Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From TO

Commission file number 000-32980

BMP SUNSTONE CORPORATION

600 W. Germantown Pike, Suite 400

Plymouth Meeting, Pennsylvania 19462

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 20-0434726 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 600 W. Germantown Pike, Suite 400 Plymouth Meeting, Pennsylvania |

19462 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(610) 940-1675

Registrant’s telephone number, including area code

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| COMMON STOCK, PAR VALUE $0.001 PER SHARE |

NASDAQ | |

| (Title of Class) | (Name of exchange on which registered) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Rule S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer þ | Non-accelerated filer ¨ | Smaller Reporting Company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No þ

The aggregate market value of Common Stock held by non-affiliates of the registrant as of the registrant’s stock on June 30, 2009 (based on the last reported sale price on the Nasdaq Global Market as of such date) was $117,376,000 assuming all officers, directors and persons deemed to be the beneficial owner (beneficial ownership determined in accordance with the rules of the Securities and Exchange Commission) of 10% or more of our capital stock are affiliates. As of March 15, 2010 there were 41,941,987 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant’s 2010 annual meeting of stockholders to be filed within 120 days after the end of the period covered by this Annual Report on Form 10-K are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

TABLE OF CONTENTS

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report and the documents into which this report is and will be incorporated contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission (the “SEC”) and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and product development. In particular, these forward-looking statements include, among others, statements about:

| • | our business strategy; |

| • | competition in the Chinese pharmaceutical industry and our ability to compete; |

| • | our belief that a significant opportunity exists to obtain an increased market share in the Chinese pharmaceutical marketing and distribution markets by offering development services with market fulfillment services; |

| • | our expectation that substantially all of our revenues, profits, cash flows and assets will continue to be derived in China and be denominated in Chinese currency; |

| • | our belief regarding the significance of brand recognition; |

| • | our future financial and operating results; |

| • | the dependence of our future success on obtaining additional promotional and market research agreements and licensing rights for China; |

| • | our ability to fund our current level of operations for the next twelve months through our cash and cash equivalents; |

| • | our expectation regarding our cash and cash equivalents; |

| • | impact of recent accounting pronouncements; |

| • | our expectation regarding our Exchange Act reporting obligations; and |

| • | any other statements regarding matters not of historical fact. |

The words “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” and similar expressions may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements involve known and unknown risks, uncertainties and achievements, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement contained in this report, we caution you that these statements are based on a combination of facts and factors currently known by us and projections of the future about which we cannot be certain. Many factors affect our ability to achieve our objectives, including:

| • | our inability to compete successfully against new and existing competitors or to leverage our marketing capabilities with our distribution capabilities; |

| • | delays in product introduction and marketing or interruptions in supply; |

| • | a decrease in business from our major clients; |

1

Table of Contents

| • | adverse economic, political or social conditions in China; |

| • | difficulties in acquiring complementary businesses or in integrating acquired businesses; |

| • | our inability to obtain additional capital when necessary; |

| • | our inability to manage our growth effectively; |

| • | our inability to attract and retain key personnel; |

| • | our inability to effectively market our services or obtain and maintain arrangements with manufacturers; and |

| • | a slowdown in the Chinese economy. |

In addition, you should refer to the “Risk Factors” section of this report for a discussion of other factors that may cause our actual results to differ materially from those implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this report will prove to be accurate. In addition, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, if at all. We may not update these forward-looking statements, even though our situation may change in the future.

2

Table of Contents

| ITEM 1. | BUSINESS |

BMP Sunstone Corporation, a Delaware corporation, referred to herein as BMP Sunstone, we, us, our and the Company, is a specialty pharmaceutical company engaged in the development, manufacture, and sales of over-the-counter, or OTC, medicinal brands for women and children in China. We also provide other international pharmaceutical manufacturers with a single point of contact for comprehensive services, including clinical research and product registration, marketing and promotional support, and product distribution, to facilitate the introduction of their pharmaceutical products into the Chinese market.

Our business in Manufactured Products medicines for children and women is conducted primarily by our subsidiary Sunstone (Tangshan) Pharmaceutical Co., Ltd, or Sunstone. Integrated market-entry services for international pharmaceutical manufacturers are provided through Beijing Med-Pharm Co. Ltd., or BMP China, Beijing WanWei Pharmaceutical Co., Ltd., or WanWei, and Shanghai Rongheng Pharmaceutical Co., Ltd., or Rongheng.

Our profit from operations derives mainly from Sunstone, BMP China, and WanWei.

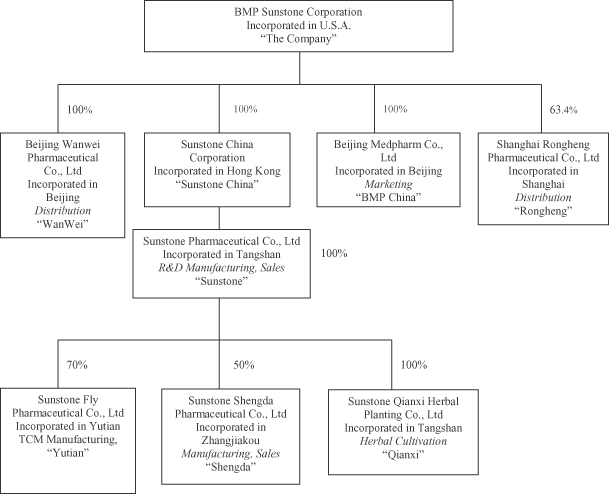

We were incorporated in the State of Delaware in November, 2003, as a wholly owned subsidiary of Just Great Coffee, Inc., a New Jersey corporation. In January 2004, Just Great Coffee, Inc. merged with and into us and we were the surviving corporation. BMP China was incorporated in China in May 1994. In December 2001, Abacus Investments Limited, or Abacus, acquired a 100% equity interest in BMP China. In February 2004, we acquired all of the equity interests of BMP China from Abacus in exchange for our issuance to Abacus of 7,807,509 shares of our common stock, which represented approximately 90% of our common stock at the time of the exchange. As a result of this exchange, BMP China became our wholly owned subsidiary. In December 2005, we completed our acquisition of WanWei. On October 31, 2007, we completed the acquisition of 49% of the issued share capital of Sunstone China Limited (formerly named Hong Kong Fly International Health Care Limited), or Sunstone China, which holds a 100% equity interest in Sunstone. On February 18, 2008, we completed the acquisition of the remaining 51% interest in Sunstone China that we had not already acquired (for the period November 1, 2007 through February 17, 2008, we accounted for Sunstone China as an equity investee). On July 4, 2008, we completed the acquisition of 63.3% of the issued share capital of Rongheng. On February 16, 2009, Sunstone received its business license for 50% of the outstanding equity of Zhangjiakou Shengda Pharmaceutical Co.Ltd, which has changed its name to Sunstone Shengda (Zhangjiakou) Pharmaceutical Co.Ltd, or Shengda. On April 16, 2009, Sunstone Fly (Tangshan) Pharmaceutical Co. Ltd, or Sunstone Fly, whose 70% outstanding equity is held by Sunstone, was founded. Sunstone Fly produces traditional Chinese medicines, or TCMs, for the pediatric market.

