Attached files

1

Cowen and Company

Health Care Conference

March 10, 2010

NYSE Amex: PTX

EXHIBIT 99.1

2

The following presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. You should be aware that our actual results could differ materially

from those contained in the forward looking statements, which are based on management’s current expectations and

are subject to a number of risks and uncertainties, including, but not limited to, our failure to successfully commercialize

our product candidates; costs and delays in the development and/or FDA approval of our product candidates, including

as a result of the need to conduct additional studies, or the failure to obtain such approval of our product candidates,

including as a result of changes in regulatory standards or the regulatory environment with any of our product

candidates; our inability to maintain or enter into, and the risks resulting from our dependence upon, collaboration or

contractual arrangements necessary for the development, manufacture, commercialization, marketing, sales and

distribution of any products, including our inability to protect our patents or proprietary rights and obtain necessary rights

to third party patents and intellectual property to operate our business; our inability to operate our business without

infringing the patents and proprietary rights of others; general economic conditions; the failure of any products to gain

market acceptance; our inability to obtain any additional required financing; technological changes; government

regulation; changes in industry practice; and one-time events. More detailed information about the Company and the

risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the

Securities and Exchange Commission. Such documents may be read free of charge on the SEC’s web site at

www.sec.gov. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as

of the date hereof.

the Private Securities Litigation Reform Act of 1995. You should be aware that our actual results could differ materially

from those contained in the forward looking statements, which are based on management’s current expectations and

are subject to a number of risks and uncertainties, including, but not limited to, our failure to successfully commercialize

our product candidates; costs and delays in the development and/or FDA approval of our product candidates, including

as a result of the need to conduct additional studies, or the failure to obtain such approval of our product candidates,

including as a result of changes in regulatory standards or the regulatory environment with any of our product

candidates; our inability to maintain or enter into, and the risks resulting from our dependence upon, collaboration or

contractual arrangements necessary for the development, manufacture, commercialization, marketing, sales and

distribution of any products, including our inability to protect our patents or proprietary rights and obtain necessary rights

to third party patents and intellectual property to operate our business; our inability to operate our business without

infringing the patents and proprietary rights of others; general economic conditions; the failure of any products to gain

market acceptance; our inability to obtain any additional required financing; technological changes; government

regulation; changes in industry practice; and one-time events. More detailed information about the Company and the

risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the

Securities and Exchange Commission. Such documents may be read free of charge on the SEC’s web site at

www.sec.gov. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as

of the date hereof.

Note: All product sales data included herein are derived from data published by Wolters Kluwer Health for the 12

months ended December 2009.

months ended December 2009.

Trademarks referenced herein are the property of their respective owners. ©2010 Pernix Therapeutics, Inc.

Safe Harbor Statement

3

A Specialty Pharmaceutical Company Focused on Serving the

Pediatric Marketplace with Commercially-Proven Branded Products

• Pernix is defined as swift, nimble, and agile in Latin

• Sudden Change

– This allows Pernix to take advantage of opportunities that other companies

cannot

cannot

• Many Members of our Senior Management and Field Sales

Representatives are Former Collegiate Athletes

Representatives are Former Collegiate Athletes

– Hate to lose

– Understand how to come back from a loss

– Athletes that excel understand working when you are not asked to, which

separates you from the pack

separates you from the pack

– Only get rewarded for winning

– Get cut when they don’t perform

Pernix Philosophy

4

4

The executive management has experience with Pernix Therapeutics,

Pfizer, Biovail, Cornerstone Therapeutics, DJ Pharma, Amneal

Pharmaceuticals, and Sepracor.

Leaders that have helped build and enjoy building companies.

Cooper Collins, Chief Executive Officer

Tracy Clifford, Chief Financial Officer

Mike Venters, Executive VP - Operations

Dave Waguespack, VP - Internal Operations

Beth DeVille, VP - Communications & Training

Robert Cline , VP - Supply Chain Management

Shawn Doll, Director - U.S. Sales East

Brandon Belanger, Director - U.S. Sales West

Pernix Management

5

5

We are in a great position to take advantage of new business

opportunities.

opportunities.

