Attached files

| file | filename |

|---|---|

| 8-K - Triangle Petroleum Corp | v176908_8-k.htm |

| EX-3.1 - Triangle Petroleum Corp | v176908_ex3-1.htm |

| EX-10.1 - Triangle Petroleum Corp | v176908_ex10-1.htm |

| EX-99.2 - Triangle Petroleum Corp | v176908_ex99-2.htm |

| EX-99.3 - Triangle Petroleum Corp | v176908_ex99-3.htm |

1

Excerpts from Presentation to Potential Investors

February 23, 2010

2

Forward-Looking Statements

These presentation materials include a number of forward-looking statements that reflect the current views of our management with respect to future events and financial

performance. You can identify these

statements by forward-looking words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate” and “continue,” or similar words.

Those statements include statements regarding

our and members of our management team’s intent, belief or current expectations as well as the assumptions on which such

statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future

performance and involve risk and

uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in these materials and in our other reports we filed with the U.S. Securities and

Exchange Commission. These presentation

materials should be read in conjunction with the sections entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” “Consolidated Financial Statements” and notes related thereto in our Annual

Report on Form 10-K for the year ended January 31, 2009 and our

Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2009. Important factors currently known to our management could cause actual results to differ

materially from those

in forward-looking statements. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the

occurrence of unanticipated events or changes in the future operating results over time. We believe that these assumptions

are based upon reasonable data derived from and

known about our business and operations. No assurances are made that actual results of operations or the results of our future activities will not differ materially from these

assumptions. Factors that

could cause differences include, but are not limited to, our ability to find oil and gas reserves that are economically recoverable, the volatility of oil

and gas prices, the uncertain economic conditions in the United States and globally, our ability to

develop reserves and sustain production, our estimate of the sufficiency of

our existing capital sources, our ability to raise additional capital to fund cash requirements for future operations, in prospect development and property acquisitions or

dispositions

and in projecting future rates of production or future reserves, the timing of development expenditures and drilling of wells, and the operating hazards attendant

to the oil and gas business.

Prior to 2010, the SEC generally permitted oil and gas companies, in their filings, to disclose only proved reserves that a company has demonstrated by actual production or

conclusive formation tests

to be economically and legally producible under existing economic and operating conditions. Beginning with year-end reserves for 2009, the SEC

permits the optional disclosure of probable and possible reserves. We use the terms “estimated

ultimately recoverable,” or EUR, “resource potential,” “recoverable reserves”

or other descriptions of volumes of hydrocarbons to describe volumes of resources potentially recoverable through additional drilling or recovery techniques

that the SEC’s

guidelines prohibit us from including in filings with the SEC. Estimates of resource potential, recoverable reserves or estimated ultimately recoverable amounts do not reflect

volumes that are demonstrated as being commercially

or technically recoverable. Even if commercially or technically recoverable, a significant recovery factor would be

applied to these volumes to determine estimates of volumes of proved reserves. Accordingly, these estimates are by

their nature more speculative than estimates of proved

reserves and accordingly are subject to substantially greater risk of being actually realized by us. The methodology for resource potential, recoverable reserves or estimated

ultimately

recoverable amounts may also be different than the methodology and guidelines used by the Society of Petroleum Engineers and is different from the SEC’s

guidelines for estimating probable and possible reserves.

Furthermore, the forward looking statements contained in these presentation materials are made as of the date hereof, and we undertake no obligation, except as required by

applicable securities legislation,

to update publicly or to revise any of the included forward looking statements, whether as a result of new information, future events or

otherwise. The forward looking statements contained herein are

expressly qualified by this cautionary statement.

3

Management Representatives

Dr. Peter Hill

Chief Executive Officer

Jonathan Samuels, CFA

Chief Financial Officer

4

Experienced Management Team

Jonathan Samuels

Chief Financial Officer

P. Jeffrey McKenna

V.P. Corporate

Development

Currently serves as Chief Financial Officer, Director, and Corporate Secretary of Triangle Petroleum Corporation.

Mr. Samuels served in several roles at Palo Alto Investors with an emphasis on oil and gas exploration and production companies as well as

oilfield services companies. Prior to that, Mr. Samuels

has held positions at several other investment organizations, including roles at Alpine

Investors, Orient Global, Ixora Capital and Banc of America Securities.

Mr. Samuels holds a bachelor’s degree from the University of California, San Diego and an MBA from the Wharton School at the University of

Pennsylvania. He is a CFA Charterholder.

