Attached files

Table of Contents

Exhibit 13

Table of Contents

VALUES WE SHARE

| Our Purpose: |

C |

USTOMER SATISFACTION | ||

| — Strive to exceed customer expectations | ||||

| — Listen, understand and respond to customer needs — Serve in a friendly, professional, caring way, adding that personal touch — Earn confidence and loyalty of customers through exceptional service | ||||

| Our Foundation: |

I |

NTEGRITY | ||

| — Uncompromising, adhere to highest professional and personal ethics | ||||

| — Accept responsibility, fulfill commitments and maintain credibility — Actions founded on honesty, fairness and trust — Do what’s right | ||||

| Our Goal: |

E |

XCELLENCE | ||

| — Approach responsibilities with passion and commitment | ||||

| — Consistently endeavor to do the best job possible — Committed to the concept of rising expectations and continual improvement — Set challenging goals, learn from mistakes, demonstrate innovation and creativity and attention to detail | ||||

| Our Style: |

T |

EAMWORK | ||

| — Value diversity and the contributions of others | ||||

| — Share information and expertise — Build trust and relationships through open candid communication — Enthusiastically work together to achieve common goals | ||||

| Our Responsibility: |

C |

OMMUNITY INVOLVEMENT | ||

| — Give time, skills and resources to improve our communities | ||||

| — Be a positive role model; strive to make a difference | ||||

| Our Strength: |

L |

EADERSHIP | ||

| — Lead by example in both words and actions | ||||

| — Stimulate and relish opportunities for positive change — Recognize performance, effectively plan and communicate, demand quality — Respect others and encourage a balanced life approach | ||||

Table of Contents

| Table of Contents | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| Management’s Discussion and Analysis of |

7 | |||

| 28 | ||||

| 33 | ||||

| 71 | ||||

| Management’s Reports to ESB Financial Corporation Shareholders |

73 | |||

| 74 | ||||

| 77 | ||||

| 78 | ||||

| 79 |

| inside back cover |

| Company Profile | ||||

| ESB Financial Corporation (NASDAQ: ESBF), a publicly traded financial services company, provides a wide range of retail and commercial financial products and services to customers in Western Pennsylvania through its wholly owned subsidiary, ESB Bank. | ||||

|

ESB Bank is a Pennsylvania chartered, FDIC insured stock savings bank which, as of December 31, 2009, conducted business through 24 offices in Allegheny, Beaver, Butler and Lawrence counties, Pennsylvania. To compliment retail and commercial operations conducted through its bank offices, the Company invests in U.S. Government, municipal and mortgage-backed securities through its subsidiary savings bank and through its investment subsidiary, PennFirst Financial Services, Inc., a Delaware corporation. | |||

| Mission Statement | ||||

| The mission of ESB Financial Corporation and its subsidiaries is to effectively provide for the financial service needs of our customers and community while creating value for our shareholders. Our mission will be accomplished by growing in a profitable and controlled manner; by identifying and meeting the financial needs of our customers; by offering quality products and services that are competitively priced and serviced by a knowledgeable, attentive and friendly staff; and by creating a positive work environment that maximizes the alignment of customer and employee objectives. | ||||

Table of Contents

Consolidated Financial Highlights

(Dollar amounts in thousands, except share data)

| As of or for the year ended December 31, | ||||||

| 2009 | 2008 | Change | ||||

| Total assets |

$1,960,677 | $1,974,839 | (1%) | |||

| Securities available for sale |

1,106,910 | 1,096,806 | 1% | |||

| Loans receivable, net |

671,387 | 691,315 | (3%) | |||

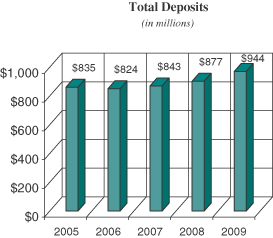

| Total deposits |

944,347 | 877,329 | 8% | |||

| Borrowed funds, including junior subordinated notes |

829,641 | 932,901 | (11%) | |||

| Stockholders’ equity |

164,752 | 143,065 | 15% | |||

| Net interest income |

38,148 | 31,143 | 22% | |||

| Net income |

12,012 | 10,215 | 18% | |||

| Net income per share (diluted) |

$1.00 | $0.84 | 19% | |||

| Cash dividends declared per share |

$0.40 | $0.40 | - | |||

| Return on average assets |

0.61% | 0.53% | 15% | |||

| Return on average stockholders’ equity |

7.66% | 7.88% | (3%) | |||

| ESB Financial Corporation | 2 | 2009 Annual Report |

Table of Contents

Consolidated Financial Highlights (continued)

| ESB Financial Corporation | 3 | 2009 Annual Report |

Table of Contents

Dear Fellow Shareholders:

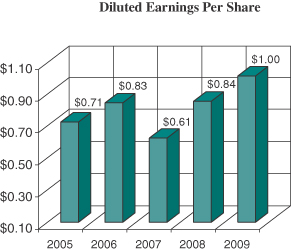

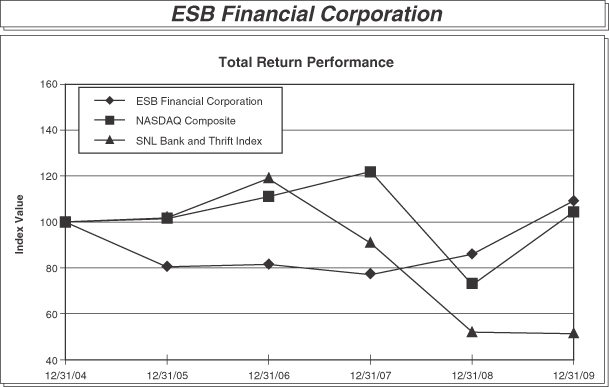

I am pleased to present ESB Financial Corporation’s Annual Report for the year 2009 and to report that the Company posted record earnings per diluted share of $1.00 on net income of $12.0 million for the year ended December 31, 2009, compared to earnings of $0.84 per diluted share on net income of $10.2 million for the year ended December 31, 2008.

The Company achieved record financial results in what was clearly another demanding year for the banking industry. Our performance in this difficult and uncertain operating environment reflects the quality of our organization, the dedication of our employees, the guidance by our Board of Directors, and the focused commitment to our fundamental strategies that have delivered consistent results to our shareholders since our initial public offering in 1990.

Throughout our 94-year history, ESB has continually and successfully responded to change. However, we believe that sticking to basics and maintaining our commitment to the strategies that have made us a leading financial service provider remains a solid roadmap for continued growth and success. In this regard our priorities have not changed and remain:

| • | Focusing on per share results and working diligently to maintain our reputation as a company that creates superior shareholder value; |

| • | Being financially conservative and managing our Company to the highest ethical standards; |

| • | Growing the Company in a controlled and safe manner; |

| • | Maintaining strong credit quality; |

| • | Continuing to strive to exceed our customer expectations for quality products and services; |

| • | Continuing to make investments in human capital, technology and physical infrastructure to ensure our long-term success; |

| • | Continuing to provide a productive work environment that maximizes the alignment of customer and employee objectives and |

| • | Seeking and consummating acquisition opportunities when practical. |

Dividends

I am also pleased to report that during 2009, the Company maintained the current quarterly cash dividend payout of $0.10 per share, which extends our record of paying cash dividends to 78 consecutive quarters. As in previous years, the Board of Directors approved a Common Stock Repurchase Program and, for the year, the Company repurchased approximately 232,000 shares with a market value of $2.9 million.

Branch Office Expansion

In July 2009, the Company opened its 24th office in Renfrew, Connoquenessing Township, Butler, Pennsylvania.

In November 2009, the Company broke ground to relocate its Zelienople Office approximately 1.4 miles south of the current location. The new location is expected to open during the fourth quarter of 2010. This full service facility will afford our customers a large lobby, safe deposit boxes, six teller windows, three drive thru lanes, a full service 24-hour ATM machine and a night drop box.

| ESB Financial Corporation | 4 | 2009 Annual Report |

Table of Contents

Letter to Shareholders (continued)

More than the Money

At ESB, we define success more broadly than just financial results. We also define it by our community involvement, both financially and through volunteerism, and our commitment and adherence to our Mission Statement, Values We Share Statement and Code of Ethics policy, which sets forth the guidance on the way we do business. We are committed to our customers, to the highest ethical behavior, to our communities, and to continued improvement in every aspect of our business. We invite you to review these essential documents which are easily accessible through our website www.esbbank.com. Through our “Casual for Charity Day” program, nearly $20,000 was donated in 2009 to organizations including The American Diabetes Association, The American Heart Association, The American Cancer Society and Project Bundle Up.

