs, P.C. regarding the application of accounting principles to a specified transaction, completed or proposed, the type of audit opinion that might be rendered on its financial statements or a reportable event, nor did the Company consult with GBH CPAs, PC regarding any disagreements with its prior auditor on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of the prior auditor, would have caused it to make a reference to the subject matter of the disagreements in connection with its reports.

|

|

|

(iii)

|

The Company did not have any disagreements with GBH CPAs, P.C. and therefore did not discuss any past disagreements with GBH CPAs, PC .

|

|

|

(c)

|

The Company requested Berman to furnish a letter addressed to the SEC stating whether it agrees with the statements made by us regarding Berman.

|

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

Pursuant to the approval of our Board of Directors and the written consent of at least a majority of the outstanding shares of common stock of the Company, we filed a Certificate of Amendment to the Company’s Articles of Incorporation (the “Certificate of Amendment”) with the Secretary of State of the State of Nevada to change the name of the Company from “Bellmore Corporation” to “MobileBits Holdings Corporation.” The Certificate of Amendment became effective on January 25, 2010. A copy of the Certificate of Amendment is attached hereto as Exhibit 3.1 and incorporated herein in its entirety by reference.

On March 12, 2010, the Board of Directors authorized the change in the fiscal year end from July 31 to October 31 to coincide with our new wholly owned subsidiary, MobileBits Corporation.

As explained more fully in Item 2.01 above, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) immediately before the Closing of the Combination. As a result of the Combination, MBH became our subsidiary and became our main operational business. Consequently, we believe that the Combination has caused us to cease to be a shell company. For information about the Combination, please see the information set forth above under Item 2.01 of this Current Report on Form 8-K which information is incorporated herein by reference.

22

Item 8.01 Other Events

In connection with the corporate name change and pursuant to the terms of the Share Exchange Agreement, the company’s stock ticker symbol has changed from “BLMR” to “MBIT” on the over-the-counter bulletin board, effective as of February 18, 2010. Stockholders do not need to exchange stock certificates in connection with the corporate name change and ticker symbol change.

Item 9.01 Financial Statement and Exhibits.

(a) FINANCIAL STATEMENTS OF BUSINESS ACQUIRED.

The Audited Financial Statements of MobileBits Corporation as of October 31, 2009, are filed as Exhibit 99.1 to this current report and are incorporated herein.

(b) PRO FORMA FINANCIAL INFORMATION.

Unaudited pro forma combined financial information describing the pro forma effect of the business combination described in this current report on the Company’s (i) unaudited combined balance sheet as of October 31, 2009 and (ii) unaudited combined statement of operations for the twelve month period ended October 31, 2009 and for the period from March 24, 2009 (inception) through October 31, 2009.

(c) SHELL COMPANY TRANSACTIONS

Reference is made to Items 9.01(a) and 9.01(b) and the exhibits referred to therein which are incorporated herein by reference.

23

(d) EXHIBITS

|

Exhibit No.

|

Description

|

|

|

3.1

|

Certificate of Amendment to the Articles of Incorporation changing the name of the Corporation to MobileBits Holdings Corporation

|

|

|

10.1

|

Share Exchange Agreement by and among MobileBits Holdings Corp, MobileBits Corporation, MobileBits Shareholders and Walter Kostiuk dated March 12, 2010

|

|

|

16.1

|

Letter from Berman & Company, P.A. to the U.S. Securities and Exchange Commission dated March 12, 2010

|

|

|

99.1

|

Financial Statements of MobileBits Corporation for the period from March 24, 2009 (inception) to October 31, 2009.

|

|

|

99.2

|

Unaudited pro forma combined financial statements describing the pro forma effect of the business combination described in this current report on the Company’s (i) unaudited combined balance sheet as of October 31, 2009 and (ii) unaudited combined statement of operations for the twelve month period ended October 31, 2009 and for the period from March 24, 2009 (inception) through October 31, 2009

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

|

MOBILEBITS HOLDINGS CORP.

|

|||

|

Date: March 15, 2010

|

By:

|

/s/ Walter Kostiuk

|

|

|

Walter Kostiuk

|

|||

|

Chief Executive Officer

|

|||

24