Attached files

Exhibit 10.16

OFFICE LEASE AGREEMENT

Between

Landlord: PPF OFF 345 SPEAR STREET, LP,

a Delaware limited partnership

and

Tenant: MEDIVATION, Inc.

a Delaware corporation

HILLS PLAZA

SAN FRANCISCO, CALIFORNIA

Sixth Floor

TABLE OF CONTENTS

LEASE AGREEMENT

| Page | ||||

| 1. | PREMISES AND COMMON AREAS | 1 | ||

| 2. | TERM | 2 | ||

| 3. | DELIVERY OF PREMISES | 2 | ||

| 4. | QUIET ENJOYMENT | 2 | ||

| 5. | BASE RENT | 2 | ||

| 6. | RENT PAYMENT | 3 | ||

| 7. | OPERATING EXPENSES AND TAXES | 3 | ||

| 8. | LATE CHARGE | 10 | ||

| 9. | PARTIAL PAYMENT | 10 | ||

| 10. | LETTER OF CREDIT | 11 | ||

| 11. | USE OF PREMISES | 14 | ||

| 12. | COMPLIANCE WITH LAWS | 17 | ||

| 13. | WASTE DISPOSAL | 18 | ||

| 14. | RULES AND REGULATIONS | 18 | ||

| 15. | SERVICES | 19 | ||

| 16. | TELEPHONE AND DATA EQUIPMENT | 23 | ||

| 17. | SIGNS | 24 | ||

| 18. | PARKING | 24 | ||

| 19. | FORCE MAJEURE | 24 | ||

| 20. | REPAIRS AND MAINTENANCE BY LANDLORD | 25 | ||

| 21. | REPAIRS BY TENANT | 25 | ||

| 22. | ALTERATIONS AND IMPROVEMENTS/LIENS | 25 | ||

| 23. | DESTRUCTION OR DAMAGE | 28 | ||

| 24. | EMINENT DOMAIN | 29 | ||

| 25. | DAMAGE OR THEFT OF PERSONAL PROPERTY | 29 | ||

| 26. | INSURANCE; WAIVERS | 29 | ||

| 27. | INDEMNITIES | 31 | ||

| 28. | ACCEPTANCE AND WAIVER | 32 | ||

| 29. | ESTOPPEL | 32 | ||

| 30. | NOTICES | 33 | ||

| 31. | DEFAULT | 33 | ||

| 32. | REMEDIES | 34 | ||

| 33. | LANDLORD DEFAULT | 37 | ||

| 34. | SERVICE OF NOTICE | 38 | ||

| 35. | ADVERTISING | 38 | ||

| 36. | SURRENDER OF PREMISES | 38 | ||

| 37. | REMOVAL OF FIXTURES | 39 | ||

| 38. | HOLDING OVER | 39 | ||

| 39. | ATTORNEYS’ FEES | 39 | ||

| 40. | SECURITY HOLDER’S RIGHTS | 39 | ||

| 41. | ENTERING PREMISES | 41 | ||

| 42. | RELOCATION [INTENTIONALLY OMITTED] | 41 | ||

| 43. | ASSIGNMENT AND SUBLETTING | 41 | ||

| 44. | SALE | 46 | ||

| 45. | LIMITATION OF LIABILITY | 46 | ||

| 46. | BROKER DISCLOSURE | 46 | ||

| 47. | JOINT AND SEVERAL | 47 | ||

| 48. | CONSTRUCTION OF THIS AGREEMENT | 47 | ||

| 49. | NO ESTATE IN LAND | 47 |

i

| 50. | PARAGRAPH TITLES; SEVERABILITY | 47 | ||

| 51. | CUMULATIVE RIGHTS | 47 | ||

| 52. | ENTIRE AGREEMENT | 47 | ||

| 53. | SUBMISSION OF AGREEMENT | 47 | ||

| 54. | AUTHORITY | 48 | ||

| 55. | OPTIONS | 48 | ||

| 56. | OFAC CERTIFICATION | 53 | ||

| 57. | COUNTERPARTS; TELECOPIED OR ELECTRONIC SIGNATURES | 53 |

LIST OF EXHIBITS

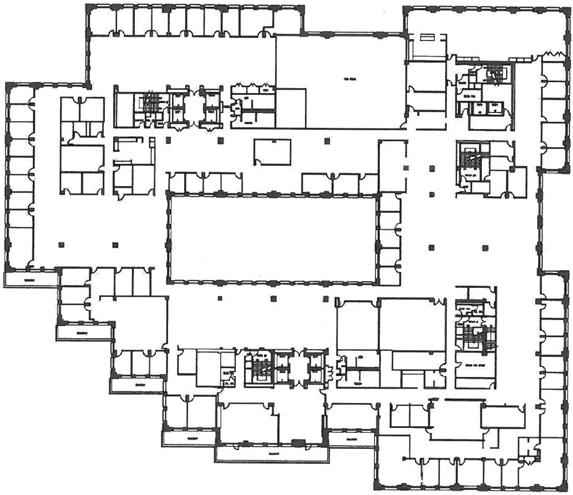

| A | Premises | |

| B | Work Agreement | |

| C | Commencement Letter | |

| D | Rules and Regulations | |

| E | Parking Agreement | |

| F | Form of Letter of Credit |

ii

BASIC LEASE PROVISIONS

The following sets forth some of the Basic Provisions of the Lease. In the event of any conflict between the terms of these Basic Lease Provisions and the referenced Sections of the Lease, the referenced Sections of the Lease shall control.

| 1. | Building (Section 1): The 7-story building located at 345 Spear Street in the City of San Francisco, California, containing approximately 415,568 rentable square feet. The Building is part of a combined office, retail and residential condominium development, including a subterranean parking garage, located on the entire block of Spear Street between Harrison Street and Folsom Street and commonly known as Hills Plaza (the “Project”). |

| 2. | Property: The Building, the parcel(s) of land on which the Building is located, the Common Areas (as defined in Section 1), the subterranean parking garage for the Project and, at Landlord’s discretion, other portions of the Project and any additional real property, land, buildings or other improvements serving the Building and/or the parcel(s) of land on which the Building is located. |

| 3. | Premises (Section 1): |

| Suite: | 600 | |

| Floor: | Sixth (6th) | |

| Rentable Square Feet: | 63,817 |

| 4. | Term (Section 2): |

Commencement Date (Section 2): The Effective Date

Expiration Date (Section 2): March 31, 2017

| 5. | Base Rent (Section 5): |

| Period |

Annual Rate Per Square Foot |

Monthly Installment | ||

| April 1, 2010 (the “Rent Commencement Date”) - March 31, 2011 |

$42.50 | $226,018.54* | ||

| April 1, 2011 - March 31, 2012 |

$43.50 | $231,336.63* | ||

| April 1, 2012 - March 31, 2013 |

$44.50 | $236,654.71 | ||

| April 1, 2013 - March 31, 2014 |

$45.50 | $241,972.79 | ||

| April 1, 2014 - March 31, 2015 |

$46.50 | $247,290.88 | ||

| April 1, 2015 - March 31, 2016 |

$47.50 | $252,608.96 | ||

| April 1, 2016 - March 31, 2017 |

$48.50 | $257,927.04 |

| * | Subject to abatement pursuant to Section 5(b) below. |

i

| 6. | Rent Payment Address (Section 6): |

PPF OFF 345 SPEAR STREET, LP

P.O. Box 601125

Los Angeles, CA 90060-1125

Tax ID No.: 20-1389347

| 7. | Base Year (Section 7): |

| Tax Base Year: | 2010 | |

| Operating Expense Base Year: | 2010 |

| 8. | Tenant’s Share (Section 7): | 15.36% | ||

| 9. | Letter of Credit Amount (Section 10): | Initially, $1,500,000.00 | ||

| 10. | Parking Spaces (Section 18): | Up to twenty-six (26), of which up to ten (10) may be reserved | ||

| 11. | Landlord’s Broker (Section 45): | Jones Lang LaSalle Americas, Inc. | ||

| Tenant’s Broker (Section 45): | Jones Lang LaSalle Americas, Inc. | |||

| 12. | Notice Addresses (Section 30): |

| Landlord |

Tenant | |

| PPF OFF 345 SPEAR STREET, LP | Medivation, Inc. | |

| c/o Jones Lang LaSalle Americas, Inc. | at the Premises | |

| 345 Spear Street, Suite 124 | Attention: Ann Mead, Senior | |

| San Francisco, California 94105 | Director Administration | |

| Attention: Hal Brownstone, Vice President |

with a copy to:

c/o Morgan Stanley US Real Estate Investing Division

555 California Street, Suite 2200, Floor 21

San Francisco, California 94104

Attention: Keith A. Fink, Executive Director

ii

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (hereinafter called the “Lease”) is entered into as of November 2, 2009 (“Effective Date”), by and between the Landlord and Tenant identified above.

