Attached files

| file | filename |

|---|---|

| EX-32 - Yongye International, Inc. | v177333_ex32.htm |

| EX-23.1 - Yongye International, Inc. | v177333_ex23-1.htm |

| EX-23.2 - Yongye International, Inc. | v177333_ex23-2.htm |

| EX-31.2 - Yongye International, Inc. | v177333_ex31-2.htm |

| EX-31.1 - Yongye International, Inc. | v177333_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| x |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For

the fiscal year ended December 31, 2009

|

|

|

OR

|

|

| o |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For

the transition period from _____ to

_____

|

COMMISSION

FILE NO. 333-143314

YONGYE

INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

NEVADA

|

20-8051010

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer Identification No.)

|

|

6th Floor,

Suite 608, Xue Yuan International Tower,

No. 1 Zhichun Road, Haidian

District, Beijing, PRC

(Address

of principal executive offices)

+86 10 8231

8626

(Issuer’s

telephone number, including area code)

Securities

Registered Pursuant to Section 12(b) of the Act: None

Securities

Registered Pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Check

whether the issuer is not required to file reports pursuant to Section 13 or

15(d) of the Exchange Act.

Yes o No x

Check

whether the issuer (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the registrant was required to file such reports); and (2) has been subject

to such filing requirements for the past 90 days.

Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer” and “large accelerated filer” in Rule 12b-2 of the Exchange

Act.

|

Large

Accelerated Filer o

|

Accelerated

Filer o

|

Non-Accelerated

Filer o

|

Smaller

Reporting Company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes o No x

The

aggregate market value of the 24,936,637 shares of common equity stock held by

non-affiliates of the Registrant was approximately $90,021,259 on the last

business day of the Registrant’s most recently completed second fiscal quarter,

based on the last sale price of the registrant’s common stock on the most recent

date on which a trade in such stock took place prior thereto.

There

were a total of 44,532,241 shares of the registrant’s Common Stock, par

value $0.001 per share, outstanding as of March 12, 2010.

DOCUMENTS

INCORPORATED BY REFERENCE

|

(2)

|

Portions

of the Registrant’s Proxy Statement relating to the Registrant’s 2009

Annual Meeting of Shareholders are incorporated by reference into Part III

of this Annual Report on Form 10-K

|

|

TABLE

OF CONTENTS

|

||

|

PART

I

|

4

|

|

|

ITEM

1

|

Business

|

4

|

|

ITEM

1A.

|

Risk

Factors

|

16

|

|

ITEM

1B.

|

Unresolved

Staff Comments

|

31

|

|

ITEM

2

|

Properties

|

31

|

|

ITEM

3

|

Legal

Proceedings

|

31

|

|

ITEM

4

|

Submission

Of Matters to a Vote Of Security Holders

|

31

|

|

PART

II

|

31

|

|

|

ITEM

5

|

Market

For Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

31

|

|

ITEM

6

|

Selected

Financial Data

|

32

|

|

ITEM

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

32

|

|

ITEM

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

|

|

ITEM

8

|

Financial

Statements and Supplementary Data

|

41

|

|

ITEM

9

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosures

|

41

|

|

ITEM

9A.

|

Controls

and Procedures

|

41

|

|

ITEM

9B.

|

Other

Information.

|

42

|

|

PART

III

|

42

|

|

|

ITEM

10

|

Directors,

Executive Officers and Corporate Governance

|

42

|

|

ITEM

11

|

Executive

Compensation

|

42

|

|

ITEM

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

43

|

|

ITEM

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

43

|

|

ITEM

14

|

Principal

Accounting Fees and Services

|

44

|

|

PART

IV

|

44

|

|

|

ITEM

15

|

Exhibits

and Financial Statement Schedules

|

44

|

|

Index

to Consolidated Financial Statements

|

||

|

Consolidated

Financial Statements

|

||

2

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains forward-looking statements and information relating to Yongye

International, Inc., that are based on the beliefs of our management as well as

assumptions made by and information currently available to us. When used in this

report, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“plan” and similar expressions, as they relate to us or our management, are

intended to identify forward-looking statements. These statements reflect our

current view concerning future events and are subject to risks, uncertainties

and assumptions, including among many others: a general economic downturn; a

downturn in the securities markets; Securities and Exchange Commission

regulations which affect trading in the securities of “penny stocks,” and other

risks and uncertainties. Should any of these risks or uncertainties materialize,

or should underlying assumptions prove incorrect, actual results may vary

materially from those described in this report as anticipated, estimated or

expected. Except as required by law, we assume no obligation to update any

forward-looking statements publicly, or to update the reasons actual results

could differ materially from those anticipated in any forward-looking

statements, even if new information becomes available in the future. Important

factors that may cause actual results to differ from those projected include the

risk factors specified above. Notwithstanding the above, Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act expressly state

that the safe harbor for forward-looking statements does not apply to companies

that issue penny stock. Because we may from time to time be considered as an

issuer of penny stock, the safe harbor for forward-looking statements may not

apply to us at certain times.

All

statements other than statements of historical fact are statements that could be

deemed forward-looking statements, including statements regarding new and

existing products and opportunities; statements regarding market and industry

segment growth and demand and acceptance of new and existing products; any

projections of sales, earnings, revenue, margins or other financial items; any

statements of the plans, strategies and objectives of management for future

operations; any statements regarding future economic conditions or performance;

uncertainties related to conducting business in China; any statements of belief

or intention; any of the factors mentioned in the “Risk Factors” section of this

Form 10-K; and any statements or assumptions underlying any of the

foregoing. Also, forward-looking statements represent our estimates and

assumptions only as of the date of this report. You should read this report and

the documents that we reference in this report, or that we filed as exhibits to

this report, completely and with the understanding that our actual future

results may be materially different from what we expect.

Except as

required by law, we assume no obligation to update any forward-looking

statements publicly, or to update the reasons actual results could differ

materially from those anticipated in any forward-looking statements, even if new

information becomes available in the future.

USE

OF CERTAIN DEFINED TERMS

Except as

otherwise indicated by the context, references in this report to:

|

·

|

“Yongye,”

“we,” “us,” “YGYB,” “the Company” or “our Company” are references to

Yongye International, Inc.;

|

|

·

|

“Yongye

Nongfeng”, “CJV” or “YNFB” are reference to Yongye Nongfeng Biotechnology

Co., Ltd.;

|

|

·

|

“Inner

Mongolia Yongye”, “YBL” or “Yongye Biotechnology, Co.”are references to

Inner Mongolia Yongye Biotechnology Co.,

Ltd.

|

|

·

|

“China”

and “PRC” are a reference to the People’s Republic of

China;

|

|

·

|

“RMB”

is a reference to Renminbi, the legal currency of

China;

|

|

·

|

“U.S.

dollar,” “$” and “US$” are a reference to the legal currency of the United

States;

|

|

·

|

“SEC”

is a reference to the United States Securities and Exchange

Commission;

|

|

·

|

“Securities

Act” is a reference to Securities Act of 1933, as amended;

and

|

|

·

|

“Exchange

Act” is a reference to the Securities Exchange Act of 1934, as

amended;

|

3

Part

I

ITEM

1 Business

Business

Overview

We

are engaged in the manufacture, research, development and sale of fulvic

acid based liquid and powder nutrient compounds for plants and animals

respectively which are used in the agriculture industry. Currently, we

manufacture and sell two principal products. Our universal liquid plant

product consists of our fulvic acid compound base mixed with additional

nutrients that plants typically need to grow. It is applied to various types of

crops by mixing with water and spraying directly on the plants, typically in

conjunction with normal fertilizer and pesticide usage. Our animal product is a

powder and consists of our fulvic acid base compound mixed with other

nutrients and Chinese herbs. Our animal product is currently targeted at

and administered to dairy cows by mixing the powder product with cows' food as

its antibiotic-type properties typically help decrease inflammation and

alleviate pain due to mastitis which occurs as a result of milking. Both of our

current products are marketed under the name Shengmingsu. We have been

engaged in the development of liquid plant products that are tailored for

specific crops and powder animal products for cows, pigs, chickens and

sheep. These products will supplement our current product offering.