3

Table of Contents

Set forth below is a chart that reflects our current corporate organization:

4

Table of Contents

Industry Environment and Development Prospects

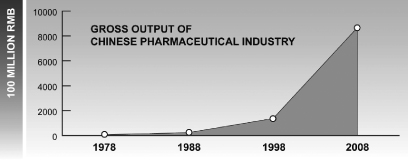

Economic reform and the gradual opening of markets in China began in the late 1970’s. Since then, the climate for both domestic and foreign businesses has undergone dramatic transformation. According to 2009 Medicine Economic News, during this 30-year period, Chinese per-capita consumption of goods and services increased 28 times, per-capita health expenditures increased 64 times, and per-capita drug spending increased from RMB4 to RMB378. Further according to 2009 Medicine Economic News, in 1978, China’s share of the global pharmaceutical market was only 0.9% and by 2008, that share had increased to 8.3%. The gross output value of the Chinese pharmaceutical industry (see the chart below) grew from $7.9 billion in 1978 to $866.6 billion in 2008. This represents a compound annual growth rate, or CAGR, of 17%, or approximately 1.5 times the CAGR of GDP in China during the same period. The total volume of foreign trade value of Chinese medicines and health products grew from $330 million in 1978 to $48.69 billion in 2008.

IMS Health forecasts that China will be the 3rd largest medicinal market in the world in 2011, and that by 2020, it will have moved into second position, behind only the United States.

We believe economic conditions for the pharmaceutical industry in China remain favorable. In 2009, the growth rate in the Chinese GDP reached 8.7% and the economic aggregate totaled RMB33.5 trillion. According to data from the Chinese Ministry of Industry and Information, during the first three quarters of 2009 the gross output value of the Chinese pharmaceutical industry reached RMB618.4 billion This represents a year-over-year increase of 17.3%, more than 14 percentage points higher than the corresponding average growth rate for all Chinese industries combined (2.97%). Given the strong growth of both domestic demand for medicines and pharmaceutical manufacturing capacity and output, we expect this robust rate of growth to continue.

Market conditions also continue to be influenced by the evolution of Chinese government healthcare policy. “Opinions of the State Council on Deepening the Reform of the Medical and Health Care System,” issued by The State Council of the People’s Republic of China (the State Council) in April 2009, signaled the formal commencement of a major public health initiative by the Chinese government. The goal of this new policy is to provide access to basic medical care for every person in China by the 2020. Subsequent government policy statements related to this reform, including “Opinions on Formulation and Implementation of National Essential Medicine System,” “National Essential Drugs List,” and “China’s National Medical Insurance Catalog,” or the 2009 NIC, are set to exert considerable, generally positive, influence on the Chinese pharmaceutical industry and its future development. For example, as stated above, a major component of these reforms is an effort to extend basic medical insurance coverage to a larger portion of the Chinese population.

In January 2009, the State Council of the People’s Republic of China announced it would spend RMB850 billion over three years to increase the enrollment rate in basic medical insurance above 90% among urban residents and participants in the new rural cooperative medical system; raise the governmental per-capita subsidy for medical insurance to RMB120 starting in 2010; and increase the reimbursement rates and payment limits for medical services. The Ministry of Human Resources and Social Security of the People’s Republic of China estimated that, by the end of 2009, the number of Chinese citizens with medical insurance had already reached

5

Table of Contents

1.2 billion. According to the State Food and Drug Administration, or the SFDA, Southern Medicine Economy Economic Research Institute, the portion of anticipated growth in the Chinese pharmaceutical market directly attributable to this expansion of medical insurance coverage will be approximately RMB200 billion in 2010. As a result, the gross output value of the Chinese pharmaceutical industry is expected to grow by 23% in 2010, reaching RMB1.25 trillion.

Our Opportunity

The centers of growth for the global pharmaceutical industry will continue a steady shift from European, American and other leading markets to Asia, Australia, Latin American, Eastern Europe and other regions. One of the largest and fastest growing of these growing markets, China, will represent a significant opportunity for the pharmaceutical industry for the foreseeable future. BMP Sunstone has made strategic investments in key sectors of this dynamic marketplace to secure a competitive position and drive market share growth. In addition to the beneficial impact of favorable economic conditions and government health policies on the Chinese pharmaceutical market, the following factors also enhance the prospects for rapid development and strong performance of our Company:

Large Population and Target Segment Size

Home to nearly 20% of all human beings, China is the most populous nation in the world. According to the Chinese National Bureau of Statistics, the total national population at the end of 2008 was 1.328 billion. Nearly half (48.5%) of this total, or 644 million Chinese, were female, with the number of women of reproductive age exceeding 350 million. The number of children (0-14 years old) was 251 million, accounting for 19% of the total population. There were 16.08 million births in 2009.

Aging Population

China’s aging population is also growing, expected to reach 173 million in 2010, representing approximately 12.5% of the total population. By 2020, it is estimated by China’s Population and Development Research Center that the growth in the aging population in China will accelerate, reaching 245 million or over 16% of the total population.

Continued Urbanization

Population migration into large urban centers continues to accelerate in China. At the end of 2008, the Chinese urban population was 606 million, or 45.7% of the total population. By 2020, an estimated 50%-55% of all Chinese will live in cities.

Large Gynecological Market

The market for medicines for women in China is approximately RMB20 billion and is dominated by treatments for common gynecological disorders including vaginal inflammation and endometriosis. Approximately 42.9% of women will experience at least one incidence of vaginal inflammation, and about 30% of women, particularly between the ages of 30 and 50, suffer from hysteromyoma (fibroids). Approximately 10-15% of the 300 million women of child-bearing age in China are diagnosed with endometriosis each year. We have obtained the exclusive license to market and distribute Depo Provera from Pfizer for the treatment of Endometriosis.

Unmet Needs in the Obstetrical Market

As a report from The World Health Organization revealed, the current caesarean birth rate in China is 40%-46%, the highest in the world. Approximately 25% of these procedures are unnecessary. The incidence of

6

Table of Contents

premature delivery ranges from 5-15% and the incidence of threatened premature delivery reached 28% as more Chinese women wait until they are older to become pregnant. The Guidelines for Labor Induction in Late Stage Pregnancy was published in the Chinese Journal of Obstetrics and Gynecology in January 2008 and selected Propess as the first line treatment for labor induction in late stage pregnancy. Propess is marketed and distributed by us in China. In addition, we market and distribute Anpo for the management of pre-term labor.

Growing Pediatric Market.

The market for pediatric medicines has grown to nearly RMB30 billion. The most significant products for this market are anti-cold medicines, drugs for respiratory diseases, anti-diarrhea medicines, anti-infectives and vitamins, which account for 80% of all pediatric medicine. Our GoodBaby product range manufactured and sold by Sunstone is a leading pediatric brand in China.

Growth of OTC Market

The market for over-the-counter, or OTC, medicines in China has shown rapid development, growing from RMB 1.9 billion in 1990 to RMB 129.5 billion in 2008. According to China Medicine News, in 2010, China is expected to become the world’s second largest market for OTC medicines. Corresponding to the rapid development of China’s OTC market, some original research-based multinational corporations accelerated the growth in China’s OTC market through mergers and acquisitions.

Progress in China’s medical reform initiatives, movement toward universal medical insurance, an aging population, as well as the consolidation and integration of the domestic pharmaceutical markets will encourage further development of the Chinese pharmaceutical industry and significantly expand commercial opportunity. Furthermore, among Chinese pharmaceutical segments, the obstetrical, gynecological and pediatric markets are relatively fragmented and underserved. Taken together, these factors define a broad range of attractive opportunities for further growth of BMP Sunstone.