Recognition

I am very proud to report that in October 2009, ESB Bank was named as one of the “50 Best Places to Work in Western Pennsylvania” in a competition sponsored by the Pittsburgh Business Times. ESB Bank received this recognition, which is based solely on employee survey results, for the fourth time in 2009

The Year Ahead

With a sound corporate strategy, the hard work and dedication of our employees and the guidance provided by our Board of Directors, I am confident that we have a sound foundation to sustain our performance, to seize new business opportunities, and to initiate new programs that will enhance service to our customers and continue to provide value to our shareholders. As always, we would like to thank all of our customers and our shareholders for their consistent support and we look forward to opportunities for further growth and profitability in 2010.

I would like to express my appreciation to the directors, officers and employees of ESB who have all contributed to our success over the past year. We are very fortunate to have such a talented and dedicated group of individuals who are committed to serving the needs of our customers.

We invite our shareholders to join us at our annual shareholders’ meeting to be held Wednesday, April 21st, at 4:00 p.m. at the Connoquenessing Country Club, 1512 Mercer Road, Ellwood City, PA. Your attendance will be very much appreciated.

Sincerely,

Charlotte A. Zuschlag

President and Chief Executive Officer

| ESB Financial Corporation | 5 | 2009 Annual Report |

Table of Contents

Selected Consolidated Financial Data

(Dollar amounts in thousands, except share data)

| As of December 31, | |||||||||||||||

| Financial Condition Data | 2009 | 2008 | 2007 | 2006 | 2005(1) | ||||||||||

| Total assets |

$ | 1,960,677 | $ | 1,974,839 | $ | 1,880,235 | $ | 1,922,722 | $ | 1,852,779 | |||||

| Securities |

1,106,910 | 1,096,806 | 1,059,972 | 1,143,924 | 1,117,063 | ||||||||||

| Loans receivable, net |

671,387 | 691,315 | 624,251 | 589,642 | 540,277 | ||||||||||

| Deposits |

944,347 | 877,329 | 842,854 | 823,644 | 834,530 | ||||||||||

| Borrowed funds, including subordinated debt |

829,641 | 932,901 | 876,727 | 951,153 | 869,242 | ||||||||||

| Stockholders’ equity |

164,752 | 143,065 | 133,657 | 129,231 | 127,367 | ||||||||||

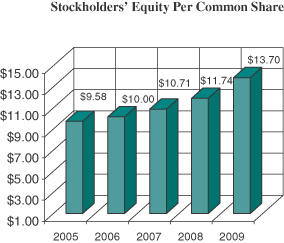

| Stockholders’ equity per common share |

$13.70 | $11.74 | $10.71 | $10.00 | $9.58 | ||||||||||

| For the year ended December 31, | |||||||||||||||

| Operations Data | 2009 | 2008 | 2007 | 2006 | 2005(1) | ||||||||||

| Net interest income |

$ | 38,148 | $ | 31,143 | $ | 24,983 | $ | 28,667 | $ | 30,530 | |||||

| Provision for loan losses |

912 | 1,406 | 865 | 1,113 | 568 | ||||||||||

| Net interest income after provision for loan losses |

37,236 | 29,737 | 24,118 | 27,554 | 29,962 | ||||||||||

| Noninterest income |

3,595 | 5,277 | 7,216 | 7,786 | 3,142 | ||||||||||

| Noninterest expense |

26,784 | 23,042 | 22,667 | 22,770 | 22,812 | ||||||||||

| Income before income taxes |

14,047 | 11,972 | 8,667 | 12,570 | 10,292 | ||||||||||

| Provision for income taxes |

2,382 | 1,548 | 400 | 1,317 | 810 | ||||||||||

| Net income |

11,665 | 10,424 | 8,267 | 11,253 | 9,482 | ||||||||||

| Less: net income attributable to the noncontrolling interest |

(347) | 209 | 606 | 637 | 303 | ||||||||||

| Net income |

$ | 12,012 | $ | 10,215 | $ | 7,661 | $ | 10,616 | $ | 9,179 | |||||

| Net income per common share: |

|||||||||||||||

| Basic |

$1.01 | $0.85 | $0.62 | $0.84 | $0.73 | ||||||||||

| Diluted |

|

$1.00

|

|

$0.84

|

|

$0.61

|

|

$0.83

|

|

$0.71

| |||||

| As of or for the year ended December 31, | |||||||||||||||

| Other Data | 2009 | 2008 | 2007 | 2006 | 2005(1) | ||||||||||

| Performance Ratios (for the year ended) |

|||||||||||||||

| Return on average assets |

0.61% | 0.53% | 0.40% | 0.56% | 0.52% | ||||||||||

| Return on average equity |

7.66% | 7.88% | 5.98% | 8.55% | 7.16% | ||||||||||

| Average equity to average assets |

7.95% | 6.72% | 6.74% | 6.57% | 7.28% | ||||||||||

| Interest rate spread (2) |

2.14% | 1.73% | 1.38% | 1.63% | 1.93% | ||||||||||

| Net interest margin (2) |

2.29% | 1.90% | 1.57% | 1.79% | 2.06% | ||||||||||

| Efficiency ratio |

57.84% | 55.21% | 63.88% | 57.27% | 55.84% | ||||||||||

| Noninterest expense to average assets |

1.36% | 1.20% | 1.22% | 1.24% | 1.31% | ||||||||||

| Dividend payout ratio (3) |

40.00% | 47.62% | 65.57% | 48.19% | 56.34% | ||||||||||

| Asset Quality Ratios (as of year end) |

|||||||||||||||

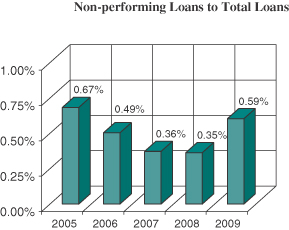

| Non-performing loans to total loans |

0.59% | 0.35% | 0.36% | 0.49% | 0.67% | ||||||||||

| Non-performing assets to total assets |

0.25% | 0.17% | 0.23% | 0.22% | 0.28% | ||||||||||

| Allowance for loan losses to total loans |

0.88% | 0.85% | 0.85% | 0.84% | 0.86% | ||||||||||

| Allowance for loan losses to non-performing loans |

147.58% | 239.95% | 236.21% | 171.75% | 127.26% | ||||||||||

| Capital Ratios (as of year end) |

|||||||||||||||

| Stockholders’ equity to assets |

8.40% | 7.24% | 7.07% | 6.69% | 6.85% | ||||||||||

| Tangible stockholders’ equity to tangible assets |

5.19% | 4.77% | 4.78% | 4.71% | 4.72% | ||||||||||

| (1) | Selected consolidated financial data for 2005 reflects increases due to the acquisition of PHSB Financial Corporation. |

| (2) | Interest income utilized in calculation is on a fully tax equivalent basis, which is deemed to be the most prevalent industry standard for measuring interest rate spread and net interest margin. |

| (3) | Dividend payout ratio calculation utilizes diluted net income per share for all periods. |

| ESB Financial Corporation | 6 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Overview

ESB Financial Corporation (the Company) is a Pennsylvania corporation and thrift holding company that provides a wide range of retail and commercial financial products and services to customers in Western Pennsylvania through its wholly-owned subsidiary, ESB Bank (ESB or the Bank). The Company is also the parent company of ESB Capital Trust II (Trust II), ESB Statutory Trust III (Trust III) and ESB Capital Trust IV (Trust IV), Delaware statutory business trusts established to facilitate the issuance of trust preferred securities to the public by the Company, and THF, Inc., a Pennsylvania corporation established as a title agency to provide residential and commercial loan closing services and title closing services.

ESB is a Pennsylvania chartered Federal Deposit Insurance Corporation (FDIC) insured stock savings bank. At December 31, 2009, the bank conducted business through 24 offices in Allegheny, Beaver, Butler and Lawrence counties, Pennsylvania. ESB operates two wholly-owned subsidiaries: (i) AMSCO, Inc., which engages in the management of certain real estate development partnerships on behalf of the Company, and (ii) ESB Financial Services, Inc., a Delaware corporation which holds loans and other investments.

ESB is a financial intermediary whose principal business consists of attracting deposits from the general public and investing such deposits in real estate loans secured by liens on residential and commercial properties, consumer loans, commercial business loans, securities and interest-earning deposits.