1. Premises and Common Areas.

(a) Premises; Rentable Area. Landlord does hereby lease to Tenant and Tenant does hereby lease from Landlord the Premises located in the Building identified in the Basic Lease Provisions, situated on the Property, such Premises as further shown on the drawing attached hereto as Exhibit A and made a part hereof by reference. The Premises shall be prepared for Tenant’s occupancy in the manner and subject to the provisions of the Work Agreement attached hereto as Exhibit B attached hereto and made a part hereof. The “rentable square feet” or “rentable area” of the Premises has been determined based upon the ANSI/BOMA Z65.1-1996 standard promulgated by the Building Owners and Managers Association, as interpreted by Landlord’s architect for the Building. Landlord and Tenant agree that the rentable area of the Premises as described in Paragraph 2 of the Basic Lease Provisions has been confirmed and conclusively agreed upon by the parties, and shall not be changed except in connection with the change in the physical size of the Building or the Premises. No easement for light, air or view is granted hereunder or included within or appurtenant to the Premises.

(b) Common Areas. Tenant shall have the nonexclusive right (in common with other tenants or occupants of the Building, Landlord and all others to whom Landlord has granted or may hereafter grant such rights) to use the Common Areas (defined below), subject to the Rules and Regulations. Provided that Tenant at all times has reasonable means of access to, and use of, the Premises and the Common Areas necessary for access to and use of the Premises, Landlord may at any time alter, renovate, rearrange, expand or reduce some or all of the Common Areas or temporarily close any Common Areas to make repairs or changes therein or to effect construction, repairs, or changes within the Building, or to prevent the acquisition of public rights in such areas, or to discourage parking by parties other than tenants and their invitees, and may do such other acts in and to the Common Areas as in its reasonable judgment may be desirable. Landlord may from time to time permit portions of the Common Areas to be used exclusively by specified tenants. Landlord may also, from time to time, place or permit customer service and information booths, kiosks, stalls, push carts and other merchandising facilities in the Common Areas. “Common Areas” shall mean any of the following or similar items: (a) to the extent included in the Building the total square footage of areas of the Building devoted to nonexclusive uses such as ground floor lobbies, seating areas and elevator foyers; fire vestibules; mechanical areas; restrooms and corridors on all floors; elevator foyers and lobbies on multi-tenant floors; electrical and janitorial closets; telephone and equipment rooms; and other similar facilities maintained for the benefit of Building tenants and invitees, but shall not mean Major Vertical Penetrations (defined below) except for Building stairwells which may be accessed in the case of emergency; and (b) all parking garage vestibules; loading docks; locker rooms, exercise and conference facilities available for use by Building tenants (if any); walkways, roadways and sidewalks; trash areas; mechanical areas; landscaped areas including courtyards, plazas and patios; and other similar facilities maintained for the benefit of Building

1

tenants and invitees. As used herein, “Major Vertical Penetrations” shall mean the area or areas within Building stairs (excluding the landing at each floor), elevator shafts, and vertical ducts that service more than one floor of the Building. The area of Major Vertical Penetrations shall be bounded and defined by the dominant interior surface of the perimeter walls thereof (or the extended plane of such walls over areas that are not enclosed). Major Vertical Penetrations shall exclude, however, areas for the specific use of Tenant or installed at the request of Tenant, such as special stairs or elevators.

2. Term. Tenant shall have and hold the Premises for the term (“Term”) identified in the Basic Lease Provisions commencing on the Effective Date (the “Commencement Date”). The Term shall terminate at 23:59:59 local time on March 31, 2017 (the “Expiration Date”), unless sooner terminated or extended as hereinafter provided.

3. Delivery of Premises. As of the Effective Date, the Premises are vacant. Upon Tenant’s delivery to Landlord of (i) one (1) month’s Base Rent, (ii) the Letter of Credit (defined in Section 10 below), and (iii) evidence of Tenant’s procurement of all insurance coverage required hereunder, Landlord will deliver possession of the Premises to Tenant, with all Building Systems (defined in Section 20 below) serving the Premises in good working order and repair and with the interior thoroughly clean so as to allow Tenant to commence the construction of the Tenant Improvements pursuant to the Work Agreement. Landlord hereby confirms and agrees that any work necessary to ensure that all Building systems serving the Premises will be in good working order and repair on the date possession is delivered to Tenant shall be borne by Landlord and not passed through to Tenant as a part of Operating Expenses.

4. Quiet Enjoyment. Tenant, upon payment in full of the required Rent and full performance of the terms, conditions, covenants and agreements contained in this Lease, shall peaceably and quietly have, hold and enjoy the Premises during the Term. The foregoing is in lieu of any implied covenant of quiet enjoyment. Landlord shall not be responsible for the acts or omissions of any other tenant or third party that may interfere with Tenant’s use and enjoyment of the Premises.

5. Base Rent.

(a) Generally. Beginning on April 1, 2010 (the “Rent Commencement Date”), (but subject to abatement as set forth in Section 5(b) below), Tenant shall pay to Landlord, at the address stated in the Basic Lease Provisions or at such other place as Landlord shall designate in writing to Tenant, annual base rent (“Base Rent”) in the amounts set forth in the Basic Lease Provisions.

(b) Abatement. So long as Tenant is not in Default (defined in Section 31, below) under this Lease, Tenant shall be entitled to an abatement of Base Rent payable hereunder for the calendar months of April and May, 2010 and April and May, 2011 (each, an “Abatement Period”). The total amount of Base Rent abated during the Abatement Periods is referred to herein as the “Abated Rent”. If Tenant is in Default hereunder at any time during the Term, and such Default occurs prior to the expiration of the Abatement Periods, there will be no further abatement of Rent pursuant to this Section 5(b) during the remainder of the Abatement

2

Periods unless and until such Default is cured; upon any cure of such Default by Tenant, any remaining scheduled abatement of Base Rent pursuant to this Section 5(b) will take place as scheduled, and any abatement of Base Rent which ceased or did not occur as a result of the pendency of such Default will commence upon the date that is thirty (30) days following Tenant’s cure of such Default.

6. Rent Payment. The Base Rent shall be payable in equal monthly installments, due on the first day of each calendar month commencing as of the Rent Commencement Date, in advance, in legal tender of the United States of America, without abatement, demand, deduction or offset whatsoever, except as may be expressly provided in this Lease. One full monthly installment of Base Rent shall be due and payable on the date of execution of this Lease by Tenant and shall be applied to the first full calendar month’s Base Rent payable hereunder after the Rent Commencement Date (unless returned to Tenant in accordance with Section 55(a)(ii) below following Tenant’s exercise of its Termination Option), and a like monthly installment of Base Rent shall be due and payable on or before the first day of each calendar month thereafter (subject to the provisions of Section 5(b) above) during the Term. Tenant shall pay, as additional Rent, all other sums due from Tenant under this Lease (the term “Rent”, as used herein, means all Base Rent, all amounts payable pursuant to Section 7 below, and all other amounts payable hereunder from Tenant to Landlord including, without limitation, Storage Rent (defined in Section 11(c) below), if applicable). Unless otherwise specified herein, all items of Rent (other than Base Rent and amounts payable pursuant to Section 7 below) shall be due and payable by Tenant on or before the date that is ten (10) days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, Landlord designates (initially set forth in Paragraph 6 of the Basic Lease Provisions) and shall be made by good and sufficient check or by other means acceptable to Landlord.