Description of Business and Position in Industry

BMP Sunstone is a fully integrated specialty pharmaceutical company with both prescription and OTC products focused primarily on pediatrics and women’s health. Sunstone is a leading domestic producer of OTC brand medicines for women and children, while BMP China operates a leading professional sales organization specializing in obstetrical prescription medicines.

The Company has been devoted to the development of the Chinese pharmaceutical market since its inception and has already made significant progress toward becoming a market leader on the basis of a flexible and highly efficient approach to mergers and acquisitions, a management team with extensive operational and business development experience in China, and a high degree of collaboration among our subsidiary companies. Through brand extensions and expanded channel coverage, Sunstone has built leading OTC brand families for children (“Goodbaby”) and for women (“Confort”). By virtue of unique product introductions, our medical sales and promotion capabilities, and a clear focus on gynecology and obstetrics, BMP China has maintained rapid growth and become the leading domestic supplier of obstetrical medicines. The pharmaceutical distribution businesses of WanWei and Rongheng have also experienced rapid growth and the enhancement of their collaboration with BMP China has laid a solid foundation for the nationwide expansion of BMP China.

Sunstone (Manufactured Products Segment)

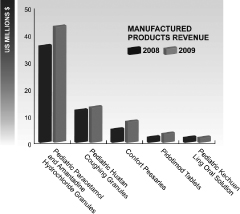

Our Manufactured Products segment consists of the operations of Sunstone. Sunstone specializes in medicines for women and children and has manufacturing facilities located in Tangshan, Hebei Province China. Revenues from the Manufactured Products segment account for more than 90% of Sunstone’s total revenue. In 2009, sales of GoodBaby products accounted for 78.3% of total revenue, and sales of Confort products accounted for 12.1% of total revenue.

7

Table of Contents

According to the China Pharmaceutical Statistical Annual Report in 2008, Sunstone ranked among the top 100 National Pharmaceutical Enterprises based on both revenue and profit.

Products

Sunstone owns 102 Product Approval Numbers, which represents the number of products approved for sale by the SFDA. Sunstone markets three brand families “Goodbaby,” “Confort” and “Nemei.”

Major products in the Goodbaby brand family include Pediatric Paracetamol and Amantadine Hydrochloride Granules, Pediatric Huatan Coughing Granules, Pediatric Kechuanling Oral Solution, Amoxicillin and Clavulanate Dispersible Tablets for children, Amoxicillin Dispersible Tablets, Roxithromycin Dispersible Tablets, Pidotimod Tablets, Montmorillonite Granules, and Pediatric Vitamin Granules.

The product portfolio under the Confort brand includes multiple products for vaginal infections, including Compound Zedoary Turmeric Oil Suppository, Econazole Nitrate Suppository, Clotrimazole and Chlorhexidine Acetate Suppositories and Nifuratel-Nystatin Vaginal Soft Capsules.

The Nemei brand family consists of a variety of OTC women’s health products related to nutrition and general well being.

GoodBaby has been designated a Certified Famous Chinese Brand. Confort has received a famous trademark designation from Hebei Province.

For three consecutive years, from 2005 to 2008, GoodBaby was ranked among the “Most Recommended Brands by Pharmacy Employees” by the Chinese OTC Medicine Association.

In August 2009, the Chinese OTC Medicine Association ranked Sunstone’s Amantadine Hydrochloride Granules No.1 among pediatric OTC medicines. In October 2009, GoodBaby and Confort were recognized as the “Most Recommended Brands by Pharmacy Employees” by China Drugstore Magazine. In December 2009, Goodbaby and Confort were named the “Favorite Brand of Chinese Women and Children” by the Chinese Women and Children Development Center.

Related Subsidiaries

Shengda specializes in antibiotic research, development and production. It has approval from the SFDA to manufacture approximately 76 products, and primarily focuses on penicillin and cephalosporin products. Dosages and flavors are specifically designed for the unique needs of children and the product portfolio includes some of the most widely prescribed and effective pediatric medicines, such as amoxicillin tablets and capsules, as well as amoxicillin and clavulanate potassium compounds. The products are formulated as dispersible tablets, which offer consistently high levels of safety and efficacy and are preferred by parents for ease of administration to children.

Distribution and Marketing

As of December 31, 2009, Sunstone had more than 1,500 salespeople in 35 regional offices promoting its products throughout China.

To broaden awareness of Sunstone brands and appreciation for our leading role in protecting the health and well-being of women and children in China, we have launched four public health campaigns, including “GoodBaby Family Medicine-chest activity,” “Bright Mother, Healthy Baby appraisal,” “GoodBaby Health Plan in Community” and “Goodbaby Cup Painting competition.” These campaigns reach children and mothers through kindergartens, elementary schools, and communities all over China. Our approach to creating value for our customers is based on the concept of “customized solution, customized health,” and we try to incorporate this

8

Table of Contents

idea into all of our promotional activities. We believe our business is about more than promoting our products; it is about promoting health. In 2009, we carried out a large public service activity, “Light New Hope,” to support the mothers and children of the Sichuan-Wenchuan earthquake disaster region in collaboration with pharmacies all over China. This activity, which included over 100,000 pharmacies, successfully heightened our corporate image and increased popular support for the Sunstone, GoodBaby and Confort brands.

Our sales system has enabled us to build a large selling network. This network, extending throughout most of China, gives us access to 25,000 target hospitals, pharmacies, and community and county-level medical institutions, as well as more than 350 independent distributors. Essentially, we have expansive coverage of primary pharmacies in all major consumer markets in China.

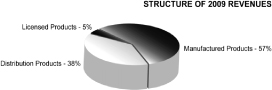

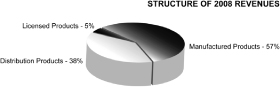

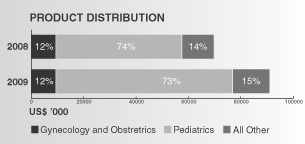

Our product distribution during 2009 and 2008 for Sunstone and BMP China is represented in the charts below:

Research and Development

Throughout its history, Sunstone has engaged in extensive research and development activities through independent research and development and cooperation with leading scientific research institutions in China. Currently, Sunstone is conducting 32 trials for drugs which have received clinical trial approval, or CTAs, including 13 products for pediatrics and 7 products for gynecology. In addition, Sunstone currently has 5 CTAs pending review for Product Approval Numbers. The successful development of new products is an important driver of Sunstone’s continued success.

Sunstone secured the Hi-tech Enterprise Certificate issued by the Hebei Science and Technology Department, which provides Sunstone with a preferential income tax rate of 15% for the years 2008, 2009 and 2010.

Intellectual Property

Sunstone owns or licenses 25 patents which have been approved by the Intellectual Property Office of the People’s Republic of China, and 13 invention patents. These patents provide protection relating to production technology, production devices and package design, giving our products unique competitive advantages and differentiation. Sunstone has obtained more than 100 trademarks, including those relating to Goodbaby, Confort, Sunstone and other major marks or names.