The Company is subject to examination and regulation by the Office of Thrift Supervision as a savings and loan holding company. The Bank is subject to examination and comprehensive regulation by the FDIC and the Pennsylvania Department of Banking. ESB is a member of the Federal Home Loan Bank (FHLB) of Pittsburgh, which is one of the twelve regional banks comprising the FHLB System. ESB is further subject to regulations of the Board of Governors of the Federal Reserve System, which governs the reserves required to be maintained against deposits and certain other matters.

During the year ended December 31, 2009, the Company reported net income of $12.0 million, an increase of $1.8 million, or 17.6%, compared to the year ended December 31, 2008. The income for the year reflects the Company’s sustained efforts to manage the net interest margin during this challenging time for the banking industry without compromising asset quality or future earnings potential. The results of these efforts are reflected in our earnings, which increased substantially over the prior year, our strong net interest margin, which increased 39 basis points since last year and the growth to our deposit base. The increase in the net interest margin was driven by a decrease to interest expense of $10.8 million, or 16.5%, partially offset by a decrease in interest income of $3.8 million, or 3.9%. The Company has an ongoing campaign to increase commercial, public and personal checking accounts. The results of which were an increase in low cost core deposits. The Company was able to replace higher priced borrowings with these lower rate deposits therefore contributing to the decline in the cost of funds for the year of 64 basis points to 3.03% at December 31, 2009 from 3.67% at December 31, 2008 and overall interest expense.

The Company is continuing efforts to improve the net interest margin by employing strategies to decrease the cost of funds, while attempting to increase the yield from the investment portfolio. The Company employs a strategy of purchasing cash-flowing fixed and variable rate mortgage-backed securities funded by wholesale borrowings, which are comprised of FHLB advances and repurchase agreements.

The Company has utilized a wholesale strategy since its initial public offering in 1990. The Company manages this strategy through its interest rate risk management on a macro level. The wholesale strategy operates with a lower cost of operations, although with lower interest rate spreads and, therefore, at a lower margin than the retail operations of the Company. This strategy historically produces wider margins during periods of lower short-term

| ESB Financial Corporation | 7 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

interest rates, reflected in a steep yield curve and can be susceptible to net interest margin strain in rapidly rising rates and rapidly declining rates as well as a sustained inverted yield curve. During 2009, this wholesale leverage strategy accounted for $6.9 million, on a tax equivalent basis, of the Company’s tax equivalent net interest income of $41.3 million.

Management continues to pursue methods of insulating this wholesale strategy from significant fluctuations in interest rates by: (1) incorporating a laddered maturity schedule of up to five years on the wholesale borrowings; (2) purchasing interest rate caps; (3) providing structure in the investment portfolio in the form of corporate bonds and municipals securities; (4) utilizing cash flows from fixed and adjustable rate mortgage-backed securities; and (5) including the Company’s securities in the available for sale portfolio thereby creating the flexibility to change the composition of the portfolio through restructuring as management deems it necessary due to interest rate fluctuations. Management believes that this insulation affords them the ability to react to measured changes in interest rates and restructure the Company’s balance sheet accordingly. This strategy is continually evaluated by management on an ongoing basis.

In addition to managing the net interest margin in the current rate environment, management was successful in maintaining strong asset quality as the Company has only been minimally impacted by the sub prime mortgage and credit issues that are currently affecting the financial industry. Our percentage of non performing loans to total loans was 0.59% at December 31, 2009 compared to 0.35% at December 31, 2008 and our non performing assets to total assets was 0.25% at December 31, 2009 compared to 0.17% at December 31, 2008.

This Management Discussion and Analysis section of the Annual Report contains certain forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). In the normal course of business, we, in an effort to help keep our shareholders and the public informed about our operations, may from time to time issue or make certain statements, either in writing or orally, that are or contain forward-looking statements, as that term is defined in the U.S. federal securities laws. Generally, these statements relate to business plans or strategies, projected or anticipated benefits from acquisitions made by or to be made by us, projections involving anticipated revenues, earnings, profitability or other aspects of operating results or other future developments in our affairs or the industry in which we conduct business. Forward-looking statements may be identified by reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “expect,” “intend,” “plan,” “estimate” or similar expressions.

Although we believe that the anticipated results or other expectations reflected in our forward-looking statements are based on reasonable assumptions, we can give no assurance that those results or expectations will be attained. Forward-looking statements involve risks, uncertainties and assumptions (some of which are beyond our control), and as a result actual results may differ materially from those expressed in forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include, but are not limited to, the following, as well as those discussed elsewhere herein:

| • | our investments in our businesses and in related technology could require additional incremental spending, and might not produce expected deposit and loan growth and anticipated contributions to our earnings; |

| • | general economic or industry conditions could be less favorable than expected, resulting in a deterioration in credit quality, a change in the allowance for loan and lease losses or a reduced demand for credit or fee-based products and services; |

| • | changes in the interest rate environment could reduce net interest income and could increase credit losses; |

| ESB Financial Corporation | 8 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

| • | the conditions of the securities markets could change, which could adversely affect, among other things, the value or credit quality of our assets, the availability and terms of funding necessary to meet our liquidity needs and our ability to originate loans and leases; |

| • | changes in the extensive laws, regulations and policies governing financial holding companies and their subsidiaries could alter our business environment or affect our operations; |

| • | the potential need to adapt to industry changes in information technology systems, on which we are highly dependent, could present operational issues or require significant capital spending; |

| • | competitive pressures could intensify and affect our profitability, including as a result of continued industry consolidation, the increased availability of financial services from non-banks, technological developments such as the internet or bank regulatory reform; |

| • | acquisitions may result in one-time charges to income, may not produce revenue enhancements or cost savings at levels or within time frames originally anticipated and may result in unforeseen integration difficulties; and |

| • | acts or threats of terrorism and actions taken by the United States or other governments as a result of such acts or threats, including possible military action, could further adversely affect business and economic conditions in the United States generally and in our principal markets, which could have an adverse effect on our financial performance and that of our borrowers and on the financial markets and the price of our common stock. |

You should not put undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events except to the extent required by federal securities laws.

Critical Accounting Policies and Estimates

The Company’s consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles and follow general practices within the industry in which it operates. Application of these principles requires management to make estimates, assumptions and judgments that affect the amounts reported in the financial statements and accompanying notes. These estimates, assumptions and judgments are based on information available as of the date of the financial statements; accordingly, as this information changes, the financial statements could reflect different estimates, assumptions and judgments. Certain policies inherently have a greater reliance on the use of estimates, assumptions and judgments and as such have a greater possibility of producing results that could be materially different than originally reported. Estimates, assumptions and judgments are necessary when assets and liabilities are required to be recorded at fair value, when a decline in the value of an asset not carried on the financial statements at fair value warrants an impairment write-down or valuation reserve to be established, or when an asset or liability needs to be recorded contingent upon a future event. Carrying assets and liabilities at fair value inherently results in more financial statement volatility. The fair values and the information used to record valuation adjustments for certain assets and liabilities are based either on quoted market prices or are provided by other third-party sources, when available. When third-party information is not available, valuation adjustments are estimated in good faith by management primarily through the use of internal cash flow modeling techniques.

The Company’s most significant accounting policies are presented in Note 1 to the consolidated financial statements. These policies along with the disclosures presented in the other financial statement notes and in this financial review, provide information on how significant assets and liabilities are valued in the financial

| ESB Financial Corporation | 9 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

statements and how those values are determined. Based on the valuation techniques used and the sensitivity of financial statement amounts to the methods, assumptions and estimates underlying those amounts, management has identified the determination of the fair value of securities, the allowance for loan losses and the valuation of goodwill and intangible assets to be the accounting areas that require the most subjective or complex judgments.