7. Operating Expenses and Taxes.

(a) Generally. Tenant will reimburse Landlord throughout the Term, as additional Rent hereunder, for Tenant’s Share (defined below) of: (i) the annual Operating Expenses (as defined below) in excess of the Operating Expenses for the Operating Expense Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Expense Amount”); and (ii) the annual Taxes (as defined below) in excess of the Taxes for the Tax Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Tax Amount”). The term “Tenant’s Share” as used in this Lease shall mean the percentage determined by dividing the rentable square footage of the Premises by the rentable square footage of the Building and multiplying the quotient by 100. Landlord and Tenant hereby agree that Tenant’s Share with respect to the Premises initially demised by this Lease is as set forth in the Basic Lease Provisions. Tenant’s Share of excess Operating Expenses and excess Taxes for any calendar year shall be appropriately prorated for any partial year occurring during the Term. The obligations of the parties pursuant to this Section 7 will survive the expiration or sooner termination of this Lease.

(b) Operating Expenses. “Operating Expenses” shall mean all of those expenses incurred or paid by Landlord in operating, servicing, managing, maintaining and repairing the Property. Operating Expenses shall include, without limitation, the following: (1)

3

all costs related to the providing of water, heating, lighting, ventilation, sanitary sewer, air conditioning and other utilities, but excluding those utility charges actually paid separately by Tenant or any other tenants of the Building; (2) janitorial and maintenance expenses, including: (a) janitorial services and janitorial supplies and other materials used in the operation and maintenance of the Building; and (b) the cost of maintenance and service agreements on equipment, window cleaning, grounds maintenance, pest control, security, trash removal, and other similar services or agreements; (3) management fees (or an imputed charge for management fees if Landlord provides its own management services) not to exceed three percent (3.0%) of all Gross Tenant Revenues; for purposes hereof, “Gross Tenant Revenues” shall be deemed to mean the aggregate of (a) the annual base rentals for all Project tenants, (b) amounts of commercially reasonable rental abatement, and (c) other income from the use or occupancy of the Building, accrued or collected with respect to the Building; and the market rental value (as reasonably determined by Landlord) of an on-site management office (or the prorated portion of any off-site management office whose occupants perform management services for the Property); provided that any such line item inclusion for the cost of a management office shall not materially exceed the amount generally charged by owners of similar properties in the downtown San Francisco, California market (“Comparable Buildings”); (4) the costs, including interest, amortized over the useful lives thereof as reasonably determined by Landlord, of (a) any capital improvement made to the Building by or on behalf of Landlord which is required under any governmental law or regulation (or any judicial interpretation thereof) or any insurance requirement that was not applicable to, and enforced against, the Building as of the Effective Date, (b) any capital cost of acquisition and installation of any device or equipment designed or anticipated to improve the operating efficiency of any system within the Building or which is reasonably intended to reduce Operating Expenses and which is properly capitalized, or (c) the cost of any capital improvement or capital equipment which is acquired to improve the safety of the Building or Property, or (d) capital improvements which are replacements or modifications of items located in the Common Areas required to keep the Common Areas in good order or condition; (5) all services, supplies, repairs, replacements or other expenses directly and reasonably associated with servicing, maintaining, managing and operating the Building, including, but not limited to the lobby, vehicular and pedestrian traffic areas and other Common Areas; (6) wages, salaries and bonuses of Landlord’s engineering and management employees (not above the level of Building or Property Manager or such other title representing the on-site management representative primarily responsible for management of the Building) engaged in the maintenance, operation, repair and services of the Building, including taxes, insurance and customary fringe benefits; (7) legal and accounting costs (but not including legal costs incurred in collecting delinquent rent from any occupants of the Property); (8) costs to maintain and repair the Building and Property; (9) landscaping and security costs unless and to the extent that Landlord hires a third party to provide such services pursuant to a service contract and the cost of that service contract is already included in Operating Expenses as described above; (10) costs or payments under any easement, license, operating agreement, master declaration, restrictive covenant, or other instrument pertaining to the sharing of costs by the Building or Property or related to the use or operation of the Building or Property; and (11) the amount paid or incurred by Landlord (a) in insuring all or any portion of the Property under policies of insurance and/or commercially reasonable self-insurance, which may include commercial general liability insurance, property insurance, worker’s compensation insurance, rent interruption insurance,

4

contingent liability and builder’s risk insurance, and any insurance as may from time to time be maintained by Landlord and (b) for deductible payments under any insured claims.

Operating Expenses shall specifically exclude the following: (i) costs of alterations of tenant spaces (including all tenant improvements to such spaces); (ii) costs of capital improvements, except as provided in the preceding paragraph; (iii) depreciation, interest and principal payments on mortgages, and other debt costs, if any; (iv) real estate brokers’ leasing commissions or compensation and advertising and other marketing expenses; (v) payments to affiliates of the Landlord for goods and/or services to the extent the same are materially in excess of what would be paid to non-affiliated parties of similar experience, skill and expertise for such goods and/or services in an arm’s length transaction; (vi) costs or other services or work performed for the singular benefit of another tenant or occupant (other than for Common Areas of the Building); (vii) legal, space planning, construction, and other expenses incurred in procuring tenants for the Building or renewing or amending leases with existing tenants or occupants of the Building; (viii) costs of advertising and public relations and promotional costs and attorneys’ fees associated with the leasing of the Building; (ix) any expense to the extent that Landlord actually receives reimbursement from insurance, condemnation awards, other tenants (except through the payment of Operating Expenses) or any other source; (x) costs incurred in connection with the sale, financing, refinancing, mortgaging, or other change of ownership of the Building; (xi) all expenses in connection with the installation, operation and maintenance of any observatory, broadcasting facilities, luncheon club, athletic or recreation club, cafeteria, dining facility or other facility not generally available to all office tenants of the Building, including Tenant; (xii) Taxes; (xiii) rental under any ground or underlying lease or leases; ; (xiv) sums (other than management fees as described in clause (3) of the foregoing definition of “Operating Expenses”) paid to subsidiaries or other affiliates of Landlord for services but only to the extent that the cost of such service materially exceeds the competitive costs for such services rendered by persons or entities of similar skill, competence and experience in the market; (xv) costs incurred in connection with the removal, encapsulation or other treatment of Hazardous Material (defined in Section 11(b) below) existing in the Building and classified as a Hazardous Material as of the date of this Lease, except to the extent such removal, encapsulation or other treatment is related to the ordinary general repair and maintenance of the Building (for example, the removal and disposal of oil from Building machinery in the course of typical building maintenance and not as a response to any action of any tenant or occupant of the Building or other release of Hazardous Materials); (xvi) costs that Landlord incurs in restoring the Building after the occurrence of a fire or other casualty or after a partial condemnation thereof; (xvii) interest, fines, penalties or damages for violation of Law or late payment by Landlord, including penalty interest; (xviii) the cost of defending any lawsuit and of paying any judgment, settlement or arbitration award resulting from Landlord’s liability for failure to perform its obligations under any lease or other contract by which it may be bound; (xix) contributions to civic organizations or charities; (xx) the cost of acquisition of objects of fine art that Landlord installs in the Building; (xxi) any increased costs resulting from the negligence or willful misconduct of Landlord or its employees, agents or contractors (provided that the issue of such negligence or willful misconduct has been fully adjudicated, beyond the exhaustion of any appeal rights); (xxii) costs incurred by Landlord to correct construction defects in the Base Building (defined in Section 12(a) (provided that the issue of the existence of a construction defect has been fully adjudicated, beyond the exhaustion of any appeal rights); (xxiii) general or administrative overhead not directly associated with

5

operation and management of the Building and (xxiv) costs incurred in connection with the operation and maintenance of the subterranean parking garage for the Project.