We

believe our proprietary process for extracting fulvic acid from humic acid, our

patented process for mixing our liquid plant product and

our patent-pending process for producing our powder animal product

differentiate us in the China market and enable us to provide high

quality products that deliver reliable results for the end users of our

products from season to season.

On

December 6, 2008, the Inner Mongolia Autonomous Region Scientific and Technology

Bureau (IMARSTB), thoroughly reviewed scientific and economic data provided by

the Company and reached the opinion that our liquid plant product effectively

increases agricultural output, improves the utilization rate of fertilizer,

enhances a plant’s resistance to disease and has a lighter weight and higher

bio-activity than the other products it tested. In addition, the IMARSTB

concluded that large scale experimentation has proven that our product can

increase overall yields of staple crops, such as wheat and rice, and vegetables

by 10-20% and 15-30%, respectively, while also improving product

quality. In a separate study, the IMARSTB concluded that our extraction

process is more efficient and produces purer fulvic acid as compared to

traditional extraction methods.

Industry

and Market Overview

China

Agriculture Industry

Limited

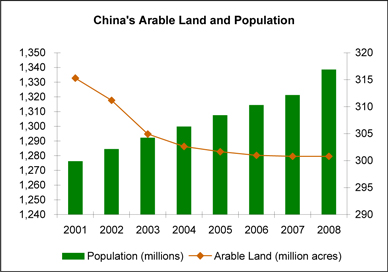

and Shrinking Arable Land

China

devotes less of its land to agricultural cultivation than most nations as

reported in the October 3, 2008 article in China Daily. Currently, crop

production in China is limited to approximately 301 million acres of arable farm

land, which is approximately 14% of China's land according to a survey conducted

by China's National Bureau of Statistics in 2008, or 0.2 acres

of arable farm land per person, which is approximately one-third of the

global per capita average and half of the United States’ per

capita amount of land devoted to agricultural production.

Moreover,

increasing urbanization and desertification in China is encroaching upon

farmland, thereby decreasing the amount of land available for crop production.

According to the Chinese Academy of Sciences, since 1996, China has lost

approximately 6.4% of its arable land to urbanization and China approves

approximately 658,667 acres of land for construction each year, which impacts

approximately 464,454 acres of farmland, as its urban population continues to

increase. In 2006, China's urban population accounted for approximately 43.9% of

its total population and projections suggest that percentage will reach 70% by

2050. In addition, desertification, the transformation of arable or habitable

land to desert due to climate changes, claimed 296,460 acres of China's

land in 2007 according to the Ministry of Land and Resources.

Pollution,

especially by heavy metals, erosion and the overuse of fertilizers also

threatens to render currently arable land unusable or less productive for

agriculture.

4

Source:

National Statistics Bureau of China; Ministry of Land and Resources;

Reuters

Increasing

Wealth is Expected to Increase Spending on Agricultural Products

As the

economy grows and individual purchasing power expands in China, demand for more

food products with higher quality is expected to increase. According to the

Asian Development Bank, over 50% of China’s population is comprised of low

income, rural farmers. An April 2009 study by the Chinese Academy of Sciences

indicates that China’s government has made the raising of rural income levels,

especially in Western China, a top economic and social goal and expects annual

rural income to grow between 5% and 10% through 2010. Data from the Economic

Research Service of the United States Department of Agriculture shows that

increased income among a large portion of a population leads to higher

consumption of meat, fruit, vegetables, poultry and dairy products.

Government

Support for the Agricultural Industry

According

to an article published in the Guangming Daily Newspaper, in 2009, China’s

government budgeted RMB 595.5 billion for spending on agriculture, rural areas

and farmers, an increase of 37.9% from the previous year. The newspaper article

also reported that the budget included RMB 102.9 billion, twice the amount from

the previous year, in direct subsidies for grain production and purchases of

agricultural materials. China’s government is planning additional farm subsidies

and land reform initiatives, and to eliminate certain agricultural taxes and

promote the production of organically grown products by setting new standards.

We believe that these government policies will encourage growth in China’s

agricultural industry and that we will benefit from such growth.

China

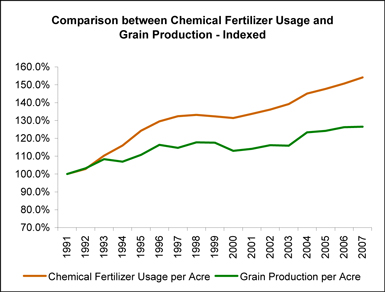

Fertilizer Industry

Fertilizers

are traditionally classified as either organic fertilizers or chemical

fertilizers. Organic fertilizers are naturally occurring mineral deposits or

naturally occurring compounds manufactured through industrial processes.

Chemical fertilizers are also manufactured using naturally occurring deposits,

but the compounds are chemically altered. While the use of chemical fertilizers

is known to improve crop yields, chemical fertilizers may have long-term adverse

impact on the organisms living in soil and a detrimental long-term effect on

productivity of the soil. When properly applied, organic fertilizers can improve

both the health and productivity of soil and plants, as they provide essential

nutrients that encourage plant growth, and thereby increase agricultural

yields.

According

to China’s National Bureau of Statistics, between 1991 and 2007, the average

grain yield per acre grew 26.5% in China, as the country’s chemical fertilizer

use increased 54.1% during the same period. However, this increase in yields

resulting from increased use of chemical fertilizers appears to have damaged

soil and contributed to water pollution in China. According to the China

Agriculture Statistical Year Book, 70% of the nutrients existing in China’s soil

in 1980 were lost by 2005 due to overuse of chemical fertilizers. We believe

that there is a growing recognition among Chinese farmers and Chinese government

officials that the use of chemical fertilizer should be replaced with

alternative means of increasing productivity and, therefore, expect that demand

for organic plant fertilizers and nutrients will grow.