Currently serves as V.P. Corporate Development for Triangle Petroleum Corporation.

Mr. McKenna is a senior landman with over 28 years of oil and gas experience in both public and private companies including as a founder of

two private oil and gas exploration and production companies (Revolve

Energy Inc. and Revolution Energy Ltd.), and as Vice President Land

at Volterra Energy Inc. and OGY Petroleum Ltd., Land Manager at Startech Energy Inc. and various roles at Husky Oil Ltd. and Conoco

Canada Limited.

Mr. McKenna holds a Bachelor of Commerce from Saint Mary’s University.

Dr. Peter Hill

Chief Executive Officer

Currently serves as Chief Executive Officer and Director of Triangle Petroleum Corporation. Dr. Hill also currently serves as Chairman of the

Board of Torreador Resource Corporation (NASDAQ: TRGL)

Dr. Hill has over 37 years of experience in the international oil and gas industry serving in various executive and non-executive roles most

notably: as Director/Chairman at Austral Pacific Energy (2006-2008),

President and CEO of Harvest Natural Resources (NYSE: HNR) (2000

to 2005), Technical Director/Chief Operating Officer at Hardy Oil & Gas (1998-2000), and 22 years with BP plc (LSE:BP) holding various

senior positions including Chief Geologist, Chief

of Staff for BP Exploration, and President of BP Venezuela. Mr. Hill has also served as an

independent advisor to Palo Alto Investors (2008 - 2009).

Mr. Hill holds a PhD in Sedimentology from Southampton University & Trinity College, Dublin as well as a B.S. in Geology from Southampton

University

5

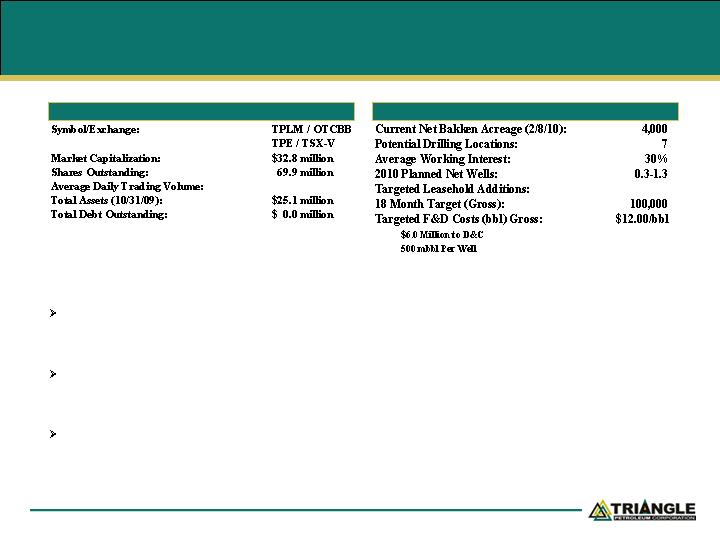

Triangle Petroleum Overview

Focused Bakken Shale acreage acquisition and development strategy – We currently hold a

participation interest in 13,000 gross (4,000 net)

acres in the Williston Basin Bakken Shale with plans to

accumulate approximately 100,000 gross (30,000 net) acres over the next eighteen months

Operating partner capable of achieving near term development plans – Entered into a two year

participation agreement with Slawson Exploration,

a private operator with significant experience in the

Bakken Shale

Management team in place to achieve strategic goals – Recent management restructuring focused on

a new technically and fiscally disciplined

approach designed to achieve growth and cost targets

Bakken Shale Portfolio Highlights

Corporate Detail

6

Investment Considerations

Focused on growing Bakken Shale acreage position

Targeting 100,000 gross (30,000 net) acres within the next 18 months

Expect to control 10,000 net acres by year end 2010

Strategic joint venture partner has significant operating experience in the Bakken Shale

Slawson Exploration has significant historical experience drilling and acquiring leasehold interests in

the Bakken Shale

Expected to commence drilling of our first well in 3Q:10

Industry activity in Rough Rider project area believed to lessen the risk of planned