(c) “Taxes” shall mean all taxes and assessments of every kind and nature which Landlord shall become obligated to pay with respect to any calendar year of the Term or portion thereof because of or in any way connected with the ownership, leasing, or operation of the Building and the Property, as well as any assessment, tax, fee, levy or charge in addition to, or in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the definition of real property tax, it being acknowledged by Tenant and Landlord that Proposition 13 was adopted by the voters of the State of California in the June 1978 election (“Proposition 13”) and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants, and, in further recognition of the decrease in the level and quality of governmental services and amenities as a result of Proposition 13, Taxes shall also include any governmental or private assessments or the Property’s contribution towards a governmental or private cost-sharing agreement for the purpose of augmenting or improving the quality of services and amenities normally provided by governmental agencies. Notwithstanding anything to the contrary contained herein, (i) Landlord shall include in Taxes each year hereunder (including, without limitation, the Tax Base Year) the amounts levied, assessed, accrued or imposed for such year, regardless of whether paid or payable in another year (except that, with respect to personal property taxes, Landlord shall include in Taxes the amounts paid during each such year), and Landlord shall each year make any other appropriate changes to reflect adjustments to Taxes for prior years (including, without limitation, the Tax Base Year) due to error by the taxing authority, supplemental assessment or other reason, regardless of whether Landlord uses an accrual system of accounting for other purposes (the amount of any tax refunds received by Landlord during the Term of this Lease (subject to the provisions of Section 7(e) below) shall be deducted from Taxes for the calendar year to which such refunds are attributable), and Tenant will receive a refund or credit against Taxes in excess of Base Year Tax Amount, if any, in the amount of any resulting retroactive reductions in Taxes previously payable (and actually paid) by Tenant [subject to the provisions of Section 7(e) below]); (ii) the amount of special taxes and special assessments to be included shall be limited to the amount of the installments (plus any interest, other than penalty interest, payable thereon) of such special tax or special assessment payable for the calendar year in respect of which Taxes are being determined; (iii) the amount of any tax or excise levied by the State or the City where the Building is located, any political subdivision of either, or any other taxing body, on rents or other income from the Property (or the value of the leases thereon) to be included shall not be greater than the amount which would have been payable on account of such tax or excise by Landlord during the calendar year in respect of which Taxes are being determined had the income received by Landlord from the Building (excluding amounts payable under this subparagraph (iii)) been the sole taxable income of Landlord for such calendar year; (iv) if any portion of the Taxes in the Tax Base Year includes an assessment which is no longer payable in a subsequent calendar year, Taxes for the Tax Base Year shall be adjusted to eliminate the amount of the annual assessment originally included therein; and (v) Taxes shall also include Landlord’s reasonable costs and expenses (including reasonable attorneys’ fees) in contesting or attempting to reduce any Taxes. Taxes will not include income taxes (except those which may be included pursuant to

6

subparagraph (iii) above), excess profits taxes, franchise taxes, capital stock taxes, personal property taxes (other than taxes on machinery or equipment used in the operation, maintenance or management of the Property (for example, but not by way of limitation, window washing equipment) and inheritance or estate taxes. Without limiting the generality of this Section 7(c), if at any time prior to or during the Term any sale, refinancing or change in ownership of the Building is consummated, and if Landlord reasonably anticipates that the Building will be reassessed for purposes of Taxes as a result thereof, but that such reassessment may not be completed during the calendar year in which such event is consummated, then for all purposes under this Lease, Landlord will calculate Taxes applicable to such calendar year and thereafter based upon Landlord’s good faith estimate of the Taxes which will result from such reassessment. Upon the finalization of any such reassessment and Landlord’s determination of actual Taxes applicable to the Tax Base Year and all calendar years subsequent thereto, as applicable, Landlord shall have the right to adjust the applicable Taxes therefor and, upon such adjustment, Landlord or Tenant, as appropriate, shall promptly make such reconciliation payment (which, in the case of Landlord, may be made in the form of a credit against the installment(s) of Tenant’s Share of excess Taxes next coming due) as may be necessary in order that Tenant pays Tenant’s Share of actual Taxes for each such calendar year.

(d) Cost Pools. Landlord shall have the right, from time to time, to equitably allocate some or all of the Operating Expenses among different portions or occupants of the Building or Property (the “Cost Pools”), in Landlord’s commercially reasonable discretion. Such Cost Pools may, for example, include, but shall not be limited to, the office space tenants of the Building and the retail space tenants. The Operating Expenses allocable to each such Cost Pool shall be allocated to such Cost Pool and charged to the tenants within such Cost Pool in an equitable manner.

(e) Proposition 8. Notwithstanding anything to the contrary herein, if Taxes for the Base Year or any subsequent year are decreased as a result of any proceeding filed by Landlord for a reduction in the Building and Property’s assessed value obtained in connection with California Revenue and Taxation Code Section 51 (a “Proposition 8 Reduction”), Landlord shall make the following adjustments in determining Taxes (i) any Proposition 8 Reduction applicable to the Tax Base Year (whether actually obtained in the Tax Base Year or obtained retroactively in any subsequent year) shall be disregarded for purposes of determining the Base Year Tax Amount; and (ii) any Proposition 8 Reduction applicable to a subsequent year shall be recognized for purposes of determining Taxes for that year; however, if and to extent that as a result of any Proposition 8 Reduction applicable to a subsequent year Taxes are reduced below the Base Tax Year amount, Tenant will not be entitled to any credit or refund related to such reduction below the Base Tax Year Amount.

(f) Procedure. As soon as reasonably possible after the commencement of each calendar year, commencing with 2011, Landlord will provide Tenant with a statement of the estimated monthly installments of Tenant’s Share of increases (if any) in Operating Expenses and increases in Taxes (if any) which will be due for the remainder of such calendar year in accordance with this Section 7. Landlord shall deliver to Tenant within ninety (90) days after the close of each calendar year (including the calendar year in which this Lease terminates), or as soon thereafter as reasonably practical, a statement (“Landlord’s Statement”) setting forth: (1) the

7

amount of any increases (if any) in the Operating Expenses for such calendar year in excess of the Operating Expenses for the Operating Expense Base Year, and (2) the amount of any increases in the Taxes (if any) for such calendar year in excess of the Taxes for the Tax Base Year.

(i) For each year following the Base Year, Tenant shall pay to Landlord, together with its monthly payment of Base Rent as provided in Section 5 above, as additional Rent hereunder, the estimated monthly installment of Tenant’s Share of the excess Operating Expenses and excess Taxes for the calendar year in question. At the end of any calendar year, and upon Landlord’s completion of Landlord’s Statement for such year, if Tenant has paid to Landlord an amount in excess of Tenant’s Share of excess Operating Expenses and excess Taxes for such calendar year, Landlord shall reimburse to Tenant any such excess amount within thirty (30) days after the date of delivery of the applicable Landlord’s Statement (or shall apply any such excess amount to any amount then owing to Landlord hereunder, and if none, to the next due installment or installments of additional Rent due hereunder, at the option of Landlord); if Tenant has paid to Landlord less than Tenant’s Share of excess Operating Expenses and excess Taxes for such calendar year, Tenant shall pay to Landlord any such deficiency within thirty (30) days after the date of delivery of the applicable Landlord’s Statement.

(ii) For the calendar year in which this Lease terminates and is not extended or renewed, the provisions of this Section 7 shall apply, but Tenant’s Share of excess Operating Expenses and excess Taxes for such calendar year shall be subject to a pro rata adjustment based upon the number of days in such calendar year prior to the expiration of the Term of this Lease. Tenant’s obligation to pay Tenant’s Share of excess Operating Expenses and excess Taxes (or any other amounts) accruing during, or relating to, the period prior to expiration or earlier termination of this Lease shall survive such expiration or termination. Landlord may reasonably estimate all or any of such obligations within a reasonable time before or after such expiration or termination. Tenant shall pay the full amount of such estimate, and any additional amount due after the actual amounts are determined, in each case within thirty (30) days after Landlord sends a statement therefor. If the actual amount is less than the amount Tenant has paid as an estimate, Landlord shall refund the difference within thirty (30) days after such determination is made. Landlord shall use commercially reasonable efforts to conclude such determination as soon as reasonably possible.

(iii) If the Building is less than one hundred percent (100%) occupied throughout any calendar year of the Term, inclusive of the Operating Expense Base Year, then those actual Operating Expenses for the calendar year in question which vary with occupancy levels in the Building (including for example, but not limited to elevator maintenance costs, janitorial costs, trash collection and disposal costs, utility costs and management fees) shall be increased by Landlord, for the purpose of determining Tenant’s Share of excess Operating Expenses, to be the amount of Operating Expenses which Landlord reasonably determines would have been incurred during that calendar year if the Building had been at least 100% occupied throughout such calendar year.

(g) Tenant’s Audit Right. Tenant shall have the right to conduct an audit of Landlord’s books and records relating to Operating Expenses in accordance with the following terms and provisions, provided that Tenant delivers written notice of its intent to audit within

8

ninety (90) days after receipt by Tenant of Landlord’s Statement (which Landlord’s Statement may be delivered in such manner as is customary for delivery of statements by Landlord under this Section 7) and completes such audit within one hundred twenty (120) days after the date Landlord gives access to its books and records:

(i) No Default is outstanding with respect to payment of Base Rent or additional Rent.

