Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 000-50947

COGENT, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4305768 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

639 North Rosemead Blvd.

Pasadena, California 91107

(Address of principal executive offices)

Registrant’s telephone number, including area code: (626) 325-9600

Securities registered pursuant to Section 12(b) of the Act: Common Stock

(Title of Class)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation of S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer þ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price of the registrant’s common stock on June 30, 2009 (the last trading day in the second calendar quarter of 2009) as reported on the NASDAQ Global Select Market was $501,079,830.*

As of February 24, 2010, there were 89,553,152 shares of the registrant’s Common Stock outstanding.

| * | Excludes shares of Common Stock held by executive officers, directors and stockholders whose ownership exceeds 5% of the shares outstanding at June 30, 2009. This calculation does not reflect a determination that such persons are affiliates for any other purposes. |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2010 Annual Meeting of Stockholders (the “Proxy Statement”) or portions of the registrant’s 10-K/A, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this Report. Such Proxy Statement or 10-K/A will be filed with the Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2009.

Table of Contents

Form 10-K

For the Fiscal Year Ended December 31, 2009

Table of Contents

| 1 | ||||

| Item 1. |

1 | |||

| Item 1A. |

16 | |||

| Item 1B. |

27 | |||

| Item 2. |

27 | |||

| Item 3. |

27 | |||

| Item 4. |

27 | |||

| 28 | ||||

| Item 5. |

28 | |||

| Item 6. |

31 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

32 | ||

| Item 7A. |

48 | |||

| Item 8. |

49 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

49 | ||

| Item 9A. |

49 | |||

| Item 9B. |

51 | |||

| 52 | ||||

| Item 10. |

52 | |||

| Item 11. |

52 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

52 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

52 | ||

| Item 14. |

52 | |||

| 53 | ||||

| Item 15. |

53 | |||

TRADEMARKS

We have registered U.S. trademarks for Cogent, Cogent Systems, BlueCheck, Live-ID, Fusion and PMA. Each trademark, trade name or service mark of another company appearing in this Annual Report on Form 10-K belongs to its holder, and does not belong to us.

Table of Contents

This Annual Report (including the following section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters such as the development of new products, sales levels, expense levels and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

We were incorporated in California in April 1990 and reincorporated in Delaware in May 2004.

Overview

We are a leading provider of Automated Fingerprint Identification Systems, or AFIS, and other fingerprint biometrics solutions to governments, law enforcement agencies and other organizations worldwide. Our AFIS solutions enable customers to capture fingerprint images electronically, encode fingerprints into searchable files and accurately compare a set of fingerprints to a database of potentially millions of fingerprints in seconds. For nearly twenty years, we have researched, designed and developed fingerprint biometric technologies that incorporate advanced concepts in fluid dynamics, neural networks, image enhancement, data mining and massively parallel processing. Our proprietary software algorithms, together with optimized hardware, enable our customers to cost-effectively achieve what we believe to be industry-leading accuracy rates and performance. We support the latest standards in fingerprint biometrics and have based our systems on cost-effective, industry-standard hardware and software platforms. We are focused on enabling our customers to expand the capabilities of their systems as their biometrics needs evolve.

Industry Background

Authentication and Identification of Individuals Plays an Important Role in Society

Effectively authenticating and identifying individuals is critical to the safety and integrity of transactions, communications, travel and life in today’s society. Security breaches and frauds resulting from failures in authentication and identification systems can cause economic harm and loss of life. As a result of growing public awareness of security and economic risks, people are becoming increasingly willing to submit to security checks and other identity verification procedures. Authentication of an individual’s identity is necessary when governments, law enforcement agencies and other organizations need to confirm that an individual is who he claims to be. This necessity arises, for example, when a traveler enters a foreign country, a citizen votes, a

1

Table of Contents

suspect is arrested, an individual withdraws money from an ATM, a consumer purchases an item on the Internet or an employee seeks access to a restricted area. To authenticate the individual’s claimed identity in these types of scenarios, organizations traditionally implement processes to examine the individual’s credentials, such as signatures, drivers’ licenses, passports, access cards, PINs or passwords. If the authentication process indicates that the credentials are invalid or if there are no credentials to examine, such as when an unknown person leaves evidence of fingerprints, known as latents, at a crime scene, organizations frequently initiate an identification process to determine the individual’s identity.

Traditional Authentication and Identification Processes are Inadequate

Traditional processes for authenticating and identifying individuals have inherent weaknesses. Criminals and imposters can easily compromise these processes by falsifying credentials by forging a signature, altering a photograph on a driver’s license or passport or stealing a physical access card. Imposters can use the compromised credentials to gain unauthorized access to physical locations, such as buildings and airplanes, and to confidential information, such as medical data and financial records, and cause significant harm. Traditional authentication and identification methodologies can also be cumbersome and inefficient to use. Individuals are required to remember several passwords and PINs for the multitude of access, credit and membership cards they carry. The costs incurred by organizations to administer these traditional processes can be significant.

Evolution of Biometric Authentication and Identification Processes

The inadequacies of traditional authentication and identification processes, coupled with more stringent security requirements and an increasingly global economy and mobile population, have in recent years contributed to the increased focus on the development of biometrics. Biometrics is the automated use of unique physiological characteristics of individuals, such as fingerprints, palm prints, faces or irises, to determine or verify an individual’s identity. The individual’s biometric characteristic is captured and encoded and then compared against previously encoded biometric data stored in an electronic database to determine or verify the individual’s identity. Because biometrics technology utilizes an unchanging, unique characteristic of a person that cannot be lost, stolen, shared or forgotten, it has the capability to be more accurate, convenient and cost-effective than traditional methodologies.

Fingerprints have been, and we believe will continue to be, the most widely used biometric because they are relatively simple to capture, either voluntarily or from latents at crime scenes, are relatively non-intrusive and benefit from a substantial existing infrastructure that employs fingerprints for identification. Governments and law enforcement agencies around the world have already created vast databases of fingerprints and the American National Standard Institute and the National Institute of Standards and Technology have standardized a common format, called ANSI/NIST, which is used to describe, classify and share fingerprints. According to the FBI, its criminal database alone contains the fingerprints of more than 60 million individuals. In addition, the United States Department of Homeland Security database contained the fingerprints of over 110 million individuals at the end of 2009. Other organizations throughout the world, including foreign governments and law enforcement agencies, other U.S. government agencies such as the Department of State, and the approximately 15,000 state and local law enforcement agencies in the United States, also have established large fingerprint databases, and these databases are continuing to grow.