Securities

Securities are reported at fair value adjusted for premiums and discounts which are recognized in interest income using the interest method over the period to maturity. Declines in the fair value of individual securities below their amortized cost, and that are deemed to be other than temporary, will be written down to current market value and included in earnings as realized losses. For a discussion on the determination of an other than temporary decline, please refer to Note 1 of the consolidated financial statements. Management systematically evaluates securities for other than temporary declines in fair value on a quarterly basis. The Company had impairment charges of approximately $66,000 on three of its equity investments in small banks that had experienced a decline in their market value for the last several quarters. Additionally, in 2009 the Company took an impairment charge of approximately $552,000 on a $2.5 million collateralized debt obligation that is comprised of sixteen financial institutions, this charge was in addition to a $553,000 impairment charge taken on the same security in 2008. The Company utilized a discounted cash flow method which is a level three pricing method. During this analysis, the Company determined that three of these financial institutions are currently deferring interest payments, and the Company is aware of two additional financial institutions that will begin deferring interest payments in February 2010. In addition, two financial institutions have defaulted. All five financial institutions that are/will be deferring interest payments as of February 2010 either lost money or broke even for the most recent quarter. Also, there were four financial institutions (including two of the five deferrals) within this pool that the non-performing assets to loans plus real estate owned ratio was greater than 10%. One institution currently deferring interest payments had a Tier 1 Risk Ratio of less than 6% and non-performing assets to loans plus real estate owned ratio greater than 10%. The Company believes, at this time, the remaining financial institutions are currently financially stable but will continue to monitor this bond to determine if additional other than temporary charges are necessary.

Allowance for loan losses

The allowance for loan losses is increased by charges to income and decreased by charge-offs (net of recoveries). The Company’s periodic evaluation of the adequacy of the allowance for loan losses is determined by management through evaluation of the loss exposure on individual non-performing, delinquent and high-dollar loans; review of economic conditions and business trends; historical loss experience and growth and composition of the loan portfolio, as well as other relevant factors.

A quantitative analysis is utilized to support the adequacy of the allowance for loan losses. This analysis includes review of historical charge-off rates for loan categories, fluctuations and trends in the amount of classified loans and economic factors. Significant to this analysis are any changes in observable trends that may be occurring relative to loans to assess potential weaknesses within the credit. Current economic factors and trends in risk ratings are considered in the determination and allocation of the allowance for loan losses.

The allowance for loan losses at December 31, 2009 and 2008 was $6.0 million, allocated as follows for 2009: residential loans $2.2 million, or 36.6%; commercial real estate $1.6 million, or 26.9%; commercial business loans $864,000, or 14.3%; consumer loans $1.3 million, or 22.2%.

Goodwill and other intangible assets

The guidance in U.S. generally accepted accounting principles (GAAP) regarding goodwill and other intangible assets establishes standards for the amortization of acquired intangible assets and the non-amortization and

| ESB Financial Corporation | 10 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

impairment assessment of goodwill. At December 31, 2009, the Company had $1.3 million of core deposit intangible assets subject to amortization and $41.6 million in goodwill, which was not subject to periodic amortization.

Goodwill arising from business combinations represents the value attributable to unidentifiable intangible elements in the business acquired. The Company’s goodwill relates to value inherent in the banking business and the value is dependent upon the Company’s ability to provide quality, cost effective services in a competitive market place. As such, goodwill value is supported ultimately by revenue that is driven by the volume of business transacted. A decline in earnings as a result of a lack of growth or the inability to deliver cost effective services over sustained periods can lead to impairment of goodwill that could adversely impact earnings in future periods.

GAAP requires an annual evaluation of goodwill for impairment. The fair value of the Company and the implied fair value of goodwill at the respective reporting unit level are estimated using the market value approach utilizing industry comparable information. The Companies implied fair value of goodwill is based on a four step approach utilizing the last twelve months earnings per share, stated book value, tangible book value and total deposits to the most recent deal values supplied by a third party. At December 31, 2009, the Company concluded that the recorded value of goodwill was not impaired as a result of the evaluation.

Income taxes

The Company files a consolidated federal income tax return. Deferred tax assets and liabilities are computed based on the difference between the financial statement and the income tax basis of assets and liabilities using the enacted marginal tax rates. Deferred income taxes or benefits are based on changes in the deferred tax asset or liability from period to period. Deferred tax assets and liabilities are reflected at currently enacted income tax rates applicable to the period in which such items are expected to be realized or settled. As changes in tax rates are enacted, deferred tax assets and liabilities are adjusted through the provision for income taxes.

Changes in Financial Condition

General. The Company’s total assets decreased $14.2 million, or 0.7%, to $1.96 billion at December 31, 2009 from $1.97 billion at December 31, 2008. This decrease was primarily composed of net decreases in cash and cash equivalents, loans receivable, real estate held for investment and intangible assets of $2.6 million, $19.9 million, $7.1 million and $517,000, respectively, partially offset by increases to securities available for sale, loans held for sale, accrued interest receivable, premises and equipment, real estate acquired through foreclosure, prepaid expenses and other assets, and bank owned life insurance of $10.1 million, $201,000, $260,000, $1.4 million, $186,000, $3.0 million and $900,000, respectively.

The decrease in the Company’s total assets reflects a corresponding decrease in total liabilities of $35.8 million, or 2.0%, to $1.80 billion at December 31, 2009 compared to $1.83 billion at December 31, 2008 and an increase in total stockholders’ equity of $21.7 million, or 15.2%, to $164.8 million at December 31, 2009 from $143.1 million at December 31, 2008. The decrease in total liabilities was primarily due to decreases in FHLB advances, other borrowings, advance payments by borrowers for taxes and insurance and accounts payable for land development of $105.3 million, $3.5 million, $155,000, and $2.0 million, respectively, partially offset by increases to deposits, repurchase agreements and accrued expenses and other liabilities of $67.0 million, $5.5 million, and $2.6 million, respectively. The net increase in total stockholders’ equity can be attributed primarily to increases in additional paid in capital, retained earnings and accumulated other comprehensive income of $530,000, $5.9 million and $16.2 million, respectively as well as decreases in unearned employee stock ownership plan (ESOP) of $858,000. These items were partially offset by an increase in treasury stock of $931,000.

| ESB Financial Corporation | 11 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Cash on hand, Interest-earning deposits and Federal funds sold. Cash on hand, interest-earning deposits and federal funds sold represent cash equivalents which decreased a combined $2.6 million, or 13.7%, to $16.3 million at December 31, 2009 from $18.9 million at December 31, 2008. Deposits from customers into savings and checking accounts, loan and security repayments and proceeds from borrowed funds typically increase these accounts. Decreases result from customer withdrawals, new loan originations, security purchases and repayments of borrowed funds.

Securities. The Company’s securities and loan portfolios represent its two largest balance sheet asset classifications. The Company’s securities portfolio increased by $10.1 million, or 0.9%, to $1.1 billion at December 31, 2009. During 2009, the Company recorded purchases of available for sale securities of $197.1 million consisting primarily of $90.1 million of fixed-rate mortgage-backed securities, $32.4 million of adjustable-rate mortgage backed securities, $10.4 million of municipal bonds, $63.3 million of corporate bonds and $911,000 of equity securities. The portfolio also increased by $24.4 million due to increases in market value. These fair value adjustments represent temporary fluctuations resulting from changes in market rates in relation to average yields in the available for sale portfolio. If securities are held to their respective maturity dates, no fair value gain or loss is realized. Offsetting these increases were repayments and maturities of securities of $209.6 million, premium amortizations of $438,000, equity securities sold of $746,000 and realized losses of $618,000.

Loans receivable. The loans receivable category consists primarily of single family mortgage loans used to purchase or refinance personal residences located within the Company’s market area and commercial real estate loans used to finance properties that are used in the borrowers’ businesses or to finance investor-owned rental properties, and to a lesser extent commercial and consumer loans. Net loans receivable decreased $19.9 million, or 2.9%, to $671.4 million at December 31, 2009 from $691.3 million at December 31, 2008. Included in this decrease were decreases in mortgage loans and other loans of $16.8 million, or 3.2%, and $3.5 million, or 1.7%, respectively, partially offset by decreases in the allowance for loan losses, deferred fees and loans in process of approximately $318,000, or 2.0%, combined. The decrease in net loans receivable is due to several factors, including an increase of approximately $50.5 million in repayments to $193.7 million in 2009 as compared to $143.2 million in 2008. These repayments were only partially offset by originations of approximately $174.0 million, which decreased approximately $32.7 million when compared to 2008. The decline in originations was the result of approximately $18.3 million of loans originated for sale as well as an overall decline in the housing market. The yield on the loan portfolio decreased to 5.82% at December 31, 2009 from 6.07% at December 31, 2008.

Loans held for sale. Loans held for sale increased to $201,000 at December 31, 2009 from $0 at December 31, 2008. During the period the Company originated loans held for sale of approximately $18.3 million and sold approximately $18.1 million, with a resulting gain of approximately $203,000.