5

Source:

National Statistics Bureau of China

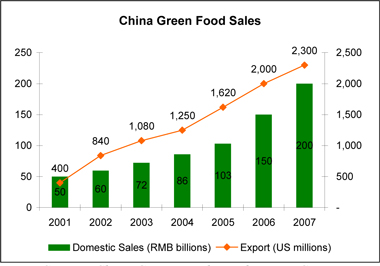

The rise

of a green food industry in China is also increasing demand for organic

fertilizers. According to the China Green Food Development Center, a

governmental agency, China’s domestic sales of green food increased at a

compound annual growth rate of 26.0% from RMB 50 billion in 2001 to RMB 200

billion in 2007, and during the same period, China’s exports of green food

increased at a compound annual growth rate of 33.8%, from US$400 million to

US$2.3 billion. We believe China’s domestic market for green food will continue

to expand as individual purchasing power grows in China.

Source:

China Green Food Development Center

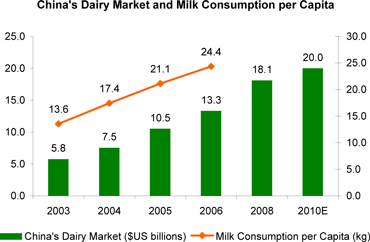

China’s

Dairy Market

The

growth of China’s economy has lead to growth in consumer demand for dairy

products and China’s government has attached great importance to the development

of this industry, particularly after a food safety incident in China involving

milk adulterated with melamine was widely reported in the international media

during 2008.

According

to The McKinsey Quarterly, the Chinese dairy market generated total revenues of

approximately $18 billion in 2008, representing a compound annual growth rate of

7.8% for the period spanning 2004-2008, and is expected to grow to nearly $20

billion by the decade’s end. However, according to a research report published

by Beijing Orient Agribusiness Consultant Ltd., China’s average milk production

per cow is only about 4,100kg in 2006, which is 60% of the average per cow yield

in developed countries. One major reason for this low production is mastitis, an

inflammation of the teats that slows down milk production. The Chinese Journal

of Veterinary Medicine has reported that, in China, 50-80% of the cows have some

form of mastitis which develops during milk production.

6

Source:

McKinsey Quarterly; National Bureau of Statistics of China

Competitive

Advantages

We

believe that we our competitive advantages include the following.

Unique and scalable distribution

model. We sell our products in China through an effective distribution

model comprised of provincial distributors who purchase our products and sell

them through a chain of local distributors whose terminal sales point is either

a retail store or a large farm. We provide advertising support, training as well

as indoor and outdoor promotional display materials for our products to our

branded stores, and, in return, these stores agree to prominently display our

products along with these materials, and to have the store front painted with

Yongye colors. Our provincial level distributors are our direct customers. We do

not receive any payments from the retail stores selling our products, including

the branded stores, and the stores may sell our competitors'

products.

As of

December 31, 2009, we sold our products through 8 provincial distributors and

9,110 branded stores in nine provinces, two autonomous regions and several test

markets in northern, central and southern China. .

We

believe our unique distribution model has the following benefits:

|

|

·

|

We

leverage our distributors local knowledge and resources to enable quicker

entry into new markets, more efficient qualification of branded stores and

better communication with farmers.

|

|

|

·

|

We

have a highly scalable and replicable distribution model that can be

replicated in new markets. We are thus uniquely situated amongst our

competitors to take advantage of China’s growing market for fulvic acid

based products. The significant expansion of our distribution network

since 2008 has paralleled our robust growth in sales during the same

period.

|

|

|

·

|

Our

“branded store” concept creates a highly synergistic partnership among

Yongye, our distributors and our branded stores. We believe retail store

owners embrace the branded store concept because they typically experience

higher customer traffic and generate more sales as their stores become

more prominent from the promotional displays and technical support we

provide them, and from our product advertising. We believe our advertising

campaign also effectively develops sales for distributors by attracting

store owners to our branded store network. With satisfied distributors and

branded stores, we are able to quickly scale up our distribution network

and provide better service to our

customers.

|

Name brand recognition supported by

integrated marketing campaign. Both of our current products are marketed

under the name Shengmingsu and we believe our integrated marketing campaign has

led to widespread recognition of our brand name by farmers in the areas serviced

by our distribution network.

Our

strategy is to build the Yongye brand by getting closer to farmers through both

media channels as well as indoor and outdoor displays. We work with our

distributors to coordinate advertisements on local television channels and in

local newspapers, and, in 2009, we began running an advertisement campaign on

CCTV-7, which is the national agriculture channel in China. We decorate the

exterior of our branded stores with Yongye color and banners, and our branded

stores prominently display our products alongside promotional display materials

that we provide. We create posters with village-specific case studies that

demonstrate a farmer’s incremental revenue, original investment and harvesting

time saved from using our products. We believe these case studies have been a

highly effective manner of marketing as they translate our product efficacy

directly into dollar terms and are communicated through stories which are highly

relevant to farmers.

7

In

addition, we support our distributors and farmers by providing product training

courses, conferences and seminars, product demonstrations, and educational

pamphlets, magazines and infomercials. Moreover, our products are associated

with increased yields and quality due to testing and analyses by the IMARSTB

that we have strived to publicize.

Proprietary extraction process for

high-quality fulvic acid backed by strong research and development platform.

We have developed a proprietary extraction process for deriving fulvic

acid from humic acid, which produces a high-quality fulvic acid compound. As

mentioned earlier, the IMARSTB has concluded that our extraction process is more

efficient and produces purer fulvic acid as compared to traditional extraction

methods. Based on both internal and industry studies, we believe our

proprietary fulvic acid extraction process is unique in the industry in that it

allows us to create products that are more effective than other fulvic acid

mixtures on the market.

In

addition to our internal research and development team with extensive experience

in the agricultural research fields, we have established project partnerships

with certain prestigious national and local agricultural universities and

research institutes including Inner Mongolia Agricultural University, Chinese

Academy of Agricultural Sciences, Beijing University of Agriculture and Inner

Mongolia Academy of Agricultural Sciences.

Compelling value proposition of

return on investment for farmers. Our patented plant product and

patent-pending animal product mixture processes are the result of large scale

experimentation to produce specific formulae. Our internal experimentation with

our products demonstrates increased production yields, shorter harvest times,

extended life cycles, and enhanced crop taste, nutrition and appearance. As

mentioned earlier, the IMARSTB concluded that it believes our product can

increase overall yields of staple crops, such as wheat and rice, and vegetables

by 10 – 20% and 15 – 30%, respectively, while improving

product quality.

Strength and experience of

management team. We believe that our management team collectively has a

great deal of experience in our relatively new market for fulvic acid based

products in China. Our chief executive officer, Wu Zishen, in particular, has

eight years of such experience in our new market alone. Additionally, our

senior management team have many years of experience and strong education

background in the Chinese agricultural industry, marketing and distribution,

finance and general management.

Growth

Strategies

Our

strategic growth plan for 2010 consists of the following key

elements.

Pursue vertical integration strategy

to improve control of raw material supply while continuing to increase our

fulvic acid production capacity. We plan to pursue vertical integration

by seeking to acquire lignite coal resources and constructing a new

manufacturing facility nearby that would be capable of extracting humic acid

from coal and producing 20,000 tons per year of our liquid plant product and

10,000 tons per year of our powder animal product. If we are able to

successfully execute this strategy, we expect that our gross margins will

increase as the cost of obtaining humic acid is currently the largest component

of our cost of sales.