Automated Fingerprint Identification Systems

The most pervasive, large-scale fingerprint biometrics technology implementations today are AFIS. AFIS are typically used to compare one person’s fingerprints against a large database of fingerprints. This is known as one-to-many matching. The technology for AFIS was originally developed by the FBI and Scotland Yard to facilitate criminal investigations, and AFIS have achieved widespread acceptance within national, state and local law enforcement agencies globally. AFIS are comprised of fingerprint input scanning devices and software and computers that encode, process and store electronic versions of fingerprints. Originally, the fingerprint input

2

Table of Contents

devices were scanners that uploaded rolled fingerprint images obtained by rolling all ten inked fingers, known as tenprints, from nail to nail on cards or from latents obtained at crime scenes. Today, electronic fingerprint scanners, known as live-scans, are also available to directly capture flat fingerprint images by pressing the finger onto an input device and submitting the fingerprints to an AFIS. After the fingerprints of the subject are captured, the AFIS encodes the unique features associated with fingerprint ridge endings or bifurcations, known as minutiae, into a data set that is submitted for matching. Most commonly, existing fingerprint biometric systems classify, or bin, the stored fingerprints using basic criteria such as loops and whorls. Using this approach, the search program disregards those portions of the database that are inconsistent with the classification of the subject’s fingerprints and only searches the relevant portions of the database.

AFIS deployments range widely in size, cost and complexity. In a local law enforcement deployment, the AFIS may be entirely contained within a single facility, with one or more fingerprint input devices attached to local computers, networked to a low-cost, small scale system capable of searching up to tens of thousands of records. As AFIS grow larger, they may consist of hundreds of fingerprint acquisition stations throughout a state or country and employ dedicated networks for transmission of biometric data and dozens of dedicated computers.

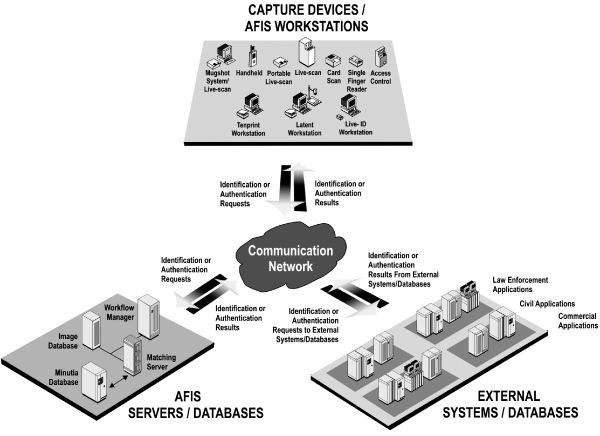

The diagram below represents a typical, full scale AFIS architecture:

Growth Expected in the AFIS Market

The widespread deployment of AFIS and the development of biometric technologies to support the AFIS market have been among the biggest contributors to the growth of the biometrics industry. This growth is being driven by the increase in the worldwide demand for elevated security measures and a general increase in willingness for people to submit to security checks and other identity verification procedures. In response to this

3

Table of Contents

demand, the United States has increased spending on security measures. Governments worldwide are establishing agencies and departments focused on security, such as the formation of the Department of Homeland Security, or DHS, which integrated numerous existing agencies and formed a single department with the mission of protecting the United States against terrorism. Governments have also announced initiatives mandating heightened security measures and recommending or requiring the use of biometrics technology as part of the overall security solution. As a result, government agencies have indicated that they will make investments in information technology, including biometrics, to fulfill their missions.

The AFIS market is also poised for growth in its core law enforcement sector. Many of the approximately 15,000 state and local law enforcement agencies in the United States utilize AFIS solutions. Many of these law enforcement agencies are upgrading their AFIS based on the development of technology that enables new AFIS capabilities, such as 1,000 pixels per inch (ppi) resolution instead of the conventional 500 ppi resolution for better image quality. Many law enforcement agencies are also seeking to make their AFIS web-enabled and to enable their AFIS to search fingerprints using both flat and rolled methods and to search palm prints. We believe law enforcement agencies not currently using AFIS solutions are also likely to deploy such solutions to achieve faster response times and increased accuracy than they are achieving through existing methods.

Growth Expected in the Market for Other Fingerprint Biometrics Products and Solutions

In addition to AFIS, the market for other fingerprint biometrics solutions is expected to increase. Advances in AFIS technology and widespread deployment of AFIS are resulting in both increased public awareness and acceptance of biometrics solutions and the establishment of an infrastructure that we believe will expedite the adoption of other fingerprint biometrics solutions. As a result of the advances necessitated by the development of the AFIS market, fingerprint biometrics solutions have become much more sophisticated and capable of application in a number of other environments. Several initiatives requiring increased spending on other fingerprint biometrics solutions have already begun. For example, numerous foreign jurisdictions around the world have begun to establish national identification card programs, which will require the issuance of smart ID cards with embedded fingerprint information for each citizen. Foreign jurisdictions such as Hong Kong, Italy, Morocco, the United Kingdom and Thailand have implemented or are in the process of implementing national identification programs.

Governments, Law Enforcement Agencies and Other Organizations Face Challenges in Implementing Successful Fingerprint Biometrics Solutions

To satisfy the evolving needs of the market for other fingerprint biometrics solutions, vendors must deliver systems that achieve increasingly high levels of both accuracy and performance in a cost-effective and scalable manner. Many existing solutions are challenged in their ability to meet these needs because they are limited by the following problems:

| • | Inaccuracy. Accuracy rates of AFIS solutions are measured in two ways: detection failure rates and false positive rates. Detection failures occur when an AFIS fails to match a submitted fingerprint against a matching fingerprint in the database. A false positive occurs when a fingerprint is incorrectly matched to a fingerprint in the database. Many AFIS solutions have a relatively high detection failure rate, particularly when tenprints are not available, due to the use of binning and a limited ability to use fingerprints with poor image quality. Classification binning relies heavily on data supplied by a full tenprint, and errors made in the binning process can also cause detection failures. Classification errors are particularly problematic for systems that attempt to search flat fingerprints because they are frequently binned differently from rolled fingerprints, even when the prints belong to the same person. Because the quality of fingerprint images stored as minutiae datasets in databases is highly variable, existing AFIS have difficulty matching against poorer quality images. This makes it difficult for existing systems to effectively match against digitized versions of older fingerprint cards, poorer quality latents taken at crime scenes and fingerprints that were improperly taken at law enforcement or government agencies. |