Non-performing assets. Non-performing assets include non-accrual loans, repossessed vehicles, real estate acquired through foreclosure (REO) and troubled debt restructuring (TDR). Non-performing assets increased to $5.0 million, or 0.25%, of total assets at December 31, 2009 from $3.3 million, or 0.17%, of total assets at December 31, 2008. Non-performing assets consisted of non-performing loans, REO, repossessed vehicles and TDR of $3.8 million, $724,000, $166,000 and $254,000, respectively, at December 31, 2009 and $2.2 million, $539,000, $293,000 and $257,000, respectively, at December 31, 2008.

Accrued interest receivable. Accrued interest receivable increased by $260,000, or 2.6%, to $10.3 million at December 31, 2009 as compared to $10.1 million at December 31, 2008. This increase was a result of increases in the balances on the securities portfolio, including increases to corporate fixed rate bonds that pay interest semiannually, partially offset by decreases in the yields on both the loan and securities portfolios and the balance on the loan portfolio.

| ESB Financial Corporation | 12 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

FHLB stock. FHLB stock remained the same at $27.5 million at December 31, 2009 and December 31, 2008. The Bank is required to maintain an investment in capital stock of the FHLB of Pittsburgh in an amount not less than 5.0% of its outstanding notes payable to the FHLB of Pittsburgh. However, the FHLB of Pittsburgh has currently restricted future redemptions of its stock, and therefore the investment could be greater than 5.0% of such notes.

Premises and equipment. Premises and equipment increased $1.4 million, or 11.9%, to $13.0 million at December 31, 2009 from $11.7 million at December 31, 2008. This increase was primarily due to the construction of the Company’s second Butler County office, which opened in July 2009. The Company has incurred costs of approximately $1.4 million related to the construction, $298,000 of which was incurred in 2008, and the remainder in 2009.

Real estate held for investment. The Company’s real estate held for investment decreased $7.1 million, or 20.6%, to $27.5 million at December 31, 2009 from $34.6 million at December 31, 2008. This decrease is the result of sales activity in the joint ventures in which the Company has a 51% ownership as well as write-downs of land acquisition and development costs and unit construction costs of approximately $2.5 million at two of the Company’s joint ventures. For a complete description of the existing projects see “Item 1. Business—Subsidiaries” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009.

Intangible assets. Intangible assets decreased $517,000, or 28.3%, to $1.3 million at December 31, 2009 from $1.8 million at December 31, 2008. The decrease primarily resulted from amortization of the core deposit intangible created through acquisitions of approximately $494,000. Additionally, the mortgage servicing asset resulting from the loan sale and securitization in 2002 experienced amortization of approximately $15,000 in 2009.

Prepaid expenses and other assets. Prepaid expenses and other assets increased $3.0 million, or 25.5%, to $14.6 million at December 31, 2009 from $11.6 million at December 31, 2008. The increase resulted primarily from the FDIC’s decision to amend its regulations and require insured institutions to prepay their estimated quarterly risk-based assessments through the year 2012. The prepaid assessments will be applied against the future quarterly assessments until the prepaid assessment is exhausted or the balance is returned, whichever occurs first. The Company’s prepaid assessment was $6.7 million and was paid in the fourth quarter of 2009. The increase also resulted from increases to securities receivable of $1.8 million, partially offset by decreases in the deferred tax asset.

Bank owned life insurance. Bank owned life insurance (BOLI) is universal life insurance, purchased by the Bank, on the lives of the Bank’s employees. The beneficial aspects of these universal life insurance policies are tax-free earnings and a tax-free death benefit, which are realized by ESB as the owner of the policies. The Company purchased the $15.0 million universal life insurance policies on December 29, 1998. In 2001, the policy was increased by the addition of Workingmens Savings Bank’s BOLI of $1.3 million in connection with their acquisition and an addition to the original policy of $3.5 million. The cash surrender value of the BOLI as of December 31, 2009 was $29.4 million.

Deposits. The Company considers various sources when evaluating funding needs, including but not limited to deposits, which are a significant source of funds totaling $944.3 million, or 53.2%, of the Company’s total funding sources at December 31, 2009. Total deposits increased $67.0 million, or 7.6%, to $944.3 million at December 31, 2009 from $877.3 million at December 31, 2008. For the year, the Company’s interest-bearing demand and savings deposits increased $26.0 million, or 11.0%, time deposits increased $38.4 million, or 6.7%, and noninterest-bearing deposits increased $2.7 million, or 4.1%. The increase to core deposits of approximately $28.6 million is primarily due to the Company’s ongoing campaign to increase these types of accounts. The Company continues to be diligent in monitoring the rates being offered by regional banks in the Company’s market area and offering special time deposit rates to remain competitive.

| ESB Financial Corporation | 13 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Advance payments by borrowers for taxes and insurance. Advance payments by borrowers for taxes and insurance decreased $155,000, or 5.5%, to $2.7 million at December 31, 2009 from $2.8 million at December 31, 2008 due to the decrease in the net loans receivable.

Borrowed funds. The Company utilizes short and long-term borrowings as another source of funding used for asset growth and liquidity needs. These borrowings primarily include FHLB advances and repurchase agreement borrowings. Borrowed funds decreased $103.3 million, or 11.1%, to $829.6 million at December 31, 2009 from $932.9 million at December 31, 2008. FHLB advances decreased $105.3 million, or 20.0%, repurchase agreements increased $5.5 million, or 1.6%, other borrowings decreased $3.5 million, or 15.0%, while junior subordinated notes remained the same at $46.4 million. The Company is reviewing its continued utilization of advances from the FHLB as a source of funding based upon recent decisions by the FHLB to suspend the dividend on, and restrict the repurchase of, FHLB stock.

Accounts payable for land development. Accounts payable for land development decreased by $2.0 million to $4.6 million at December 31, 2009 from $6.6 million at December 31, 2008. This account represents the unpaid portion of the development costs for the Company’s joint ventures. The decrease is primarily due to ongoing construction activity at the Company’s existing joint venture projects and that the Company did not begin any new projects in 2009.

Stockholders’ equity. Stockholders’ equity increased by $21.7 million, or 15.2%, to $164.8 million at December 31, 2009 from $143.1 million at December 31, 2008. The net increase in total stockholders’ equity can be attributed primarily to increases in additional paid in capital, retained earnings and accumulated other comprehensive income of $530,000, $5.9 million and $16.2 million, respectively as well as decreases in unearned employee stock ownership plan (ESOP) of $858,000. These items were partially offset by an increase in treasury stock of $931,000.

Results of Operations

General. The Company reported net income of $12.0 million, $10.2 million and $7.7 million in 2009, 2008, and 2007, respectively.

Average Balance Sheet and Yield/Rate Analysis. The following table sets forth, for the periods indicated, information concerning the total dollar amounts of interest income from interest-earning assets and the resultant average yields, the total dollar amounts of interest expense on interest-bearing liabilities and the resultant average costs, net interest income, interest rate spread and the net interest margin earned on average interest-earning assets. For purposes of this table, average balances are calculated using monthly averages and the average loan balances include non-accrual loans and exclude the allowance for loan losses, and interest income includes accretion of net deferred loan fees. Yields on tax-exempt securities and loans (tax-exempt for federal income tax purposes) are shown on a fully tax equivalent basis utilizing a federal tax rate of 34%.

| ESB Financial Corporation | 14 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

| (Dollar amounts in thousands) | 2009 | Year ended December 31, 2008 |

2007 | |||||||||||||||||||||||||

| Average Balance |

Interest | Yield / Rate |

Average Balance |

Interest | Yield / Rate |

Average Balance |

Interest | Yield / Rate | ||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||||||

| Taxable securities available for sale |

$ | 847,578 | $ | 43,095 | 5.08% | $ | 922,276 | $ | 48,140 | 5.22% | $ | 950,433 | $ | 48,848 | 5.14% | |||||||||||||

| Taxable adjustable corporate bonds AFS |

109,089 | 4,709 | 4.32% | 46,325 | 1,960 | 4.23% | 48,604 | 3,090 | 6.36% | |||||||||||||||||||

| Tax-exempt securities available for sale |

121,078 | 5,400 | 6.76% | 109,786 | 4,844 | 6.68% | 109,024 | 4,927 | 6.85% | |||||||||||||||||||

| 1,077,745 | 53,204 | 5.19% | 1,078,387 | 54,944 | 5.33% | 1,108,061 | 56,865 | 5.36% | ||||||||||||||||||||

| Mortgage loans |

489,817 | 28,438 | 5.81% | 485,950 | 29,142 | 6.00% | 451,331 | 27,785 | 6.16% | |||||||||||||||||||