drilling activity

Initial wells are expected to be drilled nearby significant producing wells

Management team has significant experience in the Bakken Shale

Additional upside with over 400,000 net acre position in Nova Scotia

7

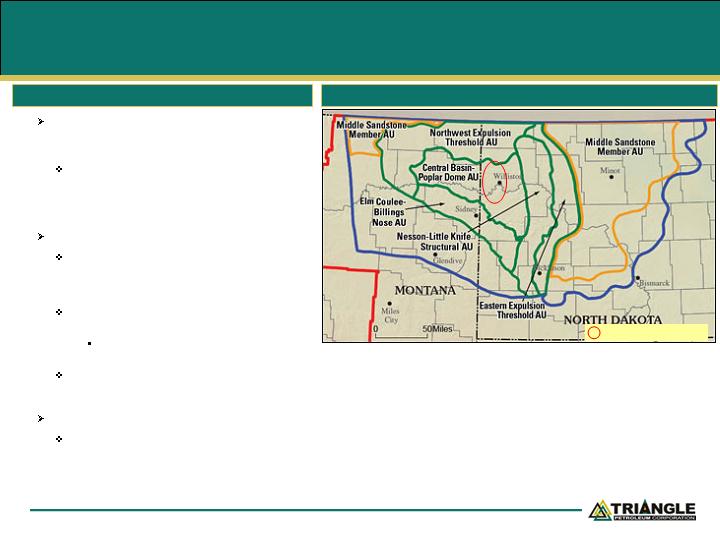

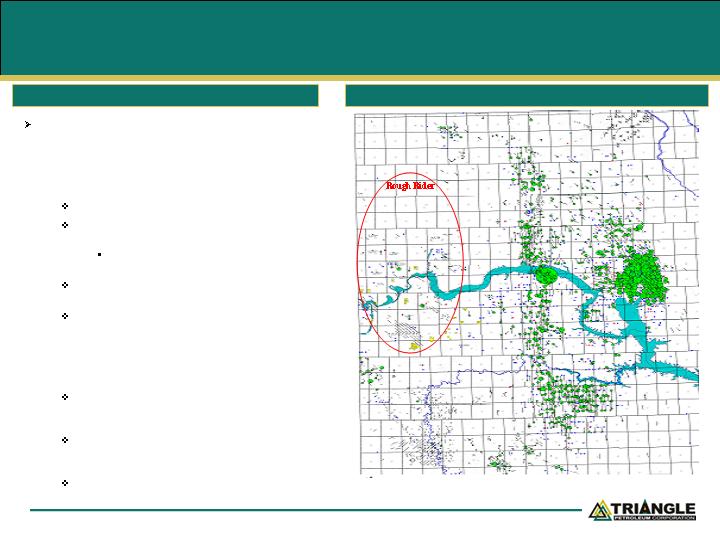

Williston Basin Bakken Shale Overview

USGS Bakken Shale Formation Assessment (April 2008)

Bakken Shale Overview

(1) Bakken Shale data collected from the published report by the United States Geological Survey (April 10, 2008)

Map showing boundary of Bakken-Lodgepole Total Petroleum System (TPS) (in blue),

five continuous assessment units (AU) (in green), and one conventional AU (in orange)

defined for the assessment of undiscovered

oil resources in the Upper Devonian–

Lower Mississippian Bakken Formation in the U.S. portion of the TPS. The outermost

green line defines the area of oil generation for the upper shale member of the

formation. Map by USGS.

Denotes Rough Rider Area

The Bakken Shale formation is the largest oil

accumulation assessed by the USGS (U.S.

Geological Survey) in the Lower 48(1)