Ø Debt-Free Balance Sheet

Ø Self-Financing to date and Strong Cash Position

Product candidates are evaluated against numerous criteria.

Ø High Gross Margins

Ø Low Product Development Risk

Pernix Today

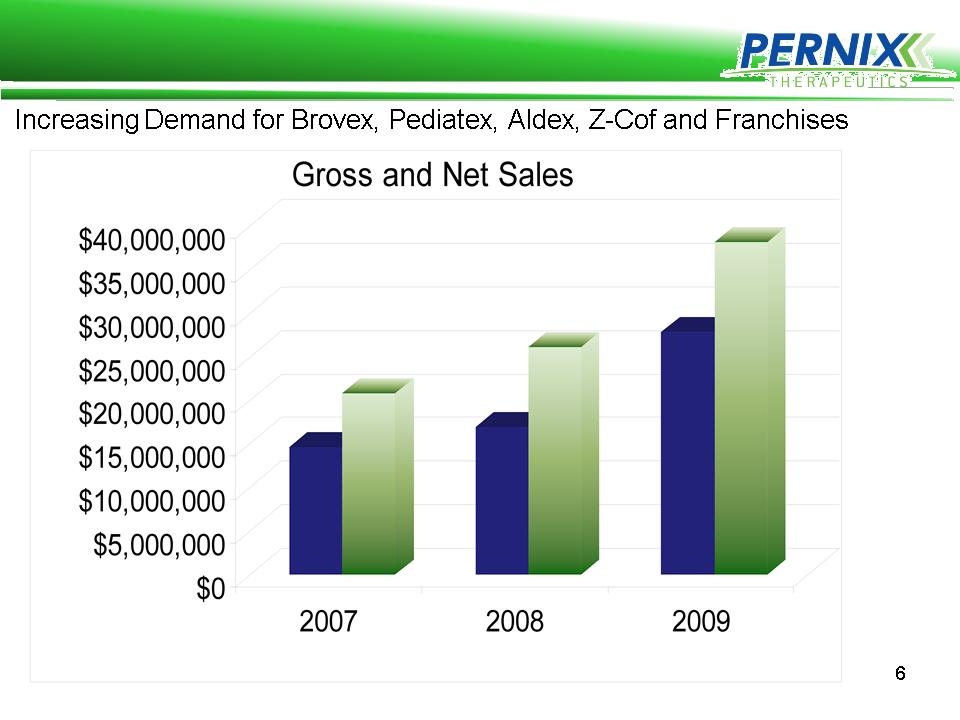

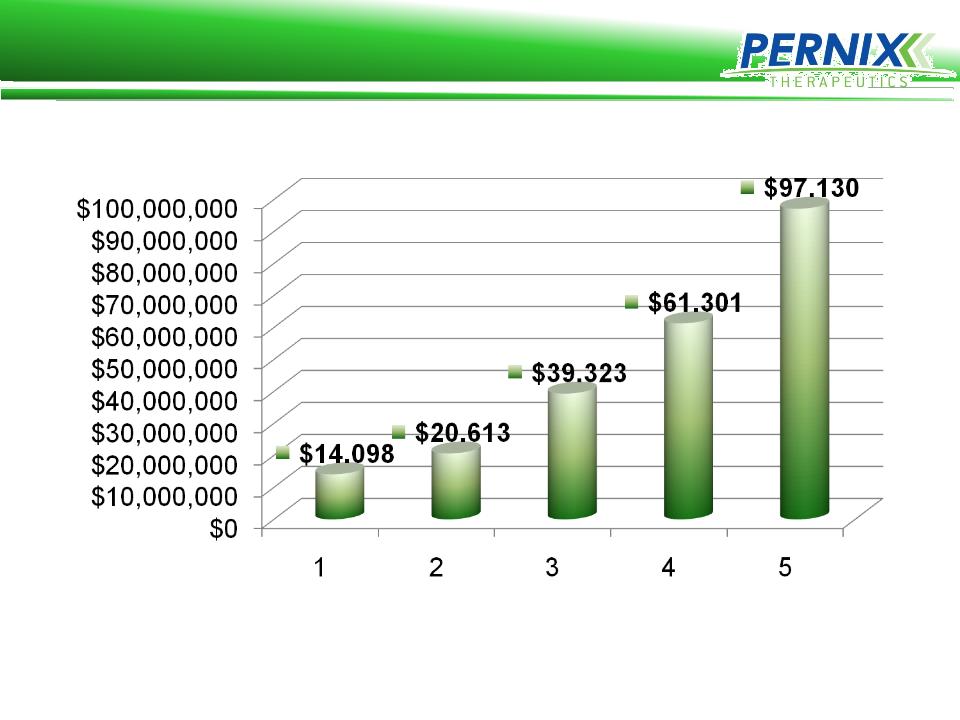

Pernix Revenue Growth

7

Pernix Revenue is Profitable

8

Solid Organic Growth supplemented by

Acquisitions/In-Licensings/Co-Promotions

Acquisitions/In-Licensings/Co-Promotions

• With emphasis on promotion sensitive products for

the pediatric market to leverage cost of sales force.

All acquisitions are targeted to be accretive to

earnings

the pediatric market to leverage cost of sales force.

All acquisitions are targeted to be accretive to

earnings

The Pernix Model

9

• Cold/Cough Sector-Annual Sales in

Excess of $2 Billion with 75MM

Prescriptions Annually

Excess of $2 Billion with 75MM

Prescriptions Annually

• Currently Very Limited Brand

Competition in Prescription Sector

of Anti-Infective & Cold/Cough

Markets

Competition in Prescription Sector

of Anti-Infective & Cold/Cough

Markets

• Competitors include: Cornerstone,

Hawthorn, Lupin, Meda, & GSK.

Hawthorn, Lupin, Meda, & GSK.