| Other loans |

173,324 | 10,027 | 5.79% | 163,179 | 10,210 | 6.26% | 148,375 | 9,897 | 6.67% | |||||||||||||||||||

| Tax-exempt loans |

19,124 | 806 | 6.38% | 16,098 | 683 | 6.43% | 11,977 | 586 | 7.41% | |||||||||||||||||||

| 682,265 | 39,271 | 5.82% | 665,227 | 40,035 | 6.07% | 611,683 | 38,268 | 6.31% | ||||||||||||||||||||

| Cash equivalents |

21,529 | 20 | 0.09% | 15,665 | 157 | 1.00% | 17,727 | 464 | 2.62% | |||||||||||||||||||

| FHLB stock |

27,470 | - | - | 29,649 | 1,122 | 3.78% | 33,052 | 1,987 | 6.01% | |||||||||||||||||||

| 48,999 | 20 | 0.04% | 45,314 | 1,279 | 2.82% | 50,779 | 2,451 | 4.83% | ||||||||||||||||||||

| Total interest-earning assets |

1,809,009 | 92,495 | 5.29% | 1,788,928 | 96,258 | 5.54% | 1,770,523 | 97,584 | 5.67% | |||||||||||||||||||

| Other noninterest-earning assets |

162,422 | - | - | 141,204 | - | - | 129,907 | - | - | |||||||||||||||||||

| Total assets |

$ | 1,971,431 | $ | 92,495 | 4.85% | $ | 1,930,132 | $ | 96,258 | 5.13% | $ | 1,900,430 | $ | 97,584 | 5.28% | |||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||||||

| Interest-bearing demand deposits |

$ | 255,929 | $ | 761 | 0.30% | $ | 238,426 | $ | 1,350 | 0.57% | $ | 224,099 | $ | 1,779 | 0.79% | |||||||||||||

| Time deposits |

588,496 | 17,035 | 2.89% | 558,076 | 21,058 | 3.77% | 557,808 | 25,927 | 4.65% | |||||||||||||||||||

| 844,425 | 17,796 | 2.11% | 796,502 | 22,408 | 2.81% | 781,907 | 27,706 | 3.54% | ||||||||||||||||||||

| FHLB advances |

459,727 | 20,372 | 4.43% | 578,565 | 27,671 | 4.78% | 657,267 | 31,274 | 4.76% | |||||||||||||||||||

| Repurchase agreements |

344,146 | 12,704 | 3.69% | 266,771 | 11,262 | 4.22% | 188,458 | 9,371 | 4.97% | |||||||||||||||||||

| Other borrowings |

29,425 | 955 | 3.25% | 18,785 | 811 | 4.32% | 14,410 | 776 | 5.39% | |||||||||||||||||||

| 833,298 | 34,031 | 4.08% | 864,121 | 39,744 | 4.60% | 860,135 | 41,421 | 4.82% | ||||||||||||||||||||

| Preferred securities- fixed |

36,083 | 2,111 | 5.85% | 36,083 | 2,111 | 5.85% | 36,083 | 2,111 | 5.85% | |||||||||||||||||||

| Preferred securities- adjustable |

10,310 | 409 | 3.97% | 13,094 | 852 | 6.51% | 15,399 | 1,363 | 8.85% | |||||||||||||||||||

| 46,393 | 2,520 | 5.43% | 49,177 | 2,963 | 6.03% | 51,482 | 3,474 | 6.75% | ||||||||||||||||||||

| Total interest-bearing liabilities |

1,724,116 | 54,347 | 3.15% | 1,709,800 | 65,115 | 3.81% | 1,693,524 | 72,601 | 4.29% | |||||||||||||||||||

| Noninterest-bearing demand deposits |

70,134 | - | - | 66,258 | - | - | 58,549 | - | - | |||||||||||||||||||

| Other noninterest-bearing liabilities |

20,438 | - | - | 24,389 | - | - | 20,237 | - | - | |||||||||||||||||||

| Total liabilities |

1,814,688 | 54,347 | 2.99% | 1,800,447 | 65,115 | 3.62% | 1,772,310 | 72,601 | 4.10% | |||||||||||||||||||

| Stockholders’ equity |

156,743 | - | - | 129,685 | - | - | 128,120 | - | - | |||||||||||||||||||

| Total liabilities and equity |

$ | 1,971,431 | $ | 54,347 | 2.76% | $ | 1,930,132 | $ | 65,115 | 3.37% | $ | 1,900,430 | $ | 72,601 | 3.82% | |||||||||||||

| Net interest income |

$ | 38,148 | $ | 31,143 | $ | 24,983 | ||||||||||||||||||||||

| Interest rate spread (difference between weighted average rate on interest-earning assets and interest-bearing liabilities) |

2.14% | 1.73% | 1.38% | |||||||||||||||||||||||||

| Net interest margin (net interest income as a percentage of average interest-earning assets) |

2.29% | 1.90% | 1.57% | |||||||||||||||||||||||||

| ESB Financial Corporation | 15 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Analysis of Changes in Net Interest Income. The following table analyzes the changes in interest income and interest expense in terms of: (i) changes in volume of interest-earning assets and interest-bearing liabilities and (ii) changes in yield and rates. The table reflects the extent to which changes in the Company’s interest income and interest expense are attributable to changes in rate (change in rate multiplied by prior year volume), changes in volume (changes in volume multiplied by prior year rate) and changes attributable to the combined impact of volume/rate (change in rate multiplied by change in volume). The changes attributable to the combined impact of volume/rate are allocated on a consistent basis between the volume and rate variances.

| (Dollar amounts in thousands) | 2009 vs. 2008 | 2008 vs. 2007 | ||||||||||||||||

| Increase (decrease) due to | Increase (decrease) due to | |||||||||||||||||

| Volume | Rate | Total | Volume | Rate | Total | |||||||||||||

| Interest income: |

||||||||||||||||||

| Securities |

$ | (33) | $ | (1,707) | $ | (1,740) | $ | (1,514) | $ | (407) | $ | (1,921) | ||||||

| Loans |

1,009 | (1,773) | (764) | 3,261 | (1,494) | 1,767 | ||||||||||||

| Cash equivalents |

43 | (180) | (137) | (49) | (258) | (307) | ||||||||||||

| FHLB stock |

(77) | (1,045) | (1,122) | (188) | (677) | (865) | ||||||||||||

| Total interest-earning assets |

942 | (4,705) | (3,763) | 1,510 | (2,836) | (1,326) | ||||||||||||

| Interest expense: |

||||||||||||||||||

| Deposits |

1,283 | (5,895) | (4,612) | 508 | (5,806) | (5,298) | ||||||||||||

| FHLB advances |

(5,376) | (1,923) | (7,299) | (3,763) | 160 | (3,603) | ||||||||||||

| Repurchase agreements |

2,980 | (1,538) | 1,442 | 3,463 | (1,572) | 1,891 | ||||||||||||

| Other borrowings |

380 | (236) | 144 | 207 | (172) | 35 | ||||||||||||

| Subordinated debt |

(162) | (281) | (443) | (151) | (360) | (511) | ||||||||||||

| Total interest-bearing liabilities |

(895) | (9,873) | (10,768) | 264 | (7,750) | (7,486) | ||||||||||||

| Net interest income |

$ | 1,837 | $ | 5,168 | $ | 7,005 | $ | 1,246 | $ | 4,914 | $ | 6,160 | ||||||

2009 Results Compared to 2008 Results

General. The Company reported net income of $12.0 million and $10.2 million for 2009 and 2008, respectively. The $1.8 million, or 17.6%, increase in net income between 2009 and 2008 can primarily be attributed to a decrease in interest expense, provision for loan losses, and net income attributable to the noncontrolling interest of $10.8 million, $494,000 and $556,000, respectively, partially offset by decreases in interest income and noninterest income of $3.8 million and $1.7 million, respectively, and increases in noninterest expense and provision for income taxes of $3.7 million and $834,000, respectively.