In

addition, we plan to acquire certain portions of our distribution channels from

specific distributors that have strong, established branded store networks. We

believe executing this initiative will enable us to establish more direct

control over sales to branded stores and large farms, improve our profit

margins, and decrease the risk of customer concentration and increase

visibility.

We expect

to benefit from the continued growth in consumption of agriculture products in

China and we believe we are well positioned in the market to capture

opportunities that arise.

Geographic expansion of our

distribution and branded store network. We believe that there is

significant market potential for our products across China and we plan to

continue to enhance our coverage and penetration of the Chinese markets for

plant and animal nutrients in order to increase our market share and commercial

opportunities. We believe this will further expand our immediate and long term

revenue base. We believe that we can benefit from the growing market demand

resulting from the increased need to boost agricultural productivity and

decrease the overuse of chemical fertilizers and the rising preference for

“green” food in China. In addition to driving further penetration in our

historical markets, we plan to increase our distribution network, particularly

in central and southern China. We will also work to ensure continued successful

replication of our branded store model in new markets by leveraging our

provincial distributors capabilities to select high-quality branded stores, by

continuing to provide our distributors with value-added technical product and

sales leadership training, and through our integrated marketing

campaigns.

Enhance brand recognition on

national and local levels. We will continue to advertise in national and

local media to develop our brand image and increase our exposure in target

markets and to provide training and technical support to our distributors,

branded stores and farmers. We will also plan to add new product demonstration

sites over the coming years in various locations throughout China to complement

our existing site in Hohhot, Inner Mongolia.

8

Share

Exchange

We were

incorporated in the State of Nevada on December 12, 2006 under the corporate

name “Golden Tan, Inc.” At that time, we were engaged in the business of

offering sunless tanning services and selling tanning lotions. In 2008, we began

to pursue an acquisition strategy, whereby we sought to acquire an undervalued

business with a history of operating revenues in markets that provide room for

growth.

On April

17, 2008, we entered into a share exchange agreement with Fullmax Pacific

Limited, a company organized under the laws of the British Virgin Islands

(“Fullmax”), the shareholders of Fullmax, who together owned 100% of the equity

of Fullmax, and our principal shareholder. Pursuant to the share exchange

agreement, the Fullmax shareholders transferred to us 100% of Fullmax’s equity

in exchange for 11,444,755 shares of our common stock (the “Share Exchange”). As

a result of the Share Exchange, Fullmax became our wholly owned

subsidiary.

Restructuring

At the

time we acquired Fullmax, it had acquired some of the principle assets

that form the basis of our trading business from Inner Mongolia Yongye

Biotechnology Co., Ltd., a company organized under the laws of the PRC (“Inner

Mongolia Yongye”), and owned and controlled by Wu Zishen, our chairman, chief

executive officer and president. The first step in this process occurred in

November 2007, when Fullmax’s wholly-owned subsidiary, Asia Standard Oil

Limited, a Hong Kong company (“Asia Standard”) entered into a Sino-foreign

cooperative joint venture agreement with Inner Mongolia Yongye (the “CJV

Agreement”). The CJV which was formed was Yongye Nongfeng Biotechnology Co., Ltd

(“Yongye Nongfeng”).

In

connection with a September 2008 private placement of our common stock, we

agreed with the investors participating in the transaction to complete the

remaining steps necessary for acquiring the assets that form the basis of our

operations from Inner Mongolia Yongye. We completed these remaining steps, which

we refer to as the “Restructuring” in this prospectus, on October, 2009. Prior

to the Restructuring, Inner Mongolia Yongye owned and operated the principle

assets of our business and had been in the business of researching, producing

and selling its own fulvic acid based plant and animal products since 2003.

Until Yongye Nongfeng obtained the required license to produce our products in

May 2009, Inner Mongolia Yongye manufactured such products exclusively for

us.

As part

of the Restructuring and pursuant to the CJV Agreement, Inner Mongolia Yongye

transferred to Yongye Nongfeng its management and other personnel, and the land,

buildings and equipment comprising its manufacturing facility. In addition,

Inner Mongolia Yongye assisted with obtaining the necessary governmental

approvals required for these transfers, as well as with the issuance in May 2009

by the PRC Ministry of Agriculture of a fertilizer license, the patented

technology under which was formerly held in the name of Inner Mongolia Yongye,

to Yongye Nongfeng.

All of

our operations are conducted through Yongye Nongfeng. Pursuant to the terms of

the CJV Agreement, we are entitled to 95% of the profits of Yongye Nongfeng and

Inner Mongolia Yongye is entitled to 5%. Wu Zishen, our chairman,

president and chief executive officer, owns 91.7% of the outstanding equity

interests of Inner Mongolia Yongye and, therefore, is entitled to a portion of

the profits of Yongye Nongfeng that are payable to Inner Mongolia Yongye. In

addition, Mr. Wu and Inner Mongolia Yongye are parties to an employment

agreement, pursuant to which Mr. Wu is employed as chairman and chief executive

officer of Inner Mongolia Yongye.

9

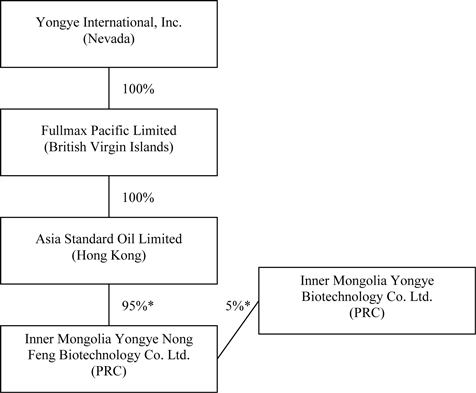

The

following chart reflects our current organizational structure as of the date

hereof. The ownership percentages of Yongye Nongfeng are

approximations.

|

*

|

Pursuant

to the terms of the CJV Agreement, as amended, we are entitled to 95% of

the profits and liquidation distributions of Yongye Nongfeng and Inner

Mongolia Yongye is entitled to 5%. In preparing the consolidated financial

statements, Inner Mongolia Yongye was treated as a 5% noncontrolling

interest as of December 31,

2009.

|

Our

Principal Products and Services

The base

of our product is our own proprietary fulvic acid base compound, which is

extracted from humic acid. Fulvic acid is a complex, acidic, biochemical polymer

which is either created naturally through the decomposition of plant material,

or can be produced through a manufacturing process. Fulvic acid binds itself to

and strengthens the cell walls of plants and cell membranes of animals, thereby

increasing the ability of cells to retain vitamins and minerals and to fight

sickness and disease. Fulvic acid also acts as a transport agent, dissolving

into itself and delivering nutrients that stimulate cell growth, increasing

oxygen intake into cells, and binding with and removing toxins such as heavy

metals and other pollutants. These attributes maximize enzyme development, which

results in better nutrient uptake in plants and digestion in

animals.

Liquid

Plant Product

Our

universal liquid plant product consists of our fulvic acid compound base and

nutrients that plants need to grow, and can be applied to various types of crops

by spraying the liquid product directly on the plants, typically in conjunction

with fertilizers and pesticides. We primarily sell our plant product by the 100

milliliter bottle and in cases of 100 bottles per case.