WanWei (Pharmaceutical Distribution Segment)

WanWei was founded in 1999 and its main business is distribution of medicinal products. In addition to the distribution of TCMs, chemical pharmaceutical preparations, chemical pharmaceutical products, antibiotics, biochemical drugs, biological products, and psychotropic drugs (Category II), since its inception, WanWei has been the sole supplier of raw materials for medicinal compounding at key hospitals in the region of Beijing. WanWei is also a qualified supplier of raw materials for medicinal precursor chemicals, Category II psychotropic

9

Table of Contents

drugs, protein assimilation drugs, and peptide hormones, providing additional business resources and unique competitive advantages. WanWei owns an extensive hospital sales network in Beijing, with access to 100% of Tier III (top tier) and 61% of Tier II hospitals, covering more than 600 hospitals or greater than 80% of the total number medical treatment institutions in Beijing. WanWei has established business relationships with 67 of the more than 240 pharmaceutical distributors in Beijing, has geographic coverage of all the districts and counties in Beijing region, and can reach the majority of retail pharmacies in these areas.

WanWei acts as the exclusive or non-exclusive agent in Beijing for some suppliers’ products. With the legal right to import drugs, WanWei functions as BMP China’s importer of licensed products and the nationwide exclusive agent for these products.

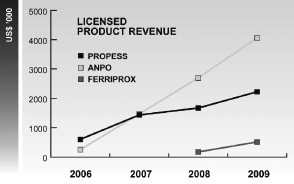

Under this arrangement with BMP China, WanWei has become the sole distributor for Propess, Anpo and Ferriprox in China. In November 2009, we acquired exclusive promotional rights in China for Depo-Provera (a treatment for endometriosis) from Pfizer. WanWei has developed a nationwide distribution network consisting of 48 distributors in over 22 provinces/municipalities and 38 cities comprising the main economically developed regions of China.

As of the end of 2009, revenues from WanWei accounted for 25.3% of our total revenue.

WanWei Product Portfolio

WanWei currently distributes approximately 800 products, including approximately eight products on an exclusive basis, in Beijing or throughout China. The five highest revenue producing products distributed by WanWei accounted for 37.9% of WanWei’s total sales in 2009.

Rongheng (Pharmaceutical Distribution Segment)

Rongheng was established in 1996 and its business activity is primarily in Shanghai, which is currently the largest pharmaceutical market in China.

Rongheng has a distribution network that covers 300 hospitals and 1,000 retail pharmacies through Tier 2 distributors. Rongheng has access to 80% of Tier III and 70% Tier II hospitals in Shanghai. Rongheng distributes approximately 450 products. The five highest revenue producing products distributed by Rongheng accounted for 24.3% of Rongheng’s total revenue in 2009. Rongheng aims to become a unique pharmaceutical distributor by offering value-added services to product suppliers.

As of the end of 2009, revenues from Rongheng accounted for 12.7% of our total revenue.

BMP China (Licensed Products Segment)

Our Licensed Products Segment consists of the operations of BMP China, which is headquartered in Beijing, China. BMP China is the successor to Beijing Medpharm Corporation Co., Ltd, which was one of the first companies to integrate drug registration, marketing and promotion in China, especially for imported licensed products.

BMP China has developed into a professional pharmaceutical marketing company focused on obstetrics, gynecology and pediatrics, and provides a package of tailored market-entry services from registration of imported medicines through professional promotion of approved products and life-cycle management for western pharmaceutical manufacturers that are seeking to enter the Chinese market.

10

Table of Contents

Product Registration

To prepare for market entry, we provide foreign pharmaceutical companies with integrated analytic services for pharmaceutical products. Through preparation of data and reports related to clinical trials, we consult with the SFDA and its subordinate Center for Drug Evaluation, or CDE, and we are able to provide comprehensive clinical trial management services until the import drug license, or IDL, is ultimately acquired.

Professional Academic Promotion

As of December 31, 2009, we employ 92 field-based marketing and sales personnel, allowing us to reach the main cities and regions in the country and cover more than 1,000 large and medium Ob/Gyn and/or specialty hospitals as well as Tier III hospitals. Most of the Company’s medical representatives have degrees in medicine or pharmacy and have extensive experience in medical marketing enhanced by the Company’s regular professional training programs.

Our proven promotion models include regular call cycles to provide doctors with the latest technical knowledge about our products and inform them about industry trends. We also expand awareness of and preference for our products through regular participation in medical symposia, case workshops, round table meeting discussions, and scientific exhibitions. By facilitating attendance by our key customers at international medical conferences, we further enhance our relationship and their understanding of our products. We also provide patients and doctors with comprehensive informational and education materials to enhance their understanding of our products

Through these efforts, the Company and our products have been widely recognized inside the Chinese pharmaceutical industry, while at the same time winning extensive support and favorable comments from numerous medical opinion leaders and professional academic institutions. These relationships have, in turn, facilitated favorable formulary position and reimbursement levels for our products. Among the four products that we have already launched, Anpo injection and Anpo tablets have been listed in Class A of the 2009 National Insurance Catalogue, or NIC, Propess® has been listed in Class B of the 2009 NIC – Limited for Maternity Reimbursement, and Ferriprox® was admitted into the “Wholly Planned Scope of Medicines for General Outpatient Service in Basic Medical Insurance of Guangdong Province (On Trial Basis)” at the end of October, 2009.

Product Portfolio for Sales and Marketing Services

We provide sales and marketing service to the following licensed products:

| Product Name |

Indication |

Active ingredient |

Partner |

Launch | ||||

| Propess |

Cervical Ripening | Dinoprostone | Cytokine Pharmasciences |

2005-Present | ||||

| Anpo injection |

Pre-term Labor Mgmt | Ritodrine hydrochloride | Taiwan Biotech | 2006-Present | ||||

| Anpo tablets |

Pre-term Labor Mgmt | Ritodrine hydrochloride | Taiwan Biotech | 2006-Present | ||||

| Ferriprox |

Iron overload (Thalassemia) |

Deferiprone | ApoPharma Inc | 2008-Present | ||||

| Depo Provera |

Endometriosis | Medroxyprogesterone Acetate |

Pfizer, Inc | 2nd half of 2010 | ||||

Competition

The consolidation of the Chinese pharmaceutical market is gradually increasing, which increases barriers to entry. Driven by the needs for product innovation and market competitiveness, mergers and restructurings of existing pharmaceutical enterprises became more common, further improving the scale and integration of the industry leaders, including China National Pharmaceutical Group and Shanghai Pharmaceutical Group. Changes

11

Table of Contents

in the bidding policy for Chinese government contracts and increased standards for Good Manufacturing Practice, or GMP, and Good Supply Practice, or GSP, are also enhancing the competitiveness of industry participants. Manufacturing enterprises that are able to combine the advantages of new drug innovation, high product quality, and brand marketing will become the dominant competitors in the future. For distribution enterprises, sales volume, terminal networks, and advanced warehousing and distribution facilities will be the keys to future competitiveness. Product marketing companies will be competitive only if they retain the professional marketing and sales staff and the specialized hospital promotions teams preferred by manufactures and hospitals.

Due to the increasing challenges of drug development and the patent expirations of major pharmaceutical brands, many international manufacturers are turning to generic drug and OTC product strategies in their life-cycle management planning. Increasing health care and health insurance costs are also increasing government interest in and support for the development of OTC products. In China, the growth rate of the OTC market has been significantly higher than foreign OTC markets over the last decade, attracting rapidly expanding interest and investment from international pharmaceutical companies. Major trends including Chinese healthcare reform, rising urbanization, and increased awareness among Chinese consumers of self-medication (coupled with greater buying power) will contribute to the rapid development of the OTC medicines market in China.