(ii) Tenant shall have the right to have an employee of Tenant or a Qualified Auditor (as defined below) inspect Landlord’s accounting records at Landlord’s office no more than once per calendar year.

(iii) Neither the employee of Tenant nor the Qualified Auditor shall be employed or engaged on a contingency basis, in whole or in part.

(iv) Prior to commencing the audit, Tenant and the auditor shall: (i) if the auditor is not an employee of Tenant, provide Landlord with evidence that the auditor is from a nationally recognized accounting firm and that the individual performing the audit is a certified public accountant (a “Qualified Auditor”); (ii) each sign a reasonable confidentiality letter to be provided by Landlord; and (iii) provide Landlord with evidence of the fee arrangement between the auditor and Tenant.

(v) The audit shall be limited solely to confirming that the Operating Expenses in the Base Year and as reported in the Landlord’s Statement are consistent with the terms of this Lease. The auditor shall not make any judgments as to the reasonableness of any item of expense and/or the total Operating Expenses, nor shall such reasonableness be subject to audit except where this Lease specifically states that a particular item must be reasonable.

(vi) If Tenant’s auditor finds errors or overcharges in Landlord’s Statement that Tenant wishes to pursue, then within the time period set forth above Tenant shall advise Landlord thereof in writing with specific reference to claimed errors and overcharges and the relevant Lease provisions disqualifying such expenses. Landlord shall have a reasonable opportunity to meet with Tenant’s auditor (and any third auditor selected hereinbelow, if applicable) to explain its calculation of Operating Expenses, it being the understanding of Landlord and Tenant that Landlord intends to operate the Building as a first-class office building with service levels at or near the top of the market, increased as circumstances may require in Landlord’s sole and reasonable judgment. If Landlord agrees with said findings, appropriate rebates or charges shall be made to Tenant. If Landlord does not agree, Landlord shall engage its own auditor to review the findings of Tenant’s auditor and Landlord’s books and records. The two (2) auditors and the parties shall then meet to resolve any difference between the audits.

(vii) If agreement cannot be reached within two (2) weeks after the two (2) auditors and the parties first meet to attempt to resolve the dispute, then the auditors shall together select a third auditor (who shall be a Qualified Auditor not affiliated with and who does not perform services for either party or their affiliates) to which they shall each promptly submit their findings in a final report, with copies submitted simultaneously to the first two (2) auditors,

9

Tenant and Landlord. Within two (2) weeks after receipt of such findings, the third auditor shall determine which of the two reports best meets the terms of this Lease, which report shall become the “Final Finding”. The third auditor shall not have the option of selecting a compromise between the first two auditors’ findings, nor to make any other finding.

(viii) If the Final Finding determines that Landlord has overcharged Tenant, Landlord shall credit Tenant toward the payment of Base Rent or additional Rent next due and payable under this Lease the amount of such overcharge, or if the Term of this Lease has ended, shall refund the overcharged amount to Tenant within thirty (30) days after the Final Finding. If the Final Finding determines that Tenant was undercharged, then within thirty (30) days after the Final Finding, Tenant shall reimburse Landlord the amount of such undercharge.

(ix) If the Final Finding results in a determination that Landlord overstated Tenant’s Share of the Operating Expenses by more than five percent (5%) for the calendar year subject to the audit, Landlord shall pay its own audit costs and reimburse Tenant for its costs associated with said audits. If the Final Finding results in no credit to Tenant for the calendar year subject to the audit (or in a determination that Tenant underpaid Operating Expense for such year), Tenant shall pay its own costs and shall reimburse Landlord for Landlord’s costs associated with said audits. In all other events, each party shall pay its own audit costs, including one half (1/2) of the cost of the third auditor.

(x) The results of any audit of Operating Expenses hereunder shall be treated by Tenant, all auditors, and their respective employees and agents as confidential, and shall not be discussed with nor disclosed to any third party, except for disclosures required by applicable law, court rule or order or in connection with any litigation or arbitration involving Landlord or Tenant.

8. Late Charge. Other remedies for nonpayment of Rent notwithstanding, if any monthly installment of Base Rent or additional Rent is not received by Landlord on or before the date due, or if any payment due Landlord by Tenant which does not have a scheduled due date is not received by Landlord on or before the thirtieth (30th) day following the date Tenant was invoiced for such charge, a late charge of five percent (5%) of such past due amount shall be immediately due and payable as additional Rent; provided, however, that Tenant shall be entitled to notice and the passage of a five (5) day grace period prior to the imposition of such late charge on the first (1st) occasion in any calendar year in which Tenant fails to timely pay any amount due hereunder. Additionally, interest shall accrue on all delinquent amounts from the date past due until paid at the rate of ten percent (10%) per year from the date such payment is due until paid (the “Interest Rate”).

9. Partial Payment. No payment by Tenant or acceptance by Landlord of an amount less than the Rent herein stipulated shall be deemed a waiver of any other Rent due. No partial payment or endorsement on any check or any letter accompanying such payment of Rent shall be deemed an accord and satisfaction, but Landlord may accept such payment without prejudice to Landlord’s right to collect the balance of any Rent due under the terms of this Lease or any late charge or interest assessed against Tenant hereunder.

10

10. Letter of Credit.

(a) Generally. Concurrently with Tenant’s execution and delivery of this Lease to Landlord, Tenant shall deliver to Landlord, as collateral for the full performance by Tenant of all of its obligations under this Lease and for all losses and damages Landlord may suffer as a result of Tenant’s failure to comply with one or more provisions of this Lease, including, but not limited to, any post lease termination damages under Section 1951.2 of the California Civil Code, a standby, unconditional, irrevocable, transferable (provided that Tenant will be responsible for the payment of any transfer fee or charge imposed by the issuing bank) letter of credit (the “Letter of Credit”) in the form of Exhibit F hereto or such other form approved in writing in advance by Landlord and containing the terms required herein, in the face amount of $1,500,000.00 (the “Letter of Credit Amount”), naming Landlord as beneficiary, issued (or confirmed) by a financial institution acceptable to Landlord (the “Issuing Bank”), permitting multiple and partial draws thereon from a location in San Francisco, California (or, alternatively, permitting draws via overnight courier or facsimile), and otherwise in form acceptable to Landlord in its reasonable discretion. Tenant shall cause the Letter of Credit to be continuously maintained in effect (whether through replacement, amendment, renewal, amendment or extension) in the Letter of Credit Amount through the date (the “Final LC Expiration Date”) that is the later to occur of (x) the date that is forty-five (45) days after the scheduled expiration date of the Term or any renewal Term and (y) the date that is forty-five (45) days after Tenant vacates the Premises and completes any restoration or repair obligations; provided that the Letter of Credit Amount may be reduced by amendment to the Letter of Credit in accordance with Sections 10(f) and 10(g) below. If the Letter of Credit held by Landlord expires earlier than the Final LC Expiration Date (whether by reason of a stated expiration date or a notice of termination or non-renewal given by the issuing bank), Tenant shall deliver a new or amended Letter of Credit or certificate of renewal or extension to Landlord not later than thirty (30) days prior to the expiration date of the Letter of Credit then held by Landlord. Any renewal, amended or replacement Letter of Credit shall comply with all of the provisions of this Section 10, shall be irrevocable and transferable and shall remain in effect (or be automatically renewable) through the Final LC Expiration Date upon the same terms as the expiring Letter of Credit or such other terms as may be acceptable to Landlord in its reasonable discretion.

(b) Drawing under Letter of Credit. Subject to the provisions of Section 10(f) below, upon Tenant’s Default under this Lease or as otherwise may be agreed by Landlord and Tenant in writing, Landlord may, without prejudice to any other remedy provided in this Lease or by law, draw on the Letter of Credit and use all or part of the proceeds as set forth in Section 10(c) below. In addition, if Tenant fails to furnish a renewal or replacement Letter of Credit at least thirty (30) days prior to the stated expiration date of the Letter of Credit then held by Landlord, Landlord may draw upon such Letter of Credit and hold the proceeds thereof (and such proceeds need not be segregated) in accordance with the terms of this Section 10.