We

believe that when used correctly, our product can help farmers more efficiently

use fertilizers and pesticides, which may reduce the farmers’ overall input

costs and environmental damage to the farmers’ land. While each crop varies in

response to our plant product, we believe based on internal studies that farmers

may be expected to experience yield increases on par with the following results

when our plant product is properly used along with sufficient amounts of

fertilizer and water:

10

|

Crop

|

Yield

|

|

|

Capsicum

(green pepper)

|

increases

yield by up to 22.7%

|

|

|

Carrot:

|

increases

yield by up to 26.5%

|

|

|

Celery:

|

increases

yield by up to 26.3%

|

|

|

Cucumbers:

|

increases

yield to 21.7%, and the leaves are greener, the plants are higher by

3.0cm, and earlier to market by 11 days

|

|

|

Grapes:

|

increases

weight of individual grape 0.4g, 18.2%, increases sugar content

37.5%

|

|

|

Potatoes:

|

increases

yield up to 17.3%, and the leaves are thicker and they bloom 7 to 10 days

earlier

|

|

|

Watermelon:

|

increases

yield by up to 16.9%, increases sugar content 0.8%-1.8%

|

|

|

Wheat:

|

increases

yield up to 10.7%

|

Source:

Company research

Powder

Animal Product

Our

animal nutrient product is a powder which consists of our fulvic acid compound

base, with additional nutrients and Chinese herbs that reduce inflammation, and

is currently targeted at and administered to dairy cows through mixture with cow

feed. We sell our animal product in bags that contain 20, 300 gram packets. In a

typical regime, one cow will digest 150 grams daily over a 100 day

period.

Our

animal product’s ability to reduce inflammation makes it attractive to Chinese

farmers because of the prevalence of mastitis, an inflammation of the teats that

slows down milk production, which is common in the global dairy industry. The

Chinese Journal of Veterinary Medicine has reported that, in China, 50-80% of

the cows have some form of mastitis, which is typically treated with antibiotics

according to the “Handbook of Organic Food Safety and Quality” (International

Standard Book Number 0849391547). Although antibiotics can clear up bacterial

infections when used correctly, overuse of antibiotics can lead to

drug-resistant strains of bacteria and antibiotics kill healthy gut bacteria,

which is vital to a healthy immune system. By using our animal product, Chinese

farmers can avoid costs and problems associated with the use of antibiotics to

treat mastitis.

Our

internal studies show that administration of our animal product to cows

increases milk production and milk quality in cows, improves immunity, reduces

mastitis and the need for antibiotics, and improves digestion and growth

rate.

New

Products

We are

evaluating the prospects for introducing animal products designed for pigs,

chickens and sheep.

We have

not introduced any new plant products in 2009 as we believe the market demand

for our universal plant product has remained strong. However, we are examining

market opportunities for introducing plant products targeted at corn, peppers,

wheat, rice, cucumbers, tomatoes, cotton, potatoes, sunflowers, grapes, tropical

fruits and flowers.

In 2010,

we will continue to evaluate opportunities to develop market driven additions to

our product lines.

Production

Raw

Materials

The

principal raw material used in the manufacture of fulvic acid is humic acid.

Humic acid is a naturally occurring organic soil matter that exists in coal,

peat, oceans and fresh waters. The best sources of humic acid are lignite coal

and leonardite coal. China is rich in humic acid resources and its lignite coal

reserves are large, widely distributed and high in quality. According to the

United States Energy Information Administration, China has approximately 52.3

billion tons of recoverable lignite coal reserves, ranking third in the

world.

The humic

acid we use comes from lignite coal or leonardite coal which is mined in Inner

Mongolia and can be purchased at normal market rates and is typically sold on a

per ton basis. We purchase humic acid from suppliers. As the industry is

experiencing rapid growth, we believe it is important to control the input of

humic acid. Currently, we have two principal suppliers which are both in Hohhot:

Wuchuan Shuntong Company and Wuchuan Sanda Company. Wuchuan Shuntong is our

largest supplier, providing us with more than 90% of our humic acid raw

material. Wuchuan Shuntong has dedicated one production line to us and has based

its production design on our specific technical requirements. The other supplier

contributes to our additional humic acid needs.

We use

various other ingredients during the production process, including nutrients and

Chinese herbs. These additional ingredients can be readily obtained in local

markets and do not carry special technical requirements.

11

Manufacturing

Process

The

manufacture of our products begins with our proprietary process for extracting

fulvic acid from humic acid and creating the fulvic acid compound base used in

both our liquid plant product and our powder animal product. We have determined

that this first step in our manufacturing process will remain a trade secret due

to its importance in the creation of our final product. If we were to patent

this process, we would necessarily have to publicly disclose certain information

as part of the patent application, and thus risk losing the competitive

advantage we believe we currently have.

After we

have created our fulvic acid compound base, we mix it with special nutrients and

other components specific to our plant and animal products, and, in the case of

our animal product, convert the resulting mixture into a powder. These processes

and mixtures are covered by current and pending patents.

Manufacturing Outsourcing

Contract (10,000 Tonnes Per Annum Capacity for Plant

Product)

From

January 2008 until June 1, 2009, Yongye Nongfeng Biotechnology had an

outsourcing contract with Inner Mongolia Yongye for the production of our

finished nutrient product. From January 2008 until September 2008, the

manufacturer was running at 2,000TPA capacity, but after constructing a new

8,000TPA facility, capacity was increased to 10,000TPA.

Raw

Materials and Our Principal Suppliers

The humic

acid we use is extracted from lignite coal by local humic acid

producers. They purchase lignite coal from nearby mines located in Inner

Mongolia and extract humic acid and sell it to us. Leonardite coal is defined as

highly oxidized low grade lignite that contains a relatively high concentration

of the smaller molecular units (fulvic acids (FA). According to the United

States Energy Information Administration, China has approximately 52.3 billion

tons of recoverable lignite coal reserves, ranking third in the world. Both

lignite coal and humic acid can be purchased locally at normal market rates on a

per ton basis.

We

believe we are able to produce a high quality fulvic acid base product

by controlling the input of humic acid from direct, contracted suppliers.

Currently, we have two principal suppliers which are both in Hohhot: Wuchuan

Shuntong Company and Wuchuan Sanda Company. Wuchuan Shuntong is our largest

supplier, providing us with more than 90% of our humic acid raw material.

Wuchuan Shuntong has dedicated one production line to us and has based its

production design on our specific technical requirements. The other supplier

contributes to our additional humic acid needs.

In

addition to humic acid, we also utilize various different components in our

production process, all of which can be readily obtained from numerous sources

in local markets and require no special purchase requirements.

Packaging

and Shipment

Our

liquid plant product is primarily packaged in 100 milliliter bottles and in

cases of 100 bottles per case. Our powder animal product is packaged in bags

that contain 20, 300 gram packets. Each type of packaging material, along with

packaging labels, are purchased from three to four separate manufacturers as

these materials are readily available in the market.

After

packaging our products at our manufacturing facility, we engage a third party to

ship them to our distributors and we bear the risk of loss until our products

are received by our distributors.