4

Table of Contents

| • | Performance Constraints. To address heightened security requirements, organizations are beginning to perform biometric authentication checks in areas of high traffic, such as airports, embassies or state/country borders, where it is more challenging to capture full tenprints. In these environments, fast capture and response times are required. Moreover, many AFIS use binning to try to expedite response times, but AFIS that use binning are ineffective at delivering accurate search results in a timely manner when the subject submits less than a full tenprint, as binning under such circumstances eliminates much less of the database and necessitates a broader and more time-consuming search. |

| • | High Costs and Lack of Linear Scalability and Flexibility. In addition, integration of these biometric products and solutions with existing networks and infrastructure can be costly and complex. As databases and the number of searches grow, governments, law enforcement agencies and other organizations need flexible systems that can be scaled in a linear and cost-effective manner. Using most existing fingerprint biometrics solutions, governments, law enforcement agencies and other organizations have had to purchase multiple costly servers to assemble the requisite processing power to achieve acceptable response times and accuracy rates, and these large server deployments are complex and costly to manage on an ongoing basis. |

The constraints and shortcomings of many existing fingerprint biometrics solutions have inhibited the rate of deployment outside of traditional law enforcement environments. These constraints have become more pronounced as a result of the increased focus on security and protection from terrorism, as well as increased attention to economic losses from fraudulent activity, the rising costs of administering and the cumbersome nature of using traditional authentication and identification methodologies. These needs create a significant opportunity for a vendor that can leverage the technology developed in large AFIS deployments to provide accurate, rapid, scalable, flexible and cost-effective fingerprint biometric solutions.

Our Solution

We are a leading provider of advanced AFIS and other fingerprint biometrics solutions to governments, law enforcement agencies and other organizations worldwide. For nearly twenty years, we have researched, designed, developed and marketed advanced fingerprint biometric technologies and integrated solutions. We believe our proprietary software algorithms, together with optimized hardware, enable our customers to cost-effectively deploy AFIS solutions that consistently deliver industry leading accuracy rates and performance. Our solutions are designed to be scalable, enabling customers to seamlessly expand the capabilities of their AFIS, and flexible, enabling customers to deploy our AFIS in a variety of operating systems and hardware configurations. As a result, we provide a complete AFIS solution that enables customers to achieve a low total cost of ownership both upon initial deployment and throughout its entire lifecycle. Key benefits of our solutions include:

End-to-End Solution and Services Capability. We have designed and developed a fully integrated AFIS solution comprised of our proprietary fingerprint biometric software, together with optimized hardware and professional services. We offer all of the elements a customer needs to deploy fingerprint biometric solutions, including:

| • | Search and Retrieval Software. At the core of our solutions are our proprietary search algorithms that accelerate the matching process while maintaining accuracy. This software can run on standard hardware, but in larger deployments our customers typically run it on servers that we enhance with our Programmable Matching Accelerator, or PMA, boards that are optimized for rapid searches. The combination of powerful searching software and optimized hardware processing speeds enables us to deliver fingerprint biometrics solutions that can meet the most demanding requirements of governments, law enforcement agencies and other organizations. |

| • | Capture Devices. We offer several types of capture devices that enable our customers to obtain and process either flat or rolled fingerprints in a wide variety of places without ink, such as police stations, airports and immigration offices. All of our live-scan devices run our proprietary Image Flow software, which employs advanced algorithms to improve feature extraction from the fingerprint images, thereby |

5

Table of Contents

| enhancing search accuracy. We also offer portable devices that enable customers to obtain and process fingerprints remotely. Our live-scan devices provide real-time image previews on screen for improved quality control and reduced processing time. |

| • | Systems Integration Services. Our service abilities enable us to deliver full end-to-end solutions regardless of the operating or network environment and to design custom interfaces to existing systems. Our highly trained and skilled engineering professionals have extensive expertise in designing and deploying AFIS and other biometrics solutions that are integrated with our customers’ existing systems. Because our core intellectual property resides in our software capabilities, we can cost-effectively bundle our software with optimized off-the-shelf hardware components to create solutions for our customers that deliver the performance capabilities they demand. Moreover, our solutions implement standards-based approaches that simplify integration and support. |

High Accuracy Rates. We believe our solutions enable our AFIS customers to search large databases with industry leading accuracy and performance. A key factor in our ability to achieve these accuracy rates is our approach of searching the entire database rather than relying on binning like most other AFIS. As a result, our solutions do not suffer from binning errors. We can more effectively search both flat and rolled prints, which leads to increased accuracy. Moreover, because our software reflects our nearly twenty years of research and development on neural network, fluid dynamics and advanced image processing principles, we are able to extract more minutiae from lower quality fingerprints to minimize detection failures and false positives.

High Performance. Our solutions deliver high performance and enable rapid response times when searching large databases while still maintaining a high degree of accuracy. Our PMA servers accelerate the processing capability of standard server architectures and can compare over ten million fingerprints per second per PMA server. We achieve this performance level by implementing our advanced search algorithms and our proprietary Data Flow technology, which enables massively parallel processing on our PMA servers to eliminate the need for binning. Because we do not need to bin, our solutions can rapidly search based on any number of prints. Furthermore, our PMA servers can be easily clustered together, which enables customers to employ multiple servers in an integrated solution and achieve throughput levels that scale with their needs. Our rapid response times enable our customers to deploy our systems in high traffic areas where real-time authentication or identification based on flat prints is critical.

Significant Cost Savings and Linear Scalability and Flexibility. The power, linear scalability and flexibility of our solutions can result in significant cost savings to our customers. The power of our solutions reduces our customers’ initial costs and related ongoing maintenance and administrative costs because one of our PMA servers running our software can typically accomplish the equivalent processing of multiple Windows, UNIX or Linux servers working with other existing AFIS solutions. In addition, our solutions enable our customers to expand their systems smoothly and economically as their processing needs grow and as their systems evolve because they can incrementally purchase additional PMA servers which can be easily connected to one another, or rack mounted, to linearly scale matching throughput and support system growth as their databases grow and the number of required searches increases. Moreover, all of our current products are backwards compatible with earlier versions, enabling our customers to integrate our solutions with their existing network and infrastructure and easily and cost-effectively upgrade their systems as we develop new generations of our technology. Furthermore, our solutions are flexible and work effectively in heterogeneous network environments that include multiple hardware systems and operating systems such as Windows, UNIX and Linux. As a result, we believe the total cost of ownership of our solutions is lower than the cost of competing solutions.

Products and Services

We principally offer biometrics solutions to the government sector, which consists of federal, state, local and foreign governments and agencies, including immigration/border control agencies, electoral commissions and law enforcement agencies. At the core of each of our products is our proprietary Image Flow Processing, Data Flow Computing and Information Fusion software.

6

Table of Contents

AFIS Solutions

We offer a variety of products and services designed to enable customers to deploy cost-effective, accurate and high performance AFIS solutions. We offer our PMA servers bundled with our proprietary software to perform the searching and matching functions that are central to an AFIS, as well as live-scan fingerprint capture devices. We also deliver design and integration services and necessary computing and equipment infrastructure to enable deployment into diverse and heterogeneous environments. Our customers typically deploy our AFIS solutions in either traditional AFIS environments, such as law enforcement, where we market our solution as Cogent Automated Fingerprint Identification System, or CAFIS, or in live production environments, such as border crossings, where we market our solution as Cogent Live-ID.