• Prescription Medical Foods are a

high growth market

high growth market

|

Products

|

Active Categories

|

|

Aldex Family

|

Cold/Cough

|

|

Brovex Family

|

Cold/Cough

|

|

Cedax

|

Antibiotic

|

|

Hylatopic

|

Dermatology

|

|

Pediatex Family

|

Cold/Cough

|

|

QuinZyme*

|

Cardiovascular

|

|

ReZyst IM

|

Gastro-Probiotic

|

|

TussiNAC*

|

Cold/Cough

|

|

Z-Cof Family

|

Cold/Cough

|

* Partnering Opportunities

Product Portfolio

10

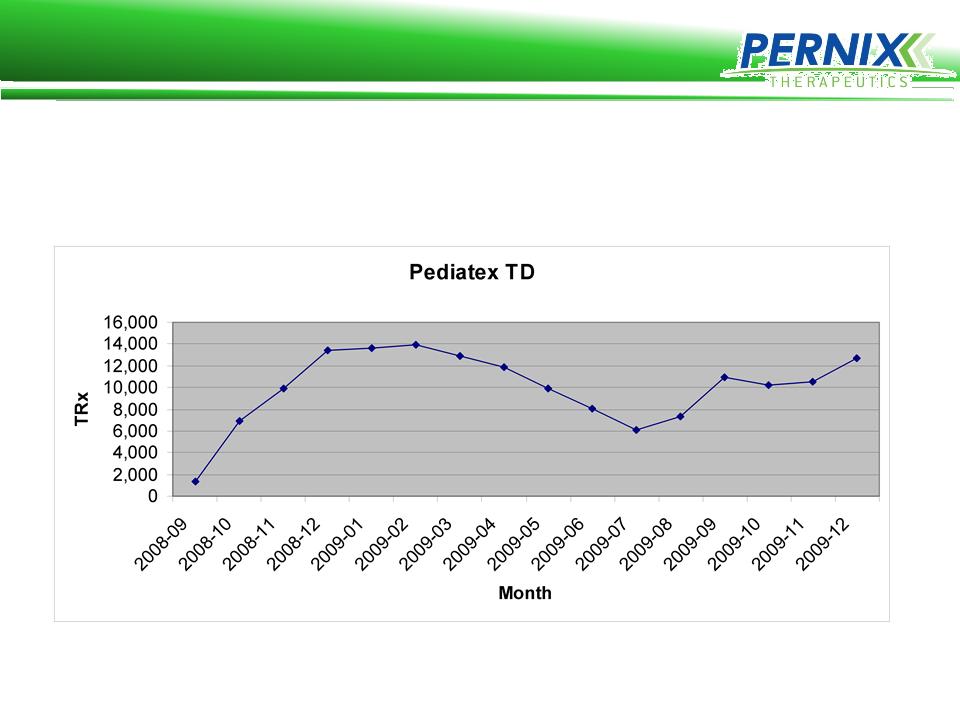

Pediatex TD Launch

Pernix’s sales force averaged almost 560 RX’s per rep for the

Pediatex TD product in the 4th month of the launch

Pediatex TD product in the 4th month of the launch

11

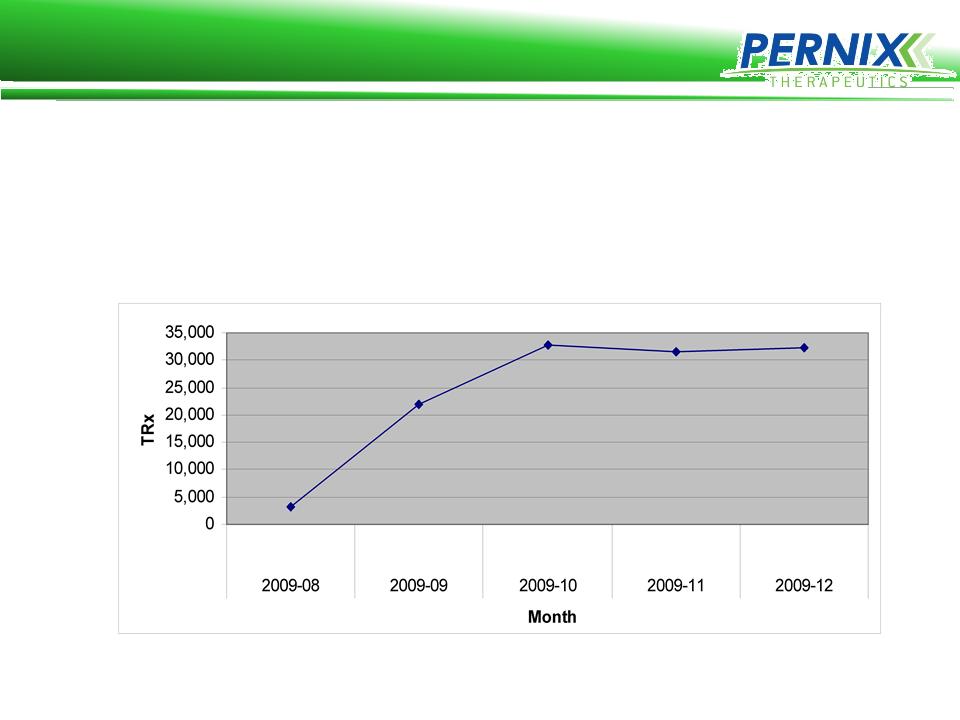

Brovex Acquisition

• Pernix acquired the Brovex product line for $450,000 in June 2009

and Launched in August 2009

and Launched in August 2009

• Pernix’s sales force achieved approximately $7,000,000 in sales

and averaged over 1600 Rx’s per Rep for this time period

and averaged over 1600 Rx’s per Rep for this time period

12

CEDAX© (ceftibuten)

• Third-generation cephalosporin indicated for Upper and Lower

Respiratory tract infections

Respiratory tract infections

• Launched by Schering-Plough with first year sales of approximately

$75,000,000

$75,000,000

• Acquired U.S Rights from Shionogi in 2010

• Patent Protection(Orange Book)

• Suspension expires in 2014

• Capsule - expires in 2013

• 2009 net sales: ~$6.0 Million

Cedax Acquisition

13

Cedax Opportunity

CEDAX© (ceftibuten)

• 2011 Cedax will likely be the only 3rd generation

patented cephalosporin promoted in pediatrics

patented cephalosporin promoted in pediatrics

• Antibiotics are promotion sensitive and highly

prescribed in pediatrics

prescribed in pediatrics

• Sales force expansion will be aligned to Cedax

Targets

Targets

• Life cycle management

•New strength of the Suspension (TBD)