Quality

Control

We have

implemented and maintain strict quality control procedures. In July 2007, Inner

Mongolia Yongye received ISO 9001:2000 accreditation after a third party audit

of its quality control procedures at its manufacturing facility. In the

Restructuring, Inner Mongolia Yongye transferred its manufacturing facility and

personnel to Yongye Nongfeng and Yongye Nongfeng also received ISO 9001:2000

accreditation following a similar third party audit.

Production

Facility

We

operate one manufacturing facility in Hohhot, Inner Mongolia, China, which can

produce 10,000 tons per year of our liquid plant product and 1,000 tons per year

of our powder animal product when operated normally.

Our

growth strategy includes pursuing vertical integration by seeking to acquire

lignite coal resources and constructing a new manufacturing facility nearby that

would be capable of extracting humic acid from coal and producing 20,000 tons

per year of our liquid plant product and 10,000 tons per year of our powder

animal product.

12

Marketing

and Sales Support

Our sales

staff is trained to work with the distributor network, retail stores and farmers

to ensure that our customers have the right product knowledge and good

after-sales support. They share their knowledge by walking through farming

communities, organizing training courses, inviting local agricultural experts

and university professors to speak on proper agricultural techniques as well as

the use of our product.

Demonstration

Sites

We also

utilize a product demonstration site for marketing purposes. This site is

located adjacent to our manufacturing facility in Hohhot, Inner Mongolia and

features six greenhouses and an open field. To improve brand awareness as well

as the accessibility of our product demonstrations for distributors, branded

store owners and farmers who may reside far from Inner Mongolia, part of our

growth strategy over the coming years is to construct additional demonstration

sites in various locations throughout China.

Media

Marketing Programs

We work

with our distributors to coordinate advertisements on local television channels

and in local newspapers, and, in 2009, we began running an advertisement

campaign on CCTV-7, which is the national agriculture channel in China. In

addition, we use conferences and seminars, newspaper ads and pamphlets to

increase customer brand recognition.

Distribution

& Sales Network

We sell

our products in China through a distribution network comprised of

provincial distributors who purchase our products and sell them through a chain

of local distributors whose terminal sales point is either a retail store or

large farm. Our distributors are our sole source of revenue, as we do not

sell our products directly to retail stores or to farmers. Nearly all of our

sales in 2008 were to distributors operating in Inner Mongolia and Xinjiang

autonomous regions, and Gansu and Hebei provinces, which are located in northern

China. Beginning in 2009, we expanded our sales in provinces located in central

and southern China, and plan to continue to expand the geographic reach of our

distribution network.

As of

December 31, 2009, there were 9,110 independently

owned retail stores selling our products. We work with our distributors to

identify these stores. Thereafter, we provide advertising support, training

and indoor and outdoor promotional display materials for our products, and,

in return, the store agrees to prominently display our products along with these

materials, and to have the store front painted with Yongye colors. Our

provincial level distributors are our direct customers

This

network of retail stores creates a “community-direct” model through which our

distributors sell our product. We believe these stores have a local feel and

have standing community recognition as the “trusted” local agricultural product

expert. The goal is to encourage farmers to make Yongye products a greater part

of their annual planning process while building brand awareness.

The table

below presents the number of retail stores that were branded stores and stores

in trials to become branded stores at the end of the periods

indicated.

|

FY2009

|

FY2008

|

|||||||

|

Branded

Stores

|

9,110 | 775 | ||||||

|

Branded

Stores in Trials

|

0 | 350 | ||||||

|

Total

|

9,110 | 1,125 | ||||||

Customers

Since our

inception, we have worked to build and maintain our sales and distribution

networks. We have established good relationships with leading agricultural

products distributors in Hebei and Gansu provinces, and Inner Mongolia and

Xinjiang autonomous regions, and an increasing number of distributors outside

these areas.

We sign

three year contracts with distributors that we identify and choose based upon

their overall business strength, credit worthiness and proven ability to develop

their local markets.

Competition

The

Chinese fertilizer industry is highly fragmented. As of November 2009, there

were over 4,000 fertilizer products in the PRC Ministry of Agriculture’s

registry. We compete more directly with producers of humic acid based products,

of which there were 522 in the registry as of November 2009.

Moreover,

the market for fulvic acid based products has not matured into a saturated

market. We believe we have a broader distribution network than our competitors

and, therefore, that we are uniquely situated amongst our competitors to take

advantage of China’s growing market for fulvic acid based

products.

13

Research

and Development

We

currently have certain research personnel on staff, including Baosheng Tong, our

chief scientist, who has 20 years of experience in China’s agriculture industry

and holds a masters degree in animal nutrition and a bachelors degree in animal

husbandry from China Agriculture University.

Our

research and development process begins with an internal evaluation of market

demand for new types of products. After we initially identify market

opportunities for new products, we, either alone or in conjunction with our

research partners, conduct research activities and develop new products. Once

our research and development activities are complete, we make a final judgment

regarding whether and when to bring the new product to market based upon a

second evaluation of market demand, an estimate of the time and expense that

will be required to obtain any necessary governmental approvals, the

desirability for obtaining patents or feasibility of protecting our intellectual

property by other means, and the results of test marketing. The entire process

may take anywhere from one to three years, depending on the

product.

We are

currently researching various customized products for plants and animals, and

are test marketing a new product for cows. We have not introduced any products

into the market other than our current universal liquid plant product and our

powder animal product targeted at cows, and no assurance can be given that we

will ultimately bring to market the products we are currently researching or the

product we are currently test marketing.

Intellectual

Property

Our

intellectual property consists of our proprietary method for extracting fulvic

acid from humic acid, our invention patent related to our plant product and our

pending patent related to our animal product. Our extraction process for fulvic

acid remains a trade secret and is protected by a non-compete contract with

Professor Gao Jing, who developed the extraction process and is the former chief

scientist of Innner Mongolia Yongye. We have chosen not to seek a patent

covering our method for extracting fulvic acid in order to avoid the public

disclosure that would be required in connection with applying for a

patent.

On

December 6, 2008, the IMARSTB, thoroughly reviewed scientific and economic data

provided by the Company and reached the opinion that our liquid plant product

effectively increases agricultural output, improves the utilization rate of

fertilizer, enhances a plant’s resistance to disease and has a lighter weight

and higher bio-activity than the other products it tested. In addition, the

IMARSTB concluded that large scale experimentation has proven that our product

can increase overall yields of staple crops, such as wheat and rice, and

vegetables by 10-20% and 15-30%, respectively, while improving product

quality. In a separate study, the IMARSTB has concluded that our

extraction process is more efficient and produces purer fulvic acid as compared

to traditional extraction methods.

The

patents related to our plant product and the pending patent application related

to our animal product cover both the mixture process of, and the base formulas

for, such products. Our current patent is valid for 20 years from October 2006

and, once issued, our pending patent will also be valid for a 20 year term. We

will work to ensure that this mixture process is consistently carried out while

also protecting our intellectual property.

We have

obtained a registered trademark for “Yongye” from the Trademark Bureau of the

State Administration of Industry and Commerce of the PRC, which is valid until

October 2017.