In April 2008, the USGS estimated the amount

of technically recoverable reserves in the

Bakken Shale formation (Montana and North

Dakota) to total between 3.0 to 4.3 billion

barrels of oil

Significant running room to acquire leasehold

The Bakken Shale formation (as of the 2008

assessment) is believed to cover approximately

7 million acres located primarily in North

Dakota and Eastern Montana

Field is expanding west of the Nesson

Anticline

Industry activity has reduced drilling risk

in the Rough Rider area

Many of the major operators are shifting focus

from acreage accumulation to development

programs

Three Forks formation offers additional upside

Formation is believed to be present across the

Rough Rider area

8

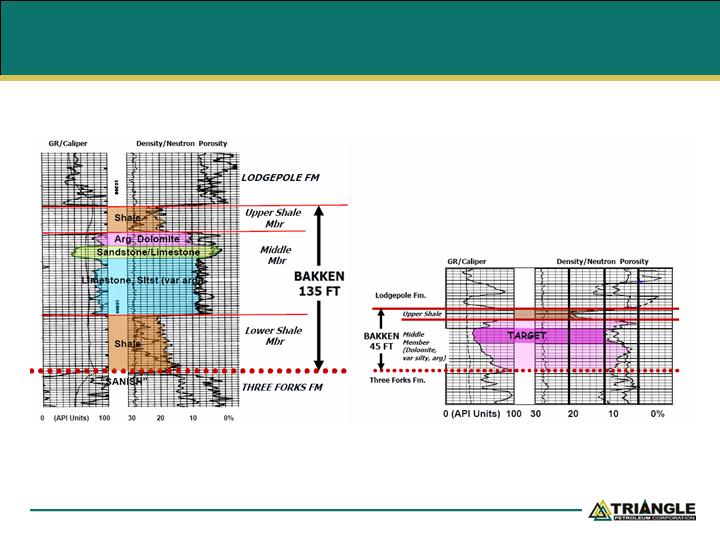

Middle Bakken Shale – Rock Types

9

Bakken Shale Geology – Reservoir Distribution

10

Bakken Shale – Cross Section

Source: Whiting Petroleum investor presentation

11

Bakken – Key Requirements

Be within hydrocarbon maturity/expulsion window

Identify rock types with

i) available rock storage/porosity capacity

ii) rock properties to permit flow and hold fractures

Drill long laterals in key sandstones/dolomite reservoirs

Deliver quality fracture stimulations/completions

Contain well/infrastructure costs

Have controlled take away capacity to avoid price erosion

12

Slawson Participation Agreement

Recently entered into a 2 year strategic participation

agreement with Slawson Exploration Corporation to

acquire and develop acreage in the Rough Rider

area of the Bakken Shale

Terms

100,000 gross acre participation agreement

$25 million gross capital expenditure requirement

per year

Either party can opt-out of additional expenditures

after meeting pro rata annual requirement

Slawson agrees to operate all wells on acquired

acreage

Drilling promote - We agree to pay 33% of well cost

to earn a 30% working interest in all wells drilled in

the covered area

2010 Planned

Activity

We have acquired 4,000 net acres to date with plans

to add a minimum of 6,000 net acres by year end

2010

Current 2010 budget of $10.0 million for leases and

$2.5-$6.0 million for drilling capex

First Slawson operated well expected to be drilled in

3Q:10

Participation Agreement Overview

Triangle Petroleum Current Leasehold

13

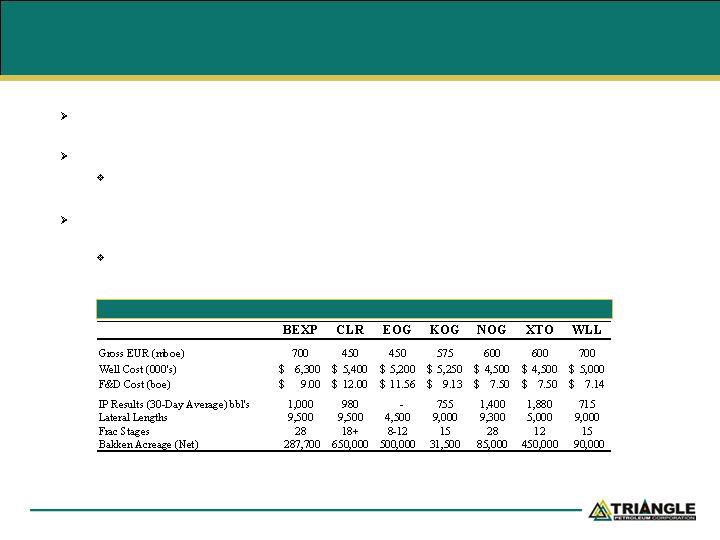

Bakken Shale Industry Peer Comparables(1)

Regional drilling results confirm statistical nature of Bakken Shale

Completion techniques have unlocked development in the play

The industry peer group continues to refine its drilling and completion techniques with the latest wells targeting long

laterals of 9,000+ feet and 25-32 stage fracs per well

Brigham Exploration has been the most active driller in the Rough Rider area to date with published 24

hour IP rates averaging 2,420 boepd

Brigham continues to project an estimated ultimate recovery (EUR) of approximately 700 mboe with additional

upside potential from the lower Three Forks formation

*XTO and NOG IP results are based on 24hour tests

Industry Peer Comparables

(1) Data related to our industry peer comparables operating in the Bakken Shale has been gathered from publicly available information, including company presentations,

conference call transcripts

and company press releases, disclosed in 2009 and 2010. We are unable to confirm whether the information was prepared by a qualified

reserves evaluator or auditor in accordance with the Canadian Oil & Gas Evaluation Handbook or by an independent engineer