Net interest income. Net interest income, the primary source of revenue for the Company, is determined by the Company’s interest rate spread, which is defined as the difference between income on earning assets and the cost of funds supporting those assets, and the relative amounts of interest earning assets and interest bearing liabilities. Management periodically adjusts the mix of assets and liabilities, as well as the rates earned or paid on those assets and liabilities in order to manage and improve net interest income. The level of interest rates and changes in the amount and composition of interest earning assets and liabilities affect the Company’s net interest income. Historically from an interest rate risk perspective, it has been management’s perception that differing interest rate environments can cause sensitivity to the Company’s net interest income, these being extended low long-term interest rates or rapidly rising short-term interest rates as well as a sustained inverted yield curve. Net interest income increased by $7.0 million, or 22.5%, to $38.1 million for 2009, compared to $31.1 million for 2008. This increase in net interest income can be attributed to a decrease in interest expense of $10.8 million, or 16.5%, which was only partially offset by a decrease in interest income of $3.8 million, or 3.9%. The decrease to interest expense reflects a 66 basis point decrease in the cost of interest bearing liabilities to 3.15% for 2009 from 3.81% for 2008.

| ESB Financial Corporation | 16 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Interest income. Interest income decreased $3.8 million, or 3.9%, to $92.5 million for 2009, compared to $96.3 million for 2008. This decrease in interest income can be attributed to decreases in interest earned on loans receivable, securities available for sale, FHLB stock and cash equivalents of $764,000, $1.7 million, $1.1 million, and $137,000, respectively. Cash equivalents include cash on hand and in banks, interest-earning deposits and federal funds sold.

Interest earned on loans receivable decreased $764,000, or 1.9%, to $39.3 million for 2009, compared to $40.0 million for 2008. This decrease was attributable to a decrease in the yield on the portfolio to 5.82% at December 31, 2009 as compared to 6.07% at December 31, 2008, partially offset by an increase in the average balance of loans outstanding of $17.0 million, or 2.6%, to $682.3 million for the year ended December 31, 2009, as compared to $665.2 million for the year ended December 31, 2008.

Interest earned on securities decreased $1.7 million, or 3.2%, to $53.2 million for 2009 compared to $54.9 million for 2008. This decrease was primarily attributable to a decline in the tax equivalent yield on the portfolio of 14 basis points to 5.19% for 2009, compared to 5.33% for 2008, as well as a slight decrease in the average balance of securities of $642,000, or 0.06%.

Interest earned on FHLB stock decreased $1.1 million, or 100.0%, for the year ended December 31, 2009 compared to the same period in the prior year. This decrease was the result of the decision by the FHLB of Pittsburgh to suspend dividends on FHLB stock beginning in the fourth quarter of 2008.

Interest earned on cash equivalents decreased $137,000, or 87.3%, to $20,000 for 2009, compared to $157,000 for 2008 as the yield decreased to 0.09% for 2009, compared to 1.00% for 2008. This decline was partially offset by an increase in the average balance of these instruments of $5.9 million, or 37.4%, to $21.5 million at December 31, 2009 as compared to $15.7 million at December 31, 2008.

Interest expense. Interest expense decreased $10.8 million, or 16.5%, to $54.3 million for 2009, compared to $65.1 million for 2008. This decrease in interest expense can be attributed to decreases in interest incurred on deposits, borrowed funds and junior subordinated notes of $4.6 million, $5.7 million and $443,000, respectively.

Interest incurred on deposits decreased $4.6 million, or 20.6%, to $17.8 million for 2009, compared to $22.4 million for 2008. This decrease was primarily attributable to a decrease in the cost of interest earning deposits to 2.11% in 2009 from 2.81% in 2008, partially offset by an increase of $47.9 million, or 6.02%, in the average balance of interest-bearing deposits to $844.4 million for 2009 as compared to $796.5 million for 2008. The Company manages its cost of interest-bearing deposits by diligently monitoring the interest rates on its products as well as the rates being offered by its competition through weekly interest rate committee meetings and utilizing rate surveys and hence subsequently adjusting rates accordingly.

Interest incurred on borrowings, which includes FHLB advances and repurchase agreements decreased $5.7 million, or 14.4%, to $34.0 million for 2009, compared to $39.7 million for 2008. This decrease was primarily attributable to a decrease in the cost of these funds to 4.08% for 2009 compared to 4.60% for 2008, as well as a decrease in the average balance of borrowed funds of $30.8 million, or 3.6%, to $833.3 million for 2009, compared to $864.1 million for 2008. The Company, as part of its wholesale strategy, continues to manage its cost of funds through its policy of laddering the maturities of borrowings up to a five year period. This strategy allows the Company the flexibility to alter its borrowing structure quarterly. During 2009, the Company replaced approximately $281.8 million of maturing wholesale borrowings at a weighted average rate of 5.15% and an original call/maturity of 2.8 years with borrowings of approximately $189.1 million at a weighted average rate of 2.89% and an average call/maturity of 3.9 years. The restructuring of these borrowings contributed to the overall decline in interest expense for 2009. For purposes of determining the average life of the borrowings, the Company utilizes the call date if applicable.

| ESB Financial Corporation | 17 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Interest expense on junior subordinated notes decreased $443,000, or 15.0%, to $2.5 million at December 31, 2009 from $3.0 million at December 31, 2008. This decrease was primarily attributable to a decrease in the cost of these funds to 5.43% for 2009, compared to 6.03% for 2008 as well as a decrease in the average balance of these funds of $2.8 million, or 5.7%, to $46.4 million for 2009, compared to $49.2 million for 2008.

Provision for loan losses. The Company records provisions for loan losses to bring the total allowance for loan losses to a level deemed adequate to cover probable losses in the loan portfolio. In determining the appropriate level of allowance for loan losses, management considers historical loss experience, the financial condition of borrowers, economic conditions (particularly as they relate to markets where the Company originates loans), the status of non-performing assets, the estimated underlying value of the collateral and other factors related to the collectibility of the loan portfolio. The provision for loan losses decreased $494,000 to $912,000 for the year ended December 31, 2009 compared to $1.4 million in the prior year. These provisions were part of the normal operations of the Company for 2009. As a result of the provisions for loan losses during 2009 and 2008, the Company’s allowance for loan losses amounted to $6.0 million, or 0.88%, of the Company’s total loan portfolio at December 31, 2009, compared to $6.0 million, or 0.85%, at December 31, 2008. The Company’s allowance for loan losses as a percentage of non-performing loans at December 31, 2009 and December 31, 2008 was 147.58% and 239.95%, respectively.

Noninterest income. Noninterest income decreased $1.7 million, or 31.9%, to $3.6 million for 2009, compared to $5.3 million for 2008. This decrease can be attributed to decreases in income from real estate joint ventures of $3.0 million and a decrease in the cash surrender value of the bank owned life insurance of $229,000, partially offset by increases in fees and service charges, net gain on sale of loans and other income of $50,000, $201,000, and $202,000, respectively, as well as a decrease in the net realized loss on securities available for sale and derivatives of $485,000 and $616,000, respectively.

Net realized loss on investments decreased $485,000 to reflect an overall loss of $371,000 for 2009 compared to a net loss of $856,000 for 2008. During 2009 the Company incurred pre-tax impairment charges of approximately $617,000, including approximately $552,000 on a $2.5 million collateralized debt obligation that is comprised of sixteen financial institutions and approximately $66,000 on three of its equity investments in small banks that had experienced a decline in their market value for the last several quarters. These losses were offset by gains of approximately $246,000 on the sale of two of the Company’s equity investments. Additionally, the Company had a gain on derivatives in 2009 of $120,000 compared to losses in 2008 of $616,000 because of market value adjustments to the Company’s interest rate caps. For additional information see Note 2 of the consolidated financial statements.

Income from real estate joint ventures decreased $3.0 million to a loss of $1.9 million for 2009 compared to income of $1.1 million for 2008. Included in this decrease was a pre-tax write-down of land acquisition and development costs as well as unit construction costs of approximately $2.5 million at two of the Company’s joint ventures.

Fees and service charges increased $50,000, or 1.3%, to $4.0 million for 2009, compared to $3.9 million for 2008. These increases are primarily attributed to increase in fees on our checking and savings products of approximately $97,000, including an increase of $72,000 in fees on NOW accounts primarily due to increased participation in our ESB Rewards program for debit card holders. The ESB Rewards program offers customers the ability to earn points, based on debit card usage, which can be redeemed for prizes. Offsetting the increase in fees related to checking and savings products were decreases to various loan fees of approximately $47,000.

Net gain on sale of loans held for sale increased to $203,000 for the period ended December 31, 2009 from $2,000 at December 31, 2008. During the period the Company originated loans held for sale of approximately $18.3 million and sold approximately $18.1 million.

| ESB Financial Corporation | 18 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Noninterest expense. Noninterest expenses increased $3.8 million, or 16.2%, to $26.8 million for 2009, compared to $23.0 million for 2008. This increase can be primarily attributed to increases in compensation and employee benefits, federal deposit insurance premiums, data processing, advertising and other expenses of $1.1 million, $2.4 million, $166,000, $132,000 and $128,000, respectively, partially offset by decreases to premises and equipment and amortization of intangible assets of $80,000 and $107,000, respectively.