We offer two primary AFIS solutions, each of which incorporates our PMAs and our live-scan devices:

Cogent Automated Fingerprint Identification System. CAFIS is our full-function, networked AFIS solution for local, regional and national systems. While each CAFIS deployment is unique to the customer due to its specific design and integration requirements, all such deployments employ our proprietary software, and the larger deployments rely significantly on our PMA servers. We believe that CAFIS is one of the most accurate systems in the world for twoprint, tenprint, latent and palm print searches.

CAFIS can be integrated with external AFIS, live-scan systems, hand-held wireless devices, secure web-based Internet solutions and other information systems. CAFIS features a modular and expandable architecture that can be scaled to meet any agency’s database size, throughput and integration requirements. CAFIS can quickly and accurately search databases of enrolled subjects, with multiple records per subject in image resolutions of both 500 ppi and 1,000 ppi. Any number of modular elements can be incorporated into CAFIS, including PMA servers, workstations, live-scans and wireless handheld computers. For agencies with modest throughput requirements, systems can be configured using an NT or UNIX-based transaction server hosting our Image Flow, Data Flow and Information Fusion software. For local agencies, we provide an affordable AFIS solution on a stand-alone workstation that incorporates much of the tenprint and latent functionality and all the accuracy of large-scale AFIS systems. This workstation can scale to support larger-scale systems as agency needs change. CAFIS can be configured with a number of built-in safeguards that ensure service resiliency, while providing safety of information through its fault tolerant architecture, disk mirroring, automated database backup and disaster recovery options. It is also capable of integrating other authentication and identification solutions, such as facial recognition and smart cards.

Cogent Live-ID. Our Live-ID AFIS solution enables our customers to rapidly identify individuals who submit their fingerprints for border crossings, background checks, fraud prevention, criminal investigation, document identification, voting stations and other activities where security is a concern. Live-ID has been deployed in many demanding environments, including the United States Visitor and Immigrant Status Indicator Technology, or US-VISIT, program. As a result of our powerful searching and matching technology and the improved feature extraction from our image capture technology, Live-ID provides a rapid and efficient identification solution using only two flat fingerprints. Our Live-ID system can be configured to run on hand-held devices, notebook computers, stand-alone workstations and enterprise systems serving users in a vast network of sites. Live-ID can be implemented on platforms operating under UNIX, Windows and Linux, enabling users to submit search transactions and receive results with a standard web browser. Live-ID can also be used in non-governmental environments to provide authentication of an individual’s identity for a variety of transactions, including e-commerce applications.

Live-ID implements our Data Flow matching technology to accurately search entire databases containing up to millions of records in a matter of seconds. Our Information Fusion technology makes it possible to combine identification systems so that Live-ID can search databases of digital photographs, signatures and demographic data simultaneously.

7

Table of Contents

AFIS Products

We offer two key products in our AFIS solutions deployments:

Programmable Matching Accelerator Servers. Our proprietary PMA server is a high-speed image matching server at the core of a customer’s AFIS or Live-ID system that can support search speeds of up to ten million print comparisons per second per server. These speeds, which are made possible by the integration of our proprietary software with our advanced design PMAs, are necessary to adequately address the needs of customers that require real-time identification results when searching databases containing thousands to millions of records.

Our PMAs are modular units that enable customers to linearly increase matching throughput to support system and database growth by rack-mounting multiple PMA servers. PMA servers are comprised of up to eighteen of our PMA boards integrated with a commercially available server that has a high-speed input/output processor board and multiple random access memory drives. Our PMA boards use field programmable gate array integrated circuits optimized to run our proprietary software, rather than costly general purpose microprocessors or inflexible ASICs. As a result, we can cost-effectively program our PMA servers to perform a variety of matching tasks for fingerprints and palm prints. Our PMA boards also provide redundancy because the PMA boards house mirrored databases in on-board random access memory that contain files used by the system to generate fingerprint matches. The mirrored configuration and speed of the random access memory allow the system to perform simultaneous search transactions at very high speeds while still maintaining the reliability of the system.

Live-scan Systems. We offer a suite of live-scan systems running our proprietary software that improve minutiae feature extraction during the capture and encoding of fingerprint and palm print data. These systems can capture rolled or flat fingerprints and palm prints of a subject in an easy-to-learn and inkless manner. Using our software, these products enable real-time previewing, which helps the operator to place, guide and align the fingers and palms correctly, and provide immediate feedback, including error messages, if prints are not captured at an acceptable quality. These features improve the efficiency of the fingerprint capture process and enhance the effectiveness of the matching process by capturing and submitting high quality fingerprints to the AFIS or Live-ID system more quickly than live-scan devices that utilize other software programs. Scanning resolution meets ANSI/NIST and Federal Bureau of Investigation standards, and the scanner is certified to meet and exceed Federal Bureau of Investigation requirements. All data formatting is done with Federal Bureau of Investigation certified compression algorithms. Textual and graphic information is displayed in a single monitor, with a graphic user interface and on-screen buttons and zoom features. Our live-scan product suite is designed to enable integration within larger AFIS and booking management systems, including CAFIS, Live-ID and legacy AFIS solutions.

Our live-scan booking station is an advanced live-scan system designed to withstand extreme working conditions such as those present in jails and prisons. The system features a high-security glass front and a ruggedized cabinet. We also offer a desktop live-scan system and a portable live-scan system.

AFIS Services

Design, Integration and Training. We offer design and integration services and training that complement our AFIS product solutions. At the commencement of a large CAFIS or Live-ID deployment, we establish project management teams that utilize a formal project management development process to meet the customer’s desired performance objectives. We develop and deliver customized solutions to governments, law enforcement agencies and other organizations that require integration with existing information systems that interface with external AFIS systems. We also work with major systems integrators in providing tailored solutions. After installation, we conduct performance tests to validate performance objectives. We also offer tailored training plans that include classes, on-the-job training and in-house seminars. As part of our training services, we provide customized user guides along with manuals.

8

Table of Contents

Web-based Application Services. We provide a fully outsourced Live-ID service on a web-based hosted application service business model. Systems are housed and maintained in a secure data center at our headquarters. The data center is equipped with high-speed, fault-tolerant Cogent PMA matchers and enterprise servers. Customers using this service can offer fingerprint matching services for applications such as background checks without investing in an entire AFIS infrastructure and pay on a transaction basis.