or geoscientist within the principles of the

Society of Petroleum Engineers

14

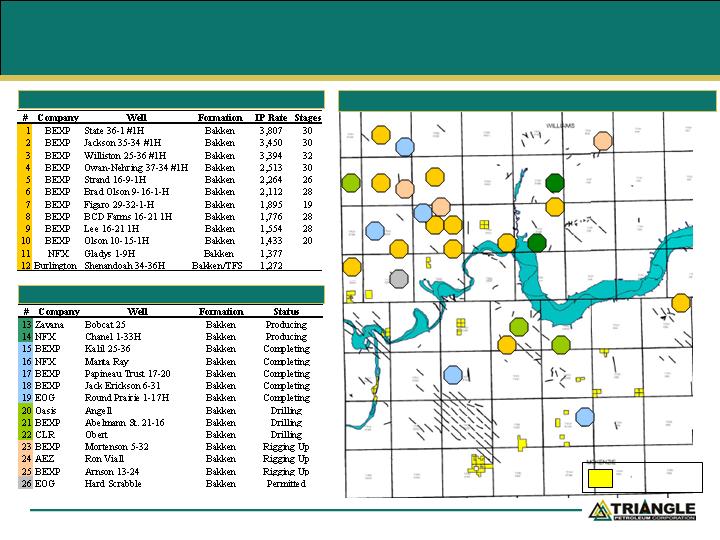

Bakken Shale – Rough Rider Project Area

Rough Rider Results/Current Activity

7

6

8

4

12

2

9

5

1

3

11

10

15

16

18

17

21

19

20

22

25

23

24

26

13

14

Rough Rider Results/Current Activity

Williams and McKenzie Counties, North Dakota

* Data gathered from publicly available datapoints including company presentations, conference call transcripts, and company press releases

TPLM Acreage

Position

15

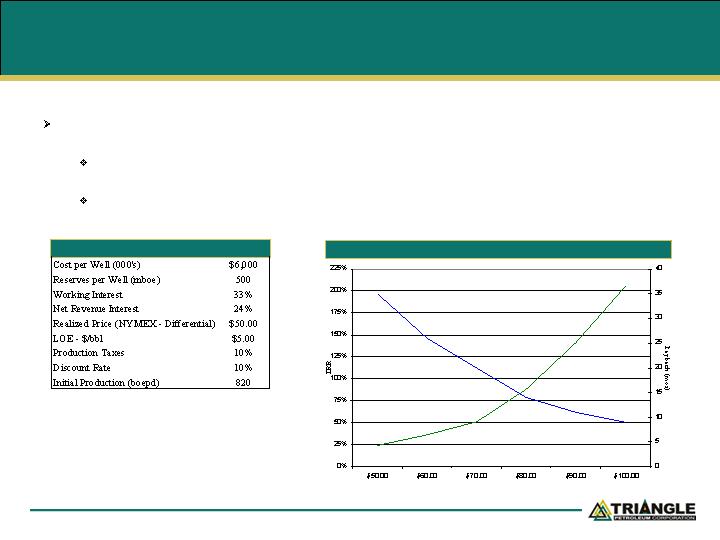

Bakken Shale Well IRR Sensitivities

Economic assumptions are based on historical performance analysis of 231 horizontal wells

(1)

targeting the Bakken Shale formation

At $60 NYMEX oil price, we expect to generate an IRR of 36% based on current well economic

assumptions

Current estimates using longer laterals provide significant upside if confirmed following initial well

drilling results

Well Economic Assumptions (8/8th’s )