Compensation and employee benefits increased $1.1 million, or 8.0%, to $14.7 million for 2009, compared to $13.6 million in 2008. This increase was related to normal salary adjustments and bonuses between the years of approximately $734,000 as well as increases to stock option expense, retirement plan expense and various taxes and insurance of $46,000, $221,000 and $80,000, respectively.

Federal deposit insurance premiums expense increased $2.4 million to $2.5 million for 2009, compared to $119,000 for 2008. This increase is primarily due to increases in the quarterly rates assessed by the Federal Deposit Insurance Corporation, as well as a special assessment by the FDIC in the amount of $891,000, paid in the third quarter of 2009.

Data processing expense increased $166,000, or 8.5%, to $2.1 million for 2009, compared to $2.0 million for 2008. This increase is primarily related to enhancements in technology.

Amortization of intangible assets decreased $107,000, or 17.8%, to $494,000 for 2009, compared to $601,000 for 2008. The decrease was to the normal amortization of the core deposit intangible of prior acquisitions. Amortization is expected to total $413,000, $332,000, $251,000, $170,000, $100,000 and $8,000 for the years 2010, 2011, 2012, 2013, 2014 and 2015, respectively.

Provision for income taxes. The provision for income taxes increased $834,000, or 53.9%, to $2.4 million for 2009 as compared to $1.5 million in 2008. The effective tax rate for 2009 was 16.6% compared to 13.2% for 2008. This was primarily due to the $2.6 million, or 22.4%, increase in pre-tax income as well as a decrease in the percentage of the Company’s tax free income to total income.

Net Income Attributable to the noncontrolling interest. Minority interest decreased $556,000 to a loss of $347,000 for 2009 compared to income of $209,000 for 2008. This decrease was directly related to the previously mentioned write-downs at the joint ventures as well as the decrease in income from sales and represents the portion of the profits on the consolidated joint ventures earned by the partners.

2008 Results Compared to 2007 Results

General. The Company reported net income of $10.2 million and $7.7 million for 2008 and 2007, respectively. The $2.6 million, or 33.3%, increase in net income between 2008 and 2007 can primarily be attributed to a decrease in interest expense of $7.5 million, partially offset by decreases in interest income and noninterest income of $1.3 million and $1.9 million, respectively, and increases in provision for loan losses and provision for income taxes of $541,000 and $1.1 million, respectively.

Net interest income. Net interest income, the primary source of revenue for the Company, is determined by the Company’s interest rate spread, which is defined as the difference between income on earning assets and the cost of funds supporting those assets, and the relative amounts of interest earning assets and interest bearing liabilities. Management periodically adjusts the mix of assets and liabilities, as well as the rates earned or paid on those assets and liabilities in order to manage and improve net interest income. The level of interest rates and changes in the amount and composition of interest earning assets and liabilities affect the Company’s net interest income. Historically from an interest rate risk perspective, it has been management’s perception that differing interest rate environments can cause sensitivity to the Company’s net interest income, these being extended low long-term

| ESB Financial Corporation | 19 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

interest rates or rapidly rising short-term interest rates as well as a sustained inverted yield curve. Net interest income increased by $6.2 million, or 24.7%, to $31.1 million for 2008, compared to $25.0 million for 2007. This increase in net interest income can be attributed to a decrease in interest expense of $7.5 million, or 10.3%, which was only partially offset by a decrease in interest income of $1.3 million, or 1.4%. The decrease to interest expense reflects a 48 basis point decrease in cost of funds to 3.67% for 2008 from 4.14% for 2007.

Interest income. Interest income decreased $1.3 million, or 1.4%, to $96.3 million for 2008, compared to $97.6 million for 2007. This decrease in interest income can be attributed to decreases in interest earned on securities available for sale, FHLB stock and cash equivalents of $1.9 million, $865,000, and $307,000, respectively. Cash equivalents include cash on hand and in banks, interest-earning deposits and federal funds sold. Partially offsetting these decreases was an increase in interest earned on loans receivable of $1.8 million.

Interest earned on loans receivable increased $1.8 million, or 4.6%, to $40.0 million for 2008, compared to $38.3 million for 2007. This increase was attributable to an increase in the average balance of loans outstanding of $53.5 million, or 8.8%, to $665.2 million for the year ended December 31, 2008, as compared to $611.7 million for the year ended December 31, 2007. Partially offsetting this increase was a decrease in the yield on the portfolio to 6.07% at December 31, 2008 as compared to 6.31% at December 31, 2007. The increase in loans outstanding is primarily attributed to growth in the residential mortgage loan portfolio.

Interest earned on securities decreased $1.9 million, or 3.4%, to $54.9 million for 2008 compared to $56.9 million for 2007. This decrease was primarily attributable to a decrease in the average balance of securities of $29.7 million, or 2.7%, and a decline in the tax equivalent yield on the portfolio of 3 basis points to 5.33% for 2008, compared to 5.36% for 2007.

Income from FHLB stock decreased $865,000, or 43.5%, to $1.1 million for 2008, compared to $2.0 million for 2007. This decrease can be primarily attributed to a decline in the yield on the FHLB stock of 223 basis points to 3.78% for 2008 compared to 6.01% for 2007, as well as a decline in the average balance of FHLB stock of $3.4 million to $29.6 million at December 31, 2008 from $33.1 million at December 31, 2007.

Interest earned on cash equivalents decreased $307,000, or 66.2%, to $157,000 for 2008, compared to $464,000 for 2007 as the yield decreased to 1.00% for 2008, compared to 2.62% for 2007 and the average balance decreased $2.1 million to $15.7 million at December 31, 2008 compared to $17.7 million at December 31, 2007.

Interest expense. Interest expense decreased $7.5 million, or 10.3%, to $65.1 million for 2008, compared to $72.6 million for 2007. This decrease in interest expense can be attributed to decreases in interest incurred on deposits, borrowed funds and junior subordinated notes of $5.3 million, $1.7 million and $511,000, respectively.

Interest incurred on deposits decreased $5.3 million, or 19.1%, to $22.4 million for 2008, compared to $27.7 million for 2007. This decrease was primarily attributable to a decrease in the cost of interest earning deposits to 2.81% in 2008 from 3.54% in 2007, partially offset by an increase of $14.6 million, or 1.9%, in the average balance of interest-bearing deposits to $796.5 million for 2008 as compared to $781.9 million for 2007. The Company manages its cost of interest-bearing deposits by diligently monitoring the interest rates on its products as well as the rates being offered by its competition through weekly interest rate committee meetings and utilizing rate surveys and hence subsequently adjusting rates accordingly.

Interest incurred on borrowings, which includes FHLB advances and repurchase agreements, the largest components of the Company’s interest-bearing liabilities, decreased $1.7 million, or 4.0%, to $39.7 million for 2008, compared to $41.4 million for 2007. This decrease was primarily attributable to a decrease in the cost of these funds to 4.60% for 2008 compared to 4.82% for 2007, partially offset by an increase in the average balance of borrowed funds of $4.0 million, or 0.5%, to $864.1 million for 2008, compared to $860.1 million for 2007. The

| ESB Financial Corporation | 20 | 2009 Annual Report |

Table of Contents

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Company, as part of its wholesale strategy, continues to manage its cost of funds through its policy of laddering the maturities of borrowings up to a five year period. This strategy allows the Company the flexibility to alter its borrowing structure quarterly. During 2008, the Company replaced approximately $297.1 million of maturing wholesale borrowings at a weighted average rate of 4.50% and an original call/maturity of 3.6 years with borrowings of approximately $340.9 million at a weighted average rate of 3.73% and an average call/maturity of 3.9 years, which caused a decrease in the cost of these borrowings by 77 basis points. For purposes of determining the average life of the borrowings, the Company utilizes the call date if applicable.

Interest expense on junior subordinated notes decreased $511,000, or 14.7%, to $3.0 million at December 31, 2008 from $3.5 million at December 31, 2007. This decrease was primarily attributable to a decrease in the cost of these funds to 6.03% for 2008, compared to 6.75% for 2007 as well as a decrease in the average balance of these funds of $2.3 million, or 4.5%, to $49.2 million for 2008, compared to $51.5 million for 2007.