(c) Use of Proceeds by Landlord. Subject to the provisions of Section 10(f) below, the proceeds of the Letter of Credit shall constitute Landlord’s sole and separate property (and not Tenant’s property or the property of Tenant’s bankruptcy estate) and Landlord may immediately upon any draw permitted hereunder (and without notice to Tenant except as may be expressly provided in this Lease) apply or offset the proceeds of the Letter of Credit: (i) against

11

any Rent payable by Tenant under this Lease that is not paid when due following any applicable notice and cure periods; (ii) against all losses and damages that Landlord has suffered or that Landlord reasonably estimates that it may suffer as a result of Tenant’s failure to comply with one or more provisions of this Lease, including any damages arising under Section 1951.2 of the California Civil Code following termination of the Lease, to the extent permitted by this Lease; (iii) against any costs incurred by Landlord permitted to be reimbursed pursuant to this Lease (including reasonable attorneys’ fees); and (iv) against any other amount that Landlord may spend or become obligated to spend by reason of Tenant’s Default for which Landlord shall be entitled to seek reimbursement in accordance with this Lease. Provided Tenant has performed all of its obligations under this Lease, Landlord agrees to pay to Tenant by the Final LC Expiration Date the amount of any proceeds of the Letter of Credit received by Landlord as a result of previous draw(s) and not applied as allowed above; provided, that if prior to the Final LC Expiration Date a voluntary petition is filed by Tenant, or an involuntary petition is filed against Tenant by any of Tenant’s creditors, under the Federal Bankruptcy Code, then Landlord shall not be obligated to make such payment in the amount of the unused Letter of Credit proceeds until either all preference issues relating to payments under this Lease have been resolved in such bankruptcy or reorganization case or such bankruptcy or reorganization case has been dismissed, in each case pursuant to a final court order not subject to appeal or any stay pending appeal.

(d) Additional Covenants of Tenant.

(i) Replacement of Letter of Credit if Issuing Bank No Longer Satisfactory to Landlord. If, at any time during the Term, Landlord determines that (i) the Issuing Bank’s credit rating does not meet Landlord’s then-current standards for banks issuing letters of credit on behalf of Building tenants or (ii) the Issuing Bank is no longer considered to be well capitalized under the “Prompt Corrective Action” rules of the FDIC (as disclosed by the Issuing Bank’s Report of Condition and Income (commonly known as the “Call Report”) or otherwise) or (iii) the Issuing Bank has been placed into receivership by the FDIC, or (iv) the Issuing Bank has entered into any other form of regulatory or governmental receivership, conservatorship or other similar regulatory or governmental proceeding, or is otherwise declared insolvent or downgraded by the FDIC or closed for any reason, then, within ten (10) business days following Landlord’s notice to Tenant, Tenant shall deliver to Landlord a new letter of credit meeting the terms of this Section 10 issued by an Issuing Bank meeting Landlord’s credit rating standards and otherwise reasonably acceptable to Landlord, in which event, Landlord shall return to Tenant the previously held Letter of Credit. If Tenant fails to timely deliver such replacement Letter of Credit to Landlord, such failure shall be deemed a default hereunder without the necessity of additional notice or the passage of additional grace periods.

(ii) Replacement of Letter of Credit Upon Draw. If, as result of any application or use by Landlord of all or any part of the Letter of Credit, the amount of the Letter of Credit plus any cash proceeds previously drawn by Landlord and not applied pursuant to Section 10 (c) above shall be less than the Letter of Credit Amount, Tenant shall, within ten (10) days thereafter, provide Landlord with additional letter(s) of credit in an amount equal to the deficiency (or a replacement or amended letter of credit in the total Letter of Credit Amount), and any such additional (or replacement or amended) letter of credit shall comply with all of the

12

provisions of this Section 10; notwithstanding anything to the contrary contained in this Lease, if Tenant fails to timely comply with the foregoing, or to deliver the same shall constitute a default by Tenant without the necessity of additional notice or the passage of additional grace periods. Tenant further covenants and warrants that it will neither assign nor encumber the Letter of Credit or any part thereof and that neither Landlord nor its successors or assigns will be bound by any such assignment, encumbrance, attempted assignment or attempted encumbrance.

(e) Nature of Letter of Credit. Landlord and Tenant waive any and all rights, duties and obligations either party may now or, in the future, will have relating to or arising from any Law applicable to security deposits in the commercial context including Section 1950.7 of the California Civil Code (as such section now exists or as it may be hereafter amended or succeeded, “Security Deposit Laws”). Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code and all other provisions of Law, now or hereafter in effect, which (i) establish the time frame by which Landlord must refund a security deposit under a lease, and/or (ii) provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in Section 10(c) above and/or those sums reasonably necessary to compensate Landlord for any loss or damage caused by Tenant’s breach of this Lease or the acts or omission of Tenant, including any damages Landlord suffers following termination of this Lease, all to the extent Landlord is entitled to recover the same from Tenant pursuant to the terms of this Lease.

(f) Application of Letter of Credit Towards Termination Fee or Base Rent Amount.

(i) Application to Termination Fee. If Tenant exercises the Termination Option (described in Section 55(a) below), Landlord will draw upon the Letter of Credit to fund Tenant’s obligation to pay the Termination Fee (defined in Section 55(a) below). If Tenant does not exercise the Termination Option, the terms of Section 10(f)(ii) below will apply.

(ii) If Tenant Does Not Exercise Termination Option. If Tenant does not exercise the Termination Option and is not in Default hereunder, Landlord shall, within five (5) business days following delivery of Tenant’s request therefore, consent in writing to the amendment of the Letter of Credit to reduce the Letter of Credit Amount to $1,356,111.25, subject to further reduction pursuant to Section 10(g) below.

(g) Reduction. Notwithstanding any provision to the contrary in Section 10(a) above, at such time as the Reduction Condition (defined below) has been met, upon written request by Tenant, Landlord will allow the Letter of Credit Amount to be reduced from $1,356,111.25 to $678,755.00 (the “Reduced Letter of Credit Amount”). Such reduction in the Letter of Credit Amount may be accomplished at Tenant’s option, by either (i) an amendment to the then-existing Letter of Credit reducing the face amount thereof to the Reduced Letter of Credit Amount or (ii) Tenant’s delivery to Landlord of a replacement Letter of Credit in the Reduced Letter of Credit Amount, in which event Landlord shall return to Tenant the Letter of Credit then held by Landlord. As used herein, “Reduction Condition” shall mean that (x)

13

Tenant is not then in Default hereunder, (y) Tenant has not previously failed to timely cure any Default hereunder and (z) Tenant has positive EBITDA during the immediately preceding four (4) consecutive calendar quarters (the “Required Positive EBITDA”), as evidenced by Tenant’s financial statements, which Tenant will furnish to Landlord. Such financial statements of Tenant shall be deemed accepted by Landlord as evidencing the Required Positive EBITDA, unless Landlord objects thereto within ten (10) business days after receipt thereof from Tenant. In the event Landlord objects to Tenant’s financial statements within such ten (10) business day period and the parties are unable to resolve, within thirty (30) days thereafter, whether or not Tenant has the Required Positive EBITDA, Landlord and Tenant shall refer the matter to a mutually agreed independent certified public accountant whose determination on the matter shall be final and binding on the parties. The cost of such certified public accountant shall be borne equally by Landlord and Tenant. The term “EBIDTA” as used herein means earnings before interest, taxes, depreciation and amortization.

11. Use of Premises.

(a) Generally. Tenant may use and occupy the Premises for general office purposes of a type customary for first-class office buildings and for any other legally permitted uses consistent with the operation, maintenance and occupancy of the Building as a first-class office building (any non-office usage is subject to Landlord’s prior written consent) and for no other purpose. The Premises shall not be used for any illegal purpose, nor in violation of any valid regulation of any governmental body, nor in any manner to create any nuisance or trespass, nor in any manner which will void the insurance or increase the rate of insurance on the Premises or the Building or which will violate any recorded easements, covenants, conditions, restrictions, declarations and similar instruments now or hereafter affecting the Building, nor in any manner inconsistent with the first-class nature of the Building, nor in any manner that would cause the occupancy level of the Premises to exceed the standard density limit for the Building (i.e., five (5) persons per 1,000 rentable square feet); Landlord acknowledges that Tenant intends to occupy the Premises at a density of not more than approximately one (1) person per one hundred seventy-five (175) rentable square feet and agrees that, provided that such occupancy density is in compliance with applicable law, such occupancy density shall not be a breach of this Lease and that no additional payment or compensation shall become due and payable under this Lease solely by reason of such occupancy density; however, Tenant acknowledges that the Building’s HVAC system is not designed to service space occupied at such density and that if and to the extent additional HVAC service is required by Tenant in order to provide for the comfortable occupancy of the Premises due to such density, Tenant will bear the cost of providing such additional HVAC service. Except when and where Tenant’s right of access is specifically prevented as a result of (i) an emergency or casualty, (ii) a requirement of law, or (iii) a specific provision set forth in this Lease, Tenant shall have the right of ingress and egress to the Premises, the Building, and the parking areas twenty-four (24) hours per day, seven (7) days per week, subject to Landlord’s reasonable security procedures.