The Chinese government permits advertising of OTC brands through mass media channels. The ability to build brand awareness and enhance corporate reputation through consumer promotion is also driving the development and acceptance of OTC drugs, while attracting additional competitors to the market.

Sunstone is one of the leaders in the Chinese OTC medicines market, particularly in the fields of pediatrics and gynecology. In August 2009, the Chinese OTC Medicine Association ranked Sunstone’s Amantadine Hydrochloride Granules No. 1 among OTC chemicals and other drugs (in the pediatrics class). In October 2009, GoodBaby and Confort were recognized as the “Most Recommended Brands by Pharmacy Employees” by China Drugstore Magazine. In December 2009, GoodBaby and Confort were named “Favorite Brand of Chinese Women and Children” by Chinese Women and Children Development Center.

With market development for more than 10 years, Sunstone has formed its unique market promotion model, and established well-known brands Goodbaby and Confort. Through TV advertising, magazine and newspaper, professional media, Sunstone established partnership with many provincial and city level women and children organizations, and we believe its four market activities (“GoodBaby Family Medicine-Chest Activity,” “Bright mother, Healthy baby Appraisal,” “GoodBaby Health Plan in Community” and “GoodBaby Cup Painting Competition”) for the public good are very popular with women and children. We believe consumers’ awareness and loyalty to GoodBaby and Confort are continuing to improve. The largest competitor to our Goodbaby products is Shanghai Johnson and Johnson Pharmaceuticals, Ltd’s cold medicines. The largest competitor to our Confort products is miconazole nitrate suppositories manufactured by Xi’an Janssen Pharmaceutical, Ltd.

BMP China’s business is based on introducing advanced pharmaceutical products for gynecological and pediatric indications into China on the basis of exclusive licensing agreements with international innovator companies. Using a unique promotion model, BMP China has established a leading position in the obstetrics field. Its hospital promotion team specializing in gynecology and pediatrics has laid a solid foundation for future product launches, robust sales growth, and the expansion of BMP China as a dominant competitor in this field.

WanWei now covers over 80% of hospital networks and a majority of retail pharmacies in Beijing. We are increasing the number and variety of products we are licensed to distribute on an exclusive basis. Due to its storage capacity and transportation capabilities, WanWei can assure these customers 24-hour delivery for normal orders and immediate delivery for special orders. With the expansion of BMP China’s business to national scale, WanWei conducts business in 38 cities and 22 provinces in China. This national reach has increased WanWei’s competitive advantage in Beijing.

12

Table of Contents

Rongheng is located in Shanghai, China’s number one pharmaceutical market. Rongheng covers 300 hospitals and nearly 1,000 retail pharmacies in Shanghai. Rongheng’s regional capabilities have allowed WanWei and BMP China to expand our business in Shanghai.

The 2009 NIC will strengthen the competitiveness of our products in the pharmaceutical market. The 2009 NIC is the official drug reimbursement list compiled as part of China’s ongoing healthcare reform plan, and includes a total of 2,151 drugs. Seventy eight of BMP Sunstone’s products have been included in the 2009 NIC, twelve of which are new additions since the last catalog published in 2004. These new additions include some of BMP Sunstone’s best selling products, including Confort, a women’s health treatment for vaginal infections, and Propess, a medication used to induce labor in late-stage pregnancy. The Company’s Amoxicillin and Amoxicillin & Clavulanate Potassium products, which treat cough and cold symptoms, were also added to the 2009 NIC. In addition, the Company’s thalassemia medication, Ferriprox, has been added on a preliminary basis to Guangdong Province’s Medical Insurance Catalog.

The 2009 NIC is a vital part of the universal healthcare system in China and will greatly expand the pharmaceutical market in China. We believe the inclusion of two of our best-performing products, Confort and Propess, as well as our cough and cold products, in the 2009 NIC and the preliminary inclusion of Ferriprox in Guangdong Province’s Medical Insurance Catalog will expand our sales. Guangdong Province has the highest incidence of thalassemia in China and treatment for this disorder can be very expensive. Therefore, we believe that the potential for partial reimbursement in Guangdong Province will boost sales of Ferriprox throughout that province. We believe that the inclusion of our products in the insurance catalogs will strengthen our brand recognition and accelerate our penetration into our key therapeutic areas, including women’s and children’s health.

Our management team has extensive experience in the domestic and foreign pharmaceutical industries. Key members of our executive management team have backgrounds in mergers and acquisitions, business development, operations management, pharmaceutical marketing and sales, and/or product development and lifecycle management with both domestic and international pharmaceutical companies.

Our Strategy

Our goal is to become a unique fully-integrated specialty pharmaceutical company focused primarily on pediatrics and women’s health. The main elements of our strategy include the following:

Further Consolidating Brand and Channel Advantages of Sunstone’s Products for Women and Children

Over more than a decade of brand-building, we believe Sunstone has firmly established the “Good Baby” and “Confort” product portfolios in their respective markets in China and made them “household names” among Chinese consumers. Moving forward, we plan to utilize mass media channels to further expand the popularity and reputation of Sunstone “GoodBaby” and “Confort” brands, including TV advertising, two-dimensional advertising and web-site promotions.

Sunstone has established a sales network with over 1400 sales representatives and more than 350 distributors, to provide adequate coverage of major drugstores in significant markets throughout China. Sunstone has also established partnerships with many regional and local women’s and children’s advocacy organizations to develop public health campaigns. With their assistance, Sunstone has reached more than ten million consumers over the past decade through participation in these special programs.

Enriching Sunstone’s Product Lines in Multiple Ways

Sunstone continues to expand its product lines of medicines for women and children through mergers and acquisitions, technology transfer, independent R&D, and other activities. Most recently, in April, 2009, after

13

Table of Contents

completing the acquisition of 50% of the outstanding equity interests in Zhangjiakou Shengda Pharmaceutical Co., LTD, we folded its Amoxicillin Dispersible Tablets and Amoxicillin Clavulanate Dispersible Tablets into the GoodBaby brand, further enriching our Goodbaby antibacterial product line.

Strengthening Our Prescription Hospital Coverage and Marketing Power By Focusing on Women and Children.

We are one of the leading companies in obstetrics in China. Propess and Anpo were included in Class B of the 2009 NIC, which will help us to expand our market coverage in hospitals. We plan to strengthen our sales force by adding personnel, enhancing the targeting of hospital accounts, and exploring ways to improve the productivity of sales calls.

In November, 2009, we signed an agreement with Pfizer for an exclusive marketing license for Depo-Provera in China. In the Chinese market, Depo Provera is highly differentiated among treatments for endometriosis because of its long-acting preparation and significant analgesic effect. It has been included in Class B of the 2009 NIC, which will expedite its utilization in the gynecology field.

Growth from consolidation, market expansion and channel synergy

We believe that we are well-positioned to expand our client base and introduce additional products into our business platform. We intend to leverage our existing marketing arm by layering new products into the current sales force. Our sales strategy includes internal growth and growth through strategic acquisitions, specifically in major urban markets in China. We believe this consolidation strategy presents an opportunity to achieve significant gains in efficiency.

Regulation of the Pharmaceutical Industry in China

The following discussion describes certain Chinese laws, rules and regulations, which apply to the Company and the Company’s activities related thereto.

Protocol on Accession of China into the World Trade Organization

China acceded to the World Trade Organization, or WTO, on December 11, 2001. According to Annex 9 of the Protocol on the Accession of the People’s Republic of China, China allowed foreign invested enterprises to distribute pharmaceutical products directly in China. In December 2004, we entered into an agreement to acquire Wanwei and completed the acquisition in 2005.