14

Relaunched Branded Cephalosporin

Five Year Growth

15

• Exclusive Patented Natural Cough

Suppressant

Suppressant

• As efficacious as Codeine without the side

effects

effects

• US cough suppressant market is

approximately $2 Billion

approximately $2 Billion

• Plan to partner the development, which will

reduce our risk and is consistent with the

Pernix business model

reduce our risk and is consistent with the

Pernix business model

Product Development

16

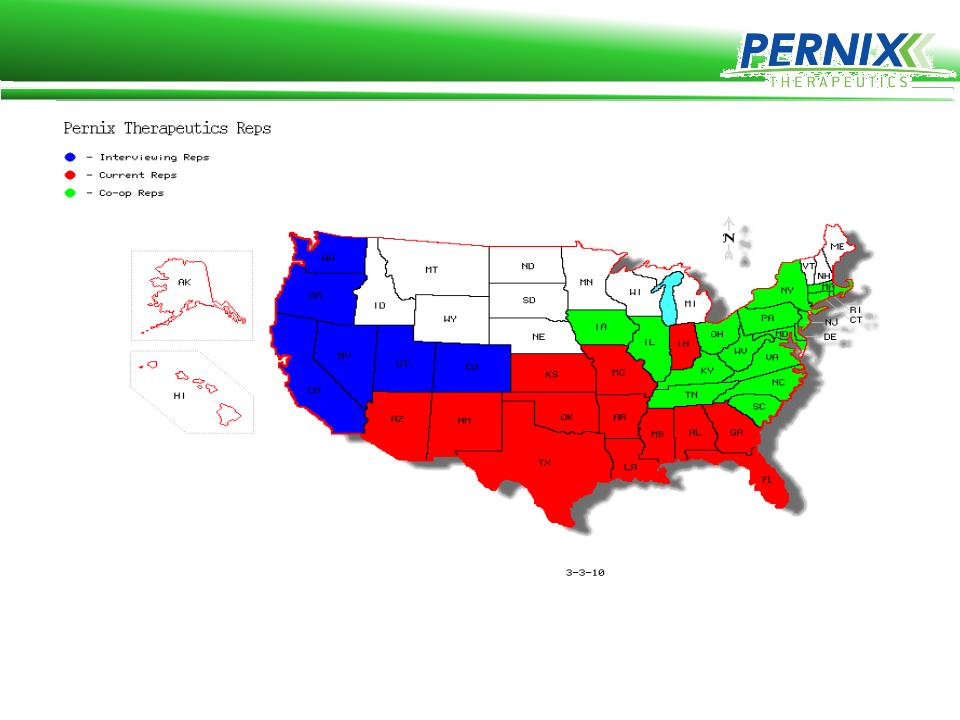

2009 Total Employees: 49

2009 Sales Representatives: 35

2010 Q2 Recruiting Class:10-12

2010 Q3 Recruiting Class: 10-12

Current/Future Sales Force

17

17

Ø Execution-Oriented Business Model

Ø Highly Productive, Competitive Sales Force

Ø Minimal Product Development Risk

Ø Outsourced Contract Manufacturing & Logistics

Ø Industry Time-To-Market Launch Leader

Ø Lean Corporate Expense Infrastructure

Ø We are not “Waiting to Hear”

Investment Highlights

Cash Generation Focus:

2009 Pre-Tax Income: $9.2 million

Low Cap Ex, High Gross Margin

Model

Model

Debt-Free Balance Sheet

Self-Financing and a Strong Cash

Position

Position

Selected Data:

Symbol: PTX

Exchange: NYSE Amex

Recent Price: $4.00

52 Week Range: $5.74- $1.82

Market Cap: $99,754,328

Shares Outstanding: 24,938,582

Employees:45

Founded:1999

CAGR 32.3% - Total Sales (6 years)

CAGR 40.2% - Pre-Tax Income (6 years)

18

Corporate Snapshot

Cooper Collins, CEO

Pernix Therapeutics, Inc.

33219 Forest West Drive

Magnolia, TX 77354

Tel: (800) 793-2145

Email: tclifford@pernixtx.com

Internet: www.pernixtx.com

NYSE Amex: PTX

19

Corporate Information