ASIC Applications

Our proprietary application specific integrated circuit, or ASIC, is designed to perform biometric image processing and matching for both fingerprints and facial images. Based on a microprocessor core, our proprietary ASIC incorporates a powerful two-dimensional digital signal processing engine and supports memory bus interfaces with synchronous dynamic random access memory, read-only memory, flash memory and static random access memory devices. Our proprietary ASIC is typically delivered as part of our proprietary Identification Module, which is a stand-alone image processing and biometric matching unit designed for applications requiring biometric identification and authentication. To provide maximum flexibility for integrating the Identification Module with a variety of user applications, the module supports a number of fingerprint sensor options, including silicon sensors and optical sensors and communication interface options, as well as magnetic stripe card, contact smart card and contactless smart card readers.

The Identification Module supports both one-to-one authentication and one-to-many identification applications. Host application systems can manage the Identification Module through common communication protocols, such as Ethernet. We also offer an original equipment manufacturer, or OEM, development kit for application development and integration. This kit comes with a variety of tools and options to provide high degrees of flexibility and customization for a wide range of applications.

Examples of applications powered by our proprietary ASIC are:

BlueCheck. BlueCheck is a Bluetooth enabled mobile fingerprint scanner for law enforcement applications. Weighing only 3 ounces the BlueCheck is equipped with a durable LCD display for real-time feedback, a 500 dpi fingerprint sensor and our proprietary ASIC technology for embedded encryption, image compression and on-device matching. Used with our Live-ID and MobileIDENT software, BlueCheck allows users to perform in-the-field fingerprint capture and identifications.

Fusion. The Fusion is a handheld device for military and law enforcement personnel operating in a variety of austere environments around the globe. The device captures and stores 10,000 plus (scalable) records: forensic-quality fingerprints, latent fingerprints, iris images, photos and textual data. Other features include internal matching against stored records, wireless connectivity via 802.11b/g or Bluetooth, GPS tagging of all records collected, and a weight of just over one pound.

BioGate. BioGate is a physical access control system that provides a sophisticated, accurate and customizable biometrics solution to support a variety of access control environments. This system can replace existing access card systems with an easy-to-use system that controls access by requiring that an individual seeking entry submit to a finger scan to confirm his right to access a restricted area. Featuring our matching software, a 500 ppi resolution silicon fingerprint sensor and a contact smart card reader or optional magnetic stripe card reader, BioGate provides a high level of accuracy and speed. BioGate can increase security while making the access control system more convenient for authorized personnel.

National Identification Card Programs. Numerous foreign jurisdictions around the world have begun to establish national identification card programs, which will require the issuance of smart ID cards with embedded fingerprint information. Foreign jurisdictions such as Hong Kong, Italy, Morocco, the United Kingdom and Thailand have implemented or are in the process of implementing national identification programs. Many of these programs involve enrolling citizens in a database and issuing each citizen an identification card, some of which are smart cards that contain a chip, such as our proprietary ASIC, that has a digital template of fingerprints

9

Table of Contents

embedded in it. This information can be accessed and matched against a real-time scan of a citizen’s finger to enable real-time authentication of the citizen’s identity for a variety of purposes. Our proprietary ASIC is currently used in the Hong Kong Smart Identity Card Program.

MobileIDENT. MobileIDENT integrates our proprietary ASIC with a forensic quality fingerprint sensor (500 ppi resolution), a digital camera, a smart card reader and a Windows mobile-based Pocket PC to create a handheld AFIS that can locally store and search fingerprints on our proprietary ASIC chip. MobileIDENT can also communicate with a central AFIS search engine with results returned to the MobileIDENT. In addition, MobileIDENT supports match-on-card authentication whereby a captured fingerprint is compared to fingerprint minutiae stored on a smart card. MobileIDENT enables law enforcement officers to make rapid and effective identifications and authentications at ports of entry and exit, at sporting events, for roadside vehicle checks, for major public events and at any remote location where timely identification or authentication checks may be required.

Technology

We developed our proprietary technology through an extensive research and development program focused on innovative algorithms for image processing and biometric identification. These highly complex matching algorithms are the core of our technology, and we have optimized the hardware deployed in our customers’ systems to run these algorithms efficiently. Our engineers have extensive expertise in matching algorithms, image enhancement, image compression, fuzzy mathematics, morphology, neural networks, security, encryption, communications, data mining and data fusion. By leveraging this expertise over our nearly twenty year history, we have developed advanced algorithms for statistical pattern recognition, structural pattern recognition, random process modeling and error and distortion modeling.

Image Flow Technology. Our Image Flow software utilizes fluid dynamics principles to perform real-time identification and classification of minutiae and other irregularities that define the unique biometric features. Since fingerprints have a natural graphical flow embodied in the ridges in human fingers, our Image Flow software enables our algorithms to identify the patterns of a fingerprint similar to the surface appearances associated with fluid flow. This enables us to employ mathematical modeling, using the principles of fluid dynamics, for enhancing poor fingerprints lifted from crime scenes or less than optimal images. Utilizing ridge pattern information in a fingerprint image, our Image Flow algorithms capture the flow information via partial differential equations, solve the numerical equations, and provide accurate feature data associated with the fingerprint image. By analytically modeling these natural flows, which are unique to each individual, our software can establish a positive identity using a variety of biometrics, including fingerprints, palm prints, and facial images. Our image processing software operates throughout our AFIS solutions to enable more detailed feature extraction to improve the accuracy of searches and descriptive function modeling to improve the speed of searches.

Data Flow Technology. Utilizing innovative hyper-pipeline and massively parallel computing architectures, our Data Flow super computing technology provides an in-depth analysis of the similarity of natural object characteristics to accurately and automatically identify matching characteristics. This technology enables very high-speed computation, and it is scalable to run on hand-held computers, desktop computers and enterprise servers. Our Data Flow technology utilizes parallel processing techniques to deliver high throughput by conducting parallel database searches while expending minimal time per comparison. The Data Flow technology implements a design paradigm that features a dataflow computing architecture based upon the Single Instruction Multiple Data, or SIMD, dataflow computer model. The SIMD model packs multiple data elements into a single register and performs the same calculation on all of them at the same time, and computational accelerators move performance bottlenecks from the processor into the processor’s memory hierarchy. This technology enables us to optimize both our accuracy and transaction throughput by capitalizing on the fact that all the fingerprints in the database can be accessed in parallel. We have also developed advanced wavelet compression and coding design technologies to enhance system speed.