Regulation of Foreign Ownership of Pharmaceutical Distribution Companies in China

Under the Administrative Measures on the Foreign Investment in Commercial Sector adopted on April 16, 2004 by the Sixth Ministry Meeting of the Ministry of Commerce of the People’s Republic of China and effective as of December 11, 2004, foreign enterprises were permitted to establish or invest in wholly foreign-owned enterprises or joint ventures that engage in wholesale or retail sales of pharmaceuticals in China.

Permits and Licenses for Pharmaceutical Distribution and Manufacture Enterprises

Before any pharmaceutical distribution enterprise, including any manufacturer, wholesaler or retailer, can produce or distribute pharmaceutical products in China, it must obtain a pharmaceutical manufacture and distribution permit issued by the appropriate provincial or county level branch of the SFDA where the pharmaceutical distribution enterprise is located. The granting of a pharmaceutical manufacture and distribution permit is subject to an inspection of the premises and facilities, warehouse, hygiene environment, quality control systems, personnel and equipment of such enterprise. The pharmaceutical production license and pharmaceutical

14

Table of Contents

distribution permit is valid for five years. Pharmaceutical distribution enterprises and pharmaceutical manufacture enterprises must apply for renewal of their permit no later than six months prior to the expiration date of the license with the appropriate governmental authority.

In addition to the pharmaceutical distribution permit and pharmaceutical production license, pharmaceutical distribution and manufacture enterprises also must obtain a business license from the appropriate administration bureau for industry and commerce to commence its business. We have obtained the appropriate business licenses for the jurisdictions in which we operate.

Good Supply Practice Standards

Good Supply Practice, or GSP, standards were established to regulate pharmaceutical wholesale and retail enterprises to ensure the quality of distribution of pharmaceutical products in China. The current applicable GSP standards, which were passed by the SFDA, came into effect on July 1, 2000. Under these standards, wholesale and retail enterprises in China must implement strict control on the distribution of pharmaceutical products with respect to, among other things, staff qualifications, distribution premises, warehouse, inspection equipment and facilities, management and quality control in order to obtain a GSP certificate to carry out business in China.

The GSP certificate is generally valid for five years. Pharmaceutical distribution enterprises must apply for renewal of their GSP certificates no later than three months prior to the date of expiration of their GSP certificates, subject to reassessment by the SFDA. Our distribution companies have valid GSP licenses in effect.

Good Manufacturing Practice Standards

Good Manufacturing Practice, or GMP, standards were established to regulate pharmaceutical manufacture enterprises to ensure quality manufacturing of pharmaceutical products in China. The current applicable GMP standards, which were passed by the SFDA, came into effect on October 1, 2005. Under these standards, pharmaceutical manufacturing enterprises in China must implement strict control on the manufacture of pharmaceutical products with respect to, among other things, staff qualifications, manufacture equipment, quality control standards, production process, purification, and environmental protection in order to obtain a GMP certificate to carry out business in China. The SFDA performs on-site inspection for enterprises applying for and holding certification.

The GMP certificate is valid for five years. Pharmaceutical manufacture enterprises must apply for renewal of their GMP certificates no later than six months prior to the date of expiration of their GMP certificates, subject to certification decision of SFDA. Our manufacturing facility has a valid GMP licenses in effect.

Bidding System for Drug Purchases by Medical Organizations

In accordance with the Notice on Issuing Certain Regulations on the Trial Implementation of Centralized Tender Purchase of Drugs by Medical Organizations, promulgated on July 7, 2000, and the Notice on Further Improvement on the Implementation of Centralized Tender Purchase of Drugs by Medical Organizations promulgated on July 23, 2001, non-profit medical organizations established by county or higher level government in China are required to implement bidding processes for the purchase of pharmaceuticals. In principle, medical organizations are required to join together to organize bids to purchase pharmaceuticals in bulk volume. The bids are to be assessed by a committee formed by pharmaceutical experts who are recognized by the relevant authorities, with reference to, most importantly, drug quality, and other criteria, including price, service and quality of the drug manufacturers.

Several Provisions on Further Regulating the Centralized Tender Purchase of Drugs by Medical Organizations, promulgated on September 23, 2004, provides that pharmaceutical wholesalers must have the due authorization of the pharmaceutical manufacturers to participate in the bidding process. Pharmaceutical manufacturers can participate in the bidding process on their own.

15

Table of Contents

Insurance Catalogue

Pursuant to the Decision of the State Council on the Establishment of the State Basic Medical Insurance System for Urban Employees and the Implementation Measures for the Administration of the Scope of Medical Insurance Coverage for Pharmaceuticals for Urban Employees, the Ministry of Labor and Social Security in China established the Insurance Catalogue. The Insurance Catalogue is divided into Class A and B drugs. The medicines included in Class A are designated by the Chinese governmental authorities for general application.

Patients purchasing medicines included in Class A are entitled to reimbursement of the costs of such medicines from the social medical fund in accordance with relevant regulations in China. Patients purchasing medicines included in Class B are required to pay a predetermined proportion of the costs of such medicines.

On November 30, 2009, the Ministry of Human Resources and Social Security published the 2009 NIC. The new catalogue is divided into Class A and B, based upon reimbursement. The 2009 NIC is China’s health care reform plans’ official drug reimbursement list and includes 2,151 drugs in total. Seventy eight of BMP Sunstone’s products have been included in the 2009 NIC, twelve of which are new additions from the last published catalog in 2004. These new additions include some of BMP Sunstone’s best selling products, such as Confort, a women’s health treatment for vaginal infections, and Propess, a first line treatment for labor induction in late-stage pregnancy. The Company’s Amoxicillin and Amoxicillin & Clavulanate Potassium products, which treat cough and cold symptoms, were also added to the 2009 NIC. In addition, the Company’s thalassemia medication, Ferriprox, has been preliminarily added to Guangdong Province’s Medical Insurance Catalog.

Price Controls

According to the “Notice on State Development and Reform Commission Pricing Drugs Catalog”, the prices of drugs are currently established in one of two ways: either the government fixes the price or the price is market-based. Drugs priced by the government are limited to the those listed in the NIC and a small number of monopoly specific drugs, including psychotropic substances, narcotic drugs, vaccines and family planning drugs, which are produced by the Chinese national government. Within these groups, the price management department of the State Council is responsible for pricing. Provincial price administration departments are responsible for pricing the drugs in Class B of the 2009 NIC, TCMs, and the compounded products produced by hospitals. Prices for drugs not subject to government control can be established by their manufacturers or distributors based on supply and demand and other market forces. The majority of our revenues are generated by products not under price controls.

Application for Registration of Imported Medicines

The SFDA is the national authority for drug registration, responsible for the review and approval of clinical studies, production and importation of drugs based on drug registration regulations.

An imported drug requires marketing approval in its origin country or region of manufacture. An import drug without such a marketing approval may still be approved after the SFDA confirms the safety and efficacy of the drug and there is a clinical need for the drug. The drug for which import application is made shall also meet the GMP standards in its country or region of origin as well as GMP requirements in China

An IDL is valid for five years. Pharmaceutical manufacture enterprises must apply for renewal of their IDL no later than six months prior to the date of expiration of their IDL, subject to correlative regulations of SFDA.