In

addition to trademark and patent protection law in China, we rely on contractual

confidentiality and non-compete provisions to protect our intellectual property

rights and brand. We also take further steps to limit the number of people

involved in the production process and refer to each ingredient by number rather

than name when collecting and preparing them for mixture.

Employees

The past

few years have seen significant growth in the Company and our employee base has

also grown. The table below presents the number of our employees as of the end

of the periods indicated.

|

Category

|

FY2009

|

FY2008

|

||||||

|

Admin

|

63 | 88 | ||||||

|

Manufacturing

|

207 | 0 | ||||||

|

Research

& Development

|

29 | 0 | ||||||

|

Sales

& Support

|

100 | 65 | ||||||

|

Total

|

399 | 153 | ||||||

14

Governmental

Regulation

Our

products and services are subject to regulation by central and provincial

governmental agencies in the PRC, which require us to obtain licenses and

certifications. We are required to renew, pass an examination with respect to,

or make a filing in connection with these licenses and certifications on a

regular basis.

Business

License

Yongye

Nongfeng’s business license enables it to research, develop, process,

manufacture, market and sell fulvic acid based products and plant and animal

nutrients. The business license is valid until January 4, 2018, although it is

subject to annual examination, which was passed in 2008.

Fertilizer

Registration

All

fertilizers produced in the PRC must be registered with the PRC Ministry of

Agriculture or its local branches at a provincial level. No fertilizer can be

manufactured without such registration. As part of the Restructuring process,

Yongye Nongfeng applied for its initial fertilizer registration certificate in

May 2009 and it was received on June 1, 2009. The certificate is valid

until February 2010 and may be renewed twice for additional one-year terms.

Thereafter, if all conditions remain satisfied, a long-term certificate

will be issued with a five-year term that is renewable for additional five-year

terms so long as all requirements continue to be met. On November 4, 2009 the

long-term certificate with a five-year term has been issued to Yongye

Nongfeng.

Feed

Certificate

Producers

of animal feed in the PRC are required to obtain a Quality Certificate for the

Examination of Feed Production Enterprises. Yongye Nongfeng was granted this

certificate in September 2009 by the Inner Mongolia agricultural authority,

which is the local branch of the Ministry of Agriculture in Inner Mongolia, but

must make an annual filing before the end of March each year to maintain its

effectiveness.

Environmental,

Health and Safety Laws

We are in

compliance in all material respects with the various laws, regulations, rules,

specifications and permits, approvals and registrations relating to human health

and safety and the environment except where noncompliance would not have a

material adverse effect on our business, financial condition and results of

operations.

Legal

Proceedings

We are

not a party to any material legal proceedings nor are we aware of any

circumstance that may reasonably lead a third party to initiate legal

proceedings against us.

Property

Our

principal executive offices are located at 6th floor, Xue Yuan International

Tower, No. 1 Zhichun Road, Haidian District, Beijing PRC and the telephone

number is 86-10-8232-8866. The office space is approximately 1,000 square meters

in area. Our manufacturing facility and the adjacent greenhouses and open

field, which serve as a research and product demonstration site, is in the High

Tech Economic Development Zone in Hohhot, Inner Mongolia.

There is

no private ownership of land in China. All land ownership is held by the

government of the PRC, its agencies and collectives. Land use rights can be

transferred upon approval by the land administrative authorities of the PRC (the

State Land Administration Bureau) upon payment of the required land transfer

fee. Yongye Nongfeng owns the land use rights for the land on which our

manufacturing facility, greenhouses and open field are situated, which have a

term of 50 years that expires in 2057. We lease our principal executive offices

under a lease that provides for a three year term.

Executive

Office

Our

principal executive offices are located on the 6th Floor, Suite 608, at Xue Yuan

International Tower, No. 1 Zhichun Road, Haidian District, Beijing, PRC. Our

telephone number at that address is 86-10-8232-8866. Our corporate website is

www.yongyeintl.com.

15

ITEM

1A Risk Factors

An

investment in our Common Stock is speculative and involves a high degree of risk

and uncertainty. You should carefully consider the risks described below,

together with the other information contained in this report, including the

consolidated financial statements and notes thereto, before deciding to invest

in our Common Stock. The risks described below are not the only ones facing our

Company. Additional risks not presently known to us or that we presently

consider immaterial may also adversely affect our Company. If any of the

following risks occur, our business, financial condition and results of

operations and the value of our Common Stock could be materially and adversely

affected.

Risks

Related to Our Business

Yongye

Nongfeng, our CJV, recently completed transitioning its business operations from

Inner Mongolia Yongye Biotechnology.

We

established our PRC cooperative joint venture, Yongye Nongfeng, on January 4,

2008, with the intention and ultimate goal of carrying out the business of

marketing and distributing our fulvic acid plant and animal nutrient products.

As of October, 2009, we have transitioned all the operations including the

manufacturing of our nutrient products from Inner Mongolia Yongye Biotechnology

(which is under the control of Mr. Zishen Wu), to the CJV (Mr. Wu is also the

CEO of the CJV), including all assets related to the manufacturing, distribution

and sales as well as all applicable licenses and titles (the “Restructuring”).

On October 10, 2009 the CJV Agreement and CJV's articles were revised to reflect

that both the profit distribution percentage and the post-dissolution remaining

asset distribution percentage of Inner Mongolia Yongye in the CJV increased to

5% from the previous 0.5%.

The

limited operating history and the early stage of development of our CJV may make

it difficult to evaluate our business and future prospects. Although Inner

Mongolia Yongye Biotechnology’s revenues have risen quickly and

although Inner Mongolia Yongye Biotechnology has transferred its agreements to

our CJV, we cannot assure you that the CJV will continue to maintain such

profitability or that it will not incur net losses in the future. We expect that

our operating expenses will increase as we pursue our growth strategies. Any

significant failure to realize anticipated revenue growth could result in

operating losses.

Failure

to manage our recent dramatic growth could strain our management, operational

and other resources, which could materially and adversely affect our business

and prospects.

We have

been expanding our operations dramatically and believe they will continue to do

so. To meet the demand of our customers, we expect to expand our distribution

network in terms of numbers and locations. The rapid growth of our business has

resulted in, and if we continue to grow at this rate, will continue to result

in, substantial demands on our management, operational and other resources. In

particular, the management of our growth will require, among other

things:

|

|

·

|

increased

sales and sales support activities;

|

|

|

·

|

improved

administrative and operational

systems;

|

|

|

·

|

stringent

cost controls and sufficient working

capital;

|

|

|

·

|

continued

responsibility for disclosure of material facts relating to our

business;

|

|

|

·

|

strengthening

of financial and management controls;

and

|

|

|

·

|

hiring

and training of new personnel.

|

As we

continue this effort, we may incur substantial costs and expend substantial

resources. We may not be able to manage our current or future operations

effectively and efficiently or compete effectively in new markets we enter. If

we are not able to manage our growth successfully, our business and prospects

may be materially and adversely affected.

We

do not own 100% of the equity interests in the CJV, which may not be as

stable and effective in providing operational control as 100% ownership,

and potential exists for conflict of interests.