(b) Hazardous Materials.

(i) Tenant shall not cause or permit the receipt, storage, use, location or handling by Tenant, Tenant’s employees, agents, contractors, subtenants or assignees on the

14

Property (including the Building and Premises) of any product, material or merchandise which is explosive, highly inflammable, or a “Hazardous Material,” as that term is hereafter defined. Nothing contained in this Lease shall be construed to make Tenant responsible for any Hazardous Material received, stored, used, located or handled by Landlord or other third party not under the control of Tenant. “Hazardous Material” shall include all materials or substances which are listed in, regulated by or subject to any applicable federal, state or local laws, rules or regulations from time to time in effect, including, without limitation, hazardous waste (as defined in the Resource Conservation and Recovery Act); hazardous substances (as defined in the Comprehensive Emergency Response, Compensation and Liability Act, as amended by the Superfund Amendments and Reauthorization Act); gasoline or any other petroleum product or by-product or other hydrocarbon derivative; toxic substances (as defined by the Toxic Substances Control Act); insecticides, fungicides or rodenticide, (as defined in the Federal Insecticide, Fungicide, and Rodenticide Act); and asbestos, radon and substances determined to be hazardous under the Occupational Safety and Health Act or regulations promulgated thereunder. Notwithstanding the foregoing, Tenant shall not be in breach of this provision as a result of the presence in the Premises of minor amounts of Hazardous Materials which are in compliance with all applicable laws, ordinances and regulations and are customarily present in a general office use (e.g., copying machine chemicals and kitchen cleansers).

(ii) Without limiting in any way Tenant’s obligations under any other provision of this Lease, Tenant and its successors and assigns shall indemnify, protect, defend (with counsel approved by Landlord) and hold Landlord, its partners, officers, directors, shareholders, employees, agents, lenders, contractors and each of their respective successors and assigns (the “Indemnified Parties”) harmless from any and all claims, damages, liabilities, losses, costs and expenses of any nature whatsoever, known or unknown, contingent or otherwise (including, without limitation, attorneys’ fees, litigation, arbitration and administrative proceedings costs, expert and consultant fees and laboratory costs, as well as damages arising out of the diminution in the value of the Premises, the Property or any portion thereof, damages for the loss of the Premises or the Property or any portion thereof, damages arising from any adverse impact on the marketing of space in the Premises, and sums paid in settlement of claims), which arise during or after the Term in whole or in part as a result of the presence of any Hazardous Materials, in, on, under, from or about the Premises due to Tenant’s acts or omissions, except to the extent such claims, damages, liabilities, losses, costs and expenses caused by any of the Indemnified Parties. Landlord and its successors and assigns shall indemnify and hold Tenant and its successors and assigns harmless against all such claims or damages to the extent caused by Landlord, its partners, officers, directors, shareholders, employees, agents, lenders, contractors and each of their respective predecessors, successors or assigns. The indemnities contained herein shall survive the expiration or earlier termination of this Lease.

(c) Storage Space.

(i) Provided such space is available for lease from time to time during the Term, Tenant will have the option to lease from Landlord certain storage space located in the basement of the Building (the “Storage Space”) on a month-to-month basis until Tenant terminates the leasing of such Storage Space; provided that in no event will the term of Tenant’s leasing of any Storage Space extend beyond the expiration or sooner termination of this Lease,

15

such option to be exercised by written notice to Landlord (“Tenant’s Storage Exercise Notice”); promptly following delivery of Tenant’s Storage Exercise Notice, Landlord will notify Tenant of the location, size and configuration of any Storage Space which is then available.

(ii) Provided the Storage Space is available for lease following the date of Tenant’s Storage Exercise Notice, the Storage Space shall be delivered in its “as-is” condition and be used by Tenant for the storage of equipment, inventory or other non-perishable items normally used in Tenant’s business, and for no other purpose whatsoever. Tenant agrees to keep the Storage Space in a neat and orderly fashion and to keep all stored items in cartons, file cabinets or other suitable containers. All items stored in the Storage Space shall be elevated at least 6 inches above the floor on wooden pallets, and shall be at least 18 inches below the bottom of all sprinklers located in the ceiling of the Storage Space, if any. Tenant shall not store anything in the Storage Space which is unsafe or which otherwise may create a hazardous condition, or which may increase Landlord’s insurance rates, or cause a cancellation or modification of Landlord’s insurance coverage. Without limitation, Tenant shall not store any flammable, combustible or explosive fluid, chemical or substance nor any perishable food or beverage products, except with Landlord’s prior written approval. Landlord reserves the right to adopt and enforce reasonable rules and regulations not inconsistent with this Lease governing the use of the Storage Space from time to time. Upon expiration or earlier termination of Tenant’s rights to the Storage Space, Tenant shall completely vacate and surrender the Storage Space to Landlord in the condition in which it was delivered to Tenant, ordinary wear and tear excepted, broom-clean and empty of all personalty and other items placed therein by or on behalf of Tenant.

(iii) Tenant shall pay Rent for the Storage Space (“Storage Rent”) in the amount equal to $20.00 per rentable square foot per annum in equal monthly installments, plus applicable sale and use taxes, each payable in advance on or before the first day of each month. Any partial month shall be appropriately prorated. All Storage Rent shall be payable in the same manner that Base Rent is payable hereunder.

(iv) All terms and provisions of this Lease shall be applicable to the Storage Space, except that Landlord need not supply air-cooling, heat, water, janitorial service, cleaning, window washing or electricity to the Storage Space and Tenant shall not be entitled to any allowances, rent credits, or expansion rights with respect to the Storage Space unless such concessions or rights are specifically provided for herein with respect to the Storage Space. Landlord shall not be liable for any theft or damage to any items or materials stored in the Storage Space, it being understood that Tenant is using the Storage Space at its own risk. The Storage Space shall not be included in the determination of Tenant’s Share nor shall Tenant be required to pay Operating Expenses, Insurance Expenses or Property Taxes in connection with the Storage Space.

(v) At any time and from time to time, Landlord shall have the right to relocate the Storage Space to a new location which shall be no smaller than the square footage of the Storage Space. Landlord shall pay the direct, out-of-pocket, reasonable expenses of such relocation.