10

Table of Contents

The design of our PMA boards also manifests our Data Flow technology. The PMA board design features extremely high input/output bandwidth to process the database using a massively parallel and hyper-pipeline architecture implemented on a single card that plugs into a standard interface on a commercially available server. Our PMA servers have been designed to support the high-speed capabilities of the Data Flow algorithms and provide scalable matching units that can individually perform ten million fingerprint comparisons per second. For every transaction, our PMA server initializes the search engine by loading the search fingerprint minutiae data to the search engine. The PMA server continues sending the fingerprint minutiae data to the data pipe of the search engine while the search engine data pipe is not full.

Information Fusion Technology. Our Information Fusion technology integrates data mining and data fusion technologies with biometric identification to enable the transformation of raw data into business information. To meet customer requirements, AFIS and other fingerprint biometrics systems must integrate with larger communications and information systems. Our Information Fusion technology improves the accuracy of our solutions by utilizing sophisticated fusion algorithms to combine biometric data from multiple sources and multiple algorithms.

Our Information Fusion technology includes system integration tools and techniques to integrate information from disparate information systems, such as intelligence systems, criminal history systems and border crossing systems. This technology includes advanced workflow and state transition modeling architectures that we use to develop custom workflows and seamless integration of data in customers’ information systems. Rather than maintaining multiple versions of our software for a variety of applications and customers, our Information Fusion software requires only one master version that is both dynamically and statically configured based on each customer’s requirements. Information Fusion facilitates the rapid development of extension modules for individual customer deployments to address specific needs, and we can frequently use the functionality developed for one customer in future customer deployments. This technology also provides an efficient framework for providing customer support of delivered systems, which can reduce customers’ maintenance costs and increase system reliability. The ability to provide integration across local, state, national and international systems is a key advantage for governments and law enforcement agencies in implementing heightened security procedures.

Customers

We have derived, and believe that we will continue to derive, a significant portion of our revenues from a limited number of customers. The table below indicates the percentage of our total revenues from customers from whom we derived at least 10% of our revenues for the years ended December 31, 2007, 2008 and 2009:

| Year Ended December 31, | |||||||||

| Percentage of Revenues |

2007 | 2008 | 2009 | ||||||

| DHS |

34 | % | 57 | % | 41 | % | |||

| CNE |

13 | % | 0 | % | 0 | % | |||

The DHS obtains our products and services either under a blanket purchase order agreement or by instructing contractors to purchase our products and services on its behalf.

Our most recent arrangement with the National Electoral Council of Venezuela (“CNE”) was completed in December 2006 and revenues from all of our arrangements with the CNE were fully recognized by June 30, 2007.

Sales and Marketing

We market our AFIS solutions and other fingerprint biometrics solutions directly to end-users and indirectly through prime contractors. We market our proprietary ASIC device indirectly through OEMs, resellers and distributors. As of December 31, 2009, we employed 40 individuals who were involved in our sales and marketing efforts.

11

Table of Contents

Sales efforts for our AFIS and other government related fingerprint biometrics solutions are predominantly focused on establishing and maintaining new and existing relationships with defense and IT solutions companies that typically serve as prime contractors on government projects. We also market our AFIS and other government related fingerprint biometrics solutions directly to end customers if the project is focused primarily on a biometrics implementation. For large AFIS deployments, a government entity typically issues a request for proposal, or RFP. In the RFP, the entity will usually provide the project’s specifications and performance requirements, and then solicit proposals from prospective prime contractors who are on the approved vendor list. Because we are one of three leading vendors that offer AFIS solutions, we are typically included in any U.S. or international RFP that is open for competitive bidding. We enhance our opportunities for being selected as a prime or subcontractor by utilizing references from our existing customers, usually bidding on a fixed price basis and employing consultants who have strong relationships in our international markets. We assemble a multi-disciplined project management team to draft the proposal, or to assist with drafting if we are the subcontractor, negotiate the actual contract and deploy the solution. Once our solution has been deployed, the project management team educates our customer on the use of our AFIS and other biometrics solutions. The project management team is also frequently involved in upgrading our customers to more comprehensive solutions as their needs grow. In addition, when competing for local, state and international contracts from governments and law enforcement agencies, we seek to team with local systems integrators in the jurisdiction in which the contract is to be performed.

As part of our general sales and marketing efforts we have also established the Cogent User Group. The main purpose of this group is to provide feedback on existing solutions, identify needs for new products and identify new desirable capabilities for both existing and new solutions. We have an annual user conference where members can provide feedback on our solutions and products. We utilize the information gathered from members of the Cogent User Group and the information gathered from clients by our project management teams to better enable us to create and deliver to our customers timely upgrades and new solutions that meet evolving customer needs.

Manufacturing and Suppliers

For our PMA servers, we conduct finish assembly operations, quality assurance, manufacturing engineering, documentation control and integration at our headquarters facility in Pasadena, California. We acquire the servers from commercial suppliers such as IBM and Hewlett-Packard. We outsource the assembly of our PMA boards to contract manufacturers to reduce fixed costs and to provide flexibility in meeting market demands. We directly purchase the components of our PMA boards, including printed circuit boards, field programmable gate arrays and memory integrated circuits, and our contract manufacturers assemble them to our specifications. The contract manufacturers deliver the assembled PMA boards to us, and we perform finish assembly procedures before testing and integrating the final products into the commercial servers with software and manuals in our Pasadena, California facility.

Samsung Semiconductor, Inc. fabricates our proprietary ASIC wafers in Asia. Various subcontractors perform assembly, packaging and testing of our ASICs, allowing us to purchase and receive only finished ASIC product. We maintain a facility in Shenzhen, China where we perform research and development and assembly of our products that incorporate our proprietary ASIC. Certain components of our products that are assembled in Shenzhen are outsourced to contract partners, none of which are sole source suppliers. We also store and distribute our inventory of consumer and commercial products from the Shenzhen facility.

Most component parts used in our products are standard off-the-shelf items, which are, or can be, purchased from two or more sources. In addition to Samsung, IBM and Hewlett-Packard, we utilize products from suppliers such as Sun Microsystems and Dell Computer, which provide computer workstations, L-1 Identity Solutions and Cross Match Technologies, which provide live-scans, Oracle, Informix, Sybase and Microsoft, who supply database software and UPEK, Validity and Atmel, who supply sensors. We select suppliers on the basis of functionality, manufacturing capacity, quality and cost. Whenever possible and practicable, we strive to have at least two manufacturing locations for each product. Nevertheless, our reliance on third-party manufacturers

12

Table of Contents

involves risks, including possible limitations on availability of products due to market abnormalities, unavailability of, or delays in obtaining access to, certain product technologies and the absence of complete control over delivery schedules, manufacturing yields, and total production costs. The inability of our suppliers to deliver products of acceptable quality and in a timely manner or our inability to procure adequate supplies of our products could disrupt our ability to meet customer demands or reduce our gross margins.