We

operate our business through our CJV. If there are disagreements between us

and our cooperative joint venture partner, Inner Mongolia Yongye Biotechnology,

regarding the business and operations of the CJV, we cannot assure you that we

will be able to resolve them in a manner that will be in our best interests. In

addition, our joint venture partner may (i) have economic or business interests

or goals that are inconsistent with ours; (ii) take actions contrary to our

instructions, requests, policies or objectives; (iii) be unable or unwilling to

fulfill their obligations; (iv) have financial difficulties; or (v) have

disputes with us as to the scope of their responsibilities and obligations. Any

of these and other factors may materially and adversely affect the performance

of our CJV, which may in turn materially and adversely affect our financial

condition and results of operations.

16

We rely

on the CJV Agreement with Inner Mongolia Yongye Biotechnology to operate our business.

If Inner Mongolia Yongye Biotechnology fails to perform its obligations under

the CJV Agreement, we may have to incur substantial costs and resources to

enforce such arrangements and rely on legal remedies under PRC laws, including

seeking specific performance or injunctive relief and damages, which we cannot

assure you would be effective. Accordingly, it may be difficult for us to change

our corporate structure or to bring claims against Inner Mongolia Yongye

Biotechnology if it does not perform its obligations under the CJV Agreement

with us.

The CJV

agreement is governed under PRC law. Accordingly, this agreement would be

interpreted in accordance with PRC laws and any disputes would be resolved in

accordance with PRC legal procedures. The legal environment in the PRC is not as

developed as in other jurisdictions, such as the United States. As a result,

uncertainties in the PRC legal system could limit our ability to enforce the CJV

Agreement. In the event we are unable to enforce the CJV Agreement, we may not

be able to exert effective control over our operating entities, and our ability

to conduct our business may be negatively affected.

Mr Zishen

Wu, our President and CEO, owns a controlling interest in Inner Mongolia Yongye.

The potential exists for conflicts of interests between his duties to us and his

ownership interests in Inner Mongolia Yongye. We can provide no assurance

that if potential conflicts of interests arise, these conflicts will not result

in a significant loss in corporate opportunities for us or a diversion of our

resources to Inner Mongolia Yongye, which may not be in the best interest of the

Company.

Our

business will be harmed if our major distributors reduce their orders or

discontinue doing business with us.

We sell

our products through a distribution network comprised of provincial or regional

distributors who purchase our products and sell them through a chain of local

agents whose terminal sales point is either a retail store or large farm. Our

distributors are our sole source of revenue, as we do not sell our products

directly to retail stores or to farmers. Although we believe that our

relationship with these distributors is good, if some or all of these

distributors reduce their orders or discontinue doing business with us, we could

have difficulties finding new distributors to distribute our products and our

revenues and net income could in turn decline considerably. Our reliance on

these major distributors could also affect our bargaining power in getting

favorable prices for our products. In addition, untimely payment and/or failure

to pay by these major distributors would negatively affect our cash

flow.

One or more of our distributors could

engage in activities that are harmful to our brand and to our

business.

Due to

our reliance on a distribution network comprised of provincial or regional sales

distributors to sell our products, we are susceptible to our distributors

engaging in activities that are harmful to our brand and to our business. If our

distributors do not implement our branding strategy properly, our brand name may

be damaged. In addition, if our distributors sell our products under another

brand, purchasers will not be aware of our brand name. Moreover, our ability to

provide appropriate customer service to these purchasers will be negatively

affected, and we may be unable to develop our local knowledge of the needs of

these purchasers and their environment. Furthermore, if any of our

distributors sell inferior products produced by other companies under our brand

name, our brand and reputation could be harmed, which could make marketing of

our products more difficult.

If

we cannot renew our fertilizer registration certificate, we will be unable to

sell some of our products which will cause our sales revenues to significantly

decrease.

All

fertilizers produced in the PRC must be registered with the PRC Ministry of

Agriculture or its local branches at a provincial level. No fertilizer can be

manufactured without such registration. As part of the Restructuring process,

the CJV applied for its initial fertilizer registration certificate in May 2009

and it was received on June 1, 2009. The certificate is valid until

February 2010 and may be renewed twice for additional one-year terms.

Thereafter, if all conditions remain satisfied, a long-term certificate

will be issued with a five-year term that is renewable for additional five-year

terms so long as all requirements continue to be met. On November 4, 2009 the

long-term certificate with a five-year term has been issued to Yongye

Nongfeng.

We

believe that the PRC Ministry of Agriculture will generally grant an application

for renewal in the absence of illegal activity by the applicant. However, there

is no guarantee that the PRC Ministry of Agriculture will renew our fertilizer

registration certificate. If we cannot obtain the necessary renewal, we will not

be able to manufacture and sell our fertilizer products in China, which will

cause the termination of our commercial operations.

Our proprietary technology for fulvic acid

extraction, patented plant product mixture process and patent pending animal

product mixture process may become obsolete which could materially and adversely

affect the competitiveness of our plant and animal nutrient

products.

The

production of our plant and animal nutrient products is based on our proprietary

fertilizer formula, patented plant product mixture process and patent pending

animal product mixture process. Our future success will depend upon our ability

to address the increasingly sophisticated needs of our customers by supporting

existing and emerging humic acid products and by developing and introducing

enhancements to our existing products and new products on a timely basis that

keep pace with evolving industry standards and changing customer requirements.

If our proprietary fertilizer formula, patented plant product mixture process

and patent pending animal product mixture process become obsolete as our

competitors develop better products than ours, our future business and financial

results could be adversely affected. In addition, although we entered into

confidentiality agreements with our key employees, we cannot assure you if there

would be any breach of such agreement in which case our rights over such

proprietary fertilizer formula would be adversely affected.

17

We may not possess all the licenses

required to operate our business, or may fail to maintain the licenses we

currently hold. This could subject us to fines and other penalties, which could

have a material adverse effect on our results of

operations.

In

addition to fertilizer registration certificate, we are required to hold a

variety of other permits, licenses and certificates to conduct our business in

China. We may not possess all the permits, licenses and certificates required

for our business. In addition, there may be circumstances under which the

approvals, permits, licenses or certificates granted by the governmental

agencies are subject to change without substantial advance notice, and it is

possible that we could fail to obtain the approvals, permits, licenses or

certificates that are required to expand our business as we intend. If we fail

to obtain or to maintain such permits, licenses or certificates or renewals are

granted with onerous conditions, we could be subject to fines and other

penalties and be limited in the number or the quality of the products that we

would be able to offer. As a result, our business, result of operations and

financial condition could be materially and adversely affected.

Zishen

Wu, our chairman, chief executive officer and president, has played an important

role in the growth and development of our business since its inception, and a

loss of his services in the future could severely disrupt our business and

negatively affect investor confidence in us, which may also cause the market

price of our common stock to go down.

To date,

we have relied heavily on Mr. Wu’s expertise in, and familiarity with, our

business operations, his relationships within the industries in which we

operate, including with our suppliers, and his reputation and experience. In

addition, Mr. Wu continues to be primarily responsible for formulating our

overall business strategies and spearheading the growth of our operations. If