Employees

Substantially all of our employees are located in China. As of December 31, 2009, we had 1,198 full time employees, 161 of whom were management, finance or administrative employees, 516 of whom were sales and

16

Table of Contents

marketing employees, 478 of whom were manufacturing and warehouse employees and 43 of whom were quality assurance and research employees. We have not experienced any strikes or other labor disturbances that have interfered with our operations, and we believe that the relationship between our management and our employees is good.

We are required to contribute a portion of our employees’ total salaries to the Chinese government’s social insurance funds, including medical insurance, unemployment insurance and job injuries insurance, and a housing assistance fund, in accordance with applicable regulations. In the last three years, we contributed the following amounts to these funds:

| Year |

Contribution in US Dollars* |

Contribution in RMB | ||

| 2009 |

$1,345,000 | RMB 9,203,000 | ||

| 2008 |

$ 812,000 | RMB 5,562,318 | ||

| 2007 |

$ 488,166 | RMB 3,476,669 |

| * | Based on exchange rates in effect at March 1 of the following year. |

We expect the amount of contribution to the government’s social insurance funds to increase in 2010 as we expand our workforce and operations.

Executive Officers

The following table identifies our current executive officers:

| Name |

Age | Position | ||

| David Gao |

60 | Chief Executive Officer and Director | ||

| Fred M Powell |

48 | Chief Financial Officer | ||

| Yanping Zhao |

47 | Corporate Vice President |

David (Xiaoying) Gao has served as our Chief Executive Officer since February 2004. Since February 2002, Mr. Gao has served as Chairman of BMP China’s board of directors. Mr. Gao served as President and director of Abacus Investments, Ltd., a private wealth management company, from August 2003 until June 2004, and as Chief Executive Officer of Abacus from July 2003 to June 2004. From 1989 to 2002, Mr. Gao held various positions at Motorola, Inc., a publicly-traded company specializing in wireless, broadband and automotive communications technologies and embedded electronic products, including: Vice President and Director, Integrated Electronic System Sector, Asia-Pacific operation, from 1998 to 2002; Member, Motorola Asia Pacific Management Board, Management Board of Motorola Japan Ltd., from 2000 to 2002; and Motorola China Management Board from 1996 to 2002. Mr. Gao holds a BSC in Mechanical Engineering from the Beijing Institute of Technology, a BSC in Mechanical Engineering from Hanover University, Germany, and an M.B.A. from The Massachusetts Institute of Technology.

Fred M. Powell, CPA, joined us as our Chief Financial Officer in January 2005. From May 2002 until December 2004, Mr. Powell served as the Chief Financial Officer of Eximias Pharmaceutical Corporation, a privately-held biopharmaceutical company. From April 1999 to May 2002, Mr. Powell served as the Senior Vice President, Finance and Administration, of InnaPhase Corporation, a technology solutions provider for life sciences companies that was acquired by Thermo-Electron Corporation in 2004. From March 1993 to April 1999, Mr. Powell held various positions at Premier Research Worldwide, a publicly-traded company specializing in providing clinical and diagnostic services to the pharmaceutical and biotech industries, including: Director of Finance and Administration, from 1993 to 1996, and Chief Financial Officer, from 1996 to 1999. Mr. Powell is a Certified Public Accountant and holds a BS in Accounting from Pennsylvania State University.

17

Table of Contents

Yanping Zhao joined us as our Corporate Vice President in October 2007. From September 2000 until September 2007, Ms. Zhao served as Vice President and Executive Director, Sino Biopharmaceutical Limited (a subsidiary of CHIATAI PHARM GROUP), a Hong Kong Stock Exchange listed company. Meanwhile, she served as the Executive Director of ChaiTai Frd, which was sold to Bausch&Lomb. she also served as Director of Xian ChaiTai Co. Ltd., and Vice Chairman in Shanxi Ankang ChaiTai Pharmaceutical Co. Ltd. From September 1992 through August 2000, Ms. Zhao served in senior management positions, with Chia Tai Pharmaceutical Group. From July 1983 through August 1992, Ms. Zhao served as Director China Inner Mongolia Autonomous Region Medicine and Health Products Import & Export Corporation. Ms. Zhao has a Pharmaceutical degree from Shenyang Pharmaceutical University and an MBA from Dalian University of Technology.

Available Information

We file annual, quarterly, and current reports and other documents with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

We make available free of charge our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendment to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing such materials with, or furnishing such materials to, the SEC, on or through our Internet website, www.bmpsunstone.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K.

18

Table of Contents

| ITEM 1A. | RISK FACTORS |

Investing in our securities involves significant risk, including the risks identified below and in our Securities and Exchange Commission, or SEC, filings that are incorporated by reference into this Annual Report on Form 10-K. If any of these risks or uncertainties actually occurs, our business, financial condition or results of operations could be materially adversely affected. Additional risks and uncertainties of which we are unaware or that we currently believe are immaterial could also materially adversely affect our business, financial condition or results of operations. In any case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Relating to Our Business

We may be unsuccessful in our strategy of expanding our product portfolio, acquiring complementary businesses or integrating acquired businesses.

Our business strategy includes expanding our business capabilities through both internal growth and the acquisition of complementary businesses and licensing pharmaceutical products for marketing and distribution in China. We may be unable to find additional complementary businesses to acquire or we may be unable to enter into additional agreements to market and distribute pharmaceutical products.

Future acquisitions or joint ventures may result in substantial per share financial dilution of our common stock from the issuance of equity securities. Completion of future acquisitions also would expose us to potential risks, including risks associated with:

| • | the assimilation of new operations, technologies and personnel; |

| • | unforeseen or hidden liabilities; |

| • | the diversion of resources from our existing businesses; |

| • | the inability to generate sufficient revenue to offset the costs and expenses of acquisitions; and |

| • | the potential loss of, or harm to relationships with, employees, customers and suppliers as a result of the integration of new businesses. |

The commercial success of our products depends upon the degree of market acceptance among the medical community. Failure to attain market acceptance among the medical community would have an adverse impact on our operations and profitability.

The commercial success of our products depends upon the degree of market acceptance they achieve among the Chinese medical community, particularly physicians and hospitals. Physicians might not prescribe or recommend our products to patients, and procurement departments of hospitals might not purchase our products. The acceptance of any of our products among the medical community will depend upon several factors, including:

| • | the safety and effectiveness of the product; |

| • | the effectiveness of our efforts to market our products to hospitals and physicians; |

| • | the product’s cost-effectiveness; |

| • | the product’s perceived advantages and disadvantages relative to competing products or treatments; and |

| • | the prevalence and severity of side effects. |

If our products fail to attain market acceptance among the medical community, our operations and profitability would be adversely affected.

19

Table of Contents

We may experience delays in product introduction and marketing or interruptions in supply.

Our revenues are dependent on the ability of the manufacturers and distributors with which we associate to supply and distribute product to our customers.

If delays occur, or manufacturers and distributors are unable to supply and distribute product to our customers in a timely manner, our operating results and financial condition will suffer. In addition, our contracts with pharmaceutical owners and manufacturers relating to some of the products in our product portfolio have a limited duration and have minimum sales requirements that, if not met, could lead to termination or non-renewal of the contract, or the ability of the manufacturer to render the contract non-exclusive, which could harm our revenues. In addition, Sunstone purchases raw materials from a limited number of suppliers, but we believe that other suppliers could provide similar raw materials on comparable terms. A change in suppliers, however, could cause a delay in manufacturing and a possible loss of sales, which would affect operating results adversely.