16

12. Compliance with Laws.

(a) By Tenant. Tenant, at its sole cost and expense, shall promptly comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity which are now in force or which may hereafter be enacted or promulgated, including, without limitation, the Americans with Disabilities Act of 1990, as amended (collectively, “Law(s)”), regarding the operation of Tenant’s business and the use, condition, configuration and occupancy of the Premises. In addition, Tenant, at its sole cost and expense, shall promptly comply with any Laws that relate to the “Base Building” (defined below) and/or any areas of the Building or the Property outside the Premises, but only to the extent such obligations are triggered by Tenant’s particular use of the Premises (as opposed to office use in general), by Alterations or improvements in the Premises performed or requested by Tenant, or by Tenant’s occupancy of the Premises in excess of the standard density limit for the Building. “Base Building” shall include the structural portions of the Building, the public restrooms (it being acknowledged that restrooms on any full floor comprising the Premises are not “public” restrooms) and the Building mechanical, electrical, life-safety and plumbing systems and equipment located in the internal core of the Building. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law. Tenant, at Tenant’s expense, may contest by appropriate proceedings in good faith the legality or applicability of any Law affecting the Premises, provided that (i) the Property or any part thereof (including the Premises) shall not be subject to being condemned or vacated by reason of non-compliance or otherwise by reason of such contest, (ii) no unsafe or hazardous condition remains unremedied as a result of such contest, (iii) such non-compliance or contest is not prohibited under any Security Documents (defined in Section 40) and Tenant posts any security required under such Security Documents in connection with such contest (or the non-compliance that is the subject thereof), (iv) such non compliance or contest shall not prevent Landlord from obtaining any and all permits and licenses then required by applicable Laws in connection with the operation of the Building, and (v) the Certificate of Occupancy for the Building (or any portion) is neither subject to being suspended by reason such of non-compliance or contest (any such proceedings instituted by Tenant being referred to herein as a “Compliance Challenge”). If Landlord may be subject to any civil fines or penalties or other criminal penalties or may be liable to any third party by reason of the Compliance Challenge, then Tenant shall furnish to Landlord, at Tenant’s option, either (x) a bond of a surety company that is issued by, and in form and substance, reasonably satisfactory to Landlord, or (y) such other security that is reasonably satisfactory to Landlord, and, in either case, in an amount equal to one hundred twenty percent (120%) of the sum of (A) the cost of such compliance, (B) the criminal or civil penalties or fines that may accrue by reason of such non-compliance (as reasonably estimated by Landlord), and (C) the amount of such liability to third parties (as reasonably estimated by Landlord). If Tenant initiates any Compliance Challenge, then Tenant shall keep Landlord advised regularly as to the status of such proceedings. Landlord shall have the right to use the aforesaid bond or other security to satisfy any such fines or penalties that are levied or assessed against Landlord as a result of the Compliance Challenge; Landlord’s obligation to so return such bond or other security shall survive the expiration or sooner termination of this Lease. Landlord shall return to Tenant the aforesaid bond or other security (or the unapplied portion thereof, as the case may be), promptly after Tenant completes the Compliance Challenge. If Tenant institutes a Compliance Challenge which concludes on or after the date of expiration or termination of this Lease, Tenant’s

17

obligations hereunder with respect to the compliance in question will survive the expiration or sooner termination of this Lease to the extent that the result of any Compliance Challenge is that Tenant is required to perform any compliance work.

(b) By Landlord. Landlord represents to Tenant that, as of the Effective Date, Landlord has not received written notice from any governmental authority of any currently existing condition in the Premises or Base Building which has been interpreted as a material violation of Laws for which Landlord’s compliance is currently required. Landlord shall comply with all Laws relating to the Base Building (exclusive of any Base Building systems that were constructed by or for the benefit of Tenant) and the Common Areas, provided that such compliance with Laws is not the responsibility of Tenant under this Lease. Landlord’s obligation hereunder shall include the obligation to perform, at Landlord’s sole cost and expense and not as an Operating Expense, any work necessary to bring the restrooms located on the sixth (6th) floor of the Building, into compliance with Law as applicable to the restrooms as of the date of Landlord’s delivery of the Premises to Tenant, and to perform any “path of travel” work applicable to the Premises as of the date of Landlord’s delivery of the Premises to Tenant (the “ADA Work”). Notwithstanding the foregoing, except with respect to the ADA Work, Landlord shall have the right to contest in good faith any alleged violation of Law, including, without limitation, the right to apply for and obtain a waiver or deferment of compliance, the right to assert any and all defenses allowed by Law and the right to appeal any decisions, judgments or rulings to the fullest extent permitted by Law. Landlord shall be permitted to include in Operating Expenses any costs or expenses incurred by Landlord under this Section 12 (other than in connection with the ADA Work) to the extent consistent with the terms of Section 7(b) above.

13. Waste Disposal. All normal trash and waste (i.e., waste that does not require special handling pursuant to the provisions of this Section 13 set forth below), including, without limitation, recycling, trash and composted materials, shall be placed in appropriate receptacles in the Premises in conformance with the guidelines of the local waste disposal plan then in effect and the rules and regulations issued by Landlord and shall be disposed of through the janitorial service. Tenant shall be responsible for the removal and disposal of any waste deemed by any governmental authority having jurisdiction over the matter to be hazardous or infectious waste or waste requiring special handling, such removal and disposal to be in accordance with any and all applicable governmental rules, regulations, codes, orders or requirements. Tenant agrees to separate and mark appropriately all waste to be removed and disposed of through the janitorial service pursuant to the first sentence of this Section 13, and hazardous, infectious or special waste to be removed and disposed of by Tenant pursuant to the immediately preceding sentence.

14. Rules and Regulations. The current rules and regulations of the Building (the “Rules and Regulations”), a copy of which is attached hereto as Exhibit D, and all reasonable rules and regulations and modifications thereto not inconsistent with the terms of this Lease which Landlord may hereafter from time to time adopt and promulgate after notice thereof to Tenant are hereby made a part of this Lease and shall be observed and performed by Tenant, its agents, employees and invitees.

18

15. Services.

(a) Generally. The normal business hours of the Building (“Building Service Hours”) shall be from 7:00 A. M. to 6:00 P.M. on Monday through Friday, exclusive of Building holidays as reasonably designated by Landlord in Landlord’s sole discretion (“Building Holidays”). Initially and until further notice by Landlord to Tenant, the Building Holidays shall be: New Year’s Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day. Landlord shall furnish the following services during the Building Service Hours except as noted:

(i) Passenger elevator service at all times;

(ii) Heating, ventilation and air conditioning (“HVAC”) reasonably adequate to allow for the comfortable occupancy of the Premises and commensurate with the service provided at Comparable Buildings, subject to governmental regulations, so long as the occupancy level of the Premises and the heat generated by electrical lighting and fixtures do not exceed the following thresholds:

| (A) | Occupant Load: The maximum occupancy load permitted by the San Francisco Department of Building Inspection with respect to the Premises; |

| (B) | Equipment & Lighting Load: 5.0 watts per usable square foot, including overhead lighting. |

(iii) Water at all times for all restrooms and lavatories;

(iv) Janitorial service Monday through Friday (exclusive of Building Holidays), commensurate with the service provided at Comparable Buildings;

(v) Electric power at all times except during required maintenance or repair or unless due to casualty or a Force Majeure Event (defined in Section 19 below) for lighting and outlets not in excess of the total watts per usable square foot of the Premises described in clause 15(a)(ii) above at 100% connected load (Tenant shall pay for any electrical service in excess of such amount); and

(vi) Replacement of Building standard lamps and ballasts as needed from time to time.

(b) Extra Services. Except as expressly set forth herein, Tenant shall have no right to any services in excess of those provided herein:

(i) Tenant shall have the right to receive HVAC service during hours other than Building Service Hours by paying Landlord’s then standard charge for additional HVAC service and providing such prior notice as is reasonably specified by Landlord (as of the Effective Date, Landlord’s charge for after hours HVAC is $189.00 per hour plus the cost of

19

engineering (currently $75.00 per hour)). The foregoing charges are subject to change from time to time to the extent necessary to meet changes in Landlord’s cost of providing such service. Any such increased charge shall be based upon the actual cost of electricity consumed by the Building’s HVAC equipment and Landlord’s reasonable, good faith estimate of the cost of increased maintenance and wear and tear on the Building’s HVAC equipment plus such after-hours usage, and labor costs, if any, related to the provision of such after-hours HVAC service.

(ii) if Tenant is permitted to connect any supplemental HVAC units to the Building’s condenser water loop, such permission shall be conditioned upon Landlord having adequate excess capacity from time to time and such connection and use shall be subject to Landlord’s reasonable approval and reasonable restrictions imposed by Landlord, and Landlord shall have the right to charge Tenant a connection fee and/or a monthly usage fee, as reasonably determined by Landlord;

(iii) Landlord shall have the right to measure Tenant’s electrical usage by commonly accepted methods, including the installation of measuring devices such as submeters and check meters. If it is determined that Tenant is using electricity in such quantities or during such periods as to cause the total cost of Tenant’s electrical usage, on a monthly, per rentable square foot basis, to exceed that which Landlord reasonably deems to be standard for the Building, Tenant shall pay Landlord as additional Rent the estimated cost of such excess electrical usage and, if applicable, for the cost of purchasing, installing and maintaining the measuring device(s);

(iv) If Tenant installs or operates a server room or supplemental HVAC units or other forms of high-consumption equipment or areas, Landlord will have the right to install, at Tenant’s sole cost and expense, a separate electrical meter to measure Tenant’s electrical consumption in such areas or from such equipment and to require that Tenant pay Landlord directly for the electricity consumed in such areas or by such equipment, on a monthly basis, within ten (10) days after the delivery and an invoice from Landlord at the rates charged to Landlord by the electric company, without markup.