Bakken Shale Well – IRR NYMEX Price Sensitivities and Payback

(1) Data gathered from the North Dakota bureau of land management database

16

Financial Overview

17

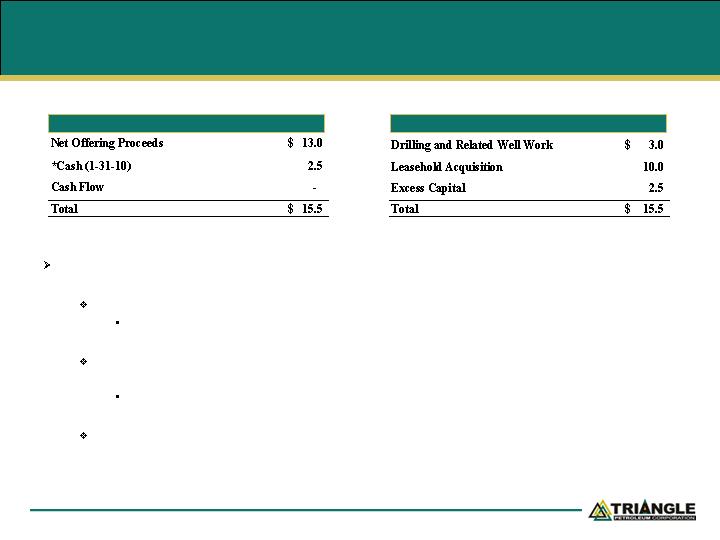

2010 Capital Plan – Pro Forma Sources and Uses

2010 Capital Expenditures Budget

Targeting exiting the year with 10,000 net acres in the Bakken Shale formation

Average cost less than $1,000/acre

We also plan to commence drilling at least one well beginning in 3Q:10 and potentially up to three

gross wells by year end depending on rig availability

$6.0 million gross ($2.0 million net) budgeted for the first well

Actively seeking other leasing opportunities outside of the area covered by the participation

agreement with Slawson

Sources

Uses

*1-31-10 cash balance adjusted for Slawson participation agreement

18

Three Year Development Plan

Phase 1: Build Company & Team

Completed a management restructuring as part of a new strategic initiative focused on acquiring and

developing acreage in onshore unconventional oil and gas basins in North America

Announced a 2 year participation agreement with Slawson Exploration whereby we will acquire

leasehold interest and Slawson will operate the wells on the respective acreage

Phase 2: Leasehold Acquisition

Acquired 13,000 gross (4,000 net) acres in McKenzie and Williams Counties, North Dakota

prospective for the Bakken Shale formation

Expect to acquire approximately 100,000 gross acres in the Bakken Shale formation over the next

eighteen months

Phase 3: Development

Expect to commence drilling first horizontal Bakken Shale well in 3Q:10

Multi year drilling program targeting approximately 50 gross (16 net wells) over the next three

years

19

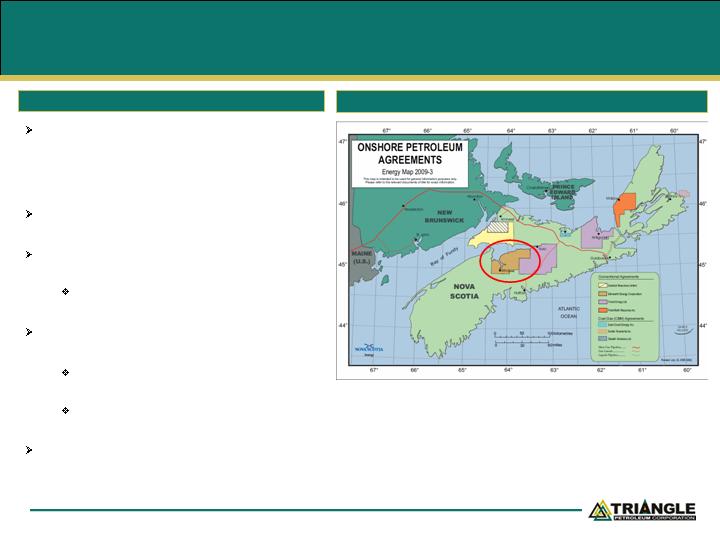

Nova Scotia Upside

We hold an 87% working interest in the

Windsor Block, a largely under-explored

land base in Nova Scotia with numerous

conventional and unconventional shale gas

formation targets

2009 2D Seismic shoot reflects a significant

4-way closure

Estimated risk capital of $2.9 million capable of

providing significant upside return with success

Currently seeking an industry partner to buy

in on a promoted basis

Access to major nearby pipeline feeding the

northeast United States

Improves time to production as well as

attractive transportation costs

Receives NYMEX or premium to NYMEX

price depending on season

Current terms require us to drill one well by

April 2011

Nova Scotia, Canada - Windsor Block (412,964 net acres)

Triangle Petroleum Current Leasehold

20

Investment Considerations

Focused on growing Bakken Shale acreage position

Targeting 100,000 gross (30,000 net) acres within the next 18 months

Expect to control 10,000 net acres by year end 2010

Strategic joint venture partner has significant operating experience in the Bakken Shale

Slawson Exploration has significant historical experience drilling and acquiring leasehold interests in

the Bakken Shale

Expected to commence drilling of our first well in 3Q:10

Industry activity in Rough Rider project area believed to lessen the risk of planned

drilling activity

Initial wells are expected to be drilled nearby significant producing wells

Management team has significant experience in the Bakken Shale

Additional upside with over 400,000 net acre position in Nova Scotia