The recent financial crisis and uncertainty in global economic conditions could negatively affect our business, results of operations, and financial condition.

The recent financial crisis affecting the banking system and financial markets and the current uncertainty in global economic conditions have resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in credit, equity and fixed-income markets. There could be a number of follow-on effects from these economic developments on our business, including insolvency of key suppliers resulting in product delays; inability of customers to obtain credit to finance purchases of our products and/or customer insolvencies; counterparty failures negatively impacting our treasury operations; decreased customer confidence; and decreased customer demand, including order delays or cancellations.

Our stock price may be volatile.

Our common stock price may be volatile. The stock market in general has experienced extreme volatility that has often been unrelated to the operating performance of particular companies. The market price for our common stock may be influenced by many factors, including:

| • | the success of competitive products or technologies; |

| • | regulatory developments in China; |

| • | developments or disputes concerning patents or other proprietary rights; |

| • | the recruitment or departure of key personnel; |

| • | variations in our financial results or those of companies that are perceived to be similar to us; |

| • | market conditions in the our industry and issuance of new or changed securities analysts’ reports or recommendations; and |

| • | general economic, industry and market conditions. |

Our operating results may fluctuate as a result of factors beyond our control.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond our control. These factors include:

| • | the costs of pharmaceutical products and development; |

| • | the relative speed and success with which we can obtain and maintain customers, merchants and vendors for our services and manufacturers and suppliers of products to market to our customers; |

| • | changes in our pricing policies, suppliers and competitors; |

20

Table of Contents

| • | the ability of our suppliers to provide products in a timely manner to our customers; |

| • | increased competition in our markets; and |

| • | other general economic and seasonal factors. |

We may be required to write off goodwill or other intangible assets in the future. If we are required to write off goodwill or other intangible assets, our financial position or results of operations could be adversely affected.

Under generally accepted accounting principles in the United States, or GAAP, we review our goodwill and other indefinite-lived assets for impairment each year as of December 31 and during interim periods when events or changes in circumstances indicate the carrying value may not be recoverable. The carrying value of our goodwill may not be recoverable due to factors such as a decline in stock price and market capitalization, reduced estimates of future cash flows and slower growth rates in our industry. Estimates of future cash flows are based on an updated long-term financial outlook of our operations. However, actual performance in the near-term or long-term could be materially different from these forecasts, which could adversely impact future estimates.

We may be unable to obtain additional capital when necessary and on terms that are acceptable to us.

Our future capital requirements will depend on many factors, including our ability to maintain our existing cost structure and return on sales and execute our business and strategic plans as currently conceived. We expect that we will need significant additional cash resources to operate and expand our business in the future and we may attempt to raise additional funds through public or private financing or from other sources. The sale of additional equity securities could result in additional dilution to our stockholders. Additional indebtedness would result in additional debt service obligations and could result in operating and financing covenants that would restrict our operations. In addition, financing may not be available in amounts or on terms acceptable to us, if at all. If we are not able to raise additional capital through fund raising activities we could be forced to curtail some of the currently anticipated expenditures in the above mentioned areas. Should we be forced to do this it could have an impact on our anticipated future growth.

We may be unsuccessful in attracting or retaining key sales, marketing and other personnel.

The success of our business is dependent on our ability to attract and retain highly skilled managers and sales and marketing personnel. BMP China, Sunstone, Wanwei and Rongheng sales and marketing personnel carry out critical promotional and sales activities of BMP China, Sunstone, Wanwei and Rongheng. We depend, and will continue to depend in the foreseeable future, on the personal efforts and abilities of our executive management team and other officers and key employees. The loss of these officers or our other key management persons could harm our business and prospects for growth. In addition, as we plan to expand in China, we will need to attract additional qualified managerial staff and other personnel. We may have difficulty in hiring and retaining a sufficient number of qualified personnel to work in China. This may impede the development of our distribution business and the expansion of our business in China.

We may be unable to manage our growth effectively.

Our business strategy is based on the assumption that we will access additional distribution channels in the future and that the number of our customers and the extent of our operations will grow. Our ability to compete effectively and to manage our future growth, if any, requires us to:

| • | continue to improve our financial and management controls and reporting systems and procedures to support the proposed expansion of our business operations as a result of our acquisition of Sunstone and the acquisition of any additional distribution channels in the future; and |

| • | locate or hire, at reasonable compensation rates, qualified personnel and other employees necessary to expand our capacity in order to accommodate the proposed expansion of our business operations. |

21

Table of Contents

If we are unable to accomplish any of these objectives, we will be unsuccessful in effectively managing our growth, which could harm our business, operating results and financial condition.

Product sales by Sunstone are concentrated in a limited number of products.

Sunstone derives a substantial portion of its revenue from the sales of Pediatric Paracetamol and Amantadine Hydrochloride Granules, Xiao’er Huatan Zhike Granules, Xiao’er Kechuan Ling Oral Solution, Jianer Xiahoshi Oral Solution, and Compound Zedoary Turmeric Oil. As Sunstone China expects sales of these products to continue to comprise a substantial portion of total revenues in the future, any factors adversely affecting the sales of any of these products will have a material adverse effect on Sunstone China’s business, financial condition and results of operations.

Competition for sales to pharmaceutical distributors in China is intense.

Sunstone sells its products to approximately 325 pharmaceutical distributors in China. Sales to distributors account for substantially all of Sunstone’s revenues. Sunstone does not have distribution agreements longer than two years and competes for desired distributors with other pharmaceutical manufacturers. Any disruption of Sunstone’s distribution network, including its failure to renew its existing distribution agreements with desired distributors, could negatively affect its ability to effectively sell its products and could materially and adversely affect its business, financial condition and results of operations.

Our business strategy to use our marketing arm to create demand for products that we will offer exclusively through a distribution arm may fail.

Our business strategy depends in large part on our ability to establish exclusive distribution and marketing relationships with pharmaceutical manufacturers and suppliers and to leverage our marketing arm to create demand for products that we will distribute exclusively through a distribution arm. A number of factors could hinder the success of this strategy, including, among other things, our failure to:

| • | obtain a sufficient number of effective distribution channels, whether through internal growth or strategic acquisition; |

| • | create sufficient demand for products that we will distribute exclusively; and |

| • | enter into and maintain exclusive distribution and marketing relationships with pharmaceutical manufacturers on profitable terms. |

If we are unable to implement this strategy effectively, our business, operating results and financial condition could suffer.

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for timing of the accomplishment of objectives material to our success, such as the receipt of regulatory approval for our acquisitions, commencement and completion of clinical trials, anticipated regulatory submission and approval dates and timing of product launches. The actual timing of these events can vary dramatically due to factors beyond our control, such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize our products. There can be no assurance that our clinical trials will be completed, that we will make regulatory submissions or receive regulatory approvals as planned or that we will be able to adhere to our current schedule for the launch of any of our products. Any failure to achieve one or more of these milestones as planned could have a material adverse effect on our business, operating results and financial condition.

22

Table of Contents

We may be unable to compete successfully against new and existing competitors.

We operate in a highly competitive market with few barriers to entry. We expect that competition will continue to intensify. Some of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than we do. Many of our competitors have greater name recognition and a larger customer base than we do. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional and distribution activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. Competition could reduce our market share or force us to lower our prices to unprofitable levels.

If we fail to increase our brand recognition, we may face difficulty in obtaining new customers and business partners.