Customer Service

We believe that customer service is critical to our success, and we have committed significant resources to this function. Our contracts provide for telephone, web-based or email support and occasionally on-site support. Our systems are configured for remote access, allowing us to solve most problems remotely and without customer involvement. We also maintain a customer support database that allows us to both resolve problems and prevent recurrences of prior problems.

Competition

The market for biometric solutions is highly competitive, rapidly evolving and fragmented, and subject to changing technology, shifting customer needs and frequent introductions of new products and services. A significant number of established companies have developed or are developing and marketing software and hardware for biometric products and applications that currently compete or will compete directly with our offerings. Our offerings also compete with non-biometric technologies such as public key infrastructure solutions, smart card security solutions, and traditional key, card, surveillance and password systems. Many of our competitors have significantly more financial and other resources than we do. We believe that additional competitors will continue to enter the biometrics market and become significant long-term competitors, and that, as a result, competition will increase in the near term. We sometimes compete with third parties who are also our suppliers or prime contractors. Companies competing with us may introduce products that are competitively priced, have increased performance or functionality or incorporate technological advances not yet developed or implemented by us. Our current principal competitors include:

| • | diversified technology providers, such as NEC and Safran Group (through its wholly owned subsidiary MorphoTrak) that offer integrated AFIS solutions to governments, law enforcement agencies and other organizations; |

| • | companies that are AFIS component providers, such as Cross Match Technologies and L-1 Identity Solutions; |

| • | prime government contractors that develop integrated information technology products and services that include biometrics-related solutions that are frequently delivered in partnership with diversified technology providers and biometrics-focused companies; and |

| • | companies focused on other fingerprint biometrics solutions, such as AuthenTec, Dermalog and UPEK. |

We believe the principal competitive factors in the market for our biometric solutions include the following:

| • | accuracy of matching; |

| • | speed of matching; |

| • | pricing including total cost of system ownership, including initial costs and ongoing maintenance and support; |

| • | customization; |

| • | scalability that enables rapid and accurate matching in extremely large databases; |

| • | quality of service and support |

| • | degree of security provided; |

13

Table of Contents

| • | ease of use; |

| • | functionality; |

| • | size; and |

| • | reliability. |

We believe that we compete favorably with our competitors on the basis of the aforementioned factors. Our ability to remain competitive will depend to a great extent upon our ongoing performance in the areas of product development and customer support.

Backlog

We record an item as backlog when we receive a contract, purchase order or other notification, such as an award document, indicating the number of units to be purchased, the purchase price, specifications and other customary terms and conditions. Our backlog also includes deferred revenue reflected on our consolidated balance sheet. Further, we include in our estimated backlog contracts that have been awarded but not yet signed or for which certain contract terms such as quantities or specifications have not yet been fully defined. For these awarded contracts, we have made assumptions based on best available information to estimate their values. There can be no assurance that any of the contracts comprising our backlog presented in this Annual Report will result in actual revenue in any particular periods or that the actual revenue from such contracts will equal our backlog estimates. Furthermore, there can be no assurance that any contract included in our estimated backlog that actually generates revenue will be profitable. These backlog estimates are based on our experience under such contracts and similar contracts and may not be accurate. As of December 31, 2008 and 2009, our total backlog was $168.1 million and $210.7 million, respectively. We have included $60.4 million in our estimated backlog as of December 31, 2009 for awarded contracts. Approximately $127.2 million of backlog is not expected to be filled in 2010. We cannot assure you that we will realize revenue from our entire backlog or as to timing thereof. In addition, a significant portion of our revenue is not recognized upon shipment, but is recognized only upon customer acceptance of our systems or over the term of our contracts under the percentage-of-completion method.

Research and Development

We engage in substantial research and development to advance our core products and develop new products and carryout research and development activities at our corporate headquarters in Pasadena, California and at various international locations. We conduct research on algorithm development, hardware development, system engineering and architecture, industry standards, technology integration, user productivity features and performance enhancement. We also invest substantial resources in commercializing the technology that we develop in our research and development efforts into products that meet the needs of our customers. We have found that while there are unique features to each client engagement, there is often a degree of commonality. Under our customer contracts, we typically obtain the rights to use any improvements to our technology developed on a particular customer deployment on other customer deployments. As a result, we have historically been able to moderate our research and development expenses by leveraging the improvements developed by our personnel working on customer engagements. Our research and development expense was $10.6 million in 2007, $14.8 million in 2008 and $15.0 million in 2009.

Intellectual Property

Our success will depend in part on our ability to protect our intellectual property. The core technology used in our products and solutions is not the subject of any patent or copyright protection. We have one issued patent and two pending patent applications relating to our Data Flow and Information Fusion technology as well as two issued patents on technology related to optical sensors and image reconstructions for the commercial markets.

14

Table of Contents

We also rely primarily on a portfolio of intellectual property rights, both foreign and domestic, including trade secrets, trademarks, contractual provisions, patent applications and licenses to protect our intellectual property. Our registered trademarks relate to Cogent, Cogent Systems, BlueCheck, Live-ID, Fusion and PMA.

If we fail to protect our intellectual property rights adequately, our competitors might gain access to our technology, and our business would thus be harmed. In addition, defending our intellectual property rights might entail significant expense. Any of our trademarks or other intellectual property rights may be challenged by others or invalidated through administrative processes or litigation. In addition, our patents, or any other patents that may be issued to us in the future, may not provide us with any competitive advantages, or may be challenged by third parties. Furthermore, legal standards relating to the validity, enforceability and scope of protection of intellectual property rights are uncertain. Effective patent, trademark, copyright and trade secret protection may not be available to us in every country where we market our solutions. The laws of some foreign countries may not be as protective of intellectual property rights as those in the United States, and domestic and international mechanisms for enforcement of intellectual property rights in those countries may be inadequate. Accordingly, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property or otherwise gaining access to our technology.

We may be required to expend significant resources to monitor and protect our intellectual property rights. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Any such litigation, whether or not it is ultimately resolved in our favor, would result in significant expense to us and divert the efforts of our technical and management personnel. For example, in April 2005 we initiated a lawsuit against Northrop Grumman which asserted that Northrop caused us harm by misappropriating our trade secrets. Our management devoted a significant amount of time to, and we spent a significant amount of funds in connection with, this lawsuit, which was settled in 2007.

As the number of entrants into our market increases, the possibility of an intellectual property claim against us grows. Our technologies may not be able to withstand any third-party claims against their use. Any intellectual property claims, with or without merit, could be time-consuming and expensive to litigate or settle, and could divert management attention from executing our business plan. In addition, we may be required to indemnify our customers for third-party intellectual property infringement claims, which would increase the cost to us of an advance ruling in such a claim. An adverse determination could also prevent us from offering our service to others.

We generally enter into confidentiality agreements with our employees, vendors, industry partners and customers. Furthermore, we generally control access to and distribution of our documentation and other proprietary information. Despite this protection, unauthorized parties may copy aspects of our current or future software products or obtain and use information that we regard as proprietary, and such unauthorized use could harm our business.

Employees

As of December 31, 2009, we employed 434 full-time employees, including 163 in research and development, 199 in operations and engineering services, 40 in sales and marketing and 32 in general and administration. At December 31, 2009, 239 of our employees were located in the United States and 195 of our employees were located outside the United States.

We have never had any work stoppage and none of our employees are represented by a labor organization or are party to any collective bargaining arrangements. We consider our employee relations to be good.

15

Table of Contents

Government Regulation

Our business is subject to various government regulations, including:

| • | the Federal Acquisition Regulations, or the FAR, and agency regulations supplemental to the FAR, which comprehensively regulate the formation and administration of, and performance under government contracts; |

| • | the Truth in Negotiations Act, which requires certification and disclosure of all cost and pricing data in connection with contract negotiations; |

| • | the Cost Accounting Standards, which impose accounting requirements that govern the right to reimbursement under cost-based government contracts; |

| • | the Foreign Corrupt Practices Act; and |

| • | laws, regulations and executive orders restricting the use and dissemination of information classified for national security purposes and the exportation of certain products and technical data. |

Segment Information; Financial Information about Geographic Areas

We consider our business activities to constitute a single segment. A summary of our revenues and assets by geographic area is set forth in Note 13 to our consolidated financial statements included elsewhere in this Annual Report.

Available Information

We file reports with the Securities and Exchange Commission (“SEC”). We make available on our website under “Investor Relations/SEC Filings,” free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. Our website address is www.cogentsystems.com. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

You should consider each of the following factors as well as the other information in this Annual Report in evaluating our business and our prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. If any of the following risks actually occur, our business and financial results could be harmed. In that case, the trading price of our common stock could decline. You should also refer to the other information set forth in this Annual Report, including our financial statements and the related notes.

Our business could be adversely affected by significant changes in the contracting or fiscal policies of governments and governmental entities.

We derive substantially all of our revenues from contracts with international, federal, state and local governments and government agencies, and subcontracts under federal government prime contracts, and we believe that the success and growth of our business will continue to depend on our successful procurement of government contracts either directly or through prime contractors. Accordingly, changes in government contracting policies or government budgetary constraints could directly affect our financial performance. Among the factors that could adversely affect our business are:

| • | changes in fiscal policies or decreases in available government funding; |

16

Table of Contents

| • | changes in government funding priorities; |

| • | changes in government programs or applicable requirements; |

| • | the adoption of new laws or regulations or changes to existing laws or regulations; |

| • | changes in political or social attitudes with respect to security and defense issues; |

| • | changes in audit policies and procedures of government entities; |

| • | potential delays or changes in the government appropriations process; and |

| • | delays in the payment of our invoices by government payment offices. |

These and other factors could cause governments and governmental agencies, or prime contractors that use us as a subcontractor, to reduce their purchases under existing contracts, to exercise their rights to terminate contracts at-will or to abstain from exercising options to renew contracts, any of which could have an adverse effect on our business, financial condition and results of operations. Many of our government customers are subject to stringent budgetary constraints. The award of additional contracts from government agencies could be adversely affected by spending reductions or budget cutbacks at these agencies.

In 2008 and 2009, we derived 57% and 41%, respectively, of our revenues from a limited number of customers.

In each fiscal period we have derived, and we believe that in each future fiscal period we will continue to derive, a significant portion of our revenues from a limited number of customers. In 2008, the DHS accounted for 57% of revenues, and in 2009 the DHS accounted for 41% of revenues. We do not have any long-term contracts with any of our customers, including the DHS, for the sale of our products, and our future sales will depend upon the receipt of new orders. To the extent that any significant customer, like the DHS, reduces or delays its purchases from us or terminates its relationship with us, our revenues would decline significantly and our financial condition and results of operations would suffer substantially. For example, a delay in the rollout of US-VISIT, or the completion of the implementation of that program, resulting in a decrease or cessation of orders for our products from the DHS, would materially affect our business.

In 2008 and 2009, we derived 80% and 79%, respectively, of our revenues from the sale of our solutions either directly or indirectly to U.S. government entities pursuant to government contracts, which involve competitive bidding and may be subject to cancellation or delay without penalty, any of which may produce volatility in our revenues and earnings.

Our performance in any one reporting period is not necessarily indicative of future operating performance because of our reliance on a small number of customers, the majority of which are government entities. Government contracts are frequently awarded only after formal competitive bidding processes, which have been and may continue to be protracted, and typically impose provisions that permit cancellation in the event that necessary funds are unavailable to the public agency. In many cases, unsuccessful bidders for government agency contracts are provided the opportunity to formally protest certain contract awards through various agency, administrative and judicial channels. The protest process may substantially delay a successful bidder’s contract performance, result in cancellation of the contract award entirely and distract management. We may not be awarded contracts for which we bid, and substantial delays or cancellation of purchases may even follow our successful bids as a result of such protests.

In addition, local government agency contracts may be contingent upon availability of matching funds from federal or state entities. Also, law enforcement and other government agencies are subject to political, budgetary, purchasing and delivery constraints which may cause our quarterly and annual revenues and operating results to fluctuate in a manner that is difficult to predict.

17

Table of Contents

If the biometrics market does not experience significant growth or if our products do not achieve broad acceptance both domestically and internationally, we will not be able to grow our business.

Our revenues are derived from sales of our biometrics solutions. We cannot accurately predict the future growth rate or the size of the biometrics market. The expansion of the biometrics market and the market for our biometrics solutions depends on a number of factors, such as:

| • | the cost, performance and reliability of our solutions and the products and services offered by our competitors; |

| • | customers’ perceptions regarding the benefits of biometrics solutions; |

| • | the development and growth of demand for biometric solutions in markets outside of government and law enforcement; |

| • | public perceptions regarding the intrusiveness of these solutions and the manner in which organizations use the biometric information collected; |

| • | public perceptions regarding the confidentiality of private information; |

| • | proposed or enacted legislation related to privacy of information; |

| • | customers’ satisfaction with biometrics solutions; and |

| • | marketing efforts and publicity regarding biometrics solutions. |

Even if biometrics solutions gain wide market acceptance, our solutions may not adequately address market requirements and may not continue to gain market acceptance. If biometrics solutions generally or our solutions specifically do not gain wide market acceptance, we may not be able to achieve our anticipated level of growth and our revenues and results of operations would suffer.

Our financial results often vary significantly from quarter to quarter and may be negatively affected by a number of factors.